Geopolitical Risk and Energy Transition in Russia: Evidence from ARDL Bounds Testing Method

Abstract

:1. Introduction

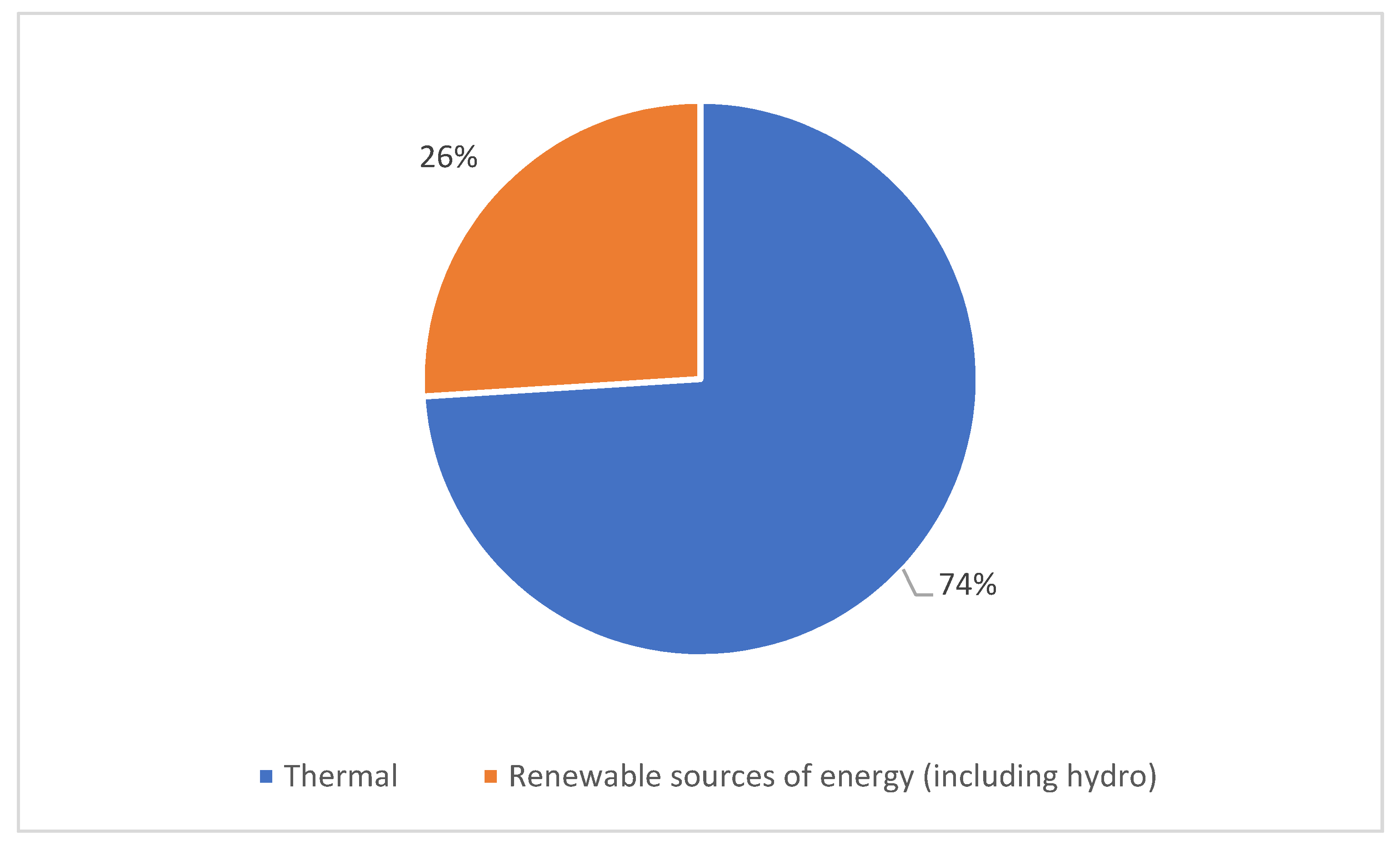

2. Energy Transition, Geopolitical Risk and Energy Security in Russia

3. Literature Review

4. Theoretical Background

5. Data Description and Model Specification

6. Results

- (i)

- Short-run analysis

- Russian economic growth negatively influences on energy transition of the country in the short-run. A 1% increase in economic growth of the country leads to energy transition reduction by nearly 0.02%, meaning that improvement of national production in Russia cannot play a useful role to replace fossil fuel energy sources with green energy ones.

- The short-run relationship between exchange rate and energy transition is found to be positive and statistically significant indicating that a 1% appreciation in Russian Ruble is linked with a 0.008% increase in energy transition. Appreciation in Ruble slightly hurts the export flows of this country, particularly exports of oil and gas. Therefore, the local SMEs of Russia may find suitable opportunity to develop their projects in related to expansion of green energy productions.

- The results confirm that CO2 emissions have negative short-run contribution to energy transition in Russia. A 1% increase in this variable leads to decrease of energy transition in Russia by nearly 0.11%.

- The short-run impacts of population growth and inflation rate on energy transition movement in Russia are negative and a 1 percent increase in them is linked to a 0.05% and 0.15% reduction in energy transition, respectively.

- Coefficient of financial openness is positive and statistically significant denoting that in the short-run, a 1% increase in financial openness degree in Russia may lead to an increase of energy transition of the country by approximately 0.25%.

- The short-run impact of geopolitical risk on energy transition movement in Russia is positive and statistically significant. A 1% increase in geopolitical risk may lead to nearly 0.31% increase in energy transition of Russia in the short-run.

- (ii)

- Long-run analysis

- Russian economic growth has negative and statistically significant long-run impacts on the energy transition process of the country. The estimation inferred that a 1% increase in economic growth is linked with a 0.28 decrease in energy transition of Russia. The main reason may be the oil-based economic structure of this country which links economic growth and non-renewable energy resources. This result is in line with [44] who proved a negative long-run relationship between clean energy and economic growth for Nigeria, while it is in contrast with [45] who revealed the positive linkage between economic growth and renewable energy consumption in Pakistan.

- The long-run relationship between exchange rate and energy transition in Russia is found to be positive, meaning that 1% appreciation of Russian Ruble against U.S. Dollars leads to increase of the energy transition process in the country by nearly 0.19%. This finding is in line with [46] who studied future scenarios of renewable transitions.

- Our empirical estimation showed that any increase in CO2 emissions has negative and statistically significant impact on energy transition in Russia. A 1% increase in CO2 emissions leads to increase of energy transition by approximately 0.3%. In other words, Russian policy makers consider substitution of fossil fuel consumption with renewable ones (green energy resources) as a solution for air pollution. This finding is similar to [42] who found out a negative relationship between CO2 emissions and green energy consumption.

- Both population growth and inflation rate have a long-run negative and statistically significant impact on the energy transition process in the Russia. A 1% rise in population and price level of commodities and services in Russia is linked with a 0.14% and 0.31% decrease in energy transition. The result of positive linkage between population growth and non-renewable energy consumption is in line with [47] who proved this relationship in OECD countries.

- The coefficient of financial openness is positive indicating that an increase in level of financial openness of Russia contributes to rise of energy transition. The estimation confirmed that financial openness is a main long-run contributor to improvement of energy transition in the case of Russia.

- Finally, the estimation proves that the long-run effect of geopolitical risk on energy transition is positive and statistically significant. A 1% rise in geopolitical risk may lead to approximately 0.27% increase in energy transition of Russia in the long-run period. This finding is in line with [1] who found out that green energies may cause more small-scale conflicts but decrease the risk of large political conflicts.

7. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Vakulchuk, R.; Overland, I.; Scholten, D. Renewable energy and geopolitics: A review. Renew. Sustain. Energy Rev. 2020, 122, 109547. [Google Scholar] [CrossRef]

- Overland, I. The geopolitics of renewable energy: Debunking four emerging myths. Energy Res. Soc. Sci. 2019, 49, 36–40. [Google Scholar] [CrossRef]

- Griffiths, S. Energy diplomacy in a time of energy transition. Energy Strategy Rev. 2019, 26, 100386. [Google Scholar] [CrossRef]

- Scholten, D.; Bazilian, M.; Overland, I.; Westphal, K. The geopolitics of renewables: New board, new game. Energy Policy 2020. [Google Scholar] [CrossRef]

- International Renewable Agency (IRENA). Available online: https://irena.org/energytransition (accessed on 1 December 2019).

- Sovacool, B.; Geels, F. Further reflections on the temporality of energy transitions: A response to critics. Energy Res. Soc. Sci. 2016, 22, 232–237. [Google Scholar] [CrossRef]

- Geels, F.W.; Kern, F.; Fucs, G.; Hinderer, N.; Kungl, G.; Mylan, J.; Neukirch, M.; Wassermann, S. The enactment of socio-technical transition pathways: A reformulated typology and a comparative multi-level analysis of the German and UK low-carbon electricity transitions (1990–2014). Res. Policy 2016, 45, 896–913. [Google Scholar] [CrossRef]

- Blazquez, J.; Fuentes-Bracamontes, R.; Manzano, B. A Road Map to Navigate the Energy Transition, the Oxford Institute for Energy Studies. 2019. Available online: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2019/10/A-road-map-to-navigate-the-energy-transition-Insight-59.pdf?v=4f74d343f26b (accessed on 11 November 2019).

- BP. Statistical Review of World Energy 2019. 2019. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2019-full-report.pdf (accessed on 19 November 2019).

- Mitrova, T.; Melnikov, Y. Energy Transition in Russia. J. Energy Transit. 2019, 3, 73–80. [Google Scholar] [CrossRef] [Green Version]

- World Bank Development Indicators (WDI). Available online: Datatopics.worldbank.org/world-development-indicators/ (accessed on 8 July 2019).

- Wiseman, J. The great energy transition of the 21st century: The 2050 Zero-Carbon World Oration. Energy Res. Soc. Sci. 2018, 35, 227–232. [Google Scholar] [CrossRef]

- Chapman, A.; Itoaka, K. Energy transition to a future low-carbon energy society in Japan’s liberalizing electricity market: Precedents, policies and factors of successful transition. Renew. Sustain. Energy Rev. 2018, 81 Pt 2, 2019–2027. [Google Scholar] [CrossRef]

- Vainio, A.; Varho, V.; Tapio, P.; Pulkka, A.; Paloniemi, R. Citizen’s images of a sustainable energy transition. Energy 2019, 183, 606–616. [Google Scholar] [CrossRef]

- Chen, B.; Xiong, R.; Sun, Q.; Yang, J. Pathways for sustainable energy transition. J. Clean. Prod. 2019, 228, 1564–1571. [Google Scholar] [CrossRef]

- Fattouh, B.; Poudine, R.; West, R. The rise of renewables and energy transition: What adaptation strategy exists for oil companies and oil-exporting countries? Energy Transit. 2019, 4, 45–58. [Google Scholar] [CrossRef] [Green Version]

- Marusyk, Y. Securing a spot under the sun? Gas and renewables in the EU-Russian energy transition discourse. East Eur. Politics 2019, 35, 182–200. [Google Scholar] [CrossRef]

- Boute, A.; Zhikharev, A. Vested interests as driver of the clean energy transition: Evidence from Russia’s solar energy policy. Energy Policy 2019, 133. [Google Scholar] [CrossRef]

- Proskuryakova, L. Foresight for the ‘energy’ priority of the Russian Science and Technology Strategy. Energy Strategy Rev. 2019, 26. [Google Scholar] [CrossRef]

- Ketenci, N. The environmental Kuznets curve in the case of Russia Russian. J. Econ. 2018, 4, 249–265. [Google Scholar]

- Mihalischev, S.; Raskina, Y. Environmental Kuznets Curve: The Case of Russia, EUSP Department of Economics Working Paper Series, Ec-03/15, European University at St. Petersburg, Department of Economics. 2015. Available online: https://eusp.org/sites/default/files/archive/ec_dep/wp/Ec-03_15.pdf (accessed on 9 October 2019).

- Saboori, B.; Rasoulinezhad, E.; Sung, J. The nexus of oil consumption, CO2 emissions and economic growth in China, Japan and South Korea. Environ. Sci. Pollut. Res. 2017, 24, 7436–7455. [Google Scholar] [CrossRef]

- Panayotou, T. Empirical Tests and Policy Analysis of Environmental Degradation at Different Stages of Economic Development; Working paper WP238 Technology and Employment Programme; International Labor Office: Geneva, Switzerland, 1993; Available online: http://www.ilo.org/public/libdoc/ilo/1993/93B09_21engl.pdf (accessed on 12 November 2019).

- Grossman, G.; Kryeger, A. Economic Growth and the Environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef] [Green Version]

- Ekins, P. The Kuznets Curve for the Environment and Economic Growth: Examining the Evidence. Environ. Plan. A 1997, 29, 805–830. [Google Scholar] [CrossRef] [Green Version]

- Stern, D. The rise and fall of the Environmental Kuznets Curve. World Dev. 2004, 32, 1419–1439. [Google Scholar] [CrossRef]

- Narayan, P.; Narayan, S. Carbon dioxide emissions and economic growth: Panel data evidence from developing countries. Energy Policy 2010, 38, 661–666. [Google Scholar] [CrossRef]

- Ang, J. CO2 emissions, energy consumption, and output in France. Energy Policy 2007, 35, 4772–4778. [Google Scholar] [CrossRef]

- Acaravci, A.; Ozturk, I. On the relationship between energy consumption, CO2 emissions and economic growth in Europe. Energy 2010, 35, 5412–5420. [Google Scholar] [CrossRef]

- Pao, H.; Yu, H.; Yang, Y. Modeling the CO2 emissions, energy use, and economic growth in Russia. Fuel Energy Abstr. 2011, 36, 5094–5100. [Google Scholar] [CrossRef]

- Saboori, B.; Sulaiman, J. Environmental degradation, economic growth and energy consumption: Evidence of the environmental Kuznets curve in Malaysia. Energy Policy 2013, 60, 892–905. [Google Scholar] [CrossRef]

- Shahbaz, M.; Hye, Q.; Tiwari, A.; Leitao, N. Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew. Sustain. Energy Rev. 2013, 25, 109–121. [Google Scholar] [CrossRef] [Green Version]

- Baek, J. Environmental Kuznets curve for CO2 emissions: The case of Arctic countries. Energy Econ. 2015, 50, 13–17. [Google Scholar] [CrossRef]

- Le, T.H.; Le, H.C.; Taghizadeh-Hesary, F. Does Financial Inclusion impact CO2 Emissions? Evidence from Asia. Financ. Res. Lett. 2020, 101451. [Google Scholar] [CrossRef]

- Pablo-Romero, M.; Jesus, J. Economic growth and energy consumption: The Energy-Environmental Kuznets Curve for Latin America and the Caribbean. Renew. Sustain. Energy Rev. 2016, 60, 1343–1350. [Google Scholar] [CrossRef]

- Suri, V.; Chapman, D. Economic growth, trade and energy: Implications for the environmental Kuznets curve. Ecol. Econ. 1998, 25, 195–208. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Yoshino, N.; Inagaki, Y. Empirical analysis of factors influencing the price of solar modules. Int. J. Energy Sect. Manag. 2019, 13, 77–97. [Google Scholar] [CrossRef] [Green Version]

- Zivot, E.; Andrews, D. Further evidence of great crash, the oil price shock and unit root hypothesis. J. Bus. Econ. Stat. 1992, 10, 251–270. [Google Scholar]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Dario, C.; Iacoviello, M. Measuring Geopolitical Risk. Working Paper. Board of Governors of the Federal Reserve Board. 2019. Available online: https://www.matteoiacoviello.com/gpr_files/GPR_PAPER.pdf (accessed on 4 January 2020).

- Taghizadeh-Hesary, F.; Yoshino, N.; Rasoulinezhad, E. Trade linkages and transmission of oil price fluctuations. Energy Policy 2019, 133, 1–10. [Google Scholar] [CrossRef]

- Bilgili, F.; Kocak, E.; Bulut, U. The dynamic impact of renewable energy consumption on CO2 emissions: A revisited Environmental Kuznets Curve approach. Renew. Sustain. Energy Rev. 2016, 54, 834–845. [Google Scholar] [CrossRef]

- Bhattacharya, M.; Churchil, S.A.; Paramati, S. The dynamic impact of renewable energy and institutions on economic output and CO2 emissions across regions. Renew. Energy 2013, 111, 157–167. [Google Scholar] [CrossRef]

- Maji, I. Does clean energy contribute to economic growth? Evidence from Nigeria. Energy Rep. 2015, 1, 145–150. [Google Scholar] [CrossRef] [Green Version]

- Malik, I.; Siyal, G.; Bin Abdullah, A.; Alam, A.; Zaman, K.; Kyophilavong, P.; Shahbaz, M.; Baloch, S.; Shams, T. Turn on the lights: Macroeconomic factors affecting renewable energy in Pakistan. Renew. Sustain. Energy Rev. 2014, 38, 277–284. [Google Scholar] [CrossRef]

- Sole, J.; Garcia-Olivares, A.; Turiel, A.; Ballabrera-Poy, J. Renewable transitions and the net energy from oil liquids: A scenarios study. Renew. Energy 2018, 116 Pt A, 258–271. [Google Scholar] [CrossRef]

- Salim, R.; Shafiei, S. Urbanization and renewable and non-renewable energy consumption in OECD countries: An empirical analysis. Econ. Model. 2014, 38, 581–591. [Google Scholar] [CrossRef] [Green Version]

| Energy Sources | 2000 | 2005 | 2010 | 2015 | 2018 |

|---|---|---|---|---|---|

| Oil | 8.83% | 11.73% | 12.46% | 12.02% | 12.07% |

| Natural gas | 22.35% | 21.39% | 18.99% | 16.69% | 17.30% |

| Coal | 5.54% | 4.91% | 4.31% | 4.68% | 5.50% |

| Variables | Unit | Mean | Maximum | Minimum | Std. Dev. |

|---|---|---|---|---|---|

| Economic Growth | % | 1.73 | 10 | −12.56 | 5.71 |

| Exchange rate | LCU per US$ | 30.90 | 67.05 | 0.99 | 16.84 |

| Energy transition | % | 3.91 | 4.37 | 3.55 | 0.21 |

| CO2 emissions | Metric tons per capita | 11.40 | 13.10 | 10.10 | 0.78 |

| Population growth | % | −0.11 | 0.21 | −0.46 | 0.22 |

| Inflation rate | % | 67.65 | 874.24 | 2.87 | 174.55 |

| Financial openness | LCU per US$ | 0.52 | 0.69 | 0.41 | 2.14 |

| Geopolitical Risk Index (GPR) | - | 105.92 | 220.07 | 47.67 | 27.23 |

| Dependent Variable | Independent Variables | ||||||

|---|---|---|---|---|---|---|---|

| Economic Growth | Exchange Rate | CO2 Emissions | Population Growth | Inflation Rate | Financial Openness | Geopolitical Risk | |

| Energy transition | −0.02 | 0.19 | 0.03 | −0.15 | −0.29 | 0.18 | 0.23 |

| Variables | Expected Sign |

|---|---|

| Economic growth | Negative (−) |

| CO2 emissions | Positive (+) |

| Inflation rate | Negative (−) |

| Population growth | Negative (−) |

| Financial openness | Positive (+) |

| Exchange rate | Positive (+) |

| Geopolitical risk | Positive (+) |

| Variable | At Level | At 1st Difference | ||

|---|---|---|---|---|

| T-Statistic | Time Break | T-Statistic | Time Break | |

| Economic Growth | −3.583 | 1993 | −10.443 * | 2014 |

| Exchange rate | −4.281 | 1997 | −8.288 * | 1997 |

| Energy transition | −3.791 | 2009 | −9.829 * | 2009 |

| CO2 emissions | −3.476 | 1997 | −10.101 * | 1993 |

| Population growth | −5.010 | 2014 | −9.029 * | 2009 |

| Inflation rate | −3.582 | 2009 | −11.593 * | 1993 |

| Financial openness | −4.118 | 2009 | −8.391 * | 1997 |

| Geopolitical risk | −3.665 | 2009 | −10.292 * | 2009 |

| Estimated Models | Optimal Lag Length | Structural Break | F-Stats. |

|---|---|---|---|

| FGro (Gro|ET, EX, CO, POP, Inf, FOP, GEO) | 5,5,5,5,5,6,6 | 1993 | 3.593 ** |

| FET (ET|Gro, EX, CO, POP, Inf, FOP, GEO) | 5,5,5,5,5,5,5 | 2009 | 3.616 ** |

| FEX (EX|Gro, ET, CO, POP, Inf, FOP, GEO) | 6,5,5,5,6,6,5 | 1997 | 4.728 * |

| FCO (CO|Gro, EX, ET, POP, Inf, FOP, GEO) | 5,5,5,6,6,6,5 | 1997 | 4.639 * |

| FPOP (POP|Gro, EX, CO, ET, Inf, FOP, GEO) | 5,6,6,6,5,5,5 | 2014 | 2.322 |

| FInf (Inf|Gro, EX, CO, POP, ET, FOP, GEO) | 5,5,5,5,5,5,6 | 2009 | 1.932 |

| FFOP(FOP|Gro, EX, CO, POP, Inf, ET, GEO) | 5,5,5,5,5,5,5 | 2009 | 1.550 |

| FGEO(GEO|Gro, EX, CO, POP, Inf, ET, FOP) | |||

| Significant Level | Lower Bounds I(0) | Upper Bounds I(1) | |

| 1% level | 2.841.83 | 3.972.87 | |

| 5% level | 2.32 | 3.38 | |

| 10% level | 1.83 | 2.87 | |

| Dependent Variable | Analysis | Independent Variables | Coefficient | p-Value |

|---|---|---|---|---|

| Energy transition | Long-run | Economic growth | −0.289 | 0.00 |

| Exchange rate | 0.192 | 0.04 | ||

| CO2 emissions | 0.332 | 0.00 | ||

| Population growth | −0.140 | 0.00 | ||

| Inflation rate | −0.319 | 0.01 | ||

| Financial openness | 0.451 | 0.00 | ||

| Geopolitical risk | 0.278 | 0.02 | ||

| Energy transition | Short-run | Economic growth | −0.023 | 0.00 |

| Exchange rate | 0.008 | 0.00 | ||

| CO2 emissions | −0.119 | 0.05 | ||

| Population growth | −0.053 | 0.00 | ||

| Inflation rate | −0.152 | 0.02 | ||

| Financial openness | 0.255 | 0.01 | ||

| Geopolitical risk | 0.313 | 0.00 | ||

| Short-run Diagnostic Tests | ||||

| Test | F-stats | p-value | ||

| Chi-2 Arch Arch LM test for higher order autocorrelation | 2.381 | 0.13 | ||

| Chi-2 White For homoskedasticity | 1.492 | 0.13 | ||

| Chi-2 Ramsay For misspecification of model | 1.792 | 0.12 | ||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rasoulinezhad, E.; Taghizadeh-Hesary, F.; Sung, J.; Panthamit, N. Geopolitical Risk and Energy Transition in Russia: Evidence from ARDL Bounds Testing Method. Sustainability 2020, 12, 2689. https://doi.org/10.3390/su12072689

Rasoulinezhad E, Taghizadeh-Hesary F, Sung J, Panthamit N. Geopolitical Risk and Energy Transition in Russia: Evidence from ARDL Bounds Testing Method. Sustainability. 2020; 12(7):2689. https://doi.org/10.3390/su12072689

Chicago/Turabian StyleRasoulinezhad, Ehsan, Farhad Taghizadeh-Hesary, Jinsok Sung, and Nisit Panthamit. 2020. "Geopolitical Risk and Energy Transition in Russia: Evidence from ARDL Bounds Testing Method" Sustainability 12, no. 7: 2689. https://doi.org/10.3390/su12072689

APA StyleRasoulinezhad, E., Taghizadeh-Hesary, F., Sung, J., & Panthamit, N. (2020). Geopolitical Risk and Energy Transition in Russia: Evidence from ARDL Bounds Testing Method. Sustainability, 12(7), 2689. https://doi.org/10.3390/su12072689