Exploring the Risk Factors of Infrastructure PPP Projects for Sustainable Delivery: A Social Network Perspective

Abstract

:1. Introduction

2. Literature Review

2.1. PPP Projects and Sustainable Development

2.2. Risk Factors of PPP Projects

2.3. Methods of Risk Management

2.4. Social Network Analysis: An Effective Approach to Settle PPP Related Issues

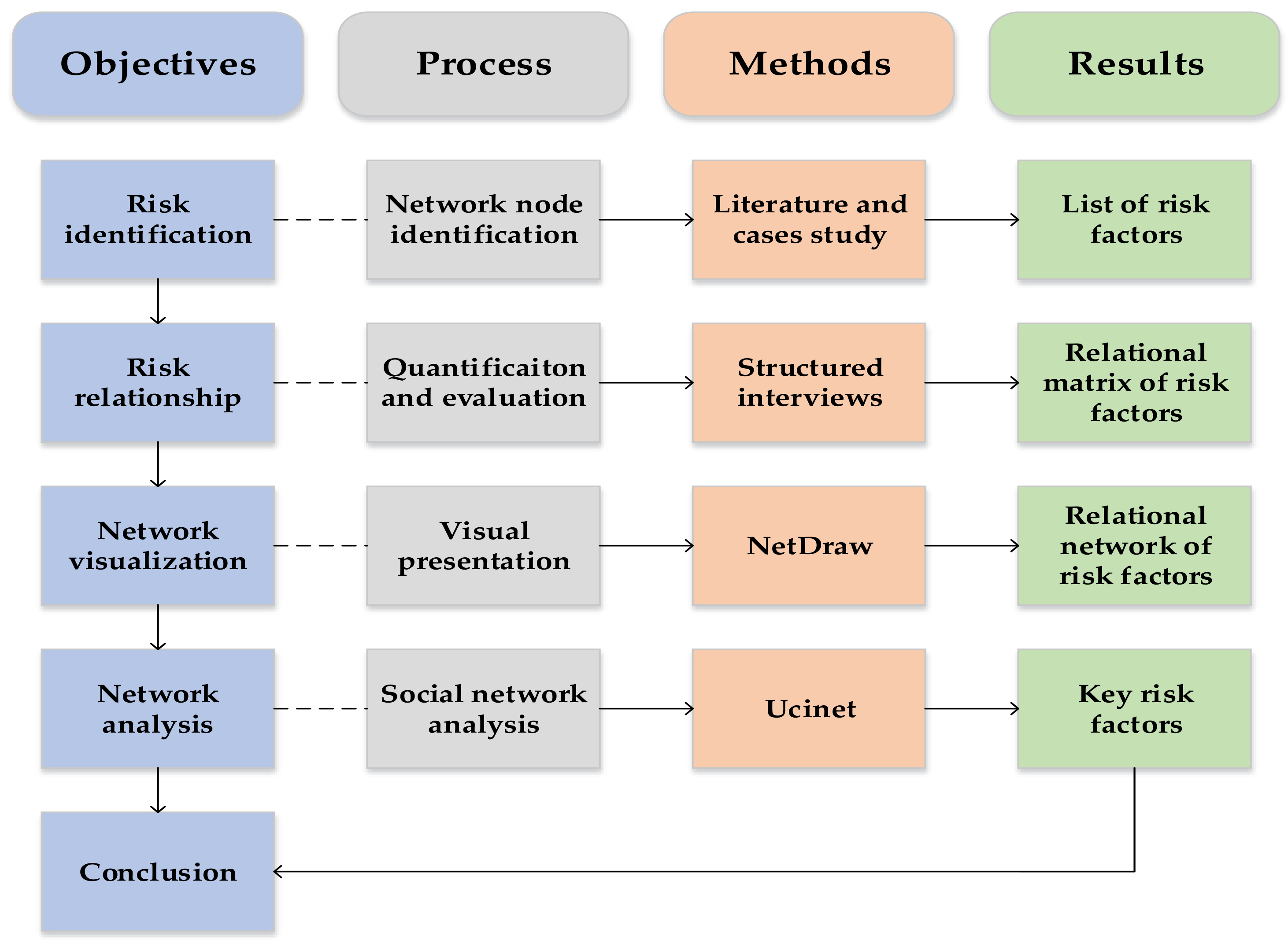

3. Methodology

3.1. Research Methods

- Determine the research object: To construct a social network model, the first and most important task is to determine the nodes in the network. In this study, the network nodes are the risk factors of each infrastructure PPP project.

- Establish the interview design: Social network analysis was used to study the relationship between risk factors, which was facilitated by the use of Ucinet 6.0 software. The data processed by the software is expressed in matrix form. Therefore, this interview was formulated as a risk factor relationship matrix for scoring the weights of answers provided by experts and determining the magnitude of the impact of different factors in different directions.

- Structured interviews and data collection: To facilitate data entry in the processing of data for this study, the results of the interview are expressed in the form of the matrix.

- Conduct data quality test: The data quality was mainly dependent on whether the respondents gave consistent answers. Answers were consistently checked using Ucinet 6.0 software.

- Analyze data: Data analysis was performed from two perspectives. First, the overall structural characteristics of the risk factor relationship network were analyzed to determine the closeness of the overall network structure. Second, the attributes and location characteristics of each node were determined. These two aspects are described based on different indicators, and their specific contents are presented in the following sections.

3.2. Interview Design and Data Collection

3.3. Reliability Test

4. Results

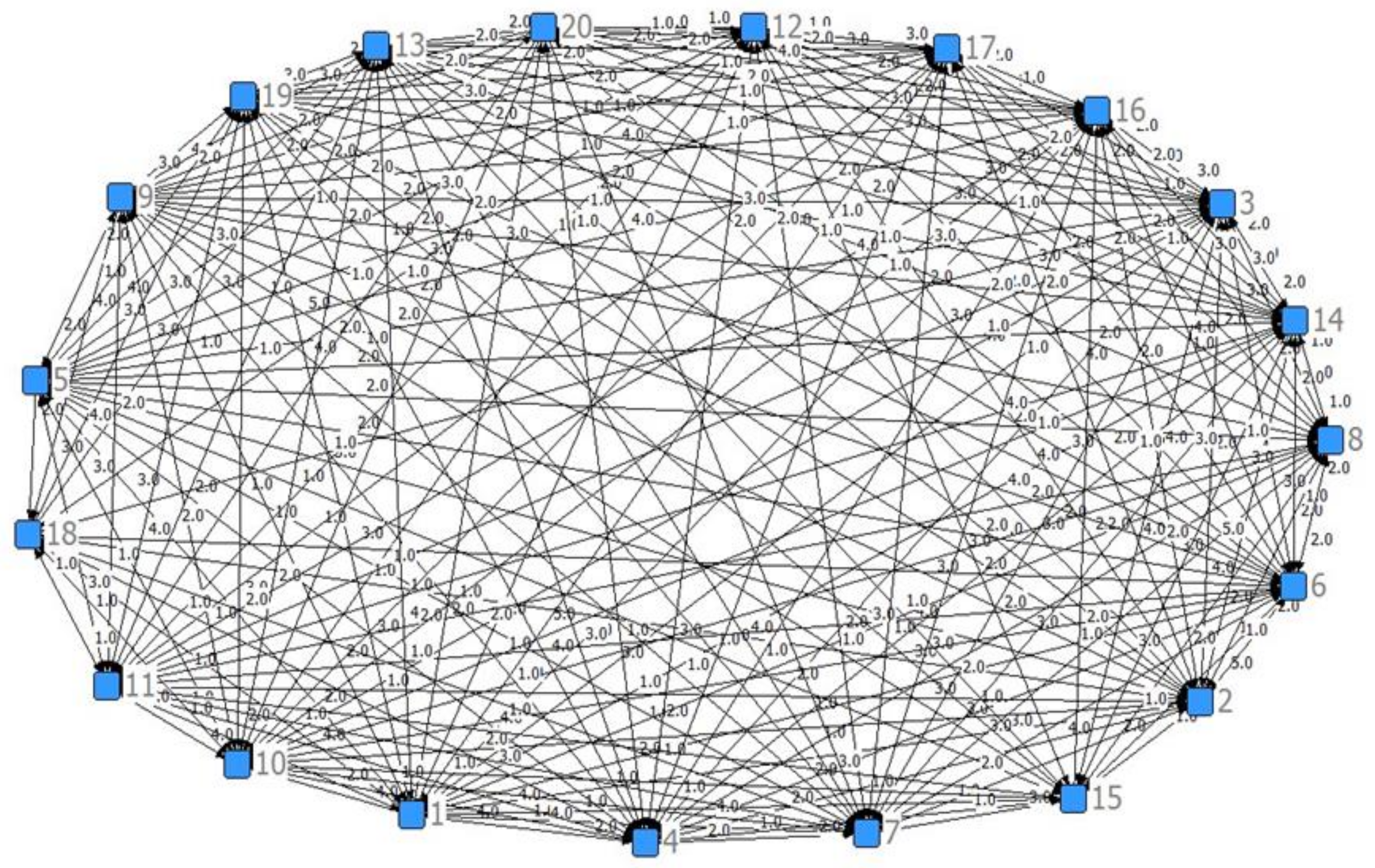

4.1. Relational Network Model

- Network nodes: Determine each risk factor as the node of network construction.

- Network relations: Ensure that the arcs constructed by the network model represent the relationships among various risk factors and that these arcs are directional segments.

- Network relation assignment: Determine the strength of the influence relationships represented by the arcs in the relational network model.

- Network relation matrix: Determine the relationship between the risk factor nodes as represented by the directed relational data, and establish a network relationship matrix based on the weight data provided by the experts for each arc.

4.2. Analysis of Relational Network Model

4.2.1. Analysis of the Characteristics of Relational Networks

- (1)

- Overall Network Density

- (2)

- Central Potential Index

- (3)

- Small-World Indicators

4.2.2. Key Risk Factors of the PPP Project

- (1)

- Degree Centrality

- (2)

- Betweenness Centrality

- (3)

- Closeness centrality

4.2.3. PPP Project Risk Factor Impact and Response Chain

4.3. Factions and Cluster Analysis

5. Discussion and Conclusions

5.1. PPP Project Risk Factor Network Characterized by High Risk

5.2. Two Risk Factors of PPP Projects that are Influential and Greatly Affected by other Risk Factors

5.3. Chain of Risk Factors Links the Risk Factors Nodes of PPP Projects

5.4. Key Bridge Nodes Link PPP Project Risk factor Subgroups in the Network

Author Contributions

Funding

Conflicts of Interest

Appendix A

| F1 | F2 | F3 | F4 | F5 | F6 | F7 | F8 | F9 | F11 | F12 | F13 | F14 | F15 | F16 | F17 | F18 | F19 | F20 | |

| F1 | 0 | 1 | 3 | 4 | 2 | 2 | 1 | 1 | 2 | 3 | 2 | 4 | 1 | 1 | 5 | 5 | 4 | 3 | 2 |

| F2 | 3 | 0 | 4 | 4 | 4 | 5 | 2 | 1 | 3 | 3 | 2 | 3 | 2 | 1 | 3 | 4 | 3 | 3 | 3 |

| F3 | 1 | 2 | 0 | 4 | 4 | 3 | 2 | 1 | 3 | 3 | 2 | 2 | 2 | 1 | 3 | 1 | 2 | 3 | 2 |

| F4 | 2 | 2 | 2 | 0 | 4 | 2 | 2 | 1 | 2 | 4 | 3 | 3 | 1 | 1 | 1 | 2 | 3 | 4 | 1 |

| F5 | 3 | 3 | 2 | 2 | 0 | 2 | 1 | 2 | 2 | 3 | 3 | 4 | 2 | 1 | 5 | 1 | 2 | 4 | 3 |

| F6 | 1 | 2 | 3 | 3 | 2 | 0 | 2 | 2 | 4 | 2 | 4 | 3 | 2 | 1 | 3 | 2 | 2 | 4 | 2 |

| F7 | 0 | 1 | 2 | 2 | 2 | 2 | 0 | 3 | 1 | 1 | 2 | 4 | 1 | 0 | 3 | 1 | 1 | 1 | 0 |

| F8 | 2 | 1 | 1 | 2 | 2 | 2 | 5 | 0 | 0 | 2 | 4 | 2 | 1 | 0 | 2 | 0 | 0 | 0 | 0 |

| F9 | 1 | 2 | 2 | 1 | 2 | 2 | 4 | 3 | 0 | 3 | 2 | 4 | 2 | 1 | 2 | 2 | 1 | 3 | 0 |

| F10 | 0 | 2 | 2 | 2 | 1 | 1 | 1 | 1 | 1 | 4 | 1 | 2 | 1 | 1 | 1 | 0 | 1 | 3 | 0 |

| F11 | 1 | 1 | 1 | 2 | 1 | 1 | 1 | 2 | 1 | 0 | 1 | 2 | 1 | 0 | 3 | 1 | 1 | 4 | 0 |

| F12 | 0 | 2 | 2 | 2 | 1 | 0 | 1 | 3 | 0 | 2 | 0 | 4 | 1 | 1 | 3 | 1 | 1 | 2 | 1 |

| F13 | 1 | 1 | 2 | 2 | 2 | 2 | 3 | 4 | 3 | 1 | 3 | 0 | 1 | 1 | 2 | 0 | 0 | 2 | 0 |

| F14 | 0 | 0 | 2 | 1 | 1 | 2 | 3 | 1 | 2 | 4 | 1 | 2 | 0 | 1 | 3 | 3 | 0 | 3 | 2 |

| F15 | 0 | 0 | 0 | 1 | 0 | 0 | 3 | 1 | 1 | 3 | 0 | 1 | 0 | 0 | 2 | 0 | 0 | 3 | 0 |

| F16 | 0 | 0 | 2 | 2 | 2 | 2 | 2 | 1 | 0 | 4 | 1 | 2 | 2 | 0 | 0 | 0 | 0 | 3 | 0 |

| F17 | 1 | 1 | 1 | 1 | 1 | 0 | 3 | 2 | 2 | 3 | 3 | 2 | 0 | 0 | 2 | 0 | 0 | 4 | 0 |

| F18 | 0 | 0 | 1 | 1 | 0 | 0 | 2 | 0 | 0 | 1 | 0 | 2 | 0 | 0 | 0 | 0 | 0 | 4 | 0 |

| F19 | 0 | 0 | 2 | 1 | 2 | 0 | 1 | 0 | 0 | 3 | 0 | 3 | 0 | 0 | 3 | 0 | 0 | 0 | 0 |

| F20 | 0 | 0 | 1 | 1 | 0 | 0 | 4 | 0 | 2 | 3 | 0 | 2 | 1 | 0 | 2 | 1 | 0 | 2 | 0 |

References

- Li, F.; Wang, R.; Paulussen, J.; Liu, X. Comprehensive concept planning of urban greening based on ecological principles: A case study in Beijing, China. Landsc. Urban Plan. 2005, 72, 325–336. [Google Scholar] [CrossRef]

- Ichimura, M. Urbanization, Urban Environment and Land Use: Challenges and Opportunities An Issue Paper. In Proceedings of the Asia-Pacific Forum for Environment and Development, Expert Meeting, Guilin, China, 23 January 2003; Volume 23. [Google Scholar]

- Zhu, J. Local Developmental State and Order in China’s Urban Development during Transition*. Int. J. Urban Reg. Res. 2004, 28, 424–447. [Google Scholar] [CrossRef]

- Wu, W. Reforming China’s Institutional Environment for Urban Infrastructure Provision. Urban Stud. 1999, 36, 2263–2282. [Google Scholar] [CrossRef]

- Koppenjan, J.F.M.; Enserink, B. Public–private partnerships in urban infrastructures: Reconciling private sector participation and sustainability. Public Adm. Rev. 2009, 69, 284–296. [Google Scholar] [CrossRef]

- Wessels, M. Stimulating sustainable infrastructure development through public–private partnerships. Proc. Inst. Civ. Eng. Procure. Law 2014, 167, 232–241. [Google Scholar] [CrossRef]

- Agarchand, N.; Laishram, B. Sustainable infrastructure development challenges through PPP procurement process. Int. J. Manag. Proj. Bus. 2017. [Google Scholar] [CrossRef]

- Carpenter, B.; Fekpe, E.; Gopalakrishna, D. Performance-Based Contracting for the Highway Construction Industry: An Evaluation of the Use of Innovative Contracting and Performance Specification in Highway Construction; Final Rep.; Koch Industries Inc.: Washington, DC, USA, 2003. [Google Scholar]

- Abdel Aziz, A.M.; Russell, A.D. Generalized economic modeling for infrastructure and capital investment projects. J. Infrastruct. Syst. 2006, 12, 18–32. [Google Scholar] [CrossRef]

- Anastasopoulos, P.C.; Labi, S.; McCullouch, B.G.; Karlaftis, M.G.; Moavenzadeh, F. Influence of highway project characteristics on contract type selection: Empirical assessment. J. Infrastruct. Syst. 2010, 16, 323–333. [Google Scholar] [CrossRef]

- Kwak, Y.H.; Chih, Y.; Ibbs, C.W. Towards a comprehensive understanding of public private partnerships for infrastructure development. Calif. Manag. Rev. 2009, 51, 51–78. [Google Scholar] [CrossRef]

- Rafaat, R.; Osman, H.; Georgy, M.; Elsaid, M. Preferred risk allocation in Egypt’s water sector PPPs. Int. J. Constr. Manag. 2020, 1–13. [Google Scholar] [CrossRef]

- Ameyaw, E.E.; Chan, A.P.C. Identifying public-private partnership (PPP) risks in managing water supply projects in Ghana. J. Facil. Manag. 2013, 11, 152–182. [Google Scholar] [CrossRef]

- Shao, Y.; Yuan, J.; Li, Q. Identification of the residual value risk factors for road PPP projects in China: Questionnaire survey and analysis. In Proceedings of the 20th International Symposium on Advancement of Construction Management and Real Estate; Springer: Berlin, Germany, 2017; pp. 379–389. [Google Scholar]

- Gurn, A.M. Courting Corporate Philanthropy in Public Education: Multi-Disciplinary Literature Review of Public–Private Partnerships (PPPs) in Urban Public Schooling. SAGE Open 2016, 6, 2158244016635714. [Google Scholar] [CrossRef] [Green Version]

- Zou, P.X.W.; Wang, S.; Fang, D. A life-cycle risk management framework for PPP infrastructure projects. J. Financ. Manag. Prop. Constr. 2008, 13, 123–142. [Google Scholar] [CrossRef]

- Abdel Aziz, A.M. Successful delivery of public-private partnerships for infrastructure development. J. Constr. Eng. Manag. 2007, 133, 918–931. [Google Scholar] [CrossRef]

- The Channel Tunnel Project. Available online: http://finance.china.com.cn/roll/20140722/2556871.shtml (accessed on 22 July 2014).

- The Bird’s Nest Stadium Project. Available online: https://www.sohu.com/a/142496023_798724 (accessed on 22 May 2017).

- Doloi, H. Understanding impacts of time and cost related construction risks on operational performance of PPP projects. Int. J. Strateg. Prop. Manag. 2012, 16, 316–337. [Google Scholar] [CrossRef]

- Wang, H.; Liu, Y.; Xiong, W.; Song, J. The moderating role of governance environment on the relationship between risk allocation and private investment in PPP markets: Evidence from developing countries. Int. J. Proj. Manag. 2019, 37, 117–130. [Google Scholar] [CrossRef]

- Cui, C.; Liu, Y.; Hope, A.; Wang, J. Review of studies on the public–private partnerships (PPP) for infrastructure projects. Int. J. Proj. Manag. 2018, 36, 773–794. [Google Scholar] [CrossRef]

- Liu, Y.; Sun, C.; Xia, B.; Liu, S.; Skitmore, M. Identification of Risk Factors Affecting PPP Waste-to-Energy Incineration Projects in China: A Multiple Case Study. Adv. Civ. Eng. 2018, 2018, 4983523. [Google Scholar] [CrossRef]

- Song, J.; Song, D.; Zhang, X.; Sun, Y. Risk identification for PPP waste-to-energy incineration projects in China. Energy Policy 2013, 61, 953–962. [Google Scholar] [CrossRef]

- Jayasuriya, S.; Zhang, G.; Yang, R.J. Challenges in public private partnerships in construction industry. Built Environ. Proj. Asset Manag. 2019. [Google Scholar] [CrossRef]

- Ma, G.; Du, Q.; Wang, K. A concession period and price determination model for PPP projects: Based on real options and risk allocation. Sustainability 2018, 10, 706. [Google Scholar]

- Shrestha, A.; Chan, T.-K.; Aibinu, A.A.; Chen, C.; Martek, I. Risk allocation inefficiencies in Chinese PPP water projects. J. Constr. Eng. Manag. 2018, 144, 4018013. [Google Scholar] [CrossRef]

- Xu, Y.; Chan, A.P.C.; Yeung, J.F.Y. Developing a fuzzy risk allocation model for PPP projects in China. J. Constr. Eng. Manag. 2010, 136, 894–903. [Google Scholar] [CrossRef]

- Shrestha, A.; Tamošaitienė, J.; Martek, I.; Hosseini, M.R.; Edwards, D.J. A Principal-Agent Theory Perspective on PPP Risk Allocation. Sustainability 2019, 11, 6455. [Google Scholar] [CrossRef] [Green Version]

- Mazher, K.M.; Chan, A.P.C.; Zahoor, H.; Ameyaw, E.E.; Edwards, D.J.; Osei-Kyei, R. Modelling capability-based risk allocation in PPPs using fuzzy integral approach. Can. J. Civ. Eng. 2019, 46, 777–788. [Google Scholar] [CrossRef]

- Li, Y.; Wang, X. Using fuzzy analytic network process and ISM methods for risk assessment of public-private partnership: A China perspective. J. Civ. Eng. Manag. 2019, 25, 168–183. [Google Scholar] [CrossRef] [Green Version]

- Wu, Y.; Xu, C.; Li, L.; Wang, Y.; Chen, K.; Xu, R. A risk assessment framework of PPP waste-to-energy incineration projects in China under 2-dimension linguistic environment. J. Clean. Prod. 2018, 183, 602–617. [Google Scholar] [CrossRef]

- Valipour, A.; Yahaya, N.; Md Noor, N.; Antuchevičienė, J.; Tamošaitienė, J. Hybrid SWARA-COPRAS method for risk assessment in deep foundation excavation project: An Iranian case study. J. Civ. Eng. Manag. 2017, 23, 524–532. [Google Scholar] [CrossRef] [Green Version]

- Jang, G.-W. Bids-Evaluation Decision Model Development and Application for PPP Transport Projects: A Project Risks Modeling Framework, The. Ph.D. Thesis, Colorado State University, Fort Collins, CO, USA, 2010. [Google Scholar]

- Valipour, A.; Yahaya, N.; Md Noor, N.; Mardani, A.; Antuchevičienė, J. A new hybrid fuzzy cybernetic analytic network process model to identify shared risks in PPP projects. Int. J. Strateg. Prop. Manag. 2016, 20, 409–426. [Google Scholar] [CrossRef]

- Li, J.; Zou, P.X.W. Fuzzy AHP-based risk assessment methodology for PPP projects. J. Constr. Eng. Manag. 2011, 137, 1205–1209. [Google Scholar] [CrossRef]

- Xu, Y.; Yeung, J.F.Y.; Chan, A.P.C.; Chan, D.W.M.; Wang, S.Q.; Ke, Y. Developing a risk assessment model for PPP projects in China—A fuzzy synthetic evaluation approach. Autom. Constr. 2010, 19, 929–943. [Google Scholar] [CrossRef]

- Imperatives, S. Report of the World Commission on Environment and Development: Our Common Future; Oxford University Press: Oxford, UK, 1987. [Google Scholar]

- Rijsberman, M.A.; Van de Ven, F.H.M. Different approaches to assessment of design and management of sustainable urban water systems. Environ. Impact Assess. Rev. 2000, 20, 333–345. [Google Scholar] [CrossRef]

- Wang, G.; Wu, P.; Wu, X.; Zhang, H.; Guo, Q.; Cai, Y. Mapping global research on sustainability of megaproject management: A scientometric review. J. Clean. Prod. 2020, 259, 120831. [Google Scholar] [CrossRef]

- Roseland, M. Toward Sustainable Communities: Solutions for Citizens and Their Governments; New Society Publishers: Gabriola Island, Canada, 2012; ISBN 0865717117. [Google Scholar]

- Gray, M.A. The United Nations Environment Programme: An Assessment. Envtl. L. 1990, 20, 291. [Google Scholar]

- Nair, D.G.; Enserink, B.; Gopikuttan, G.; Vergragt, P.; Fraaij, A.; Dalmeijer, R. A conceptual Framework for sustainable–affordable housing for the rural poor in less developed economies. In Proceedings of the 2005 World Sustainable Building Conference, Tokyo, Japan, 27–29 September 2005. [Google Scholar]

- Bai, L.; Li, Y.; Du, Q.; Xu, Y. A fuzzy comprehensive evaluation model for sustainability risk evaluation of PPP projects. Sustainability 2017, 9, 1890. [Google Scholar] [CrossRef] [Green Version]

- Yuan, J.; Wang, C.; Skibniewski, M.J.; Li, Q. Developing key performance indicators for public-private partnership projects: Questionnaire survey and analysis. J. Manag. Eng. 2012, 28, 252–264. [Google Scholar] [CrossRef]

- Shen, L.; Tam, V.W.Y.; Gan, L.; Ye, K.; Zhao, Z. Improving sustainability performance for public-private-partnership (PPP) projects. Sustainability 2016, 8, 289. [Google Scholar] [CrossRef] [Green Version]

- Wright, C.F. Leveraging Reputational Risk: Sustainable Sourcing Campaigns for Improving Labour Standards in Production Networks. J. Bus. Ethics 2016, 137, 195–210. [Google Scholar] [CrossRef]

- Wang, G.; He, Q.; Meng, X.; Locatelli, G.; Yu, T.; Yan, X. Exploring the impact of megaproject environmental responsibility on organizational citizenship behaviors for the environment: A social identity perspective. Int. J. Proj. Manag. 2017, 35, 1402–1414. [Google Scholar] [CrossRef] [Green Version]

- Amann, M.; Roehrich, J.K.; Esig, M.; Harland, C. Driving sustainable supply chain management in the public sector: The importance of public procurement in the European Union. Supply Chain Manag. 2014, 19, 351–366. [Google Scholar] [CrossRef] [Green Version]

- Roehrich, J.K.; Grosvold, J.; Hoejmose, S. Reputational risks and sustainable supply chain management: Decision making under bounded rationality. Int. J. Oper. Prod. Manag. 2014, 34, 695–719. [Google Scholar] [CrossRef]

- Hoejmose, S.; Roehrich, J.K.; Grosvold, J. Is doing more, doing better?: The relationship between responsible supply chain management and corporate reputation. Ind. Mark. Manag. 2014, 43, 77–90. [Google Scholar] [CrossRef]

- Hwang, B.-G.; Zhao, X.; Gay, M.J.S. Public private partnership projects in Singapore: Factors, critical risks and preferred risk allocation from the perspective of contractors. Int. J. Proj. Manag. 2013, 31, 424–433. [Google Scholar] [CrossRef]

- Tang, L.; Shen, Q. Factors affecting effectiveness and efficiency of analyzing stakeholders’ needs at the briefing stage of public private partnership projects. Int. J. Proj. Manag. 2013, 31, 513–521. [Google Scholar] [CrossRef] [Green Version]

- Aziz, A.A.; Shen, T.-L. Management of force majeure risks in Canadian PPP transportation projects. In Proceedings of the Construction Research Congress, San Juan, PR, USA, 31 May–2 June 2016; pp. 538–548. [Google Scholar]

- Tang, L.; Shen, Q.; Skitmore, M.; Cheng, E.W.L. Ranked critical factors in PPP briefings. J. Manag. Eng. 2013, 29, 164–171. [Google Scholar] [CrossRef] [Green Version]

- Rossi, M.; Civitillo, R. Public Private Partnerships: A general overview in Italy. Procedia-Soc. Behav. Sci. 2014, 109, 140–149. [Google Scholar] [CrossRef] [Green Version]

- Lee, C.H.; Yu, Y.-H. Service delivery comparisons on household connections in Taiwan’s sewer public–private-partnership (PPP) projects. Int. J. Proj. Manag. 2011, 29, 1033–1043. [Google Scholar] [CrossRef]

- Forsyth, T. Building deliberative public–private partnerships for waste management in Asia. Geoforum 2005, 36, 429–439. [Google Scholar] [CrossRef] [Green Version]

- Ameyaw, E.E.; Chan, A.P.C. Evaluation and ranking of risk factors in public–private partnership water supply projects in developing countries using fuzzy synthetic evaluation approach. Expert Syst. Appl. 2015, 42, 5102–5116. [Google Scholar] [CrossRef]

- Smith, N.J.; Merna, T.; Jobling, P. Managing Risk in Construction Projects; Blackwell Science Ltd: Victoria, Australia, 1998. [Google Scholar]

- Kivleniece, I.; Quelin, B. V Creating and capturing value in public-private ties: A private actor’s perspective. Acad. Manag. Rev. 2012, 37, 272–299. [Google Scholar] [CrossRef]

- Barlow, J.; Roehrich, J.; Wright, S. Europe sees mixed results from public-private partnerships for building and managing health care facilities and services. Health Aff. 2013, 32, 146–154. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Xiong, W.; Chen, B.; Wang, H.; Zhu, D. Transaction Hazards and Governance Mechanisms in Public-Private Partnerships: A Comparative Study of Two Cases. Public Perform. Manag. Rev. 2019, 42, 1279–1304. [Google Scholar] [CrossRef]

- Athias, L.; Saussier, S. Are public private partnerships that rigid? And why? Evidence from price provisions in French toll road concession contracts. Transp. Res. Part A Policy Pract. 2018, 111, 174–186. [Google Scholar] [CrossRef]

- Chung, D.; Hensher, D. Risk Management in Public–Private Partnerships. Aust. Account. Rev. 2015, 25, 13–27. [Google Scholar] [CrossRef]

- Dewulf, G.; Garvin, M.J. Responsive governance in PPP projects to manage uncertainty. Constr. Manag. Econ. 2020, 38, 383–397. [Google Scholar] [CrossRef]

- Behn, R.D.; Kant, P.A. Strategies for Avoiding the Pitfalls of Performance Contracting. Public Product. Manag. Rev. 1999, 22, 470–489. [Google Scholar] [CrossRef]

- Caldwell, N.; Roehrich, J.K.; Davies, A. Procuring complex performance in construction: London Heathrow Terminal 5 and a Private Finance Initiative hospital. J. Purch. Supply Manag. 2009, 15, 178–186. [Google Scholar] [CrossRef] [Green Version]

- Lewis, M.; Roehrich, J.K. Contracts, relationships and integration: Towards a model of the procurement of complex performance. Int. J. Procure. Manag. 2009, 2, 125–142. [Google Scholar] [CrossRef] [Green Version]

- Essig, M.; Glas, A.H.; Selviaridis, K.; Roehrich, J.K. Performance-Based Contracting in Business Markets. Ind. Mark. Manag. 2016, 59, 5–11. [Google Scholar] [CrossRef] [Green Version]

- Xu, Y.; Chan, A.P.C.; Xia, B.; Qian, Q.K.; Liu, Y.; Peng, Y. Critical risk factors affecting the implementation of PPP waste-to-energy projects in China. Appl. Energy 2015, 158, 403–411. [Google Scholar] [CrossRef] [Green Version]

- Tallaki, M.; Bracci, E.; Stefani, F. Risk Allocation and Management in PPP and PFI: Systematic Literature Review; Working Papers 2019038; University of Ferrara: Ferrara, Italy, 2019. [Google Scholar]

- Ye, S.; Tiong, R.L.K. NPV-at-risk method in infrastructure project investment evaluation. J. Constr. Eng. Manag. 2000, 126, 227–233. [Google Scholar] [CrossRef]

- Hastak, M.; Shaked, A. ICRAM-1: Model for international construction risk assessment. J. Manag. Eng. 2000, 16, 59–69. [Google Scholar] [CrossRef]

- Thomas, A.V.; Kalidindi, S.N.; Ganesh, L.S. Modelling and assessment of critical risks in BOT road projects. Constr. Manag. Econ. 2006, 24, 407–424. [Google Scholar] [CrossRef]

- Wu, Y.; Song, Z.; Li, L.; Xu, R. Risk management of public-private partnership charging infrastructure projects in China based on a three-dimension framework. Energy 2018, 165, 1089–1101. [Google Scholar] [CrossRef]

- Xiong, W.; Zhao, X.; Yuan, J.-F.; Luo, S. Ex post risk management in public-private partnership infrastructure projects. Proj. Manag. J. 2017, 48, 76–89. [Google Scholar] [CrossRef]

- Jones, F.E.; Moreno, J.L. The sociometry reader. Can. J. Econ. Polit. Sci. 1962, 28, 318–319. [Google Scholar] [CrossRef]

- Wasserman, S.; Galaskiewicz, J. Advances in Social Network Analysis: Research in the Social and Behavioral Sciences; Sage: Thousand Oaks, CA, USA, 1994. [Google Scholar]

- Lee, B.; Collier, P.M.; Cullen, J.; Gummesson, E. Case study research and network theory: Birds of a feather. Qual. Res. Organ. Manag. Int. J. 2007. [Google Scholar] [CrossRef]

- Borgatti, S.P.; Everett, M.G.; Johnson, J.C. Analyzing Social Networks; Sage: Thousand Oaks, CA, USA, 2013. [Google Scholar]

- Mok, K.Y.; Shen, G.Q.; Yang, J. Stakeholder management studies in mega construction projects: A review and future directions. Int. J. Proj. Manag. 2015, 33, 446–457. [Google Scholar] [CrossRef]

- Li, C.Z.; Hong, J.; Xue, F.; Shen, G.Q.; Xu, X.; Mok, M.K. Schedule risks in prefabrication housing production in Hong Kong: A social network analysis. J. Clean. Prod. 2016, 134, 482–494. [Google Scholar] [CrossRef] [Green Version]

- Lee, C.; Chong, H.; Liao, P.; Wang, X. Critical Review of Social Network Analysis Applications in Complex Project Management. J. Manag. Eng. 2018, 34, 4017061. [Google Scholar] [CrossRef] [Green Version]

- Mohammadfam, I.; Bastani, S.; Esaghi, M.; Golmohamadi, R.; Saee, A. Evaluation of Coordination of Emergency Response Team through the Social Network Analysis. Case Study: Oil and Gas Refinery. Saf. Health Work 2015, 6, 30–34. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Yang, R.J.; Zou, P.X.W. Stakeholder-associated risks and their interactions in complex green building projects: A social network model. Build. Environ. 2014, 73, 208–222. [Google Scholar] [CrossRef]

- Zhou, Z.; Irizarry, J. Integrated Framework of Modified Accident Energy Release Model and Network Theory to Explore the Full Complexity of the Hangzhou Subway Construction Collapse. J. Manag. Eng. 2016, 32, 5016013. [Google Scholar] [CrossRef]

- Luo, L.; Shen, G.Q.; Xu, G.; Liu, Y.; Wang, Y. Stakeholder-Associated Supply Chain Risks and Their Interactions in a Prefabricated Building Project in Hong Kong. J. Manag. Eng. 2019, 35, 5018015. [Google Scholar] [CrossRef]

- Yu, T.; Shen, G.Q.; Shi, Q.; Lai, X.; Li, C.Z.; Xu, K. Managing social risks at the housing demolition stage of urban redevelopment projects: A stakeholder-oriented study using social network analysis. Int. J. Proj. Manag. 2017, 35, 925–941. [Google Scholar] [CrossRef]

- Pinto, J.K.; Mantel, S.J. The causes of project failure. IEEE Trans. Eng. Manag. 1990, 37, 269–276. [Google Scholar] [CrossRef] [Green Version]

- Jamali, D. Success and failure mechanisms of public private partnerships (PPPs) in developing countries: Insights from the Lebanese context. Int. J. Public Sect. Manag. 2004, 17, 414–430. [Google Scholar] [CrossRef]

- Brinkmann, S. Det Kvalitative Interview; Hans Publishers: Berlin, Germany; Washington, DC, USA, 2014. [Google Scholar]

- Le, Y.; Shan, M.; Chan, A.P.C.; Hu, Y. Investigating the causal relationships between causes of and vulnerabilities to corruption in the Chinese Public Construction Sector. J. Constr. Eng. Manag. 2014, 140, 5014007. [Google Scholar] [CrossRef]

- Marshall, B.; Cardon, P.; Poddar, A.; Fontenot, R. Does sample size matter in qualitative research?: A review of qualitative interviews in IS research. J. Comput. Inf. Syst. 2013, 54, 11–22. [Google Scholar] [CrossRef]

- Denzin, N.K.; Lincoln, Y.S. Strategies of Qualitative Inquiry; Sage: Thousand Oaks, CA, USA, 2008; Volume 2, ISBN 1412957567. [Google Scholar]

- Jin, X.-H.; Zhang, G. Modelling optimal risk allocation in PPP projects using artificial neural networks. Int. J. Proj. Manag. 2011, 29, 591–603. [Google Scholar] [CrossRef]

- Yang, R.J.; Zou, P.X.W.; Wang, J. Modelling stakeholder-associated risk networks in green building projects. Int. J. Proj. Manag. 2016, 34, 66–81. [Google Scholar] [CrossRef]

- Sastoque, L.M.; Arboleda, C.A.; Ponz, J.L. A proposal for risk allocation in social infrastructure projects applying PPP in Colombia. Procedia Eng. 2016, 145, 1354–1361. [Google Scholar] [CrossRef] [Green Version]

- Valipour, A.; Yahaya, N.; Md Noor, N.; Kildienė, S.; Sarvari, H.; Mardani, A. A fuzzy analytic network process method for risk prioritization in freeway PPP projects: An Iranian case study. J. Civ. Eng. Manag. 2015, 21, 933–947. [Google Scholar] [CrossRef] [Green Version]

- Osei-Kyei, R.; Chan, A.P.C. Comparative analysis of the success criteria for public–private partnership projects in Ghana and Hong Kong. Proj. Manag. J. 2017, 48, 80–92. [Google Scholar] [CrossRef] [Green Version]

- Mazouz, B.; Facal, J.; Viola, J.-M. Public-private partnership: Elements for a project-based management typology. Proj. Manag. J. 2008, 39, 98–110. [Google Scholar] [CrossRef]

| Method | Disadvantage | Reference |

|---|---|---|

| Monte Carlo Simulation | The number of samples needed for it must be large enough to make the estimated distribution close to the real distribution. | Ye and Tiong [73] |

| Analytical Hierarchy Process | It has less quantitative data and more qualitative components, which may not be convincing, and may not consider the relationship between risks. | Hastak and Shaked [74] Wu et al. [76] |

| Fuzzy Set Theory | The fuzzy processing of simple information can reduce the control precision and dynamic quality of the risk management system. | Thomas et al. [75] Wu et al. [76] |

| The Grey Fuzzy Method | The calculation is complex and the determination of the index weight vector is subjective in risk assessment. | Wu et al. [76] |

| Risk Factors | Implications | Case Sources | Literature Sources |

|---|---|---|---|

| F1 Legal change | Refers to the risk caused by a change in the validity of the project contract due to a relevant legal change after the promulgation of the project contract. | Shanghai Da Chang Waterworks; Yan’an East Road Tunnel | Song et al. [24] |

| F2 Imperfect legal and regulatory system | Risk caused by the absence or imperfection of current relevant laws. | Quan Zhou Ertong Bridge, Fujian Province; Yan’an East Road Tunnel Double Line | Ameyaw and Chan [13] |

| F3 Government decision-making errors | Risk caused by errors or length of the government decision-making process that made the process unreasonable or inadequate staff capacity and experience. | Qingdao Veolia Sewage Treatment Project | Song et al. [24] |

| F4 Delay in Government Approval | Risk caused by cumbersome approval process or inefficiency of staff in related departments. | Beijing 10th Water Plant | Hwang et al. [52] |

| F5 Government Credit | Risk caused by the government’s failure to perform, refusal to perform, or failure to perform contractual obligations for certain reasons. | Changchun Huijin Sewage Treatment Plant; Xin yuan Four Bridges of Min Jiang River | Ameyaw and Chan [59]; Song et al. [24] |

| F6 Corruption | Illegal income demanded by government officials or staff, resulting in increased company costs and increased risk of government default. | Shenyang No. 9 Water Plant | Ameyaw and Chan [13]; Ameyaw and Chan [59] |

| F7 Insufficient revenue in the market | Operating income was lower than expected due to poor project performance or services, which leads to a risk that the investment cannot be recovered. | Tianjin Shuanggang Waste Incineration Power Plant | Song et al. [24] |

| F8 Change in market demand | Market supply-demand relationship change due to macroeconomic changes and/or other reasons, which lead to the risk of a difference between market forecast and actual demand. | Hangzhou Bay Cross-Sea Bridge; Shandong Zhong Hua Power Generation Project | Shao et al. [14]; Ameyaw and Chan [59] |

| F9 Public objection | The public interest is damaged due to a lack of environmental protection and/or other reasons, leading to the risk of public opposition to the continued construction of the project. | Beijing 10th Water Plant; Shanghai Da chang Water Plant | Ameyaw and Chan [13]; Song et al. [24]; Ameyaw and Chan [59] |

| F10 Financing risk | Risk arising from difficulties in financing due to unreasonable financing structure, credit, or national policies. | A power plant in Hunan | Ameyaw and Chan [13] Ameyaw and Chan [59] |

| F11 Completion Risk | Risk of unfinished, delayed, or substandard project quality due to inappropriate project schedule control for various reasons. | Chengdu Rail Transit Line 18 Project | Doloi [20] |

| F12 Project Uniqueness | Risk arising from commercial competition due to government building or remodeling of other similar projects. | Xin yuan Four Min Jiang River Bridge; Hangzhou Bay Sea-Crossing Bridge; | Ameyaw and Chan [13] |

| F13 Fee change | Risk arising from changes in fees due to unreasonable or inconsistent charges for project products and services. | Beijing Metro Line 4; Kaifeng Sports Center Project | Xu et al. [71] |

| F14 Poor project company management | Risk resulting from improper management of project company due to an unreasonable bidding process and internal conflict in the project company. | Hua shan Service Area Project; Hangzhou Bay Bridge Project | Ameyaw and Chan [13] |

| F15 Force Majeure | Factors, such as natural disasters, wars, or other risks to the project that cannot be predicted, controlled or prevented. | A power plant in Hunan | Ameyaw and Chan [59]; Aziz and Shen [54] |

| F16 Contract risk | Risk arising from the refusal or failure of a party to fulfill contract obligations for certain reasons. | Shanghai Da chang Water Plant; Lian Jiang China-France Water Supply Plant | Ameyaw and Chan [13]; Song et al. [24]; Ameyaw and Chan [59] |

| F17 Environmental risk | Risk arising from violations of environmental regulations or pollution that require increased investment to continue operation or project failure. | Domestic Waste Incineration Power Plant in Western Qin Huang Dao | Xu et al. [71] |

| F18 Interest rate risk | Change in the market interest rate that leads to investment difficulty for social capitalists, thus increasing the project risk. | Guangxi Lai Bin Waste Incineration Power Plant | Ameyaw and Chan [13]; Ameyaw and Chan [59] |

| F19 Cost risk | Risk arising from increased project costs due to improper cost control measures, design errors, or other factors. | China National Stadium Bird’s Nest PPP Project | Doloi [20]; Ameyaw and Chan [59] |

| F20 Inadequate Infrastructure | Risk arising from factors such as inadequate project-related infrastructure and its consequent impact on project progress. | Lake Townsend Sewage Treatment Plant | Xu et al. [71] |

| No. | Role | Company Type | Experience in The Sector | Major Research Fields |

|---|---|---|---|---|

| 1 | Project Manager | Contractor | Five years | Project Management |

| 2 | Cost Manager | Contractor | Eight years | Cost Management |

| 3 | Engineer | Contractor | Six years | The entire project management process |

| 4 | Investment manager | Contractor | Five years | Project investment and financing management |

| 5 | Professor | College | Twenty years | PPP project management mode |

| Node | Out-Degree | In-Degree | Node | Out-Degree | In-Degree |

|---|---|---|---|---|---|

| F2 | 56 | 21 | F8 | 28 | 29 |

| F1 | 50 | 16 | F17 | 28 | 24 |

| F5 | 48 | 33 | F12 | 27 | 34 |

| F6 | 47 | 28 | F11 | 26 | 52 |

| F3 | 45 | 35 | F10 | 25 | 44 |

| F4 | 44 | 38 | F16 | 24 | 48 |

| F9 | 40 | 29 | F20 | 21 | 16 |

| F13 | 32 | 51 | F15 | 16 | 11 |

| F14 | 32 | 21 | F19 | 15 | 55 |

| F7 | 31 | 43 | F18 | 14 | 21 |

| Node | Betweenness | nBetweenness | Node | Betweenness | nBetweenness |

|---|---|---|---|---|---|

| F4 | 12.248 | 3.581 | F14 | 2.894 | 0.846 |

| F3 | 9.858 | 2.882 | F2 | 2.863 | 0.837 |

| F11 | 8.102 | 2.369 | F16 | 2.122 | 0.621 |

| F13 | 7.086 | 2.072 | F8 | 2.045 | 0.598 |

| F7 | 6.695 | 1.958 | F1 | 1.779 | 0.520 |

| F5 | 6.295 | 1.841 | F17 | 1.164 | 0.340 |

| F10 | 5.103 | 1.466 | F19 | 0.559 | 0.175 |

| F9 | 3.778 | 1.105 | F20 | 0.162 | 0.047 |

| F6 | 3.139 | 0.918 | F15 | 0.162 | 0.047 |

| F12 | 2.926 | 0.856 | F18 | 0.071 | 0.021 |

| Node | inCloseness | outCloseness | Node | inCloseness | outCloseness |

|---|---|---|---|---|---|

| F11 | 100.00 | 90.48 | F12 | 82.61 | 82.61 |

| F7 | 100.00 | 86.36 | F14 | 82.61 | 86.36 |

| F13 | 100.00 | 86.36 | F9 | 79.17 | 95.00 |

| F4 | 100.00 | 100.00 | F2 | 76.00 | 100.00 |

| F19 | 95.00 | 61.29 | F6 | 76.00 | 100.00 |

| F16 | 95.00 | 73.08 | F17 | 73.08 | 79.17 |

| F3 | 95.00 | 100.00 | F18 | 70.37 | 61.29 |

| F10 | 90.48 | 86.36 | F15 | 70.37 | 65.52 |

| F8 | 86.36 | 76.00 | F1 | 67.86 | 100.00 |

| F5 | 86.36 | 100.00 | F20 | 63.33 | 70.37 |

| Node | Row Sums | Col Sums | Node | Row Sums | Col Sums |

|---|---|---|---|---|---|

| F1 | 1.039 | 1.013 | F11 | 1.021 | 1.041 |

| F2 | 1.044 | 1.017 | F12 | 1.021 | 1.027 |

| F3 | 1.036 | 1.028 | F13 | 1.025 | 1.040 |

| F4 | 1.035 | 1.030 | F14 | 1.025 | 1.017 |

| F5 | 1.038 | 1.026 | F15 | 1.013 | 1.009 |

| F6 | 1.037 | 1.022 | F16 | 1.019 | 1.038 |

| F7 | 1.025 | 1.034 | F17 | 1.022 | 1.019 |

| F8 | 1.022 | 1.023 | F18 | 1.011 | 1.017 |

| F9 | 1.032 | 1.023 | F19 | 1.012 | 1.043 |

| F10 | 1.020 | 1.035 | F20 | 1.017 | 1.013 |

| Five Factions |

|---|

| 1: 1 2 3 4 5 6 7 9 10 11 12 13 14 16 17 19 20 |

| 2: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 16 17 |

| 3: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 |

| 4: 1 2 3 4 5 6 7 9 10 11 12 13 14 15 16 19 |

| 5: 1 2 3 4 5 6 7 9 10 11 12 13 18 19 |

| 1 | 2 | 3 | 4 | 5 | |

| 1 | 17 | 15 | 14 | 15 | 13 |

| 2 | 15 | 16 | 15 | 14 | 12 |

| 3 | 14 | 15 | 16 | 15 | 12 |

| 4 | 15 | 14 | 15 | 16 | 13 |

| 5 | 13 | 12 | 12 | 13 | 14 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Y.; Wang, Y.; Wu, X.; Li, J. Exploring the Risk Factors of Infrastructure PPP Projects for Sustainable Delivery: A Social Network Perspective. Sustainability 2020, 12, 4152. https://doi.org/10.3390/su12104152

Wang Y, Wang Y, Wu X, Li J. Exploring the Risk Factors of Infrastructure PPP Projects for Sustainable Delivery: A Social Network Perspective. Sustainability. 2020; 12(10):4152. https://doi.org/10.3390/su12104152

Chicago/Turabian StyleWang, Yan, Yujie Wang, Xiuyu Wu, and Jiwang Li. 2020. "Exploring the Risk Factors of Infrastructure PPP Projects for Sustainable Delivery: A Social Network Perspective" Sustainability 12, no. 10: 4152. https://doi.org/10.3390/su12104152

APA StyleWang, Y., Wang, Y., Wu, X., & Li, J. (2020). Exploring the Risk Factors of Infrastructure PPP Projects for Sustainable Delivery: A Social Network Perspective. Sustainability, 12(10), 4152. https://doi.org/10.3390/su12104152