Interpreting the Sustainable Development of Human Capital and the Sheepskin Effects in Returns to Higher Education: Empirical Evidence from Pakistan

Abstract

:1. Introduction

2. Interpreting Convexity of Sheepskin Effects

3. Human Capital Investment toward Wage Distribution

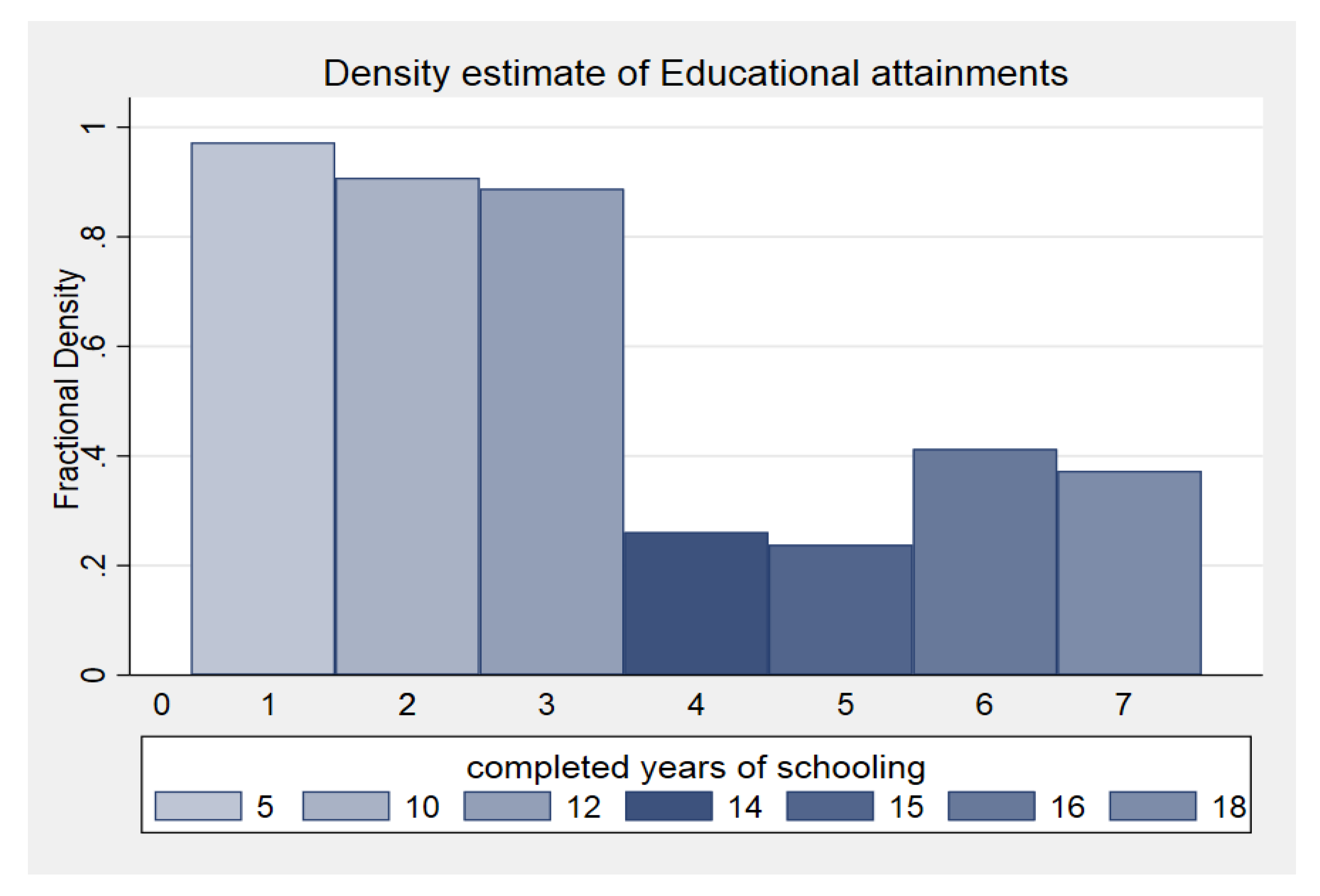

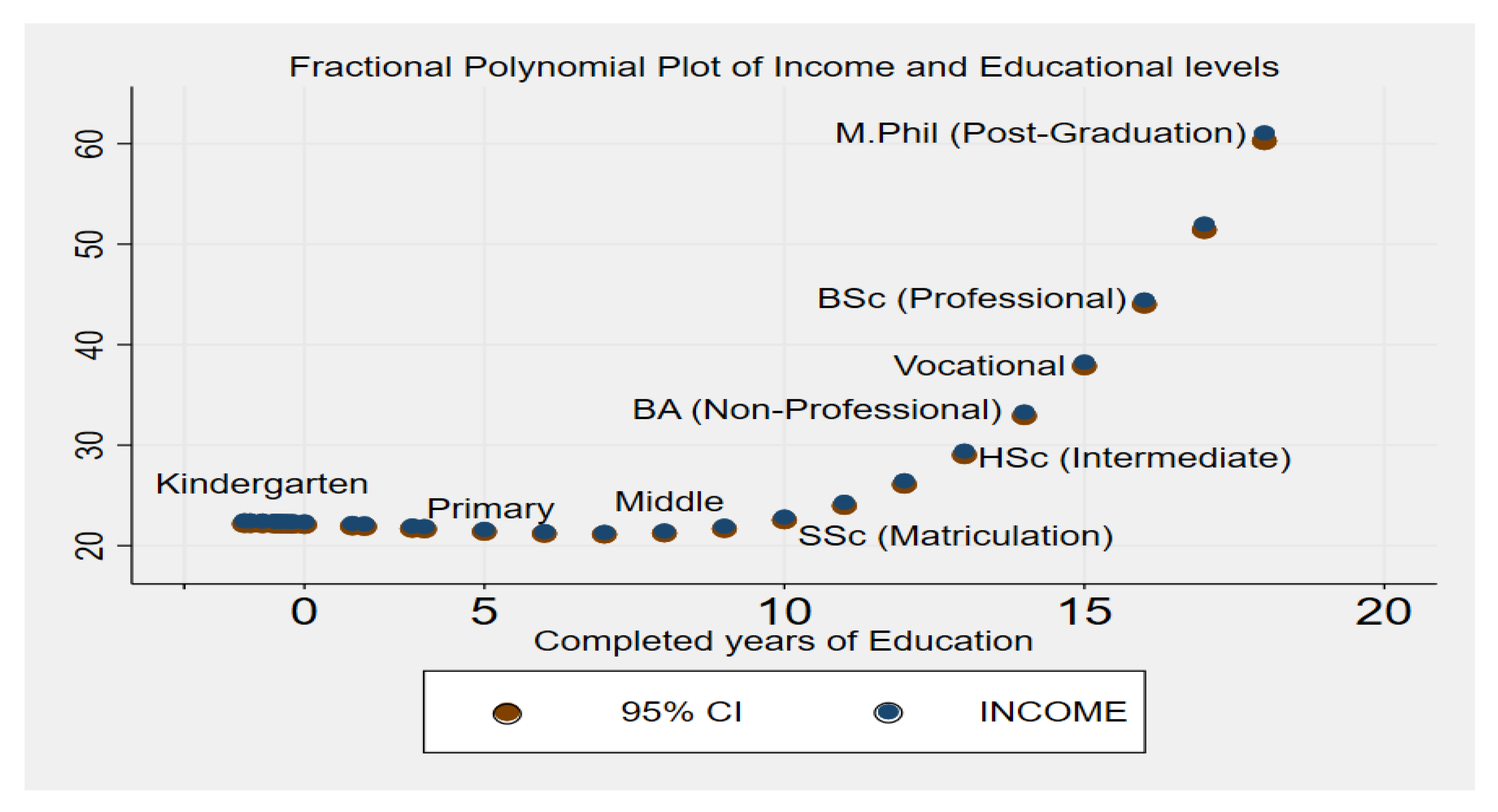

4. Data Description

4.1. Data Collection

4.2. Sheepskins Estimation Methodology

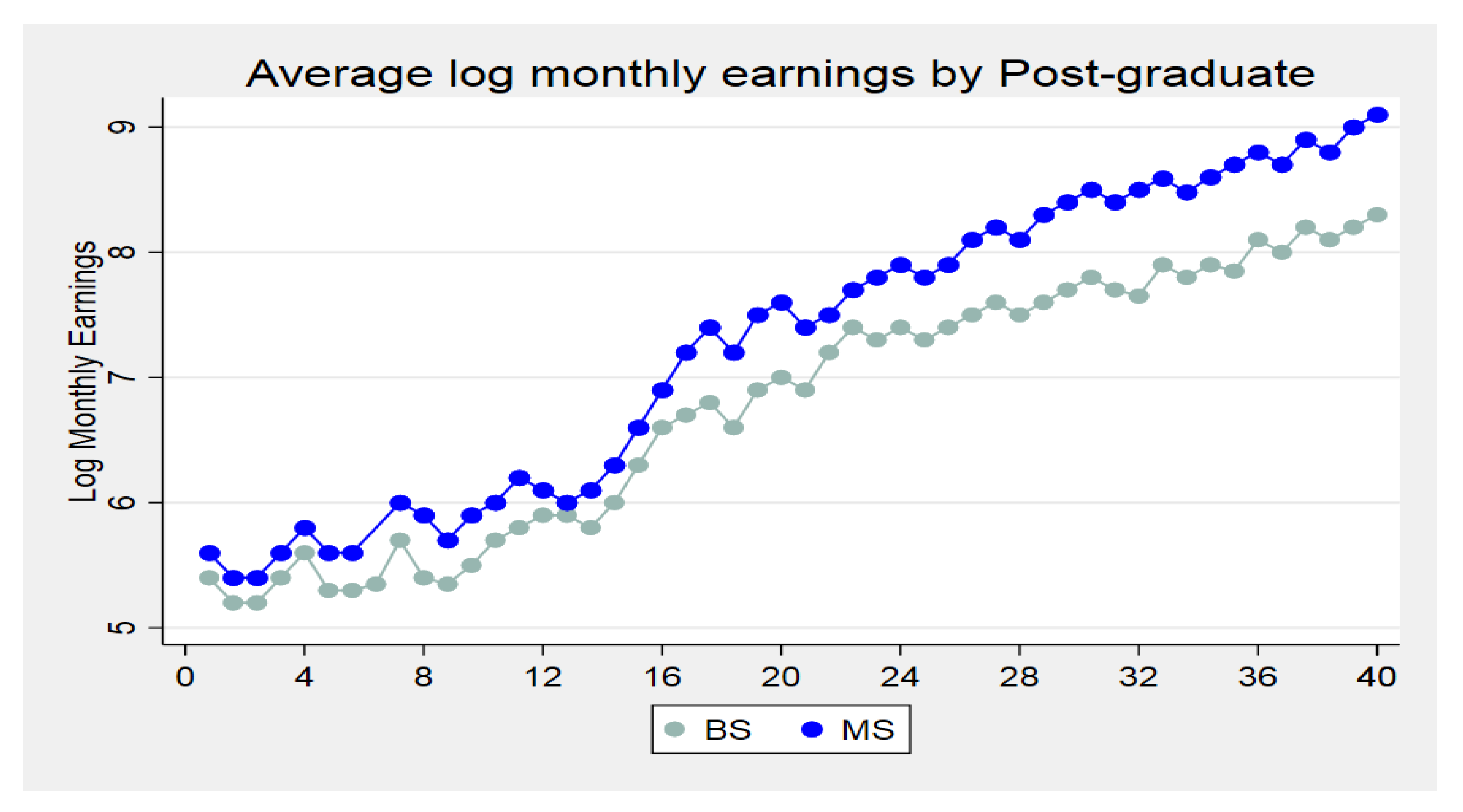

5. Results

6. Discussion

7. Conclusions

8. Policy Recommendation

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Variables | Variable’s Description |

|---|---|

| Y | Natural log of the income (Pak rupees) |

| S | Accumulated schooling |

| AGE | Age in years |

| EXP | No. years’ experience |

| D6 | Primary (s ≥ 5) |

| D10 | Secondary (s ≥ 10) |

| D12 | Higher secondary (s ≥ 12) |

| D14 | B.A (s ≥ 14) |

| D15 | Vocational/Polytechnical (s ≥ 15) |

| D16 | BSc (honors) (s ≥ 16) |

| D18 | MSc/MPhil (s ≥ 18) |

| Director Manager | Employment status |

| Professional | |

| Associated Teachers | |

| Agriculture and Fisheries | |

| Supervisors | |

| Finance | |

| Plant and machine operator | |

| Clerks | |

| Elementary |

| Variables | Mean | Standard Error | Kurtosis | Skewness | Confidence Level (95.0%) |

|---|---|---|---|---|---|

| Incomplete Primary | 0.1107023 | 0.00413537 | 13.1309219 | 3.88957257 | 0.008105996 |

| Complete Primary | 0.2867304 | 0.00797572 | 5.57123356 | 2.75142192 | 0.01563368 |

| Incomplete Secondary | 0.4938271 | 0.01189846 | 3.24266102 | 2.28957000 | 0.02332287 |

| Complete Secondary | 0.6573460 | 0.01527782 | 2.75933134 | 2.18148577 | 0.029946943 |

| Completed Higher | 1.1076772 | 0.02104994 | 0.64390550 | 1.62597670 | 0.041261215 |

| Independent Variables | Coefficient (Standard Errors) | |

|---|---|---|

| Model 1a | Model 1b | |

| Intercept | 0.655 (0.269) *** | 1.348 (0.138) *** |

| Age | 0.0044 (0.002) | −0.001 (0.001) ** |

| S | 0.115 (0.0163) *** | 0.050 (0.008) *** |

| Exp | 0.107 (0.005) *** | 0.027 (0.002) ** |

| Exp2 | 0.0114 (0.000025) ** | 0.0007 (0.0000078) * |

| Primary | −0.858 (0.352) ** | −0.478 (0.133) *** |

| SSc | 0.538 (0.212) ** | 0.434 (0.132) ** |

| HSc | 0.887 (0.161) *** | 0.851 (0.122) *** |

| Vocational | 1.92 (0.079) *** | 2.034 (0.046) *** |

| Associate degree | 1.269 (0.302) *** | 1.991 (0.055) ** |

| Graduate | 2.455 (0.100) *** | 2.492 (0.055) *** |

| Postgraduate | 1.647 (0.098) *** | 2.822 (0.047) ** |

| Marital status | 0.029 (0.093) * | −0.0107 (0.047) |

| Gender | 0.982 (0.072) ** | 0.371 (0.038) * |

| F-Test | 560.92 | 1734.4 |

| N | 3514 | 12,104 |

References

- Ferrer, A.M.; Riddell, W.C. The role of credentials in the Canadian labour market. Can. J. Econ. Rev. Can. Écon. 2002, 35, 879–905. [Google Scholar] [CrossRef]

- Mora, J.J. Sheepskin effects and screening in Colombia. Colombian Econ. J. 2003, 1, 95–108. [Google Scholar]

- Bauer, T.K.; Dross, P.J.; Haisken-DeNew, J.P. Sheepskin effects in Japan. Int. J. Manpower 2005, 26, 320–335. [Google Scholar] [CrossRef]

- Teixeira, P.N. Great expectations, mixed results and resilient beliefs: The troubles of empirical research in economic controversies. J. Econ. Methodol. 2007, 14, 291–309. [Google Scholar] [CrossRef]

- Peet, E.D.; Fink, G.; Fawzi, W. Returns to education in developing countries: Evidence from the living standards and measurement study surveys. Econ. Educ. Rev. 2015, 49, 69–90. [Google Scholar] [CrossRef]

- Memon, A.A.; Liu, Z.J.S. Assessment of Sustainable Development of the Performance of Higher Education Credentials in the Transitive Labor Market. Sustainability 2019, 11, 2628. [Google Scholar] [CrossRef] [Green Version]

- Thrane, C. Education and earnings in the tourism industry–the role of sheepskin effects. Tour. Econ. 2010, 16, 549–563. [Google Scholar] [CrossRef]

- Alba-Ramirez, A.; San Segundo, M.J. The returns to education in Spain. Econ. Educ. Rev. 1995, 14, 155–166. [Google Scholar] [CrossRef]

- Becker, G.S. Investment in human capital: A theoretical analysis. J. Polit. Econ. 1962, 70, 9–49. [Google Scholar] [CrossRef]

- Schultz, T.W. Investment in Human Capital The Role of Education. Econ. Dev. Cult. Chang. 1971, 23, 553–559. [Google Scholar] [CrossRef]

- Mincer, J.; Polachek, S. Family investments in human capital: Earnings of women. J. Polit. Econ. 1974, 82, S76–S108. [Google Scholar] [CrossRef] [Green Version]

- Flores-Lagunes, A.; Light, A. Interpreting degree effects in the returns to education. J. Hum. Resour. 2010, 45, 439–467. [Google Scholar] [CrossRef] [Green Version]

- Lemieux, T. Increasing residual wage inequality: Composition effects, noisy data, or rising demand for skill? Am. Econ. Rev. 2006, 96, 461–498. [Google Scholar] [CrossRef] [Green Version]

- Card, D. The causal effect of education on earnings. In Handbook of Labor Economics; Elsevier: Amsterdam, The Netherlands, 1999; Volume 3, pp. 1801–1863. [Google Scholar]

- Hungerford, T.; Solon, G. Sheepskin effects in the returns to education. Rev. Econ. Stat. 1987, 69, 175–177. [Google Scholar] [CrossRef]

- Belman, D.; Heywood, J.S. Sheepskin effects in the returns to education: An examination of women and minorities. Rev. Econ. Stat. 1991, 73, 720–724. [Google Scholar] [CrossRef]

- Hamdani, K.A. Education and the income differential: An estimation for Rawalpindi city. Pak. Dev. Rev. 1977, 16, 144–164. [Google Scholar] [CrossRef] [Green Version]

- Yunus, N.M. Sheepskin effects in the returns to higher education: New evidence for Malaysia. Asian Acad. Manag. J. 2017, 22, 151. [Google Scholar] [CrossRef]

- Olfindo, R. Diploma as signal? Estimating sheepskin effects in the Philippines. Int. J. Educ. Dev. 2018, 60, 113–119. [Google Scholar] [CrossRef]

- Crespo, A.; Reis, M.C. Sheepskin effects and the relationship between earnings and education: Analyzing the evolution over time in Brazil. Rev. Brasil. Econ. 2015, 69, 209–231. [Google Scholar] [CrossRef] [Green Version]

- Denny, K.J.; Harmon, C.P. Testing for sheepskin effects in earnings equations: Evidence for five countries. Appl. Econ. Lett. 2001, 8, 635–637. [Google Scholar] [CrossRef]

- Ost, B.; Pan, W.; Webber, D. The returns to college persistence for marginal students: Regression discontinuity evidence from university dismissal policies. J. Labor Econ. 2018, 36, 779–805. [Google Scholar] [CrossRef] [Green Version]

- Kaffenberger, M.; Pritchett, L.; Sandefur, J. Estimating the Impact of Women’s Education on Fertility, Child Mortality, and Empowerment When Schooling Ain’t Learning. Available online: https://www.gov.uk/dfid-research-outputs/estimating-the-impact-of-women-s-education-on-fertility-child-mortality-and-empowerment-when-schooling-ain-t-learning#abstract (accessed on 10 November 2019).

- Lang, K.; Kropp, D. Human capital versus sorting: The effects of compulsory attendance laws. Q. J. Econ. 1986, 101, 609–624. [Google Scholar] [CrossRef] [Green Version]

- Dustmann, C.; Fadlon, I.; Weiss, Y. Return migration, human capital accumulation and the brain drain. J. Dev. Econ. 2011, 95, 58–67. [Google Scholar] [CrossRef] [Green Version]

- Trostel, P.A. Nonlinearity in the return to education. J. Appl. Econ. 2005, 8, 191–202. [Google Scholar] [CrossRef] [Green Version]

- Heckman, J.J.; Lochner, L.J.; Todd, P.E. Fifty Years of Mincer Earnings Regressions, No. w9732; IZA Discussion Paper Series; National Bureau Of Economic Research: Cambridge, MA, USA, 2003. [Google Scholar]

- Psacharopoulos, G.; Teixeira, P. Rates of Return to Education: Conceptual and Methodological Issues. In Encyclopedia of International Higher Education Systems and Institutions; Springer: Dordrecht, Germany, 2019; pp. 1–8. [Google Scholar]

- Patrinos, H.A. Estimating the return to schooling using the Mincer equation. IZA World Labor 2016. [Google Scholar] [CrossRef] [Green Version]

- Mincer, J. Schooling, Experience, and Earnings; National Bureau Of Economic Research: Cambridge, MA, USA, 1974. [Google Scholar]

- Becker, G.S. Human capital revisited. In Human Capital: A Theoretical and Empirical Analysis with Special Reference to Education, 3rd ed.; The University of Chicago Press: Chicago, IL, USA, 2009; pp. 15–28. [Google Scholar]

- Schady, N. Convexity and Sheepskin Effects in the Human Capital Earnings Function: Recent Evidence for Filipino Men; The World Bank: Washington, DC, USA, 2001. [Google Scholar] [CrossRef] [Green Version]

- Shabbir, T. Sheepskin effects in the returns to education in a developing country. Pak. Dev. Rev. 1991, 30, 1–19. [Google Scholar] [CrossRef] [Green Version]

- Aslam, M. Education gender gaps in Pakistan: Is the labor market to blame? Econ. Dev. Cult. Chang. 2009, 57, 747–784. [Google Scholar] [CrossRef] [Green Version]

- Brown, S.; Sessions, J.G. Education and employment status: A test of the strong screening hypothesis in Italy. Econ. Educ. Rev. 1999, 18, 397–404. [Google Scholar] [CrossRef]

- Pagani, L.S.; Brière, F.N.; Janosz, M.J.I. Fluid reasoning skills at the high school transition predict subsequent dropout. Intelligence 2017, 62, 48–53. [Google Scholar] [CrossRef]

- Liu, V.Y.; Belfield, C.R.; Trimble, M.J. The medium-term labor market returns to community college awards: Evidence from North Carolina. Econ. Educ. Rev. 2015, 44, 42–55. [Google Scholar] [CrossRef] [Green Version]

- Limam, I.; Hafaiedh, A.B. Education, Earnings and Returns to Schooling in Tunisia. Econ. Res. Forum Working Papers 2017. Available online: https://erf.org.eg/publications/education-earnings-and-returns-to-schooling-in-tunisia/ (accessed on 10 November 2019).

- Mateos-Romero, L.; del Mar Salinas-Jiménez, M. Labor Mismatches: Effects on Wages and on Job Satisfaction in 17 OECD Countries. Soc. Indic. Res. 2018, 140, 369–391. [Google Scholar] [CrossRef]

- Weiss, A. Human capital vs. signalling explanations of wages. J. Econ. Perspect. 1995, 9, 133–154. [Google Scholar] [CrossRef]

- Van der Meer, P.H. Mobility. Educational credentials and external effects: A test for the Netherlands. Res. Soc. Stratif. Mobility 2011, 29, 107–118. [Google Scholar] [CrossRef]

| Male | Female | |||

|---|---|---|---|---|

| Mean | Std. Dev. | Mean | Std. Dev. | |

| Log Wage (Pkr) | 1.5323 | 0.8784 | 1.5130 | 0.5894 |

| Income | 26,773.82 | 13,320.33 | 24,423.55 | 21,340.71 |

| S | 4.4643 | 2.1358 | 4.1287 | 2.0744 |

| AGE | 31.6619 | 1.8466 | 31.2508 | 1.0178 |

| EXP | 12.8847 | 7.9891 | 12.7657 | 5.1641 |

| Director Manager | 0.1427 | 0.3498 | 0.0955 | 0.2940 |

| Professional | 0.0576 | 0.2331 | 0.1578 | 0.3647 |

| Associated Teachers | 0.0987 | 0.2984 | 0.0913 | 0.2882 |

| Agriculture and Fisheries | 0.0949 | 0.2932 | 0.1179 | 0.3226 |

| Supervisors | 0.0010 | 0.0331 | 0.0253 | 0.4350 |

| Finance | 0.0241 | 0.1535 | 0.0234 | 0.4167 |

| Plant and machine operator | 0.1163 | 0.3207 | 0.0789 | 0.2697 |

| Clerks | 0.2403 | 0.4274 | 0.1909 | 0.3914 |

| Elementary | 0.2261 | 0.4184 | 0.1300 | 0.3340 |

| Public | 0.6427 | 0.4793 | 0.5747 | 0.4945 |

| Private | 0.3572 | 0.4793 | 0.4252 | 0.4945 |

| Variables | Mincer Model | ||

|---|---|---|---|

| Equation (1a) | Equation (1b) | Equation (1c) | |

| α | 0.9280 (0.090) *** | 1.1226 (0.041) ** | 1.1675 (0.046) *** |

| S | 0.024 (0.005) *** | 0.026 (0.002) ** | 0.027 (0.002) *** |

| Exp | 0.050 (0.007) ** | 0.049 (0.003) ** | 0.049 (0.004) *** |

| Exp2 | −0.001 (0.0002) *** | −0.001 (0.0001) *** | −0.0014 (0.0001) *** |

| D6 | −0.779 (0.083) ** | −0.938 (0.038) ** | −0.974 (0.043) * |

| D10 | −0.06 (0.069) | 0.0005 (0.032) * | 0.002 (0.036) |

| D12 | 0.257 (0.063) | 0.254 (0.029) ** | 0.241 (0.032) |

| D14 | 0.313 (0.033) ** | 0.294 (0.015) ** | 0.290 (0.017) * |

| D15 | 0.337 (0.029) *** | 0.328 (0.013) * | 0.325 (0.015) *** |

| D16 | 0.387 (0.033) ** | 0.377 (0.015) ** | 0.374 (0.017) *** |

| D18 | 0.558 (0.029) *** | 0.556 (0.013) ** | 0.556 (0.015) *** |

| R-squared | 0.3890 | 0.3589 | 0.3524 |

| No. Obs. | 3026 | 15,257 | 12,231 |

| Variable | Spline Function | ||

|---|---|---|---|

| Equation (2a) | Equation (2b) | Equation (2c) | |

| α | 0.987 (0.087) *** | 1.203 (0.040) ** | 1.254 (0.045) *** |

| S | 0.114 | 0.127 | 0.130 |

| (0.004) *** | (0.001) ** | (0.001) *** | |

| Exp | 0.050679 (0.007) *** | 0.049 (0.003) | 0.048 (0.004) ** |

| Exp2 | −0.001438 (0.0002) *** | −0.001 (0.0001) *** | −0.001 (0.0002) ** |

| D6 | −0.637 (0.085) ** | −0.800 (0.038) *** | −0.837 (0.043) *** |

| (S-6) *D6 | 0.083 (0.016) ** | 0.085 (0.007) *** | 0.085 (0.008) ** |

| D10 | 0.1642 (0.217) * | 0.170 (0.098) | 0.171 (0.111) |

| (S-10) *D10 | 0.080 (0.033) *** | 0.091 (0.015) *** | 0.094 (0.017) ** |

| D12 | −0.721 (0.274) * | −0.826 (0.124) *** | −0.853 (0.138) ** |

| (S-12) *D12 | −0.148 (0.030) *** | −0.159 (0.014) ** | −0.162 (0.015) ** |

| D14 | 0.318 (0.033) ** | 0.299 (0.015) ** | 0.295 (0.017) *** |

| D15 | 0.344 (0.028) *** | 0.334 (0.013) *** | 0.332 (0.015) *** |

| D16 | 0.398 (0.033) * | 0.390 (0.015) ** | 0.388 (0.017) ** |

| D18 | 0.553 (0.029) *** | 0.549 (0.013) *** | 0.549 (0.015) *** |

| R-squared | 0.3962 | 0.3664 | 0.3600 |

| F-test | 164.801 *** | 734.7497 *** | 572.755 *** |

| No. of Obs. | 3026 | 15,257 | 12,231 |

| Public Sector | Private Sector | |||

|---|---|---|---|---|

| Male | Female | Male | Female | |

| α | 1.63079 (0.1541) *** | 1.5072 (0.2507) *** | 1.6104 (0.2061) *** | 1.6424 (0.3060) *** |

| S | 0.1669 (0.0173) *** | 0.1574 (0.0138) *** | 0.1741 (0.0235) *** | 0.1547 (0.0164) *** |

| Exp | 0.0282 (0.0121) *** | 0.0520 (0.0153) *** | 0.0270 (0.0162) *** | 0.0354 (0.0178) *** |

| Exp2 | −0.0004 (0.0003) ** | −0.0014 (0.0004) *** | −0.0003 (0.00051) *** | −0.0009 (0.0005) *** |

| D6 | −0.5018 (0.1252) *** | −0.6613 (0.1348) *** | −0.4295 (0.1692) *** | −0.7122 (0.1669) *** |

| (S-6) *6 | −0.1358 (0.0536) ** | −0.0454 (0.0523) * | −0.1183 (0.0723) * | −0.0233 (0.0576) |

| D10 | 0.2138 (0.1276) ** | 0.0915 (0.1147) * | 0.1929 (0.1705) ** | 0.1500 (0.1385) ** |

| (S-10) *10 | −0.1580 (0.0576) *** | −0.0884 (0.0445) ** | −0.1664 (0.0817) ** | −0.0841 (0.0527) * |

| D12 | 0.2350 (0.0835) *** | 0.1548 (0.0797) *** | 0.2030 (0.1123) *** | 0.1890 (0.0953) *** |

| (S-12) *12 | 0.2318 (0.0427) *** | 0.1195 (0.0390) *** | 0.2299 (0.0597) *** | 0.1042 (0.0447) *** |

| D14 | 0.2980 (0.0557) *** | 0.2027 (0.0775) *** | 0.2974 (0.0753) *** | 0.2165 (0.0921) *** |

| D15 | 0.3127 (0.0434) *** | 0.2473 (0.0522) *** | 0.3041 (0.0588) *** | 0.2359 (0.0612) *** |

| D16 | 0.3550 (0.0554) *** | 0.2930 (0.0685) *** | 0.3350 (0.0737) *** | 0.2695 (0.0797) *** |

| D18 | 0.4680 (0.0467) *** | 0.3792 (0.0541) *** | 0.4879 (0.0632) *** | 0.3988 (0.0641) *** |

| D10*Exp | −0.0059 (0.0138) | −0.0204 (0.0224) ** | −0.0127 (0.0186) | −0.0200 (0.0242) ** |

| D12*Exp | −0.0313 (0.0190) ** | −0.0247 (0.0244) ** | −0.0403 (0.0255) *** | −0.0163 (0.0282) * |

| D16*Exp | 0.0356 (0.0180) *** | 0.0269 (0.0311) *** | 0.0348 (0.0239) ** | 0.0285 (0.0339) *** |

| R-Squared | 0.4629 | 0.4240 | 0.4662 | 0.4171 |

| F-Statistics | 61.74 *** | 32.34 *** | 34.77 *** | 22.00 *** |

| No. of Obs | 1163 | 720 | 654 | 509 |

| All Variables | (b) Fixed-Effects | (B) Random-Effects | Hausman Test |

|---|---|---|---|

| Coef. (Std. Err.) | Coef. (Std. Err.) | Difference (b)-(B) (Std. Err.) | |

| α | 3.616 (0.383) *** | 3.161 (0.344) *** | |

| age | −0.0111 (0.005) ** | −0.010 (0.004) ** | −0.0008 (0.0028) |

| Exp | 0.410 (0.255) * | 0.407 (0.209) * | 0.0035 (0.1463) |

| Exp2 | −0.00005 (0.0005) *** | −0.0002 (0.0005) *** | 0.0001 (0.0001) ** |

| D6 | −3.137 (0.437) *** | −2.668 (0.391) *** | −0.4689 (0.1944) *** |

| D10 | −1.902 (0.597) *** | −1.423 (0.563) ** | −0.4787 (0.1982) |

| D12 | 0.566 (0.201) *** | 0.247 (0.175) | 0.3192 (0.0973) |

| D14 | −0.173 (0.261) | 0.322 (0.221) | −0.4960 (0.1403) ** |

| D15 | 1.146 (0.197) *** | 0.927 (0.180) *** | 0.2186 (0.0786) ** |

| D16 | 2.081 (0.588) *** | 1.499 (0.541) *** | 0.5822 (0.2284) *** |

| D18 | 1.367 (0.281) *** | 1.729 (0.244) *** | −0.3614 (0.1393) *** |

| R2 | |||

| Within | 0.9423 | 0.9355 | |

| Between | 0.4537 | 0.6063 | |

| Overall | 0.8240 | 0.8609 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, Z.; Memon, A.A.; Negussie, W.; Ketema, H. Interpreting the Sustainable Development of Human Capital and the Sheepskin Effects in Returns to Higher Education: Empirical Evidence from Pakistan. Sustainability 2020, 12, 2393. https://doi.org/10.3390/su12062393

Liu Z, Memon AA, Negussie W, Ketema H. Interpreting the Sustainable Development of Human Capital and the Sheepskin Effects in Returns to Higher Education: Empirical Evidence from Pakistan. Sustainability. 2020; 12(6):2393. https://doi.org/10.3390/su12062393

Chicago/Turabian StyleLiu, Zhimin, Aftab Ahmed Memon, Woubshet Negussie, and Haile Ketema. 2020. "Interpreting the Sustainable Development of Human Capital and the Sheepskin Effects in Returns to Higher Education: Empirical Evidence from Pakistan" Sustainability 12, no. 6: 2393. https://doi.org/10.3390/su12062393

APA StyleLiu, Z., Memon, A. A., Negussie, W., & Ketema, H. (2020). Interpreting the Sustainable Development of Human Capital and the Sheepskin Effects in Returns to Higher Education: Empirical Evidence from Pakistan. Sustainability, 12(6), 2393. https://doi.org/10.3390/su12062393