Community Support or Funding Amount: Actual Contribution of Reward-Based Crowdfunding to Market Success of Video Game Projects on Kickstarter

Abstract

:1. Introduction

- To investigate the relationship between funding success and market success so that the research area on crowdfunding can be broadened beyond the immediate crowdfunding platforms into product launch and new avenues for research can flourish in the field.

- To explore the role of community support and feedback on market success with the aim of increasing the awareness of project founders about performance metrics in crowdfunding platforms other than funding amount.

2. Literature Review

2.1. New Product Innovation through Community and Co-Creation

2.2. Outcomes and Motivations in Reward-Based Crowdfunding

2.2.1. Funding Success

2.2.2. Community Engagement and Co-Creation

2.2.3. Market Success

3. Research Model and Hypotheses

4. Research Methodology

4.1. Background and Research Setting

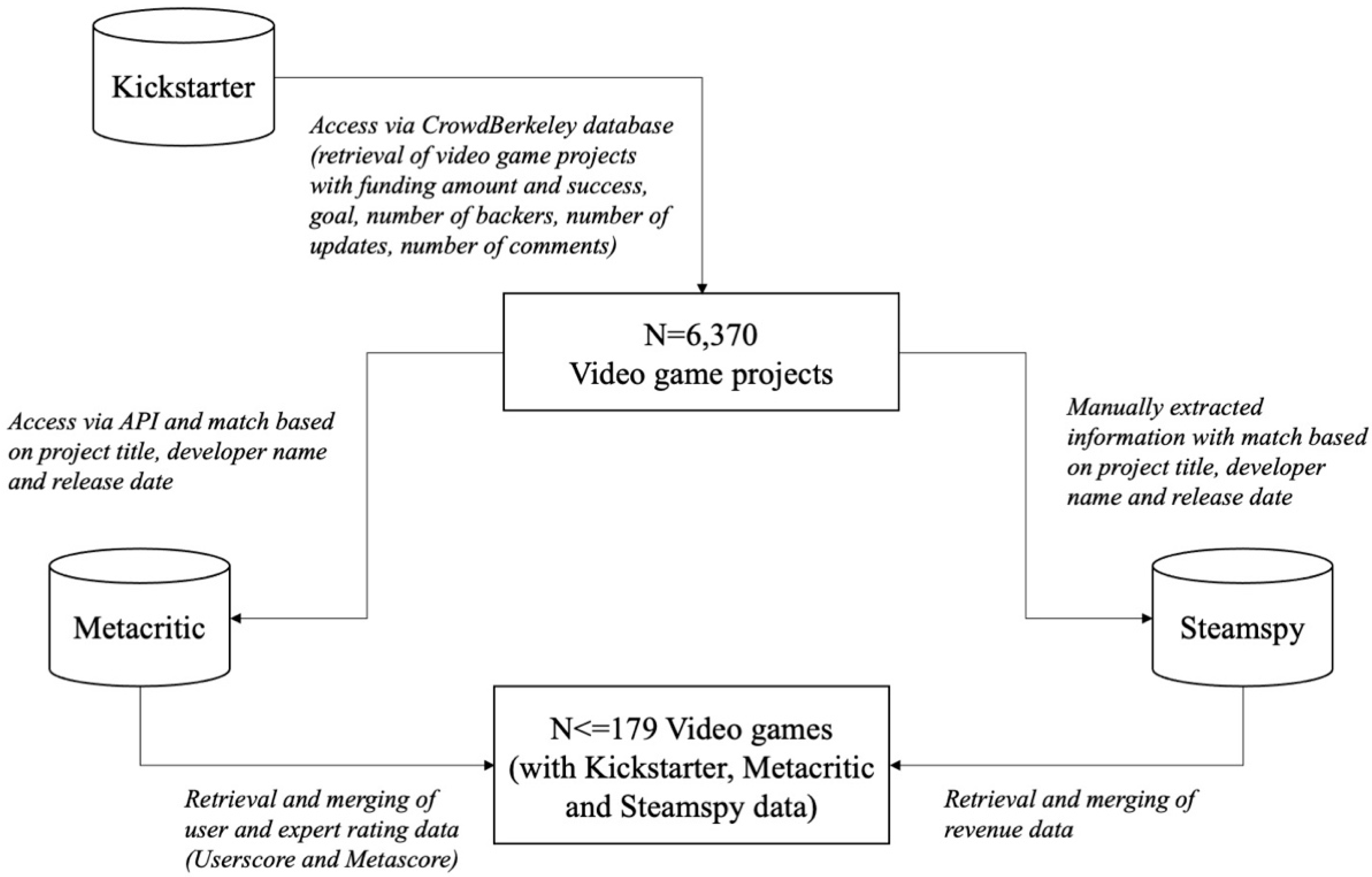

4.2. Methodology and Data Collection

4.3. Measures

4.3.1. Video Game Revenues (from Steamspy)

4.3.2. Perceived Product Quality (from Metacritic)

4.3.3. Community Engagement (from Kickstarter)

4.3.4. Funding Success (from Kickstarter)

4.3.5. Funding Goal (from Kickstarter)

4.3.6. Average Funding Amount (from Kickstarter)

4.3.7. Percentage of Goal (from Kickstarter)

5. Analysis and Results

6. Discussion

6.1. Implications for Research

6.2. Implications for Practice

6.3. Limitations and Future Research

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Planells, A.J. Video games and the crowdfunding ideology: From the gamer-buyer to the prosumer-investor. J. Consum. Cult. 2017, 17, 620–638. [Google Scholar] [CrossRef]

- Wang, N.; Li, Q.; Liang, H.; Ye, T.; Ge, S. Understanding the importance of interaction between creators and backers in crowdfunding success. Electron. Commer. Res. Appl. 2018, 27, 106–117. [Google Scholar] [CrossRef]

- Hoegen, A.; Steininger, D.M.; Veit, D. How do investors decide? An interdisciplinary review of decision-making in crowdfunding. Electron. Mark. 2017, 28, 339–365. [Google Scholar] [CrossRef]

- Kim, T.; Por, M.H.; Yang, S.B. Winning the crowd in online fundraising platforms: The roles of founder and project features. Electron. Commer. Res. Appl. 2017, 25, 86–94. [Google Scholar] [CrossRef]

- Mollick, E. The Dynamics of crowdfunding. J. Bus. Ventur. 2014, 29, 1–16. [Google Scholar] [CrossRef] [Green Version]

- Belleflamme, P.; Lambert, T.; Schwienbacher, A. Crowdfunding: Tapping the right crowd. J. Bus. Ventur. 2014, 29, 585–609. [Google Scholar] [CrossRef] [Green Version]

- Burtch, G.; Ghose, A.; Wattal, S. An empirical examination of the antecedents and consequences of contribution patterns in crowd-funded markets. Inf. Syst. Res. 2013, 24, 499–519. [Google Scholar] [CrossRef] [Green Version]

- Chan, C.S.; Parhankangas, A. Crowdfunding innovative ideas: How incremental and radical innovativeness influence funding outcomes. Entrep. Theory Pract. 2017, 41, 237–263. [Google Scholar] [CrossRef]

- McKenny, A.F.; Allison, T.H.; Ketchen, D.J.; Short, J.C.; Ireland, R.D. How should crowdfunding research evolve? A survey of the entrepreneurship theory and practice editorial board. Entrep. Theory Pract. 2017, 41, 291–304. [Google Scholar] [CrossRef]

- Efrat, K.; Gilboa, S. Relationship approach to crowdfunding: How creators and supporters interaction enhances projects’ success. Electron. Mark. 2019, 12, 1–13. [Google Scholar] [CrossRef]

- Macht, S.; Chapman, G. Getting more than money through online crowdfunding. Asia Pac. J. Bus. Adm. 2019, 11, 171–186. [Google Scholar] [CrossRef]

- Brown, T.E.; Boon, E.; Pill, L.F. Seeking funding in order to sell: Crowdfunding as a marketing tool. Bus. Horiz. 2017, 60, 189–195. [Google Scholar] [CrossRef]

- Blank, S. Why the lean start-up changes everything? Harv. Bus. Rev. 2013, 91, 63–72. [Google Scholar]

- Mollick, E. The unique value of crowdfunding is not money—It is community. Harv. Bus. Rev. 2016, 4, 2–4. [Google Scholar]

- Cappa, F.; Oriani, R.; Pinelli, M.; De Massis, A. When does crowdsourcing benefit firm stock market performance? Res. Policy 2019, 48, 103825. [Google Scholar] [CrossRef]

- Von Hippel, E. Democratizing Innovation; MIT Press: Boston, MA, USA, 2005. [Google Scholar]

- Von Hippel, E. Lead users: A source of novel product concepts. Manag. Sci. 1986, 32, 791–805. [Google Scholar] [CrossRef] [Green Version]

- Franke, N.; Von Hippel, E.; Schreier, M. Finding commercially attractive user innovations: A test of lead-user theory. J. Prod. Innov. Manag. 2006, 23, 301–315. [Google Scholar] [CrossRef] [Green Version]

- Marchi, G.; Giachetti, C.; de Gennaro, P. Extending lead-user theory to online brand communities: The case of the community Ducati. Technovation 2011, 31, 350–361. [Google Scholar] [CrossRef]

- Carbonell, P.; Rodríguez-Escudero, A.I.; Pujari, D. Customer involvement in new service development: An examination of antecedents and outcomes. J. Prod. Innov. Manag. 2009, 26, 536–550. [Google Scholar] [CrossRef]

- Chesbrough, H.W. Open Innovation: The New Imperative for Creating and Profiting from Technology; Harvard Business Press: Boston, MA, USA, 2003. [Google Scholar]

- Kaulio, M.A. Customer, consumer and user involvement in product development: A framework and a review of selected methods. Total Qual. Manag. 1998, 9, 141–149. [Google Scholar] [CrossRef]

- Von Hippel, E. Perspective: User toolkits for innovation. J. Prod. Innov. Manag. 2001, 18, 247–257. [Google Scholar] [CrossRef]

- Piller, F.T.; Walcher, D. Toolkits for idea competitions: A novel method to integrate users in new product development. R. D. Manag. 2006, 36, 307–318. [Google Scholar] [CrossRef]

- Lagrosen, S. Customer involvement in new product development: A relationship marketing perspective. Eur. J. Innov. Manag. 2005, 8, 424–436. [Google Scholar] [CrossRef]

- Sawhney, M.; Verona, G.; Prandelli, E. Collaborating to create: The internet as a platform for customer engagement in product innovation. J. Interact. Mark. 2005, 19, 4–17. [Google Scholar] [CrossRef]

- Füller, J.; Bartl, M.; Ernst, H.; Mühlbacher, H. Community based innovation: How to integrate members of virtual communities into new product development. Electron. Commer. Res. 2006, 6, 57–73. [Google Scholar] [CrossRef]

- Füller, J.; Matzler, K.; Hoppe, M. Brand community members as a source of innovation. J. Prod. Innov. Manag. 2008, 25, 608–619. [Google Scholar] [CrossRef]

- Cholakova, M.; Clarysse, B. Does the possibility to make equity investments in crowdfunding projects crowd out reward-based investments? Entrep. Theory Pract. 2015, 39, 145–172. [Google Scholar] [CrossRef]

- Allison, T.; Davis, B.; Short, J.; Webb, J. Crowdfunding in a prosocial microlending environment: Examining the role of intrinsic versus extrinsic cues. Entrep. Theory Pract. 2015, 39, 53–73. [Google Scholar] [CrossRef]

- Macht, S.; Weatherston, J. The benefits of online crowdfunding for fund-seeking business ventures. Strateg. Chang. 2014, 23, 1–14. [Google Scholar] [CrossRef]

- Hornuf, L.; Schwienbacher, A. Crowdinvesting—Angel investing for the masses? In Handbook of Research on Business Angels; Edward Elgar Publishing: Cheltenham, UK, 2014; Volume 3, pp. 381–398. [Google Scholar]

- Rossi, M. The new ways to raise capital: An exploratory study of crowdfunding. Int. J. Financ. Res. 2014, 5, 8–18. [Google Scholar] [CrossRef]

- Best, J.; Neiss, S.; Stralse, S.; Fleming, L. How Big Will the Debt and Equity Crowdfunding Investment Market be? Comparisons, Assumptions, and Estimates. Fung Institute for Engineering Leadership; Fung Technical Report No. 2013.01.15; University of California: Berkeley, CA, USA, 2013. [Google Scholar]

- Tyni, H. Game Crowdfunding as a Form of Platformised Cultural Production. PhD Thesis, Tampere University, Tampere, Finland, 2020. [Google Scholar]

- Steigenberger, N. Why supporters contribute to reward-based crowdfunding. Int. J. Entrep. Behav. Res. 2017, 23, 336–353. [Google Scholar] [CrossRef]

- Mollick, E.; Kuppuswamy, V. When Firms are Potemkin Villages: Formal Organizations and the Benefits of Crowdfunding. 2014. Available online: https://ssrn.com/abstract=2377020 (accessed on 27 June 2021).

- Gerber, E.; Hui, J. Crowdfunding: Motivations and deterrents for participation. ACM Trans. Comput. Hum. Interact. 2013, 20, 1–32. [Google Scholar] [CrossRef]

- Stegmaier, J. A Crowdfunder’s Strategy Guide; Berrett-Koehler Publishers: San Francisco, CA, USA, 2015. [Google Scholar]

- Day, G.S.; Wensley, R. Assessing advantage: A framework for diagnosing competitive superiority. J. Mark. 1988, 52, 1–20. [Google Scholar] [CrossRef]

- Kogut, B.; Zander, U. Knowledge of the firm, combinative capabilities, and the replication of technology. Organ. Sci. 1992, 3, 383–397. [Google Scholar] [CrossRef]

- Spender, J.C. Making knowledge the basis of a dynamic theory of the firm. Strat. Manag. J. 1996, 17, 45–62. [Google Scholar] [CrossRef]

- Grant, R.M. Toward a knowledge-based theory of the firm. Strat. Manag. J. 1996, 17, 109–122. [Google Scholar] [CrossRef]

- Barney, J.B. The resource-based theory of the firm. Organ. Sci. 1996, 7, 469. [Google Scholar] [CrossRef]

- Demiray, M.; Burnaz, S.; Li, D. Effects of institutions on entrepreneur’s trust and engagement in crowdfunding. J. Electron. Commer. Res. 2021, 22, 95–109. [Google Scholar]

- Report: Gaming Industry Value to Rise 30%–With Thanks to Microtransactions. Available online: https://www.forbes.com/sites/mattgardner1/2020/09/19/gaming-industry-value-200-billion-fortnite-microtransactions/ (accessed on 26 June 2021).

- Marchand, A.; Henning-Thurau, T. Value creation in the video game industry: Industry economics, consumer benefits, and research opportunities. J. Interact. Mark. 2013, 27, 141–157. [Google Scholar] [CrossRef]

- Tschang, F.T. Balancing the tensions between rationalization and creativity in the video game industry. Organ. Sci. 2007, 18, 989–1005. [Google Scholar] [CrossRef] [Green Version]

- Cadin, L.; Guerin, F. What can we learn from the video game industry? Eur. Manag. J. 2006, 24, 248–255. [Google Scholar] [CrossRef]

- Jeppesen, L.B. User toolkits for innovation: Consumers support each other. J. Prod. Innov. Manag. 2005, 22, 347–362. [Google Scholar] [CrossRef]

- Parmentier, G.; Gandia, R. Managing sustainable innovation with a user community toolkit: The case of the video game Trackmania. Creat. Innov. Manag. 2013, 22, 195–208. [Google Scholar] [CrossRef]

- Prügl, R.; Schreier, M. Learning from leading-edge customers at The Sims: Opening up the innovation process using toolkits. R. D. Manag. 2006, 36, 237–250. [Google Scholar] [CrossRef]

- Burger-Helmchen, T.; Cohendet, P. User communities and social software in the video game industry. Long Range Plan. 2011, 44, 317–343. [Google Scholar] [CrossRef]

- Yu, S.; Johnson, S.; Lai, C.; Cricelli, A.; Fleming, L. Crowdfunding and regional entrepreneurial investment: An application of the CrowdBerkeley database. Res. Policy 2017, 46, 1723–1737. [Google Scholar] [CrossRef]

- Steam Spy and the Specter of Game Sales Transparency. Available online: https://www.gamasutra.com/view/news/280417/Steam_Spy_and_the_specter_of_game_sales_transparency.php (accessed on 26 June 2021).

- What Do Developers and Publishers Really Think of Steam Spy? Available online: https://www.pcgamesn.com/steam/steam-spy-accuracy-developers (accessed on 26 June 2021).

- Tellis, G.J.; Johnson, J. The value of quality. Mark. Sci. 2007, 26, 758–773. [Google Scholar] [CrossRef] [Green Version]

- Tellis, G.J.; Yin, E.; Niraj, R. Does quality win? Network effects versus quality in high-tech markets. J. Mark. Res. 2009, 46, 135–149. [Google Scholar] [CrossRef]

- Amatriain, X.; Lathia, N.; Pujol, J.M.; Kwak, H.; Oliver, N. The wisdom of the few: A collaborative filtering approach based on expert opinions from the web. In Proceedings of the 32nd International ACM SIGIR Conference on Research and Development in Information Retrieval, Boston, MA, USA, 19–23 July 2009; Association for Computing Machinery: New York, NY, USA, 2009; pp. 532–539. [Google Scholar]

- Kuppuswamy, V.; Bayus, B.L. Does my contribution to your crowdfunding project matter? J. Bus. Ventur. 2017, 32, 72–89. [Google Scholar] [CrossRef]

- Yin, C.; Liu, L.; Mirkovski, K. Does more crowd participation bring more value to crowdfunding projects? The perspective of crowd capital. Internet Res. 2019, 29, 1149–1170. [Google Scholar] [CrossRef]

- Anderson, C. The Long Tail: Why the Future of Business is Selling Less of More; Hyperion Press: New York, NY, USA, 2006. [Google Scholar]

- Cai, Z.; Zhang, P.; Han, X. The inverted U-shaped relationship between crowdfunding success and reward options and the moderating effect of price differentiation. China Financ. Rev. Int. 2020, 11, 230–258. [Google Scholar] [CrossRef]

- Ryoba, M.J.; Qu, S.; Ji, Y.; Qu, D. The right time for crowd communication during campaigns for sustainable success of crowdfunding: Evidence from Kickstarter platform. Sustainability 2020, 12, 7642. [Google Scholar] [CrossRef]

- Kanfer, R.; Ackerman, P.L. Motivation and cognitive abilities: An integrative/aptitude-treatment interaction approach to skill acquisition. J. Appl. Psychol. 1989, 74, 657–690. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Absorptive capacity: A new perspective on learning and innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Absorptive capacity: A review, reconceptualization, and extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef] [Green Version]

- Lam, C.F.; DeRue, D.S.; Karam, E.P.; Hollenbeck, J.R. The impact of feedback frequency on learning and task performance: Challenging the “more is better” assumption. Organ. Behav. Hum. Decis. Process. 2011, 116, 217–228. [Google Scholar] [CrossRef]

- Koch, S. Exploring the effects of SourceForge. net coordination and communication tools on the efficiency of open source projects using data envelopment analysis. Empir. Softw. Eng. 2009, 14, 397–417. [Google Scholar] [CrossRef]

- Martinez-Torres, R.; Olmedilla, M. Identification of innovation solvers in open innovation communities using swarm intelligence. Technol. Forecast. Soc. Chang. 2016, 109, 15–24. [Google Scholar] [CrossRef]

- Saura, J.R.; Palacios-Marqués, D.; Iturricha-Fernández, A. Ethical design in social media: Assessing the main performance measurements of user online behavior modification. J. Bus. Res. 2021, 129, 271–281. [Google Scholar] [CrossRef]

- Oliver, R.L. Effect of expectation and disconfirmation on postexposure product evaluations: An alternative interpretation. J. Appl. Psychol. 1977, 62, 480. [Google Scholar] [CrossRef]

- Oliver, R.L. A cognitive model of the antecedents and consequences of satisfaction decisions. J. Mark. Res. 1980, 17, 460–469. [Google Scholar] [CrossRef]

- Saura, J.R.; Ribeiro-Soriano, D.; Palacios-Marqués, D. From user-generated data to data-driven innovation: A research agenda to understand user privacy in digital markets. Int. J. Inf. Manag. 2021, 19, 102331. [Google Scholar] [CrossRef]

- Raford, N. Online foresight platforms: Evidence for their impact on scenario planning & strategic foresight. Technol. Forecast. Soc. Chang. 2015, 97, 65–76. [Google Scholar]

| Variable | Min. | Max. | Median | Mean | S.D. |

|---|---|---|---|---|---|

| Owners (Steamspy, n = 164) | 0 | 5,118,665 | 59,323 | 215,908 | 502,199 |

| Players (Steamspy, n = 164) | 538 | 4,254,128 | 30,542 | 164,433 | 415,378 |

| Playtime per Owner (Steamspy, n = 164) | 0:06 | 7:16:00 | 4:11 | 9:29 | 34:18 |

| Revenue ($, Steamspy, n = 157) | 0 | 51,135,463 | 702,561 | 3,012,768 | 6,718,231 |

| MetaScore (0–100) (Steamspy, n = 104) | 0 | 92 | 70.5 | 65.87 | 17.96 |

| UserScore (0–100) (Steamspy, n = 148) | 12 | 98 | 80 | 77.03 | 15.92 |

| MetaScore (0–100) (Metacritic, n = 130) | 29 | 94 | 70 | 68.8 | 11.21 |

| UserScore (0–10) (Metacritic, n = 157) | 0.6 | 8.95 | 7.1 | 6.84 | 1.49 |

| Number of Backers | 8 | 73,986 | 1105 | 3,08 | 7583.4 |

| Number of Comments | 0 | 63,062 | 196 | 1396 | 5737.8 |

| Number of Updates | 0 | 191 | 29 | 34.27 | 25.38 |

| Funding Success (binary) | 0 | 1 | 1 | 0.82 | 0.38 |

| Goal ($) | 200 | 1,100,000 | 20,000 | 72,238 | 159,242.1 |

| Funding Amount ($) | 41 | 3,987,000 | 28,805 | 122,831 | 394,868.9 |

| Percentage of goal (%) | 0.18 | 2469 | 131.1 | 205.9 | 284,440 |

| Revenue (ln) | Backers | Comments (Average) | Updates (Average) | Average Funding Amount | Percentage of Goal | User Score | |

|---|---|---|---|---|---|---|---|

| Revenue (ln) | 1 | ||||||

| Backers | 0.339 ** | 1 | |||||

| Comments (average) | 0.132 | 0.235 ** | 1 | ||||

| Updates (average) | −0.498 ** | −0.219 ** | −0.08 | 1 | |||

| Average Funding Amount | −0.047 | 0.095 | −0.267 ** | 0.109 | 1 | ||

| Percentage of Goal | 0.247 ** | 0.087 | 0.033 | −0.107 | −0.12 | 1 | |

| User Score | 0.387 ** | 0.147 * | −0.023 | −0.311 ** | −0.063 | 0.139 | 1 |

| Model 1 (H1) | Model 2 (H2) | Model 3 (H3) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Dependent Variable | Revenue (ln) | User Score | Revenue (ln) | Revenue (ln)—Successfully Funded | Revenue (ln)—Not Successfully Funded | |||||

| Independent Variables | B | S.E. | B | S.E. | B | S.E. | B | S.E. | B | S.E. |

| Backers | 5.22 × 10−5 ** | <0.001 | <0.001 | <0.001 | 4.86 × 10−5 ** | <0.001 | 5.26 × 10−5 ** | <0.001 | 0.001 | <0.001 |

| Comments (average) | 0.319 | 0.45 | −2.95 | 3.3 | 0.384 | 0.441 | 0.114 | 0.473 | 2.645 | 1.555 |

| Updates (average) | −11.438 *** | 1.909 | −49.81 *** | 13.019 | −9.68 *** | 1.974 | −12.266 *** | 2.266 | −5.741 | 4.751 |

| Average Funding Amount | 0.001 | 0.007 | −0.006 | 0.045 | 0.001 | 0.007 | −0.001 | 0.008 | −0.003 | 0.014 |

| Percentage of Goal | 0.001 * | 0.001 | 0.005 | 0.003 | 0.001 | 0.001 | 0.001 * | 0.001 | 0.022 | 0.024 |

| Time since release (control) | 0.001 | <0.001 | 0.001 | <0.001 | <0.001 | 0.001 | 0.002 * | 0.001 | ||

| User Score | 0.028 ** | 0.01 | ||||||||

| R2 (adjusted) | 0.311 | 0.093 | 0.341 | 0.316 | 0.231 | |||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Aygoren, O.; Koch, S. Community Support or Funding Amount: Actual Contribution of Reward-Based Crowdfunding to Market Success of Video Game Projects on Kickstarter. Sustainability 2021, 13, 9195. https://doi.org/10.3390/su13169195

Aygoren O, Koch S. Community Support or Funding Amount: Actual Contribution of Reward-Based Crowdfunding to Market Success of Video Game Projects on Kickstarter. Sustainability. 2021; 13(16):9195. https://doi.org/10.3390/su13169195

Chicago/Turabian StyleAygoren, Oguzhan, and Stefan Koch. 2021. "Community Support or Funding Amount: Actual Contribution of Reward-Based Crowdfunding to Market Success of Video Game Projects on Kickstarter" Sustainability 13, no. 16: 9195. https://doi.org/10.3390/su13169195

APA StyleAygoren, O., & Koch, S. (2021). Community Support or Funding Amount: Actual Contribution of Reward-Based Crowdfunding to Market Success of Video Game Projects on Kickstarter. Sustainability, 13(16), 9195. https://doi.org/10.3390/su13169195