Investment and Decapitalization in the Fishing Industry: The Case of the Spanish Crustacean Freezer Trawler Fleet

Abstract

1. Introduction

2. The Evolution of the Spanish Fishing Sector: The Crustacean Freezer Fleet

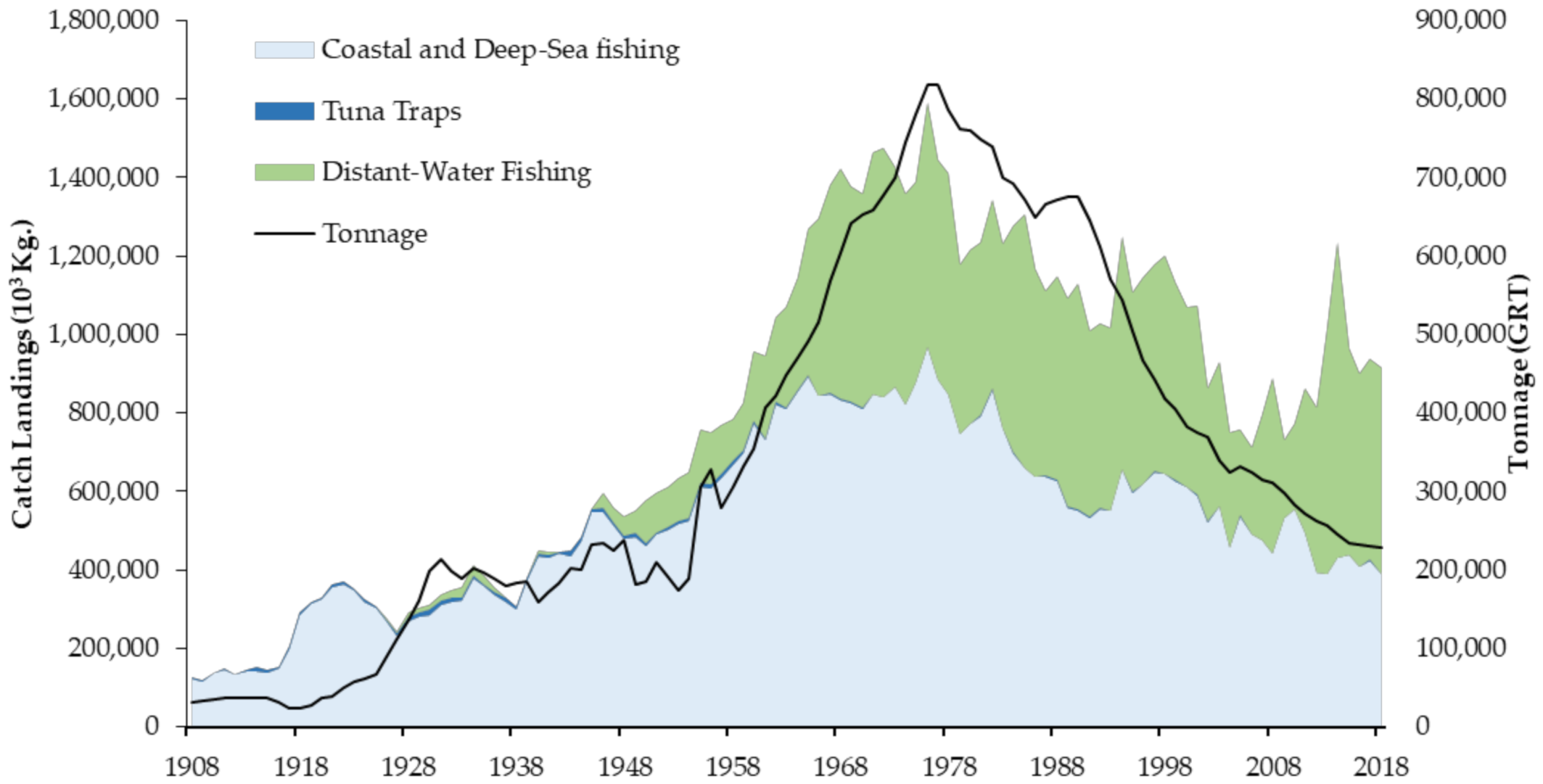

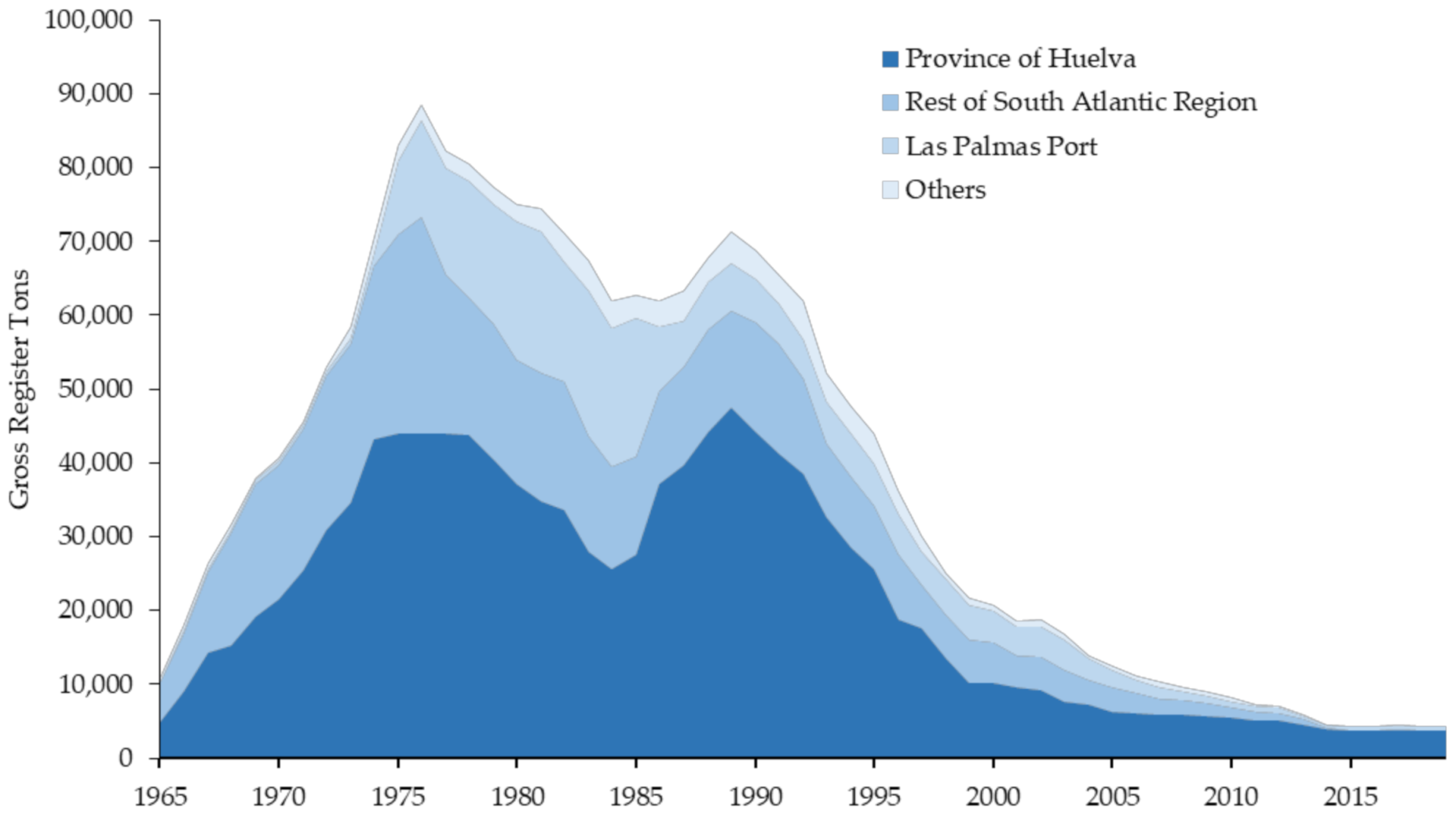

2.1. Background: The Development of Trawl Fishing

2.2. Crustacean Fishing and Consumption

3. Methodology

3.1. Background and Theorical Basis

3.2. Model to Obtain the Age-Price Profile of Assets

3.3. Obtaining the Age-Price Profile of Vessels of the Crustacean Freezer Fleet

4. Statistical Information

5. Results

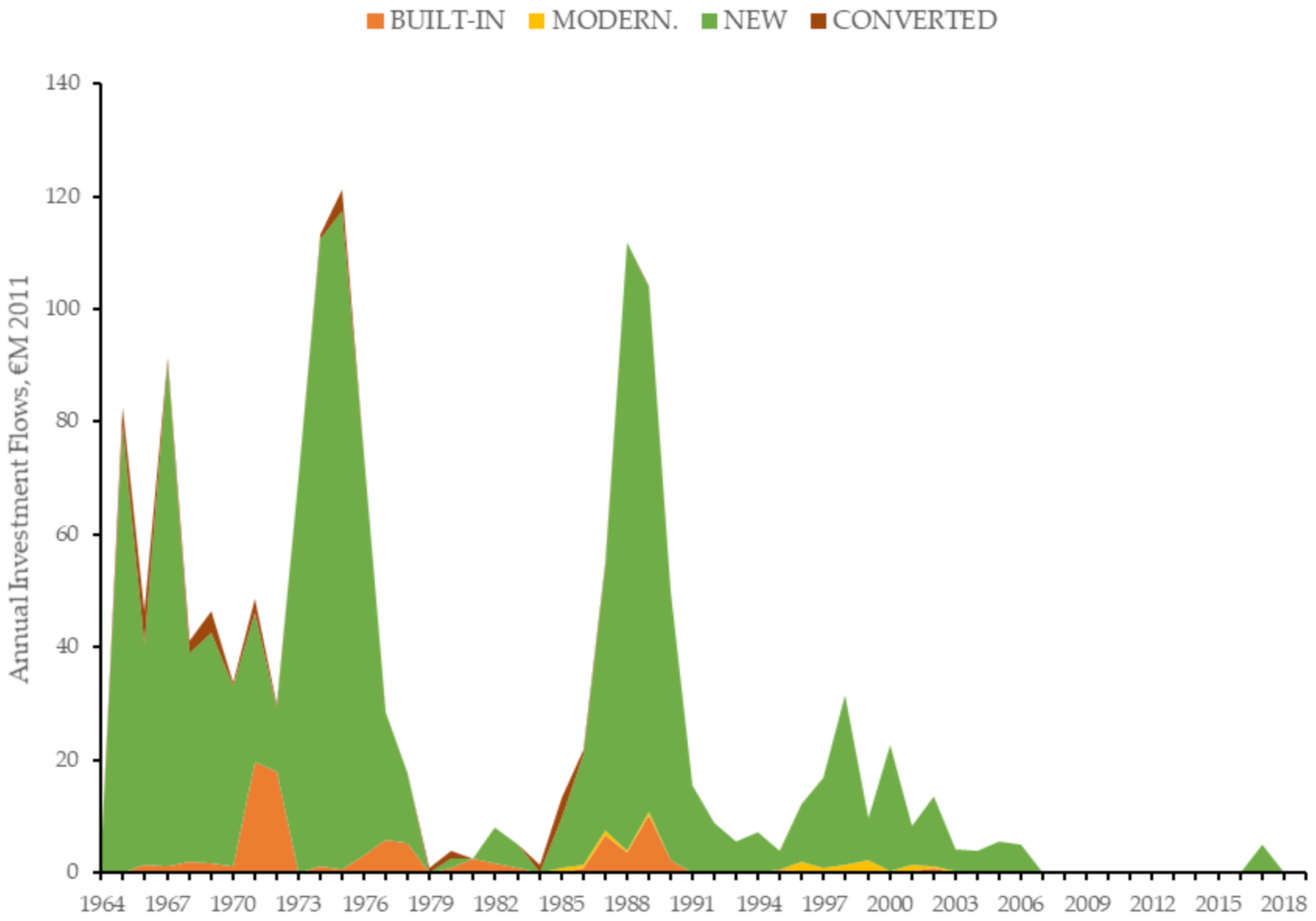

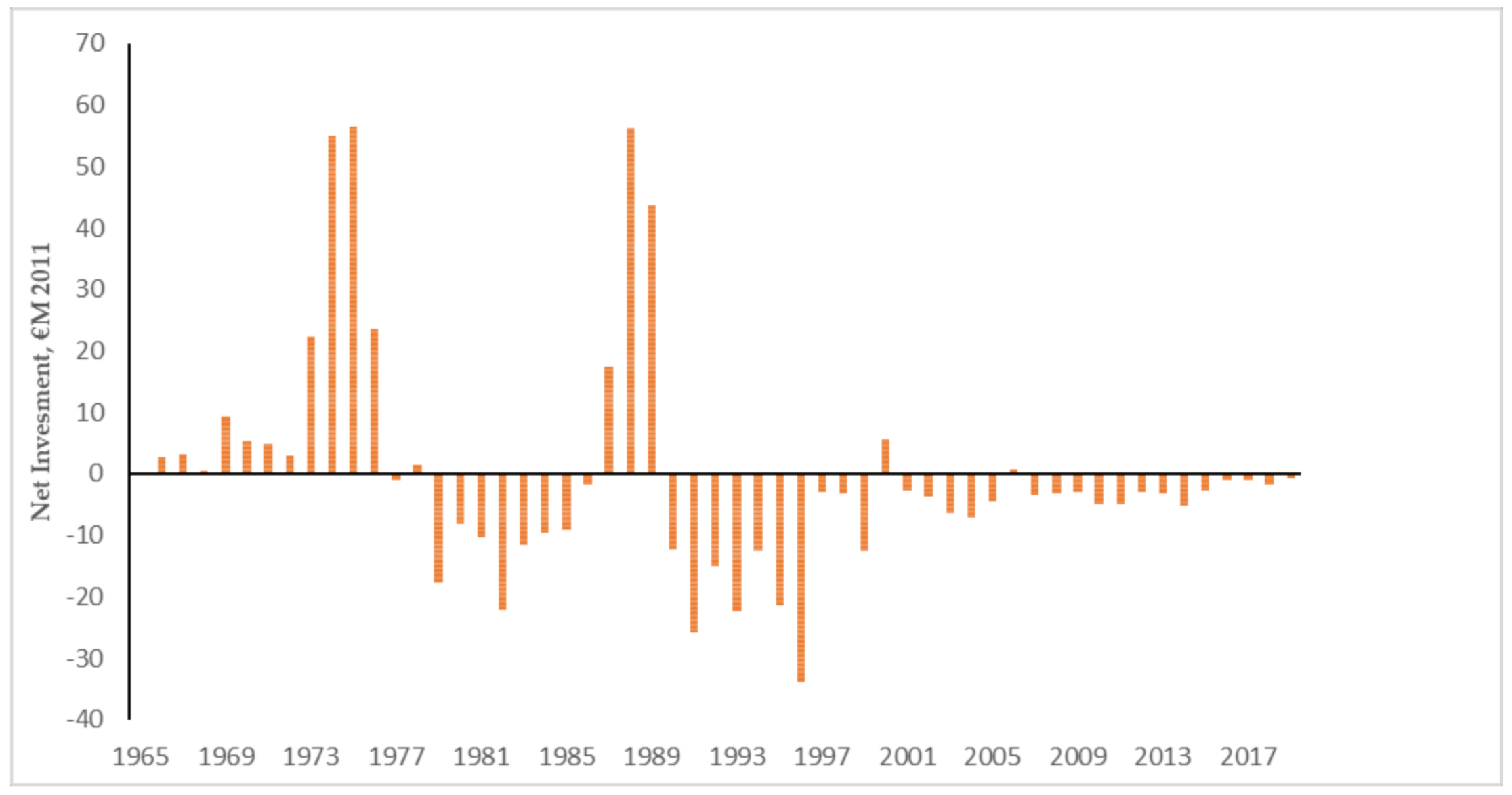

5.1. Estimation of the Gross Fixed Capital Formation

5.2. Valuation of the Gross Fixed Capital Formation

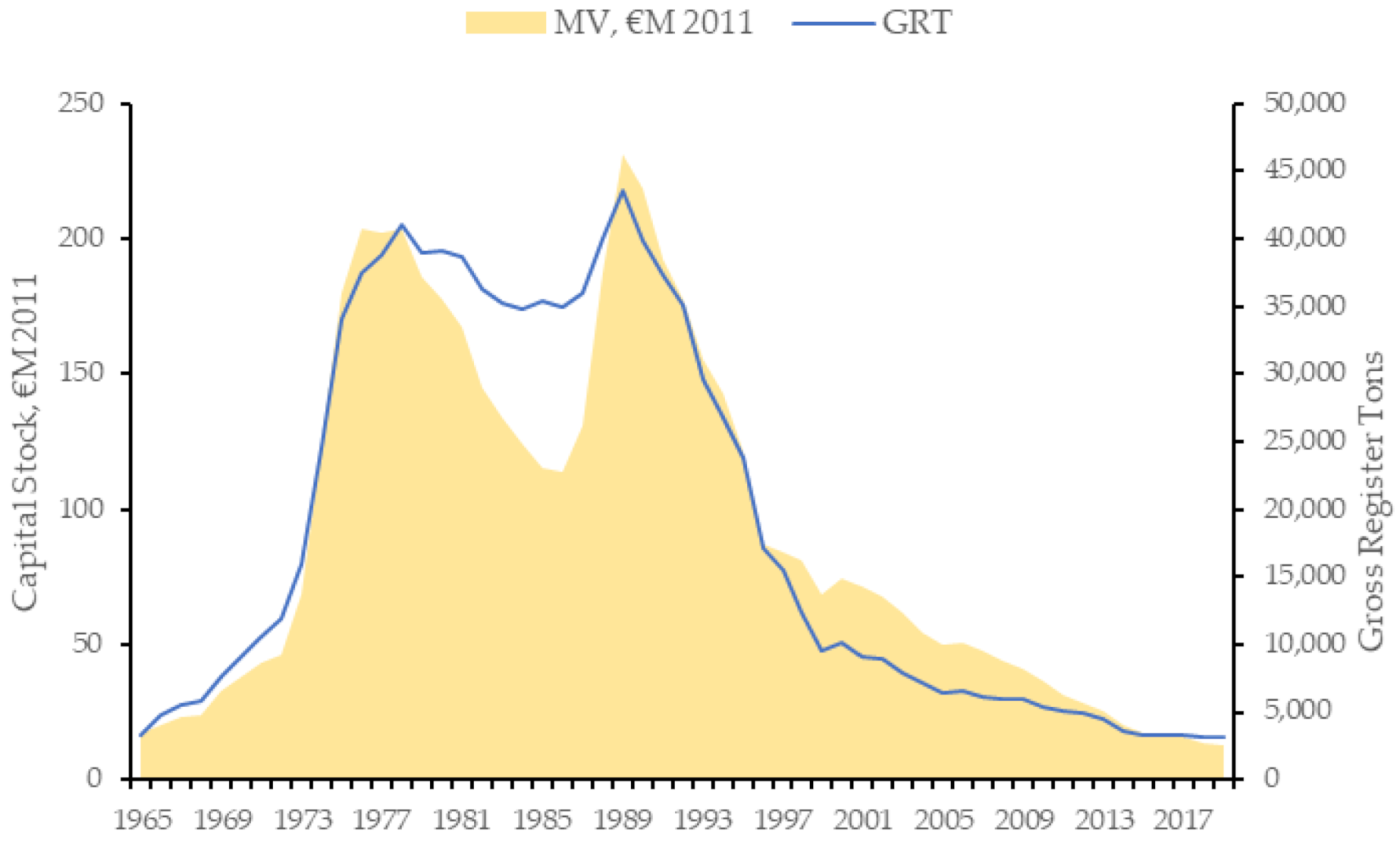

5.3. Estimation of the Capital Stock of the Fleet

6. Discussion

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Domar, E. Capital Expansion, Rate of Growth, and Employment. Econometrica 1946, 14, 137–147. [Google Scholar] [CrossRef]

- Jackson, D. Introduction to Economics: Theory and Data; Palgrave Macmillan: London, UK, 1982. [Google Scholar]

- OECD. Measuring Capital–OECD Manual 2009, 2nd ed.; OECD Publising: Paris, France, 2009. [Google Scholar] [CrossRef]

- Ward, M. The Measurement of Capital: The Methodology of Capital Stock Estimates in OECD Countries; OECD Publications Center: Paris, France, 1976. [Google Scholar]

- Hicks, J. Capital and Time: A Neo-Austrian Theory; Clarendon Press Oxford: Oxford, UK, 1987. [Google Scholar]

- Jones, H. An Introduction to Modern Theories of Economic Growth; Thomas Nelson Sons Ltd.: London, UK, 1975. [Google Scholar]

- Marítima, D.G.D.P. Anuario de Pesca Marítima, 1976; Subsecretaría de Marina Mercante: Madrid, Spain, 1977. [Google Scholar]

- Gordon, H.S. The Economic Theory of a Common-Property Resource: The Fishery. J. Polit. Econ. 1954, 62, 124–142. [Google Scholar] [CrossRef]

- Schaefer, M.B. Some Considerations of Population Dynamics and Economics in Relation to the Management of the Commercial Marine Fisheries. J. Fish. Board Canada 1957, 14, 669–681. [Google Scholar] [CrossRef]

- García del Hoyo, J.J.; Castilla Espino, D.; Jiménez Toribio, R. Determination of Technical Efficiency of Fisheries by Stochastic Frontier Models: A Case on the Gulf of Cádiz (Spain). ICES J. Mar. Sci. 2004, 61, 416–421. [Google Scholar] [CrossRef]

- Wilen, J.E. Towards a Theory of the Regulated Fishery. Mar. Resour. Econ. 1985, 1, 369–388. [Google Scholar] [CrossRef]

- Grévobal, D. Managing Fishing Capacity: Selected Papers on Underlying Conceps and Issues; FAO: Rome, Italy, 1999; Volume 386. [Google Scholar]

- Clark, C. Mathematical Bioeconomics: The Optimal Management of Renewable Resources; Wiley-Interscience: New York, NY, USA, 1976. [Google Scholar]

- Ministerio de Marina. Lista Oficial de Buques de Guerra y Mercantes de La Marina Española; Imprenta del Ministerio de Marina: Madrid, Spain, 1904. [Google Scholar]

- Ministerio de Marina. Lista Oficial de Buques de Guerra y Mercantes de La Marina Española; Imprenta del Ministerio de Marina: Madrid, Spain, 1914. [Google Scholar]

- Ministerio de Marina. Lista Oficial de Buques de Guerra y Mercantes de La Marina Española; Imprenta del Ministerio de Marina: Madrid, Spain, 1920. [Google Scholar]

- Ministerio de Marina. Lista Oficial de Buques de Guerra y Mercantes de La Marina Española; Imprenta del Ministerio de Marina: Madrid, Spain, 1930. [Google Scholar]

- Marítima, D.G.D.P. Estadística de Pesca, Año 1940; Ministerio de Comercio: Madrid, Spain, 1941.

- Marítima, D.G.D.P. Estadística de Pesca, Año 1945; Ministerio de Comercio: Madrid, Spain, 1946.

- Marítima, D.G.D.P. Estadística de Pesca, Año 1955; Ministerio de Comercio: Madrid, Spain, 1956.

- Ministerio de Agricultura, Pesca y Alimentación. Registro General de la Flota Pesquera. Available online: https://www.mapa.gob.es/es/pesca/temas/registro-flota/ (accessed on 17 September 2020).

- Buen, O.d. La Pesca Marítima En España En 1920: Ideas Generales y Resumen. Boletín de Pescas 1924, 90–91, 37–63. [Google Scholar]

- Subsecretaría de la Marina Mercante. Anuario de Pesca Marítima, 1976–1977; Dirección General de Pesca Marítima: Madrid, Spain, 1978. [Google Scholar]

- Ministerio de Agricultura, Pesca y Alimentación. Estadísticas Pesqueras: Estadísticas de Capturas y Desembarcos de Pesca Marítima. Available online: https://www.mapa.gob.es/es/estadistica/temas/estadisticas-pesqueras/pesca-maritima/estadistica-capturas-desembarcos/default.aspx (accessed on 17 September 2020).

- Rodríguez Santamaría, B. Diccionario de Artes de Pesca de España y Sus Posesiones; Imprenta de los Sucesores de Rivadeneyra: Madrid, Spain, 1923. [Google Scholar]

- Pesca, D.G. Estadística de Pesca; Ministerio de Agricultura, Industria y Comercio: Madrid, Spain, 1935.

- García del Hoyo, J.J. Evolución de La Producción Pesquera Andaluza (1985–1999); Servicio de Publicaciones y Divulgación, Junta de Andalucía: Sevilla, Spain, 2001. [Google Scholar]

- Jorgenson, D. Capital Theory and Investment Behavior. Am. Econ. Rev. 1963, 53, 247–259. [Google Scholar]

- Feldstein, M.S.; Foot, D.K. The Other Half of Gross Investment: Replacement and Modernization Expenditures. Rev. Econ. Stat. 1971, 53, 49–58. [Google Scholar] [CrossRef]

- Feldstein, M.S.; Rothschild, M. Towards an Economic Theory of Replacement Investment. Econometrica 1974, 42, 393–424. [Google Scholar] [CrossRef]

- Bitros, G.C.; Kelejian, H. On the Variability of the Replacement Investment Capital Stock Ratio: Some Evidence from Capital Scrappage. Rev. Econ. Stat. 1974, 56, 270–278. [Google Scholar] [CrossRef]

- Hulten, C.; Wykoff, F. The Estimation of Economic Depreciation Using Vintage Asset Prices: An Application of the Box-Cox Power Transformation. J. Econom. 1981, 15, 367–396. [Google Scholar] [CrossRef]

- Jorgenson, D. Capital as a Factor of Production. In Technology and Capital Formation; Jorgenson, D.W., Landau, R., Eds.; MIT Press: Cambridge, MT, USA, 1989; pp. 1–35. [Google Scholar]

- OECD. Methods Used by OECD Countries to Measure Stocks of Fixed Capital; OECD: Paris, France, 1992. [Google Scholar]

- OECD. Measuring Capital; OECD: Paris, France, 2001. [Google Scholar]

- Jorgenson, D.; Griliches, Z. The Explanation of Productivity Change. Rev. Econ. Stud. 1967, 34, 249–283. [Google Scholar] [CrossRef]

- Escribá-Pérez, F.; Murgui-García, M.; Ruiz-Tamarit, J. Economic and Statistical Measurement of Physical Capital with an Application to the Spanish Economy. IRES Discussion Papers. 2017. Available online: https://ideas.repec.org/p/ctl/louvir/2017020.html (accessed on 17 September 2020).

- Harberger, A.C. Perspectives on Capital and Technology in Less-Developed Countries; Croom Helm: London, UK, 1978. [Google Scholar]

- Griliches, Z. RD and the Productivity Slowdown; National Bureau of Economic Research: Cambridge, MA, USA, 1980; Volume 70. [Google Scholar] [CrossRef]

- De la Fuente, A.; Domenech, R. Human Capital in Growth Regressions: How Much Difference Does Data Quality Make? J. Eur. Econ. Assoc. 2006, 4, 1–36. [Google Scholar] [CrossRef]

- Jacob, V.; Sharma, S.C.; Grabowski, R. Capital Stock Estimates for Major Sectors and Disaggregated Manufacturing in Selected OECD Countries. Appl. Econ. 1997, 29, 563–579. [Google Scholar] [CrossRef]

- Kamps, C. New Estimates of Government Net Capital Stocks for 22 OECD Countries, 1960–2001. IMF Econ. Rev. 2006, 53, 120–150. [Google Scholar] [CrossRef]

- Berlemann, M.; Wesselhöft, J. Estimating Aggregate Capital Stocks Using the Perpetual Inventory Method: New Empirical Evidence for 103 Countries. EconStor 2012, 125, 43. [Google Scholar]

- Baily, M. The Productivity Growth Slowdown and Capital Accumulation. Am. Econ. Rev. 1981, 71, 326–331. [Google Scholar]

- Baily, M.; Gordon, R. Productivity and the Services of Capital and Labor. Brookings Pap. Econ. Act. 1981, 1981, 1–65. [Google Scholar] [CrossRef]

- Baily, M.N.; Nordhaus, W. The Productivity Growth Slowdown by Industry. Brookings Pap. Econ. Act. 1982, 1982, 423–459. [Google Scholar] [CrossRef][Green Version]

- Nomura, K. Measurement of Capital and Productivity in Japan; Keio University Press: Tokyo, Japan, 2004. [Google Scholar]

- Doms, M.E.; Dunn, W.E.; Oliner, S.D.; Sichel, D.E. How Fast Do Personal Computers Depreciate? Concepts and New Estimates. Tax Policy Econ. 2004, 18, 37–79. [Google Scholar] [CrossRef][Green Version]

- Geske, M.; Ramey, V.; Shapiro, M.D. Why Do Computers Depreciate? University of Chicago Press: Chicago, IL, USA, 2007. [Google Scholar] [CrossRef]

- Akerlof, G. The Market for Lemons: Quality Uncertainly and the MArket Mechanism. Q. J. Econ. 1970, 84, 488–500. [Google Scholar] [CrossRef]

- Hall, R.E. The Measurement of Quality Change from Vintage Price Data; Harvard University Press: Cambridge, MA, USA, 1971; pp. 240–271. [Google Scholar]

- Lee, B.S. Measurement of Capital Depreciation within the Japanese Fishing Fleet. Rev. Econ. Stat. 1978, 60, 225–237. [Google Scholar] [CrossRef]

- Kirkley, J.; Squires, D. A Limited Information Approach for Determining Capital Stock and Investment in a Fishery. Fish. Bull. 1988, 86, 339–349. [Google Scholar]

- del Valle Erkiaga, I.; Ikazuriaga, K.A. Assessing Changes in Capital and Investment as a Result of Fishing Capacity Limitation Programs. Environ. Resour. Econ. 2012, 54, 223–260. [Google Scholar] [CrossRef]

- Griliches, Z. Hedonic Price Indexes for Automobiles: An Econometric of Quality Change. In The Price Statistics of the Federal Government; NBER: Cambridge, MA, USA, 1961; pp. 173–196. [Google Scholar]

- Lancaster, K. Change and Innovation in the Technology of Consumption. Am. Econ. Rev. 1966, 56, 14–23. [Google Scholar]

- Ridker, R.G.; Henning, J. The Determinants of Residential Property Values with Special Reference to Air Pollution. Rev. Econ. Stat. 1967, 49, 246–257. [Google Scholar] [CrossRef]

- Rosen, S. Hedonic Prices and Implicit Markets: Product Differentiation in Pure Competition. J. Polit. Econ. 1974, 82, 34–55. [Google Scholar] [CrossRef]

- Lau, J. Functional Forms in Econometric Model Building. Handb. Econom. 1986, 3, 151–1566. [Google Scholar] [CrossRef]

- Christensen, L.; Jorgenson, D.; Lau, L. Transcendental Logarithmic Production Frontiers. Rev. Econ. Stat. 1973, 55, 28–45. [Google Scholar] [CrossRef]

- Bjorndal, T.; Conrad, J. The Dynamics of an Open Access Fishery. Can. J. Econ. 1987, 20, 74–85. [Google Scholar] [CrossRef]

- Bjørndal, T. Production in a Schooling Fishery: The Case of the North Sea Herring Fishery. Land Econ. 1989, 65, 49–56. [Google Scholar] [CrossRef]

- Millan, J. Una Funcion Translog de La Produccion Tradicional de Aceite. Investig. Agrar. Econ. 1987, 2, 147–155. [Google Scholar]

- Berndt, E.; Christensen, L. Testing for the Existence of a Consistent Aggregate Index of Labor Inputs. Am. Econ. Rev. 1974, 64, 391–404. [Google Scholar]

- Belsley, D.A.; Kuh, E.; Welsch, R. Regression Diagnostics: Identifying Influential Data and Sources of Collinearity; Wiley: New York, NY, USA, 1980. [Google Scholar]

- Kaiser, H. An Index of Factorial Simplicity. Psychometrika 1974, 39, 31–36. [Google Scholar] [CrossRef]

- Mahalanobis, P.C. On the Generalized Distance in Statistics. Proc. Nat. Inst. Sci. India 1936, 12, 49–55. [Google Scholar]

- Cox, D.R.; Hinkley, D.V. Monographs on Statistics and Applied Probability; CRC Press: Boca Raton, FL, USA, 1982. [Google Scholar]

- White, H. A Heteroskedasticity-Consistent Covariance Matrix Estimator and a Direct Test for Heteroskedasticity. Econometrica 1980, 48, 817–838. [Google Scholar] [CrossRef]

- OECD. Measuring Capital OECD-Manual; OECD: Paris, France, 2009. [Google Scholar]

| Description | Units | Data Sample Statistics to Estimate Building Value | Complete Data Sample Statistics | ||

|---|---|---|---|---|---|

| Mean | Std. Error | Mean | Std. Error | ||

| Y | €M, 2011 | 2.8821 | 1.4692 | 3.1475 | 2.1562 |

| X1 | GRT | 239.4384 | 128.2654 | 298.1320 | 272.6662 |

| X2 | CV | 853.3956 | 302.5250 | 926.0513 | 494.1602 |

| X3 | m | 34.1195 | 6.1813 | 36.2241 | 10.0619 |

| X4 | m | 7.6137 | 0.9671 | 7.8141 | 1.3214 |

| X5 | m | 29.8960 | 5.8443 | 32.0545 | 9.5366 |

| X6 | m | 3.8872 | 0.6829 | 4.0732 | 0.9104 |

| R | 1 = yes, 0 = no | 0.0824 | 0.2750 | 0.1120 | 0.3154 |

| A1 | 1 = yes, 0 = no | 0.4345 | 0.4957 | 0.2440 | 0.4295 |

| A2 | 1 = yes, 0 = no | 0.0262 | 0.1598 | 0.0340 | 0.1812 |

| A3 | 1 = yes, 0 = no | 0.0262 | 0.1598 | 0.0300 | 0.1706 |

| A4 | 1 = yes, 0 = no | 0.0262 | 0.1598 | 0.0640 | 0.2448 |

| A5 | 1 = yes, 0 = no | 0.0524 | 0.2229 | 0.0640 | 0.2448 |

| A6 | 1 = yes, 0 = no | 0.0449 | 0.2072 | 0.0340 | 0.1812 |

| A7 | 1 = yes, 0 = no | 0.0449 | 0.2072 | 0.0200 | 0.1400 |

| A8 | 1 = yes, 0 = no | 0.0262 | 0.1598 | 0.0160 | 0.1255 |

| A9 | 1 = yes, 0 = no | 0.0300 | 0.1705 | 0.0500 | 0.2179 |

| A10 | 1 = yes, 0 = no | 0.0787 | 0.2692 | 0.0640 | 0.2448 |

| A11 | 1 = yes, 0 = no | 0.0787 | 0.2692 | 0.0420 | 0.2006 |

| A12 | 1 = yes, 0 = no | 0.0337 | 0.1805 | 0.0220 | 0.1467 |

| Number of observations | 267 | 500 | |||

| Test | F Statistic | df | p-Value |

|---|---|---|---|

| Homogeneity | 0.9825 | 4.238 | 0.4177 |

| Constant returns to scale | 245.031 | 1.242 | 0.0000 |

| Weak global separability | 17.664 | 6.242 | 0.1066 |

| Parameters | Estimates | Parameters | Estimates | Parameters | Estimates |

|---|---|---|---|---|---|

| 14.7485 | δ | −0.2916 | ϑ6 | 0.1699 | |

| [0.0267] | [0.0687] | [0.0589] | |||

| 0.2355 | ϑ1 | 0.2432 | ϑ7 | −0.2989 | |

| [0.0138] | [0.0329] | [0.0579] | |||

| 0.0950 | ϑ3 | −0.1884 | ϑ9 | −0.2794 | |

| [0.0179] | [0.0735] | [0.0914] | |||

| 0.0792 | ϑ4 | 0.2508 | ϑ10 | −0.3194 | |

| [0.0132] | [0.0461] | [0.0395] | |||

| 0.1576 | ϑ5 | 0.2006 | ϑ12 | −0.1559 | |

| [0.0172] | [0.0484] | [0.0728] |

| Parameters | Estimates | Estándar Error | t-Statistic | p-Value |

|---|---|---|---|---|

| −22.7169 | 5.6334 | −4.0325 | 0.0001 | |

| 0.7600 | 0.0820 | 9.2683 | 0.0000 | |

| −0.0554 | 0.0047 | −11.7872 | 0.0000 | |

| 0.0006 | 0.0001 | 6.0000 | 0.0000 | |

| 0.0127 | 0.0029 | 4.3793 | 0.0000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

González Galán, A.; García del Hoyo, J.J.; García Ordaz, F. Investment and Decapitalization in the Fishing Industry: The Case of the Spanish Crustacean Freezer Trawler Fleet. Sustainability 2021, 13, 8760. https://doi.org/10.3390/su13168760

González Galán A, García del Hoyo JJ, García Ordaz F. Investment and Decapitalization in the Fishing Industry: The Case of the Spanish Crustacean Freezer Trawler Fleet. Sustainability. 2021; 13(16):8760. https://doi.org/10.3390/su13168760

Chicago/Turabian StyleGonzález Galán, Ana, Juan José García del Hoyo, and Félix García Ordaz. 2021. "Investment and Decapitalization in the Fishing Industry: The Case of the Spanish Crustacean Freezer Trawler Fleet" Sustainability 13, no. 16: 8760. https://doi.org/10.3390/su13168760

APA StyleGonzález Galán, A., García del Hoyo, J. J., & García Ordaz, F. (2021). Investment and Decapitalization in the Fishing Industry: The Case of the Spanish Crustacean Freezer Trawler Fleet. Sustainability, 13(16), 8760. https://doi.org/10.3390/su13168760