The Impact of Mergers and Acquisitions and Sustainability on Company Performance in the Pharmaceutical Sector

Abstract

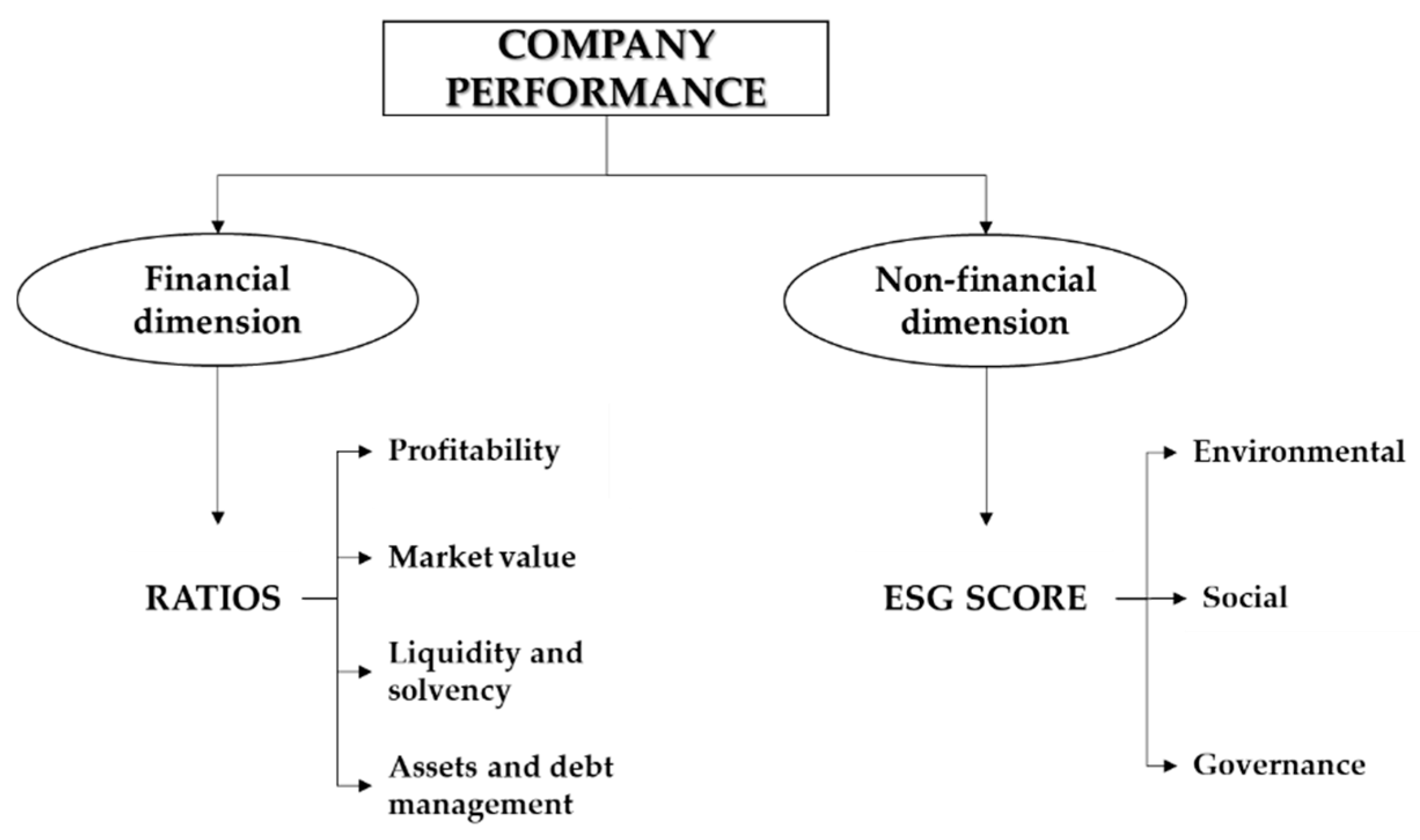

1. Introduction

2. Literature Review

2.1. Mergers and Acquisitions—Between Success and Failure

2.2. The Impact of M&A on Company Performance

2.3. Measuring Post-M&A Financial Performance

2.4. Measuring the Sustainability of the Company

3. Materials and Methods

3.1. Sample Study Description

- n = the sample size;

- t = the t-value;

- p = the non-percentage share of the components of the sample that are characterized by a certain attribute;

- q = the non-percentage share of the sample components that are not characterized by a certain attribute is determined as 1-p;

- e = the margin of error.

3.2. Determining the Z-Score Function

3.3. Z-Score Function Data Normalization

- = the calculated value of the Z-score i for company j;

- = the maximum value of the Z-score i function; and

- = the minimum value of the Z-score i function.

4. Results

- Statistical significance was at the 0.01 level;

- Intensity between the variables: 0.00–0.19, very weak; 0.20–0.39], weak; 0.40–0.59, moderate; 0.60–0.79, strong; 0.80–1.0, very strong;

- Sense of the correlation: positive “+” or negative “–”.

- between the variables Solvency 2 and Long-term debt ratio, there was a negative (−1.000), very strong (1.000 > 0.80), and statistically significant (Sig. (2-tailed) < 0.01) relationship; a perfect negative correlation means the relationship that exists between two variables is exactly opposite all of the time. In this case, the perfect correlation between the two variables could be explained by the fact that the variables have a common denominator (Shareholders Equity + Long-term debt). For Solvency 2, the numerator is Shareholder Equity while, for the Long-term debt ratio, the numerator is Long-term debt. These two variables show the share of long-term financing sources of shareholders and creditors. If the share of shareholder financing sources decreases by x%, then the share of creditor financing sources increases by the same x%.

- between the variable ROE and ROA, there was a positive (+0.648), strong (0.648 > 0.60), and statistically significant (Sig. (2-tailed) < 0.01) relationship;

- between ROE and the variables Operating Profit Margin (+0.485), Solvency 2 (+0.410), and Long-term debt (+0.403), there were moderate (0.485, 0.410, and 0.403 > 0.40), and statistically significant (Sig. (2-tailed) < 0.01) relationships;

- between the other variables, there were negative and positive, low and very low, and statistically significant (Sig. (2-tailed) < 0.01) relationships.

- Green—scores between 90 and 100;

- Orange—scores between 70 and 90;

- Yellow—scores between 50 and 70; and

- Red—scores lower than 50.

5. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Company Name | ZAYear2020 | ZAYear2019 | ZAYear2018 | ZAYear2017 | ZAYear2016 | ZAYear2015 | ZAYear2014 | ZAYear2013 | ZAYear2012 | ZAYear2011 |

|---|---|---|---|---|---|---|---|---|---|---|

| Johnson & Johnson | 0.69160 | 0.80738 | 0.66201 | 0.76384 | 0.84178 | 0.62468 | 0.93299 | 0.92167 | 0.64278 | 0.15249 |

| Pfizer Inc. | 0.83501 | 0.23889 | 0.12684 | 0.89416 | 0.68967 | 0.80024 | 0.97193 | 1.35992 | 1.29230 | 1.17508 |

| Eli Lilly and Co. | 0.83008 | 0.51776 | 0.61237 | 0.21375 | −0.21864 | −0.09042 | −0.24834 | 0.49396 | 0.29423 | 0.69758 |

| Merck & Co Inc. | 0.99490 | 1.28227 | 1.23466 | 1.31196 | 2.00111 | 1.47861 | 0.25221 | 0.19765 | 1.53149 | 1.39623 |

| Abbvie Inc. | 0.90526 | 1.86019 | 1.57803 | 1.49930 | 1.48045 | 1.38675 | −0.06568 | 1.27856 | 1.60545 | 0.70590 |

| Bristol-Myers Squibb Co. | −0.54140 | 0.86493 | 1.29999 | 1.13158 | 0.60895 | −0.66215 | 0.09033 | 0.01569 | 0.72046 | 1.37586 |

| Amgen Inc. | 1.63883 | 1.94276 | 2.18525 | 2.33042 | 1.93294 | 1.83118 | 1.28112 | 1.36198 | 1.50338 | 1.44194 |

| Novartis AG | 0.50555 | 0.27826 | 0.13484 | 0.09545 | −0.18693 | 0.07727 | 0.29578 | 0.30180 | 0.14702 | 0.23576 |

| Roche Holding AG | 1.29674 | 1.15570 | 1.14490 | 1.08968 | 1.12800 | 1.29029 | 1.57613 | 1.76288 | 1.81191 | 1.54125 |

| AstraZeneca PLC | −0.23659 | −0.42758 | −0.79111 | −0.23230 | 0.01472 | 0.44873 | 0.12074 | −0.43321 | 1.02401 | 1.47200 |

| Novo Nordisk A/S | 2.35017 | 2.15960 | 1.96161 | 2.22593 | 2.04256 | 2.20258 | 1.94291 | 1.82902 | 1.93326 | 1.47681 |

| Sanofi SA | 0.04362 | −0.13374 | −0.18486 | −0.04612 | 0.05198 | 0.14467 | 0.05689 | 0.23550 | 0.20994 | 0.23455 |

| CSL Ltd | 1.21720 | 1.02942 | 1.08431 | 0.51625 | 0.37214 | 1.12439 | 1.01565 | 1.01689 | 0.82934 | 0.94344 |

| GlaxoSmithKline PLC | 0.64002 | 0.67872 | 0.77231 | 0.77643 | 0.52887 | 0.46277 | 0.53041 | 0.88694 | 0.96837 | 0.97790 |

| Zoetis Inc. | 1.48136 | 1.11362 | 1.15051 | 1.20155 | 0.76793 | 0.36494 | 0.12873 | −0.02551 | 0.13154 | −0.29618 |

| Otsuka Holdings Co. Ltd | −0.52284 | −0.71706 | −1.26499 | −1.20455 | −1.19644 | −0.84525 | #N/A | −0.45762 | −0.66259 | −0.77740 |

| Chugai Pharmaceutical Co. Ltd | 1.87358 | 0.94986 | 0.13051 | −0.13125 | −0.44927 | −0.14439 | −0.29861 | −0.02829 | −0.00790 | −0.24235 |

| Bayer AG | −0.26767 | −0.38440 | −0.31620 | 0.02975 | −0.13468 | −0.34243 | −0.55787 | −0.44744 | −0.50802 | −0.54359 |

| Daiichi Sankyo Co. Ltd | −0.55656 | −1.02225 | −1.05773 | −0.97926 | −0.66268 | −0.98046 | −0.67618 | −0.86278 | 0.13314 | −0.67774 |

| Takeda Pharmaceutical Co. Ltd | −1.10340 | −1.04536 | −0.74858 | −0.81984 | −1.11172 | −1.25964 | −1.02439 | −1.30429 | −0.19206 | 0.68223 |

| Samsung Biologics Co. Ltd | 0.55068 | −0.65188 | −0.84231 | −0.52901 | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A |

| Biogen Inc. | 1.74542 | 2.93836 | 2.53818 | 2.34769 | 2.54048 | 2.45398 | 2.05997 | 1.76189 | 2.01973 | 2.19540 |

| Alexion Pharmaceuticals Inc. | 2.66174 | 2.03657 | 1.39249 | 0.14189 | 0.34077 | 0.42517 | 2.08288 | 1.75735 | 1.67054 | 1.22024 |

| Astellas Pharma Inc. | 0.17677 | 0.16536 | 0.12286 | 0.08562 | −0.11059 | −0.19015 | −0.29608 | −0.21074 | −0.61234 | −0.66901 |

| Changchun High & New Technology Industries Group Inc. | 2.53954 | 1.59812 | 1.08441 | 0.71304 | 0.53779 | 0.57274 | 0.38409 | 0.79489 | 0.79089 | −0.32733 |

| Canopy Growth Corp | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A |

| Ucb SA | 0.08367 | 0.21165 | 0.35812 | 0.46035 | −0.13439 | −0.37004 | −0.79504 | −0.90592 | −0.69039 | −0.64269 |

| Trulieve Cannabis Corp | 2.23516 | 2.23551 | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A |

| Torrent Pharmaceuticals Ltd | −0.05391 | −0.21890 | −0.36537 | −0.13258 | 1.46830 | −0.10589 | 0.31414 | 0.04606 | −0.31725 | −0.43153 |

| Tilray Inc. | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A |

| Teva Pharmaceutical Industries Ltd | −0.06599 | −0.36121 | −0.28401 | −0.17432 | 0.00966 | 0.45890 | 0.24591 | 0.04266 | −0.20213 | 0.28156 |

| Sun Pharmaceutical Industries Ltd | −0.43785 | −0.30693 | −0.34019 | 0.67905 | 0.53572 | .56750 | 2.20495 | 2.13742 | 1.87698 | 1.17408 |

| Swedish Orphan Biovitrum AB (publ) | 0.96419 | 1.21735 | 1.25632 | 0.50107 | 0.09350 | −1.29355 | −1.75033 | #N/A | #N/A | #N/A |

| Dr.Reddy’s Laboratories Ltd | −0.26104 | −0.63131 | −0.97177 | −0.84393 | −0.07888 | −0.06394 | −0.01206 | −0.05921 | 0.01494 | −0.37448 |

| Recordati Industria Chimica e Farmaceutica SpA | 1.31317 | 1.01573 | 1.14472 | 1.08526 | 0.77415 | 0.71317 | 0.41969 | 0.32205 | 0.29195 | 0.23653 |

| Perrigo Company PLC | −1.04508 | −1.03038 | −0.86054 | −0.52097 | −0.72266 | #N/A | −0.41341 | 0.06186 | −0.12367 | −0.12958 |

| Pacira Biosciences Inc. | −0.56183 | −1.06968 | −1.30087 | #N/A | #N/A | −1.36672 | #N/A | #N/A | #N/A | #N/A |

| OPKO Health Inc. | −1.56794 | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A |

| Mckesson Corp | −1.84394 | −1.70533 | −1.62500 | −1.66811 | −1.65811 | −1.54025 | −1.70205 | −1.63301 | −1.83702 | −1.73264 |

| Lupin Ltd | −1.05532 | −0.77146 | −0.60699 | 0.05778 | 0.17694 | 0.62369 | 0.55059 | 0.18196 | −0.17239 | −0.16591 |

| H Lundbeck A/S | −0.31297 | 0.11691 | 0.87304 | 0.52341 | −0.53534 | #N/A | −1.66324 | −0.65351 | −0.81284 | 0.21068 |

| Kalbe Farma Tbk PT | −0.34621 | −0.42602 | −0.38513 | −0.36586 | −0.40252 | −0.34044 | −0.31918 | −0.27800 | −0.33293 | #N/A |

| Jazz Pharmaceuticals PLC | 0.21034 | 0.39843 | 1.30489 | 1.17187 | 1.67795 | 2.08805 | 0.30330 | 2.02505 | 1.89922 | 3.23107 |

| Ipsen SA | 0.72036 | 0.39825 | 0.32819 | 0.46841 | 0.13252 | 0.19869 | 0.00207 | −0.10521 | −0.58292 | −0.30872 |

| IPCA Laboratories Ltd | −0.37311 | −0.56077 | −1.00928 | −1.09072 | −1.31799 | −0.69879 | 0.20146 | 0.02748 | −0.06524 | −0.22219 |

| Horizon Therapeutics PLC | 0.47470 | −0.84513 | −1.27217 | #N/A | #N/A | −1.05062 | #N/A | #N/A | #N/A | #N/A |

| Hypera SA | 0.92097 | −0.51358 | 1.09943 | 1.28366 | 1.03412 | 1.08164 | 1.13526 | 0.56626 | 0.48565 | −0.65187 |

| Hikma Pharmaceuticals PLC | 0.34234 | 0.12795 | 0.18922 | −0.00068 | 0.06834 | 0.84478 | 0.88730 | 0.99065 | −0.32276 | −0.42511 |

| Green Thumb Industries Inc. | −0.06060 | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A |

| Elanco Animal Health Inc. | 0.54687 | 0.88937 | 0.82963 | 0.79452 | 0.94043 | 1.20571 | 0.84691 | −0.27820 | −0.66505 | −0.68538 |

| Dechra Pharmaceuticals PLC | −0.83254 | −0.88594 | −0.78186 | −0.78278 | −0.66095 | −0.54037 | −0.61032 | −0.73006 | −0.77136 | −1.33755 |

| Dermapharm Holding SE | −0.01038 | −0.16045 | 0.05962 | −0.04683 | −0.12883 | −0.07259 | −0.57727 | #N/A | #N/A | #N/A |

| Curaleaf Holdings Inc. | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A |

| Catalent Inc. | −0.66084 | −0.78247 | −0.72077 | −0.71853 | −0.73362 | −0.34325 | −0.49436 | −0.59896 | −0.73294 | −0.52107 |

| Cronos Group Inc. | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A |

| Cresco Labs Inc. | −1.62617 | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A |

| Cipla Ltd | −0.73512 | −0.72514 | −0.66820 | −0.78993 | −0.72371 | −0.39407 | −0.20004 | 0.37686 | 0.03319 | −0.17243 |

| Bausch Health Companies Inc. | −0.33310 | −0.43060 | −1.23289 | −1.26453 | −.78237 | 0.14014 | 1.04342 | −0.33267 | −0.19597 | 0.45113 |

| Aurobindo Pharma Ltd | −0.26496 | −0.30547 | −0.02481 | 0.00626 | −0.05702 | −0.01844 | 0.29422 | −0.73848 | −1.09997 | −0.06710 |

| Aspen Pharmacare Holdings Ltd | 0.34944 | 0.42020 | 0.48626 | 0.35369 | 0.30445 | 0.47576 | 0.51870 | 0.80734 | 0.80687 | 0.81212 |

| Aphria Inc. | #N/A | #N/A | #N/A | −1.53741 | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A |

| Almirall SA | −0.69484 | −0.69347 | −1.09928 | #N/A | −1.11178 | −0.61717 | #N/A | −1.73070 | −1.18849 | −0.66172 |

| ALK-Abello A/S | −1.43471 | −1.75484 | #N/A | −1.60878 | −0.42218 | −0.67943 | −0.64653 | −1.25693 | −1.22289 | −0.64471 |

| Alembic Pharmaceuticals Ltd | 0.44849 | −0.12869 | −0.32359 | −0.25657 | 0.77395 | −0.16416 | −0.24293 | −0.46279 | −0.65885 | −0.83130 |

| Abbott Laboratories | −0.40027 | −0.50991 | −0.68327 | −1.20760 | −0.53497 | −0.40334 | −0.57070 | −0.77374 | −1.28831 | −1.18346 |

| Abcam PLC | −0.58975 | 0.85658 | 1.56098 | 0.64754 | 0.81499 | 1.16780 | 1.38914 | 1.59129 | 2.00568 | 1.94765 |

| Tasly Pharmaceutical Group Co. Ltd | −0.93932 | −0.60882 | −0.61395 | −0.71385 | −0.49178 | −0.27005 | −0.54964 | −0.62199 | −0.84872 | −0.63504 |

| Zhejiang Hisun Pharmaceutical Co. Ltd | −0.99035 | #N/A | −1.48462 | −1.35570 | −1.62881 | −1.54567 | −1.13645 | −1.05234 | −1.49470 | −0.75933 |

| Shanghai Fosun Pharmaceutical Group Co. | −1.10190 | −1.04936 | −0.94929 | −0.72585 | −0.83872 | −0.73614 | −1.00319 | −0.82657 | −1.24751 | −1.42744 |

| Beijing Tongrentang Co. Ltd | −0.50213 | −0.55890 | −0.58943 | −0.19928 | −0.17154 | 0.05522 | 0.16715 | 0.25753 | 0.29689 | 0.22099 |

| Humanwell Healthcare Group Co. Ltd | −0.86039 | −0.93128 | −0.65669 | −0.85951 | −0.90829 | −0.52719 | −0.47468 | −0.54982 | −0.46309 | −0.23292 |

| Oneness Biotech Co. Ltd | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A |

| Taisho Pharmaceutical Holdings Co. Ltd | −1.23098 | −0.75584 | −0.59494 | −0.78451 | −0.95158 | −0.71876 | −0.52824 | −0.62526 | −0.54974 | #N/A |

| JCR Pharmaceuticals Co. Ltd | −0.66193 | 0.10923 | −0.13961 | −0.63397 | −0.74009 | −0.63378 | −0.93993 | −1.03286 | −1.14689 | −0.94778 |

| Santen Pharmaceutical Co. Ltd | −0.31859 | −0.23271 | −0.23860 | −0.33446 | 1.79884 | 0.25660 | 0.08713 | 0.17828 | 0.41795 | 0.87211 |

| Hisamitsu Pharmaceutical Co. Inc. | −1.04162 | −0.37517 | −0.38957 | −0.16573 | −0.23763 | −0.16814 | −0.62410 | −0.59603 | −0.17367 | −0.02912 |

| Ono Pharmaceutical Co. Ltd | 0.68656 | 0.15356 | 0.19119 | 1.02605 | −0.15513 | −0.72870 | −0.10475 | 0.20076 | 0.69519 | 0.69876 |

| Eisai Co. Ltd | −0.00829 | −0.52095 | −0.63944 | −0.79798 | −0.93974 | −1.23935 | −0.84185 | −0.63574 | −0.48514 | −0.44487 |

| Shionogi & Co. Ltd | 1.90686 | 2.20194 | 1.18564 | 1.10276 | 0.77587 | −0.05587 | 0.17725 | 0.18529 | −0.18973 | −0.25315 |

| Sumitomo Dainippon Pharma Co. Ltd | −0.52741 | −0.74073 | −0.11012 | −0.52442 | −1.02183 | −1.14472 | −0.84003 | −1.12545 | −1.42672 | −1.10744 |

| Kyowa Kirin Co. Ltd | −0.24575 | −0.23365 | −0.01018 | −0.20807 | −0.50209 | −0.62831 | −0.84214 | −0.35459 | −0.36915 | −0.57491 |

| China Resources Pharmaceutical Group | −1.48073 | −1.40263 | −1.20476 | −1.27447 | −1.29677 | −1.16681 | −1.29241 | −1.13525 | #N/A | #N/A |

| Porton Pharma Solutions Ltd | −0.13800 | −0.70771 | −0.85002 | −0.39019 | −0.29254 | −0.41696 | −0.38938 | −0.05506 | −0.35172 | −0.48324 |

| Anhui Anke Biotechnology Group Co. Ltd | 0.54999 | 0.17898 | 0.28261 | 0.83603 | 0.41619 | 0.37998 | 0.24548 | 0.33577 | 0.12223 | −0.24213 |

| Innovent Biologics Inc. | 0.65440 | −0.01613 | −0.21823 | −0.27650 | −0.19479 | −0.25658 | −0.53288 | −0.76349 | #N/A | #N/A |

| Sino Biopharmaceutical Ltd | 0.10289 | 0.34230 | 0.09783 | 0.20972 | 0.00235 | 0.06247 | −0.08400 | −0.08324 | 0.13144 | −0.24757 |

| CSPC Pharmaceutical Group Ltd | −0.58346 | −0.82328 | −0.99694 | −1.21073 | −1.13249 | −1.33821 | −0.51924 | −0.45218 | −0.55841 | −0.53137 |

| Guangzhou Baiyunshan Pharmaceutical | −1.37380 | −1.09093 | −0.95432 | −1.30090 | −1.28966 | −1.12176 | −1.38194 | −1.29346 | −1.72693 | −1.53673 |

| China Traditional Chinese Medicine | −0.23935 | −0.29704 | −0.11512 | 0.10227 | −0.20291 | −0.13763 | 0.12969 | −0.05820 | 0.15305 | −0.93725 |

| China Grand Pharmaceutical and Healthcare Holdings Ltd | 0.98882 | 0.06158 | −0.33211 | −0.48630 | −0.68986 | −0.72179 | −0.87935 | −0.55614 | −1.28068 | −1.16961 |

| Sihuan Pharmaceutical Holdings Group | 0.00488 | 2.56470 | 3.44365 | 3.07636 | 3.54050 | 4.18016 | 4.33001 | 3.78506 | 1.49585 | 2.56686 |

| Green Cross Corp | −1.64338 | −1.56165 | −1.42635 | −1.19101 | −1.25261 | −0.92161 | −0.93005 | −0.96438 | −1.07583 | −0.80795 |

| Shenzhen Hepalink Pharmaceutical | −0.02408 | −0.34608 | 0.06837 | −1.31707 | −0.58152 | 0.22141 | −0.83502 | −0.87624 | 0.87809 | 0.38217 |

| Shenzhen Salubris Pharmaceuticals Co. | −0.59734 | −0.03509 | 1.44949 | 1.83868 | 1.85922 | 2.05822 | 2.04143 | 2.10734 | 2.04392 | 0.99976 |

| Jiangsu Nhwa Pharmaceutical Co. Ltd | 0.44837 | −0.27901 | −0.40624 | −0.64381 | −0.83248 | −0.71606 | −0.83792 | −0.89102 | −1.11237 | −1.12698 |

| Yifan Pharmaceutical Co. Ltd | 0.14900 | 0.24922 | 0.08207 | 1.57697 | 0.52807 | −0.30349 | −0.14592 | −0.56852 | #N/A | #N/A |

| China Resources Sanjiu Medical & Pharmaceutical Co. Ltd | −0.40291 | −0.66926 | −0.65113 | −0.58311 | −0.57383 | −0.28322 | −0.29901 | −0.04696 | −0.12885 | −0.27284 |

| Apeloa Pharmaceutical Co. Ltd | −0.80890 | −0.96958 | −1.09256 | −1.14089 | −1.32551 | −1.20452 | −1.14533 | −1.26774 | −1.33801 | −1.39827 |

| Jilin Aodong Pharmaceutical Group Co. | −1.83233 | −1.00938 | −0.74395 | −0.55052 | −0.72673 | −0.54687 | −0.45703 | −0.83786 | −1.00115 | −1.38212 |

| Yunnan Baiyao Group Co. Ltd | −0.72966 | −0.95208 | −0.33740 | −0.54877 | −0.55100 | −0.35874 | −0.47884 | −0.62590 | −0.67358 | −0.73903 |

Appendix B

| No. | Variables | Formulas and Description | Category |

|---|---|---|---|

| 1 | Current ratio | , measures a company’s ability to pay off short-term debt with current assets [62] | Liquidity and solvency |

| 2 | Quick ratio | , measures a company’s ability to pay off short-term debt with quick assets [62] | |

| 3 | Cash ratio | , measures a company’s ability to pay off short-term liabilities with cash and cash equivalents [67] | |

| 4 | General solvency | , measures the company’s ability to meet its obligations to its creditors on account of total assets [68] | |

| 5 | Patrimonial solvency | , measures the company’s ability to meet its obligations to its creditors on account of shareholder equity [68] | |

| 6 | Return on assets | , measures the company’s ability to make a satisfactory net profit by using its assets [63] | Profitability |

| 7 | Return on equity | , measures the return on equity (i.e., the financial investment which shareholders have made by buying the company’s shares) [62] | |

| 8 | Return on research capital | , measures the revenues that a company generates from R&D activity [67] | |

| 9 | Operating profit margin | , measures how efficiently a company can generate profit from its operating activity [62] | |

| 10 | Net profit Margin | measures how much net income is generated as a percentage of revenues [62] | |

| 11 | Fixed assets turnover | measures how effectively the company uses its plant and equipment [62] | Assets Management |

| 12 | Inventories turnover | , measures how many times the particular fixed asset is “turned over” during the year [62] | |

| 13 | Total assets turnover | , measures the turnover of all of the company’s assets [62] | |

| 14 | Intangible assets turnover | , measures the effectiveness of intangible assets used in the company [68] | |

| 15 | Equity multiplier | , measures the portion of the company’s assets that is financed by stock (rather than debt) [62] | Debt Management |

| 16 | Debt-to-equity ratio | , measures the degree to which a company is financing its operations through debt vs. shareholder funds [67] | |

| 17 | Long-term debt ratio (or financial leverage) | , measures how much of the total funds to finance the company’s wealth are provided by long-term debt [68] | |

| 18 | P/B ratio | , measures the market’s valuation of a company relative to its book value [62] | Market Value |

| 19 | P/E ratio | , measures how much investors are willing to pay per currency unit of reported profits [62] | |

| 20 | Tobin’s Q ratio | , measures whether a company is relatively over- or under-valued [68] | |

| 21 | EV/Net income ratio | , measures the value of a stock that compares a company’s enterprise value to its net income [68] | |

| 22 | ESG | ESG, measures sustainability based on the environmental, social, and governance pillars [63] | Sustainability |

Appendix C

| ROA | Operating Profit Margin | ESG | Long-Term Debt | Solvency 2 | Total Assets Turnover | ROE | |

|---|---|---|---|---|---|---|---|

| ROA | 1 | 0.577 **(0.000) | −0.031 (0.000) | −0.123 **(0.000) | 0.129 **(0.000) | 0.440 **(0.000) | 0.648 **(0.000) |

| Operating Profit Margin | 0.577 **(0.000) | 1 | 0.156 **(0.000) | 0.134 **(0.000) | −0.134 **(0.000) | −0.104 **(0.000) | 0.485 **(0.000) |

| ESG | −0.031 (0.000) | 0.156 **(0.000) | 1 | 0.241 **(0.000) | −0.236 **(0.000) | 0.032 (0.000) | 0.189 **(0.000) |

| Long-term debt | −0.123 **(0.000) | 0.134 **(0.000) | 0.241 **(0.000) | 1 | −1.000 **(0.000) | −0.194 **(0.000) | 0.403 **(0.000) |

| Solvency 2 | 0.129 **(0.000) | −0.134 **(0.000) | −0.236 **(0.000) | −1.000 **(0.000) | 1 | 0.197 **(0.000) | −0.410 **(0.000) |

| Total assets turnover | 0.440 **(0.000) | −0.104 **(0.000) | 0.032 (0.000) | −0.194 **(0.000) | 0.197 **(0.000) | 1 | 0.343 **(0.000) |

| ROE | 0.648 **(0.000) | 0.485 **(0.000) | 0.189 **(0.000) | 0.403 **(0.000) | −0.410 **(0.000) | 0.343 **(.000) | 1 |

Appendix D

| Company Name | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|

| Johnson & Johnson | 2.94 | 3.07 | 3.06 | 3.04 | 3.17 | 3.08 | 3.19 | 3.01 | 3.00 | 2.94 |

| Pfizer | 2.45 | 2.37 | 2.28 | 2.62 | 2.57 | 2.48 | 2.55 | 2.59 | 2.55 | 2.57 |

| Eli Lilly and Co. | 2.35 | 2.15 | 2.77 | 2.78 | 2.55 | 2.53 | 2.53 | 2.98 | 2.85 | 3.05 |

| Merck & Co. | 2.96 | 3.18 | 3.17 | 2.92 | 2.92 | 2.74 | 2.79 | 2.55 | 2.84 | 2.94 |

| Abbvie | 1.96 | 1.95 | 2.11 | 2.16 | 2.29 | 1.98 | 1.56 | 1.88 | 1.61 | 2.43 |

| Bristol-Myers Squibb Co. | 2.14 | 2.57 | 3.21 | 3.05 | 2.93 | 2.42 | 2.58 | 2.48 | 2.70 | 3.19 |

| Amgen | 2.35 | 2.70 | 2.68 | 2.77 | 2.92 | 2.79 | 2.57 | 2.32 | 2.36 | 2.39 |

| Novartis | 2.73 | 2.71 | 2.68 | 2.58 | 2.58 | 2.61 | 2.78 | 2.73 | 2.76 | 2.75 |

| Roche Holding | 3.51 | 3.52 | 3.41 | 3.32 | 3.51 | 3.43 | 3.41 | 3.65 | 3.36 | 3.01 |

| AstraZeneca | 2.64 | 2.49 | 2.35 | 2.61 | 2.72 | 2.88 | 2.64 | 2.59 | 3.12 | 3.43 |

| Novo Nordisk | 2.40 | 2.52 | 2.35 | 2.56 | 2.52 | 2.51 | 2.31 | 2.35 | 2.42 | 3.77 |

| Sanofi | 2.74 | 2.54 | 2.50 | 2.58 | 2.56 | 2.60 | 2.60 | 2.58 | 2.61 | 2.47 |

| CSL | 3.32 | 3.42 | 3.34 | 3.06 | 3.13 | 3.63 | 3.45 | 3.40 | 3.24 | 3.24 |

| GlaxoSmithKline | 2.75 | 2.61 | 2.29 | 1.95 | 2.05 | 2.41 | 2.37 | 2.88 | 2.63 | 3.01 |

| Zoetis | 2.57 | 2.49 | 2.33 | 2.09 | 2.12 | 1.65 | 2.13 | 1.39 | 1.92 | 1.81 |

| Otsuka Holdings | 2.49 | 2.41 | 2.07 | 2.03 | 2.02 | 2.05 | 1.83 | 2.20 | 2.20 | 1.71 |

| Chugai Pharmaceutical | 2.23 | 1.95 | 2.48 | 2.40 | 2.31 | 2.49 | 2.50 | 2.54 | 2.53 | 1.57 |

| Bayer | 2.43 | 2.61 | 2.47 | 2.64 | 2.50 | 2.58 | 2.60 | 2.70 | 2.71 | 2.62 |

| Daiichi Sankyo | 2.53 | 2.29 | 2.24 | 2.19 | 2.41 | 2.18 | 2.26 | 2.30 | 2.59 | 2.44 |

| Takeda Pharmaceutical | 2.17 | 2.12 | 2.39 | 2.29 | 2.25 | 2.03 | 2.04 | 2.05 | 2.29 | 2.60 |

| Samsung Biologics | 2.15 | 1.80 | 1.64 | 1.63 | 0.84 | 0.95 | 1.04 | 0.83 | 0.32 | 0.20 |

| Biogen | 3.43 | 3.69 | 3.47 | 3.35 | 3.25 | 3.39 | 3.33 | 3.05 | 3.08 | 3.03 |

| Alexion Pharmaceuticals | 2.69 | 2.72 | 2.07 | 1.82 | 1.80 | 1.71 | 2.75 | 2.44 | 2.51 | 1.51 |

| Astellas Pharma | 2.85 | 3.06 | 2.99 | 3.05 | 3.03 | 2.84 | 2.68 | 2.53 | 1.48 | 1.43 |

| Changchun High & New Technology Industries | 2.69 | 2.59 | 2.25 | 2.08 | 1.95 | 2.14 | 2.17 | 2.28 | 2.36 | 1.82 |

| Canopy Growth | 1.06 | 1.10 | 1.14 | 1.01 | 0.99 | 0.85 | 0.05 | 0.09 | 0.32 | 0.20 |

| Ucb | 2.70 | 2.74 | 2.79 | 2.68 | 2.50 | 2.17 | 1.97 | 1.91 | 2.04 | 2.00 |

| Trulieve Cannabis | 2.62 | 2.71 | 1.82 | 1.63 | 0.07 | 0.46 | 0.05 | 0.10 | 0.32 | 0.20 |

| Torrent Pharmaceuticals | 2.61 | 2.30 | 1.69 | 1.96 | 2.79 | 2.07 | 2.37 | 2.26 | 2.15 | 2.15 |

| Tilray | 1.09 | 0.76 | 0.51 | 0.12 | 0.57 | 0.46 | 0.05 | 0.09 | 0.32 | 0.20 |

| Teva Pharmaceutical Industries | 2.03 | 2.06 | 2.02 | 2.06 | 2.29 | 2.41 | 2.56 | 2.40 | 2.30 | 2.49 |

| Sun Pharmaceutical Industries | 2.28 | 2.27 | 2.08 | 2.54 | 2.49 | 2.46 | 2.80 | 2.84 | 2.73 | 2.54 |

| Swedish Orphan Biovitrum | 2.65 | 2.69 | 2.96 | 2.45 | 2.30 | 1.56 | 1.16 | 1.07 | 1.05 | 1.04 |

| Dr.Reddy’s Laboratories | 2.00 | 2.85 | 2.59 | 2.67 | 3.06 | 3.09 | 3.25 | 3.22 | 3.25 | 3.14 |

| Recordati Industria Chimica e Farmaceutica | 3.05 | 3.26 | 3.40 | 2.80 | 2.67 | 2.30 | 2.19 | 2.14 | 2.17 | 2.20 |

| Perrigo Company | 2.10 | 2.17 | 2.11 | 2.16 | 2.14 | 1.42 | 1.86 | 2.25 | 2.44 | 2.43 |

| Pacira Biosciences | 2.13 | 1.79 | 1.63 | 1.46 | 1.66 | 0.41 | 0.29 | 1.21 | 1.09 | 0.92 |

| OPKO Health | 1.71 | 1.43 | 1.48 | 1.40 | 1.34 | 0.95 | 0.87 | 0.87 | 0.94 | 0.20 |

| Mckesson | 1.63 | 1.58 | 1.77 | 2.05 | 1.91 | 1.71 | 1.69 | 1.75 | 1.73 | 1.75 |

| Lupin | 2.03 | 2.06 | 2.06 | 2.53 | 2.50 | 2.99 | 3.00 | 2.81 | 2.50 | 2.64 |

| H Lundbeck | 2.26 | 2.35 | 3.04 | 2.89 | 2.44 | 1.94 | 1.91 | 2.31 | 2.35 | 2.70 |

| Kalbe Farma Tbk | 2.84 | 2.91 | 3.00 | 3.09 | 3.14 | 2.97 | 3.03 | 2.04 | 2.01 | 1.59 |

| Jazz Pharmaceuticals | 1.89 | 2.19 | 2.32 | 2.19 | 2.38 | 2.74 | 1.60 | 2.18 | 2.18 | 3.03 |

| Ipsen | 3.01 | 2.52 | 2.87 | 2.68 | 2.68 | 1.68 | 1.58 | 2.57 | 2.36 | 1.79 |

| IPCA Laboratories | 2.55 | 2.02 | 1.77 | 1.76 | 1.59 | 1.82 | 2.48 | 2.37 | 2.34 | 2.34 |

| Horizon Therapeutics | 2.05 | 1.99 | 1.18 | 0.97 | 1.00 | 1.47 | 1.02 | 0.05 | 0.89 | 0.87 |

| Hypera | 2.49 | 1.96 | 2.41 | 2.39 | 2.11 | 1.93 | 2.08 | 2.02 | 1.94 | 1.54 |

| Hikma Pharmaceuticals | 2.81 | 2.73 | 2.62 | 2.29 | 2.34 | 2.73 | 3.00 | 3.03 | 2.45 | 2.40 |

| Green Thumb Industries | 1.79 | 0.96 | 1.08 | 0.08 | 3.00 | 0.46 | 0.05 | 0.09 | 0.32 | 0.20 |

| Luye Pharma Group | 2.25 | 2.47 | 2.29 | 1.12 | 1.10 | 1.03 | 0.97 | 1.01 | 0.90 | 0.84 |

| Dechra Pharmaceuticals | 2.08 | 1.95 | 1.79 | 1.99 | 1.93 | 2.31 | 2.17 | 1.86 | 1.82 | 2.63 |

| Dermapharm Holding | 2.18 | 1.70 | 2.29 | 2.57 | 3.37 | 2.00 | 1.53 | 0.39 | 0.32 | 0.20 |

| Curaleaf Holdings | 1.33 | 1.05 | 0.92 | 0.13 | 0.07 | 0.46 | 0.05 | 0.09 | 0.32 | 0.20 |

| Catalent | 2.03 | 1.77 | 1.54 | 1.54 | 1.22 | 1.41 | 0.57 | 0.61 | 0.49 | 0.51 |

| Cronos Group | 0.09 | 0.38 | 0.51 | 0.91 | 0.07 | 0.86 | 0.05 | 0.09 | 0.32 | 0.20 |

| Cresco Labs | 1.32 | 0.98 | 0.51 | 0.13 | 0.07 | 0.46 | 0.05 | 0.10 | 0.32 | 1.16 |

| Cipla | 2.68 | 2.64 | 2.47 | 2.22 | 2.29 | 2.40 | 2.41 | 2.46 | 2.27 | 2.21 |

| Bausch Health Companies | 1.04 | 1.09 | 0.76 | 1.08 | 0.81 | 1.09 | 1.49 | 0.89 | 1.02 | 1.47 |

| Aurobindo Pharma | 1.63 | 2.55 | 2.64 | 2.88 | 2.75 | 2.72 | 2.59 | 1.81 | 1.57 | 2.08 |

| Aspen Pharmacare | 2.43 | 2.50 | 2.41 | 2.62 | 2.45 | 2.57 | 2.32 | 2.45 | 2.47 | 2.44 |

| Aphria | 1.30 | 1.12 | 0.89 | 0.96 | 0.03 | 0.46 | 0.05 | 0.09 | 0.32 | 0.20 |

| Almirall | 1.91 | 1.87 | 1.65 | 1.04 | 1.27 | 1.42 | 1.61 | 1.14 | 0.53 | 0.65 |

| ALK-Abello | 2.03 | 1.69 | 1.28 | 1.32 | 1.78 | 1.75 | 1.77 | 1.52 | 1.57 | 1.78 |

| Alembic Pharmaceuticals | 2.30 | 2.20 | 2.08 | 1.50 | 2.28 | 2.67 | 3.03 | 2.73 | 2.60 | 2.51 |

| Abbott Laboratories | 2.64 | 2.49 | 2.43 | 2.31 | 2.37 | 2.48 | 2.46 | 2.47 | 2.36 | 2.26 |

| Abcam | 1.06 | 1.60 | 1.80 | 1.13 | 1.12 | 1.29 | 1.40 | 1.43 | 1.39 | 2.06 |

| Tasly Pharmaceutical | 2.07 | 2.01 | 2.05 | 1.92 | 2.10 | 2.29 | 2.32 | 2.30 | 2.11 | 1.98 |

| Zhejiang Hisun Pharmaceutical | 1.56 | 1.28 | 1.44 | 1.49 | 1.39 | 1.23 | 1.53 | 1.58 | 1.43 | 1.72 |

| Shanghai Fosun Pharmaceutical | 2.26 | 2.19 | 2.10 | 2.14 | 2.19 | 2.05 | 1.48 | 1.49 | 1.41 | 1.35 |

| Sawai Group | 1.63 | 1.64 | 1.56 | 1.85 | 1.89 | 1.93 | 1.93 | 2.03 | 1.91 | 2.00 |

| Humanwell Healthcare | 1.67 | 1.42 | 1.63 | 1.53 | 1.61 | 1.71 | 1.79 | 1.85 | 1.80 | 1.78 |

| Oneness Biotech | 0.13 | 0.42 | 0.51 | 0.13 | 0.07 | 0.46 | 0.08 | 0.17 | 0.32 | 0.20 |

| Taisho Pharmaceutical Holdings | 0.81 | 1.02 | 1.02 | 1.00 | 0.79 | 0.68 | 0.83 | 0.72 | 0.74 | 0.20 |

| JCR Pharmaceuticals | 1.63 | 1.90 | 1.82 | 1.60 | 1.58 | 1.57 | 1.48 | 1.39 | 1.39 | 1.47 |

| Santen Pharmaceutical | 2.38 | 2.47 | 2.51 | 1.42 | 3.07 | 2.29 | 2.40 | 1.38 | 1.45 | 1.64 |

| Hisamitsu Pharmaceutical | 1.72 | 2.01 | 1.98 | 1.99 | 2.07 | 1.99 | 1.90 | 1.95 | 2.22 | 2.29 |

| Ono Pharmaceutical | 1.81 | 2.68 | 2.54 | 2.68 | 2.24 | 1.93 | 2.17 | 2.20 | 2.08 | 2.13 |

| Eisai | 2.92 | 2.66 | 2.61 | 2.49 | 2.49 | 2.25 | 2.42 | 2.43 | 2.75 | 2.71 |

| Shionogi & Co. | 3.20 | 2.26 | 3.08 | 2.86 | 2.62 | 2.18 | 2.28 | 2.41 | 2.23 | 2.27 |

| Sumitomo Dainippon Pharma | 2.20 | 2.30 | 2.40 | 2.18 | 2.10 | 2.06 | 2.21 | 1.90 | 1.88 | 1.95 |

| Kyowa Kirin | 1.38 | 2.19 | 2.20 | 2.23 | 2.22 | 1.20 | 1.03 | 1.07 | 1.15 | 2.05 |

| China Resources Pharmaceutical | 2.31 | 2.45 | 2.55 | 1.95 | 2.03 | 2.09 | 2.15 | 2.11 | 0.32 | 0.20 |

| Porton Pharma Solutions | 1.73 | 1.49 | 1.30 | 1.55 | 1.70 | 1.57 | 1.75 | 2.13 | 2.16 | 2.21 |

| Anhui Anke Biotechnology | 0.96 | 1.75 | 2.01 | 2.11 | 1.93 | 0.88 | 1.04 | 1.02 | 0.93 | 0.77 |

| Zhejiang Starry Pharmaceutical | 1.92 | 1.57 | 1.57 | 1.55 | 1.85 | 1.78 | 1.84 | 1.72 | 0.32 | 0.20 |

| Sino Biopharmaceutical | 2.53 | 2.62 | 2.50 | 2.65 | 2.48 | 2.66 | 2.69 | 1.52 | 2.63 | 2.28 |

| Virbac | 2.78 | 2.25 | 1.68 | 1.51 | 1.60 | 1.32 | 1.75 | 2.00 | 2.02 | 2.22 |

| Guangzhou Baiyunshan Pharmaceutical | 2.67 | 2.57 | 1.46 | 2.25 | 2.14 | 1.25 | 2.30 | 1.18 | 0.93 | 0.85 |

| China Traditional Chinese Medicine | 2.17 | 2.11 | 2.17 | 1.65 | 1.57 | 1.39 | 1.84 | 1.50 | 1.10 | 0.65 |

| China Grand Pharmaceutical and Healthcare | 1.98 | 1.84 | 1.64 | 1.81 | 1.64 | 1.64 | 1.67 | 1.64 | 1.58 | 1.64 |

| Sihuan Pharmaceutical Holdings | 2.06 | 2.41 | 1.73 | 0.62 | 0.59 | 1.60 | 1.64 | 1.56 | 2.14 | 2.12 |

| Green Cross | 1.56 | 1.42 | 1.55 | 1.64 | 1.67 | 1.76 | 1.77 | 1.80 | 1.82 | 1.92 |

| Shenzhen Hepalink Pharmaceutical | 1.88 | 1.59 | 1.63 | 1.12 | 1.31 | 1.51 | 1.27 | 0.25 | 0.72 | 0.71 |

| Shenzhen Salubris Pharmaceuticals | 1.73 | 2.17 | 2.75 | 2.62 | 2.66 | 2.77 | 1.71 | 1.73 | 1.63 | 1.30 |

| Jiangsu Nhwa Pharmaceutical | 2.25 | 2.34 | 2.22 | 2.19 | 2.12 | 2.16 | 2.40 | 2.46 | 2.47 | 2.39 |

| Yifan Pharmaceutical | 2.00 | 1.85 | 1.79 | 2.33 | 2.03 | 1.77 | 0.76 | 1.95 | 0.33 | 0.15 |

| China Resources Sanjiu Medical & Pharmaceutical | 1.23 | 1.24 | 1.21 | 2.11 | 1.87 | 1.95 | 1.96 | 2.09 | 2.17 | 2.02 |

| Apeloa Pharmaceutical | 1.51 | 1.13 | 1.03 | 0.87 | 1.74 | 1.68 | 1.83 | 1.69 | 1.73 | 1.60 |

| Jilin Aodong Pharmaceutical | 1.52 | 1.23 | 1.24 | 0.42 | 0.38 | 0.51 | 0.51 | 0.38 | 0.27 | 0.54 |

| Yunnan Baiyao | 2.26 | 2.11 | 2.13 | 2.10 | 2.16 | 2.36 | 2.44 | 2.53 | 2.49 | 2.41 |

| Company Name | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|

| Johnson & Johnson | 83.66 | 82.05 | 86.97 | 90.94 | 89.91 | 82.48 | 91.58 | 81.42 | 85.18 | 77.66 |

| Pfizer | 70.36 | 62.96 | 62.14 | 79.15 | 74.03 | 65.57 | 74.43 | 71.15 | 72.31 | 68.13 |

| Eli Lilly and Co. | 66.67 | 55.52 | 79.59 | 85.58 | 74.23 | 67.41 | 74.22 | 81.44 | 82.21 | 81.60 |

| Merck & Co. | 84.68 | 86.10 | 90.20 | 86.80 | 82.54 | 72.28 | 81.60 | 69.67 | 80.25 | 76.98 |

| Abbvie | 60.36 | 50.56 | 56.38 | 65.08 | 78.41 | 51.28 | 48.11 | 61.65 | 45.97 | 66.59 |

| Bristol-Myers Squibb Co. | 61.33 | 67.21 | 92.71 | 92.30 | 84.49 | 64.09 | 75.34 | 68.77 | 77.30 | 84.97 |

| Amgen | 66.82 | 78.13 | 73.19 | 84.77 | 83.92 | 75.25 | 75.69 | 65.45 | 68.67 | 64.84 |

| Novartis | 77.61 | 71.35 | 75.00 | 77.21 | 73.86 | 68.75 | 80.44 | 74.17 | 78.43 | 72.79 |

| Roche Holding | 100 | 95.28 | 98.66 | 99.46 | 100 | 94.01 | 99.74 | 100 | 100 | 85.10 |

| AstraZeneca | 76.10 | 65.24 | 65.43 | 78.54 | 78.73 | 76.45 | 76.11 | 70.67 | 89.31 | 91.50 |

| Novo Nordisk | 74.68 | 72.10 | 63.51 | 83.85 | 79.88 | 73.07 | 73.63 | 69.51 | 73.43 | 100 |

| Sanofi | 78.49 | 66.22 | 68.48 | 76.84 | 73.25 | 68.28 | 75.20 | 70.17 | 73.72 | 65.59 |

| CSL | 94.29 | 92.10 | 97.17 | 93.51 | 91.29 | 100 | 100 | 92.47 | 92.82 | 85.38 |

| GlaxoSmithKline | 81.06 | 72.35 | 61.71 | 59.61 | 69.35 | 62.69 | 75.39 | 84.08 | 73.39 | 83.90 |

| Zoetis | 76.52 | 69.96 | 70.15 | 69.69 | 67.18 | 46.03 | 67.10 | 46.54 | 55.37 | 49.82 |

| Otsuka Holdings | 71.07 | 63.11 | 55.97 | 62.41 | 59.63 | 53.75 | 55.96 | 61.32 | 62.72 | 47.58 |

| Chugai Pharmaceutical | 65.89 | 52.45 | 68.71 | 72.64 | 67.26 | 65.69 | 72.86 | 69.31 | 71.73 | 44.20 |

| Bayer | 68.77 | 67.99 | 67.37 | 78.88 | 72.26 | 68.69 | 76.04 | 73.73 | 76.87 | 69.62 |

| Daiichi Sankyo | 72.11 | 60.03 | 60.77 | 66.36 | 69.51 | 56.77 | 66.51 | 63.61 | 73.36 | 65.01 |

| Takeda Pharmaceutical | 62.37 | 55.22 | 65.82 | 69.21 | 65.22 | 52.50 | 60.61 | 57.61 | 64.87 | 68.97 |

| Samsung Biologics | 62.27 | 47.08 | 43.32 | 51.14 | 30.13 | 31.39 | 35.14 | 28.44 | 11.32 | 11.17 |

| Biogen | 97.49 | 100 | 100 | 100 | 92.66 | 92.43 | 95.56 | 82.63 | 87.67 | 79.96 |

| Alexion Pharmaceuticals | 75.87 | 72.56 | 55.39 | 56.73 | 54.30 | 44.35 | 80.26 | 67.15 | 71.62 | 43.63 |

| Astellas Pharma | 80.73 | 80.84 | 83.54 | 90.43 | 85.71 | 74.85 | 77.22 | 68.92 | 43.33 | 40.77 |

| Changchun High & New Technology Industries | 78.16 | 69.98 | 63.81 | 65.22 | 59.22 | 58.64 | 66.71 | 65.70 | 70.81 | 52.04 |

| Canopy Growth | 34.38 | 28.64 | 28.27 | 34.57 | 33.73 | 21.61 | 10.06 | 11.02 | 11.32 | 11.17 |

| Ucb | 75.53 | 70.89 | 76.16 | 78.88 | 70.99 | 56.27 | 58.62 | 53.69 | 57.46 | 53.74 |

| Trulieve Cannabis | 73.40 | 69.95 | 47.96 | 51.16 | 11.08 | 11.34 | 10.00 | 11.30 | 11.32 | 11.17 |

| Torrent Pharmaceuticals | 73.25 | 59.53 | 44.32 | 59.91 | 78.28 | 53.76 | 68.61 | 62.06 | 60.49 | 57.17 |

| Tilray | 35.12 | 19.79 | 10.00 | 10.88 | 23.50 | 11.34 | 10.06 | 11.02 | 11.32 | 11.17 |

| Teva Pharmaceutical Industries | 58.76 | 53.26 | 53.87 | 62.50 | 65.80 | 62.68 | 73.36 | 65.33 | 64.57 | 65.32 |

| Sun Pharmaceutical Industries | 64.97 | 58.59 | 55.54 | 75.24 | 70.94 | 63.95 | 79.35 | 75.50 | 75.99 | 66.52 |

| Swedish Orphan Biovitrum | 74.29 | 69.56 | 81.09 | 72.86 | 66.14 | 40.25 | 38.13 | 34.12 | 30.96 | 31.12 |

| Dr. Reddy’s Laboratories | 57.85 | 73.68 | 70.46 | 78.51 | 84.84 | 80.48 | 90.73 | 84.60 | 90.07 | 80.74 |

| Recordati Industria Chimica e Farmaceutica | 84.27 | 84.21 | 93.95 | 81.97 | 75.23 | 59.72 | 64.19 | 59.14 | 60.89 | 58.36 |

| Perrigo Company | 60.54 | 56.05 | 56.60 | 65.03 | 62.25 | 36.59 | 55.78 | 61.84 | 68.16 | 64.02 |

| Pacira Biosciences | 61.15 | 46.39 | 42.57 | 46.61 | 50.21 | 10.00 | 16.18 | 37.25 | 31.89 | 28.21 |

| OPKO Health | 50.56 | 36.91 | 38.23 | 44.82 | 42.49 | 24.21 | 30.72 | 29.24 | 27.96 | 11.17 |

| Mckesson | 48.63 | 40.78 | 46.65 | 62.11 | 56.44 | 44.12 | 51.34 | 49.90 | 49.14 | 47.89 |

| Lupin | 58.77 | 53.35 | 55.07 | 74.97 | 70.97 | 77.83 | 84.42 | 74.95 | 70.01 | 68.94 |

| H Lundbeck | 64.55 | 60.82 | 83.54 | 84.41 | 69.53 | 50.32 | 57.01 | 63.20 | 65.79 | 70.18 |

| Kalbe Farma Tbk | 78.90 | 75.33 | 82.33 | 89.65 | 86.84 | 77.41 | 85.36 | 56.74 | 56.61 | 44.13 |

| Jazz Pharmaceuticals | 55.21 | 56.63 | 62.66 | 65.86 | 68.01 | 71.18 | 49.30 | 60.17 | 61.19 | 78.03 |

| Ipsen | 83.38 | 65.27 | 78.69 | 78.96 | 75.51 | 43.36 | 48.59 | 69.19 | 66.09 | 48.69 |

| IPCA Laboratories | 71.77 | 52.14 | 46.69 | 54.42 | 48.48 | 47.16 | 71.33 | 64.48 | 65.59 | 61.86 |

| Horizon Therapeutics | 59.27 | 51.38 | 29.42 | 33.43 | 34.02 | 37.85 | 34.57 | 10.00 | 26.58 | 26.92 |

| Hypera | 70.27 | 50.74 | 65.25 | 71.08 | 61.39 | 49.93 | 61.33 | 56.40 | 54.92 | 42.92 |

| Hikma Pharmaceuticals | 78.13 | 70.47 | 71.31 | 68.42 | 67.18 | 71.09 | 84.48 | 80.06 | 68.58 | 63.30 |

| Green Thumb Industries | 52.71 | 24.85 | 26.50 | 10.00 | 83.46 | 11.34 | 10.06 | 11.02 | 11.32 | 11.17 |

| Luye Pharma Group | 64.08 | 63.88 | 61.84 | 37.56 | 36.45 | 26.28 | 33.19 | 32.70 | 26.87 | 26.22 |

| Dechra Pharmaceuticals | 59.92 | 50.51 | 47.08 | 60.61 | 57.02 | 59.85 | 63.63 | 52.47 | 51.53 | 68.61 |

| Dermapharm Holding | 62.48 | 44.06 | 61.58 | 75.98 | 92.60 | 51.87 | 47.50 | 17.98 | 11.32 | 11.17 |

| Curaleaf Holdings | 41.07 | 27.17 | 21.87 | 11.26 | 11.08 | 11.34 | 10.06 | 11.02 | 11.32 | 11.17 |

| Catalent | 58.70 | 45.83 | 39.97 | 48.77 | 39.42 | 36.27 | 23.24 | 23.30 | 15.96 | 18.54 |

| Cronos Group | 10.00 | 10.00 | 10.01 | 31.88 | 11.08 | 21.74 | 10.06 | 11.02 | 11.32 | 11.17 |

| Cresco Labs | 40.85 | 25.32 | 10.01 | 11.26 | 11.08 | 11.34 | 10.06 | 11.14 | 11.32 | 33.78 |

| Cipla | 74.89 | 68.15 | 66.92 | 66.58 | 65.86 | 62.36 | 69.63 | 66.76 | 63.63 | 58.73 |

| Bausch Health Companies | 33.82 | 28.23 | 17.28 | 36.51 | 29.24 | 27.89 | 46.39 | 29.69 | 30.09 | 41.32 |

| Aurobindo Pharma | 48.57 | 65.94 | 71.78 | 84.07 | 77.23 | 70.65 | 74.20 | 51.33 | 44.82 | 55.72 |

| Aspen Pharmacare | 68.71 | 64.69 | 65.29 | 77.20 | 69.77 | 66.73 | 67.34 | 66.53 | 69.15 | 64.07 |

| Aphria | 40.33 | 29.02 | 21.17 | 33.32 | 10.00 | 11.34 | 10.06 | 11.02 | 11.32 | 11.17 |

| Almirall | 55.73 | 48.28 | 42.99 | 35.46 | 40.58 | 36.50 | 49.39 | 35.59 | 16.98 | 21.79 |

| ALK-Abello | 58.75 | 43.84 | 32.44 | 42.84 | 53.31 | 45.13 | 53.52 | 44.53 | 44.85 | 48.60 |

| Alembic Pharmaceuticals | 65.43 | 56.94 | 55.57 | 47.48 | 65.52 | 69.27 | 85.24 | 73.10 | 72.63 | 65.88 |

| Abbott Laboratories | 74.02 | 64.39 | 65.91 | 69.07 | 67.76 | 64.39 | 70.83 | 66.86 | 66.17 | 59.86 |

| Abcam | 34.45 | 41.32 | 47.53 | 37.74 | 36.96 | 33.25 | 44.20 | 42.36 | 40.11 | 55.20 |

| Tasly Pharmaceutical | 59.57 | 51.98 | 54.61 | 58.76 | 61.16 | 59.37 | 67.39 | 62.87 | 59.34 | 53.31 |

| Zhejiang Hisun Pharmaceutical | 46.97 | 33.10 | 36.99 | 47.41 | 43.77 | 31.57 | 47.47 | 46.08 | 41.09 | 47.18 |

| Shanghai Fosun Pharmaceutical | 64.58 | 56.71 | 56.13 | 64.68 | 63.33 | 53.14 | 46.05 | 43.80 | 40.57 | 38.27 |

| Sawai Group | 48.60 | 42.40 | 40.57 | 56.95 | 56.08 | 50.08 | 57.55 | 56.52 | 54.04 | 53.78 |

| Humanwell Healthcare | 49.71 | 36.74 | 42.52 | 48.37 | 49.02 | 44.07 | 53.92 | 52.38 | 51.03 | 48.62 |

| Oneness Biotech | 11.04 | 10.99 | 10.01 | 11.26 | 11.08 | 11.34 | 10.83 | 12.87 | 11.32 | 11.17 |

| Taisho Pharmaceutical Holdings | 28.17 | 26.37 | 24.78 | 34.22 | 28.70 | 17.05 | 29.69 | 25.81 | 22.53 | 11.17 |

| JCR Pharmaceuticals | 48.77 | 49.23 | 47.97 | 50.20 | 48.33 | 40.48 | 46.16 | 41.52 | 39.93 | 41.15 |

| Santen Pharmaceutical | 67.54 | 63.82 | 68.13 | 45.48 | 85.07 | 59.34 | 69.46 | 41.24 | 41.74 | 45.13 |

| Hisamitsu Pharmaceutical | 50.81 | 52.01 | 52.61 | 60.59 | 60.55 | 51.56 | 56.69 | 54.62 | 62.45 | 60.57 |

| Ono Pharmaceutical | 53.14 | 69.40 | 69.04 | 78.78 | 64.53 | 50.03 | 63.58 | 60.54 | 58.65 | 56.77 |

| Eisai | 81.00 | 68.68 | 70.91 | 73.91 | 70.72 | 58.31 | 69.82 | 66.05 | 76.54 | 70.48 |

| Shionogi & Co. | 87.98 | 58.46 | 84.79 | 83.71 | 73.96 | 56.48 | 66.43 | 65.59 | 62.57 | 60.03 |

| Sumitomo Dainippon Pharma | 63.05 | 59.58 | 64.90 | 65.62 | 61.23 | 53.43 | 64.64 | 53.45 | 53.24 | 52.52 |

| Kyowa Kirin | 42.33 | 56.53 | 59.25 | 66.92 | 64.24 | 30.69 | 34.83 | 33.98 | 33.73 | 54.83 |

| China Resources Pharmaceutical | 65.79 | 63.34 | 69.27 | 59.65 | 59.46 | 54.10 | 63.19 | 58.37 | 11.32 | 11.17 |

| Porton Pharma Solutions | 51.15 | 38.52 | 32.91 | 48.92 | 51.32 | 40.56 | 53.03 | 58.84 | 60.72 | 58.68 |

| Anhui Anke Biotechnology | 31.76 | 45.36 | 53.52 | 63.71 | 57.06 | 22.32 | 34.95 | 32.92 | 27.58 | 24.55 |

| Zhejiang Starry Pharmaceutical | 55.81 | 40.75 | 40.66 | 49.05 | 55.03 | 46.15 | 55.24 | 49.24 | 11.32 | 11.17 |

| Sino Biopharmaceutical | 71.28 | 67.72 | 67.96 | 78.17 | 70.69 | 69.11 | 76.64 | 44.52 | 73.39 | 60.27 |

| Virbac | 77.45 | 58.10 | 44.07 | 47.99 | 48.84 | 33.94 | 52.99 | 55.91 | 57.05 | 59.00 |

| Guangzhou Baiyunshan Pharmaceutical | 74.83 | 66.33 | 37.52 | 67.55 | 62.21 | 31.97 | 66.73 | 36.51 | 27.60 | 26.50 |

| China Traditional Chinese Medicine | 62.22 | 54.53 | 58.31 | 51.60 | 48.14 | 35.83 | 55.30 | 44.21 | 32.17 | 21.85 |

| China Grand Pharmaceutical and Healthcare | 57.48 | 47.49 | 42.91 | 55.80 | 49.75 | 42.30 | 50.92 | 47.39 | 45.11 | 45.25 |

| Sihuan Pharmaceutical Holdings | 59.36 | 62.35 | 45.37 | 24.36 | 23.97 | 41.34 | 50.09 | 45.44 | 60.28 | 56.65 |

| Green Cross | 46.80 | 36.65 | 40.28 | 51.32 | 50.53 | 45.44 | 53.45 | 51.12 | 51.71 | 51.80 |

| Shenzhen Hepalink Pharmaceutical | 54.94 | 41.17 | 42.59 | 37.59 | 41.73 | 38.88 | 40.87 | 14.77 | 22.01 | 23.22 |

| Shenzhen Salubris Pharmaceuticals | 51.19 | 56.04 | 75.11 | 77.39 | 75.12 | 72.03 | 52.02 | 49.44 | 46.39 | 37.17 |

| Jiangsu Nhwa Pharmaceutical | 64.16 | 60.59 | 59.82 | 65.88 | 61.61 | 56.05 | 69.40 | 66.71 | 68.98 | 62.92 |

| Yifan Pharmaceutical | 57.97 | 47.95 | 47.30 | 69.57 | 59.57 | 45.76 | 28.03 | 54.67 | 11.54 | 10.00 |

| China Resources Sanjiu Medical & Pharmaceutical | 38.51 | 32.09 | 30.26 | 63.89 | 55.52 | 50.44 | 58.33 | 57.86 | 60.89 | 54.28 |

| Apeloa Pharmaceutical | 45.71 | 29.24 | 25.06 | 30.87 | 52.37 | 43.39 | 55.02 | 48.68 | 49.21 | 44.20 |

| Jilin Aodong Pharmaceutical | 45.89 | 31.86 | 31.29 | 18.92 | 18.73 | 12.73 | 21.58 | 17.71 | 10.00 | 19.19 |

| Yunnan Baiyao | 64.33 | 54.54 | 57.12 | 63.57 | 62.64 | 61.15 | 70.35 | 68.32 | 69.73 | 63.54 |

References

- Gomes, E.; Angwin, D.N.; Weber, Y.; Yedidia Tarba, S. Critical success factors through the mergers and acquisitions process: Revealing pre-and post-M&A connections for improved performance. Thunderbird Int. Bus. Rev. 2013, 55, 13–35. [Google Scholar]

- Institute for Mergers, Acquisitions and Alliances (IMAA). Available online: https://imaa-institute.org/mergers-and-acquisitions-statistics/ (accessed on 15 March 2021).

- Christensen, C.M.; Alton, R.; Rising, C.; Waldeck, A. The new M&A playbook. Harv. Bus. Rev. 2011, 89, 48–57. [Google Scholar]

- Straub, T. Reasons for Frequent Failure in Mergers and Acquisitions: A Comprehensive Analysis; Deutscher Universitätsverlag: Wiesbaden, Germany, 2007. [Google Scholar]

- Wang, D.; Moini, H. Performance assessment of mergers and acquisitions: Evidence from Denmark. E-Leader Berlin. 2012, pp. 1–15. Available online: http://www.g-casa.com/PaperDatabase.htm (accessed on 10 March 2021).

- Pacquisitions Blog: What Happens When I Change My Mind (and Don’t Complete the Transaction)? Available online: https://pacquisitions.wordpress.com/2014/08/14/what-happenswhen-i-change-my-mind-and-dont-complete-the-transaction/ (accessed on 16 March 2021).

- Rao-Nicholson, R.; Salaber, J.; Cao, T.H. Long-term performance of mergers and acquisitions in ASEAN countries. Res. Int. Bus. Financ. 2016, 36, 373–387. [Google Scholar] [CrossRef]

- Liargovas, P.; Repousis, S. The impact of mergers and acquisitions on the performance of the Greek banking sector: An event study approach. Int. J. Econ. Financ. 2011, 3, 89–100. [Google Scholar] [CrossRef]

- Grigorieva, S.; Petrunina, T. The performance of mergers and acquisitions in emerging capital markets: New angle. J. Manag. Control 2015, 26, 377–403. [Google Scholar] [CrossRef]

- Calipha, R.; Tarba, S.; Brock, D. Mergers and acquisitions: A review of phases, motives, and success factors. In Advances in Mergers and Acquisitions; Emerald Group Publishing Limited: Bingley, UK, 2010. [Google Scholar]

- Wang, Q.; Lau, R.Y.; Yang, K. Does the interplay between the personality traits of CEOs and CFOs influence corporate mergers and acquisitions intensity? An econometric analysis with machine learning-based constructs. Decis. Support Syst. 2020, 139, 113424. [Google Scholar] [CrossRef]

- Hu, X.; Yin, X.; Jin, Z.; Li, J. How Do International M&As Affect Rival Firm’s Sustainable Performance?—Empirical Evidence from an Emerging Market. Sustainability 2020, 12, 1318. [Google Scholar]

- Cloodt, M.; Hagedoorn, J.; Van Kranenburg, H. Mergers and acquisitions: Their effect on the innovative performance of companies in high-tech industries. Res. Policy 2006, 35, 642–654. [Google Scholar] [CrossRef]

- Hagedoorn, J.; Duysters, G. The effect of mergers and acquisitions on the technological performance of companies in a high-tech environment. Technol. Anal. Strateg. Manag. 2002, 14, 67–85. [Google Scholar] [CrossRef][Green Version]

- Zhang, W.; Wang, K.; Li, L.; Chen, Y.; Wang, X. The impact of firms’ mergers and acquisitions on their performance in emerging economies. Technol. Forecast. Soc. Chang. 2018, 135, 208–216. [Google Scholar] [CrossRef]

- Hassan, M.; Patro, D.K.; Tuckman, H.; Wang, X. Do mergers and acquisitions create shareholder wealth in the pharmaceutical industry? Int. J. Pharm. Healthc. Mark. 2007, 1, 58–78. [Google Scholar] [CrossRef]

- Danzon, P.M.; Epstein, A.; Nicholson, S. Mergers and acquisitions in the pharmaceutical and biotech industries. Manag. Decis. Econ. 2007, 28, 307–328. [Google Scholar] [CrossRef]

- Patel, R. Pre & post-merger financial performance: An Indian perspective. J. Cent. Bank. Theory Pract. 2018, 7, 181–200. [Google Scholar]

- Rani, N.; Yadav, S.S.; Jain, P. Post-M&A operating performance of Indian acquiring firms: A Du Pont analysis. Int. J. Econ. Financ. 2013, 5, 65. [Google Scholar]

- Rani, N.; Yadav, S.S.; Jain, P. Financial performance analysis of mergers and acquisitions: Evidence from India. Int. J. Commer. Manag. 2015, 25, 402–423. [Google Scholar] [CrossRef]

- Martynova, M.; Oosting, S.; Renneboog, L. The long-term operating performance in European mergers and acquisitions. In International Mergers and Acquisitions Activity Since 1990; Elsevier: Amsterdam, The Netherlands, 2007; pp. 79–116. [Google Scholar]

- Borodin, A.; Sayabek, Z.S.; Islyam, G.; Panaedova, G. Impact of mergers and acquisitions on companies’ financial performance. J. Int. Stud. 2020, 13, 34–47. [Google Scholar] [CrossRef] [PubMed]

- Chen, J.; Zhao, X.; Niu, X.; Fan, Y.H.; Taylor, G. Does M&A Financing Affect Firm Performance under Different Ownership Types? Sustainability 2020, 12, 3078. [Google Scholar]

- Kwon, J.; Kim, C.; Lee, K.C. Moderating Effect of the Continental Factor on the Business Strategy and M&A Performance in the Pharmaceutical Industry for Sustainable International Business. Sustainability 2020, 12, 4985. [Google Scholar]

- Weber, Y.; Tarba, S.Y.; Reichel, A. A model of the influence of culture on integration approaches and international mergers and acquisitions performance. Int. Stud. Manag. Organ. 2011, 41, 9–24. [Google Scholar] [CrossRef]

- Rottig, D.; Reus, T.H.; Tarba, S.Y. The impact of culture on mergers and acquisitions: A third of a century of research. In Advances in Mergers and Acquisitions; Emerald Group Publishing Limited: Bingley, UK, 2014. [Google Scholar]

- Weber, Y.; Tarba, S.Y.; Bachar, Z.R. Mergers and acquisitions performance paradox: The mediating role of integration approach. Eur. J. Int. Manag. 2011, 5, 373–393. [Google Scholar] [CrossRef]

- Nagasha, S.; Bananuka, J.; Musimenta, D.; Lulu, G. The Impact of Merger and Acquisition on Firm Performance in East Africa; Services for Science and Education: Birmingham, UK, 2017. [Google Scholar]

- Dickerson, A.P.; Gibson, H.D.; Tsakalotos, E. The impact of acquisitions on company performance: Evidence from a large panel of UK firms. Oxf. Econ. Pap. 1997, 49, 344–361. [Google Scholar] [CrossRef]

- Mihaiu, D.M. Financial Synergies of Mergers and Acquisitions: Between Intentions and Achievements. In Emerging Issues in the Global Economy; Springer: New York, NY, USA, 2018; pp. 237–252. [Google Scholar]

- Pillania, R.K.; Kumar, S.; Bansal, L.K. The impact of mergers and acquisitions on corporate performance in India. Manag. Decis. 2008, 46, 1531–1543. [Google Scholar]

- Srivastava, R. Managing mergers and acquisitions in health care: A case study in the pharmaceutical sector. Int. J. Healthc. Manag. 2020, 13 (Suppl. 1), 61–73. [Google Scholar] [CrossRef]

- Paniagua, J.; Rivelles, R.; Sapena, J. Corporate governance and financial performance: The role of ownership and board structure. J. Bus. Res. 2018, 89, 229–234. [Google Scholar] [CrossRef]

- Alshehhi, A.; Nobanee, H.; Khare, N. The impact of sustainability practices on corporate financial performance: Literature trends and future research potential. Sustainability 2018, 10, 494. [Google Scholar] [CrossRef]

- Barauskaite, G.; Streimikiene, D. Corporate social responsibility and financial performance of companies: The puzzle of concepts, definitions and assessment methods. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 278–287. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Lahouel, B.B.; Zaied, Y.B.; Song, Y.; Yang, G.-L. Corporate social performance and financial performance relationship: A data envelopment analysis approach without explicit input. Financ. Res. Lett. 2021, 39, 101656. [Google Scholar] [CrossRef]

- Cho, S.Y.; Lee, C. Managerial efficiency, corporate social performance, and corporate financial performance. J. Bus. Ethics 2019, 158, 467–486. [Google Scholar] [CrossRef]

- Bacidore, J.M.; Boquist, J.A.; Milbourn, T.T.; Thakor, A.V. The search for the best financial performance measure. Financ. Anal. J. 1997, 53, 11–20. [Google Scholar] [CrossRef]

- Ferguson, R.; Leistikow, D. Search for the best financial performance measure: Basics are better. Financ. Anal. J. 1998, 54, 81–85. [Google Scholar] [CrossRef]

- Galant, A.; Cadez, S. Corporate social responsibility and financial performance relationship: A review of measurement approaches. Econ. Res. Ekon. Istraživanja 2017, 30, 676–693. [Google Scholar] [CrossRef]

- Ismail, T.H.; Abdou, A.A.; Annis, R.M. Review of literature linking corporate performance to mergers and acquisitions. Rev. Financ. Account. Stud. 2011, 1, 89–104. [Google Scholar]

- Krishnakumar, D.; Sethi, M. Methodologies used to determine mergers and acquisitions’ performance. Acad. Account. Financ. Stud. J. 2012, 16, 75–91. [Google Scholar]

- González-Torres, T.; Rodríguez-Sánchez, J.-L.; Pelechano-Barahona, E.; García-Muiña, F.E. A systematic review of research on sustainability in mergers and acquisitions. Sustainability 2020, 12, 513. [Google Scholar] [CrossRef]

- Investopedia. Available online: https://www.investopedia.com/terms/s/sustainability.asp (accessed on 22 February 2021).

- Elkington, J. Cannibals with Forks. The Triple Bottom Line of 21st Century; John Wiley & Sons: Hoboken, NJ, USA, 1997; p. 73. [Google Scholar]

- Oprean-Stan, C.; Oncioiu, I.; Iuga, I.C.; Stan, S. Impact of Sustainability Reporting and Inadequate Management of ESG Factors on Corporate Performance and Sustainable Growth. Sustainability 2020, 12, 8536. [Google Scholar] [CrossRef]

- Kell, G.; The remarkable rise of ESG. Forbes. Available online: https://www.forbes.com/advisor/investing/esg-investing/ (accessed on 18 February 2021).

- D’Aquila, J.M. The current state of sustainability reporting. CPA J. 2018, 88, 44–50. [Google Scholar]

- Huber, B.; Comstock, M.; Polk, D.; Wardwell, L.L.P. ESG reports and ratings: What they are, why they matter. In Proceedings of the Harvard Law School Forum on Corporate Governance and Financial Regulation, Cambridge, MA, USA, 27 July 2017. [Google Scholar]

- Mooij, S. The ESG rating and ranking industry; Vice or virtue in the adoption of responsible investment? In Vice or Virtue in the Adoption of Responsible Investment; Elsevier BV: Amsterdam, The Netherlands, 2017. [Google Scholar]

- Novethic Research. Available online: https://www.novethic.com/fileadmin/user_upload/tx_ausynovethicetudes/pdf_complets/2013_overview_ESG_rating_agencies.pdf (accessed on 16 February 2021).

- American Council for Capital Formation (ACCF). Available online: https://accfcorpgov.org/wp-content/uploads/2018/07/ACCF_RatingsESGReport.pdf (accessed on 18 February 2021).

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Financ. Investig. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Bititci, U.S.; Ackermann, F.; Ates, A.; Davies, J.; Garengo, P.; Gibb, S.; MacBryde, J.; Mackay, D.; Maguire, C.; Van Der Meer, R.; et al. Managerial processes: Business process that sustain performance. Int. J. Oper. Prod. Manag. 2011, 31, 851–891. [Google Scholar] [CrossRef]

- Neely, A.; Gregory, M.; Platts, K. Performance measurement system design: A literature review and research agenda. Int. J. Oper. Prod. Manag. 1995, 15, 80–116. [Google Scholar] [CrossRef]

- Neely, A. The performance measurement revolution: Why now and what next? Int. J. Oper. Prod. Manag. 1999, 19, 205–228. [Google Scholar] [CrossRef]

- Neely, A.; Mills, J.; Platts, K.; Richards, H.; Gregory, M.; Bourne, M.; Kennerley, M. Performance measurement system design: Developing and testing a process-based approach. Int. J. Oper. Prod. Manag. 2000, 20, 1119–1145. [Google Scholar] [CrossRef]

- Neely, A. The evolution of performance measurement research. Int. J. Oper. Prod. Manag. 2005, 25, 1264–1277. [Google Scholar] [CrossRef]

- Beaver, W.H. Financial Ratios As Predictors of Failure. JSTOR 1966, 4, 71. [Google Scholar] [CrossRef]

- Ohlson, J.A. Financial Ratios and the Probabilistic Prediction of Bankruptcy. JSTOR 1980, 18, 109. [Google Scholar] [CrossRef]

- Brigham, E.F.; Houston, J.F. Fundamentals of Financial Management; Cengage Learning: Belmont, CA, USA, 2019. [Google Scholar]

- Refinitiv. An Overview of Environmental, Social and Corporate Governance—ESG. Available online: https://www.refinitiv.com/en/financial-data/company-data/esg-data (accessed on 10 February 2021).

- Refinitiv Business Classification. Available online: https://www.refinitiv.com/content/dam/marketing/en_us/documents/quick-reference-guides/trbc-business-classification-quick-guide.pdf (accessed on 1 February 2021).

- Malhotra, N.K.; Dash, S. Marketing Research: An Applied Orientation; Pearson: Upper Saddle River, NJ, USA, 2016. [Google Scholar]

- Evans, J.D. Straightforward Statistics for the Behavioral Sciences; Thomson Brooks/Cole Publishing, Co.: Boston, MA, USA, 1996. [Google Scholar]

- Corporate Finance Institute. Financial Ratios. Available online: https://corporatefinanceinstitute.com/resources/knowledge/finance/financial-ratios/ (accessed on 15 March 2021).

- Investopedia. Ratio Analysis. Available online: https://www.investopedia.com/terms/r/ratioanalysis.asp (accessed on 15 March 2021).

| Transactions | Merger | Acquisition of Assets | Acquisition of Remaining Interest | Buyback | Acquisition of Majority Assets | Acquisition of Partial Interest | Exchange Offer | Acquisition of Certain Assets |

|---|---|---|---|---|---|---|---|---|

| 1663 complete transactions | 570 | 582 | 47 | 56 | 191 | 197 | 9 | 11 |

| 492 complete transactions | 192 | 154 | 13 | 19 | 41 | 70 | 2 | 1 |

| (%) sample from total | 34% | 26% | 28% | 34% | 21% | 36% | 22% | 9% |

| Variables | Symbol 1 | Parameter a | Parameter b | % |

|---|---|---|---|---|

| ROA | P1 | 2.032051978 | −0.001581337 | 24.91% |

| Operating profit margin | P3 | 1.936599118 | −0.017859762 | 23.74% |

| ESG | ESG | 1.171556088 | −0.107123814 | 14.36% |

| Long-term debt ratio | D3 | 0.995227225 | −0.000008928 | 12.20% |

| Solvency 2 | S2 | 0.784753639 | −0.056025349 | 9.62% |

| Total assets turnover | A1 | 0.581538108 | −0.000596670 | 7.13% |

| ROE | P2 | 0.182699172 | −0.000416209 | 2.24% |

| Equity multiplier | D1 | 0.075495118 | −0.076391673 | 0.93% |

| Debt-to-equity ratio | D2 | 0.075495118 | −0.000896555 | 0.93% |

| Cash ratio | L3 | 0.066687383 | −0.000004827 | 0.82% |

| Net profit margin | P4 | 0.047918136 | −0.000037562 | 0.59% |

| Inventory turnover | A3 | 0.045891095 | −0.002291720 | 0.56% |

| Quick ratio | L2 | 0.037825541 | −0.000084211 | 0.46% |

| Current ratio | L1 | 0.037526071 | −0.000083544 | 0.46% |

| Solvency 1 | S1 | 0.032257654 | −0.002450579 | 0.40% |

| Fixed assets turnover | A2 | 0.019838478 | −0.000112619 | 0.24% |

| Intangible assets turnover | A4 | 0.019252365 | −0.000206717 | 0.24% |

| RORC | P5 | 0.008334616 | −0.000004827 | 0.10% |

| P/E ratio | M1 | 0.003228197 | −0.000550215 | 0.04% |

| P/B ratio | M2 | 0.002196156 | −0.000066079 | 0.03% |

| EV/Net income | M4 | 0.000645724 | −0.000649634 | 0.01% |

| Tobin’s Q | M3 | 0.000075432 | −0.000001434 | 0.00% |

| TOTAL | 8.157092411 | 100% |

| Company Name | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|

| Johnson & Johnson | 84.83 | 84.43 | 87.44 | 91.79 | 91.23 | 84.59 | 93.36 | 84.82 | 89.85 | 79.38 |

| Pfizer Inc. | 72.11 | 66.67 | 63.94 | 80.94 | 75.80 | 67.86 | 77.23 | 74.65 | 76.58 | 70.10 |

| Eli Lilly and Co. | 69.41 | 61.10 | 78.72 | 84.97 | 75.24 | 69.17 | 76.75 | 84.09 | 85.33 | 82.02 |

| Merck & Co. Inc. | 85.36 | 87.09 | 90.98 | 88.68 | 84.92 | 75.07 | 83.24 | 73.71 | 85.04 | 79.18 |

| Abbvie Inc. | 59.08 | 56.25 | 58.53 | 68.86 | 68.40 | 53.89 | 52.13 | 57.54 | 49.50 | 66.58 |

| Bristol-Myers Squibb Co. | 63.81 | 71.83 | 92.23 | 92.18 | 85.11 | 66.21 | 78.06 | 72.02 | 81.11 | 85.47 |

| Amgen Inc. | 69.57 | 75.02 | 76.12 | 84.88 | 84.73 | 76.57 | 77.77 | 68.04 | 71.31 | 65.68 |

| Novartis AG | 79.39 | 75.25 | 76.04 | 79.73 | 75.95 | 71.41 | 83.02 | 77.98 | 82.89 | 74.56 |

| Roche Holding AG | 100 | 95.56 | 98.03 | 99.12 | 100 | 94.43 | 98.99 | 100 | 100 | 81.07 |

| AstraZeneca PLC | 77.19 | 69.64 | 66.01 | 80.52 | 79.59 | 78.90 | 79.58 | 74.54 | 93.13 | 91.36 |

| Novo Nordisk A/S | 70.82 | 70.48 | 66.00 | 79.35 | 74.53 | 68.76 | 71.09 | 68.73 | 72.99 | 100 |

| Sanofi SA | 79.80 | 71.08 | 70.39 | 79.73 | 75.45 | 71.06 | 78.50 | 74.45 | 78.44 | 67.53 |

| CSL Ltd. | 94.98 | 93.12 | 96.08 | 92.39 | 90.10 | 100 | 100 | 94.09 | 96.55 | 86.79 |

| GlaxoSmithKline PLC. | 79.90 | 72.88 | 64.11 | 63.48 | 62.43 | 65.99 | 72.78 | 81.63 | 79.02 | 80.95 |

| Zoetis Inc. | 75.18 | 69.63 | 65.29 | 67.09 | 64.22 | 44.80 | 66.65 | 45.74 | 58.37 | 51.16 |

| Otsuka Holdings Co. Ltd. | 73.16 | 67.76 | 57.49 | 65.58 | 61.43 | 55.86 | 59.10 | 65.11 | 66.65 | 48.75 |

| Chugai Pharmaceutical Co. Ltd. | 66.29 | 56.25 | 69.95 | 75.18 | 69.10 | 68.07 | 76.07 | 73.33 | 76.22 | 45.13 |

| Bayer AG | 71.61 | 72.75 | 69.67 | 81.50 | 73.92 | 70.52 | 78.46 | 77.26 | 81.25 | 71.34 |

| Daiichi Sankyo Co. Ltd. | 74.08 | 64.74 | 62.52 | 69.70 | 71.65 | 59.34 | 69.90 | 67.67 | 77.71 | 66.87 |

| Takeda Pharmaceutical Co. Ltd. | 64.80 | 60.54 | 67.28 | 72.29 | 67.39 | 55.18 | 64.21 | 61.58 | 69.13 | 70.75 |

| Samsung Biologics Co. Ltd. | 64.25 | 52.40 | 44.22 | 55.16 | 31.16 | 25.16 | 39.11 | 32.33 | 12.19 | 11.23 |

| Biogen Inc. | 97.75 | 100 | 100 | 100 | 93.38 | 93.27 | 96.96 | 85.76 | 92.11 | 81.53 |

| Alexion Pharmaceuticals Inc. | 78.51 | 75.58 | 57.47 | 60.08 | 55.95 | 46.34 | 82.36 | 70.98 | 75.63 | 43.79 |

| Astellas Pharma Inc. | 82.56 | 84.03 | 85.38 | 91.97 | 87.67 | 77.76 | 80.60 | 73.05 | 45.77 | 41.66 |

| Changchun High & New Technology Industries | 78.28 | 72.29 | 62.96 | 66.82 | 59.78 | 58.33 | 67.71 | 67.12 | 71.26 | 51.55 |

| Company Name (A) | Stock Market Capitalization (B) | Ranking by Stock Market Capitalization (C) | Average Growth Index (D) | Ranking by an Average Growth Index (E) | Difference in Rankings (C-E) |

|---|---|---|---|---|---|

| Johnson & Johnson | $421,022,434,674.40 | 1 | 1.008298926 | 60 | −59 |

| Roche Holding | $292,100,941,230.87 | 2 | 1.018090905 | 53 | −51 |

| Novartis | $213,647,903,609.71 | 3 | 1.007153289 | 62 | −59 |

| Pfizer | $207,340,357,887.18 | 4 | 1.003581429 | 65 | −61 |

| Merck & Co | $193,391,338,870.80 | 5 | 1.010652165 | 59 | −54 |

| Abbvie | $186,895,052,749.50 | 6 | 0.989146158 | 80 | −74 |

| Eli Lilly and Co | $175,495,565,097.00 | 7 | 0.977791901 | 93 | −86 |

| Amgen | $143,731,814,308.74 | 8 | 1.003351613 | 66 | −58 |

| Bristol-Myers Squibb Co | $142,546,941,596.16 | 9 | 0.964430486 | 96 | −87 |

| AstraZeneca | $131,510,755,321.28 | 10 | 0.979735963 | 91 | −81 |

| Company Name (A) | Stock Market Capitalization (B) | Ranking by Stock Market Capitalization (C) | Average Growth Index (D) | Ranking by an Average Growth Index (E) | Difference in Rankings (C-E) |

|---|---|---|---|---|---|

| OPKO Health Inc. | $2,817,498,852.80 | 91 | 1.182630652 | 8 | 83 |

| Jilin Aodong Pharmaceutical Group | $2,774,691,098.60 | 92 | 1.101729822 | 19 | 73 |

| Almirall | $2,670,351,354.50 | 93 | 1.109985819 | 16 | 77 |

| Zhejiang Hisun Pharmaceutical | $2,588,458,339.99 | 94 | 0.999514548 | 71 | 23 |

| Alembic Pharmaceuticals | $2,558,099,445.17 | 95 | 0.999246331 | 72 | 23 |

| Jiangsu Nhwa Pharmaceutical | $2,299,278,167.47 | 96 | 1.002169573 | 68 | 28 |

| Zhejiang Starry Pharmaceutical | $2,289,186,178.09 | 97 | 1.195674036 | 6 | 91 |

| Virbac | $2,263,280,372.72 | 98 | 1.030694763 | 39 | 59 |

| Luye Pharma Group | $2,086,697,816.22 | 99 | 1.104396302 | 18 | 81 |

| Sawai Group Holdings | $2,072,107,374.97 | 100 | 0.988802842 | 82 | 18 |

| Transactions | Merger | Acquisition of Assets | Acquisition of Remaining Interest | Buyback | Acquisition of Majority Assets | Acquisition of Partial Interest | Exchange Offer | Acquisition of Certain Assets |

|---|---|---|---|---|---|---|---|---|

| 1663 complete transactions | 34% | 35% | 3% | 3% | 11% | 12% | 1% | 1% |

| 492 complete transactions | 39% | 31% | 3% | 4% | 9% | 14% | 0% | 0% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mihaiu, D.M.; Șerban, R.-A.; Opreana, A.; Țichindelean, M.; Brătian, V.; Barbu, L. The Impact of Mergers and Acquisitions and Sustainability on Company Performance in the Pharmaceutical Sector. Sustainability 2021, 13, 6525. https://doi.org/10.3390/su13126525

Mihaiu DM, Șerban R-A, Opreana A, Țichindelean M, Brătian V, Barbu L. The Impact of Mergers and Acquisitions and Sustainability on Company Performance in the Pharmaceutical Sector. Sustainability. 2021; 13(12):6525. https://doi.org/10.3390/su13126525

Chicago/Turabian StyleMihaiu, Diana Marieta, Radu-Alexandru Șerban, Alin Opreana, Mihai Țichindelean, Vasile Brătian, and Liliana Barbu. 2021. "The Impact of Mergers and Acquisitions and Sustainability on Company Performance in the Pharmaceutical Sector" Sustainability 13, no. 12: 6525. https://doi.org/10.3390/su13126525

APA StyleMihaiu, D. M., Șerban, R.-A., Opreana, A., Țichindelean, M., Brătian, V., & Barbu, L. (2021). The Impact of Mergers and Acquisitions and Sustainability on Company Performance in the Pharmaceutical Sector. Sustainability, 13(12), 6525. https://doi.org/10.3390/su13126525