State Intervention in Land Supply and Its Impact on Real Estate Investment in China: Evidence from Prefecture-Level Cities

Abstract

:1. Introduction

2. State Intervention in Land Supply and its Impact on Real Estate Investment

3. Empirical Analysis

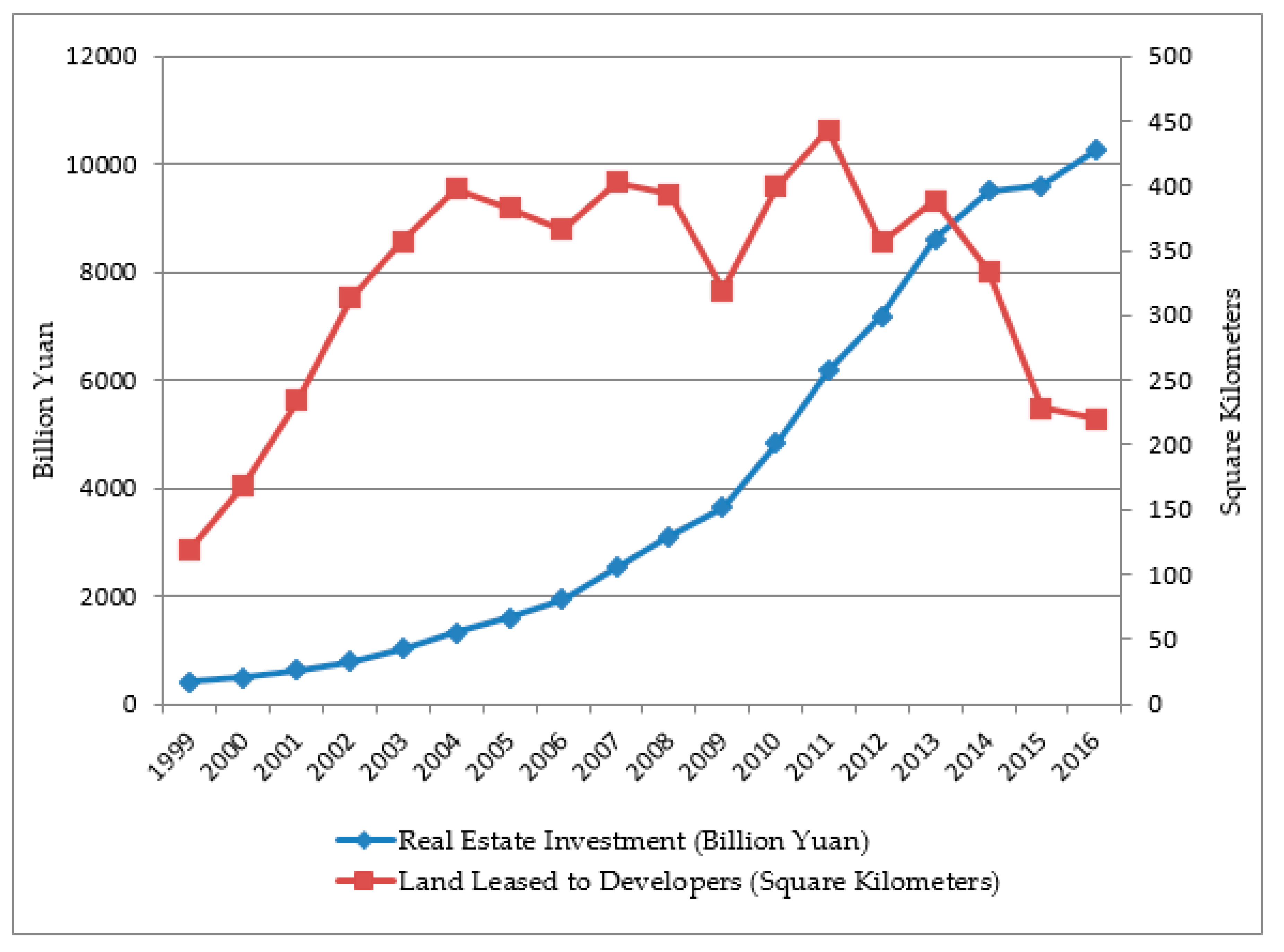

3.1. The Chinese Central State’s Intervention in Land Supply and its Impact on Prefecture-Level Cities

3.2. The Impact of Land Supply on Real Estate Investment in Prefecture-Level Chinese Cities

+ α6Ln(CBPit) + εit.

3.2.1. Data and Variables

3.2.2. Discussion of Results

4. Conclusions and Discussion

Author Contributions

Funding

Conflicts of Interest

References

- 2017 China Statistical Yearbook. Available online: http://www.stats.gov.cn/tjsj/ndsj/2017/indexeh.htm (accessed on 3 November 2019).

- He, G.; Mol, A.; Lu, Y. Wasted cities in urbanizing China. Environ. Dev. 2016, 18, 2–13. [Google Scholar] [CrossRef] [Green Version]

- Alexander, E. Land-property markets and planning: A special case. Land Use Policy 2014, 41, 533–540. [Google Scholar] [CrossRef]

- Evans, A. Economics, Real Estate and the Supply of Land; Blackwell: Oxford, UK, 2004. [Google Scholar]

- Pigou, A. The Economics of Welfare; Macmillan: London, UK, 1932. [Google Scholar]

- Han, L.; Lu, M. Housing prices and investment: An assessment of China’s inland-favoring land supply policies. J. Asia Pac. Econ. 2017, 22, 106–121. [Google Scholar] [CrossRef]

- Shen, X.; Huang, X.; Li, H.; Li, Y.; Zhao, X. Exploring the relationship between urban land supply and housing stock: Evidence from 35 cities in China. Habitat Int. 2018, 77, 80–89. [Google Scholar] [CrossRef]

- Tian, L.; Ma, W. Government intervention in city development of China: A tool of land supply. Land Use Policy 2009, 26, 599–609. [Google Scholar] [CrossRef]

- Deng, Y.; Morck, R.; Wu, J.; Yeung, B. Monetary and fiscal stimuli, ownership structure, and China’s housing market. NBER Working Pap. 2011, 16871, 1–62. [Google Scholar] [CrossRef]

- Deng, Y.; Morck, R.; Wu, J.; Yeung, B. China’s Pseudo-monetary Policy. Rev. Financ. 2015, 19, 55–93. [Google Scholar] [CrossRef]

- Wei, Y.; Lam, P.; Chiang, Y.; Leung, B. The effects of monetary policy on real estate investment in China: A regional perspective. Int. J. Strateg. Prop. Manag. 2014, 18, 368–379. [Google Scholar] [CrossRef]

- Xu, X.; Chen, T. The effect of monetary policy on real estate price growth in China. Pac.-Basin Financ. J. 2012, 20, 62–77. [Google Scholar] [CrossRef]

- Lin, G. Developing China: Land, Politics and Social Conditions; Routledge: New York, NY, USA, 2009. [Google Scholar]

- Xu, J.; Yeh, A. Decoding urban land governance: State reconstruction in contemporary chinese cities. Urban Stud. 2009, 46, 559–581. [Google Scholar] [CrossRef] [Green Version]

- Rithmire, M. Land institutions and Chinese political economy: Institutional complementarities and macroeconomic management. Politics Soc. 2017, 45, 123–153. [Google Scholar] [CrossRef]

- Li, M. Evolution of Chinese ghost cities: Opportunity for a paradigm shift? The case of Changzhou. China Perspect. 2017, 1, 69–78. [Google Scholar] [CrossRef] [Green Version]

- Deng, L.; Chen, J. Market development, state intervention, and the dynamics of new housing investment in China. J. Urban Aff. 2019, 41, 223–247. [Google Scholar] [CrossRef] [Green Version]

- Zhang, X.; Bao, H.; Skitmore, M. The land hoarding and land inspector dilemma in China: An evolutionary game theoretic perspective. Habitat Int. 2015, 46, 187–195. [Google Scholar] [CrossRef]

- Bao, H.; Zhuang, H. The mechanism and governance on land reserve strategies of the real estate developers in different region. China Land Sci. 2012, 9, 28–34. (In Chinese) [Google Scholar]

- Huang, Z.; Du, X. Strategic interaction in local governments’ industrial land supply: Evidence from China. Urban Stud. 2017, 54, 1328–1346. [Google Scholar] [CrossRef]

- Tian, L.; Liang, Y.; Zhang, B. Measuring residential and industrial land use mix in the PERI-urban areas of China. Land Use Policy 2017, 69, 427–438. [Google Scholar] [CrossRef]

- Tao, R.; Su, F.; Liu, M.; Cao, G. Land leasing and local public finance in China’s regional development: Evidence from prefecture-level cities. Urban Stud. 2010, 47, 2217–2236. [Google Scholar] [CrossRef]

- Peng, L.; Thibodeau, T. Government Interference and the Efficiency of the Land Market in China. J. Real Estate Financ. Econ. 2012, 45, 919–938. [Google Scholar] [CrossRef]

- Glaeser, E.; Ward, B. The causes and consequences of land use regulation: Evidence from greater Boston. J. Urban Econ. 2009, 65, 265–278. [Google Scholar] [CrossRef] [Green Version]

- Restuccia, D.; Rogerson, R. Misallocation and productivity. Rev. Econ. Dyn. 2013, 16, 1–10. [Google Scholar] [CrossRef]

- Coase, R. The problem of social cost. J. Law Econ. 1960, 3, 1–44. [Google Scholar] [CrossRef]

- Buchanan, J. The Limits of Liberty: Between Anarchy and Leviathan; University of Chicago Press: Chicago, IL, USA, 1975. [Google Scholar]

- Wu, F.; Xu, J.; Yeh, A. Urban Development in Post-Reform China: State, Market, and Space; Routledge: New York, NY, USA, 2007. [Google Scholar] [CrossRef]

- Wang, J.; Lin, Y.; Glendinning, A.; Xu, Y. Land-use changes and land policies evolution in China’s urbanization processes. Land Use Policy 2018, 75, 375–387. [Google Scholar] [CrossRef]

- Wei, X.; Wei, C.; Cao, X.; Li, B. The general land-use planning in China: An uncertainty perspective. Environ. Plan. B 2016, 43, 361–380. [Google Scholar] [CrossRef]

- Zhong, T.; Mitchell, B.; Scott, S.; Huang, X.; Li, Y.; Lu, X. Growing centralization in China’s farmland protection policy in response to policy failure and related upward-extending unwillingness to protect farmland since 1978. Environ. Plan. C 2017, 35, 1075–1097. [Google Scholar] [CrossRef]

- Zhou, Y.; Huang, X.; Chen, X.; Zhong, T.; Xu, G.; He, J.; Xu, Y.; Meng, H. The effect of land use planning (2006–2020) on construction land growth in China. Cities 2017, 68, 37–47. [Google Scholar] [CrossRef]

- Guo, S.; Shi, Y. Infrastructure investment in China: A model of local government choice under land financing. J. Asian Econ. 2018, 56, 24–35. [Google Scholar] [CrossRef]

- Li, J.; Chiu, L. Urban investment and development corporations, new town development and China’s local state restructuring—The case of Songjiang new town, Shanghai. Urban Geogr. 2018, 39, 687–705. [Google Scholar] [CrossRef]

- Shen, J.; Wu, F. The suburb as a space of capital accumulation: The development of new towns in Shanghai, China. Antipode 2017, 49, 761–780. [Google Scholar] [CrossRef]

- Qian, Z. Master plan, plan adjustment and urban development reality under China’s market transition: A case study of Nanjing. Cities 2013, 30, 77–88. [Google Scholar] [CrossRef]

- Wu, F. Planning for Growth: Urban and Regional Planning in China; Routledge: New York, NY, USA, 2015. [Google Scholar] [CrossRef]

- Wu, F. China’s emergent City-Region governance: A new form of state spatial selectivity through state-orchestrated rescaling. Int. J. Urban Reg. Res. 2016, 40, 1134–1151. [Google Scholar] [CrossRef]

- Wu, F. Planning centrality, market instruments: Governing Chinese urban transformation under state entrepreneurialism. Urban Stud. 2018, 55, 1383–1399. [Google Scholar] [CrossRef] [Green Version]

- Yang, Z.; Ren, R.; Liu, H.; Zhang, H. Land leasing and local government behaviour in China: Evidence from Beijing. Urban Stud. 2015, 52, 841–856. [Google Scholar] [CrossRef] [Green Version]

- Huang, D.; Chan, R. On ‘Land finance’ in urban China: Theory and practice. Habitat Int. 2018, 75, 96–104. [Google Scholar] [CrossRef]

- Pan, F.; Zhang, F.; Zhu, S.; Wójcik, D. Developing by borrowing? Inter-jurisdictional competition, land finance and local debt accumulation in China. Urban Stud. 2017, 54, 897–916. [Google Scholar] [CrossRef]

- Wu, Q.; Li, Y.; Yan, S. The incentives of China’s urban land finance. Land Use Policy 2015, 42, 432–442. [Google Scholar] [CrossRef]

- Zhu, J. Local developmental state and order in China’s urban development during transition. Int. J. Urban Reg. Res. 2004, 28, 424–447. [Google Scholar] [CrossRef]

- Ong, L. State-Led Urbanization in China: Skyscrapers, Land Revenue and “Concentrated Villages”. China Q. 2014, 217, 162–179. [Google Scholar] [CrossRef]

- Xu, J.; Yeh, A.; Wu, F. Land commodification: New land development and politics in China since the late 1990s. Int. J. Urban Reg. Res. 2009, 33, 890–913. [Google Scholar] [CrossRef]

- Huang, Y. Low-income housing in chinese cities: Policies and practices. China Q. 2012, 212, 941–964. [Google Scholar] [CrossRef] [Green Version]

- Huang, D.; Leung, C.; Qu, B. Do bank loans and local amenities explain Chinese urban house prices? China Econ. Rev. 2015, 34, 19–38. [Google Scholar] [CrossRef] [Green Version]

- Leung, C.; Chow, K.; Yiu, M.; Tam, D. House market in Chinese cities: Dynamic modeling, in-sample fitting and out-of-sample forecasting. Int. Real Estate Rev. 2011, 14, 85–117. [Google Scholar] [CrossRef] [Green Version]

- Peng, W.; Tam, D.; Yiu, M. Property market and the macroeconomy of mainland China: A cross region study. Pac. Econ. Rev. 2008, 13, 240–258. [Google Scholar] [CrossRef]

- Yan, S.; Ge, X.; Wu, Q. Government intervention in land market and its impacts on land supply and new housing supply: Evidence from major Chinese markets. Habitat Int. 2014, 44, 517–527. [Google Scholar] [CrossRef]

- Mak, S.; Choy, L.; Ho, W. Region-specific estimates of the determinants of real estate investment in China. Urban Stud. 2012, 49, 741–755. [Google Scholar] [CrossRef]

- Kong, Y.; Glascock, J.; Lu-Andrews, R. An Investigation into real estate investment and economic growth in China: A dynamic panel data approach. Sustainability 2016, 8, 66. [Google Scholar] [CrossRef] [Green Version]

- Zhang, H.; Li, L.; Chen, T.; Li, V. Where will China’s real estate market go under the economy’s new normal? Cities 2016, 55, 42–48. [Google Scholar] [CrossRef]

- Choy, L.; Ho, W.; Mak, S. Region-specific estimates of the determinants of residential investment. J. Urban Plan. Dev. 2011, 137, 1–6. [Google Scholar] [CrossRef]

- He, C.; Wang, J.; Cheng, S. What attracts foreign direct investment in China’s real estate development? Ann. Reg. Sci. 2011, 46, 267–293. [Google Scholar] [CrossRef]

- Leung, C.; Tse, C. Flipping in the housing market. J. Econ. Dyn. Control 2017, 76, 232–263. [Google Scholar] [CrossRef]

- Nathanson, C.; Zwick, E. Arrested Development: Theory and Evidence of Supply-Side Speculation in the Housing Market. J. Financ. 2018, 73, 2587–2633. [Google Scholar] [CrossRef] [Green Version]

- Chan, K.; Dang, V.; Lai, J.; Yan, I. Regional capital mobility in China: 1978–2006. J. Int. Money Financ. 2011, 30, 1506–1515. [Google Scholar] [CrossRef] [Green Version]

- Pesaran, H. Time Series and Panel Data Econometrics; Oxford University Press: Oxford, UK, 2015. [Google Scholar]

- Hausman, J. Specification test in econometrics. Econometrica 1978, 46, 1251–1272. [Google Scholar] [CrossRef] [Green Version]

- Dang, Y. The Impact Factors of Land Price in Chinese Cities; Jilin University Press: Changchun, China, 2015. (In Chinese) [Google Scholar]

- Wang, Y.; Tang, W.; Jia, S. Uncertainty, competition and timing of land development: Theory and empirical evidence from Hangzhou, China. J. Real Estate Financ. Econ. 2016, 53, 218–245. [Google Scholar] [CrossRef]

- Su, X.; Qian, Z. The impact of housing market fluctuation and housing supply on the housing opportunities of moderate- and low-income households in 21st-century urban China: A case study of Ordos city. China Rev. 2018, 18, 107–135. [Google Scholar]

- Barras, R. Building Cycles: Growth and Instability; Wiley-Blackwell: Oxford, UK, 2009. [Google Scholar]

- Chen, J.; Guo, F.; Zhu, A. The housing-led growth hypothesis revisited: Evidence from the Chinese provincial panel data. Urban Stud. 2011, 48, 2049–2067. [Google Scholar] [CrossRef]

| Variable | Definition | Data Source | |

|---|---|---|---|

| Dependent Variable | Real Estate Investment (REI) | Investment made by real estate development companies in land development (excluding land purchasing fees; Unit: million Yuan) | China City Statistical Yearbooks; Provincial Statistical Yearbooks |

| Independent Variables | Land Supply (LS) | Area of land leased to developers by local governments (Unit: square kilometers) | China Land and Resources Statistical Yearbooks |

| Per Capita GDP (PGDP) | Per capita Gross Domestic Product (Unit: Yuan) | China Regional Economic Statistical Yearbooks; China City Statistical Yearbooks | |

| Interest Rate (IR) | Six-month interest rates for loans | People’s Bank of China | |

| Commodity Building Floor Area Sold (SOLD) | Gross floor area of commodity building being sold, including commodity housing, office buildings, commercial and retail properties, etc. (Unit: m2) | China Regional Economic Statistical Yearbooks; Provincial Statistical Yearbooks; Statistical Yearbooks of certain individual cities | |

| Commodity Building Price (CBP) | Average price of commodity building (Unit: Yuan/m2) | China Regional Economic Statistical Yearbooks; Provincial Statistical Yearbooks; Statistical Yearbooks of certain individual cities | |

| Dependent Variable: Natural Log of Real Estate Investment Ln(REI) | ||||||

|---|---|---|---|---|---|---|

| Independent variables | Model 1: All prefecture-level cities | Model 2: First-tier cities | Model 3: Second-tier cities | Model 4: Third-tier cities | Model 5: Fourth-tier cities | Model 6: Fifth-tier cities |

| Constant | 0.1721 | 2.8396 *** | −0.2778 | −0.0470 | −0.4520 ** | 0.1399 |

| (0.1198) | (0.5604) | (0.2627) | (0.1893) | (0.2063) | (0.3343) | |

| Ln(SOLDit) | 0.6229 *** | −0.0541 | 0.6273 *** | 0.5740 *** | 0.6337 *** | 0.6371 *** |

| (0.0109) | (0.0832) | (0.0324) | (0.0206) | (0.0179) | (0.023) | |

| Ln(CBPit) | 0.4775 *** | 0.1269 | 0.5691 *** | 0.4630 *** | 0.3834 *** | 0.5723 *** |

| (0.0221) | (0.1324) | (0.0474) | (0.0351) | (0.035) | (0.0626) | |

| Ln(PGDPi,t−1) | 0.5368 *** | 1.0993 *** | 0.5343 *** | 0.5890 *** | 0.5850 *** | 0.4388 *** |

| (0.0207) | (0.1566) | (0.0507) | (0.0351) | (0.0325) | (0.0508) | |

| IRit | 1.6994 * | −13.0451 *** | 5.4811 *** | 3.4859 ** | 0.8140 | −0.6408 |

| (1.0687) | (3.5879) | (1.9757) | (1.4853) | (1.6004) | (2.8117) | |

| Ln(LSit) | 0.0532 *** | 0.0732 | 0.0107 | 0.0437 *** | 0.0641 *** | 0.0691 *** |

| (0.0086) | (0.0449) | (0.0221) | (0.0139) | (0.0137) | (0.0216) | |

| Ln(LSi,t−1) | 0.0526 *** | 0.0817 * | 0.0636 *** | 0.0552 *** | 0.0456 *** | 0.0577 *** |

| (0.0084) | (0.0464) | (0.0209) | (0.0134) | (0.0135) | (0.0207) | |

| Observations | 4760 | 85 | 527 | 1428 | 1615 | 1105 |

| Adjusted R2 | 0.961 | 0.961 | 0.965 | 0.953 | 0.946 | 0.903 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Su, X.; Qian, Z. State Intervention in Land Supply and Its Impact on Real Estate Investment in China: Evidence from Prefecture-Level Cities. Sustainability 2020, 12, 1019. https://doi.org/10.3390/su12031019

Su X, Qian Z. State Intervention in Land Supply and Its Impact on Real Estate Investment in China: Evidence from Prefecture-Level Cities. Sustainability. 2020; 12(3):1019. https://doi.org/10.3390/su12031019

Chicago/Turabian StyleSu, Xing, and Zhu Qian. 2020. "State Intervention in Land Supply and Its Impact on Real Estate Investment in China: Evidence from Prefecture-Level Cities" Sustainability 12, no. 3: 1019. https://doi.org/10.3390/su12031019