The inclusion of both aspects, agents’ interaction and feedback loops on the one side, and global relations into a market equilibrium approach on the other side, is hard to implement in a single model as different logics and behaviours drive the two elements. On the other hand, a soft-linking approach might help exploit the advantages of both tools by informing each other. In this paper we propose a one-way linkage approach, where the agents’ interaction is defined with a system thinking approach, and the direction of linkages are used to develop a dynamic CGE model and formulate policy scenarios.

In particular, CGE models provide reliable results in a long-term perspective but they are affected by a strong rigidity in modelling assumptions, as for instance fixed technical coefficients, homogeneous agents and no feedback loops that can change behavioural parameters, such as demand elasticity to price and income, substitution elasticity across inputs in the production function, or substitution elasticity in consumer (households) basket expenditure.

All these sources of rigidity might be smoothed by first applying a ST approach to draw a complete picture of the complexity of the dynamic linkages arising from the policy issue under investigation. Then, parameters and coefficients in the CGE model can be updated or modelled as exogenous shocks on the basis of the ST indications, and simulation results are selected and interpreted from the point of view of the evolution of complex systems.

2.1. Systems Thinking

The starting point for the systemic analysis is the review of past drivers of change and the dynamics these have triggered. With an understanding of the known patterns of change that brought us to the need for the introduction of the EGD it will be possible to identify stated entry points for intervention, and their direct, indirect and induced outcomes. The use of ST provides a simplified system map (or causal loop diagram, CLD) to understand how the key variables of our socioeconomic and environmental system are interrelated, and how policy intervention can shift the dynamics experienced historically, leading to a more sustainable future. The CLDs presented in this paper were created with the software Vensim.

Figure 2 shows that when GDP increases, a stable trend in the past decades, with only a few exceptions, two main outcomes emerge: (a) consumption increases, leading to higher GDP directly and indirectly via production (reinforcing loop R1), and (b) investment increases, leading to more innovation and cost competitiveness, in turn increasing production and GDP (reinforcing loop R2). It is these reinforcing loops (R) that trigger economic growth, also through employment creation and trade.

On the other hand, economic growth has given rise to various balancing factors (or balancing loops). One of these is the growing need for mobility, resulting in congestion. Congestion increases time spent in traffic and away from work and families (B1), creating societal costs. It also reduces the potential to grow for productivity, production and value added (B3). It further leads to air pollution (B2) resulting from energy use (both for transport, industries and in buildings), which affects labour productivity via health. Finally, the increase in energy use resulting from higher investment and income has led to higher vulnerability to market dynamics, price volatility and extreme weather events impacting the supply of energy (B4), which has negative impacts on production. Production, in turn, leads to the generation of waste, which impacts water pollution and food quality, creating societal costs both in urban and rural areas (B5). These are only a few examples of growing costs to society, those highlighted in the EGD. In addition, these costs are not emerging in the same measure in all countries and regions. As an example, urban areas are being impacted more strongly by air pollution than rural areas.

When considering historical trends, it emerges that the reinforcing loops R1 and R2 have been dominating the dynamics of the system. This is because GDP, consumption and investment have grown over time, as have congestion and societal costs. On the other hand, the reinforcing dynamics have been stronger and have dominated the economy over the balancing ones. In 2009, after the financial crisis of 2008, GDP and investments decreased by 4.3% and 11.7%, respectively, for the EU27+UK. However, between 2015 and 2018 GDP increased by 2–2.5% each year, while investments also grew by 2.3–4.9% during the same period. Moreover, consumption expenditure increased by 9.8% from 2008 to 2018 on the basis of information on national accounts provided by Eurostat [

23]. On the other hand, thanks to energy efficiency improvements, little change has emerged for energy consumption and emissions, as well as for waste generation, indicating relative decoupling. Gross inland energy consumption was relatively stable between 1990 and 2017, increasing only by 1.6% according to the national energy balances [

24] while greenhouse gas emissions were around 22% lower than 1990 levels as emphasised by the statistics provided by the European Environment Agency (EEA) [

25]. According to Eurostat, waste generation, excluding major mineral waste, slightly increased from 779.5 million tonnes in 2004 to 785.0 million tonnes in 2016 [

26], thus revealing that deeper investigation on specific environment-related themes might unveil inefficiencies in the sustainability of the development trajectory. Overall, this highlights that the emergence of balancing loops has been countered by energy efficiency, the use of renewable energy, collection, sorting, recycling and reuse of waste. Limiting these balancing factors has allowed GDP to continue growing at 1.5–2.5% in the last decade, but more should be done both to support the economy via reinforcing loops and reducing constraints to growth via balancing loops.

The EGD is designed to use various strategies (in orange in

Figure 2) to influence energy, buildings, transport and food production. The expected outcomes (in pink) include cleaner air, water and soils (through interventions on energy efficiency, clean energy, waste reduction, improved agriculture practices), also resulting in better human health, better transport alternatives and access to distributed power generation options (and so better access to more modern and resilient services).

Specifically, energy efficiency, clean energy and affordable energy are designed to reduce energy consumption and air pollution, as well as to stimulate innovation and increase competitiveness. As a result, these interventions strengthen reinforcing loops R1 and R2 via GDP, consumption and investment. At the same time, balancing loops B2, B3 and B4 will become weaker, further stimulating economic growth by reducing societal costs and making production more effective. Investments to realize these opportunities include renovated homes, schools and hospitals (energy efficiency), renewable energy use, installation of charging stations for e-vehicles, and adoption of environment-friendly technologies (clean and affordable energy). Smart mobility via better public transport and non-motorized transport will make B1 and B2 weaker, by reducing congestion, energy use and emissions, leading to lower societal costs (e.g., health costs) and more effective production activities. Outcomes include better health for current and future generations, via cleaner air, water, soil (also in conjunction with waste reduction, recycling and reuse). Waste reduction, recycling and reuse affect primarily B5 and B6, which then indirectly affect R1 and R2. As a result, reducing waste both unlocks opportunities for existing drivers of growth, and stimulates new paths for sustainable growth by stimulating innovation and competitiveness. Healthy food systems are expected to increase food quality by reducing the use of fertilizers and pesticides. This reduces societal costs (B2, B3), increasing labour productivity, lowering public and private costs, resulting in a stimulus taking place through R1 and R2.

Practically, the EGD aims at making balancing factors weaker, so that the economy can continue to grow, but in a more sustainable and resilient way. This results in lower costs for society, higher productivity, and improved well-being.

The inclusion of the COVID-19 pandemic crisis in the analysis requires the addition of several variables to the CLD, representing (i) impacts of the outbreak (e.g., consumption) and (ii) response measures (e.g., public stimulus). These additions introduce new dynamics and feedback loops (

Figure 3), namely:

reduction of GDP via the reduction of production (due to demand and limited labour force availability);

reduction of GDP via the reduction of consumption (due to social distancing, avoided travel);

reduced economic performance due to the higher cost of doing business and insurance premiums;

reduced country performance due to the increase of country risk and public costs (higher country risk leading to higher debt costs, higher public costs related to health and stimulus packages).

These four dynamics affect two existing reinforcing loops (R1 and R2), having a negative impact on GDP via consumption and production, possibly triggering a vicious cycle and hence a recession. The introduction of a public stimulus instead adds reinforcing loops R4 and R5. The former represents the short-term solution implemented by governments, to stimulate investments. The latter represents the expectation that, once the economy starts growing again, it will generate additional growth that allows the reduction of the debt accumulated in the short-term. The dynamics triggered by the increase of debt are represented by the balancing loop B4. Higher debt will reduce the potential for new investments in the future, due to the higher cost of debt servicing and to budget constraints related to financial stability.

It has emerged that COVID-19 has temporarily turned two drivers of growth (R1 and R2) from virtuous to vicious, making them causes of recession rather than growth. This triggers balancing loop B7, which highlights the limited (finite) amount of financial resources available to governments. The expectation is that, if the stimulus is allocated well (R4), after the lockdown ends and the economy recovers, it will kick start production and consumption to levels that will stimulate employment, increase government revenues (R5) and limit the constraints posed by medium and long-term debt (B7).

Concerning environmental performance, the reduction of economic activity reduces energy consumption and air pollution, and hence societal impacts, driven by R2, as well as by B1, B2, B3 and B4. With economic recovery the opposite dynamics return, as described earlier. As a result, little change is expected to these dynamics, unless permanent impacts emerge (e.g., smart working remains common practice with a structural impact on transport modes).

2.2. The GDynEP Model

By focusing on the behavioural aspects related to the energy system, some of the linkages and loops obtained by the ST approach can be simulated into a dynamic CGE model hereafter called GDynEP. The model we develop for this purpose is based on RunDynam software designed for GTAP-type models. The specific GTAP-type version of the model is called GDynEP and all details on the modelling approach are provided in [

27,

28]. With respect to the previous GDynEP model version, there are some novelties related to the construction of the base year, the emissions data and the regional aggregation.

The base year relies on the GTAP 10 database, meaning that the starting point is the year 2014, with updated values for Leontief input-output matrices for the factor costs of sectors included. The GTAP 10 database is a consistent representation of the world economy for a pre-determined reference year [

29].

Together with combustion-based CO2 emissions as in all standard GTAP-E models, the GDynEP also introduces non-CO2 emissions associated with the use of energy commodities in the production and consumption activities. In detail, the new version of GDynEP includes three energy-related data sources.

The GTAP-E 10 database provides carbon dioxide (CO

2) emissions data distinguished by fuel and by user for each of the 141 countries/regions and the 65 sectors in the GTAP10 database. GTAP-E data is based on: GTAP 10 and extended energy balances compiled by the International Energy Agency (IEA). A complete description of all features in the GTAP-E database is provided by [

30].

The GTAP-Power 10 database is an electricity-detailed extension of the GTAP 10 database including seven base load technologies (nuclear, coal, gas, hydroelectric, oil, wind and other power technologies), and four peak load technologies (gas, oil, hydroelectric, and solar) for 2014 [

31]. Moreover, an updated version of the methodology allows output of the electricity and heat generation sector to be split using electricity generation data together with heat generation volumes [

32].

The GTAP-NCO2_V10a database is based on the methodology developed by [

33] and is integrated in GDynEP with three major non-CO

2 groups of gases, CH4, N2O, and fluorinated gases (F-gases), including CF4, HFCs, and SF6. Emissions come from three emissions drivers: consumption (by consumers and firms), endowment use (land and capital), and output. With respect to the emissions associated with consumption by firms and households the original GTAP file has been transformed in order to be compatible with the structure of combustion-based CO

2 emissions used in GTAP-Power with 76 sectors. Accordingly, the new emissions database contains the sum of combustion-based CO

2 emissions and non-CO

2 emissions associated with the use of energy inputs including the chemical sector.

The regional aggregation: takes into account the Brexit process and the United Kingdom is excluded by the EU aggregate, while the sector aggregation is based on the technological content as well as the energy intensity of the production process. Details on aggregation are provided in

Appendix A,

Table A1,

Table A2 and

Table A3.

With respect to the time frame, the starting point is 2014, so the first period is 2014–2015, while the following periods are five-year steps up to 2050 with a total of eight periods. Details regarding the software adopted, the aggregation files, the elaboration of shocks are available in the

Supplementary Material file.

2.3. Simulation Setup

Scenarios are based on a business as usual reference case (BAU) that is alternatively tested with and without the economic crisis due to COVID-19 pandemic. This helps us better investigate the role played by investments in clean energy technologies (CETs) in contributing also to exiting the crisis. By comparing the GDP growth rate with COVID-19 shock with growth patterns associated with a general economic recovery based on GDP levels, it is possible to highlight the magnitude of investments required to escape from the crisis in a short-term perspective. By adding the financial support to CETs associated with the implementation of the EGD targets, we can emphasize the additional impact played by longer term investments.

The source on which scenarios are based is divided between the current period 2014–2020 and projections for the time span 2025–2050. The different variables on which the baseline and the policy scenarios are based are listed.

2.3.1. Model Calibration to Current Baseline

For what concerns the calibration for the current period 2014–2020, we provide details on the procedure adopted for each variable.

Population: for the reference period (2014) data are taken from the GTAP10 database while for updates 2015–2020, data come from Eurostat and World Development Indicators (WDI) from the World Bank;

CO2 emissions: for the reference period on combustion-based CO2 emissions (2014) data are taken from GTAP-E while for updates 2015–2020, data come from Eurostat, IEA CO2 emissions highlights and WDI;

GDP: for the reference period (2014) data are taken from the GTAP10 database while for updates 2015–2020, data come from Eurostat and WDI;

Non-CO2 emissions: for the reference period (2014) data are based on GTAP-NCO2V10a updated with change in 2015–2020 based on Eurostat and IEA energy balances;

Labour force: for the reference period (2014) data for skilled and unskilled labour force are calculated as the share of total labour force from CEPII information applied to GTAP population data and for the period 2015–2020 they are also calibrated with ILO information on labour force and CEPII statistics;

Production of electricity from renewable sources (RSELE) in the electricity sector: for the reference period (2014) data on RSELE are taken from GTAP Power version 10 and for the period 2015–2020 data comes from growth rates computed on Eurostat and IEA energy balances;

Production of electricity from fossil fuels (FFELE): for the reference period (2014) data on FFELE are taken from GTAP Power version 10 and for the period 2015–2020 data come from growth rates computed on Eurostat and IEA energy balances.

For the projections in the time span 2025–2050, the baseline case (called BAU) is computed on the basis of the combination of data from different sources:

Data on GDP, population, GHG emissions and production of electricity divided into RSELE and FFELE are based on the reference case used by the JRC model (Keramidas et al., 2020) for all regions in the model setting except for the EU region;

data on GDP, population, GHG emissions and production of electricity divided into RSELE and FFELE only for the EU members with country-based information are based on the reference case developed by the European Commission for the PRIMES model [

34];

Data on labour force divided into skilled and unskilled are based on CEPII projections [

35].

The baseline is calibrated with shocks associated with GDP, population, skilled and unskilled labour force and CO2 and non-CO2 emissions that are considered as exogenous and are calibrated with the increase in production and consumption efficiency. This is a requirement for the GTAP modelling exercise because otherwise emissions are not bounded, and they proportionally follow the GDP and population trends without any assumptions on technological improvements that will reduce carbon intensity of economic dynamics.

A further element for building the BAU case is reflected in the energy balances for all regions, and in particular the proportion of renewable and fossil fuel sources in the electricity production process. On the basis of the projections available from the JRC model and the EU reference case for PRIMES, the two electricity sub-domains have been treated as exogenous, thus calibrating the BAU case at the end of 2050 with a share of RSELE on total electricity for the EU compatible with the JRC baseline case. The shocks in BAU are based on the evolution over time of the production of electricity by the two sources expressed in GWh, where the starting point is 2014 according to the value of electricity production provided in the GTAP-Power database in GWh. The calibration has also been compared with the composition of the energy mix on the consumption side with respect to the reference case of the EU models, in order to obtain an overall energy consumption at the EU level compatible with expected values simulated with the help of bottom-up technology scenarios.

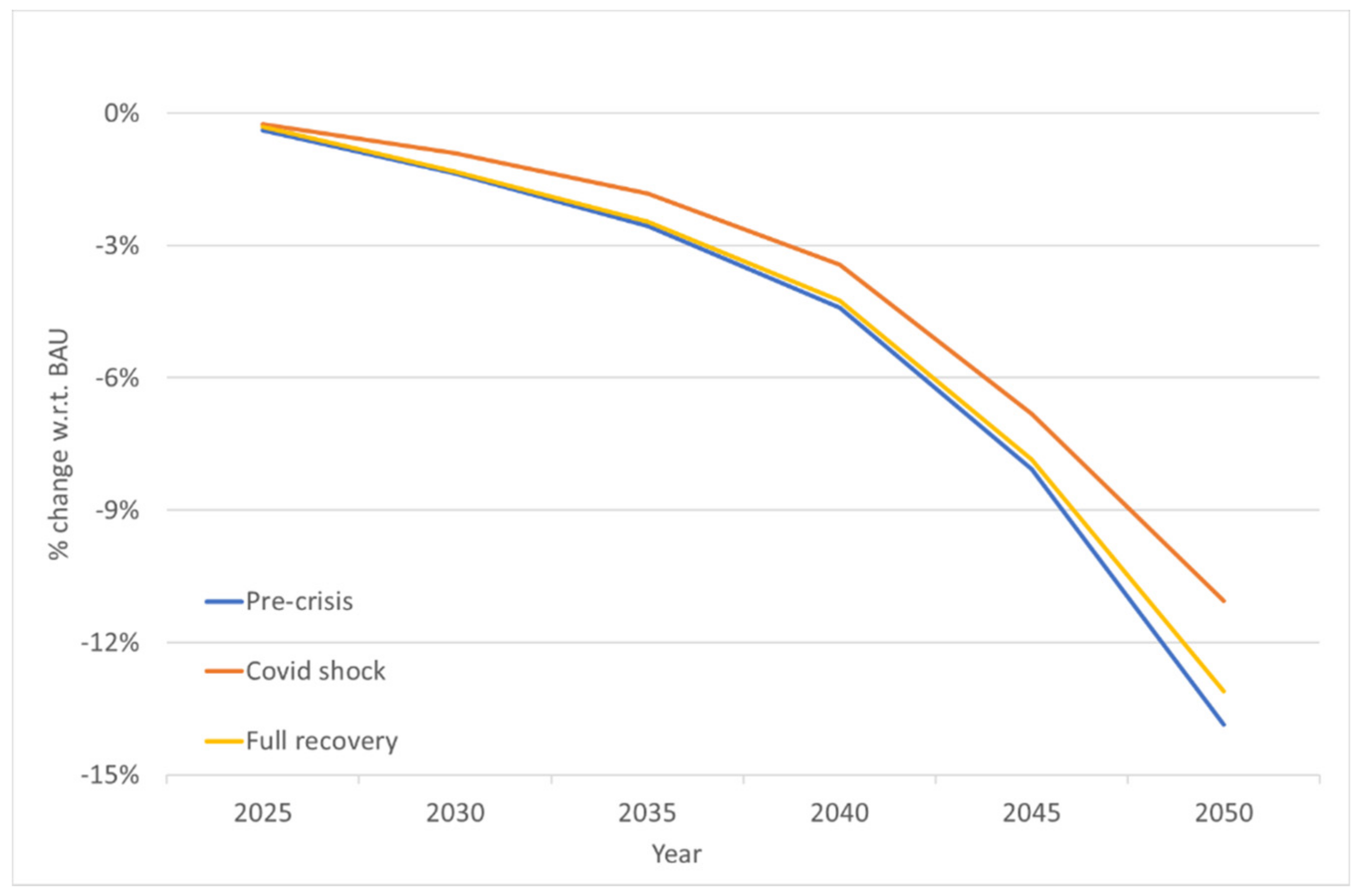

2.3.2. Model Calibration for Policy Scenarios—Paris Agreement

For the projections in the time span 2025–2050 related to the policy case, we consider as a starting point the decarbonization process for the EU27 region according to the implementation of the Paris Agreement with an emissions pattern to 2050 compatible with the EU targets associated with the increase in global temperature by a maximum of 1.5 °C with respect to pre-industrial levels. The emissions target designed for the Paris Agreement scenario for the EU is equivalent to the net zero emissions target described in the EGD with the updated target by 2030 of cutting emissions by 55% with respect to 1990 levels. Accordingly, there is a common CO2-eq emissions trend in all policy scenarios for the EU.

Given that the GDynEP model is an economic-energy model without enough technological details to simulate the role played by LULUCF and CCS activities, the final emissions in 2050 account for gross emission levels without the impacts of carbon sinks. This results in an apparent overestimation of emissions with respect to the EU reference scenario that is fully explained by the absence of sinks. Accordingly, while in the EU reference case emissions in 2050 are around 2% of the BAU case, in GDynEP in 2050 emissions are around 9% of the BAU case. The remaining 7% is supposed to be absorbed by carbon sinks to reach the target of net zero emissions by 2050.

In order to obtain the first policy scenario in which the EU will respect the abatement target for the full implementation of the Paris Agreement, resulting in an emission reduction by 2050 of 91% with respect to the BAU case (called EU-PA), a policy instrument based on a Pigouvian carbon tax is adopted. According to the model version in Bassi et al. (2020), by considering the EU as an aggregated region it is worth mentioning that the cost effectiveness criterion is fully respected, since the value at the margin of the carbon tax is perfectly equivalent to a carbon price level if an emission trading system is applied. The only difference between the EU-ETS and the modelling approach we adopt is that in GDyn-EP all sectors are involved in the carbon policy with the same instrument, without differentiated treatment for energy-intensive and non-energy intensive sectors [

28]. This assumption allows consideration of carbon tax and carbon price as fully equivalent market-based environmental policy instruments. Accordingly, in the following sections we will consider carbon tax and carbon price as if they are synonymous.

In order to calibrate the model with respect to the emissions trend, we take CO

2 emissions as exogenous only for the EU, with a specific trend that is compatible with the PA target. On the contrary, emissions for the rest of the world are left as endogenous, considering a case in which the other regions are not respecting their NDCs under the PA. This is consistent with a notion of unilateral policy, and in a comparative exercise perspective, it is the only way to compute the economic impacts of a specific policy in an ex-ante evaluation with a counter factual benchmark. If, on the other hand, we adopt a multilateral perspective in which all regions implement abatement targets, it is no longer possible to single out the economic impact of the EGD [

36].

Together with the calibration of emissions with exogenous shocks, we also control for the energy mix at the EU level, with particular attention to electricity production. More specifically, we consider electricity production, both from fossil fuels and for RES as exogenous, following the production trends available in GECO 1.5 °C policy case. This is a requirement because electricity is a carbon free energy source in a sense that consuming electricity is not associated with CO2 emissions. This leads to an overestimation of electricity consumption in a policy scenario with no control for electricity production. In other words, the model cannot consider for instance technical constraints to substitutability between sources related to competition to inputs (capital and labour mainly), or diffusion obstacles, for example, associated with the absorptive and distribution capacity of the power grid.

2.3.3. Model Calibration for Policy Scenarios—European Green Deal

In order to make an economic assessment of the impacts associated with the EGD, on top of the first policy scenario (EU-PA), based on a simple carbon pricing instrument, we associate an additional instrument based on a revenue recycling mechanism for financing the development, deployment and diffusion of CETs. The recycling mechanism is based on the hypothesis that part of the revenues collected from carbon pricing (CTR) by the government can be reused for sustaining green energy technologies.

In detail, given that GDynEP has a standard production structure where sectors are classified according to the ISIC codes, without a specific sector producing technology, we compute an elasticity parameter with which investment flows in R&D are directly transformed into benefits on the consumption and production side.

We test different shares of CTR to be allocated to finance CETs through an ideal innovation fund that can be compared with real figures available in the estimation provided for the ETS innovation fund by the European Commission. It is worth mentioning that in our model, given that a carbon price (equivalent to an equilibrium carbon tax) is paid by all sectors (as if the ETS has been applied to the whole economy without free allowances), from the one side the higher the abatement target the higher the cost, given by the carbon price, but on the other hand a higher carbon price is associated with a larger CTR and consequently to a higher amount of the innovation fund for CETs.

In GDynEP it is possible to account for the efforts in development and diffusion of two technology options: energy efficiency, both in the production processes and in the households’ consumption patterns; and production of electricity with renewable sources.

In order to quantify the contribution of public support to CETs, we need two parameters related to elasticity of substitution that are required for developing evolutionary scenarios of technological trajectories for clean energy technologies sustained by public support [

37]. We compute them on historical data for the last ten years of R&D public investments in the EU for energy efficiency (obtained in all sectors) and renewable sources in electricity with respect to the starting date of GDynEP (2014). In this model we consider two assumptions: (i) energy efficiency uniformly influences productivity across all sectors independently from the specific share of energy used within the input mix, (ii) the diffusion of innovation is not influenced by additional technical barriers different from those already accounted for with the historical estimation.

The model is programmed in order to use R&D investments to increase input augmenting technical change for the use of energy as an input in the consumption (households) and production (firms) function. For a given amount of public budget invested in energy efficiency, the effect consists of a reduction of the energy intensity with respect to the reference case, with a lower cost for saving energy [

38].

Concerning renewable sources in electricity generation, by promoting renewable energies by capacity investments (rather than by generation subsidies) the impact of uncertainty for demand conditions and capacity availability is substantially reduced. Accordingly, the elasticity is computed considering the public R&D investment in renewable sources for electricity generation provided by the IEA R&D database and the corresponding increase in installed capacity in renewable electricity in EU countries during the same period (1994–2014 Eurostat energy balance dataset available online). The estimated parameter comprises an output-augmenting technical change, meaning that the R&D efforts have the main effect of reducing the production cost of electricity from renewables with respect to fossil fuel sources. The economic rationale behind this modelling choice is simple: given a certain number of inputs used for producing RES (mainly capital and labour), the investments in RES allow the system to transform the same amount of inputs into a larger amount of output (electricity in this case) [

39].

It is worth mentioning that the investments in RES are combined with the exogeneity of RES production in the EU-PA policy case. This means that the amount of RES produced are exogenously determined but the production cost is endogenously driven by the amount of investments directed to technical change from the CTR. Accordingly, the higher the share of CTR invested into the innovation fund, the higher the output augmenting technical change, the lower the unitary production cost. In order to compare model results with the EU energy strategy pillars, in the case of RES it is possible to compare the amount of energy, and in particular of electricity from RES as a share of total consumption of electricity. Given that the production cost is lower, in the EU-GD scenario it is likely to obtain an increase in the share of electricity from RES consumed than in the EU-PA policy scenario.

2.3.4. Scenarios Accounting for COVID-19 Crisis

Together with these three scenarios we introduce the economic impact of the crisis due to the COVID-19 pandemic to the BAU case as follows. Starting from the BAU case we implement a policy shock in 2020 with an exogenous reduction of GDP w.r.t. the BAU case with an impact associated with the main regions according to [

40] compatible with the IMF and the World Bank estimates at the world level, recently provided by the updated report [

41]. The average reduction at the world level is estimated around 6% in 2020 w.r.t. BAU and around 3% w.r.t. the GDP level in 2019.

The economic impacts of COVID-19 are many and varied and growing by the day. Following the outbreak, financial conditions have worsened at an unparalleled speed, weakening economies worldwide. Emerging dynamics include the increased risk of defaults of private companies due to weaker demand, higher volatility in the stock market due to future uncertainty on the profitability of businesses and impacts on the solidity of national finances due to growing expenses and reduced revenues. These impacts depend on both global and local dynamics, with local consumption as well global trade being impacted by the number of infected countries and the duration and severity of epidemiological shocks. The uncertainty of impacts, effectiveness of policy responses, and duration of current challenges leads to consideration and creation of various scenarios for a possible recovery.

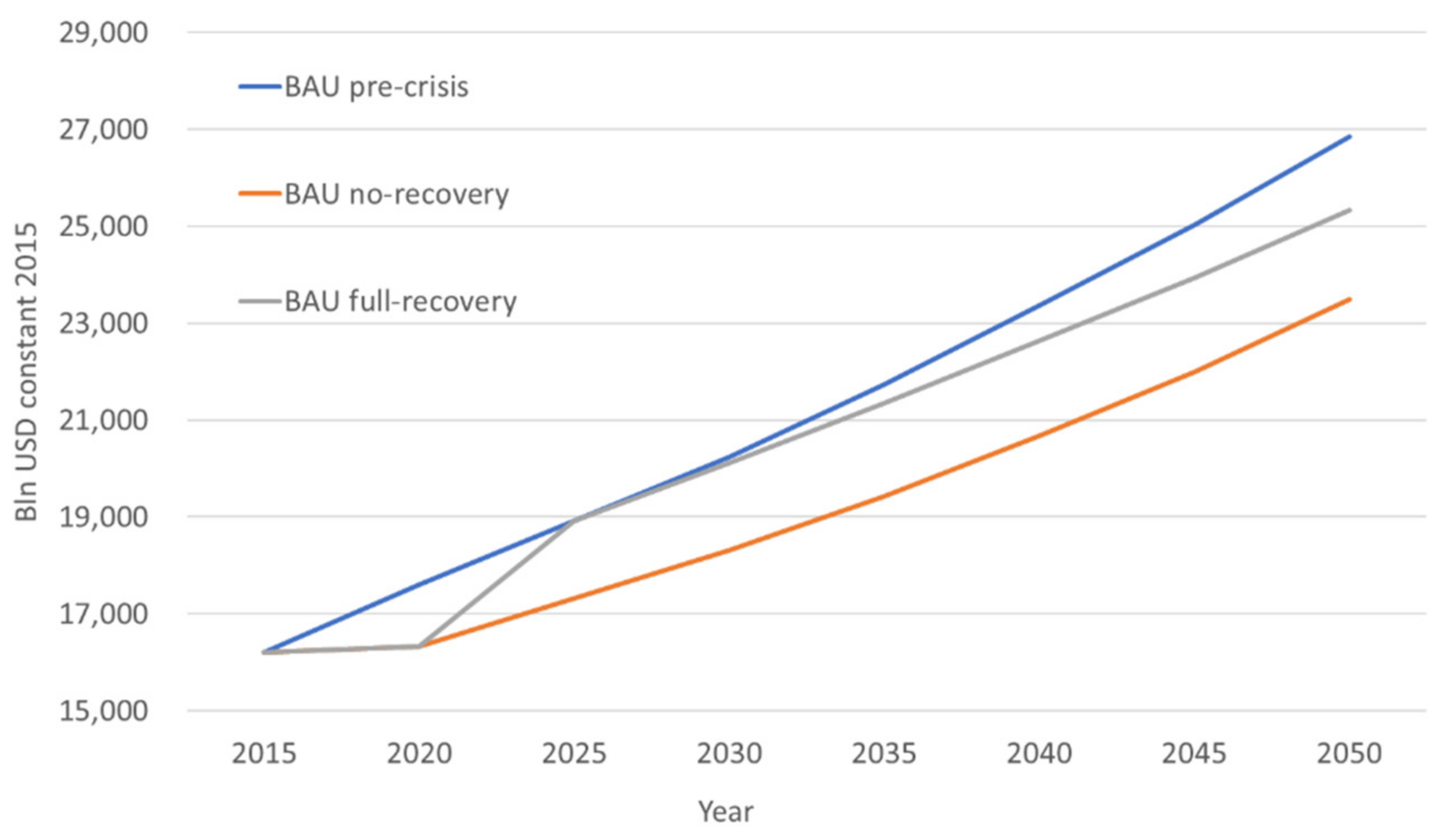

The assumption is that once the shock has been assigned to the 2020 policy scenario, then the GDP is left to be determined endogenously by the model. Accordingly, it is possible to obtain changes in GDP from 2025 according to a path dependence approach related to the dynamic recursive nature of the model. It is worth mentioning that in the case of a COVID-19 shock without any recovery measure, the GDP growth pattern can be lower than in the case of a BAU pre-crisis case because the amount of capital stock for the economic system is dependent on savings produced in the previous period in a system of national account methodology.

The BAU case that accounts for the shock which occurred in 2020 assumes that no additional shocks will occur, but the endogenous solution provides GDP values for the period 2025–2050 that incorporate the negative impacts due to capital stock reduction and a demand decrease that persists over time. This BAU case with the COVID-19 shock with no recovery measures is named BAU no-recovery.

A second scenario is built with an exogenous shock that allows GDP in 2025 to turn back to 2025 original BAU values before the COVID-19, hereafter called BAU full-recovery. This means that the shock is calibrated in order to give impulse to the economic system to completely recover from the negative impacts in the medium-term (5 years). In order to make sure that the amount of resources is compatible with policy feasible solutions, we have computed the endogenous increase in capital formation required to recover from the crisis. As a benchmark, we looked at the resources that the EU is allocating in different forms during 2020 amounting to a recovery package of around €750 billion, that corresponds to around 5% of the EU GDP in 2020 from GDyn-EP without COVID-19. In 2025, according to the full-recovery scenario, the total resources to be invested along a 5-year period required to go back to a GDP pre-COVID-19 amount to around 9.5% of GDP in 2025. Considering that in the years 2021–2025 additional resources could be invested within the Next Generation EU fund according to the recovery plans presented by Member States, together with additional private resources, a total of 9.5% of GDP in the form of capital investments is reasonable. The same mechanism is applied to all regions belonging to the GDyn-EP, with examples of resources invested in other large economies as 4% of GDP in China and 8% in the US.

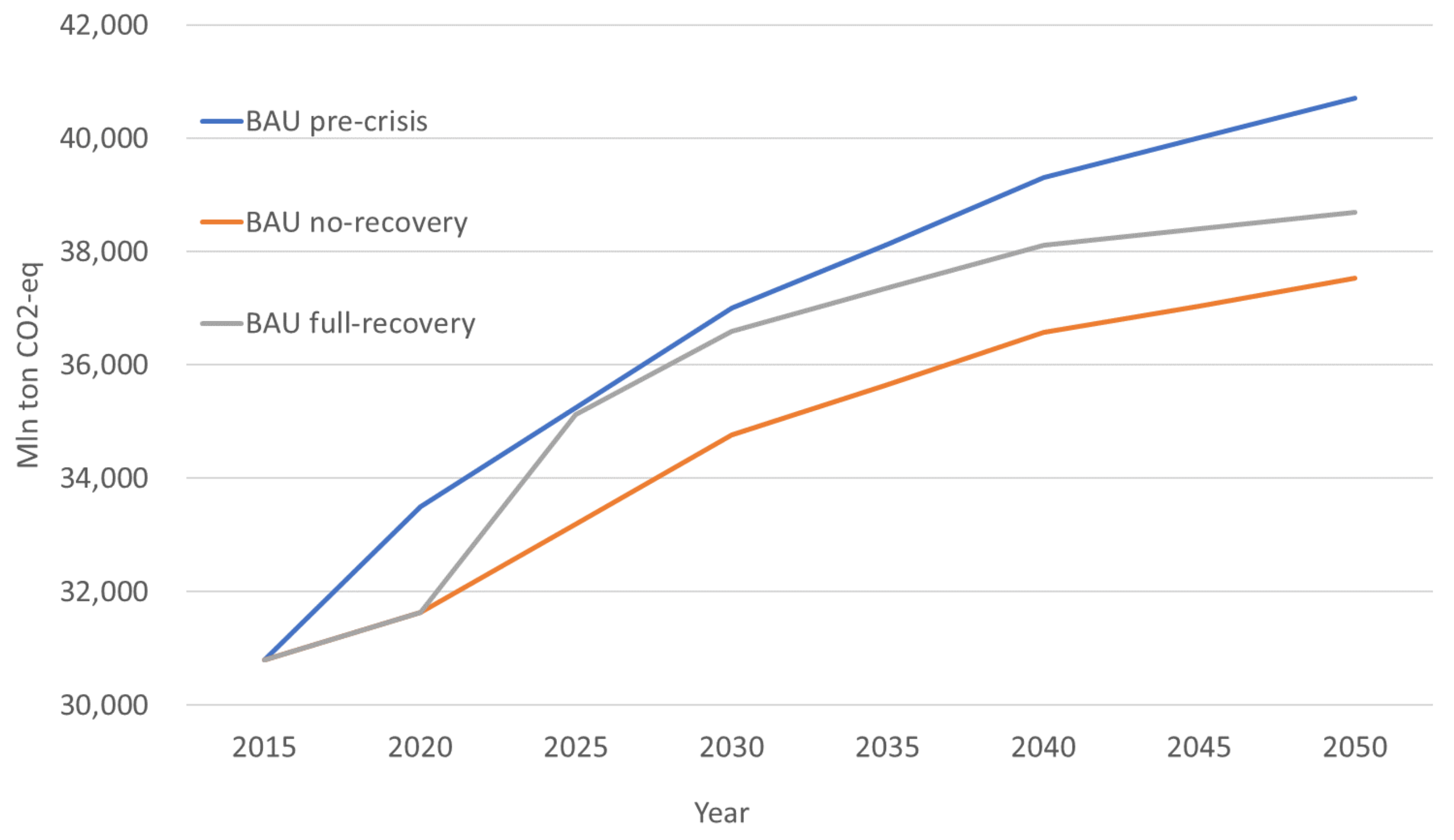

On the basis of the two additional BAU scenarios that include COVID-19 GDP shock with and without recovery, we are able to compute the new emissions trend for the two BAU cases. Different from the original BAU where emissions are exogenously projected according to bottom-up energy scenarios, in the two BAU cases with COVID-19 emissions are left free to move endogenously, following the GDP shocks in 2020 and in 2025 (only in the case of full-recovery), and the endogenous GDP patterns from 2025 on. Accordingly, together with the GDP, CO

2-eq emissions will also be changed with respect to a BAU pre-crisis, and on this new reference case the two policy options associated with the simple carbon pricing and the additional measures planned within the EGD are implemented and evaluated. As a final calibration check, emissions endogenously determined with the BAU no-recovery and BAU full-recovery GDP shocks have been compared with emissions provided by the bottom-up model by the International Energy Agency available in the World Energy Outlook 2020 [

42].