Research on the Transmission Ability of China’s Thermal Coal Price Information Based on Directed Limited Penetrable Interdependent Network

Abstract

:1. Introduction

2. Analyzing Data and Constructing Network

2.1. The Source, Stationarity Tests, and Processing About the Data

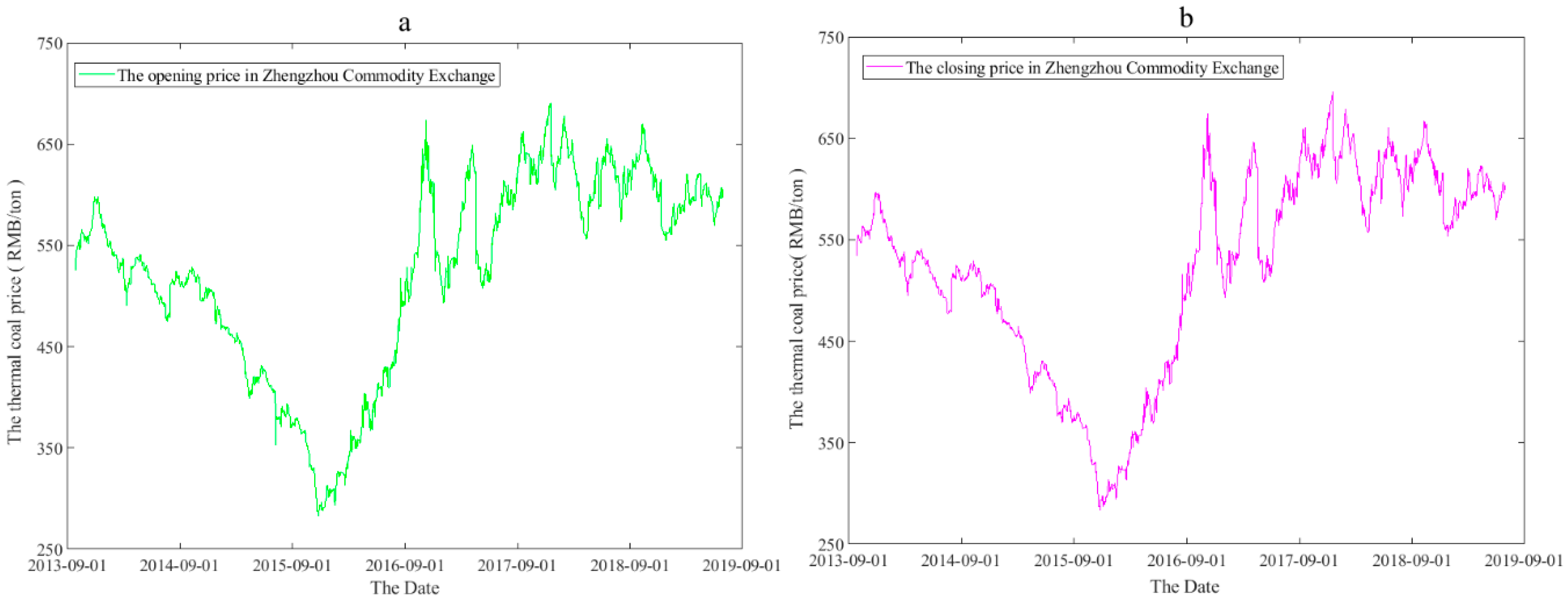

2.1.1. The Source and Basic Statistical Analysis of the Data

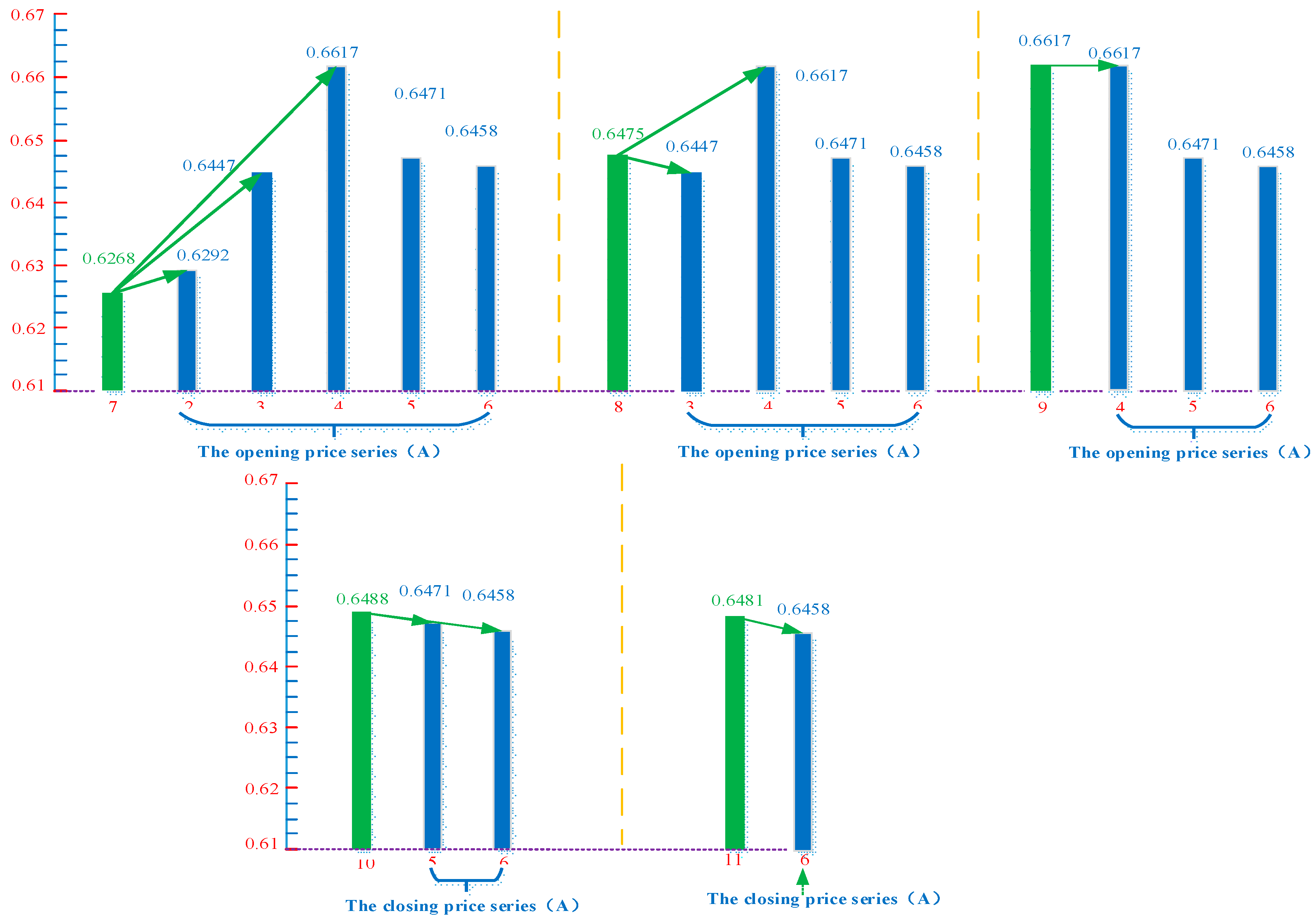

2.1.2. The Processing of the Data

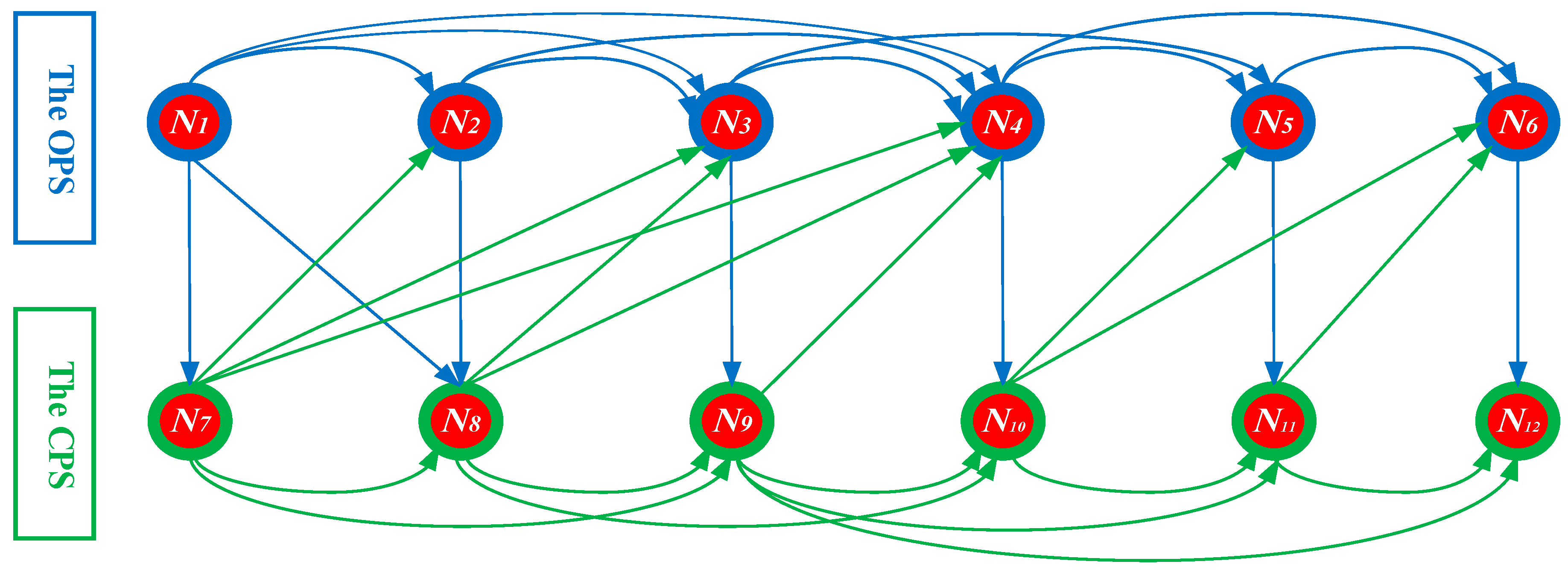

2.2. The Constructing Network

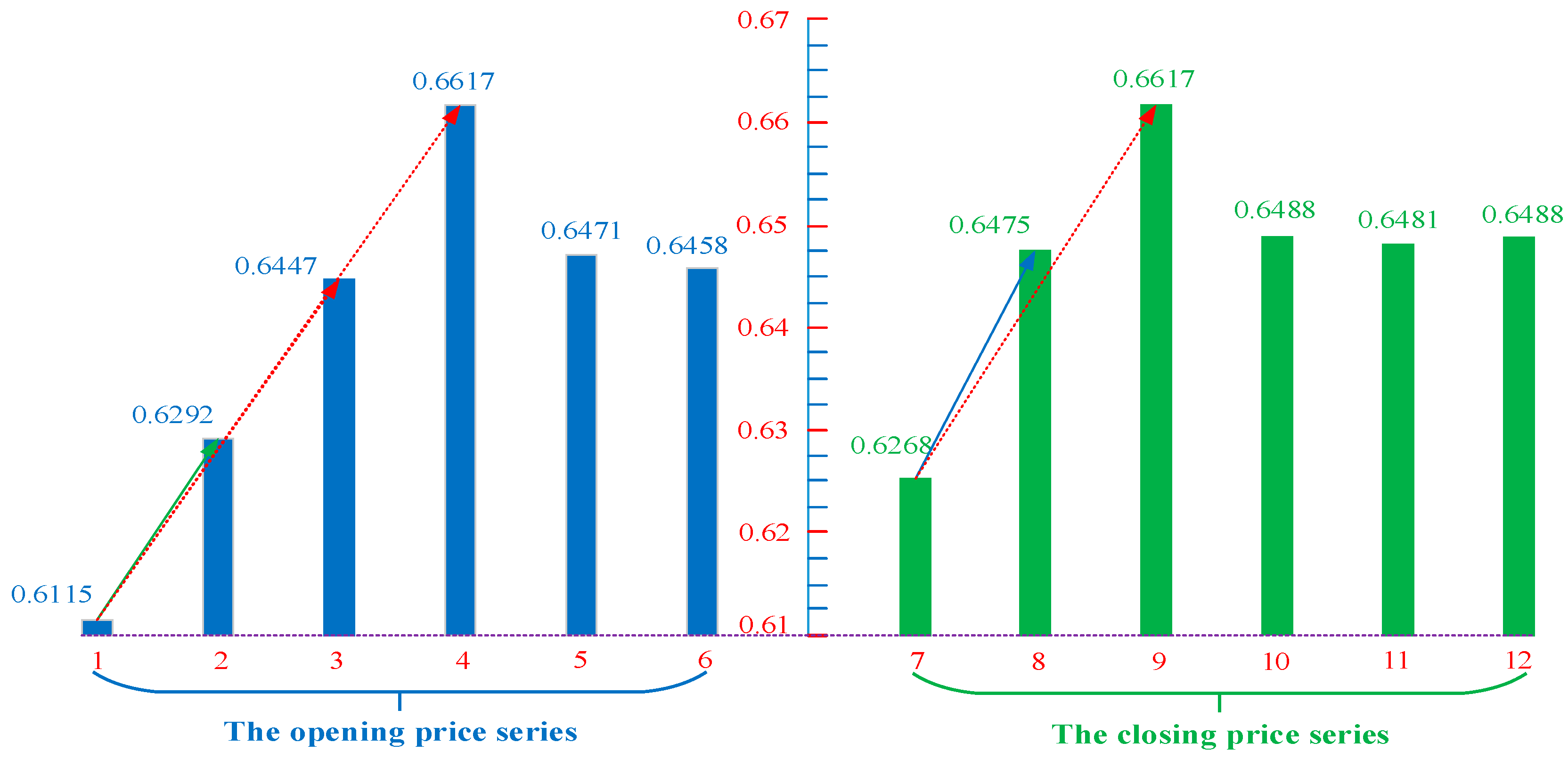

2.2.1. The Definition of the Network Node

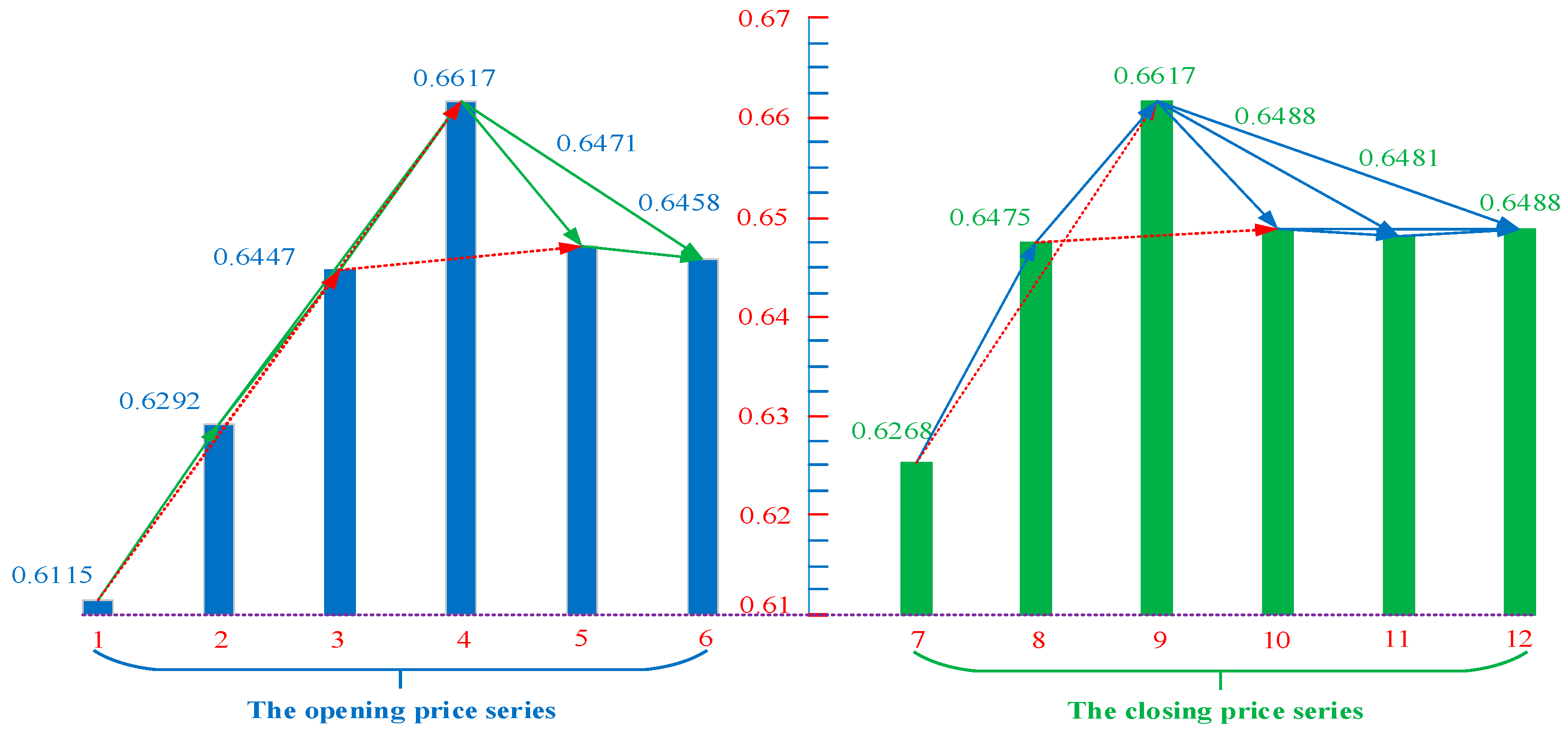

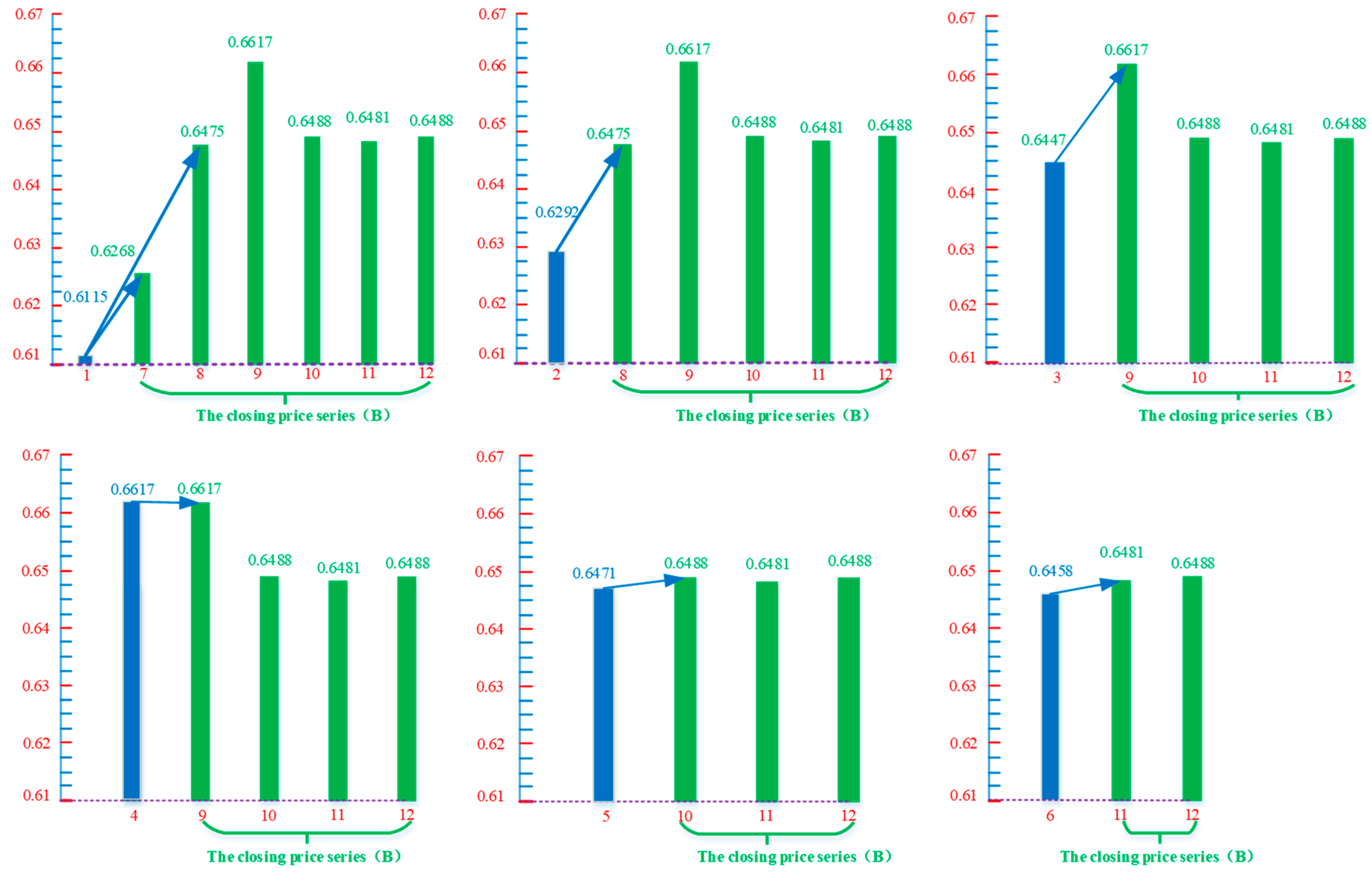

2.2.2. The Rules of the Constructing Network

| Algorhitm 1. Construction process the edge between the node (ti, Xi) and (ti+j, Xi+j), |

| 1: As for the adjacent nodes: |

| 2: for i = 1:n − 1 |

| 3: [(ti, Xi), (ti+1, Xi+1)] = 1 |

| 4: end |

| 5: As for the non-adjacent nodes, when N = 0: |

| 6: for i = 1:n − 1% Note: The adjacent nodes are visible |

| 7: [(ti, Xi), (ti+1, Xi+1)] = 1; |

| 8: for j = 2:n − i |

| 9: X1 = [Xi+j − Xi]/j; |

| 10: N = 0; |

| 11: for u = 1:j − 1% Note: Whether the node blocks the their visibility (ti, Xi) and (ti+j, Xi+j). |

| 12: X2 = [Xi+u − Xi]/u; |

| 13: if (X2 > X1) % Note: Blocked |

| 14: N = N + 1; |

| 15: [(ti, Xi), (ti+j Xi+j] = 0; |

| 16: elseif N > 1 |

| 17: break; |

| 18: end |

| 19: end |

| 20: if (N = 0) % Note: The node (ti, Xi) and (ti+j, Xi+j) are not blocked. |

| 21: [(ti, Xi), (ti+j Xi+j] = 1; |

| 22: elseif (N > = 1) |

| 23: [(ti, Xi), (ti+j Xi+j] = 0; |

| 24: end |

| 25: end |

| 26: end |

| 27: As for the non-adjacent nodes, and when N = 1: |

| 28: for i = 1:n − 1% Note: The adjacent nodes are visible. |

| 29: [(ti, Xi), (ti+1, Xi+1)] = 1; |

| 30: for j = 2:n − i |

| 31: X1 = [Xi+j − Xi]/j; |

| 32: N = 0; |

| 33: for u = 1:j − 1% Note: Whether the node blocks the their visibility (ti, Xi) and (ti+j, Xi+j). |

| 34: X2 = [Xi+u − Xi]/u; |

| 35: if (X2 > X1) % Note: Blocked |

| 36: N = N + 1; |

| 37: [(ti, Xi), (ti+j Xi+j] = 1; |

| 38: elseif N > = 2 |

| 39: break; |

| 40: end |

| 41: end |

| 42: if (N == 0) % Note: The node (ti, Xi) and (ti+j, Xi+j) are not blocked. |

| 43: [(ti, Xi), (ti+j Xi+j] = 1; |

| 44: elseif (N == 1) |

| 45: [(ti, Xi), (ti+j Xi+j] = 1; |

| 46: end |

| 47: end |

| 48: end |

2.3. The Statistical Characteristics of the DLPIN

3. Analysis of the DLPIN

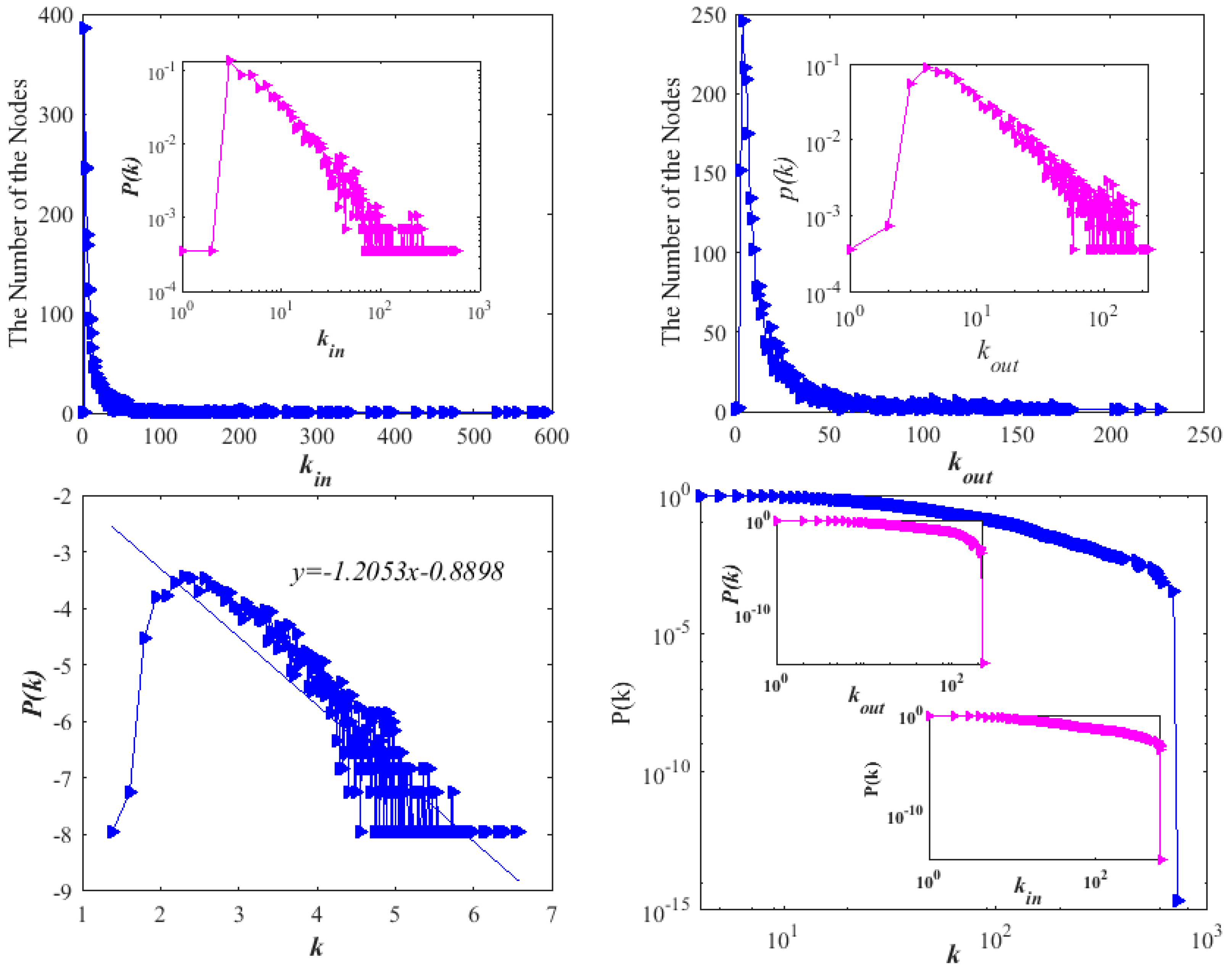

3.1. The In-Degree, Out-Degree, and Degree Distribution of the Nodes for DLPIN

3.2. The Centrality of the Nodes for DLPIN

- Betweenness Centrality (BC)The BC [35] means the ratio of the shortest path through a point, and is one of the criteria to measure the centrality of network graph based on the shortest path, the calculation of which is shown in Equation (9):where, indicates the number of the shortest path from the node to , is the number of the shortest path about the node passed by the edges of the shortest path from the node to .

- Closeness Centrality (C-C)The C-C [36] means the sum of the distances from a point to all other points. The smaller the sum, the shorter the path from this point to all other points, and the closer the point is to all other points, the calculation of which is shown in Equation (10):where, is the distance from the node to , is the number of the total nodes.

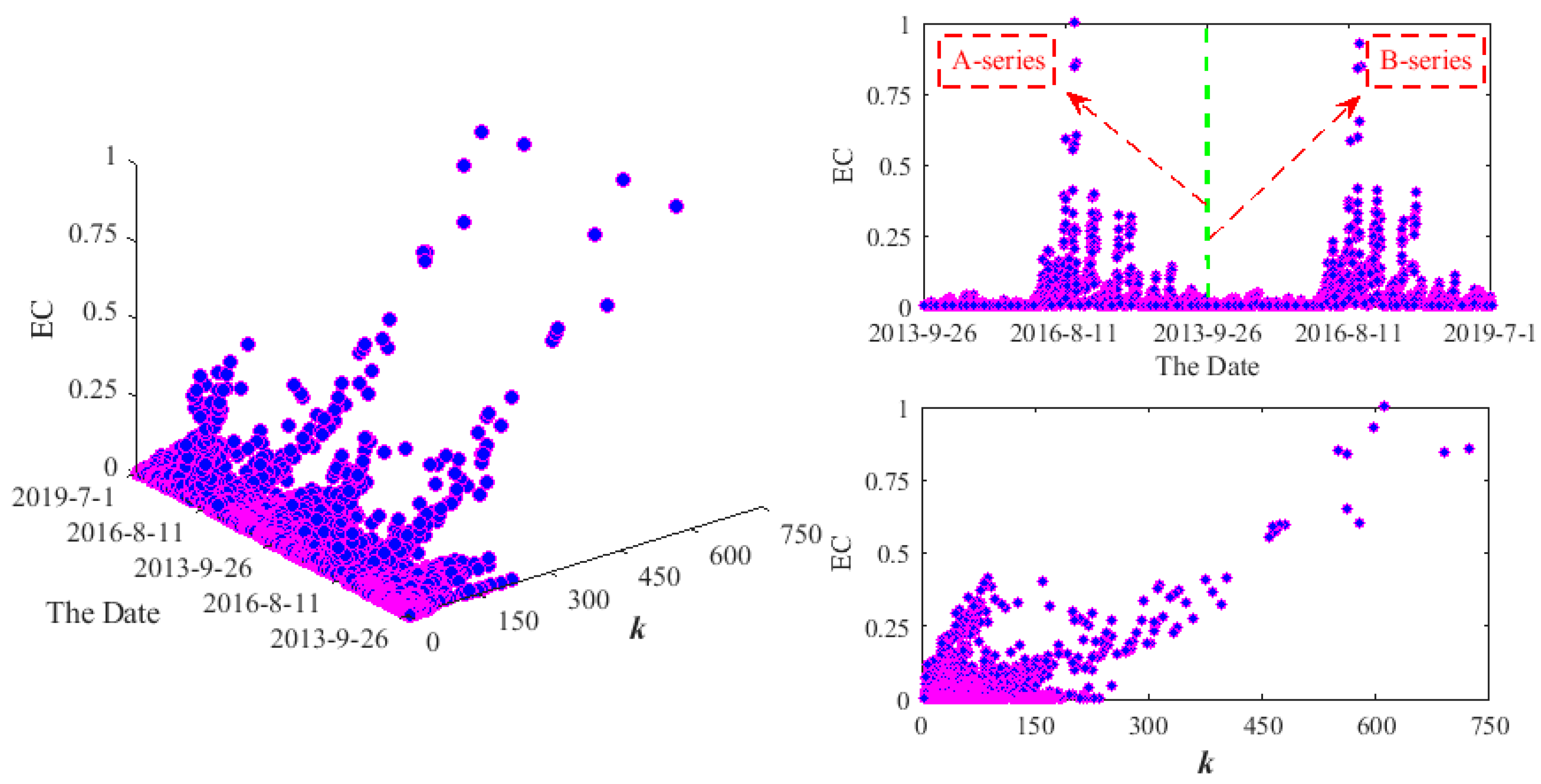

- Eigenvector Centrality (EC)The EC [37] is different from that of degree centrality. A node with a high degree centrality has many connections but the EC of the nodes is not necessarily high, because all the connecters may have low EC. Similarly, a node with a high EC is not necessarily a node with a high degree centrality, which is because it has few but very important connecters and can also have high EC, the calculation of which is shown in Equation (11):where, is the of the value of importance measure for the node , is a proportional constant, and is the element of the adjacency matrix .

3.2.1. The BC of the Nodes for DLPIN

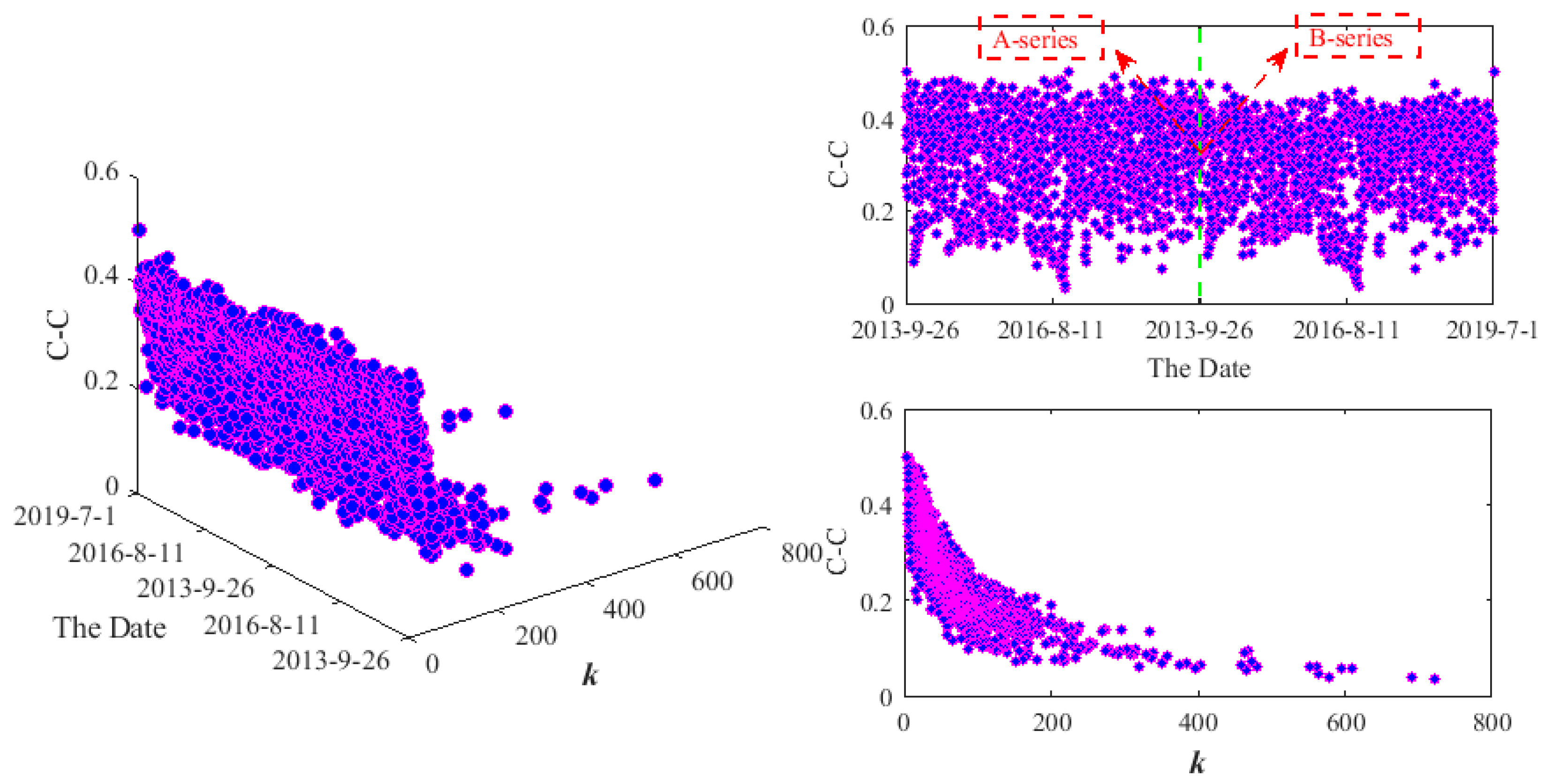

3.2.2. The C-C of the Nodes for DLPIN

3.2.3. The EC of the Nodes for DLPIN

3.3. The Clustering Coefficient (CC) of the Nodes for DLPIN

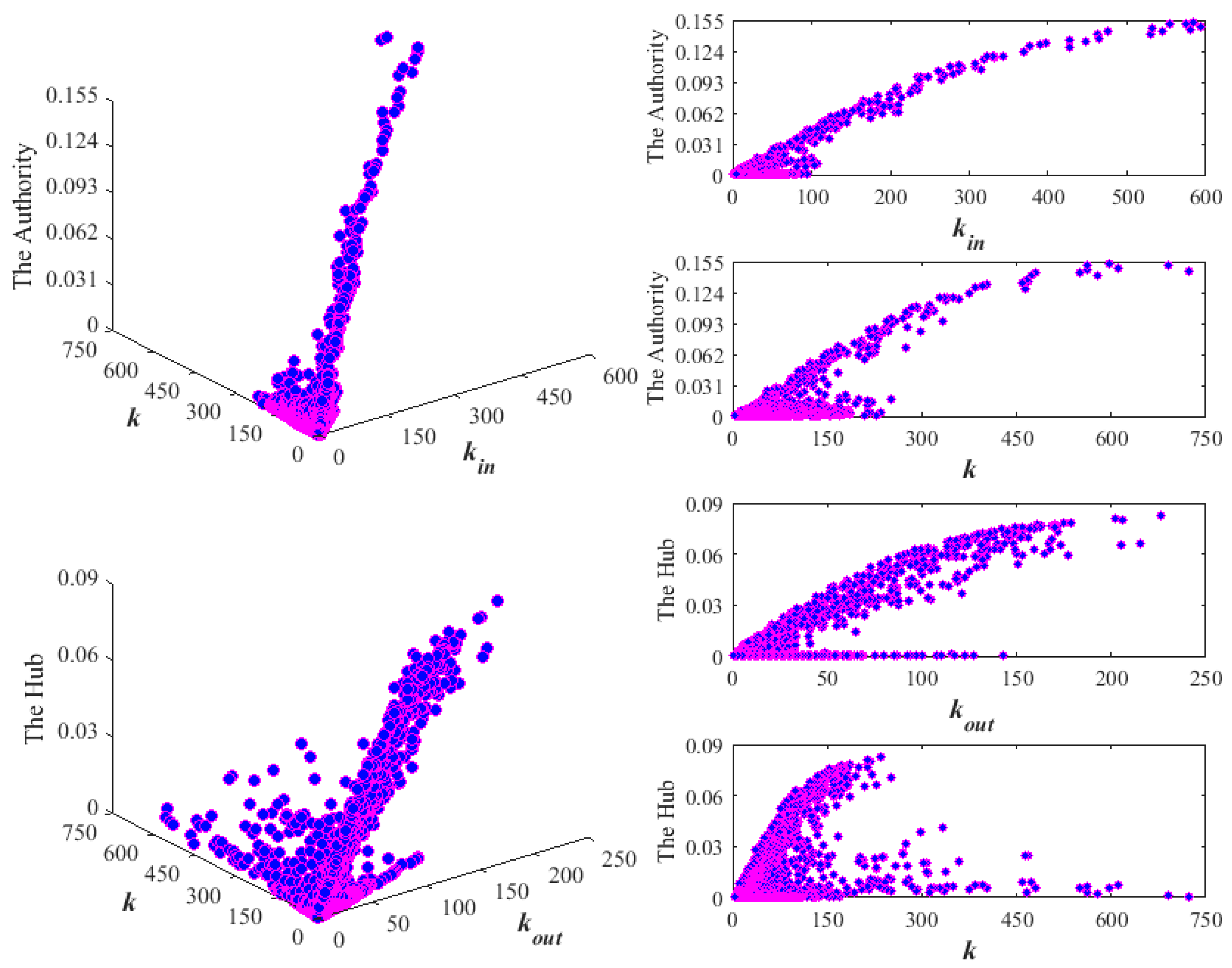

3.4. The Authority and the Hub of the Nodes for the DLPIN

- (1)

- Initial step: Let the initial value of the authority and the hub of all nodes in the network be ;

- (2)

- Iterative process: Perform the following three operations in the step ;

- The correction rules of the authority: The authority of each node is corrected to the sum of the hubs pointing to this node, as shown in Equation (12):

- The correction rules of the hub: The hub of each node is corrected to the sum of the authorities pointing to this node, as shown in Equation (13):

- Equations (9) and (10) are normalized, the pattern of which is shown in the Equation (14):

4. Summaries and Enlightenments

- (1)

- In this network, the number of the nodes with a smaller in-degree, out-degree, and degree is larger, while the number of the nodes with a smaller in-degree, out-degree, and degree is smaller, which show that there is a weak influence relationship among the most nodes, and only a few nodes have strong influence. Meanwhile, their distributions present a long tail distribution, which means that the DLPIN has an obvious scale-free feature and is a special network with a unique and complex static evolutionary feature.

- (2)

- By analyzing the information flow of the nodes in the DLPIN, it is found that some nodes have weak ability to transmit the price information, that is, they cannot transmit the received information completely, resulting in the loss of the price fluctuation information of the thermal coal, which is dependent on the thermal coal price fluctuation.

- (3)

- Most of the nodes are far from the infectious source of the price information, but only a few nodes are closer. Meanwhile, the transmission of the thermal coal price information has a certain distance, and there is a strong influence on the future price in a short distance.

- (4)

- The nodes with a larger CC generally have lower degree in the DLPIN, but a small number of the nodes with a larger CC also appear in the nodes with a larger degree, which indicates that the DLPIN is not completely random, and has the characteristics of “community” to some extent. By analyzing the CC corresponding to each time node, this paper explores the closeness of the price information, which can provide some references for the future research on the “mass generation” and information transmission for the thermal coal price information.

- (5)

- There is an obvious increasing relationship between the in-degree and authority of the nodes in the DLPIN, and between the out-degree and hub of the nodes, but there is no significant change relationship between the degree and the authority and hub.

Author Contributions

Funding

Conflicts of Interest

References

- Cui, H.R.; Wei, P.B. Analysis of thermal coal pricing and the coal price distortion in China from the perspective of market forces. Energy Policy 2017, 106, 148–154. [Google Scholar] [CrossRef]

- Ding, Z.H.; Zhou, M.H.; Ning, B. Research on the influencing effect of coal price fluctuation on CPI of China. Energy Procedia 2011, 5, 1508–1513. [Google Scholar]

- Chen, Z.M. Inflationary effect of coal price change on the Chinese economy. Appl. Energy 2014, 114, 301–309. [Google Scholar] [CrossRef]

- Guo, J.; Zheng, X.Y.; Chen, Z.M. How does coal price drive up inflation? Reexamining the relationship between coal price and general price level in China. Energy Econ. 2016, 57, 265–276. [Google Scholar] [CrossRef]

- Chen, D.; Zhou, K.; Tan, X.; Zhou, Z.X.; Shi, L.; Ma, Z. Desulfurization Electricity Price and Emission Trading: Comparative analysis of thermal power industry in China and the United States. Energy Procedia 2019, 158, 3513–3518. [Google Scholar] [CrossRef]

- Lei, Y.L.; Li, L.; Pan, D.Y. Study on the Relationships Between Coal Consumption and Economic Growth of the Six Biggest Coal Consumption Countries: With Coal Price as a Third Variable. Energy Procedia 2014, 61, 624–634. [Google Scholar] [CrossRef] [Green Version]

- Haftendorn, C.; Holz, F. Modeling and Analysis of the International Steam Coal Trade. Energy J. 2010, 31, 201–225. [Google Scholar] [CrossRef]

- Ellerman, A.D. The world price of coal. Energy Policy 1995, 23, 499–506. [Google Scholar] [CrossRef]

- Humphreys, D.; Welham, K. The restructuring of the international coal industry. Int. J. Glob. Energy Issues 2000, 13, 333–347. [Google Scholar] [CrossRef]

- Warell, L. Defining geographic coal markets using price data and shipments data. Energy Policy 2005, 33, 2216–2230. [Google Scholar] [CrossRef]

- Li, R.; Joyeux, R.; Ripple, R.D. International steam coal market integration. Energy J. 2010, 31, 181–202. [Google Scholar] [CrossRef] [Green Version]

- Ekawan, R.; Duchêne, M. The evolution of hard coal trade in the Atlantic market. Energy Policy 2006, 34, 1487–1498. [Google Scholar] [CrossRef]

- Chi-Jen Yang, C.J.; Xuan, X.W.; Jackson, R.B. China’s coal price disturbances: Observations, explanations, and implications for global energy economies. Energy Policy 2012, 51, 720–727. [Google Scholar] [CrossRef]

- Batten, J.A.; Brzeszczynski, J.; Ciner, C.; Lau, M.C.K.; Lucey, B.; Yarovaya, L. Price and volatility spillovers across the international steam coal market. Energy Econ. 2019, 77, 119–138. [Google Scholar] [CrossRef]

- Zaklan, A.; Cullmann, A.; Neumann, A.; Hirschhausen, C.V. The globalization of steam coal markets and the role of logistics: An empirical analysis. Energy Econ. 2012, 34, 105–116. [Google Scholar] [CrossRef] [Green Version]

- Krzemien, A.; Fernandez, P.R.; Sanchez, A.S.; Lasheras, F.S. Forecasting European thermal coal spot prices. J. Sustain. Min. 2015, 14, 203–210. [Google Scholar] [CrossRef] [Green Version]

- Papież, M.; Śmiech, S. Causality-in-mean and causality-in-variance within the international steam coal market. Energy Econ. 2013, 36, 594–604. [Google Scholar] [CrossRef]

- Papież, M.; Śmiech, S. Dynamic steam coal market integration: Evidence from rolling cointegration analysis. Energy Econ. 2015, 51, 510–520. [Google Scholar] [CrossRef]

- Huang, Y.H.; Wu, J.H. A portfolio theory based optimization model for steam coal purchasing strategy: A case study of Taiwan Power Company. J. Purch. Supply Manag. 2016, 22, 131–140. [Google Scholar] [CrossRef]

- Śmiech, S.; Papiez, M.; Fijorek, K. Causality on the steam coal market. Energy Sources Part B Econ. Plan. Policy 2016, 11, 328–334. [Google Scholar] [CrossRef]

- Sun, Q.; Xu, W.J.; Xiao, W.L. An empirical estimation for mean-reverting coal prices with long memory. Econ. Model. 2013, 33, 174–181. [Google Scholar] [CrossRef]

- Matyjaszek, M.; Fernández, P.R.; Krzemień, A.; Wodarski, K.; Valverde, G.F. Forecasting coking coal prices by means of ARIMA models and neural networks, considering the transgenic time series theory. Resour. Policy 2019, 61, 283–292. [Google Scholar] [CrossRef]

- Alameer, Z.; Fathalla, A.; Li, K.L.; Ye, H.W.; Zhang, J.H. Multistep-ahead forecasting of coal prices using a hybrid deep learning model. Resour. Policy 2020, 65, 101588. [Google Scholar] [CrossRef]

- Haftendorn, C.; Kemfert, C.; Holz, F. What about Coal? Interactions between Climate Policies and the Global Steam Coal Market until 2030. Energy Policy 2012, 48, 274–283. [Google Scholar] [CrossRef] [Green Version]

- Wang, S.B.; Luo, K.L. Atmospheric emission of mercury due to combustion of steam coal and domestic coal in China. Atmos. Environ. 2017, 162, 45–54. [Google Scholar] [CrossRef]

- Schernikau, L. The Global Steam Coal Market and Supply Curve. In Economics of the International Coal Trade; Springer: Dordrecht, The Netherlands, 2010; pp. 111–137. [Google Scholar]

- Li, R. The evolution of the international steam coal market. Int. J. Energy Sect. Manag. 2010, 45, 19–34. [Google Scholar] [CrossRef]

- Shao, J.; Buldyrev, S.V.; Havlin, S.; Stanley, H.E. Cascade of failures in coupled network systems with multiple support-dependence relations. Phys. Rev. E 2010, 83, 1127–1134. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Buldyrev, S.V.; Parshani, R.; Paul, G.; Stanley, H.E.; Havlin, S. Catastrophic cascade of failures in interdependent network. Nature 2010, 464, 1025–1028. [Google Scholar] [CrossRef] [Green Version]

- Johansen, S. Estimation and hypothesis testing of cointegration vectors in gaussian vector autoregressive models. Econometrica 1991, 59, 1551–1580. [Google Scholar] [CrossRef]

- Zhou, T.T.; Jin, N.D.; Gao, Z.K.; Luo, Y.B. Limited penetrable visibility graph for establishing complex network from time series. Acta Phys. Sin. 2012, 61, 355–367. [Google Scholar]

- Tang, Y.; Yi, N.; Mao, J.H. Derived network based on directed limited penetrable visibility graph for time series. J. Syst. Eng. 2017, 32, 156–162. [Google Scholar]

- Intanagonwiwat, C.; Estrin, D.; Govindan, R.; Heidemann, J. Impact of Network Density on Data Aggregation in Wireless Sensor Networks. In Proceedings of the 22nd International Conference on Distributed Computing Systems, Vienna, Austria, 2–5 July 2002. [Google Scholar] [CrossRef]

- Blondel, V.D.; Guillaume, J.L.; Lambiotte, R.; Lefebvre, E. Fast unfolding of communities in large networks. J. Stat. Mech. Theory Exp. 2008, 10, P10008. [Google Scholar] [CrossRef] [Green Version]

- Freeman, L.C. A set of centrality based on betweenness. Sociometry 1977, 40, 35–41. [Google Scholar] [CrossRef]

- Freeman, L.C. Centrality in social networks: Conceptual clarification. Soc. Netw. 1979, 1, 215–239. [Google Scholar] [CrossRef] [Green Version]

- Bavelas, A. Communication patterns in task-oriented groups. J. Acoust. Soc. Am 1950, 22, 725–730. [Google Scholar] [CrossRef]

- Wei, D.C. An Optimized Floyd Algorithm for the Shortest Path Problem. J. Netw. 2010, 5, 1496–1504. [Google Scholar] [CrossRef]

- Kleinberg, J.M. Authoritative sources in a hyperlinked environment. J. ACM 1997, 46, 604–632. [Google Scholar] [CrossRef]

| Price Series | Mean | Std. Dev | Skewness | Kurtosis | Jarque-Bera | Probability |

|---|---|---|---|---|---|---|

| Opening Price | 522.15 | 98.92 | −0.6290 | 2.3953 | 114.0466 *** | 0.0000 |

| Closing Price | 522.38 | 99.03 | −0.6265 | 2.3874 | 113.8754 *** | 0.0000 |

| Different Times | Level | First Difference | ||||||

|---|---|---|---|---|---|---|---|---|

| ADF | PP | KPSS | ERS | ADF | PP | KPSS | ERS | |

| The OPS | −1.3428 | −1.2742 | 1.9876 *** | 6.2557 | −39.3769 *** | −39.3651 *** | 0.1307 | 0.0959 *** |

| The CPS | −1.3753 | −1.2694 | 1.9941 *** | 6.0629 | −40.1153 *** | −40.1515 *** | 0.1400 | 0.1407 *** |

| Variables | Test | Hypothesized No. of CE(s) | Statistic Value | Critical Value | Prob.** | |

|---|---|---|---|---|---|---|

| 0.01 | 0.05 | |||||

| The OPS vs. the CPS | Trace | None * | 307.5460 | 19.9371 | 15.4947 | 0.0001 |

| At most 1 | 1.6982 | 6.6349 | 3.8415 | 0.1925 | ||

| Maximum Eigenvalue | None * | 305.8478 | 18.5200 | 14.2646 | 0.0001 | |

| At most 1 | 1.6982 | 6.6349 | 3.8415 | 0.1925 | ||

| Different Series | Numbers | Times | ||

|---|---|---|---|---|

| The Opening Prices Series (The OPS) | 1 | 26 September 2013 | 525.40 | 0.6115 |

| 2 | 27 September 2013 | 535.80 | 0.6292 | |

| 3 | 30 September 2013 | 545.00 | 0.6447 | |

| 4 | 8 October 2013 | 555.00 | 0.6617 | |

| 5 | 9 October 2013 | 546.40 | 0.6471 | |

| 6 | 10 October 2013 | 545.60 | 0.6458 | |

| … | … | … | … | |

| 1405 | 1 July 2019 | 605.40 | 0.7471 | |

| The Closing Prices Series (The CPS) | 1406 | 26 September 2013 | 534.40 | 0.6268 |

| 1407 | 27 September 2013 | 546.60 | 0.6475 | |

| 1408 | 30 September 2013 | 555.00 | 0.6617 | |

| 1409 | 8 October 2013 | 547.40 | 0.6488 | |

| 1410 | 9 October 2013 | 547.00 | 0.6481 | |

| 1411 | 10 October 2013 | 547.40 | 0.6488 | |

| … | … | … | … | |

| 2810 | 1 July 2019 | 598.80 | 0.7359 |

| Index Name | Corresponding Value |

|---|---|

| Total number of the edges | 68,573 |

| The average degree | 24.403 |

| The average path length | 4.397 |

| The diameter | 12 |

| The density (D(G)) | 0.0087 |

| The modularity (M) | 0.586 |

| Sort BC From Big to Small | Sort k From Big to Small | ||||||

|---|---|---|---|---|---|---|---|

| BC | k | kin | kout | k | kin | kout | BC |

| 0.0900 | 723 | 580 | 143 | 723 | 580 | 143 | 0.0900 |

| 0.0880 | 690 | 574 | 116 | 690 | 574 | 116 | 0.0880 |

| 0.0805 | 161 | 74 | 87 | 610 | 594 | 16 | 0.0043 |

| 0.0667 | 153 | 94 | 59 | 596 | 585 | 11 | 0.0028 |

| 0.0534 | 88 | 41 | 47 | 579 | 530 | 49 | 0.0339 |

| 0.0377 | 96 | 56 | 40 | 563 | 532 | 31 | 0.0266 |

| DLPIN | |||

|---|---|---|---|

| EC | k | The Nodes | Time |

| 1.0000 | 610 | N750 | 26 October 2016 |

| 0.9294 | 596 | N2154 | 25 October 2016 |

| 0.8572 | 723 | N759 | 08 October 2016 |

| 0.8495 | 551 | N749 | 25 October 2016 |

| 0.8454 | 690 | N2163 | 07 October 2016 |

| 0.8386 | 561 | N2153 | 24 October 2016 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, G.; Tian, L.; Fu, M.; Wan, B.; Zhang, W. Research on the Transmission Ability of China’s Thermal Coal Price Information Based on Directed Limited Penetrable Interdependent Network. Sustainability 2020, 12, 7815. https://doi.org/10.3390/su12187815

Zhang G, Tian L, Fu M, Wan B, Zhang W. Research on the Transmission Ability of China’s Thermal Coal Price Information Based on Directed Limited Penetrable Interdependent Network. Sustainability. 2020; 12(18):7815. https://doi.org/10.3390/su12187815

Chicago/Turabian StyleZhang, Guangyong, Lixin Tian, Min Fu, Bingyue Wan, and Wenbin Zhang. 2020. "Research on the Transmission Ability of China’s Thermal Coal Price Information Based on Directed Limited Penetrable Interdependent Network" Sustainability 12, no. 18: 7815. https://doi.org/10.3390/su12187815

APA StyleZhang, G., Tian, L., Fu, M., Wan, B., & Zhang, W. (2020). Research on the Transmission Ability of China’s Thermal Coal Price Information Based on Directed Limited Penetrable Interdependent Network. Sustainability, 12(18), 7815. https://doi.org/10.3390/su12187815