Innovative Finance, Technological Adaptation and SMEs Sustainability: The Mediating Role of Government Support during COVID-19 Pandemic

Abstract

:1. Introduction

2. COVID-19, SMEs, and the Bangladesh Economy

3. Literature Review, Theoretical Development, and Hypothesis Development

3.1. Theoretical Development

3.2. Literature Survey

3.3. Hypothesis Development

3.3.1. Innovative Finance and SMEs

3.3.2. Technological Adaptation and SMEs

3.3.3. Government Support and SMEs

4. Research Sample and Instruments

4.1. Research Design and Sample

4.2. Measurement Models

4.3. SMEs Sustainability

4.4. Innovative Finance

4.5. Technological Adaptation

4.6. Government Support

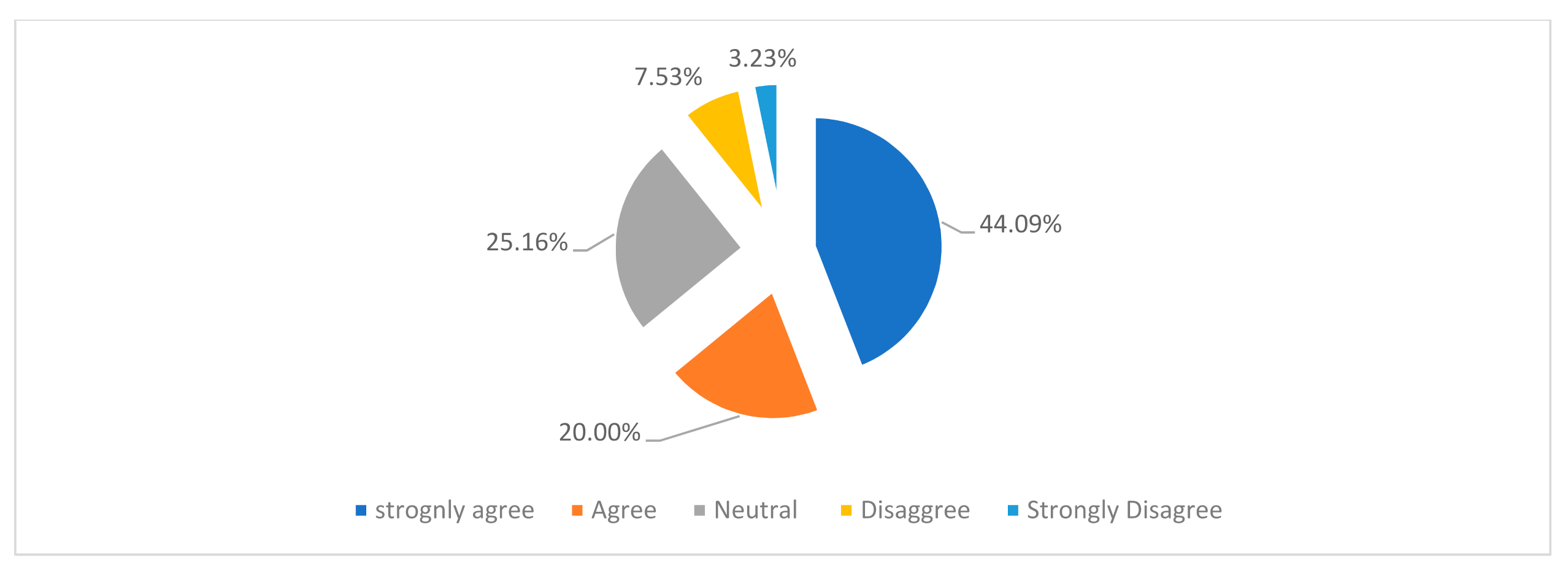

4.7. Descriptive Statistics

4.8. Methodology for Hypothesis Testing

4.9. Instrument Validation

5. Discussion and Theoretical Contribution

5.1. Discussion

5.2. Theoretical Contribution

5.3. Managerial Implications

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Sansa, N.A. The Impact of the COVID-19 on the Financial Markets: Evidence from China and USA. Electron. Res. J. Soc. Sci. Humanit. 2020, 2. Available online: https://ssrn.com/abstract=3567901 (accessed on 15 February 2021). [CrossRef]

- Ruiz Estrada, M.A.; Koutronas, E.; Lee, M. Stagpression: The economic and financial impact of Covid-19 Pandemic. Contemp. Econ. 2021, 15, 19–33. [Google Scholar] [CrossRef]

- McCloskey, B.; Heymann, D.L. SARS to novel coronavirus—Old lessons and new lessons. Epidemiol. Infect. 2020, 148. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Puriwat, W.; Tripopsakul, S. Customer Engagement with Digital Social Responsibility in Social Media: A Case Study of COVID-19 Situation in Thailand. J. Asian Financ. Econ. Bus. 2021, 8, 475–483. [Google Scholar]

- Runyan, R.C. Small business in the face of crisis: Identifying barriers to recovery from a natural disaster 1. J. Contingencies Crisis Manag. 2006, 14, 12–26. [Google Scholar] [CrossRef]

- Le, H.; Nguyen, T.; Ngo, C.; Pham, T.; Le, T. Policy related factors affecting the survival and development of SMEs in the context of Covid 19 pandemic. Manag. Sci. Lett. 2020, 10, 3683–3692. [Google Scholar] [CrossRef]

- Nseobot, I.R.; Simeon, I.I.; Effiong, A.I.; Frank, E.I.; Ukpong, E.S.; Essien, M.O. COVID-19: The aftermath for businesses in developing countries. Int. J. Bus. Educ. Manag. Stud. 2020. Available online: https://ssrn.com/abstract=3592603 (accessed on 15 February 2021).

- Fernandes, N. Economic Effects of Coronavirus Outbreak (COVID-19) on the World Economy. IESE Business School Working Paper No. WP-1240-E. Available online: https://ssrn.com/abstract=3557504 (accessed on 15 February 2021).

- Gregurec, I.; Tomičić Furjan, M.; Tomičić-Pupek, K. The impact of COVID-19 on sustainable business models in SMEs. Sustainability 2021, 13, 1098. [Google Scholar] [CrossRef]

- Bretas, V.P.G.; Alon, I. The impact of COVID-19 on franchising in emerging markets: An example from Brazil. Glob. Bus. Organ. Excell. 2020, 39, 6–16. [Google Scholar] [CrossRef]

- Kuckertz, A.; Brändle, L.; Gaudig, A.; Hinderer, S.; Morales Reyes, C.A.; Prochotta, A.; Steinbrink, K.M.; Berger, E.S.C. Startups in times of crisis—A rapid response to the COVID-19 pandemic. J. Bus. Ventur. Insights 2020, 13, e00169. [Google Scholar] [CrossRef]

- Emejulu, G.; Agbasi, O.; Nosike, C. Strategic agility and performance of small and medium enterprises in the phase of Covid-19 pandemic. Int. J. Financ. Account. Manag. 2020, 2, 41–50. [Google Scholar] [CrossRef]

- Hadi, S.; Supardi, S. Revitalization strategy for small and medium enterprises after Corona virus disease pandemic (covid-19) in Yogyakarta. J. Xian Univ. Archit. Technol. 2020, 12, 4068–4076. [Google Scholar]

- Nyanga, T.; Zirima, H. Reactions of small to medium enterprises in masvingo, Zimbabwe to covid 19: Implications on productivity. Bus. Excell. Manag. 2020, 10, 22–32. [Google Scholar] [CrossRef]

- McGeever, N.; McQuinn, J.; Myers, S. SME Liquidity Needs during the COVID-19 Shock. Financial Stability Notes 2/FS/20, Central Bank of Ireland. 2020. Available online: https://www.centralbank.ie/docs/default-source/publications/financial-stability-notes/no-2-sme-liquidity-needs-during-the-covid-19-shock-(mcgeever-mcquinn-and-myers).pdf?sfvrsn=6 (accessed on 12 October 2020).

- Ratnasingam, J.; Khoo, A.; Jegathesan, N.; Wei, L.C.; Abd Latib, H.; Thanasegaran, G.; Liat, L.C.; Yi, L.Y.; Othman, K.; Amir, M.A. How are small and medium enterprises in Malaysia’s furniture industry coping with COVID-19 pandemic? Early evidences from a survey and recommendations for policymakers. BioResources 2020, 15, 5951–5964. [Google Scholar] [CrossRef]

- Liguori, E.W.; Pittz, T.G. Strategies for small business: Surviving and thriving in the era of COVID-19. J. Int. Counc. Small Bus. 2020, 1, 106–110. [Google Scholar] [CrossRef]

- Fitriasari, F. How do Small and Medium Enterprise (SME) survive the COVID-19 outbreak? J. Inov. Ekon. 2020, 5, 53–62. [Google Scholar]

- Saidu, M.; Aifuwa, H.O. Coronavirus Pandemic in Nigeria: How Can Small and Medium Enterprises (SMEs) Cope and Flatten the Curve. Musa S Aifuwa HO (2020). Coronavirus Pandemic Niger. How Can S Small Medium Enterp. SMEs Cope Flatten Curve. Eur. J. Account. Financ. Invest. 2020, 6, 55–61. [Google Scholar]

- Manyati, T.K.; Mutsau, M. Exploring technological adaptation in the informal economy: A case study of innovations in small and medium enterprises (SMEs) in Zimbabwe. Afr. J. Sci. Technol. Innov. Dev. 2019, 11, 253–259. [Google Scholar] [CrossRef]

- Das, S.; Kundu, A.; Bhattacharya, A. Technology Adaptation and Survival of SMEs: A Longitudinal Study of Developing Countries. Technol. Innov. Manag. Rev. 2020, 10, 64–72. [Google Scholar] [CrossRef]

- McGuinness, G.; Hogan, T.; Powell, R. European trade credit use and SME survival. J. Corp. Financ. 2018, 49, 81–103. [Google Scholar] [CrossRef]

- Mocking, R.; Möhlmann, J.; Palali, A. Dependence on External Finance and SME Survival. CPB Neth. Bur. Econ. Policy Anal. 2016, 6, 12–85. [Google Scholar]

- Ryandono, M.N.H.; Muafi, M.; Guritno, A. Sharia Stock Reaction Against COVID-19 Pandemic: Evidence from Indonesian Capital Markets. J. Asian Financ. Econ. Bus. 2021, 8, 697–710. [Google Scholar]

- Brumagim, A.L. A hierarchy of corporate resources. Adv. Strateg. Manag. 1994, 10, 81–112. [Google Scholar]

- Penrose, E.T. Tiie Theory of the Growth of the Firm; Oxford University Press: New York, NY, USA, 1959. [Google Scholar]

- Lichtenstein, B.M.B.; Brush, C.G. How Do “Resource Bundles” Develop and Change in New Ventures? A Dynamic Model and Longitudinal Exploration. Entrep. Theory Pract. 2001, 25, 37–58. [Google Scholar] [CrossRef]

- Adeola, O.; Gyimah, P.; Appiah, K.O.; Lussier, R.N. Can critical success factors of small businesses in emerging markets advance UN Sustainable Development Goals? World J. Entrep. Manag. Sustain. Dev. 2021, 17, 85–105. [Google Scholar] [CrossRef]

- Yang, T.; Hughes, K.D.; Zhao, W. Resource combination activities and new venture growth: Exploring the role of effectuation, causation, and entrepreneurs’ gender. J. Small Bus. Manag. 2020, 4, 1–29. [Google Scholar] [CrossRef]

- Amit, R.; Schoemaker, P.J.H. Strategic assets and organizational rent. Strateg. Manag. J. 1993, 14, 33–46. [Google Scholar] [CrossRef]

- Mikalef, P.; Gupta, M. Artificial intelligence capability: Conceptualization, measurement calibration, and empirical study on its impact on organizational creativity and firm performance. Inf. Manag. 2021, 58, 103434. [Google Scholar] [CrossRef]

- Brush, C.G.; Greene, P.G.; Hart, M.M. From initial idea to unique advantage: The entrepreneurial challenge of constructing a resource base. Acad. Manag. Perspect. 2001, 15, 64–78. [Google Scholar] [CrossRef]

- Wiklund, J.; Shepherd, D. Entrepreneurial orientation and small business performance: A configurational approach. J. Bus. Ventur. 2005, 20, 71–91. [Google Scholar] [CrossRef]

- Rindova, V.P.; Yeow, A.; Martins, L.L.; Faraj, S. Partnering portfolios, value-creation logics, and growth trajectories: A comparison of Yahoo and Google (1995 to 2007). Strateg. Entrep. J. 2012, 6, 133–151. [Google Scholar] [CrossRef]

- Wang, Y.; Hong, A.; Li, X.; Gao, J. Marketing innovations during a global crisis: A study of China firms’ response to COVID-19. J. Bus. Res. 2020, 116, 214–220. [Google Scholar] [CrossRef]

- Barney, J.B.; Arikan, A.M. The resource-based view: Origins and implications. Blackwell Handb. Strateg. Manag. 2001, 5, 124–188. [Google Scholar]

- Cowling, M.; Liu, W.; Ledger, A.; Zhang, N. What really happens to small and medium-sized enterprises in a global economic recession? UK evidence on sales and job dynamics. Int. Small Bus. J. 2015, 33, 488–513. [Google Scholar] [CrossRef] [Green Version]

- Nason, R.S.; Wiklund, J. An Assessment of Resource-Based Theorizing on Firm Growth and Suggestions for the Future. J. Manag. 2015, 44, 32–60. [Google Scholar] [CrossRef]

- Joseph, J.; Wilson, A.J. The growth of the firm: An attention-based view. Strateg. Manag. J. 2018, 39, 1779–1800. [Google Scholar] [CrossRef]

- Barney, J.; Wright, M.; Ketchen, D.J., Jr. The resource-based view of the firm: Ten years after 1991. J. Manag. 2001, 27, 625–641. [Google Scholar] [CrossRef]

- Brinckmann, J.; Salomo, S.; Gemuenden, H.G. Financial Management Competence of Founding Teams and Growth of New Technology—Based Firms. Entrep. Theory Pract. 2011, 35, 217–243. [Google Scholar] [CrossRef]

- Brown, R.; Rocha, A.; Cowling, M. Financing entrepreneurship in times of crisis: Exploring the impact of COVID-19 on the market for entrepreneurial finance in the United Kingdom. Int. Small Bus. J. 2020, 38, 380–390. [Google Scholar] [CrossRef]

- Weaven, S.; Quach, S.; Thaichon, P.; Frazer, L.; Billot, K.; Grace, D. Surviving an economic downturn: Dynamic capabilities of SMEs. J. Bus. Res. 2021, 128, 109–123. [Google Scholar] [CrossRef]

- Barney, J.B. Resource-based theories of competitive advantage: A ten-year retrospective on the resource-based view. J. Manag. 2001, 27, 643–650. [Google Scholar] [CrossRef]

- Calabrò, A.; Torchia, M.; Jimenez, D.G.; Kraus, S. The role of human capital on family firm innovativeness: The strategic leadership role of family board members. Int. Entrep. Manag. J. 2021, 17, 261–287. [Google Scholar] [CrossRef] [Green Version]

- Wapshott, R.; Mallett, O. Managing Human Resources in Small and Medium-Sized Enterprises: Entrepreneurship and the Employment Relationship; Routledge: London, UK, 2015. [Google Scholar]

- Harney, B.; Alkhalaf, H. A quarter-century review of HRM in small and medium-sized enterprises: Capturing what we know, exploring where we need to go. Hum. Resour. Manag. 2021, 60, 5–29. [Google Scholar] [CrossRef]

- Kor, Y.Y.; Mahoney, J.T. Penrose’s Resource-Based Approach: The Process and Product of Research Creativity. J. Manag. Stud. 2000, 37. [Google Scholar] [CrossRef]

- Watson, W.; Stewart, W.H.; BarNir, A. The effects of human capital, organizational demography, and interpersonal processes on venture partner perceptions of firm profit and growth. J. Bus. Ventur. 2003, 18, 145–164. [Google Scholar] [CrossRef]

- von Krogh, G. Building Capacity for Empirical Discovering in Management and Organization Studies. Acad. Manag. Discov. 2020, 6, 159–164. [Google Scholar] [CrossRef]

- Shang, Y.; Li, H.; Zhang, R. Effects of Pandemic Outbreak on Economies: Evidence From Business History Context. Front. Public Health 2021, 9, 1–12. [Google Scholar] [CrossRef]

- Ojong-Ejoh, M.U.; Angioha, P.U.; Agba, R.U.; Aniah, E.A.; Salimon, M.G.; Akintola, A. Operating SMEs in the Face of the Covid-19 Pandemic in Calabar. Quant. Econ. Manag. Stud. 2021, 2, 272–280. [Google Scholar] [CrossRef]

- Popovic, J.; Kvrgic, G.; Coric, G.; Avakumovic, J.; Milosevic, D. Uncertainty in Smes’assessment of Coronavirus Pandemic Risk Impact on Agri-Food Sector in Western Balkans. Eкoнoмuкa Noљonpuвpeдe 2020, 67, 25–41. [Google Scholar]

- Miocevic, D. Investigating strategic responses of SMEs during COVID-19 pandemic: A cognitive appraisal perspective. BRQ Bus. Res. Q. 2021, 12, 1–40. [Google Scholar]

- Aidoo, S.O.; Agyapong, A.; Acquaah, M.; Akomea, S.Y. The performance implications of strategic responses of SMEs to the covid-19 pandemic: Evidence from an African economy. Afr. J. Manag. 2021, 7, 74–103. [Google Scholar] [CrossRef]

- Li, Z.; Anaba, O.A.; Ma, Z.; Li, M. Ghanaian SMEs Amidst the COVID-19 Pandemic: Evaluating the Influence of Entrepreneurial Orientation. Sustainability 2021, 13, 1131. [Google Scholar] [CrossRef]

- Amankwah-Amoah, J.; Khan, Z.; Wood, G. COVID-19 and business failures: The paradoxes of experience, scale, and scope for theory and practice. Eur. Manag. J. 2021, 39, 179–184. [Google Scholar] [CrossRef]

- Dzingirai, M.; Tshuma, N.; Sikomwe, S. Post-Pandemic Sustainability Strategies for Zimbabwean SMEs. In Handbook of Research on Strategies and Interventions to Mitigate COVID-19 Impact on SMEs; IGI Global: Hershey, PA, USA, 2021; pp. 457–476. [Google Scholar]

- Elshenawi, D.M.; Wang, Y. How to protect factory workers from COVID-19? BioResources 2020, 15, 7315–7318. [Google Scholar] [CrossRef]

- Beraha, I.; Đuričin, S. The Impact of COVID-19 Crisis on Medium-sized Enterprises in Serbia. Econ. Anal. 2020, 53, 14–27. [Google Scholar]

- Robinson, J.; Kengatharan, N. Exploring the effect of Covid-19 on Small and Medium Enterprises: Early Evidence from Sri Lanka. J. Appl. Econ. Bus. Res. 2020, 10, 115–125. [Google Scholar]

- Lu, Y.; Wu, J.; Peng, J.; Lu, L. The perceived impact of the Covid-19 epidemic: Evidence from a sample of 4807 SMEs in Sichuan Province, China. Environ. Hazards 2020, 19, 323–340. [Google Scholar] [CrossRef]

- Garba, A. Effect of covid 19 on small and medium scale enterpriss performance in Makurdi Metropolis, Benue State, Nigeria. GRA’s Multidiscip. Int. GRAM I J. 2020, 4, 25–45. [Google Scholar]

- Omar, A.R.C.; Ishak, S.; Jusoh, M.A. The impact of Covid-19 Movement Control Order on SMEs’ businesses and survival strategies. Geogr. Malays. J. Soc. Space 2020, 16, 1–22. [Google Scholar]

- Akpan, I.J.; Udoh, E.A.P.; Adebisi, B. Small business awareness and adoption of state-of-the-art technologies in emerging and developing markets, and lessons from the COVID-19 pandemic. J. Small Bus. Entrep. 2020, 6, 1–18. [Google Scholar] [CrossRef]

- Fitriyani, I.; Sudiyarti, N.; Fietroh, M.N. Strategi Manajemen Bisnis Pasca Pandemi Covid-19. Indones. J. Soc. Sci. Humanit. 2020, 1, 87–95. [Google Scholar]

- Khan, S.; Hassan, M.K.; Rabbani, M.R.; Atif, M. An artificial intelligence-based Islamic FinTech model on Qardh-Al-Hasan for COVID 19 affected SMEs. In Islamic Perspective for Sustainable Financial System; Istanbul University Press: Istanbul, Turkey, 2021. [Google Scholar]

- Zimon, G.; Dankiewicz, R. Trade Credit Management Strategies in SMEs and the COVID-19 Pandemic—A Case of Poland. Sustainability 2020, 12, 6114. [Google Scholar] [CrossRef]

- Islam, A.; Jerin, I.; Hafiz, N.; Nimfa, D.T.; Wahab, S.A. Configuring a blueprint for Malaysian SMEs to survive through the COVID-19 crisis: The reinforcement of Quadruple Helix Innovation Model. J. Entrep. Bus. Econ. 2021, 9, 32–81. [Google Scholar]

- Kukanja, M.; Planinc, T.; Sikošek, M. Crisis Management Practices in Tourism SMEs During the Covid-19 Pandemic. Organizacija 2020, 53, 27–35. [Google Scholar] [CrossRef]

- Islam, M.A.; Igwe, P.A.; Rahman, M.; Saif, A.N.M. Remote working challenges and solutions: Insights from SMEs in Bangladesh during the COVID-19 pandemic. Int. J. Qual. Innov. 2020. [Google Scholar]

- Syriopoulos, K. The impact of COVID-19 on entrepreneurship and SMEs. J. Int. Acad. Case Stud. 2020, 26, 1–2. [Google Scholar]

- Chowdhury, M.T.; Sarkar, A.; Paul, S.K.; Moktadir, M.A. A case study on strategies to deal with the impacts of COVID-19 pandemic in the food and beverage industry. Oper. Manag. Res. 2020. [Google Scholar] [CrossRef]

- Raimi, L.; Uzodinma, I. Trends in Financing Programmes for the Development of Micro, Small and Medium Enterprises (MSMEs) in Nigeria: A Qualitative Meta-synthesis. In Contemporary Developments in Entrepreneurial Finance; Springer: Berlin/Heidelberg, Germany, 2020; pp. 81–101. [Google Scholar]

- Popon, S.; Muhammad Iqbal, F.; Sri, N.; Anugrahwanto, R.B.; Ahmad Wahyu, H.; Deddy, S.; Anggi, F.; Siti, R.; Dwi Noviatul, Z. The Nexus Between Dynamic Capability and Islamic Financial Literacy Towards Innovation of Small Medium Enterprises (SMEs) in Indonesia. In Proceedings of the 1st Paris Van Java International Seminar on Health, Economics, Social Science and Humanities (PVJ-ISHESSH 2020), Paris, France, 8 March 2021; Atlantis Press: Amsterdam, The Netherlands; pp. 36–39. [Google Scholar]

- Kabanda, S.; Brown, I. A structuration analysis of Small and Medium Enterprise (SME) adoption of E-Commerce: The case of Tanzania. Telemat. Inform. 2017, 34, 118–132. [Google Scholar] [CrossRef]

- Muchiri, J.W. Effect of mobile banking adoption on the performance of small and medium enterprises in Nairobi County. Int. J. Econ. Bus. Manag. 2018, 2, 445–486. [Google Scholar]

- Clarke, R. Risks inherent in the digital surveillance economy: A research agenda. J. Inf. Technol. 2019, 34, 59–80. [Google Scholar] [CrossRef]

- Barati, S.; Mohammadi, S. An efficient model to improve customer acceptance of mobile banking. In Proceedings of the World Congress on Engineering and Computer Science, San Francisco, CA, USA, 20–22 October 2009; pp. 20–22. [Google Scholar]

- Ibrahim, E.E.; Joseph, M.; Ibeh, K.I. Customers’ perception of electronic service delivery in the UK retail banking sector. Int. J. Bank Mark. 2006, 24, 475–493. [Google Scholar] [CrossRef]

- Evangelista, P.; McKinnon, A.; Sweeney, E. Technology adoption in small and medium-sized logistics providers. Ind. Manag. Data Syst. 2013, 113, 967–989. [Google Scholar] [CrossRef] [Green Version]

- ERIND, H. He technological, organizational and environmental framework of IS innovation adaption in small and medium enterprises. Evidence from research over the last 10 years. Int. Ournal Bus. Manag. 2015, 3, 1–14. [Google Scholar]

- Lee, H.; Kelley, D.; Lee, J.; Lee, S. SME Survival: The Impact of Internationalization, Technology Resources, and Alliances. J. Small Bus. Manag. 2012, 50, 1–19. [Google Scholar] [CrossRef]

- Windrum, P.; De Berranger, P. The Adoption of E-Business Technology by SMEs; Maastricht Economic Research Institute on Innovation and Technology: Maastricht, The Netherlands, 2002. [Google Scholar]

- Quaddus, M.; Hofmeyer, G. An investigation into the factors influencing the adoption of B2B trading exchanges in small businesses. Eur. J. Inf. Syst. 2007, 16, 202–215. [Google Scholar] [CrossRef]

- Esselaar, P.; Miller, J. Towards electronic commerce in Africa: A perspective from three country studies. South. Afr. J. Inf. Commun. 2001, 2001, 1–19. [Google Scholar] [CrossRef] [Green Version]

- Hanadi, A.; Aruna, M. Technology innovation for SME growth: A perception for the emerging economies. Technology 2013, 4, 156–162. [Google Scholar]

- Cassiman, B.; Veugelers, R. R&D cooperation and spillovers: Some empirical evidence from Belgium. Am. Econ. Rev. 2002, 92, 1169–1184. [Google Scholar]

- Tiwari, M. Competitiveness of SMEs through different strategies. IOSR J. Bus. Manag 2014, 16, 63–68. [Google Scholar] [CrossRef]

- Myers, S.; Majiuf, N. Corporate financing and investment decisions when firms have information that investors do not have. J. Financ. Econ. 1984, 25, 187–220. [Google Scholar] [CrossRef] [Green Version]

- Storey, D.J.; Tether, B.S. Public policy measures to support new technology-based firms in the European Union. Res. Policy 1998, 26, 1037–1057. [Google Scholar] [CrossRef]

- Ganotakis, P.; D’Angelo, A.; Konara, P. From latent to emergent entrepreneurship: The role of human capital in entrepreneurial founding teams and the effect of external knowledge spillovers for technology adoption. Technol. Forecast. Soc. Chang. 2021, 170, 120912. [Google Scholar] [CrossRef]

- Burt, R.S. The Network Structure Of Social Capital. Res. Organ. Behav. 2000, 22, 345–423. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Sheng, S.; Zhou, K.Z.; Li, J.J. The Effects of Business and Political Ties on Firm Performance: Evidence from China. J. Mark. 2011, 75, 1–15. [Google Scholar] [CrossRef]

- Wei, J.; Liu, Y. Government support and firm innovation performance. Chin. Manag. Stud. 2015, 9, 38–55. [Google Scholar] [CrossRef]

- Clement, K.; Hansen, M. Financial incentives to improve environmental performance: A review of Nordic public sector support for SMEs. Eur. Environ. 2003, 13, 34–47. [Google Scholar] [CrossRef]

- Wu, W.; Wu, C.; Zhou, C.; Wu, J. Political connections, tax benefits and firm performance: Evidence from China. J. Account. Public Policy 2012, 31, 277–300. [Google Scholar] [CrossRef]

- Li, H.; Meng, L.; Wang, Q.; Zhou, L.-A. Political connections, financing and firm performance: Evidence from Chinese private firms. J. Dev. Econ. 2008, 87, 283–299. [Google Scholar] [CrossRef]

- Guariglia, A.; Liu, X.; Song, L. Internal finance and growth: Microeconometric evidence on Chinese firms. J. Dev. Econ. 2011, 96, 79–94. [Google Scholar] [CrossRef] [Green Version]

- Loader, K. Supporting SMEs through government purchasing activity. Int. J. Entrep. Innov. 2005, 6, 17–26. [Google Scholar] [CrossRef]

- Smallbone, D.; Welter, F. The role of government in SME development in transition economies. Int. Small Bus. J. 2001, 19, 63–77. [Google Scholar] [CrossRef]

- Arshad, M.; Arshad, D. Internal capabilities and SMEs performance: A case of textile industry in Pakistan. Manag. Sci. Lett. 2019, 9, 621–628. [Google Scholar] [CrossRef]

- Fosfuri, A.; Tribó, J.A. Exploring the antecedents of potential absorptive capacity and its impact on innovation performance. Omega 2008, 36, 173–187. [Google Scholar] [CrossRef] [Green Version]

- Arshad, M.; Ahmad, M.; Ali, M.; Khan, W.; Arshad, M. The role of government business support services and absorptive capacity on SMES performance. Int. J. Adv. Sci. Technol. 2020, 29, 1492–1499. [Google Scholar]

- Teixeira, A.A.; Jabbour, C.J.C.; de Sousa Jabbour, A.B.L. Relationship between green management and environmental training in companies located in Brazil: A theoretical framework and case studies. Int. J. Prod. Econ. 2012, 140, 318–329. [Google Scholar] [CrossRef]

- Lin, H.-F. Understanding the determinants of electronic supply chain management system adoption: Using the technology–organization–environment framework. Technol. Forecast. Soc. Chang. 2014, 86, 80–92. [Google Scholar] [CrossRef]

- Razumovskaia, E.; Yuzvovich, L.; Kniazeva, E.; Klimenko, M.; Shelyakin, V. The Effectiveness of Russian Government Policy to Support SMEs in the COVID-19 Pandemic. J. Open Innov. Technol. Mark. Complex. 2020, 6, 160. [Google Scholar] [CrossRef]

- Prasanna, R.; Jayasundara, J.; Naradda Gamage, S.K.; Ekanayake, E.; Rajapakshe, P.; Abeyrathne, G. Sustainability of smes in the competition: A systemic review on technological challenges and sme performance. J. Open Innov. Technol. Mark. Complex. 2019, 5, 100. [Google Scholar] [CrossRef] [Green Version]

- Robson, C.; McCartan, K. Real World Research; John Wiley & Sons: New York, NY, USA, 2016. [Google Scholar]

- Meng, L.; Qamruzzaman, M.; Adow, A.H.E. Technological Adaption and Open Innovation in SMEs: An Strategic Assessment for Women-Owned SMEs Sustainability in Bangladesh. Sustainability 2021, 13, 2942. [Google Scholar] [CrossRef]

- Ye, J.; Kulathunga, K. How does financial literacy promote sustainability in SMEs? A developing country perspective. Sustainability 2019, 11, 2990. [Google Scholar] [CrossRef] [Green Version]

- Ardic, O.P.; Mylenko, N.; Saltane, V. Access to Finance by Small and Medium Enterprises: A Cross-Country Analysis with A New Data Set. Pac. Econ. Rev. 2012, 17, 491–513. [Google Scholar] [CrossRef]

- Okello Candiya Bongomin, G.; Mpeera Ntayi, J.; Munene, J.C.; Akol Malinga, C. The relationship between access to finance and growth of SMEs in developing economies. Rev. Int. Bus. Strategy 2017, 27, 520–538. [Google Scholar] [CrossRef]

- Alkahtani, A.; Nordin, N.; Khan, R.U. Does government support enhance the relation between networking structure and sustainable competitive performance among SMEs? J. Innov. Entrep. 2020, 9, 14. [Google Scholar] [CrossRef]

- Zamberi Ahmad, S.; Xavier, S.R. Entrepreneurial environments and growth: Evidence from Malaysia GEM data. J. Chin. Entrep. 2012, 4, 50–69. [Google Scholar] [CrossRef]

- Ying, Q.; Hassan, H.; Ahmad, H. The Role of a Manager’s Intangible Capabilities in Resource Acquisition and Sustainable Competitive Performance. Sustainability 2019, 11, 527. [Google Scholar] [CrossRef] [Green Version]

- Eniola, A.A.; Entebang, H. SME Firm Performance-Financial Innovation and Challenges. Procedia Soc. Behav. Sci. 2015, 195, 334–342. [Google Scholar] [CrossRef] [Green Version]

- Qamruzzaman, M.; Wei, J. Financial innovation and financial inclusion nexus in South Asian countries: Evidence from symmetric and asymmetric panel investigation. Int. J. Financ. Stud. 2019, 7, 61. [Google Scholar] [CrossRef] [Green Version]

- Engwa, F.E.; Yakum, I.M.; Mukah, S.T. The Role of Banking Institutional Services on the Sustainable growth of SMEs in Cameroon. J. Econ. Manag. Sci. 2021, 4, 1–14. [Google Scholar]

- Muneeb, M.A.; Asad, A.L.I.; Hina, S.; Md, Q.; Rimsha, K. The Effect of Technology and Open Innovation on Women-Owned Small and Medium Enterprises in Pakistan. J. Asian Financ. Econ. Bus. 2021, 8, 411–422. [Google Scholar] [CrossRef]

- Chigozie, M.P.; Ifeanyi, E.R.; Irenaus, O.N. Technology Adaptation Strategies By Smes In Nigeria. Econspeak A J. Adv. Manag. IT Soc. Sci. 2016, 6, 49–61. [Google Scholar]

- Peter, F.; Adegbuyi, O.; Olokundun, M.; Peter, A.O.; Amaihian, A.B.; Ibidunni, A.S. Government financial support and financial performance of SMEs. Acad. Strateg. Manag. J. 2018, 17, 1–10. [Google Scholar]

- Lamoureux, S.M.; Movassaghi, H.; Kasiri, N. The role of government support in SMEs’ adoption of sustainability. IEEE Eng. Manag. Rev. 2019, 47, 110–114. [Google Scholar] [CrossRef]

- Loehlin, J.C. Latent Variable Models: An Introduction to Factor, Path, and Structural Equation Analysis; Psychology Press: New York, NY, USA, 2004. [Google Scholar]

- Steenkamp, J.-B.E.M.; Baumgartner, H. On the use of structural equation models for marketing modeling. Int. J. Res. Mark. 2000, 17, 195–202. [Google Scholar] [CrossRef]

- Lei, P.-W.; Wu, Q. Introduction to Structural Equation Modeling: Issues and Practical Considerations. Educ. Meas. Issues Pract. 2007, 26, 33–43. [Google Scholar] [CrossRef]

- Bagozzi, R.P. A Holistic Methodology for Modeling Consumer Response to Innovation. Oper. Res. 1983, 31, 128–176. [Google Scholar] [CrossRef] [PubMed]

- Neale, M.C.; Hunter, M.D.; Pritikin, J.N.; Zahery, M.; Brick, T.R.; Kirkpatrick, R.M.; Estabrook, R.; Bates, T.C.; Maes, H.H.; Boker, S.M. OpenMx 2.0: Extended Structural Equation and Statistical Modeling. Psychometrika 2016, 81, 535–549. [Google Scholar] [CrossRef]

- Al-Gahtani, S.S. Empirical investigation of e-learning acceptance and assimilation: A structural equation model. Appl. Comput. Inform. 2016, 12, 27–50. [Google Scholar] [CrossRef] [Green Version]

- Tajdini, S. The effects of the subjective-experiential knowledge gap on consumers’ information search behavior and perceptions of consumption risk. J. Bus. Res. 2021, 135, 66–77. [Google Scholar] [CrossRef]

- Masukujjaman, M.; Alam, S.S.; Siwar, C.; Halim, S.A. Purchase intention of renewable energy technology in rural areas in Bangladesh: Empirical evidence. Renew. Energy 2021, 170, 639–651. [Google Scholar] [CrossRef]

- Curran, P.J.; West, S.G.; Finch, J.F. The robustness of test statistics to nonnormality and specification error in confirmatory factor analysis. Psychol. Methods 1996, 1, 16. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Hult, G.T.M.; Ringle, C.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Springer International Publishing AG: New York, NY, USA, 2017. [Google Scholar]

- Sarstedt, M.; Hair, J.F., Jr.; Cheah, J.-H.; Becker, J.-M.; Ringle, C.M. How to specify, estimate, and validate higher-order constructs in PLS-SEM. Australas. Mark. J. 2019, 27, 197–211. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Structural equation models with unobservable variables and measurement error: Algebra and statistics. J. Mark. Res. 1981, 18, 382–388. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef] [Green Version]

- Yusoff, A.S.M.; Peng, F.S.; Abd Razak, F.Z.; Mustafa, W.A. Discriminant Validity Assessment of Religious Teacher Acceptance: The Use of HTMT Criterion. J. Phys. Conf. Ser. 2020, 1529, 042045. [Google Scholar] [CrossRef]

- Ab Hamid, M.; Sami, W.; Sidek, M.M. Discriminant validity assessment: Use of Fornell & Larcker criterion versus HTMT criterion. J. Phys. Conf. Ser. 2017, 890, 012163. [Google Scholar]

- Voorhees, C.M.; Brady, M.K.; Calantone, R.; Ramirez, E. Discriminant validity testing in marketing: An analysis, causes for concern, and proposed remedies. J. Acad. Mark. Sci. 2016, 44, 119–134. [Google Scholar] [CrossRef]

- Arbuckle, J. IBM SPSS Amos 20 User’s Guide; Amos Development, SPSS: Chicago, IL, USA, 2011. [Google Scholar]

- Manimala, M.J.; Vijay, D. Technology Business Incubators (TBIs): A Perspective for the Emerging Economies. IIM Bangalore Research Paper. 2012. Available online: https://ssrn.com/abstract=2117720 (accessed on 15 February 2021).

- Drucker, P.F. The theory of the business. Harward Bus. Rev. 1994, 72, 95–104. [Google Scholar]

- Singh, R.K.; Kumar, R. Strategic issues in supply chain management of Indian SMEs due to globalization: An empirical study. Benchmarking Int. J. 2020, 27, 913–932. [Google Scholar] [CrossRef]

- Abor, Q. Issues in SME Development in Ghana and South Africa. Int. Res. J. Financ. Econ. 2010, 19, 218–228. [Google Scholar]

- Schiffer, M.; Weder di Mauro, B. Firm Size and the Business Environment. 2001. Available online: https://openknowledge.worldbank.org/handle/10986/13988 (accessed on 15 February 2021).

- Beck, T.; Demirgüç-Kunt, A.; Maksimovic, V. Financial and Legal Constraints to Growth: Does Firm Size Matter? J. Financ. 2005, 60, 137–177. [Google Scholar] [CrossRef]

- Beck, T.; Demirguckunt, A.; Maksimovic, V. Financing patterns around the world: Are small firms different? J. Financ. Econ. 2008, 89, 467–487. [Google Scholar] [CrossRef] [Green Version]

- Wasiuzzaman, S.; Nurdin, N.; Abdullah, A.H.; Vinayan, G. Creditworthiness and access to finance of SMEs in Malaysia: Do linkages with large firms matter? J. Small Bus. Enterp. Dev. 2020, 27, 197–217. [Google Scholar] [CrossRef]

- Kevane, M.; Wydick, B. Microenterprise Lending to Female Entrepreneurs: Sacrificing Economic Growth for Poverty Alleviation? World Dev. 2001, 29, 1225–1236. [Google Scholar] [CrossRef] [Green Version]

- Tiwari, A.K.; Shahbaz, M.; Islam, F. Does financial development increase rural-urban income inequality? Int. J. Soc. Econ. 2013, 40, 151–168. [Google Scholar] [CrossRef] [Green Version]

- Kumar, A.; Ayedee, D. Technology Adoption: A Solution for SMEs to Overcome Problems during COVID-19. Forthcom. Acad. Mark. Stud. J. 2021, 25, 245–260. [Google Scholar]

- Moeuf, A.; Lamouri, S.; Pellerin, R.; Eburdy, R.; Tamayo, S. Industry 4.0 and the SME: A technology-focused review of the empirical literature. In Proceedings of the 7th International Conference on Industrial Engineering and Systems Management IESM, Saarbrücken, Germany, 11–13 October 2017. [Google Scholar]

| Authors’ | Country | Assessment | Remark |

|---|---|---|---|

| Zimon and Dankiewicz [68] | Poland | Trade strategies | SMEs prefers a conservative approach during economic instability, |

| Khan, Hassan, Rabbani and ATIF [67] | Bahrain | Islamic finance | FinTech Islamic financial services play an essential role in saving COVID affected SMEs |

| Islam et al. [69] | Malaysia | Islamic finance | Access to financial services, digital financial services, and financial resources exploitation helps SMEs, especially in a pandemic |

| Ojong-Ejoh, Angioha, Agba, Aniah, Salimon and Akintola [52] | Calabar | Operation | Pandemic substantially decreases revenue generation capacity by lowing output sales |

| Garba [63] | Nigeria | Performance | Pandemic has created a difficult time for SMEs for generating substantial revenue and organizational growth |

| Beraha and Đuričin [60] | Serbia | Performance | COVID has hampered SMEs’ daily business activities, unemployment creation, delay payment to suppliers, and limited access to resources. |

| Kukanja et al. [70] | Slovenia | Crisis management | SMEs mainly concentrate on personnel, cost management, organizational support, and promotional and customer-related marketing tactics to recover from pandemic effects |

| Islam et al. [71] | Bangladesh | Operation | IT integration allows SMEs for remote operation during the pandemic |

| Syriopoulos [72] | Performance | In turbulent times when opportunities are increasing, convex policies and strategies work better | |

| Omar, Ishak and Jusoh [64] | Malaysia | survival strategies | Both financial and marketing survivable strategies have to be initiated by SMEs for removing these pandemic impacts |

| Lu et al. [62] | China | Impact | Over 90% of small businesses could not return to work due to an epidemic control shortage, interrupted supply chains, and diminished market demand |

| Chowdhury et al. [73] | Bangladesh | strategies | Results suggest that short-term implications such as product expiration, funding shortages, and distributor operations are severe. In contrast, medium-to-long-term implications promise to be complicated and ambiguous. In the long run, many performance criteria, such as return on investment, GDP contribution, and workforce size, are all predicted to fall |

| Category | Remarks |

|---|---|

| Sector | SMEs |

| Geographical location | Bangladesh (Dhaka) |

| Methodology | Structured questionnaire |

| Procedure | Random sampling |

| Sample size (response) | 2000 (1395) |

| Period of data collection | From 10 December 2020, to 28 January 2021 |

| Variable Name | Definition | Items | Reference | Likert Scale |

|---|---|---|---|---|

| SMEs’ sustainability | Improve response to the customer; improve market intelligence; enhance the relationship with the trading partner | 4 | Das, Kundu and Bhattacharya [21], Prasanna, Jayasundara, Naradda Gamage, Ekanayake, Rajapakshe and Abeyrathne [109] | Disagree 1 to strongly agree 5 |

| Technological adaptation | IT adoption is suggested for small businesses to reduce operating costs, improve service to consumers, increase reaction time between producer and customer, producer and input supplier, improve market knowledge, and strengthen trade relationships | 5 | Meng, Qamruzzaman and Adow [111] | Disagree 1 to strongly agree 5 |

| Financial innovation | Financial products and services for operational efficiency | 5 | Ye and Kulathunga [112]; Ardic, Mylenko and Saltane [113]; Okello Candiya Bongomin, Mpeera Ntayi, Munene and Akol Malinga [114] | Disagree 1 to strongly agree 5 |

| Government support | The tax holiday, subsidized rate financing, financial incentives | 5 | Alkahtani et al. [115]; Zamberi Ahmad and Xavier [116] | Disagree 1 to strongly agree 5 |

| Classification | Total | % | 1395 | |

|---|---|---|---|---|

| Gender | Male | 915 | 65.60% | |

| Female | 485 | 34.40% | ||

| Nature of business | Manufacturing Units | 750 | 53.76% | |

| Services units | 645 | 46.24% | ||

| Yeas of establishment | less than 10 | 245 | 17.56% | 1395 |

| between 10 to 15 years | 554 | 39.71% | ||

| between 15 to 20 years | 323 | 23.15% | ||

| more than 20 years | 273 | 19.57% | ||

| No of employees | more than 150 | 175 | 12.54% | 1395 |

| between 25 to 150 | 685 | 49.10% | ||

| less than 25 | 535 | 38.35% | ||

| Average revenue | more than 10 million | 375 | 26.88% | 1395 |

| between 5 to 10 million | 580 | 41.58% | ||

| less than 5 million | 440 | 31.54% |

| [1] | [2] | [3] | [4] | VIF | |

|---|---|---|---|---|---|

| IF1 | 0.912 | 2.8593 | |||

| IF2 | 0.895 | 2.0832 | |||

| IF3 | 0.914 | 2.7827 | |||

| IF4 | 0.884 | 1.5543 | |||

| IF5 | 0.812 | 1.3554 | |||

| TA1 | 0.984 | 2.1634 | |||

| TA2 | 0.887 | 2.8694 | |||

| TA3 | 0.904 | 2.7493 | |||

| TA4 | 0.886 | 1.2811 | |||

| GS1 | 0.913 | 1.5771 | |||

| GS2 | 0.889 | 2.8375 | |||

| GS3 | 0.911 | 1.8847 | |||

| GS4 | 0.886 | 1.823 | |||

| GS5 | 0.987 | 1.0284 | |||

| SME1 | 0.885 | 2.8593 | |||

| SME2 | 0.875 | 2.0832 | |||

| SME3 | 0.941 | 2.7827 | |||

| SME4 | 0.911 | 1.5543 | |||

| SME5 | 0.875 | 1.3554 |

| Cronbach’s Alpha | rho_A | CR | AVE | |

|---|---|---|---|---|

| Innovative finance | 0.924 | 0.916 | 0.907 | 0.793 |

| IT adaptation | 0.897 | 0.914 | 0.874 | 0.795 |

| Government support | 0.918 | 0.926 | 0.892 | 0.803 |

| SMEs’ sustainability | 0.922 | 0.924 | 0.897 | 0.816 |

| Constructs | Fornell and Larcker | Heterotrait-Monotrait | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| AF | ES | LC | PWEA | SL | AF | ES | LC | PWEA | ||

| IF | 0.890 | - | ||||||||

| TA | 0.652 | 0.891 | 0.591 | - | ||||||

| GS | 0.702 | 0.668 | 0.995 | 0.773 | 0.761 | - | ||||

| SME | 0.691 | 0.721 | 0.618 | 0.903 | 0.713 | 0.701 | 0.61 | - | ||

| ϒ | R2 | CR | AVE | The Goodness of Fit Index | |

|---|---|---|---|---|---|

| IF1 | 0.855 | 0.731 | 0.934 | 0.782 | (p = 0.00) NFI = 0.917 RFI = 0.895 GFI = 0.995 IFI = 0.938 CFI = 0.938 TLI = 0.922 RMSEA = 0.03 |

| IF2 | 0.867 | 0.752 | |||

| IF3 | 0.87 | 0.757 | |||

| IF4 | 0.943 | 0.889 | |||

| IF5 | 0.86 | 0.740 | |||

| TA1 | 0.888 | 0.789 | 0.932 | 0.777 | |

| TA2 | 0.829 | 0.687 | |||

| TA3 | 0.945 | 0.893 | |||

| TA4 | 0.869 | 0.755 | |||

| GS1 | 0.84 | 0.706 | 0.925 | 0.757 | |

| GS2 | 0.834 | 0.696 | |||

| GS3 | 0.935 | 0.874 | |||

| GS4 | 0.945 | 0.893 | |||

| GS5 | 0.837 | 0.701 | |||

| SME1 | 0.921 | 0.848 | 0.965 | 0.876 | |

| SME2 | 0.906 | 0.821 | |||

| SME3 | 0.952 | 0.906 | |||

| SME4 | 0.964 | 0.929 | |||

| SME5 | 0.921 | 0.848 |

| Relationships | Path | Std. Dev. | t Value | p-Value | Remarks |

|---|---|---|---|---|---|

| Panel-A: Direct effects | |||||

| Technology adaptation positively induces SME sustainability during pandemic | 0.171 | 0.065 | 4.538 | 0.003 | S |

| Innovative finance positively induces SME sustainability during the pandemic | 0.272 | 0.064 | 6.609 | 0.000 | S |

| Government role positively induces SME sustainability during the pandemic | 0.207 | 0.072 | 5.416 | 0.023 | S |

| Technology adaptation positively induces government support during pandemic | 0.192 | 0.074 | 2.594 | 0.23 | |

| Innovative finance positively induces government support during a pandemic | 0.186 | 0.069 | 2.695 | 0.113 | |

| Panel-B: Indirect effects | |||||

| Government role has positive mediating effects between technological adaptation and SME sustainability | 0.079 | 0.077 | 3.3506 | 0.001 | support |

| Government role has positive mediating effects between innovative finance and SMEs sustainability | 0.129 | 0.067 | 2.5074 | 0.006 | support |

| Category | Name of Index | Values | Fit Value | Inference |

|---|---|---|---|---|

| The goodness of fit index (GIF) | 0.964 | Close to 1 | Fit | |

| Absolute | Root mean square error of approximation(RMSE) | 0.011 | <0.05 | Fit |

| fit | Standardized root mean square residual (SRMR) | 0.025 | <0.08 | Fit |

| measures | Adjusted good-of-fit index (AGFI) | 0.949 | >0.90 | Fit |

| Tucker-Lewis index (TLI) | 0.998 | >0.90 | Fit | |

| Incremental | Comparative fit index (CFI) | 0.998 | >0.90 | Fit |

| fit | Normed fit index (NFI) | 0.956 | >0.90 | Fit |

| measures | incremental fit index (IFI) | 0.998 | >0.90 | Fit |

| Chi-square test (χ2) | 227.87 | p > 0.05 | ||

| Degrees of freedom (Df) | 129 | ≥0 | ||

| Parsimonious | Chi-square/degrees of freedom ratio (χ2/df) | 1.76 | 1–5 | Fit |

| fit | Parsimony Adjustment to The NFI (PNFI) | 0.758 | >0.50 | Fit |

| measures | Parsimony Adjustment to The CFI (PCFI) | 0.792 | >0.50 | Fit |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pu, G.; Qamruzzaman, M.; Mehta, A.M.; Naqvi, F.N.; Karim, S. Innovative Finance, Technological Adaptation and SMEs Sustainability: The Mediating Role of Government Support during COVID-19 Pandemic. Sustainability 2021, 13, 9218. https://doi.org/10.3390/su13169218

Pu G, Qamruzzaman M, Mehta AM, Naqvi FN, Karim S. Innovative Finance, Technological Adaptation and SMEs Sustainability: The Mediating Role of Government Support during COVID-19 Pandemic. Sustainability. 2021; 13(16):9218. https://doi.org/10.3390/su13169218

Chicago/Turabian StylePu, Ganlin, Md. Qamruzzaman, Ahmed Muneeb Mehta, Farah Naz Naqvi, and Salma Karim. 2021. "Innovative Finance, Technological Adaptation and SMEs Sustainability: The Mediating Role of Government Support during COVID-19 Pandemic" Sustainability 13, no. 16: 9218. https://doi.org/10.3390/su13169218

APA StylePu, G., Qamruzzaman, M., Mehta, A. M., Naqvi, F. N., & Karim, S. (2021). Innovative Finance, Technological Adaptation and SMEs Sustainability: The Mediating Role of Government Support during COVID-19 Pandemic. Sustainability, 13(16), 9218. https://doi.org/10.3390/su13169218