A twenty-three-year panel dataset of fifteen developing economies of Asia was taken from 1990 to 2013. The primary source of this dataset is “World Development Indicators.” This dataset has been divided into two income categories classified by World bank 2021. Here, Nepal, Bangladesh, India, Mongolia, Pakistan, Philippine, Vietnam, and Sri Lanka sorted out as lower-middle-income economies. At the same time, China, Iran, Jordan, Malaysia, Thailand, Turkey, and Indonesia are upper-middle-income economies [

33]. This study is based on two different methods of research. First, the ARDL method of econometrics utilizes the EKC theory of environment and economic growth. Secondly, the DEA method of operational research to assess the energy efficiency of underline countries.

2.2. Hybrid Error Correction Model

The Error Correction Model might show an error correction of the first difference exclusively, which is as follows:

Error Correction Model can use for quantitative computation, and it is necessary to point out that it is the base of the Auto Regressive Distributive Lag Model (ARDL). We have used the Error Correction Model to condition that, if the ARDL sum coefficient is equal to 1, by decreasing the constant terms. Consequently, the coefficient of error correction term long-run association can attain if and only if the transformation at term grows at the constant rate, N. Hence, the coefficient mathematical model Error Correction Model can be presented as:

The proposed term

is deducted from the ARDL both sides:

Through addition and deducting

in the right-hand side of the mathematical model. The new equation is as follows:

or

To fulfill the condition of the Error Correction Model, the coefficient (

must be analogous to the deducted coefficient

. So, the newly construed mathematical model is as follows:

Consequently, the term of error correction constant considers as:

If the variation in constant term increases at a continuous rate N, the association of the long-run phenomena is:

then the original order having and without having the value of log is considered as:

If we take the log from both sides, then it will be as:

Through using the anti-log of the new model, the long run will consider:

where K represents the association between the variable Y and Z, the Error Correction Model is being used to measure the long-run relationship, and the Error Correction Model characterizes the previous imbalance in an existing factor. It can be:

2.3. Model Specification of DEA

DEA (Data Envelopment Analysis) is one of the many techniques for efficiency assessment. However, there are the following advantages to use the DEA method.

Simultaneous analysis of outputs and inputs

It is not necessary, a Priori, to define the frontier form

Relative efficiency compared to the best observation

Need no information on price

Let

be the set of “n” environmental variables aimed at entity

. Environmental index (EVI) develops through underlying variables for each entity. Ranking the environmental performance of various entities is a general practice to develop an environmental index. It can differentiate with a choice of ordering

) defined on Rn. Therefore, the EVI can demonstrate through a mapping function such that

, which satisfies

The assessment of each fundamental variable, which can represent through the function of the transformation unit, may be improved

such that

As pointed out by [

37] and [

38], an admissible transformation engages extension and translation in such a way that

In correspondence with EVI, the order of various underlying entities which are expected to be chosen as inconsistent and associated with any acceptable conversion and transformation of fundamental factors being assessed in construction of EVI.

The geometric mean proved to choose with a useful index with strictly positive and ratio-scale variables—criteria for information loss in the direction of alternate combination techniques designed to develop indices [

39]. The author of [

40] used a non-compensatory approach of aggregation and discussed its usefulness. A nonparametric DEA methodology identifies a good frontier practice using a linear programming approach. It measures the comparative efficiency of underlying indicators based on outputs and inputs from comparable and measurable entities [

41]. The DEA study by [

42,

43] used to measure the energy system performance, environmental performance, and productivity of different entities or decision-making units.

DEA’s traditional use to measure environmental performance takes the difference between a good and a lousy output. For performance assessment, [

42] introduced a fundamental academic foundation, which was the reason for the nonparametric DEA frontier practice’s popularity to measure the wrong outputs. The vector

is replaced by

(xk1,⋯, xkm, yk1,⋯, yks) to differentiate between inputs and outputs, where

and

are input and output vectors, respectively. The input vector

=

is used to produce the output vector

. = (

. The inputs are X ∈

and the outputs are Y ∈

As a result, the production is the set of a potential combination of inputs and outputs:

In Equation (24) with constraint, the range-adjusted DEA model can be as follows:

the

is the i-th input and

is the r-th output for entity

and

show the ranges for output

r and input

i, which can be defined as:

=

The additive DEA model’s objective function is the inefficiency measurement of the entity’s slack-based values, which can use to measure energy efficiency. The constraints decide the maximum possible reduction form the maximum reduction and the recognized extension in inputs and outputs. A variable having zero to one shows that all the entities have zero value to exclude in EVI. It is necessary to separate the relevant constituent in the objective function (Equation (25) while an equivalent restraint is required. The final constraint

appears to be a convexity situation, ensuring that the ratio-scale measurement units do not vary in the objective function. Any permissible conversion for the original factors,

major attention on slacks accommodate the shifting parameter and the scaling factor

can be controlled through the adjustment range. After getting the optimal solution form Equation (25), the environmental index can define as:

* shows the variable of consistent optimum slack. The EI derived from Equation (26) satisfies the following properties [

44]:

P1.0 ≤ EI ≥1;

P2.EI (V0) = 1 ⇔ Entity o is situated on the best practice frontier;

P3.EI (V0) is inconsistent with the measurement units of outputs and inputs;

P4.EI (V0) contains the properties of strongly monotonic;

P5.EI (V0) is a conversion invariant.

P1 represents that Equation (26) provides a standardized index between 0 and 1, while the higher values are associated with better performance.

P2 shows that the underlying entities are essential to developing the best frontier practice with index values less than 1. It can see from Equation (27) that the identification of underlying entities determines the frontier of best practice associated with non-zero Zk, which are determined by the employed model.

P3 shows that the EVI index values are invariant through the ratio of scale dimension variables.

P4 demonstrates that a decrease in any input or any output causes the highest index value.

P5 translates that the addition and subtraction of constants through any variables do not impact indexes’ values, especially after the interval-scale factors encompassed in constructing EVI [

45]. In Equation (27), the normalization of linear min-max is accepted, while the normalized weighted version of underlying factors for all the entities is not. Indeed, the mentioned practice makes Equation (27) feasible, resulting in the ease of assessing the environmental index. However, [

46] highlighted that the weighted sum aggregation rule presupposed the full compensability among underlying variables that are fully replaceable with each other [

47]. Since various dimensions of underlying variables are not entirely replaceable with each other, the assumption may not be appropriate for measuring an environmental efficiency index [

48].

For now, exact preference and equal weights do not provide insights and robust results. Due to the standard weights associated with each dimension, it is considerably hard to achieve a consensus. Therefore, this study provides an insight into the virtue of the nonparametric frontier method through an apprehensive environmental perspective. In contrast, commonly used inputs, such as capital and labor, may not be incorporated to construct the development of EVIs.

Generally, [

49] excluded inputs to develop an environmental efficiency index since it generates per unit of lousy output. In this study, the wrong outputs are considered inputs as they both indicate the cost type, which implies that they follow the properties of “smaller the best.” Considering the view, this study treats energy consumption as input and assumes that it would also follow the “smaller the best,” considering the sustainable environment. Based on diversification indices that measure risk-free energy supplies by assuming that riskier energy supplies pose a more significant threat to energy security while at the same time reducing the energy security impact on energy efficiency and energy intensity. Therefore, risk-free energy supplies need to assess.

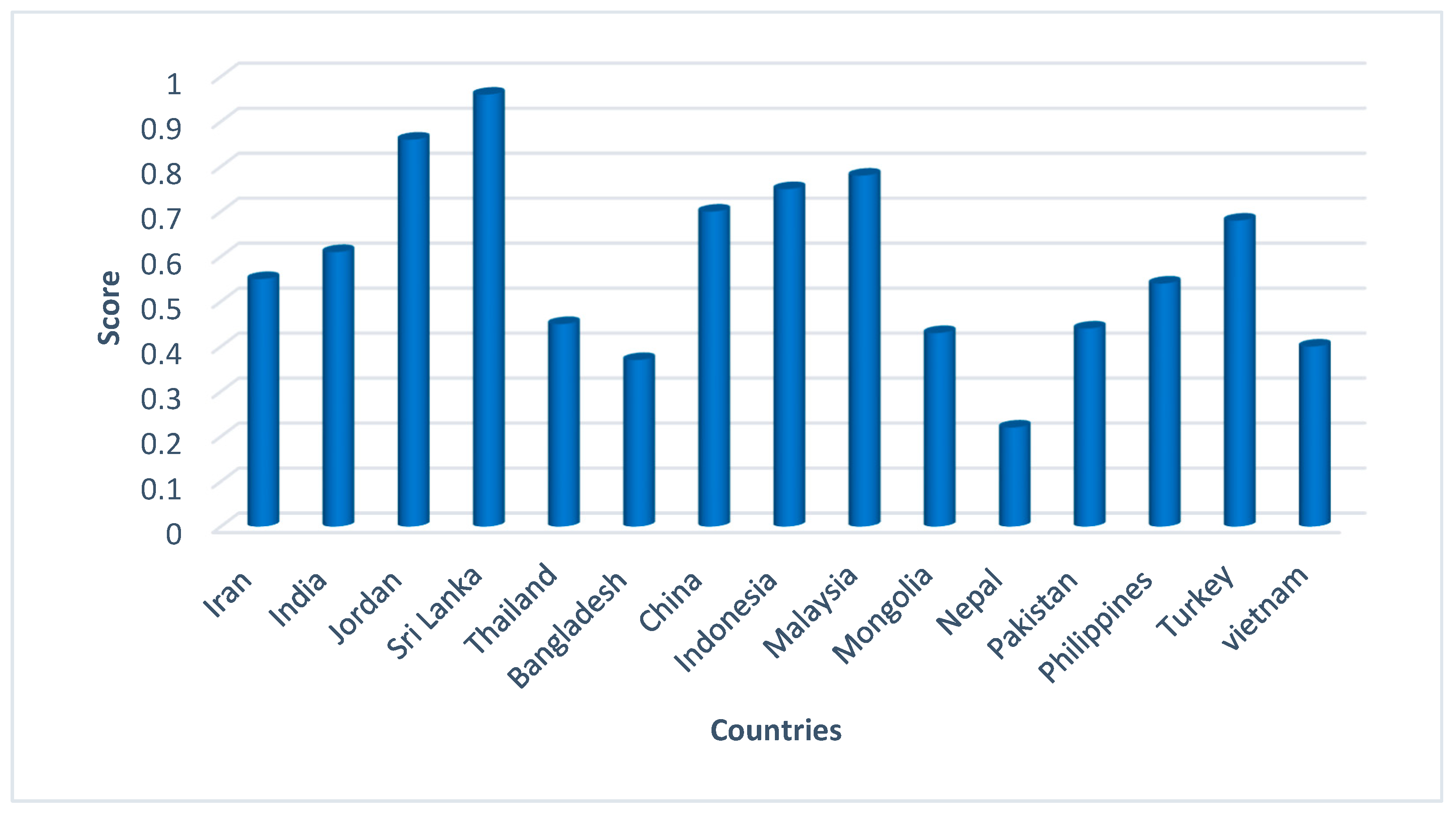

The RIES represents the risk in energy supplies, CR is the country risk, HHI is the Herfindahl Hirschman Index, DEP is the energy dependency on energy suppliers, PE shows potential exports, represents the contribution of energy suppliers in over-all energy imports of the economy. The fourth variable is a financial indicator, i.e., gross domestic product (GDP), which shows each country’s capability to produce revenue against a specific amount of GHGs emissions. Out of these variables, GHG emissions and energy consumption are inputs, while total energy supplies and GDP are outputs. It is necessary to explain that Equations (6), (7), and (10) measure the energy efficiency, environmental index, and energy intensity, respectively, to analyze other countries or regions.