Abstract

Background: Unlike other financial services, technology-driven changes in the insurance industry have not been a vastly explored topic in scholarly literature. Incumbent insurance companies have hitherto been holding their positions using the complexity of the product, heavy regulation, and gigantic balance sheets as paramount factors for a relatively slow digitalization and technological transformation. However, new technologies such as car telematic devices have been creating a new insurance ecosystem. The aim of this study is to assess the telematics technology acceptance for insurance purposes. Methods: The study is based on the Unified Theory of Acceptance and Use of Technology (UTAUT). By interviewing 502 new car buyers, we tested the factors that affect the potential usage of telematic devices for insurance purposes. Results: The results indicate that facilitating conditions are the main predictor of telematics use. Moreover, privacy concerns related to the potential abuse of driving behavior data play an important role in technology acceptance. Conclusions: Although novel insurance technologies are mainly presented as user-driven, users (drivers and insurance buyers) are often neglected as an active party in the development of such technologies.

1. Introduction

Unlike their banking counterpart [1], technology-driven changes in the insurance industry have not been a vastly explored topic in scholarly literature. Incumbent insurance companies have hitherto been holding their positions using the complexity of the product, heavy regulation, and gigantic balance sheets as paramount factors for a relatively slow digitalization and technological transformation. This, however, does not imply that the digital tones have not been playing a part in the realm of insurance business. As a matter of fact, the whole insurance value chain has been affected with the digitalization paradigm shift. For supporting activities such as general management, IT, human resources, controlling, legal department, or public relations in an insurance company, these changes are more or less the same as in other service or financial companies. However, Ref. [2] imply that even the core activities in insurance, such as contract administration, claims management, asset management, and risk management, are witnessing the change based on technologies such as the Internet of Things, cloud computing, chatbots and artificial intelligence, blockchain, robot-advisors, and big data.

One of the Internet of Things’ (IoT) technologies that might propel the digitalization of the insurance industry is vehicle telematics. In general, vehicle telematics encompass the collection, transmission, and analysis of data collected from a device installed in a motor vehicle [3]. For more than a decade now, telematic devices in automobiles have been propounded as a technology that will reshape the future of car insurance [4]. By 2030, the industry of the car telematics value pool is expected to be as large as $750 billion [5]. Although the technology can be used for a myriad of different purposes, it is best suited to the decision-making process of car insurance companies [4]. The main idea behind the introduction of telematic devices is that they can affect driving behavior and decrease the moral hazard of drivers. This will consequently decrease accidents and improve safety. Ultimately, risk premiums will decrease. As stated by [6] (p. 19), “[b]y recording data on drivers’ behavior, the information asymmetry between the policyholder and the insurer is reduced, enabling a granular risk differentiation based on the true risk levels of drivers.”

The main problem with this approach is the axiomatic presumption that all drivers are the same. Some scholars have already made the argument that telematic devices are not “one size fits all” [7]. Neither the devices nor the approach to potential users has been personalized. The aim of our study is to fill the gap in the present body of knowledge by examining the main factors that affect customers’ intention to use vehicle telematics. Specifically, we question how drivers respond to new technology, and whether or not they are willing to accept it. For the purpose of this study, we adopted the Unified Theory of Acceptance and Use of Technology (UTAUT), developed by [8] as one of the most prominent theories on user acceptance of technology. The present body of knowledge recognizes the importance of novel insurance technologies, and especially vehicle telematics. However, most of them shed light on technology push or pool strategies, thus putting the spotlight on high-tech or insurance companies.

Only a paucity of studies even tangentially mentions users (drivers and potential users of telematics) as an active player in the telematic-based insurance ecosystem. Technology-driven advances in the insurance industry allow for the creation of new business models and emphasize the digital transformation of the industry. Accordingly, our study is motivated by a recent call to research the opportunities, challenges, and global trends of this sector and how they might contribute directly and indirectly to the achievement of a sustainable development of the insurance industry. Telematics-based insurance products have already been promoted in the literature as a perspective solution for sustainable insurance, as they directly affect environmental, safety, energy, and resources saving [9].

The remainder of this study is organized in as follows. Section 2 explains how telematics affect the insurance ecosystem and puts the emphasis on the role of end users (drivers). Section 3 thoroughly elaborates on the methodology used in the study-variables, measures, sampling procedure, and data processing. Section 4 presents the results of the study. Section 5 contextualizes the results by explaining the main findings, contributions, implications, limitations, and further recommendations. The final section is reserved for concluding remarks.

2. Theoretical Framework

2.1. The Telematic-Based Car Insurance Ecosystem

In this subsection, we explain how the car insurance ecosystem has changed due to the emergence of a novel Internet of Things device-telematics. Insurance is a complex financial service business based on pooling funds from a large number of policyholders and paying to the ones experiencing losses. Car insurance, specifically, involves writing insurance for both commercial or private vehicle owners. The mandatory third-party vehicle liability insurance policy, for instance, is linked exclusively to the vehicle, not to the driver. This means that any damage will be covered, regardless of who is driving the vehicle. The essence of the insurance business is related to the selection and quantification of numerous policy risks and setting the right price. This assignment is conducted by actuaries. Once the decision on the premium is set, the insurance policy can be sold either directly by the insurance company or via the broker or insurance agent.

Some studies simplify the revenue model of insurance companies by dissecting two main streams [10]. The first revenue stream is by investing the premiums collected into a portfolio of investments, which is usually highly regulated and specified by a supervising national body. This stream will be completely neglected in this study.

The second stream comes from underwriting activities. The profit from such activities is basically the difference between the premiums sold and the payment made to, or on behalf of, the losses, together with the service-related expenses. This stream is particularly important for our study, as one of the main differentiators in the “core” business is the efficiency of the underwriting process. This holds for both life and non-life insurance, including car insurance. The conventional and highly saturated car insurance industry has been facing major challenges recently. The World Bank Group reports that, especially in less developed insurance markets, vehicle insurance can be the largest class of non-life business [11]. The nature of the risk has changed dramatically since February, as vehicle use has fallen sharply in many countries as a result of public health measures. The first evidence of reduced risk implies that this type of business makes a positive contribution to the business of insurers in the short term. In the long run, however, insurance renewal is likely to decline, and reduced economic activity will lead to a reduction in portfolio size, with a proportionate reduction in claims. In addition, changes in the way you go to work may mean that some clients change vehicle use and location in a way not provided for in the policies.

In a concurrent business environment, technology is the paramount driver of efficiency for insurance companies [12]. One technology that fundamentally disrupts the car insurance industry is telematics. Given its prolificacy, vehicle telematics is a subclass of the Internet of Things (IoT), usually referred to as the Internet of Vehicles (IoV) [13]. These devices enable data sharing through vehicle-to-vehicle (V2V), vehicle-to-person (V2P), and vehicle-to-road (V2R) interconnectivity [14]. Ever since their introduction into the car industry, telematic devices have spread rapidly, from commercial to non-commercial uses [15].

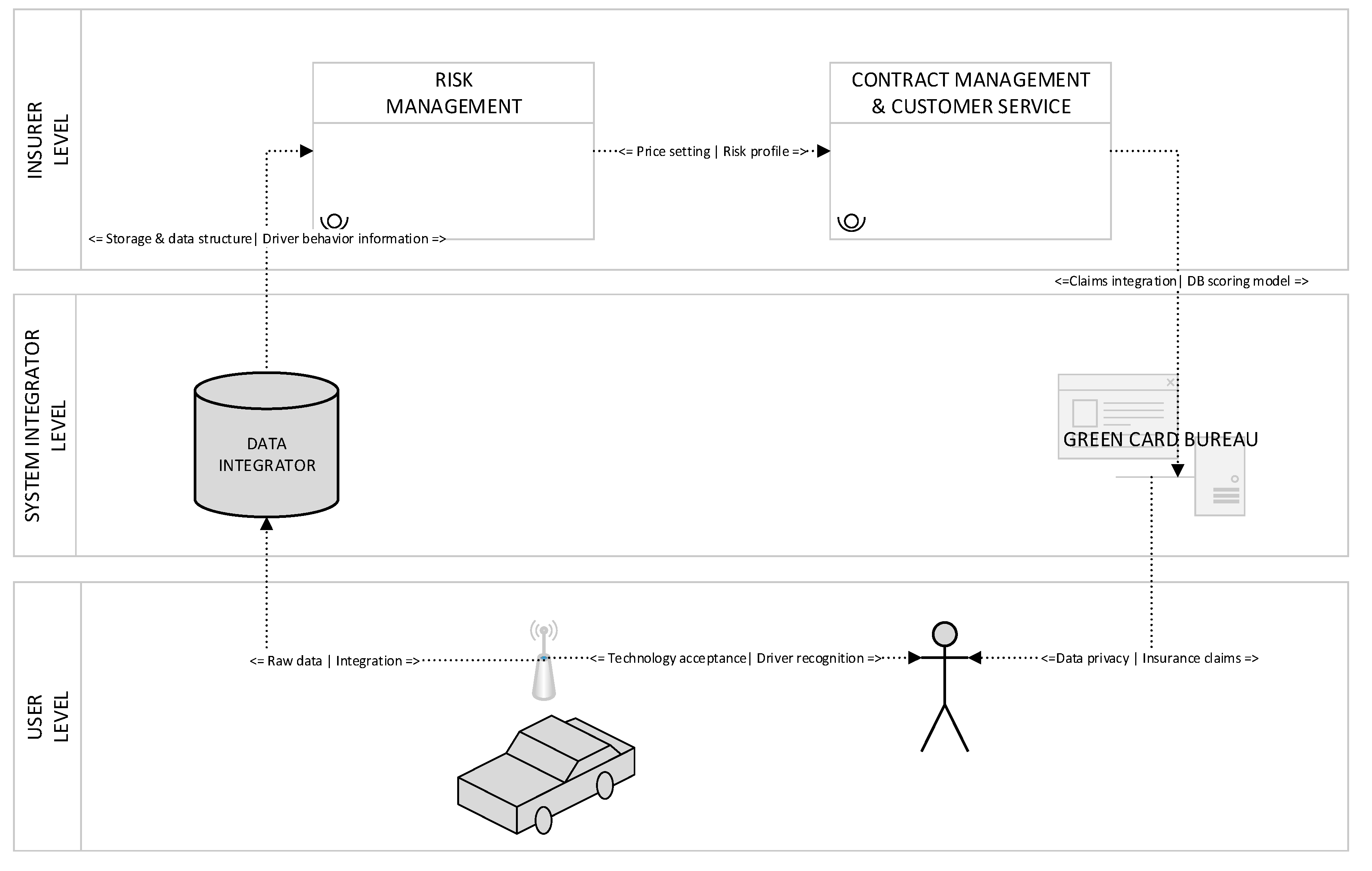

Telematic devices are not a novelty in the car industry, but their use in industries such as insurance certainly is. Innovative insurance companies that favor the use of telematics will experience initial profit increases, but the profits are eroded by entry [16]. Thus, only first-movers will benefit from the new telematics-based car insurance ecosystem. This novel ecosystem is displayed in Figure 1.

Figure 1.

Simplified telematics-based car insurance ecosystem.

As shown in Figure 1, three main levels of stakeholders in this simplified ecosystem are users, data and system integrators, and insurers. As for the users, they are represented by drivers, vehicles, and telematic devices, either integrated or added later to the vehicle. As for the integrators, they encompass data processors and insurance system integrators, such as the Green Card Bureaus. The third level dissects the core functions of insurance companies. The relationship among the main stakeholders is described in the section below.

2.2. The Dissection of Relationships among Main Stakeholders

Following the aforementioned car insurance paradigm shift, in the following subsection, we thoroughly examine and discuss the main nods (stakeholders) and the relationships among them. We also set the stage for the role of drivers and their willingness to accept the novel Internet of Vehicles technology for insurance premium purposes.

To start with, the four main types of vehicle telematic devices that can serve for data collection from customers are (1) black boxes, (2) dongle, (3) embedded, and (4) smartphone-based [17]. The extant body of knowledge has centered on telematic device usage in all main categories of vehicles. For instance, ref. [18] examined the use of telematic devices in semi-autonomous vehicles and discussed how this technology will require great collaboration between the car manufacturers and insurance companies in order to get a full understanding of the risks. Some authors raise another question for telematic devices and their use in the insurance context [19]. Namely, these authors emphasize the difference for telematics of two-wheelers and provide a novel crash detection algorithm proved against the experimental data for this type of vehicles. This is of particular interest, as motorcycle drivers cause the highest number of accidents [20]. Other vehicles, such as heavy-duty trucks [21], have also been investigated, but this is out of the scope of our study.

The telematic device connects the driver, the vehicle, and the data integrator. As for the connectivity with the driver, an issue with telematic device use is the fact that the driver is not necessarily driving one vehicle. A number of biometric matching techniques are used for this purpose [22]. For instance, ref. [23] propose a mechanism for driver identification based on driving dynamics signals currently available in production cars. The system collects and filters sensing data in a sliding window iteration, computes statistical and spectral features, and, finally, provides driver identification for each window frame through a classification process.

As for connectivity with the data integrator, this integration is made through Internet services usually by the LTE (Long-Term Evolution) standard for wireless communication [24]. Different classes of information, such as GPS data, vehicle temperature, engine information, vehicle information, break-system usage, and other data, are then sent to the data integrator. Important concerns have been raised for this information flow. First, the information can be subject to DDoS (hacking). Second, [25] shed light on data privacy, compare the privacy policies given on the companies’ websites and model privacy requirements, and focus on privacy requirements engineering in V2X (vehicle-to-everything, which encapsulates vehicle-to-vehicle, vehicle-to-person, and vehicle-to-road interconnectivity) telematic insurance applications.

This information is further processed to generate risk profiles within the insurers. The raw data is first combined and contextualized, at least for environmental factors, when an accident occurs. Some scholars [26] specify that these environmental factors include the location where certain events occurred, conditions on the road, weather conditions, and their overall contribution to risk.

Risk assessment and price setting are the core activity of insurers. A myriad of different data mining and machine learning approaches have been proposed to predict car accidents and accident claims [27,28]. For instance, [29] explained how new information (the event of a serious road accident being detected, based on airbag deployment and impact sensor information, transmitting GPS co-ordinates to local authorities in an effort to reduce response times and get assistance to the crash scene more quickly) would impact the price setting for European insurers. Obviously, insurance companies still lack the capacity to develop various algorithms using artificial intelligence. Accordingly, ref. [3] described the partnership of a system integrator and auto insurers based on the use of telematic devices, which in turn created a profitable business venture. This has opened an avenue for a number of data mining [30] and risk modeling approaches [31] based on the close ties between system integrators and the risk and contract management departments of insurers.

Individual assessment of risk is the core value of a telematic-based insurance ecosystem. Insurance companies in general can differentiate the policies and prices of their products by a precise formulation and calculation of the expected risk. Traditional models, however, only rely on general vehicle- or driver-specific variables [32]. With the richness of data provided by novel technology, insurance companies and their risk departments can count on the full modeling of drivers’ behavior. Namely, insurance companies can create driver behavior scoring models. These models could be applied to individual levels and driving styles as proposed by [33]. This particular scoring model would allow for a direct extension of common tariff functions, either by using ex post discounts or by entering an ex ante risk factor into the tariff model. Walcott-Bryant et al. [34] extend current usage-based insurance models and present context-based driving scores and driving behavior that include weather, time-of-day, and road quality. Most of the studies only pinpoint how insurers can appraise the behavior and attitudes of drivers. Nonetheless, this information is typically withheld from drivers. To fully close this feedback loop, [35] modeled a behavior change support system based on a telematic device that generates textual feedback for automobile drivers. This feedback is delivered as a weekly report via the smartphone application. Using the simulation-based approach, [36] experimented with sending safety messages to drivers and proved that in-vehicle telematics can play a pivotal role for novice drivers in relation to their driving behaviors.

To actually tailor the premium against a specific customer, an insurance company needs to create a driving behavior scoring system. The simple collection of a large amount of driving behavior data is not sufficient. The processing of such data and the creation of useful information and scoring models is another challenge for insurers. From an actuarial point of view, [37] made an attempt to scale sensitive telematic observables and generate efficient and effective scoring models that would be used in individual actuarial pricing. Additionally, [38] used multivariate credibility modeling for different strata of drivers, ranging from new drivers without a telematics record to contracts with different seniority, as well as drivers using their vehicle in a different capacity, to examine the nature and frequency of claims.

2.3. Predictors of Customer Acceptance of Telematic Devices and Research Hypotheses

The insurance ecosystem based on novel technology is a multifaceted phenomenon and includes a number of stakeholders. This study investigates the perspective of a single stakeholder—the user (driver insurance customer). Currently, insurance companies are changing the paradigm of their business, and some of them have been actively advocating for usage-based insurance (UBI) policies. As inferred by [26] (p. 817), “UBI is based on a myriad of data such as mileage, speed, location, time, total duration of trip, G-force, etc. extrapolated from telematics devices.” These policies include different services, such as pay-as-you-drive (PAYD), pay-how-you-drive (PHYD), and manage-how-you-drive (MHYD). Most of the concurrent telematics are based simply on OBD-II programs, but by 2022, black-box devices will be dominant [39]. Recently, most of the practical and scholarly attempts to analyze telematic-based insurance and UBI models have evolved around the “technology push”. Contrary to that, we wanted to examine the “pull” side-technology acceptance by users.

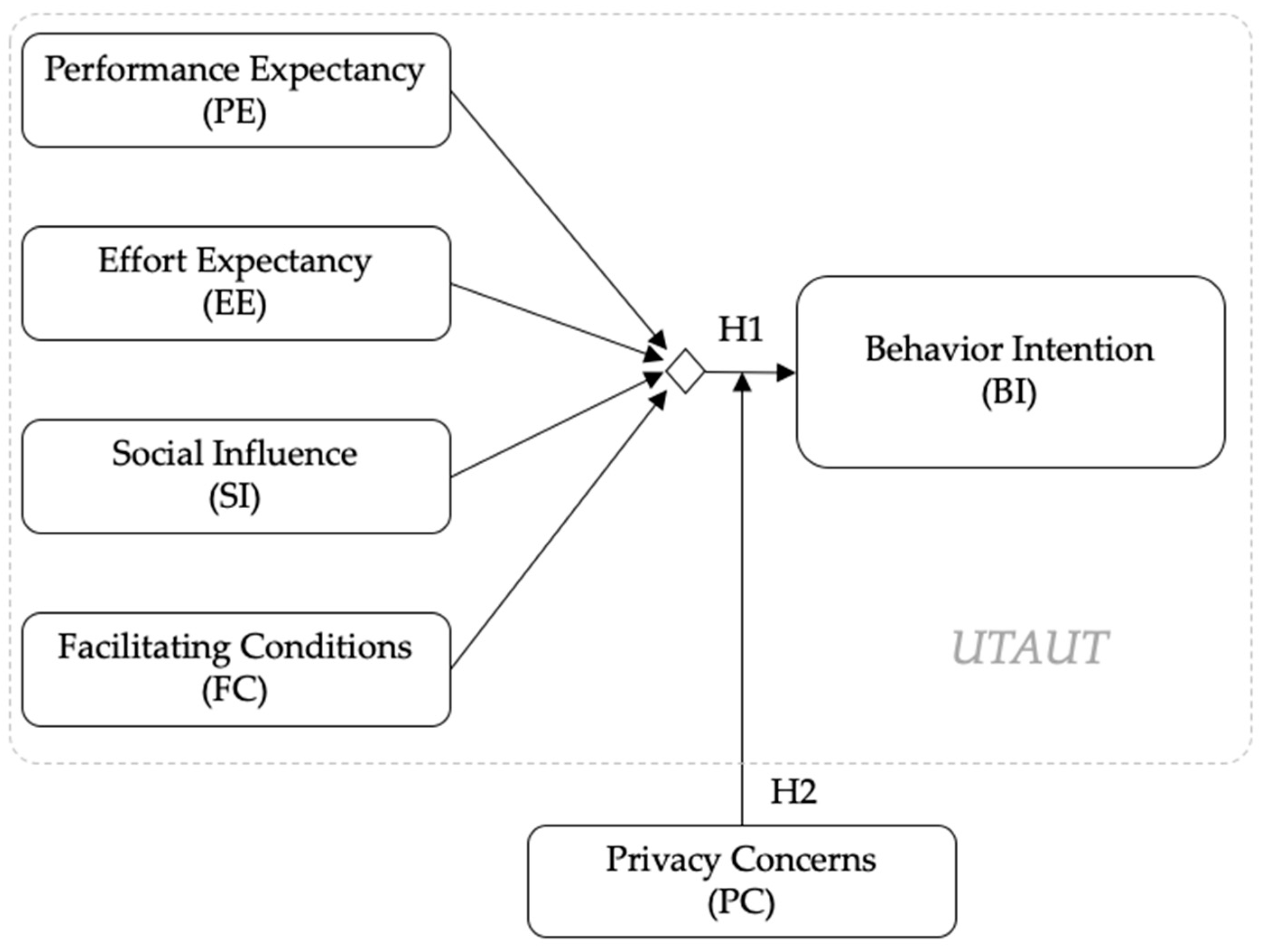

A number of models of technology acceptance have been proposed in the literature. The theoretical research frameworks used in this context are TPB (Theory of Planned Behavior), TRA (Theory of Reasoned Action), TAM (Technology Acceptance Model), and UTAUT (Unified Theory of Acceptance and Use of Technology). As explained by [40], TAM and UTAUT were most commonly employed in investigating driver technology acceptance.

Venkatesh et al. [8] reviewed eight prominent information technology user acceptance models and integrated their elements into the UTAUT model. This empirically validated model introduced four determinants of behavioral intention and usage behavior, along with four moderator variables: gender, age, experience, and voluntariness of use. Given that UTAUT effectively explains technology acceptance for novel information technology products [41], this model was specifically selected and adapted to examine telematics acceptance in the following terms: performance expectancy, effort expectancy, social influence, facilitating conditions, and behavioral intentions. UTAUT has been vastly used when examining user acceptance of a myriad of different technologies, which range from mobile devices and smart grids IoT to blockchain technology and beyond [42,43,44]. For behavioral intention, in particular, the scenario is thoroughly explained in Appendix A. Simply put, the use of telematic devices would improve the users’ bonus-malus scheme.

Besides the constructs drawn from UTAUT, our proposed research model was extended by adding a privacy concerns variable. The original UTAUT model has already been enriched with additional variables, which also stand for privacy concerns [42]. The main theoretical assumption behind introducing privacy concerns is that sharing any personal data raises questions on the acceptance of the technology. Furthermore, the geographical context of the study implies a high sensitivity of respondents to the privacy setting for any innovation [45].

Following these conclusions, we set two main hypotheses:

Hypothesis 1 (H1):

Performance expectancy (PE), effort expectancy (EE), social influence (SI), and facilitating conditions (FC) positively affect behavioral intention (BI) to use telematics for insurance purposes.

Hypothesis 2 (H2):

Privacy concerns (PC) moderate the relationship between technology acceptance predictors and behavioral intention to use telematics for insurance purposes.

Following a literature review and the aforementioned hypotheses, our proposed research model is given in Figure 2.

Figure 2.

The proposed research framework for telematics-for-insurance users’ acceptance.

3. Methodology

Our study was based on primary data collected in the premises of several insurance companies and car dealerships in Belgrade (Serbia) in August and September 2020. We used a Pen-and-Paper Personal Interview (PAPI) questionnaire form to collect the data. The main rationale behind the use of a hard copy, rather than an electronic version of the questionnaire, was the novelty of telematics technology. Prior to responding to the questionnaire, trained assistants explained the use of the technology to potential respondents.

3.1. Variables and Measures

The aim of our study was to assess drivers’ openness to embracing and using new technology for insurance purposes motivated by discounts and improved bonus-malus schemes. Technology readiness is a vividly discussed topic in the literature, and a number of scholars have already made an effort to examine the readiness of customers to participate in IoT-based business models [43,46].

Following these approaches, we first set a scenario for the use of telematics for insurance purposes. For the scenario explanations, we adapted the prerequisites of [47], who implies that “customers who consent to the installation of a black-box on their vehicles and allow the insurance company to collect and record data concerning their driving patterns, are normally rewarded with cheaper car insurance rates.” To some extent, this is a specific trade-off between the intrusion on customers’ privacy and the lower price they would pay for this intrusion. The detailed description of the scenario is given in Appendix A.

Afterwards, we operationalized measures based on UTAUT and the theoretical model set in Section 2. For the independent variables, we developed the following measures:

- FC: Facilitating condition (inspired by [8] and [48])

- SI: Social influence (based on [8] and [49])

- EE: Effort expectancy (adapted from [8] and [48])

- PE: Performance expectancy (inspired by [48], [40], and three inquires modestly contributed by the authors)

- PC: Privacy concerns (inspired by [50]).

Due to the lack of instantaneous readiness to implement an insurance operated telematic device, the dependent variable was determined as a possibility, rather than a firm readiness to purchase the device, following [40].

Even though the majority of the items and constructs were based on previous scales, we pilot-tested the questionnaire. The reason for this was that the items were translated into our native language (Serbian). The pilot testing was conducted by eight undergraduate students at the University of Belgrade. After collecting feedback, the inquiries were refined. The final list of individual items and a full questionnaire are given in Appendix B. Aside from the demographic part, all the items were measured on a Likert-type scale ranging from 1 (strongly disagree) to 7 (strongly agree).

3.2. Sampling Procedure, Data Collection, and Processing

The particular aim of our study was to assess users’ readiness to embrace and use new telematic technology, which could be installed in new vehicles. Using a convenience sampling method, the survey involved 502 respondents. As we tried to include respondents from various demographic groups, and as the questionnaire was simultaneously delivered by several trained assistants, the questionnaires were coded in order to decrease any possible invasive sub-clustering [51,52].

The data were entered into SPSS (Statistical Package for Social Science) version 20.0. The pre-analysis was done with descriptive statistics (means, standard deviations) and internal reliability tests (Cronbach’s Alpha). The interdependence of variables was tested with correlations (Pearson moment two-tailed correlation coefficient analysis). The main analysis and hypotheses testing were conducted by a series of multiple regressions.

4. Results

In this section, we first describe the main sample characteristics, then conduct a pre-analysis, and afterwards test the study hypotheses.

4.1. Sample Characteristics

The total number of respondents in our study was 502. The sample was gender balanced (Female = 48.4%; Male = 50.8%; refuse to say or other = 8%). The age structure was also balanced (Mean = 37.97 years, SD = 11.11); 48.4% of respondents was between 17 and 35 years old (two respondents being only 17, and three being older than 65). Most of the respondents were experienced drivers (see Table 1).

Table 1.

Driving experience of respondents.

When asked about their usual driving frequency, most of the respondents were commuters, using their vehicle between two and five days a week (54.4%), followed by those using their vehicle only occasionally (23.9%). Of the total, 12.4% of respondents used their vehicle for professional purposes.

As for automated driving assistance in their cars, the majority of respondents claimed not to have any device at all, or having low assistance, such as parking sensors (47.6% and 34.1%, respectively).

When asked about how tech-savvy they considered themselves to be, contrary to our expectations, approximately 70% of respondents claimed to be very interested in new technologies. Only 2.19% of respondents considered themselves not to be interested in new technologies.

4.2. Pre-Analysis

Since all the constructs of the independent variables and the dependent variables were multi-itemed, we first analyzed the descriptive statistics (means and standard deviations) of particular items. The results are displayed in Table 2.

Table 2.

Descriptive statistics for particular items.

After examining singular items, we created composite measures for each construct. Namely, we calculated arithmetic means for each multi-itemed construct (FC, SI, EE, PE, and BI). Prior to doing this, we examined the internal reliability by calculating Cronbach’s Alpha (α) for each construct. Using a standard threshold of α > 0.70, we ascertained constructs for FC (α = 0.86), EE (α = 0.70), PE (α = 0.81), and BI (α = 0.72). We also accepted the internal reliability for SI (where α = 0.64), as the value was approaching the traditional threshold for statistical significance. As indicated by respondents, Facilitating Conditions (FC) were rarely marked as an obstacle (Mean = 5.32, SD = 1.33). Performance Expectancy (PE), on the other hand, was marked relatively low compared to other constructs (Mean = 3.82, SD = 1.21). All other results are shown in Table 3.

Table 3.

Descriptive statistics, reliability analysis, and correlation matrix for constructs.

Table 3 also displays the correlation matrix for independent, dependent, and control variables. Bearing in mind that the scale used in the study has already been actively used for technology acceptance, it was not odd to see that a number of positive correlations were captured. At the same time, these results have opened an avenue for further hypotheses testing, but also drawn our attention to the possible multi-collinearity issue.

4.3. Hypotheses Testing

After conducting the pre-analysis, the hypotheses were tested. For this purpose, three standard multiple regression analyses were conducted. Table 4 shows the results of the regression analyses of behavioral intention to use telematic devices for insurance purposes based on independent variables (Model 1: FC, SI, EE, and PE; Model 2: FC, SI, EE, PE, and PC1; and Model 3: FC, SI, EE, PE, and PC2).

Table 4.

Regression models for behavioral intention to use telematics.

Prior to acknowledging the theoretical model, we tested the variables for auto-collinearity and multi-collinearity issues. As for auto-collinearity, we examined Durbin–Watson statistics. None of the models showed autocorrelation for the given threshold, 1.5 < d < 2.5 (the results were d1 = 2.059, d2 = 2.076, and d3 = 2.044, respectively). For the purpose of multi-collinearity check, we calculated the Variance inflation factor (VIF) as a quantification of the severity of multi-collinearity in an ordinary least square regression analysis. The traditional thresholds are 1.5 < VI F < 2.5. As shown in Table 4, none of the variables had VIF below or above the standard thresholds.

After testing for auto- and multi-collinearity, we tested the hypotheses of the study. In general, H1 was confirmed. However, the overall effect was modest, as only about 7% of variability was found (Adj. R2 = 0.067; p < 0.00). In particular, only Facilitating Condition (FC) was found to be a significant predictor of Behavioral Intention and was able to explain as much as 14.2% of the variability of the independent variable.

For H2, we split the overall moderating effect of Privacy Concerns into those related to the insurance company (H2a) and the ones related to the telematics manufacturer (H2b). When added to the regression model, Privacy Concerns related to insurance companies do not affect the overall effect. Accordingly, H2a is not confirmed.

However, the technology manufacturer plays a pivotal role in the decision to use a telematic device for car insurance purposes. When added to the regression model, PC2 significantly changes the overall effect. Privacy concern accounts for more than half of the variability of the model (B = 0.459, SE = 0.034; β = 0.541; p < 0.00). Accordingly, H2b is confirmed.

5. Discussion

In this section, we contextualize the study results by elaborating on key findings and contributions, twofold implications (for scholars and practitioners), as well as limitations and further recommendations.

5.1. Key Findings, Contributions, and Implications

The aim of our study was to question how drivers respond to new technology, and whether or not they are willing to accept it for car insurance purposes. For the purpose of this study, we adopted the Unified Theory of Acceptance and Use of Technology (UTAUT), one of the most prominent theories on user acceptance of technology, and interviewed 502 drivers/insurance premium buyers.

As the results indicate, Facilitating Conditions (FC) are a statistically significant predictor of the behavioral intention to use car telematic devices for insurance purposes. This is in line with some studies that recognize physical potential and capacity as the foremost driver of novel technology usage [53]. Nonetheless, other studies, such as [40], find all the other factors to be significant predictors, isolating only Facilitating Conditions as insignificant. One explanation for this phenomenon might be the fact that users would generally need pre-experience in order to fully understand Effort Expectancy and Performance Expectancy, as inferred in [54].

We developed a rich understanding of the main drivers behind technology adoption and how insurers can benefit from it. However, an even more profound insight and general contribution can be drawn from the testing of the second hypothesis. Namely, we found that users generally do not see insurance companies as privacy invaders. Although it might be a judicious judgment, the underlying rationale for this is probably the heavy regulation of the insurance industry and layers of information flow control. On the other hand, respondents generally see high-tech manufacturers as information abusers.

The study results indicate that insurance companies should go on introducing new technologies into the changing insurance ecosystem, following the users’ readiness to accept novelties. However, the innovative side of our findings comes from a lateral conclusion, which emphasizes the direction of their cooperation with technology producers. Users find insurance companies to be reliable partners in using their personal driving behavior data. Telematic device producers, however, are not seen as a trustworthy partner at the moment. Seemingly, digital technologies in general are poised to create privacy vulnerabilities.

This study has twofold implications. For researchers, it provides an opportunity to further question the development of the technology-driven ecosystem. As insurance technologies advance, the business, revenue models, dynamics, and growth of the insurance industry change. This study puts the spotlight on a single stakeholder—the user. Although some progress has been made for other stakeholders in the insurance ecosystem, this remains a “blue ocean”. As for practitioners, this study emphasizes the importance of facilitating conditions on one side and privacy concerns on the other. As for the facilitating conditions, new vehicles are inevitably going to be equipped with more sophisticated technologies. Their uses will go beyond the current ones—electronic diagnostics, navigation system, automated driving assistance, internet data, etc. Insurance companies should become a stronghold in the usage of this technology for car insurance purposes. Even though this study finds a positive relationship between facilitating conditions and behavioral intentions to use telematics, we might speculate that this factor will not be the uppermost determinant in the near future. As for privacy concerns, new vehicle technologies should convince drivers and insurance users that their data would be safely stored and that any information on driving behavior would not be abused. As the results indicate, the main driver of car telematic use might be the partnership between the device manufacturers, data integrators and insurance companies. This network might alleviate concerns related to the possible misuse of driving behavior data.

5.2. Limitations and Further Recommendations

As all other quantitative studies, ours has a number of flaws and limitations. The first limitations that might raise the question of the generalizability of the findings is the narrow geographical context of the study. The study was conducted in Serbia. At best, the findings could be replicated in those countries with a similar level of economic development, tech-savvy attitude, and insurance sector features. It should be noted that both risky driving behavior [55] and preference toward insurance [56] are highly contextual and culture-driven phenomena. A further body of knowledge should be built around new evidence from authors’ markets, as well as from comparative studies.

Another limitation of the study is the paucity of factors taken into consideration for the use telematics for insurance. An avenue for further research is the inclusion of new potential drivers of technology use. Moreover, additional studies might inspect new mediating variables. For instance, an interesting mediating variable might be the experience of drivers with insurance claims, as [57] generally find that the trust in insurance falls with previous bad experiences.

It should be noted that this study is cross-sectional by nature. Technology acceptance in general, and telematics for insurance purposes acceptance in particular, are dynamic phenomena. Thus, we only captured a singular moment. Follow-up studies should examine and explore evolutionary time-based characteristics of telematics acceptance.

6. Conclusions

The market for telematic devices and the Internet of Vehicles (IoV) is evolving and becoming more saturated and consolidated. Concurrent approaches to the development of these promising technologies have mostly been based on technology push models, putting the spotlight on those stakeholders aimed either at manufacturing the devices or capturing, processing, and analyzing the data generated from them. As the devices become more sophisticated and the data become more manageable, standardized, and actionable, the focal point will transfer from supply to demand. This study is a modest contribution to the alleviation of this paradigm shift. We report on early user acceptance of this novel technology, considering insurance as the main purpose of telematics.

As reported in the study findings, users have a statistically significant influence on the acceptance and intentional use of car telematic devices for car insurance purposes. However, this influence is relatively low, as we captured only a small portion of the variability. When moderated for privacy concerns, however, the variability significantly increases. Accordingly, we conclude that novel technologies are highly affected by the consciousness of technology users of the accustomed collection of data on their everyday actions and behaviors.

This study adds to the concurrent body of knowledge in several ways. First, we delineate the possible model of telematic-based insurance market. Second, we draw attention to the pull rather than push effects of the introduction of novel telematic technology. Third, we empirically validate the main factors of the possible usage of novel technologies by the end users. With regards to the practical use, this study sheds the light on the need of insurers (both companies and regulatory bodies) to manage regulatory requirements and demonstrate high-quality data security management for a digital paradigm shift. The use of telematics will help insurers in accurately estimating policies and reducing frauds, but every technology comes with apprehensions.

Author Contributions

Conceptualization, N.M., D.S. and S.B.; methodology, M.M.; investigation, N.M. and M.M.; resources, Ž.S.; writing—original draft preparation, N.M.; writing—review and editing, M.M., S.B. and D.S.; supervision, D.S.; project administration, S.B.; funding acquisition, S.B. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Acknowledgments

The authors thank the Association of Serbian Insurers (UOS) for their technical support.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Scenario Description

The telematics system is a system for collecting, processing, and transmitting data on the driving style and operation of vehicles. An example of a telematics system for the purposes of this research is a combination of so-called “Dongle” devices and mobile phone applications. The “Dongle” device simply plugs into an OBD2 diagnostic connector that all new cars have. The device collects data on speed, mileage, driving time, movement maps, sudden accelerations and braking, airbag deployment, etc. The driver can monitor the collected data in real time or after driving via a mobile phone application.

If you accept usage of the telematic device, and allow an insurance company to retrieve the data on your driving behavior, you will be granted a premium discount and/or advanced bonus-malus scheme.

Appendix B. Final Questionnaire (Constructs Only)

Table A1.

Individual items and constructs used as a part of the questionnaire.

Table A1.

Individual items and constructs used as a part of the questionnaire.

| Construct | Items |

|---|---|

| Facilitating Conditions (FC) | FC1 I have the necessary resources to use telematics in my vehicle. |

| FC2 I have the necessary knowledge to use telematics in my vehicle. | |

| FC3 If I have difficulty using telematics, there will be experts to help me. | |

| FC4 Telematics is compatible with other technology I use in my vehicle. | |

| Social Influence (SI) | SI1 People who are important to me think that I should use telematics in my vehicle. |

| SI2 People who influence my behavior think that I should use telematics in my vehicle. | |

| SI3 In general, the insurance company I am associated with would support the use of telematics. | |

| Effort Expectancy (EE) | EE1 I could quickly and easily utilize a new telematics device. |

| EE2 It would be easy for me to become skillful at using telematics. | |

| EE3 I find telematics easy to use | |

| EE4 Learning to operate telematics is easy for me. | |

| Performance Expectancy (PE) | PE1 I would find telematics useful in collecting all information about my driving behavior. |

| PE2 Using telematics would quickly provide my company with all the information that it needs. | |

| PE3 Using telematics would improve my driving performance. | |

| PE4 If I use the system, I will increase my chances to improve my bonus-malus scheme. | |

| PE5 Using telematics in driving would increase my safety. | |

| PE6 Using telematics would enhance the effectiveness of my driving. | |

| Privacy Concerns (PC) | PC1 I am concerned that my vehicle telematic data could be misused or abused by the insurance company I am associated with. |

| PC2 I am concerned that my vehicle telematic data could be misused or abused by the manufacturers of the vehicle or telematic device. | |

| Behavioral Intention (BI) | BI1 If a telematics system is available on the market free of charge or at an affordable price, I intend to purchase the system. |

| BI2 If my vehicle was equipped with a telematics system, I predict that I would use the system regularly when driving. | |

| BI3 Assuming that the system is available, I intend to use the system regularly when driving. |

References

- Aguayo, F.Z.; Ślusarczyk, B. Risks of banking services’ digitalization: The practice of diversification and sustainable development goals. Sustainability 2020, 12, 4040. [Google Scholar] [CrossRef]

- Eling, M.; Lehmann, M. The impact of digitalization on the insurance value chain and the insurability of risks. Geneva Pap Risk Ins. 2018, 43, 359–396. [Google Scholar] [CrossRef]

- Vaia, G.; Carmel, E.; DeLone, W.; Trautsch, H.; Menichetti, F. Vehicle telematics at an Italian insurer: New auto insurance products and a new industry ecosystem. MIS Q. Exec. 2012, 11, 113–125. [Google Scholar]

- Malek, M. Telematic future: eCall, insurance, drive-share. GPS World 2012, 23, 30–31. [Google Scholar]

- Dharani, S.; Isherwood, T.; Mattone, D.; Moretti, P. Telematics: Poised for strong global growth. McKinsey & Company. 2018. Available online: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/telematics-poised-for-strong-global-growth# (accessed on 20 October 2020).

- Wahlström, J.; Skog, I.; Händel, P. Driving behavior analysis for smartphone-based insurance telematics. In Proceedings of the 2nd workshop on Workshop on Physical Analytics, Florence, Italy, 22 May 2015; ACM: New York, NY, USA, 2015; pp. 19–24. [Google Scholar] [CrossRef]

- Baig, J. A personalised intervention model for improving the effectiveness of driving-behaviour apps. In Proceedings of the 28th ACM Conference on User Modeling, Adaptation and Personalization, Genoa, Italy, 14–17 July 2020; ACM: New York, NY, USA, 2020; pp. 372–375. [Google Scholar] [CrossRef]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User acceptance of information technology: Toward a unified view. MIS Quart. 2003, 27, 425–478. [Google Scholar] [CrossRef]

- Nedić, A.; Nedić, N.; Stevanović, I.; Stanojević, D. Review of vehicle telematics usage based insurance: Contribution to sustainable insurance strategy. J. Appl. Eng. Sci. 2014, 12, 165–169. [Google Scholar] [CrossRef]

- Desyllas, P.; Sako, M. Profiting from business model innovation: Evidence from Pay-As-You-Drive auto insurance. Res. Policy 2013, 42, 101–116. [Google Scholar] [CrossRef]

- World Bank Group. COVID-19 Outbreak: Insurance Implications and Response. 2020. Available online: http://pubdocs.worldbank.org/en/687971586471330943/COVID-19-Outbreak-Global-Policy-Actions-on-Insurance.pdf (accessed on 18 October 2020).

- Händel, P.; Ohlsson, J.; Ohlsson, M.; Skog, I.; Nygren, E. Smartphone-based measurement systems for road vehicle traffic monitoring and usage-based insurance. IEEE Syst. J. 2013, 8, 1238–1248. [Google Scholar] [CrossRef]

- Sun, S.; Bi, J.; Guillen, M.; Pérez-Marín, A.M. Assessing driving risk using internet of vehicles data: An analysis based on generalized linear models. Sensors 2020, 20, 2712. [Google Scholar] [CrossRef]

- Hamid, U.Z.A.; Zamzuri, H.; Limbu, D.K. Internet of vehicle (IoV) applications in expediting the implementation of smart highway of autonomous vehicle: A survey. In Performability in Internet of Things; Springer: Berlin/Heidelberg, Germany, 2019; pp. 137–157. [Google Scholar] [CrossRef]

- Hampton, P.; Langham, M. A contextual study of police car telematics: The future of in-car information systems. Ergonomics 2005, 48, 109–118. [Google Scholar] [CrossRef]

- Reimers, I.; Shiller, B.R. The impacts of telematics on competition and consumer behavior in insurance. J. Law Econ. 2019, 62, 613–632. [Google Scholar] [CrossRef]

- Arumugam, S.; Bhargavi, R. A survey on driving behavior analysis in usage based insurance using big data. J. Big Data 2019, 6, 86. [Google Scholar] [CrossRef]

- Sheehan, B.; Murphy, F.; Ryan, C.; Mullins, M.; Liu, H.Y. Semi-autonomous vehicle motor insurance: A Bayesian Network risk transfer approach. Transp. Res. C-Emer. 2017, 82, 124–137. [Google Scholar] [CrossRef]

- Gelmini, S.; Strada, S.; Tanelli, M.; Savaresi, S.; De Tommasi, C. Automatic crash detection system for two-wheeled vehicles: Design and experimental validation. IFAC Pap. 2019, 52, 498–503. [Google Scholar] [CrossRef]

- Jomnonkwao, S.; Watthanaklang, D.; Sangphong, O.; Champahom, T.; Laddawan, N.; Uttra, S.; Ratanavaraha, V. A comparison of motorcycle helmet wearing intention and behavior between urban and rural areas. Sustainability 2020, 12, 8395. [Google Scholar] [CrossRef]

- Farzaneh, R.; Johnson, J.; Jaikumar, R.; Ramani, T.; Zietsman, J. Use of vehicle telematics data to characterize drayage heavy-duty truck idling. Transp. Res. Record 2020, 0361198120945990. [Google Scholar] [CrossRef]

- Obrenovic, Z.; Starcevic, D. Modeling multimodal human-computer interaction. Computer 2004, 37, 65–72. [Google Scholar] [CrossRef]

- Jafarnejad, S.; Castignani, G.; Engel, T. Towards a real-time driver identification mechanism based on driving sensing data. In Proceedings of the 2017 IEEE 20th International Conference on Intelligent Transportation Systems (ITSC), Yokohama, Japan, 16–19 October 2017; pp. 1–7. [Google Scholar] [CrossRef]

- Perraud, E. Machine learning algorithm of detection of DoS attacks on an automotive telematic unit. Int. J. Comput. Commun. 2019, 11, 27–43. [Google Scholar] [CrossRef]

- Mukisa, S.S.; Rashid, A. Challenges of privacy requirements modelling in V2X applications: A telematic insurance case study. In Proceedings of the 2017 IEEE 25th International Requirements Engineering Conference Workshops (REW), Lisbon, Portugal, 4–8 September 2017; pp. 97–103. [Google Scholar] [CrossRef]

- Husnjak, S.; Peraković, D.; Forenbacher, I.; Mumdziev, M. Telematics system in usage based motor insurance. Procedia Eng. 2015, 100, 816–825. [Google Scholar] [CrossRef]

- Pesantez-Narvaez, J.; Guillen, M.; Alcañiz, M. Predicting motor insurance claims using telematics data—XGBoost versus logistic regression. Risks 2019, 7, 70. [Google Scholar] [CrossRef]

- Henckaerts, R.; Côté, M.P.; Antonio, K.; Verbelen, R. Boosting insights in insurance tariff plans with tree-based machine learning methods. N. Am. Actuar J. 2020, 1–31. [Google Scholar] [CrossRef]

- Courtney, M. Premium binds. Eng. Technol. 2013, 8, 68. [Google Scholar] [CrossRef]

- Huang, Y.; Meng, S. Automobile insurance classification ratemaking based on telematics driving data. Decis. Support Syst. 2019, 127, 113156. [Google Scholar] [CrossRef]

- Eling, M.; Kraft, M. The impact of telematics on the insurability of risks. J. Risk Financ. 2020, 21, 77–109. [Google Scholar] [CrossRef]

- Baecke, P.; Bocca, L. The value of vehicle telematics data in insurance risk selection processes. Decis. Support Syst. 2017, 98, 69–79. [Google Scholar] [CrossRef]

- Weidner, W.; Transchel, F.W. Aktuarielle besonderheiten bei der kalkulation von Telematik-Tarifen in der Kfz-Versicherung. Zeitschrift für die gesamte Versicherungswissenschaft 2015, 104, 595–614. [Google Scholar] [CrossRef]

- Walcott-Bryant, A.; Tatsubori, M.; Bryant, R.E.; Oduor, E.; Omondi, S.; Osebe, S.; Wamburu, J.; Bent, O. Harsh brakes at potholes in Nairobi: Context-based driver behavior in developing cities. In Proceedings of the 2016 IEEE 19th International Conference on Intelligent Transportation Systems (ITSC), Rio de Janeiro, Brazil, 1–4 November 2016; pp. 675–681. [Google Scholar] [CrossRef]

- Braun, D.; Reiter, E.; Siddharthan, A. SaferDrive: An NLG-based behaviour change support system for drivers. Nat. Lang Eng. 2018, 24, 551–588. [Google Scholar] [CrossRef]

- Stevenson, M.; Harris, A.; Mortimer, D.; Wijnands, J.S.; Tapp, A.; Peppard, F.; Buckis, S. The effects of feedback and incentive-based insurance on driving behaviours: Study approach and protocols. Inj. Prev. 2018, 24, 89–93. [Google Scholar] [CrossRef]

- Weidner, W.; Transchel, F.W.; Weidner, R. Classification of scale-sensitive telematic observables for riskindividual pricing. Eur. Actuar J. 2016, 6, 3–24. [Google Scholar] [CrossRef]

- Denuit, M.; Guillen, M.; Trufin, J. Multivariate credibility modelling for usage-based motor insurance pricing with behavioural data. Ann. Actuar. Sci. 2019, 13, 378–399. [Google Scholar] [CrossRef]

- Sumant, O. Usage-Based Insurance Market by Service Type (Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), and Manage-How-You-Drive (MHYD)) and Technology (OBD-II, Smartphone, Hybrid, and Black-Box): Global Opportunity Analysis and Industry Forecasts, 2014–2022. 2016. Available online: https://www.alliedmarketresearch.com/usage-based-insurance-market#:~:text=Usage%2Dbased%20insurance%20(UBI),which%20the%20premiums%20are%20charged (accessed on 20 October 2020).

- Rahman, M.M.; Lesch, M.F.; Horrey, W.J.; Strawderman, L. Assessing the utility of TAM, TPB, and UTAUT for advanced driver assistance systems. Accid. Anal. Prev. 2017, 108, 361–373. [Google Scholar] [CrossRef] [PubMed]

- Huang, C.-Y.; Kao, Y.-S. UTAUT2 Based Predictions of Factors Influencing the Technology Acceptance of Phablets by DNP. Math Probl. Eng. 2015, 2015, 1–23. [Google Scholar] [CrossRef]

- Lin, C.A.; Kim, T. Predicting user response to sponsored advertising on social media via the technology acceptance model. Comput. Hum. Behav. 2016, 64, 710–718. [Google Scholar] [CrossRef]

- Radenković, M.; Bogdanović, Z.; Despotović-Zrakić, M.; Labus, A.; Lazarević, S. Assessing consumer readiness for participation in IoT-based demand response business models. Technol. Forecast. Soc. Chang. 2020, 150, 119715. [Google Scholar] [CrossRef]

- Milosavljevic, M.; Joksimovic, N.Z.; Milanovic, N. Blockchain accounting: Trailblazers’ response to a changing paradigm. Econ. Digit. Transform. 2019, 2019, 425–441. [Google Scholar]

- Milosavljevic, M.; Milanovic, N.; Benkovic, S. Waiting for Godot: Testing transparency, responsiveness and interactivity of Serbian local governments. Lex Localis 2017, 15, 513–528. [Google Scholar] [CrossRef]

- Roy, S.K.; Balaji, M.S.; Quazi, A.; Quaddus, M. Predictors of customer acceptance of and resistance to smart technologies in the retail sector. J. Retail Consum. Serv. 2018, 42, 147–160. [Google Scholar] [CrossRef]

- Pertot, T. Black Box Car Insurance: Discount Rates Versus Personal Data. Oss del Dirit Civ e Commer 2018, 7, 529–546. [Google Scholar] [CrossRef]

- Wang, H.; Tao, D.; Yu, N.; Qu, X. Understanding consumer acceptance of healthcare wearable devices: An integrated model of UTAUT and TTF. Int. J. Med. Inform. 2020, 139, 104156. [Google Scholar] [CrossRef]

- Melnicuk, V.; Birrell, S.; Thompson, S.; Mouzakitis, A.; Jennings, P. How acceptable is it to monitor driver state? Using the UTAUT model to analyse drivers’ perceptions towards the system. Adv. Hum. Asp. Transp. 2018, 579–590. [Google Scholar] [CrossRef]

- Dinev, T.; Hart, P. An extended privacy calculus model for e-commerce transactions. Inf. Syst. Res. 2006, 17, 61–80. [Google Scholar] [CrossRef]

- Milanović, N.; Milosavljević, M.; Milošević, N. Failure management approaches and public service quality: Empirical evidence from Serbia. Lex Localis 2019, 19. [Google Scholar] [CrossRef]

- Radonić, M.; Milosavljević, M. Human resource practices, failure management approaches and innovations in Serbian public administration. Transylv. Rev. Adm. Sci. 2019, 2019, 77–93. [Google Scholar] [CrossRef]

- Osswald, S.; Wurhofer, D.; Trösterer, S.; Beck, E.; Tscheligi, M. Predicting information technology usage in the car: Towards a car technology acceptance model. In Proceedings of the 4th International Conference on Automotive User Interfaces and Interactive Vehicular Applications, Portsmouth, NH, USA, 17–19 October 2012; ACM: New York, NY, USA, 2012; pp. 51–58. [Google Scholar] [CrossRef]

- Rödel, C.; Stadler, S.; Meschtscherjakov, A.; Tscheligi, M. Towards autonomous cars: The effect of autonomy levels on acceptance and user experience. In Proceedings of the 6th International Conference on Automotive User Interfaces and Interactive Vehicular Applications, Seattle, WA, USA, 17–19 September 2014; ACM: New York, NY, USA, 2014; pp. 1–8. [Google Scholar] [CrossRef]

- Mohamed, M.; Bromfield, N.F. Attitudes, driving behavior, and accident involvement among young male drivers in Saudi Arabia. Transp. Res. Part F Traffic Psychol. Behav. 2017, 47, 59–71. [Google Scholar] [CrossRef]

- Gaganis, C.; Hasan, I.; Papadimitri, P.; Tasiou, M. National culture and risk-taking: Evidence from the insurance industry. J. Bus Res. 2019, 97, 104–116. [Google Scholar] [CrossRef]

- Courbage, C.; Nicolas, C. Trust in insurance: The importance of experiences. J. Risk Insur. 2020. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).