Modern Methods of Business Valuation—Case Study and New Concepts

Abstract

:1. Introduction

2. Methodology

3. Literature Review

The Process of Business Valuation–The Essence and Classification of Methods

- is an invariably important issue of the economic essence of ownership, which is closely linked to issues of usability and the problem of the monetary value of an object of property,

- is the market measure of the effectiveness and efficiency of actions taken by the enterprise.

- Valuation objective;

- Who orders (recipient);

- Type of the company due to usability;

- Economic condition of the company and the condition of the environment (economy, industry, region);

- Type, scale and diversity of business;

- Type and number of assets;

- Operation and development prospects of the company;

- Type and quality of information about the company and the market that it is possible to obtain;

- Approaches and types of value in business valuation.

- Compliance of the valuation with the facts;

- Timeliness of data, transparency and relative simplicity;

- Clearly defined purpose of its preparation;

- Being based on the financial data of the company;

- Not being made exclusively on the basis of the value of the company’s assets unless it concerns the so-called liquidation method;

- Taking into account income and intangible factors;

- Taking into account the company’s development forecasts and risk factors;

- Taking into account all relevant information which affects the valuation and is available in the process of its preparation;

- Being objective and reliable.

4. Results

- Freedom of selection of input data,

- Use of wide subjectivity in the common valuation procedure,

- Subjectivity of selection of valuation methods and internal parameters,

- Lack of coherence in estimation of parameters,

- Lack of legal regulations and standards of valuation.

4.1. The Examples of Business Valuation Using the Adjusted Net Assets Method–Case Study

4.1.1. The Practice Example No. 1—Valuations Using the Adjusted Net Assets Method

4.1.2. The Practice Example No. 2

- -

- Intangible and legal assets—this is an integral part of computer hardware. In this case, the equipment along with the software was included under the item of technical equipment and machinery;

- -

- Means of transport—the market value of the means of transport was lower than their balance sheet value by 11.7%. One of the three vehicles had had an accident; therefore, its value was reduced, which resulted in a lower value of the whole item;

- -

- Fixed assets under construction—these were repair expenditures in the company’s main office; the liquidation value of 0 PLN was accepted for the balance sheet after adjustment;

- -

- Long-term receivables—20% was assumed, considering the failure in getting back all the deposits;

- -

- Long-term investments—revaluation of the B2X Ltd. company, in which the Service company has 51% of shares, lowered the value by 24.5% from the balance sheet value;

- -

- Goods and receivables on account of supplies and services—the adjustment indicator of 20% was adopted.

- -

- Real estate (buildings, premises)—revaluation prepared by valuators increased the value by 23.7%, to PLN 5125 thousand and this amount was accepted for the adjusted balance sheet;

- -

- Technical equipment and machinery—were subjected to adjustment on the basis of current market prices and the total value increased;

- -

- Other fixed assets—the appraisal reports produced by valuators indicated a higher value than the balance sheet value.

4.1.3. The Practice Example No. 3

- The office building worth (according to the appraisal report of 2009) PLN 3 million,

- The production building worth (according to the appraisal report of 2009) PLN 5 million,

- The assembly line of 2003 worth (in the valuator’s opinion) PLN 0.5 million,

- Stocks of materials and products worth PLN 4 million,

- Receivables worth PLN 3 million, PLN 0.5 million of which is uncollectible.

- Objectivity and ease in carrying out by oneself,

- Access only to basic data,

- Taking into account the condition and usability of assets for operation,

- Possibility to compare with the value determined using other methods,

- Possibility to determine the lower range of values in negotiations.

- On the other hand, the primary disadvantages include:

- Not taking into account important components of the company’s value not recorded in the balance sheet, e.g., contracts of the company, knowledge of employees, possessed brands and value of trademarks;

- Possibility to determine only the value of assets in the categories of the so-called material substance, which usually underestimates the value of the operating enterprise.

4.1.4. The Practice Example No. 4

4.2. The Analysis of Methods and the Valuation Process to Establish the Determinants of Value Subjectivity

- WP—business value (net book value),

- A—total balance sheet value of assets,

- Po—balance sheet value of foreign liabilities,

- KW—balance sheet value of equity.

- AW—total adjusted assets value,

- POW—value of adjusted foreign liabilities,

- KWW—value of adjusted equity.

- WON—net replacement value (the value of the fixed asset, taking into account its physical and moral wear),

- WOB—gross replacement value (the value of the new fixed asset),

- Zf—physical (technical) wear indicator, ,

- Zm—moral wear indicator (technological change, aging), .

- t—year of the analysis,

- at—discount rate for the year t,

- Dt—income in the year t.

- Wd—income value,

- at—discount rate for the year t,

- NCFt—net cash flows for the year t,

- RV—residual value.

4.3. The Methodology of Business Valuation According to the MDI-R Concept

- M—the company’s assets,

- A—assets,

- Po—foreign liabilities,

- Wst—value of the fixed asset,

- Wn—value of a new fixed asset,

- Zf—wear rate of the fixed physical asset, in the range of 0 <= Zf <= 1,

- NOPAT—projected annual net operating profit after tax,

- WACC—discount rate, reflecting weighted average cost of capital of the valuated company.

- WNiP—market value of single, specific intangible and legal assets,

- w1, w2—known market prices of similar intangible and legal assets,

- n—number of transactions of the specific value.

- -

- Specific knowledge, experience, technology,

- -

- Legal assets (brand, know-how, reputation, etc.),

- -

- Relationships with customers and professional skills.

- -

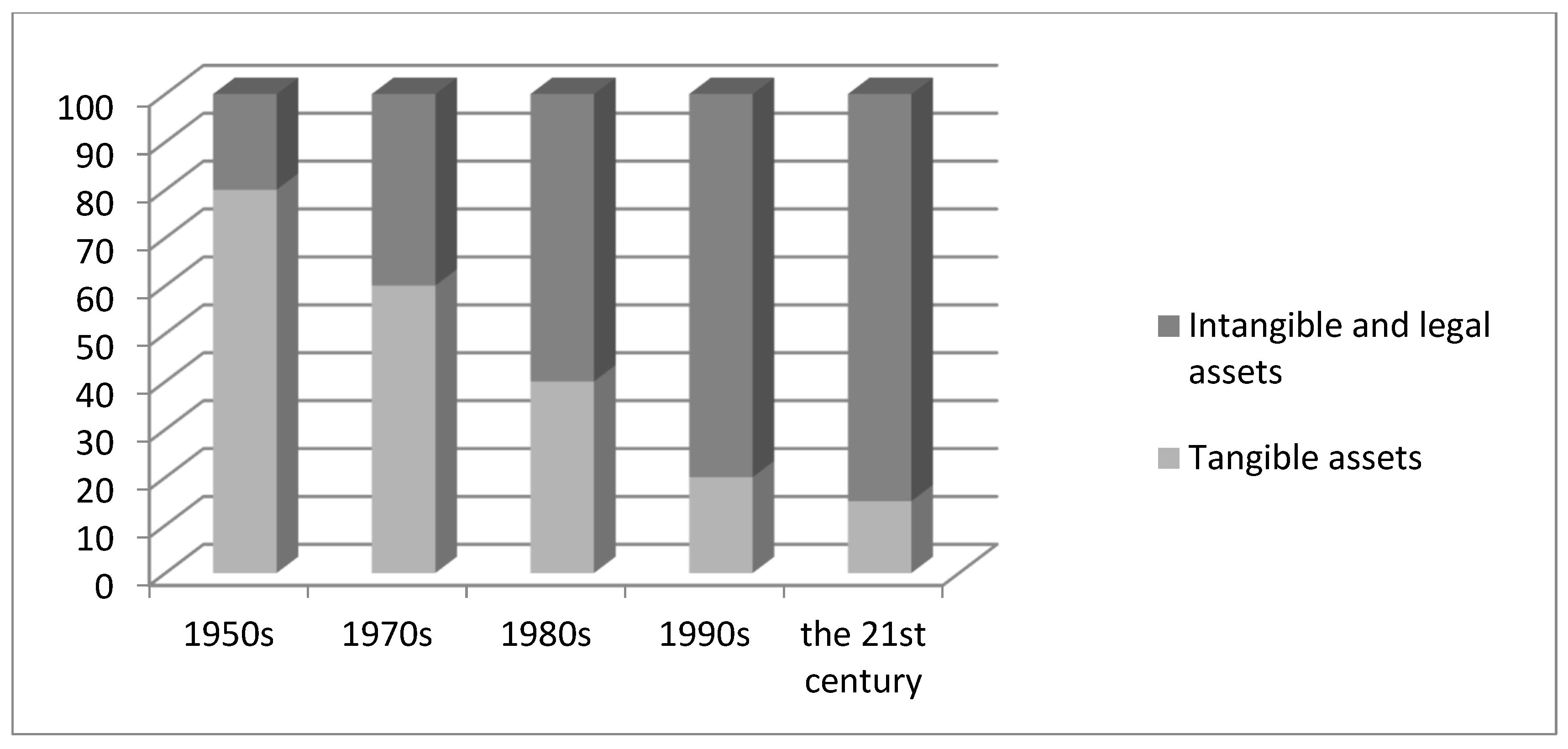

- Taking into account both tangible and intangible assets (WNiP),

- -

- Taking into account the abilities to generate income,

- -

- Taking into account the current situation in the market in which the company operates,

- -

- Taking into account the company’s financing method,

- -

- Taking into account future investment needs,

- -

- Universality—variability of the applied methods in the valuation of specific components, taking into account the conditions for the specific industry.

5. Discussion and Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Mączyńska, E. Valuation of Companies; The Association of Accountants in Poland: Warsaw, Poland, 2005. [Google Scholar]

- Mohnen, P.; Hall, B.H. Innovation and productivity: An update. Eurasian Bus. Rev. 2013, 3, 47–65. [Google Scholar] [CrossRef]

- Ngo, L.V.; O’cass, A. Innovation and business success: The mediating role of customer participation. J. Bus. Res. 2013, 66, 1134–1142. [Google Scholar] [CrossRef]

- Stryjakiewicz, T.; Męczyński, M.; Stachowiak, K. Role of creative industries in the post-socialist urban transformation. Quaest. Geogr. 2014, 33, 19–35. [Google Scholar] [CrossRef] [Green Version]

- Van de Schootbrugge, E.; Wong, M.K. Multi-Stage valuation for start-up high tech projects and companies. J. Account. Financ. 2013, 13, 45–50. [Google Scholar]

- Schumpeter, J.A. Essays: On Entrepreneurs, Innovations, Business Cycles and the Evolution of Capitalism; Taylor & Francis Group, Routledge: Abingdon, UK, 2017. [Google Scholar]

- Miles, R.C. Basis Business Appraisal; John Wiley & Sons: New York, NY, USA, 1984; ISBN 978-047188559. [Google Scholar]

- Nita, B. Methods of Measurement and Development of Enterprises; Polish Economic Publishing House: Warsaw, Poland, 2007; ISBN 978-83-7655-632-8. [Google Scholar]

- Cornell, B. Corporate Valuation; McGraw – Hill: London, UK, 1993; ISBN – 10: 1556237308. [Google Scholar]

- Machała, R. Financial Management and Business Valuation; OFICYNA: Warsaw, Poland, 2009. [Google Scholar]

- Jaki, A. Valuation and Development of the Company’s Value; PWN: Cracov, Poland, 2008; ISBN 978-83-7556-463-1. [Google Scholar]

- Klingenberg, B.; Timberlake, R.; Geurts, T.G.; Brown, R.J. The relationship of operational innovation and financial performance—A critical perspective. Int. J. Prod. Econ 2013, 142, 317–323. [Google Scholar] [CrossRef]

- Steffens, P.R.; Douglas, E.J. Valuing technology investments: Use real options thinking but forget real options valuation. Int. J. Technoentrepreneurship 2007, 1, 58–77. [Google Scholar] [CrossRef] [Green Version]

- Miciuła, I. Methods of creating innovation indices versus determinants of their values. Eurasian Econ. Perspect. Eurasian Stud. Bus. Econ. 2018, 8, 357–366. [Google Scholar] [CrossRef]

- Capel, C. Mindfulness, indigenous knowledge, indigenous innovations and entrepreneurship. J. Res. Mark. Entrep. 2014, 16, 63–83. [Google Scholar] [CrossRef]

- Galindo, M.A.; Mendez, M.T. Entrepreneurship, economic growth, and innovation: Are feedback effects at work? J. Bus. Res. 2014, 67, 825–829. [Google Scholar] [CrossRef]

- Fernandez, P. Valuation Methods and Shareholder Value Creation; Academic Press: San Diego, CA, USA, 2002. [Google Scholar]

- Zhao, F. Exploring the synergy between entrepreneurship and innovation. Int. J. Entrep. Behav. Res. 2005, 11, 25–41. [Google Scholar] [CrossRef]

- Miciuła, I. Współczesna metodyka wyceny przedsiębiorstw i jej wyzwania w przyszłości (Contemporary corporate valuation methodology and its challenges in the future). Acta Univ. Lodz. Folia Oecon. 2014, 2, 183–193. [Google Scholar]

- Engel, D.; Keilbach, M. Firm-level implication of early stage venture capital investment: An empirical investigation. J. Empir. Financ. 2007, 14, 150–167. [Google Scholar] [CrossRef] [Green Version]

- Zwolak, J. The effectiveness of innovation projects in Polish industry. Rev. Innov. Compet. J. Econ. Soc. Res. 2016, 2, 97–110. [Google Scholar] [CrossRef]

- Zarzecki, D. Metody Wyceny Przedsiębiorstw (Business Valuation Methods); Fundacja Rozwoju Rachunkowości: Warszawa, Poland, 1999. [Google Scholar]

- Kraus, S.; Richter, C.; Brem, A.; Cheng, C.-F.; Chang, M.L. Strategies for reward-based crowdfunding campaigns. J. Innov. Knowl. 2016, 1, 13–23. [Google Scholar] [CrossRef] [Green Version]

- Eurostat. 2019. Available online: http://europa.eu/statistics/ (accessed on 10 January 2019).

- Borowiecki, R.; Czaja, J.; Jaki, A. New Methods for Estimating the Value of Companies; LIBER: Warsaw, Poland, 2005; ISBN 978-83-7641-552-9. [Google Scholar]

- Garcia, S.; Luis, J.; Perez-Ruiz, S. Development of capabilities from the innovation of the perspective of poverty and disability. J. Innov. Knowl. 2017, 2, 74–86. [Google Scholar] [CrossRef]

- Nowa Nota Interpretacyjna Nr 5 – Ogólne Zasady Wyceny Przedsiębiorstw. 2019. Available online: http://pfsrm.pl/NI_5.pdf (accessed on 10 September 2019).

- Mitek, A.; Miciuła, I. Determinants of functioning of private enterprises and barriers to their development. Transylv. Rev. 2017, 1, 123–139. [Google Scholar]

- Brzozowska, A.; Kabus, J. Determinants of enterprises’ innovativeness in the light of empirical studies—Case studies of Austria and Poland, scientific notebooks of the Silesian University of Technology. Organ. Manag. 2018, 116, 7–22. [Google Scholar] [CrossRef]

- Panfil, M. Business Valuation in Practice – Methods and eXamples; MT Business: Wroclaw, Poland, 2009. [Google Scholar]

- E-BizCom. 2020. Available online: https://www.e-bizcom.net/program_aplikacja_wycena_spolek/ (accessed on 4 March 2020).

- Volante. 2020. Available online: https://volante.pl/wycena-spolek-przedsiebiorstw-firm (accessed on 2 March 2020).

- Miciuła, I. Metodyka wyceny wartości przedsiębiorstwa według koncepcji MDR, a kryzys zaufania (The methodology of valuation of the enterprise according to the MDR concept and the crisis of trust). J. Manag. Financ. 2012, 10, 65–74. [Google Scholar]

- Festel, G.; Wuermseher, M.; Cattaneo, G. Valuation of early stage high-tech start-up companies. Int. J. Bus. 2013, 18, 216–231. [Google Scholar]

- Behrouzi, F.; Wong, K.Y. Lean performance evaluation of manufacturing systems: A dynamic and innovative approach. Procedia Comput. Sci. 2011, 3, 388–395. [Google Scholar] [CrossRef] [Green Version]

- Miciuła, I. The universal elements of strategic management of risks in contemporary enterprises. Przedsiębiorczość Zarz. Entrep. Manag. 2015, 16, 313–323. [Google Scholar]

- Morris, S.; Snell, S. Intellectual capital configurations and organizational capability: An empirical examination of human resource subunits in the multinational enterprise. J. Int. Bus. Stud. 2011, 42, 805–827. [Google Scholar] [CrossRef]

| Internal | External | Internal–External |

|---|---|---|

| - Ability to control the capital invested by the owner to multiply value - Measurement of the value of shares for the purposes of their presentation - Acceptance of new shareholders or exclusion of some of the existing ones - Change in the legal form of the business - Management contracts, remuneration systems based on value creation - Identification of value determinants - Strategic planning - Division of the company | - Dimension of taxes - Determination of the amount of stamp duty, notarial fees, etc. - Determination of the amount of insurance premiums - Public offers - Determination of the amount of compensation arising from insurance | - Purchase or sale of the company - Ownership transformations - Privatization and re-privatization - Transfer of the company under the rent, franchise or lease - Merger of enterprises - Valuation of listed companies for the comparison with the stock market valuation - Sale of newly issued shares - Loan and credit collateral |

| Business Valuation Methods | ||||

|---|---|---|---|---|

| Asset-Based | Income-Based | Mixed | Comparable Company | Unconven-tional |

| - Book value method - Adjusted net assets method - Replacement method - Liquidation method | - Discounted dividend method - Discounted cash flow method - Discounted future earnings method | - Average cost method - Swiss method - Berlin method - Excess earnings method - Stuttgart method - UEC1 method | - Multiples method - Method of comparable transactions | - Option theory-based methods - Time lag methods - Others |

| No. | The Name of the Fixed Asset | Book Value [PLN] | Market Value on the Valuation Date [PLN] |

|---|---|---|---|

| 1. | A fiscal printer—Viking | 1.499 | 800 |

| 2. | A printer—Canon 250 | 0 | 210 |

| 3. | A computer set | 3.200 | 1.200 |

| 4. | A car—Toyota Avensis | 14.500 | 9.500 |

| 5. | Cell phones—Motorola M3588—2 pieces | 1.350 | 250 |

| 6. | A fax machine | 0 | 200 |

| 7. | Software—WF-MAG | 658.25 | 658.25 |

| 8. | A computer upgrade—HDD 4GB | 340 | 0 |

| 9. | A truck—Citroen Berlingo OP15937 | 15.100 | 12.000 |

| 10. | Etc. till the inclusion of all the assets | … | … |

| (PLN Thousand) | Prior to Adjustment | Adjustment % | Adjustment | After Adjustment | |

|---|---|---|---|---|---|

| A. | Fixed Assets | 9453.39 | 10,303.05 | ||

| I. | Intangible and Legal Assets | 81.54 | 0 | ||

| 1. | Other intangible and legal assets (software) | 81.54 | −81.54 | 0 | |

| II. | Tangible Fixed Assets | 6550.52 | 7825.00 | ||

| 1. | Fixed assets | 6539.09 | 7825.00 | ||

| a) | Buildings, premises and civil engineering facilities | 4144.62 | 23.7% | 980.38 | 5125.00 |

| b) | Technical equipment and machinery | 1076.26 | 23.7% | 255.29 | 1331.54 |

| c) | Means of transport | 169.79 | −11.7% | −19.79 | 150.00 |

| d) | Other fixed assets | 1148.42 | 13.2% | 151.58 | 1300.00 |

| 2. | Fixed assets under construction | 11.43 | −100.0% | −11.43 | 0.00 |

| III. | Long-term Receivables | 583.01 | −20.0% | −116.60 | 466.41 |

| IV. | Long-terms Investments | 1258.22 | 950.00 | ||

| 1. | Long-term financial assets | 1258.22 | 950.00 | ||

| a) | in affiliated entities | ||||

| Shares in B2X Ltd. | 1258.22 | −24.5% | −308.22 | 950.00 | |

| V. | Long-term Accruals | 980.10 | 980.10 | ||

| 1. | Deferred tax assets | 964.47 | 964.47 | ||

| 2. | Other accruals | 15.63 | 15.63 | ||

| B. | Current Assets | 3939.26 | 3692.45 | ||

| I. | Stocks | 1234.05 | 987.24 | ||

| 1. | Goods | 1234.05 | −20.0% | −246.81 | 987.24 |

| II. | Short-term Receivables | 461.54 | 390.26 | ||

| 2. | Receivables for the other entities | 461.54 | 390.26 | ||

| a) | On account of supplies and services, in the repayment period of up to 12 months | 356.39 | −20.0% | −71.28 | 285.11 |

| b) | Due to taxes, subsidies, custom duties, social and health insurances and other benefits | 79.60 | 79.60 | ||

| c) | Others | 25.55 | 25.55 | ||

| III. | Short-term Investments | 2000.00 | 2000.00 | ||

| 1. | Short-term financial assets | 2000.00 | 2000.00 | ||

| a) | Cash and other monetary assets | 2000.00 | 2000.00 | ||

| - cash in hand and at bank | 1000.00 | 1000.00 | |||

| - other cash | 900.00 | 900,00 | |||

| - other monetary assets | 100.00 | 100.00 | |||

| IV. | Short-term Accruals | 243.68 | 243.68 | ||

| Total assets | 13,392.65 | 13,924.22 |

| XYZ S.A. | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2026+ | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Model DCF (Discounted Cash Flows) | Forecast | Forecast | Forecast | Forecast | Forecast | Forecast | Forecast | Forecast | Forecast | |||

| 1. Operating result (EBIT) | 1531 | 1607 | 1688.1 | 1772.5 | 1861.1 | 1861 | 1861 | 1861 | 1861 | 1861 | 1861 | |

| 2. Tax rate % | 19% | 19% | 19% | 19% | 19% | 19% | 19% | 19% | 19% | 19% | 19% | |

| 3. Tax on EBIT | 290.9 | 305.5 | 320.7 | 336.8 | 353.6 | 353.6 | 353.6 | 353.6 | 353.6 | 353.6 | 353.6 | |

| 4. Tax-adjusted operating result (NOPLAT) | 1240 | 1302 | 1367.4 | 1435.7 | 1507.5 | 1507 | 1507 | 1507 | 1507 | 1507 | 1507 | |

| 5. Depreciation | 1317 | 1445 | 1597.6 | 1764.9 | 1949 | 2154 | 2384 | 2643 | 2936 | 3268 | 3644 | |

| 6. Investment outlays (CAPEX) | 1310 | 1517 | 1646,5 | 1788.6 | 1945.5 | 2154 | 2384 | 2643 | 2936 | 3268 | 3644 | |

| 7. Change in working capital | 180.0 | 171.8 | 180.3 | 189.4 | 198.8 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | |

| 8. FCF–free cash flow | 1067 | 1058 | 1138.1 | 1222.7 | 1312.8 | 1507 | 1507 | 1507 | 1507 | 1507 | 1507 | |

| 9. Risk-free rate% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | ||

| 10. Beta indicator | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | ||

| 11. Market premium % | 2% | 2% | 2% | 2% | 2% | 2% | 2% | 2% | 2% | 2% | ||

| 12. Cost of equity % | 7.4% | 7.4% | 7.4% | 7.4% | 7.4% | 7.4% | 7.4% | 7.4% | 7.4% | 7.4% | ||

| 13. Cost of debt % | 8% | 8% | 8% | 8% | 8% | 8% | 8% | 8% | 8% | 8% | ||

| 14. Tax rate % | 19% | 19% | 19% | 19% | 19% | 19% | 19% | 19% | 19% | 19% | 19% | |

| 15. Cost of debt after tax % | 6.5% | 6.5% | 6.5% | 6.5% | 6.5% | 6.5% | 6.5% | 6.5% | 6.5% | 6.5% | ||

| 16. Value of equity (resulting from the valuation) | 14092.6 | 14092.6 | 14092.6 | 14092.6 | 14092.6 | 14092.6 | 14092.6 | 14092.6 | 14092.6 | 14092.6 | ||

| 17. Value of debt | 7075 | 7075 | 7075 | 7075 | 7075 | 7075 | 7075 | 7075 | 7075 | 7075 | ||

| 18. Share of equity | 66.6% | 66.6% | 66.6% | 66.6% | 66.6% | 66.6% | 66.6% | 66.6% | 66.6% | 66.6% | ||

| 19. Share of debt | 33.4% | 33.4% | 33.4% | 33.4% | 33.4% | 33.4% | 33.4% | 33.4% | 33.4% | 33.4% | ||

| 20. Weighted Cost of Capital (WACC) | 7.09% | 7.09% | 7.09% | 7.09% | 7.09% | 7.09% | 7.09% | 7.09% | 7.09% | 7.09% | 7.09% | |

| 21. Discount indicator | 0.933 | 0.871 | 0.8142 | 0.7603 | 0.709 | 0.662 | 0.619 | 0.578 | 0.539 | 0.504 | 0.504 | |

| 22. FCF growth rate after 2026 | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | ||

| 23. Residual value after 2026 | - | - | - | - | - | - | - | - | - | 21,255 | ||

| 24. Discounted FCF–Free Cash Flow | 996.9 | 923.2 | 926.6 | 929.6 | 932.0 | 999.3 | 933.1 | 871.3 | 813.6 | 759.8 | 10,712 | |

| 25. Discounted Free Cash Flow Ascending | 996.9 | 1920.1 | 2846.7 | 3776.3 | 4708 | 5707 | 6640 | 7512 | 8325 | 9085 | 19,797 | |

| 1. Value of the Company from the Valuation | 19,797.6 | |||||||||||

| 2. Net debt at the end of 2018 | 5705.0 | |||||||||||

| 3. Value of Equity from the Valuation | 14,092.6 | |||||||||||

| 4. Number of shares in the company | 1000 | |||||||||||

| 5. Value of 1 share | 14.09 | |||||||||||

| Method | Assets and Income | Stuttgart Formula: W = M + (5r/1 + 5r) (D − M) | Anglo-Saxon Formula: W = M + [1 − 1/(1 + r)n] (D − M) | German Formula: W = (M + D)/2 | Swiss Formula: W = (2D + M)/3 |

|---|---|---|---|---|---|

| Valuation (in PLN Thousand) | M = 120 D = 410 | 216 | 230 | 265 | 313 |

| M = 98 D = 546 | 247 | 268 | 322 | 397 | |

| M = 290 D = 110 | 230 | 221.5 | 200 | 170 |

| α0 | α1 | α2 |

|---|---|---|

| S (α0) | S (α1) | S (α2) |

| 4.791 | 0.119 | 0.252 |

| R2 = 0.8065 = 80.65% | ||

| Method | Assets and Income | MDI-R |

|---|---|---|

| Valuation (in PLN thousand) | M = 120 D = 410 | 299 |

| M = 98 D = 546 | 375 | |

| M = 290 D = 110 | 177 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Miciuła, I.; Kadłubek, M.; Stępień, P. Modern Methods of Business Valuation—Case Study and New Concepts. Sustainability 2020, 12, 2699. https://doi.org/10.3390/su12072699

Miciuła I, Kadłubek M, Stępień P. Modern Methods of Business Valuation—Case Study and New Concepts. Sustainability. 2020; 12(7):2699. https://doi.org/10.3390/su12072699

Chicago/Turabian StyleMiciuła, Ireneusz, Marta Kadłubek, and Paweł Stępień. 2020. "Modern Methods of Business Valuation—Case Study and New Concepts" Sustainability 12, no. 7: 2699. https://doi.org/10.3390/su12072699

APA StyleMiciuła, I., Kadłubek, M., & Stępień, P. (2020). Modern Methods of Business Valuation—Case Study and New Concepts. Sustainability, 12(7), 2699. https://doi.org/10.3390/su12072699