Sustainable Location Selection for Investing in Public–Private Partnership Infrastructure Projects: From a Developing Country’s Perspective

Abstract

:1. Introduction

2. Literature Review

2.1. Public–Private Partnership (PPP) Context in Vietnam

2.2. Perception of Project Location Selection

2.3. Criteria of Sustainable Location Selection

3. Research Methodology

3.1. Muti-Criteria Decision Making and Fuzzy Set Theory

3.2. Fuzzy TOPSIS

4. Numerical Example of Fuzzy Technique for Order of Preference by Similarity to Ideal Solution (TOPSIS) Application

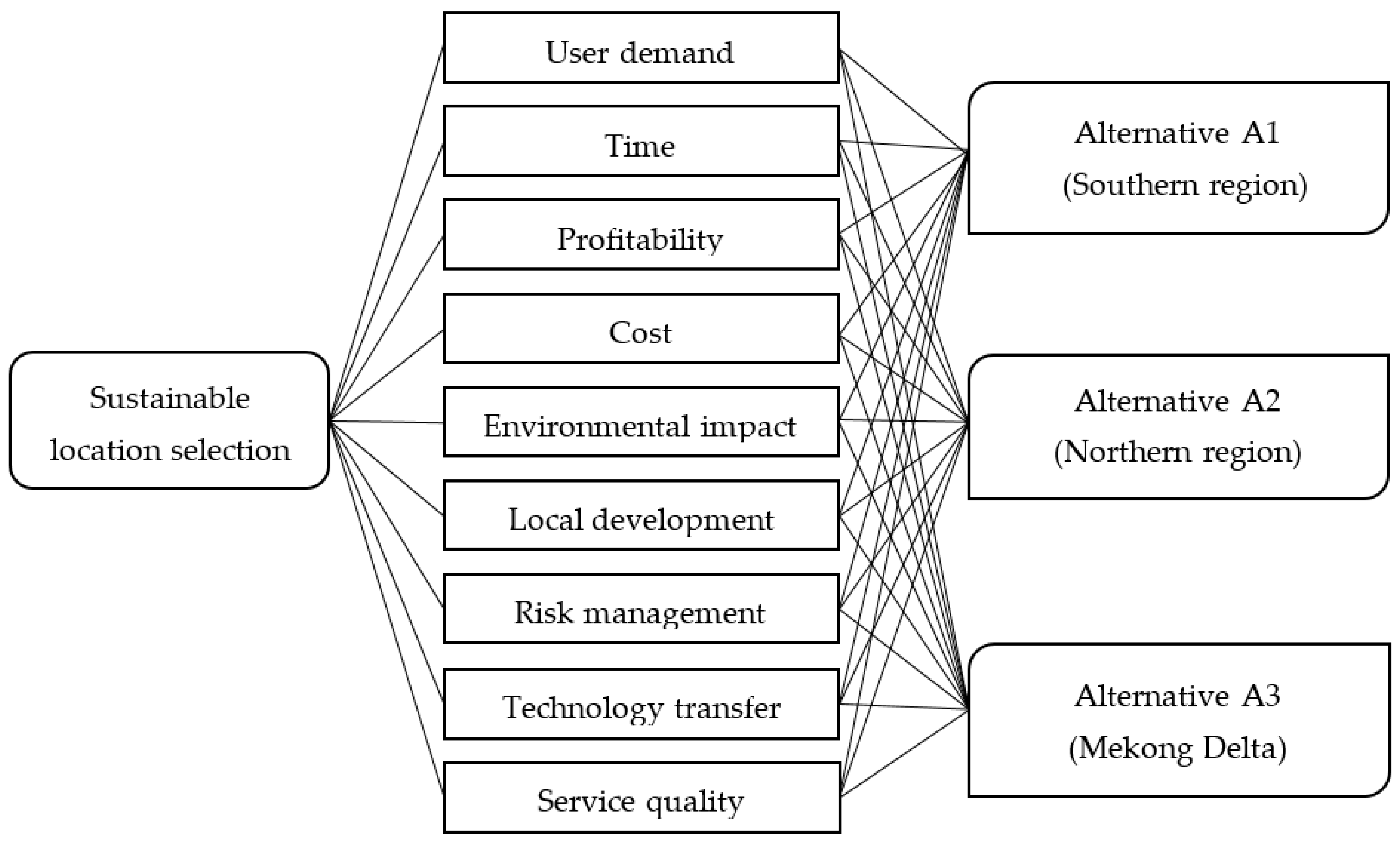

4.1. Identification of Success Criteria

4.2. Selection of Alternatives

4.3. Measuring the Success Index of PPP Projects

4.4. Sensitivity Analysis

5. Conclusions

- Carefully assessing the project feasibility before calling the investment.

- Maintaining tax preferential policies for PPP projects.

- Completing the legal framework of the PPP model.

- Ensuring the stability of the financial structure.

- Reasonably allocating risks between the public and private sectors.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A. Fuzzy Set Theory and Fuzzy TOPSIS

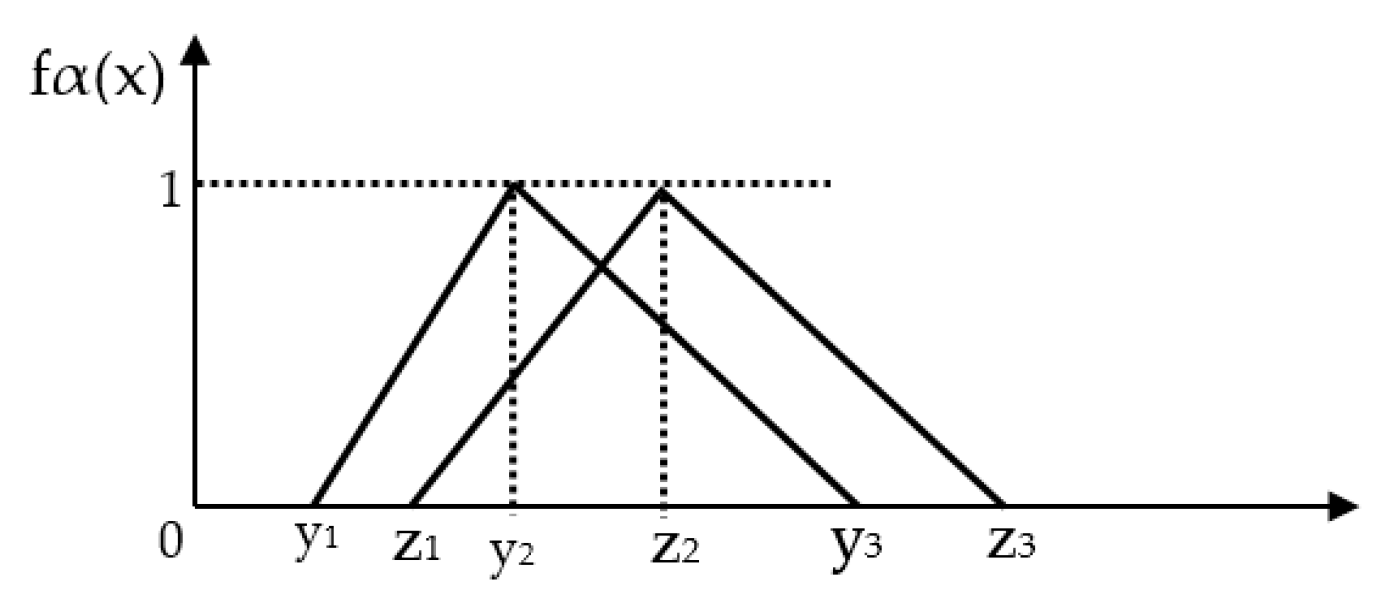

Appendix A.1. Fuzzy Set Theory

Appendix A.2. Fuzzy TOPSIS

| Linguistic Variable | Fuzzy Numbers |

|---|---|

| Low importance (LI) | (0.00, 0.00, 0.25) |

| Relatively importance (RI) | (0.00, 0.25, 0.50) |

| Important (I) | (0.25, 0.50, 0.75) |

| Very important (VI) | (0.50, 0.75, 1.00) |

| Extremely important (EI) | (0.75, 1.00, 1.00) |

| Linguistic Variable | Fuzzy Numbers |

|---|---|

| Very poor (VP) | (0.0, 0.0, 2.5) |

| Poor (P) | (0.0, 2.5, 5.0) |

| Medium (M) | (2.5, 5.0, 7.5) |

| Good (G) | (5.0, 7.5, 10.0) |

| Very good (VG) | (7.5, 10.0, 10.0) |

Appendix A.3. Numerical Application

| Criteria | E1 | E2 | E3 | E4 | Aggregated Fuzzy Weight |

|---|---|---|---|---|---|

| C1 | (0.75, 1.00, 1.00) | (0.75, 1.00, 1.00) | (0.75, 1.00, 1.00) | (0.75, 1.00, 1.00) | (0.75, 1.00, 1.00) |

| C2 | (0.50, 0.75, 1.00) | (0.75, 1.00, 1.00) | (0.75, 1.00, 1.00) | (0.50, 0.75, 1.00) | (0.63, 0.88, 1.00) |

| C3 | (0.50, 0.75, 1.00) | (0.75, 1.00, 1.00) | (0.75, 1.00, 1.00) | (0.75, 1.00, 1.00) | (0.69, 0.94, 1.00) |

| C4 | (0.25, 0.50, 0.75) | (0.50, 0.75, 1.00) | (0.75, 1.00, 1.00) | (0.75, 1.00, 1.00) | (0.56, 0.81, 0.94) |

| C5 | (0.50, 0.75, 1.00) | (0.50, 0.75, 1.00) | (0.50, 0.75, 1.00) | (0.75, 1.00, 1.00) | (0.56, 0.81, 1.00) |

| C6 | (0.50, 0.75, 1.00) | (0.50, 0.75, 1.00) | (0.50, 0.75, 1.00) | (0.75, 1.00, 1.00) | (0.56, 0.81, 1.00) |

| C7 | (0.50, 0.75, 1.00) | (0.50, 0.75, 1.00) | (0.50, 0.75, 1.00) | (0.75, 1.00, 1.00) | (0.56, 0.81, 1.00) |

| C8 | (0.50, 0.75, 1.00) | (0.25, 0.50, 0.75) | (0.25, 0.50, 0.75) | (0.50, 0.75, 1.00) | (0.38, 0.63, 0.88) |

| C9 | (0.50, 0.75, 1.00) | (0.75, 1.00, 1.00) | (0.25, 0.50, 0.75) | (0.50, 0.75, 1.00) | (0.50, 0.75, 0.94) |

| Cri. | Alter. | E1 | E2 | E3 | E4 | Aggregated Fuzzy Weight |

|---|---|---|---|---|---|---|

| C1 | A1 | (7.5, 10.0, 10.0) | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (5.63, 8.13, 10.0) |

| A2 | (2.5, 5.0, 7.5) | (5.0, 7.5, 10.0) | (2.5, 5.0, 7.5) | (5.0, 7.5, 10.0) | (3.75, 6.25, 8.75) | |

| A3 | (2.5, 5.0, 7.5) | (2.5, 5.0, 7.5) | (2.5, 5.0, 7.5) | (2.5, 5.0, 7.5) | (2.50, 5.00, 7.50) | |

| C2 | A1 | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (2.5, 5.0, 7.5) | (5.0, 7.5, 10.0) | (4.38, 6.88, 9.38) |

| A2 | (0.0, 2.5, 5.0) | (2.5, 5.0, 7.5) | (2.5, 5.0, 7.5) | (2.5, 5.0, 7.5) | (1.88, 4.38, 6.88) | |

| A3 | (5.0, 7.5, 10.0) | (0.0, 2.5, 5.0) | (2.5, 5.0, 7.5) | (2.5, 5.0, 7.5) | (2.50, 5.00, 7.50) | |

| C3 | A1 | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (5.00, 7.50, 10.0) |

| A2 | (2.5, 5.0, 7.5) | (5.0, 7.5, 10.0) | (2.5, 5.0, 7.5) | (5.0, 7.5, 10.0) | (3.75, 6.25, 8.75) | |

| A3 | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (5.00, 7.50, 10.0) | |

| C4 | A1 | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (5.00, 7.50, 10.0) |

| A2 | (2.5, 5.0, 7.5) | (2.5, 5.0, 7.5) | (2.5, 5.0, 7.5) | (2.5, 5.0, 7.5) | (2.50, 5.00, 7.50) | |

| A3 | (2.5, 5.0, 7.5) | (2.5, 5.0, 7.5) | (2.5, 5.0, 7.5) | (7.5, 10.0, 10.0) | (3.75, 6.25, 8.13) | |

| C5 | A1 | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (5.00, 7.50, 10.0) |

| A2 | (2.5, 5.0, 7.5) | (5.0, 7.5, 10.0) | (2.5, 5.0, 7.5) | (5.0, 7.5, 10.0) | (3.75, 6.25, 8.75) | |

| A3 | (5.0, 7.5, 10.0) | (2.5, 5.0, 7.5) | (5.0, 7.5, 10.0) | (2.5, 5.0, 7.5) | (3.75, 6.25, 8.75) | |

| C6 | A1 | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (7.5, 10.0, 10.0) | (5.63, 8.13, 10.0) |

| A2 | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (5.00, 7.50, 10.0) | |

| A3 | (5.0, 7.5, 10.0) | (7.5, 10.0, 10.0) | (5.0, 7.5, 10.0) | (7.5, 10.0, 10.0) | (6.25, 8.75, 10.0) | |

| C7 | A1 | (2.5, 5.0, 7.5) | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (4.38, 6.88, 9.38) |

| A2 | (2.5, 5.0, 7.5) | (5.0, 7.5, 10.0) | (2.5, 5.0, 7.5) | (5.0, 7.5, 10.0) | (3.75, 6.25, 8.75) | |

| A3 | (2.5, 5.0, 7.5) | (2.5, 5.0, 7.5) | (5.0, 7.5, 10.0) | (2.5, 5.0, 7.5) | (3.13, 5.63, 8.13) | |

| C8 | A1 | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (5.00, 7.50, 10.0) |

| A2 | (2.5, 5.0, 7.5) | (5.0, 7.5, 10.0) | (2.5, 5.0, 7.5) | (5.0, 7.5, 10.0) | (3.75, 6.25, 8.75) | |

| A3 | (2.5, 5.0, 7.5) | (2.5, 5.0, 7.5) | (2.5, 5.0, 7.5) | (2.5, 5.0, 7.5) | (2.50, 5.00, 7.50) | |

| C9 | A1 | (5.0, 7.5, 10.0) | (5.0, 7.5, 10.0) | (2.5, 5.0, 7.5) | (5.0, 7.5, 10.0) | (4.38, 6.88, 9.38) |

| A2 | (2.5, 5.0, 7.5) | (2.5, 5.0, 7.5) | (2.5, 5.0, 7.5) | (5.0, 7.5, 10.0) | (3.13, 5.63, 8.13) | |

| A3 | (5.0, 7.5, 10.0) | (2.5, 5.0, 7.5) | (2.5, 5.0, 7.5) | (5.0, 7.5, 10.0) | (3.75, 6.25, 8.75) |

| Criteria | A1 | A2 | A3 |

|---|---|---|---|

| C1 | (0.56, 0.81, 1.00) | (0.38, 0.63, 0.88) | (0.25, 0.50, 0.75) |

| C2 | (0.47, 0.73, 1.00) | (0.20, 0.47, 0.73) | (0.27, 0.53, 0.80) |

| C3 | (0.38, 0.50, 0.75) | (0.43, 0.60, 1.00) | (0.38, 0.50, 0.75) |

| C4 | (0.25, 0.33, 0.50) | (0.33, 0.50, 1.00) | (0.31, 0.40, 0.67) |

| C5 | (0.50, 0.75, 1.00) | (0.38, 0.63, 0.88) | (0.38, 0.63, 0.88) |

| C6 | (0.56, 0.81, 1.00) | (0.50, 0.75, 1.00) | (0.63, 0.88, 1.00) |

| C7 | (0.47, 0.73, 1.00) | (0.40, 0.67, 0.93) | (0.33, 0.60, 0.87) |

| C8 | (0.50, 0.75, 1.00) | (0.38, 0.63, 0.88) | (0.25, 0.50, 0.75) |

| C9 | (0.47, 0.73, 1.00) | (0.33, 0.60, 0.87) | (0.40, 0.67, 0.93) |

| Criteria | A1 | A2 | A3 |

|---|---|---|---|

| C1 | (0.422, 0.813, 1.00) | (0.281, 0.625, 0.875) | (0.188, 0.50, 0.75 |

| C2 | (0.292, 0.642, 1.00) | (0.125, 0.408, 0.733) | (0.167, 0.467, 0.80) |

| C3 | (0.258, 0.469, 0.75) | (0.295, 0.563, 1.00) | (0.258, 0.469, 0.75) |

| C4 | (0.141, 0.271, 0.469) | (0.188, 0.406, 0.938) | (0.173, 0.325, 0.625) |

| C5 | (0.281, 0.609, 1.00) | (0.211, 0.508, 0.875) | (0.211, 0.508, 0.875) |

| C6 | (0.316, 0.66, 1.00) | (0.281, 0.609, 1.00) | (0.352, 0.711, 1.00) |

| C7 | (0.263, 0.596, 1.00) | (0.225, 0.542, 0.933) | (0.188, 0.488, 0.867) |

| C8 | (0.188, 0.469, 0.875) | (0.141, 0.391, 0.766) | (0.094, 0.313, 0.656) |

| C9 | (0.233, 0.55, 0.938) | (0.167, 0.45, 0.813) | (0.20, 0.50, 0.875) |

| Criteria | ||||||

|---|---|---|---|---|---|---|

| C1 | 0.351 | 0.474 | 0.569 | 0.783 | 0.642 | 0.532 |

| C2 | 0.458 | 0.629 | 0.583 | 0.706 | 0.490 | 0.543 |

| C3 | 0.546 | 0.479 | 0.546 | 0.532 | 0.684 | 0.532 |

| C4 | 0.719 | 0.582 | 0.653 | 0.323 | 0.600 | 0.419 |

| C5 | 0.472 | 0.542 | 0.542 | 0.695 | 0.597 | 0.597 |

| C6 | 0.441 | 0.472 | 0.410 | 0.716 | 0.695 | 0.737 |

| C7 | 0.486 | 0.521 | 0.560 | 0.689 | 0.636 | 0.584 |

| C8 | 0.565 | 0.623 | 0.686 | 0.583 | 0.503 | 0.423 |

| C9 | 0.515 | 0.587 | 0.549 | 0.642 | 0.545 | 0.593 |

| 4.553 | 4.909 | 5.099 | 5.669 | 5.391 | 4.960 | |

| Alternatives | Ranking | |||

|---|---|---|---|---|

| A1 | 4.553 | 5.669 | 0.555 | 1 |

| A2 | 4.909 | 5.391 | 0.523 | 2 |

| A3 | 5.099 | 4.960 | 0.493 | 3 |

Appendix A.4. Assumptions for Sensitivity Analysis

| No. | Description | CCi | Ranking | ||

|---|---|---|---|---|---|

| A1 | A2 | A3 | |||

| 1 | wC1-C9 = (0.00, 0.25, 0.50) | 0.258 | 0.252 | 0.232 | A1 > A2 > A3 |

| 2 | wC1-C9 = (0.25, 0.50, 0.75) | 0.403 | 0.387 | 0.360 | A1 > A2 > A3 |

| 3 | wC1-C9 = (0.50, 0.75, 1.00) | 0.537 | 0.511 | 0.481 | A1 > A2 > A3 |

| 4 | wC1-C9 = (0.75, 1.00, 1.00) | 0.615 | 0.575 | 0.544 | A1 > A2 > A3 |

| 5 | wC1 = (0.75, 1.00, 1.000) wC2-C9 = (0.00, 0.25, 0.50) | 0.305 | 0.280 | 0.262 | A1 > A2 > A3 |

| 6 | wC2 = (0.75, 1.00, 1.000) wC1,C3-C9 = (0.00, 0.25, 0.50) | 0.301 | 0.280 | 0.264 | A1 > A2 > A3 |

| 7 | wC3 = (0.75, 1.00, 1.000) wC1-C2, C4-C9 = (0.00, 0.25, 0.50) | 0.290 | 0.291 | 0.265 | A2 > A1 > A3 |

| 8 | wC4 = (0.75, 1.00, 1.000) wC1-C3, C5-C9 = (0.00, 0.25, 0.50) | 0.279 | 0.287 | 0.259 | A2 > A1 > A3 |

| 9 | wC5 = (0.75, 1.00, 1.000) wC1-C4, C6-SC9 = (0.00, 0.25, 0.50) | 0.302 | 0.289 | 0.269 | A1 > A2 > A3 |

| 10 | wC6 = (0.75, 1.00, 1.000) wC1-C5, C7-C9 = (0.00, 0.25, 0.50) | 0.305 | 0.296 | 0.282 | A1 > A2 > A3 |

| 11 | wC7 = (0.75, 1.00, 1.000) wC1-C6, C8-C9 = (0.00, 0.25, 0.50) | 0.301 | 0.291 | 0.268 | A1 > A2 > A3 |

| 12 | wC8 = (0.75, 1.00, 1.000) wC1-C7, C9 = (0.00, 0.25, 0.50) | 0.302 | 0.289 | 0.262 | A1 > A2 > A3 |

| 13 | wC9 = (0.75, 1.00, 1.000) wC1-C8 = (0.00, 0.25, 0.50) | 0.301 | 0.287 | 0.272 | A1 > A2 > A3 |

References

- Asian Development Bank (ADB). Public—Private Partnership Development in Southest Asia. 2018. Available online: https://www.adb.org/sites/default/files/publication/444631/ewp-553-ppp-development-southeast-asia.pdf (accessed on 16 November 2019).

- Zhang, X.; Chen, S. A systematic framework for infrastructure development through public private partnerships. IATSS Res. 2013, 36, 88–97. [Google Scholar] [CrossRef] [Green Version]

- Akintoye, A.; Hardcastle, C.; Beck, M.; Chinyio, E.; Asenova, D. Achieving best value in private finance initiative project procurement. Constr. Manag. Econ. 2003, 21, 461–470. [Google Scholar] [CrossRef]

- Skietrys, E.; Raipa, A.; Bartkus, E.V. Dimensions of the efficiency of the public—Private partnership. Eng. Econ. 2008, 58, 3–45. [Google Scholar]

- Kang, S.; Mulaphong, D.; Hwang, E.; Chang, C.K. Public-private partnerships in developing countries: Factors for successful adoption and implementation. Int. J. Public Sect. Manag. 2019, 32, 334–351. [Google Scholar] [CrossRef]

- Ahmadabadi, A.A.; Heravi, G. The effect of critical success factors on project success in Public-Private Partnership projects: A case study of highway projects in Iran. Trans. Policy 2019, 73, 152–161. [Google Scholar] [CrossRef]

- Kwak, Y.H.; Chih, Y.Y.; Ibbs, C.W. Towards a comprehensive understanding of Public-Private Partnerships for infrastructure development. Calif. Manag. Rev. 2009, 51, 51–78. [Google Scholar] [CrossRef]

- Zou, P.X.W.; Wang, S.; Fang, D. A life-cycle risk management framework for PPP infrastructure projects. J. Financ. Manag. Prop. Constr. 2008, 13, 123–142. [Google Scholar] [CrossRef]

- Rahman, I.A.; Memon, A.H.; Zulkiffli, N.S.M. Failure reasons of PPP infrastructure projects: Case study of Kuala Lumpur LRT project. Life Sci. J. 2014, 11, 238–246. [Google Scholar]

- Cho, C.S.; Gibson, G.E. Building project scope definition using definition rating index. J. Archit. Eng. 2001, 7, 115–125. [Google Scholar] [CrossRef]

- Ke, Y.; Wang, S.Q.; Chan, A.P.C.; Cheung, E. Research trend of Public—Private Partnership in Construction Journals. J. Constr. Eng. Manag. 2009, 135, 1076–1086. [Google Scholar] [CrossRef]

- Kim, S.Y.; Nguyen, M.V.; Luu, V.T. A performance evaluation framework for construction and demolition waste management: Stakeholder perspectives. Eng. Constr. Archit. Manag. 2020, 0969–9988. [Google Scholar] [CrossRef]

- Sy, T.D.; Likhitruangsilp, V.; Onishi, M.; Nguyen, T.P. Impacts of risk factors on the performance of Public-Private Partnership transportation projects in Vietnam. ASEAN Eng. J. 2017, 7, 30–52. [Google Scholar]

- PPP Knowledge Lab. Vietnam: PPP Projects in Infrastructure. 2020. Available online: https://pppknowledgelab.org/countries/vietnam (accessed on 20 May 2020).

- JICA (Japan International Cooperation Agency). Final Report: VGF Survey for PPP Projects in Vietnam. 2017. Available online: https://openjicareport.jica.go.jp/pdf/12292850.pdf (accessed on 16 June 2020).

- Onut, S.; Efendigil, T.; Kara, S.S. A combined fuzzy MCDM approach for selecting shopping center site: An example from Istanbul, Turkey. Expert Syst. Appl. 2010, 37, 1973–1980. [Google Scholar] [CrossRef]

- Rezaeiniya, N.; Ghadikolaei, A.S.; Tekmeh, J.M.; Rezaeiniya, H. Fuzzy ANP approach for new application: Greenhouse location selection; a case in Iran. J. Math. Comput. Sci. 2014, 8, 1–20. [Google Scholar] [CrossRef] [Green Version]

- Athawale, V.M.; Chatterjee, P.; Chakraborty, S. Decision making for facility location selection using PROMETHEE II method. Int. J. Ind. Syst. Eng. 2012, 11, 16–30. [Google Scholar] [CrossRef]

- Awasthi, A.; Chauhan, S.S.; Goyal, S.K. A multi-criteria decision making approach for location planning for urban distribution centers under uncertainty. Math. Comput. Model. 2011, 53, 98–109. [Google Scholar] [CrossRef]

- Sennaroglu, B.; Celebi, G.V. A military airport location selection by AHP integrated PROMETHE and VIKOR methods. Transp. Res. Part D 2018, 29, 160–173. [Google Scholar] [CrossRef]

- Rao, C.; Goh, M.; Zhao, Y.; Zheng, J. Location selection of city logistics centers under sustainability. Transp. Res. Part D 2015, 36, 29–44. [Google Scholar] [CrossRef]

- Mulholland, B.; Christian, J. Risk Assessment in construction schedules. J. Constr. Eng. Manag. 1999, 125, 8–15. [Google Scholar] [CrossRef]

- Bian, K. Application of fuzzy AHP and ELECTRE to China dry port location selection. Asian J. Shipp. Logis. 2011, 27, 331–353. [Google Scholar]

- Zhao, J.; Lee, K.W. Construction and ultilization of rock caverns in Singapore Part C: Planning and location selection. Tunn. Undergr. Space Technol. 1996, 11, 81–84. [Google Scholar] [CrossRef]

- Cheng, E.W.L.; Li, H. Exploring quantitative methods for project location selection. Build. Environ. 2004, 39, 1467–1476. [Google Scholar] [CrossRef]

- Yang, J.; Lee, H. An AHP decision model for facility location selection. Facilities 1997, 15, 241–254. [Google Scholar] [CrossRef]

- Khalili-Damghani, K.; Sadi-Nezhad, S. A decision support system for fuzzy multi-objective multi-period sustainable project selection. Comp. Ind. Eng. 2013, 64, 1045–1060. [Google Scholar] [CrossRef]

- Labuschagne, C.; Brent, A.C. Sustainable projectlife cycle management: The needto integrate life cycles in the manufacturing sector. Int. J. Proj. Manag. 2005, 23, 159–168. [Google Scholar] [CrossRef] [Green Version]

- United Nations Economic and Social Commission for Asia and the Pacific (ESCAP). A Primer to Public-Private Partnerships Infrastructure Development. 2008. Available online: https://www.unescap.org/ttdw/ppp/ppp_primer/04_differences_between_ppp_and_conventional_projects.html#:~:text=A%20PPP%20project%20is%20different,managed%20like%20a%20construction%20project.&text=The%20focus%20of%20a%20PPP,specified%20services%20at%20defined%20levels (accessed on 16 June 2020).

- Liu, J.; Love, P.E.D.; Smith, J.; Regan, M.; Palaneeswaran, E. Review of performance measurement: Implications for public-private partnerships. Built Environ. Proj. Asset Manag. 2015, 5, 35–51. [Google Scholar] [CrossRef]

- Chan, A.P.C.; Chan, A.P.L. Key performance indicators for measuring construction success. Benchmarking Int. J. 2004, 11, 203–221. [Google Scholar] [CrossRef]

- Osei-Kyei, R.; Chan, A.P.C. Comparative analysis of the success criteria for Public—Private Partnership projects in Ghana and Hong Kong. Proj. Manag. J. 2017, 48, 80–92. [Google Scholar] [CrossRef] [Green Version]

- Lim, C.S.; Mohamed, M.Z. Criteria of project success: An exploratory re-examination. Int. J. Proj. Manag. 1999, 17, 243–248. [Google Scholar] [CrossRef]

- Atkinson, R. Project management: Cost, time, and quality, two best guesses and a phenomenon, it’s time to accept other success criteria. Int. J. Proj. Manag. 1999, 17, 337–342. [Google Scholar] [CrossRef]

- Al-Tmeemy, S.M.H.M.; Rahman, H.A.; Harun, Z. Future criteria for success of building projects in Malaysia. Int. J. Proj. Manag. 2011, 29, 337–348. [Google Scholar] [CrossRef]

- Baccarini, D. The logical framework method for defining project success. Proj. Manag. J. 1999, 30, 25–32. [Google Scholar] [CrossRef]

- Chan, A.P.C.; Scott, D.; Lam, E.W.M. Framework of success criteria for design/build projects. J. Manag. Eng. 2002, 18, 120–128. [Google Scholar] [CrossRef]

- Cox, R.F.; Issa, R.R.A.; Ahrens, D. Management’s perception of key performance indicators for construction. J. Constr. Eng. Manag. 2003, 129, 142–151. [Google Scholar] [CrossRef]

- Zhang, S.; Chan, A.P.C.; Feng, Y.; Duan, H.; Ke, Y. Crirical review on PPP Research—A search from the Chinese and International Journals. Int. J. Proj. Manag. 2016, 34, 597–612. [Google Scholar] [CrossRef]

- Tam, C.M. Build—Operate—Transfer model for infrastructure developments in Asia: Reasons for success and failures. Int. J. Proj. Manag. 1999, 17, 377–382. [Google Scholar]

- Yuan, J.; Zeng, A.Y.; Skibniewski, M.J.; Li, Q. Selection of performance objectives and key performance indicators in public—Private partnership projects to achieve value for money. Constr. Manag. Econ. 2009, 27, 253–270. [Google Scholar] [CrossRef]

- Abdul-Aziz, A.R.; Kassim, P.S.J. Objectives, success and failure factors of housing public-private partnerships in Malaysia. Habitat Int. 2011, 35, 150–157. [Google Scholar] [CrossRef]

- Mladenovic, G.; Vajdic, N.; Wundsch, B.; Temeljotov-Salaj, A. Use of key performance indicators for PPP transport projects to meet stakeholders’ performance objectives. Built Environ. Proj. Asset Manag. 2013, 3, 228–249. [Google Scholar] [CrossRef]

- Villalba-Romero, F.; Liyanage, C. Evaluating success in PPP road projects in Europe: A comparison of performance measurement approachs. Transp. Res. Proced. 2016, 14, 372–381. [Google Scholar] [CrossRef] [Green Version]

- Nadaban, S.; Dzitac, S.; Dzitac, I. Fuzzy TOPSIS: A general review. Proce. Comput. Sci. 2016, 91, 823–831. [Google Scholar] [CrossRef] [Green Version]

- Erdogan, S.A.; Saparauskas, J.; Turskis, Z. A Multi-Criteria Decision-Making Model to Choose the Best Option for Sustainable Construction Management. Sustainability 2019, 11, 2239. [Google Scholar] [CrossRef] [Green Version]

- Kangas, Y.Z.; Miettinen, K. Decision making in multiobjective optimization problems under uncertainty: Balancing between robustness and quality. OR Spectr. 2019, 41, 391–413. [Google Scholar] [CrossRef] [Green Version]

- Junior, F.R.L.; Osiro, L.; Carpinetti, L.C.R. A comparison between fuzzy AHP and fuzzy TOPSIS methods to supplier selection. Appl. Soft. Comp. 2014, 21, 194–209. [Google Scholar] [CrossRef]

- Tan, Y.T.; Shen, L.Y.; Langston, C.; Liu, Y. Construction project selection using fuzzy TOPSIS approach. J. Model. Manag. 2010, 5, 302–315. [Google Scholar] [CrossRef]

- Bellman, R.E.; Zadeh, L.A. Decision-making in a fuzzy environment. Manag. Sci. 1970, 17, 141–164. [Google Scholar] [CrossRef]

- Islam, M.S.; Nepal, M.P.; Skitmore, M.; Attarzadeh, M. Current research trend and application areas of fuzzy and hybrid methods to risk assessment of construction projects. Adv. Eng. Infom. 2017, 33, 112–131. [Google Scholar] [CrossRef]

- De Boer, L.; Wegen, L.V.D.; Tegen, J. Outranking methods in suppot of supplier selection. Eur. J. Purch. Supply Manag. 1998, 4, 109–118. [Google Scholar] [CrossRef]

- Liu, J.; Wei, Q. Risk evaluation of electric vehicle charging infrastructure public–private partnership projects in China using fuzzy TOPSIS. J. Clean. Prod. 2018, 189, 211–222. [Google Scholar] [CrossRef]

- Maghsoodi, A.I.; Khalilzadeh, M. Identification and evaluation of construction projects’ critical success factors employing fuzzy-TOPSIS approach. KSCE J. Cilvil Eng. 2018, 22, 1593–1605. [Google Scholar] [CrossRef]

- Awasthi, A.; Chauhan, S.S.; Omrani, H. Application of fuzzy TOPSIS in evaluating sustainable transportation systems. Expert Syst. Appl. 2011, 38, 12270–12280. [Google Scholar] [CrossRef]

- Beskese, A.; Demir, H.H.; Ozcan, H.K.; Okten, H.E. Landfill site selection using fuzzy AHP and fuzzy TOPSIS: A case study for Istanbul. Environ. Earth Sci. 2015, 73, 3513–3521. [Google Scholar] [CrossRef]

- Vietnam National University Ho Chi Minh City. The Economic Region of South Area Must be the Driving Force in the Innovation. 2019. Available online: https://vnuhcm.edu.vn/tin-tuc_32346864/vung-kinh-te-trong-diem-phia-nam-phai-la-dong-luc-trong-doi-moi-sang-tao/323336336864.html (accessed on 2 June 2020).

- Review of Finance. The Southern Key Economic Regions must Play the Leading Role. 2019. Available online: http://tapchitaichinh.vn/su-kien-noi-bat/cac-vung-kinh-te-trong-diem-phia-nam-phai-giu-vai-tro-la-dau-tau-306627.html (accessed on 15 June 2020).

- The Organ of Dong Nai Province’s Vietnam Communist Party. Southern Key Economic Region: Leading Role in Development. 2019. Available online: http://www.baodongnai.com.vn/kinhte/201905/vung-kinh-te-trong-diem-phia-nam-vai-tro-dan-dat-trong-phat-trien-2944651/ (accessed on 2 June 2020).

- Nhan Dan-Electronic. Developing the Northern Key Economic Region. 2020. Available online: https://www.nhandan.com.vn/kinhte/item/44549602-phat-trien-vung-kinh-te-trong-diem-bac-bo.html (accessed on 20 June 2020).

- Wikipedia. Key Economic Region of the Mekong Delta. 2019. Available online: https://vi.wikipedia.org/wiki/V%C3%B9ng_kinh_t%E1%BA%BF_tr%E1%BB%8Dng_%C4%91i%E1%BB%83m_v%C3%B9ng_%C4%91%E1%BB%93ng_b%E1%BA%B1ng_s%C3%B4ng_C%E1%BB%ADu_Long#:~:text=V%C3%B9ng%20kinh%20t%E1%BA%BF%20tr%E1%BB%8Dng%20%C4%91i%E1%BB%83m%20v%C3%B9ng%20%C4%91%E1%BB%93ng%20b%E1%BA%B1ng%20s%C3%B4ng%20C%E1%BB%ADu,16%20th%C3%A1ng%204%20n%C4%83m%202009 (accessed on 2 June 2020).

- Azari, A.R.K.; Mousavi, N.; Mousavi, S.F.; Hosseini, S.B. Risk assessment model selection in construction industry. Expert Syst. Appl. 2011, 38, 9105–9111. [Google Scholar]

- Liang, G.S. Fuzzy MCDM based on ideal and anti-ideal concepts. Eur. J. Oper. Res. 1999, 112, 682–691. [Google Scholar] [CrossRef]

- Chen, C.T. Extension of the TOPSIS for group decision-making under fuzzy environment. Fuzzy Sets Syst. 2000, 114, 1–9. [Google Scholar] [CrossRef]

| Sector | Project Location (No. of Project) | Total Investment (Million USD) | ||

|---|---|---|---|---|

| Southern Region | Northern Region | Mekong Delta Region | ||

| Water supply | 1 | 2 | − | 93.043 |

| Wastewater treatment | − | 2 | 1 | 166.556 |

| Solid water | − | 2 | − | 447.913 |

| Transportation | ||||

| Highway1 | 2 | 4 | − | 2962.213 |

| Provincial road, bridge1 | 3 | 4 | 5 | 736.162 |

| Port1 | 1 | 1 | − | 579.439 |

| Urban train1 | 1 | − | − | 365.217 |

| Other infrastructure | 2 | 84.058 | ||

| Total | 8 | 15 | 8 | 5434.602 |

| Success Criteria | [32] | [33] | [35] | [37] | [41] | [42] | [43] | [44] | |

|---|---|---|---|---|---|---|---|---|---|

| 1 | User demand | × | × | ||||||

| 2 | Time | × | × | × | × | × | × | × | |

| 3 | Profitability | × | × | × | × | × | |||

| 4 | Cost | × | × | × | × | × | × | × | × |

| 5 | Environmental impact | × | |||||||

| 6 | Local development | × | × | ||||||

| 7 | Risk management | × | × | × | × | ||||

| 8 | Technology transfer | × | × | × | × | × | |||

| 9 | Service quality | × | × | × | × | × |

| Criteria | Code | Definition | Type |

|---|---|---|---|

| User demand | C1 | Demand for service facilities of local people | B (more is better) |

| Time | C2 | Accomplishing the project on time | B (more is better) |

| Profitability | C3 | Assuring operating cost during the project operation | C (less is better) |

| Cost | C4 | Completing the project within the estimated cost | C (less is better) |

| Environmental impact | C5 | Do not affect the health and safety of local people and environment condition | B (more is better) |

| Local development | C6 | Creating jobs, improving sustainable local infrastructure, and managing local resources. | B (more is better) |

| Risk management | C7 | Identifying and sharing risks effectively between both the public and private sectors | B (more is better) |

| Technology transfer | C8 | Encouraging innovation and transfer of design and construction method | B (more is better) |

| Service quality | C9 | Providing good services for satisfying the users | B (more is better) |

| Criteria | E1 | E2 | E3 | E4 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A1 | A2 | A3 | w | A1 | A2 | A3 | w | A1 | A2 | A3 | w | A1 | A2 | A3 | w | |

| C1 | VG | M | M | EI | G | G | M | EI | G | M | M | EI | G | G | M | EI |

| C2 | G | P | G | VI | G | M | P | EI | M | M | M | EI | G | M | M | VI |

| C3 | G | M | G | VI | G | G | G | EI | G | M | G | EI | G | G | G | EI |

| C4 | G | M | M | I | G | M | M | VI | G | M | M | EI | G | M | VG | EI |

| C5 | G | M | G | VI | G | G | M | VI | G | M | G | VI | G | G | M | EI |

| C6 | G | G | G | VI | G | G | VG | VI | G | G | G | VI | VG | G | VG | EI |

| C7 | M | M | M | VI | G | G | M | VI | G | M | G | VI | G | G | M | EI |

| C8 | G | M | M | VI | G | G | M | I | G | M | M | I | G | G | M | VI |

| C9 | G | M | G | VI | G | M | M | EI | M | M | M | I | G | G | G | VI |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, S.-Y.; Thuc, L.D. Sustainable Location Selection for Investing in Public–Private Partnership Infrastructure Projects: From a Developing Country’s Perspective. Sustainability 2020, 12, 5914. https://doi.org/10.3390/su12155914

Kim S-Y, Thuc LD. Sustainable Location Selection for Investing in Public–Private Partnership Infrastructure Projects: From a Developing Country’s Perspective. Sustainability. 2020; 12(15):5914. https://doi.org/10.3390/su12155914

Chicago/Turabian StyleKim, Soo-Yong, and Le Dinh Thuc. 2020. "Sustainable Location Selection for Investing in Public–Private Partnership Infrastructure Projects: From a Developing Country’s Perspective" Sustainability 12, no. 15: 5914. https://doi.org/10.3390/su12155914