The Spillover Effect between Carbon Emission Trading (CET) Price and Power Company Stock Price in China

Abstract

:1. Introduction

- Although there is abundant research about the relationship between the CET market and energy markets in China, this paper is the first to examine the spillover effect between the CET market and power sector in China. The empirical results of the spillover effect between the two markets can reflect the effectiveness of the policy well. Based on the results, we put forward some suggestions for the construction of China’s CET market.

- The existing research on the interactions between the CET market and power sector is mainly at the industry level, while this paper measures the connectedness between these two markets both at the industry level and company level with the connectedness network method. This could provide useful information for company managers and financial market participants when they make strategic decisions.

- In addition to the connectedness network method, this paper adopts the rolling window method to obtain dynamic connectedness between these two sectors. By measuring time-varying connectedness, the relationship between the CET market and the power sector is further investigated.

2. Data and Methodology

2.1. Data

2.1.1. Carbon Price

2.1.2. Power Company Stock Price

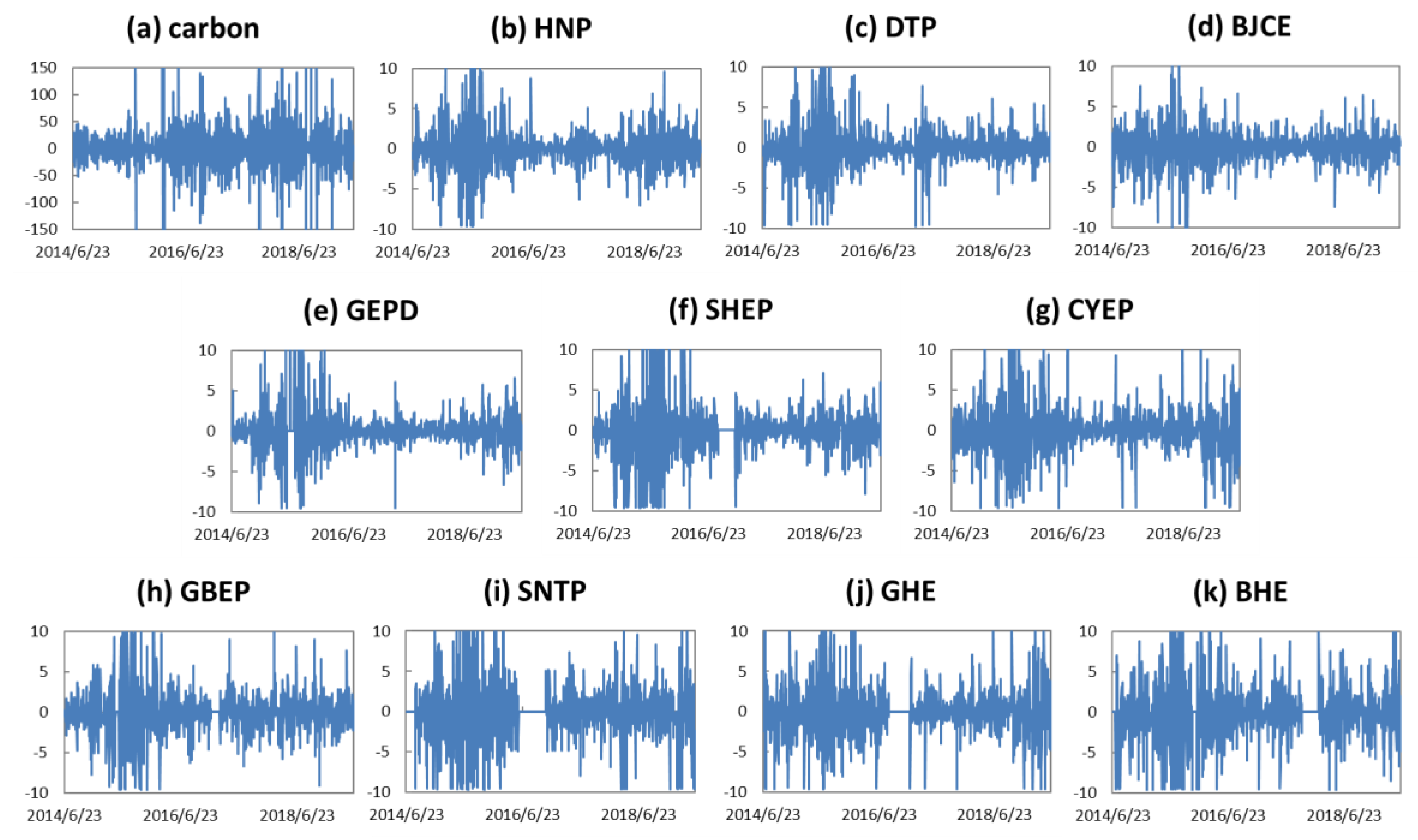

2.1.3. Preliminary Analysis

2.2. Method

2.2.1. The Connectedness Network Method

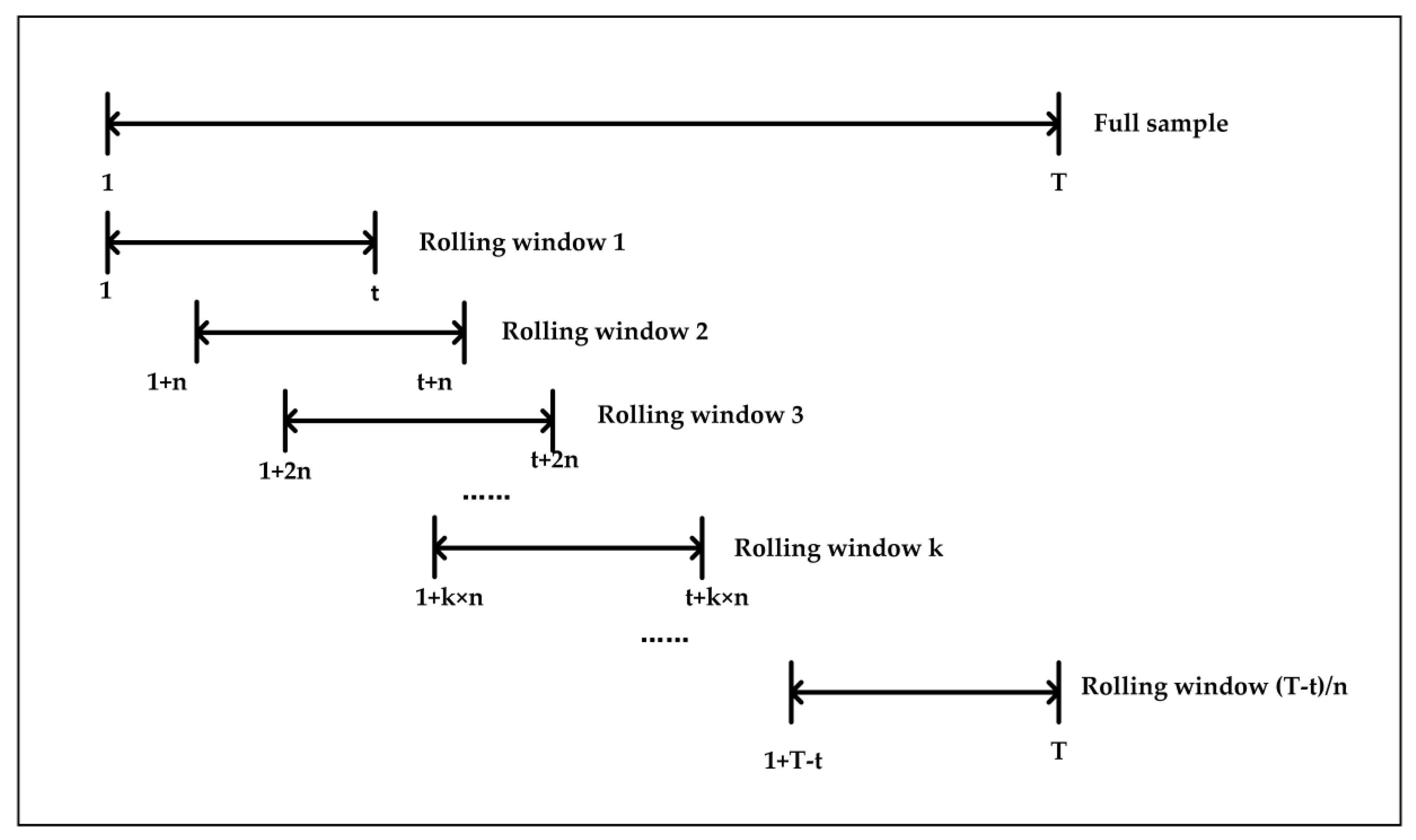

2.2.2. The Rolling Window Method

3. Empirical Analysis and Discussion

3.1. Static Connectedness Analysis

- There was a significant system-wide spillover effect, and the variables of the carbon-power system were closely connected. The TSI was 60.5735%, which indicates that, on the whole, 60.5735% of the changes of the variables in the system could be explained by the changes of other variables in the system. As to each variable, it was found that all the variables gained more spillovers from others than themselves except for carbon price and Beijing Jingneng Clean Energy Co. Ltd. (BJCE). The spillovers carbon price and BJCE gains from the system were 35.3618% and 35.9368%, respectively, and others gained more than 60% from the system.

- There were weak bidirectional spillovers between the carbon market and the electricity market, and the spillover effect was asymmetric. A total of 35.3618% of the changes of carbon price returns could be explained by the changes of power companies’ stock price returns, while the changes of the carbon price returns only contributed to the changes of power companies’ stock price returns by 0.0541%.

- According to the second finding, the net connectedness of the carbon market was 35.3076% (35.3618% minus 0.0541%). This indicates that China’s carbon market mainly received information from the electricity market during the sample period, but transmitted less information to the electricity market. This was consistent with the results of the research of Ji et al. on EU CET [13]. The stock price of power enterprises can provide some information for the change of carbon price, and future research on carbon price should also take financial market factors into consideration.

- BJCE only gained 35.9368% of spillovers from the system, which was far lower than that of the other nine companies. It was found that although the BJCE’s spillovers from carbon price was relatively low, the gap between BJCE’s and other power enterprises’ was very small. The main reason for its low spillovers was that it obtained less spillovers from other power enterprises. We therefore suppose that BJCE is weakly related to the other enterprises in the sample, and this assumption was supported by some information in its annual report. According to BJCE’s 2018 annual report, BJCE’s holding installed capacity in Beijing was 4702 MW, accounting for 54.25% of its total holding installed capacity. Its power generation accounted for more than 50% of Beijing’s gas-fired power generation and more than 60% of central heating. Furthermore, BJCE states that focusing on Beijing and surrounding areas is an important part of its development strategy.

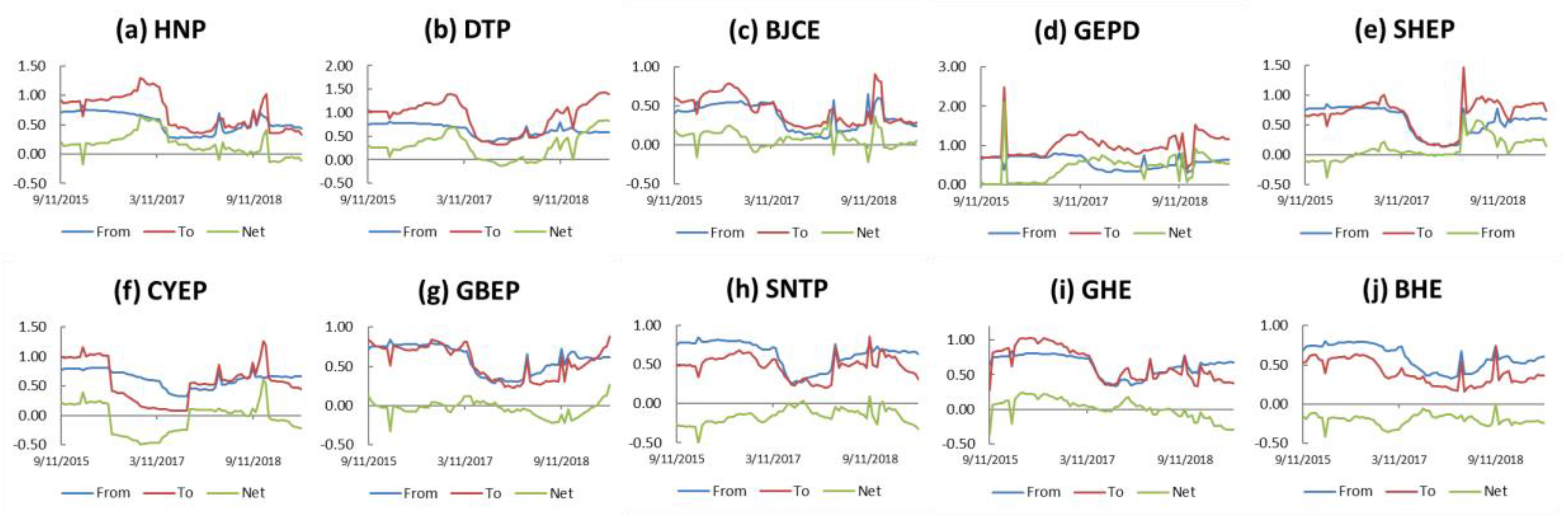

- From the perspective of net connectedness, carbon, GHE, Shenzhen Nanshan Thermal Power Co. Ltd. (SNTP), Binhai Energy Development Co. Ltd. (BHE), and CYEP are information receivers, and Huaneng Power International INC. (HNP), Datang International Power Generation Company (DTP), BJCE, Guangdong Electric Power Development Co. Ltd. (GEPD), Shanghai Electric Power Co. Ltd. (SHEP), and Guangdong Baolihua Electric Power Co. Ltd. (GBEP) are information transmitters. For information transmitters, their stock returns are less likely to be affected by carbon price returns and other enterprises’ stock price returns. They play a leading role in the system to some extent. For information receivers, their stock returns are more likely to be affected by carbon price returns and other enterprises’ stock price returns. As a result, they face more uncertainty.

- The interactions between the power enterprise and the carbon-power system may be related to its total holding installed capacity. According to Table 1, the information transmitters in the system were in a leading position in terms of total installed holding capacity, while SNTP and GHE, with the smallest capacity, were information receivers.

- The interactions between power enterprises and the carbon-power system may be related to the degree of power enterprises’ dependence on renewable energy to generate electricity. As shown in Table 1, the proportions of information transmitters’ renewable energy holding installed capacity were at a very high or high level. The enterprises with very high, high, and medium levels of renewable energy holding installed ratios were information transmitters, while the renewable energy installed ratios of information receivers were at a low or very low level. This finding indicates that the stock price returns of power enterprises with a higher proportion of renewable energy installed are less likely to be affected by carbon price returns and stock price returns of other enterprises, and, thus, they are less likely to be exposed to uncertainty in the carbon-power system. This suggests that increasing the proportion of the renewable energy installed is helpful for power enterprises to reduce their risks.

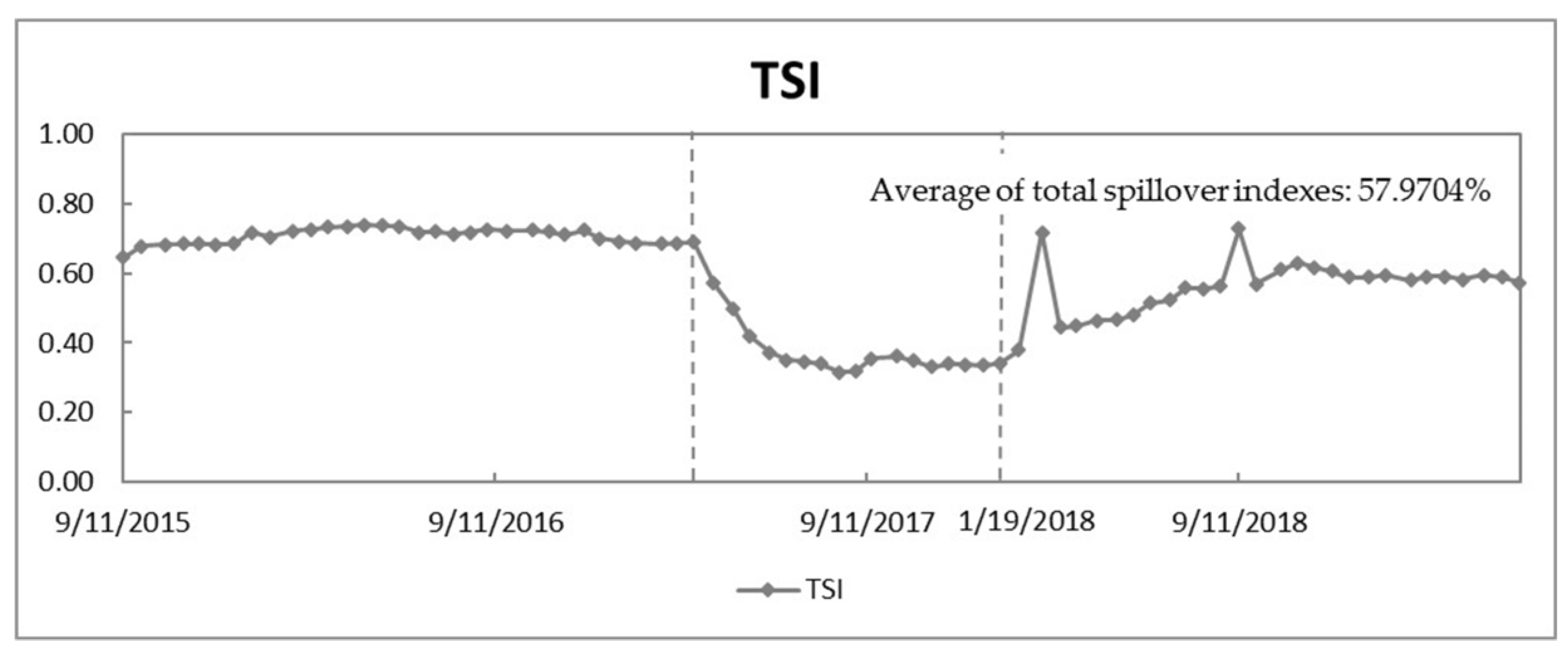

3.2. Dynamic Connectedness Analysis

- In the first stage, from the end of 2015 to the beginning of 2017, the spillover index was generally at a relatively stable and relatively high level. During this period, China’s carbon trading market was very active, and both the volume and the price of carbon quota spot trading showed an upward trend with an obvious growth rate. In addition, the high spillover index during this period was also related to financial markets. In 2015, China’s stock market experienced several market shocks. In the first half of 2015, China’s stock market experienced a period of continuous rise, but from June to August, the stock market suffered a rare consecutive slump, with the Shanghai stock exchange composite index dropping by more than 40% from its highs. The impact of this incident lasted for a long time until the stock market gradually stabilized in 2016. When financial markets are more volatile, the connections between financial market participants are also strengthened, which also leads to a higher spillover effect of the carbon-power system.

- In the second stage, the spillover index had a significant decline after March 2017, and reached its lowest level during this period. During this year, the carbon trading market was less active. It was found that the total trading volume of carbon quota spot and its growth rate declined compared with 2015 and 2016.

- In the third stage, the spillover index showed a slow upward trend on the whole, during which China started the construction of a national carbon trading market and the total carbon trading volume picked up. In this stage, there were two spikes.

- (a)

- The first spike may have been affected by the release of the policy to construct the national CET market in China and a series of carbon emission verification activities. Since the end of 2017, China has begun the construction of a national CET market, and a series of policies and measures have been introduced in the following months. In December 2017, the National Development and Reform Commission (NDRC) announced the National Carbon Emission Trading Market Construction Plan (Power Generation Industry), which proposed to first launch the national CET market in the power industry. This policy released a very important message that the construction process of the CET market was going to be further promoted, which greatly strengthened the information flow in the carbon-power system. In addition, the NDRC issued a document in February 2018, requiring local governments to strictly check the carbon emission data of key enterprises in 2016 and 2017, which promoted power enterprises to actively participate in CET market to meet the allowance target.

- (b)

- The second spike may have been caused by the active allowance transactions. First, the regulated enterprises in the CET market in China have little incentive to engage in allowance trading and tend to make transactions close to the deadline of the compliance period. The deadline of the compliance period in pilot markets in 2018 was from May to July, and transactions during these months were very active. Second, the transactions were very active during September 2018, to October 2018, according to the market liquidity index of China’s CET market. (The index was released by the Beijing Green Finance Association. It was calculated based on the daily transaction volume of allowances in Shenzhen, Beijing, Shanghai, Tianjin, Guangdong, and Chongqing pilot markets, which reflects the activity of allowance transactions.) The index reached much higher levels during September and October than other periods. The active transactions in the CET market can enhance the interactions between the enterprises, as well as the information exchange in the system.

4. Conclusions

4.1. Main Findings

- The spillover effect of this carbon-power system is relatively strong. This shows that the CET market and power companies are closely connected, and the emission trading policy has worked in China.

- There is a weak spillover effect between the CET market and the power sector in China, and the CET market is a net receiver of the information from the power sector. This means that the information in the CET market cannot be quickly incorporated into the stock price of power companies, and the effectiveness of the policy still needs to be improved.

- Through the analysis of dynamic connectedness, we found that, although the spillover of the CET market to the power sector is very low most of the time, the CET market occasionally generates a high degree of spillover for the power sector, which company managers and financial market participants should pay attention to.

- From the perspective of the company level, we found that the interactions between the power company and the carbon-power system—that is, whether it is mainly affected by the system or plays a leading role in the system—may be related to the power generation capacity or energy mix of the power company.

4.2. Implications and Suggestions

- Set the total volume of allowances at national level and allocate them according to certain standards. In Phase I and Phase II of the EU CET market, the total volume of allowances—the emission cap—and allocation scheme were mainly set by the members of the market, which caused the over-allocation of allowances. To solve the problem, National Allocation Plans (NAPs) were canceled in Phase III, the cap was determined at the EU level, and a single set of rules were adopted to govern their allocations [37]. China should also set the emission cap at a national level and allocate allowances to different areas based on certain standards, which might be applicable for other countries or regions that plan to establish the CET market.

- Gradually reduce the proportion of free allowance and increase the proportion of auctioned allowances. Compared to the free allocation of allowances, the auction is more efficient, as it is beneficial for allocating allowances to the agents who need them most [38]. For the CET market in China, only the Hubei and Guangdong pilot market has adopted the auction method, and the proportion of auctioned allowances is very low. The CET market in China should gradually increase the proportion of auctioned allowances to improve the efficiency of allowances allocation. Other countries or regions can also consider increasing the proportion of auctioned allowances with the development of the market to promote enterprises to reduce carbon emissions.

- Adopt the benchmarking method to allocate free allowance. The grandfathering method was widely adopted by the members of EU CET market in Phase I and Phase II to allocate allowances, which is not conducive to promoting enterprises to invest in low-carbon technology. In Phase III, the benchmarking method was adopted, which can overcome the shortcomings of the grandfathering method. In China, the benchmarking method should be adopted to allocate free allowances before all the allowances are auctioned.

- Promote the marketization of electricity prices. CET internalizes the external environmental cost, which increases the cost of regulated companies. However, the regulated electricity price in China has not incorporated an emission reduction cost, which damages the motivation of power companies actively involved in the CET market. Other countries with regulated electricity prices can also promote the power enterprises to participate in carbon trading through price marketization.

- Improve the efficiency and transparency of information disclosure. Timely and transparent information can help regulated enterprises better understand the policies and market situations and provide an incentive for the companies to actively participate in carbon trading.

4.3. Limitations and Future Research

Author Contributions

Funding

Conflicts of Interest

References

- Zhang, Y.J.; Peng, Y.L.; Ma, C.Q.; Shen, B. Can Environmental Innovation Facilitate Carbon Emissions Reduction? Evidence from China. Energy Policy 2017, 100, 18–28. [Google Scholar] [CrossRef]

- Riti, J.S.; Song, D.; Shu, Y.; Kamah, M. Decoupling CO2 Emission and Economic Growth in China: Is There Consistency in Estimation Results in Analyzing Environmental Kuznets Curve? J. Clean. Prod. 2017, 166, 1448–1461. [Google Scholar] [CrossRef]

- Lin, B.; Chen, Y. Dynamic Linkages and Spillover Effects between CET Market, Coal Market and Stock Market of New Energy Companies: A Case of Beijing CET Market in China. Energy 2019, 172, 1198–1210. [Google Scholar] [CrossRef]

- Aatola, P.; Ollikainen, M.; Toppinen, A. Impact of the Carbon Price on the Integrating European Electricity Market. Energy Policy 2013, 61, 1236–1251. [Google Scholar] [CrossRef]

- Pereira, C.J.; Pereira, P. European Union Emissions Trading Scheme Impact on the Spanish Electricity Price during Phase II and Phase III Implementation. Util. Policy 2015, 33, 54–62. [Google Scholar] [CrossRef]

- Zachmann, G.; von Hirschhausen, C. First Evidence of Asymmetric Cost Pass-through of EU Emissions Allowances: Examining Wholesale Electricity Prices in Germany. Econ. Lett. 2008, 99, 465–469. [Google Scholar] [CrossRef] [Green Version]

- Alberola, E.; Chevallier, J.; Chèze, B. Price Drivers and Structural Breaks in European Carbon Prices 2005–2007. Energy Policy 2008, 36, 787–797. [Google Scholar] [CrossRef]

- Boersen, A.; Scholtens, B. The Relationship between European Electricity Markets and Emission Allowance Futures Prices in Phase II of the EU (European Union) Emission Trading Scheme. Energy 2014, 74, 585–594. [Google Scholar] [CrossRef]

- Zhu, B.; Ye, S.; Han, D.; Wang, P.; He, K.; Wei, Y.M.; Xie, R. A Multiscale Analysis for Carbon Price Drivers. Energy Econ. 2019, 78, 202–216. [Google Scholar] [CrossRef]

- Keppler, J.H.; Mansanet-Bataller, M. Causalities between CO2, Electricity, and Other Energy Variables during Phase I and Phase II of the EU ETS. Energy Policy 2010, 38, 3329–3341. [Google Scholar] [CrossRef] [Green Version]

- Zhu, B.; Han, D.; Chevallier, J.; Wei, Y.M. Dynamic Multiscale Interactions between European Carbon and Electricity Markets during 2005–2016. Energy Policy 2017, 107, 309–322. [Google Scholar] [CrossRef]

- Ji, Q.; Xia, T.; Liu, F.; Xu, J.H. The Information Spillover between Carbon Price and Power Sector Returns: Evidence from the Major European Electricity Companies. J. Clean. Prod. 2019, 208, 1178–1187. [Google Scholar] [CrossRef]

- Oberndorfer, U. EU Emission Allowances and the Stock Market: Evidence from the Electricity Industry. Ecol. Econ. 2009, 68, 1116–1126. [Google Scholar] [CrossRef] [Green Version]

- Veith, S.; Werner, J.R.; Zimmermann, J. Capital Market Response to Emission Rights Returns: Evidence from the European Power Sector. Energy Econ. 2009, 31, 605–613. [Google Scholar] [CrossRef]

- Mo, J.L.; Zhu, L.; Fan, Y. The Impact of the EU ETS on the Corporate Value of European Electricity Corporations. Energy 2012, 45, 3–11. [Google Scholar] [CrossRef]

- Moreno, B.; Pereira, P. How Do Spanish Polluting Sectors’ Stock Market Returns React to European Union Allowances Prices ? A Panel Data Approach. Energy 2016, 103, 240–250. [Google Scholar] [CrossRef]

- da Silva, P.P.; Moreno, B.; Figueiredo, N.C. Firm-Specific Impacts of CO2 Prices on the Stock Market Value of the Spanish Power Industry. Energy Policy 2016, 94, 492–501. [Google Scholar] [CrossRef]

- Tian, Y.; Akimov, A.; Roca, E.; Wong, V. Does the Carbon Market Help or Hurt the Stock Price of Electricity Companies? Further Evidence from the European Context. J. Clean. Prod. 2016, 112, 1619–1626. [Google Scholar] [CrossRef] [Green Version]

- Cong, R.; Wei, Y. Potential Impact of (CET) Carbon Emissions Trading on China’s Power Sector: A Perspective from Different Allowance Allocation Options. Energy 2010, 35, 3921–3931. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. Impacts of Carbon Price Level in Carbon Emission Trading Market. Appl. Energy 2019, 239, 157–170. [Google Scholar] [CrossRef]

- Zhang, L.; Li, Y.; Jia, Z. Impact of Carbon Allowance Allocation on Power Industry in China’s Carbon Trading Market: Computable General Equilibrium Based Analysis. Appl. Energy 2018, 229, 814–827. [Google Scholar] [CrossRef]

- Li, W.; Zhang, Y.; Lu, C. The Impact on Electric Power Industry under the Implementation of National Carbon Trading Market in China: A Dynamic CGE Analysis. J. Clean. Prod. 2018, 200, 511–523. [Google Scholar] [CrossRef]

- Zhang, F.; Fang, H.; Wang, X. Impact of Carbon Prices on Corporate Value: The Case of China’s Thermal Listed Enterprises. Sustainability 2018, 10, 3328. [Google Scholar] [CrossRef] [Green Version]

- Wen, F.; Wu, N.; Gong, X. China’s Carbon Emissions Trading and Stock Returns. Energy Econ. 2020, 86, 104627. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yılmaz, K.; Lynch, M.; Gregory, P. On the Network Topology of Variance Decompositions: Measuring the Connectedness of Financial Firms. J. Econ. 2014, 182, 119–134. [Google Scholar] [CrossRef] [Green Version]

- Zhang, D. Oil Shocks and Stock Markets Revisited: Measuring Connectedness from a Global Perspective. Energy Econ. 2017, 62, 323–333. [Google Scholar] [CrossRef]

- Aromi, D.; Clements, A. Spillovers between the Oil Sector and the S&P500: The Impact of Information Flow about Crude Oil. Energy Econ. 2019, 81, 187–196. [Google Scholar] [CrossRef]

- Maghyereh, A.I.; Awartani, B.; Bouri, E. The Directional Volatility Connectedness between Crude Oil and Equity Markets: New Evidence from Implied Volatility Indexes. Energy Econ. 2016, 57, 78–93. [Google Scholar] [CrossRef] [Green Version]

- Ma, Y.R.; Zhang, D.; Ji, Q.; Pan, J. Spillovers between Oil and Stock Returns in the US Energy Sector: Does Idiosyncratic Information Matter? Energy Econ. 2019, 81, 536–544. [Google Scholar] [CrossRef]

- Apergis, N.; Baruník, J.; Lau, M.C.K. Good Volatility, Bad Volatility: What Drives the Asymmetric Connectedness of Australian Electricity Markets? Energy Econ. 2017, 66, 108–115. [Google Scholar] [CrossRef]

- Zhang, D.; Ji, Q.; Kutan, A.M. Dynamic Transmission Mechanisms in Global Crude Oil Prices: Estimation and Implications. Energy 2019, 175, 1181–1193. [Google Scholar] [CrossRef]

- Restrepo, N.; Uribe, J.M.; Manotas, D. Financial Risk Network Architecture of Energy Firms. Appl. Energy 2018, 215, 630–642. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yilmaz, K. Measuring financial asset return and volatility spillovers, with application to global equity markets Francis. Econ. J. 2009, 119, 158–171. [Google Scholar] [CrossRef] [Green Version]

- Diebold, F.X.; Yilmaz, K. Better to Give than to Receive: Predictive Directional Measurement of Volatility Spillovers. Int. J. 2012, 28, 57–66. [Google Scholar] [CrossRef] [Green Version]

- Koop, G.; Pesaran, M.H.; Potter, S.M. Impulse Response Analysis in Nonlinear Multivariate Models. J. Econ. 1996, 74, 119–147. [Google Scholar] [CrossRef]

- Pesaran, H.H.; Shin, Y. Capital Taxation and Production Efficiency in an Open Economy. Econ. Lett. 1999, 62, 85–90. [Google Scholar]

- Verde, S.F.; Teixidó, J.; Marcantonini, C.; Labandeira, X. Free Allocation Rules in the EU Emissions Trading System: What Does the Empirical Literature Show? Clim. Policy 2019, 19, 439–452. [Google Scholar] [CrossRef]

- Cong, R.G.; Wei, Y.M. Experimental Comparison of Impact of Auction Format on Carbon Allowance Market. Renew. Sustain. Energy Rev. 2012, 16, 4148–4156. [Google Scholar] [CrossRef]

| Stock Code | Name | Total Holding Installed Capacity (104 kW) | Main Methods of Power Generation | Renewable Energy Installed Ratio | Abbreviation |

|---|---|---|---|---|---|

| 600011.SH | Huaneng Power Internatinal INC. | 10,599,100.00 | thermal wind solar hydroelectric biomass | Medium | HNP |

| 601991.SH | Datang International Power Generation Company | 6,285,330.00 | Thermal wind solar hydroelectric biomass | Medium | DTP |

| 00579.HK | Beijing Jingneng Clean Energy Co. Ltd. | 866,700.00 | thermal wind solar hydroelectric | Very High | BJCE |

| 000539.SZ | Guangdong Electric Power Development Co. Ltd. | 2095.00 | thermal wind hydroelectric | Low | GEPD |

| 600021.SH | Shanghai Electric Power Co. Ltd. | 1500.25 | thermal wind solar | High | SHEP |

| 000966.SZ | Guodian Changyuan Electric Power Co. Ltd. | 369.43 | thermal wind biomass | Low | CYEP |

| 000690.SZ | Guangdong Baolihua Electric Power Co. Ltd. | 351.80 | thermal wind | Very Low | GBEP |

| 000037.SZ | Shenzhen Nanshan Thermal Power Co. Ltd. | 126.00 | thermal | Very Low | SNTP |

| 000531.SZ | Guangzhou Hengyun Enterprises Holdings Ltd. | 117.00 | thermal | Very Low | GHE |

| 000695.SZ | Binhai Energy Development Co. Ltd. | - | thermal | Very Low | BHE |

| Mean | Maximum | Minimum | Std. Dev. | Skewness | Kurtosis | Jarque-Bera | |

|---|---|---|---|---|---|---|---|

| Carbon | 0.034372 | 623.9094 | −634.537 | 56.49274 | −0.009310 | 45.6864 | 92,169.34 *** |

| HNP | −0.016120 | 10.57661 | −9.57624 | 2.390904 | 0.483460 | 8.145115 | 1386.345 *** |

| DTP | 0.010732 | 10.60281 | −9.64603 | 2.448630 | 0.282056 | 8.749117 | 1687.994 *** |

| BJCE | 0.006892 | 19.63214 | −9.59284 | 2.296964 | 1.037525 | 12.90468 | 5180.164 *** |

| GEPD | 0.062658 | 13.19648 | −15.1461 | 2.065816 | −0.381570 | 9.852094 | 2404.407 *** |

| SHEP | −0.054070 | 10.54752 | −9.55752 | 2.945599 | 0.123362 | 7.295312 | 936.3269 *** |

| CYEP | 0.009432 | 74.76124 | −9.61702 | 3.558675 | 7.713434 | 163.2829 | 1,311,556 *** |

| GBEP | −0.039910 | 10.59121 | −9.57624 | 2.776494 | 0.337524 | 6.889662 | 788.3495 *** |

| SNTP | −0.089960 | 10.57737 | −9.59121 | 3.531683 | 0.045209 | 5.075112 | 218.2298 *** |

| GHE | 0.047094 | 72.80714 | −9.59547 | 3.626129 | 6.735767 | 136.5029 | 910,728.2 *** |

| BHE | −0.000098 | 10.57553 | −9.56865 | 3.319137 | 0.212539 | 5.332773 | 284.4058 *** |

| From | |||||

|---|---|---|---|---|---|

| To | TSI | ||||

| Net |

| Variable | Carbon | HNP | DTP | BJCE | GEPD | SHEP | CYEP | GBEP | SNTP | GHE | BHE | From |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Carbon | 0.646382 | 0.049368 | 0.020918 | 0.012467 | 0.026125 | 0.054305 | 0.052976 | 0.057439 | 0.016904 | 0.026161 | 0.036955 | 0.353618 |

| HNP | 0.000025 | 0.370518 | 0.187697 | 0.042576 | 0.121013 | 0.080156 | 0.046794 | 0.064418 | 0.032186 | 0.026883 | 0.027733 | 0.629482 |

| DTP | 0.000038 | 0.163646 | 0.310157 | 0.044771 | 0.136232 | 0.097959 | 0.054278 | 0.071471 | 0.043905 | 0.038600 | 0.038942 | 0.689843 |

| BJCE | 0.000020 | 0.051846 | 0.062635 | 0.640632 | 0.046064 | 0.036666 | 0.024996 | 0.041093 | 0.027741 | 0.028128 | 0.040179 | 0.359368 |

| GEPD | 0.000041 | 0.107478 | 0.136510 | 0.033728 | 0.363332 | 0.092831 | 0.049525 | 0.092451 | 0.048622 | 0.039100 | 0.036383 | 0.636668 |

| SHEP | 0.000056 | 0.098403 | 0.138271 | 0.042868 | 0.130879 | 0.304532 | 0.054069 | 0.085248 | 0.058941 | 0.037253 | 0.049481 | 0.695468 |

| CYEP | 0.000011 | 0.087988 | 0.117742 | 0.042505 | 0.110076 | 0.080826 | 0.327661 | 0.089302 | 0.049159 | 0.046567 | 0.048164 | 0.672339 |

| GBEP | 0.000142 | 0.080220 | 0.099523 | 0.047625 | 0.129621 | 0.083210 | 0.057449 | 0.332130 | 0.060979 | 0.042979 | 0.066122 | 0.667870 |

| SNTP | 0.000053 | 0.063663 | 0.099539 | 0.057028 | 0.109184 | 0.088888 | 0.050674 | 0.102421 | 0.311639 | 0.049301 | 0.067611 | 0.688361 |

| GHE | 0.000116 | 0.059815 | 0.093416 | 0.053754 | 0.106558 | 0.067353 | 0.056863 | 0.079957 | 0.055293 | 0.362846 | 0.064028 | 0.637154 |

| BHE | 0.000040 | 0.052596 | 0.082692 | 0.075481 | 0.079095 | 0.071374 | 0.050142 | 0.104240 | 0.061934 | 0.055318 | 0.367090 | 0.632910 |

| To | 0.000541 | 0.815022 | 1.038943 | 0.452803 | 0.994847 | 0.753567 | 0.497766 | 0.788039 | 0.455665 | 0.390290 | 0.475598 | TSI = 0.605735 |

| Net | −0.353076 | 0.185540 | 0.349100 | 0.093435 | 0.358179 | 0.058099 | −0.174574 | 0.120169 | −0.232696 | −0.246864 | −0.157313 |

| Variable | Carbon | HNP | DTP | BJCE | GEPD | SHEP | CYEP | GBEP | SNTP | GHE | BHE |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carbon | −0.049343 | −0.020879 | −0.012447 | −0.026084 | −0.054249 | −0.052965 | −0.057297 | −0.016852 | −0.026045 | −0.036915 | |

| HNP | −0.024051 | 0.009270 | −0.01354 | 0.018246 | 0.041193 | 0.015801 | 0.031477 | 0.032932 | 0.024863 | ||

| DTP | 0.017864 | 0.000279 | 0.040312 | 0.063464 | 0.028052 | 0.055634 | 0.054816 | 0.043750 | |||

| BJCE | −0.012336 | 0.006202 | 0.017508 | 0.006532 | 0.029287 | 0.025626 | 0.035302 | ||||

| GEPD | 0.038048 | 0.060552 | 0.037170 | 0.060562 | 0.067459 | 0.042712 | |||||

| SHEP | 0.026757 | −0.002038 | 0.029947 | 0.030100 | 0.021893 | ||||||

| CYEP | −0.031853 | 0.001515 | 0.010296 | 0.001978 | |||||||

| GBEP | 0.041441 | 0.036978 | 0.038117 | ||||||||

| SNTP | 0.005992 | −0.005677 | |||||||||

| GHE | −0.008710 | ||||||||||

| BHE |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Y.; Nie, D.; Li, B.; Li, X. The Spillover Effect between Carbon Emission Trading (CET) Price and Power Company Stock Price in China. Sustainability 2020, 12, 6573. https://doi.org/10.3390/su12166573

Li Y, Nie D, Li B, Li X. The Spillover Effect between Carbon Emission Trading (CET) Price and Power Company Stock Price in China. Sustainability. 2020; 12(16):6573. https://doi.org/10.3390/su12166573

Chicago/Turabian StyleLi, Yanbin, Dan Nie, Bingkang Li, and Xiyu Li. 2020. "The Spillover Effect between Carbon Emission Trading (CET) Price and Power Company Stock Price in China" Sustainability 12, no. 16: 6573. https://doi.org/10.3390/su12166573

APA StyleLi, Y., Nie, D., Li, B., & Li, X. (2020). The Spillover Effect between Carbon Emission Trading (CET) Price and Power Company Stock Price in China. Sustainability, 12(16), 6573. https://doi.org/10.3390/su12166573