Three Barriers to Effective Programs with Payment for Ecosystem Services: Behavioral Responses in a Computer-Based Experiment

Abstract

:1. Introduction

1.1. Traditional Regulation and Voluntary Conservation: Endangered Species in the United States

1.2. Existing Research

2. Materials and Methods

2.1. Experimental Design

2.2. Empirical Specifications

3. Results

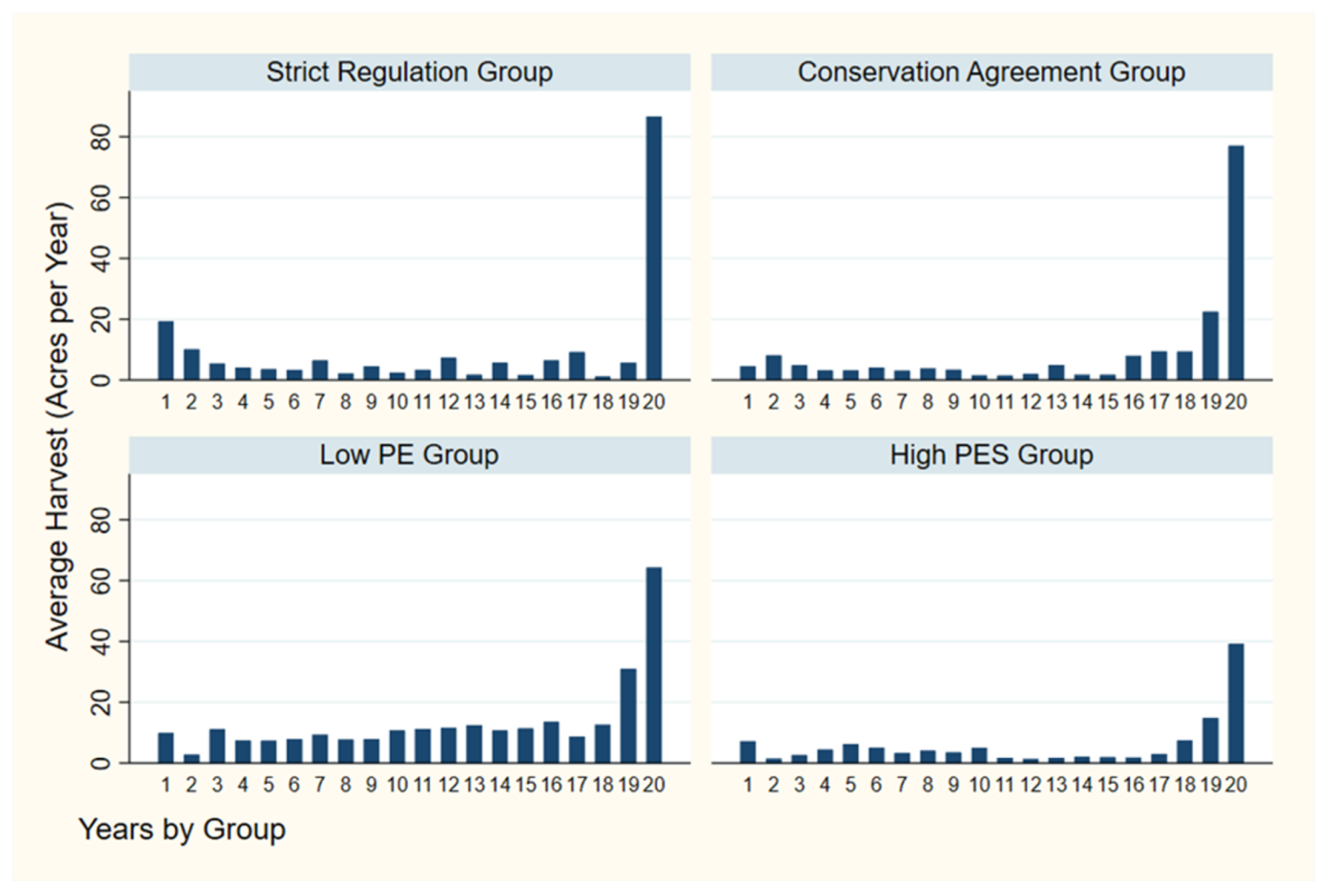

3.1. Harvest Behavior

3.2. Habitat Improvement Behavior

3.3. Other Outcomes

Landowner Profits

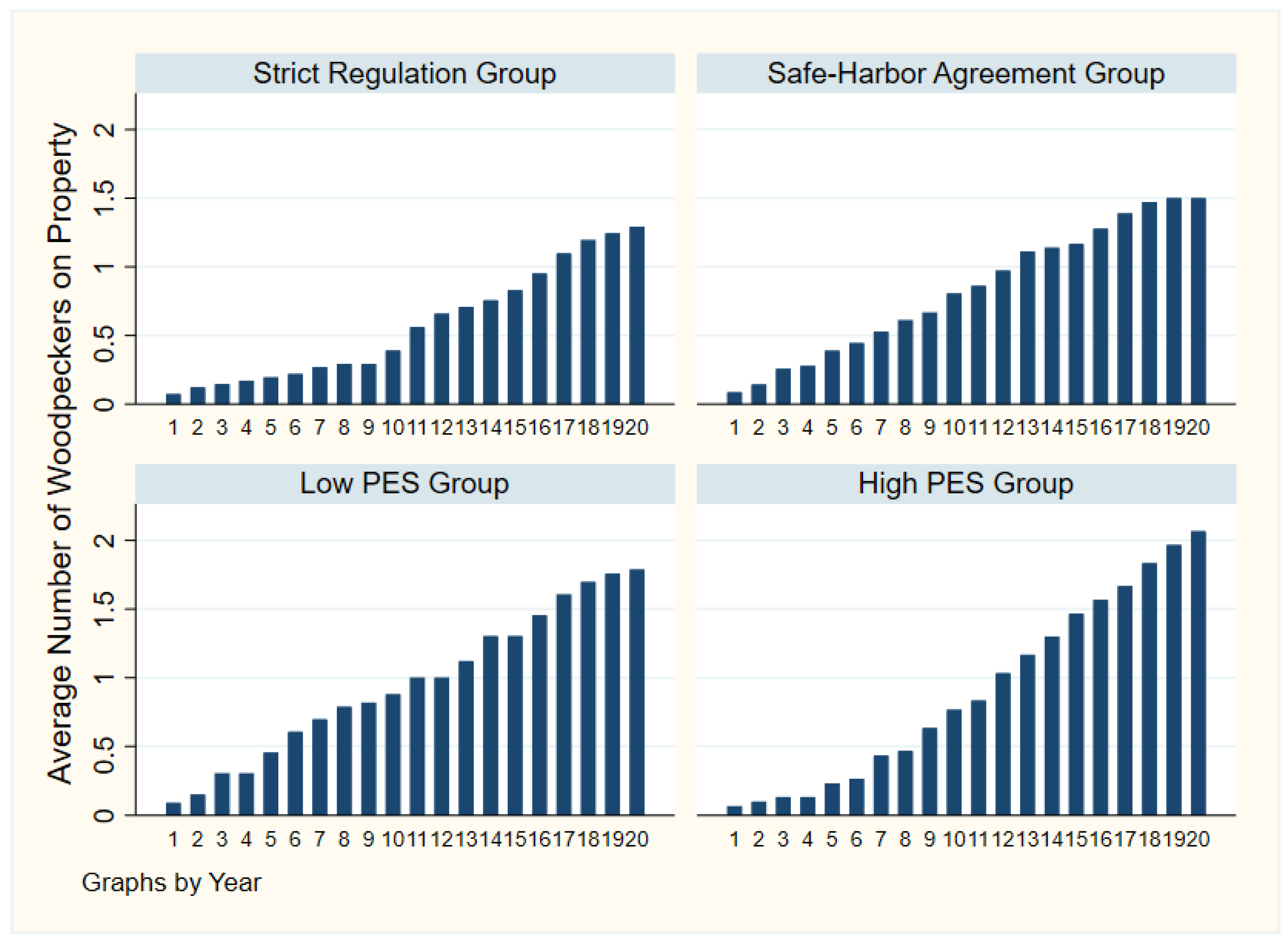

Woodpecker Populations

4. Discussion

4.1. Promise of PES to Voluntary Conservation

4.2. First Barrier: Crowd out Taste for Conservation

4.3. Second Barrier: Guilt Avoidance Mechanism

4.4. Third Barrier: Exit or Breach with Weak Enforcement

4.5. External Validity: The Importance of Context

5. Conclusions

Supplementary Materials

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Langpap, C.; Kerkvliet, J.; Shogren, J.F. The Economics of the Endangered Species Act: A Review of Recent Developments. Rev. Environ. Econ. Policy 2018, 12, 69–91. [Google Scholar] [CrossRef] [Green Version]

- Lueck, D.; Michael, J.A. Preemptive Habitat Destruction under the Endangered Species Act. J. Law Econ. 2003, 46, 27–60. [Google Scholar] [CrossRef]

- Ruhl, J.B. Endangered Species Act and Private Property: A Matter of Timing and Location. Cornell J. Law Public Policy 1998, 8, 37–53. [Google Scholar]

- Langpap, C. Conservation of Endangered Species: Can Incentives Work for Private Landowners? Ecol. Econ. 2006, 57, 558–572. [Google Scholar] [CrossRef] [Green Version]

- U.S. Fish and Wildlife Service. The Safe Harbor Program for Red-Cockaded Woodpeckers in North Carolina; Government Printing Office: Atlanta, GA, USA, 2006.

- Bean, M.J. Endangered Species Safe Harbor Agreements: An Assessment; Sand County Foundation: Madison, WI, USA, 2017. [Google Scholar]

- U.S. Fish and Wildlife Service. Habitat Conservation Planning Handbook; Government Printing Office: Washington, DC, USA, 2016.

- Byl, J.P. Perverse Incentives and Safe Harbors in the Endangered Species Act: Evidence from Timber Harvests near Woodpeckers. Ecol. Econ. 2019, 157, 100–108. [Google Scholar] [CrossRef]

- Mandle, L.; Symington, M. Voluntary Mechanisms. In Green Growth That Works; Mandle, L., Ouyang, Z., Salzman, J.E., Daily, G., Eds.; Island Press: Washington, DC, USA, 2019. [Google Scholar]

- Kohsaka, R.; Uchiyama, Y. Motivation, strategy and challenges of conserving urban biodiversity in local contexts: Cases of 12 municipalities in Ishikawa, Japan. Procedia Eng. 2017, 198, 212–218. [Google Scholar] [CrossRef]

- Uchiyama, Y.; Kohsaka, R. Application of the City Biodiversity Index to populated cities in Japan: Influence of the social and ecological characteristics on indicator-based management. Ecol. Indic. 2019, 106, 105420. [Google Scholar] [CrossRef]

- Deslauriers, M.R.; Asgary, A.; Nazarnia, N.; Jochen, A.G.J. Implementing the connectivity of natural areas in cities as an indicator in the City Biodiversity Index (CBI). Ecol. Indic. 2018, 94, 99–113. [Google Scholar] [CrossRef]

- Quevedo, J.M.D.; Uchiyama, Y.; Kohsaka, R. A blue carbon ecosystems qualitative assessment applying the DPSIR framework: Local perspective of global benefits and contributions. Mar. Policy 2021, 128, 104462. [Google Scholar] [CrossRef]

- U.S. Fish and Wildlife Service. Policy Regarding Voluntary Prelisting Conservation; Actions. 79 Fed. Reg. 42525, 22 July 2014; Government Publishing Office: Washington, DC, USA, 2014.

- Li, Y.W.; Male, T. Pre-Listing Conservation: Law, Policy, and Pilot Projects. In Proactive Strategies for Protecting Species; Donlan, C.J., Ed.; University of California Press: Berkeley, CA, USA, 2015. [Google Scholar]

- Gneezy, U.; Aldo, R. A Fine is a Price. J. Leg. Stud. 2000, 29, 1. [Google Scholar] [CrossRef] [Green Version]

- Hauge, K.E. Generosity and Guilt: The Role of Beliefs and Moral Standards of Others. J. Econ. Psychol. 2016, 54, 35–43. [Google Scholar] [CrossRef]

- Ouyang, Z.; Zheng, H.; Xiao, Y.; Polasky, S.; Liu, J.; Xu, W.; Wang, Q.; Zhang, L.; Xiao, Y.; Rao, E.; et al. Improvements in Ecosystem Services from Investments in Natural Capital. Science 2016, 352, 1455–1459. [Google Scholar] [CrossRef]

- Sone, J.S.; Gesualdo, G.C.; Zamboni, P.A.P.; Vieira, N.O.M.; Mattos, T.S.; Carvalho, G.A.; Rodrigues, D.B.B.; Sobrinho, T.A.; Oliveira, P.T.S. Water provisioning improvement through payment for ecosystem services. Sci. Total Environ. 2019, 655, 1197–1206. [Google Scholar] [CrossRef]

- Curnick, D.J.N.; Pettorelli, A.A.; Amir, T.; Balke, E.B.; Barbier, S.; Crooks, F.; Dahdouh-Guebas, C.; Duncan, C.; Endsor, D.A.; Friess, A.; et al. The value of small mangrove patches. Science 2019, 363, 239. [Google Scholar] [CrossRef] [Green Version]

- Grima, N.; Simron, J.S.; Smetschka, B.; Ringhofer, L. Payment for Ecosystem Services (PES) in Latin America: Analysing the performance of 40 case studies. Ecosyst. Serv. 2016, 17, 24–32. [Google Scholar] [CrossRef]

- Tyack, N.; Dempewolf, H.; Khoury, C.K. The Potential of Payment for Ecosystem Services for Crop Wild Relative Conservation. Plants 2020, 9, 1305. [Google Scholar] [CrossRef] [PubMed]

- Piñeiro, V.; Arias, J.; Dürr, J.; Elverdin, P.; Ibáñez, A.M.; Kinengyere, A.; Opazo, C.M.; Owoo, N.; Page, J.R.; Prager, S.D.; et al. A scoping review on incentives for adoption of sustainable agricultural practices and their outcomes. Nat. Sustain. 2020, 3, 809–820. [Google Scholar] [CrossRef]

- Goldman, R.L.; Tallis, H.; Kareiva, P.; Gretchen, C.D. Field Evidence that Ecosystem Service Projects Support Biodiversity and Diversify Options. Proc. Natl. Acad. Sci. USA 2008, 105, 9445–9448. [Google Scholar] [CrossRef] [Green Version]

- Zhang, L.; Turvey, S.T.; Chapman, C.; Fan, P. Effects of Protected Areas on Survival of Threatened Gibbons in China. Conserv. Biol. 2020, 35, 1288–1298. [Google Scholar] [CrossRef] [PubMed]

- Ferraro, P.J.; McIntosh, C.; Ospina, M. The Effectiveness of the U.S. Endangered Species Act: An Econometric Analysis Using Matching Methods. J. Environ. Econ. Manag. 2007, 54, 245–261. [Google Scholar] [CrossRef]

- Langpap, C.; Kerkvliet, J. Endangered Species Conservation on Private Land: Assessing the Effectiveness of Habitat Conservation Plans. J. Environ. Econ. Manag. 2012, 64, 1–15. [Google Scholar] [CrossRef] [Green Version]

- Brick, C.; David, K.S. When Does Being Watched Change Pro-Environmental Behaviors in the Laboratory? Sustainability 2021, 13, 2766. [Google Scholar] [CrossRef]

- Parkhurst, G.M.; Shogren, J.F. Spatial Incentives to Coordinate Contiguous Habitat. Ecol. Econ. 2007, 64, 344–355. [Google Scholar] [CrossRef]

- Suter, J.F.; Collie, S.; Messer, K.D.; Duke, J.M.; Michael, H.A. Common Pool Resource Management at the Extensive and Intensive Margins: Experimental Evidence. Environ. Resour. Econ. 2019, 73, 973–993. [Google Scholar] [CrossRef]

- Kerr, J.M.; Lapinski, M.K.; Liu, R.W.; Zhao, J. Long-Term Effects of Payments for Environmental Services: Combining Insights from Communication and Economics. Sustainability 2017, 9, 1627. [Google Scholar] [CrossRef] [Green Version]

- Mesa-Vázquez, E.; Velasco-Muñoz, J.F.; Aznar-Sánchez, J.A.; López-Felices, B. Experimental Economics in Agriculture: A Review of Worldwide Research. Agronomy 2021, 11, 1566. [Google Scholar] [CrossRef]

- Newell, L.W.; Stephen, K.S. Real-Payment Choice Experiments: Valuing Forested Wetlands and Spatial Attributes Within a Landscape Context. Ecol. Econ. 2013, 92, 37–47. [Google Scholar] [CrossRef]

- Dolan, P.; Metcalfe, R. Neighbors, Knowledge, and Nuggets: Two Natural Field Experiments on the Role of Incentives on Energy Conservation. In Becker Friedman Institute for Research in Economics Working Paper No. 2589269; University of Chicago: Chicago, IL, USA, 2015; Available online: https://ssrn.com/abstract=2589269 (accessed on 1 November 2021).

- Kecinski, M.; Keisner, D.K.; Kent, D.M.; William, D.S. Measuring Stigma: The Behavioral Implications of Disgust. Environ. Resour. Econ. 2018, 70, 131–146. [Google Scholar] [CrossRef] [Green Version]

- List, J.A.; Sadoff, S.; Wagner, M. So You Want to Run an Experiment, Now What? Some Simple Rules of Thumb for Optimal Experimental Design. Exp. Econ. 2011, 14, 439–457. [Google Scholar] [CrossRef]

- Banerjee, P.; Shogren, J.F. Material Interests, Moral Reputation, and Crowding Out Species Protection on Private Land. J. Environ. Econ. Manag. 2012, 63, 137–149. [Google Scholar] [CrossRef]

- Wunder, S. When Payments for Environmental Service Will Work for Conservation. Conserv. Lett. 2013, 6, 230–237. [Google Scholar] [CrossRef]

- Kits, G.J.; Adamowicz, W.L.; Boxall, P.C. Do Conservation Auctions Crowd out Voluntary Environmentally Friendly Activities? Ecol. Econ. 2014, 105, 118–123. [Google Scholar] [CrossRef]

- Rode, J.; Gómez-Baggethun, E.; Krause, T. Motivation Crowding by Economic Incentives in Conservation Policy: A Review of the Empirical Evidence. Ecol. Econ. 2015, 117, 270–282. [Google Scholar] [CrossRef]

- Fréchette, G.R. Laboratory Experiments: Professionals versus Students. In Handbook of Experimental Economics; Guillame, R.F., Adrew, S., Eds.; Oxford University Press: Oxford, UK, 2015; pp. 360–390. [Google Scholar]

- Fischbacher, U. Z-Tree: Zurich Toolbox for Ready-made Economic Experiments. Exp. Econ. 2007, 10, 171–178. [Google Scholar] [CrossRef] [Green Version]

- Wilkerson-Ryan, T. Incentives to Breach. Am. Law Econ. Rev. 2015, 17, 290–311. [Google Scholar] [CrossRef]

- Polasky, S.; Doremus, H. When the Truth Hurts: Endangered Species Policy on Private Land with Private Information. J. Environ. Econ. Manag. 1998, 35, 22–47. [Google Scholar] [CrossRef] [Green Version]

- Tobin, J. Estimation of Relationships for Limited Dependent Variables. Econometrica 1958, 26, 24–36. [Google Scholar] [CrossRef] [Green Version]

- Salzman, J.; Ruhl, J.B. Currencies and Commodification of Environmental Law. Stanf. Law Rev. 2000, 53, 607. [Google Scholar] [CrossRef] [Green Version]

- Sims, C.; Finnoff, D.; Hastings, A.; Hochard, J. Listing and Delisting Thresholds under the Endangered Species Act. Am. J. Agric. Econ. 2017, 99, 549–570. [Google Scholar] [CrossRef]

- Fréchette, G.R. Session Effects in the Laboratory. Exp. Econ. 2012, 15, 485–498. [Google Scholar] [CrossRef] [Green Version]

| Participant Attributes | Mean (Standard Deviation) |

|---|---|

| Strict Regulation Group Safe-Harbor Agreement Group | 0.29 (0.46) 0.25 |

Low PES Group | (0.44) 0.24 |

High PES Group | (0.43) 0.22 |

Age | (0.41) 19.65 |

Male | (2.49) 0.64 |

Nonwhite | (0.48) 0.49 |

Republican | (0.50) 0.23 |

| (0.42) | |

| Democrat | 0.25 |

| (0.43) | |

| Environmentalist | 0.39 |

| (0.49) | |

| Risk Averse | 0.63 |

| (0.48) |

| Tree Age | Timber Value | Probability of Woodpeckers |

|---|---|---|

| 20 | $4.24 | 0% |

| 25 | $6.06 | 5% |

| 30 | $8.00 | 10% |

| 35 | $9.97 | 13% |

| 40 | $11.91 | 15% |

| 45 | $13.74 | 18% |

| 50 | $15.09 | 20% |

| Strict Regulation Group N = 599 | Safe-Harbor Agreement Group N = 646 |

| 8.816 (21.733) | 7.837 (21.449; 0.247) |

| Low PES Group N = 639 | High PES Group N = 597 |

| 12.994 (30.546; 0.001) | 5.762 (18.392; 0.001) |

| (1) OLS Model | (2) Tobit Model | (3) Probit Model | |

|---|---|---|---|

| Safe-Harbor Agreement Group | –1.07 * (0.39) | 2.71 (1.88) | 0.24 *** (0.02) |

| Low PES Group | 4.49 *** (0.33) | 10.11 *** (0.99) | 0.19 *** (0.03) |

| High PES Group | –2.97 (1.59) | –6.40 *** (1.65) | –0.08 (0.08) |

| Age | –0.22 (0.29) | 0.24 (0.36) | 0.03 (0.04) |

| Male | –0.33 (2.36) | –2.14 (5.18) | –0.09 (0.19) |

| Nonwhite | –0.19 (0.95) | 1.89 (2.04) | 0.12 (0.11) |

| Republican | 1.92 (2.46) | 7.85 (5.24) | 0.26 *** (0.10) |

| Democrat | –0.08 (1.90) | 2.28 (1.54) | 0.13 (0.11) |

| Environmentalist | –0.92 (1.07) | –1.05 (1.21) | 0.00 (0.12) |

| Risk Averse | –0.96 (0.492) | 0.81 (2.14) | 0.11 (0.08) |

| Constant | 13.816 * (5.562) | –9.15 (15.46) | –0.54 (0.83) |

| R-squared | 0.273 |

| OLS Model | |

|---|---|

| Strict Regulation Group * Period 1 | 10.28 ** (1.82) |

| Strict Regulation Group | 1.47 (1.29) |

| Period 1 | 2.45 (4.71) |

| Age | –0.43 *** (0.11) |

| Male | –0.29 (2.93) |

| Nonwhite | –2.66 *** (0.52) |

| Republican | –0.99 (2.80) |

| Democrat | –1.38 (2.43) |

| Environmentalist | –1.16 (2.24) |

| Risk Averse | 0.89 (0.65) |

| Constant | 15.86 ** (4.79) |

| OLS Model | |

|---|---|

| Low PES Group | –0.005 ** (0.001) |

| High PES Group | –0.021 *** (0.001) |

| Age | –0.001 (0.001) |

| Male | 0.002 (0.001) |

| Nonwhite | 0.003 (0.005) |

| Republican | 0.007 ** (0.001) |

| Democrat | 0.003 (0.005) |

| Environmentalist | 0.005 (0.005) |

| Risk Averse | –0.009 ** (0.001) |

| Constant | 0.05 ** (0.01) |

| Strict Regulation Group N = 599 | Safe-Harbor Agreement Group N = 646 |

| 0.072 (0.258) | 0.050 (0.217; 0.010) |

| Low PES Group N = 639 | High PES Group N = 597 |

| 0.189 (0.392; 0.000) | 0.302 (0.459; 0.000) |

| (1) OLS Model | (2) Probit Model | |

|---|---|---|

| Safe-Harbor Agreement Group | –0.013 (0.007) | –0.124 *** (0.039) |

| Low PES Group | 0.117 *** (0.015) | 0.651 *** (0.028) |

| High PES Group | 0.223 *** (0.024) | 0.961 *** (0.028) |

| Age | 0.012 * (0.005) | 0.053 *** (0.011) |

| Male | 0.001 (0.030) | 0.003 (0.142) |

| Nonwhite | –0.069 (0.043) | –0.297 * (0.177) |

| Republican | –0.020 (0.033) | 0.042 (0.209) |

| Democrat | 0.007 (0.053) | 0.117 (0.183) |

| Environmentalist | 0.030 (0.046) | 0.122 (0.181) |

| Risk Averse | –0.074 (0.054) | –0.357 * (0.181) |

| Constant | –0.103 * (0.041) | –1.729 *** (0.353) |

| R-squared | 0.127 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Byl, J.P. Three Barriers to Effective Programs with Payment for Ecosystem Services: Behavioral Responses in a Computer-Based Experiment. Sustainability 2021, 13, 12346. https://doi.org/10.3390/su132212346

Byl JP. Three Barriers to Effective Programs with Payment for Ecosystem Services: Behavioral Responses in a Computer-Based Experiment. Sustainability. 2021; 13(22):12346. https://doi.org/10.3390/su132212346

Chicago/Turabian StyleByl, Jacob P. 2021. "Three Barriers to Effective Programs with Payment for Ecosystem Services: Behavioral Responses in a Computer-Based Experiment" Sustainability 13, no. 22: 12346. https://doi.org/10.3390/su132212346

APA StyleByl, J. P. (2021). Three Barriers to Effective Programs with Payment for Ecosystem Services: Behavioral Responses in a Computer-Based Experiment. Sustainability, 13(22), 12346. https://doi.org/10.3390/su132212346