3.1. Statistical Analysis of Data

The first step of the study consists in statistical analysis of data. Each variable included in the model is analyzed in order to highlight its economic evolution in each country and compared to the EU, during the period for which the data were selected.

The annual GDP growth rate (G_GDP) allowed us to perform analyses and comparisons of the dynamics of economic development both over time and between the economies of EU states of different sizes. From an economic point of view, it can be said that at the level of the EU states, the economic growth registers a sinuous evolution, experiencing periods of significant economic growth at the level of all states (very large before the crisis of 2008) and, conversely, significant decreases of the economic growth rate (periods of economic crisis, 2009) (

Figure 1).

The crisis was visible in the EU-28 since 2008, amid a significant slowdown in GDP growth. The recovery at EU-28 level meant an increase in the GDP index (based on chained volumes) of around 2% in 2010 and 2011, after which GDP fell in 2012 and 2013, before gradually registering higher positive rates of variation.

The decrease is obvious at the average G_GDP (see

Appendix A,

Table A1); thus, if in the period 1996–2008 the averages were between 1.06% (It) and 6.81% (Es), in the period 2009–2019 the average values were between −1.89% (Gr) to 4.34% (Ir). The significant decrease in G_GDP compared to the before the crisis period is shown in

Figure 2.

The recovery at EU-28 level meant an increase in the GDP index (based on chained volumes) of around 2% in 2010 and 2011, after which GDP fell in 2012 and 2013, before gradually registering higher positive rates of variation.

Emerging countries had the highest annual GDP growth rates in 2019 compared to 1996 (over 4% in Bulgaria, Hungary, Lithuania, Poland, and Romania), and the lowest rates were recorded in Sweden (0.11%), Germany, and Luxembourg (with growth rates of about 0.3%), and Italy, Malta, England, and Finland (below 0.1%).

There is a significant reduction in the 2019 growth rate (1.36%) compared to 1996 and obviously there will be a significant decrease in 2020 due to the COVID-19 crisis, which has severely affected the economic growth of all countries. Thus, following the analysis of the first two quarters of 2020 compared to the same period of 2019 (

Figure 3), it is observed that the year 2020 began with a relatively slow decline and then intensified in the second quarter, in all EU countries. At EU level (excluding the UK as it left the EU on 1 January 2020) in the first quarter of 2020, the decline in GDP was 4.4%, and in the second quarter compared to the same quarter of 2019 it was 16.65%.

At individual EU states level, in the first quarter of 2020, there is a slight increase compared to the same period of 2019 in most states (16 states). In the second quarter there is a drastic decrease in all EU states, the largest decrease recorded for Spain (20.81%), followed by Croatia and Greece, with over 17%.

For the 1996–2019 time interval, the average calculated at EU level (until 2020) identifies a level of economic growth of 1.53% per year. The homogeneity coefficient exceeds the value of one, revealing a completely heterogeneous structure, asymmetrical to the right, and strongly leptokurtic, with several values concentrated around the average, and high probabilities for extreme values. There is the same trend in all states, respectively, a strong heterogeneity, asymmetric to the right, and leptokurtic (see

Appendix A Table A1).

In 2008, compared to 1996, GDP growth rate shows the relative heterogeneity in SL and heterogeneity for the other countries. Twenty-four states have a slight asymmetry, more pronounced to the right for Bg and UK, and two states have a slight asymmetry on the left (Ge and Sl). The distribution is leptokurtic for three states (Bg, Ir, UK), presenting higher probabilities for the extreme values, while for the other states the distribution is platykurtic, with values dispersed in a larger interval around the average (see

Appendix A,

Table A1).

Compared to 2009, in 2019 GDP growth rate shows heterogeneity for all 28 EU member states. Twenty-three states have a slight asymmetry, while other five have a more pronounced asymmetry, to the right (Dk, Es, Lt, UK) or to the left (Ir). The distribution is leptokurtic for 17 states (At, Be, Cz, Dk, Es, Fi, Fr, Ge, Hu, Ir, La, Lt, Lu, Nl, Sk, Sl, UK) with higher probabilities for extreme values, while for the other states the distribution is platykurtic, with values dispersed in a larger range around the average (see

Appendix A,

Table A1).

In order to assess living standards in the EU countries, we analyzed GDP per capita, thus eliminating the influence of the absolute size of the population. Following the analysis of the evolution of the GDP per capita for the period 1996–2019, for the EU-28 states, we found a significant increase of this indicator at the level of all states (

Table 1).

The most significant increases in GDP per capita are noticeable in the emerging states of Estonia, Latvia, Lithuania, and Romania (over 460%), and the smallest increases were in Italy and Greece (

Figure 4).

In 2008, the first year of the economic crisis, compared to 2007, GDP per capita increased in almost all states (except for Ir, which fell by 5.09%), although in a much lower percentage than in previous years. The value of GDP_C increased throughout the analyzed period (1996–2019). The largest increase is recorded for all states after the economic crisis (2009–2019). The evolution of the average GDP_C during 1996–2019 is represented in

Figure 5.

The average of GDP_C in EU is 30,712.38 dollars/capita. Regarding the distribution of states compared to the EU GDP_C average, it is found that 12 countries have an average greater than the EU average, Luxembourg having an average of two times higher than the EU average, followed by Ireland, the Netherlands, Austria, Denmark, Sweden, Germany, Belgium, Finland, England, France, and Italy. Most member states that joined the EU in 2004, 2007, or 2013 are still far from the EU-28 average. The lowest values of the average GDP_C compared to the EU are Bulgaria (13,084.07 dollars/capita) and Romania (14,812.74 dollars/capita).

The homogeneity coefficient has a value that reveals a relatively heterogeneous structure of GDP_C values for both the EU and most member states (14 states). For Italy and Greece, the value of the homogeneity coefficient shows us that they have a relatively homogeneous structure and for the others the homogeneity coefficient shows a heterogeneous structure. All states have a platikurtic distribution with values scattered over a larger range around the average, most with an asymmetry to the left (22 and EU) or to the right (Cy, Fi, Gr, Nl, Sl, Sp).

In 2008 compared to 1996, GDP_C shows relative homogeneity for At, Be, Dk, Fr, Ge, It, Mt, Nl, Pt, Sw, and UK; relative heterogeneity for Bg, Cr, Cy, Cz, Fi, Gr, Hu, Ir, Lu, Po, Sk, Sl, and Sp; and heterogeneity for other countries. One state has a slight right asymmetry (Ir), and the other ones have a slight left asymmetry. The distribution is platykurtic, with values scattered in a larger range around the average for all 28 EU member states.

In 2019 compared to 2009, GDP_C shows homogeneity for Fi, Gr, It, and Nl; relative homogeneity for At, Be, Bg, Cr, Cy, Cz, Dk, Es, Fr, Ge, Hu, Lu, Mt, Po, Pt, Sk, Sl, Sp, Sw, and UK; and relative heterogeneity for Ir, La, Lt, Ro. One state has a slight right asymmetry (Ge), while the other states have a slight asymmetry to the left. The distribution is platykurtic, with values scattered in a larger range around the average for all 28 EU member states.

Analyzing GDP/capita in the first two quarters of 2020, we find that in the first quarter, at EU-27 level, this indicator decreased by 0.80% compared to 2019, and in the second quarter by 12.39 compared to the same period of 2019. At state level, there is a sharp decrease in the second quarter for all states, with the largest decrease in Spain (21.31%) and the least decrease in Ireland and Lithuania at around 3% (

Table 2).

Another indicator of appreciation of the level of economic development is the employed population. The labor force participation rate at EU level in 2019 was above the value in 1996, increasing by 3.92%, but at states level the situation is very different, with the evolution of this indicator varying between countries (

Table 3).

Analyzing Labor by periods, there is a decrease in the labor force in 2009 compared to 2008 in eight states (Cy, Cz, Dk, Hu, Ir, Pt, Ro, Sl), but the mean value in the following period shows an increase in population occupied in most states (

Figure 6). For the economically developed states, however, we find a decrease in Labor throughout the period 1996–2019; this decrease is accentuated in the period following the 2009–2019 crisis.

Italy has the lowest employment rate at around 49%, followed by Croatia at around 50%. The highest averages are recorded by economically developed countries (Sw, UK, Nl, Dk, Ir, Pt), mainly due to the attraction of labor force from emerging EU countries.

Fifteen countries have a labor force participation rate higher than EU; the highest increases in 2019 compared to 1996 are recorded in Croatia (31.37%) and Malta (28.18%), and the lowest increase is recorded in Finland (0.11%). It should be noted that in seven countries (Sk, Fr, Cz, Es, Po, Dk, Ro) the labor force participation rate decreased, and the most significant decrease was in Romania with a percentage of 14.9% (

Figure 7).

The continuous increase in labor force participation rates in the EU contrasted with a decrease in population of 1.3%.

For the 1996–2019 interval, the statistical analysis of the indicator shows a homogeneous distribution of the labor force participation rate over the studied period; the indicator does not show extreme variations either at the EU level or at individual level.

The average labor force participation rate also shows that most countries (18) have a higher average than the EU average; Sweden has the highest value (66.28%) and Italy has the lowest value (48.79%). In 2019, the trend is largely maintained; the labor force participation rate at EU level was 57.58%, with Sweden having the highest labor force participation rate (73.36%) and Italy the lowest (49.89%).

Greece, the Netherlands, and Malta have a leptokurtic distribution, sharper than the normal distribution, with more values concentrated around the average and showing extreme values. The other countries have a platikurtic distribution, with homogeneously dispersed values around the average. Bulgaria, Czechia, Estonia, Finland, Germany, Hungary, Romania, and Slovakia show a slight asymmetry to the left, and the others a slight asymmetry to the right.

In 2008 compared to 1996, labor force participation rates are homogeneous for all 28 EU member states. Sixteen states have a slight asymmetry to the right (At, Be, Dk, Fi, Fr, Gr, Hu, It, Lu, Mt, Nl, Pt, Sk, Sl, Sp, Sw), while the other states have a slight asymmetry to the left. The distribution is leptokurtic for one state (Sw), presenting higher probabilities for the extreme values, while for the other states the distribution is platykurtic, with values dispersed in a larger interval around the average.

For 2019 compared to 2009, labor force participation rates show homogeneity in all 28 EU member states. Eight states have a slight (Fr, Hu, It, Lu, Po, Ro, Sk, Sp) or a more pronounced (Sw) asymmetry to the right, while the other states have a slight asymmetry to the left, except for Ir where the left asymmetry is more pronounced. The distribution is leptokurtic for two states (Ir and Sw) presenting higher probabilities for the extreme values, and for the other states the distribution is platykurtic, with values dispersed in a larger interval around the average.

Regarding 2020 (

Figure 8), the effect of the COVID-19 pandemic on the labor force participation rate is imperceptible in the first quarter; however, the decrease in the rate is evident for the second quarter in almost all states (except Croatia), the largest decrease recorded by Spain (almost 7%).

The main factor of economic growth along with the final consumption by the population is the gross fixed capital formation. Across the EU, GCF growth was only 1.3% in 2019 compared to 1996; this was due to the fact that in a number of important countries the value of investments in GDP remained at about the same value or even decreased when compared to 1996.

Greece had the largest decrease in GCF (45%), followed by Sk (34%) and Cz, Pt, Cy, and Mt with over 20%. In contrast, the highest increases were registered by Bulgaria with 310% and Ireland with 119.4%, which, however, also had very strong variations (

Table 4).

Analyzing GCF in the first year after the crisis, it is observed that in most states the value of investments decreased. The emerging states had higher increases (Bg 16.6% and Ro 5.5%) than the developed states (between 1–3%). After the crisis period (2009–2019), there is a moderate increase in investment in 16 states (At, Be, Cz, Dk, Es, Fi, Fr, Ge, Hu, Ir, La, Lt, Mt, Sk, Sw, UK), the highest increase in Ireland (105.97%) and the lowest La and Fi, around 3%. The other states registered decreases, the largest decrease registered by Greece with 45.08%.

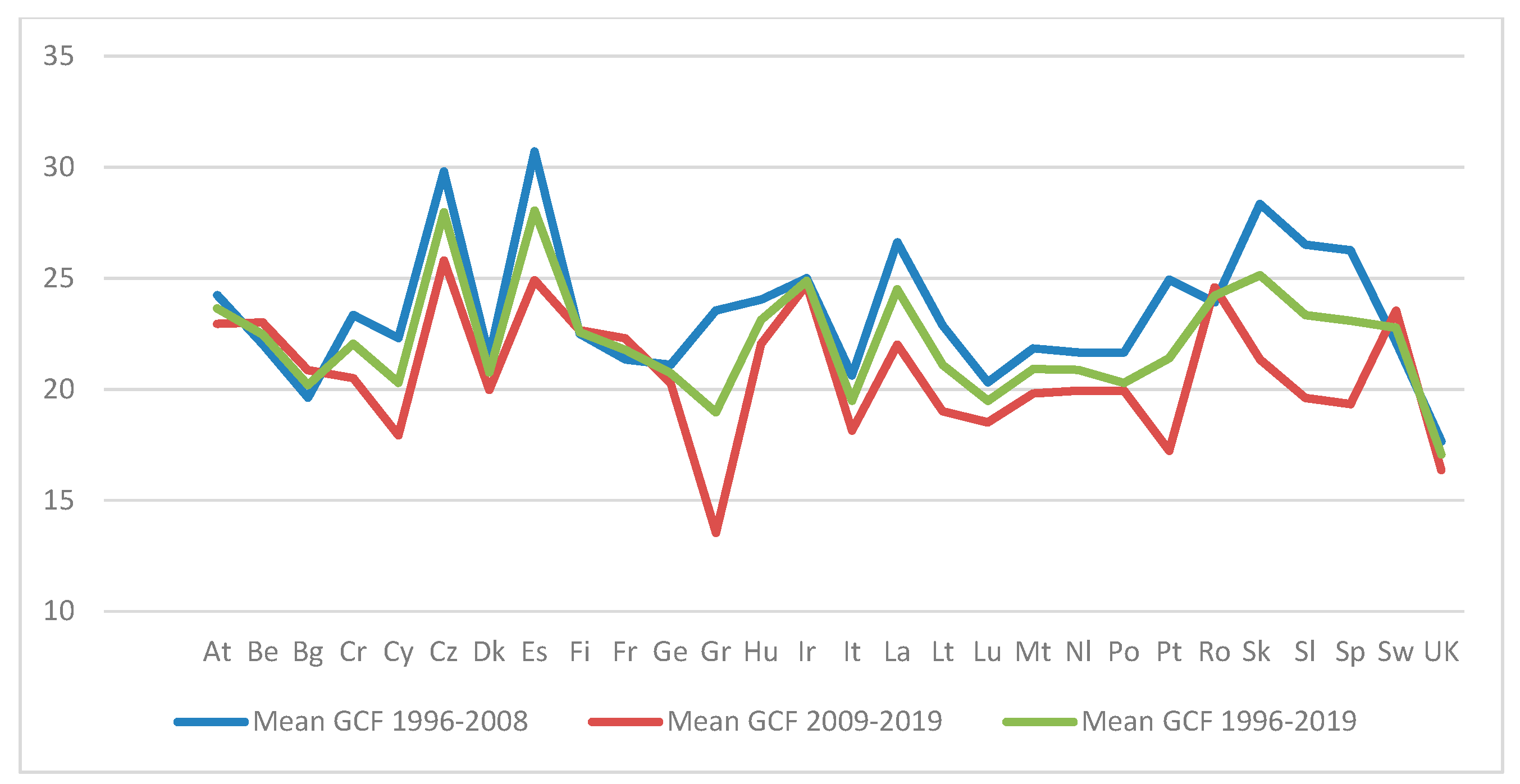

The largest investments are obviously made until the crisis, averaging around 20% of GDP (excluding the UK, 17.66%). The average values for the period 1996–2019 are lower than those for the period 1996–2008, which means that gross fixed capital formation in the EU-28 has not fully recovered since its dramatic collapse in 2009, although it has shown relative increases each year (

Figure 9).

Thus, it is observed that at the level of EU member states (

Figure 10), there are large differences in terms of investment intensity, which is reflected, in part, in the different stages of economic development of countries, as well as the dynamics of growth in later years. The average of GCF at EU level for the period 1996–2019 is 21.44%; 15 states have higher average values than the EU average, the highest averages registered by Estonia (28.05%) and Czechia (27.99%).

In 2019, gross fixed capital formation (in current prices) as a percentage of GDP was 21.64% at EU-28 level, with 13 countries having higher GCF shares than the EU average, with the highest values in Ireland (43.4%), followed by Hungary (28.6%), Estonia and Czechia (over 25%), and the other 15 countries registering values lower than the EU average, with the lowest level in Greece (11.42%).

In 2019 compared to 1996, according to the analysis of the homogeneity coefficient, it is observed that 13 states and the EU as a whole have a homogeneous structure of GCF values, 11 countries have a relatively homogeneous GCF value, and the other four states (Croatia, Cyprus, Estonia, and Portugal) have relatively heterogeneous values.

GCF for most EU member states and the EU as a whole has a platikurtic distribution, with the exception of Bulgaria, Hungary, Ireland, Latvia, Lithuania, and Romania, which have a leptokurtic distribution. Half of the countries and the EU have a slight asymmetry to the left, and the other 14 states have a slight asymmetry to the right.

For 2008 compared to 1996, GCF shows homogeneity (for At, Be, Cz, Dk, Fi, Fr, Ge, Gr, Hu, It, Lu, Mt, Nl, Po, Pt, Sl, Sw, UK), relative homogeneity (for Cr, Cy, Es, Ir, Lt), and relative heterogeneity (La, Sk, Sp) or heterogeneity (Bg and Ro). Six states have a slight asymmetry to the right (Bg, Gr, It, Lu, Mt, Sp), while the others have a slight asymmetry to the left. The distribution is platykurtic, with values scattered in a larger range around the average for all 28 EU member states.

In 2019 compared to 2009, GCF shows homogeneity (in At, Be, Cr, Cz, Dk, Es, Fi, Fr, Ge, It, La, Lt, Lu, Nl, Po, Ro, Sk, Sl, Sp, Sw, UK), relative homogeneity (in Bg, Hu, Mt, Pt), or relative heterogeneity (Cy, Gr, Ir). Ten states have a slight asymmetry to the right (Cy, Es, Fi, La, Lt, Lu, Nl, Po, Ro, UK), while the other states have a slight asymmetry to the left, except for Cr where it is more pronounced. The distribution is leptokurtic for three states (Bg, Cr, Sl), presenting higher probabilities for the extreme values, while for the others the distribution is platykurtic, with values dispersed in a larger interval around the average.

At EU-27 level, the first quarter of 2020 marked an increase in the share of GCF in GDP of 3.4% (

Table 5). Regarding the share of investments in GDP by state, in the first quarter of 2020 compared to 2019 there is a decrease in most states (except for Ro, Po, Nl, La, Lt, Ge, Cy, Cr, At), the largest decrease being registered by Luxembourg (12.94%). In the second quarter compared to the same period of 2019, 11 countries mark an increase in GCF in GDP, but for EU-27 there is a decrease of 6.5%. The largest decrease is recorded by Ireland (71%).

Given that remittances represent a capital inflow into the country of origin, remittances can affect the country’s economic balance and the macroeconomic variable GDP. Remittances are an important source of foreign transfers to developing countries and can be considered a financial mechanism for development. The trend of this currency inflow in the countries of origin obviously illustrates that the value of remittances decreases visibly [

8,

55], and the strategic analysis of this trend, especially due to the COVID-19 pandemic cannot be optimistic—foreign exchange inflows into countries of origin will fall drastically. The economic and geopolitical situation of the host countries is only one of these factors, but the UK’s exit from the EU (1 January 2020) will clearly have a negative impact on remittance inflows to the external balance of payments of emerging countries.

The share of remittances in GDP represents an increase of 100.58% in 2019 compared to 1996. The largest increases in Rem_GDP were, as expected, in the emerging countries Lt, Ro, Sk, Es, Cz, Bg, Hu, with the share of remittances in GDP increasing from around 0.03% to over 3% (

Table 6,

Figure 11). A decrease in Rem_GDP was recorded in six countries (Gr, Ir, Lu, Pt, Sl, Sp) with the largest decrease recorded in Portugal (92.42%) and followed by Greece (84.73%).

The share of remittances in GDP has increased significantly in emerging countries due to the free movement of people in the EU, which has led to an increase in labor migration to developed countries.

In the pre-crisis period, developed countries received massive labor from emerging countries, which led to an increase in the value of remittances sent to their countries of origin, the largest increase recorded by Lithuania, followed by Estonia. In the post-crisis period, their share in GDP decreased but remained significant.

The analysis of the average share of remittances in GDP shows a significant increase after the crisis (2009–2019) (

Figure 12); most states recorded increases of average Rem_GDP, except for Pt and Gr, which recorded significant decreases. UK, Sp, Ir, and Dk generally remained at the same values.

In 2019 compared to 1996, the share of remittances in GDP shows homogeneity in Luxembourg, relative homogeneity in four states (At, Be, Dk, Fi), relative heterogeneity for four states (Cr, Fi, Ir, Nl), and heterogeneity for the other states. Ten states have a slight asymmetry and Finland a more pronounced asymmetry to the right, and the other states generally have a slight left asymmetry (except Pt). The distribution is leptokurtic for six states (At, Fi, Fr, Ir, Pt, Sp) presenting higher probabilities for the extreme values, and for the other states the distribution is platikurtic, with values dispersed over a larger range around the average.

In 2008 compared to 1996, Rem_GDP shows homogeneity (in Be, Lu), relative homogeneity (in Cr, Fr, Ge), relative heterogeneity (in At, Dk, Fi, Hu, Ir, It, Nl, Sl), and heterogeneity for the other countries. Seven states have a slight (As, Cr, Dk, Fi, Hu, Lu, NL) or more pronounced (Fr) asymmetry to the right, while the other states have a slight asymmetry on the left, except Cy where it is more pronounced. The distribution is leptokurtic for six states (Cy, Fi, Fr, Ir, It, La) presenting higher probabilities for the extreme values, while for the others the distribution is platykurtic, with values dispersed in a larger interval around the average.

In 2019 compared to 2009, Rem_GDP shows homogeneity (in At, Be, Es, Fi, Ge, Lu, Pt), relative homogeneity (in Bg, Dk, Fr, It, La, Mt, Nl, Po, Sk, Sw), relative heterogeneity (in Cr, Cy, Hu, Ir, Lt, Sp), and heterogeneity for the other countries. Thirteen states have a slight (At, Cz, Dk, Fr, Ge, Hu, Ir, It, La, Pt, Ro, Sl, Sp) or more pronounced (Fi) asymmetry to the right, while the other states have a slight asymmetry to the left. The distribution is leptokurtic for one state (Fi) presenting higher probabilities for the extreme values, while for the others the distribution is platykurtic, with values dispersed in a larger interval around the average.