Social Finance and Banking Research as a Driver for Sustainable Development: A Bibliometric Analysis

Abstract

1. Introduction

2. Background

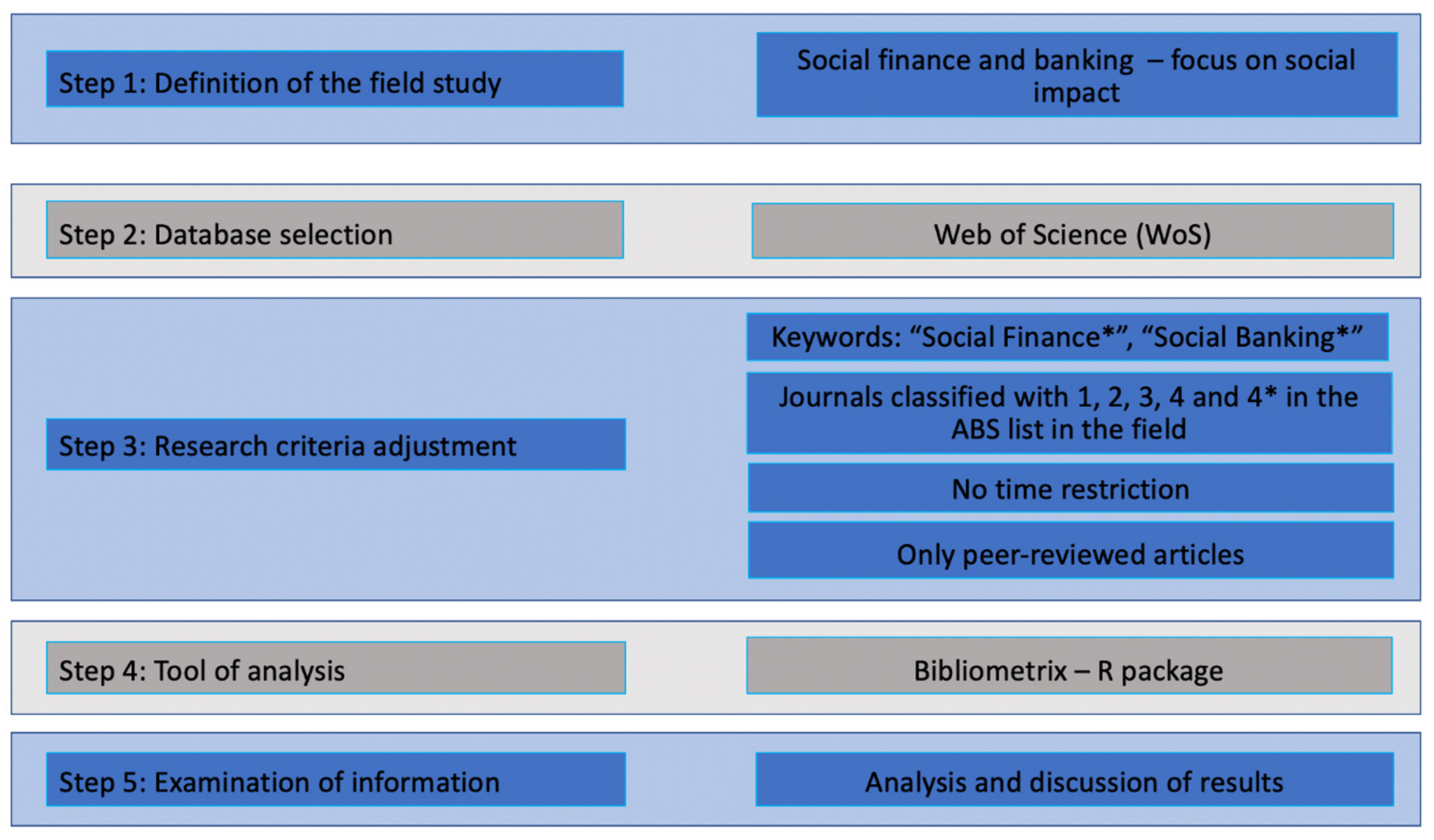

3. Methodology

4. Results

4.1. Main Information

4.2. Sources

4.3. Subject Areas

4.4. Social Structure (Countries, Institutions, and Relevant Authors)

4.5. Conceptual Structure (Trends and Thematic Analysis)

4.6. Conceptual Structure (Trends and Thematic Analysis)

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Bishop, M.; Green, M. Philanthrocapitalism: How Giving Can Save the World; Bloomsbury Publishing: New York, NY, USA, 2010. [Google Scholar]

- Emerson, J.; Spitzer, J. From Fragmentation to Function: Critical Concepts and Writing on Social Capital Markets’ Structure, Operation and Innovation; University of Oxford: Oxford, UK, 2007. [Google Scholar]

- Nicholls, A. The Legitimacy of Social Entrepreneurship: Reflexive Isomorphism in a Pre-Paradigmatic Field. Entrep. Theory Pract. 2010, 34, 611–633. [Google Scholar] [CrossRef]

- Weber, O.; Duan, Y. Social Finance and Banking. In Socially Responsible Finance and Investing: Financial Institutions, Corporations, Investors, and Activists; John Wiley & Sons: Hoboken, NJ, USA, 2012; Volume 160, p. 180. [Google Scholar]

- Périlleux, A. When Social Enterprises Engage in Finance: Agents of Change in Lending Relationships, a Belgian Typology. Strateg. Chang. 2015, 24, 285–300. [Google Scholar] [CrossRef]

- Allison, T.H.; Davis, B.C.; Short, J.C.; Webb, J.W. Crowdfunding in a Prosocial Microlending Environment: Examining the Role of Intrinsic versus Extrinsic Cues. Entrep. Theory Pract. 2015, 39, 53–73. [Google Scholar] [CrossRef]

- Howard, E. Challenges and Opportunities in Social Finance in the UK.; Cicero Group: Washington, DC, USA, 2012. [Google Scholar]

- Martínez-Gómez, C.; Jiménez-Jiménez, F.; Alba-Fernández, M.V. Determinants of Overfunding in Equity Crowdfunding: An Empirical Study in the UK and Spain. Sustainability 2020, 12, 10054. [Google Scholar] [CrossRef]

- Rizzi, F.; Pellegrini, C.; Battaglia, M. The Structuring of Social Finance: Emerging Approaches for Supporting Environmentally and Socially Impactful Projects. J. Clean. Prod. 2018, 170, 805–817. [Google Scholar] [CrossRef]

- De Clerck, F. Ethical banking. In Ethical Prospects; Springer: Berlin/Heidelberg, Germany, 2009; pp. 209–227. [Google Scholar]

- Weber, O.; Remer, S. Social Banks and the Future of Sustainable Finance; Taylor & Francis: Oxfordshire, UK, 2011; Volume 64. [Google Scholar]

- Baraibar-Diez, E.; Luna, M.; Odriozola, M.D.; Llorente, I. Mapping Social Impact: A Bibliometric Analysis. Sustainability 2020, 12, 9389. [Google Scholar] [CrossRef]

- Höhnke, N. Doing Good or Avoiding Evil? An Explorative Study of Depositors’ Reasons for Choosing Social Banks in the Pre and Post Crisis Eras. Sustainability 2020, 12, 10082. [Google Scholar] [CrossRef]

- Rizzello, A.; Kabli, A. Sustainable Financial Partnerships for the SDGs: The Case of Social Impact Bonds. Sustainability 2020, 12, 5362. [Google Scholar] [CrossRef]

- Dal Mas, F.; Massaro, M.; Lombardi, R.; Garlatti, A. From Output to Outcome Measures in the Public Sector: A Structured Literature Review. Int. J. Organ. Anal. 2019, 27, 1631–1656. [Google Scholar] [CrossRef]

- Dumay, J.; Cai, L. A Review and Critique of Content Analysis as a Methodology for Inquiring into IC Disclosure. J. Intellect. Cap. 2014, 15, 264–290. [Google Scholar] [CrossRef]

- Massaro, M.; Dumay, J.; Guthrie, J. On the Shoulders of Giants: Undertaking a Structured Literature Review in Accounting. Account. Audit. Account. J. 2016, 29, 767–801. [Google Scholar] [CrossRef]

- Massaro, M.; Dumay, J.; Garlatti, A.; Dal Mas, F. Practitioners’ Views on Intellectual Capital and Sustainability: From a Performance-Based to a Worth-Based Perspective. J. Intellect. Cap. 2018, 19, 367–386. [Google Scholar] [CrossRef]

- Secinaro, S.; Brescia, V.; Calandra, D.; Biancone, P. Employing Bibliometric Analysis to Identify Suitable Business Models for Electric Cars. J. Clean. Prod. 2020, 264, 121503. [Google Scholar] [CrossRef]

- Secinaro, S.; Calandra, D. Halal Food: Structured Literature Review and Research Agenda. Br. Food J. 2020. ahead-of-print. [Google Scholar] [CrossRef]

- Rangan, V.K.; Appleby, S.; Moon, L. The Promise of Impact Investing; Background Note; Harvard Business School: Boston, MA, USA, 2011. [Google Scholar]

- Eurosif Impact Investing in Europe: Extract from European SRI Study 2014. European Sustainable Investment Forum, Brussel. Available online: https://informaconnect.com/sustainability-and-impact-investor-forum/?vip_code=FKN2742GOOGLE&gclid=Cj0KCQjw7qn1BRDqARIsAKMbHDaP7nZqySPzBzxA_RJDzCAt4JJ8vTBCODDpIH_IL20WG_0AN6sv1CoaAiZEEALw_wcB (accessed on 30 April 2020).

- Baumli, K.; Jamasb, T. Assessing Private Investment in African Renewable Energy Infrastructure: A Multi-Criteria Decision Analysis Approach. Sustainability 2020, 12, 9425. [Google Scholar] [CrossRef]

- Di Domenico, M.; Haugh, H.; Tracey, P. Social Bricolage: Theorizing Social Value Creation in Social Enterprises. Entrep. Theory Pract. 2010, 34, 681–703. [Google Scholar] [CrossRef]

- Gundry, L.K.; Kickul, J.R.; Griffiths, M.D.; Bacq, S.C. Creating Social Change out of Nothing: The Role of Entrepreneurial Bricolage in Social Entrepreneurs’ Catalytic Innovations. Adv. Entrep. Firm Emerg. Growth 2011, 13, 1–24. [Google Scholar]

- Huybrechts, B.; Nicholls, A. Social entrepreneurship: Definitions, drivers and challenges. In Social Entrepreneurship and Social Business; Springer: Berlin/Heidelberg, Germany, 2012; pp. 31–48. [Google Scholar]

- Urmanaviciene, A.; Arachchi, U.S. The Effective Methods and Practices for Accelerating Social Entrepreneurship through Corporate Social Responsibility. Eur. J. Soc. Impact Circ. Econ. 2020, 1, 27–47. [Google Scholar] [CrossRef]

- Martin, M.; Impact Economy. Status of the Social Impact Investing Market: A Primer. 2013. Available online: https://www.impacteconomy.com/papers/IE_PRIMER_JUNE2013_EN (accessed on 10 November 2020).

- Barigozzi, F.; Tedeschi, P. Credit Markets with Ethical Banks and Motivated Borrowers. Rev. Financ. 2015, 19, 1281–1313. [Google Scholar] [CrossRef]

- Nicholls, A. The Institutionalization of Social Investment: The Interplay of Investment Logics and Investor Rationalities. J. Soc. Entrep. 2010, 1, 70–100. [Google Scholar] [CrossRef]

- Secinaro, S.; Corvo, L.; Brescia, V.; Iannaci, D. Hybrid Organizations: A Systematic Review of the Current Literature. Int. Bus. Res. 2019, 12, p1. [Google Scholar] [CrossRef][Green Version]

- Iannaci, D. Reporting Tools for Social Enterprises: Between Impact Measurement and Stakeholder Needs. Eur. J. Soc. Impact Circ. Econ. 2020, 1, 1–18. [Google Scholar] [CrossRef]

- Bugg-Levine, A.; Emerson, J. Impact Investing: Transforming How We Make Money While Making a Difference. Innov. Technol. Gov. Glob. 2011, 6, 9–18. [Google Scholar] [CrossRef]

- Hebb, T. Impact Investing and Responsible Investing: What Does It Mean? Taylor & Francis: Oxfordshire, UK, 2013. [Google Scholar]

- Glänzel, G.; Scheuerle, T. Social Impact Investing in Germany: Current Impediments from Investors’ and Social Entrepreneurs’ Perspectives. Volunt. Int. J. Volunt. Nonprofit Organ. 2016, 27, 1638–1668. [Google Scholar] [CrossRef]

- Dionisio, M. The Evolution of Social Entrepreneurship Research: A Bibliometric Analysis. Soc. Enterp. J. 2019, 15, 22–45. [Google Scholar] [CrossRef]

- Biancone, P.P.; Saiti, B.; Petricean, D.; Chmet, F. The Bibliometric Analysis of Islamic Banking and Finance. J. Islamic Account. Bus. Res. 2020. ahead-of-print. [Google Scholar] [CrossRef]

- Fabregat-Aibar, L.; Barberà-Mariné, M.G.; Terceño, A.; Pié, L. A Bibliometric and Visualization Analysis of Socially Responsible Funds. Sustainability 2019, 11, 2526. [Google Scholar] [CrossRef]

- Okoli, C.; Schabram, K. A Guide to Conducting a Systematic Literature Review of Information Systems Research. SSRN Electron. J. 2010. [Google Scholar] [CrossRef]

- Neely, A. The Evolution of Performance Measurement Research. Int. J. Oper. Prod. Manag. 2005, 25, 1264–1277. [Google Scholar] [CrossRef]

- Riva, P.; Comoli, M.; Bavagnoli, F.; Gelmini, L. Performance Measurement: From Internal Management to External Disclosure. Corp. Ownersh. Control 2015, 13, 907–926. [Google Scholar] [CrossRef]

- Taticchi, P.; Tonelli, F.; Cagnazzo, L. Performance Measurement and Management: A Literature Review and a Research Agenda. Meas. Bus. Excell. 2010, 14, 4–8. [Google Scholar] [CrossRef]

- Chen, G.; Xiao, L. Selecting Publication Keywords for Domain Analysis in Bibliometrics: A Comparison of Three Methods. J. Informetr. 2016, 10, 212–223. [Google Scholar] [CrossRef]

- Dal Mas, F.; Garcia-Perez, A.; José Sousa, M.; Lopes da Costa, R.; Cobianchi, L. Knowledge Translation in the Healthcare Sector, A Structured Literature Review. Electron. J. Knowl. Manag. 2020, 18. [Google Scholar]

- Massaro, M.; Secinaro, S.; Mas, F.D.; Brescia, V.; Calandra, D. Industry 4.0 and Circular Economy: An Exploratory Analysis of Academic and Practitioners’ Perspectives. Bus. Strategy Environ. 2020. [Google Scholar] [CrossRef]

- Li, J.; Wu, D.; Li, J.; Li, M. A Comparison of 17 Article-Level Bibliometric Indicators of Institutional Research Productivity: Evidence from the Information Management Literature of China. Inf. Process. Manag. 2017, 53, 1156–1170. [Google Scholar] [CrossRef]

- Mingers, J.; Willmott, H. Taylorizing Business School Research: On the ‘One Best Way’ Performative Effects of Journal Ranking Lists. Hum. Relat. 2013, 66, 1051–1073. [Google Scholar] [CrossRef]

- Tüselmann, H.; Sinkovics, R.R.; Pishchulov, G. Revisiting the Standing of International Business Journals in the Competitive Landscape. J. World Bus. 2016, 51, 487–498. [Google Scholar] [CrossRef]

- Xu, X.; Chen, X.; Jia, F.; Brown, S.; Gong, Y.; Xu, Y. Supply Chain Finance: A Systematic Literature Review and Bibliometric Analysis. Int. J. Prod. Econ. 2018, 204, 160–173. [Google Scholar] [CrossRef]

- Easterby-Smith, M.; Thorpe, R.; Jackson, P.; Lowe, A. Management Research, 4th ed.; SAGE: London, UK, 2012. [Google Scholar]

- Levy, Y.; Ellis, T.J. A Systems Approach to Conduct an Effective Literature Review in Support of Information Systems Research. Inf. Sci. Int. J. Emerg. Transdiscipl. 2006, 9, 181–212. [Google Scholar] [CrossRef]

- Aria, M.; Cuccurullo, C. Bibliometrix: An R-Tool for Comprehensive Science Mapping Analysis. J. Informetr. 2017, 11, 959–975. [Google Scholar] [CrossRef]

- Fry, M.J. Money and Capital or Financial Deepening in Economic Developments. In Money and Monetary Policy in Less Developed Countries; Elsevier: Amsterdam, The Netherlands, 1980; pp. 107–113. [Google Scholar]

- Galbis, V. Financial Intermediation and Economic Growth in Less-Developed Countries: A Theoretical Approach. J. Dev. Stud. 1977, 13, 58–72. [Google Scholar] [CrossRef]

- Cobo, M.J.; López-Herrera, A.G.; Herrera-Viedma, E.; Herrera, F. An Approach for Detecting, Quantifying, and Visualizing the Evolution of a Research Field: A Practical Application to the Fuzzy Sets Theory Field. J. Informetr. 2011, 5, 146–166. [Google Scholar] [CrossRef]

- Aparicio, G.; Iturralde, T.; Maseda, A. Conceptual Structure and Perspectives on Entrepreneurship Education Research: A Bibliometric Review. Eur. Res. Manag. Bus. Econ. 2019, 25, 105–113. [Google Scholar] [CrossRef]

- Garfield, E.; Sher, I.H. Key Words plus [TM]-Algorithmic Derivative Indexing. J. Am. Soc. Inf. Sci. 1993, 44, 298–299. [Google Scholar] [CrossRef]

- Zhang, J.; Yu, Q.; Zheng, F.; Long, C.; Lu, Z.; Duan, Z. Comparing Keywords plus of WOS and Author Keywords: A Case Study of Patient Adherence Research. J. Assoc. Inf. Sci. Technol. 2016, 67, 967–972. [Google Scholar] [CrossRef]

- Latané, B. The Psychology of Social Impact. Am. Psychol. 1981, 36, 343. [Google Scholar] [CrossRef]

- Noyons, E. Bibliometric Mapping of Science in a Policy Context. Scientometrics 2004, 50, 83–98. [Google Scholar] [CrossRef]

- Forina, M.; Armanino, C.; Raggio, V. Clustering with Dendrograms on Interpretation Variables. Anal. Chim. Acta 2002, 454, 13–19. [Google Scholar] [CrossRef]

- Small, H. Co-Citation in the Scientific Literature: A New Measure of the Relationship between Two Documents. J. Am. Soc. Inf. Sci. 1973, 24, 265–269. [Google Scholar] [CrossRef]

- Vogel, B.; Reichard, R.J.; Batistič, S.; Černe, M. A Bibliometric Review of the Leadership Development Field: How We Got Here, Where We Are, and Where We Are Headed. Leadersh. Q. 2020, 101381. [Google Scholar] [CrossRef]

- Garfield, E. Historiographic Mapping of Knowledge Domains Literature. J. Inf. Sci. 2004, 30, 119–145. [Google Scholar] [CrossRef]

- Cetindamar, D.; Ozkazanc-Pan, B. Assessing Mission Drift at Venture Capital Impact Investors. Bus. Ethics A Eur. Rev. 2017, 26, 257–270. [Google Scholar] [CrossRef]

- Ormiston, J.; Charlton, K.; Donald, M.S.; Seymour, R.G. Overcoming the Challenges of Impact Investing: Insights from Leading Investors. J. Soc. Entrep. 2015, 6, 352–378. [Google Scholar] [CrossRef]

- Tullberg, J. Triple Bottom Line—A Vaulting Ambition? Bus. Ethics A Eur. Rev. 2012, 21, 310–324. [Google Scholar] [CrossRef]

- Bacq, S.; Eddleston, K.A. A Resource-Based View of Social Entrepreneurship: How Stewardship Culture Benefits Scale of Social Impact. J. Bus. Ethics 2018, 152, 589–611. [Google Scholar] [CrossRef]

- Herrera, M.E.B. Innovation for Impact: Business Innovation for Inclusive Growth. J. Bus. Res. 2016, 69, 1725–1730. [Google Scholar] [CrossRef]

- Maas, K.; Grieco, C. Distinguishing Game Changers from Boastful Charlatans: Which Social Enterprises Measure Their Impact? J. Soc. Entrep. 2017, 8, 110–128. [Google Scholar] [CrossRef]

- Smith, B.R.; Kistruck, G.M.; Cannatelli, B. The Impact of Moral Intensity and Desire for Control on Scaling Decisions in Social Entrepreneurship. J. Bus. Ethics 2016, 133, 677–689. [Google Scholar] [CrossRef]

- Agyekum, E.O.; Fortuin, K.K.; van der Harst, E. Environmental and Social Life Cycle Assessment of Bamboo Bicycle Frames Made in Ghana. J. Clean. Prod. 2017, 143, 1069–1080. [Google Scholar] [CrossRef]

- Neugebauer, S.; Emara, Y.; Hellerström, C.; Finkbeiner, M. Calculation of Fair Wage Potentials along Products’ Life Cycle–Introduction of a New Midpoint Impact Category for Social Life Cycle Assessment. J. Clean. Prod. 2017, 143, 1221–1232. [Google Scholar] [CrossRef]

- Prasara-A, J.; Gheewala, S.H. Applying Social Life Cycle Assessment in the Thai Sugar Industry: Challenges from the Field. J. Clean. Prod. 2018, 172, 335–346. [Google Scholar] [CrossRef]

- Subramanian, K.; Yung, W.K. Modeling Social Life Cycle Assessment Framework for an Electronic Screen Product—A Case Study of an Integrated Desktop Computer. J. Clean. Prod. 2018, 197, 417–434. [Google Scholar] [CrossRef]

- Jeucken, M. Sustainable Finance and Banking: The Financial Sector and the Future of the Planet; Earthscan: London, UK, 2010. [Google Scholar]

- Zuo, Z.; Zhao, K. The More Multidisciplinary the Better—The Prevalence and Interdisciplinarity of Research Collaborations in Multidisciplinary Institutions. J. Informetr. 2018, 12, 736–756. [Google Scholar] [CrossRef]

- Klemeš, J.J.; Varbanov, P.S.; Huisingh, D. Recent Cleaner Production Advances in Process Monitoring and Optimisation. J. Clean. Prod. 2012, 34, 1–8. [Google Scholar] [CrossRef]

- McCrea, R.; Walton, A.; Leonard, R. Rural Communities and Unconventional Gas Development: What’s Important for Maintaining Subjective Community Wellbeing and Resilience over Time? J. Rural Stud. 2019, 68, 87–99. [Google Scholar] [CrossRef]

- Luo, J.; Kaul, A. Private Action in Public Interest: The Comparative Governance of Social Issues. Strateg. Manag. J. 2019, 40, 476–502. [Google Scholar] [CrossRef]

- Aledo-Tur, A.; Domínguez-Gómez, J.A. Social Impact Assessment (SIA) from a Multidimensional Paradigmatic Perspective: Challenges and Opportunities. J. Environ. Manag. 2017, 195, 56–61. [Google Scholar] [CrossRef]

- Schinckus, C. Financial Innovation as a Potential Force for a Positive Social Change: The Challenging Future of Social Impact Bonds. Res. Int. Bus. Financ. 2017, 39, 727–736. [Google Scholar] [CrossRef]

- Arena, M.; Bengo, I.; Calderini, M.; Chiodo, V. Social Impact Bonds: Blockbuster or Flash in a Pan? Int. J. Public Adm. 2016, 39, 927–939. [Google Scholar] [CrossRef]

- Revelli, C. Re-Embedding Financial Stakes within Ethical and Social Values in Socially Responsible Investing (SRI). Res. Int. Bus. Financ. 2016, 38, 1–5. [Google Scholar] [CrossRef]

- Shen, C.-H.; Chang, Y. Ambition Versus Conscience, Does Corporate Social Responsibility Pay off? The Application of Matching Methods. J. Bus. Ethics 2009, 88, 133–153. [Google Scholar] [CrossRef]

- Campra, M.; Esposito, P.; Lombardi, R. The Engagement of Stakeholders in Nonfinancial Reporting: New Information-Pressure, Stimuli, Inertia, under Short-Termism in the Banking Industry. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1436–1444. [Google Scholar] [CrossRef]

- Davila, A.; Rodriguez-Lluesma, C.; Elvira, M.M. Engaging Stakeholders in Emerging Economies: The Case of Multilatinas. J. Bus. Ethics 2018, 152, 949–964. [Google Scholar] [CrossRef]

- Haggerty, J.; McBride, K. Does Local Monitoring Empower Fracking Host Communities? A Case Study from the Gas Fields of Wyoming. J. Rural Stud. 2016, 43, 235–247. [Google Scholar] [CrossRef]

- Muñoz de Prat, J.; Escriva-Beltran, M.; Gómez-Calvet, R. Joint Ventures and Sustainable Development. A Bibliometric Analysis. Sustainability 2020, 12, 10176. [Google Scholar] [CrossRef]

| Variables | Explanation | Results |

| Timespan | Year of publication | 1986–2019 |

| Sources (journals, books, etc.) | The frequency distribution of sources as journals | 19 |

| Documents (articles) | Total number of documents | 270 |

| Average years from publication | - | 5.96 |

| Average citations per document | The average number of citations in each document | 19.19 |

| Average citations per year per document | The average number of citations in each article | 2411 |

| References | Total number of references | 13.964 |

| DOCUMENT CONTENTS | ||

| Keywords plus (ID) | Total number of phrases that frequently appear in the title and on the article’s references | 832 |

| Author’s keywords (DE) | Total number of keywords | 1.065 |

| AUTHORS | ||

| Authors | Total number of authors | 741 |

| Author appearances | The authors’ frequency distribution | 774 |

| Authors of single-authored documents | The number of single authors per article | 43 |

| Authors of multi-authored documents | The number of authors of multi-authored articles | 698 |

| AUTHORS COLLABORATION | ||

| Single-authored documents | - | 44 |

| Documents per author | - | 0.364 |

| Authors per document | - | 2.74 |

| Co-Authors per documents | - | 2.87 |

| Collaboration index | - | 3.09 |

| Journal | Number of Articles | H-Index | Citations |

|---|---|---|---|

| Journal of Cleaner Production | 40 | 14 | 649 |

| Journal of Business Ethics | 23 | 13 | 618 |

| Physica A: Statistical Mechanics and its Applications | 17 | 7 | 189 |

| Journal of Business Research | 13 | 6 | 230 |

| Journal of Social Entrepreneurship | 11 | 4 | 35 |

| Social Enterprise Journal | 11 | 3 | 37 |

| Technological Forecasting and Social Change | 11 | 6 | 143 |

| Energy Policy | 10 | 6 | 371 |

| Human Organization | 10 | 7 | 135 |

| Computers in Human Behavior | 9 | 6 | 157 |

| Authors | A | C | C/A | 1st A | Last A | H-Index | Country | Affiliation |

|---|---|---|---|---|---|---|---|---|

| Aseem Kaul | 3 | 28 | 9.33 | 2018 | 2019 | 11 | USA | University of Minnesota |

| Jiao Luo | 3 | 28 | 9.33 | 2018 | 2019 | 9 | USA | University of Minnesota |

| Jarrod Ormiston | 3 | 14 | 4.67 | 2015 | 2019 | 4 | Netherlands | Maastricht University |

| Jing Shao | 3 | 26 | 8.67 | 2016 | 2016 | 8 | China | Northwestern Polytechnical University |

| Frank Vanclay | 3 | 46 | 15.33 | 2017 | 2018 | 57 | Netherlands | University of Groningen |

| Irene Bengo | 2 | 18 | 9.00 | 2016 | 2018 | 7 | Italy | Politecnico di Milano |

| Mario Calderini | 2 | 18 | 9.00 | 2016 | 2018 | 17 | Italy | Politecnico di Milano |

| Jana Dlouhà | 2 | 36 | 18.00 | 2013 | 2018 | 13 | Czech Republic | Charles University |

| Bob Doherty | 2 | 2 | 1.00 | 2019 | 2019 | 29 | UK | The University of York |

| Daniel M. Franks | 2 | 39 | 19.50 | 2012 | 2014 | 28 | Australia | University of Queensland |

| Keywords Plus (Top 20) | Articles |

|---|---|

| Entrepreneurship | 23 |

| Framework | 21 |

| Management | 19 |

| Performance | 18 |

| Sustainability | 16 |

| Innovation | 15 |

| Impact | 14 |

| Social impact | 14 |

| Behavior | 12 |

| Governance | 10 |

| Model | 10 |

| Perceptions | 10 |

| Challenges | 9 |

| Consumption | 9 |

| Impacts | 9 |

| Responsibility | 9 |

| Business | 8 |

| Care | 8 |

| Community | 8 |

| Energy | 8 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Secinaro, S.; Calandra, D.; Petricean, D.; Chmet, F. Social Finance and Banking Research as a Driver for Sustainable Development: A Bibliometric Analysis. Sustainability 2021, 13, 330. https://doi.org/10.3390/su13010330

Secinaro S, Calandra D, Petricean D, Chmet F. Social Finance and Banking Research as a Driver for Sustainable Development: A Bibliometric Analysis. Sustainability. 2021; 13(1):330. https://doi.org/10.3390/su13010330

Chicago/Turabian StyleSecinaro, Silvana, Davide Calandra, Denisa Petricean, and Federico Chmet. 2021. "Social Finance and Banking Research as a Driver for Sustainable Development: A Bibliometric Analysis" Sustainability 13, no. 1: 330. https://doi.org/10.3390/su13010330

APA StyleSecinaro, S., Calandra, D., Petricean, D., & Chmet, F. (2021). Social Finance and Banking Research as a Driver for Sustainable Development: A Bibliometric Analysis. Sustainability, 13(1), 330. https://doi.org/10.3390/su13010330