Intention to Use Accounting Platforms in Romania: A Quantitative Study on Sustainability and Social Influence

Abstract

1. Introduction

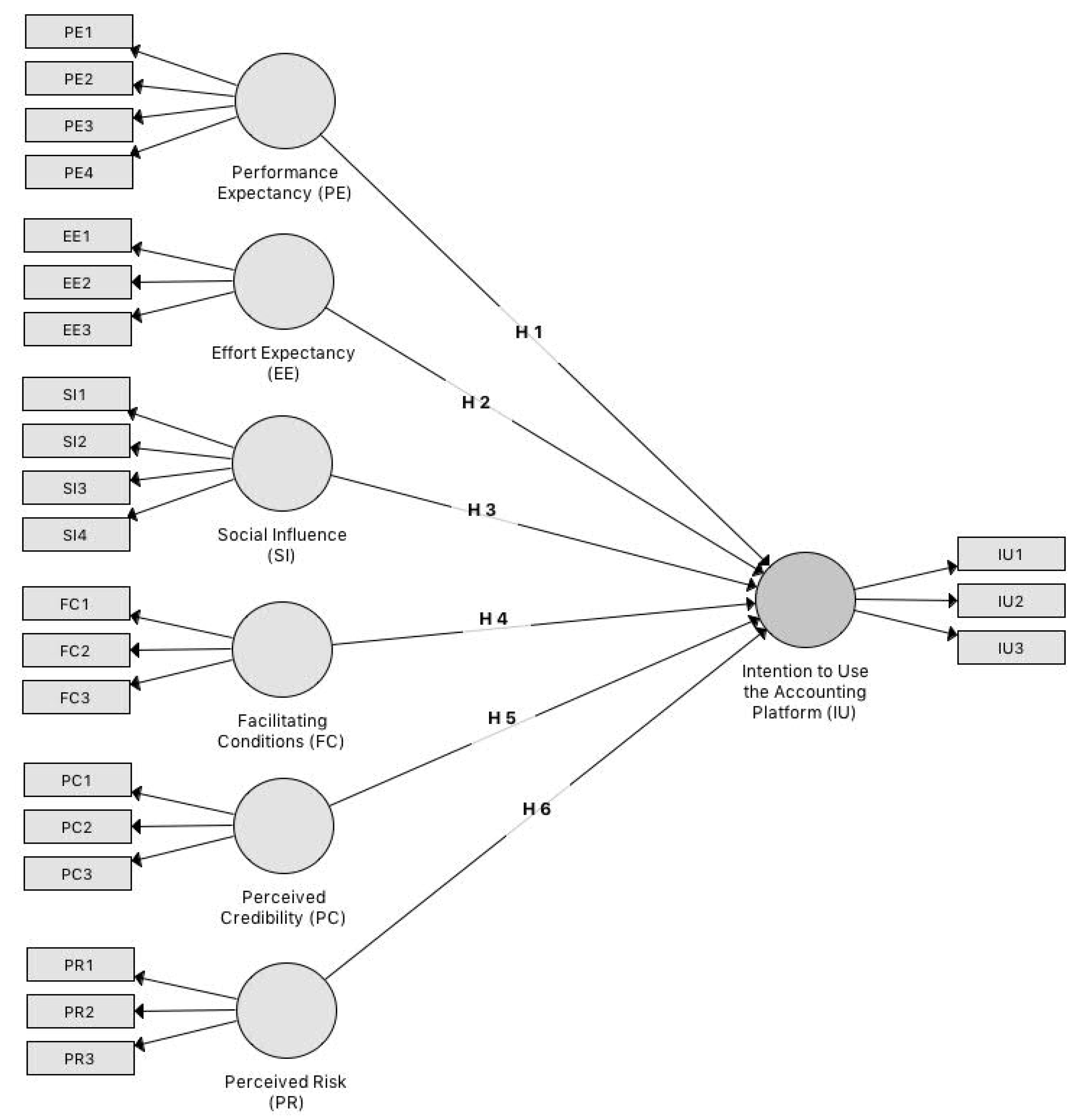

2. Literature Review and Hypothesis Development

2.1. Theoretical Analysis of Unified Theory of Acceptance and Use of Technology (UTAUT)

2.2. Bibliometric Analysis of UTAUT Constructs

2.2.1. Performance Expectancy (PE)

2.2.2. Effort Expectancy (EE)

2.2.3. Social Influence (SI)

2.2.4. Facilitating Conditions (FC)

2.2.5. Perceived Consequences (PCs)

2.2.6. Perceived Credibility (PC)

2.2.7. Perceived Risk (PR)

3. Methodology of Research

3.1. Collecting Data

3.2. Data Analysis

4. Results and Discussions

4.1. The Measurement Model

4.2. Structural Model

5. Conclusions

5.1. Theoretical Implications

5.2. Practical Implications

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Characteristics | Frequency | Percentage |

|---|---|---|

| Indicate the size of your company. | ||

| Less than 100 employees | 255 | 63.6 |

| Between 100 and 250 employees | 98 | 24.4 |

| More than 250 employees | 48 | 12.0 |

| Total | 401 | 100 |

| In which industry does your company primarily operate? | ||

| Farming/fishing/forestry | 26 | 6.5 |

| Chemical/pharmaceutical/medical | 35 | 8.7 |

| Commerce | 70 | 17.5 |

| Tourism | 43 | 10.7 |

| Energy/raw materials | 17 | 4.2 |

| Infrastructure/construction | 13 | 3.2 |

| Industry | 41 | 10.2 |

| IT/media | 52 | 13.0 |

| Consumer goods | 22 | 5.5 |

| Telecommunications | 6 | 1.5 |

| Logistics | 18 | 4.5 |

| Other industries | 58 | 14.5 |

| Total | 401 | 100 |

| What is the legal organization of the business? | ||

| Joint stock company | 48 | 12.0 |

| Limited liability company | 137 | 34.2 |

| Authorized natural person | 60 | 15.0 |

| Individual/family enterprise | 44 | 11.0 |

| Non-governmental organization | 32 | 8.0 |

| Cooperative society | 21 | 5.2 |

| Other | 59 | 14.7 |

| Total | 401 | 100 |

| Do you use accounting platform? | ||

| No | 337 | 84.0 |

| Yes | 64 | 16.0 |

| Total | 401 | 100 |

References

- Davis, F.D.; Bagozzi, R.P.; Warsaw, P.R. User acceptance of computer technology: A comparison of two theoretical models. Manag. Sci. 1989, 35, 982–1003. [Google Scholar] [CrossRef]

- Ferguson, C. The effect of computer micro on the works of the professional accountant. Account. J. 1997, 37, 41–67. [Google Scholar]

- Nasution, F. Information Technology Based Behavior Aspect. USU Digital Library 2006. Available online: http://library.usu.ac.id (accessed on 17 March 2020).

- Shin, N.; Edington, B.H. An integrative framework for contextual factors affecting implementation of information technology. J. Inf. Technol. Theory Appl. 2007, 8, 21–38. [Google Scholar]

- Davis, F.D. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Q. 1989, 13, 319–340. [Google Scholar] [CrossRef]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User acceptance of information technology: Toward a unified view. MIS Q. 2003, 27, 425–478. [Google Scholar] [CrossRef]

- Fishbein, M.; Ajzen, I. Belief, Attitude, Intention and Behaviour: An Introduction to Theory and Research; Addison-Wesley: Boston, MA, USA, 1975. [Google Scholar]

- Thompson, R.L.; Higgins, C.A.; Howell, J.M. Personal computing: Toward a conceptual model of utilization. MIS Q. 1991, 15, 124–143. [Google Scholar] [CrossRef]

- Ajzen, I. Theory of Planned Behavior. Organ. Behav. Hum. Decis. Process. 1991, 50, 179–211. [Google Scholar] [CrossRef]

- Davis, F.D.; Bagozzi, R.P.; Warshaw, P.R. Extrinsic and intrinsic motivation to use computers in the workplace. J. Appl. Soc. Psychol. 1992, 22, 1111–1132. [Google Scholar] [CrossRef]

- Taylor, S.; Todd, P.A. Understanding the information technology usage: A test of competing models. Inf. Syst. Res. 1995, 6, 144–176. [Google Scholar] [CrossRef]

- Compeau, D.R.; Higgins, C.A.; Huff, S. Social cognitive theory and individual reactions to computing technology: A longitudinal study. MIS Q. 1999, 23, 145–158. [Google Scholar] [CrossRef]

- Moore, G.C.; Benbasat, I. Development of an Instrument to Measure the Perceptions of Adopting an Information Technology Innovation. Inf. Syst. Res. 2001, 2, 173–239. [Google Scholar] [CrossRef]

- CheMusa, Z.K.; Muhayiddin, M.N.; Yusoff, M.N.H.; Ismail, M.; Muhamad, M. Intention to Use Cloud Accounting System among SMEs in Malaysia: A Conceptual Framework of a Modified Unified Theory of Acceptance and Use of Technology (UTAUT) Model. Res. World Econ. 2019, 10, 74–78. [Google Scholar]

- Islam, M.S.; Karia, N.; Khaleel, M.; Fauzi, F.B.A.; Soliman, M.S.M.; Khalid, J. Intention to adopt mobile banking in Bangladesh: An empirical study of emerging economy. Int. J. Bus. Inf. Syst. 2019, 31, 136–151. [Google Scholar] [CrossRef]

- Chua, W.F. Interpretive sociology and management accounting research—A critical review. Account. Audit. Account. J. 1988, 1, 59–79. [Google Scholar] [CrossRef]

- Adams, C.A.; Larrinaga-González, C. Engaging with organisations in pursuit of improved sustainability accounting and performance. Account. Audit. Account. J. 2007, 20, 333–355. [Google Scholar] [CrossRef]

- Dobers, P.; Halme, M. Corporate social responsibility and developing countries. Corp. Soc. Responsib. Environ. Manag. 2009, 16, 237–249. [Google Scholar] [CrossRef]

- Islam, M.A. Social and environmental accounting research: Major contributions and future directions for developing countries. J. Asia Pac. Cent. Environ. Account. 2010, 16, 27–43. [Google Scholar]

- Watson, L. Corporate social responsibility research in accounting. J. Account. Lit. 2015, 34, 1–16. [Google Scholar]

- Zyznarska-Dworczak, B. The development perspectives of sustainable management accounting in central and Eastern European countries. Sustainability 2018, 10, 1445. [Google Scholar] [CrossRef]

- Fijałkowska, J.; Zyznarska-Dworczak, B.; Garsztka, P. Corporate social-environmental performance versus financial performance of banks in Central and Eastern European Countries. Sustainability 2018, 10, 772. [Google Scholar] [CrossRef]

- Handayani, R. Analysis of Factors Affecting Interest in Information Systems Utilization and Use of Information Systems (Empirical Study of Manufacturing Companies on the Jakarta Stock Exchange). Master’s Thesis, Accounting Science, Diponegoro University, Semarang, Indonesia, 2007. [Google Scholar]

- Vankatesh, V.; Davis, F. A Theoretical Extension of the Technology Acceptance Model: Four Longitudinal Field Studies. Manag. Sci. 2000, 45, 186–204. [Google Scholar] [CrossRef]

- Bhattacherjee, A. Understanding information systems continuance: An expectation confirmation model. MIS Q. 2001, 25, 351–370. [Google Scholar] [CrossRef]

- Chen, J.L. The effects of education compatibility and technological expectancy on eLearning acceptance. Comput. Educ. 2011, 57, 1501–1511. [Google Scholar] [CrossRef]

- Yuniman, A. Analysis of the Factors That Influence the Use and Use of Accounting Information Systems. Ph.D. Thesis, Faculty of Economics, University of Bengkulu, Bengkulu, Indonesia, 2012. [Google Scholar]

- Rogers, E.; Shoemaker, F. Communication of Innovations; The Free Press: New York, NY, USA, 1971. [Google Scholar]

- Zhou, T. Understanding mobile Internet continuance usage from the perspectives of UTAUT and flow. Inf. Dev. 2011, 27, 207–218. [Google Scholar] [CrossRef]

- Bagozzi, R.P.; Lee, K.H. Multiple routes for social influence: The role of compliance, internalization, and social identity. Soc. Psychol. Q. 2002, 65, 226–247. [Google Scholar] [CrossRef]

- Triandis, H. Value Attitude and Interpersonal Behavior, Nebraska Symposium on Motivation; Lincoln, N.E., Ed.; University of Nebraska Press: Lincoln, NE, USA, 1980. [Google Scholar]

- Saha, S.K.; Zhuang, G.; Li, S. Will Consumers Pay More for Efficient Delivery? An Empirical Study of What Affects E-Customers’ Satisfaction and Willingness to Pay on Online Shopping in Bangladesh. Sustainability 2020, 12, 1121. [Google Scholar] [CrossRef]

- Lin, X.; Wu, R.; Lim, Y.T.; Han, J.; Chen, S.C. Understanding the Sustainable Usage Intention of Mobile Payment Technology in Korea: Cross-Countries Comparison of Chinese and Korean Users. Sustainability 2019, 11, 5532. [Google Scholar] [CrossRef]

- Tran, V.; Zhao, S.; Diop, E.B.; Song, W. Travelers’ Acceptance of Electric Carsharing Systems in Developing Countries: The Case of China. Sustainability 2019, 11, 5348. [Google Scholar] [CrossRef]

- Lee, S.W.; Sung, H.J.; Jeon, H.M. Determinants of Continuous Intention on Food Delivery Apps: Extending UTAUT2 with Information Quality. Sustainability 2019, 11, 3141. [Google Scholar] [CrossRef]

- Palau-Saumell, R.; Forgas-Coll, S.; Sánchez-García, J.; Robres, E. User Acceptance of Mobile Apps for Restaurants: An Expanded and Extended UTAUT-2. Sustainability 2019, 11, 1210. [Google Scholar] [CrossRef]

- Lee, J.; Kim, K.; Shin, H.; Hwang, J. Acceptance Factors of Appropriate Technology: Case of Water Purification Systems in Binh Dinh, Vietnam. Sustainability 2018, 10, 2255. [Google Scholar] [CrossRef]

- Chuang, L.M.; Chen, P.C.; Chen, Y.Y. The Determinant Factors of Travelers’ Choices for Pro-Environment Behavioral Intention-Integration Theory of Planned Behavior, Unified Theory of Acceptance, and Use of Technology 2 and Sustainability Values. Sustainability 2018, 10, 1869. [Google Scholar] [CrossRef]

- Baganzi, R.; Lau, A.K.W. Examining Trust and Risk in Mobile Money Acceptance in Uganda. Sustainability 2017, 9, 2233. [Google Scholar] [CrossRef]

- Gbongli, K.; Xu, Y.; Amedjonekou, K.M.; Kovács, L. Evaluation and Classification of Mobile Financial Services Sustainability Using Structural Equation Modeling and Multiple Criteria Decision-Making Methods. Sustainability 2020, 12, 1288. [Google Scholar] [CrossRef]

- Zimmer, J.C.; Arsal, R.E.; Al-Marzouq, M.; Grover, Y. Investigating Online Information Disclosure: Effects of Information Relevance, Trust and Risk. Inf. Manag. 2010, 47, 115–123. [Google Scholar] [CrossRef]

- Herrero, A.; San Martín, H. Effects of the risk sources and user involvement on e-commerce adoption: Application totourist services. J. Risk Res. 2012, 15, 841–855. [Google Scholar] [CrossRef]

- Slade, E.L.; Dwivedi, Y.K.; Piercy, N.C.; Williams, M.D. Modeling consumers’ adoption intentions of remotemobile payments in the United Kingdom: Extending UTAUT with innovativeness, risk, and trust. Psychol. Mark. 2015, 32, 860–873. [Google Scholar] [CrossRef]

- Liébana-Cabanillas, F.; Mũnoz-Leiva, F.; Sánchez-Fernández, J. A global approach to the analysis of user behavior inmobile payment systems in the new electronic environment. Serv. Bus. 2018, 12, 25–64. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Hult, G.T.M.; Ringle, C.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Sage Publications: Thousand Oaks, CA, USA, 2016. [Google Scholar]

- Lorber, A.; Wangen, L.E.; Kowalski, B.R. A theoretical foundation for the PLS algorithm. J. Chemom. 1987, 1, 19–31. [Google Scholar] [CrossRef]

- Mota, L.J.; Ramsden, A.E.; Liu, M.; Castle, J.D.; Holden, D.W. SCAMP3 is a component of the Salmonella-induced tubular network and reveals an interaction between bacterial effectors and post Golgi trafficking. Cell. Microbiol. 2009, 11, 1236–1253. [Google Scholar] [CrossRef]

- Liu, P.; Long, W. Current matehmatical methods used in QSAR/QSPR studies. Int. J. Mol. Sci. 2009, 10, 1978–1998. [Google Scholar] [CrossRef] [PubMed]

- Herrador-Alcaide, T.C.; Hernández-Solís, M.; Hontoria, J.F. Online Learning Tools in the Era of m-Learning: Utility and Attitudes in Accounting College Students. Sustainability 2020, 12, 5171. [Google Scholar] [CrossRef]

- Badia, F.; Bracci, E.; Tallaki, M. Quality and Diffusion of Social and Sustainability Reporting in Italian Public Utility Companies. Sustainability 2020, 12, 4525. [Google Scholar] [CrossRef]

- Joshi, A.; Kale, S.; Chandel, S.; Pal, D. Likert Scale: Explored and Explained. Br. J. Appl. Sci. Technol. 2015, 7, 396–403. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. Using partial squares path modeling in international advertising research. Basic concepts and recent issues. In Handbook of Research in International Advertising; Okazaki, S., Ed.; Edward Elgar Publishing: Cheltenham, UK, 2012; pp. 252–276. [Google Scholar]

- Henseler, J. Partial least squares path modeling. In Advanced Methods for Modeling Markets: International Series in Quantitative Marketing; Leeflang, P., Bijmolt, T., Pauwels, K., Eds.; Springer: Heidelberg, UK, 2017; pp. 361–381. [Google Scholar]

- Chin, W.W. The partial least squares approach for structural equation modeling. In Modern Methods for Business Research; Macoulides, G.A., Ed.; Lawrence Erlbaum Associates: Mahwah, NJ, USA, 1998; pp. 295–336. [Google Scholar]

- Höck, M.; Ringle, C.M. Strategic Networks in the Software Industry: An Empirical Analysis of the Value Continuum; IFSAM VIIIth World Congress: Berlin, Germany, 2006; Available online: http://www.ibl-unihh.de/IFSAM06.pdf (accessed on 22 March 2020).

- Hair, J.F.J.; Black, W.C.; Babin, B.J.; Anderson, R.E.; Tatham, R.L. Multivariate Data Analysis; Prentice Hall: Upper Saddle River, NJ, USA, 2010. [Google Scholar]

- Daskalakis, S.; Mantas, J. Evaluating the Impact of a Service-Oriented Framework for Healthcare Interoperability. Stud. Health Technol. Inform. 2008, 136, 285–290. [Google Scholar] [PubMed]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Clark, L.A.; Watson, D. Constructing validity: Basic issues in objective scale development. Psychol. Assess. 1995, 7, 309–319. [Google Scholar] [CrossRef]

- Kline, R.B. Principles and Practice of Structural Equation Modeling; Guilford Press: New York, NY, USA, 2011. [Google Scholar]

- Stone, M. Cross-validatory choice and assessment of statistical predictions. J. R. Stat. Soc. 1974, 36, 111–147. [Google Scholar] [CrossRef]

- Geisser, S. A predictive approach to the random effects model. Biometrika 1974, 61, 101–107. [Google Scholar] [CrossRef]

- Moore, W.B.; Poznanski, P.J. Sustainability Reporting: An Accountant’s Perspective. J. Manag. Sustain. 2015, 5, 92–96. [Google Scholar] [CrossRef]

| Model Construct | Exogenous Variables | Sources |

|---|---|---|

| Performance Expectancy (PE) | In carrying out the company’s activity | |

| (PE1) using the accounting platform would give me a real-time record and good control over the business | [6,24] | |

| (PE2) Using the accounting platform would allow me to bill online and use the latest technology | [23] | |

| (PE3) Using the accounting platform would give me accounting consulting and representation in case of control | [25,26] | |

| (PE4) Using the accounting platform would save me time | [27] | |

| Effort Expectancy (EE) | (EE1) Using the accounting platform would allow me to improve and expand the learning experience | [23,27] |

| (EE2) Using the accounting platform would allow me to develop online communication skills | [26] | |

| (EE3) Using the accounting platform would allow me an easy interaction with the visual interface and an easy navigation | [23,27] | |

| Social Influence (SI) | (SI1) Employees, consumers, and suppliers are very important to my business so I think I should use the accounting platform | [30] |

| (SI2) The achievements and traditions of the community are respected and promoted by my business so I think I should use the accounting platform | [29] | |

| (SI3) Knowing consumer behaviors provides the company with guidelines for action and understanding the value of human nature so I think I should use the accounting platform. | [6,23,27] | |

| (SI4) Strategic involvement in community partnerships to solve social problems ensures the growth of the company’s reputation so I think I should use the accounting platform | [29,30] | |

| Facilitating conditions (FC) | When I use the accounting platform I believe that: | |

| (FC1) I have all the necessary resources to use the accounting platform | [23] | |

| (FC2) I have the necessary knowledge to use the accounting platform | [6] | |

| (FC3) I benefit from technical support for quickly solving the problems caused by the use of the accounting platform | [29] | |

| Perceived credibility (PC) | (PC1) The protection of my business data is ensured with the help of antivirus/antimalware software systems | [15] |

| (PC2) My business is secured by storing information on multiple servers | [15] | |

| (PC3) The confidentiality of personal data is ensured, including the user and the access password to the accounting platform | [15] | |

| Perceived risk (PR) | (PR1) There is a risk of other third parties having quick access to the information, documents, and financial resources of my business when using the accounting platform | [41,42] |

| (PR2) There is a significant risk of information about my business being disclosed to third parties for marketing purposes through the accounting platform | [43] | |

| (PR3) I consider that the organization and management of the accounting records using this platform is a risky choice | [44] | |

| Intention to use the accounting platform(IU) | (ITU1) prefer to use platform accounting services | [6] |

| (ITU2) intend to use platform accounting services | [6] | |

| (ITU3) I would use platform accounting services | [29,30] | |

| Cronbach’s Alpha | Composite Reliability | Average Variance Extracted (AVE) | |

|---|---|---|---|

| Effort Expectancy (EE) | 0.733 | 0.848 | 0.657 |

| Facilitating Conditions (FC) | 0.759 | 0.861 | 0.674 |

| Intention to Use the Accounting Platform (IU) | 0.855 | 0.911 | 0.773 |

| Perceived Credibility (PC) | 0.751 | 0.854 | 0.663 |

| Perceived Risk (PR) | 0.813 | 0.889 | 0.728 |

| Performance Expectancy (PE) | 0.856 | 0.901 | 0.695 |

| Social Influence (SI) | 0.793 | 0.865 | 0.617 |

| Variables | Effort Expectancy (EE) | Facilitating Conditions (FC) | Intention to Use the Accounting Platform (IU) | Perceived Credibility (PC) | Perceived Risk (PR) | Performance Expectancy (PE) | Social Influence (SI) |

|---|---|---|---|---|---|---|---|

| Effort Expectancy (EE) | 0.810 | ||||||

| Facilitating Conditions (FC) | 0.525 | 0.821 | |||||

| Intention to Use the Accounting Platform (IU) | 0.497 | 0.479 | 0.879 | ||||

| Perceived Credibility (PC) | 0.723 | 0.588 | 0.643 | 0.814 | |||

| Perceived Risk (PR) | 0.411 | 0.693 | 0.485 | 0.558 | 0.853 | ||

| Performance Expectancy (PE) | 0.514 | 0.559 | 0.557 | 0.559 | 0.603 | 0.833 | |

| Social Influence (SI) | 0.246 | 0.368 | 0.247 | 0.274 | 0.264 | 0.225 | 0.785 |

| Effort Expectancy (EE) | Facilitating Conditions (FC) | Intention to Use the Accounting Platform (IU) | Perceived Credibility (PC) | Perceived Risk (PR) | Performance Expectancy (PE) | Social Influence (SI) | |

|---|---|---|---|---|---|---|---|

| EE1 | 0.611 | 0.394 | 0.265 | 0.394 | 0.280 | 0.270 | 0.119 |

| EE2 | 0.877 | 0.393 | 0.393 | 0.591 | 0.279 | 0.395 | 0.222 |

| EE3 | 0.910 | 0.492 | 0.507 | 0.715 | 0.421 | 0.533 | 0.235 |

| FC1 | 0.363 | 0.787 | 0.344 | 0.426 | 0.426 | 0.362 | 0.223 |

| FC2 | 0.411 | 0.831 | 0.404 | 0.437 | 0.617 | 0.478 | 0.275 |

| FC3 | 0.509 | 0.845 | 0.426 | 0.574 | 0.643 | 0.523 | 0.393 |

| IU1 | 0.624 | 0.415 | 0.895 | 0.667 | 0.476 | 0.577 | 0.213 |

| IU2 | 0.323 | 0.419 | 0.869 | 0.488 | 0.374 | 0.427 | 0.212 |

| IU3 | 0.309 | 0.433 | 0.872 | 0.511 | 0.416 | 0.439 | 0.229 |

| PC1 | 0.403 | 0.589 | 0.531 | 0.819 | 0.608 | 0.478 | 0.271 |

| PC2 | 0.451 | 0.292 | 0.359 | 0.734 | 0.263 | 0.267 | 0.128 |

| PC3 | 0.843 | 0.508 | 0.628 | 0.883 | 0.449 | 0.558 | 0.244 |

| PE1 | 0.237 | 0.555 | 0.383 | 0.270 | 0.566 | 0.786 | 0.135 |

| PE2 | 0.292 | 0.508 | 0.399 | 0.365 | 0.568 | 0.860 | 0.214 |

| PE3 | 0.254 | 0.370 | 0.409 | 0.433 | 0.543 | 0.849 | 0.160 |

| PE4 | 0.761 | 0.448 | 0.597 | 0.682 | 0.390 | 0.837 | 0.221 |

| PR1 | 0.309 | 0.656 | 0.391 | 0.360 | 0.814 | 0.495 | 0.178 |

| PR2 | 0.386 | 0.633 | 0.417 | 0.484 | 0.870 | 0.538 | 0.274 |

| PR3 | 0.355 | 0.496 | 0.434 | 0.575 | 0.874 | 0.509 | 0.221 |

| SI1 | 0.168 | 0.325 | 0.193 | 0.190 | 0.237 | 0.239 | 0.787 |

| SI2 | 0.204 | 0.307 | 0.161 | 0.214 | 0.199 | 0.156 | 0.778 |

| SI3 | 0.213 | 0.260 | 0.226 | 0.229 | 0.204 | 0.177 | 0.840 |

| SI4 | 0.187 | 0.274 | 0.186 | 0.228 | 0.188 | 0.130 | 0.733 |

| Hypothesis | Correlation | |? | t-Value | p-Values | Decision | R2 | Q2 |

|---|---|---|---|---|---|---|---|

| H1 | Performance Expectancy (PE)-Intention to Use the Accounting Platform (IU) | 0.250 | 1.976 | 0.025 | Supported | ||

| H2 | Effort Expectancy (EE)-Intention to Use the Accounting Platform (IU) | 0.002 | 0.033 | 0.973 | Not Supported | ||

| H3 | Social Influence (SI)-Intention to Use the Accounting Platform (IU) | 0.046 | 1.984 | 0.023 | Supported | ||

| H4 | Facilitating Conditions (FC)-Intention to Use the Accounting Platform (IU) | 0.017 | 0.186 | 0.852 | Not Supported | ||

| H5 | Perceived Credibility (PC)-Intention to Use the Accounting Platform (IU) | 0.444 | 4.169 | 0.000 | Supported | 0.476 | 0.328 |

| H6 | Perceived Risk (PR)-Intention to Use the Accounting Platform (IU) | 0.062 | 2.264 | 0.007 | Supported |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cokins, G.; Oncioiu, I.; Türkeș, M.C.; Topor, D.I.; Căpuşneanu, S.; Paștiu, C.A.; Deliu, D.; Solovăstru, A.N. Intention to Use Accounting Platforms in Romania: A Quantitative Study on Sustainability and Social Influence. Sustainability 2020, 12, 6127. https://doi.org/10.3390/su12156127

Cokins G, Oncioiu I, Türkeș MC, Topor DI, Căpuşneanu S, Paștiu CA, Deliu D, Solovăstru AN. Intention to Use Accounting Platforms in Romania: A Quantitative Study on Sustainability and Social Influence. Sustainability. 2020; 12(15):6127. https://doi.org/10.3390/su12156127

Chicago/Turabian StyleCokins, Gary, Ionica Oncioiu, Mirela Cătălina Türkeș, Dan Ioan Topor, Sorinel Căpuşneanu, Carmen Adina Paștiu, Delia Deliu, and Alina Nicoleta Solovăstru. 2020. "Intention to Use Accounting Platforms in Romania: A Quantitative Study on Sustainability and Social Influence" Sustainability 12, no. 15: 6127. https://doi.org/10.3390/su12156127

APA StyleCokins, G., Oncioiu, I., Türkeș, M. C., Topor, D. I., Căpuşneanu, S., Paștiu, C. A., Deliu, D., & Solovăstru, A. N. (2020). Intention to Use Accounting Platforms in Romania: A Quantitative Study on Sustainability and Social Influence. Sustainability, 12(15), 6127. https://doi.org/10.3390/su12156127