Assessment of Formal Credit and Climate Change Impact on Agricultural Production in Pakistan: A Time Series ARDL Modeling Approach

Abstract

:1. Introduction

2. Review of Literature

3. Data and Methods

3.1. Model Specification

3.2. Estimation Techniques

3.2.1. Autoregressive Distributed Lag (ARDL)

3.2.2. Vector Error Correction Model (VECM) Grounded Ganger Causality Test

4. Results and Discussion

4.1. Descriptive Statistics and Correlation Analysis

4.2. Unit Root Tests Results

4.3. Cointegration Testing Results

4.4. Long-Run and Short-Run Estimates

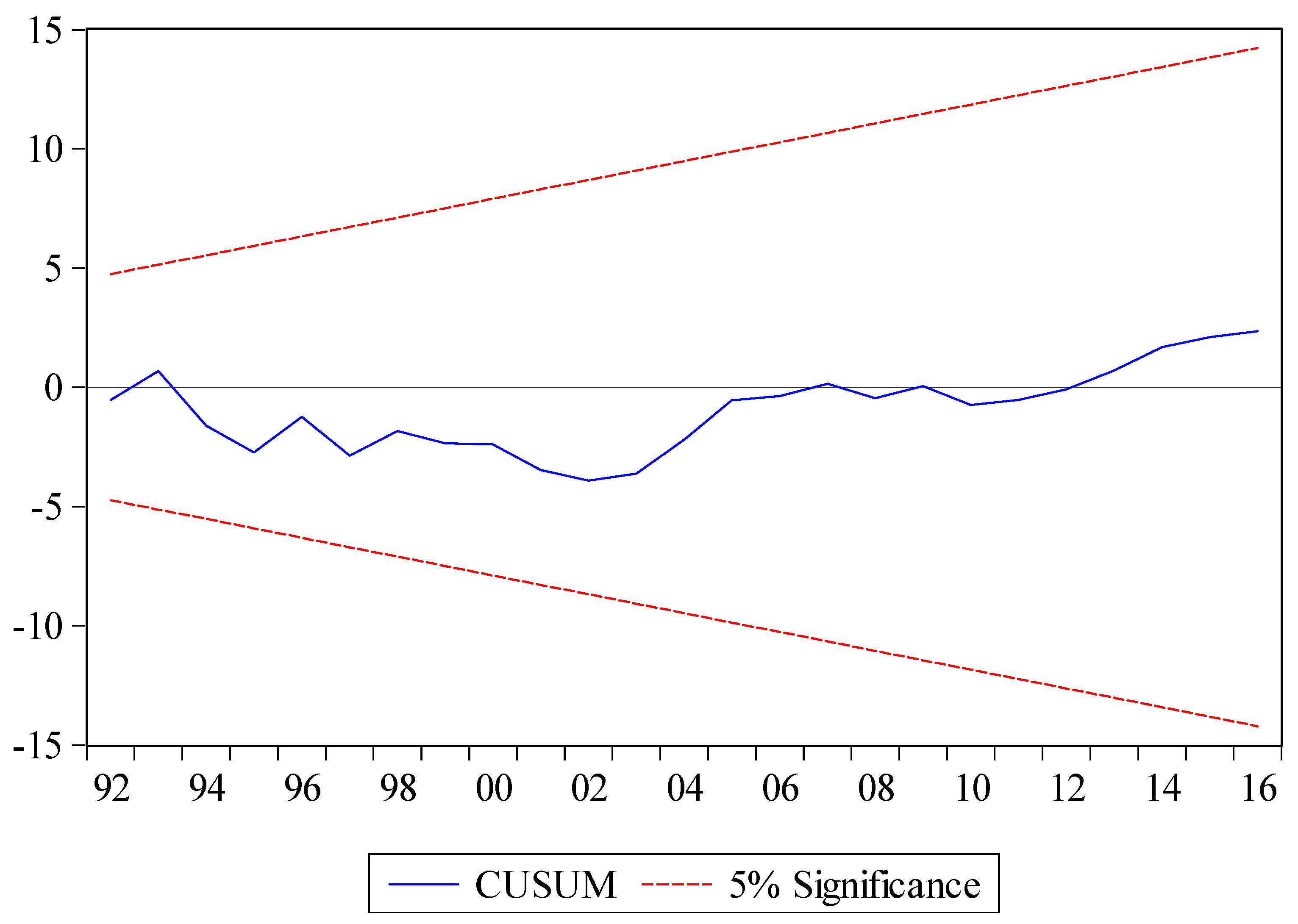

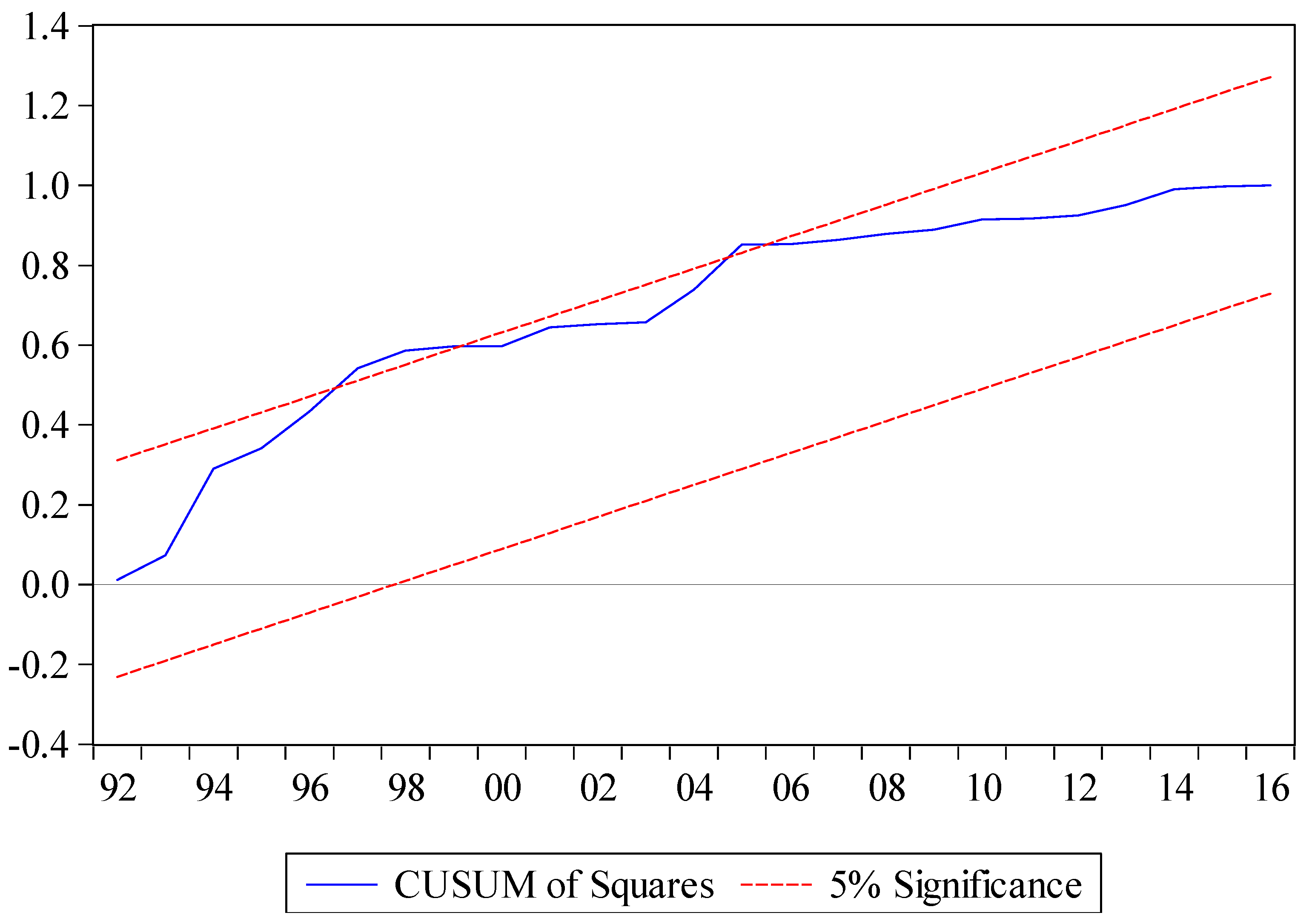

4.5. Diagnostic Tests

4.6. VECM Results

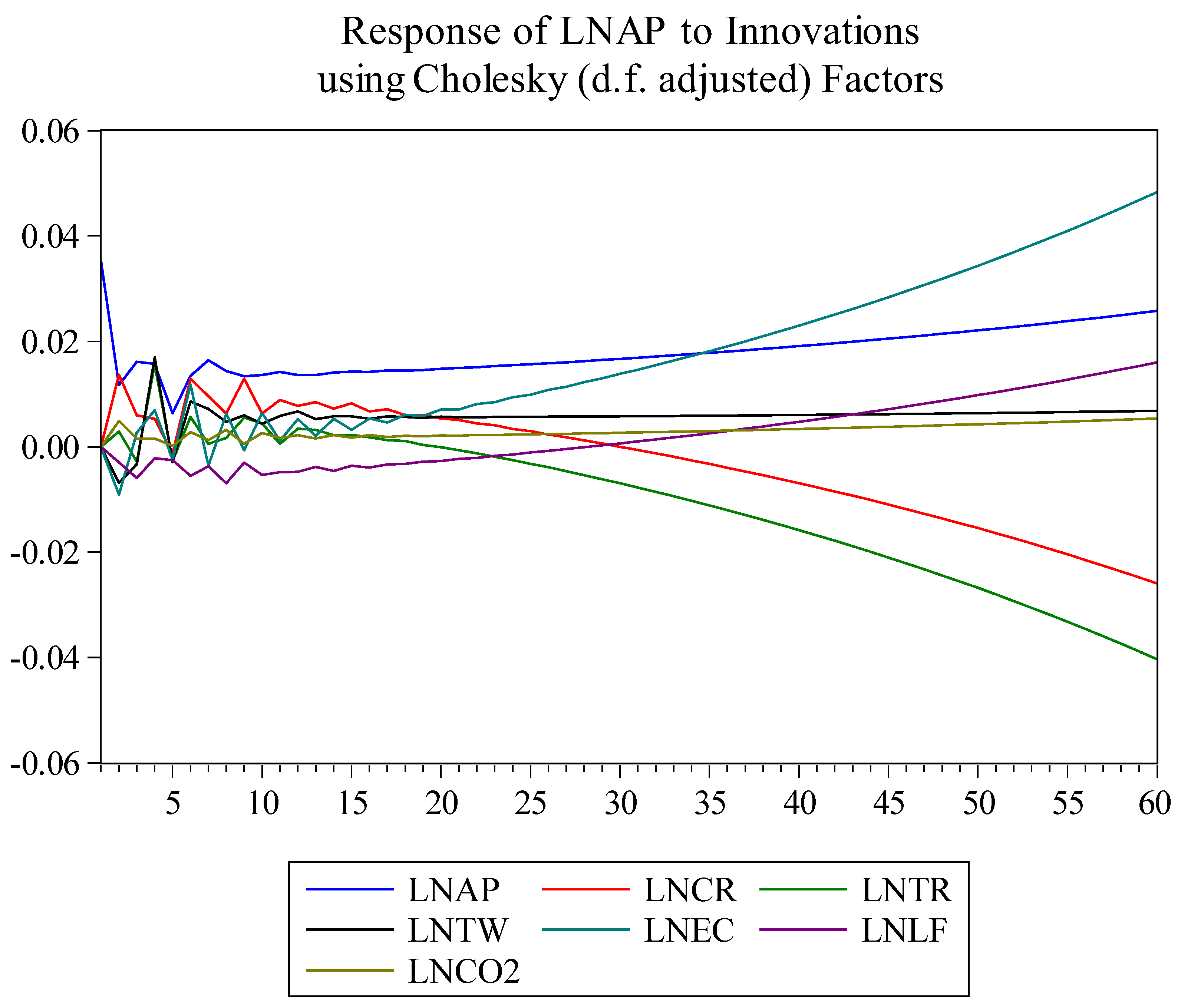

4.7. Impulse Response Function Results

5. Conclusions and Policy Implications

Author Contributions

Funding

Conflicts of Interest

References

- GOP. Pakistan Economic Survey 2018–2019; Economic Advisor’s Wing; Ministry of Finance, Government of Pakistan: Islamabad, Pakistan, 2019.

- GOP. Pakistan Economic Survey 2017–2018; Economic Advisor’s Wing; Ministry of Finance, Government of Pakistan: Islamabad, Pakistan, 2018.

- Chandio, A.A.; Jiang, Y.; Wei, F.; Guangshun, X. Effects of agricultural credit on wheat productivity of small farms in Sindh, Pakistan: Are short-term loans better? Agric. Financ. Rev. 2018, 78, 592–610. [Google Scholar] [CrossRef] [Green Version]

- Hussain, A.; Thapa, G.B. Smallholders’ access to agricultural credit in Pakistan. Food Secur. 2012, 4, 73–85. [Google Scholar] [CrossRef]

- Khan, R.E.A. Demand for Formal and Informal Credit in Agriculture: A Case Study of Cotton Growers in Bahawalpur. Interdiscip. J. Contemp. Res. Bus. 2011, 2, 10. [Google Scholar]

- Akram, W.; Hussain, Z. Agricultural credit constraints and borrowing behavior of farmers in rural Punjab. Eur. J. Sci. Res. 2008, 23, 294–304. [Google Scholar]

- Park, A.; Ren, C.; Wang, S. Microfinance, Poverty Alleviation, and Financial Reform in China. 2011. Available online: https://ora.ox.ac.uk/objects/uuid:e2e1e676-76d4-4dd1-96ab-c660a0c80eef (accessed on 17 June 2020).

- Adejobi, O.; Atobatele, J. An analysis of loan delinquency among small scale farmers in Southwestern Nigeria: Application of logit and loan performance indices. East Afr. Agric. For. J. 2008, 74, 149–157. [Google Scholar]

- Ahmad, A.; Jan, I.; Ullah, S.; Pervez, S. Impact of agricultural credit on wheat productivity in District Jhang, Pakistan. Sarhad J. Agric. 2015, 31, 65–69. [Google Scholar]

- Ayaz, S.; Anwar, S.; Sial, M.H.; Hussain, Z. Role of agricultural credit on production efficiency of farming sector in Pakistan–a data envelopment analysis. Pak. J. Life Soc. Sci. 2011, 9, 38–44. [Google Scholar]

- Bashir, M.K.; Gill, Z.A.; Hassan, S.; Adil, S.A.; Bakhsh, K. Impact of credit disbursed by commercial banks on the productivity of sugarcane in Faisalabad district. Pak. J. Agric. Sci. 2007, 44, 361–363. [Google Scholar]

- Bashir, M.K.; Mehmood, Y. Institutional credit and rice productivity: A case study of District Lahore, Pakistan. China Agric. Econ. Rev. 2010, 2, 412–419. [Google Scholar] [CrossRef]

- Akmal, N.; Rehman, B.; Ali, A.; Shah, H. The Impact of Agriculture Credit on Growth in Pakistan. Asian J. Agric. Rural Dev. 2012, 2, 579. [Google Scholar]

- Iqbal, M.; Ahmad, M.; Abbas, K. The impact of institutional credit on agricultural production in Pakistan. Pak. Dev. Rev. 2003, 469–485. [Google Scholar] [CrossRef] [Green Version]

- Sial, M.H.; Awan, M.S.; Waqas, M. Role of Institutional Credit on Agricultural Production: A Time Series Analysis of Pakistan. Int. J. Econ. Financ. 2011. [Google Scholar] [CrossRef] [Green Version]

- Attiaoui, I.; Boufateh, T. Impacts of climate change on cereal farming in Tunisia: A panel ARDL–PMG approach. Environ. Sci. Pollut. Res. 2019, 26, 13334–13345. [Google Scholar] [CrossRef]

- Chandio, A.A.; Ozturk, I.; Akram, W.; Ahmad, F.; Mirani, A.A. Empirical analysis of climate change factors affecting cereal yield: Evidence from Turkey. Environ. Sci. Pollut. Res. 2020, 27, 11944–11957. [Google Scholar] [CrossRef] [PubMed]

- Guntukula, R. Assessing the impact of climate change on Indian agriculture: Evidence from major crop yields. J. Public Aff. 2019, 20, e2040. [Google Scholar] [CrossRef]

- Dubey, S.K.; Sharma, D. Assessment of climate change impact on yield of major crops in the Banas River Basin, India. Sci. Total Environ. 2018, 635, 10–19. [Google Scholar] [CrossRef]

- Praveen, B.; Sharma, P. A review of literature on climate change and its impacts on agriculture productivity. J. Public Aff. 2019, 19, e1960. [Google Scholar] [CrossRef]

- Ali, S.; Liu, Y.; Ishaq, M.; Shah, T.; Ilyas, A.; Din, I.U. Climate change and its impact on the yield of major food crops: Evidence from Pakistan. Foods 2017, 6, 39. [Google Scholar] [CrossRef]

- Ahsan, F.; Chandio, A.A.; Fang, W. Climate change impacts on cereal crops production in Pakistan. Int. J. Clim. Chang. Strateg. Manag. 2020. [Google Scholar] [CrossRef]

- Abid, M.; Schneider, U.A.; Scheffran, J. Adaptation to climate change and its impacts on food productivity and crop income: Perspectives of farmers in rural Pakistan. J. Rural Stud. 2016, 47, 254–266. [Google Scholar] [CrossRef]

- Chandio, A.A.; Magsi, H.; Ozturk, I. Examining the effects of climate change on rice production: Case study of Pakistan. Environ. Sci. Pollut. Res. 2020, 27, 7812–7822. [Google Scholar] [CrossRef]

- Qureshi, M.I.; Awan, U.; Arshad, Z.; Rasli, A.M.; Zaman, K.; Khan, F. Dynamic linkages among energy consumption, air pollution, greenhouse gas emissions and agricultural production in Pakistan: Sustainable agriculture key to policy success. Nat. Hazards 2016, 84, 367–381. [Google Scholar] [CrossRef]

- Abraham, T.W.; Fonta, W.M. Climate change and financing adaptation by farmers in northern Nigeria. Financ. Innov. 2018, 4, 11. [Google Scholar] [CrossRef]

- Johansen, S.; Juselius, K. Maximum likelihood estimation and inference on cointegration—with applications to the demand for money. Oxf. Bull. Econ. Stat. 1990, 52, 169–210. [Google Scholar] [CrossRef]

- Saqib, S.E.; Ahmad, M.M.; Panezai, S. Landholding size and farmers’ access to credit and its utilisation in Pakistan. Dev. Pract. 2016, 26, 1060–1071. [Google Scholar] [CrossRef]

- Saqib, S.E.; Kuwornu, J.K.M.; Panezia, S.; Ali, U. Factors determining subsistence farmers’ access to agricultural credit in flood-prone areas of Pakistan. Kasetsart J. Soc. Sci. 2018, 39, 262–268. [Google Scholar] [CrossRef]

- Carter, M.R. The impact of credit on peasant productivity and differentiation in Nicaragua. J. Dev. Econ. 1989, 31, 13–36. [Google Scholar] [CrossRef]

- Chaudhry, M.G.; Hussain, Z. Mechanization and agricultural development in pakistan [with comments]. Pak. Dev. Rev. 1986, 25, 431–449. [Google Scholar] [CrossRef]

- Feder, G.; Lau, L.J.; Lin, J.Y.; Luo, X. The relationship between credit and productivity in Chinese agriculture: A microeconomic model of disequilibrium. Am. J. Agric. Econ. 1990, 72, 1151–1157. [Google Scholar] [CrossRef]

- Khandker, S.R.; Faruqee, R.R. The Impact of Farm Credit in Pakistan. Agric. Econ. 2003, 28, 197–213. [Google Scholar] [CrossRef]

- Malik, S.L.; Broca, S.S.; Gill, M.A. Access by Farm Households to Credit from Formal Sources: The Case of Pakistan. Z. Ausl. Landwirtsch. 1996, 35, 269–280. [Google Scholar]

- Saleem, M.A.; Jan, F.A. The Impact of Agricultural Credit on Agricultural Productivity in Dera Ismail Khan (District) Khyber Pakhtonkhawa Pakistan. Eur. J. Bus. Manag. 2011, 3, 38–44. [Google Scholar]

- Shrestha, C.M. Institutional credit as a catalyst for agricultural sector growth: Evidence from Nepal. J. Econ. Dev. 1992, 17, 137–144. [Google Scholar]

- Zuberi, H.A. Production function, institutional credit and agricultural development in Pakistan. Pak. Dev. Rev. 1989, 28, 43–55. [Google Scholar] [CrossRef] [Green Version]

- Meyer, R.L. Analyzing the farm-level impact of agricultural credit: Discussion. Am. J. Agric. Econ. 1990, 72, 1158–1160. [Google Scholar] [CrossRef] [Green Version]

- Agbodji, A.E.; Johnson, A.A. Agricultural Credit and Its Impact on the Productivity of Certain Cereals in Togo. Emerg. Mark. Financ. Trade 2019, 1–17. [Google Scholar] [CrossRef]

- Afrin, S.; Haider, M.Z.; Islam, M. Impact of financial inclusion on technical efficiency of paddy farmers in Bangladesh. Agric. Financ. Rev. 2017, 77, 484–505. [Google Scholar] [CrossRef]

- Malik, S.J.; Mushtaq, M.; Gill, M.A. The role of institutional credit in the agricultural development of Pakistan. Pak. Dev. Rev. 1991, 30, 1039–1048. [Google Scholar] [CrossRef] [Green Version]

- Dong, F.; Lu, J.; Featherstone, A.M. Effects of credit constraints on household productivity in rural China. Agric. Financ. Rev. 2012, 72, 402–415. [Google Scholar] [CrossRef]

- Obilor, S.I. The impact of commercial banks’ credit to agriculture on agricultural development in Nigeria: An econometric analysis. Int. J. Bus. Humanit. Technol. 2013, 3, 85–94. [Google Scholar]

- Rahman, S.; Hussain, A.; Taqi, M. Impact of agricultural credit on agricultural productivity in Pakistan: An empirical analysis. Int. J. Adv. Res. Manag. Soc. Sci. 2014, 3, 125–139. [Google Scholar]

- Rehman, A.; Chandio, A.A.; Hussain, I.; Jingdong, L. Fertilizer consumption, water availability and credit distribution: Major factors affecting agricultural productivity in Pakistan. J. Saudi Soc. Agric. Sci. 2019, 18, 269–274. [Google Scholar] [CrossRef]

- Jan, I.; Manig, W. The Influence of Participation in Agricultural Support Services on Income from Agriculture: Results from the Multiple Regression Model (A Case from Rural Northwest Pakistan). Sarhad J. Agric. 2008, 24, 129. [Google Scholar]

- Islam, M.T.; Nursey-Bray, M. Adaptation to climate change in agriculture in Bangladesh: The role of formal institutions. J. Environ. Manag. 2017, 200, 347–358. [Google Scholar] [CrossRef] [PubMed]

- Zhou, L.; Turvey, C.G. Climate change, adaptation and China’s grain production. China Econ. Rev. 2014, 28, 72–89. [Google Scholar] [CrossRef]

- Janjua, P.Z.; Samad, G.; Khan, N. Climate change and wheat production in Pakistan: An autoregressive distributed lag approach. NJAS-Wagening. J. Life Sci. 2014, 68, 13–19. [Google Scholar] [CrossRef] [Green Version]

- Bank, W. World Bank (2016) World Development Indicators. 2016. Available online: http://data.worldbank.org/indicator (accessed on 30 December 2019).

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Engle, R.F.; Granger, C.W. Co-integration and error correction: Representation, estimation, and testing. Econom. J. Econom. Soc. 1987, 251–276. [Google Scholar] [CrossRef]

- Ozturk, I.; Acaravci, A. Electricity consumption and real GDP causality nexus: Evidence from ARDL bounds testing approach for 11 MENA countries. Appl. Energy 2011, 88, 2885–2892. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Likelihood ratio statistics for autoregressive time series with a unit root. Econom. J. Econom. Soc. 1981, 49, 1057–1072. [Google Scholar] [CrossRef]

- Phillips, P.C.; Perron, P. Testing for a unit root in time series regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Ng, S.; Perron, P. Lag length selection and the construction of unit root tests with good size and power. Econometrica 2001, 69, 1519–1554. [Google Scholar] [CrossRef] [Green Version]

- Ahmad, N. Impact of Institutional Credit on Agricultural Output. Pak. Dev. Rev. 2011, 42, 469–485. [Google Scholar]

- Hussain, A.H. Impact of Credit Disbursement, Area under Cultivation, Fertilizer Consumption and Water Availability on Rice Production in Pakistan (1988–2010). Sarhad J. Agric. 2012, 28, 95–101. [Google Scholar]

- Javed, M.I.; Khurshid, W.; Hassan, I.; Ali, A.; Nadeem, N. Impact of institutional credit and extension services on productive efficiency of farms: Evidence from irrigated Punjab, Pakistan. J. Agric. Res. 2012, 50, 145–153. [Google Scholar]

- Ahmad, D.; Chani, M.I.; Afzal, M. Impact of Formal Credit on Agricultural Output: Empirical Evidence from Pakistan. Sarhad J. Agric. 2018, 34. [Google Scholar] [CrossRef]

- Zakaria, M.; Jun, W.; Khan, M.F. Impact of financial development on agricultural productivity in South Asia. Agric. Econ. Zemed. Ekon. 2019, 65, 232–239. [Google Scholar] [CrossRef] [Green Version]

- Raifu, I.A.; Aminu, A. Financial development and agricultural performance in Nigeria: What role do institutions play? Agric. Financ. Rev. 2019, 80, 231–254. [Google Scholar] [CrossRef]

- Longe, J. Economics of agricultural production in Nigeria. J. Policy Issues 2008, 1, 2–10. [Google Scholar]

- Akbar, M.; Noor, F.; Ahmad, I.; Sattar, A. Impact of energy consumption and CO2 emissions on food production in Pakistan: An econometric analysis. Pak. J. Agric. Sci. 2018, 55, 455–461. [Google Scholar]

- Chandio, A.A.; Jiang, Y.; Rehman, A.; Rauf, A. Short and long-run impacts of climate change on agriculture: An empirical evidence from China. Int. J. Clim. Chang. Strateg. Manag. 2020, 12, 201–221. [Google Scholar] [CrossRef]

| LNAP | LNCR | LNTR | LNTW | LNEC | LNLF | LNCO2 | |

|---|---|---|---|---|---|---|---|

| Mean | 7.7036 | 10.8255 | 10.3344 | 7.9921 | 8.6757 | 18.3058 | −0.3025 |

| Median | 7.7071 | 10.6271 | 10.2033 | 6.9155 | 8.7213 | 18.3344 | −0.2780 |

| Maximum | 8.0275 | 13.3018 | 12.7815 | 12.6921 | 9.1787 | 18.5812 | −0.0090 |

| Minimum | 7.3427 | 8.7119 | 8.2180 | 5.8284 | 7.8473 | 17.9328 | −0.7613 |

| Std. Dev. | 0.2125 | 1.3734 | 0.8781 | 2.5593 | 0.3717 | 0.1926 | 0.2220 |

| Skewness | −0.0289 | 0.3375 | 0.4105 | 1.1730 | −0.8448 | −0.3486 | −0.5315 |

| Kurtosis | 1.7081 | 1.7121 | 3.7912 | 2.5004 | 2.8205 | 1.9556 | 2.1487 |

| Jarque-Bera | 2.3688 | 2.9953 | 1.8419 | 8.1509 | 4.0906 | 2.2338 | 2.6275 |

| Probability | 0.3059 | 0.2236 | 0.3981 | 0.0169 | 0.1293 | 0.3272 | 0.2688 |

| Sum | 261.9258 | 368.0692 | 351.3712 | 271.7331 | 294.9768 | 622.3973 | −10.2867 |

| Sum Sq. Dev. | 1.4912 | 62.2494 | 25.4462 | 216.1661 | 4.5604 | 1.2247 | 1.6270 |

| Observations | 34 | 34 | 34 | 34 | 34 | 34 | 34 |

| Correlation | LNAP | LNCR | LNTR | LNTW | LNEC | LNLF | LNCO2 |

|---|---|---|---|---|---|---|---|

| LNAP | 1.0000 | ||||||

| ----- | |||||||

| ----- | |||||||

| LNCR | 0.9644 | 1.0000 | |||||

| (20.3330) | ----- | ||||||

| [0.0000] | ----- | ||||||

| LNTR | 0.6963 | 0.6925 | 1.0000 | ||||

| (5.4015) | (5.3457) | ----- | |||||

| [0.0000] | [0.0000] | ----- | |||||

| LNTW | −0.5866 | −0.4338 | −0.1773 | 1.0000 | |||

| (−4.0335) | (−2.6811) | (−1.0031) | ----- | ||||

| [0.0003] | [0.0117] | [0.3236] | ----- | ||||

| LNEC | 0.8418 | 0.7969 | 0.5374 | −0.7181 | 1.0000 | ||

| (8.6834) | (7.3448) | (3.5480) | (−5.7451) | ----- | |||

| [0.0000] | [0.0000] | [0.0013] | [0.0000] | ----- | |||

| LNLF | 0.9793 | 0.9457 | 0.6358 | −0.6648 | 0.8909 | 1.0000 | |

| (26.9476) | (16.2104) | (4.5874) | (−4.9555) | (10.9251) | ----- | ||

| [0.0000] | [0.0000] | [0.0001] | [0.0000] | [0.0000] | ----- | ||

| LNCO2 | 0.9385 | 0.8862 | 0.6444 | −0.6879 | 0.9197 | 0.9657 | 1.0000 |

| (15.1406) | (10.6520) | (4.6923) | (−5.2778) | (13.0497) | (20.7362) | ----- | |

| [0.0000] | [0.0000] | [0.0000] | [0.0001] | [0.0000] | [0.0000] | ----- |

| Variables | MZa | MZt | MSB | MPT |

|---|---|---|---|---|

| Ng-Perron Test at Levels | ||||

| LNAP | −15.6800 *** | −2.7968 | 0.1783 | 5.8299 |

| LNCR | 2.0549 | 2.5628 | 1.2471 | 126.444 |

| LNTR | −5.2084 | −1.6105 | 0.3092 | 4.7121 |

| LNTW | −2.3893 | −1.0224 | 0.4279 | 9.8214 |

| LNEC | −1.3914 | −0.6331 | 0.4550 | 13.0253 |

| LNLF | −19.2617 *** | −2.9937 | 0.1554 | 5.3794 |

| LNCO2 | 0.5295 | 0.5586 | 1.0549 | 69.3321 |

| Ng-Perron Test at 1st Difference | ||||

| LNAP | - | - | - | - |

| LNCR | −14.2491 *** | −2.6646 | 0.1870 | 1.7368 |

| LNTR | −13.7443 *** | −2.4964 | 0.1816 | 2.2488 |

| LNTW | −15.9774 *** | −2.8258 | 0.1768 | 1.5356 |

| LNEC | −13.8933 *** | −2.6337 | 0.1895 | 1.7707 |

| LNLF | - | - | - | - |

| LNCO2 | −15.8300 *** | −2.7595 | 0.1743 | 1.7460 |

| Variables | Level | 1st Difference | ||

|---|---|---|---|---|

| T-Statistic | Break | T-Statistic | Break | |

| LNAP | −7.87 | 1998 | - | - |

| LNCR | −3.71 | 1989 | −5.36 | 1998 |

| LNTR | −5.61 | 2004 | - | - |

| LNTW | −6.65 | 1991 | - | - |

| LNEC | −3.34 | 1990 | −5.42 | 1999 |

| LNLF | −1.81 | 1999 | −6.31 | 2001 |

| LNCO2 | −2.90 | 2011 | −9.08 | 2007 |

| Model for Estimation | F-Statistics | |

|---|---|---|

| FLNAP (LNAP/LNCR, LNTR, LNTW, LNEC, LNLF, LNCO2) | ARDL(1, 0, 0, 0, 1, 0, 0) | 6.2039 *** |

| FLNCR (LNCR/LNAP, LNTR, LNTW, LNEC, LNLF, LNCO2) | ARDL(1, 1, 0, 0, 0, 0, 0) | 1.1285 |

| FLNTR (LNTR/LNCR, LNAP, LNTW, LNEC, LNLF, LNCO2) | ARDL(1, 0, 0, 1, 0, 1, 0) | 3.9080 ** |

| FLNTW (LNTW/LNTR, LNCR, LNAP, LNEC, LNLF, LNCO2) | ARDL(1, 0, 0, 0, 0, 1, 1) | 4.4103 ** |

| FLNEC (LNEC/LNTW, LNTR, LNCR, LNAP, LNLF, LNCO2) | ARDL(1, 1, 1, 0, 0, 0, 0) | 2.5071 |

| FLNLF (LNLF/LNEC, LNTW, LNTR, LNCR, LNAP, LNCO2) | ARDL(1, 1, 0, 0, 0, 0, 0) | 5.6844 *** |

| FLNCO2 (LNCO2/LNLF, LNEC, LNTW, LNTR, LNCR, LNAP) | ARDL(1, 1, 0, 0, 0, 0, 0) | 1.8823 |

| Critical Value Bounds | I(0) Bound | I(1) Bound |

| 1% | 3.15 | 4.43 |

| 5% | 2.45 | 3.61 |

| 10% | 2.12 | 3.23 |

| Hypothesized No. of CE(s) | λtrace Test Statistic | Critical Value | Prob. |

|---|---|---|---|

| None | 181.3517 *** | 125.6154 | 0.0000 |

| At most 1 | 122.7452 *** | 95.7536 | 0.0002 |

| At most 2 | 71.3572 ** | 69.8188 | 0.0375 |

| At most 3 | 41.6250 | 47.8561 | 0.1695 |

| At most 4 | 20.8441 | 29.7970 | 0.3674 |

| At most 5 | 7.40815 | 15.4947 | 0.5307 |

| At most 6 | 0.03405 | 3.8414 | 0.8535 |

| Hypothesized No. of CE(s) | λmax test statistic | Critical value | Prob. |

| None | 58.6065 *** | 46.2314 | 0.0016 |

| At most 1 | 51.3878 *** | 40.0775 | 0.0018 |

| At most 2 | 29.7322 | 33.8768 | 0.1444 |

| At most 3 | 20.7809 | 27.5843 | 0.2897 |

| At most 4 | 13.4360 | 21.1316 | 0.4129 |

| At most 5 | 7.3740 | 14.2646 | 0.4459 |

| At most 6 | 0.0340 | 3.8414 | 0.8535 |

| Variables | Coefficient | Std. Error | T-Statistic | Prob. |

|---|---|---|---|---|

| Long term estimation | ||||

| LNCR | 0.0753 *** | 0.0198 | 3.8053 | 0.0008 |

| LNTR | 0.0177 ** | 0.0086 | 2.0526 | 0.0507 |

| LNTW | −0.0065 | 0.0049 | −1.3327 | 0.1946 |

| LNEC | −0.0654 | 0.0401 | −1.6302 | 0.1156 |

| LNLF | 0.4538 ** | 0.2227 | 2.0370 | 0.0524 |

| LNCO2 | 0.0885 | 0.1162 | 0.7616 | 0.4534 |

| C | −0.9556 | 3.9680 | −0.2408 | 0.8116 |

| Statistical tests | ||||

| R2 | 0.9809 | |||

| Adj-2 | 0.9748 | |||

| Durbin–Watson stat | 2.2565 | |||

| F-statistic | 160.86 | |||

| Prob(F-statistic) | 0.0000 | |||

| Short term dynamics | ||||

| LNAP(-1) | −0.1965 | 0.1523 | −1.2900 | 0.2088 |

| LNCR | 0.0901 *** | 0.0265 | 3.3995 | 0.0023 |

| LNTR | 0.0212 ** | 0.0102 | 2.0803 | 0.0479 |

| LNTW | −0.0078 | 0.0059 | −1.3186 | 0.1992 |

| LNEC | −0.2162 ** | 0.0778 | −2.7784 | 0.0102 |

| LNEC(-1) | 0.1379 * | 0.0760 | 1.8136 | 0.0817 |

| LNLF | 0.5430 * | 0.2790 | 1.9459 | 0.0630 |

| LNCO2 | 0.1059 | 0.1396 | 0.7581 | 0.4554 |

| ECT (−1) | −1.1965 *** | 0.1523 | −7.8550 | 0.0000 |

| Test | F-Statistic | Prob. |

|---|---|---|

| Serial correlation | 2.3505 | 0.1178 |

| Heteroskedasticity | 0.4290 | 0.5173 |

| Dependent | Independent Variables | ||||||

|---|---|---|---|---|---|---|---|

| Variable | ΔLNAP | ΔLNCR | ΔLNTR | ΔLNTW | ΔLNLF | ΔLNEC | ΔLNCO2 |

| ΔLNAP | ----- | 6.9964 ** | 2.8847 | 4.4475 | 10.2873 *** | 1.0093 | 1.7282 |

| ΔLNCR | 0.5306 | ----- | 0.8025 | 1.6761 | 1.2048 | 0.1290 | 11.8917 *** |

| ΔLNTR | 0.4467 | 2.0992 | ----- | 0.2637 | 43.2285 *** | 5.3851 * | 6.0821 ** |

| ΔLNTW | 9.9108 *** | 0.9168 | 1.2251 | ----- | 5.6029 * | 52.0655 *** | 1.7066 |

| ΔLNLF | 0.2209 | 53.3740 *** | 6.0783 ** | 4.8609 * | ----- | 1.6841 | 0.3188 |

| ΔLNEC | 0.6569 | 8.2059 ** | 2.9274 | 1.0222 | 2.1504 | ----- | 0.5213 |

| ΔLNCO2 | 2.5161 | 3.4813 | 5.2998 * | 7.6488 ** | 2.8207 | 7.3640 ** | ----- |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chandio, A.A.; Jiang, Y.; Rauf, A.; Ahmad, F.; Amin, W.; Shehzad, K. Assessment of Formal Credit and Climate Change Impact on Agricultural Production in Pakistan: A Time Series ARDL Modeling Approach. Sustainability 2020, 12, 5241. https://doi.org/10.3390/su12135241

Chandio AA, Jiang Y, Rauf A, Ahmad F, Amin W, Shehzad K. Assessment of Formal Credit and Climate Change Impact on Agricultural Production in Pakistan: A Time Series ARDL Modeling Approach. Sustainability. 2020; 12(13):5241. https://doi.org/10.3390/su12135241

Chicago/Turabian StyleChandio, Abbas Ali, Yuansheng Jiang, Abdul Rauf, Fayyaz Ahmad, Waqas Amin, and Khurram Shehzad. 2020. "Assessment of Formal Credit and Climate Change Impact on Agricultural Production in Pakistan: A Time Series ARDL Modeling Approach" Sustainability 12, no. 13: 5241. https://doi.org/10.3390/su12135241