The Consumption of Alcoholic Beverages Can Be Reduced by Fiscal Means? Study on the Case of Romania

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methods

3.1. Data

3.2. Methods

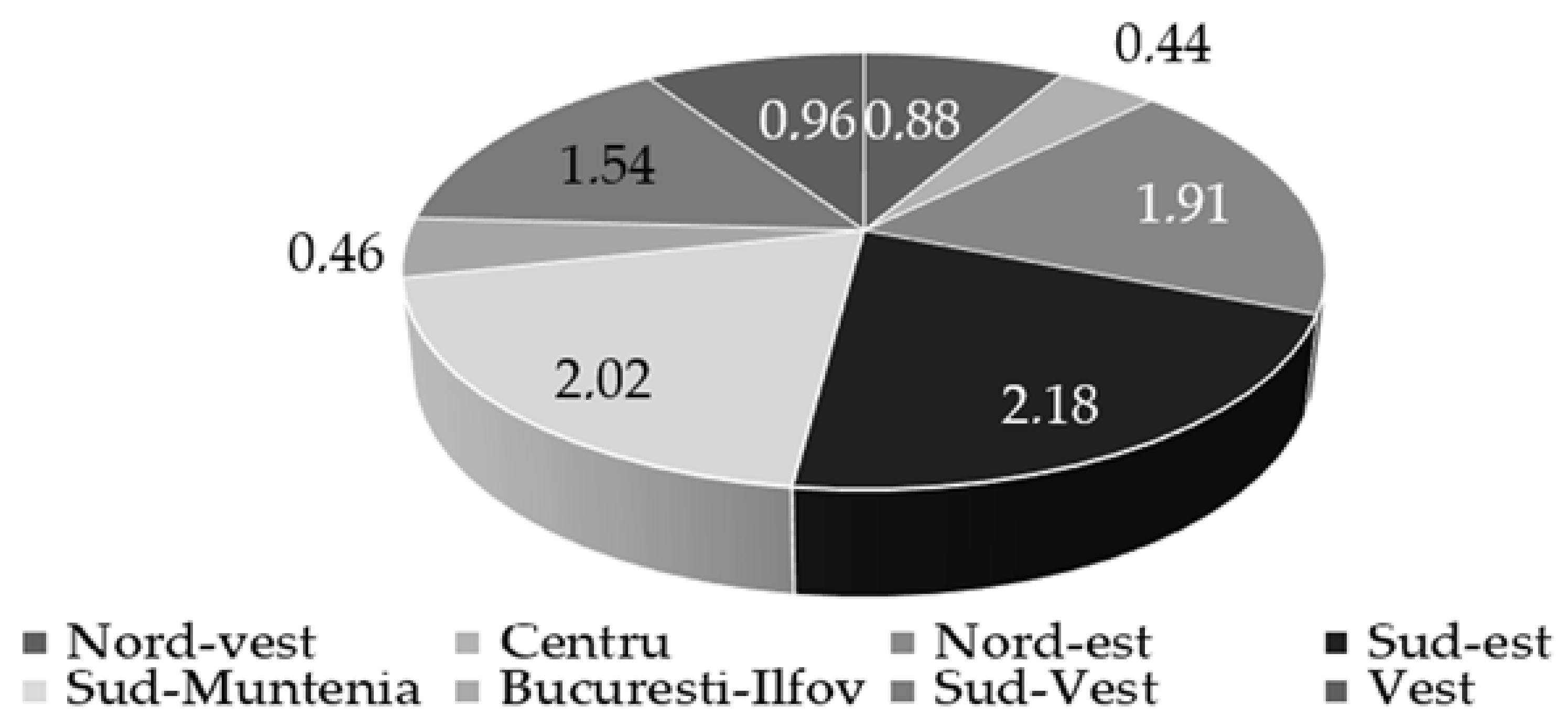

4. Results and Discussions

4.1. The Relation between Excise Taxes and Prices of Alcoholic Beverages

4.2. The Relation between Prices and Consumption of Alcoholic Beverages

4.3. The Relation between Alcohol Related Deaths and Consumption of Alcoholic Beverages

4.4. Alcohol Consumption and Sustainability of Public Health

5. Conclusions

5.1. Signals for Macro Decision Makers

5.2. Referring to Some Practical Implications and Additional Research Objectives

5.3. About Some Limitations of the Research

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Alcoholic Beverage | Definition | |

|---|---|---|

| 1. | Beer | Means any product falling within CN code 2203 or any product containing a mixture of beer and non-alcoholic beverages falling within CN code 2206 and having, in either case, an alcoholic strength exceeding 0.5% in volume. |

| 1.1. | Beer produced by independent producers | Refers to the producers whose production in the previous calendar year did not exceed 200,000 hl/year, and for the current year the authorized warehouse keeper declares on his own responsibility that he will produce a quantity of less than 200,000 hl/year. |

| 2. | Wines from which: | |

| 2.1. | Still wines | 1. Having an alcoholic strength by volume exceeding 1.2%, but not exceeding 15% by volume, and in which the alcohol contained in the finished product results entirely from fermentation; or 2. Have an alcoholic strength by volume of more than 15% volume but not more than 18% volume, have been obtained without any enrichment and in which the alcohol contained in the finished product results entirely from fermentation. |

| 2.2. | Sparkling wines | 1. Are presented in closed bottles with a mushroom stopper fixed by means of connections or which are under pressure equal to or greater than 3 bar due to carbon dioxide in solution; 2. Have an alcoholic strength exceeding 1.2% volume, but not exceeding 15% volume, and in which the alcohol contained in the finished product results wholly from fermentation. |

| 3. | Fermented beverages other than beer and wine | |

| 3.1. | Still fermented beverages | 1. Have an alcoholic strength exceeding 1.2% volume, but not exceeding 10% volume; or 2. Have an alcoholic strength exceeding 10% volume, but not exceeding 15% volume, and in which the alcohol contained in the finished product results wholly from fermentation. |

| 3.2. | Sparkling fermented beverages | 1. Have an alcoholic strength exceeding 1.2% by volume but not exceeding 13% by volume; or Methodological norms 2. Have an alcoholic strength exceeding 13% volume, but not exceeding 15% volume, and in which the alcohol contained in the finished product results wholly from fermentation. |

| 4. | Intermediate products | 1. Intermediate products represent all products that have an alcoholic concentration exceeding 1.2% by volume, but not exceeding 22% by volume, and which fall within CN codes 2204, 2205 and 2206, but which do not fall under art. 349-351. 2. Intermediate products shall also be considered as: (a) any still fermented beverage provided in art. 351 par. (1) lit. a), which has an alcoholic strength exceeding 5.5% by volume and which does not result entirely from fermentation; (b) any sparkling fermented beverage provided in art. 351 par. (1) lit. b), which has an alcoholic strength exceeding 8.5% by volume and which does not result entirely from fermentation. |

| 5. | Ethyl alcohol | (a) All products with an alcoholic strength exceeding 1.2% by volume and falling within CN codes 2207 and 2208, even when those products are part of a product falling within another heading of the combined nomenclature; (b) Products with an alcoholic strength exceeding 22% volume and falling within CN codes 2204, 2205 and 2206; (c) Brandy and fruit spirits; (d) Potable spirits containing products, in solution or not. |

| 5.1. | Ethyl alcohol produced by small distilleries | Whose production in the previous calendar year did not exceed 10 hl of pure alcohol and for the current year the authorized warehouse keeper declares on his own responsibility that he will have a production of less than 10 hl of pure alcohol |

| Beverage | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|

| 1. | Beer | 0.82 | 3.9 | 3.3 | 3.3 | 3.3 | 3.40 | 3.53 |

| 1.1. | Beer produced by independent producers (Hl/1 grade Plato) | 0.47 | 2.24 | 1.82 | 1.82 | 1.82 | 1.88 | 1.95 |

| 2. | Wines from which: | |||||||

| 2.1. | Still wines | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2.2. | Sparkling wines | 34.05 | 161.33 | 47.38 | 47.38 | 47.38 | 48.87 | 50.73 |

| 3. | Fermented beverages other than beer and wine: | |||||||

| 3.1. | Still | 100 | 47.38 | 396.84 | 396.84 | 396.84 | 409.34 | 424.90 |

| 3.2. | Sparkling | 45 | 213.21 | 47.38 | 47.38 | 47.38 | 48.87 | 50.73 |

| 4. | Intermediate products | 165 | 781.77 | 396.84 | 396.84 | 396.84 | 409.34 | 424.90 |

| 5. | Ethyl alcohol | 750 | 4738.01 | 3306.98 | 3306.98 | 3306.98 | 3411.15 | 3540.78 |

| 6. | Ethyl alcohol produced by small distilleries | 475 | 2250.56 | 1653.49 | 1653.49 | 1653.49 | 1075.57 | 1779.39 |

References

- World Health Organization. Alcohol in the European Union. Consumption, Harm and Policy Approaches. 2012. Available online: https://www.euro.who.int/__data/assets/pdf_file/0003/160680/e96457.pdf?ua=1 (accessed on 16 March 2021).

- OECD. State of Health in the EU. România: Profilul de Țară din 2019 în Ceea ce Privește Sănătatea; OECD Publishing: Paris, France; European Observatory on Health Systems and Policies: Brussels, Belgium, 2019. [Google Scholar]

- World Health Organization. Global Status Report on Alcohol and Health. 2018. Available online: https://www.who.int/substance_abuse/publications/global_alcohol_report/en (accessed on 19 March 2021).

- World Health Organization. Global Health Observatory. Global Information System on Alcohol and Health. 2019. Available online: https://www.who.int/gho/alcohol/en/ (accessed on 20 March 2021).

- Dávalos, M.E.; Fang, H.; French, M.T. Easing the pain of an economic downturn: Macroeconomic conditions and excessive alcohol consumption. Health Econ. 2012, 21, 1318–1335. [Google Scholar] [CrossRef] [PubMed]

- Dee, T.S. Alcohol abuse and economic conditions: Evidence from repeated cross-sections of individual-level data. Health Econ. 2001, 10, 257–270. [Google Scholar] [CrossRef] [PubMed]

- Freeman, D.G. A note on economic conditions and alcohol problems. Health Econ. 1999, 18, 661–670. [Google Scholar] [CrossRef]

- Johansson, E.; Böckerman, P.; Prättälä, R.; Uutela, A. Alcohol-related mortality, drinking behavior, and business cycles. Eur. J. Health Econ. 2006, 7, 212–217. [Google Scholar] [CrossRef] [PubMed]

- World Health Organization. Management of Substance Abuse. Country Profiles. 2019. Available online: https://www.who.int/substance_abuse/publications/global_alcohol_report/profiles/rou.pdf?ua=1 (accessed on 22 February 2021).

- European Centre for Monitoring Alcohol Marketing. Regulations on Alcohol Marketing—Romania. 2019. Available online: http://eucam.info/regulations-on-alcohol-marketing/romania (accessed on 23 March 2021).

- Rădulescu, S.M.; Dâmboeanu, C. Alcohol consumption and abuse as a social and medical problem. Rom. J. Sociol. 2006, XVII, 433–461. [Google Scholar]

- Probst, C.; Kilian, C.; Sanchez, S.; Lange, S.; Rehm, J. The role of alcohol use and drinking patterns in socioeconomic inequalities in mortality: A systematic review. Lancet Public Health 2020, 5, e324–e332. [Google Scholar] [CrossRef]

- Chisholm, D.; Moro, D.; Bertram, M.; Pretorius, C.; Gmel, G.; Shield, K.; Rehm, J. Are the ‘Best Buys’ for Alcohol Control Still Valid? An Update on the Comparative Cost-Effectiveness of Alcohol Control Strategies at the Global Level. J. Stud. Alcohol Drugs 2018, 79, 514–522. [Google Scholar] [CrossRef]

- World Health Organization. Global Strategy to Reduce the Harmful Use of Alcohol. 2010. Available online: https://www.who.int/substance_abuse/msbalcstragegy.pdf (accessed on 29 March 2021).

- Wagenaar, A.C.; Tobler, A.L.; Komro, K.A. Effects of Alcohol Tax and Price Policies on Morbidity and Mortality: A Systematic Review. Am. J. Public Health 2010, 100, 2270–2278. [Google Scholar] [CrossRef]

- Babor, T.; Caetano, R.; Casswell, S.; Edwards, G.; Giesbrecht, N.; Graham, K.; Grube, J.W.; Hill, L.; Holder, H.; Homel, R.; et al. Alcohol: No Ordinary Commodity—Research and Public Policy, 2nd ed.; Oxford University Press: Oxford, UK, 2010. [Google Scholar] [CrossRef]

- La Foucade, A.; Metivier, C.; Gabriel, S.; Scott, E.; Theodore, K.; Lapiste, C. The potential for using alcohol and tobacco taxes to fund prevention and control of noncommunicable diseases in Caribbean Community countries. The potential for using alcohol and tobacco taxes to found prevention and control of noncommunicable diseases in Caribbean Community Countries. Rev. Panam. Salud Publica 2018, 42, e192. [Google Scholar]

- Chaloupka, F.J.; Powell, L.M.; Warner, K.E. The Use of Excise Taxes to Reduce Tobacco, Alcohol, and Sugary Beverage Consumption. Annu. Rev. Public Health 2019, 40, 187–201. [Google Scholar] [CrossRef] [Green Version]

- Nelson, J.P.; McNall, A.D. Alcohol Prices, Taxes, and Alcohol-Related Harms: A Critical Review of Natural Experiments in Alcohol Policy for Nine Countries. Health Policy 2016, 120, 264–272. [Google Scholar] [CrossRef]

- McClelland, R.; Iselin, J. Do state excise taxes reduce alcohol-related fatal motor vehicle crashes? Econ. Inq. 2019, 57, 1821–1841. [Google Scholar] [CrossRef]

- Angus, C.; Holmes, J.; Meier, P.S. Comparing alcohol taxation throughout the European Union. Addiction 2019, 114, 1489–1494. [Google Scholar] [CrossRef] [Green Version]

- Nuță, A.-C.; Nuță, F.-M. Modelling the Influences of Economic, Demographic, and Institutional Factors on Fiscal Pressure Using OLS, PCSE, and FD-GMM Approaches. Sustainability 2020, 12, 1681. [Google Scholar] [CrossRef] [Green Version]

- Onofrei, M.; Gavriluţă, A.F.; Bostan, I.; Oprea, F.; Paraschiv, G.; Lazăr, C.M. The Implication of Fiscal Principles and Rules on Promoting Sustainable Public Finances in the EU Countries. Sustainability 2020, 12, 2772. [Google Scholar] [CrossRef] [Green Version]

- Costea, I.M. Fiscalitate Europeană. Note de Curs; Hamangiu: Bucharest, Romania, 2016; 408p. [Google Scholar]

- Oprea, F.; Mehdian, S.; Stoica, O. Fiscal and financial stability in Romania-an overview. Transylv. Rev. Adm. Sci. 2013, 40, 159–182. [Google Scholar]

- Vintilă, G.; Onofrei, M.; Ţibulcă, I.L. Fiscal convergence in an enlarged European Union. Transylv. Rev. Adm. Sci. 2014, 10, 213–223. [Google Scholar]

- Oprea, F.; Bilan, I.; Stoica, O. Public Debt Policy in Romania—A Critical Review. In Models and Methods in Applied Sciences, Proceedings of the 2nd International Conference on Environment, Economics, Energy, Devices, Systems, Communications, Computers, Mathematics (EDSCM ‘12), Saint Malo & Mont Saint-Michel, France, 2–4 April 2012; WSEAS Press: Saint Malo & Mont Saint-Michel, France, 2012; pp. 212–217. [Google Scholar]

- Anton, S.G.; Onofrei, M. Health Care Performance and Health Financing System in Selective Countries from Central and Eastern Europe. A Comparative Study. Transylv. Rev. Adm. Sci. 2012, 35, 22–32. [Google Scholar]

- Anton, S.G. Financing health care in Romania and implications on the access to health services. USV Ann. Econ. Public Adm. 2013, 12, 195–200. [Google Scholar]

- Morariu, A. The Management of the Human Resources in the Public Health System: The Complexity and the Euro-Global Socio-Economic Challenges. Rev. Cercet. Interv. Soc. 2014, 44, 266–278. [Google Scholar]

- Costea, I.M. Combaterea Evaziunii Fiscale si Frauda Comunitara; C.H. Beck: Bucharest, Romania, 2010; 344p. [Google Scholar]

- Morariu, A. The Phenomenon of not Declaring Paid Activities to the Public Authorities. Ovidius Univ. Ann. Econ. Sci. Ser. 2017, 17, 263–267. [Google Scholar]

- Tofan, M.; Gavriluţă (Vatamanu), A.F. Heterogeneity of taxation and fiscal challenges. In European Union Financial Regulation and Administrative Area; Tofan, M., Bilan, I., Cigu, E., Eds.; Editura Universităţii “Alexandru Ioan Cuza”: Iaşi, Romania, 2019; pp. 771–779. [Google Scholar]

- The Official Gazette of Romania. Fiscal Code of Romania with Its Application Norms. The Law No. 227/2015 on the Fiscal Code, Updated by Government Emergency Ordinance No. 1/202; Romanian Parliament: Bucharest, Romania, 2015. [Google Scholar]

- National Institute of Statistics. Romanian Statistical Yearbook 2018; National Institute of Statistics: Bucharest, Romania, 2019; Available online: https://insse.ro/cms/sites/default/files/field/publicatii/anuarul_statistic_al_romaniei_carte_en_1.pdf (accessed on 4 March 2021).

- National Institute of Statistics. Consumul de Băuturi în Anul 2015; National Institute of Statistics: Bucharest, Romania, 2016; Available online: https://insse.ro/cms/sites/default/files/field/publicatii/consumul_de_bautruri_in_anul_2016.pdf (accessed on 4 April 2021).

- National Institute of Statistics. Consumul de Băuturi în Anul 2017; National Institute of Statistics: Bucharest, Romania, 2018; Available online: https://insse.ro/cms/sites/default/files/field/publicatii/consumul_de_bauturi_in_anul_2017.pdf (accessed on 5 April 2021).

- National Institute of Statistics. Consumul de Băuturi în Anul 2018; National Institute of Statistics: Bucharest, Romania, 2019; Available online: https://insse.ro/cms/sites/default/files/field/publicatii/consumul_de_bauturi_in_anul_2018.pdf (accessed on 6 April 2021).

- National Institute of Public Health. Luna Națională a Informării Despre Efectele Consumului de Alcool; Analiză de Situație; National Institute of Public Health: Bucharest, Romania, 2019. Available online: https://insp.gov.ro/sites/cnepss/wp-content/uploads/2016/01/ANALIZA-DE-SITUATIE-2019.pdf (accessed on 7 April 2021).

- World Health Organization. Indicators. 2020. Available online: https://www.who.int/data/gho/data/indicators (accessed on 8 April 2021).

- Institute for Health Metrics and Evaluation. 2020. Available online: https://vizhub.healthdata.org/cod/ (accessed on 8 March 2021).

- Fiscal Code of Romania with the Application Norms. 2014. Available online: https://static.anaf.ro/static/10/Anaf/Legislatie_R/Cod_fiscal_norme_2014.htm (accessed on 10 April 2021).

- Fiscal Code of Romania with the Application Norms. 2015. Available online: https://static.anaf.ro/static/10/Anaf/legislatie/CFN_ante_21ian15_OG4.htm (accessed on 11 April 2021).

- Fiscal Code of Romania with the Application Norms. 2016. Available online: http://static.anaf.ro/static/10/Anaf/legislatie/L_227_2015.htm (accessed on 12 April 2021).

- Fiscal Code of Romania with the Application Norms. 2017. Available online: https://static.anaf.ro/static/10/Anaf/legislatie/Cod_fiscal_norme_2018.htm (accessed on 13 April 2021).

- Fiscal Code of Romania with the Application Norms. 2018. Available online: https://static.anaf.ro/static/10/Anaf/legislatie/Cod_fiscal_norme_10122018.htm (accessed on 15 April 2021).

- Ministry of Public Finance. 2020. Available online: www.mfinante.gov (accessed on 16 April 2021).

- Spirits Romania–Asociația Producătorilor și Importatorilor de Băuturi Spirtoase din Romania. Sectorul Bauturilor Spirtoase in Romania; Asociația Producătorilor și Importatorilor de Băuturi Spirtoase din Romania: Bucharest, Romania, 2014; Available online: http://www.spirits-romania.ro/wp-content/uploads/2015/09/Spirits-Ro.pdf (accessed on 16 April 2021).

- Consiliul Fiscal. Raport Anual 2015; Consiliul Fiscal: Bucharest, Romania, 2016; Available online: http://consiliulfiscal.ro/RA2015%20ro%203iunie2016%20c.pdf (accessed on 17 April 2021).

- Consiliul Fiscal. Raport Anual 2017; Consiliul Fiscal: Bucharest, Romania, 2018; Available online: http://www.consiliulfiscal.ro/raport_2017_final.pdf (accessed on 17 April 2021).

- Consiliul Fiscal. Raport Anual 2018; Consiliul Fiscal: Bucharest, Romania, 2019; Available online: http://www.consiliulfiscal.ro/raport2018final.pdf (accessed on 18 April 2021).

- Sopek, P. The Alcohol Taxation System in European Union and Croatia. Institute of Public Finance Newsletter 2013, No. 76. Available online: http://www.ijf.hr/upload/files/file/ENG/newsletter/76.pdf (accessed on 18 April 2021).

- European Commission. Data on Taxation 2020; European Commission: Brussels, Belgium, 2020; Available online: https://ec.europa.eu/taxation_customs/business/economic-analysis-taxation/data-taxation_en (accessed on 18 April 2021).

- National Institute of Public Health. Ghid de Prevenție; National Institute of Public Health: Bucharest, Romania, 2016; Volume 2, Partea I. Available online: http://insp.gov.ro/sites/1/wp-content/uploads/2014/11/Ghid-Volumul-2-web.pdf (accessed on 19 April 2021).

- Furtunescu, F.; Galan, A.; Mihăescu-Pinția, C. Studiu Privind Impactul Economic al Consumului Dăunător de Alcool Asupra Sistemului de Sănătate din România. Studiu de Cercetare; Asociația Română Pentru Promovarea Sănătății: Bucharest, Romania, 2016; Available online: https://arps.ro/sites/default/files/Studiu_impact%20economic%20consum%20alcool_.pdf (accessed on 19 April 2021).

- Eurostat Database. 2020. Available online: https://appsso.eurostat.ec.europa.eu/nui/submitViewTableAction.do (accessed on 20 April 2021).

- Alcohol and Disease Related Impact Software. 2008. Available online: https://nccd.cdc.gov/DPH_ARDI/default/default.aspx (accessed on 1 May 2021).

- Hedlund, J.H. If they didn’t drink, would they crash anyway? The role of alcohol in traffic crashes. Alcohol Drugs Driv. 1994, 110, 115–125. [Google Scholar]

- United Nations. Transforming Our World: The 2030 Agenda for Sustainable Development; United Nations: New York, NY, USA, 2015. [Google Scholar]

- Nissensohn, M.; Sánchez-Villegas, A.; Galan, P.; Turrini, A.; Arnault, N.; Mistura, L.; Ortiz-Andrellucchi, A.; Edelenyi, F.S.d.; D’Addezio, L.; Serra-Majem, L. Beverage Consumption Habits among the European Population: Association with Total Water and Energy Intakes. Nutrients 2017, 9, 383. [Google Scholar] [CrossRef] [Green Version]

- Agarwal, S.; Marwell, N.; McGranahan, L. Consumption responses to temporary tax incentives: Evidence from state sales tax holidays. Am. Econ. J. Econ. Policy. 2017, 9. [Google Scholar] [CrossRef] [Green Version]

- Surrey, S.S. Tax incentives as a device for implementing government policy: A comparison with direct government expenditures. Harv. Law Rev. 1970, 83, 705–738. [Google Scholar] [CrossRef]

- Alonso, S.L.N.; Forradellas, R.R. Tax Incentives in Rural Environment as Economic Policy and Population Fixation. Case study of Castilla-León Region. In Business, Economics and Science Common Challenges; Bernat, T., Duda, J., Eds.; Filodiritto Editore: Bologna, Italy, 2020; pp. 205–210. [Google Scholar]

- Alonso, S.L.N. The Tax Incentives in the IVTM and “Eco-Friendly Cars”: The Spanish Case. Sustainability 2020, 12, 3398. [Google Scholar] [CrossRef] [Green Version]

- Jappelli, T.; Pistaferri, L. Do people respond to tax incentives? An analysis of the Italian reform of the deductibility of home mortgage interests. Eur. Econ. Rev. 2007, 51, 247–271. [Google Scholar] [CrossRef]

- Alhulail, I.; Takeuchi, K. Effects of Tax Incentives on Sales of Eco-Friendly Vehicles: Evidence from Japan (No. 1412); Kobe University: Kobe, Japan, 2014. [Google Scholar]

| Model | Relation Tested | Dependent Variable | Definition (Source) | Independent Variable (Source) | Definition (Source) |

|---|---|---|---|---|---|

| Model 1 | Between excise taxes on alcoholic beverages and the prices of these beverages | Price of alcoholic beverages | The consumer price indices for main alcoholic beverages (Romanian Statistical Yearbook 2019) | Excise taxes on alcoholic beverages | Taxes imposed by the national government on alcoholic beverages (Fiscal Code of Romania) |

| Model 2 | Between excise taxes on alcoholic beverages and excise taxes collected to the budget from the sale of these beverages | Excise taxes revenues to the budget | Total revenues to the budget that come from excise taxes on alcoholic beverages (European Commission, Data on taxation) | Excise taxes on alcoholic beverages | Taxes imposed by the national government on alcoholic beverages (Fiscal Code of Romania) |

| Model 3 | Between prices of alcoholic beverages and the level of consumption of alcoholic beverages | Consumption of alcoholic beverages | Average consumption, per capita, per year of alcoholic beverages (National Institute of Statistics) | Price of alcoholic beverages | The consumer price indices for main alcoholic beverages (Romanian Statistical Yearbook 2019) |

| Model 4 | Between alcohol consumption and its harmful effects on human health | Alcohol related deaths | The percentage of people which deaths was caused by an alcohol used disorder (Institute for Health Metrics and Evaluation) | Consumption of alcoholic beverages | Average consumption, per capita, per year of alcoholic beverages (National Institute of Statistics) |

| Correlation | Pearson Correlation Coefficient | Sig. (2-Tailed) | N |

|---|---|---|---|

| Changes in excise tax wine → changes in prices wine | −0.119 | 0.848 | 5 |

| Changes in excise tax other alcoholic beverages → changes in prices other alcoholic beverages | −0.166 | 0.789 | 5 |

| Changes in excise tax beer → changes in prices beer | −0.625 | 0.260 | 5 |

| Correlation | Pearson Correlation Coefficient | Sig. (2-Tailed) | N |

|---|---|---|---|

| Changes in price → Budget revenues from alcohol excise taxes | 0.849 * | 0.039 | 5 |

| Unstandardized B | Std. Error | Standardized Coefficients Beta | t | Sig. | |

|---|---|---|---|---|---|

| Budget revenues from alcohol excise taxes | 6.848 * | 4.622 | 0.849 | 2.781 | 0.039 |

| Constant | 1.097 | 3.495 | 1.400 | 0.000 | |

| R-square | 0.721 | ||||

| Adjusted R-squared | 0.627 | ||||

| Correlation | Pearson Correlation Coefficient | Sig. (2-Tailed) | N |

|---|---|---|---|

| Changes in price → Average per capita consumption, total population, liters | −0.300 | 0.624 | 5 |

| Changes in price → Average per capita consumption, total population, liters of alcohol 100% | 0.300 | 0.624 | 5 |

| Changes in price → Average per capita consumption,15 years and over population, liters of alcohol 100% | 0.103 | 0.870 | 5 |

| Correlation | Type of Alcoholic Beverage | Pearson Correlation Coefficient | Sig. (2-Tailed) | N |

|---|---|---|---|---|

| Changes in price → Average per capita consumption, total population, liters | Wine | 0.895 * | 0.040 | 5 |

| Plum brandy, brandy and other alcoholic beverages | −0.327 | 0.591 | 5 | |

| Beer | −0.522 | 0.367 | 5 | |

| Changes in price → Average per capita consumption, total population, liters of alcohol 100% | Wine | 0.884 | 0.087 | 5 |

| Plum brandy, brandy and other alcoholic beverages | −0.310 | 0.611 | 5 | |

| Beer | −0.613 | 0.271 | 5 | |

| Changes in price → Average consumption per capita,15 years and over population, liters of alcohol 100% | Wine | 0.874 | 0.083 | 5 |

| Plum brandy, brandy and other alcoholic beverages | −0.246 | 0.689 | 5 | |

| Beer | −0.613 | 0.271 | 5 |

| Correlation | Pearson Correlation Coefficient | Sig. (2-Tailed) | N |

|---|---|---|---|

| Average per capita consumption, total population, liters → Cause of death alcohol use disorder | 0.918 * | 0.042 | 4 |

| Unstandardized B | Std. Error | Standardized Coefficients Beta | t | Sig. | |

|---|---|---|---|---|---|

| Alcohol related deaths | 0.115 * | 0.035 | 0.918 | 3.276 | 0.042 |

| Constant | −8.725 | 3.895 | −2.240 | 0.154 | |

| R-square | 0.843 | Adjusted R-square | 0.674 | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bostan, I.; Rusu, V.D. The Consumption of Alcoholic Beverages Can Be Reduced by Fiscal Means? Study on the Case of Romania. Sustainability 2021, 13, 7553. https://doi.org/10.3390/su13147553

Bostan I, Rusu VD. The Consumption of Alcoholic Beverages Can Be Reduced by Fiscal Means? Study on the Case of Romania. Sustainability. 2021; 13(14):7553. https://doi.org/10.3390/su13147553

Chicago/Turabian StyleBostan, Ionel, and Valentina Diana Rusu. 2021. "The Consumption of Alcoholic Beverages Can Be Reduced by Fiscal Means? Study on the Case of Romania" Sustainability 13, no. 14: 7553. https://doi.org/10.3390/su13147553

APA StyleBostan, I., & Rusu, V. D. (2021). The Consumption of Alcoholic Beverages Can Be Reduced by Fiscal Means? Study on the Case of Romania. Sustainability, 13(14), 7553. https://doi.org/10.3390/su13147553