Can Co-Creation and Crowdfunding Types Predict Funder Behavior? An Extended Model of Goal-Directed Behavior

Abstract

:1. Introduction

2. Literature Review

2.1. Theoretical Framework

2.1.1. Visitor Economy Crowdfunding

2.1.2. Co-Creation

2.1.3. Model of Goal-Directed Behavior (MGB)

2.2. Hypothesis Development

2.2.1. Co-Creation, Attitude, and Behavioral Intention

2.2.2. Attitude, Subjective Norm, Emotion, Perceived Behavioral Control, and Desire

2.2.3. Perceived Behavioral Control and Behavioral Intention

2.2.4. Desire and Behavioral Intention

2.2.5. Moderating Role of Reward and Investment Crowdfunding Types

3. Methods

3.1. Measurement

3.2. Operational Definition of Variables

3.2.1. Co-Creation

3.2.2. Attitude

3.2.3. Subjective Norm

3.2.4. Positive Anticipated Emotion

3.2.5. Negative Anticipated Emotion

3.2.6. Perceived Behavioral Control

3.2.7. Desire

3.2.8. Behavioral Intention

3.3. Content Validity and Pre-Test

3.4. Data Collection

3.5. Data Analysis

4. Results

4.1. Grouping Check

4.2. Respondents’ Profile

4.3. Measurement Model

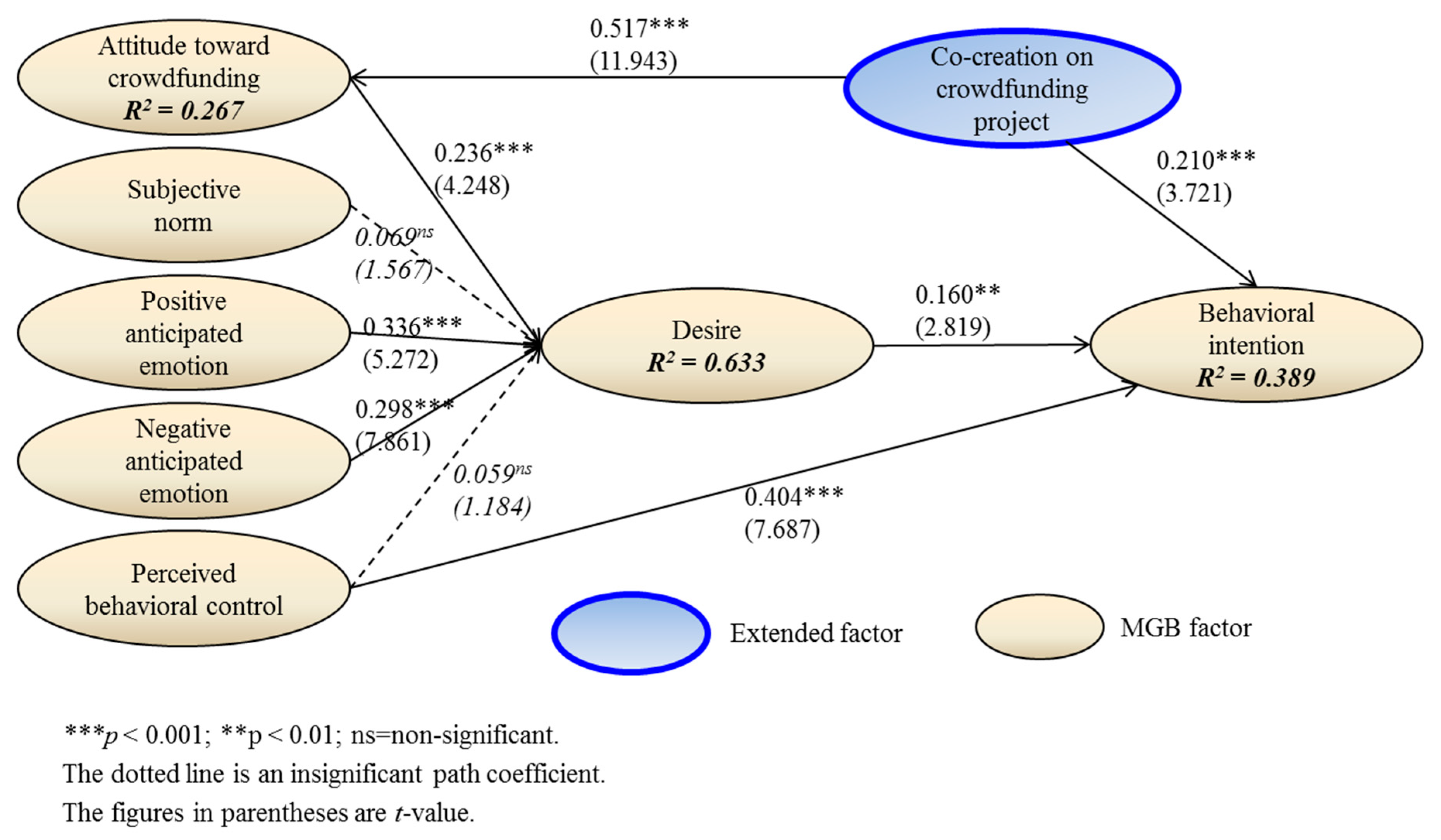

4.4. Structural Model

4.5. Moderating and Mediating Effects

5. Discussion and Conclusion

5.1. Discussion

5.2. Theoretical Implications

5.3. Practical Implications

5.4. Limitations and Future Study Directions

Author Contributions

Funding

Conflicts of Interest

References

- Kim, M.J.; Hall, C.M. Investment crowdfunding in the visitor economy: The roles of venture quality, uncertainty, and funding amount. Curr. Issues Tour. 2019. [Google Scholar] [CrossRef]

- Cabiddu, F.; Lui, T.W.; Piccoli, G. Managing value co-creation in the tourism industry. Ann. Tour. Res. 2013, 42, 86–107. [Google Scholar] [CrossRef]

- Grissemann, U.S.; Stokburger-Sauer, N.E. Customer co-creation of travel services: The role of company support and customer satisfaction with the co-creation performance. Tour. Manag. 2012, 33, 1483–1492. [Google Scholar] [CrossRef]

- Prebensen, N.K.; Vittersø, J.; Dahl, T.I. Value co-creation significance of tourist resources. Ann. Tour. Res. 2013, 42, 240–261. [Google Scholar] [CrossRef]

- Chu, C.C.; Cheng, Y.F.; Tsai, F.S.; Tsai, S.B.; Lu, K.H. Open innovation in crowdfunding context: Diversity, Knowledge, and networks. Sustainability 2019, 11, 180. [Google Scholar] [CrossRef] [Green Version]

- Demiray, M.; Aslanbay, Y. The crowdfunding communities and the value of identification for sustainability of co-creation. In Crowdfunding for Sustainable Entrepreneurship and Innovation; IGI Global: Hershey, PA, USA, 2016; pp. 155–174. [Google Scholar] [CrossRef]

- Frydrych, D.; Bock, A.J. Bring the noize: Syndicate and role-identity co-creation during crowdfunding. SAGE Open 2018. [Google Scholar] [CrossRef] [Green Version]

- Ryu, S.; Kim, Y.G. A typology of crowdfunding sponsors: Birds of a feather flock together? Electron. Commer. Res. Appl. 2016, 16, 43–54. [Google Scholar] [CrossRef]

- Zheng, H.; Xu, B.; Zhang, M.; Wang, T. Sponsor’s cocreation and psychological ownership in reward-based crowdfunding. Inf. Syst. J. 2018, 28, 1213–1238. [Google Scholar] [CrossRef]

- Chen, Y.; Dai, R.; Yao, J.; Li, Y. Donate time or money? The determinants of donation intention in online crowdfunding. Sustainability 2019, 11, 4269. [Google Scholar] [CrossRef] [Green Version]

- Pérez y Pérez, L.; Egea, P. About intentions to donate for sustainable rural development: An exploratory study. Sustainability 2019, 11, 765. [Google Scholar] [CrossRef] [Green Version]

- Trusiak, H.C. What’s Happening in the Crowd? Analysis of Crowdfunding Contributor Behaviors Using the Theory of Planned Behavior. Ph.D. Dissertation, San Diego State University, San Diego, CA, USA, 2016. [Google Scholar]

- Kim, M.J.; Lee, M.J.; Lee, C.K.; Song, H.J. Does gender affect korean tourists’ overseas travel? Applying the model of goal-directed behavior. Asia Pac. J. Tour. Res. 2012, 17, 509–533. [Google Scholar] [CrossRef]

- Kim, J.M.; Park, J.Y.; Lee, C.K.; Chung, I.Y. The role of perceived ethics in the decision-making process for responsible tourism using an extended model of goal-directed behavior. Int. J. Tour. Hosp. Res. 2017, 31, 5–25. [Google Scholar] [CrossRef]

- Kim, M.J.; Preis, M.W. Why seniors use mobile devices: Applying an extended model of goal-directed behavior. J. Travel Tour. Mark. 2016, 33, 404–423. [Google Scholar] [CrossRef]

- Kim, Y.; Yun, S.; Lee, J. Can companies induce sustainable consumption? The impact of knowledge and social embeddedness on airline sustainability programs in the U.S. Sustainability 2014, 6, 3338–3356. [Google Scholar] [CrossRef] [Green Version]

- Lee, C.K.; Song, H.J.; Bendle, L.J.; Kim, M.J.; Han, H. The impact of non-pharmaceutical interventions for 2009 H1N1 influenza on travel intentions: A model of goal-directed behavior. Tour. Manag. 2012, 33, 89–99. [Google Scholar] [CrossRef]

- Meng, B.; Choi, K. The role of authenticity in forming slow tourists’ intentions: Developing an extended model of goal-directed behavior. Tour. Manag. 2016, 57, 397–410. [Google Scholar] [CrossRef]

- Song, H.J.; Lee, C.K.; Kang, S.K.; Boo, S.J. The effect of environmentally friendly perceptions on festival visitors’ decision-making process using an extended model of goal-directed behavior. Tour. Manag. 2012, 33, 1417–1428. [Google Scholar] [CrossRef]

- Galuszka, P.; Brzozowska, B. Crowdfunding: Towards a redefinition of the artist’s role—The case of MegaTotal. Int. J. Cult. Stud. 2017, 20, 83–99. [Google Scholar] [CrossRef]

- Rey-Martí, A.; Mohedano-Suanes, A.; Simón-Moya, V. Crowdfunding and social entrepreneurship: Spotlight on intermediaries. Sustainability 2019, 11, 1175. [Google Scholar] [CrossRef] [Green Version]

- Yang, X.; Zhao, K.; Tao, X.; Shiu, E. Developing and validating a theory-based model of crowdfunding investment intention—Perspectives from social exchange theory and customer value perspective. Sustainability 2019, 11, 2525. [Google Scholar] [CrossRef] [Green Version]

- Kim, M.J.; Bonn, M.; Lee, C.; Kim, M.J. The effects of motivation, deterrents, trust, and risk on tourism crowdfunding behavior. Asia Pac. J. Tour. Res. 2019, 25, 244–260. [Google Scholar] [CrossRef]

- Mollick, E. The dynamics of crowdfunding: An exploratory study. J. Bus. Ventur. 2014, 29, 1–16. [Google Scholar] [CrossRef] [Green Version]

- Hall, C.M. Tourism in capital cities. Tourism 2002, 50, 235–248. [Google Scholar]

- Hall, C.M.; Williams, A.M. Tourism and Innovation, 2nd ed.; Routledge: Abingdon, UK, 2020. [Google Scholar] [CrossRef]

- Connell, J.; Page, S.J.; Sheriff, I.; Hibbert, J. Business engagement in a civil society: Transitioning towards a dementia-friendly visitor economy. Tour. Manag. 2017, 61, 110–128. [Google Scholar] [CrossRef] [Green Version]

- World Travel and Tourism Council. Visitor Economy. Available online: https://www.foundationforpuertorico.org/visitoreconomy (accessed on 29 November 2019).

- Victoria State Government. Victorian Visitor Economy Review. Available online: https://economicdevelopment.vic.gov.au/__data/assets/pdf_file/0006/1340979/Visitor_Economy_Strategy.pdf (accessed on 29 November 2019).

- Deloltte. The Economic Case for the Visitor Economy. Available online: https://www.visitbritain.org/sites/default/files/vb-corporate/Documents-Library/documents/EconomicCaseforTourism.pdf (accessed on 30 November 2019).

- Dzhandzhugazova, E.A.; Ilina, E.L. Crowdfunding as a tool for promotion and development of tourism-related innovation projects. J. Environ. Manag. Tour. 2017, 8, 896–902. [Google Scholar] [CrossRef]

- Wang, Z.; Li, H.; Law, R. Determinants of tourism crowdfunding performance: An empirical study. Tour. Anal. 2017, 22, 323–336. [Google Scholar] [CrossRef]

- Beier, M.; Wagner, K. Crowdfunding Success of Tourism Projects—Evidence from Switzerland. Available online: http://ssrn.com/abstract=2520925 (accessed on 29 November 2019).

- Grèzes, V.; Emery, L.; Schegg, R.; Perruchoud, A. Crowdfunded Tourism Activities: Study on the Direct Impact of Swiss Crowdfunding Platforms on the Tourism Industry. Available online: https://www.hevs.ch/media/document/1/grezes-et-al.-2015-crowdfunded-tourism-activities_study-on-the-direct-impact-of-swiss-crowdfunding-platforms-on-the-tourism-industry.pdf (accessed on 29 November 2019).

- Boiko, M.G.; Vedmid, N.I.; Okhrimenko, A.G. The crowdfunding technology in development of the national tourism system. Financ. Credit Act. Probl. Theory Pract. 2017, 2, 91–100. [Google Scholar] [CrossRef] [Green Version]

- Bento, N.; Gianfrate, G.; Groppo, S.V. Do crowdfunding returns reward risk? Evidences from clean-tech projects. Technol. Forecast. Soc. Chang. 2019, 141, 107–116. [Google Scholar] [CrossRef] [Green Version]

- Temelkov, Z.; Gulev, G. Role of Crowdfunding Platforms in Rural Tourism Development. Available online: http://sociobrains.com/MANUAL_DIR/SocioBrains/Issue%2056,%20April%202019/11%20Zoran%20Temelkov,%20Gule%20Gulev%202.pdf (accessed on 29 November 2019).

- Prahalad, C.K.; Ramaswamy, V. Co-creation experiences: The next practice in value creation. J. Interact. Mark. 2004, 18, 5–14. [Google Scholar] [CrossRef] [Green Version]

- Payne, A.F.; Storbacka, K.; Frow, P. Managing the co-creation of value. J. Acad. Mark. Sci. 2008, 36, 83–96. [Google Scholar] [CrossRef]

- Quero, M.J.; Ventura, R.; Kelleher, C. Value-in-context in crowdfunding ecosystems: How context frames value co-creation. Serv. Bus. 2017, 11, 405–425. [Google Scholar] [CrossRef]

- Perugini, M.; Bagozzi, R.P. The role of desires and anticipated emotions in goal-directed behaviours: Broadening and deepening the theory of planned behaviour. Br. J. Soc. Psychol. 2001, 40, 79–98. [Google Scholar] [CrossRef] [PubMed]

- Shneor, R.; Munim, Z.H. Reward crowdfunding contribution as planned behaviour: An extended framework. J. Bus. Res. 2019, 103, 56–70. [Google Scholar] [CrossRef]

- Ajzen, I.; Fishbein, M. Attitude-behavior relations: A theoretical analysis and review of empirical research. Psychol. Bull. 1977, 84, 888–918. [Google Scholar] [CrossRef]

- Lacan, C.; Desmet, P. Does the crowdfunding platform matter? Risks of negative attitudes in two-sided markets. J. Consum. Mark. 2017, 34, 472–479. [Google Scholar] [CrossRef]

- Rodriguez-Ricardo, Y.; Sicilia, M.; López, M. What drives crowdfunding participation? The influence of personal and social traits. Span. J. Mark. ESIC 2018, 22, 163–182. [Google Scholar] [CrossRef] [Green Version]

- Adams, C. Crowdfunding Guidance and Practice: Value Added Co-Creation. Available online: http://blogs.oii.ox.ac.uk/ipp-conference/sites/ipp/files/documents/IPP2014_Adams.pdf (accessed on 9 October 2019).

- Ajzen, I. The theory of planned behavior. Organ. Behav. Hum. Decis. Process. 1991, 50, 179–211. [Google Scholar] [CrossRef]

- Conner, M.; Abraham, C. Conscientiousness and the theory of planned behavior: Toward a more complete model of the antecedents of intentions and behavior. Personal. Soc. Psychol. Bull. 2001, 27, 1547–1561. [Google Scholar] [CrossRef]

- Cai, C.W. Disruption of financial intermediation by FinTech: A review on crowdfunding and blockchain. Account. Financ. 2018, 58, 965–992. [Google Scholar] [CrossRef] [Green Version]

- Fenwick, M.; McCahery, J.A.; Vermeulen, E.P.M. Fintech and the financing of entrepreneurs: From crowdfunding to marketplace lending. SSRN Electron. J. 2017. [Google Scholar] [CrossRef]

- Wonglimpiyarat, J. Challenges and dynamics of FinTech crowd funding: An innovation system Approach. J. High Technol. Manag. Res. 2018, 29, 98–108. [Google Scholar] [CrossRef]

- Ahlstrom, D.; Cumming, D.J.; Vismara, S. New methods of entrepreneurial firm financing: Fintech, crowdfunding and corporate governance implications. Corp. Gov. Int. Rev. 2018, 26, 310–313. [Google Scholar] [CrossRef]

- Churchill, G.A., Jr. A paradigm for developing better measures of marketing constructs. J. Mark. Res. 1979, 16, 64–73. [Google Scholar] [CrossRef]

- Brislin, R.W. Back-translation for cross-cultural research. J. Cross. Cult. Psychol. 1970, 1, 185–216. [Google Scholar] [CrossRef]

- Wright, K.B. Researching internet-based populations: Advantages and disadvantages of online survey research, online questionnaire authoring software packages, and web survey services. J. Comput. Commun. 2005, 10, JCMC1034. [Google Scholar] [CrossRef]

- Embrain. The Largest Panel in Asia 3 Million Panelists. Available online: http://www.embrain.com/eng/ (accessed on 12 May 2019).

- Lee, Y.S.; Lee, J.; Lee, K.T. Amounts of responding times and unreliable responses at online survey. Surv. Res. 2008, 9, 51–83. [Google Scholar]

- Korea Internet & Security Agency. Survey Report on the Internet Usage. Available online: https://www.kisa.or.kr/eng/usefulreport/surveyReport_View.jsp?cPage=1&p_No=262&b_No=262&d_No=82&ST=&SV= (accessed on 12 May 2019).

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis; Prentice Hall: Upper Saddle River, NJ, USA, 2010. [Google Scholar]

- American Association for Public Opinion Research. Standard Definitions: Final Dispositions of Case Codes and Outcome Rates for Surveys. Available online: http://www.aapor.org/AAPOR_Main/media/publications/Standard-Definitions20169theditionfinal.pdf (accessed on 12 May 2019).

- Hair, J.F., Jr.; Hult, G.T.M.; Ringle, C.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM), 2nd ed.; Sage Publications: Thousand Oaks, CA, USA, 2017. [Google Scholar] [CrossRef]

- Ringle, C.M.; Wende, S.; Becker, J.M. SmartPLS 3.2.8. Available online: http://www.smartpls.com (accessed on 22 September 2018).

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879–903. [Google Scholar] [CrossRef]

- Korsgaard, M.A.; Roberson, L. Procedural justice in performance evaluation: The role of instrumental and non-instrumental voice in performance appraisal discussions. J. Manag. 1995, 21, 657–669. [Google Scholar] [CrossRef]

- Hair, J.F.; Sarstedt, M.; Ringle, C.M.; Mena, J.A. An assessment of the use of partial least squares structural equation modeling in marketing research. J. Acad. Mark. Sci. 2012, 40, 414–433. [Google Scholar] [CrossRef]

- Hair, J.F.; Sarstedt, M.; Hopkins, L.; Kuppelwieser, V.G. Partial least squares structural equation modeling (PLS-SEM). Eur. Bus. Rev. 2014, 26, 106–121. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2014, 43, 115–135. [Google Scholar] [CrossRef] [Green Version]

- Cohen, J. A power primer. Psychol. Bull. 1992, 112, 155–159. [Google Scholar] [CrossRef] [PubMed]

- Brent, D.A.; Lorah, K. The economic geography of civic crowdfunding. Cities 2019, 90, 122–130. [Google Scholar] [CrossRef]

- Jancenelle, V.E.; Javalgi, R.R.G.; Cavusgil, E. The role of economic and normative signals in international prosocial crowdfunding: An illustration using market orientation and psychological capital. Int. Bus. Rev. 2018, 27, 208–217. [Google Scholar] [CrossRef]

- Renwick, M.J.; Mossialos, E. Crowdfunding our health: Economic risks and benefits. Soc. Sci. Med. 2017, 191, 48–56. [Google Scholar] [CrossRef] [Green Version]

- Sakamoto, M.; Nakajima, T. Micro-crowdfunding: Achieving a sustainable society through economic and social incentives in micro-level crowdfunding. In Proceedings of the 12th International Conference on Mobile and Ubiquitous Multimedia, MUM 2013, New York, NY, USA, 2–5 December2013. [Google Scholar] [CrossRef]

- Wang, C. The promise of Kickstarter: Extents to which social networks enable alternate avenues of economic viability for independent musicians through crowdfunding. Soc. Media Soc. 2016. [Google Scholar] [CrossRef]

- Wehnert, P.; Baccarella, C.V.; Beckmann, M. In crowdfunding we trust? Investigating crowdfunding success as a signal for enhancing trust in sustainable product features. Technol. Forecast. Soc. Chang. 2018, 141, 128–137. [Google Scholar] [CrossRef]

- Cumming, D.J.; Leboeuf, G.; Schwienbacher, A. Crowdfunding Models: Keep-It-All vs. All-or-Nothing. Available online: https://onlinelibrary.wiley.com/doi/abs/10.1111/fima.12262 (accessed on 29 November 2019).

- Cumming, D.J.; Leboeuf, G.; Schwienbacher, A. Crowdfunding cleantech. Energy Econ. 2017, 65, 292–303. [Google Scholar] [CrossRef]

| Characteristics | Reward (%) | Investment (%) | Characteristics | Reward (%) | Investment (%) |

|---|---|---|---|---|---|

| Gender | Career participation length | ||||

| Male | 47.5 | 63.4 | Less than 7 months | 47.0 | 29.4 |

| Female | 52.5 | 36.6 | 7–12months | 26.0 | 35.0 |

| Age | 13–36 months | 24.5 | 31.6 | ||

| Less than 20 years old | 9.2 | 1.6 | 37 months and over | 2.5 | 4.0 |

| 20–29 years old | 28.5 | 21.1 | Experienced fields ** | ||

| 30–39 years old | 25.0 | 29.3 | Product reward | 59.5 | 24.4 |

| 40–49 years old | 23.7 | 28.5 | Non-product reward (e.g., services, experiences) | 55.1 | 19.5 |

| 50–59 years old | 9.8 | 13.0 | Equity | 19.1 | 67.5 |

| 60 years old and over | 3.8 | 6.5 | Lending | 12.3 | 50.4 |

| Educational level | Frequency of visiting platforms | ||||

| Less than or high school diploma | 20.9 | 13.0 | Daily | 2.2 | 4.1 |

| 2-year college | 9.8 | 7.3 | Weekly | 14.2 | 10.6 |

| University | 55.4 | 69.1 | Monthly | 21.5 | 29.3 |

| Graduate school or higher | 13.9 | 10.6 | Quarterly | 33.3 | 30.1 |

| Marital status | Yearly | 28.8 | 26.0 | ||

| Single | 51.9 | 47.2 | Average investment amount | ||

| Married | 46.2 | 49.5 | From 10,000 to less than 30,000 KRW | 16.1 | 5.7 |

| Divorce | 1.9 | 3.3 | From 30,000 to 90,000 KRW | 36.1 | 7.3 |

| Monthly household income | From 100,000 to 900,000 KRW | 36.0 | 58.5 | ||

| Less than 2.00 million KRW * | 4.1 | 4.9 | From 1 million KRW to over | 11.8 | 28.5 |

| From 2.00 to 3.99 million KRW | 23.4 | 28.5 | Primary reason for crowdfunding | ||

| From 4.00 to 5.99 million KRW | 30.8 | 29.2 | Product reward | 55.1 | |

| From 6.00 to 6.99 million KRW | 21.8 | 18.7 | Non-product reward (e.g., services, experiences) | 44.9 | |

| From 8.00 million KRW to over | 19.9 | 18.7 | Investment | - | 62.6 |

| Occupation | Lending | - | 37.4 | ||

| Professionals | 10.4 | 13.9 | Participated projects | ||

| Business owner | 5.7 | 7.3 | Travel and leisure | 31.7 | 26.9 |

| Service worker | 4.7 | 2.4 | Sports | 2.5 | 2.4 |

| Office worker | 41.9 | 53.8 | Films | 10.4 | 13.0 |

| Civil servant | 3.8 | 0.8 | Game | 6.0 | 6.5 |

| Home maker | 7.3 | 8.9 | Art/Culture (fine art, craft, photography) | 25.0 | 13.8 |

| Retiree | 0.9 | 0.0 | Music | 1.6 | 1.6 |

| Student | 19.0 | 8.1 | Other (e.g., food/beverage, events, hobbies) | 22.8 | 35.8 |

| Unemployed | 3.8 | 2.4 | Used visitor economy-related platforms | ||

| Other | 2.5 | 2.4 | OhMyCompnay | 6.0 | 5.7 |

| Residential district | Wadiz | 42.1 | 40.7 | ||

| Metropolitan areas | 60.4 | 60.2 | Corwdy | 11.1 | 13.8 |

| Non-metropolitan areas | 39.6 | 39.8 | Tumblebug | 21.5 | 1.6 |

| Characteristics of project | HappyBean | 6.3 | 7.3 | ||

| Profit crowdfunding project | 58.8 | 71.5 | Other | 13.0 | 30.9 |

| Non-profit crowdfunding project | 26.3 | 9.8 | Involved in overseas funding | ||

| Don’t know | 14.9 | 18.7 | Yes | 13.6 | 7.3 |

| No | 86.4 | 92.7 |

| Constructs | Factor Loading | Mean | Skewness | Kurtosis |

|---|---|---|---|---|

| Co-creation on crowdfunding project | ||||

| 1. The visitor economy crowdfundraiser encourages co-creation with funders. | 0.877 | 4.794 | −0.265 | 0.109 |

| 2. The visitor economy crowdfundraiser encourages co-creation with the platform. | 0.847 | 4.652 | −0.303 | 0.260 |

| 3. The visitor economy crowdfundraiser encourages co-creation with employees. | 0.798 | 4.500 | −0.337 | 0.760 |

| 4. The visitor economy crowdfundraiser encourages co-creation with others. | 0.805 | 4.559 | −0.219 | 0.397 |

| Attitude | ||||

| 1. Participating in visitor economy crowdfunding is an affirmative behavior. | 0.877 | 5.023 | −0.443 | 0.534 |

| 2. Participating in visitor economy crowdfunding is a beneficial behavior. | 0.863 | 4.907 | −0.139 | 0.157 |

| 3. Participating in visitor economy crowdfunding is a valuable behavior. | 0.857 | 5.000 | −0.334 | 0.676 |

| 4. Participating in visitor economy crowdfunding is an essential behavior. | 0.835 | 4.618 | −0.142 | 0.344 |

| 5. Participating in visitor economy crowdfunding is a legitimate behavior. | 0.808 | 4.584 | −0.043 | 0.264 |

| Subjective norm | ||||

| 1. Most people who are close to me agree with my participation in visitor economy crowdfunding. | 0.903 | 4.516 | −0.283 | 0.029 |

| 2. Most people who are close to me support my participation in visitor economy crowdfunding. | 0.908 | 4.405 | −0.120 | 0.057 |

| 3. Most people who are close to me understand my participation in visitor economy crowdfunding. | 0.893 | 4.666 | −0.142 | −0.053 |

| Positive anticipated emotion | ||||

| 1. If I participate in visitor economy crowdfunding, I will be excited. | 0.899 | 4.536 | −0.474 | 0.929 |

| 2. If I participate in visitor economy crowdfunding, I will be glad. | 0.890 | 4.643 | −0.371 | 0.966 |

| 3. If I participate in visitor economy crowdfunding, I will be happy. | 0.908 | 4.567 | −0.347 | 0.914 |

| 4. If I participate in visitor economy crowdfunding, I will be satisfied. | 0.872 | 4.864 | −0.607 | 1.618 |

| Negative anticipated emotion | ||||

| 1. If I fail to participate in visitor economy crowdfunding, I will be disappointed. | 0.922 | 3.462 | 0.254 | −0.464 |

| 2. If I fail to participate in visitor economy crowdfunding, I will be sad. | 0.902 | 3.292 | 0.165 | −0.579 |

| 3. If I fail to participate in visitor economy crowdfunding, I will be sorry. | 0.877 | 3.848 | −0.273 | −0.632 |

| Perceived behavioral control | ||||

| 1. I am financially able to participate in visitor economy crowdfunding. | 0.791 | 4.819 | −0.124 | −0.146 |

| 2. I have enough time to participate in visitor economy crowdfunding. | 0.857 | 4.900 | −0.350 | 0.076 |

| 3. I have an opportunity to participate in visitor economy crowdfunding. | 0.870 | 5.109 | −0.287 | 0.182 |

| Desire for crowdfunding participation | ||||

| 1. I hope to participate in visitor economy crowdfunding. | 0.881 | 4.871 | −0.660 | 1.135 |

| 2. I am eager to participate in visitor economy crowdfunding. | 0.903 | 4.234 | −0.305 | 0.281 |

| 3. I am enthusiastic in my desire to participate in visitor economy crowdfunding. | 0.905 | 4.197 | −0.243 | 0.116 |

| Behavioral intention to crowdfunding | ||||

| 1. I have a willingness to invest in visitor economy crowdfunding. | 0.865 | 4.991 | −0.559 | 1.010 |

| 2. I would like to encourage people around me to invest in visitor economy crowdfunding. | 0.868 | 4.407 | −0.267 | 0.347 |

| 3. I have a willingness to invest in visitor economy crowdfunding regularly. | 0.812 | 4.597 | −0.337 | 0.164 |

| 4. I have a willingness to invest the visitor economy crowdfunding within a year. | 0.803 | 4.975 | −0.536 | 0.555 |

| Construct | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|

| 1. Co-creation on crowdfunding project | ||||||||

| 2. Attitude | 0.586 | |||||||

| 3. Subjective norm | 0.520 | 0.586 | ||||||

| 4. Positive anticipated emotion | 0.591 | 0.705 | 0.647 | |||||

| 5. Negative anticipated emotion | 0.370 | 0.437 | 0.391 | 0.564 | ||||

| 6. Perceived behavioral control | 0.444 | 0.578 | 0.576 | 0.643 | 0.327 | |||

| 7. Desire for crowdfunding participation | 0.558 | 0.709 | 0.590 | 0.793 | 0.684 | 0.567 | ||

| 8. Behavioral intention to crowdfunding | 0.508 | 0.611 | 0.482 | 0.614 | 0.264 | 0.673 | 0.521 | |

| AVE ≥ 0.5 | 0.693 | 0.720 | 0.813 | 0.797 | 0.811 | 0.706 | 0.803 | 0.698 |

| Composite reliability (CR) ≥ 0.7 | 0.900 | 0.928 | 0.929 | 0.940 | 0.928 | 0.878 | 0.925 | 0.902 |

| Rho_A (reliability coefficient) ≥ 0.7 | 0.858 | 0.904 | 0.886 | 0.916 | 0.884 | 0.795 | 0.879 | 0.859 |

| Cronbach’s alpha (α) ≥ 0.7 | 0.852 | 0.902 | 0.885 | 0.915 | 0.883 | 0.791 | 0.878 | 0.855 |

| Q2 (predictive relevance) > 0 | 0.179 | 0.475 | 0.253 |

| H10 | Path | Reward Group (A) | Investment Group (B) | t-Value (A-B) | p-Value (A-B) | Hypothesis Test |

|---|---|---|---|---|---|---|

| H10a | Co-creation on crowdfunding project → Attitude toward crowdfunding | 0.541 *** | 0.446 *** | 15.197 | <0.001 | Supported |

| H10b | Co-creation on crowdfunding project → Behavioral intention to crowdfunding | 0.215 ** | 0.222 ** | −0.910 | ns | Not supported |

| H10c | Attitude → Desire for crowdfunding | 0.254 *** | 0.204 * | 6.264 | <0.001 | Supported |

| H10d | Subjective norm → Desire for crowdfunding | 0.076 ns | 0.025 ns | 8.150 | <0.001 | Supported |

| H10e | Positive anticipated emotion → Desire for crowdfunding | 0.365 *** | 0.251 * | 11.749 | <0.001 | Supported |

| H10f | Negative anticipated emotion → Desire for crowdfunding | 0.258 *** | 0.417 *** | −27.737 | <0.001 | Supported |

| H10g | Perceived behavioral control → Desire for crowdfunding | 0.008 ns | 0.198 ** | −27.165 | <0.001 | Supported |

| H10h | Perceived behavior control → Behavioral intention | 0.384 *** | 0.492 *** | −6.197 | <0.001 | Supported |

| H10i | Desire for crowdfunding → Behavioral intention | 0.133 ns | 0.225 * | −11.157 | <0.001 | Supported |

| R2: Explanatory power (coefficient of determination) | ||||||

| Reward group: Attitude (29.2%); Desire (59.9%); Behavioral intention (33.9%) | ||||||

| Investment group: Attitude (19.9%); Desire (73.6%); Behavioral intention (52.5%) | ||||||

| Path | Direct Effect | Indirect Effect | Total Effect | Inner VIF a | f2 b |

|---|---|---|---|---|---|

| Co-creation on crowdfunding → Attitude | 0.517 *** | 0.517 *** | 1.000 | 0.365 | |

| Co-creation on crowdfunding → Desire | 0.122 *** | 0.122 *** | |||

| Co-creation on crowdfunding → Behavioral intention | 0.210 *** | 0.020 * | 0.229 *** | 1.349 | 0.053 |

| Attitude → Desire for crowdfunding | 0.236 *** | 0.236 *** | 1.873 | 0.081 | |

| Attitude → Behavioral intention | 0.038 * | 0.038 * | |||

| Subjective norm → Desire for crowdfunding | 0.069 ns | 0.069 ns | 1.677 | 0.008 | |

| Subjective norm → Behavioral intention | 0.011 ns | 0.011 ns | |||

| Positive anticipated emotion → Desire for crowdfunding | 0.336 *** | 0.336 *** | 2.383 | 0.130 | |

| Positive anticipated emotion → Behavioral intention | 0.054 * | 0.054 * | |||

| Negative anticipated emotion → Desire for crowdfunding | 0.298 *** | 0.298 *** | 1.370 | 0.177 | |

| Negative anticipated emotion → Behavioral intention | 0.048 ** | 0.048 ** | |||

| Perceived behavioral control → Desire for crowdfunding | 0.059 ns | 0.059 ns | 1.561 | 0.006 | |

| Perceived behavior control → Behavioral intention | 0.404 *** | 0.009 ns | 0.414 *** | 1.330 | 0.201 |

| Desire for crowdfunding → Behavioral intention | 0.160 ** | 0.160 ** | 1.508 | 0.028 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, M.J.; Hall, C.M. Can Co-Creation and Crowdfunding Types Predict Funder Behavior? An Extended Model of Goal-Directed Behavior. Sustainability 2019, 11, 7061. https://doi.org/10.3390/su11247061

Kim MJ, Hall CM. Can Co-Creation and Crowdfunding Types Predict Funder Behavior? An Extended Model of Goal-Directed Behavior. Sustainability. 2019; 11(24):7061. https://doi.org/10.3390/su11247061

Chicago/Turabian StyleKim, Myung Ja, and C. Michael Hall. 2019. "Can Co-Creation and Crowdfunding Types Predict Funder Behavior? An Extended Model of Goal-Directed Behavior" Sustainability 11, no. 24: 7061. https://doi.org/10.3390/su11247061

APA StyleKim, M. J., & Hall, C. M. (2019). Can Co-Creation and Crowdfunding Types Predict Funder Behavior? An Extended Model of Goal-Directed Behavior. Sustainability, 11(24), 7061. https://doi.org/10.3390/su11247061