4.2. Statistical and Geo-Spatial Analysis

The analysis of the airports’ impact on the real estate market utilized several statistical models, including both OLS regression models, as well as spatial autoregression models (SAR) and geographically weighted regression models (GWR). The paper hypothesizes that airports’ locations affect prices in airports’ surroundings. Classic regression models usually ignore the spatial aspect or take it into account indirectly, hence the use of spatial models designed to help identify sources of price formation, with particular emphasis on the airport-operation related factors.

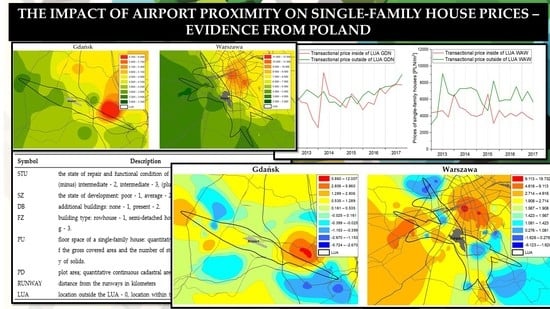

The natural logarithm of a real estate price—a developed plot with a single-family house—was adopted as the dependent variable. The log-linear model form makes it possible to take into account the relative relation (percentage) and at the same time eliminates the adverse effect of large price differentiation. Estimation results of the OLS model for the area around the Lech Walesa Airport in Gdańsk and the area around the Chopin Airport in Warsaw are shown in

Table 4.

For the OLS model developed for the area around Gdańsk airport, the statistically significant parameters with a significance level of less than 0.05 are found with the DATE, SZ, PU, PD, and LUA variables. Interestingly, the model shows that parameters related to the size of the property (PU, PD) are more important for the unit prices development rather than its technical and functional condition (STU). The parameter estimation results indicate that there is no reason to reject the hypothesis that there is no significant relationship between the distance from the runway (RUNWAY) and transaction prices. This may mean that the lower living comfort associated with airport proximity and airport noise is compensated by other factors that have a positive impact on prices (including infrastructure and a well-developed public transport network). The parameter attached to the LUA variable is noteworthy. This parameter is significant at the 0.027 significance level and its value is −0.131. This means that unit prices in the limited use area around Lech Walesa airport are slightly more than 12% lower than real estate prices outside the area. Therefore, the model suggests that prices may abruptly change at the area border, rather than in a linear manner associated with increasing distance.

For the OLS model developed for the transactional data around the Warsaw airport, the statistically significant parameters with a significance level of less than 0.05 are found with the SZ, DB, PU, and LUA variables. Although the RUNWAY variable proved to be the stimulus as expected, the parameter value of this variable was 0.068, at a significance level of 0.232, which means that there is no reason to reject the hypothesis that there is no impact of the distance from the runway on prices. The parameter value of the LUA variable of −0.345 is extremely important information. After conversion (e−0.345 − 1), this indicates that prices in the limited use area around the Fryderyk Chopin airport in Warsaw are approximately 29% lower than real estate prices outside this area.

Unfortunately, neither of the models shows a great fitting level measured by the coefficient of determination. Therefore, OLS modelling results should be approached with great caution. This problem may arise from the failure to take into account relevant spatial factors which affect prices. These factors are extremely difficult to identify. The problem’s solution may be the use of models which take into account spatial relationships directly. Therefore, the study examined the possibilities of using spatial autoregression (SAR) models. The basis for SAR model construction is the assumption that there is a significant spatial autocorrelation between the dependent variable values. This autocorrelation was examined by determining the global Moran’s

I statistics and verifying the lack of a spatial correlation hypothesis. In the global autocorrelation study, a spatial weight matrix determined on the inverse of distance was used.

Figure 7 presents the Moran plot showing the relations between price logarithms and their spatially delayed values (standardized values were used for the purpose).

The Moran’s chart indicates a slightly greater spatial autocorrelation of data for the area around the Warsaw airport; this has been confirmed by the results presented in

Table 5.

A significant positive global spatial autocorrelation was observed for both the area around the Gdańsk airport and the area around the Warsaw airport. This can be interpreted as follows—location similarity also means unit price similarity. The spatial autocorrelation occurrence may be an important premise for the spatial autoregression (SAR) models’ purposefulness. Spatial relations in spatial autoregression models may take the spatial delay model form or a spatial error model form. The Lagrange Multiplier (LM) test was thus performed to determine the correct model form. The test results are presented in

Table 6.

The analysis demonstrates that the spatial error model (RLMerr is significant, the level of significance for RLMlag is higher than 0.05) is the correct one for the area around the airport in Gdańsk. The spatial delay model (RLMerr is irrelevant, while RLMlag is important) is an appropriate form of the spatial autoregression model for the area around the airport in Warsaw.

Table 7 presents the results of the SAR models’ parameters estimation.

The preliminary SAR model assessment makes it possible to detect that they are much better data-fitted compared to OLS models. The residual standard error(RSE) may also prove that in OLS models it was 0.280 for Gdańsk and 0.473 for Warsaw. In SAR models, the deviation was 0.212 and 0.311, respectively. Both models indicate high positive spatial autocorrelation. In the case of the spatial error model for Gdańsk, the spatial autocorrelation coefficient for residuals was 0.908, in the spatial delay model for Warsaw the spatial autocorrelation coefficient for price logarithms was 0.965.

In the SAR model for Gdańsk, there is a greater number of significant parameters compared to the OLS model (furthermore, STU and DB variables parameters proved to be significant). It is worth noting that distance from the runway does not significantly affect prices, similar to the OLS model. This model indicates that the property being located in the limited use area does not significantly affect prices, either. At the same time, it is worth noting that the significant spatial autocorrelation assumption in some specific locations may not be met, e.g., in the case of real estate located near the limited use area’s border (in that case, adjacent properties sold may be located inside the LUA and outside the LUA).

In the Warsaw SAR model, the parameter values changed at the RUNWAY and LUA variables. This indicates that in this case, a significant part of the price logarithms’ variability was explained by spatial autocorrelation. The distance from the runway is a stimulus, similar to the OLS model. The parameter value at the RUNWAY variable indicates that prices decrease by approximately 11% with each kilometer away from the runway. According to the SAR model, the location in the limited use area results in a lower price decrease than in the OLS model. In this case, the price difference was about 10% (this results from the (e−0.111 − 1) × 100% = −10.5% conversion), however, with a 0.009 significance level.

Considering the specificity of the around-airports area and the diversity of factors which affect prices, the assumption that the same level of spatial autocorrelation exists throughout the analysed area may seem oversimplistic.

Figure 8 presents the spatial distribution of local Moran statistics for both Gdańsk and Warsaw. The distribution may indicate the analysed area’s heterogeneity.

As it turns out, the interpretation of both the global OLS model and SAR models may not be unambiguous, especially when we consider RUNWAY and LUA’s impact on prices. There are clear high-price clusters in the analysed area, as well as areas with negative spatial autocorrelation, i.e., high- and low-price real estates are adjacent. Therefore, another hypothesis was put forward during the study—the airport’s impact is not uniform throughout the entire analysed area, which means that the impact of both distance from the runway and location in the limited use area may differ depending on the specific location. The use of geographically weighted regression models (GWR) may offer the solution to the problem of individual variables’ impact depending on the location.

The same variables set from the areas around Gdańsk and Warsaw airports were used for GWR modelling. The overall modelling results for both areas are shown in

Table 8.

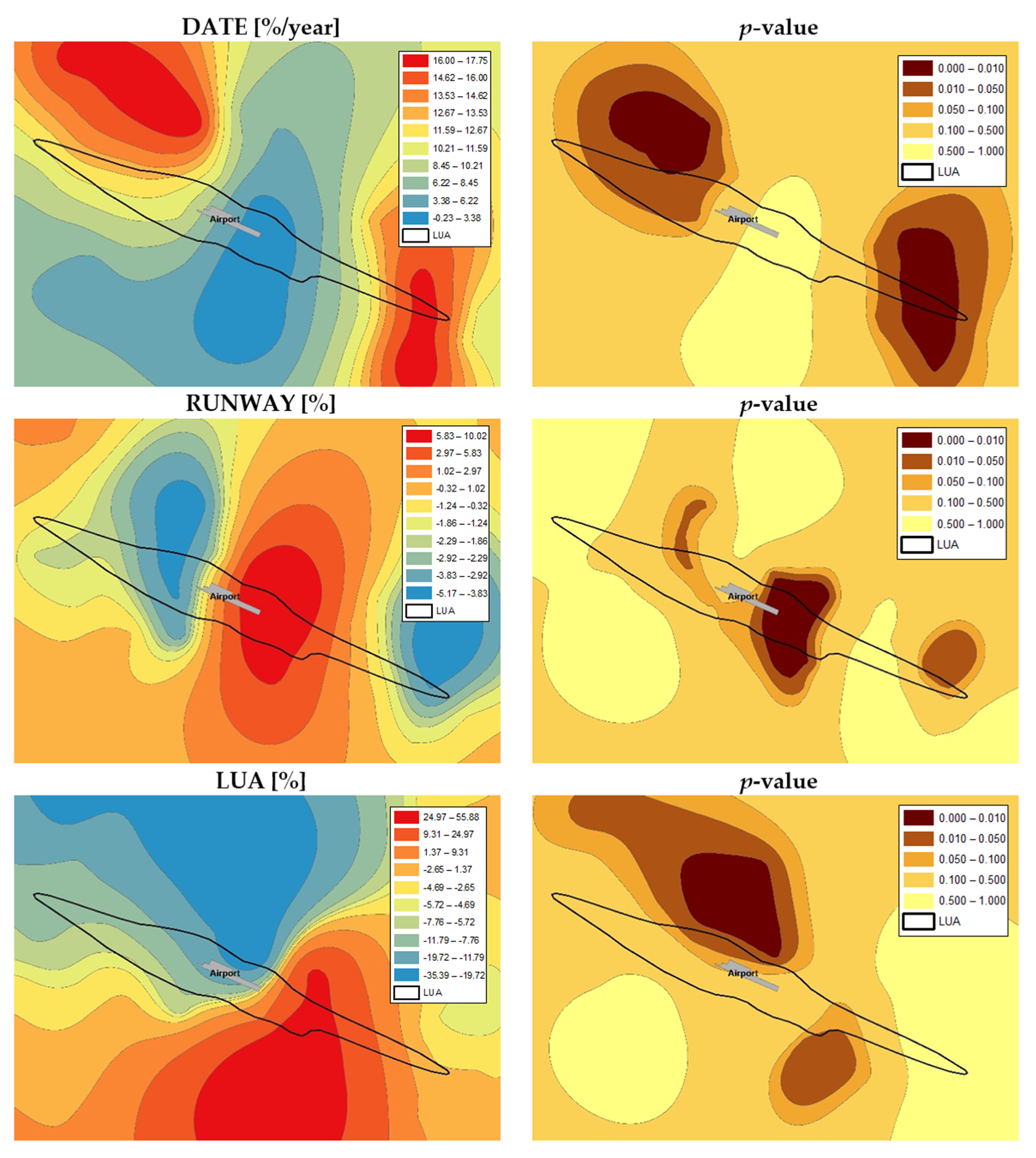

In the spatial analysis of the airports’ impact on prices, the DATE, RUNWAY, and LUA variables may be of particular importance. The spatial distribution of the parameter at the date of the transaction variable may indicate locations where the price change rate differs from the price change rate in neighboring areas—taking into account the airport location, this may lead to conclusions about the airport’s impact on the price-change trend. For the sake of interpretation clarity, this trend is presented as a percentage change on an annual basis.

Figure 9 shows the spatial distribution of the three variables for the area around the airport in Gdańsk along with the distribution of the significance level.

The highest price-change trend value was recorded in the northwest and southeast parts of the analyzed area. Significant values (with a significance level lower than 0.05) relate to the ends of the limited use area. However, it can be concluded that the overwhelming area of significant price increase is located outside the LUA. This may be treated as indication that this area may in a way negatively affect prices. The result of the spatial analysis of the RUNWAY variable’s impact on prices is interesting. This variable is a price stimulus in the majority of areas and its impact decreases with distance. This parameter changes quite rapidly in the direction consistent with the shape of the limited use area’s boundaries. The significance distribution map indicates that the distance from the runway and thus the price change occurs only in the immediate airport vicinity and in limited housing estates areas located in the LUA vicinity. The values presented on the spatial distribution map of the parameter at the LUA variable can be interpreted as showing that a potential change in the limited use area boundaries would result in a change in prices corresponding to the parameter value in a given location. These values are positive in the southern part, while in the northern part, towards the city center, the impact is negative. The area is directly adjacent to the airport itself where the influence of the parameter related to the LUA variable is statistically significant. This area could potentially experience the negative effects of restrictions related to the introduction of a limited use area and maximum permitted aircraft noise.

Figure 10 shows the spatial distribution of parameter values at the DATE, RUNWAY, and LUA variables for the area around the airport in Warsaw along with the distribution of the significance level.

The spatial distribution of the variable at the date of the transaction indicates that there are significant price drops near the airport. As the distance from the airport grows, the rate of price decline decreases. At the ends of the limited use area, this trend is positive. It can therefore be concluded that there is a fundamental relationship between distance from the airport and the rate of price changes. The significance level of spatial distribution indicates that a significant, negative trend is primarily attached to areas within a c.a. 3 km radius from the airport. At the same time, it is not correlated with the limited use area’s boundaries’ shape. It can be concluded, based on the parameter value distribution at the RUNWAY variable, that the strength of influence of the distance from the runway decreases with distance, which means, for example, that the assumption of a linear nature of relations in the OLS and SAR model is not fully met. However, when attention is paid to the spatial distribution of the significance level, the parameter controlling the influence of the distance from the runway turns out to be statistically significant only in certain small areas which can be compared to islands. This may be related to the surrounding built-up nature, the occurrence of open areas and thus, certain areas’ greater exposure to aircraft noise. The spatial distribution of the parameter at the LUA variable indicates primarily the possibility of price changes in areas at risk of aircraft noise. This parameter’s substantive interpretation is somewhat difficult to carry out because it indicates price differences within and outside the LUA, determined for data located in a radius equal to the bandwidth calculated based on the Akaike information criterion minimization (in this case the radius was 7930 m). However, for the area around the Gdańsk airport, this may mean a price change accompanied by a potential change in the LUA boundaries. Based on the spatial distribution of the level of significance, it can be concluded that the area of significant impact of this variable extends primarily west of the airport and covers strongly urbanized areas towards the city centre.

Analysis of the airport vicinity’s impact with the use of GWR models makes it possible both to identify factors which affect the price level and to determine their spatial distribution and to indicate locations where this impact is significant. The GWR models’ validity is also confirmed by a comparative analysis of the criteria fit of particular models used in the research.

Table 9 presents selected criteria for OLS, SAR, and GWR model assessment.

The least-squares fit of GWR models is much better than of OLS models, especially for the area around the Warsaw airport. Additionally, information criteria (AIC) indicate that spatial models reflect the analyzed relations better than global OLS models. It is also worth noting that the GWR models have the smallest residual standard error (RSE). The analyses lead to the conclusion that geographically weighted regression models are purposefully used to analyze the airport vicinity’s impact on prices of residential real estate.