Research on the Two-Way Time-Varying Relationship between Foreign Direct Investment and Financial Development Based on Functional Data Analysis

Abstract

1. Introduction

2. Literature Review

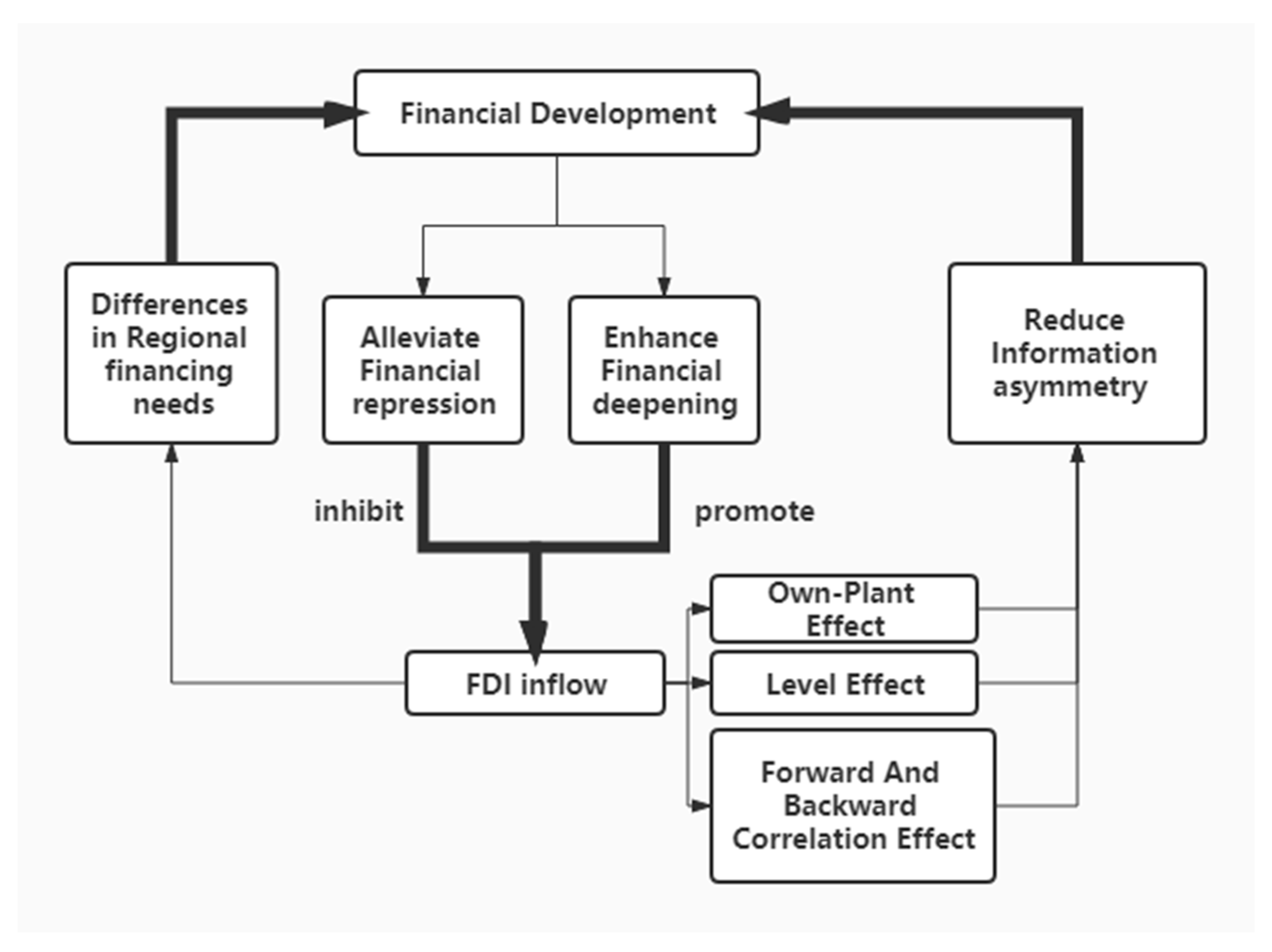

3. The Mutual Impact between Financial Development and FDI

3.1. The Impact of FDI on Financial Development

3.2. The Impact of Financial Development on FDI

4. Data and Model

4.1. Data Source and the Construction of the Index System

4.1.1. Foreign Direct Investment Variable (FDI)

4.1.2. Financial Development

- (1)

- Financial scale expansion (FSE), expressed by the ratio of value added in financial assets to GDP in a region and reflects the share of a financial asset in the wealth of the region [36];

- (2)

- Financial asset structure (FSA), expressed as the ratio of total securities assets to financial assets in a region and reflects the share of direct financing in the financial assets of the region [37];

- (3)

- Financial intermediary efficiency (FIE), equal to the ratio of the balance of loan to the balance of deposit in financial institutions in a region and reflects the deposit–loan conversion rate of financial intermediaries in the region [38].

4.1.3. Control Variable

- (1)

- Marketization index (MD), a comprehensive index for measuring the marketization level and degree of a region. A higher degree of marketization will always promote a rise in the financial development level of the region and attract more FDI inflows;

- (2)

- Urbanization level (UL), expressed as the ratio of urban population to total population of a region. In the process of urbanization, regional requirements for financial development will be increased, and better financial services and a more complete financial system are needed to promote regional financial development. At the same time, FDI inflow will also be attracted in the process of urbanization;

- (3)

- Industrialization level (IND), expressed by the ratio of industrial production value to GDP of a region and measures the industrial development level of the region. As the level increases, the requirements of industrial enterprises for financial services will also increase. At the same time, this increase will further attract the inflow of foreign capital;

- (4)

- Economic development level (ED), expressed by the GDP per capita of a region and measures the economic strength of the region. Compared with the total GDP, GDP per capita can better reflect the economic strength of the region. Governments of regions with strong economic strength often promote the development of local financial industry, and also foster competitive market and attract foreign investors to settle in;

- (5)

- Resident consumption index (CS), expressed by the consumption level of a region (i.e., the ratio of total consumption to the permanent population in the region). In a region with high consumption per capita, the consumption potential is high, which can promote the regional economic development and is closely related to the degree of financial development in the region. At the same time, having a huge number of high-quality consumers will help enterprises increase the market share and attract foreign investors to settle in.

4.2. Functional Fitting of Discrete Data

4.3. Functional Linear Model

4.4. Analysis of the Convergence and Divergence

5. Empirical Results

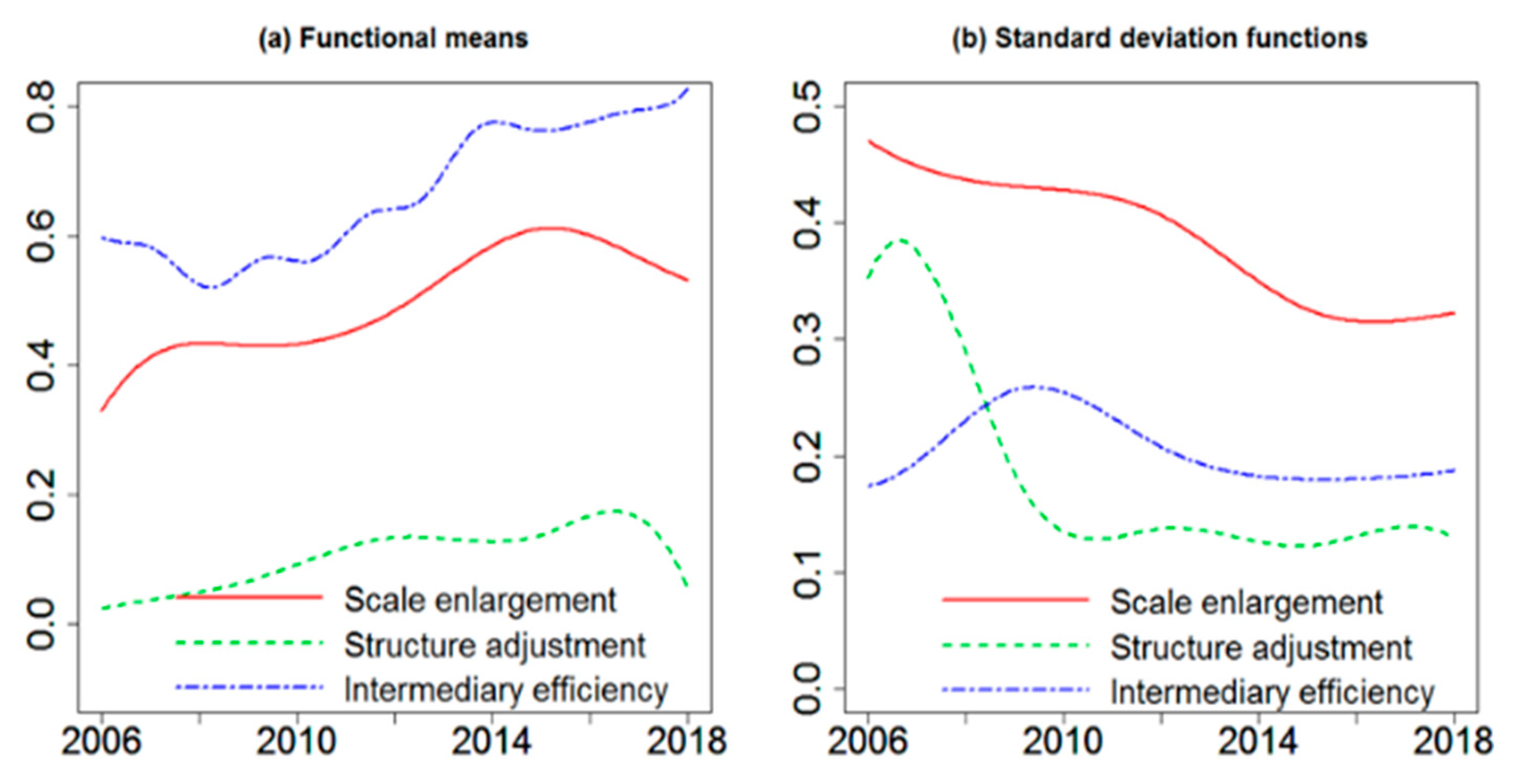

5.1. Statistical Description and Analysis of China’s Overall Financial Development Level Based on Functional Data Analysis

5.2. Statistical Description and Analysis of China’s Overall FDI level Based on Functional Data Analysis

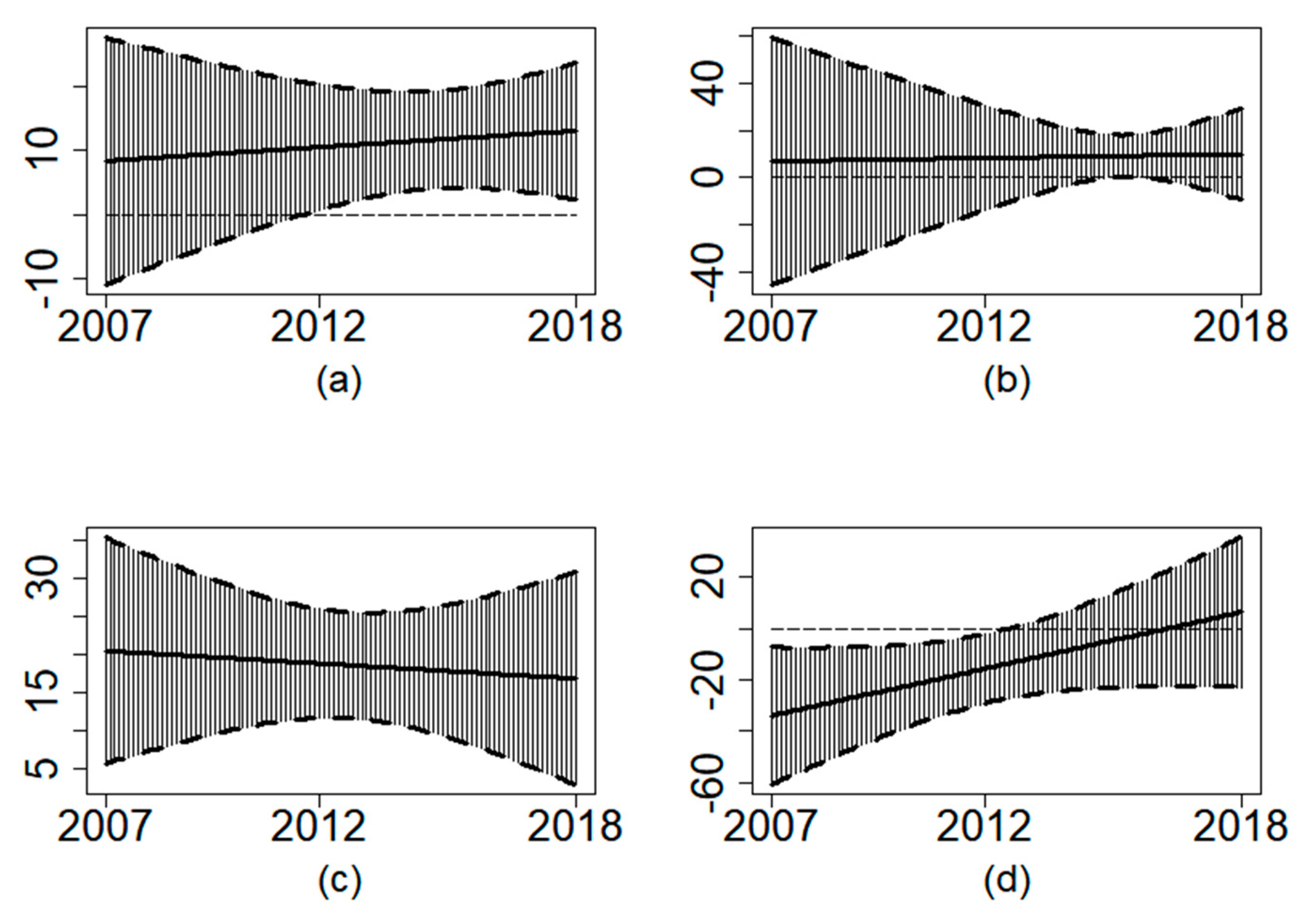

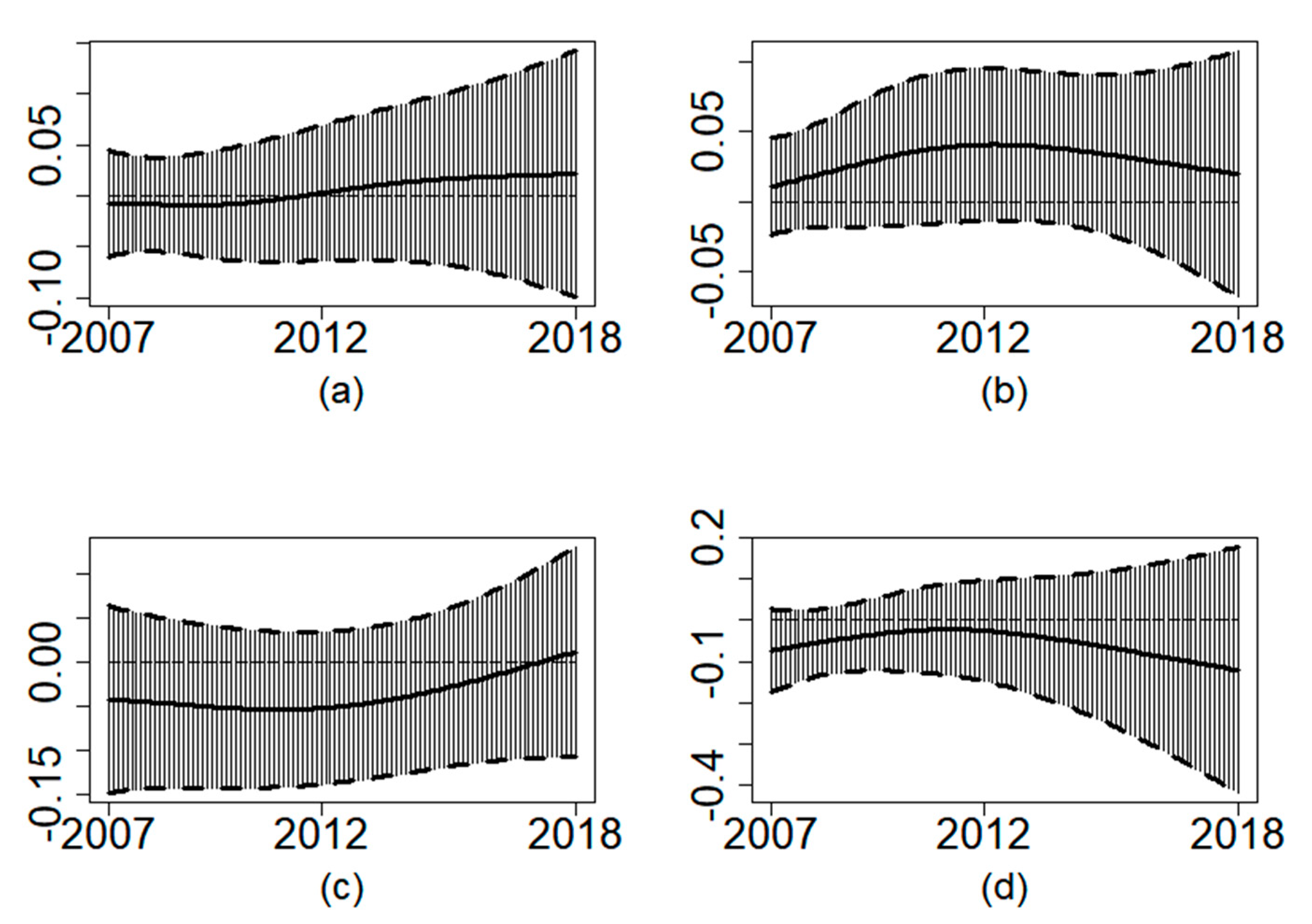

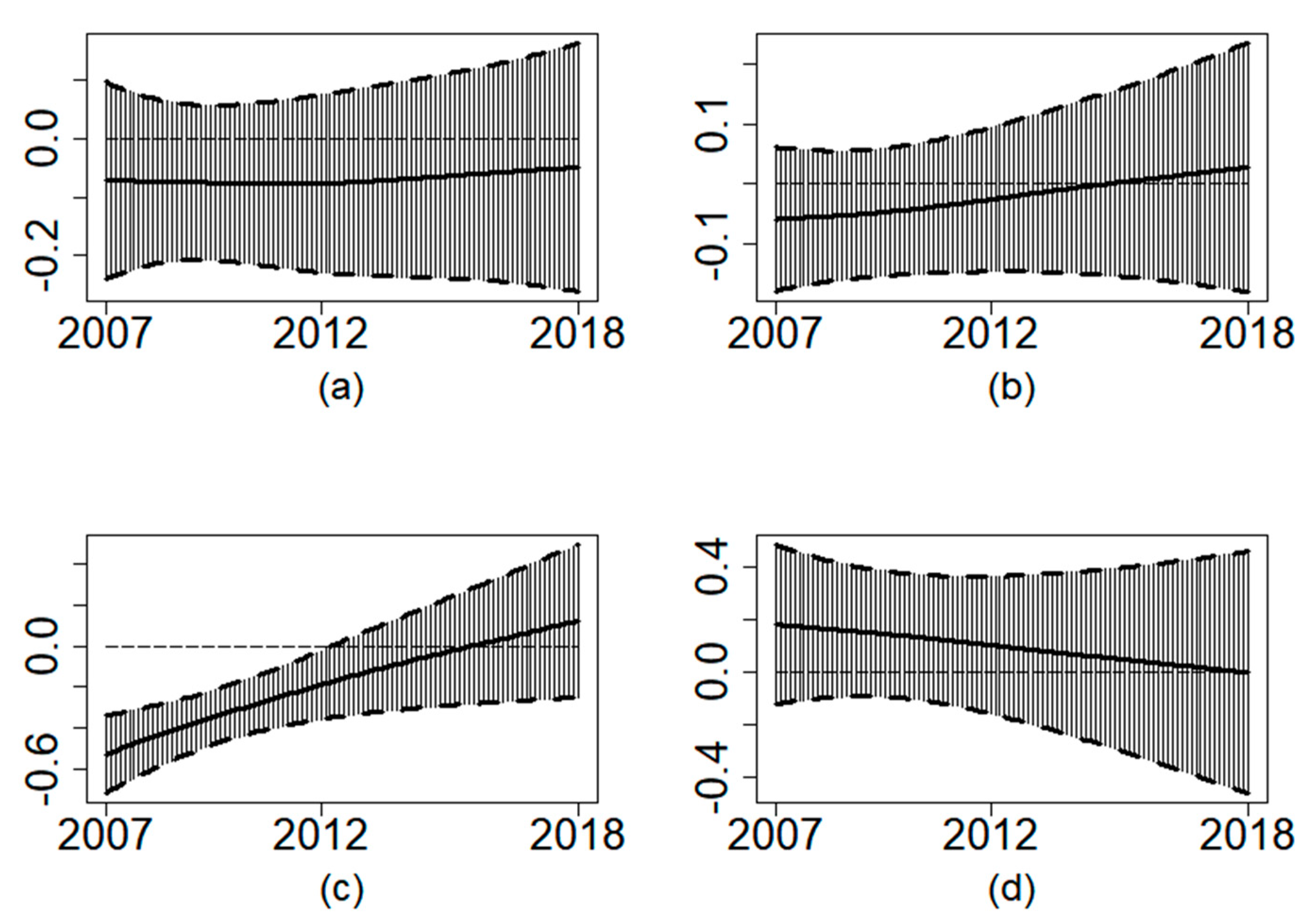

5.3. Analysis on the Time Varying of Financial Development with FDI

5.3.1. Analysis on the Time Varying of FSE with FDI

5.3.2. Analysis on the Time Varying of FSA with FDI

5.3.3. Analysis on the Time Varying of FIE with FDI

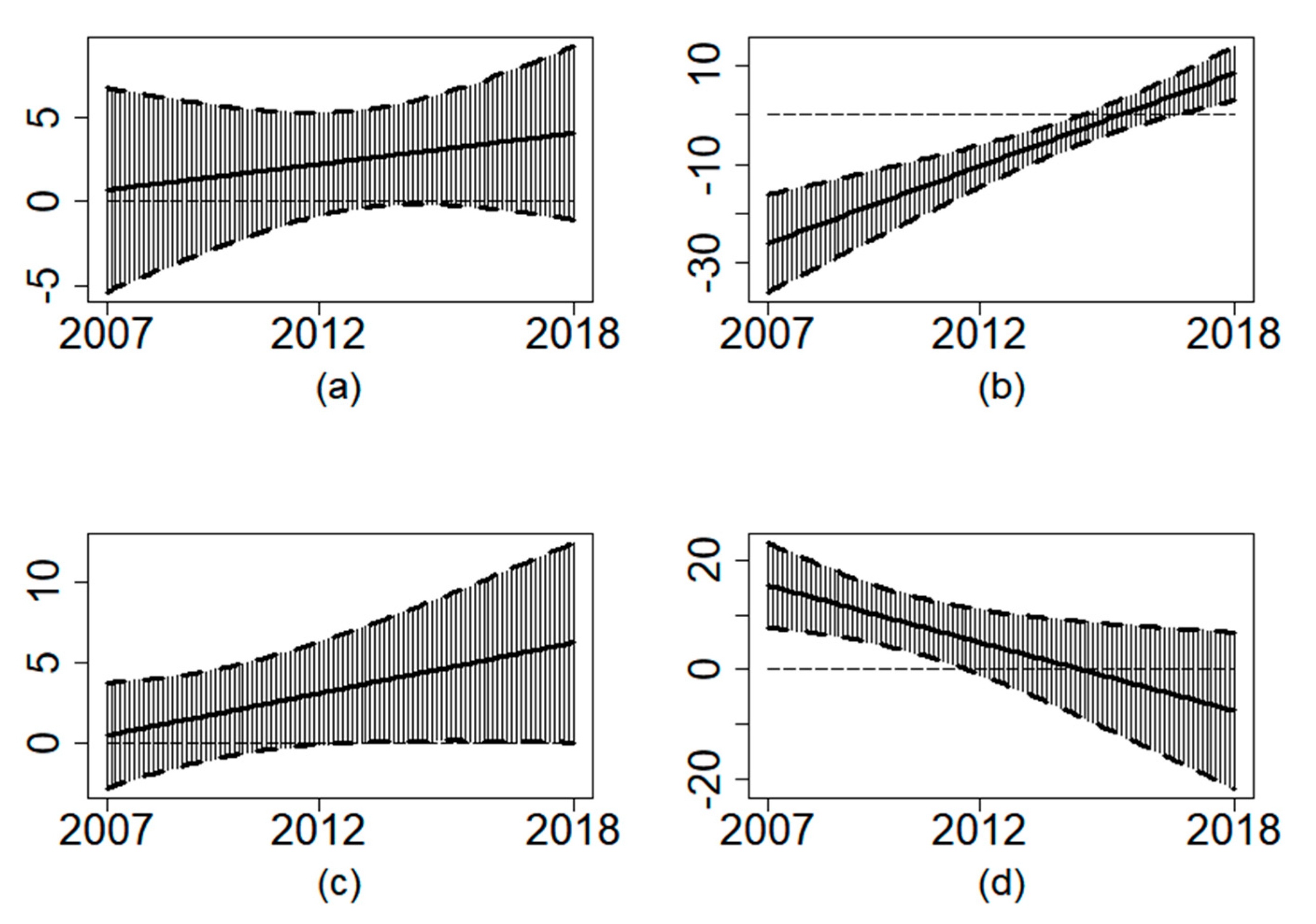

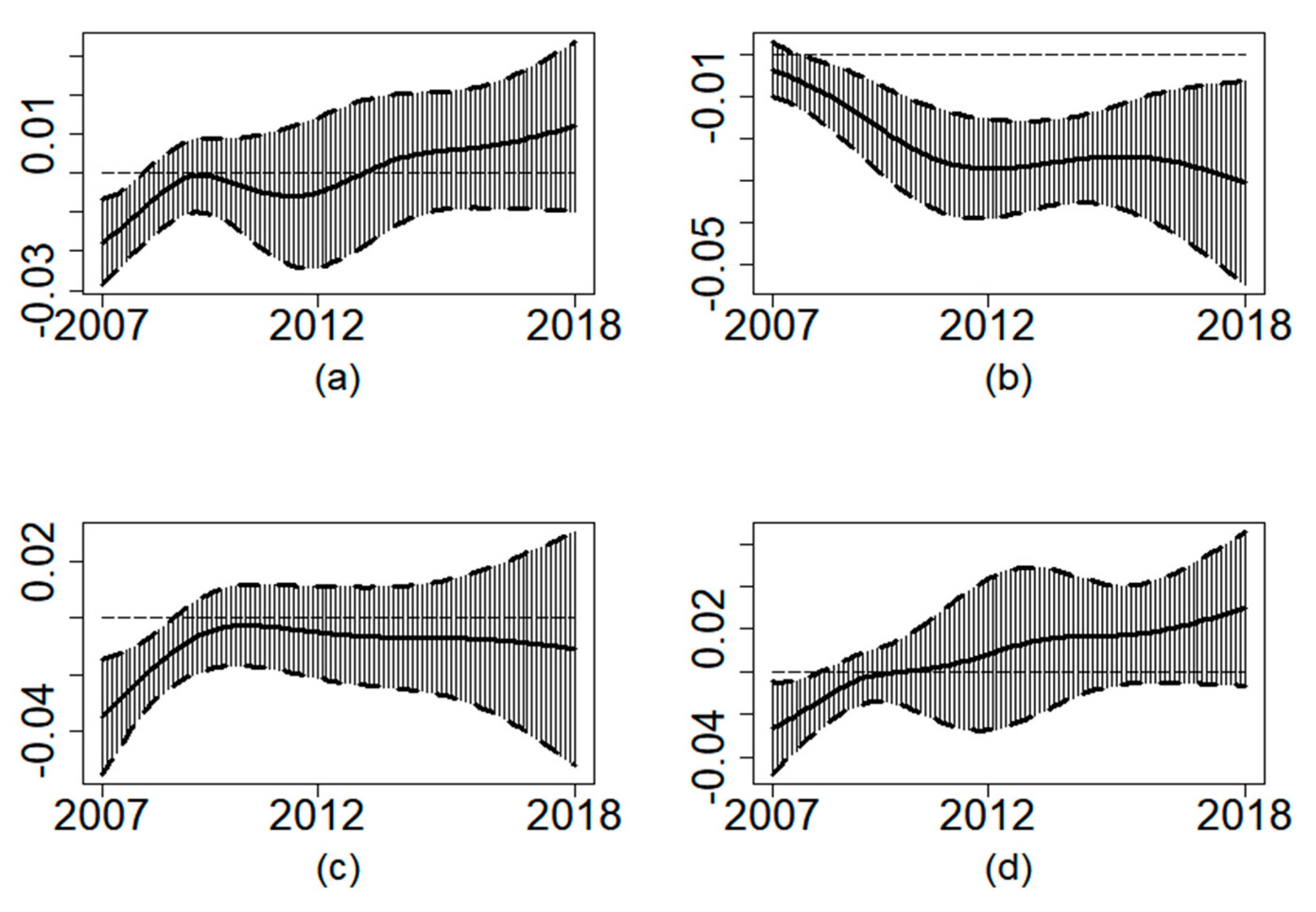

5.4. Analysis on the Time Varying of FDI with Financial Development

5.4.1. Analysis on the Time Varying of FDI with FSE

5.4.2. Analysis on the Time Varying of FDI with FSA

5.4.3. Analysis on the Time Varying of FDI with FIE

6. Discussion

7. Conclusions and Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- UNCTAD. World Investment Report 2019: Special Economic Zones; United Nations Publications: New York, NY, USA, 2019. [Google Scholar]

- Wang, Y.; Jiang, X.L. Empirical Analysis of Financial Development Constraints FDI Spillover Effects. Int. Trade Issues 2011, 5, 138–148. [Google Scholar]

- Eduardo, F.A.; Ricardo, H. Is foreign direct investment a safer form of financing? Emerg. Mark. Rev. 2001, 2, 34–39. [Google Scholar]

- Zhang, L. Financial Market Development, Labour Market Incompleteness and Foreign Direct Investment. Ph.D. Thesis, Nankai University, Tianjin, China, 2013. [Google Scholar]

- Huang, Y. Selling China: Foreign Direct Investment during the Reform Era. China Bus. Re. 2004, 31, 56–57. [Google Scholar]

- Sun, L.J. Financial development, FDI and economic growth. Quant. Econ. Tech. Econ. Stud. 2008, 1, 3–14. [Google Scholar]

- Jia, L.; Kong, F.C. The Empirical Study on Human Capital Accumulation, Financial Development and FDI—Based on Provincial Panel Data in Eastern China. J. Xi’an Inst. Financ. Econ. 2015, 28, 31–35. [Google Scholar]

- Fujita, M.; Hu, D. Regional disparity in China 1985–1994: The effects of globalization and economic liberalization. Ann. Reg. Sci. 2001, 35, 3–37. [Google Scholar] [CrossRef]

- Zhu, T.; Qi, X.; Zhang, L. Does financial distortion cause FDI to flow into our country in large quantities?—Evidence from provincial panel data in China. Nankai Econ. Res. 2010, 4, 33–47. [Google Scholar]

- Zhong, J.; Zhang, Q.L. Effect of Financial Market Development on China’s FDI Technology Spillover and its Threshold Effect Test. Financ. Trade Res. 2010, 21, 98–104. [Google Scholar]

- Li, Z.Y.; Yu, M.J. Productivity, Credit Constraints and Corporate Exports: An Analysis Based on Chinese Enterprise Level. Econ. Res. 2013, 6, 86–100. [Google Scholar]

- Shi, B.Z. Whether FDI improve the quality of exports from local enterprises. Int. Bus. Stud. 2015, 2, 5–20. [Google Scholar]

- Cai, G.W.; Yang, H. Can Foreign Direct Investment Improve the Distortion of China’s Factor Market. China Ind. Econ. 2019, 10, 42–60. [Google Scholar]

- Zhou, B.C.; Shao, H.l. Spatial econometric analysis of FDI, Financial Development and Regional Economic Growth—Based on Interprovincial Panel Data. Econ. Restruct. 2020, 4, 150–157. [Google Scholar]

- Zhang, Z.Y. Promoting the sustainable development of regional finance in China. China Soc. Sci. J. 2020, 3, 27–28. [Google Scholar]

- Ju, J.; Wei, S.J. Domestic Institutions and the Bypass Effect of Financial Globalization. Am. Econ. J. Econ. Policy 2010, 2, 173–204. [Google Scholar] [CrossRef]

- Ezeoha, A.E.; Cattaneo, N. FDI Flows to Sub-Saharan Africa: The Impact of Finance, Institutions, and Natural Resource Endowment. Comp. Econ. Stud. 2012, 54, 597–632. [Google Scholar] [CrossRef]

- Xian, G.M.; Leng, Y.L. The Empirical Analysis of Local Government Debt, Financial Development and FDI—Based on Spatial Metrological Economic Model. Nankai Econ. Res. Inst. 2016, 3, 52–74. [Google Scholar]

- Ma, Y.J. Research on the Relationship between Financial Development, FDI and Economic Growth. Master’s Thesis, Jilin University, Changchun, China, 2013. [Google Scholar]

- Xia, P.l. A Study on the Impact of Foreign Direct Investment in China’s Financial Development. Master’s Thesis, Northeast University of Finance and Economics, Dalian, China, 2019. [Google Scholar]

- Guariglia, A.; Poncet, S. Could Financial Distortions Be No Impediment to Economic Growth? Evidence from China. J. Comp. Econ. 2008, 36, 633–657. [Google Scholar] [CrossRef]

- Wang, J.l. An Empirical Analysis of the Impact of Financial Deepening Foreign Direct Investment. Master’s Thesis, Hangzhou University of Electronic Science and Technology, Hangzhou, China, 2013. [Google Scholar]

- Ni, K.Q. Foreign Direct Investment and Financial Innovation. Financ. Econ. 2002, 04, 23–26. [Google Scholar]

- Zhang, C.S.; Zhu, Y.T.; Lu, Z. A Mystery on the Curbing Effect of Opening to the World. Financ. Dev. Financ. Res. 2013, 6, 16–30. [Google Scholar]

- Yu, Q.H. Foreign Direct Investment, Financial Development and Green Economic Growth. Master’s Thesis, Southwest University of Finance and Economics, Chengdu, China, 2019. [Google Scholar]

- Zeng, L.T.; Ye, A.Z. Spatial Nonlinear Relationship between Foreign Direct Investment and Financial Development from the Perspective of Technology Innovation—An Empirical Test Based on Semi-parametric Spatial Model. Ind. Technol. Econ. 2017, 36, 126–132. [Google Scholar]

- Xun, X.Y. Study on the impact of FDI on Regional Financial Development in China. Master’s Thesis, Shandong University of Technology, Shandong, China, 2020. [Google Scholar]

- Wang, H.; Liu, H.F.; Carlucci, F. An Empirical Research of FDI Spillovers and Financial Development Threshold Effects in Different Regions of China. Sustainability 2017, 9, 933. [Google Scholar] [CrossRef]

- Mollah, A.I.; Muhammad, A.K.; József, P.W.; Sroka, J.O. Financial Development and Foreign Direct Investment—The Moderating Role of Quality Institutions. Sustainability 2020, 12, 3556. [Google Scholar]

- Chen, Q.X.; Zhang, F.; Chen, M.-H.; Cong, X.J. Estimation of treatment effects and model diagnostics with two-way time-varying treatment switching: An application to a head and neck study. Lifetime Data Anal. 2020, 26, 1–23. [Google Scholar] [CrossRef] [PubMed]

- Wang, D.; Li, X.; Tian, S.; He, L.; Xu, Y.; Wang, X. Quantifying the dynamics between environmental information disclosure and firms’ financial performance using functional data analysis. Sustain. Prod. Consum. 2021, 28, 192–205. [Google Scholar] [CrossRef]

- Wang, D.; Ye, T.; Tian, S.; Wang, X. Reexamining Spatiotemporal Disparities of Financial Development in China Based on Functional Data Analysis. Math. Prob. Eng. 2021, 2021, 1–19. [Google Scholar]

- You, W.; Xu, G. Does financial development have a non-linear impact on energy consumption? Evidence from 30 provinces in China. Energy Econ. 2020, 90, 104845. [Google Scholar]

- Xie, Q.X.; Zhang, Y. The Empirical Analysis of the Impact of Financing Constraints and FDI Flow on Industrial Growth—Taking Zhejiang Province as an Example. Tech. Econ. 2014, 33, 54–58 + 79. [Google Scholar]

- Luo, C.Y. FDI, domestic capital and economic growth—Evidence of interprovincial panel data in China from 1987 to 2001. World Econ. Bull. 2006, 4, 27–43. [Google Scholar]

- Beck, T. Financial development and International Trade: Is there a Link? Soc. Sci. Electron. Publ. 2002, 57, 107–131. [Google Scholar]

- Osterberg, W.P. Tobin’s q, investment, and the endogenous adjustment of financial structure. J. Public Econ. 1989, 40, 293–318. [Google Scholar] [CrossRef]

- Brockett, P.L.; Cooper, W.W.; Golden, L.L. Financial Intermediary Versus Production Approach to Efficiency of Marketing Distribution Systems and Organizational Structure of Insurance Companies. J. Risk Insur. 2005, 72, 393–412. [Google Scholar] [CrossRef]

- Ramsay, J.O.; Silverman, B.W. Functional Data Analysis, 2nd ed.; Springer: New York, NY, USA, 2005. [Google Scholar]

- Ramsay, J.O.; Hooker, G.; Graves, S. Functional Data Analysis with R and MATLAB; Springer: New York, NY, USA, 2009; p. 35. [Google Scholar]

- Craven, P.; Wahba, G. Smoothing noisy data with spline functions. Numer. Math. 1978, 31, 377–403. [Google Scholar] [CrossRef]

- Wang, G.C. Estimation of functional regression model via functional dimension reduction. J. Comput. Appl. Math. 2020, 379, 112948. [Google Scholar] [CrossRef]

- Wang, D.Q.; Tian, S.H.; Zhu, J.P.; Xu, Y. The temporal and spatial differences in income and consumption of urban and rural residents in China and their convergence. J. Appl. Stat. Manag. (accepted).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, D.; Huang, Q.; Ye, T.; Tian, S. Research on the Two-Way Time-Varying Relationship between Foreign Direct Investment and Financial Development Based on Functional Data Analysis. Sustainability 2021, 13, 6033. https://doi.org/10.3390/su13116033

Wang D, Huang Q, Ye T, Tian S. Research on the Two-Way Time-Varying Relationship between Foreign Direct Investment and Financial Development Based on Functional Data Analysis. Sustainability. 2021; 13(11):6033. https://doi.org/10.3390/su13116033

Chicago/Turabian StyleWang, Deqing, Qian Huang, Tianzhi Ye, and Sihua Tian. 2021. "Research on the Two-Way Time-Varying Relationship between Foreign Direct Investment and Financial Development Based on Functional Data Analysis" Sustainability 13, no. 11: 6033. https://doi.org/10.3390/su13116033

APA StyleWang, D., Huang, Q., Ye, T., & Tian, S. (2021). Research on the Two-Way Time-Varying Relationship between Foreign Direct Investment and Financial Development Based on Functional Data Analysis. Sustainability, 13(11), 6033. https://doi.org/10.3390/su13116033