A Comparative Study between Government Support and Energy Efficiency in Malaysian Transport

Abstract

1. Introduction

2. Literature Review

3. Methodology

3.1. Description of Scenarios

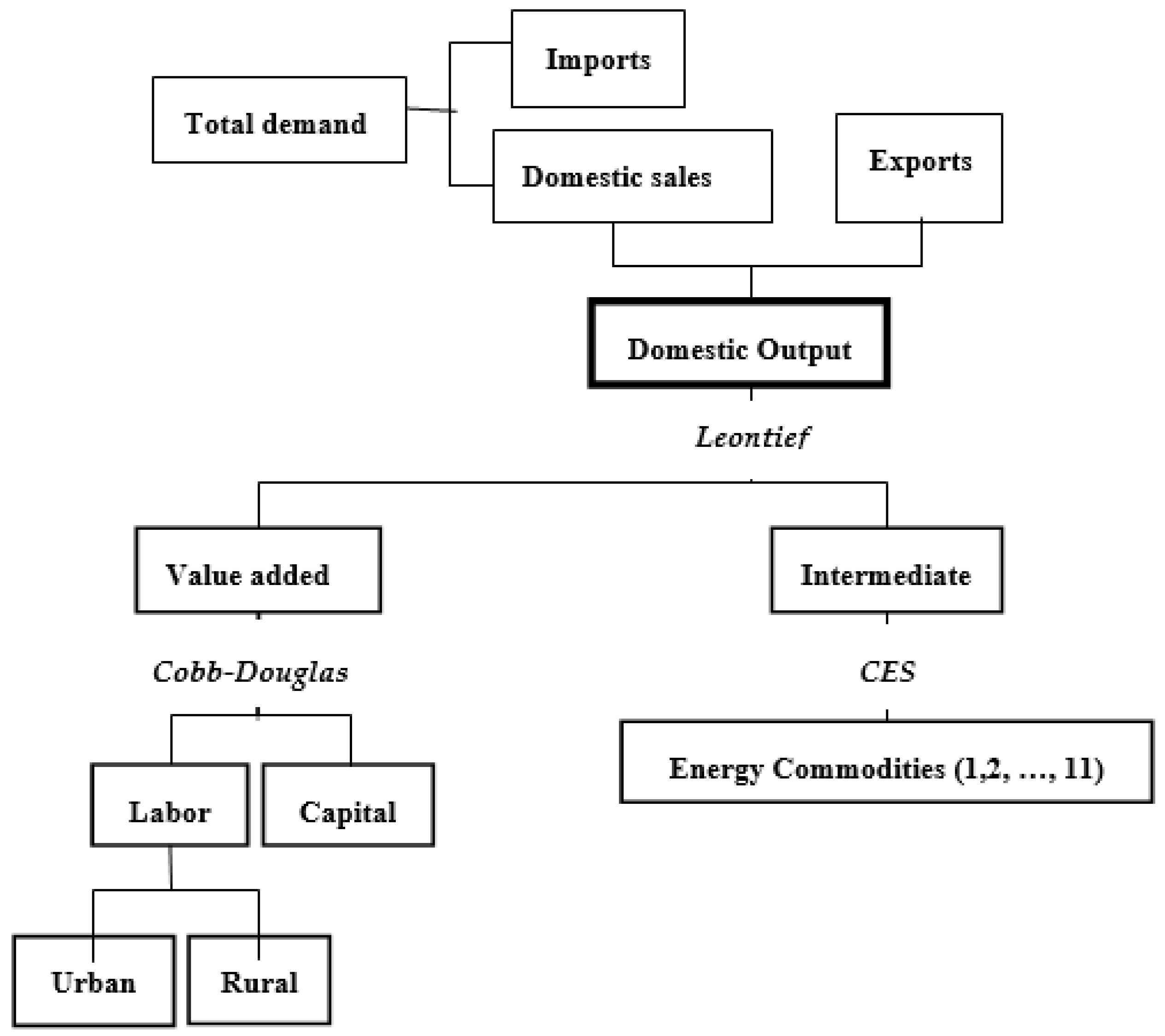

3.2. The Model

3.3. Data and Macro Closures

4. Results and Discussion

4.1. Impacts on Key Macro Variables

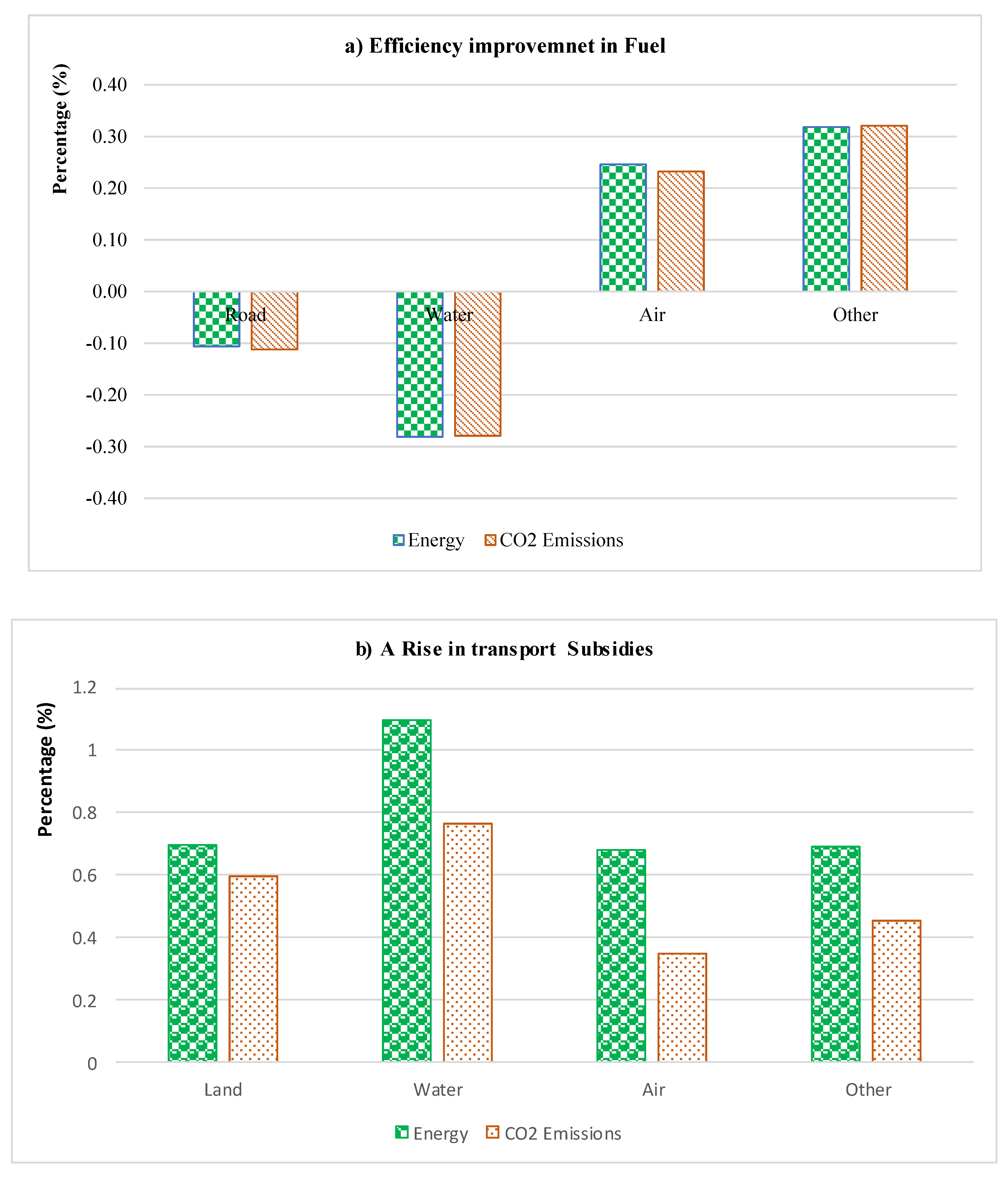

4.2. Impacts on Key Transport Indicators

5. Conclusions and Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Solaymani, S.; Kardooni, R.; Kari, F.; Yusoff, S.B. Economic and environmental impacts of energy subsidy reform and oil price shock on the Malaysian transport sector. Travel Behav. Soc. 2015, 2, 65–77. [Google Scholar]

- Solaymani, S. CO2 emissions patterns in 7 top carbon emitter economies: The case of transport sector. Energy 2019, 168, 989–1001. [Google Scholar] [CrossRef]

- UNECE (United Nations Economic Commission for Europe). Sustainable Development Goals and the UN Transport Conventions; UNECE: Geneva, Switzerland, 2019. [Google Scholar]

- Skorobogatova, O.; Kuzmina-Merlino, I. Transport Infrastructure Development Performance. In Proceedings of the 16th Conference on Reliability and Statistics in Transportation and Communication, Riga, Latvia, 19–22 October 2016. [Google Scholar]

- Elena, K. Energy efficiency of Bulgarian maritime transport. J. Mar. Technol. Environ. 2020, 2, 23–28. [Google Scholar]

- Hue, P.H.; Tuyet, N.T.A. Evaluation of energy intensity of transport service sectors in Vietnam. Environ. Sci. Pollut. Res. 2021, 28, 11860–11868. [Google Scholar] [CrossRef] [PubMed]

- Du, H.; Chen, Z.; Zhang, Z.; Southworth, S. The rebound effect on energy efficiency improvements in China’s transportation sector: A CGE analysis. J. Manag. Sci. Eng. 2020, 5, 249–263. [Google Scholar] [CrossRef]

- Ziolo, M.; Jednak, S.; Savic, G.; Kragulj, D. Link between Energy Efficiency and Sustainable Economic and Financial Development in OECD Countries. Energies 2020, 13, 5898. [Google Scholar] [CrossRef]

- Li, Z.; Solaymani, S. Effectiveness of energy efficiency improvements in the context of energy subsidy policies. Clean Technol. Environ. Policy 2021. [Google Scholar] [CrossRef]

- Cui, Q.; Li, Y. The evaluation of transportation energy efficiency: An application of three-stage virtual frontier DEA. Transp. Res. Part D 2014, 29, 1–11. [Google Scholar] [CrossRef]

- Department of Statistics Malaysia. Time Series Data; Department of Statistics Malaysia: PutraJaya, Malaysia, 2021. [Google Scholar]

- International Energy Agency—IEA. CO2 Emissions from Fuel Combustion: 2019 Highlights; International Energy Agency—IEA: Paris, France, 2019. [Google Scholar]

- Energy Comission. Malaysia’ Energy Information Hub: Statistics; Energy Comission: Putrajaya, Malaysia, 2020. [Google Scholar]

- Solaymani, S.; Kari, F. Environmental and economic effects of high petroleum prices on transport sector. Energy 2013, 60, 435–441. [Google Scholar] [CrossRef]

- Solaymani, S.; Kari, F. Impacts of energy subsidy reform on the Malaysian economy and transportation sector. Energy Policy 2014, 70, 115–125. [Google Scholar] [CrossRef]

- Solaymani, S.; Kardooni, R.; Yusoff, S.B.; Kari, F. The impacts of climate change policies on the transportation sector. Energy 2015, 81, 719–728. [Google Scholar] [CrossRef]

- Solaymani, S. Which government supports are beneficial for the transportation subsectors. Energy 2021. forthcoming. [Google Scholar]

- Agaton, C.B.; Guno, C.S.; Villanueva, R.O.; Villanueva, R.O. Diesel or Electric Jeepney? A Case Study of Transport Investment in the Philippines Using the Real Options Approach. World Electr. Veh. J. 2019, 10, 51. [Google Scholar] [CrossRef]

- Lenz, N.V.; Skender, H.P.; Mirković, P.A. The macroeconomic effects of transport infrastructure on economic growth: The case of Central and Eastern, E.U. member states. Econ. Res. Ekon. Istraživanja 2018, 31, 1953–1964. [Google Scholar] [CrossRef]

- Romp, W.E.; de Haan, J. Public capital and economic growth: A critical survey. EIB Pap. 2007, 10, 41–70. [Google Scholar] [CrossRef]

- Lakshmanan, T.R. The blander economic consequences of transport infrastructure investments. J. Transp. Geogr. 2011, 19, 1–12. [Google Scholar] [CrossRef]

- Banerjee, A.; Duflo, E.; Qian, N. On the land: Access to transportation infrastructure and economic growth in China. J. Dev. Econ. 2020, 145, 102442. [Google Scholar] [CrossRef]

- Ke, X.; Lin, J.Y.; Fu, C.; Wang, Y. Transport Infrastructure Development and Economic Growth in China: Recent Evidence from Dynamic Panel System-GMM Analysis. Sustainability 2020, 12, 5618. [Google Scholar] [CrossRef]

- Tripathi, S.; Gautam, V. Land Transport Infrastructure and Economic Growth in India. J. Infrastruct. Dev. 2010, 2, 135–151. [Google Scholar] [CrossRef]

- Sun, C.; Luo, Y.; Li, J. Urban traffic infrastructure investment and air pollution: Evidence from the 83 cities in China. J. Clean. Prod. 2018, 172, 488–496. [Google Scholar] [CrossRef]

- Pupavac, D.; Krpan, L.; Maršanić, R. The Effect of Subsidies on the Offer of Sea Transport. Naše More Znan. Časopis Za More I Pomor. 2017, 64, 54–57. [Google Scholar]

- Dawood, G.; Mokonyama, M. Towards a More Optimal Passenger Transport System for South Africa: Design of Public Transport Operating Subsidies. Counc. Sci. Ind. Res. 2015, 62, 192–213. [Google Scholar]

- Hu, Y.; Wang, Z.; Li, X. Impact of policies on electric vehicle diffusion: An evolutionary game of small world network analysis. J. Clean. Prod. 2020, 265, 121703. [Google Scholar] [CrossRef]

- Saidi, S.; Shahbaz, M.; Akhtar, P. The long-run relationships between transport energy consumption, transport infrastructure, and economic growth in MENA countries. Transp. Res. Part A 2018, 111, 78–95. [Google Scholar] [CrossRef]

- Raza, S.A.; Shah, N.; Sharif, A. Time frequency relationship between energy consumption, economic growth and environmental degradation in the United States: Evidence from transportation sector. Energy 2019, 173, 706–720. [Google Scholar] [CrossRef]

- Manuela, T. Towards sustainable and secure development: Energy efficiency peculiarities in transport sector. J. Secur. Sustain. Issues 2018, 7, 719–726. [Google Scholar]

- Melo, P.C.; Graham, D.J.; Brage-Ardao, R. The productivity of transport infrastructure investment: A meta-analysis of empirical evidence. Reg. Sci. Urban Econ. 2013, 43, 695–706. [Google Scholar] [CrossRef]

- Liu, W.; Lin, B. Analysis of energy efficiency and its influencing factors in China’s transport sector. J. Clean. Prod. 2018, 170, 674–682. [Google Scholar] [CrossRef]

- Abdallah, K.B.; Belloumi, M.; Wolf, D.D. International comparisons of energy and environmental efficiency in the land transport sector. Energy 2015, 93, 2087–2101. [Google Scholar] [CrossRef]

- Xie, C.; Bai, M.; Wang, X. Accessing provincial energy efficiencies in China’s transport sector. Energy Policy 2018, 123, 525–532. [Google Scholar] [CrossRef]

- Hao, H.; Liu, Z.; Zhao, F. An overview of energy efficiency standards in China’s transport sector. Renew. Sustain. Energy Rev. 2017, 67, 246–256. [Google Scholar] [CrossRef]

- Liang, Y.; Niu, D.; Wang, H.; Li, Y. Factors Affecting Transportation Sector CO2 Emissions Growth in China: An LMDI Decomposition Analysis. Sustainability 2017, 9, 1730. [Google Scholar] [CrossRef]

- Tromaras, A.; Margaritis, D.; Moschovou, T. Energy Consumption and Perspectives on Alternative Fuels for the Transport Sector: A National Energy Policy for Greece. In Advances in Mobility-as-a-Service Systems; Nathanail, E.G., Adamos, G., Karakikes, I., Eds.; Springer: Berlin/Heidelberg, Germany, 2021; p. 1278. [Google Scholar] [CrossRef]

- Solaymani, S.; Yusma, N. Poverty effects of food price escalation and mitigation options: The case of Malaysia. J. Asian Afr. Stud. 2018, 53, 685–702. [Google Scholar] [CrossRef]

- Bröcker, J.; Mercenier, J. General equilibrium models for transportation economics. In A Handbook of Transportation Economics; De Palma, R.A., Indsey, E., Quinet, R., Vickerman, H., Eds.; Edward Elgar Publishing: Cheltenham, UK, 2011. [Google Scholar] [CrossRef]

- Figus, G.; Lecca, P.; McGregor, P.; Turner, K. Energy efficiency as an instrument of regional development policy? The impact of regional fiscal autonomy. Reg. Stud. 2019, 53, 815–825. [Google Scholar] [CrossRef]

- Konur, O.; Bayraktar, M.; Pamik, M.; Kuleyin, B.; Nuran, M. The Energy Efficiency Gap in Turkish Maritime Transportation. Pol. Marit. Res. 2019, 26, 98–106. [Google Scholar] [CrossRef]

- Sperling, D.; Lutsey, N. Energy Efficiency in Passenger Transportation. Natl. Acad. Eng. 2014, 44, 22–30. [Google Scholar]

- Meersman, H.; Nazemzadeh, M. The contribution of transport infrastructure to economic activity: The case of Belgium. Case Stud. Transp. Policy 2017, 5, 316–324. [Google Scholar] [CrossRef]

- Rokicki, B.; Stępniak, M. Major transport infrastructure investment and regional economic development- An accessibility-based approach. J. Transp. Geogr. 2018, 72, 36–49. [Google Scholar] [CrossRef]

- Martínez-Moya, J.; Vazquez-Paja, B.; Maldonado, J.A.G. Energy efficiency and CO2 emissions of port container terminal equipment: Evidence from the Port of Valencia. Energy Policy 2019, 131, 312–319. [Google Scholar] [CrossRef]

- Blesl, M.; Das, A.; Fahl, U.; Remme, U. Role of energy efficiency standards in reducing CO2 emissions in Germany: An assessment with TIMES. Energy Policy 2007, 35, 772–785. [Google Scholar] [CrossRef]

- Danish; Baloch, M.A.; Suad, S. Modeling the impact of transport energy consumption on CO2 emission in Pakistan: Evidence from ARDL approach. Environ. Sci. Pollut. Res. 2018, 25, 9461–9473. [Google Scholar] [CrossRef] [PubMed]

- Danish; Baloch, M.A. Dynamic linkages between land transport energy consumption, economic growth, and environmental quality: Evidence from Pakistan. Environ. Sci. Pollut. Res. 2018, 25, 7541–7552. [Google Scholar] [CrossRef] [PubMed]

- Brockway, P.E.; Sorrell, S.; Semieniuk, G.; Heun, M.K.; Court, V. Energy efficiency and economy-wide rebound effects: A review of the evidence and its implications. Renew. Sustain. Energy Rev. 2021, 141, 110781. [Google Scholar] [CrossRef]

| Commodities | Activities | Factors | Households | Enterprises/Corporations | Government | Savings–Investment | Rest of the World | Total | |

|---|---|---|---|---|---|---|---|---|---|

| Commodities | 1221.2 | 556.7 | 152.1 | 193.7 | 638.7 | 2762.4 | |||

| Activities | 2762.4 | 2762.4 | |||||||

| Factors | 1119.6 | 1119.6 | |||||||

| Households | 412.2 | 194.1 | 6.3 | 612.6 | |||||

| Enterprises/Corporations | 707.4 | 7.8 | 715.2 | ||||||

| Government | 17.5 | 26.3 | 123 | 166.8 | |||||

| Savings–Investment | 28.3 | 378 | −212.6 | 193.7 | |||||

| Rest of the World | 404.1 | 1.3 | 20.1 | 0.6 | 426.1 | ||||

| Total | 2762.4 | 2762.4 | 1119.6 | 612.6 | 715.2 | 166.8 | 193.7 | 426.1 |

| Variable | Base Values | Fuel Efficiency | Transport Subsidies |

|---|---|---|---|

| RM Million | |||

| Real GDP | 1085.6 | 0.103 | −0.005 |

| Nominal GDP | 1145.7 | 0.497 | −0.004 |

| Investment | 193.7 | 0.906 | −0.021 |

| Inflation | 1.00 | −0.046 | −0.001 |

| Government Savings | 22.1 | 4.011 | −0.179 |

| Household Consumption | 556.7 | 0.164 | 0.001 |

| Welfare | 1761 | 0.534 | 0.124 |

| Exports | 638.7 | −1.080 | −0.006 |

| Imports | 404.1 | −1.422 | −0.009 |

| Energy Consumption | 216.9 | 0.354 | 0.047 |

| CO2 emission | 4.81 | 0.242 | 0.001 |

| Sector | Base Values | Fuel Efficiency | Transport Subsidies |

|---|---|---|---|

| RM Million | Output | ||

| Land transport | 24 | 0.305 | 0.045 |

| Water transport | 14.1 | −0.632 | 0.002 |

| Air transport | 19 | 0.339 | 0.024 |

| Other transport | 27.5 | 0.258 | 0.031 |

| RM Million | Investment | ||

| Land transport | 0.93 | 0.301 | 0.040 |

| Water transport | 0.11 | −0.630 | 0.001 |

| Air transport | 0.15 | 0.333 | 0.022 |

| Other transport | 0.24 | 0.246 | 0.028 |

| RM | Output prices | ||

| Land transport | 1.00 | −0.588 | −0.070 |

| Water transport | 1.00 | 0.534 | −0.012 |

| Air transport | 1.00 | 0.008 | −0.038 |

| Other transport | 1.00 | 0.211 | −0.030 |

| Sector | Base Values | Fuel Efficiency | Transport Subsidies |

|---|---|---|---|

| Million Person | Employment | ||

| Land transport | 2.03 | −0.106 | 0.698 |

| Water transport | 0.34 | −0.281 | 1.097 |

| Air transport | 0.93 | 0.246 | 0.681 |

| Other transport | 2.52 | 0.318 | 0.693 |

| RM Million | Household demand | ||

| Land transport | 4.13 | 1.277 | 0.081 |

| Water transport | 0.31 | −0.075 | 0.020 |

| Air transport | 0.54 | 0.632 | 0.049 |

| Other transport | 8.20 | 0.335 | 0.035 |

| Sector | Base Values | Fuel Efficiency | Transport Subsidies |

|---|---|---|---|

| RM Million | Exports | ||

| Land transport | 7.29 | 1.011 | 0.091 |

| Water transport | 6.53 | −0.661 | 0.010 |

| Air transport | 7.61 | 0.654 | 0.050 |

| Other transport | 7.43 | 0.449 | 0.052 |

| RM Million | Imports | ||

| Land transport | 3.76 | −1.058 | −0.045 |

| Water transport | 0.66 | −0.553 | −0.021 |

| Air transport | 3.17 | −0.420 | −0.038 |

| Other transport | 2.88 | −0.073 | −0.005 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Solaymani, S.; Sharafi, S. A Comparative Study between Government Support and Energy Efficiency in Malaysian Transport. Sustainability 2021, 13, 6196. https://doi.org/10.3390/su13116196

Solaymani S, Sharafi S. A Comparative Study between Government Support and Energy Efficiency in Malaysian Transport. Sustainability. 2021; 13(11):6196. https://doi.org/10.3390/su13116196

Chicago/Turabian StyleSolaymani, Saeed, and Saeed Sharafi. 2021. "A Comparative Study between Government Support and Energy Efficiency in Malaysian Transport" Sustainability 13, no. 11: 6196. https://doi.org/10.3390/su13116196

APA StyleSolaymani, S., & Sharafi, S. (2021). A Comparative Study between Government Support and Energy Efficiency in Malaysian Transport. Sustainability, 13(11), 6196. https://doi.org/10.3390/su13116196