Abstract

As organic farming gains more popularity across the world, it is important to discuss the underlying trends of its development in Ukraine, who is an important agricultural producer. Organic farming may have lower environmental pressures—therefore, we seek to identify the major trends in the production and sales of the organic agricultural products in Ukraine. In this study, data on the production structure, costs, and selling prices from Ukrainian enterprises are analyzed. Conventional and organic enterprises are contrasted in order to identify the possibilities for the development of organic agriculture in Ukraine. Our results suggest that enterprises that use organic farming in Ukraine tend to produce higher output per hectare, as opposed to those engaged in conventional farming. However, labor profitability remains low in labor-intensive organic farming, especially in larger companies, and organic products remain a low percentage of Ukraine’s agricultural exports. This calls for further study into the development of organic production and consumption in the domestic market, as well as the implementation of appropriate certification practices in order to ensure the growth of organic exports.

1. Introduction

Organic agricultural production has gained more popularity recently due to changes in customer tastes and income [1,2,3]. In 2017, organic agriculture was licensed in 181 countries, and approximately 2.4 million farmers were engaged in organic production [4,5]. In 2017, global organic farming increased from 11 million hectares in 1999 to 69.8 million hectares. The largest areas used for organic farming, as of 2017, were in Australia (35.6 million hectares), Argentina (3.4 million hectares), and China (3 million hectares). The largest numbers of organic enterprises were in India (835,000), Uganda (210,300), and Mexico (210,000). According to the research of the Forschungsinstitut fur biologischen Landbau (FiBL), organic production has been expanding rapidly in the world [6]. In Europe, agricultural land area for organic production has increased tenfold over the last 10 years. The area of organic farming is growing at a slower pace in countries where the process began a relatively long time ago (Germany, the Netherlands, and France). In Austria, the share of the land area under organic production reached 24.0% [7].

Ukraine is a developing country with underdeveloped organic agriculture sector. The major reason for this is the limited purchasing power of the domestic population. However, it is important to identify Ukraine’s major trends in the production of organic agriculture in order to ensure the balanced development of the sector. Among the determinants of customers’ decisions to purchase organic products, willingness to avoid contamination of food with pesticides and other chemical compounds is an important factor. A survey of respondents in Thailand indicated that the reasons for purchasing organic products were due to consumers’ desires to get healthier products. At the same time, respondents who bought organic vegetables are usually older, have higher education and higher family income than those who did not buy them [8]. A similar study was also conducted in Ukraine. It was found that consumers were willing to pay no more than 25% for eco-friendly products [9]. As organic products are more expensive in Ukraine, the demand remains low if compared to developed countries of the world [10].

The Ministry of Agrarian Policy of Ukraine in addition to Germany, Switzerland, and some companies from the European Union has sought to improve the regulation of the organic market in Ukraine. An example of this is the long-term cooperation agreement concluded in 2005 between the Ukrainian company Ukragrofin and the German ECOLAND Grains & Legumes for organic soybean cultivation [11]. Since the end of the twentieth century, there has been a steady increase in global production, sales, and consumption of organic products, which is up to 20% annually [12]. At the same time, growth in conventional food sales was only up 3% per year [13].

This paper seeks to identify major trends in the production and sales of the organic agricultural products in Ukraine over the past two nationwide agricultural censuses. Data on the production structure, selling prices, labor use, and production costs from Ukrainian agricultural enterprises were used to calculate profits for organic and conventional farms (grouped by the cost of production intervals). Economic indicators for organic farms were compared to those for conventional farms in order to identify possible areas for improvement for further growth and development of Ukrainian organic agriculture.

2. Literature Review

There are different views as to what the “organic farming” category includes. In particular, one of the most common definitions considers it as a production system that supports the health of soils, existing ecosystems, and humans. It depends on ecological processes, biodiversity, and natural cycles specific to local conditions, avoiding the use of non-renewable resources [14].

Ayuya stressed the need for certification of organic farming at the state level within the home country of such enterprises. His analysis confirmed the positive economic impact of developed and adopted programs at the state level for farmers engaged in organic farming [15]. He also emphasized that there is no deliberate policy on the part of supermarkets and manufacturers themselves regarding the clear positioning of their products and their promotion in the markets. Today, organic products are sold by specialized stores, but the vast majority of these products are not organic—they are other so-called eco-friendly products [16]. The importance of the factor of trust in the quality of products is also highlighted by a study in Denmark and the United Kingdom [17]. Some authors even emphasize that this problem has an ethical aspect [18].

Klitna and Bryzhan highlighted the following difficulties of developing the organic sector: Innovative passivity of manufacturers and management structures; lack of institutional support and lack of state financial support; poor awareness of producers about the specifics of organic production and the population regarding organic products; predominance of exports of organic raw materials; processing, production, wholesale, and retail sale of organic products are still underdeveloped; deficiency of grain and other crops of organic origin [19,20]. Løes and Adler noted the need to solve problems between stakeholders involved in organic farming, such as making better use of resources [21]. Wallenbeck et al. showed the heterogeneity of the results obtained from a study of the main types of organic dairy farms in seven EU countries. They noted that businesses have significant differences in both farm size, technological features, animal care, and management strategy. Other limiting factors, such as the natural and climatic features of the geographical location of farms, resource availability, land size and state regulation, are also important [22]. Furthermore, Muller et al. noted that organic farming requires larger land areas to produce a similar amount of production compared to the conventional farming system [23]. Kobets argued that the transition to organic farming requires not only suitable land, but also a long conversion period, which lasts two to five years [24].

Kulish emphasized that organic production can be used as an alternative model of management that does not use any chemicals [25]. Lotter [12] and Smith [26] identified the positive environmental impact of organic farming. They note that organic farming contributes to the conservation of biological diversity, nutrients in the soil, and reduces the level of wind flow and water erosion. Other research indicates a negative influence from the use of chemicals, which damages soil ecosystems and compromises soil fertility—thus, reducing crop yields [27]. Caradonna stressed the negative impact of conventional agriculture, such as reduced agroecosystem diversity, due to state support for agricultural monocultures. Adherents of conventional farming practices are introducing organic farming practices to save costs and conserve biodiversity [28]. Porodina argued that organic products that are produced in Ukraine are of high quality and can satisfy the requirements of the foreign markets [29].

In addition to marketing policy, other factors can lead to farmers’ decision to switch to organic production. A study in Finland concluded that lower prices for produce, and an increase in direct subsidies, could encourage the transition to organic farming. Here, a transition to organic production was also more likely on farms with large land areas and low yields, where intensive livestock production and labor-intensive requirements discourage the switch to organic methods [30]. Therefore, it is important to identify the key challenges to organic agriculture within different contexts.

3. The Market of Organic Products in Ukraine

In 2007, at the initiative of public organizations of the organic movement, with the support of the Ministry of Agrarian Policy of Ukraine, the certification body, Organic Standard, was established to deal with the review and issuance of licenses to enterprises and farmers who want to produce and sell organic products [31]. This certification body is recognized in the European Union (EU) and Switzerland [32]. According to official data of the Ministry of Agrarian Policy of Ukraine, there were 504 certified functioning agricultural enterprises in 2017. The largest number of organic producers is concentrated in the following areas: Vinnytsia, Zhytomyr, Kyiv, Odesa, Kharkiv, and Kherson regions [33].

Ukrainian organic agricultural area, producers, and sales volume and value constitute a small percentage of Ukraine’s total agricultural production, as well as European and global organic agriculture (Table 1). Ukrainian organic agricultural exports include corn, wheat, barley, sunflower, soybeans, spelt, apples/juice, peas, millet, and rapeseed. Top importing countries are The Netherlands, Germany and United Kingdom.

Table 1.

Main indicators of organic market development in Ukraine, 2017.

The Ukrainian organic market is still developing. As of 2017, the total share of organic farmland was negligible (less than 1% of the total agricultural area in Ukraine). Meanwhile, Ukraine ranks 11th in Europe in terms of agricultural land for organic production. During 2013–2017, the area for organic production increased 1.5 times. Approximately 45.5% of all organic area in 2017 was sown under cereal crops [35].

The growth in organic production in Ukraine is one of the highest in the world: The growth rate exceeds the European one by 5.5 times and the global one—by 4.9 times [36]. About 90% of the organic products produced in Ukraine are exported. The most popular organic products exported from Ukraine include corn, wheat, barley, sunflower, soybeans, spelt, apples (juice), peas, millet and rapeseed. The total volume of the exported organic products was 264 metric tons, and the total value was €99 million in 2017. These products were exported to the Netherlands, Germany, the United Kingdom, among others. Such a situation improves the balance of payments of Ukraine, yet the domestic market faces increasing pressure in terms of the prices of the organic products. The lack of the local market may induce a lack in the resilience of organic farming in Ukraine in the case of economic turmoil resulting in a decline of international trade.

The low penetration of the organic products in the Ukrainian market can be illustrated by a comparison to a developed economy—the United States (US). In Ukraine, the domestic retail sales of organic products total €29 million, which corresponds to €1 per inhabitant. As for the US, the domestic market is €40 billion—corresponding to per capita consumption of €122. Thus, the Ukrainian organic products market comprises 0.072% of that of the US, and the rate of consumption per capita is 0.82% of that in the US. Cernansky argues that the US, as one of the global leaders in the production of corn, imports substantial quantities of organic corn for the needs of the feed industry and for the production of organic livestock products [37].

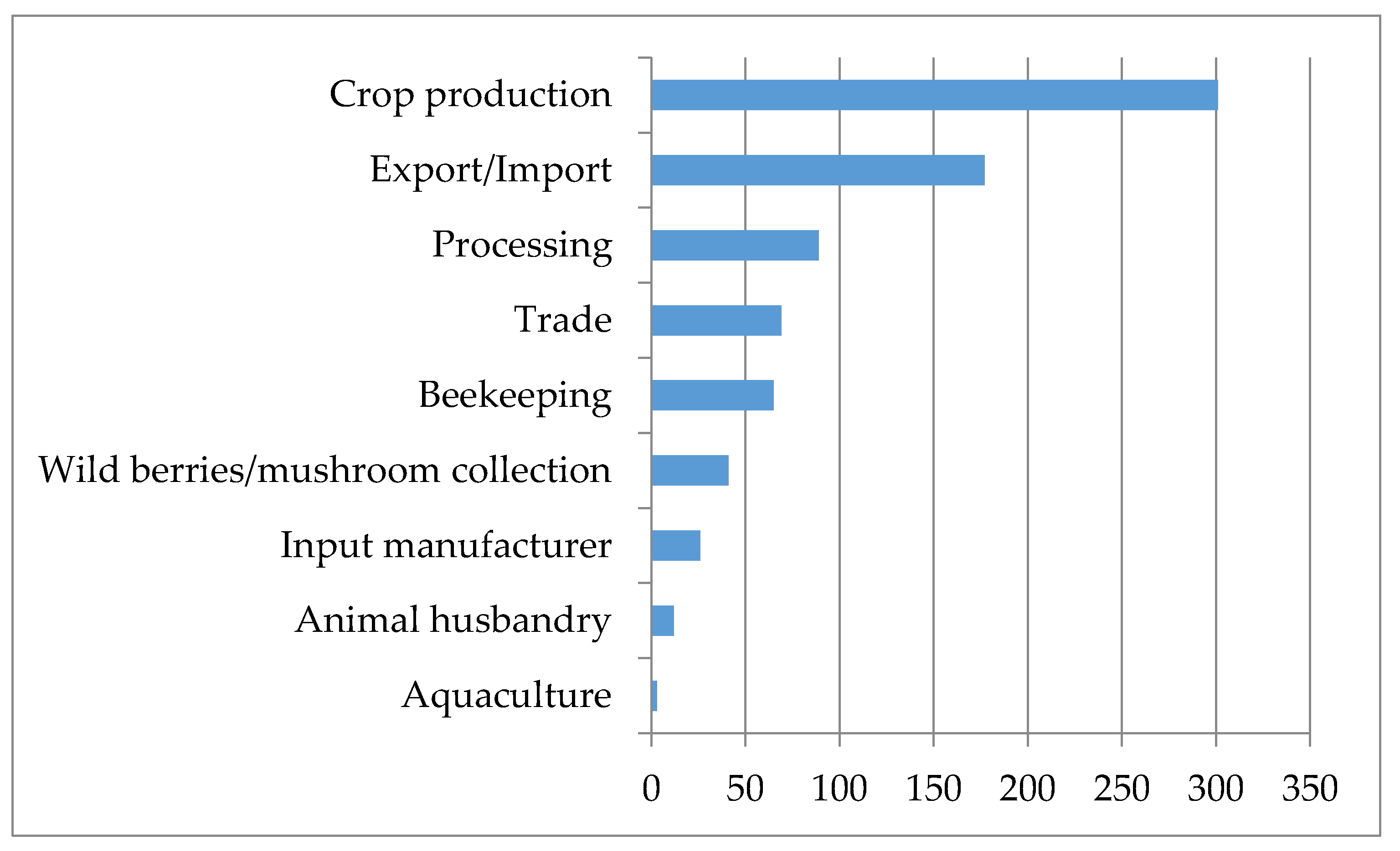

The Ukrainian enterprises are engaged in production and supply of different types of organic products. We use the data on the certificates issued by Organic Standard in order to quantify the different activities undertaken by Ukrainian enterprises. The highest number of certificates were issued for organic crop producers (mostly cereal growing). Beekeeping is the second most frequent type of certified production type, with five times fewer certificates issued if compared to crop farming (Figure 1). The least popular farming type is aquaculture. As regards the components of the supply chain, the foreign trade operations appear as the most important activity after production in terms of the number of certificates issued. Retail trade of the organic products was certified for 69 enterprises in Ukraine.

Figure 1.

The number of enterprises certified for certain activities as of 2017.

As it was mentioned above, Ukraine’s organic agricultural production is mainly oriented towards foreign markets. The EU is a market with favorable geographical location and developed logistics network. Therefore, it has become the most attractive market for export of Ukraine’s organic producers. In Ukraine, 489 organic producers have implemented standards equivalent to European Commission Regulations No 834/07 and 889/08.

Among the exported products, most of the total sales came from cereals (maize, wheat, barley, millet) and industrial crops (sunflower, soybean, and rapeseed). Table A1 presents detailed data on the export structure. The shares of crops in the national export structure fluctuate from 0.02% for sunflower to 5.5% for millet. These values are rather low and should increase in case a successful policy for promotion of organic farming is implemented.

4. Data

In Ukraine, no official body keeps official statistics on the operation of the organic producers at the national level. Information on certified enterprises and products certified by 16 internationally accredited certification bodies can be found in the Organic Business Directory of Ukraine [38]. The data on organic producers were collected from the website of Organic Standard Ltd [39]. The data from report F-50 of agricultural enterprises are used. The comparison of organic and conventional enterprises is based on indicators of enterprise size, output size and structure, the structure of crop area, input intensity, and profitability. We were able to find data on 82 enterprises in 2012, and 75 enterprises in 2017, in the websites mentioned above. The changes in the number of enterprises may be due to the changes in the form of ownership of enterprises, certification expiry, merger or acquisition, changes in their type of activity or liquidation. The data for conventional agricultural companies come from the State Statistical Reporting of Ukrainian Enterprises. The number of conventional enterprises selected for the analysis is equal to that of organic enterprises (75 enterprises in 2017). The random sampling was applied to select conventional enterprises from the database of enterprises with similar characteristics (compared to organic enterprises).

5. Results

5.1. Production Structure in Ukrainian Agricultural Enterprises

The volume of production in organic enterprises is higher than it is the case for conventional enterprises in Ukraine (Table 2). In 2012, on average, an organic enterprise generated revenue of €2104.8 thousand from the sales, whereas an average conventional enterprise generated just €1269.6 thousand. In 2017, these figures went down to €1776.5 thousand and €1075.7 thousand respectively. Thus, the ratio of these indicators virtually did not change with time. The share of the livestock output is much lower than that of the crop output in organic enterprises of Ukraine.

Table 2.

Average farm and crop area, livestock inventory, employees, and total farm revenues for organic and conventional enterprises in Ukraine, 2012 and 2017.

In regards to the agricultural land area, organic enterprises are approximately 1.5 times larger than conventional enterprises in Ukraine. The areas sown under organic soybean, winter wheat and sunflower increased during 2012–2017, whereas that under organic corn for grain fell. The number of workers remained rather stable, although the declining trend persists for both conventional and organic enterprises. The organic farming showed growth in the number of livestock, yet the rate of growth was lower for milk cows and cattle. The structure of the agricultural output of conventional and organic enterprises of Ukraine is presented in Table 3. Even though the share of the livestock output is rather low in organic enterprises, it shows an increase during 2012–2017, whereas the opposite trend is observed for conventional farms. In the output of the organic sector, the share of grain and legume crops shrunk by 2.5 p.p. and that of soybeans increased by 5.1% p.p. during 2012–2017.

Table 3.

The structure of the agricultural output of organic and conventional enterprises in Ukraine (%), 2012 and 2017.

There has been an increase in the share of areas sown under winter wheat, sunflowers and soybeans (Table 4). At the same time, the share of corn for grain and cereals and legumes decreased. The largest difference between organic and conventional enterprises in terms of land use structure was noted for soybean. In 2017, its share in conventional enterprises amounted to 8.0%, while there was an 11.6% increase for organic products. These changes are related to the relative prices of the agricultural products and the changing patterns in the international markets. Particularly, the transition towards winter wheat is evident. Indeed, Ukraine and countries in the neighboring region may exploit their competitive advantage in wheat production, due to favorable geoclimatic conditions.

Table 4.

Crop structure of organic and conventional enterprises in Ukraine, 2012 and 2017.

The differences in the production structure of the Ukrainian organic agricultural companies can be illustrated by considering particular cases. Table A2 summarizes data on some of the Ukrainian organic producers. In general, the increase in the livestock output would increase diversification and ensure the generation of higher agricultural value-added.

5.2. Profitability in Ukrainian Agricultural Enterprises

The differences in revenue can be due to land intensity (per labor unit) and labor productivity. In this sub-section, we further analyze the differences in the input use intensity and the profitability of both conventional and organic enterprises in Ukraine. Table 5 presents the cost, revenue and profit indicators per hectare of agricultural land for conventional enterprises.

Table 5.

Profitability of conventional agricultural enterprises in Ukraine in 2017.

The increasing input intensity corresponds to the increasing cost per hectare. As a result, there exists an almost linear dependence between the cost and revenue per hectare: At the cost level of 70 €/ha, the revenue is 24.6 €/ha, whereas, at the cost level of more than 704.1 €/ha, the revenue approaches 1,031.6 €/ha. The relationship between costs and profit per hectare is not that straightforward. Indeed, the profit is maximized at the cost level of 493–704 €/ha and declines thereafter. The largest share of the profit per hectare is generated from crop farming (99.3% on average in Ukrainian enterprises).

Cost profitability follows an inverted U-shape curve with cost per hectare. Therefore, the lowest profitability is observed for the lowest and highest cost intensity. The land area varies with the cost level, whereas the number of employees keeps increasing. This suggests that labor costs comprise a substantial share of the total costs. Crop farming profitability exceeds that of the animal husbandry for conventional enterprises in Ukraine.

The same kind of analysis is carried out for the organic enterprises (Table 6). The organic enterprises show higher levels of revenue per 1 ha of agricultural land (658.5 €/ha against 519.6 €/ha in conventional enterprises). The same applies to the profits: Organic enterprises show the average value of 218.8 €/ha, whereas 148.9 €/ha is observed for conventional enterprises. The profit per hectare fluctuates with the cost level. Again, the influence of the labor intensity is evident.

Table 6.

The profitability of organic agricultural enterprises in Ukraine, 2017.

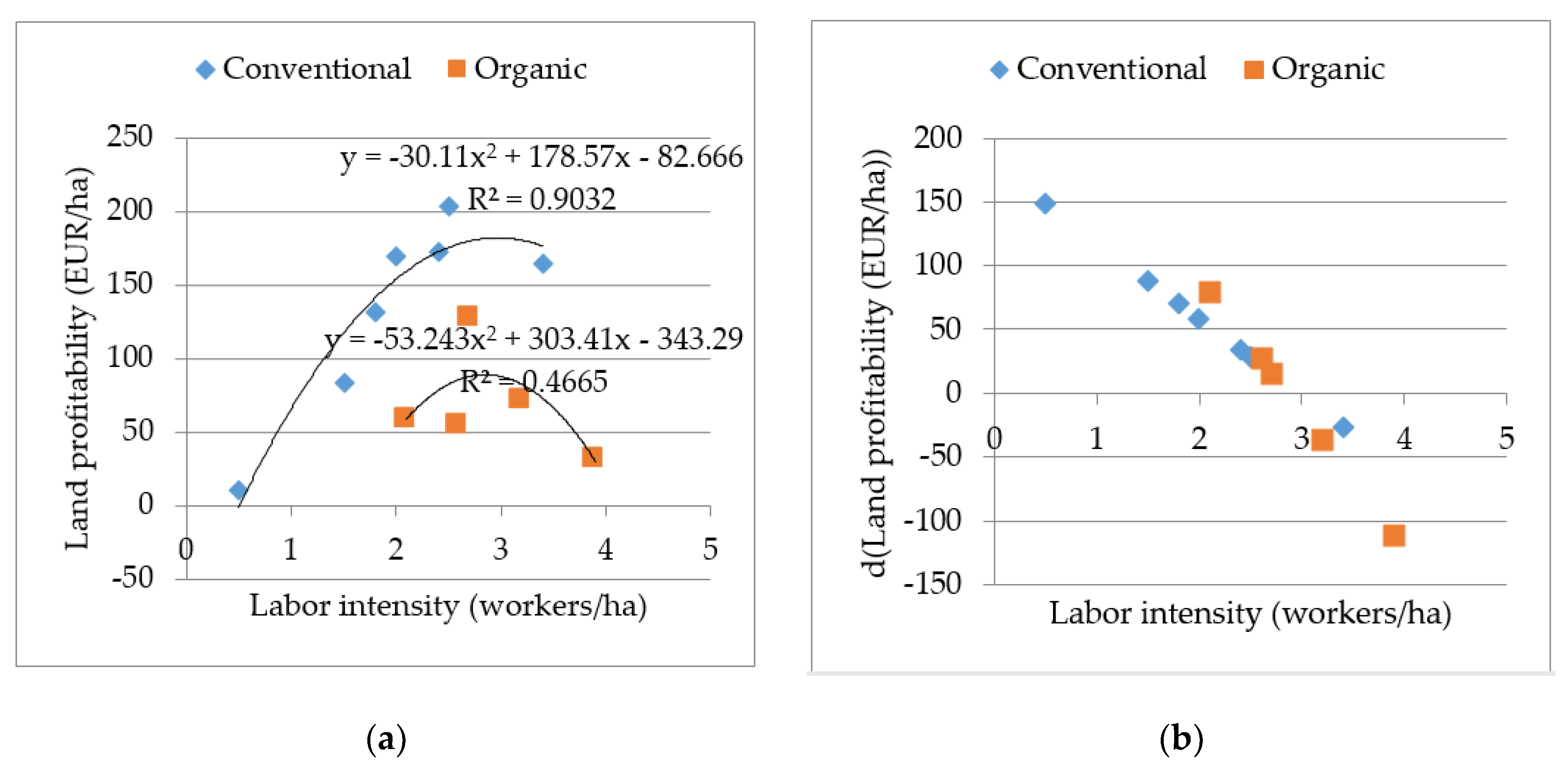

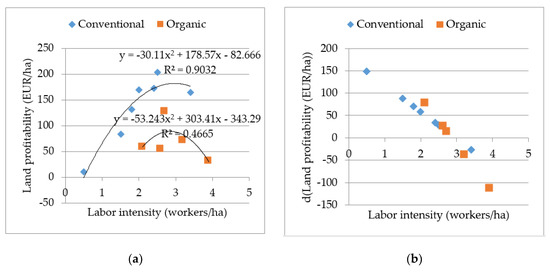

In the case of Ukraine, we can note the declining returns to labor if comparing different groups of conventional and organic farms once the most optimal scale size is exceeded (Figure 2a). The results suggest that the economies of scale exist in the production of both organic and conventional products. Indeed, the largest farms (in terms of the labor force) show decreasing returns to scale. Nevertheless, another observation is that organic farms operate at an inferior technology compared to conventional farms, in the sense that the same amount of labor can produce a lower profit, in general. A deeper analysis of data in Table 6 suggests that there are two options for organic farms in terms of the optimal scale size as the declining profit per hectare is observed for medium- and high-intensity organic farms. Furthermore, organic farms are more labor-intensive than conventional farms, which further reduces the profitability.

Figure 2.

Labor—profit relationship in Ukrainian agricultural enterprises, 2017. (a) Levels; (b) marginal responsiveness (change in land profitability due to change in labor intensity).

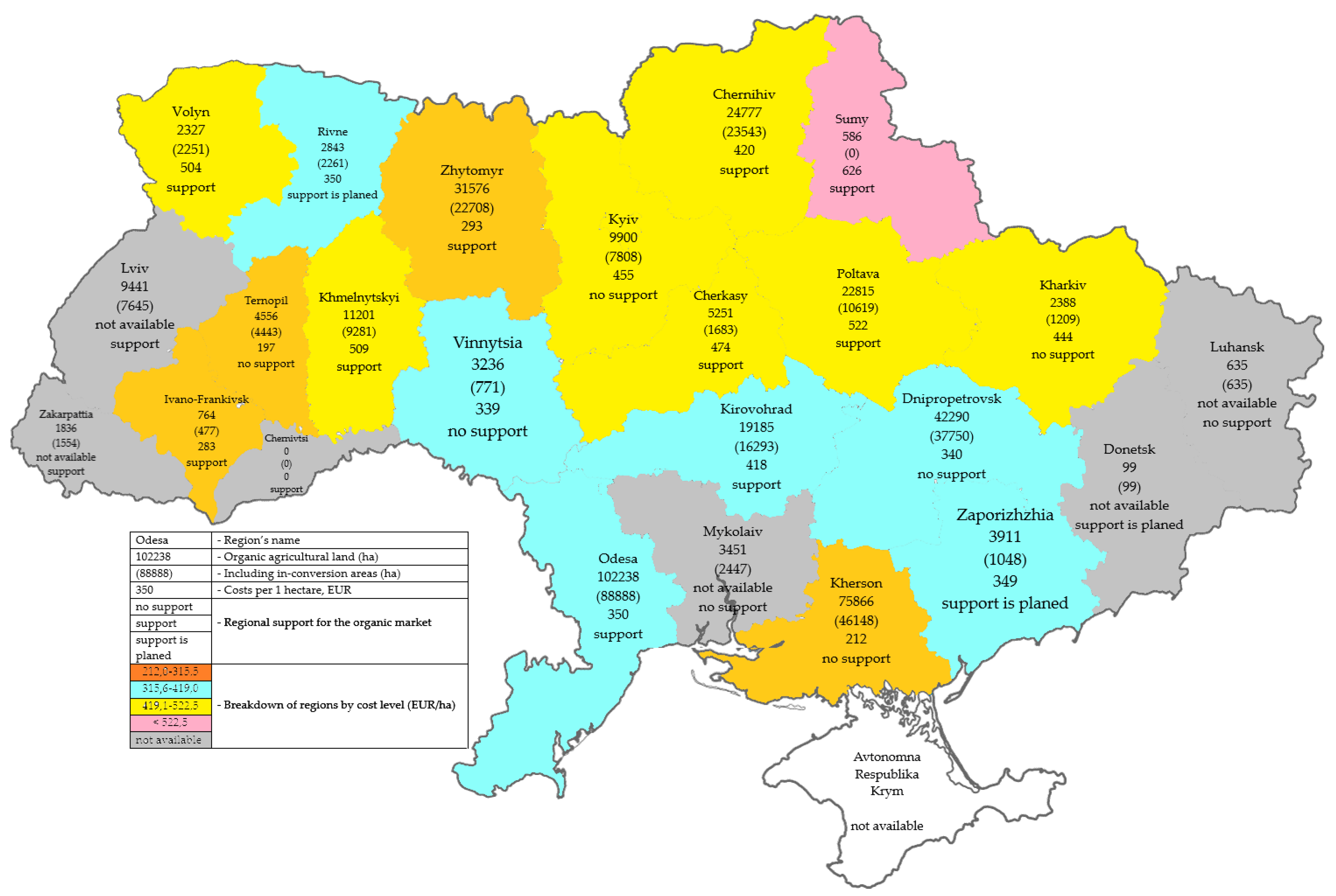

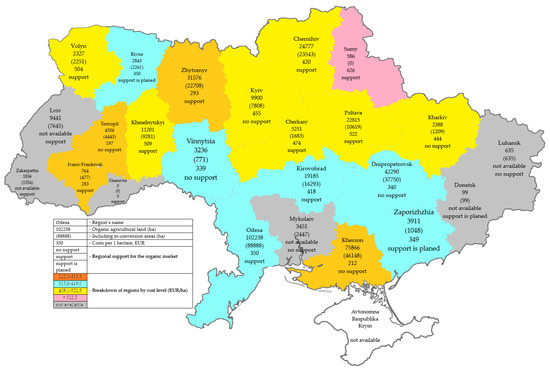

The previous findings indicate that there exist differences in the levels of input use intensity (as indicated by the cost per hectare) and profitability. Therefore, Ukrainian organic enterprises are further analyzed in the regional aspect as different regions may be associated with differences in soil quality. Table 7 presents the distribution of the organic enterprises across different levels of cost per hectare and regions they operate in.

Table 7.

Grouping of organic agricultural enterprises by cost per 1 hectare (€) in Ukraine, 2017.

The data on costs levels per hectare in organic enterprises are further summarized in Figure 3. The regions in northern and central Ukraine show the highest cost per ha. In addition, the largest areas of agricultural land under organic farming are also found in these regions.

Figure 3.

Distribution of regions by cost level per hectare of organic farmland, €/ha. Source: Data from the Research Institute of Organic Agriculture (FiBL) and own calculation.

In order to further explain the differences in profitability of conventional and organic enterprises in Ukraine, we compare the crop yields across these two types of enterprises. The yields for 2017 are presented in Table 8. The organic enterprises how higher yields (with the exception of wheat) if compared to conventional farms. This counterintuitive result can be explained by (i) higher level of development of enterprises embarking on organic farming, and (ii) generally low crop yields in Ukraine.

Table 8.

Yield levels in organic and conventional enterprises in Ukraine in 2017.

The results indicate that organic farming should be promoted in regions with favorable climatic conditions and soils. The crop structure also needs to be adjusted to increase the profitability of farming. The scale of operation also plays an important role in terms of cost intensity.

Besides the input intensity and productivity, price level also determines the profitability of farming. The organic production features high rates of output growth (10–20% per year) and higher prices for products if compared to conventional enterprises (30–50% on average) [40]. At the same time, production costs increase, due to energy consumption corresponding to a large number of mechanical treatments of soil and high costs of the organic fertilizers. In European countries, the level of prices for organic products is often 1.5–2 times higher than usual, which compensates for additional costs [41]. The supply chain is also longer for the organic products, which further adds to the prices of the organic products [42,43].

In Ukraine, organic enterprises receive higher prices than conventional enterprises (Table 9). For example, the price for organic corn is 29% higher than for a conventional one—moreover, it is 26% higher for winter wheat, and 45% higher for pork. The smallest difference of 7% is observed for milk. The difference in milk price is significant at the 10% level, whereas the other prices are significantly different at the 1% level. As the previously discussed differences in the profitability suggest, the price differences are still not high enough to support the development of organic farming.

Table 9.

Statistical parameters for estimating prices for agricultural products in conventional and organic enterprises in Ukraine in 2017.

The low difference in milk prices can be explained by the fact that livestock production is primarily directed at the domestic market, whereas the largest share of crop production is oriented towards the external markets. Successful integration into foreign markets requires direct contracts with European companies. The dairy sector of Ukraine has not yet managed to increase its productivity or provide products to foreign markets [44].

6. Discussion

Lotter [12] and Smith et al. [26] noted a lower level of economic efficiency of organic farms associated with lower crop yields. Moreover, the level of operating expenses is lower than that of conventional enterprises, with a higher price level for such products, which increases gross profit per hectare of organic land. State substantiated the need to provide technical support and financial incentives for the widespread dissemination of advanced methods of conducting organic farming, increasing the effectiveness of management decisions [45]. Adamchak corroborated the aforementioned trends, also notes the need to solve a complex of interrelated complex problems related to increasing the yield (productivity) of organic farms, lowering prices and maintaining the environmental benefits of organic farming aimed at implementing the principles of sustainable development of organic farming [46]. A study, conducted by Freyer et al., identified seven myths related to organic agriculture and food research. The organic production still needs to ensure that both higher performance (yield, productivity, efficiency and others), and reduction in the environmental pressures are achieved [47]. However, this requires a systematic approach towards the regulation of the economic activities [48,49].

Freedman noted that development of the organic production system requires (1) access to organic products; and (2) systematic studies with the participation of state institutions, businesses and research institutions aimed at mitigating damage from farming [50]. Our research has also shown that the Ukrainian market is not yet ready for a large-scale introduction of organic produce as this market is associated with a high level of poverty and low income. Thus, the most acceptable scenario for the development of organic production is its export. Taking into account transportation costs, product prices remain higher than in the Ukrainian market, which will stimulate further growth in the number of manufacturers in Ukraine.

Regarding the microeconomics of organic production in Ukraine, the labor input appears as a limiting factor. Specifically, the marginal profit (per land area) declines with the labor input (Figure 2b) for both conventional and organic enterprises. The land profitability starts declining when 2.85 workers/ha is reached in organic farms, whereas the turning point for conventional farms is 2.97 workers/ha. However, the organic enterprises are located in the high labor intensity region where this issue becomes even more acute. This indicates that, besides economic and technological considerations, the Ukrainian organic producers may face a bottleneck in terms of the labor supply. Due to recently increasing depopulation of the rural regions in Ukraine (as it is the case in Eastern Europe), the labor-intensive organic farming faces increasing labor costs and pressure.

7. Conclusions

The organic products market in Ukraine has been growing rapidly during 2002–2017. There is a significant discrepancy between conventional and organic enterprises from the viewpoint of the size of the sown area, the level of economic efficiency and the intensity of production. Further development of the organic products market is highly dependent on growth in the income of the domestic population and state support for producers.

The low difference in prices for conventional and organic products (e.g., milk) indicates the absence of developed markets for organic production in Ukraine. In order to further develop organic farming specialized in production of the aforementioned products, the support schemes are required. In particular, the direct sales promotion may help to supply the organic production to the domestic markets, whereas large scales measures are needed to support exports of the organic products.

The results suggest that organic farms in Ukraine utilize a larger amount of agricultural area when compared to conventional farms. This indicates that organic farming in Ukraine is still in its early development stage, where only well-established agricultural enterprises can embark on organic farming. Indeed, conversion to organic farming induces transitional losses in revenue and additional costs which can only be borne by large enterprises which are able to diversify without undermining their cash flows.

Certain products (e.g., pig meat) face significant differences in prices under organic and conventional farming. However, the results also show that organic farms face lower land profitability (profitability) than conventional farms in Ukraine. In this instance, the promotion of organic farming can rely on market signals. The further development of these sectors should rely on improvement of certification and labelling practices. In any case, the state-wide programs aimed at increasing the quality of organic products should be supported in order to increase the prevalence of organic farming in Ukraine. The promotion of the organic animal husbandry should be a topical issue as the livestock output currently corresponds to a meagre share of the total agricultural output in Ukraine.

The results showed that organic farms are also more labor intensive than conventional farms. This adds to the land profitability (productivity) gap between the two farming systems. Accordingly, training and advisory services are important to improve the labor productivity.

The results suggest that when enterprises embarked on organic farming in Ukraine, they tended to produce lower output per hectare, as opposed to enterprises engaged in conventional farming. The profitability (per hectare) is also lower for the organic companies. It should also be noted that organic enterprises in Ukraine require more labor force per land unit. This, of course, improves the level of qualification of employees in the activities of organic enterprises. The problem, in this case, is caused not so much by the additional costs, but by the scarcity of skilled staff in a rural area. Moreover, in turn, this can lead to disruption of the work schedule and significant losses. However, cost productivity is higher in organic farms, due to the different levels of intermediate consumption. Therefore, organic farming can be developed in Ukraine, given the economic arguments. Moreover, further research is needed regarding the environmental aspects of organic farming in Ukraine. Furthermore, another important direction for further research is the analysis of the homogeneity of organic farms—in order to propose effective support measures, one should identify the groups of organic farms exhibiting similar performance and output-mix.

This study is limited by the random sampling used to establish the sample of conventional farms, compared to the organic farms. In future studies, propensity score matching and bootstrapping can be applied to ensure more accurate inference. In addition, this is an exploratory study seeking to present the stylized facts about the development of Ukrainian organic agriculture. Future research should analyze the enterprise-level data, in order to obtain the estimates of microeconomic indicators.

Author Contributions

Conceptualization, R.O. and V.N.; Methodology, T.B.; Validation, Y.H., V.N. and S.K.; Formal Analysis, Y.H.; Investigation, S.K.; Data Curation, R.O.; Writing—Original Draft Preparation, R.O.; Writing—Review & Editing, T.B. and D.S.; Visualization, T.B. and D.S. All authors have read and agreed to the published version of the manuscript.

Funding

The research has not received any funding.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A. Context Data for Organic Farming in Ukraine

Table A1.

The most export-oriented types of organic produce, 2017.

Table A1.

The most export-oriented types of organic produce, 2017.

| Indicator | Corn | Wheat | Barley | Sunflower | Soybeans | Peas * | Millet * | Rapeseed |

|---|---|---|---|---|---|---|---|---|

| Export of organic products, thousand tons | 100 | 58 | 23 | 12 | 11 | 5 | 4 | 3 |

| Total exports of products, million tons | 19.4 | 17.3 | 4.9 | 73.2 | 2.9 | 873.5 | 72.7 | 2.1 |

| Share (%) | 0.52 | 0.34 | 0.47 | 0.02 | 0.38 | 0.57 | 5.50 | 0.14 |

* For these crops, total exports are measured in thousands of tons (1 Ton = 1000 kg).

Table A2.

General characteristics of some organic producers.

Table A2.

General characteristics of some organic producers.

| Title | Operation Area | Certified Activity | Number and Validity of the Certificate | Products | Main Retailers |

|---|---|---|---|---|---|

| Svit Bio (“Lybid-K”) | Khmelnytsky region | Plant growing; Trade | 19-0110-09-01, 2020-12-31 | Chicken eggs, Walnut | Ashan, Silpo, Mehamarket, Varus |

| Zolotyi Parmen | Chernihiv region | Plant growing; Processing; Export/Import | 19-0186-08-01, 2020-12-31 | Cereals, fodder crops, apples, pumpkins, currants, juice production | Ok Wine, Silpo |

| Orhanik milk (“Haleks-ahro”) | Zhytomyr region | Livestock; Plant growing; Processing; Export/Import; Apiculture | 19-0038-08-03, 2020-12-31 | Honey, milk, meat, fodder crops, vegetables, cereals, cereals, | Large trading networks |

| Skvyrskyi kombinat khliboproduktiv | Kyiv region | Processing; Export/Import | 19-0294-06-01, 2020-12-31 | Buckwheat, oatmeal, corn grits, flour and flakes | Large trading networks |

| Etnoprodukt | Chernihiv region | Plant growing; Livestock; Processing; Export/Import; Trade | 19-0196-12-03, 2020-12-31 | Meat, milk, milk products, cereals | Not available |

| Kasper | Odesa region | Trade; Export/Import; Processing | 19-0182-08-01, 2020-12-31 | Production of oil, cake, sunflower, flax, rapeseed, soybean, wheat, corn, spelt, barley, oats, rye | Fozzy, Ashan, Mehamarket |

| Orhanik Oryhinal | Kyiv region | Export/Import; Trade; Processing | 19-0135-09-01, 2020-12-31 | Flour, flakes, bran, cereals, honey, sunflower oil, beans, peas, lentils | Novus, Ashan, MehaMarket |

Source: References [51,52].

References

- Mariyono, J.; Kuntariningsih, A.; Suswati, E.; Kompas, T. Quantity and monetary value of agrochemical pollution from intensive farming in Indonesia. Manag. Environ. Qual. 2018, 29, 759–779. [Google Scholar] [CrossRef]

- Czyżewski, B.; Matuszczak, A.; Miśkiewicz, R. Public goods versus the farm price-cost squeeze: Shaping the sustainability of the EU’s common agricultural policy. Technol. Econ. Dev. Eco. 2019, 25, 82–102. [Google Scholar] [CrossRef]

- Trukhachev, V.; Sklyarov, I.; Sklyarova, Y.; Gorlov, S.; Volkogonova, A. Monitoring of Efficiency of Russian Agricultural Enterprises Functioning and Reserves for Their Sustainable Development. Montenegrin J. Econ. 2018, 14, 95–108. [Google Scholar] [CrossRef]

- The World of Organic Agriculture 2019. Available online: https://www.organic-world.net/yearbook/yearbook-2019/data-tables.html (accessed on 19 September 2019).

- Kovalchuk, S.Y.; Muliar, L.V. Sustainable development of the world economy: The role of organic production. Agrosvit 2014, 23, 61–66. (In Ukrainian) [Google Scholar]

- Forschungsinstitut für Biologischen Landbau (FiBL). Available online: http://www.fibl.org/en/homepage.htm (accessed on 6 September 2019).

- Novak, N.P. Principles and competitive advantages of the development of organic agricultural production in Ukraine. Agrosvit 2016, 9, 23–28. (In Ukrainian) [Google Scholar]

- Roitner-Schobesberger, B.; Darnhofer, I.; Somsook, S.; Vogl, C.R. Consumer Perceptions of Organic Foods in Bangkok, Thailand. Food Policy 2008, 33, 112–121. [Google Scholar] [CrossRef]

- Kucher, A.; Heldak, M.; Kucher, L.; Fedorchenko, O.; Yurchenko, Y. Consumer willingness to pay a price premium for ecological goods: A case study from Ukraine. Environ. Socio-Econ. Stud. 2019, 7, 38–49. [Google Scholar] [CrossRef]

- Kosark, N.S.; Kuzio, N.I. Research of the organic Food Market of Ukraine and Directions of Increasing its Competitiveness. Electron. Sci. Prof. Ed. Eff. Econ. 2016, 3. Available online: http://www.economy.nayka.com.ua/?op=1&z=4777&p=1 (accessed on 10 February 2020). (In Ukrainian).

- Federation of Organic Movement of Ukraine. Organic Soybean Cultivation in Ukraine. Available online: http://organic.com.ua/en/organic-soybean-cultivation-in-ukraine/ (accessed on 3 November 2019). (In Ukrainian).

- Lotter, D.W. Organic Agriculture. J. Sustain. Agric. 2003, 21, 59–128. [Google Scholar] [CrossRef]

- Bhavsar, H. The rise of organic food and farming practices. J. Agric. Sci. Bot. 2017, 1, 1. [Google Scholar] [CrossRef]

- Act of Sweden on Organic Production Control (SFS 2013:363) from 23 May 2013 H Wcb-sitc Eco-Lcx. Available online: https://www.ecolex.org/details/legislation/act-on-organic-production-control-sfs-2013363-lex-faoc125965/ (accessed on 3 November 2019).

- Ayuya, O.I. Organic certified production systems and household income: Micro level evidence of heterogeneous treatment effects. Org. Agric. 2019, 9, 417–433. [Google Scholar] [CrossRef]

- Voskobiinyk, Y.P.; Havaza, I.V. Capacity of the organic produce market in Ukraine. Agroinkom 2013, 4, 7–10. (In Ukrainian) [Google Scholar]

- Wiera, M.; Jensen, K.O.; Andersena, L.A.; Millock, K. The character of demand in mature organic food markets: Great Britain and Denmark compared. Food Policy 2008, 33, 406–421. [Google Scholar] [CrossRef]

- Browne, A.W.; Harris, P.J.C.; Hofny-Collins, A.H.; Pasiecznik, N.; Wallace, R.R. Organic production and ethical trade: Definition, practice and links. Food Policy 2000, 25, 69–89. [Google Scholar] [CrossRef]

- Klitna, M.; Bryzhan, I. State and Development of Organic Production and Market of Organic Products in Ukraine. Eff. Econ. 2013, 10. Available online: http://www.economy.nayka.com.ua/?op=1&z=2525 (accessed on 26 November 2019).

- Dabija, D.C.; Bejan, B.M.; Dinu, V. How sustainability oriented is generation Z in retail? A literature review. Transform. Bus. Econ. 2019, 18, 140–155. [Google Scholar]

- Løes, A.; Adler, S. Increased utilisation of renewable resources: Dilemmas for organic agriculture. Org. Agric. 2019, 9, 459–469. [Google Scholar] [CrossRef]

- Wallenbeck, A.; Rousing, T.; Sørensen, J.T.; Bieber, A.; Neff, A.S.; Fuerst-Waltl, B.; March, S. Characteristics of organic dairy major farm types in seven European countries. Org. Agric. 2019, 9, 275–291. [Google Scholar] [CrossRef]

- Muller, A.; Schader, C.; El-Hage Scialabba, N.; Brüggemann, J.; Isensee, A.; Erb, K.H.; Niggli, U. Strategies for feeding the world more sustainably with organic agriculture. Nat. Commun. 2017, 8, 1290. [Google Scholar] [CrossRef]

- Kobets, M.I. Organic farming in the context of sustainable development. In Agrarian Policy for Human Development Project; UNDP: New York, NY, USA, 2004. (In Ukrainian) [Google Scholar]

- Kulish, L. Development of Competitive Organic Production in Ukraine. Invest. Prac. Exp. 2019, 1, 42–46. (In Ukrainian) [Google Scholar] [CrossRef][Green Version]

- Smith, O.M.; Cohen, A.L.; Rieser, C.J.; Davis, A.G.; Taylor, J.M.; Adesanya, A.W.; Jones, M.S.; Meier, A.R.; Reganold, J.P.; Orpet, R.J.; et al. Organic Farming Provides Reliable Environmental Benefits but Increases Variability in Crop Yields: A Global Meta-Analysis. Front. Sustain. Food Syst. 2019, 3, 82. [Google Scholar] [CrossRef]

- Madhusudhan, L. Organic Farming-Ecofriendly Agriculture. J. Ecosys Ecograph 2016, 6, 209. [Google Scholar] [CrossRef]

- Caradonna, J.L. Organic Agriculture is Going Mainstream, but not the Way You Think it is. Available online: https://theconversation.com/organic-agriculture-is-going-mainstream-but-not-the-way-you-think-it-is-92156 (accessed on 5 December 2019).

- Porodina, L.V. The current state of regulation of the safe food market: World experience. Commod. Sci. Innov. 2013, 5, 188–197. (In Ukrainian) [Google Scholar]

- Pietola, K.S.; Lansink, A.O. Farmer response to policies promoting organic farming technologies in Finland. Eur. Rev. Agric. Econ. 2001, 28, 1–15. [Google Scholar] [CrossRef]

- Wikipedia. Organic Farming. Available online: https://en.wikipedia.org/wiki/Organic_farming (accessed on 18 December 2019).

- Organic Standard—More than 10 Years of Leadership and Reliability. Available online: https://organicstandard.ua/en (accessed on 16 December 2019).

- Ministry of Agrarian Policy and Food of Ukraine. Organic Production in Ukraine. 4 February 2019. Available online: https://agro.me.gov.ua/en/napryamki/organichne-virobnictvo-v-ukrayini (accessed on 17 December 2019).

- Willer, H.; Lernoud, J. (Eds.) The World of Organic Agriculture. In Statistics & Emerging Trends 2019; Research Institute of Organic Agriculture FiBL; IFOAM—Organics International: Bonn, Germany, 2019. [Google Scholar]

- AgroPolit.com. Organic Production in Ukraine is Growing 5 Times Faster than in the EU. 17 June 2019. Available online: https://agropolit.com/news/12556-organichne-virobnitstvo-v-ukrayini-zrostaye-u-5-raziv-shvidshe-nij-v-yes (accessed on 20 October 2019).

- AgroPortal. Organic Ukraine in Infographic. 13 March 2019. Available online: https://agroportal.ua/en/publishing/infografika/organicheskaya-ukraina-v-infografike/ (accessed on 29 October 2019).

- Cernansky, R. We don’t Have Enough Organic Farms. Why Not? Available online: https://www.nationalgeographic.com/environment/future-of-food/organic-farming-crops-consumers/ (accessed on 2 February 2020).

- Prokopchuk, N.; Zigg, T.; Vlasyuk, J. Organizational Business Owner of Ukraine. Available online: http://www.ukraine.fibl.org/fileadmin/documentsukraine/UKRAINE_ORGANIC_BUSINESS_DIRECTORY_part2.pdf (accessed on 15 November 2019).

- Organic Standard Ltd. Available online: https://www.organicstandard.ua/ua (accessed on 16 December 2019).

- Makarenko, N.A.; Bondar, V.I.; Nikityuk, Y.A. Ecological inspection of technologies of growing the grain crops (on the example of technologies of growing summer wheat in the area of northern forest-steppe). Agroecol. J. 2009, 1, 24–30. (In Ukrainian) [Google Scholar]

- Kovalenko, N.P. Ecologically balanced crop rotation of alternative agriculture: Historical aspects. Agroecol. J 2012, 4, 95–99. (In Ukrainian) [Google Scholar]

- Feshchenko, N.M. Problematic moments of the organic agricultural market. Innov. Econ. 2013, 7, 141–149. (In Ukrainian) [Google Scholar]

- Yatsenko, O.M.; Yatsenko, O.V.; Nitsenko, V.S.; Butova, D.V.; Reva, O.V. Asymmetry of the development of the world agricultural market. Financ. Credit Act. Probl. Theory Prac. 2019, 30, 423–434. [Google Scholar] [CrossRef]

- Kruhliak, O.V. Organic production in dairy cattle breeding in Ukraine. Econ. Agric. 2017, 5, 33–38. (In Ukrainian) [Google Scholar]

- Penn State. Conservation Dairy Farming Could Help Pa. Meet Chesapeake Target. Available online: http://www.sciencedaily.com/releases/2018/09/180913134548.htm (accessed on 16 February 2020).

- Adamchak, R. Organic Farming; Encyclopædia Britannica, Inc.: Chicago, IL, USA, 2018; Available online: https://www.britannica.com/topic/organic-farming (accessed on 19 February 2020).

- Freyer, B.; Bingen, J.; Fiala, V. Seven myths of organic agriculture and food research. Org. Agric. 2019, 9, 263–273. [Google Scholar] [CrossRef]

- Leu, A.; Regeneration International. Organic Agriculture Can Feed the World. Available online: https://regenerationinternational.org/2018/10/22/organic-agriculture-can-feed-the-world/ (accessed on 15 February 2020).

- Zhang, L.; Li, X. Changing institutions for environmental policy and politics in New Era China. Chin. J. Popul. Resour. Environ. 2018, 16, 242–251. [Google Scholar] [CrossRef]

- Freedman, B. Organic Farming. Available online: https://science.jrank.org/pages/4904/Organic-Farming-popularity-organic-culture.html (accessed on 22 February 2020).

- Organic Standard. Available online: https://organicstandard.ua/en/clients (accessed on 8 February 2020).

- Ekonomichna Pravda. Who Produces Real Organic Produce in Ukraine. Available online: https://www.epravda.com.ua/rus/publications/2019/04/3/646613/ (accessed on 10 February 2020).

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).