Advance Purchase Discounts for Supply Chain Finance System Coordination

Abstract

:1. Introduction

2. Literature Review

2.1. The Advance Purchase Discounts Literature

2.2. Literature on Option Contract Modelling

3. The APD Model

- K is the price discount offered to the retailer on the original regular price P for each unit of the product ordered in advance, where K ∈ (0, 1]. By purchasing the product in advance, the retailer obtains a price discount and guaranteed product delivery. Let TAPD be the preselling time, namely how much time in advance the product can be bought. Generally, K depends on TAPD since different discounts and price tiers may exist for different TAPD. For the sake of simplicity, we assume one single value for TAPD (as per standard industry trade terms), and therefore one value for discount K. Regular price P can be assumed to be deterministic since it is generally fixed at the beginning of the contractual relationship and does not vary in the short time horizon of validity of an APD program (here we assume 1 year).Dt is the total (stochastic) demand of the product that is sold to the retailer at t (i.e., the agreed amount under a standard contract).

- Qt is the total (stochastic) quantity of the product sold under the APD scheme at t to those retailers who agree to advance their orders and subscribe to the APD program for the product in question. Qt is a stochastic variable since it is not known how many orders will be made under the APD program. Also, Qt is generally less than Dt (the total demand under a standard contract) since the usual contract setting assumes that the retailer has the faculty to not make the order early and not exploit the discount offered by the upstream firm.

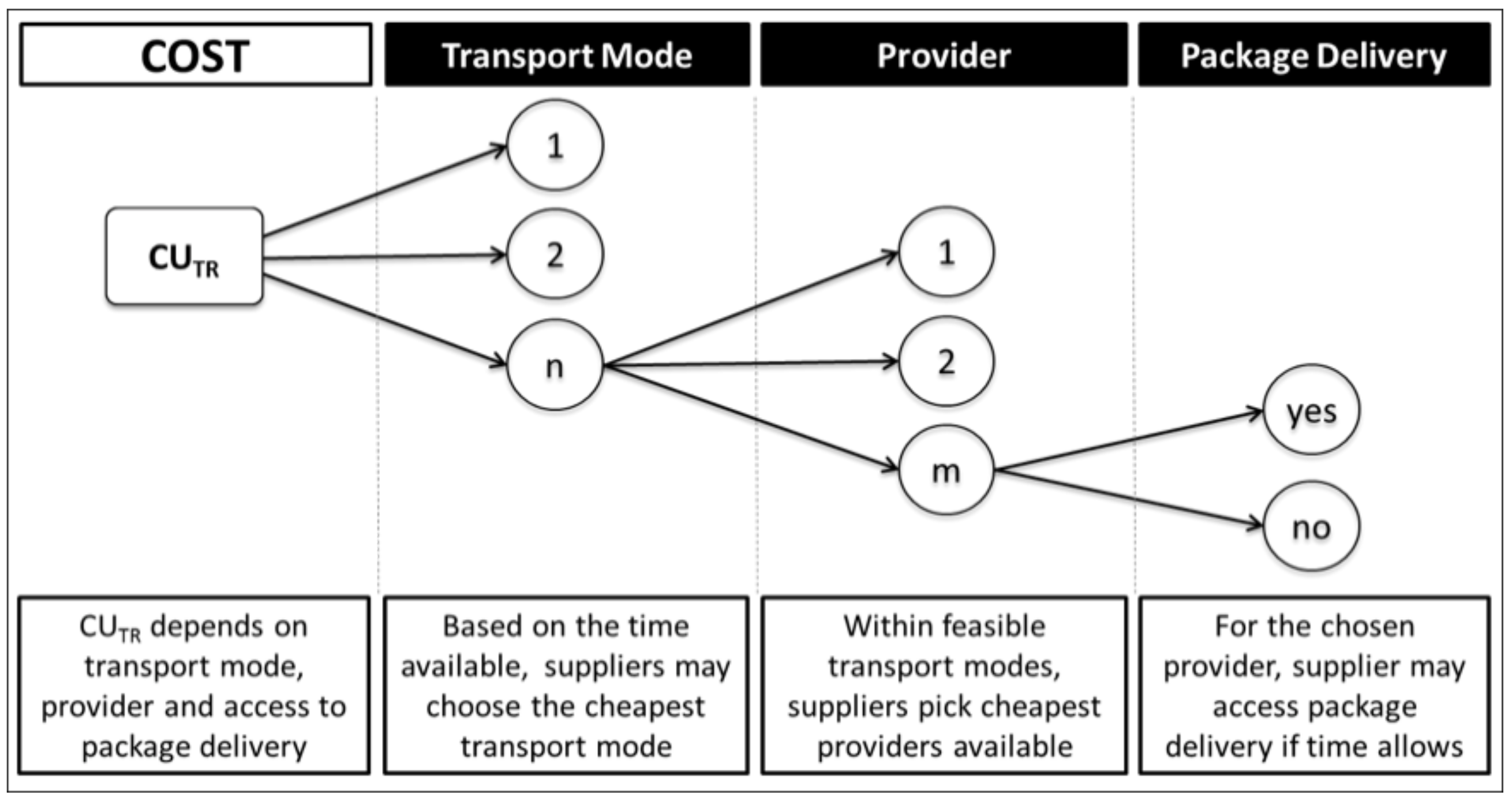

- “Transport-Mode”: being based on the time available for transportation, the supplier may choose to deliver via m different transport options (e.g., jet, truck, rail etc.), preferring the lowest-cost option that is able to deliver within the expected delivery date;

- “Provider”: since the preferred providers (tier 1) may not have assets available to accept last minute loads, the supplier has to move on to the next provider(s) n in order of preference (tier 2, 3, …) complete with increased costs, until the load is accepted;

- “Package Delivery” enables the reduction of costs by a certain value, as deliveries could be grouped, if the time available is sufficient to organize package delivery (the proper transportation lane and space have to be available)

4. A Numerical Application: The Case of a Fortune 100 Company

4.1. The Model’s Inputs

- We assume that the portion of demand that the retailer will allocate to APD (Qt) will vary stochastically in time, depending on both the historical behavior of the retailer and the APD discount, as described in (12).

- For crashing and tardiness times (, , as statistically relevant historical data are not available, we reached out to production experts from the plant. Since experts generally do not know these values with any certainty, they usually express them as three-point estimates (reflecting the best/worst/most likely scenarios for the considered variable. Experts’ opinions expressed as three point-estimates are usually modeled as non-parametric probability distributions rather than parametric distributions where shape and range are determined by one or more distribution-specific parameters (which is more difficult to assess) [89]. One of the most commonly used probability distributions is the BetaPert distribution, which, strictly speaking, is a parametric distribution (since it derives from Beta) adapted to be able to estimate only min, max and expected values. Compared to triangular distributions, a BetaPert may be closer to a bell-shaped distribution, to give more importance to the central value rather than the extremes.

- For bullwhip effect reduction (BW, that will have a direct impact on inventory reduction), the literature generally considers a range between 10% and 40% [85]. Therefore, as statistically relevant historical data are not available, we reached out to supply chain experts to check what the expected value range in this case might be. The experts returned a range between 15% and 25%, with the same probability between the extremes. This suggests the use of a Uniform distribution. For perspective, the difference in the upper bound of the distribution (estimated rather than literature) arises from the fact that the experts considered 40% as high considering also the high service levels required in the industry.

- The fraction of the unsold units at the end of selling season I is a uniformly distributed variable, ranging between 0% (i.e., all the quantity ordered under the APD program has been sold) and a maximum quantity that, as suggested by the experts, is linked to the time of advanced orders TAPD (the higher the pre-order time, the greater the likelihood that retailers will have a higher level of unsold units at the end of the selling season compared with the simpler contract).

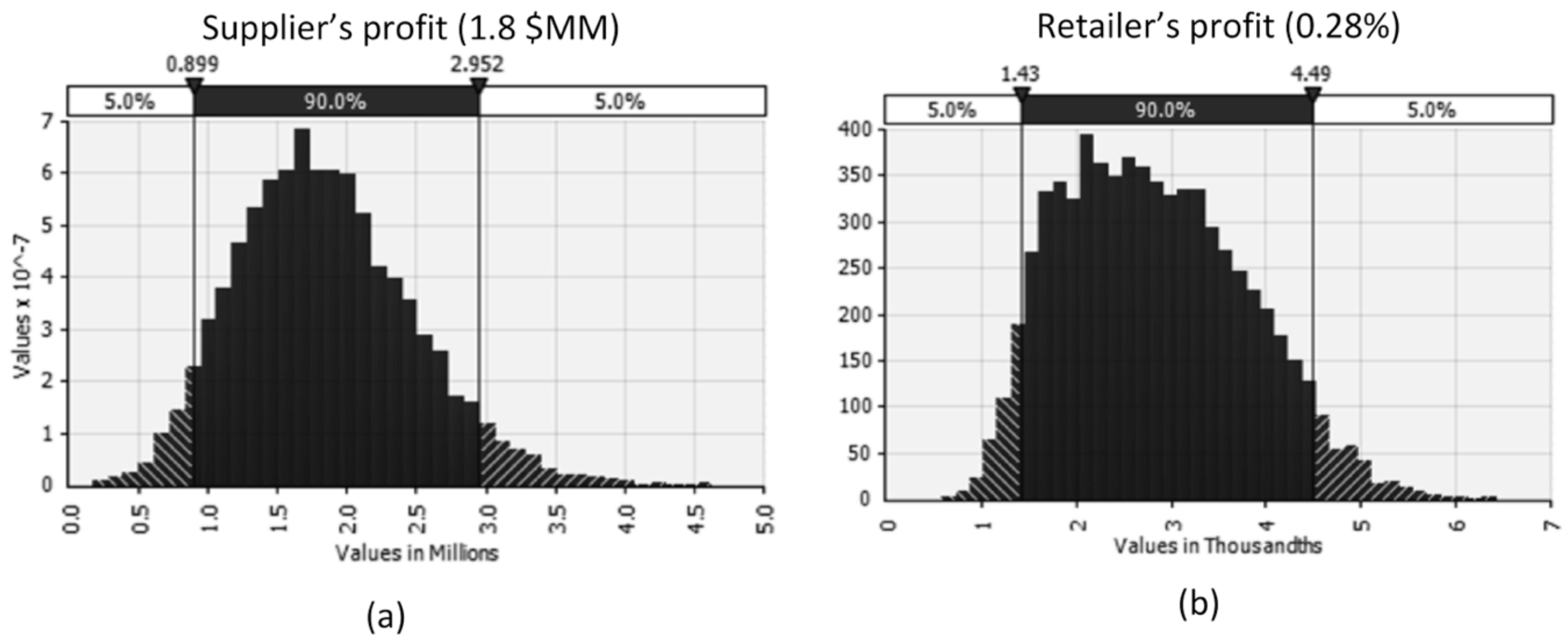

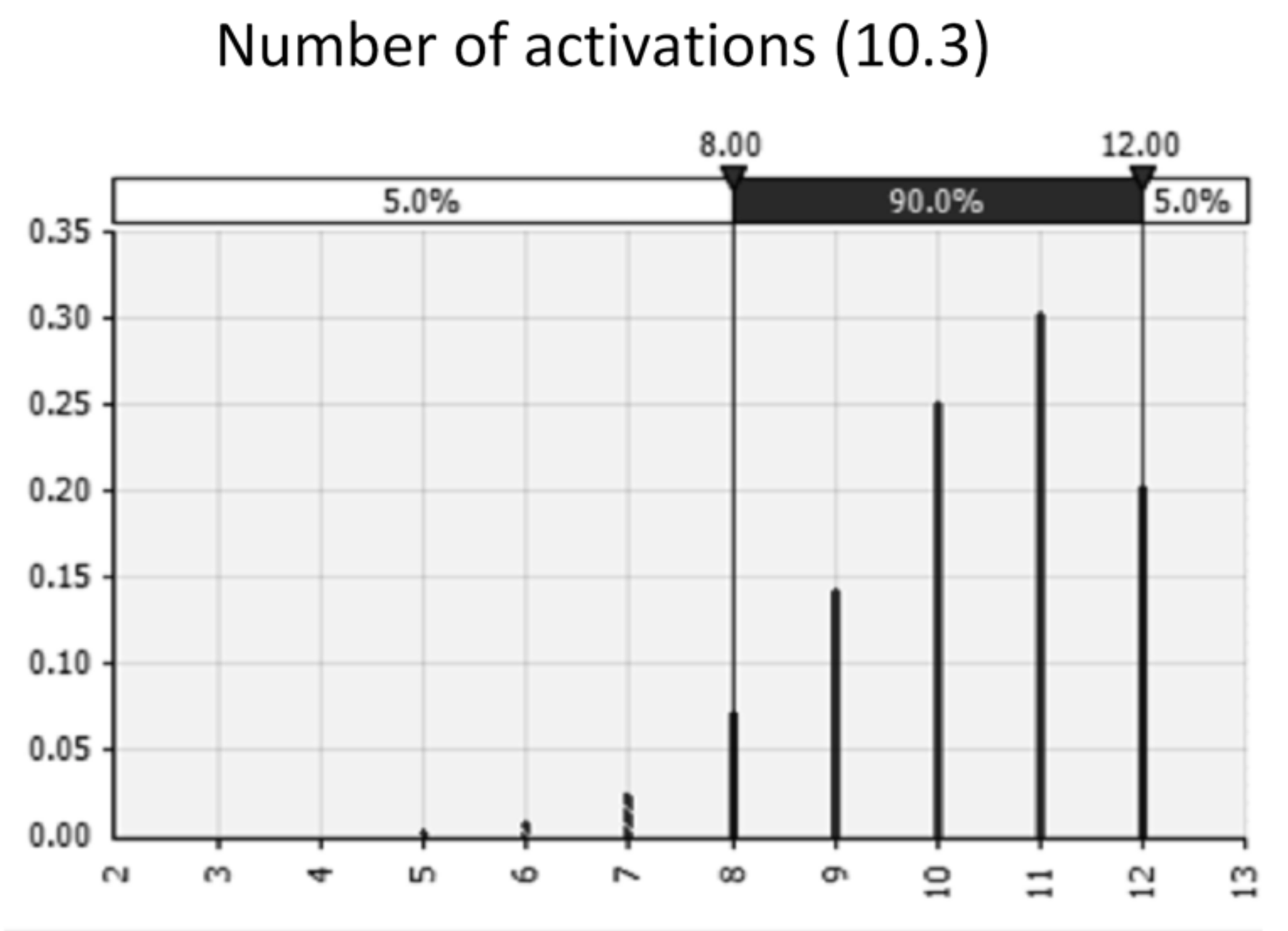

4.2. Results

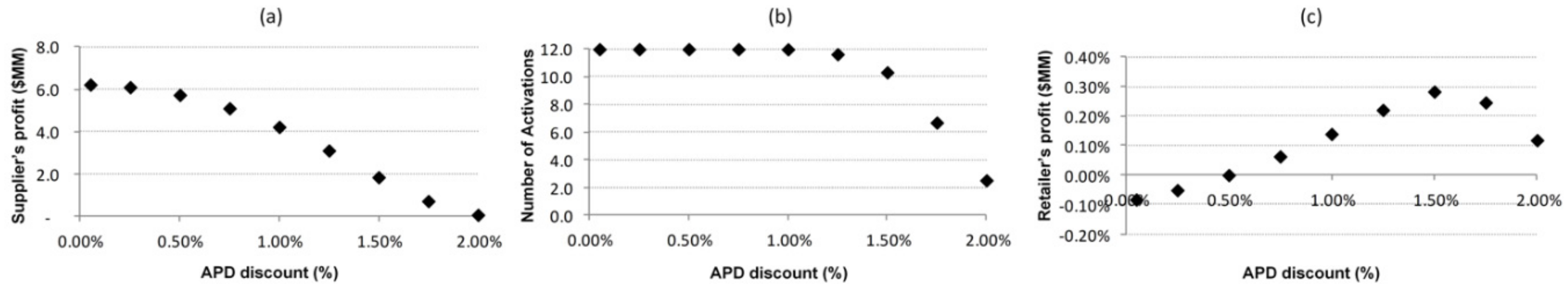

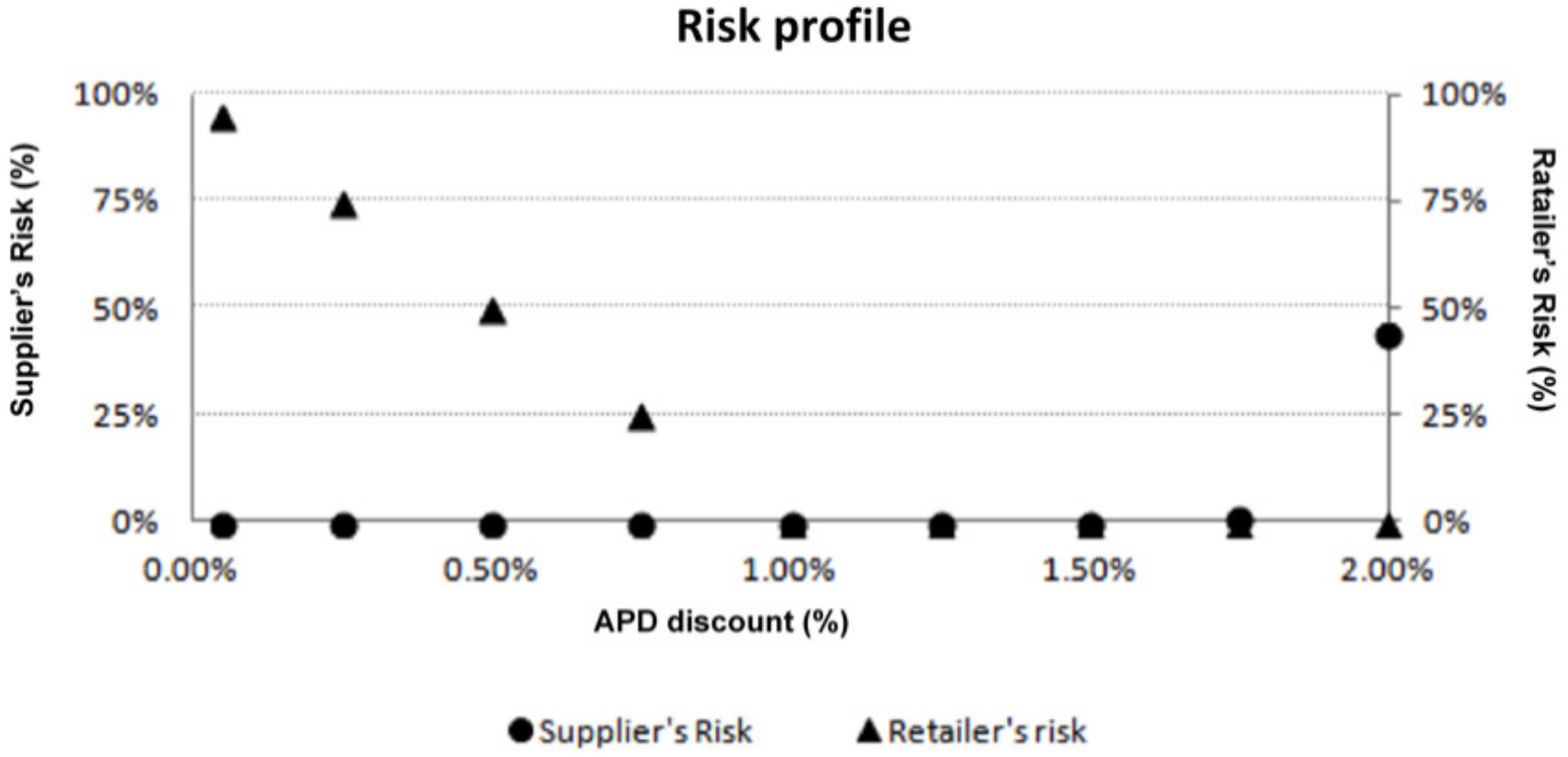

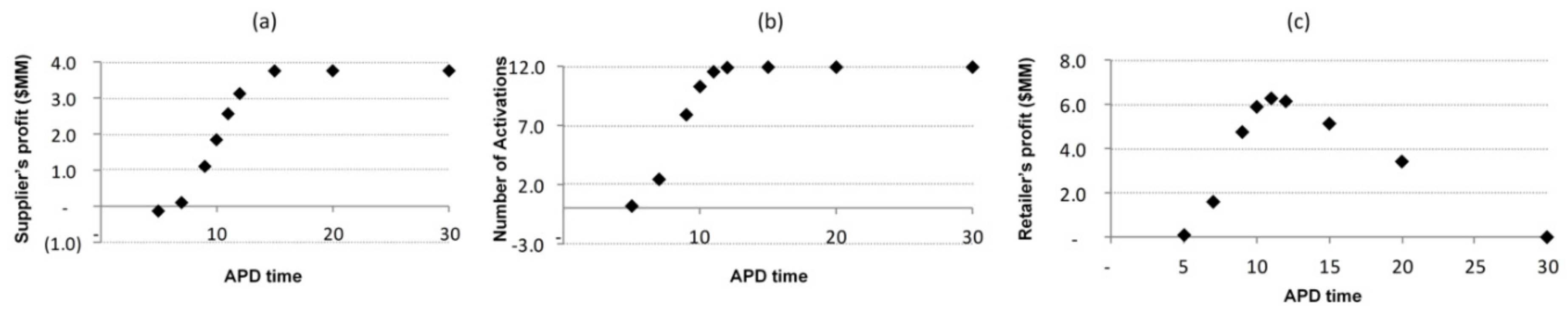

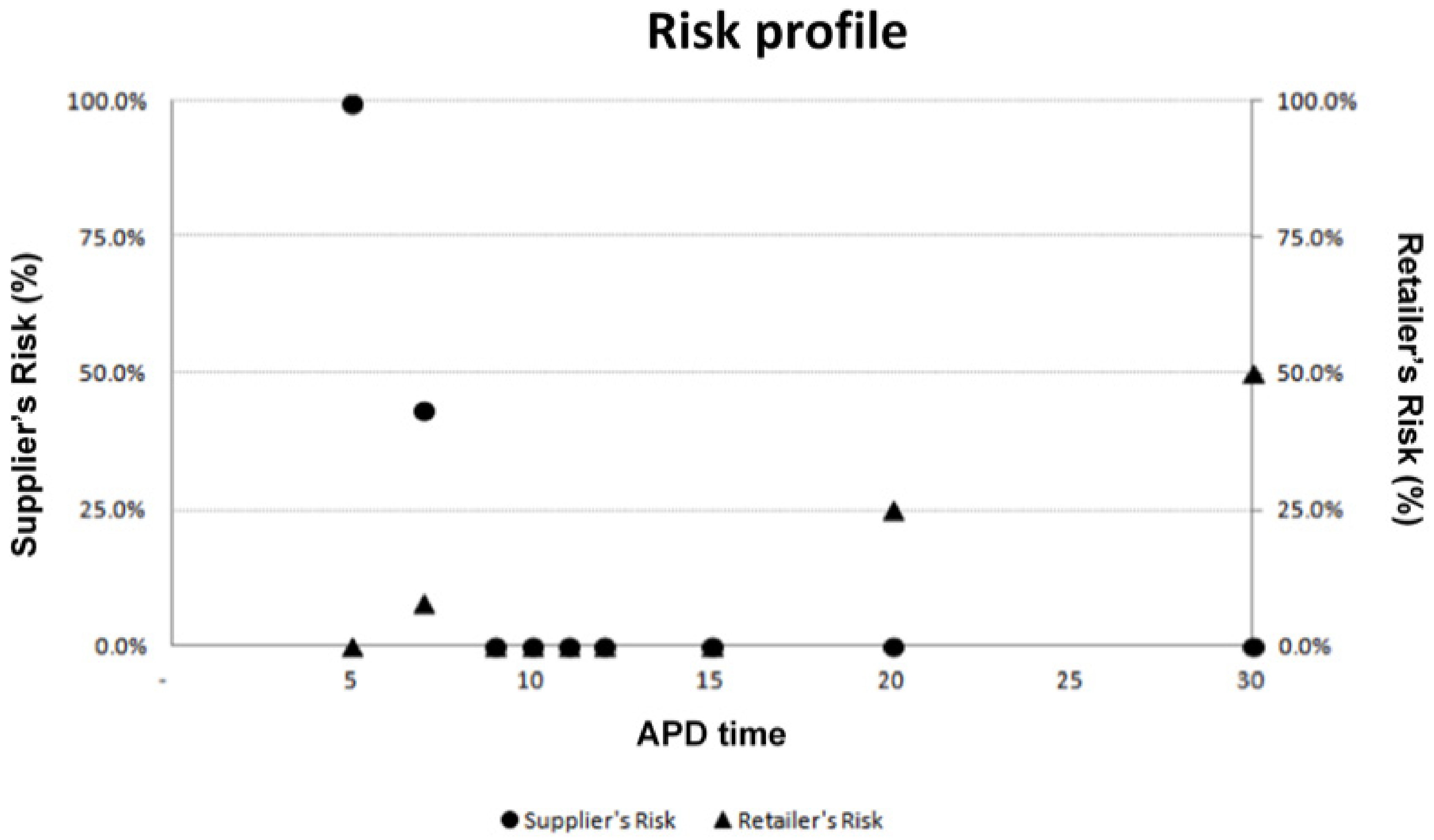

4.3. Sensitivity Analysis

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Christopher, M. Logistics and Supply Chain Management; Pitman Publishing: London, UK, 1992. [Google Scholar]

- Tsay, A.A.; Nahmias, S.; Agrawal, N. Modeling supply chain contracts: A review. In Quantitative Models for Supply Chain Management; Tayur, S., Ganeshan, R., Magazine, M., Eds.; Kluwer Academic Publisher: Norwell, MA, USA, 1999; pp. 299–336. [Google Scholar]

- Giannoccaro, I.; Pontrandolfo, P. Supply chain coordination by revenue sharing contracts. Int. J. Prod. Econ. 2004, 89, 131–139. [Google Scholar] [CrossRef]

- Schneeweiss, C. Distributed decision making in supply chain management. Int. J. Prod. Econ. 2003, 84, 71–83. [Google Scholar] [CrossRef]

- Whang, S. Coordination in operations: A taxonomy. J. Oper. Manag. 1995, 12, 413–422. [Google Scholar] [CrossRef]

- Lee, H.L.; Billington, C. The evolution of supply chain management models and practices at Hewlett-Packard. Interfaces 1995, 25, 42–63. [Google Scholar] [CrossRef]

- Lambert, D.M.; Cooper, M.C.; Pagh, J.D. Supply chain management: Implementation issues and research opportunities. Int. J. Logist. Manag. 1998, 9, 1–12. [Google Scholar] [CrossRef]

- Cachon, G.P.; Zipkin, P.H. Competitive and cooperative inventory policies in a two-stage supply chain. Manag. Sci. 1999, 45, 936–953. [Google Scholar] [CrossRef] [Green Version]

- Frohlich, M.T.; Westbrook, R. Arcs of integration: An international study of supply chain strategies. J. Oper. Manag. 2001, 19, 185–210. [Google Scholar] [CrossRef]

- De Kok, T.; Janssen, F.; van Doremalen, J.; van Wachem, E.; Clerkx, M.; Peeters, W. Electronics synchronizes its supply chain to end the bull whip effect. Interfaces 2005, 35, 37–48. [Google Scholar] [CrossRef] [Green Version]

- Tang, S.Y.; Kouvelis, P. Pay-Back-Revenue-Sharing Contract in Coordinating Supply Chains with Random Yield. Prod. Oper. Manag. 2014, 23, 2089–2102. [Google Scholar] [CrossRef]

- Saudi, M.H.M.; Juniati, S.; Kozicka, K.; Razimi, M.S.A. Influence of lean practices on supply chain performance. Pol. J. Manag. Stud. 2019, 19, 353–363. [Google Scholar] [CrossRef]

- Saudi, M.H.M.; Sinaga, H.O.; Roespinoedji, D.S. The role of tax education in supply chain management a case of Indonesian supply chain companies. Pol. J. Manag. Stud. 2018, 18, 284–299. [Google Scholar] [CrossRef]

- Kot, S.; Goldbach, I.R.; Ślusarczyk, B. Supply chain management in SMEs-Polish and Romanian approach. Econ. Sociol. 2018, 11, 142–156. [Google Scholar] [CrossRef]

- Kot, S.; Haque, A.; Baloch, A. Supply Chain Management in SMEs: Global Perspective. Montenegrin J. Econ. 2020, 16, 87–104. [Google Scholar] [CrossRef]

- Narayanan, V.G.; Raman, A. Aligning incentives in supply chains. Harvard Bus. Rev. 2004, 82, 94–103. [Google Scholar]

- Asian, S.; Nie, X. Coordination in supply chains with uncertain demand and disruption risks: Existence, analysis, and insights. IEEE Trans. Syst. Man Cybern. Syst. 2014, 44, 1139–1154. [Google Scholar] [CrossRef]

- Cachon, G.P. Supply Chain Coordination with Contracts. In Handbooks in Operations Research and Management Science: Supply Chain Management; Graves, S., de Kok, T., Eds.; Elsevier: Amsterdam, The Netherlands, 2003. [Google Scholar]

- Choi, T.M. Supply chain systems coordination with multiple risk sensitive retail buyers. IEEE Trans. Syst. Man Cybern. Syst. 2016, 46, 636–645. [Google Scholar] [CrossRef]

- Kouvelis, P.; Zhao, W. Supply chain contract design under financial constraints and bankruptcy costs. Manag. Sci. 2015, 62, 2341–2357. [Google Scholar] [CrossRef]

- Chakuu, S.; Masi, D.; Godsell, J. Exploring the relationship between mechanisms, actors and instruments in supply chain finance: A systematic literature review. Int. J. Prod. Econ. 2019, 216, 35–53. [Google Scholar] [CrossRef]

- Gelsomino, L.U.C.A.; Mangiaracina, R.; Perego, A.; Tumino, A. Supply chain finance: A literature review. Int. J. Phys. Distrib. Logist. Manag. 2016, 46. [Google Scholar] [CrossRef]

- Hofmann, E.; Belin, O. Supply Chain Finance Solutions; Springer: Berlin/Heidelberg, Germany, 2011; pp. 644–645. [Google Scholar]

- Wang, Z.; Wang, Q.; Lai, Y.; Liang, C. Drivers and outcomes of supply chain finance adoption: An empirical investigation in China. Int. J. Prod. Econ. 2020, 220, 107453. [Google Scholar] [CrossRef]

- Gomm, M.L. Supply chain finance: Applying finance theory to supply chain management to enhance finance in supply chains. Int. J. Logist. Res. Appl. 2010, 13, 133–142. [Google Scholar] [CrossRef]

- Xu, X.; Chen, X.; Jia, F.; Brown, S.; Gong, Y.; Xu, Y. Supply chain finance: A systematic literature review and bibliometric analysis. Int. J. Prod. Econ. 2018, 204, 160–173. [Google Scholar] [CrossRef]

- Lin, Q.; Su, X.; Peng, Y. Supply chain coordination in confirming warehouse financing. Comput. Ind. Eng. 2018, 118, 104–111. [Google Scholar] [CrossRef]

- Shi, J.; Du, Q.; Lin, F.; Li, Y.; Bai, L.; Fung, R.Y.; Lai, K.K. Coordinating the supply chain finance system with buyback contract: A capital-constrained newsvendor problem. Comput. Ind. Eng. 2020, 146, 106587. [Google Scholar] [CrossRef]

- Pellegrino, R.; Costantino, N.; Tauro, D. Supply Chain Finance: A supply chain-oriented perspective to mitigate commodity risk and pricing volatility. J. Purch. Supply Manag. 2019, 25, 118–133. [Google Scholar] [CrossRef]

- Eppen, G.D.; Iyer, A.V. Backup agreements in fashion buying—The value of upstream flexibility. Manag. Sci. 1997, 43, 1469–1484. [Google Scholar] [CrossRef]

- Emmons, H.; Gilbert, S.M. Note: The role of returns policies in pricing and inventory decisions for catalogue goods. Manag. Sci. 1998, 44, 276–283. [Google Scholar] [CrossRef]

- Lee, H.L.; Whang, S. Decentralized multi-echelon supply chains: Incentives and information. Manag. Sci. 1999, 45, 633–640. [Google Scholar] [CrossRef] [Green Version]

- Cachon, G.P.; Lariviere, M.A. Supply chain coordination with revenue sharing contracts: Strength and limitations. Manag. Sci. 2005, 51, 30–44. [Google Scholar] [CrossRef] [Green Version]

- Cachon, G.; Lariviere, M.A. Capacity choice and allocation: Strategic behavior and supply chain performance. Manag. Sci. 1999, 45, 1091–1108. [Google Scholar] [CrossRef] [Green Version]

- Weng, Z.K. Channel coordination and quantity discounts. Manag. Sci. 1995, 41, 1509–1522. [Google Scholar] [CrossRef]

- Tang, C.S.; Rajaram, K.; Alptekinoğlu, A.; Ou, J. The benefits of advance booking discount programs: Model and analysis. Manag. Sci. 2004, 50, 465–478. [Google Scholar] [CrossRef] [Green Version]

- Bernstein, F.; DeCroix, G.A. Advance demand information in a multiproduct system. Manuf. Serv. Oper. Manag. 2014, 17, 52–65. [Google Scholar] [CrossRef]

- Cachon, G.P. The Allocation of Inventory Risk in a Supply Chain: Push, Pull, and Advance-Purchase Discount Contracts. Manag. Sci. 2004, 50, 222–238. [Google Scholar] [CrossRef] [Green Version]

- Cho, S.H.; Tang, C.S. Advance selling in a supply chain under uncertain supply and demand. Manuf. Serv. Oper. Manag. 2013, 15, 305–319. [Google Scholar] [CrossRef]

- Li, C.; Zhang, F. Advance demand information, price discrimination, and preorder strategies. Manuf. Serv. Oper. Manag. 2013, 15, 57–71. [Google Scholar] [CrossRef] [Green Version]

- Nasiry, J.; Popescu, I. Advance selling when consumers regret. Manag. Sci. 2012, 58, 1160–1177. [Google Scholar] [CrossRef] [Green Version]

- Yu, M.; Kapuscinski, R.; Ahn, H.S. Advance selling: Effects of interdependent consumer valuations and seller’s capacity. Manag. Sci. 2015, 61, 2100–2117. [Google Scholar] [CrossRef]

- Gilbert, S.M.; Ballou, R.H. Supply chain benefits from advanced customer commitments. J. Oper. Manag. 1999, 18, 61–73. [Google Scholar] [CrossRef]

- Tang, W.; Girotra, K. Synchronizing Global Supply Chains: Advance Purchase Discounts. Working Paper. 2010. Available online: http://www.insead.edu/facultyresearch/research/doc.cfm?did=43578 (accessed on 3 December 2013).

- McCardle, K.; Rajaram, K.; Tang, C. Advance Booking Discount Programs under Retail Competition. Manag. Sci. 2004, 50, 701–708. [Google Scholar] [CrossRef] [Green Version]

- Xie, J.; Shugan, S. Electronic tickets, smart cards, and online prepayments: When and how to advance sell. Market. Sci. 2001, 20, 219–243. [Google Scholar] [CrossRef] [Green Version]

- Dana, J., Jr. Advance-Purchase Discounts and Price Discrimination in Competitive Markets. J. Political Econ. 1998, 106, 395–422. [Google Scholar] [CrossRef]

- Gundepudi, P.; Rudi, N.; Seidmann, A. Forward vs. spot buying of information goods on Web: Analysing the consumer decision process. J. Manag. Inf. Syst. 2001, 18, 107–131. [Google Scholar] [CrossRef]

- Akan, M.; Ata, B.; Dana, J. Revenue Management by Sequential Screening; Working Paper; Northwestern University: Evanston, IL, USA, 2009. [Google Scholar]

- Bellantuono, N.; Giannoccaro, I.; Pontrandolfo, P.; Tang, C. The implications of joint adoption of revenue sharing and advance booking discount programs. Int. J. Prod. Econ. 2009, 121, 383–394. [Google Scholar] [CrossRef]

- Donohue, K. Efficient supply contracts for fashion goods with forecast updating and two production modes. Manag. Sci. 2000, 46, 1397–1411. [Google Scholar] [CrossRef]

- Ozer, O.; Uncu, O.; Wei, W. Selling to the newsvendor with a forecast update. Eur. J. Oper. Res. 2007, 182, 1150–1176. [Google Scholar] [CrossRef]

- Kogut, B.; Kulatilaka, N. Option thinking and platform investment: Investing in opportunity. Calif. Manag. Rev. 1994, 36, 52–71. [Google Scholar] [CrossRef]

- Boute, R.; Demeulemeester, E.; Herroelen, W. A real options approach to project management. Int. J. Prod. Res. 2004, 42, 1715–1725. [Google Scholar] [CrossRef]

- Olafsson, S. Making decisions under uncertainty—Implications for high technology investments. BT Technol. J. 2003, 21, 170–183. [Google Scholar] [CrossRef]

- Luehrman, T.A. Investment Opportunities as Real Options: Getting Started on the Numbers; Harvard Business Review: Boston, MA, USA, 1998. [Google Scholar]

- Trigeorgis, L. Real Options; The MIT Press: Cambridge, MA, USA, 1996. [Google Scholar]

- Wang, X.; Liu, L. Coordination in a retailer-led supply chain through option contract. Int. J. Prod. Econ. 2007, 110, 115–127. [Google Scholar] [CrossRef]

- Newbery, D. Competition, contracts, and entry in the electricity spot market. RAND J. Econ. 1998, 29, 726–749. [Google Scholar] [CrossRef]

- Spinler, S.; Huchzermeier, A.; Kleindorfer, P. Options on capacity: Applications to e-transport platforms. In Logistics Management; Sebastian, H.J., Grünert, T., Eds.; Teubner: Stuttgart, Germany, 2001; pp. 305–315. [Google Scholar]

- Spinler, S.; Huchzermeier, A.; Kleindorfer, P. An options approach to enhance economic efficiency in a dyadic supply chain. In Cost Management in Supply Chains; Stefan, S., Maria, G., Eds.; Physica: Heidelberg, Germany, 2002; pp. 350–360. [Google Scholar]

- Wu, D.; Kleindorfer, P.; Zhang, J. Optimal bidding and contracting strategies for capital-intensive goods. Eur. J. Oper. Res. 2002, 137, 657–676. [Google Scholar] [CrossRef]

- Barnes-Schuster, D.; Bassok, Y.; Anupindi, R. Coordination and flexibility in supply contracts with options. Manuf. Serv. Oper. Manag. 2002, 4, 171–207. [Google Scholar] [CrossRef]

- Milner, J.M.; Rosenblatt, M.J. Flexible supply contracts for short life-cycle goods: The buyer’s perspective. Nav. Res. Logist. 2002, 49, 25–45. [Google Scholar] [CrossRef]

- Wang, Q.Z.; Tsao, D.B. Supply contract with bidirectional options: The buyer’s perspective. Int. J. Prod. Econ. 2006, 101, 30–52. [Google Scholar] [CrossRef]

- Cheng, F.; Ettl, M.; Lin, G.Y.; Schwarz, M.; Yao, D.D. Flexible Supply Contracts via Options; Working Paper; IBM T.J. Watson Research Center: Yorktown Heights, NY, USA, 2003. [Google Scholar]

- Cachon, G.; Lariviere, M.A. Contracting to assure supply: How to share demand forecasts in a supply chain. Manag. Sci. 2001, 47, 629–646. [Google Scholar] [CrossRef] [Green Version]

- Costantino, N.; Pellegrino, R. Choosing between single and multiple sourcing based on supplier default risk: A real options approach. J. Purch. Supply Manag. 2010, 16, 27–40. [Google Scholar] [CrossRef]

- Black, F.; Scholes, M. The pricing of options and corporate liabilities. J. Political Econ. 1973, 81, 637–654. [Google Scholar] [CrossRef] [Green Version]

- Merton, R.C. The Theory of Rational Option Pricing. Bell J. Econ. Manag. Sci. 1973, 4, 141–183. [Google Scholar] [CrossRef] [Green Version]

- Boyle, P.P. Options: A Monte Carlo Approach. J. Financ. Econ. 1977, 4, 323–338. [Google Scholar] [CrossRef]

- Cox, J.C.; Ross, S.A.; Rubinstein, M. Option pricing: A simplified approach. J. Financ. Econ. 1979, 7, 229–263. [Google Scholar] [CrossRef]

- Longstaff, F.A.; Schwartz, E.S. Valuing American Options by Simulation: A Simple Least-Squares Approach. Rev. Financ. Stud. 2001, 14, 113–147. [Google Scholar] [CrossRef] [Green Version]

- De Neufville, R.; Scholtes, S.; Wang, T. Real Options by Spreadsheet: Parking Garage Case Example. J. Infrastruct. Syst. 2006, 12, 107–111. [Google Scholar] [CrossRef] [Green Version]

- Lander, D.M.; Pinches, G.E. Challenges to the Practical Implementation of Modelling and Valuing Real Options. Q. Rev. Econ. Financ. 1998, 38, 537–567. [Google Scholar] [CrossRef]

- Evers, P.T.; Wan, X. Systems analysis using simulation. J. Bus. Logist. 2012, 33, 80–89. [Google Scholar] [CrossRef]

- Chang, Y.; Makatsoris, H. Supply chain modelling using simulation. Int. J. Simul. 2001, 2, 24–30. [Google Scholar]

- Goldsby, T.J.; Griffis, S.E.; Roath, A.S. Modeling lean, agile, and leagile supply chain strategies. J. Bus. Logist. 2006, 27, 57–80. [Google Scholar] [CrossRef]

- Wan, X.; Evers, P.T. Supply chain networks with multiple retailers: A test of the emerging theory on inventories, stockouts, and bullwhips. J. Bus. Logist. 2011, 32, 27–39. [Google Scholar] [CrossRef]

- Manuj, I.; Mentzer, J.T.; Bowers, M.R. Improving the rigor of discrete-event simulation in logistics and supply chain research. Int. J. Phys. Distrib. Logist. Manag. 2009, 39, 172–201. [Google Scholar] [CrossRef]

- Manuj, I.; Esper, T.L.; Stank, T.P. Supply chain risk management approaches under different conditions of risk. J. Bus. Logist. 2014, 35, 241–258. [Google Scholar] [CrossRef]

- Chiara, N.; Garvin, M.; Vecer, J. Valuing Simple Multiple-Exercise Real Options in Infrastructure Projects. ASCE J. Infrastruct. Syst. 2007, 13, 97–104. [Google Scholar] [CrossRef] [Green Version]

- Cakravastia, A.; Toha, I.S.; Nakamura, N. A two-stage model for the design of supply chain networks. Int. J. Prod. Econ. 2002, 80, 231–248. [Google Scholar] [CrossRef]

- Slotnick, S.A.; Sobel, M.J. Manufacturing lead-time rules: Customer retention versus tardiness costs. Eur. J. Oper. Res. 2005, 163, 825–856. [Google Scholar] [CrossRef]

- AMR Research. Beyond CPFR: Collaboration Comes of Age, The Report on Retail E-Business; AMR Research: Boston, MA, USA, 2001. [Google Scholar]

- Law, A.M. Simulation Modeling and Analysis; McGraw-Hill: New York, NY, USA, 2006. [Google Scholar]

- Benavides, D.L.; Duley, J.R.; Johnson, B.E. As good as it gets: Optimal Fab design and deployment. IEEE Trans. Semicond. Manuf. 1999, 12, 281–287. [Google Scholar] [CrossRef]

- Chou, Y.C.; Cheng, C.T.; Yang, F.C.; Liang, Y.Y. Evaluation of alternative capacity strategies in semiconductor manufacturing under uncertain demand and price scenarios. Int. J. Prod. Econ. 2007, 105, 591–606. [Google Scholar] [CrossRef]

- Vose, D. Quantitative Risk Analysis. A Guide to Monte Carlo Simulation Modelling; John Wiley & Sons: Hoboken, NJ, USA, 1996. [Google Scholar]

- Brealey, R.; Myers, S. Principles of Corporate Finance, 6th ed.; Irwin McGraw-Hill: Boston, MA, USA, 2000. [Google Scholar]

| Deterministic Variables | Unit of Measure | Value |

|---|---|---|

| Unitary Crashing Cost— | $/good/day | 0.025 |

| Unitary Tardiness Cost— | $/good/day | 0.09 |

| Time of advanced orders from APD— | Days | 10 |

| Standard time needed for delivery— | Days | 1 |

| Time to use preferred Rail Provider— | Days | 5 |

| Time to use not-preferred Rail Provider— | Days | 4 |

| Time to use preferred Truck Provider— | Days | 2 |

| Time to use preferred Rail Provider— | Days | 1 |

| Unitary Transport Cost, Rail Mode, Provider 1— | $/good | 0.450 |

| Unitary Transport Cost, Rail Mode, Provider 2— | $/good | 0.500 |

| Unitary Transport Cost, Truck Mode, Provider 1— | $/good | 0.060 |

| Unitary Transport Cost, Truck Mode, Provider 2— | $/good | 0.066 |

| Unitary Transport Standard Cost (no APD)— | $/good | 0.062 |

| Inventory Depreciation Expenses—IDE | [] | 16% |

| Inventory Level on Spend—INV | [] | 8% |

| Discount offered by APD—K | [] | 1.5% |

| Product Price—P | $/good | 3 |

| Discount for Package Delivery with Rail— | [] | 25% |

| Time to access Package Delivery with Rail— | Days | 6 |

| Discount for Package Delivery with Truck— | [] | 10% |

| Time to access Package Delivery with Truck— | Days | 3 |

| Weighted Average Cost of Capital—WACC | [] | 8% |

| ip | [] | 0.64% |

| ciR | $/good | 0.3 |

| Option cost Co | $/year | 150,000 |

| Stochastic Variables | Unit of Measure | Value |

|---|---|---|

| Dt | Number of goods | Geometric Brownian Motion (GBM)—Demand Growth Rate μD = 5.2% |

| GBM—standard deviation σD = 0.18 | ||

| GBM—Dto = 58,000,000 | ||

| Qt | Number of goods | Mean Reverting (MR)—long run mean = 23% of D |

| MR—mean reversion rate α = 0.435 | ||

| MR—standard deviation σ = 0.144 | ||

| MR—Qto (%) = 15% | ||

| Portion related to discount, β = +10% × [(K − 0.5%)/0.5%)] | ||

| Random factor for retailer engagement, θt = (0.5, 1.5) | ||

| Days | BetaPert (0, 5, 11) | |

| Days | BetaPert (0, 1, 3) | |

| BW | [] | Uniform (15–25%) |

| I | [] | Uniform (0–TAPD%) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pellegrino, R.; Costantino, N.; Tauro, D. Advance Purchase Discounts for Supply Chain Finance System Coordination. Sustainability 2020, 12, 10156. https://doi.org/10.3390/su122310156

Pellegrino R, Costantino N, Tauro D. Advance Purchase Discounts for Supply Chain Finance System Coordination. Sustainability. 2020; 12(23):10156. https://doi.org/10.3390/su122310156

Chicago/Turabian StylePellegrino, Roberta, Nicola Costantino, and Danilo Tauro. 2020. "Advance Purchase Discounts for Supply Chain Finance System Coordination" Sustainability 12, no. 23: 10156. https://doi.org/10.3390/su122310156