1. Introduction

The COVID-19 pandemic has impacted billions of lives across the world and has revealed and worsened the social and economic inequalities that have emerged over the past several decades. As governments consider public health and economic strategies to address the crisis, it is critical they also look beyond the pandemic and address the weaknesses of their economic and social systems that inhibited their ability to respond comprehensively to the pandemic. This paper identifies over 30 interventions that should be seriously considered when adopting an integrated strategy for increasing earning capacity, providing all citizens with access to essential goods and services, and improving the environment and mitigating global climate change. These include: (1) Income and wealth transfers to facilitate an equitable increase in purchasing power/disposable income; (2) broadening worker and citizen ownership of the means of production and supply of services, allowing corporate profit-taking to be more equitably distributed; (3) changes in the supply of essential goods and services for more citizens; (4) changes in the demand for more sustainable goods and services desired by people; (5) stabilizing and securing employment and the workforce; (6) reducing the disproportionate power of corporations and the very wealthy on the market and political system through the expansion and enforcement of antitrust law such that the dominance of a few firms in critical sectors no longer prevails; (7) government provision of essential goods and services such as education, healthcare, housing, food, and mobility; (8) a reallocation of government spending between military operations and domestic social needs; and (9) suspending or restructuring debt from emerging and developing countries. Any interventions that focus on growing the economy must also be accompanied by those that offset the resulting compromises to health, safety, and the environment from increasing unsustainable consumption.

The interventions explored in

Section 2 operate over different timeframes and have different economic, societal, and environmental impacts. Even before the COVID-19 pandemic, not all the interventions could have been adopted immediately and some would have been, and still will be, met with significant business, political, or cultural resistance. However, addressing the pre-existing social (inequality) crises [

1], now exacerbated by the pandemic, requires new thinking and new or redesigned institutions. This paper contributes to the options that must be considered as an important foundational first step towards a sustainability transition. It also offers a useful set of strategies to advance a component of SDG 10 to reduce inequality

within countries but is less focused on strategies to reduce inequality between countries.

Two of the current authors addressed sustainability in our book

Technology, Globalization, and Sustainable Development: Transforming the Industrial State [

2]. In this work, sustainable development is described as resting on three pillars: Competitiveness, environment, and employment/earning capacity, and we argue that policies to advance all three pillars should be co-optimized in order to advance sustainability. In this article, we assert that, above all, there is now a need to ensure inequality is addressed

before taking actions aimed at improving the environment and competitiveness. While some interventions can co-optimize all three dimensions, the fact that inequality within countries had steadily worsened over the past several decades indicates that efforts to address environmental concerns and promote economic growth have failed to benefit all citizens. High levels of inequality also undermine efforts to promote an economic democracy, which limits the diversity of voices in our economic and political decision-making processes, effectively locking us into existing development trajectories [

2]. Therefore, we believe addressing inequality is a fundamental first step to opening up space for new ideas and ways of thinking that will be critical to addressing sustainability. In this article, we explore a continuum of interventions that range from only targeting inequality to more holistic approaches that could lead to a sustainable economic transformation. Further, some interventions may undermine efforts to protect health, safety, and the environment. We welcome this complexity and highlight where additional interventions (or thinking) may be needed to address known or expected problems.

The following sections look at a number of approaches to addressing inequality that have held a dominant position in the public policy discourse or are currently emerging. These include addressing inequality through public policy interventions, green growth agendas, future of work initiatives, reforming the financial sector, providing a universal basic income (UBI), establishing a Green New Deal, enhancing public–private partnerships, and promoting the Sustainable Development Goals (SDGs).

1.1. Addressing Inequality Through Public Policy Interventions

Joseph Stiglitz [

3] has opined that continued inequality will stymie future economic growth and that public policy initiatives utilizing changes in governance and the law need to be focused on “rewriting the rules” [

4] to encourage changes in our approach to industrial growth (see

Table A1 in

Appendix A for a summary of Stiglitz’s main recommendations that we endorse). However, these new rules are silent on how to go green. Integrated solutions will be critical to resolving the systemic problems we face.

An important observation that carries implications for both growth and redistribution policies is the fact that a greater amount of wealth does not equate to a greater amount of real capital. Varoufakis [

5] has criticized Piketty’s failure to distinguish increases in wealth from increases in capital capable of producing goods that can be enlisted in the production of other goods. The latter—but not necessarily the former—is regarded as being essential to economic growth, i.e., growth in GDP. Redistribution of wealth does not necessarily easily translate into increases in purchasing power. However, increased revenue to the government from taxing wealth can provide essential goods and services that would benefit ordinary citizens. At the same time, expectations of future economic growth are being called into question and other methods of improving wellbeing are emerging—see Banerjee and Duflo [

6] and the work on “degrowth” by Kallis [

7] and Burkhart et al. [

8].

The COVID-19 pandemic has clearly revealed how industrial economic systems are heavily weighted towards benefitting the wealthy and corporate health and profit to the disadvantage of ordinary citizens and workers. The planned response of governments to the crisis—e.g., cash payments by the government as payer-of-last resort to individuals who lose their jobs, are put on reduced hours (called partial idling) or furlough, or who run out of state-provided benefits such as sick-leave—is not only too short-term for what will turn out to be a long-term pandemic, but will pale in comparison to the social welfare provided to corporations and big business bailouts that will further exacerbate inequality [

9]. In the aftermath of the pandemic, it is critical that systemic economic changes are made to rebalance the scale and reduce inequality through a portfolio of reinforcing or complementary interventions. If properly implemented, these interventions could significantly increase the economic resilience of workers and citizens during the next crisis and limit its potential negative economic impacts. These interventions will also grow the arsenal of policy options open to governments and increase the speed at which they can respond.

1.2. Addressing Inequality Through Green Growth

Prior to the pandemic, faith in the next industrial revolution (following four previous periods of boom and bust) had been expressed by Carlota Perez [

10], with the proviso that industrial systems “go green” without addressing the fact that all prior industrial revolutions owe their origins to an increasing supply of cheap energy [

11,

12]. Ulrich Hoffman [

13] argues that going green is not enough and Parrique et al. [

14] write that “decoupling” growth and environmental sustainability is unlikely to be achieved. For a more optimistic view on “going green”, see Bivens [

15].

Techno-optimists argue that the past is prologue for the future of industrial societies, but are we on the right path? D’Alessandro et al. [

16] recently ran a set of scenarios to address two crises facing industrial or industrializing societies: Inequality and global climate challenges. They concluded that governments can only achieve improvements in both areas if there are increases in government deficits/spending. We argue that a better way to address these challenges is to reformulate the crises as the need to increase earning capacity, improve the environment with a focus on toxic pollution and global climate disruption, and provide all individuals in society with more access to essential goods and services. This could happen either through increasing disposable income or alternatively by government directly providing social benefits such as education, healthcare, housing, food, and mobility. Today, the COVID-19 pandemic has complicated the challenges before us, but the potential set of solutions remain the same.

1.3. Addressing Inequality Through the Future of Work

The Future of Work initiatives being undertaken by MIT [

17], the European Union [

18], the OECD [

19], and others [

20,

21] address the crisis of inequality in the context of emerging technologies such as artificial intelligence (AI) and computer-driven growth, but concerns relating to the environment sometimes take a backseat to employment-focused policies. For computer-related changes, these studies are quasi-optimistic about the future of work and thus often frame the needed policy responses as ensuring that workers have the right education and skills to match the emerging technological changes [

22].

Prior to the COVID-19 pandemic, enthusiasm and even cautious optimism by the private sector, government, and academia that AI and computer-driven changes will create enough well-paying and permanent jobs, dominated the news and academic literature with rare exceptions [

2,

23,

24,

25,

26,

27,

28,

29,

30]. However, we have yet to be convinced that these drivers of change will result in sufficient, well-paid, and meaningful jobs for the majority. No serious alternative plan is envisioned in the event that sufficient well-paying and permanent jobs do not materialize in a timely manner. In this paper, we argue that the future of work is embedded in the future of the economy, and work-related initiatives and policies cannot be separated from those that address the economy and the environment.

Recognizing that the COVID-19 pandemic presents new challenges to the world financial system, Project Syndicate [

31] has argued for the formation of a Digital Bretton Woods to rethink global institutions in the context of future impacts and challenges of AI and data-driven societal change. While we are sympathetic to the need for this reform, more immediate challenges face us that require less sophisticated global responses emanating from country-specific interventions.

1.4. Addressing Inequality Through Financial Reforms

The COVID-19 pandemic has not only created twin shocks affecting the supply and demand of the real economy; it has also unleashed chaos in financial markets. See the important analysis of Singh [

32] in a series of essays in Exploring Economics [

33]. These essays contribute a rich treatment of monetary and fiscal interventions, as well as those that address the health challenges presented by the pandemic. A critical concern is that the response to the pandemic will reinforce an economic model that had serious faults to begin with—a model that fails, for the most part, to address the inequality it creates. Steve Keen [

34] describes the current market economy and mainstream economics as propagating “the dismantling of the state and the globalization of production—both of which make the crisis now so devastating”. One essay, which is the most consonant with ours by Bőhm et al. [

35], provides a contrasting perspective that includes the state providing a universal basic income and basic universal goods, increasing the minimum wage, direct state-financing by central banks, instituting capital controls to minimize capital flight, debt relief, creating an international central bank, and increasing the role of the IMF. In this paper, we focus on the role of the state—rather than the market—in addressing the fundamental inequalities. The subtitle of a recent editorial in the Financial Times makes the point: “Radical reforms are required to forge a society that will work for all” [

36].

1.5. Addressing Inequality Through a UBI

In a recent paper, we compared the many renditions of government providing a universal basic income (UBI)—with the majority of approaches requiring a redistribution of current income or wealth—with a binary economics approach, which democratizes credit and involves a redistribution of

future income or wealth [

30] (see

Section 2.1.3). Both require changes to the tax code and statutory approaches to profit-sharing and investment involving research and development. Both also require serious and mandatory safeguards to discourage unsustainable environmental consequences from increased production and consumption made possible by increased purchasing power/disposable income. Many have raised questions as to whether there is enough money to fund serious UBI initiatives and how the fair and timely allocation of those initiatives will be based on true need [

37,

38], while others have questioned whether an environmentally sustainable ownership-based system can be achieved without statutory and other broad-based UBI initiatives [

39]. In any event, having many people dependent upon government welfare and out of work for extended periods may not be a desirable permanent solution from a societal perspective. This argument is typically used to set a basic income at a level where essential needs could be covered, but additional income would be needed to support all livelihood needs.

1.6. Addressing Inequality Through a Green New Deal

Recent proposals for a Green New Deal in the U.S. [

40], EU [

41], and UK [

42] present comprehensive strategies to decarbonize the economy, promote innovation, create jobs, and support a just transition. While such Keynesian spending programs are likely to result in a net gain in employment in the near term (see

Section 2.1.6), their focus on an energy revolution means that reductions in inequality may be limited to those individuals with green-energy-related jobs. While these jobs would spread across different infrastructure systems and sectors of the economy, attention also needs to be given to the full complement of interventions that could comprehensively address inequality in

all economic sectors, for

all job categories. We consider the interventions explored in this paper as expanding the potential impact and scope of the Green New Deal agendas.

1.7. Addressing Inequality Through Public-Private Partnerships

Laplane and Mazzucato [

43] have emphasized the importance of the state in undertaking high-risk innovation-driven projects that the private sector alone would be unlikely to invest in. These projects go beyond what could emerge from the government acting to correct market failures. Laplane and Mazzucato [

43] argue that what is needed is “market-co-creating and shaping” innovation policy, whereby policy measures institutionalize rewards through public–private partnerships in which both the risks and rewards of public investments are shared appropriately between public and private actors. Described as “legal institutionalism”, this intervention not only has the government invest in high-risk innovation, but through legal interventions (such as taxes, regulation, and other means) and the removal of legal barriers, forces the rewards (and power) to be shared (financially) with the public in a redefined partnership with business. This optimistic view of public–private partnerships ignores the capture of government by the private sector and the curtailment of competing innovations by entities outside the established system. In our view, the present private–sector orientation of both the administrations in the U.S. and UK, have demonstrated an inability to find a proper “balance” that benefits all sectors of the public. What will be needed in post-COVID-19 recovery are policies that ensure the “least advantaged” are made relatively better off, to borrow a phrase from the legal philosopher John Rawls [

44].

1.8. Addressing Inequality Through the Sustainable Development Goals (SDGs)

While widespread adoption of the Sustainable Development Goals (SDGs) would achieve improvements in social and environmental welfare, their voluntary nature leaves much to be desired. The literature reveals slow progress in achieving these goals [

45]. Further, much attention has been given to the SDGs being “more dynamic, integrated, natural and human system models that incorporate the dynamics of stocks, flows, trade-offs, and synergies” [

46], but this real-world complexity comes at a cost. For example, the relationship between one SDG target or another is likely to vary by geographic location, governance structures, and available technology [

47], revealing the importance of allowing nations to advance their own set of solutions based on their own priorities [

48]. There is also evidence that it will be impossible to achieve all 17 SDGs based on previous development trajectories [

49,

50,

51], highlighting the critical importance of disruptive innovation/change and opening up the decision-making space for new ideas and voices [

2]. The COVID-19 pandemic has also severely compromised the ability of nations to achieve many of the SDGs [

52].

Of particular interest in this article is SDG 10 to reduce inequality both within and among countries. While the latter aspect falls largely beyond the scope of this paper, it could be argued that addressing disparities within countries would be a first step towards reducing inequality between countries.

Saiz and Donald [

53] use an SDG 10 lens to argue that social exclusion and economic inequality are deprivations of human rights—including the erosion of labor rights, the weakening of public services, and the capture of democratic decision-making by elites—and recite the Post-2015 Agenda exhortation to “Leave No One Behind”. They define “substantive inequality” as being concerned with the results and outcomes of laws and policies. Their work is comparable to that of Stiglitz [

4].

Mariotti [

54] provides a more focused look at the application of SDG 10 in the UK, and argues that not only is inequality “bad for economic growth”, but “reducing inequality would be more effective at eradicating extreme poverty than increasing economic growth” [

54].

What Saiz and Donald [

53] and Mariotti [

54] do not endorse is the dominant historical model that assumes that equitable sustainable growth and employment can be achieved primarily through R&D, innovation, and the training of workers. Our paper is premised on the same conviction.

In addition, an increased awareness of systemic racism, militarization, and over-sized budgets for domestic policing, on top of the COVID-19 pandemic, has focused public attention on intersecting racial, gender, health, and economic inequalities—“leaving no one behind”—within and among all countries. This emergent international social movement is occurring at a time when income inequality is at its highest levels, perhaps indicating that the “social peace line” [

55] is being reached in many nations. This line reveals the lowest standard of living acceptable by citizens, below which social unrest, populism, and polarization start to appear. The social peace line is a function of the real wages in an economy, which are inversely related to the competitiveness of a country abroad and the living standards of the people in the country, which in turn is a function of domestic demand and the supply of essential goods and services by the government. Hence, there are multiple ways to ensure that citizens close to the “social peace line” live well, while countries maintain their competitiveness. These interventions will be explored throughout this paper.

A closer look at the SDG 10 targets helps frame the focus of this article. SDG target 10.1 states that “By 2030, progressively achieve and sustain income growth of the bottom 40% of the population at a rate higher than the national average”, and SDG target 10.4 highlights the need to “Adopt policies, especially food, wage and social protection policies, and progressively achieve greater equality”. The interventions presented in this article have the potential to directly address these targets. Further,

Section 3 considers how each of the interventions presented in

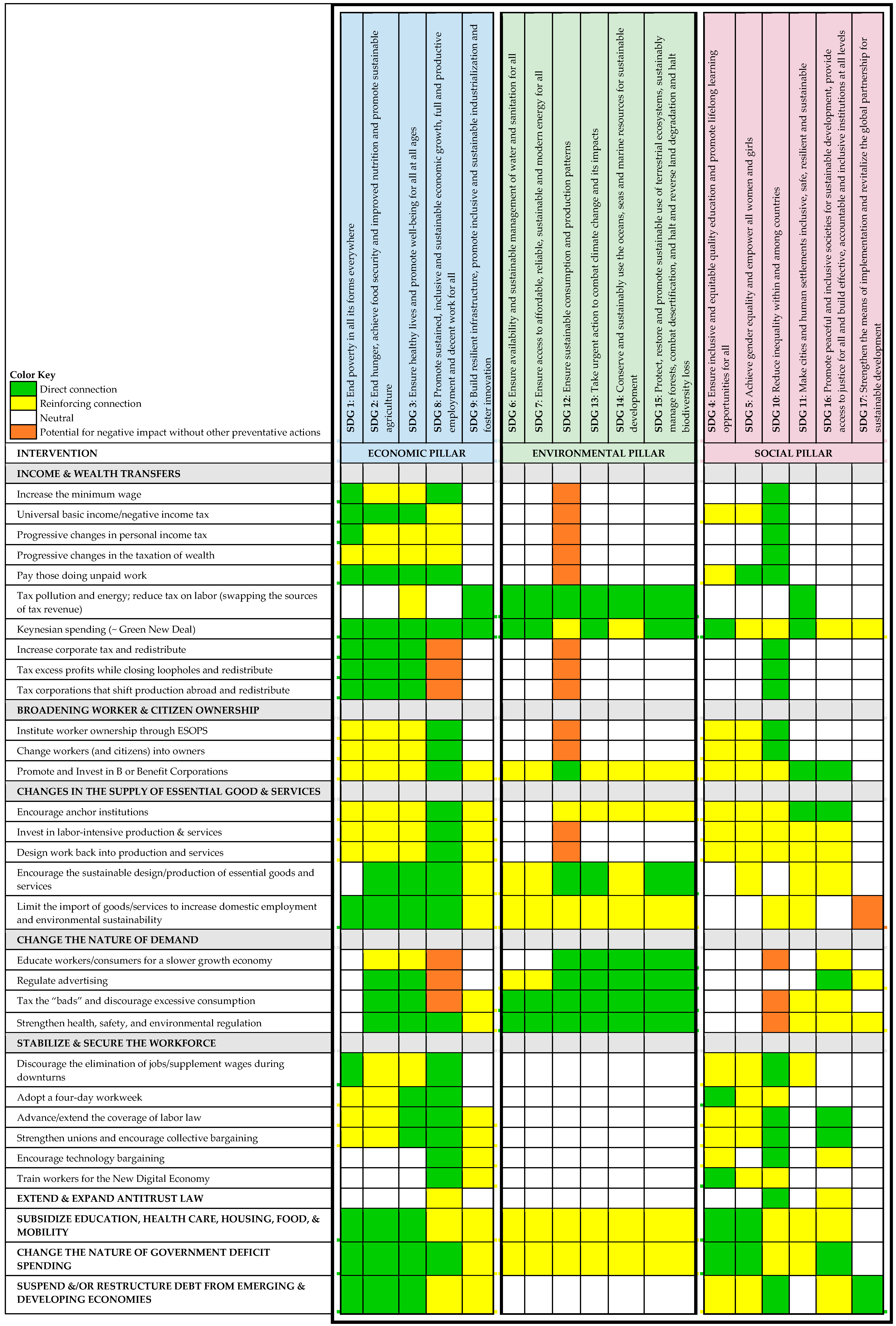

Section 2 are likely to impact the 17 SDGs. As the comparative assessment shows, a number of interventions are likely to undermine environmental goals if other measures are not taken to counteract increased unsustainable consumption.

1.9. Summary

The above discussion reveals a diversity of approaches that can address inequality. While some target inequality directly, others consider inequality as a component of a larger transformation process. The purpose of this article is to combine the promising elements from these approaches with other emerging or established ideas to provide decision-makers with a comprehensive portfolio of options. In doing so, a broad range of interventions are outlined that hold the potential to increase earning capacity, reduce inequality, and improve access to essential goods and services within countries, without compromising health, safety, and the environment. These interventions could be used by governments to advance the component of SDG 10 focused on reducing inequality within countries.

In

Section 2, we describe the individual interventions without attempting to relate them to one another in order to familiarize the reader with the nature, strengths, and weaknesses of each measure in isolation.

Section 3 of this article presents a comparative assessment of these interventions in terms of their political feasibility; the significance of their economic, social, and environmental impacts; and whether they are likely to reinforce or undermine the SDGs. The final section of this article offers a conclusion.

2. Interventions

This section outlines more than 30 recommended interventions across nine different categories that governments could deploy as part of a targeted approach to reducing inequality and laying a foundation for a transition towards sustainability. While the goal of SDG 10 is to “reduce inequality within and among countries”, the devil is in the details, which is the focus of this article.

2.1. Income and Wealth Transfers

A broad range of strategies exist to enhance purchasing power for essential goods and services (e.g., healthcare, education, housing, food, and mobility) through income and wealth transfers without increasing the deficit. These include increasing the minimum wage, progressive changes in the taxation of personal income and wealth, a universal basic income/negative income tax, paying those doing unpaid work, taxing pollution and energy and reducing the effective per capita tax on labor, green Keynesian spending, and increasing the tax on corporations, especially those making excess profits and/or shifting production/the provision of services/ownership abroad.

Currently, the federal government estimates that in fiscal year (FY) 2021, it will receive

$3.863 trillion in revenue, primarily from income or payroll taxes [

56]. The revenue breakdown is as follows:

Income taxes: $1.932 trillion (50% of total receipts);

Social Security, Medicare, and other payroll taxes: $1.373 trillion (36%);

Corporate taxes: $284 billion (7%);

Excise taxes and tariffs: $141 billion (4%);

Earnings from the Federal Reserve’s holdings (i.e., interest on U.S. Treasury debt acquired through quantitative easing): $71 billion (2%);

Estate taxes and other miscellaneous revenue: $62 billion (2%).

Revenues from corporations contribute relatively little to finance the overall social benefit, despite corporate profits being at an all-time high. The options explored in this first set of interventions include those that appropriately reallocate the tax burden among ordinary citizens, the very wealthy, and business operations (both corporate and non-corporate), providing citizens with more disposable income and hence more purchasing power.

Addressing income disparities by redistributing purchasing power through tax reforms suggested by Piketty and Goldhammer [

57,

58], Stiglitz [

3], Standing [

25], and Zucman and Saez [

9] envisages more consumption of essential goods and services by those at lower income levels. Increasing disposable income among the less-affluent is associated with increased consumption, which outstrips the ability of technology to reduce greenhouses gas emissions [

59]. Both discouraging consumption of environmentally destructive goods and services and advancing technology development to reduce emissions are needed. Aside from the fact that increasing affluence increases consumption, if “labour productivity continuously rises, then aggregate economic growth becomes necessary to keep employment constant, otherwise technological unemployment results” [

59].

While redistributing purchasing power will address fundamental inequalities, such interventions must be accompanied by those that offset the resulting compromises to health, safety, and the environment from increased unsustainable consumption [

60]. Other options include those that have the government shoulder the burden of directly providing essential goods and services (see

Section 2.7), with or without an increase in deficit spending to finance social programs (see

Section 2.8).

2.1.1. Increase the Minimum Wage

Studies of the effect of raising the minimum wage in U.S. cities and states show that, contrary to the reservations of some economists, economic growth actually increases with an increase in the minimum wage [

61,

62,

63,

64]. A study conducted by the Economic Policy Institute showed that a gradual rise of the minimum wage in the U.S. to

$15 per hour by 2024 would improve the salaries of more than 40 million American workers by almost

$3000 per year, a significant amount for those who fall within the low-income bracket [

65]. A rise in salaries means more money is circulating in the economy, which, based on the multiplier effect, will increase demand and consumption, which in turn drives economic growth. Furthermore, raising the minimum wage can act as a mechanism to improve health outcomes [

66]. A recent study in the U.S. found that an increase of

$1 in the minimum wage could have led to a decrease in suicides rates ranging from 3.4% to 5.9% over the period 1990–2015 among adults aged 18–64 years with a high-school education or less [

67]. Another study examined 24 OECD countries for 31 years and found that higher minimum wages (with a 10% increase in the Kaitz index) led to an increase in life expectancy (by 0.44 years) and a reduction in death rates (by 21.95 per 100,000 individuals) [

68]. Similarly, research in the U.S. found that improvements in birth weight [

69,

70] and postneonatal mortality [

69] can be attained with higher minimum wages.

An increase in domestic wages is likely to increase demand for both domestic and imported products [

71]. Thus, changes in the minimum wage need to be considered or coordinated with trade policy and other strategies that target the provision of essential goods and services (see

Section 2.3). Countries other than the U.S. are seriously considering raising the minimum wage [

72], and there is likely to be significant variation in how it is implemented.

2.1.2. Progressive Changes in the Taxation of Personal Income and Wealth

In recognition that wealth accumulates and passes on within families [

57], a wealth tax will dampen the effects of inherited wealth, as well as provide revenue for others, potentially closing racial and generational wealth gaps through redistribution. However, other interventions may also be needed to lessen the influence/control of the wealthy elite of political agendas and government [

2,

73]. In addition, progressive taxation of personal income and an increased capital gains tax would address growing trends in inequality and generate funds for critical social programs.

Using a model inspired by Piketty, Hartley et al. [

74] examined policies to reduce inequality under conditions of low or no growth and concluded that “except in the case of complete wealth equality, any strategy to prevent increasing income equality must reduce returns to wealth below the rate of growth”. They also argue that interventions designed to prevent rising inequality under zero, declining, or negative GDP growth are likely to require reductions in the income of the wealthy—a scenario that the wealthy are likely to oppose given their disproportionate influence on political decision-making.

2.1.3. Universal Basic Income (UBI)/Negative Income Tax

In response to growing inequality trends over the past several decades, the idea of providing workers/citizens with a guaranteed universal basic income (UBI) is gaining traction. According to the Economic Policy Institute, CEO pay has risen 940% since the early 1980s against 12% for a typical worker over the same period. Two other reasons for growing inequality, captured by The Aspen Institute, relate to uncertainty around the technological displacement of well-paying jobs and inefficiencies in the U.S. system of transfer programs [

38]. Those in favor of a UBI tend to defend the idea from the perspective of social justice, individual liberty, and financial security [

75]. Those opposing a UBI tend to raise concerns about its affordability, its cost to taxpayers and the related potential suppression of growth-enhancing investment, and the disincentive it may pose to work.

Amidst the current COVID-19 pandemic, public and political support for a UBI has been gaining ground in many nations around the world. For example, Spain has announced the adoption of a UBI for about 1 million of its poorest citizens, although final details are being drafted at the time of writing of this paper [

76]. Concurrently, leaders across the U.S. are becoming more vocal on the merits of a UBI [

77,

78], largely due to the influence of Andrew Yang’s Democratic Presidential campaign that put forward the Freedom Dividend, which would provide every U.S. citizen (over the age of 18) with

$1000 every month [

79].

What these positions reveal is the need for a comprehensive, integrated, and system-wide perspective of how a UBI could be financed and fairly allocated. For example, the progressive taxation of personal income and wealth (discussed above) is one approach. However, many other proposals exist on how to finance and deliver a UBI, including whom should receive the basic income [

30]. There is also the question of whether an expansion in the nature and extent of the “social safety net” could accomplish the same goals of a UBI more efficiently (see

Section 2.1.4).

2.1.4. Pay Those Doing Unpaid Work Such as Child Raising/Caring for the Elderly

One argument for providing a UBI is that it would correct the distortion of what is considered “work” by providing equitable compensation for

unpaid work. If the political will does not exist for a UBI, creating a mechanism to compensate individuals for socially beneficial unpaid work could nonetheless be a realistic option (see Neva Goodwin [

80]).

Two key areas of unpaid labor are caring for children and caring for the elderly or disabled, but unpaid labor can also include other tasks that keep households functioning, such as cooking and cleaning. This work is disproportionately undertaken by women, who account for around 75% of the world’s total unpaid work [

81]. Though there is obvious value to this work, it does not presently contribute to the measured GDP, and has, in fact, been conservatively estimated to be valued at as much as

$10 trillion per year, or about 13% of global GDP as of 2015. In the United States alone, the value of the unpaid care work carried out by women is about

$1.5 trillion a year [

81]. According to a Pew Research Center analysis of U.S. Census Bureau data, in 2016, more than 11 million U.S. parents, or 18% of parents, did not work outside the home, effectively providing unpaid labor in the form of childcare. There are many drivers behind this, with one being the fact that childcare expenditures rose 40% from 1990 to 2011, or twice as fast as overall inflation [

82], even with childcare workers being paid remarkably low wages themselves. There is a distinct absence of a national solution for childcare in the U.S. for children under the age of 5, though there are a variety of “First Five Years” policies being proposed [

83].

At the other end of the age spectrum, due to a fundamental demographic shift in the U.S., adults aged 65 or over will soon outnumber children under the age of 18 for the first time in U.S. history [

84]. According to the AARP’s 2019 Valuing the Invaluable report, as of 2017 “an estimated 41 million caregivers in the United States provide 34 billion hours of unpaid care to adult loved ones”, which is equivalent to

$470 billion in labor assuming an average wage of

$13.81 per hour [

84]. Though there are some federal efforts to better support caregivers, such as the Caregiver Advise, Record, Enable (CARE) Act and the RAISE Family Caregivers Act of 2018 (Public Law 115–119), U.S. efforts related to the support and compensation of caregivers is generally characterized by a patchwork of programs at all levels of government. These efforts provide some nominal compensation for those providing informal care to disabled or elderly family members, effectively converting them into formal, or paid, caregivers, though normally at extremely low rates of pay. Some of the most robust plans are those enacted by the Department of Veterans Affairs (VA), including the VA MISSION Act (Public Law No: 115–182), which provides “eligible family caregivers with a financial stipend, training, access to health insurance, counseling, respite care, and legal and financial planning services” [

85].

Compensating unpaid work would not only recognize the valuable contribution these individuals make to society, but also provide an important income to those who typically lack resources.

2.1.5. Tax Pollution and Energy, and Reduce the Effective per Capita Tax on Labor

Ecological economist Herman Daly was one of the most vocal advocates for taxing the “bads”, such as non-renewable resource extraction and pollution, and reducing taxes on the “goods”, such as employment. If designed well and made adaptive over time, this form of a Pigouvian tax could be revenue-neutral.

A new paper by Acemoglu et al. [

86] finds that “the U.S. tax system favors excessive automation. In particular, the heavy taxation of labor and low taxes on capital encourage firms to automate more tasks and use less labor than is socially optimal”. Thus, changing the calculus of a firm’s investments by incentivizing employment through reducing its cost relative to capital and pollution abatement costs, would be an important component of any overhaul of the tax code.

2.1.6. Jump-Start the Economy Through Green Keynesian Spending

The development of a green Keynesian spending program, which could result from fiscal policy initiatives such as a Green New Deal [

40,

41,

42], an Evergreen Action Plan [

87,

88], or a green infrastructure program [

89], would create employment opportunities and wage income in the near term, but their long-term viability may be limited [

90,

91]. The main idea behind these types of interventions is to influence aggregate demand and investment in the economy through higher government expenditures and lower taxes/higher personal disposable income. In response to this strategic infusion of government funds, additional investment is expected to come from the private sector, pension funds, and other investors.

Keynes’s idea of two budgets, the current budget and the capital budget, suggests that governments can run deficits in the capital budget by engaging in long-term investments where private capital fails to participate. These interventions can be funded by a surplus in the current budget as the economy reaps the benefits of higher competitiveness and wage stabilization that stem from those long-term investments and which can work as automatic stabilizers when economic conditions deteriorate. During the current global state of emergency and threat of a prolonged recession, Keynesian spending is one of the tools that governments have to support aggregate demand and restart the economy. The globally coordinated liquidity injections of all the major central banks provides an environment favorable for borrowing due to the historic low-interest rates, a situation that is likely to persist for the foreseeable future.

While the details of the various green Keynesian spending programs differ, they all focus on mitigating climate change by revolutionizing energy systems to decarbonize the economy, investing in more sustainable/resilient infrastructure systems, creating meaningful and well-paid jobs, and addressing social and environmental inequalities (what some connect with a just transition). What differs is the extent to which they also focus on issues such as regulating banks and the financial system or promoting shared ownership [

42], international trade policies relating to clean energy and labor and environmental standards [

87], or a specific sector such as transportation [

89].

With regards to this article’s focus on inequality, a critical question is whether the proposals are limited to energy-related jobs or whether their scope will impact

all jobs in

all economic sectors. Interestingly, the proposed U.S. Green New Deal [

40] and the Evergreen Action Plan [

87] reach similar recommendations to those outlined in this paper with regards to enabling strong unions and worker rights to organize and collectively bargain (see

Section 2.5.4 and

Section 2.5.5), but they are framed through an energy-transformation lens. We believe that an inequality lens provides a more valuable economy-wide perspective since it targets change for all workers, regardless of whether they are working in a green or dirty sector of the economy.

2.1.7. Increase the Tax on Corporations and Redistribute Revenues to Individuals or Alternatively Have Government Provide the Needed Goods and Services

Many corporations and privately owned businesses pay hardly any tax when compared to the taxes employees pay relative to their income [

9,

92]. In parallel with progressive taxation of personal income and wealth, increasing taxes on corporations can contribute revenue towards a UBI, compensate unpaid work, and/or pay for essential goods and services. However, corporate strategies such as retaining earnings and purchasing stock for owners, which do not result in tax revenues, will need to be addressed to ensure loopholes are not exploited. Furman [

93] suggests a scheme to reform the U.S. tax code that could raise revenue more equitably and in a growth-friendly manner. It is estimated that the domestic corporate taxation proposal would (efficiently) generate

$1.1 trillion over the next decade in a way that does not negatively impact low-paid workers. The main components of the proposal are included in

Box 1. As mentioned in

Section 2.1.5, Acemoglu et al. [

86] have written that the present tax code favors automation over labor.

Box 1. Furman’s [

93] corporate tax code proposal (p. 2).

Making expensing of investment costs permanent and expanding it to more categories of investment. Applying expensing not only to equipment but also to structures and intangibles would ensure that different types of investment are not taxed at different rates. At the same time, interest deductibility for new investments would be eliminated to prevent negative rates on new investment.

Eliminating the tax preference for business pass-throughs. Large businesses would be required to file as C corporations.

Eliminating wasteful corporate loopholes, including tax extenders. Closing loopholes would not raise additional revenue relative to current law, but it would prevent further revenue loss and remove distortions from the tax code.

Expanding the tax incentive for R&D. Increasing the alternative simplified credit rate from 14 percent to 20 percent while repealing other credits would simplify the tax code and help spur investment in R&D.

Raising the corporate tax rate from 21 percent to 28 percent. This rate increase would place the U.S. on par with other advanced economies and, when combined with expensing and R&D incentives, offer a growth-increasing and welfare-enhancing reform.

2.1.8. Tax Excess Profits While Closing Tax Loopholes and Redistribute Revenues to Individuals or Alternatively Have Government Provide the Needed Goods and Services

Taxing excess profits, as an alternative to raising the general corporate tax rate, can redistribute excessive income/wealth from the owners of firms (who are profit-takers, but do not necessarily invest profits in more production) with more disposable income (and purchasing power) to workers. This measure requires a simultaneous action to close any possible accounting loopholes that corporations can use to decrease their tax liability, such as increasing their tax shield through higher interest payments, accelerated depreciation, or other allowable reductions. If planned effectively, it is expected that taxing excess profits will have a positive net effect on tax receipts. Taxes on excess profits are designed to tax the proportion of profits that were derived from some external event not of the company’s making [

94]. The COVID-19 pandemic could be interpreted as such an event. In addition, corporations are likely to increase their capital expenditures, effectively reinvesting part of their excess profits into production. Such ideas have recently seen a revival in the context of the corporate bailouts associated with the COVID-19 pandemic [

95,

96]. Alternatively, rather than redistributing income/wealth to individuals, the government could directly provide a greater safety net through the establishment of healthcare, education, housing, food, mobility, or other services (see

Section 2.7).

2.1.9. Tax Corporations That Shift Production/Services/Ownership Abroad, and Redistribute to Individuals or Alternatively have Government Provide the Needed Goods and Services

Taxing corporations that shift their activities or ownership overseas not only redistributes income, but can also create more domestic production, employment, and higher wages at the cost of diminished corporate profit from economic activities abroad.

Clausing [

97] suggests a scheme that would reform the taxation of multinationals to generate more investment, profit, and domestic tax revenue.

Box 2 outlines several policy options that can be enacted immediately without comprehensive changes in the current tax code, as well as options to be pursued over a longer time horizon. It is estimated that these changes to the tax code would generate

$1.4 trillion over a 10-year period.

Box 2. Clausing’s [

97] corporate tax code proposal (pp. 250–251).

Increase the corporate rate from 21 percent to 28 percent. This should raise about $700 billion over 10 years. […]

Strengthen the GILTI [global intangible low taxed income] minimum tax by either moving to a per country version at 21 percent or keeping a global version but harmonizing the rate to the U.S. rate of 28 percent. The first option is estimated to raise about $510 billion over 2021–2030.

Reform the GILTI by removing the 10 percent exemption for returns on foreign assets. This would raise an unspecified amount of revenue.

Repeal FDII [foreign-derived intangible income]. This will raise $170 billion over 2021–2030.

Clausing [

97] also makes a compelling case for adopting a sales-based formulary apportionment approach to the taxation of multinational corporate income. Whereas companies currently account for their income and expenses in each country in which they operate, a formulary apportionment approach would tax a company based on its global income and distribute this tax to each country in proportion to the company’s total percentage of global sales in each country. Such an approach is considered to reconcile the competing priorities of keeping a country, such as the U.S., internationally competitive while also protecting its corporate tax base. The implementation of such a mechanism would require policymakers to build international consensus around a reformed international corporate tax regime, which is likely to be problematic given the recent trade wars.

In a subsequent essay, Clausing [

98] argues that technological change has been the major source of job loss, followed by declining unionization rather than trade. Arguing against protectionism and tariffs, she not only advocates reforming the corporate tax system for firms operating both here and abroad, but also encourages immigration and pathways to citizenship. Additionally, she supports decreasing government borrowing rather than trying to reduce the deficit by other means.

2.2. Broadening Worker and Citizen Ownership

Individual earning capacity can be enhanced by some combination of increasing wages and the return to capital through broadening the ownership of the economy’s productive capacity. The latter can be accomplished in a number of ways, some restricted to workers, some accruing more broadly to workers and citizens, and others focusing primarily on citizens. The measures we address here are expanding worker ownership through ESOPS, changing workers and citizens into owners through the tenets of binary economics, and promoting and investing in B or Benefit corporations.

New legislation and structural changes may be required in some cases. In others, increased political will may suffice. In all cases, as discussed above, increased consumption must not compromise health, safety, and the environment, i.e., that consumption is environmentally sustainable [

60].

2.2.1. Institute Worker Ownership Through ESOPS

The first employee stock ownership plan (ESOP) was implemented by Louis Kelso in 1956 with a company known as Peninsula Newspapers in Palo Alto, California. Since then, around 7000 ESOPs have been created in the U.S. as a way to broaden capital ownership. Put simply, an ESOP turns workers into worker-owners, with the advantage of creating greater labor commitment to the enterprise. It is estimated that some 2.34 million businesses are likely to sell or close in the next decade as baby boom entrepreneurs retire [

99]. This “silver tsunami” presents a unique opportunity to transfer the ownership of their firms to workers through ESOPs.

2.2.2. Change Workers (and Citizens) into Owners—Through Changes in Business Ownership and Corporate Structures by Allowing them to Acquire Capital with the (Future) Earnings of Capital (Two-Factor Economics)

The ESOP is part of a much larger approach to broadening capital ownership known as binary (or two-factor) economics [

100]. Through this approach, workers (and citizens more generally) acquire capital with the future earnings of capital, in much the same way that well-capitalized individuals are able to. The approach is based on the premise that if the effect of technological innovation is to both replace and vastly supplement the work of labor with increasingly productive capital, such as AI and automation, the only way to ensure that everyone benefits from this transformation is to enable workers and citizens to obtain a capital ownership stake in the job-displacing capital. Hall et al. [

30] argue that “like well-capitalized people, everyone needs the competitive opportunity to acquire capital, not merely with the earnings of labor, but also increasingly with the earnings of capital”. While the basic premise of the approach is clear and it could impact all citizens, since it is relatively unknown, it may take time for this intervention to gain broad support.

2.2.3. Promote and Invest in ‘B or Benefit Corporations’ as an Alternative Enterprise Model

Designing “next generation enterprises” is necessary to create a sustainable and equitable society [

101]. A 2020 Report from The Democracy Collaborative’s “Fifty by Fifty” initiative [

101], recommends enterprise models that combine mission-driven employee-ownership (e.g., ESOPs) with B or benefit-corporation principles. Fifty by Fifty is an initiative focused on promoting employee ownership (specifically increasing the number of employee-owners in the U.S. from 10 million to 50 million by 2050) as a way to create a more inclusive economy. A benefit corporation rejects profit maximization as the primary lens on corporate decision-making and replaces this with a mission to create public benefit and sustainable value while minimizing negative social and environmental impacts. Converting the millions of businesses that are about to undergo an ownership transition into employee-owned benefit corporations holds the potential to shift investments from unsustainable or unnecessary economic activity to business enterprises that prioritize the planet and people alongside reasonable profits.

An interesting idea would be to provide finance for these employee-owned benefit corporations through financial institutions that also prioritize the public good. Neva Goodwin identifies credit unions and co-operative banks as avenues for constructive investment and highlights Paul Raskin’s description of the ideal new economy situation:

“Publicly controlled regional and community investment banks, supported by participatory regulatory processes, recycle social savings and tax-generated capital funds. To receive funds from these banks, capital-seeking entrepreneurs must demonstrate that their projects, in addition to financial viability, promote larger social and environmental goals”

(Raskin, as cited in Goodwin [

102]).

The Bank of North Dakota (BND) is a proven model of public ownership that has been in operation for 100 years, providing a positive return on assets (ROA) while prioritizing the public good and strengthening community investment. BND’s ROA came in above the national average of 1.01% at 1.54% in 2014 [

103]. The BND provides a local banking alternative for state funds and individual and institutional deposits. The BND invests to benefit the people of the state and, as exemplified during the 2008 financial crisis, these investments are more secure than investments with banks focused on profits [

102].

2.3. Changes in the Supply of Essential Goods and Services

In addition to reshaping the ownership of the real economy, a range of proposals exist that could change the supply of essential goods and services to advance more rooted and sustainable activities and provide workers with an ability to claim a greater share of the wealth being created. Here, we focus on encouraging anchor institutions, investing in labor-intensive production and services, designing work back into production and the provision of services, encouraging the preferential design and production of essential goods and services, and limiting the importation/use of goods/services that decrease domestic employment and unnecessarily increase energy and material use. Unlike other categories of interventions, all these measures can be advanced concurrently, as explained in the final section of this paper.

2.3.1. Encourage Anchor Institutions (e.g., Hospitals, Universities, Government Agencies, Industry) to Purchase Local Goods and Services, Ideally from Employee-Owned Benefit-Corporations

So-called “anchor institutions” such as universities and hospitals can be leveraged to support local purchasing while providing jobs. Kelly and Howard [

99] write that anchor work is a “sophisticated community organizing strategy”. The Democracy Collaborative is putting significant energy into the building of three anchor networks in healthcare, higher education, and place-based anchor collaboratives. The healthcare anchor network is made up of 40 nonprofit hospital systems that together employ over 1 million people, spend

$50 billion in goods and services, and hold

$150 billion in investment assets. Representing 8.7% of U.S. GDP, hospitals and universities have incredible potential to distribute wealth locally, but it requires the slow work of changing mindsets, aligning with the multi-year contract cycle, and public investment [

99].

2.3.2. Invest in Labor-Intensive Production and Services

One strategy to reverse the increasing share of GDP going to capital rather than labor, is to shift investment in, and utilization of, goods and services from capital to labor. This outcome could be achieved by shifting subsidies from capital to the utilization of labor through a revision of the tax code (see Acemoglu et al. [

86] and

Section 2.1.5). This approach could also be coupled with the establishment of worker-owned benefit corporations that serve anchor institutions.

2.3.3. Increase Labor’s Claim on Profits from Production/Services by Designing Work Back into Production and Services

The “efficiency agenda” is relentless in its objective of achieving more with less. In a business context, this agenda has resulted in less labor being used in the production of goods or the delivery of services. Growth in labor productivity can occur through efficiency gains from enhanced worker skills/knowledge, the use of more efficient technology, or some combination of the two. In reality, it is likely that the vast majority of labor productivity gains can be attributed to shifts to more technology (or capital), which means that those who own the capital are able to claim a greater share of the wealth being created. If wages are to remain the main mechanism for distributing wealth (notwithstanding efforts to broaden capital ownership—see

Section 2.2.2), specific attention needs to be paid to designing labor back into production and services. Such action, over time, is likely to increase the claim of labor on profits and labor’s share of GDP.

2.3.4. Encourage the Design and Production of Essential Goods and Services (and Discourage non-Essential Production and Consumption Systems)

Identifying opportunities to shift investment from unsustainable or unnecessary economic activity to more essential goods and services is likely to be an essential component of a transition to a more sustainable economy. One strategy could be to leverage anchor institutions such as healthcare providers or institutions of higher education, or place-based anchor collaboratives more generally, to encourage the design, production, and delivery of essential goods and services (see

Section 2.3.1). Another complementary approach could be to identify ways to meet the essential needs of consumers in a different way, such as through a shift away from products to product services (i.e., replace the need to purchase a private car with a comprehensive mobility service).

The COVID-19 pandemic has exposed many of the prior problems that existed with essential systems. For example, a communiqué from the International Panel of Experts on Sustainable Food Systems revealed how, in a matter of weeks, “COVID-19 has laid bare the underlying risks, fragilities, and inequities in global food systems, and pushed them close to breaking point” [

104]. Thus, it is important that when responding to the pandemic, public and private entities focus on creating sustainable and resilient systems that provide essential goods and services.

Rather than adopting reforms that are premised on getting the economic system working better and changing the way markets operate, Rodrik and Stantcheva [

105] put the responsibility on firms to reorganize production by internalizing externalities and changing

what is produced and

who gets a say in these decisions—i.e., a radical departure in the narrative of how market economies should work. While many benefit corporations and other socially and environmentally responsible business entities/cooperatives could advance such an agenda, we are less convinced that the needed scale of change would result from such an approach. Government intervention is likely to be essential.

2.3.5. Limit the Import of Goods/Services to Increase Domestic Employment and Environmental Sustainability

Prior to sustainable development, the idea of “eco-development”—ecologically sound, regional development—was gaining popularity [

2]. However, with the emergence of an interconnected and globalizing economy, the concept was soon replaced by sustainable development, which advanced a more globalized agenda. Today, the ongoing trade disputes and global COVID-19 pandemic are refocusing attention on strategies that grow local production systems and employment. If combined with the principles of eco-development, the circular economy, and degrowth, such interventions could shift investment away from unsustainable or unnecessary economic activity from imports, towards more sustainable and essential goods and services produced domestically that may not be currently or adequately provided by imports.

2.4. Changes in the Nature of Demand

Changing the nature of demand involves both “bottom-up” approaches where personal preferences can be changed by cultural shifts due to education, public messaging, etc., or by “top-down” approaches where government reigns in commercial advertising embodying “producer-created demand”. Alternatively, the government can shift the nature of consumption patterns and exposures to harmful substances and practices by taxing luxury goods, and other “bads”, or taxing and otherwise discouraging excessive consumption from an environmental perspective [

106]. Strengthening and enforcing regulations can also shape demand by ensuring prices adequately incorporate negative externalities and risk/uncertainty.

2.4.1. Educate Workers/Consumers for a Slower Growth Economy

Educating workers/consumers on the benefits of sustainable consumption, may decrease overall levels of consumption, especially with other interventions like reigning in advertising and taxing the “bads”, and thus shift consumption towards more sustainable goods and services.

2.4.2. Regulate Advertising

The regulation of advertising may create less consumption overall, as well as promote more sustainable consumption of goods and services. Galbraith [

107] famously coined the term “producer-created demand” whereby through advertising, supply and demand are not in fact independent entities. Advertising needs to be reined in.

2.4.3. Tax the “Bads” and Discourage Excessive Consumption

Taxing material and energy intensive (i.e., unsustainable) goods and services—or excessive consumption—needs to be part of a sustainability strategy [

60]. For example, instead of rewarding high electricity/water consumers with discounts, a surcharge should be applied for their higher levels of consumption. In addition, pricing policies could be adopted whereby producers are allowed more profit by rewarding them for selling less—or providing less services—while consumers pay more for excessive or unsustainable consumption. This involves decoupling profit from production, and in the process, decoupling profit from consumption indirectly [

108].

2.4.4. Strengthen Health, Safety, and Environmental Regulation

An important strategy to shape the demand of consumers, citizens, and workers for goods and services is to strengthen health, safety, and environmental regulation [

106]. Adopting both the polluter pays principle [

109] and the precautionary principle [

110] in the design and review of regulation would be an important first step. Further, reducing the influence of cost–benefit analysis and economic considerations in establishing and enforcing regulatory standards in both the U.S. and abroad is also necessary. Regulatory targeting can also be an effective strategy to induce innovation for sustainability [

2,

111].

2.5. Stabilize and Secure the Workforce

Both volatility of the economy and the “sunk costs” of substantial permanent employment are increasingly important factors in destabilizing or making even permanent employment less desirable by employers. Even when using labor as a factor of production may be cheaper, employers may prefer using energy and physical capital in volatile times because workers are less “movable”. This helps explain both the decrease in wages and the precariousness of employment. There are, however, interventions that can stabilize or restabilize employment.

We addressed the intervention of shortening the workweek in a prior article [

112] and argued there were both positive and negative effects on total consumption, but here we will examine recent developments that have experimented with these policies. In addition, we add the following interventions: (1) Advance the coverage of U.S. labor law; (2) advance the practice of “technology bargaining” between employers and unions/workers; (3) increase unionization; (4) subsidize college loans and lower tuition to train workers for the new economy; and (5) extend and expand antitrust law and enforcement to AI and platform-based emerging industries. In the latter case, it is argued that increased labor market power, which suppresses wages and worsens working conditions, now predominates antitrust activity by firms and deserves to be reversed [

113]. Because the reader may not be as familiar with these measures as those addressed earlier, we go into some detail in this section.

2.5.1. Discourage the Elimination of Jobs (~Germany’s Kurzarbeit) and Supplement the Shortfall in Paid Wages during Economic Downturns

During the aftermath of the 2008 financial crisis, Germany, Austria, and several other European countries were able to leverage their ‘Kurzarbeit’ (short work) policies, which encourage employers to retain workers—for 6 to 18 months—during periods of economic decline. The Kurzarbeit policies can be considered as an insurance policy to protect jobs when businesses are faced with the need to make redundancies. During a period of economic decline, workers could either be put on furlough or a shorter work schedule with any shortfall in income being covered by a government fund that employers contribute to during periods of economic growth. In some cases, employees on furlough have undertaken training to enhance their skills, which could prove to be extremely helpful during a recovery period. Saez and Zucman [

95] have recently raised the issue of government support for workers laid off as a result of the economic dislocations in response to the COVID-19 pandemic.

With the potential for significant growth in employee-owned benefit corporations (see

Section 2.2.1 and

Section 2.2.3), Kurzarbeit policies could provide an essential lifeline to these organizations, which must follow more stringent social, environmental, and fiduciary responsibilities than a regular corporation. The introduction of Kurzarbeit policies could also reduce the demand for contract or contingent workers during an economic downturn.

2.5.2. Adopt a Four-Day Workweek (and Possibly Expand Employment), but Maintain Work Pay Parity

The idea of a four-day workweek is not a recent one; it has been analyzed, proposed, and critiqued by many industry professionals and scholars over the last 30 years—see [

112,

114,

115]. One of the first academics to raise this idea was Juliet Schor in her book

The Overworked American [

116]. The premise for her argument was that despite Americans working longer hours today than they did prior to the Second World War, their relative income has been declining on an annual basis. Today, studies show that the argument for a shorter workweek is not simply a method to give people more free time, but a viable solution to partially address income inequality, mental and physical health problems related to overall wellbeing or to being overworked [

117], productivity loss, and environmental damage [

118]. After the 2008 financial crisis and the subsequent widening gap between low- and high-income workers, the idea of a shorter workweek has been receiving more attention due to the potential further elimination of jobs (especially lower-skilled jobs) driven by AI and computer-driven changes in the workplace. In a 2015 report entitled The New Work Order, the Foundation of Young Australians showed that 60% of young adults are currently training for jobs that will be obsolete in 10 to 15 years.

The intervention of a shorter workweek delivers equal or improved enterprise output while increasing the extent of labor participation due to the partial allocation of jobs to more people. It is also likely to result in more sustainable consumption of goods and services when coupled with other interventions. In their review of wellbeing and productivity, Isham et al. [

118] showed that high physical and mental wellbeing levels result in higher levels of labor productivity. Further, findings from shorter workweek pilot programs reveal that the first reported improvement is lower stress levels among employees. Some of the most recent examples of shorter workweek pilot programs are presented in

Box 3.

Box 3. Recent examples of a shorter workweek implementation.

United States: In 2008, the state of Utah ran the first and most extensive pilot of a four-day 10-h workweek in the U.S. Surveys conducted by a third party agency at the time revealed that the new four-day schedule was well-received among state workers and boosted productivity, while a majority of citizens were also found to be in favor of the program. However, after three years of implementation, in 2011, Utah reverted back to the traditional five-day eight-hour workweek based on an internal report that found mixed results from the program.

In 2004, Google offered its employees the option to pursue any projects they wished during the week using 20% of their work time, equivalent to one workday each week. Despite controversies around the impact of this idea on employees’ performance and wellbeing, the goal was to provide employees with time to work on something other than their assigned tasks and become more creative and productive.

In 2016, Amazon followed a slightly different approach offering some of its employees the option of a four-day workweek, though at reduced pay with the hope of attracting more talent who value flexible working hours.

New Zealand: In 2018, the Perpetual Guardian, a 240-employee financial advisory company, reduced—for a period of 8 weeks—the workweek from 40 to 32 h, resulting in a four-day workweek, while maintaining their employees’ salaries. At the end of the pilot, employee stress levels were reduced from 45% to 38%, work-life balance was reportedly significantly improved, and overall job performance was not affected by working one day less each week.

UK: In 2019, Simply Business, a private home and small business insurer was the largest UK company to launch a trial to reduce its call-center operators’ workweek from five to four days without a loss in pay. Reportedly, this decision was made after consulting with other companies, such as Perpetual Guardian in New Zealand, that had already implemented this measure and were comfortable with the results.

Japan: In August 2019, Microsoft in Japan implemented a four-day workweek without a reduction in worker pay. At the end of the one-month pilot, the company reported a 40% increase in productivity, with employees taking 25% less time off during the month, while costs dropped by 23%.

Ireland: In 2016, Pursuit Marketing, a B2B telemarketing consulting firm adopted a four-day workweek without a reduction in basic salaries. The company’s decision to change the workweek was based on an internal analysis that revealed employees were mostly achieving their KPIs between Monday and Thursday, and Fridays were the least productive.

2.5.3. Advance/Extend the Coverage of Labor Law to Contract and Contingent Workers and Strengthen the Reach and Enforcement of Labor Law to Workers in General

As a result of decreasing unionization and the weakening of labor law generally, workers have continuously lost ground in terms of wages, pensions, and other benefits they once received. Guy Standing has characterized contingent workers as “the precariat” [

25] and interventions are required to reverse the balance of power in industrial relations.

Advance/extend the coverage of labor law to all workers: Despite the successful enactment of legislation providing protections and rights to workers during the New Deal era, the history of labor law in the U.S. has been characterized by strong opposition to the establishment of these laws, resulting in the exclusion of workers and the deteriorated ability of unions and collective bargaining mechanisms to safeguard workers’ best interests. The 1935 National Labor Relations Act (NLRA) is a prime example of the aforementioned exclusions; in the NLRA, farm and domestic workers, who were predominantly African American, were excluded due to a compromise the New Dealers made with Jim Crow Southern Democrats [

119,

120,

121]. Today, the list of excluded workers also includes supervisors, independent contractors, professional employees, graduate students, employees of religious institutions, and immigrant workers. An additional group of workers who are not explicitly exempted, but are effectively unprotected, are employees of subcontractors, temporary workers, and franchisees. An amendment to the statutory definitions of employment has the potential to facilitate the expansion of the provision of NLRA protections to these workers. On 10 February 2020, the U.S. House of Representatives expanded the protections offered under the NLRA by passing the Protecting the Right to Organize Act (PRO Act—H.R.2474), which adjusted the definition of independent contractors and supervisors. Under the definition of an independent contractor, in the PRO Act, more workers in the “gig-economy” would be classified as employees and be granted NLRA protections. Similarly, the misclassification of workers as supervisors would also be addressed. By departing from a more judicious definition of supervisor, employers can design work duties in ways that could prevent workers from NLRA rights. Andrias and Rogers [

120] provide an example of how nurses are misclassified as supervisors because they assign tasks to nursing assistants. The same misclassification happens with manager positions. Additionally, the PRO Act amended the definition of an “employee” in order to ensure more workers are covered by existing labor law. However, the Act still has to pass the Senate, where it is expected to encounter strong opposition. The PRO Act represents one approach to expanding labor coverage and also highlights the growing support for reconsidering the current state of labor law in order to reverse the failure to hold employers accountable for failing to guarantee basic labor standards for workers.

Sectoral bargaining: In the U.S., bargaining agreements are based on the concept of a single bargaining unit, meaning that the impact of collective bargaining agreements is restricted to individual companies and workplaces. Conversely, European countries and Australia adopted sectoral bargaining, which enables governments to extend the bargaining agreements’ terms to non-unionized workplaces [

122]. Although sectoral bargaining can lack the flexibility needed to address employer-specific matters [

123], it presents an effective way to cover workers who are currently unprotected by labor law. It would also be a better fit to address the challenges posed by the current fissured workplace [

124], where firms driven by capital markets (i.e., short-term financial pressures, cost reduction) are strongly encouraged to shed employment to outside contractors, franchises, and suppliers. The idea of sectoral bargaining is supported by key actors in the labor movement, as demonstrated by the fact that it has the stated support of the Service Employees International Union (SEIU) and the American Federation of Labor and Congress of Industrial Organizations (AFL-CIO). Andrias and Rogers [

120] have also proposed that Congress encourage sectoral bargaining by empowering “the Department of Labor to set wages and minimum terms” and by extending the limited rights that the NLRA provides to workers to “organize, collectively bargain, strike, and strike at the sectoral level”.

2.5.4. Strengthen Unions and Encourage Collective Bargaining

Strengthening unions and encouraging collective bargaining would improve wages for both union and non-union workers and result in increases in disposable income. Proposed solutions include reducing employer opposition to unionization, making it easier for workers to organize and bargain collectively, the creation of wage boards, repealing “right-to-work” laws, and implementing a codetermination system with work councils.

Reduce employer opposition to workers’ organization: The rules administered by the National Labor Relations Board (NLRB) have shown the inability of the NLRB to protect the rights of workers to organize and to prevent employers from engaging in unfair labor practices. Between 2016 and 2017, two out of five union campaigns charged employers with violating federal law [

125]. At this point, minimal monetary penalties and fines only require employers to post notices of infractions in the workplace. These modest penalties are not sufficient deterrents to prevent employers from violating federal law. One of the tools that employers can use to discourage workers from organizing is the concurrent use of anti-union campaigns in the workplace and denying union members access to the facility. A conservative estimate found that between 2014 and 2018, employers spent

$340 million a year to hire consultants to advise them on how to undermine unionization [

125]. Although the current rules provide employers with an advantage over workers who wish to unionize and collectively bargain, taking measures to reduce employers’ opposition to unionization and to make it easier for workers to organize is possible through the enactment of legislation that amends the rules that govern the NLRB process. It is important to recognize that throughout history, U.S. labor efforts have been successful when workers have leveraged the system of government for their benefit, but not when the administration in power was hostile to their concerns [

126]. See Clausing [

98] for her commentary advocating trade, unionization, and immigration.

Wage boards: Over the last four decades, workers in the U.S. have not benefited economically from higher productivity. As wages stagnated, the productivity–wage gap widened due to a deliberate reversal of a social contract that had been established in the 1950s. Had wages kept growing in tandem with productivity, the current minimum wage would be

$24 per hour [

127], far exceeding the current federal minimum wage of

$7.25 per hour, or the state and city with the highest minimum wages in the country—Washington at

$13.50 and Seattle at

$15.45. In order to get U.S. wages on par with livable wages, the experience of New York State provides an illustrative example of how wage boards can improve wages within the context of the U.S. economy and labor law system.

Wage boards consist of representatives of the public, labor, and business that come together to set minimum standards (i.e., wages and benefits) for jobs in different sectors and regions [

128]. Currently, five states in the U.S. have legislation that allows the creation of wage boards (Arizona, Colorado, California, New Jersey, and New York), but in order to implement them at the national level, changes in U.S. federal law would be necessary [

129]. In 2015, the NY state labor commissioner found that wages for fast food workers were deficient, which led the New York Governor to empanel a tripartite Fast Food Wage Board (FFWB). The FFWB Report [

130] found that fast food workers did not have any health benefits and that wages in New York State corresponded to poverty levels among the workers that would make them eligible for public assistance programs. Therefore, the FFWB established that an hourly rate of

$15 in the State of New York met labor law requirements. The biggest success of the FFWB in New York is that it was able to increase the minimum wage not only for fast-food workers, but for all workers in New York. The FFWB also set a wage floor, which is a useful tool for preventing the suppression of wages by employers [

131,

132].

Considering that the number of workers represented by a union “is now well less than half where it was 40 years ago” covering 11.7% of workers (16.4 million) [