Second Use Value of China’s New Energy Vehicle Battery: A View Based on Multi-Scenario Simulation

Abstract

:1. Introduction

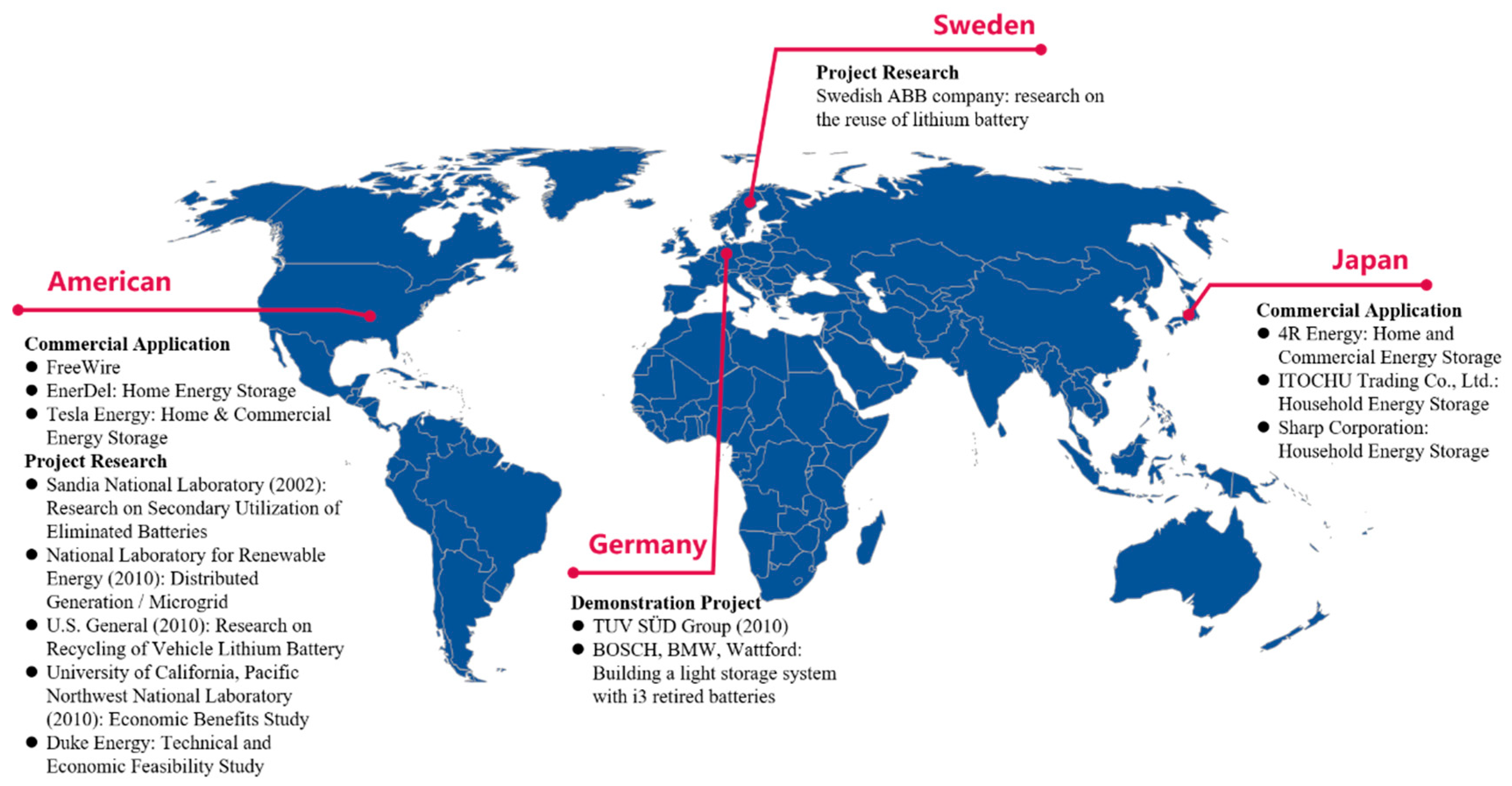

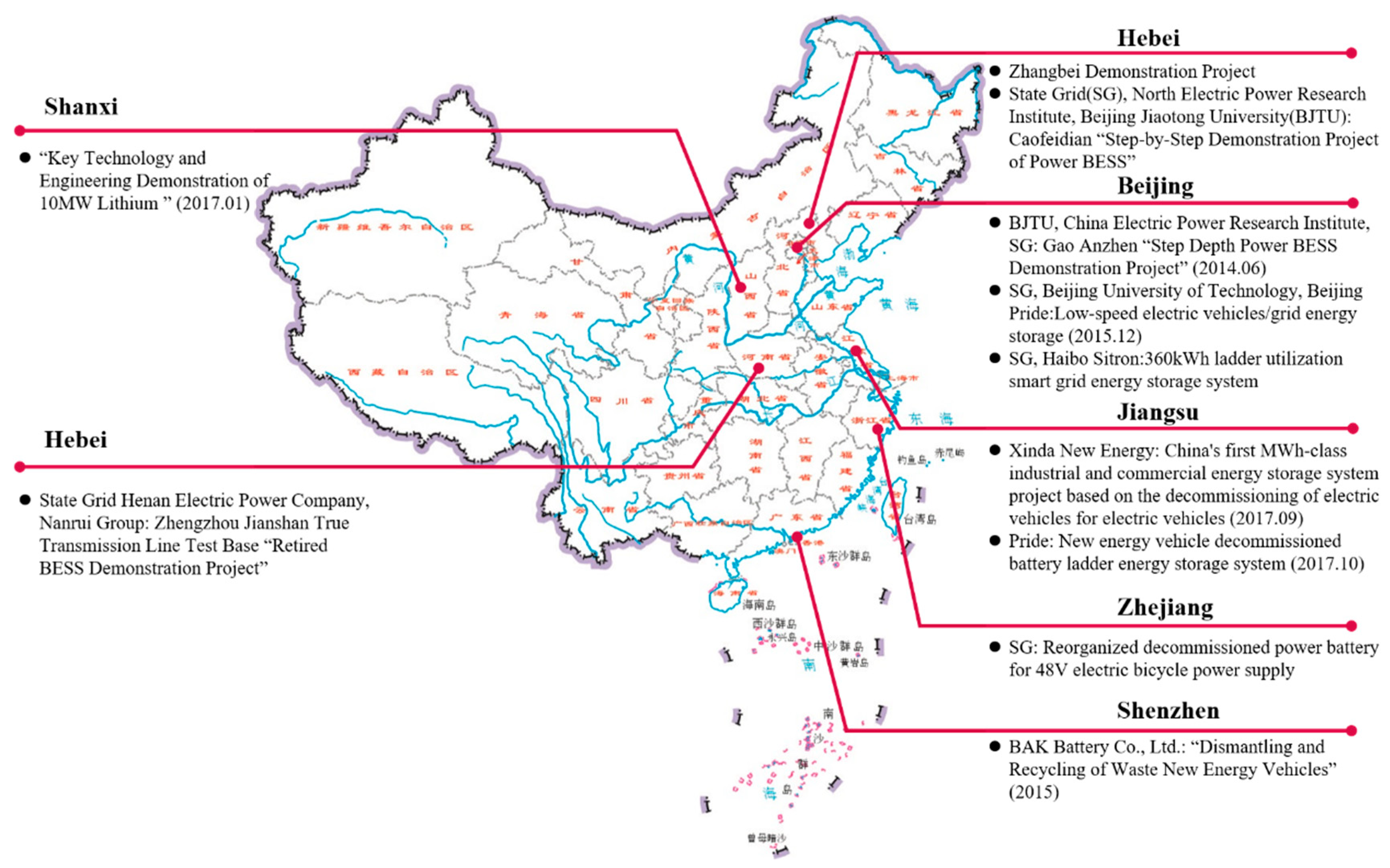

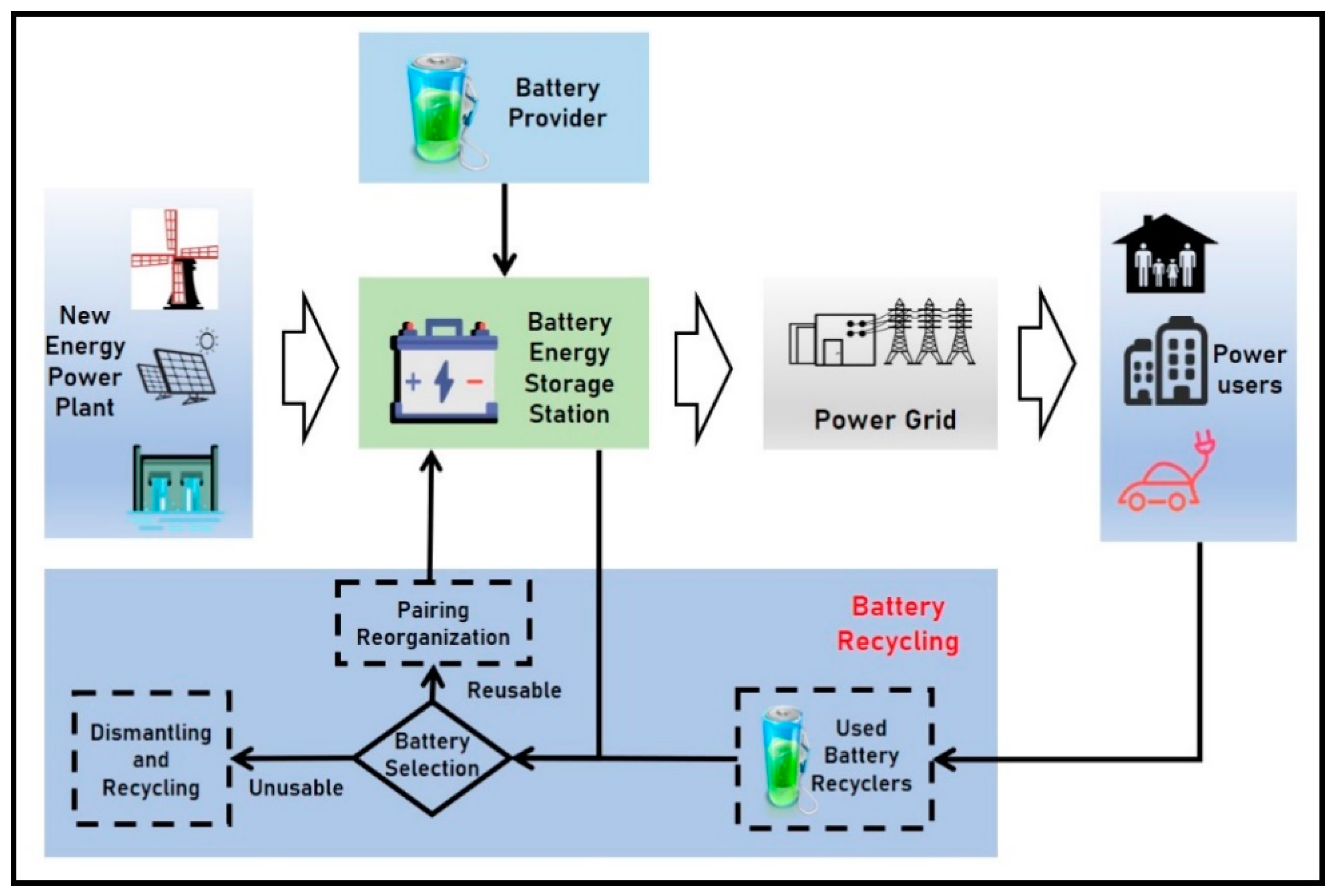

2. Development and Literature Review

3. Methodology and Research Framework

3.1. Methodology

- The cost of the monitoring system and the selection equipment are fixed, and they do not change with changes in the capacity of the energy storage station.

- The change in the rate of decline caused by each battery charge and discharge is negligible, that is, the annual income from balancing the power network load is calculated according to the battery degradation rate in the first year.

- The expected loss of power in the power outage is greater than the rated capacity of the energy storage system. That is, when the power is cut off, the rated capacity of the energy storage station is fully compensated to the power grid.

3.2. Research Framework

- Step 1: We analyze the technical indicators and cost indicators that affect the value of NEV’s battery second use in energy storage, and fully consider the quantitative indicators such as environmental income and government subsidies.

- Step 2: We summarize the causal relationship between various technical indicators and cost-effective indicators, which are based on the characteristics of the BESS structure.

- Step 3: By using the VENSIM software, we build the SD model under the correlation between the indicators.

- Step 4: Firstly, we calculate the application of the SD model in a special case and compare the value difference between the old and new batteries. Secondly, we select specific factors for case studies based on the actual situation, and make recommendations for future development.

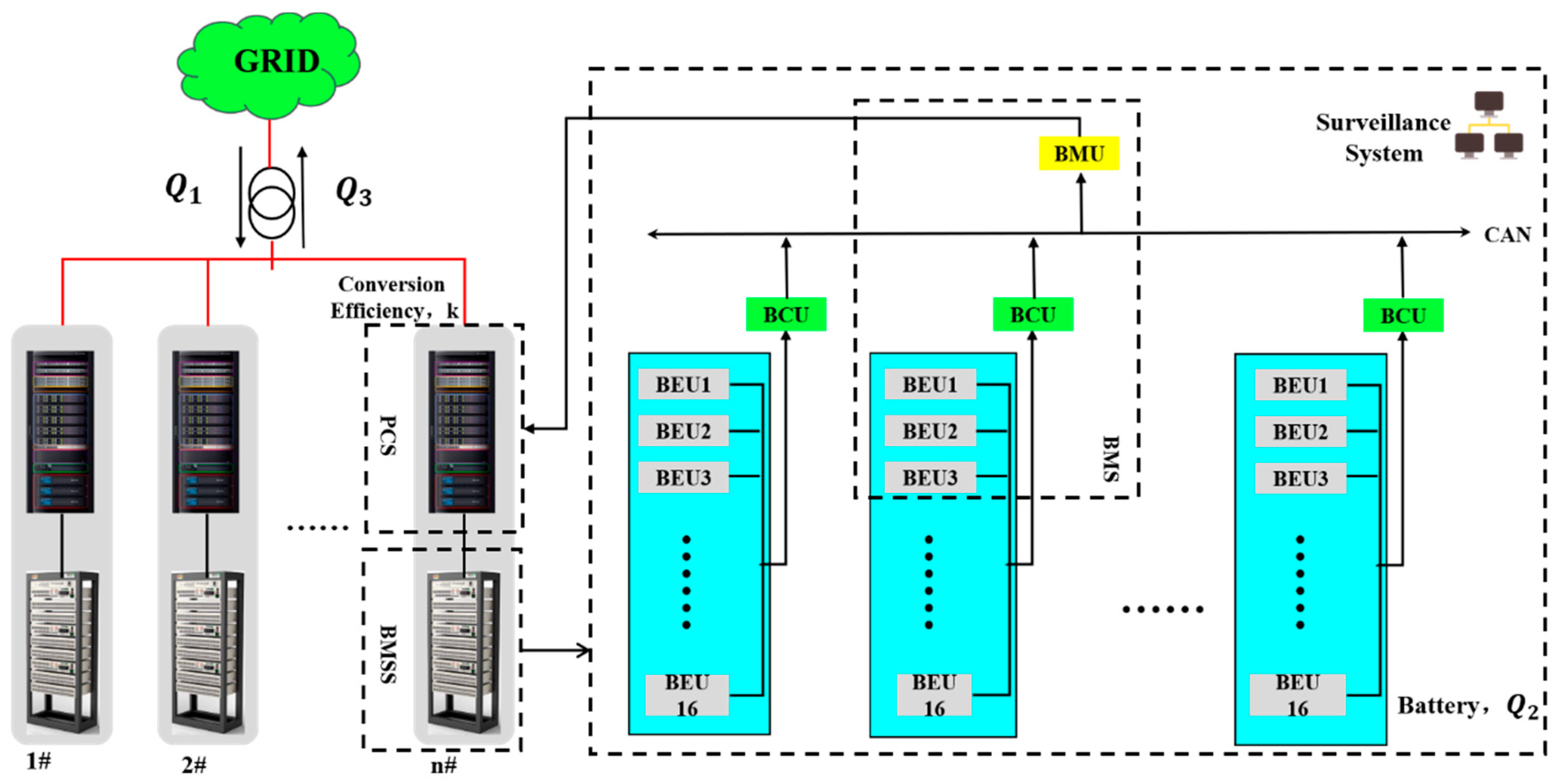

4. System Dynamic Model

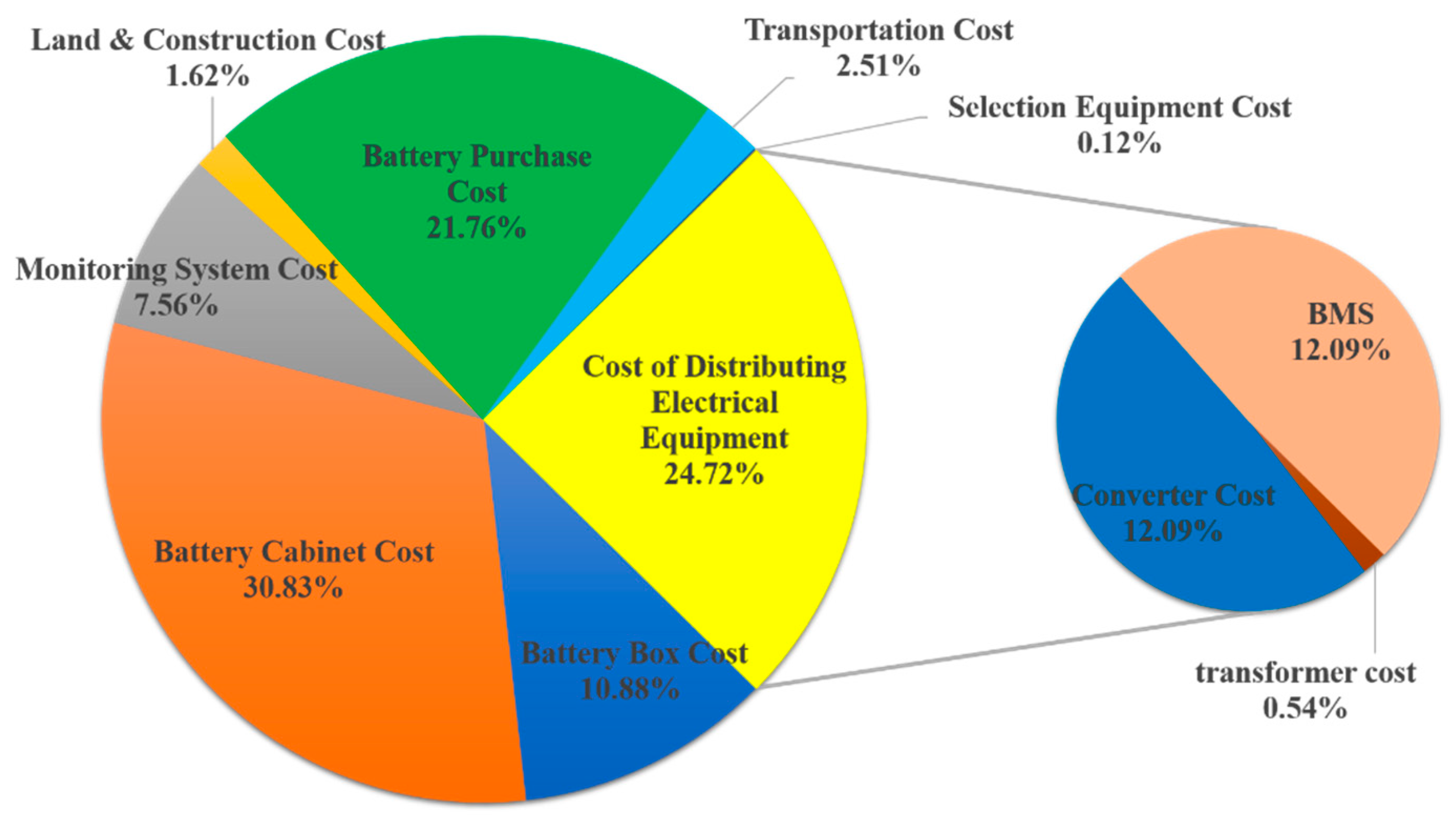

4.1. Initial Investment Cost (Part 1)

- is the land and construction costs, RMB.

- is the battery cost, RMB.

- is the equipment costs, RMB.

4.2. Annual Operating Cost (Part 2)

- is the annual labor cost, RMB.

- is the per capita monthly salary, RMB/Month.

- is the annual number of workers.

- is the annual equipment repair cost, RMB.

4.3. Battery Replaced Cost (Part 3)

- is the service life of the BESS, year.

- is the ratio of battery cost change, %.

- is the capacity degradation rate, %.

- is the battery capacity loss rate for each charge/discharge, %.

- is the daily charge and discharge times.

4.4. Direct Income (Part 4)

4.4.1. Income from Balancing the Power Network Load

- is the battery capacity loss rate for each charge/discharge, %.

- is the one-way conversion efficiency, %.

- is the BESS rated capacity, MWh.

- is the electricity price at the peak of electricity consumption, RMB/kWh.

- is the electricity price at the valley of electricity consumption, RMB/kWh.

4.4.2. Annual Government Subsidy

- is the BESS rated capacity, MWh.

- is the unit capacity government subsidy, RMB/kWh.

- is the daily charge and discharge times.

- is the annual interest rate, %.

- is the service life of the BESS, year.

4.4.3. Annual Average Residual Value

- is the average residual rate of fixed assets, %.

- is the old battery unit weight price, RMB/ton.

- is the total battery weight, tons.

- is the land and construction costs, RMB.

- is the equipment costs, RMB.

4.5. Indirect Income (Part 5)

4.5.1. Income from Postponing Power Grid Upgrade

- is the years postponed by power grid upgrade [62], years.

- is the rate of reduction of the peak electricity consumption, %.

- is the annual growth rate of the peak load, %.

- is the unit capacity power grid construction cost, RMB/kWh.

- is the annual interest rate, %.

- is the BESS rated capacity, MWh.

4.5.2. Income from Increased Grid Reliability

- is the annual power outage frequency, times/year.

- is the comprehensive economic loss of the power outage per unit capacity, RMB.

- is the average power outage expected loss capacity, kWh.

4.5.3. Environmental Income

- is the electric emission factor, tons/MWh.

- is the carbon trading price, RMB/tons.

4.6. Net Present Value (NPV, Part 6)

5. Multi-Scenario Simulation

5.1. Data

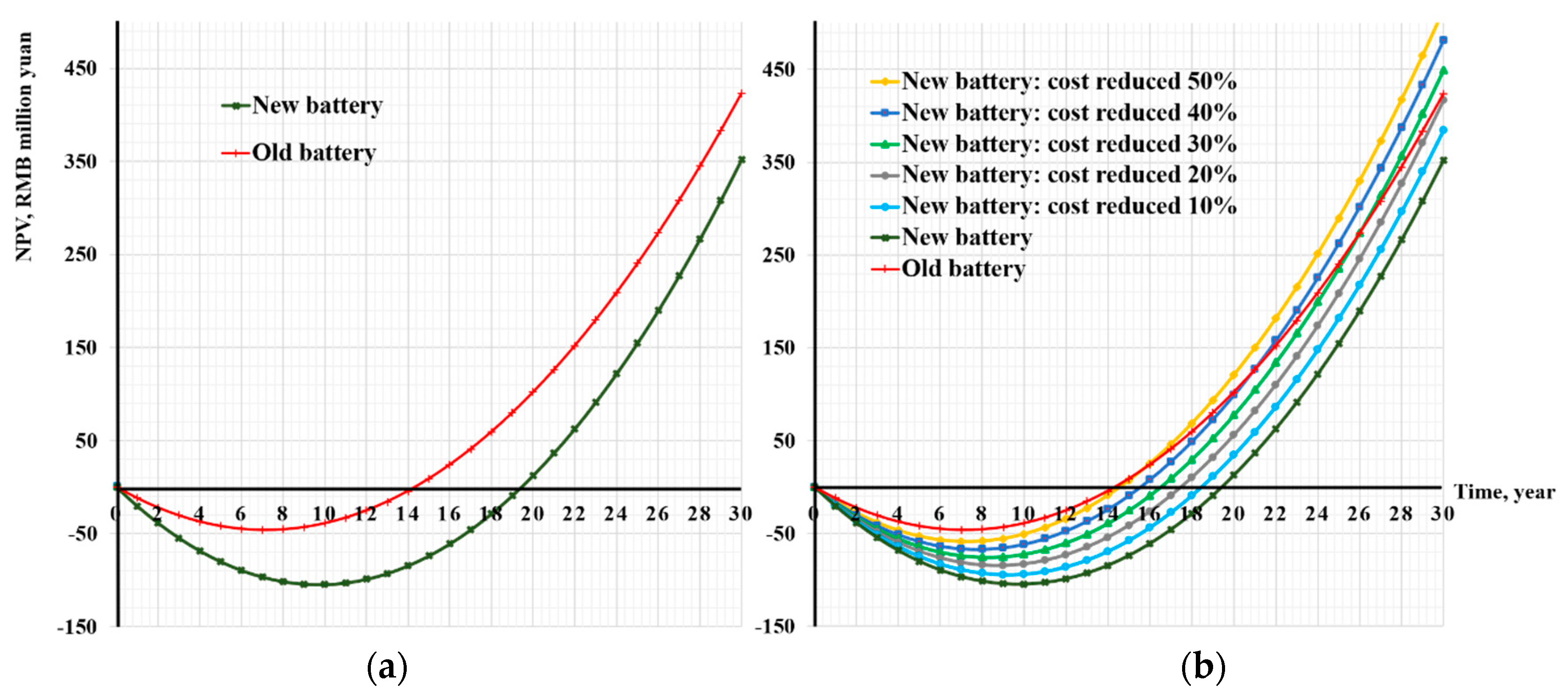

5.2. Model Simulation

5.3. Multiple Scenario Analysis

5.3.1. Factor Selection

5.3.2. Scenarios Simulation

- 1.

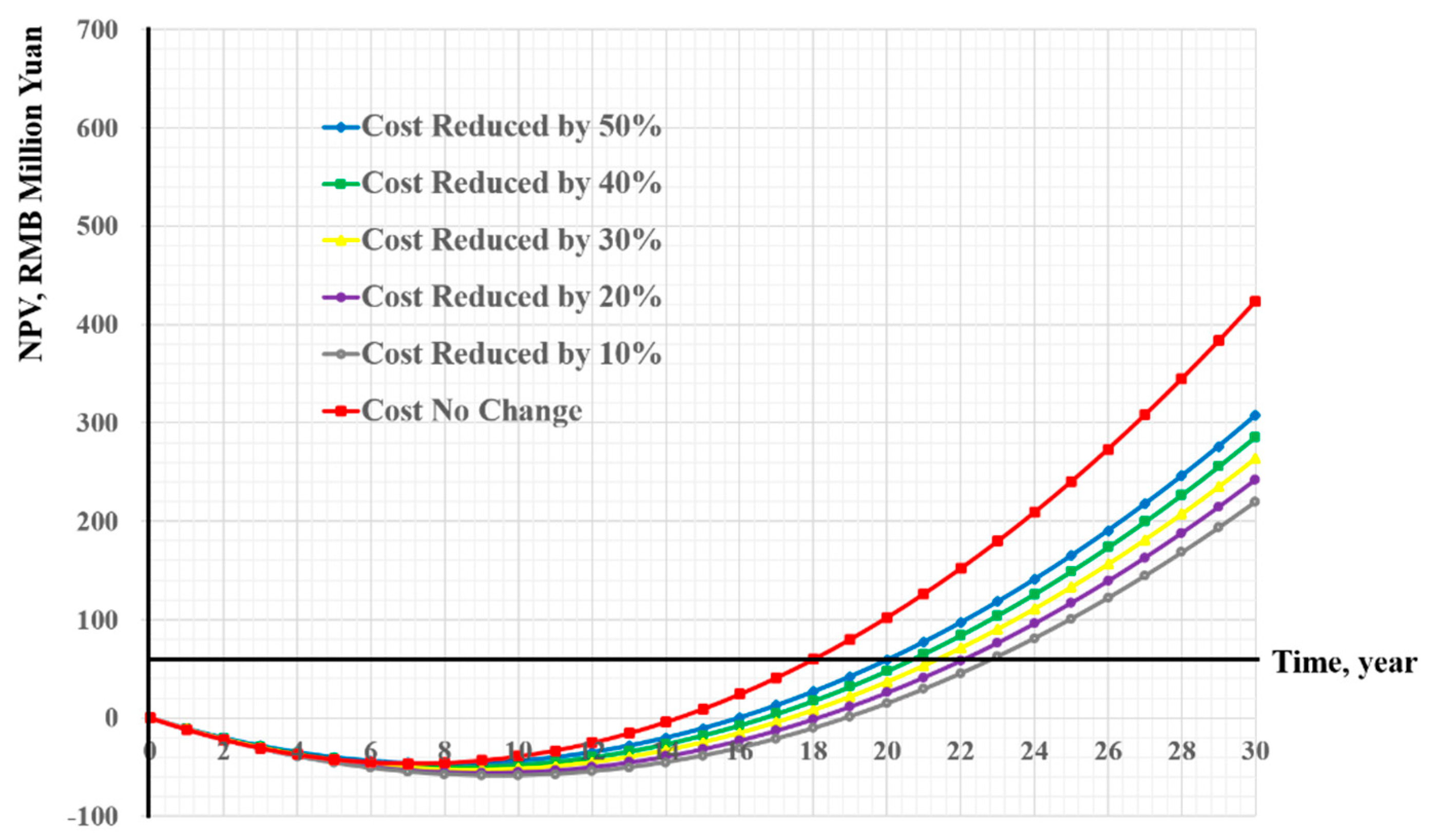

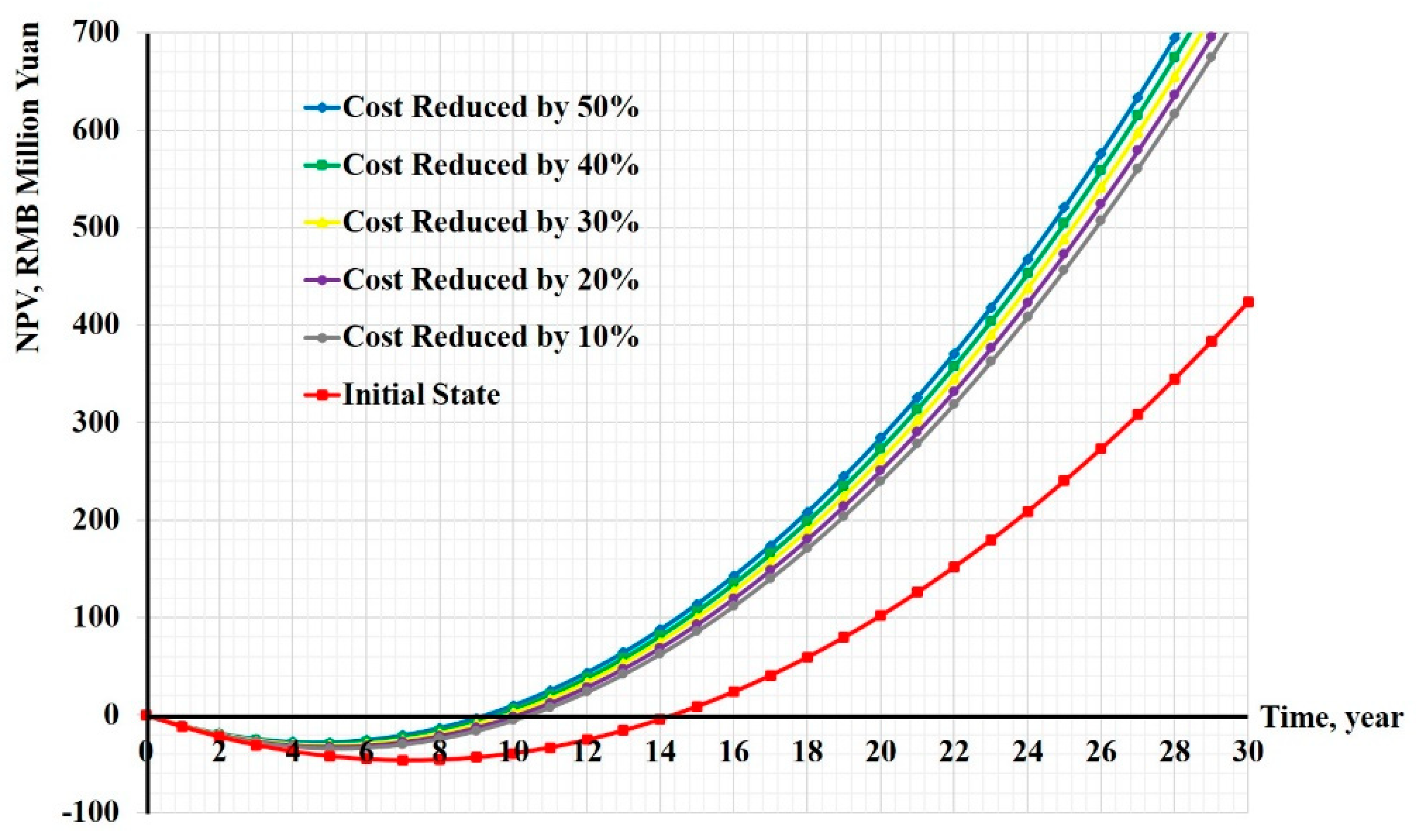

- (Scenario 1) The government will no longer provide subsidies, the cost of the old battery will be reduced by 10%, and the electricity price will remain unchanged. The parameters are shown in Table 3.

- 2.

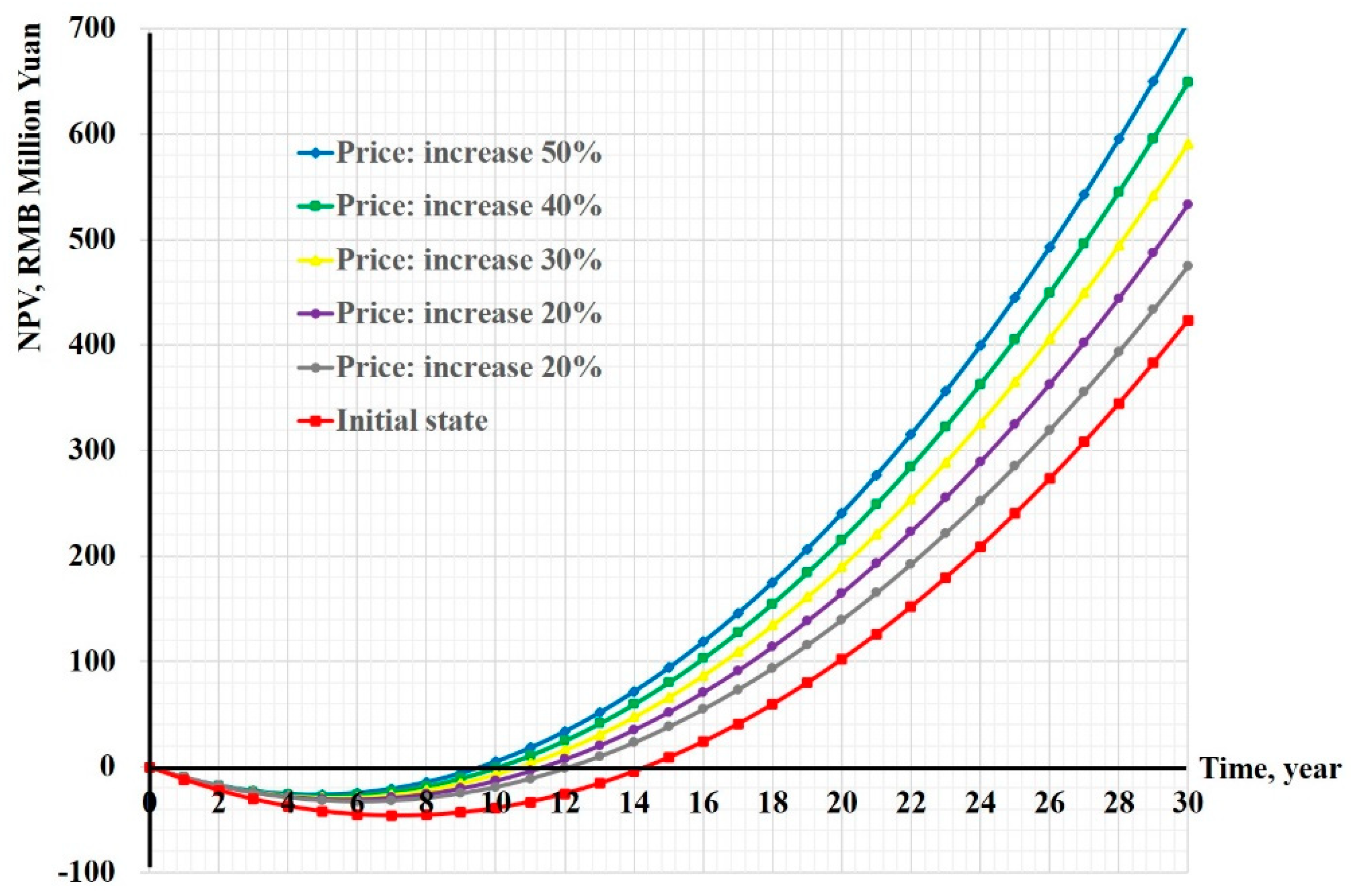

- (Scenario 2) In order to encourage the market to use the electric vehicle battery for second use, the government changed the model of “providing government subsidies to related enterprises” to “no government subsidies, but old batteries are provided for free.” At the same time, the electricity price difference between the peak period and the valley period is continuously increasing.

- 3.

- (Scenario 3) In order to increase the utilization of new energy power stations, the government no longer provides cash subsidies to battery storage (similar to scenario 2), but the battery energy storage operators can obtain electricity for free, which means the cost of purchasing electricity is zero, that is, electricity price at the valley of power consumption in the model is 0. On this basis, the battery purchase cost decreased by 10%. Data are as shown in Table 5.

6. Discussion and Conclusions

6.1. Discussion

6.2. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Tiba, S.; Omri, A. Literature survey on the relationships between energy, environment and economic growth. Renew. Sustain. Energy Rev. 2017, 69, 1129–1146. [Google Scholar] [CrossRef]

- Lin, B.; Ouyang, X. Energy demand in China: Comparison of characteristics between the US and China in rapid urbanization stage. Energy Convers. Manag. 2014, 79, 128–139. [Google Scholar] [CrossRef]

- Tang, Y.; Zhang, Q.; Li, Y.; Wang, G.; Li, Y. Recycling mechanisms and policy suggestions for spent electric vehicles’ power battery—A case of Beijing. J. Clean Prod. 2018, 186, 388–406. [Google Scholar] [CrossRef]

- Podias, A.; Pfrang, A.; Di Persio, F.; Kriston, A.; Bobba, S.; Mathieux, F.; Messagie, M.; Boon-Brett, L. Sustainability Assessment of Second Use Applications of Automotive Batteries: Ageing of Li-Ion Battery Cells in Automotive and Grid-Scale Applications. World Electr. Veh. J. 2018, 9, 24. [Google Scholar] [CrossRef] [Green Version]

- Debnath, U.K.; Ahmad, I.; Habibi, D. Quantifying economic benefits of second life batteries of gridable vehicles in the smart grid. Int. J. Electr. Power 2014, 63, 577–587. [Google Scholar] [CrossRef]

- Neubauer, J.; Pesaran, A. The ability of battery second use strategies to impact plug-in electric vehicle prices and serve utility energy storage applications. J. Power Sources 2011, 196, 10351–10358. [Google Scholar] [CrossRef]

- Heymans, C.; Walker, S.B.; Young, S.B.; Fowler, M. Economic analysis of second use electric vehicle batteries for residential energy storage and load-levelling. Energy Policy 2014, 71, 22–30. [Google Scholar] [CrossRef]

- Gallo, A.B.; Simões-Moreira, J.R.; Costa, H.K.M.; Santos, M.M.; Moutinho Dos Santos, E. Energy storage in the energy transition context: A technology review. Renew. Sustain. Energy Rev. 2016, 65, 800–822. [Google Scholar] [CrossRef]

- Weimer, L.; Braun, T.; Hemdt, A.V. Design of a systematic value chain for lithium-ion batteries from the raw material perspective. Resour. Policy 2019, 64, 101473. [Google Scholar] [CrossRef]

- Bobba, S.; Mathieux, F.; Blengini, G.A. How will second-use of batteries affect stocks and flows in the EU? A model for traction Li-ion batteries. Resour. Conserv. Recycl. 2019, 145, 279–291. [Google Scholar] [CrossRef]

- Gu, X.; Ieromonachou, P.; Zhou, L.; Tseng, M. Developing pricing strategy to optimise total profits in an electric vehicle battery closed loop supply chain. J. Clean Prod. 2018, 203, 376–385. [Google Scholar] [CrossRef]

- Martin, G.; Rentsch, L.; Höck, M.; Bertau, M. Lithium market research—Global supply, future demand and price development. Energy Storage Mater. 2017, 6, 171–179. [Google Scholar] [CrossRef]

- Liu, D.; Xiao, B. Exploring the development of electric vehicles under policy incentives: A scenario-based system dynamics model. Energy Policy 2018, 120, 8–23. [Google Scholar] [CrossRef]

- Zakeri, B.; Syri, S. Electrical energy storage systems: A comparative life cycle cost analysis. Renew. Sustain. Energy Rev. 2015, 42, 569–596. [Google Scholar] [CrossRef]

- Winfield, M.; Shokrzadeh, S.; Jones, A. Energy policy regime change and advanced energy storage: A comparative analysis. Energy Policy 2018, 115, 572–583. [Google Scholar] [CrossRef]

- Zheng, M.; Wang, X.; Meinrenken, C.J.; Ding, Y. Economic and environmental benefits of coordinating dispatch among distributed electricity storage. Appl. Energy 2018, 210, 842–855. [Google Scholar] [CrossRef]

- Escalante Soberanis, M.A.; Mithrush, T.; Bassam, A.; Mérida, W. A sensitivity analysis to determine technical and economic feasibility of energy storage systems implementation: A flow battery case study. Renew. Energy 2018, 115, 547–557. [Google Scholar] [CrossRef]

- Newbery, D. Shifting demand and supply over time and space to manage intermittent generation: The economics of electrical storage. Energy Policy 2018, 113, 711–720. [Google Scholar] [CrossRef]

- Sidhu, A.S.; Pollitt, M.G.; Anaya, K.L. A social cost benefit analysis of grid-scale electrical energy storage projects: A case study. Appl. Energy 2018, 212, 881–894. [Google Scholar] [CrossRef]

- Heredia, F.J.; Cuadrado, M.D.; Corchero, C. On optimal participation in the electricity markets of wind power plants with battery energy storage systems. Comput. Oper. Res. 2018, 96, 316–329. [Google Scholar] [CrossRef] [Green Version]

- Atherton, J.; Sharma, R.; Salgado, J. Techno-economic analysis of energy storage systems for application in wind farms. Energy 2017, 135, 540–552. [Google Scholar] [CrossRef] [Green Version]

- Agnew, S.; Dargusch, P. Consumer preferences for household-level battery energy storage. Renew. Sustain. Energy Rev. 2017, 75, 609–617. [Google Scholar] [CrossRef]

- McKenna, E.; McManus, M.; Cooper, S.; Thomson, M. Economic and environmental impact of lead-acid batteries in grid-connected domestic PV systems. Appl. Energy 2013, 104, 239–249. [Google Scholar] [CrossRef] [Green Version]

- Hawkins, T.R.; Gausen, O.M.; Strømman, A.H. Environmental impacts of hybrid and electric vehicles—A review. Int. J. Life Cycle Assess. 2012, 17, 997–1014. [Google Scholar] [CrossRef]

- Lei, Z.; Yingqi, L.; Li, Z.; Beibei, P. Commercial Value of Power Battery Echelon Utilization in China’s Energy Storage Industry. J. Beijing Inst. Technol. (Soc. Sci. Ed.) 2018, 20, 34–44. [Google Scholar]

- Dufo-López, R.; Bernal-Agustín, J.L. Techno-economic analysis of grid-connected battery storage. Energy Convers. Manag. 2015, 91, 394–404. [Google Scholar] [CrossRef]

- Yingqi, L.; Suxiu, L.; Lei, Z.; Jingyu, W. Characteristics and Application Prospects of Second Use Batteries for Energy Storage. Sci. Technol. Manag. Res. 2017, 37, 59–65. [Google Scholar]

- Stenzel, P.; Koj, J.C.; Schreiber, A.; Hennings, W.; Zapp, P. Primary control provided by large-scale battery energy storage systems or fossil power plants in Germany and related environmental impacts. J. Energy Storage 2016, 8, 300–310. [Google Scholar] [CrossRef]

- Ahmadi, L.; Yip, A.; Fowler, M.; Young, S.B.; Fraser, R.A. Environmental feasibility of re-use of electric vehicle batteries. Sustain. Energy Technol. Assess. 2014, 6, 64–74. [Google Scholar] [CrossRef]

- Mahlia, T.M.I.; Saktisahdan, T.J.; Jannifar, A.; Hasan, M.H.; Matseelar, H.S.C. A review of available methods and development on energy storage; technology update. Renew. Sustain. Energy Rev. 2014, 33, 532–545. [Google Scholar] [CrossRef]

- Akorede, M.F.; Hizam, H.; Pouresmaeil, E. Distributed energy resources and benefits to the environment. Renew. Sustain. Energy Rev. 2010, 14, 724–734. [Google Scholar] [CrossRef]

- Li, X.; Chalvatzis, K.; Stephanides, P. Innovative Energy Islands: Life-Cycle Cost-Benefit Analysis for Battery Energy Storage. Sustainability 2018, 10, 3371. [Google Scholar] [CrossRef] [Green Version]

- Han, X.; Liang, Y.; Ai, Y.; Li, J. Economic evaluation of a PV combined energy storage charging station based on cost estimation of second-use batteries. Energy 2018, 165, 326–339. [Google Scholar] [CrossRef]

- Wang, Y.; Liu, S.; Nian, V.; Li, X.; Yuan, J. Life cycle cost-benefit analysis of refrigerant replacement based on experience from a supermarket project. Energy 2019, 187, 115918. [Google Scholar] [CrossRef]

- Reinhardt, R.; Christodoulou, I.; Gassó-Domingo, S.; Amante García, B. Towards sustainable business models for electric vehicle battery second use: A critical review. J. Environ. Manag. 2019, 245, 432–446. [Google Scholar] [CrossRef]

- Mahmoud, T.S.; Ahmed, B.S.; Hassan, M.Y. The role of intelligent generation control algorithms in optimizing battery energy storage systems size in microgrids: A case study from Western Australia. Energy Convers. Manag. 2019, 196, 1335–1352. [Google Scholar] [CrossRef]

- Casals, L.C.; Amante García, B.; Canal, C. Second life batteries lifespan: Rest of useful life and environmental analysis. J. Environ. Manag. 2019, 232, 354–363. [Google Scholar] [CrossRef]

- Gur, K.; Chatzikyriakou, D.; Baschet, C.; Salomon, M. The reuse of electrified vehicle batteries as a means of integrating renewable energy into the European electricity grid: A policy and market analysis. Energy Policy 2018, 113, 535–545. [Google Scholar] [CrossRef]

- Ma, T.; Yang, H.; Lu, L. Feasibility study and economic analysis of pumped hydro storage and battery storage for a renewable energy powered island. Energy Convers. Manag. 2014, 79, 387–397. [Google Scholar] [CrossRef]

- Chen, C.; Duan, S.; Cai, T.; Liu, B.; Hu, G. Optimal Allocation and Economic Analysis of Energy Storage System in Microgrids. IEEE Trans. Power Electr. 2011, 26, 2762–2773. [Google Scholar]

- Ma, T.; Yang, H.; Lu, L. A feasibility study of a stand-alone hybrid solar–wind–battery system for a remote island. Appl. Energy 2014, 121, 149–158. [Google Scholar] [CrossRef]

- Laurischkat, K.; Jandt, D. Techno-economic analysis of sustainable mobility and energy solutions consisting of electric vehicles, photovoltaic systems and battery storages. J. Clean Prod. 2018, 179, 642–661. [Google Scholar] [CrossRef]

- Lin, B.; Wu, W. Economic viability of battery energy storage and grid strategy: A special case of China electricity market. Energy 2017, 124, 423–434. [Google Scholar] [CrossRef]

- Gandhi, O.; Rodríguez-Gallegos, C.D.; Zhang, W.; Srinivasan, D.; Reindl, T. Economic and technical analysis of reactive power provision from distributed energy resources in microgrids. Appl. Energy 2018, 210, 827–841. [Google Scholar] [CrossRef]

- Tong, S.; Fung, T.; Klein, M.P.; Weisbach, D.A.; Park, J.W. Demonstration of reusing electric vehicle battery for solar energy storage and demand side management. J. Energy Storage 2017, 11, 200–210. [Google Scholar] [CrossRef]

- Richa, K.; Babbitt, C.W.; Gaustad, G. Eco-Efficiency Analysis of a Lithium-Ion Battery Waste Hierarchy Inspired by Circular Economy. J. Ind. Ecol. 2017, 21, 715–730. [Google Scholar] [CrossRef]

- Halabi, L.M.; Mekhilef, S.; Olatomiwa, L.; Hazelton, J. Performance analysis of hybrid PV/diesel/battery system using HOMER: A case study Sabah, Malaysia. Energy Convers. Manag. 2017, 144, 322–339. [Google Scholar] [CrossRef]

- Hittinger, E.; Wiley, T.; Kluza, J.; Whitacre, J. Evaluating the value of batteries in microgrid electricity systems using an improved Energy Systems Model. Energy Convers. Manag. 2015, 89, 458–472. [Google Scholar] [CrossRef] [Green Version]

- May, G.J.; Davidson, A.; Monahov, B. Lead batteries for utility energy storage: A review. J. Energy Storage 2018, 15, 145–157. [Google Scholar] [CrossRef]

- Li, J.; Xiong, R.; Mu, H.; Cornélusse, B.; Vanderbemden, P.; Ernst, D.; Yuan, W. Design and real-time test of a hybrid energy storage system in the microgrid with the benefit of improving the battery lifetime. Appl. Energy 2018, 218, 470–478. [Google Scholar] [CrossRef] [Green Version]

- Cortés, P.; Muñuzuri, J.; Berrocal-de-O, M.; Domínguez, I. Genetic algorithms to optimize the operating costs of electricity and heating networks in buildings considering distributed energy generation and storage. Comput. Oper. Res. 2018, 96, 157–172. [Google Scholar] [CrossRef]

- Bahmani-Firouzi, B.; Azizipanah-Abarghooee, R. Optimal sizing of battery energy storage for micro-grid operation management using a new improved bat algorithm. Int. J. Electr. Power 2014, 56, 42–54. [Google Scholar] [CrossRef]

- Khodayari, M.; Aslani, A. Analysis of the energy storage technology using Hype Cycle approach. Sustain. Energy Technol. Assess. 2018, 25, 60–74. [Google Scholar] [CrossRef]

- Feng, Y.Y.; Chen, S.Q.; Zhang, L.X. System dynamics modeling for urban energy consumption and CO2 emissions: A case study of Beijing, China. Ecol. Model. 2013, 252, 44–52. [Google Scholar] [CrossRef]

- Xing, L.; Xue, M.; Hu, M. Dynamic simulation and assessment of the coupling coordination degree of the economy–resource–environment system: Case of Wuhan City in China. J. Environ. Manag. 2019, 230, 474–487. [Google Scholar] [CrossRef] [PubMed]

- Honti, G.; Dörgő, G.; Abonyi, J. Review and structural analysis of system dynamics models in sustainability science. J. Clean Prod. 2019, 240, 118015. [Google Scholar] [CrossRef]

- Yang, W.; Zhou, H.; Liu, J.; Dai, S.; Ma, Z.; Liu, Y. Market evolution modeling for electric vehicles based on system dynamics and multi-agents. In Proceedings of the International Symposium on Smart Electric Distribution Systems and Technologies (EDST), Vienna, Austria, 8–11 September 2015; IEEE: Piscataway, NJ, USA, 2015; pp. 133–138. [Google Scholar]

- Onat, N.C.; Kucukvar, M.; Tatari, O.; Egilmez, G. Integration of system dynamics approach toward deepening and broadening the life cycle sustainability assessment framework: A case for electric vehicles. Int. J. Life Cycle Assess. 2016, 21, 1009–1034. [Google Scholar] [CrossRef]

- Sverdrup, H.U.; Ragnarsdottir, K.V. A system dynamics model for platinum group metal supply, market price, depletion of extractable amounts, ore grade, recycling and stocks-in-use. Resour. Conserv. Recycl. 2016, 114, 130–152. [Google Scholar] [CrossRef]

- Yan, J.; Lai, F.; Liu, Y.; Yu, D.C.; Yi, W.; Yan, J. Multi-stage transport and logistic optimization for the mobilized and distributed battery. Energy Convers. Manag. 2019, 196, 261–276. [Google Scholar] [CrossRef]

- Gaines, L. Lithium-ion battery recycling processes: Research towards a sustainable course. Sustain. Mater. Technol. 2018, 17, e00068. [Google Scholar] [CrossRef]

- Dong, H.; Zheng, Y.; Yiqun, S.; Qiang, S.; Yibin, Z. Dynamic Assessment Method for Smart Grid Based on System Dynamics. Autom. Electr. Power Syst. 2012, 36, 16–21. [Google Scholar]

- Casals, L.C.; García, B.A.; Aguesse, F.; Iturrondobeitia, A. Second life of electric vehicle batteries: Relation between materials degradation and environmental impact. Int. J. Life Cycle Assess. 2017, 22, 82–93. [Google Scholar] [CrossRef]

- Zhang, J.; Zhang, Y.; Yang, Z.; Fath, B.D.; Li, S. Estimation of energy-related carbon emissions in Beijing and factor decomposition analysis. Ecol. Model. 2013, 252, 258–265. [Google Scholar] [CrossRef]

- Rui, L. The Study on Economics Evaluation of Distribution System Reliability with Consideration of Important Power Users. Master’s Thesis, China Elevtric Power Research Institute, Beijing, China, July 2010. [Google Scholar]

- Hu, S.; Jun, L.; Yuguang, W.; Ruifang, Z.; Yingjie, Z. Assessment of the Economic Value of the Energy Storage Battery Systems. J. Shang Univ. Electr. Power 2013, 29, 315–320. [Google Scholar]

- Jinguo, Z.; Dongsheng, J.; Xiaojun, W.; Jie, Z.; Jinghan, H.; Chao, G. Analysis on Economic Operation of Energy Storage Based on Sencond-Use Batteries. Power Syst. Technol. 2014, 38, 2551–2555. [Google Scholar]

| Classification | Time | Policy Name |

|---|---|---|

| Instructions | 28 June 2012 | Energy-saving and new energy automobile industry development plan |

| 29 February 2016 | Guidance on promoting the development of “Internet+” smart energy | |

| 22 September 2017 | Guidance on promoting energy storage technology and industrial development | |

| Action Plan | 7 June 2014 | Energy Development Strategic Action Plan (2014–2020) |

| 20 February 2017 | Promote the development plan of the automotive power battery industry | |

| 5 March 2018 | Pilot implementation plan for recycling of new energy vehicle power battery | |

| Standard | 11 September 2015 | Electric Vehicle Power Battery Recycling Technology Policy (2015 Version) |

| 4 February 2016 | New energy vehicle waste power battery comprehensive utilization industry-standard conditions | |

| Interim Measures for the Administration of the Announcement of the Comprehensive Utilization of Waste Electrical Power Battery for New Energy Vehicles | ||

| Financial Subsidy | 7 June 2016 | Notice on Promoting the Participation of Electric Energy Storage in the Pilot Work of the Electric Power Auxiliary Service Replenishment (Market) Mechanism in the “Three North” Region |

| 15 November 2017 | Improve the work plan of the power-assisted service compensation (market) mechanism | |

| 25 December 2017 | Regulations on the operation of the grid-connected operation of power plants in the southern region | |

| Regulations on the Administration of Auxiliary Services for Grid-connected Power Plants | ||

| 24 March 2019 | Measures for the Management of Special Funds for Green Development of Suzhou Industrial Park |

| No. | Indicators | Data | Number | Indicators | Data |

|---|---|---|---|---|---|

| 1 | Unit capacity battery box cost, RMB/kWh | 120 | 12 | Old battery capacity loss rate each charge/discharge, % | 0.02 |

| 2 | Unit transformer cost, RMB/kWh | 59.3 | 13 | One-way energy conversion efficiency, % | 95 |

| 3 | Unit capacity converter cost, RMB/kWh | 133.3 | 14 | Total battery weight, tons | 106 |

| 4 | Unit capacity BMS cost, RMB/kWh | 133.3 | 15 | Average residual rate of fixed assets, % | 5 |

| 5 | Unit capacity battery cabinet cost, RMB/kWh | 340 | 16 | Annual equipment repair cost, RMB/year | 200,000 |

| 6 | Monitoring system cost, RMB | 750,000 | 17 | The daily charge/discharge times of BESS | 1 |

| 7 | Battery selection equipment purchase cost, RMB | 80,000 | 18 | Annual power outage frequency, times/year | 0.35 |

| 8 | Unit capacity battery purchase cost, RMB/kWh | 240 | 19 | Comprehensive economic loss of power outage per unit capacity, RMB/kWh | 99.08 |

| 9 | Unit capacity battery transportation cost, RMB/kWh | 27.7 | 20 | Rate of reducing the peak electricity consumption, % | 30 |

| 10 | Per capita monthly salary, RMB/Month | 4200 | 21 | Annual growth rate of peak load, % | 5 |

| 11 | Electricity price at the peak/valley of electricity consumption, RMB/kWh | 0.8546/0.343 | 22 | Unit capacity power grid construction cost, RMB/kWh | 8000 |

| Data | Cost of Old Battery, RMB/kWh | Government Subsidy, RMB/kWh | Electricity Price at the Peak of Power Consumption, RMB/kWh | |

|---|---|---|---|---|

| Level | ||||

| Cost No Change | 240 | 0.30 | 0.854 6 | |

| Cost: Reduced by 10% | 216 | 0 | 0.854 6 | |

| Cost: Reduced by 20% | 192 | 0 | 0.854 6 | |

| Cost: Reduced by 30% | 168 | 0 | 0.854 6 | |

| Cost: Reduced by 40% | 144 | 0 | 0.854 6 | |

| Cost: Reduced by 50% | 120 | 0 | 0.854 6 | |

| Data | Cost of Old Battery, RMB/kWh | Government Subsidy, RMB/kWh | Electricity Price at the Peak of Power Consumption, RMB/kWh | |

|---|---|---|---|---|

| Level | ||||

| Initial state | 240 | 0.30 | 0.8546 | |

| Price: increase 10% | 0 | 0 | 0.8973 | |

| Price: increase 20% | 0 | 0 | 0.9400 | |

| Price: increase 30% | 0 | 0 | 0.9827 | |

| Price: increase 40% | 0 | 0 | 1.0254 | |

| Price: increase 50% | 0 | 0 | 1.0681 | |

| Data | Cost of Old Battery, RMB/kWh | Government Subsidy, RMB/kWh | Electricity Price at the Valley of Power Consumption, RMB/kWh | |

|---|---|---|---|---|

| Level | ||||

| Initial state | 240 | 0.30 | 0.3430 | |

| Cost: Reduced by 10% | 216 | 0 | 0 | |

| Cost: Reduced by 20% | 192 | 0 | 0 | |

| Cost: Reduced by 30% | 168 | 0 | 0 | |

| Cost: Reduced by 40% | 144 | 0 | 0 | |

| Cost: Reduced by 50% | 120 | 0 | 0 | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, L.; Liu, Y.; Pang, B.; Sun, B.; Kokko, A. Second Use Value of China’s New Energy Vehicle Battery: A View Based on Multi-Scenario Simulation. Sustainability 2020, 12, 341. https://doi.org/10.3390/su12010341

Zhang L, Liu Y, Pang B, Sun B, Kokko A. Second Use Value of China’s New Energy Vehicle Battery: A View Based on Multi-Scenario Simulation. Sustainability. 2020; 12(1):341. https://doi.org/10.3390/su12010341

Chicago/Turabian StyleZhang, Lei, Yingqi Liu, Beibei Pang, Bingxiang Sun, and Ari Kokko. 2020. "Second Use Value of China’s New Energy Vehicle Battery: A View Based on Multi-Scenario Simulation" Sustainability 12, no. 1: 341. https://doi.org/10.3390/su12010341

APA StyleZhang, L., Liu, Y., Pang, B., Sun, B., & Kokko, A. (2020). Second Use Value of China’s New Energy Vehicle Battery: A View Based on Multi-Scenario Simulation. Sustainability, 12(1), 341. https://doi.org/10.3390/su12010341