The Impact of Monetary Policies on the Sustainable Economic and Financial Development in the Euro Area Countries

Abstract

:1. Introduction

2. Literature Review—The ECB, Its Monetary Policy at a Time of Financial Crisis and Now

3. Materials and Methods

3.1. Methodology

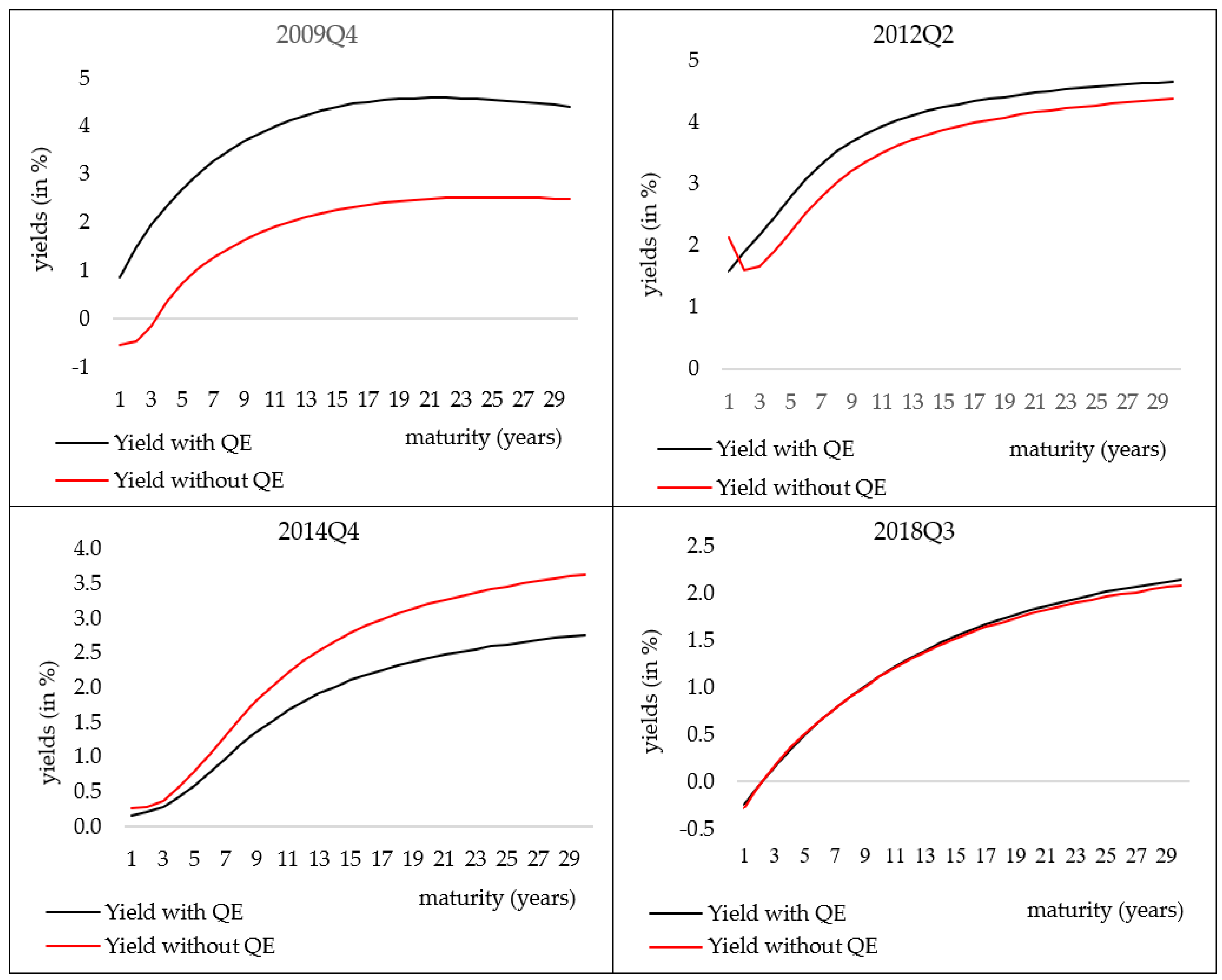

- Research question 1 (RQ1). What will be the impact of the non-standard monetary policy instruments of the ECB in the form of Asset Purchase Programme (or Quantitative easing—QE) mechanisms on zero-coupon yield curve spot rate of all EMU government bonds?

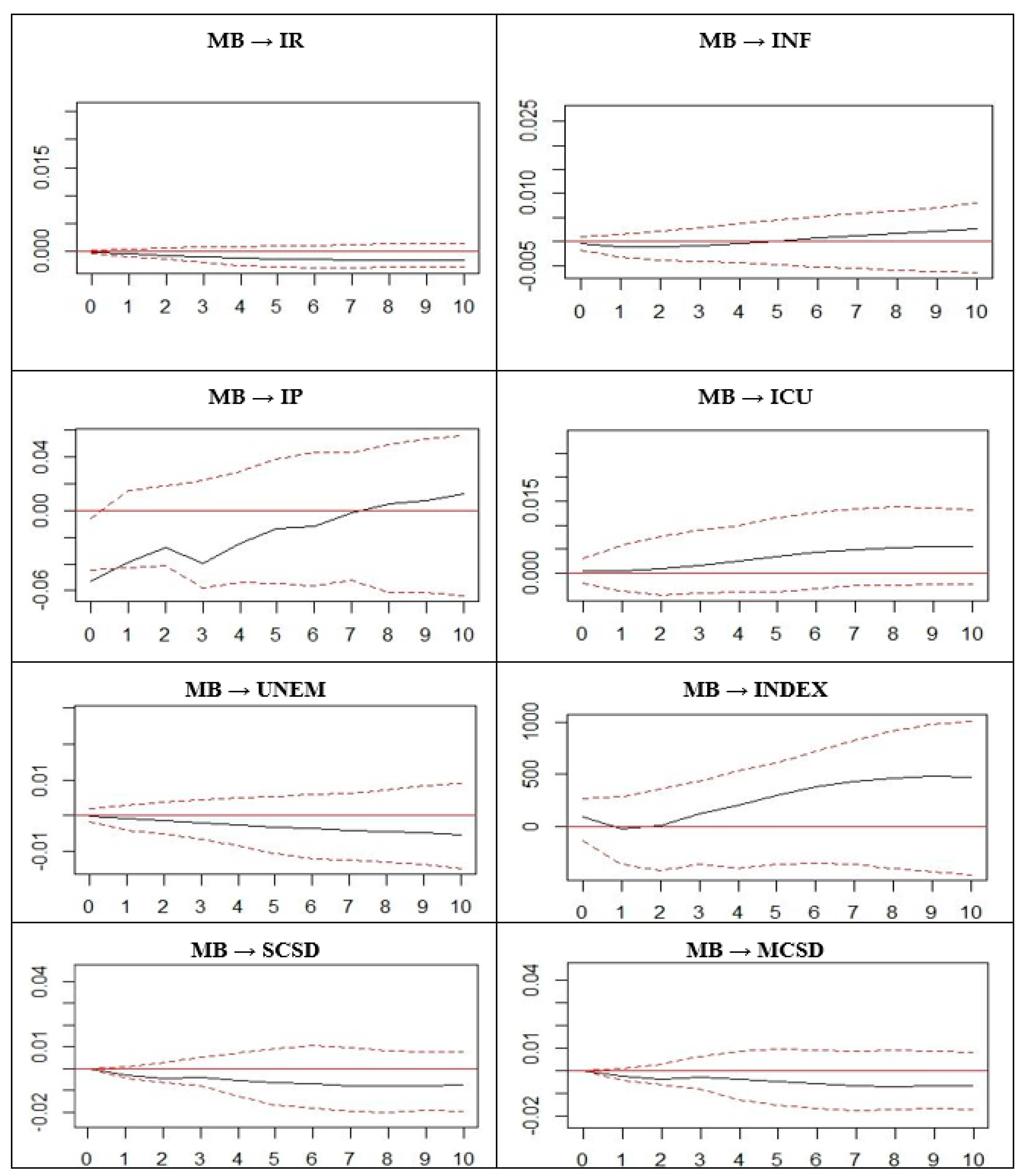

- Research question 2 (RQ2). What additional impact will these instruments have on the financial markets, on the goods and services markets, respectively, or on the labor market?

- Research question 3 (RQ3). How did these policies affect GDP change rates?

- Research question 4 (RQ4). How does the policy effectiveness change over the time?

3.2. Data

4. Results

4.1. Design the Seemingly Unrelated Regression (SUR) Model

4.2. The Effects of Quantitative Easing (QE) on the Euro Area Countries’ Economies

4.3. The Impact of QE on EMU Member States

5. Discussion

6. Conclusions and Implications

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Dependent Variable | ||||

|---|---|---|---|---|

| L | S | C1 | C2 | |

| (Intercept) | −99.5313 | 103.8896 | 261.7688 | −112.4328 |

| (16.8056) | (18.4130) | (287.3828) | (279.2007) | |

| [3.53e−07] *** | [9.92e−07] *** | [0.3668] | [0.6889] | |

| inf | 46.3794 | −49.6565 | −1299.9182 | 1242.2123 |

| (10.7868) | (11.6949) | (310.0719) | (304.6689) | |

| [8.56e−05] *** | [1.05e−04] *** | [1.15e−04] *** | [1.67e−04] *** | |

| rai | −5.5655 | 6.7498 | 182.9972 | −177.8072 |

| (2.9218) | (3.2662) | (98.2926) | (97.1804) | |

| [0.0629] * | [0.0444] ** | [0.0686] * | [0.0734] * | |

| unem | −25.5095 | 48.0143 | ||

| (20.7809) | (24.2454) | |||

| [0.2257] | [0.0536] * | |||

| i | 90.5917 | 3124.3168 | −3172.8688 | |

| (14.4116) | (872.9733) | (861.9229) | ||

| [1.08e−07] *** | [7.89e−04] *** | [5.78e−04] *** | ||

| debt | −8.8539 | 1234.0326 | −1350.4979 | |

| (6.0657) | (346.7578) | (344.3086) | ||

| [0.1512] | [8.39e−04] *** | [2.73e−04] *** | ||

| eer | −18.3413 | 18.9328 | 1224.0684 | −1198.6198 |

| (8.3332) | (8.9778) | (335.4502) | (332.7937) | |

| [0.0327] ** | [0.0404] ** | [6.38e−04] *** | [7.37e−04] *** | |

| bci | 0.7450 | −0.7444 | ||

| (0.1466) | (0.1627) | |||

| [6.35e−06] *** | [3.59e−05] *** | |||

| sales | −0.1883 | 0.2126 | ||

| (0.1179) | (0.1303) | |||

| [0.1170] | [0.1096] | |||

| fed | 18.0833 | −225.9533 | ||

| (5.9553) | (101.2076) | |||

| [3.89e−03] *** | [0.0302] ** | |||

| index | −0.4946 | 8.1242 | ||

| (1.1505) | (17.5261) | |||

| [0.6698] | [0.6450] | |||

| euribor | −100.9918 | |||

| (22.6294) | ||||

| [5.04e−05] *** | ||||

| m1 | 21.6146 | −22.6128 | −526.0143 | 469.7899 |

| (4.6284) | (5.4707) | (124.3242) | (121.2256) | |

| [2.54e−05] *** | [1.49e−04] *** | [1.02e−04] *** | [3.17e−04] *** | |

| Mult. R2 | 0.7175 | 0.7440 | 0.3907 | 0.4131 |

| Adj. R2 | 0.6634 | 0.6884 | 0.3036 | 0.3293 |

| MB&IR | MB&INF | ||||

|---|---|---|---|---|---|

| Cointegration Equation | Cointegration Equation | ||||

| MB(t−1) | 1.0000 | MB(t−1) | 1.0000 | ||

| (0.0000) | (0.0000) | ||||

| IR(t−1) | 8.6035 | INF(t−1) | −1.9308 | ||

| (3.1076) | (0.8946) | ||||

| [8.94e−3] *** | [0.0378] ** | ||||

| (Intercept) | −0.0818 | (Intercept) | 1.9705 | ||

| (0.0540) | (0.7911) | ||||

| [0.1389] | [0.0176] ** | ||||

| ECM for cointegrated series | ECM for cointegrated series | ||||

| Δ MB | Δ IR | Δ MB | Δ INF | ||

| ECT | −0.0639 | −0.0085 | ECT | −0.0107 | −0.0304 |

| (0.0386) | (0.0048) | (0.0210) | (0.0072) | ||

| [0.1068] | [0.0853] * | [0.6136] | [1.63e−4] *** | ||

| ∆ MB(t−1) | 0.5498 | −0.0125 | ∆ MB(t−1) | 0.5532 | −0.1078 |

| (0.1476) | (0.0184) | (0.1681) | (0.0581) | ||

| [6.86e−4] *** | [0.5014] | [2.28e−3] *** | [0.0720] * | ||

| ∆ IR(t−1) | 0.6174 | 0.6488 | ∆ INF(t−1) | 0.0065 | 0.1120 |

| (0.9202) | (0.1145) | (0.4747) | (0.1639) | ||

| [0.5067] | [2.13e−6] *** | [0.9892] | [0.4989] | ||

| Q1 | 0.0025 | -0.0004 | Q1 | 0.0044 | 0.0011 |

| (0.0029) | (0.0004) | (0.0038) | (0.0013) | ||

| [0.3945] | [0.3242] | [0.2547] | [0.4032] | ||

| Q2 | −0.0014 | 0.0001 | Q2 | 0.0004 | 0.0023 |

| (0.0030) | (0.0004) | (0.0040) | (0.0014) | ||

| [0.6436] | [0.8040] | [0.9209] | [0.1094] | ||

| Q3 | −0.0001 | −0.0002 | Q3 | 0.0018 | −0.0021 |

| (0.0029) | (0.0004) | (0.0041) | (0.0041) | ||

| [0.9727] | [0.6202] | [0.6633] | [0.6117] | ||

| R2 | 0.3531 | 0.4461 | R2 | 0.3273 | 0.6607 |

| Adj. R2 | 0.2722 | 0.3769 | Adj. R2 | 0.2432 | 0.6183 |

| AIC | −15.5846 | −15.6390 | AIC | −15.3337 | −15.3521 |

| BIC | −15.0006 | −15.1280 | BIC | −14.7498 | −14.8412 |

| Cross-equation covariance matrix: | Cross-equation covariance matrix: | ||||

| MB | IR | MB | INF | ||

| MB | 2.34e−3 | −2.16e−6 | MB | 2.35e−3 | −2.07e−4 |

| IR | −2.16e−6 | 3.67e−5 | INF | −2.07e−4 | 4.42e−4 |

| MB&IP | MB&ICU | ||||

| Cointegration equation | Cointegration equation | ||||

| MB(t−1) | 1.0000 | MB(t−1) | 1.0000 | ||

| (0.0000) | (0.0000) | ||||

| IP(t−1) | 2.3442 | ICU(t−1) | 0.3991 | ||

| (0.6353) | (0.1683) | ||||

| [7.37e−4] *** | [0.0236] *** | ||||

| (Intercept) | −0.2084 | ECM for cointegrated series | |||

| (0.0489) | Δ MB | ∆ ICU | |||

| [1.39e−4] *** | ECT | −0.0006 | −0.0117 | ||

| ECM for cointegrated series | (0.0051) | (0.0034) | |||

| Δ MB | ∆ IP | [0.9075] | [0.0026] *** | ||

| ECT | −0.0681 | −0.2583 | ∆ MB(t−1) | −0.3662 | −0.0437 |

| (0.0713) | (0.0772) | (0.1735) | (0.1536) | ||

| [0.3509] * | [0.0032] *** | [0.0476] ** | [0.7789] | ||

| ∆ MB(t−1) | −0.3133 | 0.0675 | ∆ ICU(t−1) | 0.0510 | 0.1467 |

| (0.2037) | (0.2204) | (0.2182) | (0.2362) | ||

| [0.1397] | [0.7626] | [0.8176] | [0.5416] | ||

| ∆ MB(t−2) | 0.0249 | 0.1467 | Q1 | 0.0026 | −0.0030 |

| (0.2182) | (0.2362) | (0.0034) | (0.0023) | ||

| [0.9103] | [0.5416] | [0.4534] | [0.2069] | ||

| ∆ MB(t−3) | −0.0919 | 0.4344 | Q2 | −0.0016 | 0.0112 |

| (0.2034) | (0.2201) | (0.0033) | (0.0022) | ||

| [0.6563] | [0.0624] * | [0.6331] | [0.0001] *** | ||

| ∆ IP(t−1) | 0.1813 | −0.4952 | Q3 | −0.0013 | 0.0006 |

| (0.2416) | (0.2615) | (0.0044) | (0.0029) | ||

| [0.4617] | [0.0728] * | [0.7707] | [0.8382] | ||

| ∆ IP(t−2) | 0.1523 | −0.5089 | R2 | 0.0778 | 0.3772 |

| (0.2362) | (0.2556) | Adj. R2 | 0.0059 | 0.3205 | |

| [0.5264] | [0.0603] * | AIC | −235.7561 | −235.5732 | |

| ∆ IP(t−3) | 0.1726 | −0.2605 | BIC | −229.4220 | −229.2391 |

| (0.1817) | (0.1967) | Cross-equation covariance matrix: | |||

| [0.3535] | [0.2003] | MB | ICU | ||

| Q1 | −0.0215 | −0.0851 | MB | 2.64e−3 | 6.80e−5 |

| (0.0274) | (0.0296) | ICU | 680e−5 | 1.67e−3 | |

| [0.4418] | [0.0094] *** | MB&INDEX | |||

| Q2 | −0.0084 | −0.0252 | Cointegration equation | ||

| (0.0110) | (0.0119) | MB(t−1) | 1.0000 | ||

| [0.4540] | [0.0469] ** | (0.0000) | |||

| Q3 | −0.0253 | −0.0967 | |||

| (0.0276) | (0.0299) | INDEX(t−1) | 2.2736 | ||

| [0.3702] | [0.0042] *** | (0.6083) | |||

| R2 | 0.3794 | 0.9576 | [0.0013] *** | ||

| Adj. R2 | 0.1407 | 0.9413 | (Intercept) | −0.0423 | |

| AIC | −206.3884 | −186.6335 | (0.0115) | ||

| BIC | −192.9199 | −173.1649 | [0.0015] *** | ||

| Cross-equation covariance matrix: | ECM for cointegrated series | ||||

| MB | IP | Δ MB | ∆ INDEX | ||

| MB | 2.52e−3 | 3.22e−4 | ECT | −0.0031 | −0.6725 |

| IP | 3.22e−4 | 4.22e−3 | (0.0698) | (0.1739) | |

| MB&UNEM | [0.9652] | [0.0017] *** | |||

| Cointegration equation | ∆ MB(t−1) | −0.3622 | −0.0460 | ||

| MB(t−1) | 1.0000 | (0.2238) | (0.5579) | ||

| (0.0000) | [0.1279] | [0.9355] | |||

| ∆ MB(t−2) | −0.0111 | 0.4490 | |||

| UNEM(t−1) | 0.5836 | (0.2362) | (0.5887) | ||

| (0.1603) | [0.9632] | [0.4583] | |||

| [8.95e−3] ** | ∆ MB(t−3) | −0.0744 | 0.4345 | ||

| (Intercept) | −1.9587 | (0.2084) | (0.5194) | ||

| (1.5096) | [0.7264] | [0.4169] | |||

| [0.2032] | ∆ INDEX(t−1) | −0.0336 | 0.6786 | ||

| ECM for cointegrated series | (0.1346) | (0.3354) | |||

| Δ MB | ∆ UNEM | [0.8065] | [0.0626] * | ||

| ECT | −0.0008 | −0.0038 | ∆ INDEX(t−2) | 0.0339 | 0.5069 |

| (0.0022) | (0.0004) | (0.1119) | (0.2789) | ||

| [0.7199] | [4.21e−10] *** | [0.7664] | [0.0906] * | ||

| ∆ MB(t−1) | −0.3758 | −0.0494 | ∆ INDEX(t−3) | 0.0442 | 0.6087 |

| (0.1748) | (0.0315) | (0.0853) | (0.2125) | ||

| [0.0440] ** | [0.1325] | [0.6124] | [0.0125] ** | ||

| ∆ UNEM(t−1) | 0.3093 | −0.2859 | Q1 | 0.0035 | 0.0018 |

| (0.8212) | (0.1479) | (0.0040) | (0.0100) | ||

| [0.7104] | [0.0675] * | [0.3963] | [0.8597] | ||

| Q1 | 0.0016 | −0.0051 | Q2 | −0.0037 | −0.0268 |

| (0.0034) | (0.0009) | (0.0041) | (0.0101) | ||

| [0.6430] | [1.52e−5] *** | [0.3821] | [0.0189] ** | ||

| Q2 | −0.0003 | −0.0173 | Q3 | −0.0018 | −0.0208 |

| (0.0052) | (0.0009) | (0.0038) | (0.0096) | ||

| [0.9546] | [2.30e−14] *** | [0.6430] | [0.0480] ** | ||

| Q3 | 0.0042 | −0.0083 | R2 | 0.5267 | 0.2251 |

| (0.0132) | (0.0024) | Adj. R2 | 0.3116 | 0.1272 | |

| [0.7536] | [0.0025] *** | AIC | −197.6212 | −81.6992 | |

| R2 | 0.3453 | 0.9072 | BIC | −182.9638 | −67.0419 |

| Adj. R2 | 0.2143 | 0.8886 | Cross-equation covariance matrix: | ||

| AIC | −208.5049 | −295.1540 | MB | INDEX | |

| BIC | −195.0363 | −281.6855 | MB | 2.39e−3 | −7.93e−4 |

| Cross-equation covariance matrix: | INDEX | −7.93e−4 | 2.45e−2 | ||

| MB | UNEM | MB&MCSD | |||

| MB | 2.64e−3 | −2.89e−5 | Cointegration equation | ||

| UNEM | −2.89e−5 | 3.61e−4 | MB(t−1) | 1.0000 | |

| MB&SCSD | (0.0000) | ||||

| Cointegration equation | |||||

| MB(t−1) | 1.0000 | MCSD(t−1) | 12.5902 | ||

| (0.0000) | (5.4337) | ||||

| [0.0263] *** | |||||

| SCSD(t−1) | 46.8329 | (Intercept) | −0.6466 | ||

| (13.7090) | (0.3749) | ||||

| [0.0269] *** | [0.0932] * | ||||

| (Intercept) | −2.6962 | ECM for cointegrated series | |||

| 1.1806 | Δ MB | ∆ MCSD | |||

| [0.0844] * | ECT | −0.0011 | −0.0431 | ||

| ECM for cointegrated series | (0.0037) | (0.0172) | |||

| Δ MB | ∆ SCSD | [0.7709] | [0.0263] ** | ||

| ECT | −0.0056 | 0.1274 | ∆ MB(t−1) | 0.4669 | −0.8504 |

| (0.0084) | (0.0413) | (0.1896) | (0.8750) | ||

| [0.5133] | [0.0041] *** | [0.0285] ** | [0.3488] | ||

| ∆ MB(t−1) | 0.5568 | −0.3715 | ∆ MB(t−2) | 0.1458 | 0.8700 |

| (0.1437) | (0.7037) | (0.1928) | (0.4896) | ||

| [0.0005] *** | [0.6011] | [0.4630] | [0.0989] * | ||

| ∆ SCSD (t−1) | −0.0417 | 0.2657 | ∆ MCSD (t−1) | −0.0451 | 0.3194 |

| (0.0360) | (0.1763) | (0.0422) | (0.1947) | ||

| [0.2550] | [0.1413] | [0.3046] | [0.1249] | ||

| Q1 | 0.0041 | −0.0313 | ∆ MCSD (t−2) | 0.0207 | −0.0193 |

| (0.0030) | (0.0139) | (0.0474) | (0.2190) | ||

| [0.2017] | [0.0480] ** | [0.6695] | [0.9311] | ||

| Q2 | −0.0017 | −0.0269 | Q1 | 0.0037 | 0.0329 |

| (0.0031) | (0.0143) | (0.0033) | (0.0151) | ||

| [0.5955] | [0.0894] * | [0.2825] | [0.0483] ** | ||

| Q3 | −0.0003 | −0.0168 | Q2 | −0.0024 | −0.0244 |

| (0.0033) | (0.0151) | (0.0037) | (0.0169) | ||

| [0.9294] | [0.2919] | [0.5279] | [0.1425] | ||

| R2 | 0.3632 | 0.3725 | Q3 | −0.0006 | −0.0175 |

| Adj. R2 | 0.2359 | 0.247 | (0.0034) | (0.0157) | |

| AIC | −238.2884 | −117.0010 | [0.8626] | [0.2852] | |

| BIC | −233.5378 | −112.2504 | R2 | 0.3903 | 0.4038 |

| Cross-equation covariance matrix: | Adj. R2 | 0.2160 | 0.2335 | ||

| MB | SCSD | AIC | −238.2551 | −116.1820 | |

| MB | 2.22e−3 | 4.92e−4 | BIC | −233.5046 | −111.4315 |

| SCSD | 4.92e−4 | 6.61e−2 | Cross-equation covariance matrix: | ||

| MB | MCSD | ||||

| MB | 2.15e−3 | 2.13e−4 | |||

| MCSD | 2.13e−4 | 5.62e−2 | |||

| Dependent Variable: ∆ ln (GDP) | ||||

|---|---|---|---|---|

| (Intercept) | 4.3407 | 2.9486 | 2.8257 | 4.5464 |

| (0.7810) | (0.7193) | (0.7057) | (0.6642) | |

| [952e−7] *** | [1.46e−4] *** | [1.99e−4] *** | [8.74e−9] *** | |

| ln(GDPpc)t−4 | −0.4028 | −0.3282 | −0.3004 | −0.4238 |

| (0.0709) | (0.0584) | (0.0593) | (0.0586) | |

| [6.11e−7] *** | [7.49e−7] *** | [5.41e−6] *** | [2.08e−9] *** | |

| ln(I/GDP) | 0.3194 | 0.2289 | 0.1885 | 0.3413 |

| (0.0783) | (0.0716) | (0.0730) | (0.0789) | |

| [1.56e−4] *** | [2.35e−3] *** | [0.0127] ** | [6.89e−5] *** | |

| ln(OPEN) | 0.1912 | 0.1567 | 0.1663 | 0.2152 |

| (0.0636) | (0.0438) | (0.0425) | (0.0576) | |

| [4.07e−3] *** | [7.61e−4] *** | [2.67e−4] *** | [4.69e−4] *** | |

| ln(SECOND) | 0.5251 | -0.0732 | 0.1540 | 0.5809 |

| (0.2165) | (0.2254) | (0.1894) | (0.1881) | |

| [0.0188] ** | [0.7469] | [0.4197] | [3.23e−3] *** | |

| ln(GOV) | 0.0286 | 0.1463 | 0.1535 | 0.0958 |

| (0.0472) | (0.0455) | (0.0446) | (0.0508) | |

| [0.5480] | [2.26e−3] *** | [1.13e−3] *** | [0.0648] * | |

| ln(LLY)t−4 | −0.0099 | |||

| (0.0102) | ||||

| [0.3380] | ||||

| ln(PRIV)t−4 | 0.3603 | |||

| (0.0849) | ||||

| [9.02e−5] *** | ||||

| ln(BANK)t−4 | 0.3648 | |||

| (0.0793) | ||||

| [2.72e−5] *** | ||||

| ln(SMC)t−4 | −0.0447 | |||

| (0.0171) | ||||

| [0.0115] ** | ||||

| R2 | 0.7571 | 0.8171 | 0.8250 | 0.7786 |

| Adj. R2 | 0.7291 | 0.7960 | 08048 | 0.7530 |

| AIC | −350.0101 | −366.7549 | −369.3582 | −355.4690 |

| BIC | −333.3898 | −350.1346 | −352.7379 | −338.8487 |

References

- Ugai, H. Effects of the Quantitative Easing Policy: A Survey of Empirical Analyzes. Monet. Econ. Stud. 2007, 25, 1–48. [Google Scholar]

- Shiratsuka, S. Size and Composition of the Central Bank Balance Sheet: Revisiting Japan’s Experience of the Quantitative Easing Policy. Monet. Econ. Stud. 2010, 28, 79–105. [Google Scholar] [CrossRef]

- Joyce, M.; Miles, D.; Scott, A.; Vayanos, D. Quantitative easing and unconventional monetary policy-an introduction. Econ. J. 2012, 122, 271–288. [Google Scholar] [CrossRef] [Green Version]

- Fawley, B.; Neel, C. Four stories of quantitative easing. Fed. Reserve Bank St. Louis Rev. 2013, 95, 51–88. [Google Scholar] [CrossRef]

- Langfield, S.; Pagano, M. Bank bias in Europe: Effects on systemic risk and growth. Econ. Policy 2016, 31, 51–106. [Google Scholar] [CrossRef] [Green Version]

- Benford, J.; Berry, S.; Nikolov, K.; Young, C.; Robson, M. Quantitative Easing. Q. Bull. (Bank Engl.) 2009, 49, 90–100. [Google Scholar]

- Joyce, M.; Lasaosa, A.; Stevens, I.; Tong, M. The Financial Market Impact of Quantitative Easing in the United Kingdom. Int. J. Cent. Bank. 2011, 7, 113–161. [Google Scholar]

- Honkapohja, S. Monetary policies to counter the zero interest rate: An overview of research. Empirica 2016, 43, 235–256. [Google Scholar] [CrossRef] [Green Version]

- Steeley, J.M. The side effects of quantitative easing: Evidence from the UK bond market. J. Int. Money Financ. 2015, 51, 303–336. [Google Scholar] [CrossRef] [Green Version]

- Voutsinas, K.; Werner, R.A. New Evidence on the Effectiveness of ’Quantitative Easing’ and the Accountability of the Central Bank in Japan; CFS Working Paper Series 2011/30; Center for Financial Studies: Frankfurt pe Main, Germany, 2011. [Google Scholar]

- Lenza, M.; Pill, H.; Reichlin, L. Monetary policy in exceptional times. Econ. Policy 2010, 25, 295–339. [Google Scholar] [CrossRef]

- Lyonnet, V.; Werner, R. Lessons from the Bank of England on ‘quantitative easing’ and other ‘unconventional’ monetary policies. Int. Rev. Financ. Anal. 2012, 25, 94–105. [Google Scholar] [CrossRef]

- Breedon, F.; Chadha, J.; Waters, A. The Financial Market Impact of UK Quantitative Easing. Oxf. Rev. Econ. Policy 2012, 28, 702–728. [Google Scholar] [CrossRef]

- Belke, A. Driven by the Markets? ECB Sovereign Bond purchases and the Securities Markets Program. Intereconomics 2010, 45, 357–363. [Google Scholar] [CrossRef] [Green Version]

- Veld, J. Fiscal consolidations and spillovers in the euro area periphery and core. Eur. Econ. Econ. Pap. 2013, 506, 1–32. [Google Scholar]

- Claeys, G.; Leandro, Á.; Mandra, A. European Central Bank Quantitative Easing: The Detailed Manual. Bruegel Policy Contrib. 2015, 2, 1–18. [Google Scholar]

- Ellison, J.; Tischbirek, A. Unconventional government debt purchases as a supplement to conventional monetary policy. J. Econ. Dyn. Control 2013, 43, 199–217. [Google Scholar] [CrossRef] [Green Version]

- Herbst, A.F.; Wu, J.S.K.; Ho, C.P. Quantitative easing in an open-Not and economy but liquidity and reserve trap. Glob. Financ. J. 2014, 25, 1–16. [Google Scholar] [CrossRef]

- Kinateder, H.; Wagner, M. Quantitative easing and the pricing of the EMU sovereign debt. Q. Rev. Econ. Financ. 2017, 66, 1–12. [Google Scholar] [CrossRef]

- Breuss, J. The Crisis Management of the ECB. Austrian Inst. Econ. Res. (Wifo) Work. Pap. 2016, 507, 1–28. [Google Scholar]

- De Grauwe, P.; Ji, Y. Fiscal Implications of the ECB’s Bond Buying Program. Open Econ. Rev. 2013, 24, 843–852. [Google Scholar] [CrossRef]

- Coeur, B. Embarking on Public Sector Asset Purchases; Speech by the Member of the Executive Board of the ECB. In Proceedings of the Second International Conference on Sovereign Bond Markets, Frankfurt, Germany, 10 March 2015. [Google Scholar]

- Urbschat, F.; Watzka, S. Quantitative easing in the Euro Area—An event study approach. Q. Rev. Econ. Financ. 2020, 77, 14–36. [Google Scholar] [CrossRef] [Green Version]

- Gibson, H.D.; Hall, S.G.; Tavlas, G.S. The Effectiveness of the ECB’s Asset Purchase Programs of 2009 to 2012. J. Macroecon. 2016, 47, 45–57. [Google Scholar] [CrossRef] [Green Version]

- Demary, M. The case for reviving securitization. Cologne Inst. Econ. Res. 2016, 63, 1–32. [Google Scholar]

- Demertzis, M.; Wolff, G. The effectiveness of the European Central Bank’s asset purchase program. Bruegel Policy Contrib. 2016, 10, 1–14. [Google Scholar]

- Blaszkiewicz, M. Sovereign Bond Purchases and Risk-Sharing Arrangements Implications for Monetary Policy. SSRN Electron. J. 2015. [Google Scholar] [CrossRef] [Green Version]

- Krishnamurthy, A.; Vissing-Jorgensen, A. The Effects of Quantitative Easing on Interest Rates: Channels and Implications for Policy. Natl. Bur. Econ. Res. Res. Rep. 2011, 17555, 1–19. [Google Scholar] [CrossRef]

- Diebold, F.X.; Rudebusch, G.D.; Aruoba, S.B. The macroeconomy and the yield curve: A dynamic latent factor approach. J. Econom. 2006, 131, 309–338. [Google Scholar] [CrossRef] [Green Version]

- Afonso, A.; Martins, M. Level, slope, curvature of the sovereign yield curve, and fiscal behavior. J. Bank. Financ. 2012, 36, 1789–1807. [Google Scholar] [CrossRef] [Green Version]

- Svensson, L. Estimating and interpreting forward interest rates: Sweden 1992 to 1994. Work. Pap. Nber 1994, 4871, 1–87. [Google Scholar]

- Tsuji, C. Did the expectations channel work? Evidence from quantitative easing in Japan, 2001–06. Cogent Econ. Financ. 2016, 4, 1210996. [Google Scholar] [CrossRef] [Green Version]

- Belke, A.; Gros, D.; Osowski, T. The effectiveness of the Fed’s quantitative easing policy: New evidence based on international interest rate differentials. J. Int. Money Financ. 2017, 73, 335–349. [Google Scholar] [CrossRef]

- Belke, A.; Beckmann, J.; Verheyen, F. Interest rate pass-through in the EMU–New evidence from nonlinear cointegration techniques for fully harmonized data. J. Int. Money Financ. 2013, 37, 1–34. [Google Scholar] [CrossRef] [Green Version]

- Johansen, S. Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econometrica 1991, 59, 1551–1580. [Google Scholar] [CrossRef]

- Capolupo, R. Finance, investment and growth: Evidence for Italy. Economic Notes: Review of Banking. Financ. Monet. Econ. 2018, 47, 145–186. [Google Scholar] [CrossRef] [Green Version]

- Daetz, S.L.; Subrahmanyam, M.G.; Tang, D.Y.; Wang, S.Q. Did the ECB Liquidity Injections Help the Real Economy? SSRN Electron. J. 2017, 1–16. Available online: http://www.fmaconferences:Taiwan/Papers/DaetzSubrahmanyamTangandWang_20160831.pdf (accessed on 25 May 2017). [CrossRef] [Green Version]

- Georgiadis, G.; Grab, J. Global financial market impact of the announcement of the ECB’s asset purchase program. J. Financ. Stab. 2016, 26, 257–265. [Google Scholar] [CrossRef]

- Szczerbowicz, U. The ECB’s unconventional monetary policies: They have lowered market borrowing costs for banks and governments? Int. J. Cent. Bank. 2015, 11, 91–127. [Google Scholar]

- De Santis, R. Impact of the Asset Purchase Programme on Euro Area Government Bond Yields Using Market News. Ecb Work. Pap. 2016, 1939, 1–49. [Google Scholar] [CrossRef] [Green Version]

- Martin, F.; Zhang, J. Impact of QE on European Sovereign Bond Market Equilibrium. In Handbook of Global Financial Markets; World Scientific Pub Co.: Singapore, 2019; pp. 411–466. [Google Scholar]

- Hausken, K.; Ncube, M. Quantitative Easing and Its Impact in the US, Japan, the UK and Europe; Springer: Berlin, Germany, 2013; pp. 1–130. [Google Scholar]

- Altavilla, C.; Giannone, D.; Lenza, M. The Financial and Macroeconomic Effects of OMT Announcements; ECB Working Paper No. 1707; European Central Bank (ECB): Frankfurt, Germany, 2014. [Google Scholar]

- Lovreta, L.; Lopez Pascual, J. Structural breaks in the interaction between bank and sovereign default risk. Ser. J. Span. Econ. Assoc. 2020, 1–29. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kiseľáková, D.; Filip, P.; Onuferová, E.; Valentiny, T. The Impact of Monetary Policies on the Sustainable Economic and Financial Development in the Euro Area Countries. Sustainability 2020, 12, 9367. https://doi.org/10.3390/su12229367

Kiseľáková D, Filip P, Onuferová E, Valentiny T. The Impact of Monetary Policies on the Sustainable Economic and Financial Development in the Euro Area Countries. Sustainability. 2020; 12(22):9367. https://doi.org/10.3390/su12229367

Chicago/Turabian StyleKiseľáková, Dana, Paulina Filip, Erika Onuferová, and Tomáš Valentiny. 2020. "The Impact of Monetary Policies on the Sustainable Economic and Financial Development in the Euro Area Countries" Sustainability 12, no. 22: 9367. https://doi.org/10.3390/su12229367