Spatio-Temporal Nonstationary Effects of Impact Factors on Industrial Land Price in Industrializing Cities of China

Abstract

:1. Introduction

2. Materials and Methods

2.1. Research Program

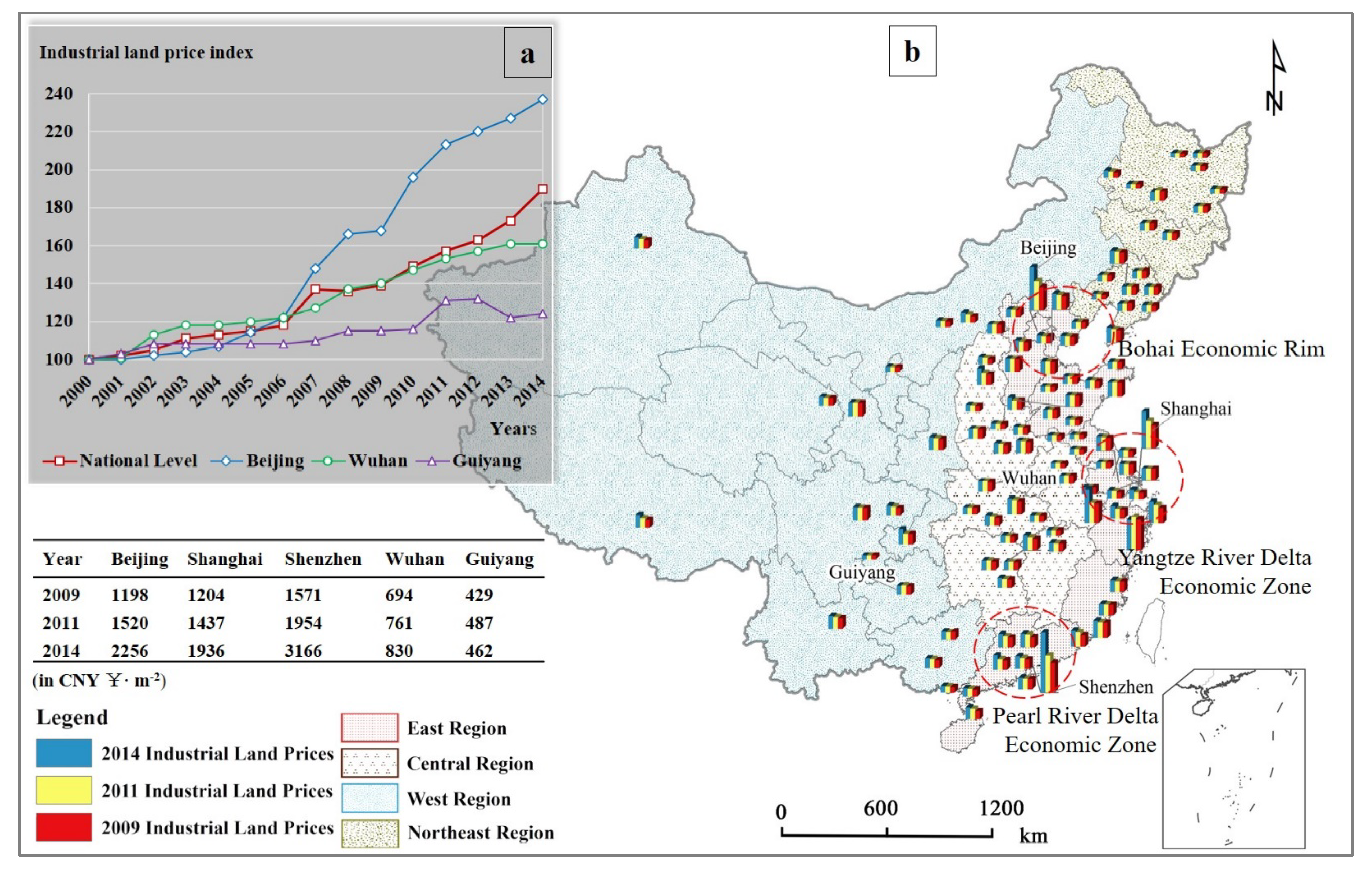

2.2. Industrial Land Price

2.3. Impact Factors

2.4. Geographically Weighted Regression Model

2.5. Model Fitting and Residual Spatial Autocorrelation

3. Results

3.1. Evaluation of GWR Models

3.2. Spatio-Temporal Varying Effects of Major Impact Factors

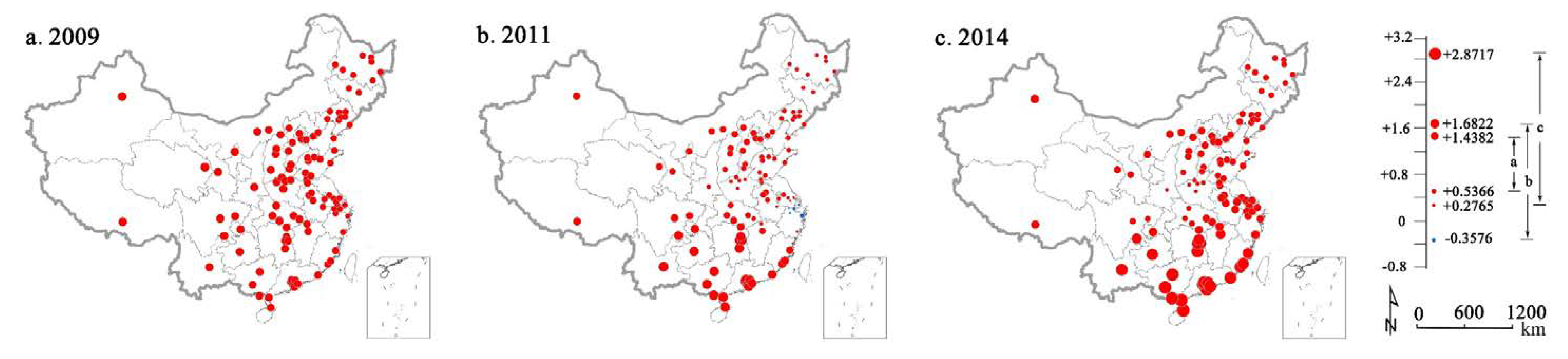

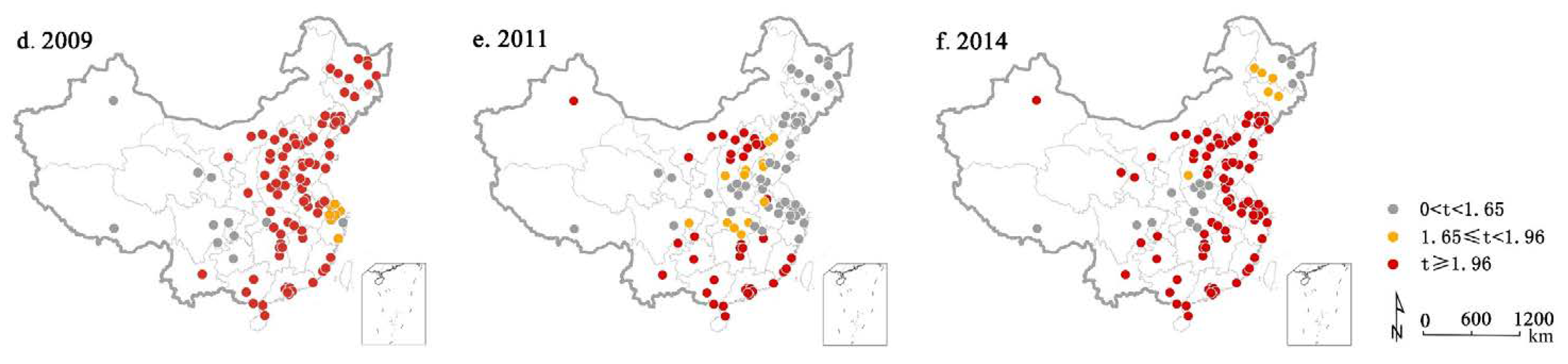

3.2.1. Relationship between Industrial Land Price and Tax

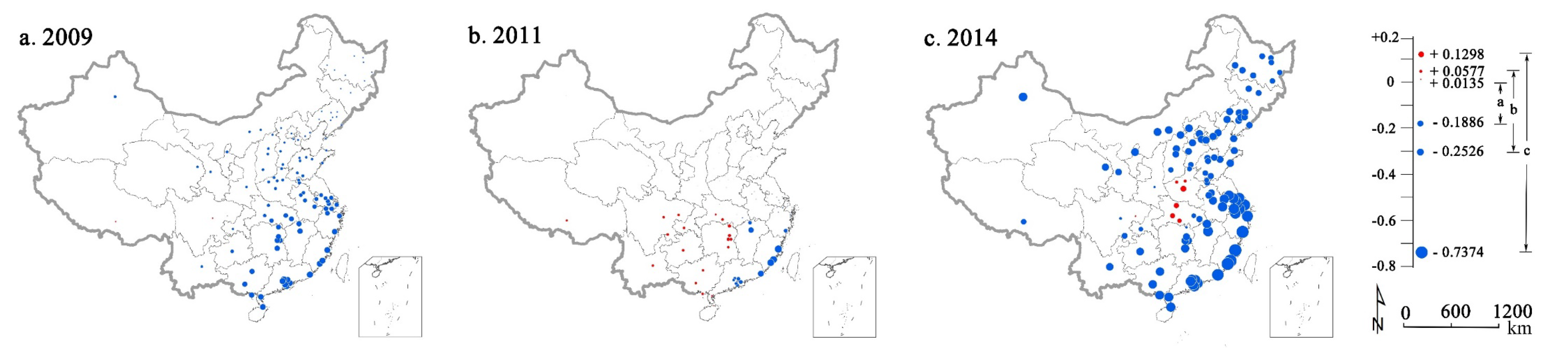

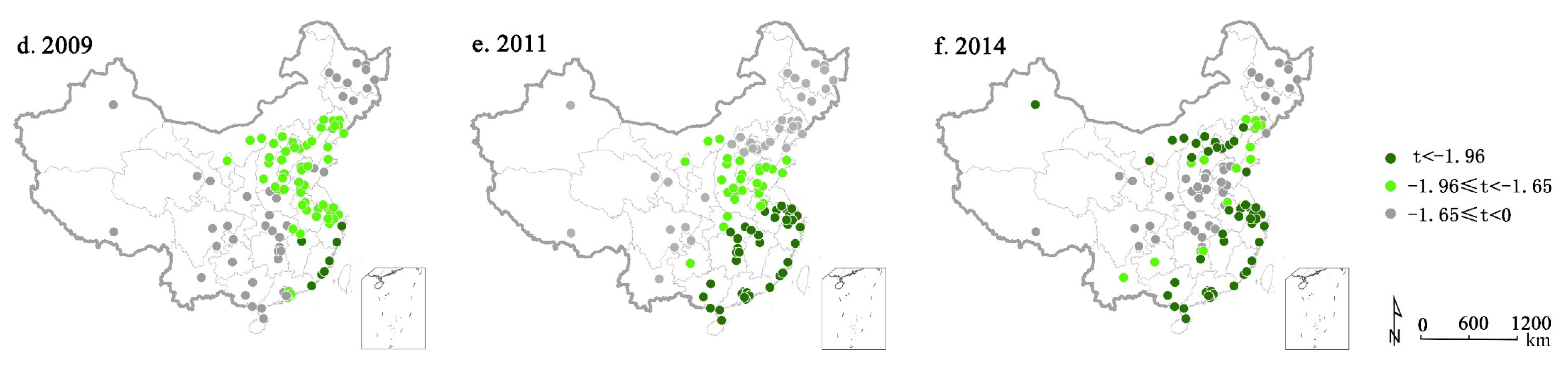

3.2.2. Relationship between Industrial Land Price and Leased Land

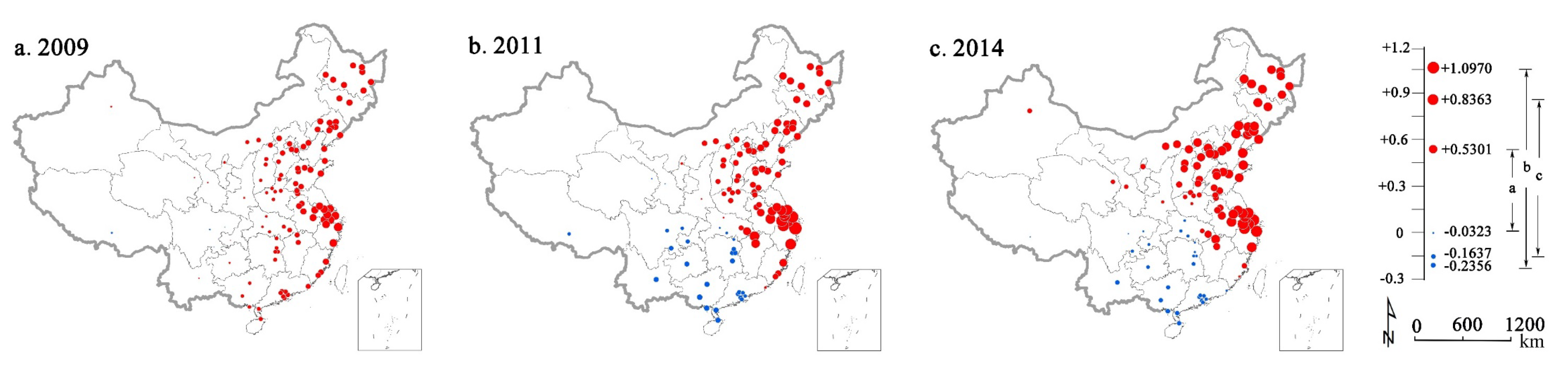

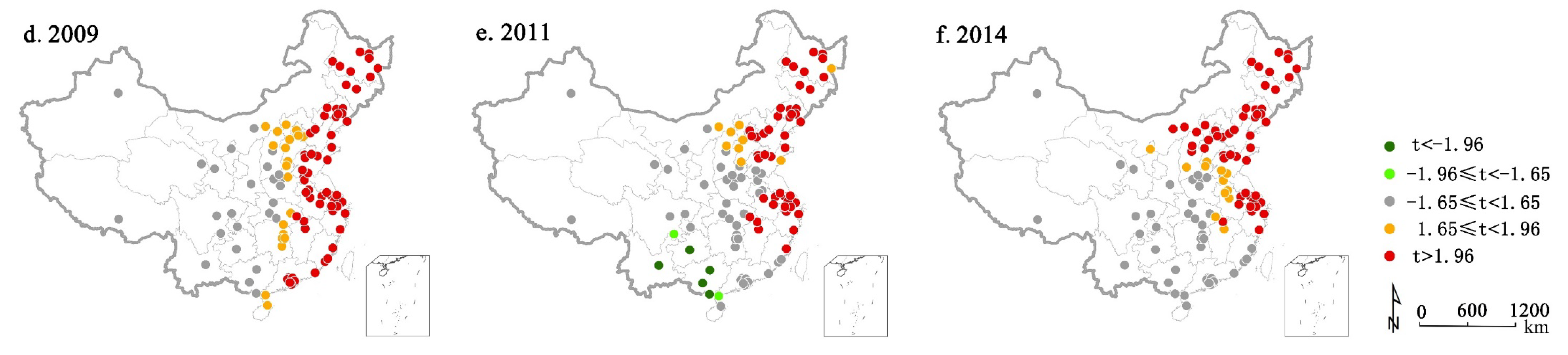

3.2.3. Relationship between Industrial Land Price and Population

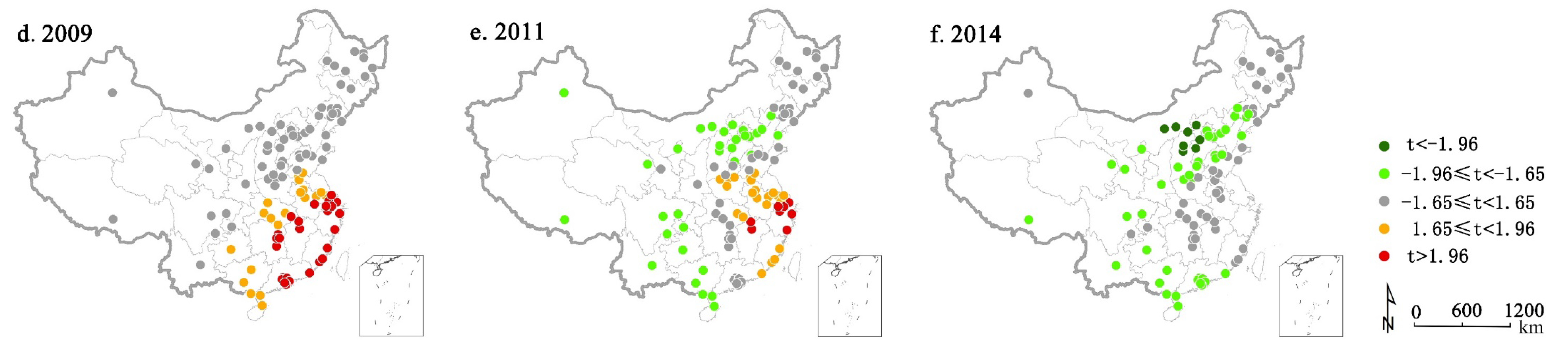

3.2.4. Relationship between Industrial Land Price and Location Quotient Index

4. Discussions

4.1. Tendency of Population Mobility and Industrial Agglomeration

4.2. Coupling between Land Supply Plan and Local Tax Growth

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Needham, B.; Louw, E.; Metzemakers, P. An economic theory for industrial land policy. Land Use Policy 2013, 33, 227–234. [Google Scholar] [CrossRef]

- Erwin, V.D.K.; Edwin, B. Industrial land and property markets: Market processes, market institutions and market outcomes: The Dutch case. Eur. Plan. Stud. 2011, 19, 2127–2146. [Google Scholar]

- Bai, X.; Shi, P.; Liu, Y. Society: Realizing China’s urban dream. Nature 2014, 509, 158–160. [Google Scholar] [CrossRef] [Green Version]

- Thompson, B.; Tsolacos, S. Industrial land values—A guide to future markets? J. Real Estate Res. 2001, 21, 55–76. [Google Scholar]

- Ihlanfeldt, K.R. The effect of land use regulation on housing and land prices. J. Urban Econ. 2007, 61, 420–435. [Google Scholar] [CrossRef]

- Barufi, A.M.B.; Haddad, E.A.; Nijkamp, P. Industrial scope of agglomeration economies in Brazil. Ann. Reg. Sci. 2016, 56, 707–755. [Google Scholar] [CrossRef] [Green Version]

- Restuccia, D.; Rogerson, R. Misallocation and productivity. Rev. Econ. Dyn. 2013, 16, 1–10. [Google Scholar] [CrossRef]

- Wu, Y.Z.; Zhang, X.L.; Skitmore, M.; Song, Y.; Eddie, C.M.H. Industrial land price and its impact on urban growth: A Chinese case study. Land Use Policy 2014, 36, 199–209. [Google Scholar] [CrossRef] [Green Version]

- Huang, Z.; Du, X. Government intervention and land misallocation: Evidence from China. Cities 2017, 60, 323–332. [Google Scholar] [CrossRef]

- Chen, W.; Shen, Y.; Wang, Y.; Wu, Q. The effect of industrial relocation on industrial land use efficiency in China: A spatial econometrics approach. J. Clean. Prod. 2018, 208, 525–535. [Google Scholar] [CrossRef]

- Yang, D.; Wang, H. Dilemmas of local governance under the development zone fever in China: A case study of the Suzhou region. Urban Stud. 2008, 45, 1037–1054. [Google Scholar] [CrossRef]

- Lu, J.; Tao, Z. Trends and determinants of China’s industrial agglomeration. J. Urban Econ. 2009, 65, 167–180. [Google Scholar] [CrossRef] [Green Version]

- Linard, C.; Tatem, A.; Gilbert, M. Modelling spatial patterns of urban growth in Africa. Appl. Geogr. 2013, 44, 23–32. [Google Scholar] [CrossRef]

- Meng, Y.; Zhang, F.R.; An, P.L.; Dong, M.L.; Wang, Z.Y. Industrial land-use efficiency and planning in Shunyi, Beijing. Landsc. Urban Plan. 2008, 85, 40–48. [Google Scholar] [CrossRef]

- Tu, F.; Yu, X.; Ruan, J. Industrial land use efficiency under government intervention: Evidence from Hangzhou, China. Habitat Int. 2014, 43, 1–10. [Google Scholar] [CrossRef]

- Chen, W.; Shen, Y.; Wang, Y. Does industrial land price lead to industrial diffusion in China? An empirical study from a spatial perspective. Sustain. Cities Soc. 2018, 40, 307–316. [Google Scholar] [CrossRef]

- Li, C.; Meng, Y.; Li, Y.; Ge, J.; Zhao, C. Inter-Metropolitan Land-Price characteristics and patterns in the Beijing-Tianjin-Hebei urban agglomeration in China. Sustainability 2019, 11, 4726. [Google Scholar] [CrossRef] [Green Version]

- Atteberry, W.; Rutherford, R. Industrial real estate prices and market efficiency. J. Real Estate Res. 1993, 8, 377–385. [Google Scholar]

- Brueckner, J.K. Government land-use interventions: An economic analysis. In Urban Landmarkets: Improving Land Management for Successful Urbanization; Lall, S.V., Freire, M., Yuen, B., Eds.; Springer: Berlin/Heidelberg, Germany, 2009. [Google Scholar]

- Brandt, L.; Thun, E. Constructing a ladder for growth: Policy, markets, and industrial upgrading in China. World Dev. 2016, 80, 78–95. [Google Scholar] [CrossRef]

- Long, H.L. Land use policy in China: Introduction. Land Use Policy 2014, 40, 1–5. [Google Scholar] [CrossRef]

- Epifani, P.; Gancia, G. Trade, markup heterogeneity and misallocations. J. Int. Econ. 2011, 83, 1–13. [Google Scholar] [CrossRef] [Green Version]

- Kowalski, J.G.; Paraskevopoulos, C.C. The impact of location on urban industrial land prices. J. Urban Econ. 1990, 27, 16–24. [Google Scholar] [CrossRef]

- Lockwood, L.J.; Rutherford, R.C. Determinants of industrial property value. Real Estate Econ. 1996, 24, 257–272. [Google Scholar] [CrossRef]

- Mondal, B.; Das, D.N. How residential compactness and attractiveness can be shaped by environmental amenities in an industrial city? Sustain. Cities Soc. 2018, 41, 363–377. [Google Scholar] [CrossRef]

- Saz-Salazar, S.D.; García-Menéndez, L. Public provision versus private provision of industrial land: A hedonic approach. Land Use Policy 2005, 22, 215–223. [Google Scholar] [CrossRef]

- Asabere, P.K.; Huffman, F.E. Zoning and industrial land values: The case of Philadelphia. Real Estate Econ. 1991, 19, 154–160. [Google Scholar] [CrossRef]

- Thomas, J. Environmental contamination and industrial real estate prices. J. Real Estate Res. 2002, 23, 179–200. [Google Scholar]

- Brunsdon, C.; Fotheringham, A.S.; Charlton, M.E. Geographically weighted regression: A method for exploring spatial nonstationarity. Geogr. Anal. 1996, 28, 281–298. [Google Scholar] [CrossRef]

- Nakaya, T.; Fotheringham, A.S.; Charlton, M.; Brunsdon, C. Semiparametric geographically weighted generalised linear modelling in GWR 4.0. In Proceedings of the 10th International Conference on Geocomputation, Sydney, Australia, 30 November–2 December 2009; Available online: http://www.geocomputation.org/2009/PDF/Nakaya_et_al.pdf (accessed on 24 March 2020).

- Margaritis, E.; Kang, J. Relationship between green space-related morphology and noise pollution. Ecol. Indic. 2017, 72, 921–933. [Google Scholar] [CrossRef]

- Hu, S.G.; Yang, S.F.; Li, W.D.; Zhang, C.Z.; Xu, F. Spatially non-stationary relationships between urban residential land price and impact factors in Wuhan city, China. Appl. Geogr. 2016, 68, 48–56. [Google Scholar] [CrossRef] [Green Version]

- Fotheringham, A.S.; Crespo, R.; Yao, J. Exploring, modelling and predicting spatiotemporal variations in house prices. Ann. Reg. Sci. 2015, 54, 417–436. [Google Scholar] [CrossRef]

- Pasculli, A.; Palermi, S.; Sarra, A.; Piacentini, T.; Miccadei, E. A modelling methodology for the analysis of radon potential based on environmental geology and geographically weighted regression. Environ. Model. Softw. 2014, 54, 165–181. [Google Scholar] [CrossRef]

- Kontokosta, C.E.; Jain, R.K. Modeling the determinants of large-scale building water use: Implications for data-driven urban sustainability policy. Sustain. Cities Soc. 2015, 18, 44–55. [Google Scholar] [CrossRef] [Green Version]

- Páez, A.; Farber, S.; Wheeler, D. A simulation-based study of geographically weighted regression as a method for investigating spatially varying relationships. Environ. Plan. A 2011, 43, 2992–3010. [Google Scholar] [CrossRef]

- Wang, K.; Zhang, C.R.; Li, W.D. Predictive mapping of soil total nitrogen at a regional scale: A comparison between geographically weighted regression and cokriging. Appl. Geogr. 2013, 42, 73–85. [Google Scholar] [CrossRef]

- Silva, A.R.D.; Fotheringham, A.S. The multiple testing issue in geographically weighted regression. Geogr. Anal. 2016, 48, 233–247. [Google Scholar] [CrossRef]

- China Urban Land Price Dynamic Monitor (CULPDM). Available online: http://www.landvalue.com.cn (accessed on 10 February 2017).

- Combes, P.P.; Duranton, G.; Gobillon, L.; Puga, D.; Roux, S. The productivity advantages of large cities: Distinguishing agglomeration from firm selection. Econometrica 2012, 80, 2543–2594. [Google Scholar]

- Yang, S.; Hu, S.; Li, W.; Zhang, C.; Torres, A.J. Spatiotemporal effects of main impact factors on residential land price in major cities of China. Sustainability 2017, 9, 2050. [Google Scholar] [CrossRef] [Green Version]

- Lu, M.; Zhang, H.; Liang, W.Q. How the bias toward central/western land supplies boosts wages in the east. Soc. Sci. China 2015, 5, 59–83. (In Chinese) [Google Scholar]

- Malmberg, A.; Maskell, P. Towards an explanation of regional specialization and industry agglomeration. Eur. Plan. Stud. 1997, 5, 25–41. [Google Scholar] [CrossRef]

- Ding, C. Policy and praxis of land acquisition in China. Land Use Policy 2007, 24, 1–13. [Google Scholar] [CrossRef]

- Gluszak, M.; Zygmunt, R. Development density, administrative decisions, and land values: An empirical investigation. Land Use Policy 2018, 70, 153–161. [Google Scholar] [CrossRef]

- National Bureau of Statistics of China (NBSC). Available online: http://www.stats.gov.cn/english/Statisticaldata/AnnualData/ (accessed on 10 February 2019).

- Ministry of Land and Resources of China (MLRC). Available online: https://tongji.cnki.net/overseas/engnavi/HomePage.aspx?id=N2011110053&name=YGTTJ&floor=1 (accessed on 10 February 2019).

- Billings, S.B.; Johnson, E.B. The location quotient as an estimator of industrial concentration. Reg. Sci. Urban Econ. 2012, 42, 642–647. [Google Scholar] [CrossRef]

- Green, R.K.; Malpezzi, S.; Mayo, S.K. Metropolitan-specific estimates of the price elasticity of supply of housing, and their sources. Am. Econ. Rev. 2005, 95, 334–339. [Google Scholar] [CrossRef]

- Cundy, A.B.; Bardos, R.P.; Puschenreiter, M.; Mench, M.; Bert, V.; Friesl-Hanl, W.; Müller, I.; Li, X.N.; Witters, N.; Vangronsveld, J. Brownfields to green fields: Realising wider benefits from practical contaminant phytomanagement strategies. J. Environ. Manag. 2016, 184, 67–77. [Google Scholar] [CrossRef] [Green Version]

- Davidoff, T. Supply elasticity and the housing cycle of the 2000s. Real Estate Econ. 2013, 41, 793–813. [Google Scholar] [CrossRef]

- Tao, R.; Su, F.B.; Liu, M.X.; Cao, G. Land leasing and local public finance in China’s regional development: Evidence from prefecture-level cities. Urban Stud. 2010, 47, 2217–2236. [Google Scholar]

- Zhang, H. Effects of urban land supply policy on real estate in China: An econometric analysis. J. Real Estate Lit. 2008, 16, 55–72. [Google Scholar]

| Abbreviation | POP | LQI | LAND | TAX | |

|---|---|---|---|---|---|

| Variable | Population | Location quotient index | Leased land | Tax | |

| Description | Annual average population in a city. | The ratio of manufacture employing in all the employing of city divided by the ratio of manufacture employing in total of the employment of the whole country. Compared with real estate, excavation and electric power, the manufacturing industry has fewer limitations by natural resources. The LQI greatly presents the industrial concentration level [48]. | The total leased land for industry, mining and warehousing in a city. It is an important index to weigh government intervention. | The total industrial value-added tax payable in a city. Tax revenue is an important index to weigh economic achievements of a city. | |

| Unit | 10 thousand | - | ha | 100 million | |

| VIF | 2009 | 1.51 | 1.26 | 1.22 | 1.66 |

| 2011 | 1.31 | 1.26 | 1.01 | 1.58 | |

| 2014 | 2.37 | 1.29 | 2.20 | 2.01 |

| Year | Residual Moran’s I | AICc | Adjusted R2 | P Value | ||||

|---|---|---|---|---|---|---|---|---|

| GWR | OLS | GWR | OLS | GWR | OLS | GWR | OLS | |

| 2009 | −0.02 | 0.16 | 1377.37 | 1419.57 | 0.52 | 0.30 | 0.00 | 0.00 |

| 2011 | −0.02 | 0.20 | 1378.82 | 1448.04 | 0.50 | 0.34 | 0.00 | 0.00 |

| 2014 | 0.00 | 0.19 | 1438.29 | 1509.86 | 0.57 | 0.43 | 0.00 | 0.00 |

| VARIABLE | Min | Lwr Quartile | Mean | Upr Quartile | Max | DIFF of Criterion |

|---|---|---|---|---|---|---|

| β1_TAX_2009 | 0.5366 | 0.8007 | 0.9901 | 1.1692 | 1.4382 | 1.0066 |

| β2_LAND_2009 | −0.1886 | −0.1172 | −0.0711 | −0.0218 | 0.0136 | −5.4236 |

| β3_POP_2009 | −0.0323 | 0.1247 | 0.2048 | 0.2774 | 0.5301 | −8.9099 |

| β4_LQI_2009 | −83.1875 | −3.0371 | 49.5306 | 122.2089 | 197.4760 | −3.3798 |

| β1_TAX_2011 | −0.3576 | 0.3767 | 0.7084 | 1.0443 | 1.6822 | −8.8626 |

| β2_LAND_2011 | −0.2526 | −0.0036 | −0.0091 | −0.0005 | 0.0577 | −1.0158 |

| β3_POP_2011 | −0.2236 | −0.0194 | 0.2439 | 0.3785 | 1.0970 | −12.3876 |

| β4_LQI_2011 | −239.9373 | −87.3454 | −5.9006 | 91.7083 | 201.9048 | −2.0133 |

| β1_TAX_2014 | 0.2765 | 0.7382 | 1.2120 | 1.3182 | 2.8717 | −16.7267 |

| β2_LAND_2014 | −0.7334 | −0.3896 | −0.2780 | −0.1791 | 0.1298 | −2.7771 |

| β3_POP_2014 | −0.1637 | −0.0168 | 0.3261 | 0.5839 | 0.8683 | −1.2208 |

| β4_LQI_2014 | −368.3462 | −175.4142 | −90.1802 | −20.9673 | 193.5961 | 1.7033 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, S.; Hu, S.; Li, W.; Zhang, C.; Song, D. Spatio-Temporal Nonstationary Effects of Impact Factors on Industrial Land Price in Industrializing Cities of China. Sustainability 2020, 12, 2792. https://doi.org/10.3390/su12072792

Yang S, Hu S, Li W, Zhang C, Song D. Spatio-Temporal Nonstationary Effects of Impact Factors on Industrial Land Price in Industrializing Cities of China. Sustainability. 2020; 12(7):2792. https://doi.org/10.3390/su12072792

Chicago/Turabian StyleYang, Shengfu, Shougeng Hu, Weidong Li, Chuanrong Zhang, and Dongdong Song. 2020. "Spatio-Temporal Nonstationary Effects of Impact Factors on Industrial Land Price in Industrializing Cities of China" Sustainability 12, no. 7: 2792. https://doi.org/10.3390/su12072792