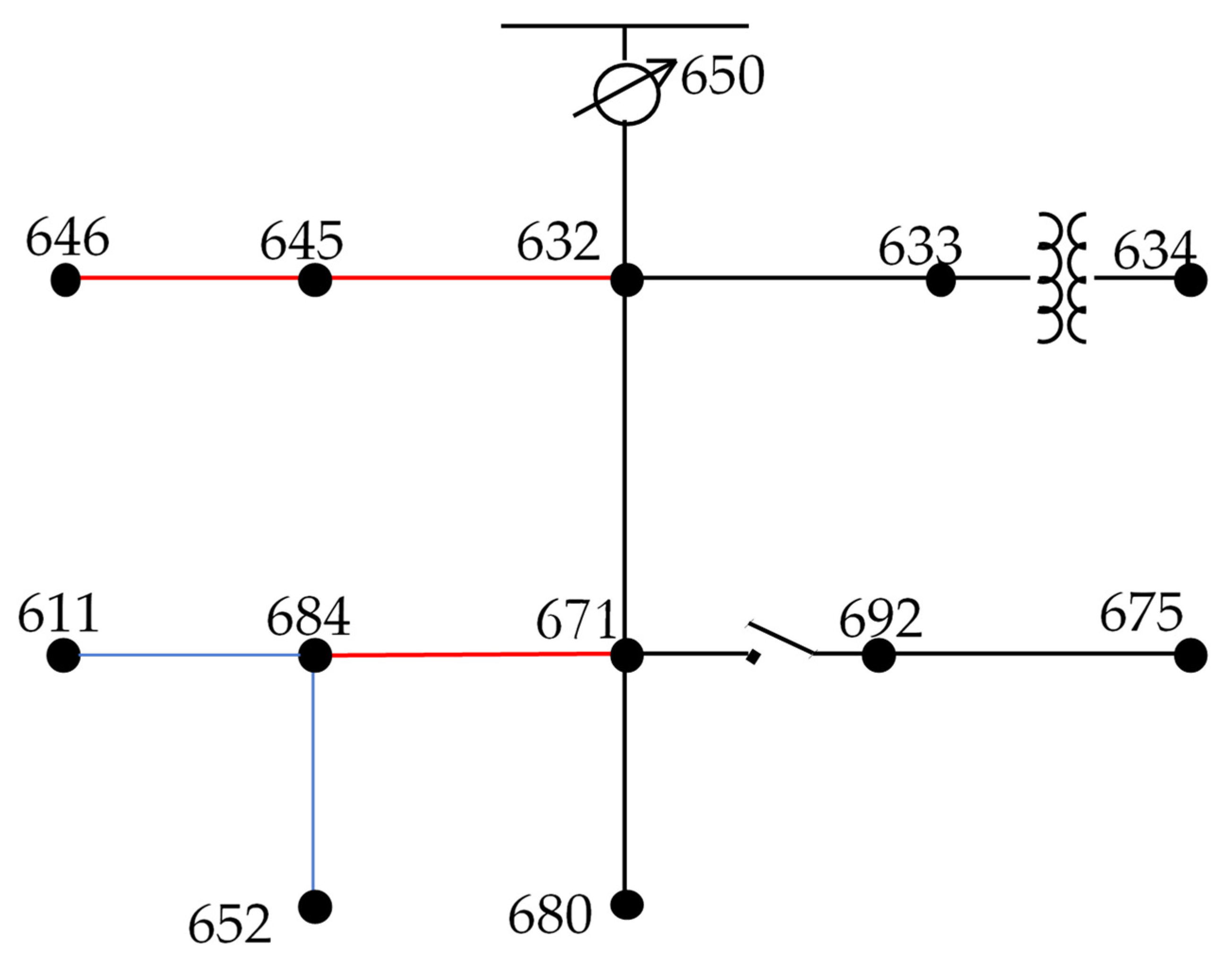

Figure 1.

The standard IEEE 13-node Test Feeder.

Figure 1.

The standard IEEE 13-node Test Feeder.

Figure 2.

Load profile and generation mix from the IEEE test system for 2017 (base case).

Figure 2.

Load profile and generation mix from the IEEE test system for 2017 (base case).

Figure 3.

Emissions from the electricity sector from the IEEE test system for 2017 (base case).

Figure 3.

Emissions from the electricity sector from the IEEE test system for 2017 (base case).

Figure 4.

Load profile and generation mix from the IEEE test system for 2017, after applying ESS.

Figure 4.

Load profile and generation mix from the IEEE test system for 2017, after applying ESS.

Figure 5.

Load profile and generation mix from the IEEE test system on 5 September 2017 after applying ESS.

Figure 5.

Load profile and generation mix from the IEEE test system on 5 September 2017 after applying ESS.

Figure 6.

Emissions from the electricity sector from the IEEE test system for 2017, after applying ESS.

Figure 6.

Emissions from the electricity sector from the IEEE test system for 2017, after applying ESS.

Figure 7.

Load profile and generation mix from the IEEE test system for 2017, after applying energy conservation.

Figure 7.

Load profile and generation mix from the IEEE test system for 2017, after applying energy conservation.

Figure 8.

Emissions from the electricity sector from the IEEE test system for 2017, after applying energy conservation.

Figure 8.

Emissions from the electricity sector from the IEEE test system for 2017, after applying energy conservation.

Figure 9.

Load profile and generation mix from the test system, for 2017, after combining ESS and energy conservation.

Figure 9.

Load profile and generation mix from the test system, for 2017, after combining ESS and energy conservation.

Figure 10.

Emissions from the electricity sector from the IEEE test system for 2017, after combining ESS and energy conservation.

Figure 10.

Emissions from the electricity sector from the IEEE test system for 2017, after combining ESS and energy conservation.

Figure 11.

Residential load profile and generation mix from the IEEE test system for 2017, after using residential DR.

Figure 11.

Residential load profile and generation mix from the IEEE test system for 2017, after using residential DR.

Figure 12.

Residential load profile from the IEEE test system on 9 January 2017.

Figure 12.

Residential load profile from the IEEE test system on 9 January 2017.

Figure 13.

Residential load profile from the IEEE test system on 1 June 2017.

Figure 13.

Residential load profile from the IEEE test system on 1 June 2017.

Figure 14.

Emissions from the electricity residential sector from the IEEE test system for 2017, after using residential DR.

Figure 14.

Emissions from the electricity residential sector from the IEEE test system for 2017, after using residential DR.

Figure 15.

Residential load profile and generation mix from the IEEE test system for 2017, after using residential DR with ESS.

Figure 15.

Residential load profile and generation mix from the IEEE test system for 2017, after using residential DR with ESS.

Figure 16.

Emissions from the electricity residential sector from the IEEE test system for 2017, after using residential DR with ESS.

Figure 16.

Emissions from the electricity residential sector from the IEEE test system for 2017, after using residential DR with ESS.

Figure 17.

Residential load profile and generation mix from the IEEE test system for 2017, after using residential DR with energy conservation.

Figure 17.

Residential load profile and generation mix from the IEEE test system for 2017, after using residential DR with energy conservation.

Figure 18.

Emissions from the electricity residential sector from the IEEE test system for 2017, after using residential DR with energy conservation.

Figure 18.

Emissions from the electricity residential sector from the IEEE test system for 2017, after using residential DR with energy conservation.

Figure 19.

Residential load profile and generation mix from the IEEE test system for 2017, after combining all options.

Figure 19.

Residential load profile and generation mix from the IEEE test system for 2017, after combining all options.

Figure 20.

Emissions from the electricity residential sector from the IEEE test system for 2017, after combining all options.

Figure 20.

Emissions from the electricity residential sector from the IEEE test system for 2017, after combining all options.

Figure 21.

Load profile and generation mix from the IEEE test system for 2017, after considering ESS and energy conservation.

Figure 21.

Load profile and generation mix from the IEEE test system for 2017, after considering ESS and energy conservation.

Figure 22.

Residential load profile and generation mix from the IEEE test system for 2017, for all MCDM alternatives.

Figure 22.

Residential load profile and generation mix from the IEEE test system for 2017, for all MCDM alternatives.

Figure 23.

Emissions from electricity sector from the IEEE test system for 2017, after ESS and energy conservation.

Figure 23.

Emissions from electricity sector from the IEEE test system for 2017, after ESS and energy conservation.

Figure 24.

Emissions from the electricity residential sector from the IEEE test system for 2017, for all MCDM alternatives.

Figure 24.

Emissions from the electricity residential sector from the IEEE test system for 2017, for all MCDM alternatives.

Figure 25.

A trade-off between the alternatives.

Figure 25.

A trade-off between the alternatives.

Table 1.

Emissions reduction from the IEEE test system, after integrating ESS and energy conservation.

Table 1.

Emissions reduction from the IEEE test system, after integrating ESS and energy conservation.

| Scenario | Emissions

(Tons of CO2) | Reduction from 2005

Level (%) |

|---|

| 2005 level | 16,350 | -- |

| Base case | 13,692 | 16.26% |

| ESS | 13,385 | 18.13% |

| Energy conservation (EC) | 13,016 | 20.39% |

| ESS and EC | 12,725 | 22.17% |

Table 2.

Emissions from the electricity residential sector from the IEEE Test System, for all MCDM alternatives.

Table 2.

Emissions from the electricity residential sector from the IEEE Test System, for all MCDM alternatives.

| Scenario | Emissions

(Tons of CO2) | Reduction from 2005 Level (%) |

|---|

| 2005 level | 5068 | -- |

| Base case | 4382 | 13.54% |

| Residential DR | 4363 | 13.91% |

| Residential DR and ESS | 4273 | 15.68% |

| Residential DR and EC | 4154 | 18.04% |

Table 3.

Economic results for ESS project.

Table 3.

Economic results for ESS project.

| NPV (USD) | 644,975 |

| IRR | 20.40% |

| Payback (years) | 4.05 |

| BCR | 1.39 |

Table 4.

Economic results for energy conservation project.

Table 4.

Economic results for energy conservation project.

| NPV (USD) | 95,229 |

| IRR | 13.34% |

| Payback (years) | 5.37 |

| BCR | 1.05 |

Table 5.

Economic results after using ESS and energy conservation project.

Table 5.

Economic results after using ESS and energy conservation project.

| NPV (USD) | 82,837 |

| IRR | 7.02% |

| Payback (years) | 6.58 |

| BCR | 1.02 |

Table 6.

Residential energy rate before DR program.

Table 6.

Residential energy rate before DR program.

| Usage Charge | Summer Season | Non-Summer Season |

|---|

| First 500 kWh | USD 0.09582 | USD 0.09031 |

| Next 500 kWh | USD 0.11448 | USD 0.09487 |

| All additional kWh | USD 0.15158 | USD 0.10494 |

Table 7.

Economic results for residential DR project.

Table 7.

Economic results for residential DR project.

| NPV (USD) | 52,450 |

| IRR | 18.83% |

| Payback (years) | 4.40 |

Table 8.

Economic results after combining residential DR and ESS project.

Table 8.

Economic results after combining residential DR and ESS project.

| NPV (USD) | 163,759 |

| IRR | 15.27% |

| Payback (years) | 4.84 |

| BCR | 1.13 |

Table 9.

Economic results for residential DR with energy conservation project.

Table 9.

Economic results for residential DR with energy conservation project.

| NPV (USD) | 14,746 |

| IRR | 7.26% |

| Payback (years) | 6.96 |

| BCR | 1.01 |

Table 10.

Economic results for combining all MCDM alternatives.

Table 10.

Economic results for combining all MCDM alternatives.

| NPV (USD) | 160,315 |

| IRR | 13.30% |

| Payback (years) | 5.37 |

| BCR | 1.09 |