4.1. Sustainable Investing Model SIM

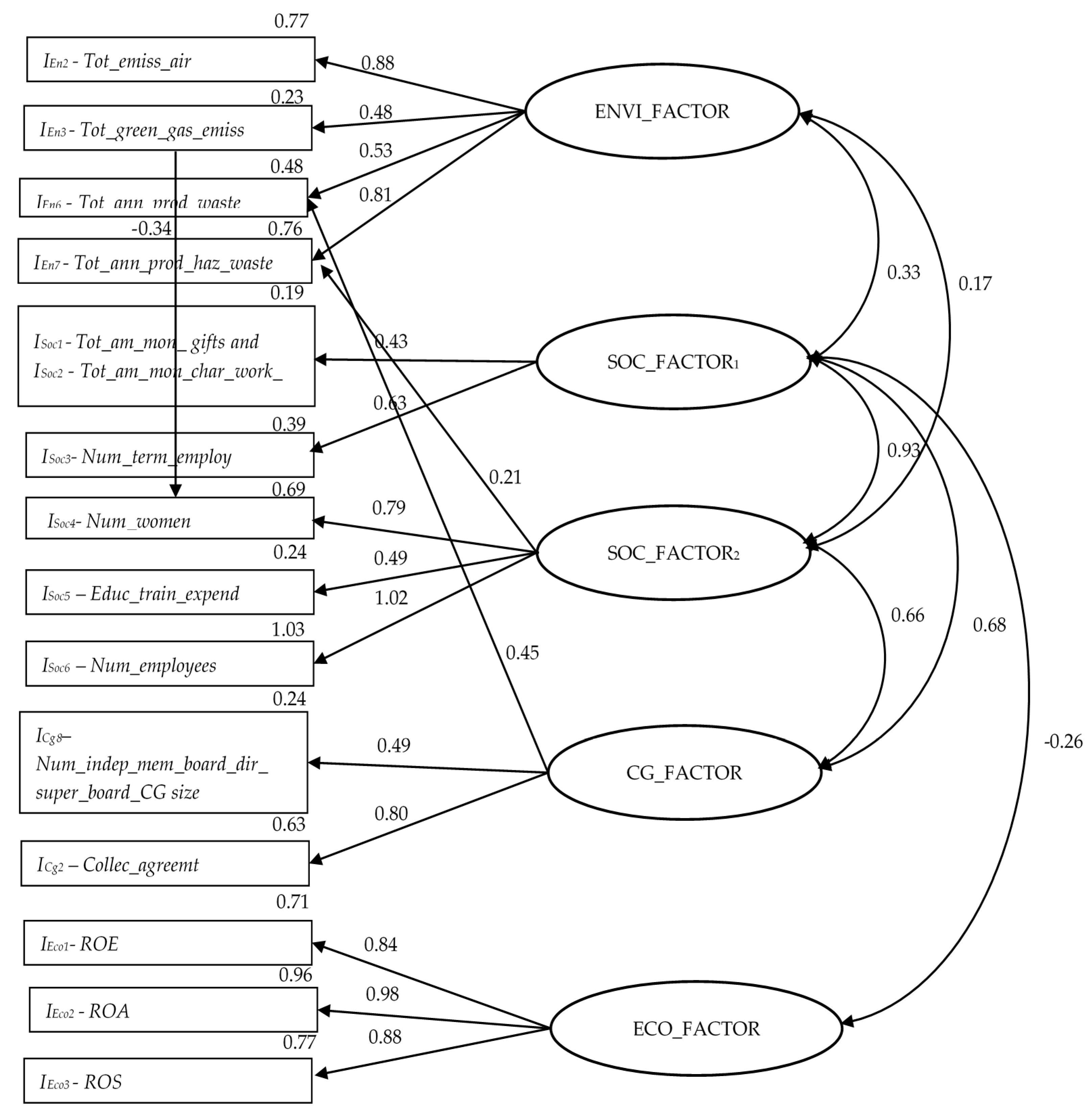

The indicators “Market Value of the Stock (MV)” and “Risk”, which were tested in the structural model on the basis of the formulated hypotheses H1–H4 shown in

Figure 1, were added to the ESGE

M model.

Furthermore, correlation relations between individual latent variables were replaced by regression relations. In terms of the social factor, regression relations were added: ENVI_FACTOR to SOC_FACTOR1; SOC_FACTOR

1 to SOC_FACTOR

2; and additional regression relationships were added: CG_FACTOR to SOC_FACTOR

2, CG_FACTOR to ECO_FACTOR; SOC_FACTOR

1 to ECO_FACTOR. The SPSS Amos 26 software program was used to calculate the parameters of the model. The model of the structure of relations is expressed in

Figure 3 and consists of the ESGE

M model and the relationship model, which graphically illustrates the regression relationships of ESG and economic factors to “Market Value of the Stock (MV)” and “Risk”.

For clarity, correlations between residual variables (errors) e1–e19 were omitted. The numerical values shown in the graph are standardised values of the structural coefficients for each regression relationship, and above each endogenous variable there are the values of the square of the coefficients, which determine how much variability of the variable is explained by the bound exogenous variable. The χ

2 good agreement test worked out at 104,521; the number of degrees of freedom was df = 76 and the

p-value 0.017 (

p > 0.05); this meant that it was statistically insignificant, which meant that the model corresponded to the measured data. Other model characteristics are shown in

Table 3.

The model included four areas and worked with the following factors and their measurable indicators,

Appendix A Table A2.

When optimising the structural model, some statistically insignificant regression relations were excluded (ENVI_FACTOR→MV, ENVI_FACTOR→Risk, ENVI_FACTOR→ECO_FACTOR, SOC_FACTOR1→Risk, SOC_FACTOR2→MV, SOC_FACTOR2→ECO_FACTOR).

4.2. Hypothesis Testing in the Sustainable Investing Model SIM

In the resulting structural model of

Figure 3, hypothetical relationships related to environmental, social, corporate governance and economic factors were tested. In addition, because of the bifurcation of the social factor in the model, a strong significant relationship emerged between SOC_FACTOR

1 and SOC_FACTOR

2 (standardized regression coefficient 0.76). In addition to the hypotheses in the model, regression dependences between ENVI_FACTOR and SOC_FACTOR

1 (standardised regression coefficient 0.24) and CG_FACTOR and SOC_FACTOR

2 (standardised regression coefficient 0.34) turned out to be statistically significant. The results of testing individual hypotheses follow, and

Table 4 summarises the results of testing hypotheses and other regression relationships of the structural model.

Hypothesis 1a (H1a). Companies with better social performance have better economic performance.

The effect of both SOC_FACTOR1 and SOC_FACTOR2 on ECO_FACTOR was tested. The relationship between SOC_FACTOR2 and ECO_FACTOR proved to be statistically insignificant. SOC_FACTOR1, in contrast to SOC_FACTOR2, showed a statistically significant negative relationship to ECO_FACTOR; the standardised coefficient was −0.28. This negative relationship was due to the fact that if the turnover of employees increases sharply and the financial amounts for gratuitous performance and public benefit activities in support of the local community increase proportionally, the economic performance of the company will not decrease. The hypothesis that better social performance improves economic performance was not confirmed.

Hypothesis 1b (H1b). Companies with better environmental performance have better economic performance.

The relationship ENVI_FACTOR→ECO_FACTOR proved to be statistically insignificant. The direct influence, i.e., the hypothesis that the environmental performance factor has a positive effect on the economic performance factor of the company, was not confirmed. The hypothesis was not confirmed.

Hypothesis 1c (H1c). Increased acceptance of corporate governance performance improves economic performance.

The relationship CG_FACTOR→ECO_FACTOR proved to be statistically significant, with a standardised coefficient of 0.34. This means that with a higher number of independent members on the board of directors and the supervisory board and with compliance with the conditions in the collective agreement, the economic performance given by the indicators ROE, ROA, and profit margin will improve. The hypothesis was confirmed.

Hypothesis 2a (H2a). Social performance has a positive effect on the growth of the stock market value.

The influence of SOC_FACTOR1 and SOC_FACTOR2 on the growth of the market price of the stock was monitored within this hypothesis. The dependence of the MV indicator on SOC_FACTOR2 was insignificant. The number of employees, human rights given by equal opportunities, and education did not affect the growth of the market value of the stock. For SOC_FACTOR1, the dependence was significant (standardised coefficient was 0.26); the MV was affected by lower employee turnover and optimised financial amounts for gratuitous performance and for public benefit activities in support of the local community. The hypothesis was partially confirmed.

Hypothesis 2b (H2b). Environmental performance has a positive effect on the growth of the stock market value.

ENVI_FACTOR was tested in relation to MV. The environmental factor had no direct positive effect on MV. The hypothesis was rejected.

Hypothesis 2c (H2c). Increased acceptance of corporate governance strengthens the market value of the stock.

The CG_FACTOR→MV relationship showed a statistically significant negative relationship, with a standardised coefficient of −0.71. This negative relationship was due to the fact that if the number of independent members on the board of directors and the supervisory board is equal to or lower than the total number of CGs and the company does not have a collective agreement, it has a negative impact on MV. The hypothesis that better acceptance of corporate governance improves the MV was not confirmed.

Hypothesis 2d (H2d). Increased economic performance strengthens the market value of the stock.

The relationship ECO_FACTOR→MV proved to be statistically significant, with a standardised coefficient of 0.31. This means that better economic results given by the indicators ROE, ROA, and profit margin will have a positive effect on the growth of the market value of the stock. The hypothesis was confirmed.

Hypothesis 3a (H3a). Increased acceptance of corporate governance reduces the risk.

The CG_FACTOR →Risk relationship showed a statistically significant negative relationship, with a standardised coefficient of −0.34. This negative relationship was due to the fact that if the number of independent members on the board of directors and the supervisory board is equal to or lower than the total number of CGs and the company does not have a collective agreement, it has a negative impact on risk. The hypothesis that better acceptance of corporate governance will reduce risk within this hypothesis was not confirmed.

Hypothesis 3b (H3b). Increased social performance reduces the risk.

The dependence of the Risk indicator on SOC_FACTOR1 was insignificant and the dependence on SOC_FACTOR2 was significant (the standardised coefficient was 0.23). Employee turnover and financial amounts for gratuitous performance and for public benefit activities in support of the local community do not have an effect on reducing risk, but the direct impact on company risk is influenced by the number of employees, education costs, and equal opportunities. The hypothesis was partially confirmed.

Hypothesis 3c (H3c). Environmental performance reduces the risk.

ENVI_FACTOR was tested in relation to Risk. The environmental factor did not have a direct effect on the company’s risk given by the CAPM model. The hypothesis was rejected.

Hypothesis 4 (H4). Stable risk increases the market value of the stock.

Relationship of Risk→MV showed a statistically significant negative relationship, with a standardised coefficient of −0.26. This negative relationship occurs when the Risk of the company is not stable, and thus the market value of the stock will not increase. In this case, the hypothesis that stable Risk will increase the market value of the stock was not confirmed.

In the structural model, the indirect effects of ENVI_FACTOR→ECO_FACTOR and SOC_FACTOR2→MV were investigated. Although the hypothesis describing the direct relationship between SOC_FACTOR2→MV was rejected, they indirectly affected the market value of the stock through the Risk posed by the CAPM model.

ENVI_FACTOR (emissions, greenhouse gas emissions, waste, including hazardous waste) indirectly affected economic indicators (ECO_FACTOR) through SOC_FACTOR

1 (staff turnover and financial amounts for gratuitous performance and for public benefit activities in support of the local community). These overall indirect relationships are described in

Table 5.

4.4. Determining the Classification Scale of Areas of the Sustainable Investing Model (SIM)

To apply the model of sustainable investing SI

M, it was necessary to create a classification scale for individual areas (factors)—environmental, social, corporate governance and economic—in accordance with the structural model of sustainable investing SI

M, and to set benchmarking for these areas so that it is applicable to investor decisions on sustainable investment,

Appendix A Table A3. The classification scale (limits) was determined using medians and percentiles, factor values, factor scores, Equations (1)–(4) were used. The basic database thus consisted of 121 cases, which were used for benchmarking, see

Table 6, where the mean, median, standard deviation, maximum and minimum values are expressed.

The classification scale included three groups: the group “above average” corresponded to a percentile of 75%, the group “average” corresponded to a percentile of 50%, and the group “below average” corresponded to a percentile of 25%, see

Table 7.

The evaluation of a company in terms of sustainable investing was defined by three groups of the classification scale,

Appendix A Table A4.

Through a classification scale of three groups, a quick orientation of the investor was then enabled in the evaluation of individual areas (environmental, social, corporate governance and economic) in relation to sustainable investments: whether the company fell into the below-average, average, or above-average group and whether sustainable investment was appropriate.

4.5. Verification of the Sustainable Investing Model (SIM)

The aim was to apply the proposed SIM to existing Czech joint-stock companies and present its outputs. The companies concerned were joint-stock companies of the manufacturing industry (engineering, food, and chemical) from the research sample belonging to the groups CZ-NACE 25 Production of metal structures and metal working products excluding machinery and equipment (Česká Zbrojovka, a.s.); CZ-NACE 10 Production of food products (Madeta, a.s.); and CZ-NACE 20 Production of chemicals and chemical preparations (Fosfa, a.s.). These companies pay attention to the social and environmental aspects of their business (reporting in the financial statements and on their websites). They also cooperate with research institutes in the Czech Republic and abroad; they are also active in professional publishing.

The mathematical model SI

M for the period 2015–2018 was tested on selected Czech joint-stock companies. The SI

M provided investors and company owners with evaluations in individual areas—ESG and economic—and in individual years. It also made it possible to compare individual areas with the classification scale according to

Table 7. The outputs of the performed analysis are shown in

Figure 4,

Figure 5 and

Figure 6.

The joint-stock company Česká zbrojovka, a.s., reached the highest, “above average” evaluation in the environmental and social area throughout the entire period. In the environmental area, the company took a responsible approach to the impacts polluting the environment by reducing emissions to air, waste, and greenhouse gases. In the social area, the company intensively focused on reducing employee turnover, human rights represented by equal opportunities, and employee education; it financially supported public benefit activities. Corporate governance and the economic area belonged to the “average” evaluation due to the structure of members of the board, where members were only employees of TOP management. Fluctuations in the economic area in the period 2015–2018 were mainly influenced by sales and profit/loss for the accounting period, which were related to profitability indicators. From the point of view of investors’ decisions, a suitable sustainable investment can be considered if the economic and corporate governance area improve,

Figure 4.

The joint-stock company Madeta, a.s., reached the “average” evaluation in the environmental area and in corporate governance throughout the entire period. Only the social area belonged to the “above average” evaluation. In the economic area, it achieved lower, “below average” results in the evaluation for the period 2015–2017; fluctuations occurred in 2018, when it achieved the highest, “above average” evaluation. From the point of view of investors’ decisions, it is not yet a suitable sustainable investment,

Figure 5.

The joint-stock company Fosfa, a.s., reached the highest, “above average” evaluation in the environmental and social area throughout the entire period. Corporate governance and the economic area fell into the “average” evaluation. From the point of view of investors’ decisions, a suitable sustainable investment can be considered if the economic and corporate governance area improve,

Figure 6.

The above graphic outputs of the proposed SIM informed investors of the evaluation of sustainable investment in four areas: environmental, social, economic and corporate governance given by the factors: ENVI_FACTOR, SOC_FACTOR1, SOC_FACTOR2, CG_FACTOR, and ECO_FACTOR. Graphical expression of area values in the context of their classification scale made the outputs of the SIM clear and easy to understand, as it was clear from a single point of view which areas in terms of the overall evaluation of sustainable investments were positive and which were negative. The outputs of the SIM then served as a basis for investors when deciding on sustainable investments and the opportunity to create a portfolio of these investments. The SIM enabled investors to identify weaknesses in individual areas, quantify their size, and decide on sustainable investments.