People and the City: Urban Fragility and the Real Estate-Scape in a Neighborhood of Catania, Italy

Abstract

:1. Introduction

1.1. Fragility and the City. General Premises for a Definition of “Real Estate-Scape”

1.2. Metaphores and Synecdoches of Fragility

- On the one hand, by internal production of entropy, whose higher rate is due to the greater urban vitality and vibrancy [18];

- On the other hand, by incoming/outgoing fluxes of entropy [19] whose higher rate is due to the greater capacity by the administrative system to manage the system-environment exchanges, thus replacing the production of entropy (the natural disorder from inside), with fluxes of neg-entropy (the artificial order form outside) [20].

1.3. Urban Fragility. Some Literature Coordinates

- To outline a comparative social-urban profile of the neighborhood, characterized by the combination of different urban and social life-quality levels, and expressing a heterogeneous vulnerability/resilience profile, compared to the whole urban context of the city of Catania.

- To refer this vulnerability/resilience profile to the abstract monetary measurement of the housing market price, thus assuming the real estate-scape as the more general and explicit form of the urban and human scape. Such monetary measurement, in fact, can be considered explicit and significant because real estate capital asset is one of the main items of the household budget for both owners and tenants. Accordingly, a real estate survey and a structured cluster analysis have been carried out to highlight the quantitative and spatial relationships between social-material vulnerability/resilience indices and real estate capital asset market prices. A further hypothesis is that real estate capital asset is a sort of stock-value accumulator that prevents urban-human-scape from being affected by sudden economic fluctuations, such as the recent economic-financial crisis.

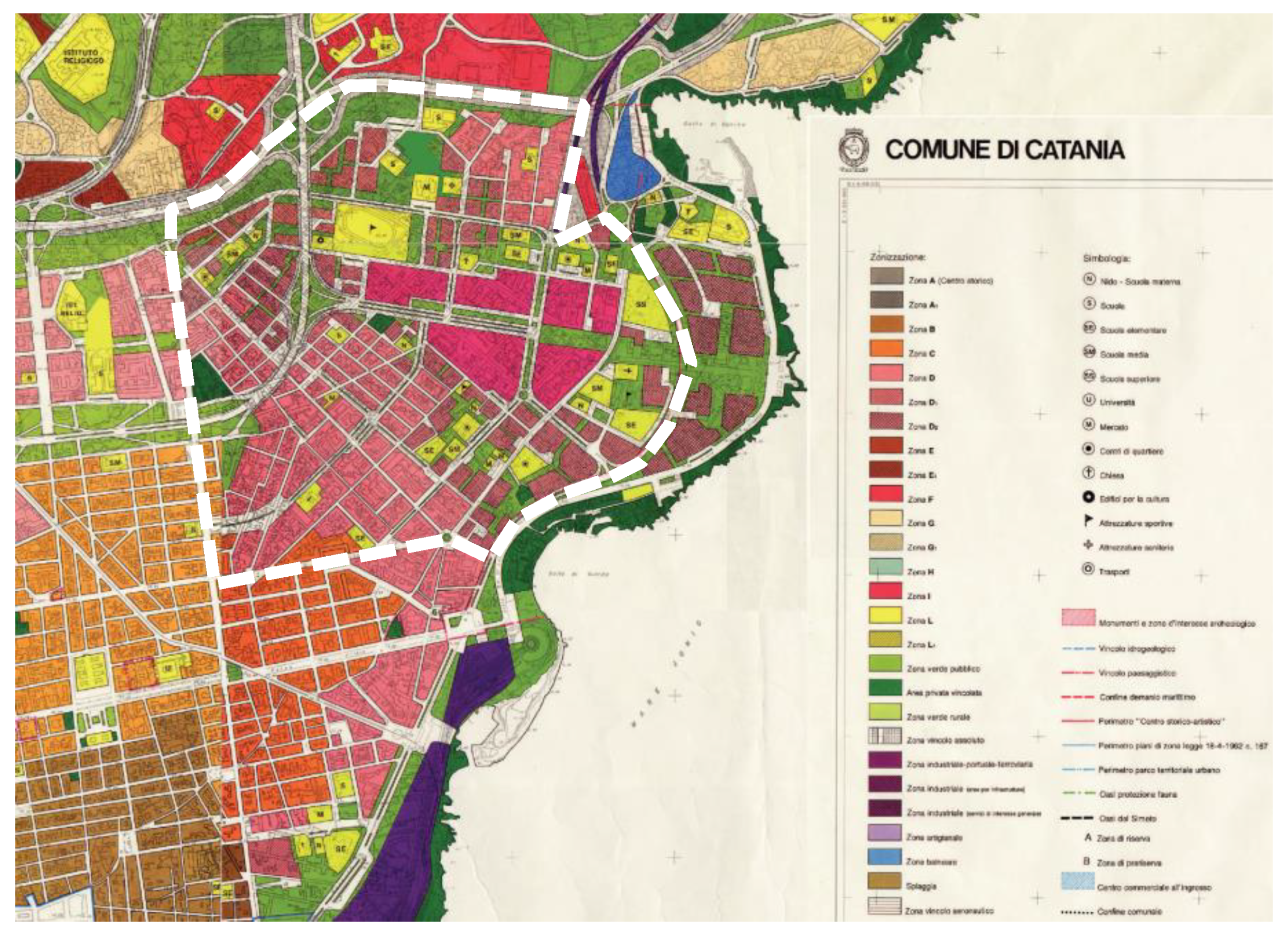

2. Materials: Picanello Neighborhood and the City of Catania

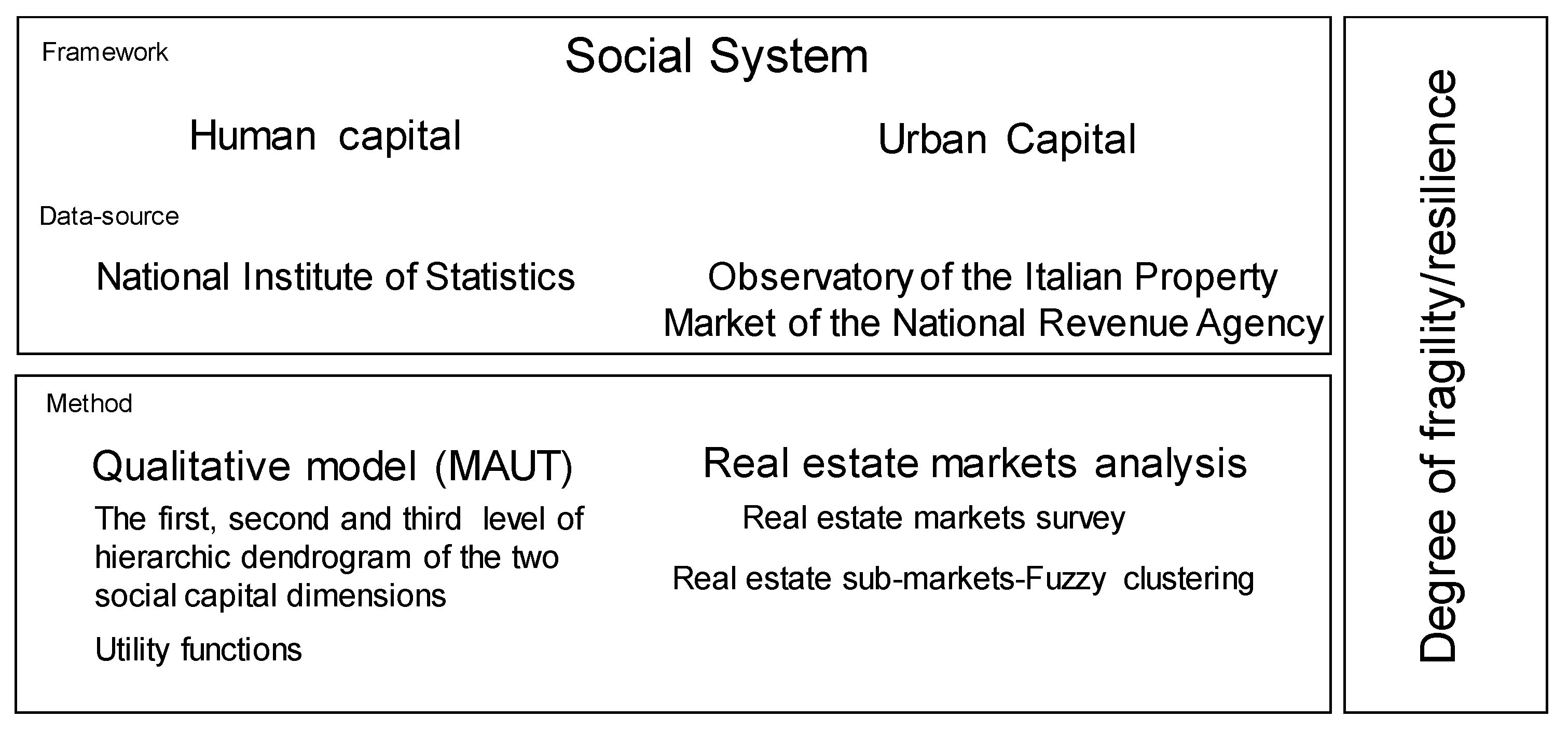

3. Methods

3.1. The Overall Multidimensional Qualitative Pattern

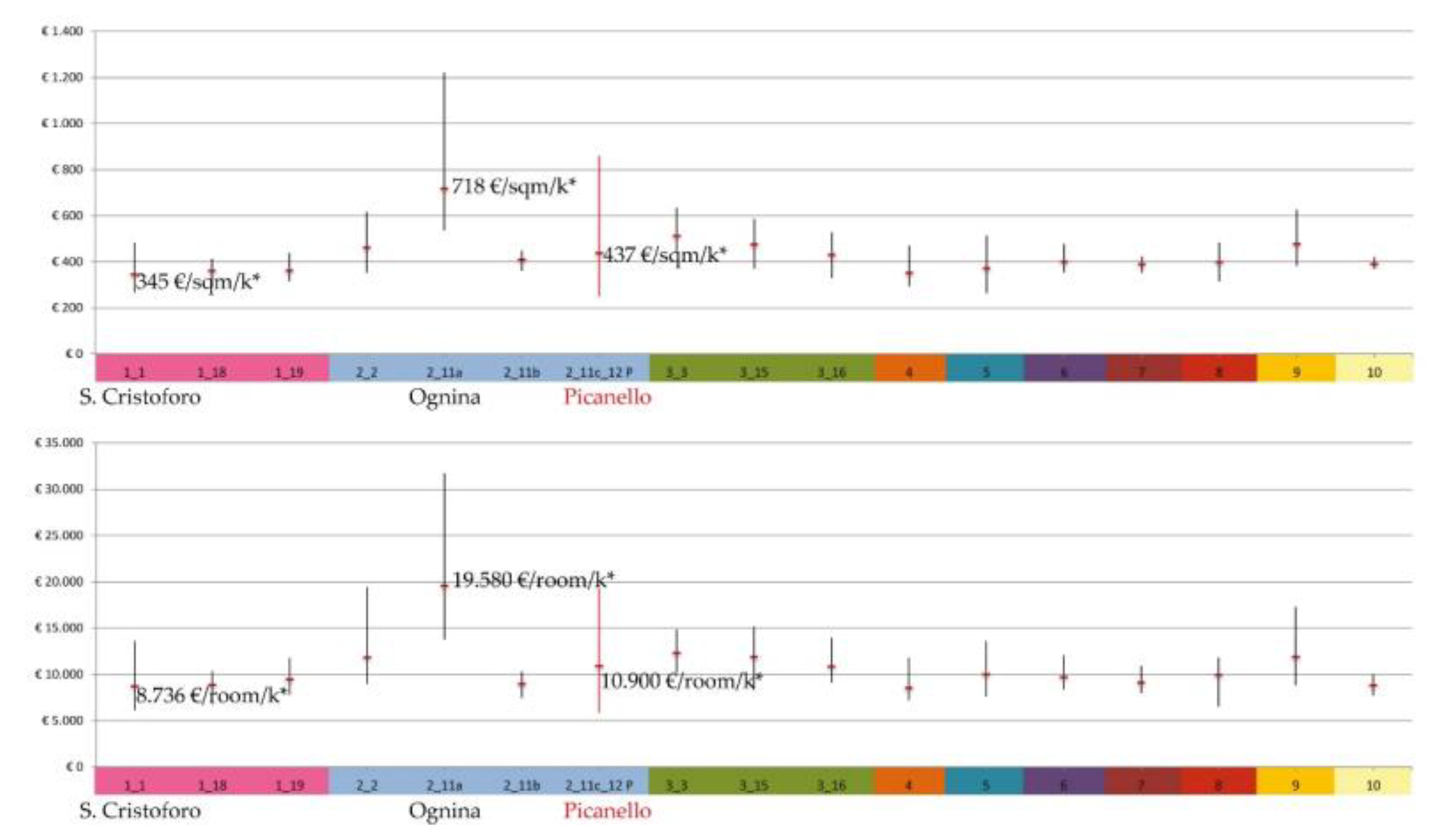

3.2. Real Estate Market Survey

3.2.1. Housing Market of Picanello and Overall Urban Real Estate-Scape References

3.2.2. Sub-Markets Analysis

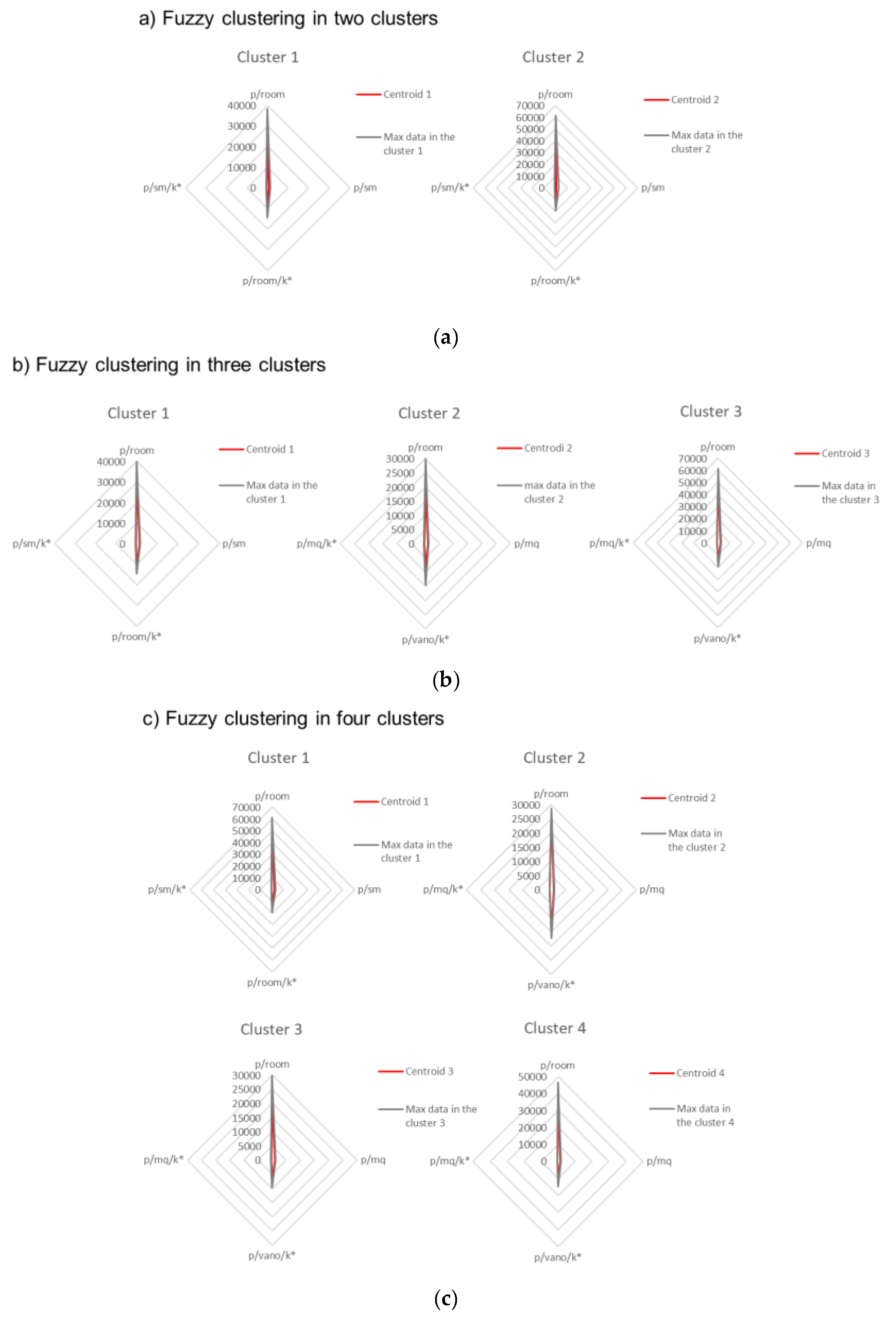

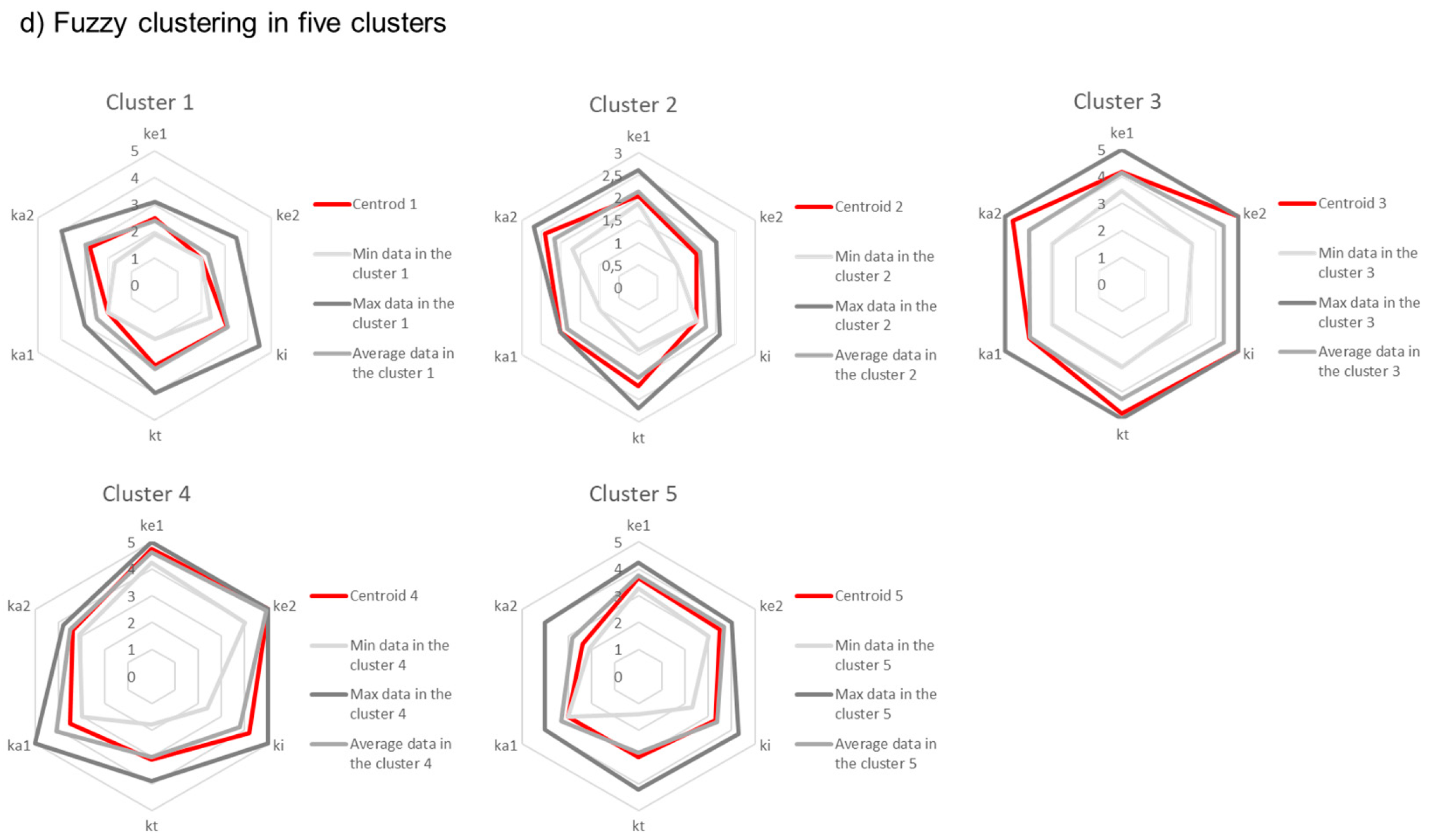

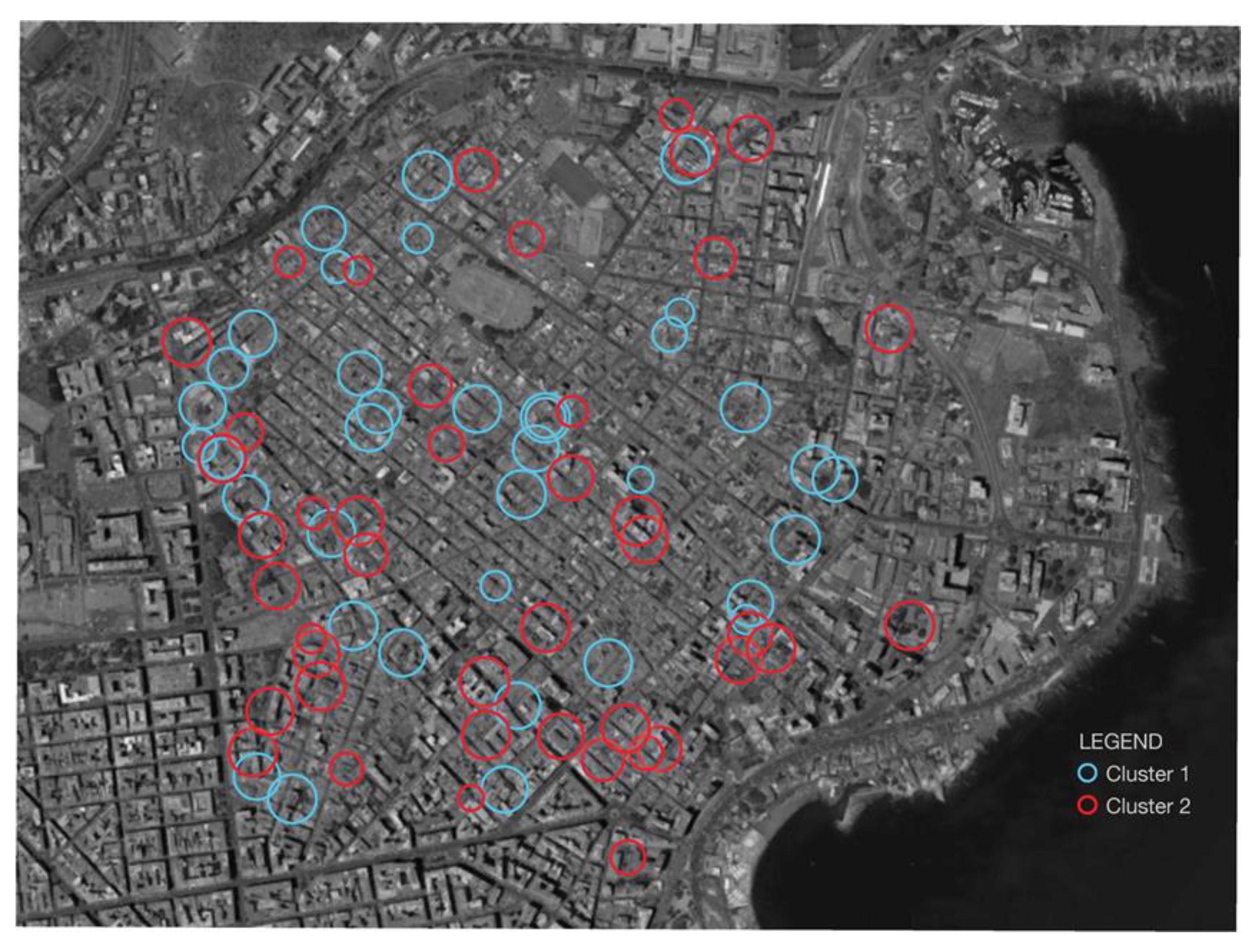

3.2.3. Identifying Real Estate Submarkets Based on Fuzzy K-Means Clustering

4. Results: Fragility and Resilience in Numbers and Comparisons

4.1. Real Estate-Scape. An Early Overview

4.2. Identifying Real Estate Submarkets in Picanello Based on a Fuzzy K-Medoids Clustering

- the first dataset is characterized on the basis of the six real estate characteristics: —location, urbanization and accessibility; —neighborhood characteristics: functional symbolic characteristics; —unit location within the building: panoramic quality and view, brightness, accessibility within the building; —technical characteristics: building overall technological quality, unit finishes and windows quality, maintenance levels; —building architectural quality; —unit architectural quality;

- the second dataset is characterized on the basis of four types of price:k*, k*;

- the third dataset is characterized on the basis of six real estate characteristics ) and the four types of price (k*, k*).

- The influence of the six real estate characteristics is not reconfirmed, result that it was highlighted in the analysis of the first data set;

- A net influence is confirmed in the classification of the two real estate and , which reconfirms a data highlighted in the analysis of the second dataset.

4.3. Overall Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

- Human capital

- 1.1.

- Education

- 1.1.1.

- Educational level by age

- 1.1.1.1.

- % H.S. or University graduates

- 1.1.1.2.

- % young graduates

- 1.1.1.3.

- Educational level 15-19 years old

- 1.1.1.4.

- % Grade 12 adults

- 1.1.2.

- University

- 1.1.2.1.

- Attraction index

- 1.1.2.2.

- Allocation index

- 1.1.2.3.

- Coexistence index

- 1.1.3.

- General educational level

- 1.1.3.1

- Higher education gender differences

- 1.1.3.2.

- Adults in lifelong learning

- 1.1.3.3.

- High/middle school graduates

- 1.1.3.4.

- Illiterate incidence

- 1.1.3.5.

- Education system abandonment

- 1.2.

- Health

- 1.2.1.

- Health general level

- 1.2.1.1.

- Birth rate

- 1.2.1.2.

- Life expectancy

- 1.2.2.

- Mortality by age

- 1.2.2.1.

- Infant mortality index

- 1.2.2.2.

- Cancer mortality index

- 1.2.2.3.

- Car-crash mortality index

- 1.2.3.

- Access to care

- 1.2.3.1.

- Hospitalization rate

- 1.2.3.2.

- Customer satisfaction

- 1.2.4.

- Lifestyle

- 1.2.4.1.

- Obesity rate

- 1.2.4.2.

- Physical inactivity rate

- 1.3.

- Population

- 1.3.1.

- Demographic territorial dynamics

- 1.3.1.1.

- Resident population

- 1.3.1.2.

- Demographic density

- 1.3.2.

- Population structure

- 1.3.2.1.

- % Residents under 6 years old

- 1.3.2.2.

- % Residents over 74 years old

- 1.3.2.3.

- Old age index

- 1.3.2.4.

- Foreign residents index

- 1.3.3.

- Families

- 1.3.3.1.

- Average family size

- 1.3.3.2.

- % Large families

- 1.3.3.3.

- % Families with potential economic disease

- 1.3.3.4.

- % Young people living home

- 1.3.3.5.

- % Old people living alone

- 1.3.3.6.

- % Young couples

- 1.3.3.7.

- % Older couples

- 1.4.

- Labor market

- 1.4.1.

- People activity

- 1.4.1.1.

- Labor market inclusion

- 1.4.1.2.

- Young people inactive

- 1.4.1.3.

- Young people active/inactive ratio

- 1.4.2.

- Employment

- 1.4.2.1.

- Employment rate

- 1.4.2.2.

- Young people employment rate

- 1.4.2.3.

- Employment turn over index

- 1.4.2.4.

- Foreign employment ratio

- 1.4.2.5.

- Specialized employment ratio

- 1.4.3.

- Unemployment

- 1.4.3.1.

- Unemployment rate

- 1.4.3.2.

- Young unemployment rate

- Urban capital

- 2.1.

- Housing conditions and settlements

- 2.1.1.

- Housing stock

- 2.1.1.1.

- Owner-occupied housings incidence

- 2.1.1.2.

- Average surface area of occupied housings

- 2.1.1.3.

- Residential potential intended use in the urban centers

- 2.1.1.4.

- Buildings in good condition incidence

- 2.1.1.5.

- Buildings in bad state of maintenance incidence

- 2.1.2.

- Housing conditions

- 2.1.2.1.

- Surface area per inhabitant

- 2.1.2.2.

- Underutilization index

- 2.1.2.3.

- Concentration rate.

- 2.1.2.4.

- Occupants/rooms ratio in the occupied housings

- 2.2.

- Transportation system

- 2.2.1.

- Mobility

- 2.2.1.1.

- Daily mobility for studying and working

- 2.2.1.2.

- Extra-municipality mobility for studying and working

- 2.2.1.3.

- Job mobility

- 2.2.1.4.

- Mobility for studying

- 2.2.1.5.

- Private mobility

- 2.2.1.6.

- Public mobility

- 2.3.

- Urban Social system/Environment relationship

- 2.3.1.

- Air quality

- 2.3.1.1.

- PM 10 air concentration

- 2.3.2.

- Urban waste

- 2.3.2.1.

- Waste per capita

- 2.3.2.2.

- Total municipal waste

- 2.3.2.3.

- Waste recycling rate

- 2.3.3.

- Town planning standards

- 2.3.3.1.

- Public green per capita

- 2.3.3.2.

- Public facilities per capita

- 2.3.4.

- Urban real estate capital asset

- 2.3.4.1.

- Average rate of property characteristics

- 2.3.4.2.

- Unit and marginal price, per room and per sq.m

- 2.3.4.3.

- Capitalization rate

- 2.3.4.4.

- Real estate segment structure

Appendix B

References

- United Nations: Sustainable Development Goals. Available online: https://www.un.org/sustainabledevelopment/sustainable-development-goals/ (accessed on 28 January 2020).

- United Nations Department of Economic and Social Affairs (UN-DESA). World Urbanization Prospects; United Nations Department of Economic and Social Affairs: New York, NY, USA, 2014. [Google Scholar]

- United Nations Department of Economic and Social Affairs (UN-DESA). World Population Prospects; Key Findings and Advance Tables; United Nations Department of Economic and Social Affairs: New York, NY, USA, 2015. [Google Scholar]

- Giuffrida, S. City as Hope. Valuation Science and the Ethics of Capital. Green Energy and Technology; Springer: Berlin/Heidelberg, Germany, 2018; pp. 469–485. ISSN 1865-3529. [Google Scholar] [CrossRef]

- EC (European Commission). Social Protection Committee Indicators Sub-group EU Social Indicators—Europe 2020 Poverty and Social Exclusion Target. Available online: http://ec.europa.eu/social/main.jsp?catId=756&langId=en (accessed on 27 July 2017).

- National Institute of Statistics, 8milaCensus—ISTAT. Available online: www.ottomilacensus.istat.it (accessed on 13 May 2017).

- Giuffrida, S.; Trovato, M.R.; Circo, C.; Ventura, V.; Giuffrè, M.; Macca, V. Seismic Vulnerability and Old Towns. A Cost-Based Programming Model. Geosciences 2019, 9, 427. [Google Scholar] [CrossRef] [Green Version]

- Barreca, A.; Curto, R.; Rolando, D. Assessing Social and Territorial Vulnerability on Real Estate Submarkets. Buildings 2017, 7, 94. [Google Scholar] [CrossRef] [Green Version]

- Debenedetti, P.G.; Stillinger, F.H. Supercooled liquids and the glass transition”. Nature 2001, 410, 259–267. [Google Scholar] [CrossRef]

- Berthier, L.; Biroli, G.; Bouchaud, J.P.; Cipelletti, L.; van Saarloos, W. Dynamical Heterogeneities in Glasses, Colloids and Granular Media; Oxford University Press: New York, NY, USA, 2011; ISBN 978-0-19-969147-0. [Google Scholar]

- Luhmann, N. Soziale Systeme, Niklas Luhmann: Soziale Systeme. Grundriß einer allgemeinen Theorie, Frankfurt: Suhrkamp 1984. In Klassiker der Sozialwissenschaften; Springer VS: Wiesbaden, Germany, 2016; pp. 350–353. [Google Scholar]

- Rizzo, F. Valore e valutazioni. In La Scienza Dell’economia o L’economia della Scienza; FrancoAngeli: Milano, Italy, 1999. [Google Scholar]

- Giuffrida, S.; Gagliano, F.; Giannitrapani, E.; Marisca, C.; Napoli, G.; Trovato, M.R. Promoting Research and Landscape Experience in the Management of the Archaeological Networks. A Project-Valuation Experiment in Italy. Suistanibility 2020, 12, 4022. [Google Scholar] [CrossRef]

- Naselli, F.; Trovato, M.R.; Castello, G. An evaluation model for the actions in supporting of the environmental and landscaping rehabilitation of the Pasquasia’s site mining (EN). In Computational Science and Its Applications—ICCSA 2014, LNCS 8581; Murgante, B., Misra, S., Rocha, A.M.A.C., Torre, C.M.., Rocha, J.G., Falcão, M.I., Taniar, D., Apduhan, B.O., Gervasi, O., Eds.; Springer Nature Switzerland AG: Cham, Switzerland, 2014; Part III; pp. 26–41. [Google Scholar] [CrossRef]

- Trovato, M.R.; Giuffrida, S. The Monetary Measurement of Flood Damage and the Valuation of the Proactive Policies in Sicily. Geosciences 2018, 8, 141. [Google Scholar] [CrossRef] [Green Version]

- Swiny, A.; Georgiou, M.; Hadjichristou, Y. In/Out of Crisis, Emergent and Adaptive Cities. In Proceedings of the International Conference on Changing Cities II, Spatial, Design, Landscape & Socio-economic Dimensions, Thessaloniki, Greece, 22–26 June 2015; Volume 1, pp. 49–57, ISBN 978-960-6865-88-6. [Google Scholar]

- Giuffrida, S. A Fair City. Value, Time and the Cap Rate. Green Energy and Technology; Springer: Berlin/Heidelberg, Germany, 2018; pp. 425–439. ISSN 1865-3529. [Google Scholar] [CrossRef]

- Barreca, A.; Curto, R.; Rolando, D. Urban Vibrancy: An Emerging Factor that Spatially Influences the Real Estate Market. Sustainability 2020, 12, 346. [Google Scholar] [CrossRef] [Green Version]

- Prigogine, I.; Stangers, I. La Nouvelle Alliance; Métamorphose de la Science: Gallimard, Paris, 1979. [Google Scholar]

- Schrödinger, E. What Is Life? The Physical Aspect of the Living Cell—Mind and Matter; Cambridge University Press: Cambridge, UK, 1944. [Google Scholar]

- Giuffrida, S.; Trovato, M.R.; Falzone, M. The Information Value for Territorial and Economic Sustainability in the Enhancement of the Water Management Process. In ICCSA 2017; LNCS 10406; Borruso, G., Cuzzocrea, A., Apduhan, B.O., Rocha, A.M.A.C., Taniar, D., Misra, S., Gervasi, O., Torre, C.M., Stankova, E., Murgante, B., Eds.; Springer Nature Switzerland AG: Cham, Switzerland, 2017; Volume III, pp. 575–590. [Google Scholar] [CrossRef]

- Giuffrida, S.; Ventura, V.; Nocera, F.; Trovato, M.R.; Gagliano, F. Technological, Axiological and Praxeological Coordination in the Energy-Environmental Equalization of the Strategic Old Town Renovation Programs. In Values and Functions for Future Cities; Green Energy and Technology; Mondini, G., Oppio, A., Stanghellini, S., Bottero, M., Abastante, F., Eds.; Springer Nature Switzerland AG: Cham, Switzerland, 2020; pp. 425–446. [Google Scholar] [CrossRef]

- Tate, E. Uncertainty analysis for a social vulnerability index. Ann. Assoc. Am. Geogr. 2013, 103, 526–543. [Google Scholar] [CrossRef]

- Trovato, M.R.; Giuffrida, S. A DSS to Assess and Manage the Urban Performances in the Regeneration Plan: The Case Study of Pachino. In International Conference on Computational Science and Its Applications–ICCSA 2014- ICCSA 2014, LNCS 8581; Murgante, B., Misra, S., Rocha, A.M.A.C., Torre, C.M., Rocha, J.G., Falcão, M.I., Taniar, D., Apduhan, B.O., Gervasi, O., Eds.; Springer Nature Switzerland AG: Cham, Switzerland, 2014; Part III; pp. 224–239. [Google Scholar] [CrossRef]

- Trovato, M.R.; Giuffrida, S. The choice problem of the urban performances to support the Pachino’s redevelopment plan. IJBIDM 2014, 9, 330–355. [Google Scholar] [CrossRef]

- Chandler, D.; Coaffee, J. The Routledge Handbook of International Resilience; Routlege Handbook: Singapore, 2016. [Google Scholar]

- Brand, F.S.; Jax, K. Focusing the meaning(s) of resilience: Resilience as a descriptive concept and a boundary object. Ecol. Soc. 2007, 12, 23. [Google Scholar] [CrossRef] [Green Version]

- Khan, S. Vulnerability assessments and their planning implications: A case study of the Hutt Valley, New Zealand. Nat. Hazards 2012, 64, 1587–1607. [Google Scholar] [CrossRef]

- De Boer, J. The Fragile City: The Epicentre of Extreme Vulnerability. United Nation University Centre for Policy Research; United Nations University: Tokyo, Japan, 2017. [Google Scholar]

- Lebel, L.; Anderies, J.M.; Campbell, B.; Folke, C.; Hatfield-Dodds, S.; Hughes, T.P.; Wilson, J. Governance and the capacity to manage resilience in regional social-ecological systems. Ecol. Soc. 2006, 11, 19. [Google Scholar] [CrossRef] [Green Version]

- Boer, J.; Muggan, R.; Patel, R. Conceptualizing City Fragility and Resilience; Working Paper (5); United Nation University Centre for Policy Research: Tokyo, Japan, 2016. [Google Scholar]

- Van den Bosch, M.; Bird, W. (Eds.) Oxford Textbook of Nature and Public Health: The Role of Nature in Improving the Health of A Population; Oxford University Press: Oxford, UK, 2018. [Google Scholar] [CrossRef]

- Bahadur, A.V.; Ibrahim, M.; Tanner, T. The Resilience Renaissance? Unpacking of Resilience for Tackling Climate Change and Disasters. In Strengthening Climate Resilience Discussion Paper 1; IDS: Brighton, UK, 2010. [Google Scholar]

- Berkes, F. Understanding Uncertainty and Reducing Vulnerability: Lessons from Resilience Thinking. Nat. Hazards 2007, 41, 283–295. [Google Scholar] [CrossRef]

- Cutter, S.L.; Barnes, L.; Berry, M.; Burton, C.; Evans, E.; Tate, E.; Webb, J. A Place-based Model for Understanding Community Resilience to Natural Disasters. Glob. Environ. Chang. 2008, 18, 598–606. [Google Scholar] [CrossRef]

- Folke, C. Resilience: The Emergence of a Perspective for Social-Ecological Systems Analyses. Global Environ. Chang. 2006, 16, 253–267. [Google Scholar] [CrossRef]

- Cutter, S.L.; Barnes, L.; Berry, M.; Burton, C.G.; Evans, E.; Tate, E.C.; Webb., J. Community and Regional Resilience: Perspectives from Hazards, Disasters, and Emergency Management CARRI Research Report 1; Community and Regional Resilience Institute: Oak Ridge, TN, USA, 2008. [Google Scholar]

- Community and Regional Resilience: Perspectives from Hazards, Disasters, and Emergency Management. Available online: http://www.resilientus.org/library/FINAL_CUTTER_9-25-08_1223482309.pdf (accessed on 1 March 2020).

- Cutter, S.L.M.; Boruff, B.J.; Shirley, W.L. Social Vulnerability to Environmental Hazards. Soc. Sci. Q. 2003, 84, 242–261. [Google Scholar] [CrossRef]

- Cutter, S.L.; Burton, C.G.; Emrich, C.T. Disaster Resilience Indicators for Benchmarking Baseline Conditions. J. Homel. Secur. Emerg. Manag. 2010, 7. [Google Scholar] [CrossRef]

- Meerow, S.; Newell, J.P.; Stults, M. Defining urban resilience: A review. Landsc. Urban Plan. 2016, 147, 38–49. [Google Scholar] [CrossRef]

- Moraci, F.; Errigo, M.F.; Fazia, C.; Burgio, G.; Foresta, S. Making less vulnerable cities: Resilience as a new paradigm of smart planning. Sustainability 2018, 10, 755. [Google Scholar] [CrossRef] [Green Version]

- Miklos, M.; Paoliello, T. Fragile Cities: A Critical Perspective on the Repertoire for New Urban Humanitarian Interventions. Contexto Int. 2017, 39. [Google Scholar] [CrossRef] [Green Version]

- Corchia, L.; Partore, G. Povertà e Impoverimento: I Meccanismi Selettivi Della Vulnerabilità Sociale”, Università Segli Studi di Pisa; Dipartimento di Scienze Politiche e Sociali; LARISS: Pisa, Italy, 2011. [Google Scholar]

- Giuffrida, S.; Trovato, M.R. From the object to land. Architectural Design and Economic Valuation in the Multiple Dimensions of the Industrial Estates. In Computational Science and Its Applications–ICCSA 2017; LNCS 10406; Borruso, G., Cuzzocrea, A., Apduhan, B.O., Rocha, A.M.A.C., Taniar, D., Misra, S., Gervasi, O., Torre, C.M., Stankova, E., Murgante, B., Eds.; Springer Nature Switzerland AG: Cham, Switzerland, 2017; Volume III, pp. 591–606. [Google Scholar] [CrossRef]

- Trovato, M.R.; Nocera, F.; Giuffrida, S. Life-Cycle Assessment and Monetary Measurements for the Carbon Footprint Reduction of Public Buildings. Sustainability 2020, 12, 3460. [Google Scholar] [CrossRef] [Green Version]

- Trovato, M.R.; Giuffrida, S. The Protection of Territory in the Perspective of the Intergenerational Equity. In Seminar of the Italian Society of Property Evaluation and Investment Decision; Green Energy and Technology; Springer Nature: Cham, Switzerland, 2018; Volume Part F8, pp. 469–485. [Google Scholar] [CrossRef]

- Pagello, E. Architettura minore a Catania all’inizio del secolo: Un caso di studio Picanello; University of Catania: Catania, Italy, 1990. [Google Scholar]

- Keeney, R.L.; Raiffa, H. Decision with Multiple Objectives: Preferences and Values Tradeoffs; Wiley: New York, NY, USA, 1976. [Google Scholar]

- Trovato, M.R. A multi-criteria approach to support the retraining plan of the Biancavilla’s old town”. In Proceedings of the Smart Innovation, Systems and Technologies, 3rd International New Metropolitan Perspectives, Local Knowledge and Innovation Dynamics towards Territory Attractiveness through the Implementation of Horizon/Europe2020/Agenda2030, Reggio Calabria, Italy, 22–25 May 2018; Calabrò, F., Della Spina, L., Bevilacqua, C., Eds.; Springer Science and Business Media Deutschland GmbH: Cham, Switzerland, 2019; Volume 101, pp. 434–441. [Google Scholar] [CrossRef]

- Giuffrida, S.; Ferluga, G.; Valenti, A. Capitalisation rates and ‘real estate semantic chains’: An application of clustering analysis. IJBIDM 2015, 10, 174–198. [Google Scholar] [CrossRef]

- Giuffrida, S.; Valenti, A.; Linguanti, F. Decision trees analysis in a low tension real estate market: The case of Troina (Italy). In Computational Science and Its Applications—ICCSA 2015, LCNS 9157; Gervasi, O., Murgante, B., Misra, S., Gavrilova, M.L., Rocha, A.M.A.C., Torre, C.M., Taniar, D., Apduhan, B.O., Eds.; Springer Nature Switzerland AG: Cham, Switzerland, 2015; Volume III, pp. 237–252. [Google Scholar] [CrossRef]

- Fisher, E.M.; Fisher, R.M. Urban Real Estate; Henry Holt: New York, NY, USA, 1954. [Google Scholar]

- Rapkin, C.; Grigsby, W.G. Residential Renewal in the Urban Core; University of Pennsylvania Press: Philadelphia, PA, USA, 1960. [Google Scholar]

- Baer, W.C.; Williamson, C.B. The Filtering of Households and Housing Units. J. Plan. Lit. 1988, 3. [Google Scholar] [CrossRef]

- Lowry, I.S. Filtering and housing standards. Land Econ. 1960, 36, 362–370. [Google Scholar] [CrossRef]

- Myers, D. Housing allowances, housing submarkets and the filtering process. Urban Aff. Q. 1975, 11, 215–240. [Google Scholar] [CrossRef]

- Quigley, J.M. Housing market and demand. Urban Housing Market. In Recent Directions in Housing Research; Bourne, L., Hitchcok, J., Eds.; University of Toronto Press: Toronto, ON, Canada, 1978; p. 21. [Google Scholar]

- Quigley, J.M. What Have Learned about Urban Housing Market? In Current Issue in Urban Economics; Straszheim, M., Mieszkowski, P., Eds.; Johns Hopkins University Press: Baltimore, DM, USA, 1979; pp. 391–429. [Google Scholar]

- Maclennan, D. Housing Economics; An applied approach; Longman: London, UK, 1982. [Google Scholar]

- Straszheim, M.R. An Econometric Analysis of the Urban Housing Market; Columbia University Press: New York, NY, USA; London, UK, 1975. [Google Scholar]

- Galster, G.C. Homeowerns and Neighborhood Reinvestiment; Duke University Press: Durham, NC, USA, 1987. [Google Scholar]

- Schnare, A.; Struyk, R. Segmentation in urban housing markets. J. Urban Econ. 1976, 3, 146–166. [Google Scholar] [CrossRef]

- Ball, M.; Kirwan, R. Accessibility and supply constraints in the urban housing markets. Urban Stud. 1977, 14, 11–32. [Google Scholar] [CrossRef]

- Maclennan, D.; Tu, Y. The Efficient Market Framework and Real Estate Economics (mimeo); University of Glasgow: Glasgow, UK, 1987. [Google Scholar]

- Sonstelie, J.C.; Portney, P.R. Gross rent market values: Testing the implication of Tiebout’s hypothesis. J. Urban Econ. 1980, 7, 102–118. [Google Scholar] [CrossRef]

- Bourassa, S.C.; Hamelink, F.; Hoesli, M.; Macgregor, B.D. Defining housing submarkets. J. Hous. Econ. 1999, 8, 160–183. [Google Scholar] [CrossRef]

- Goodman, A.; Kawai, M. Estimation and policy implications of rental housing demand. J. Urban Econ. 1984, 16, 76–90. [Google Scholar] [CrossRef]

- Adair, A.S.; Berry, J.; Mc Greal, W.S. Hedonic modelling, housing submarkets and residential valuation. J. Prop. Res. 1996, 16, 67–83. [Google Scholar] [CrossRef]

- Munro, M. Testing for the Segmentation in the Price Housing Markets Glasgow; Centre of Housing Research, Discussion Paper, N. 8; University of Glasgow: Glasgow, UK, 1986. [Google Scholar]

- Palm, R. Spatial segmentation of the urban housing. Rev. Econ. Stat. 1978, 66, 394–404. [Google Scholar]

- Michaels, R.; Smith, V.K. Market segmentation and valuing amenities with hedonic model: The case of hazardous waste cities. J. Urban Econ. 1990, 28, 223–242. [Google Scholar] [CrossRef]

- Rapkin, C.; Winnick, L.; Blanck, D.M. Housing Market Analysis; US Housing and Home Finance Agency: Washington, DC, USA, 1953. [Google Scholar]

- Dale-Johnson, D. An alternative approach to housing market segmentation using hedonic price data. J. Urban Econ. 1982, 11, 311–332. [Google Scholar] [CrossRef]

- Grigsby, W. Housing Market and Public Policy; Philadelphia University of Pennsylvania Press: Philadelphia, PA, USA, 1963. [Google Scholar]

- Grisby, W.; Baratz, M.; Galster, G.; Maclemann, D. The Dynamics of Neighbourhood Change and Decline; Pergamon: Oxford, UK, 1987. [Google Scholar]

- Sweeney, J. A commodity hierarchy of the residential housing market. J. Law Econ. 1974, 28, 555–585. [Google Scholar]

- Sweeney, J. Quality Commodity, hierarchy model of the rental housing market. Econometria 1974, 42, 147–168. [Google Scholar] [CrossRef]

- Schall, L. Commodity chain system on the housing market. J. Urban Econ. 1981, 10, 141–163. [Google Scholar] [CrossRef]

- Braid, R. The short run comparative statics of a rental housing market. J. Urban Econ. 1981, 10, 280–310. [Google Scholar] [CrossRef]

- Butler, R.V. The Specification of Hedonic Indexes for Urban Housing. Land Econ. 1982, 58, 96–108. [Google Scholar] [CrossRef]

- Goodman, A. Housing market within urban area. J. Reg. Sci. 1981, 21, 175–186. [Google Scholar] [CrossRef]

- Allen, M.T.; Springer, T.M.; Waller, N.G. Implicit pricing across residential submarkets. J. Real Estate Financ. Econ. 1995, 11, 137–151. [Google Scholar] [CrossRef]

- Abraham, J.; Goetzmann, W.; Wachter, S. Homogeneous Groupings of Metropolitan Housing Markets. J. Hous. Econ. 1994, 3, 186–206. [Google Scholar] [CrossRef]

- Hoesli, M.; Lizieri, C.; MacGregor, B. The spatial dimensions of the investment performance of UK commercial property. Urban Stud. 1997, 34, 93–109. [Google Scholar] [CrossRef]

- Bourassa, S.C.; Hoesli, M.; Sun, J. What’s in a new? Environ. Plan. A 2004, 36, 1427–1450. [Google Scholar] [CrossRef]

- Napoli, G.; Giuffrida, S.; Trovato, M.R. Efficiency versus Fairness in the Management of Public Housing Assets in Palermo (Italy). Sustainability 2019, 11, 1190. [Google Scholar] [CrossRef] [Green Version]

- Giuffrida, S.; Ferluga, G.; Valenti., A. Clustering analysis in a complex real estate market: The case of Ortigia (Italy). In Computational Science and Its Applications—ICCSA 2014, LNCS 8581; Murgante, B., Misra, S., Rocha, A.M.A.C., Torre, C.M., Rocha, J.G., Falcão, M.I., Taniar, D., Apduhan, B.O., Gervasi, O., Eds.; Springer Nature Switzerland AG: Cham, Switzerland, 2014; Part III; pp. 106–121. [Google Scholar] [CrossRef]

- Basu, S.; Thibodeau, T.G. Analysis of Spatial Autocorrelation in House Prices. J. Real Estate Financ. Econ. 1998, 17, 61–85. [Google Scholar] [CrossRef]

- Pace, R.K.; Gilley, O.W. Using the Spatial Configuration of the Data to Improve Estimation. J. Real Estate Financ. Econ. 1997, 14, 333–340. [Google Scholar] [CrossRef]

- Goodman, A.; Thibodeau, T. The spatial proximity of metropolitan area housing submarkets. Real Estate Econ. 2007, 35, 209–232. [Google Scholar] [CrossRef]

- Bourassa, S.; Cantoni, E.; Hoesli, M. Predicting house prices with spatial dependence: A comparison of alternative methods. J. Real Estate Res. 2010, 32, 139–159. [Google Scholar]

- Kuntz, M.; Helbich, M. Geostatistical mapping of real estate prices: An empirical comparison of kriging and cokriging. Int. J. Geogr. Inf. Sci. 2014, 28, 1904–1921. [Google Scholar] [CrossRef]

- Hwang, S.; Thill, J.C. Delineating urban housing submarkets with fuzzy clustering. Environ. Plan. B Plan. Des. 2009, 36, 865–882. [Google Scholar] [CrossRef]

- Derudder, B.; Witlox, F.; Taylor, P.J.; Catalano, G. Pattern recognition in large geographical databases: Towards a detailed assessment of the world city network”. Int. J. Pattern Recognit. Artif. Intell. 2007, 21, 439–462. [Google Scholar] [CrossRef]

- Gabrielli, L.; Giuffrida, S.; Trovato, M.R. Gaps and Overlaps of Urban Housing Sub Market: A Fuzzy Clustering Approach. In Appraisal from Theory to Practice; Green Energy and Technology; Stanghellini, S., Morano, P., Bottero, M., Oppio, A., Eds.; Springer Nature Switzerland AG: Cham, Switzerland, 2017; pp. 203–219. ISBN 9783319496757. [Google Scholar] [CrossRef]

- Luo, T.T.; Gao, X.W. New Urban Development of Beijing’s Real Estate Development Level of the Fuzzy Clustering Analysis. In Proceedings of the ICAE 2011, International Conference on New Technology of Agricultural Engineering 5943848; IEEE Press: Hoboken, NJ, USA, 2011; pp. 500–504. [Google Scholar]

- Malinowski, A.; Piwowarczyk, M.; Telec, Z.; Trawiński, B.; Kempa, O.; Lasota, T. An approach to property valuation based on market segmentation with crisp and fuzzy clustering. In International Conference on Computational Collective Intelligence; Lecture Notes in Computer Science (including subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics); Springer Nature: Cham, Switzerland, 2018; Volume 11055 LNAI, pp. 534–548. [Google Scholar]

- Zadeh, L.A. Fuzzy sets. Inf. Control 1965, 8, 338–353. [Google Scholar] [CrossRef] [Green Version]

- Gan, G.; Ma, C.; Wu, J. Data Clustering: Theory, Algorithms and Application; SIAM: Philadelphia, PA, USA, 2007. [Google Scholar]

- Gabrielli, L.; Giuffrida, S.; Trovato, M.R. From Surface to Core: A Multi-layer Approach for the Real Estate Market Analysis of a Central Area in Catania. In Computational Science and Its Applications—ICCSA 2015, LCNS 9157; Gervasi, O., Murgante, B., Misra, S., Gavrilova, M.L., Rocha, A.M.A.C., Torre, C.M., Taniar, D., Apduhan, B.O., Eds.; Springer Nature Switzerland AG: Cham, Switzerland, 2015; Volume III, pp. 284–300. [Google Scholar] [CrossRef]

- Gabrielli, L.; Giuffrida, S.; Trovato, M.R. Functions and Perspectives of Public Real Estate in the Urban Policies: The Sustainable Development Plan of Syracuse. In Computational Science and Its Applications--ICCSA 2016, LNCS 9789; Gervasi, O., Murgante, B., Misra, S., Rocha, A.M.A.C., Torre, C.M., Taniar, D., Apduhan, B.O., Stankova, E., Wang, S., Eds.; Springer Nature Switzerland AG: Cham, Switzerland, 2016; Volume IV, pp. 13–28. [Google Scholar] [CrossRef]

- Napoli, G.; Giuffrida, S.; Valenti, A. Forms and Functions of the Real Estate Market of Palermo (Italy). Science and Knowledge in the Cluster Analysis Approach. Science and Knowledge in the Cluster Analysis Approach. In Appraisal: From Theory to Practice; Stanghellini, S., Morano, P., Bottero, M., Oppio, A., Eds.; Green Energy and Technology; Springer Nature Switzerland AG: Cham, Switzerland, 2017; pp. 191–202. ISBN 9783319496757. [Google Scholar] [CrossRef]

- Goodman, A.C. Housing sub-markets within urban areas: Definition and evidence. J. Reg. Sci. 1981, 21, 175–185. [Google Scholar] [CrossRef]

- Watkins, C. The definition and identification on submarkets. Environ. Plan. A 2001, 33, 2235–2253. [Google Scholar] [CrossRef]

- Giuffrida, S.; Casamassima, G.; Trovato, M.R. Le norme EMAS-ISO nella valutazione della qualità del servizio idrico integrato. Aestimum 2017, 70, 109–134. [Google Scholar] [CrossRef]

- Napoli, G.; Giuffrida, S.; Trovato, M.R.; Valenti, A. Cap rate as the Interpretative Variable of the Urban Real Estate Capital Asset: A Comparison of Different Sub-Market Definitions in Palermo, Italy. Buildings 2017, 7, 80. [Google Scholar] [CrossRef] [Green Version]

- Giuffrida, S.; Ventura, V.; Trovato, M.R.; Napoli, G. Axiology of the historical city and the cap rate the case of the old town of Ragusa superior. Valori E Valutazioni 2017, 18, 41–55. [Google Scholar]

- Giuffrida, S.; Gagliano, F.; Nocera, F.; Trovato, M.R. Landscape assessment and Economic Accounting in wind farm Programming: Two Cases in Sicily. Land 2018, 7, 120. [Google Scholar] [CrossRef] [Green Version]

- Giannelli, A.; Giuffrida, S.; Trovato, M.R. Madrid Rio Park. Symbolic Values and Contingent Valuation. Valori E Valutazioni 2018, 21, 75–85. [Google Scholar]

- Giuffrida, S.; Trovato, M.R.; Giannelli, A. Semiotic-Sociological Textures of Landscape Values. Assessments in Urban-Coastal Areas. In Information and Communication Technologies in Modern Agricultural Development, Communications in Computer and Information Science; Salampasis, M., Bournaris, T., Eds.; Springer: Cham, Switzerland, 2019; Volume 953, pp. 35–50. [Google Scholar] [CrossRef]

- Giuffrida, S.; Trovato, M.R. A Semiotic Approach to the Landscape Accounting and Assessment. An Application to the Urban-Coastal Areas. In Proceedings of the 8th International Conference on Information and Communication Technologies in Agriculture, Food and Environment, HAICTA 2017, Crete Island, Greece, 21–24 September 2017; Volume 2030, pp. 696–708. [Google Scholar]

- Napoli, G.; Giuffrida, S.; Trovato, M.R. A Paradigm Interpreting the City and the Analytic Network Process for the Management of Urban Transformations. In Proceedings of the Smart Innovation, Systems and Technologies, 3rd International New Metropolitan Perspectives. Local Knowledge and Innovation dynamics towards territory attractiveness through the implementation of Horizon/Europe2020/Agenda2030, Reggio Calabria, Italy, 22–25 May 2018; Bevilacqua, C., Calabrò, F., Della Spina, L., Eds.; Springer Science and Business Media Deutschland GmbH: Cham, Switzerland, 2019; Volume 100, pp. 672–680. [Google Scholar] [CrossRef] [Green Version]

| Weights | |||||||

|---|---|---|---|---|---|---|---|

| … | … | ||||||

| Criteria | Overall Assessments | ||||||

| Actions | … | … | |||||

| … | … | … | … | … | … | ||

| … | … | … | … | … | … | ||

| Human Capital | Education | Educational Level by Age |

| University | ||

| General Educational Level | ||

| Health | Health General Level | |

| Mortality by Age | ||

| Lifestyle | ||

| Population | Demographic Territorial Dynamics | |

| Population Structure | ||

| Families | ||

| Labor Market | ||

| Employment | ||

| Unemployment | ||

| Urban Capital | Housing Conditions and Settlements | Housing Stock |

| Housing Conditions | ||

| Infrastructures | Mobility | |

| Social System/Environment Relationship | Air Quality | |

| Urban Waste | ||

| Town Planning Standards | ||

| Urban Real Estate Capital Asset | Characteristics | |

| Prices | ||

| Capitalization Rates | ||

| Sub-Market Structure |

| Criteria | ACEs | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 01 | 02 | 03 | 04 | 05 | 06 | 07 | 08 | 09 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | Catania | |||

| Human capital | Education | Educ. level by age | 0.65 | 1.59 | 1.60 | 1.38 | 1.07 | 1.39 | 0.94 | 1.14 | 0.71 | 0.78 | 1.16 | 1.29 | 0.86 | 1.17 | 1.63 | 1.65 | 0.72 | 0.99 | 1.29 | 1.12 |

| University | 0.19 | 0.58 | 0.63 | 0.56 | 0.49 | 0.50 | 0.39 | 0.44 | 0.28 | 0.31 | 0.44 | 0.45 | 0.36 | 0.50 | 0.59 | 0.56 | 0.32 | 0.32 | 0.56 | 0.42 | ||

| General educ. level | 0.11 | 0.30 | 0.44 | 0.32 | 0.14 | 0.45 | 0.45 | 0.36 | 0.06 | 0.15 | 0.16 | 0.49 | 0.35 | 0.28 | 0.52 | 0.60 | 0.00 | 0.17 | 0.28 | 0.18 | ||

| Health | Health general level | 0.24 | 1.15 | 1.24 | 1.05 | 0.79 | 0.95 | 0.60 | 0.80 | 0.31 | 0.46 | 0.78 | 0.86 | 0.57 | 0.79 | 1.20 | 1.16 | 0.36 | 0.56 | 1.05 | 0.68 | |

| Mortality by age | 0.36 | 0.98 | 1.04 | 0.92 | 0.77 | 0.82 | 0.58 | 0.74 | 0.42 | 0.53 | 0.75 | 0.75 | 0.59 | 0.74 | 0.99 | 0.94 | 0.47 | 0.58 | 0.94 | 0.61 | ||

| Life style | 0.33 | 0.66 | 0.70 | 0.67 | 0.59 | 0.55 | 0.41 | 0.49 | 0.35 | 0.40 | 0.55 | 0.49 | 0.43 | 0.57 | 0.64 | 0.60 | 0.38 | 0.42 | 0.68 | 0.46 | ||

| Population | Demogr. territorial dyn. | 1.28 | 1.12 | 1.69 | 0.31 | 0.67 | 0.97 | 0.84 | 1.60 | 0.89 | 0.35 | 0.63 | 1.95 | 1.31 | 0.62 | 1.16 | 1.59 | 1.07 | 1.70 | 0.93 | 0.39 | |

| Population structure | 1.55 | 0.85 | 0.92 | 1.05 | 1.12 | 0.73 | 0.90 | 0.67 | 1.11 | 1.03 | 1.12 | 0.76 | 1.05 | 1.25 | 0.67 | 0.49 | 1.17 | 1.22 | 1.26 | 1.18 | ||

| Families | 0.92 | 0.88 | 0.82 | 1.14 | 1.25 | 1.01 | 1.03 | 0.96 | 1.15 | 1.08 | 1.01 | 0.85 | 1.00 | 1.16 | 0.89 | 0.94 | 1.15 | 0.76 | 0.90 | 0.99 | ||

| Labour market | 0.00 | 1.34 | 1.81 | 1.24 | 1.66 | 0.68 | 1.23 | 0.50 | 1.17 | 0.47 | 1.00 | 0.40 | 0.62 | 2.00 | 0.96 | 0.33 | 1.81 | 0.50 | 1.76 | 1.08 | ||

| Employment | 0.00 | 1.60 | 1.69 | 1.44 | 1.18 | 1.29 | 0.71 | 1.09 | 0.26 | 0.51 | 0.93 | 1.15 | 0.72 | 1.18 | 1.55 | 1.56 | 0.34 | 0.54 | 1.41 | 0.87 | ||

| Unemployment | 0.00 | 1.77 | 2.00 | 1.56 | 1.00 | 1.20 | 0.49 | 1.00 | 0.08 | 0.41 | 1.15 | 0.99 | 0.50 | 0.80 | 1.88 | 1.62 | 0.23 | 0.68 | 1.69 | 0.35 | ||

| Urban capital | Housing conditions and settlements | Housing stock | 0.07 | 0.82 | 1.21 | 0.83 | 0.61 | 0.78 | 1.36 | 0.92 | 1.03 | 1.18 | 1.24 | 0.90 | 0.79 | 1.55 | 0.93 | 1.07 | 1.38 | 0.80 | 0.73 | 1.08 |

| Housing conditions | 0.00 | 1.92 | 2.00 | 1.32 | 0.91 | 1.13 | 0.64 | 1.00 | 0.11 | 0.31 | 1.11 | 1.31 | 0.40 | 1.00 | 1.81 | 1.84 | 0.33 | 0.83 | 1.63 | 1.09 | ||

| Infrastructures | Mobility | 1.15 | 1.02 | 1.27 | 1.19 | 1.21 | 0.70 | 1.03 | 0.89 | 1.19 | 1.15 | 0.56 | 0.94 | 1.00 | 0.67 | 0.83 | 0.78 | 1.05 | 0.98 | 1.18 | 1.07 | |

| Social system/ Environment relationship | Air quality | 1.00 | 1.70 | 1.00 | 1.80 | 1.20 | 0.90 | 0.60 | 1.00 | 1.20 | 0.80 | 0.70 | 0.80 | 1.10 | 1.80 | 0.70 | 0.70 | 1.10 | 1.20 | 1.20 | 1.08 | |

| Urban waste | 0.00 | 1.40 | 2.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.00 | 0.00 | 0.00 | 0.30 | 0.08 | ||

| Town plann. standards | 0.07 | 0.38 | 0.44 | 0.30 | 0.22 | 0.27 | 0.31 | 0.28 | 0.19 | 0.22 | 0.36 | 0.29 | 0.22 | 0.32 | 0.37 | 0.36 | 0.23 | 0.23 | 0.27 | 0.30 | ||

| Urban real estate capital asset | Characteristics | 0.61 | 1.43 | 1.59 | 1.44 | 0.98 | 1.10 | 1.60 | 1.14 | 0.61 | 0.97 | 1.52 | 1.00 | 1.14 | 1.10 | 1.29 | 1.09 | 0.61 | 1.08 | 0.82 | 1.12 | |

| Prices | 0.14 | 1.06 | 1.13 | 0.43 | 0.40 | 0.67 | 0.54 | 0.66 | 0.74 | 0.44 | 1.09 | 0.73 | 0.66 | 0.67 | 1.06 | 0.93 | 0.74 | 0.35 | 0.37 | 0.73 | ||

| Capitalization rates | 0.38 | 1.19 | 1.37 | 0.99 | 0.78 | 0.83 | 0.98 | 0.88 | 0.70 | 0.77 | 1.05 | 0.93 | 0.76 | 0.95 | 1.12 | 1.08 | 0.78 | 0.77 | 0.90 | 0.97 | ||

| Sub-market Structure | 0.31 | 1.01 | 1.12 | 0.79 | 0.60 | 0.71 | 0.86 | 0.73 | 0.56 | 0.60 | 1.00 | 0.73 | 0.70 | 0.74 | 0.95 | 0.85 | 0.59 | 0.61 | 0.57 | 0.74 | ||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Trovato, M.R.; Clienti, C.; Giuffrida, S. People and the City: Urban Fragility and the Real Estate-Scape in a Neighborhood of Catania, Italy. Sustainability 2020, 12, 5409. https://doi.org/10.3390/su12135409

Trovato MR, Clienti C, Giuffrida S. People and the City: Urban Fragility and the Real Estate-Scape in a Neighborhood of Catania, Italy. Sustainability. 2020; 12(13):5409. https://doi.org/10.3390/su12135409

Chicago/Turabian StyleTrovato, Maria Rosa, Claudia Clienti, and Salvatore Giuffrida. 2020. "People and the City: Urban Fragility and the Real Estate-Scape in a Neighborhood of Catania, Italy" Sustainability 12, no. 13: 5409. https://doi.org/10.3390/su12135409