Risk Assessment of New Energy Vehicle Supply Chain Based on Variable Weight Theory and Cloud Model: A Case Study in China

Abstract

1. Introduction

2. Literature Review

2.1. New Energy Vehicle Supply Chain

2.2. Supply Chain Risk Management

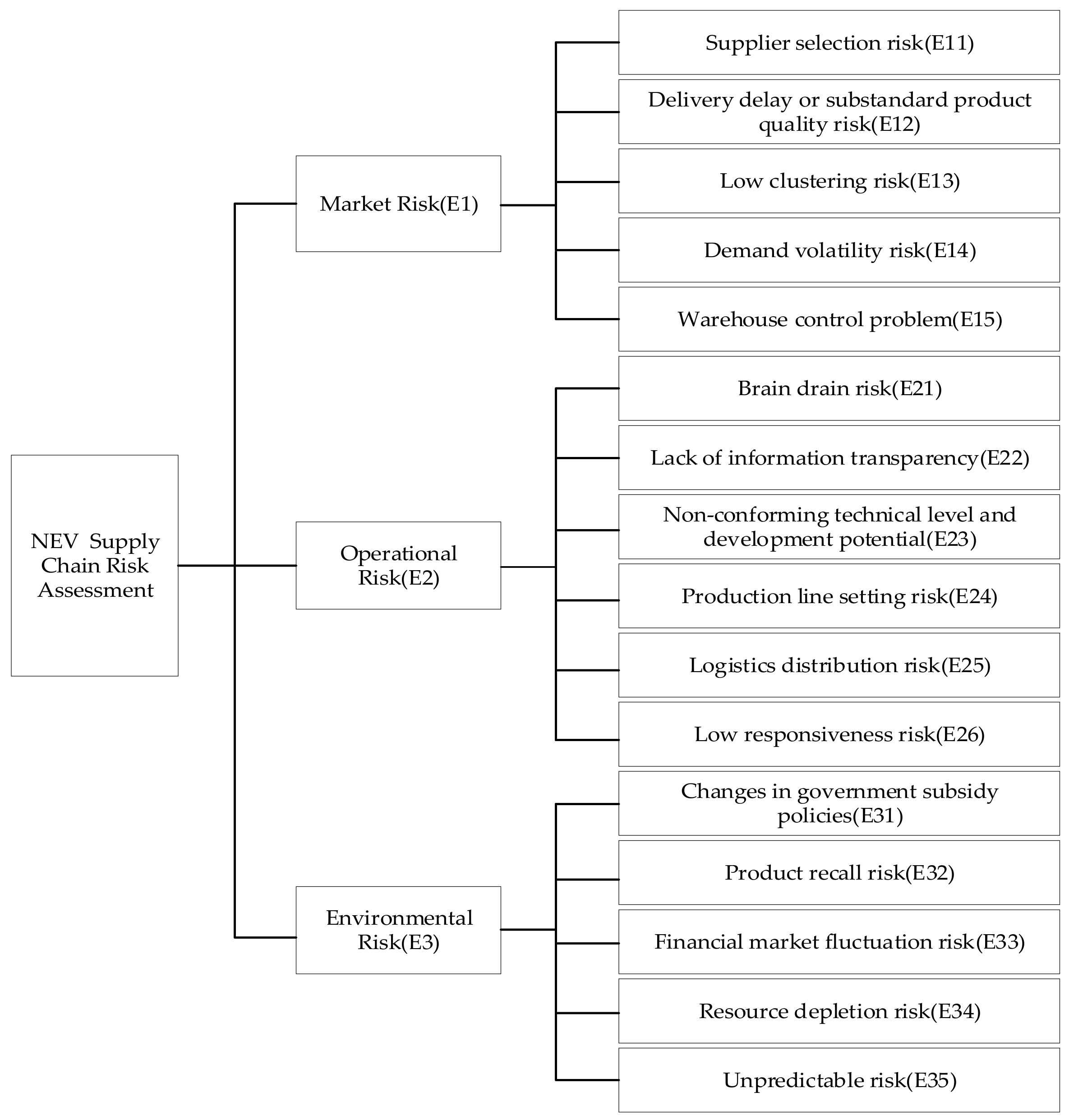

3. Determination of NEV Supply Chain Risk Assessment Criteria System

3.1. Market Risk (E1)

3.1.1. Supplier Selection Risk (E11)

3.1.2. Delivery Delay or Substandard Product Quality Risk (E12)

3.1.3. Low Clustering Risk (E13)

3.1.4. Demand Volatility Risk (E14)

3.1.5. Warehouse Control Problem (E15)

3.2. Operational Risk (E2)

3.2.1. Brain Drain Risk (E21)

3.2.2. Lack of Information Transparency (E22)

3.2.3. Non-Conforming Technical Level and Development Potential (E23)

3.2.4. Production Line Setting Risk (E24)

3.2.5. Logistics Distribution Risk (E25)

3.2.6. Low Responsiveness Risk (E26)

3.3. Environmental Risk (E3)

3.3.1. Changes in Government Subsidy Policies (E31)

3.3.2. Product Recall Risk (E32)

3.3.3. Financial Market Fluctuation Risk (E33)

3.3.4. Resource Depletion Risk (E34)

3.3.5. Unpredictable Risk (E35)

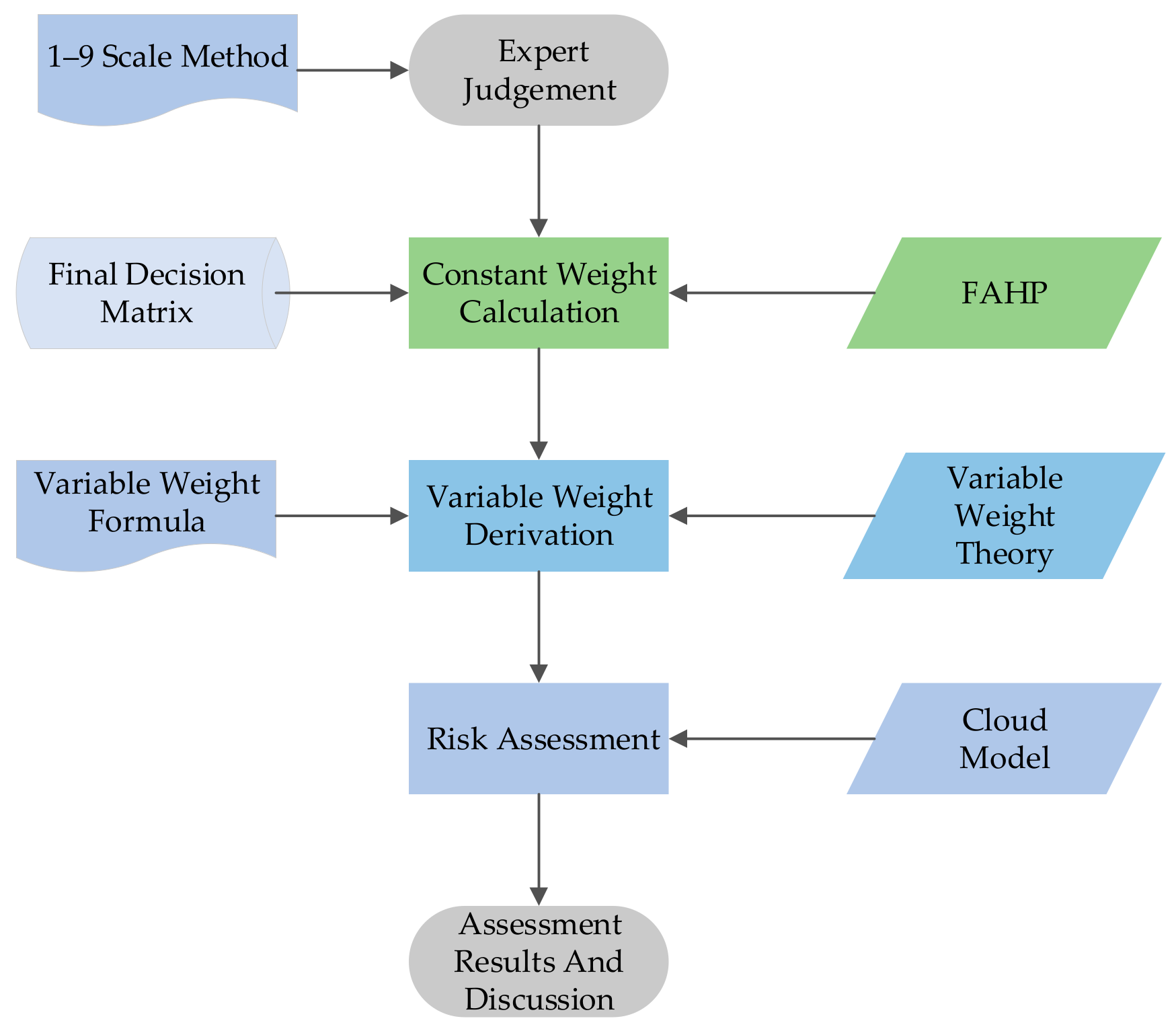

4. Methodology

4.1. Fuzzy Analytic Hierarchy Process (FAHP)

4.1.1. Establishing a Hierarchical Model and Judgement Matrix

4.1.2. Hierarchical Single Ordering and Consistency Test

4.2. Variable Weight Theory

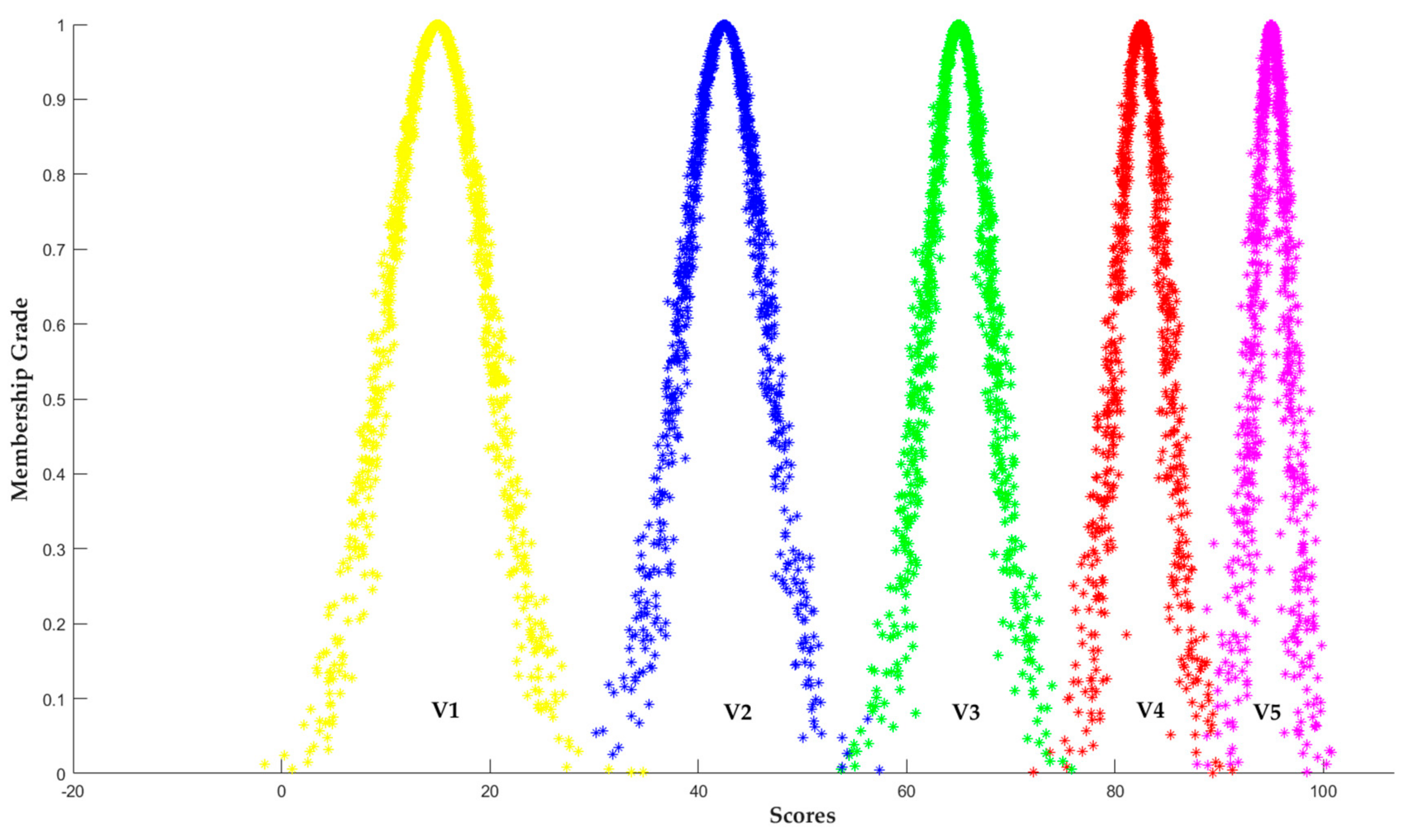

4.3. Cloud Model

5. Case Study

5.1. Determination of Weight

5.1.1. Constant Weight Recalculation

5.1.2. Derivation of Variable Weight

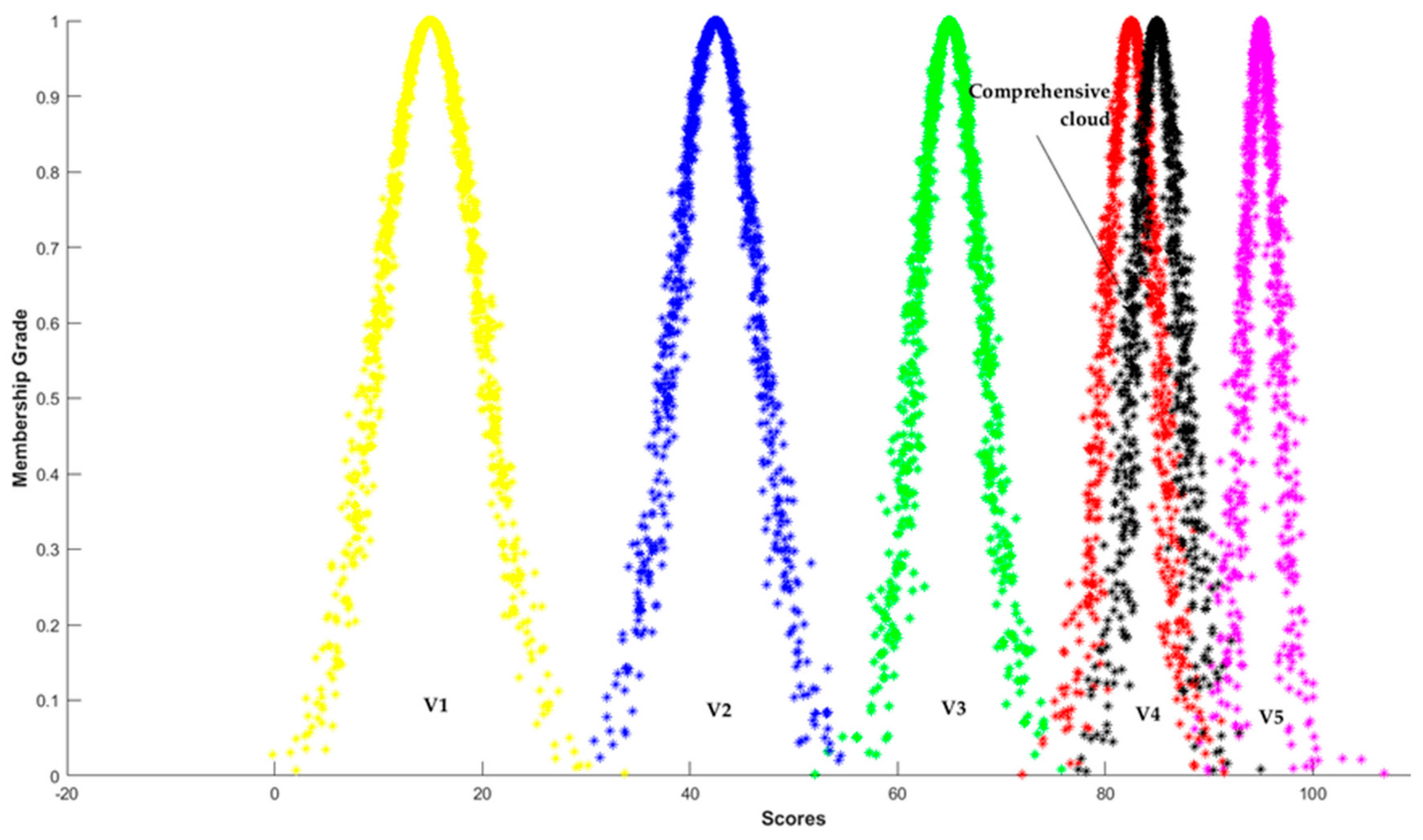

5.2. Cloud Model Construction

5.3. Discussion

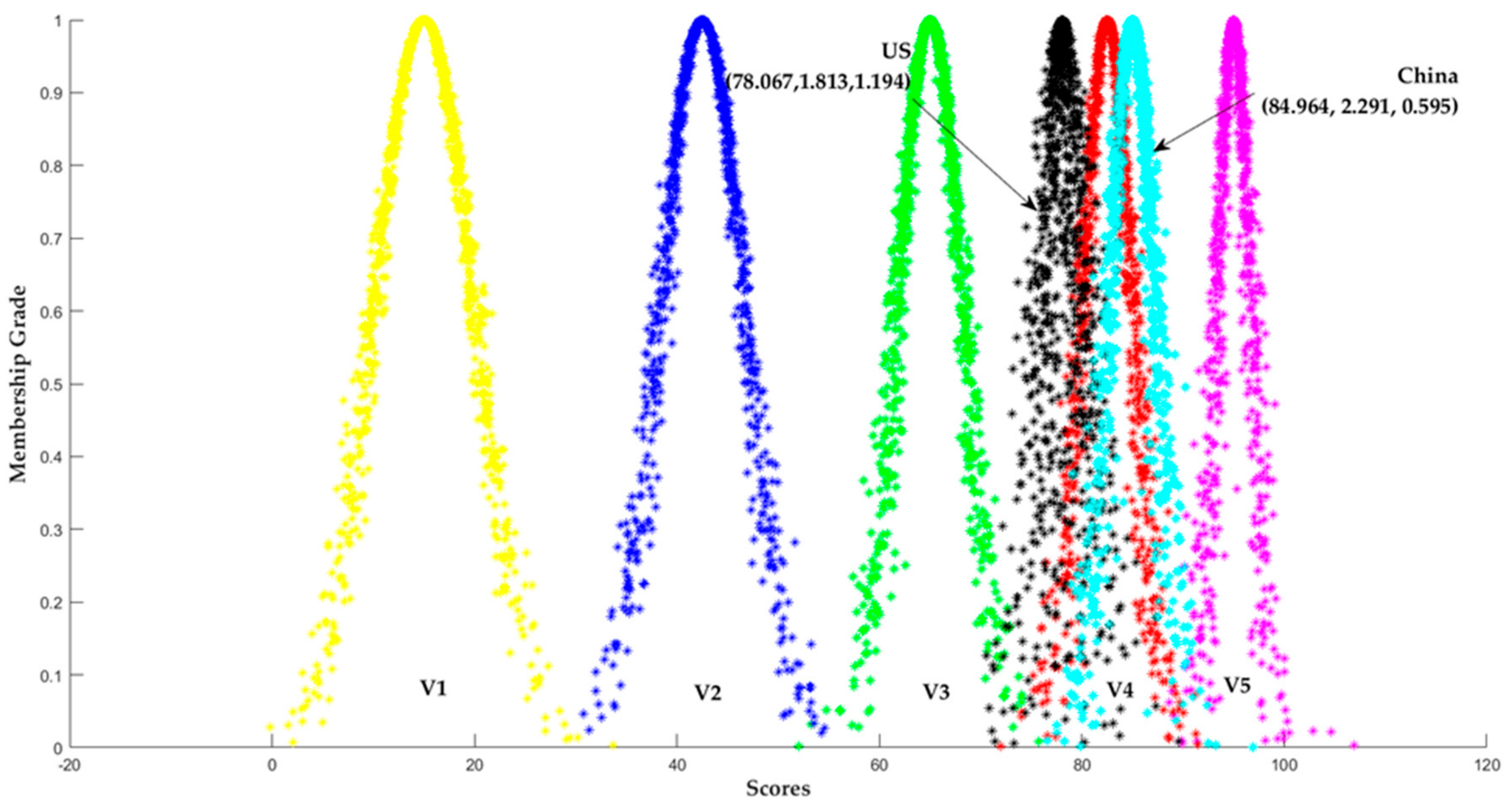

5.3.1. Discussion on the Assessment Results

5.3.2. Comparative Analysis

5.3.3. Sensitivity Analysis

5.3.4. External Validity Analysis

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- China Signs Paris Agreement on Climate Change. Available online: http://english.www.gov.cn/state_council/vice_premiers/2016/04/23/content_281475333331232.htm (accessed on 15 February 2020).

- Hao, Y.; Liu, Y.M. The influential factors of urban PM2.5 concentrations in China: A spatial econometric analysis. J. Clean. Prod. 2016, 112, 1443–1453. [Google Scholar] [CrossRef]

- Circular of the State Council on Printing and Distributing the Comprehensive Work Plan for Energy Conservation and Emission Reduction during the 13th Five Year Plan. Available online: http://www.gov.cn/zhengce/content/2017-01/05/content_5156789.htm (accessed on 16 January 2020).

- Public Comments on “The New Energy Vehicle Industry Development Plan (2021–2035)” (Draft for Comments). Available online: http://www.miit.gov.cn/n1278117/n1648113/c7553623/content.html (accessed on 29 January 2020).

- A Comprehensive Review of the World’s New Energy Vehicle Development in 2020. Available online: http://chuneng.bjx.com.cn/news/20200224/1046572.shtml (accessed on 1 February 2020).

- Fang, S.H.; Chen, Y.; Yang, Y.J. Optimization design and energy-saving control strategy of high power dc contactor. Int. J. Electr. Power Energy Syst. 2020, 117, 8. [Google Scholar] [CrossRef]

- Hao, X.; Wang, H.W.; Lin, Z.H.; Ouyang, M.G. Seasonal effects on electric vehicle energy consumption and driving range: A case study on personal, taxi, and ridesharing vehicles. J. Clean. Prod. 2020, 249, 13. [Google Scholar] [CrossRef]

- Xiong, H.Y.; Tan, Z.R.; Zhang, R.H.; He, S. A New Dual Axle Drive Optimization Control Strategy for Electric Vehicles Using Vehicle-to-Infrastructure Communications. IEEE Trans. Ind. Inform. 2020, 16, 2574–2582. [Google Scholar] [CrossRef]

- Ali, A.M.; Ganbar, A.; Soffker, D. Optimal Control of Multi-Source Electric Vehicles in Real Time Using Advisory Dynamic Programming. IEEE Trans. Veh. Technol. 2019, 68, 10394–10405. [Google Scholar] [CrossRef]

- Einaddin, A.H.; Yazdankhah, A.S. A novel approach for multi-objective optimal scheduling of large-scale EV fleets in a smart distribution grid considering realistic and stochastic modeling framework. Int. J. Electr. Power Energy Syst. 2020, 117, 18. [Google Scholar] [CrossRef]

- Li, Y.M.; Zhang, Q.; Tang, Y.Y.; McLellan, B.; Ye, H.Y.; Shimoda, H.; Ishihara, K. Dynamic optimization management of the dual-credit policy for passenger vehicles. J. Clean. Prod. 2020, 249, 14. [Google Scholar] [CrossRef]

- Ata, M.; Erenoglu, A.K.; Sengor, I.; Erdinc, O.; Tascikaraoglu, A.; Catalao, J.P.S. Optimal operation of a multi-energy system considering renewable energy sources stochasticity and impacts of electric vehicles. Energy 2019, 186, 12. [Google Scholar] [CrossRef]

- Michaelides, E.E. Thermodynamics and energy usage of electric vehicles. Energy Convers. Manag. 2020, 203, 9. [Google Scholar] [CrossRef]

- Pahlavanhoseini, A.; Sepasian, M.S. Optimal planning of PEV fast charging stations using an auction-based method. J. Clean. Prod. 2020, 246, 12. [Google Scholar] [CrossRef]

- Pan, Y.J.; Qiao, F.X.; Tang, K.; Chen, S.Y.; Ukkusuri, S.V. Understanding and estimating the carbon dioxide emissions for urban buses at different road locations: A comparison between new-energy buses and conventional diesel buses. Sci. Total Environ. 2020, 703, 13. [Google Scholar] [CrossRef] [PubMed]

- He, L.Y.; Pei, L.L.; Yang, Y.H. An optimised grey buffer operator for forecasting the production and sales of new energy vehicles in China. Sci. Total Environ. 2020, 704, 12. [Google Scholar] [CrossRef] [PubMed]

- Ji, S.F.; Zhao, D.; Luo, R.J. Evolutionary game analysis on local governments and manufacturers’ behavioral strategies: Impact of phasing out subsidies for new energy vehicles. Energy 2019, 189, 16. [Google Scholar] [CrossRef]

- Perera, P.; Hewage, K.; Sadiq, R. Electric vehicle recharging infrastructure planning and management in urban communities. J. Clean. Prod. 2020, 250, 18. [Google Scholar] [CrossRef]

- Han, L.; Wang, S.Y.; Zhao, D.T.; Li, J. The intention to adopt electric vehicles: Driven by functional and non-functional values. Trans. Res. Part A Policy Pract. 2017, 103, 185–197. [Google Scholar] [CrossRef]

- He, X.H.; Zhan, W.J.; Hu, Y.Y. Consumer purchase intention of electric vehicles in China: The roles of perception and personality. J. Clean. Prod. 2018, 204, 1060–1069. [Google Scholar] [CrossRef]

- Okada, T.; Tamaki, T.; Managi, S. Effect of environmental awareness on purchase intention and satisfaction pertaining to electric vehicles in Japan. Trans. Res. Part D Trans. Environ. 2019, 67, 503–513. [Google Scholar] [CrossRef]

- Abdel-Basset, M.; Gunasekaran, M.; Mohamed, M.; Chilamkurti, N. A framework for risk assessment, management and evaluation: Economic tool for quantifying risks in supply chain. Future Gener. Comput. Syst. Int. J. Escience 2019, 90, 489–502. [Google Scholar] [CrossRef]

- Dias, G.C.; Hernandez, C.T.; Oliveira, U.R.d. Supply chain risk management and risk ranking in the automotive industry. Gestão Produção 2020, 27, e3800. [Google Scholar] [CrossRef]

- Li, J.Z.; Ku, Y.Y.; Liu, C.L.; Zhou, Y.P. Dual credit policy: Promoting new energy vehicles with battery recycling in a competitive environment? J. Clean. Prod. 2020, 243, 14. [Google Scholar] [CrossRef]

- Kalaitzi, D.; Matopoulos, A.; Clegg, B. Managing resource dependencies in electric vehicle supply chains: A multi-tier case study. Supply Chain Manag. Int. J. 2019, 24, 256–270. [Google Scholar] [CrossRef]

- Wu, Y.N.; Jia, W.B.; Li, L.W.Y.; Song, Z.X.; Xu, C.B.; Liu, F.T. Risk assessment of electric vehicle supply chain based on fuzzy synthetic evaluation. Energy 2019, 182, 397–411. [Google Scholar] [CrossRef]

- Mangla, S.K.; Kumar, P.; Barua, M.K. Risk analysis in green supply chain using fuzzy AHP approach: A case study. Res. Conserv. Recycl. 2015, 104, 375–390. [Google Scholar] [CrossRef]

- Abdel-Basset, M.; Mohamed, R. A novel plithogenic TOPSIS- CRITIC model for sustainable supply chain risk management. J. Clean. Prod. 2020, 247, 15. [Google Scholar] [CrossRef]

- Buyukozkan, G.; Cifci, G. A novel hybrid MCDM approach based on fuzzy DEMATEL, fuzzy ANP and fuzzy TOPSIS to evaluate green suppliers. Expert Syst. Appl. 2012, 39, 3000–3011. [Google Scholar] [CrossRef]

- Giannakis, M.; Papadopoulos, T. Supply chain sustainability: A risk management approach. Int. J. Prod. Econ. 2016, 171, 455–470. [Google Scholar] [CrossRef]

- Song, W.; Ming, X.; Liu, H.-C. Identifying critical risk factors of sustainable supply chain management: A rough strength-relation analysis method. J. Clean. Prod. 2017, 143, 100–115. [Google Scholar] [CrossRef]

- Giunipero, L.C.; Hooker, R.E.; Joseph-Matthews, S.; Yoon, T.E.; Brudvig, S. A Decade of SCM Literature: Past, present and future implications. J. Supply Chain Manag. 2008, 44, 66–86. [Google Scholar] [CrossRef]

- Mentzer, J.T.; DeWitt, W.; Keebler, J.S.; Min, S.; Nix, N.W.; Smith, C.D.; Zacharia, Z.G. Defining supply chain management. J. Bus. Logist. 2001, 22, 1–25. [Google Scholar] [CrossRef]

- Yang, Y.; Ziwei, H. Study on Risk Recognition and Evaluation of New Energy Automobile Supply Chain Based on SCOR Model. Logist. Technol. 2015, 34, 186–191. [Google Scholar]

- Masiero, G.; Ogasavara, M.; Jussani, A.; Risso, M. The global value chain of electric vehicles: A review of the Japanese, South Korean and Brazilian cases. Renew. Sustain. Energy Rev. 2017, 80, 290–296. [Google Scholar] [CrossRef]

- Morton, C.; Anable, J.; Nelson, J. Exploring consumer preferences towards electric vehicles: The influence of consumer innovativeness. Res. Trans. Bus. Manag. 2016, 18, 18–28. [Google Scholar] [CrossRef]

- Rezvani, Z.; Jansson, J.; Bodin, J. Advances in consumer electric vehicle adoption research: A review and research agenda. Trans. Res. Part D Trans. Environ. 2015, 34, 122–136. [Google Scholar] [CrossRef]

- Shafie-khah, M.; Neyestani, N.; Damavandi, M.Y.; Gil, F.A.S.; Catalão, J.P.S. Economic and technical aspects of plug-in electric vehicles in electricity markets. Renew. Sustain. Energy Rev. 2016, 53, 1168–1177. [Google Scholar] [CrossRef]

- Noori, M.; Tatari, O. Development of an Agent-Based Model for Regional Market Penetration Projections of Electric Vehicles in the United States. Energy. 2016, 96, 215–230. [Google Scholar] [CrossRef]

- Huang, J.; Leng, M.; Liang, L.; Liu, J. Promoting Electric Automobiles: Supply Chain Analysis under a Government’s Subsidy Incentive Scheme. IIE Trans. 2013, 45, 826–844. [Google Scholar] [CrossRef]

- Luo, C.; Leng, M.; Huang, J.; Liang, L. Supply chain analysis under a price-discount incentive scheme for electric vehicles. Eur. J. Op. Res. 2014, 235, 329–333. [Google Scholar] [CrossRef]

- Guenther, H.O.; Kannegiesser, M.; Autenrieb, N. The role of electric vehicles for supply chain sustainability in the automotive industry. J. Clean. Prod. 2015, 90, 220–233. [Google Scholar] [CrossRef]

- Bode, C.; Wagner, S.M. Structural drivers of upstream supply chain complexity and the frequency of supply chain disruptions. J. Op. Manag. 2015, 36, 215–228. [Google Scholar] [CrossRef]

- Jüttner, U.; Peck, H.; Christopher, M. Supply Chain Risk Management: Outlining an Agenda for Future Research. Int. J. Logist. Res. Appl. 2003, 6, 197–210. [Google Scholar] [CrossRef]

- Lavastre, O.; Gunasekaran, A.; Spalanzani, A. Supply chain risk management in French companies. Decis. Support Syst. 2012, 52, 828–838. [Google Scholar] [CrossRef]

- Prakash, A.; Agarwal, A.; Kumar, A. Risk Assessment in Automobile Supply Chain. Mater. Today Proc. 2018, 5, 3571–3580. [Google Scholar] [CrossRef]

- Zsidisin, G.A. A grounded definition of supply risk. J. Purch. Supply Manag. 2003, 9, 217–224. [Google Scholar] [CrossRef]

- Manuj, I.; Mentzer, J.T. Global supply chain risk management. J. Bus. Logist. 2008, 29, 133–155. [Google Scholar] [CrossRef]

- Cagliano, A.C.; De Marco, A.; Grimaldi, S.; Rafele, C. An integrated approach to supply chain risk analysis. J. Risk Res. 2012, 15, 817–840. [Google Scholar] [CrossRef]

- Govindan, K.; Jepsen, M.B. Supplier risk assessment based on trapezoidal intuitionistic fuzzy numbers and ELECTRE TRI-C: A case illustration involving service suppliers. J. Op. Res. Soc. 2016, 67, 339–376. [Google Scholar] [CrossRef]

- Junaid, M.; Xue, Y.; Syed, M.W.; Li, J.Z.; Ziaullah, M. A Neutrosophic AHP and TOPSIS Framework for Supply Chain Risk Assessment in Automotive Industry of Pakistan. Sustainability 2019, 12, 154. [Google Scholar] [CrossRef]

- Wu, T.; Backhurst, J.; Chidambaram, V. A model for inbound supply risk analysis. Comput. Ind. 2006, 57, 350–365. [Google Scholar] [CrossRef]

- Aqlan, F.; Lam, S.S. A fuzzy-based integrated framework for supply chain risk assessment. Int. J. Prod. Econ. 2015, 161, 54–63. [Google Scholar] [CrossRef]

- Chiu, C.-H.; Choi, T.-M. Supply chain risk analysis with mean-variance models: A technical review. Ann. Op. Res. 2016, 240, 489–507. [Google Scholar] [CrossRef]

- Er Kara, M.; Firat, S.; Ghadge, D.A. A data mining-based framework for supply chain risk management. Comput. Ind. Eng. 2018, 139. [Google Scholar] [CrossRef]

- Mulyati, H.; Geldermann, J. Managing risks in the Indonesian seaweed supply chain. Clean Technol. Environ. Policy 2016, 19, 175–189. [Google Scholar] [CrossRef]

- Munir, M.; Jajja, M.S.S.; Chatha, K.A.; Farooq, S. Supply Chain Risk Management and Operational Performance: The Enabling Role of Supply Chain Integration. Int. J. Prod. Econ. 2020, 227. [Google Scholar] [CrossRef]

- Yan, Q.; Qin, G.; Zhang, M.; Xiao, B. Research on Real Purchasing Behavior Analysis of Electric Cars in Beijing Based on Structural Equation Modeling and Multinomial Logit Model. Sustainability 2019, 11, 5870. [Google Scholar]

- Saaty, T. The Analytic Hierarchy Process; Mc-Graw-Hill: New York, NY, USA, 1980. [Google Scholar]

- Laarhoven, P.M.J.; Pedrycz, W. A Fuzzy Extension of Saaty’s Priority Theory. Fuzzy Sets Syst. 1983, 134, 365–385. [Google Scholar] [CrossRef]

- Chang, D.Y. Application of extend analysis method on Fuzzy AHP. Eur. J. Op. Res. 1996, 96, 343–350. [Google Scholar]

- Dhivya, J.; Sridevi, B. A novel similarity measure between intuitionistic fuzzy sets based on the mid points of transformed triangular fuzzy numbers with applications to pattern recognition and medical diagnosis. Appl. Math. A J. Chin. Univ. 2019, 34, 229–252. [Google Scholar] [CrossRef]

- Liou, T.-S.; Wang, M.-J. Ranking fuzzy numbers with integral value. Fuzzy Sets Syst. 1992, 50, 247–255. [Google Scholar]

- Zhixiang, L.; Jin, L. Optimization of Mining Method based on variable weight theory and TOPSIS. Nonferrous Metals Eng. 2019, 9, 76–81. [Google Scholar]

- Renjie, S.; Yuming, C. Fuzzy synthetic evaluation of relay protection based on variable weight value. Power Syst. Prot. Control 2016, 44, 46–50. [Google Scholar]

- Gaofeng, Y.; Dengfeng, L.; Wenqi, L. Method for incentive type variable weight decision making considering decision maker’s psychological behavioral character. Syst. Eng. Theory Pract. 2017, 37, 1304–1312. [Google Scholar]

- Wenxiu, Z.; Lin, W.; Renjie, S.; Jianglin, D. Comprehensive evaluation method of distribution network based on cloud model. Comput. Eng. Des. 2018, 39, 2096–2101. [Google Scholar]

- Jun, W.; Jianjun, Z.; Hehua, W.; Shitao, Z. Decision Making Method for Cloud Model Based on Prospect Theory Considering Attribute Aspirations. Syst. Eng. 2017, 35, 130–136. [Google Scholar]

- Kun, Z.; Jianwei, G.; Zhiqiang, Q.; Cunbin, L. Multi-criteria risky-decision-making approach based on prospect theory and cloud model. Control Decis. 2015, 30, 395–402. [Google Scholar]

- Yingpan, L.; Mingqiang, L.; Fang, W.; Ruige, L. Safety performance assessment of fabricated building project based on cloud model. China Saf. Sci. J. 2017, 27, 115–120. [Google Scholar]

- Aiyan, W.; ChongChong, Y.; Guangping, Z.; Xuyan, T. Study on the Approach of Fuzzy Multiattribute Cloud Decision Based on Natural Lauguage. Comput. Sci. 2010, 37, 199–202. [Google Scholar]

- Yonglin, Z.; Lei, W. Multi Level Fuzzy Comprehensive Evaluation Method Based on Cloud Model Theory. Comput. Simul. 2016, 33, 390–395. [Google Scholar]

- Deyi, L.; Changyu, L. Study on the Universality of the Normal Cloud Model. Strateg. Study CAE. 2004, 2, 28–34. [Google Scholar]

- Hao, X.; Zhou, Y.; Wang, H.W.; Ouyang, M.G. Plug-in electric vehicles in China and the USA: A technology and market comparison. Mitig. Adapt. Strateg. Glob. Ch. 2020, 25. [Google Scholar] [CrossRef]

- Stokes, L.C.; Breetz, H.L. Politics in the US energy transition: Case studies of solar, wind, biofuels and electric vehicles policy. Energy Policy 2018, 113, 76–86. [Google Scholar] [CrossRef]

- Electric Vehicle Supply Chain Strategy. Available online: https://www.benchmarkminerals.com/price-assessments/ (accessed on 23 March 2020).

| Score | Implication |

|---|---|

| 1 | The two elements are of equal significance. |

| 3 | The former is slightly more significant than the latter. |

| 5 | The former is more significant than the latter. |

| 7 | The former is intensively more significant than the latter. |

| 9 | The former is extremely more significant than the latter. |

| 2,4,6,8 | Median of the above adjoining judgments. |

| Criterion | Weight Relative to Target Layer | Sub-Criterion | Weight Relative to Criterion Layer | Constant Weight |

|---|---|---|---|---|

| E1 | 0.260 | E11 | 0.219 | 0.057 |

| E12 | 0.090 | 0.023 | ||

| E13 | 0.414 | 0.108 | ||

| E14 | 0.174 | 0.045 | ||

| E15 | 0.103 | 0.027 | ||

| E2 | 0.525 | E21 | 0.054 | 0.028 |

| E22 | 0.277 | 0.146 | ||

| E23 | 0.275 | 0.144 | ||

| E24 | 0.106 | 0.056 | ||

| E25 | 0.049 | 0.026 | ||

| E26 | 0.238 | 0.125 | ||

| E3 | 0.215 | E31 | 0.470 | 0.101 |

| E32 | 0.120 | 0.026 | ||

| E33 | 0.235 | 0.051 | ||

| E34 | 0.096 | 0.021 | ||

| E35 | 0.078 | 0.017 |

| Grade | Cloud Model |

|---|---|

| Very Low (V1) | (15, 5, 0.5) |

| Low (V2) | (42.5, 4.2, 0.5) |

| General (V3) | (65, 3.3, 0.5) |

| High (V4) | (82.5, 2.5, 0.5) |

| Very High (V5) | (95, 1.7, 0.5) |

| Grades | Very Low (V1) | Low (V2) | General (V3) | High (V4) | Very High (V5) | Results |

|---|---|---|---|---|---|---|

| Cloud model | (15, 5, 0.5) | (42.5, 4.2, 0.5) | (65, 3.3, 0.5) | (82.5, 2.5, 0.5) | (95, 1.7, 0.5) | |

| Comprehensive cloud | (84.964, 2.291, 0.595) | |||||

| Euclidean distance | 70.017 | 42.507 | 19.990 | 2.475 | 94.939 | High (V4) |

| Membership degree of fuzzy synthesis evaluation | 0 | 0 | 0.034 | 0.729 | 0.311 | High (V4) |

| Comprehensive Cloud | Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 |

|---|---|---|---|---|

| E11 | (84.991, 2.295, 0.595) | (85.018, 2.299, 0.596) | (84.937, 2.287, 0.594) | (84.910, 2.282, 0.593) |

| E12 | (84.981, 2.292, 0.595) | (84.999, 2.292, 0.595) | (84.947, 2.290, 0.594) | (84.930, 2.289, 0.594) |

| E13 | (84.972, 2.298, 0.598) | (84.981, 2.305, 0.601) | (84.956, 2.284, 0.591) | (84.947, 2.277, 0.588) |

| E14 | (84.961, 2.290, 0.593) | (84.958, 2.290, 0.591) | (84.967, 2.291, 0.596) | (84.970, 2.292, 0.598) |

| E15 | (84.978, 2.292, 0.594) | (84.993, 2.293, 0.594) | (84.950, 2.290, 0.595) | (84.935, 2.289, 0.595) |

| E21 | (84.976, 2.291, 0.593) | (84.988, 2.291, 0.592) | (84.952, 2.291, 0.596) | (84.940, 2.291, 0.597) |

| E22 | (84.939, 2.303, 0.598) | (84.915, 2.316, 0.601) | (84.989, 2.278, 0.591) | (85.015, 2.266, 0.588) |

| E23 | (84.832, 2.277, 0.599) | (84.699, 2.264, 0.603) | (85.094, 2.304, 0.590) | (85.223, 2.318, 0.586) |

| E24 | (85.007, 2.285, 0.586) | (85.051, 2.279, 0.578) | (84.921, 2.297, 0.602) | (84.879, 2.303, 0.610) |

| E25 | (84.994, 2.291, 0.594) | (85.023, 2.291, 0.593) | (84.935, 2.290, 0.595) | (84.905, 2.290, 0.596) |

| E26 | (84.915, 2.288, 0.593) | (84.867, 2.284, 0.591) | (85.013, 2.294, 0.596) | (85.061, 2.297, 0.598) |

| E31 | (84.885, 2.287, 0.599) | (84.806, 2.284, 0.603) | (85.043, 2.294, 0.590) | (85.121, 2.297, 0.586) |

| E32 | (85.003, 2.290, 0.595) | (85.042, 2.290, 0.596) | (84.925, 2.291, 0.594) | (84.886, 2.291, 0.593) |

| E33 | (84.960, 2.291, 0.594) | (84.956, 2.292, 0.594) | (84.968, 2.290, 0.595) | (84.972, 2.289, 0.595) |

| E34 | (85.000, 2.290, 0.593) | (85.036, 2.289, 0.591) | (84.928, 2.291, 0.596) | (84.892, 2.292, 0.598) |

| E35 | (84.998, 2.291, 0.595) | (85.032, 2.292, 0.595) | (84.930, 2.290, 0.594) | (84.896, 2.289, 0.594) |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yan, Q.; Zhang, M.; Li, W.; Qin, G. Risk Assessment of New Energy Vehicle Supply Chain Based on Variable Weight Theory and Cloud Model: A Case Study in China. Sustainability 2020, 12, 3150. https://doi.org/10.3390/su12083150

Yan Q, Zhang M, Li W, Qin G. Risk Assessment of New Energy Vehicle Supply Chain Based on Variable Weight Theory and Cloud Model: A Case Study in China. Sustainability. 2020; 12(8):3150. https://doi.org/10.3390/su12083150

Chicago/Turabian StyleYan, Qingyou, Meijuan Zhang, Wei Li, and Guangyu Qin. 2020. "Risk Assessment of New Energy Vehicle Supply Chain Based on Variable Weight Theory and Cloud Model: A Case Study in China" Sustainability 12, no. 8: 3150. https://doi.org/10.3390/su12083150

APA StyleYan, Q., Zhang, M., Li, W., & Qin, G. (2020). Risk Assessment of New Energy Vehicle Supply Chain Based on Variable Weight Theory and Cloud Model: A Case Study in China. Sustainability, 12(8), 3150. https://doi.org/10.3390/su12083150