Farmer Perceptions of Agricultural Risks; Which Risk Attributes Matter Most for Men and Women

Abstract

:1. Introduction

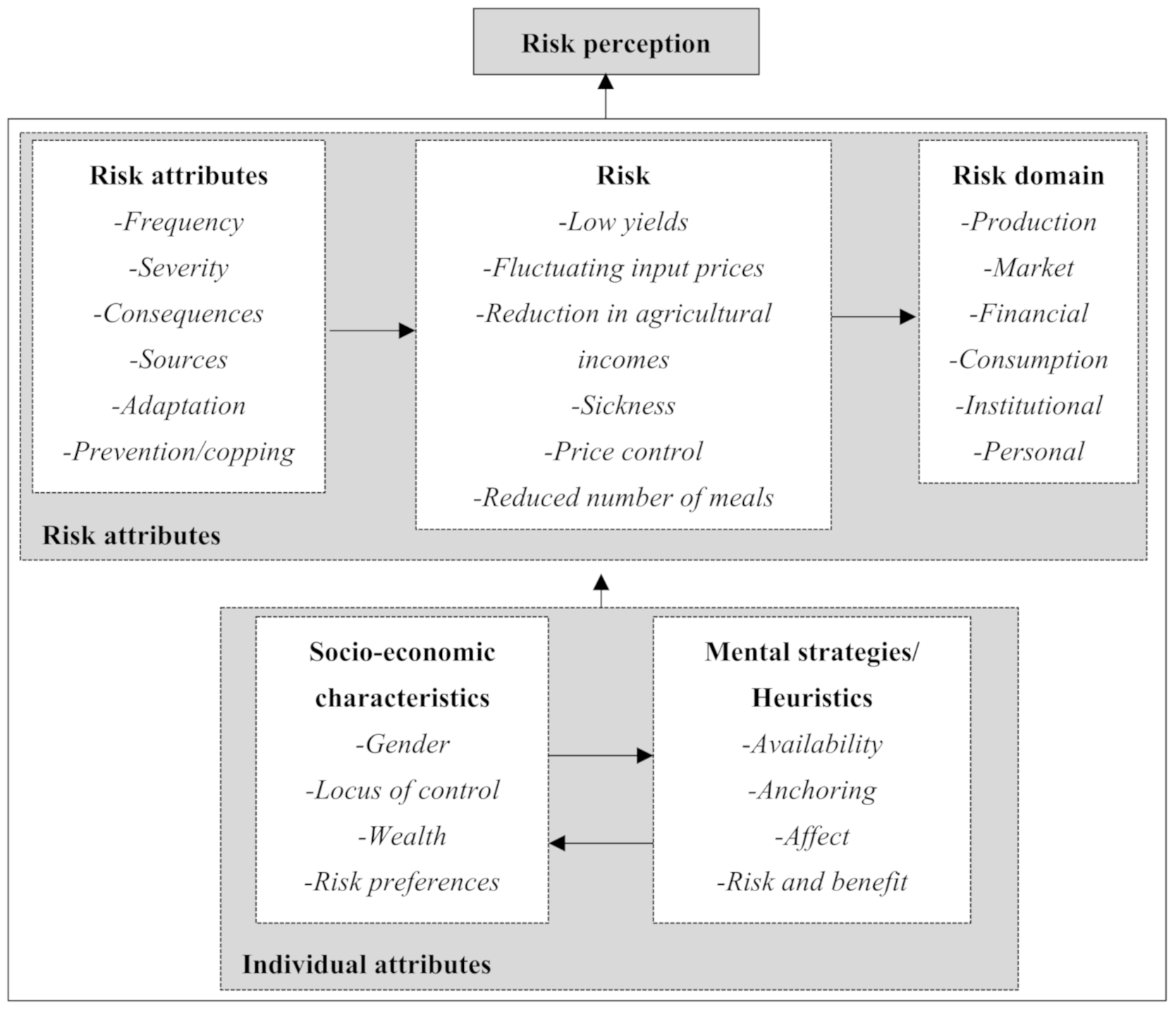

2. Theoretical Framework

3. Definition of Concepts

Risk Attributes, Risk Sources, and Consequences

4. Materials and Methods

4.1. Study Site

4.2. Sampling

4.3. Empirical Approach

4.3.1. Individual and Farm Characteristics

4.3.2. Dietary Diversity

4.3.3. Locus of Control

4.3.4. Risk Aversion

4.3.5. Perceptions of Risk Attributes

4.4. Measurement and Analysis of Risk Perceptions

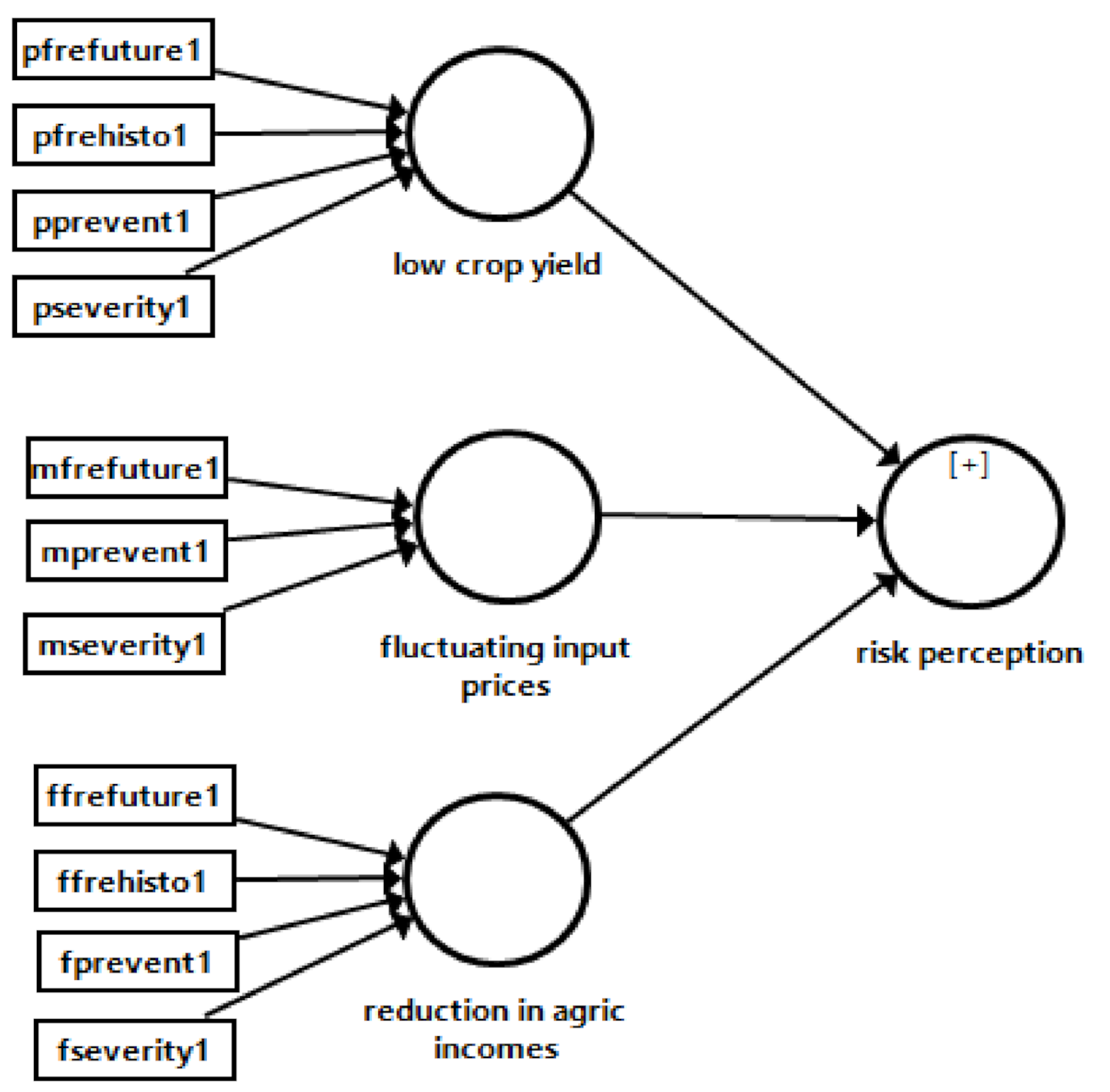

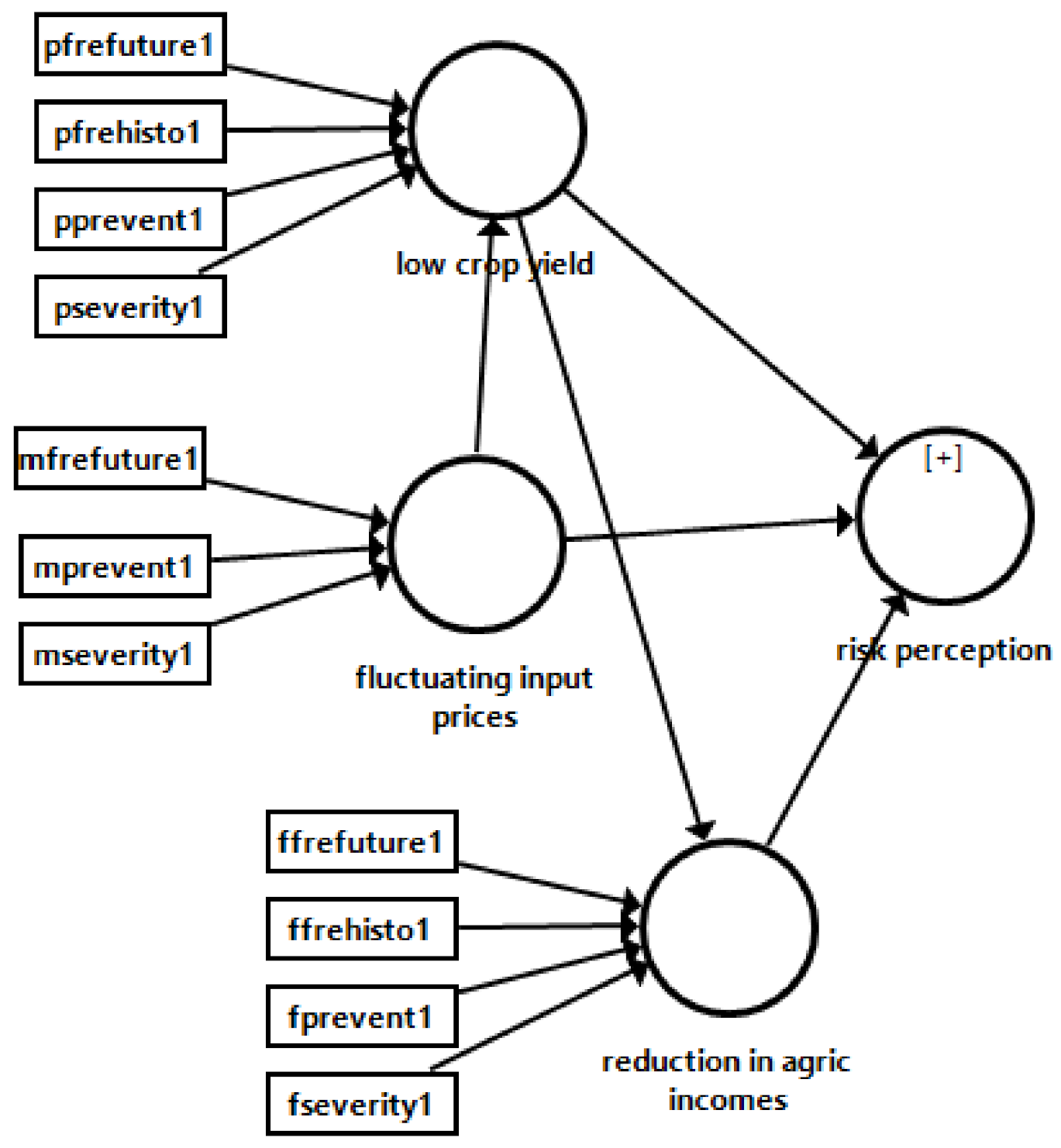

4.4.1. Measurement Model

4.4.2. Structural Model

4.4.3. Estimation

5. Results

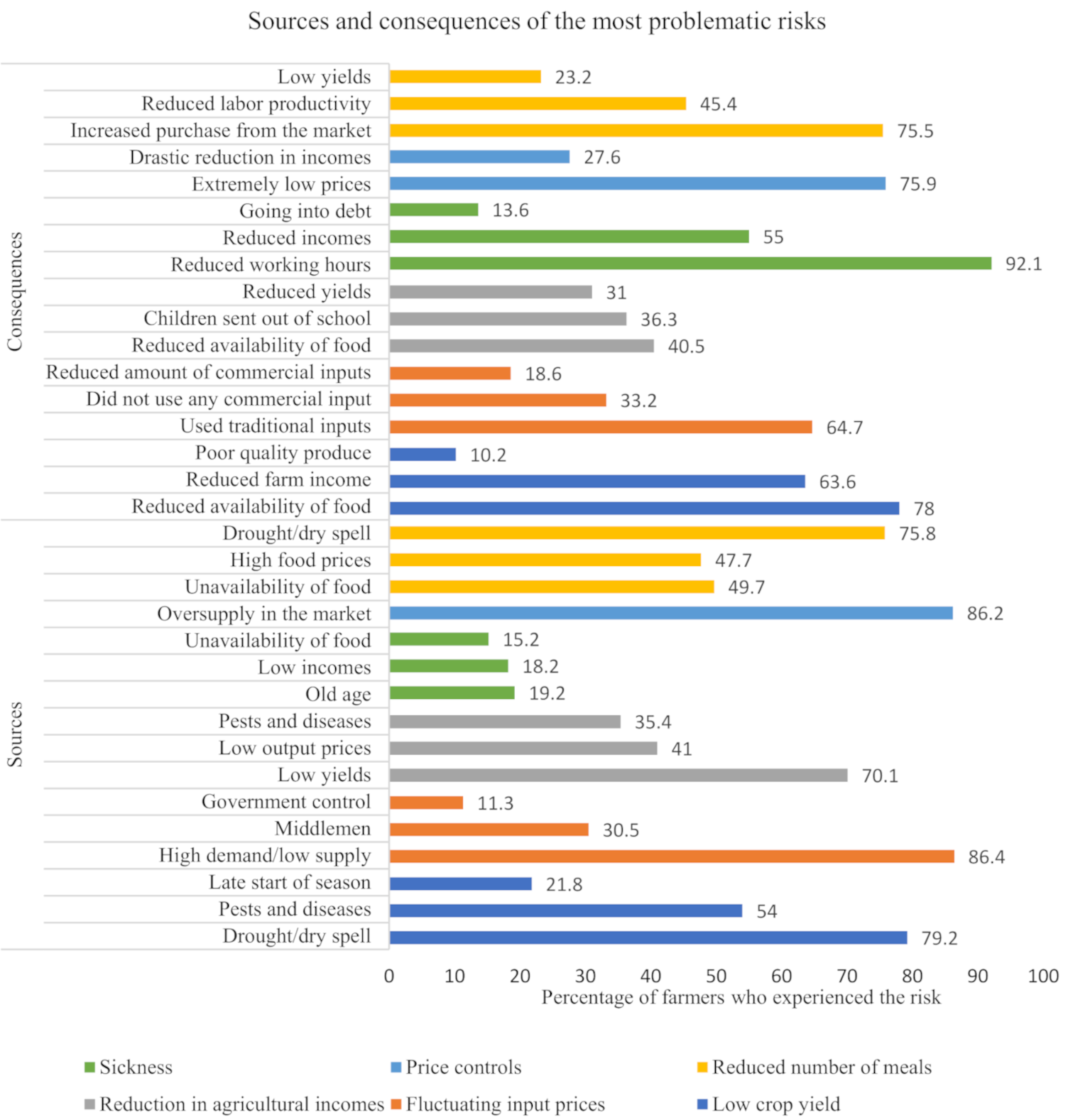

5.1. Risk Characterization: Most Problematic Risk, Main Sources, and Consequences

5.2. Determination of Important Risk Attributes through Partial Least Squares Path Modelling

5.3. Determination of Differences in Perceptions between Men and Women

6. Discussion

Limitations of the Study

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix A.1. Indicators of Locus of Control

Appendix A.1.1. Internal Items (Self-Drive, Motivation, Belief That We Can Change Our Circumstances)

- When I make plans, I am almost certain that I can make them work;

- What happens to me is my own doing;

- Getting people to do the right things depends on ability; luck has nothing to do with it;

- When I work hard, I get rewards;

- I have the needed knowledge and skills to make my life better;

- If I plan myself well, I can avoid many unpleasant outcomes, now and in the future.

Appendix A.1.2. External Items (Wellbeing Is Controlled by Some Strong Other)

- 7.

- Many of the unhappy things in people’s lives are partly due to bad luck;

- 8.

- Getting a good job depends on mainly on being in the right place at the right time;

- 9.

- Many times, I feel that I have little influence over the things that happen to me;

- 10.

- Whatever you do, if things are to go wrong, they will go wrong;

- 11.

- The yields I get from agriculture at the end of the season are beyond my control.

Appendix A.2. Indicators of General Satisfaction with Life

- I am satisfied with my life;

- I have achieved all the goals/dreams I wanted to achieve in life;

- I am working to my best to see that I improve the quality of my life;

- I am satisfied with my social relations (including my family);

- I am satisfied with the material things that I have now;

- Every morning, I look forward to a good day ahead;

- I have suffered a lot in this life;

- I live a life of poverty;

- I have access to nutritious food.

Appendix A.3. Reported Propensity to Take Risks

- How likely are you to take risks (1 = very likely; 2 = likely; 3 = Not sure; 4 = unlikely; 5 = very unlikely);

- How likely can (do) you adopt new agricultural technologies that you have never used before (1 = very likely; 2 = likely; 3 = Not sure; 4 = unlikely; 5 = very unlikely);

- I like learning about something, see results from other people, before I can try that thing (1 = Strongly agree; 2 = Agree; 3 = Not sure; 4 = Disagree; 5 = Strongly disagree).

Appendix B

Appendix B.1. Risk Game

Appendix B.1.1. Instructions

| Series 1 | Series 2 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Option A | Option B | Option A | Option B | ||||||||

| # | Balls 1–3 | Balls 4–10 | # | Ball 1 | Balls 4–10 | # | Balls 1–9 | Ball 10 | # | Balls 1–7 | Balls 8–10 |

| 1 | 120 | 30 | 1 | 204 | 15 | 1 | 120 | 90 | 1 | 162 | 15 |

| 2 | 120 | 30 | 2 | 225 | 15 | 2 | 120 | 90 | 2 | 168 | 15 |

| 3 | 120 | 30 | 3 | 249 | 15 | 3 | 120 | 90 | 3 | 174 | 15 |

| 4 | 120 | 30 | 4 | 279 | 15 | 4 | 120 | 90 | 4 | 180 | 15 |

| 5 | 120 | 30 | 5 | 318 | 15 | 5 | 120 | 90 | 5 | 186 | 15 |

| 6 | 120 | 30 | 6 | 375 | 15 | 6 | 120 | 90 | 6 | 195 | 15 |

| 7 | 120 | 30 | 7 | 450 | 15 | 7 | 120 | 90 | 7 | 204 | 15 |

| 8 | 120 | 30 | 8 | 555 | 15 | 8 | 120 | 90 | 8 | 216 | 15 |

| 9 | 120 | 30 | 9 | 660 | 15 | 9 | 120 | 90 | 9 | 231 | 15 |

| 10 | 120 | 30 | 10 | 900 | 15 | 10 | 120 | 90 | 10 | 249 | 15 |

| 11 | 120 | 30 | 11 | 1200 | 15 | 11 | 120 | 90 | 11 | 270 | 15 |

| 12 | 120 | 30 | 12 | 1800 | 15 | 12 | 120 | 90 | 12 | 300 | 15 |

| 13 | 120 | 30 | 13 | 3000 | 15 | 13 | 120 | 90 | 13 | 330 | 15 |

| 14 | 120 | 30 | 14 | 5100 | 15 | 14 | 120 | 90 | 14 | 390 | 15 |

| σ | Switching Question in Series 1 | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Series 2 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | Never |

| 1 | 1.50 | 1.40 | 1.35 | 1.25 | 1.15 | 1.10 | 1.00 | 0.95 | 0.90 | 0.85 | 0.80 | 0.75 | 0.65 | 0.55 | 0.50 |

| 2 | 1.40 | 1.30 | 1.25 | 1.15 | 1.10 | 1.00 | 0.95 | 0.90 | 0.85 | 0.80 | 0.75 | 0.70 | 0.60 | 0.55 | 0.50 |

| 3 | 1.30 | 1.20 | 1.15 | 1.10 | 1.00 | 0.95 | 0.90 | 0.85 | 0.80 | 0.75 | 0.70 | 0.65 | 0.55 | 0.50 | 0.45 |

| 4 | 1.20 | 1.15 | 1.05 | 1.00 | 0.95 | 0.90 | 0.85 | 0.80 | 0.75 | 0.70 | 0.65 | 0.60 | 0.50 | 0.45 | 0.40 |

| 5 | 1.15 | 1.05 | 1.00 | 0.95 | 0.90 | 0.85 | 0.80 | 0.75 | 0.70 | 0.65 | 0.60 | 0.55 | 0.50 | 0.40 | 0.35 |

| 6 | 1.05 | 1.00 | 0.95 | 0.90 | 0.85 | 0.80 | 0.75 | 0.70 | 0.65 | 0.60 | 0.55 | 0.50 | 0.45 | 0.40 | 0.35 |

| 7 | 1.00 | 0.95 | 0.90 | 0.85 | 0.80 | 0.75 | 0.70 | 0.65 | 0.60 | 0.55 | 0.50 | 0.45 | 0.40 | 0.35 | 0.30 |

| 8 | 0.95 | 0.90 | 0.85 | 0.80 | 0.75 | 0.70 | 0.65 | 0.60 | 0.55 | 0.50 | 0.45 | 0.40 | 0.35 | 0.30 | 0.25 |

| 9 | 0.90 | 0.85 | 0.80 | 0.75 | 0.70 | 0.65 | 0.60 | 0.55 | 0.50 | 0.45 | 0.40 | 0.35 | 0.30 | 0.25 | 0.20 |

| 10 | 0.85 | 0.80 | 0.75 | 0.70 | 0.65 | 0.60 | 0.55 | 0.50 | 0.45 | 0.40 | 0.35 | 0.30 | 0.25 | 0.20 | 0.20 |

| 11 | 0.80 | 0.70 | 0.65 | 0.65 | 0.60 | 0.55 | 0.50 | 0.45 | 0.40 | 0.35 | 0.30 | 0.25 | 0.20 | 0.15 | 0.15 |

| 12 | 0.75 | 0.65 | 0.60 | 0.55 | 0.50 | 0.50 | 0.45 | 0.40 | 0.35 | 0.30 | 0.25 | 0.20 | 0.20 | 0.15 | 0.10 |

| 13 | 0.65 | 0.60 | 0.55 | 0.50 | 0.45 | 0.45 | 0.40 | 0.35 | 0.30 | 0.25 | 0.20 | 0.15 | 0.15 | 0.10 | 0.10 |

| 14 | 0.60 | 0.55 | 0.50 | 0.45 | 0.40 | 0.35 | 0.35 | 0.30 | 0.25 | 0.20 | 0.15 | 0.10 | 0.10 | 0.10 | 0.05 |

| Never | 0.50 | 0.45 | 0.40 | 0.40 | 0.35 | 0.30 | 0.30 | 0.25 | 0.20 | 0.15 | 0.10 | 0.10 | 0.05 | 0.05 | 0.05 |

| α | Switching Question in Series 1 | ||||||||||||||

| Series 2 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | Never |

| 1 | 0.60 | 0.75 | 0.75 | 0.85 | 0.90 | 0.95 | 1.00 | 1.05 | 1.10 | 1.15 | 1.20 | 1.25 | 1.30 | 1.40 | 1.45 |

| 2 | 0.60 | 0.70 | 0.75 | 0.80 | 0.85 | 0.90 | 0.95 | 1.00 | 1.05 | 1.10 | 1.15 | 1.20 | 1.25 | 1.35 | 1.40 |

| 3 | 0.55 | 0.60 | 0.70 | 0.75 | 0.80 | 0.85 | 0.90 | 0.95 | 1.00 | 1.05 | 1.10 | 1.15 | 1.20 | 1.25 | 1.30 |

| 4 | 0.50 | 0.60 | 0.65 | 0.70 | 0.75 | 0.80 | 0.85 | 0.90 | 0.95 | 1.00 | 1.05 | 1.10 | 1.15 | 1.20 | 1.25 |

| 5 | 0.45 | 0.55 | 0.60 | 0.65 | 0.70 | 0.75 | 0.80 | 0.85 | 0.90 | 0.95 | 1.00 | 1.05 | 1.10 | 1.15 | 1.20 |

| 6 | 0.45 | 0.50 | 0.55 | 0.60 | 0.65 | 0.70 | 0.75 | 0.80 | 0.85 | 0.90 | 0.95 | 1.00 | 1.05 | 1.10 | 1.15 |

| 7 | 0.40 | 0.45 | 0.50 | 0.55 | 0.60 | 0.65 | 0.70 | 0.75 | 0.80 | 0.85 | 0.90 | 0.95 | 1.00 | 1.05 | 1.10 |

| 8 | 0.35 | 0.40 | 0.45 | 0.50 | 0.55 | 0.60 | 0.65 | 0.70 | 0.75 | 0.80 | 0.85 | 0.90 | 0.95 | 1.00 | 1.05 |

| 9 | 0.30 | 0.35 | 0.40 | 0.45 | 0.50 | 0.55 | 0.60 | 0.65 | 0.70 | 0.75 | 0.80 | 0.85 | 0.90 | 0.95 | 1.00 |

| 10 | 0.25 | 0.30 | 0.35 | 0.40 | 0.45 | 0.50 | 0.55 | 0.60 | 0.65 | 0.70 | 0.75 | 0.80 | 0.85 | 0.90 | 0.95 |

| 11 | 0.20 | 0.25 | 0.30 | 0.35 | 0.40 | 0.45 | 0.50 | 0.55 | 0.60 | 0.65 | 0.70 | 0.75 | 0.80 | 0.85 | 0.90 |

| 12 | 0.15 | 0.20 | 0.25 | 0.30 | 0.35 | 0.40 | 0.45 | 0.50 | 0.55 | 0.60 | 0.65 | 0.70 | 0.75 | 0.80 | 0.85 |

| 13 | 0.10 | 0.15 | 0.20 | 0.25 | 0.30 | 0.35 | 0.40 | 0.45 | 0.50 | 0.55 | 0.60 | 0.65 | 0.70 | 0.75 | 0.80 |

| 14 | 0.05 | 0.10 | 0.15 | 0.20 | 0.25 | 0.30 | 0.35 | 0.40 | 0.45 | 0.50 | 0.55 | 0.60 | 0.65 | 0.70 | 0.75 |

| Never | 0.05 | 0.05 | 0.10 | 0.15 | 0.20 | 0.25 | 0.30 | 0.35 | 0.40 | 0.45 | 0.45 | 0.55 | 0.55 | 0.65 | 0.60 |

Appendix C

| Domain | Risk | Total | Gender | Sub County | ||||

|---|---|---|---|---|---|---|---|---|

| n = 792 | Male n = 327 | Female n = 465 | Kathiani n = 187 | Machakos n = 178 | Mwala n = 193 | Yatta n = 234 | ||

| Production | Low crop yields | 95.3 | 93.6 | 96.6 | 95.2 | 93.8 | 93.8 | 97.9 |

| Death of livestock | 47.7 | 42.5 | 51.4 | 44.4 | 49.4 | 41.5 | 54.3 | |

| Lack of fertilizer | 28.0 | 26.9 | 28.8 | 40.6 | 16.9 | 26.4 | 27.8 | |

| Post-harvest loss | 24.5 | 22.0 | 26.2 | 24.6 | 16.3 | 23.8 | 31.2 | |

| Reseeding/replanting | 23.1 | 20.5 | 24.9 | 17.1 | 33.1 | 24.9 | 18.8 | |

| Poor germination | 22.0 | 19.6 | 23.7 | 15.5 | 24.2 | 20.7 | 26.5 | |

| Lack of water | 18.1 | 22.0 | 15.3 | 10.2 | 30.3 | 10.9 | 20.9 | |

| Low animal production | 13.4 | 16.2 | 11.4 | 7.0 | 16.9 | 13.5 | 15.8 | |

| Poor quality produce | 10.4 | 11.9 | 9.2 | 11.2 | 19.1 | 5.2 | 7.3 | |

| Pests and diseases | 4.2 | 3.7 | 4.5 | 1.1 | 2.1 | 11.5 | ||

| Equipment breakdown | 3.9 | 4.3 | 3.7 | 0.5 | 11.8 | 1.0 | 3.0 | |

| Lack of seeds | 0.8 | 0.6 | 0.9 | 1.6 | 0.5 | 0.9 | ||

| Financial | Reduction in agricultural incomes | 69.6 | 13.1 | 10.3 | 15.5 | 9.6 | 12.4 | 9.0 |

| Reduction in daily wages | 15.7 | 2.8 | 2.6 | 3.2 | 2.2 | 4.1 | 1.3 | |

| Inability to replay loan | 11.5 | 0.9 | 1.1 | 0.5 | 0.4 | |||

| Increase in interest rates | 2.7 | 15.6 | 15.7 | 14.4 | 7.3 | 16.1 | 22.6 | |

| Reduction in non-agricultural income | 0.5 | 73.7 | 66.7 | 75.9 | 62.9 | 70.5 | 68.8 | |

| Market | Fluctuating output prices | 72.9 | 75.5 | 71.0 | 78.1 | 57.3 | 79.8 | 74.8 |

| Fluctuating input prices | 50.1 | 46.8 | 52.5 | 50.3 | 50.0 | 48.7 | 51.3 | |

| Fluctuating interest rates | 1.1 | 0.9 | 1.3 | 1.1 | 3.1 | 0.4 | ||

| Lack of markets | 1.1 | 0.9 | 1.3 | 1.1 | 2.1 | 1.3 | ||

| Consumption | Reduced quantities of food | 38.1 | 38.8 | 37.6 | 38.0 | 39.9 | 37.8 | 37.2 |

| Reduced number of meals | 33.7 | 33.9 | 33.5 | 31.0 | 43.3 | 36.8 | 26.1 | |

| Lack of a balanced diet | 21.5 | 23.5 | 20.0 | 20.3 | 16.3 | 25.9 | 22.6 | |

| Food contamination | 3.2 | 3.1 | 3.2 | 4.3 | 3.4 | 4.1 | 1.3 | |

| Food lacking necessary nutrients | 2.5 | 3.4 | 1.9 | 2.1 | 5.6 | 1.6 | 1.3 | |

| Institutional | Importation of cheaper produce | 11.1 | 12.5 | 10.1 | 8.6 | 19.7 | 10.9 | 6.8 |

| Price controls | 3.7 | 4.0 | 3.4 | 0.5 | 12.4 | 1.0 | 1.7 | |

| Tenure security | 3.4 | 4.9 | 2.4 | 3.7 | 7.9 | 1.6 | 1.3 | |

| COVID-19-related restrictions | 1.5 | 1.5 | 1.5 | 1.1 | 1.1 | 1.6 | 2.1 | |

| High export tariff | 0.9 | 2.1 | 2.7 | 0.9 | ||||

| Breach of contract farming agreement | 0.4 | 0.6 | 0.2 | 1.1 | 0.4 | |||

| Lack of price control | 0.3 | 0.6 | 0.5 | 0.5 | ||||

| Personal | Sickness | 38.1 | 37.0 | 38.9 | 36.4 | 42.7 | 38.9 | 35.5 |

| Traffic accident | 4.8 | 6.4 | 3.7 | 5.9 | 4.5 | 2.6 | 6.0 | |

| Divorce | 1.3 | 1.2 | 1.3 | 0.5 | 2.8 | 1.0 | 0.9 | |

| Death of family member | 0.4 | 0.6 | 0.5 | 0.6 | 0.4 | |||

| Land disputes | 0.6 | 1.1 | 1.1 | 0.6 | 0.5 | 0.4 | ||

| Other accidents | 0.4 | 0.6 | 0.2 | 0.5 | 1.1 | |||

| Domestic conflicts | 0.1 | 0.2 | 0.6 | |||||

| Domain | Risk | Gender | Sub-County | |||||

|---|---|---|---|---|---|---|---|---|

| Total | Male | Female | Kathiani | Machakos | Mwala | Yatta | ||

| Production | Low crop production | 56.5 | 56.3 | 56.6 | 57.2 | 56.3 | 58.0 | 54.7 |

| Low animal production | 16.8 | 18.0 | 16.0 | 16.6 | 18.2 | 19.7 | 13.7 | |

| Reseeding/replanting | 13.7 | 13.5 | 13.8 | 16.6 | 10.2 | 14.0 | 13.7 | |

| Equipment breakdown | 5.3 | 5.5 | 5.2 | 3.7 | 6.3 | 3.6 | 7.3 | |

| Poor germination | 4.1 | 2.8 | 5.0 | 3.7 | 4.5 | 1.6 | 6.0 | |

| Death of livestock | 2.0 | 2.4 | 1.7 | 0.5 | 2.8 | 2.1 | 2.6 | |

| Post-harvest loss | 0.6 | 0.3 | 0.9 | 0.5 | 1.1 | 0.9 | ||

| Lack of seeds | 0.4 | 0.3 | 0.4 | 0.5 | 0.9 | |||

| Pest and diseases | 0.3 | 0.6 | 0.5 | 0.5 | ||||

| Poor quality produce | 0.3 | 0.3 | 0.2 | 0.5 | 0.6 | |||

| Lack of water | 0.1 | 0.2 | 0.4 | |||||

| Financial | Reduction in agricultural incomes | 93.2 | 93.6 | 92.9 | 95.8 | 93.1 | 90.8 | 93.1 |

| Increase in interest rates | 5.7 | 6.0 | 5.5 | 2.4 | 5.4 | 8.6 | 6.4 | |

| Inability to repay loan | 0.5 | 0.4 | 0.5 | 1.8 | ||||

| Reduction in non-agricultural incomes | 0.6 | 1.1 | 1.5 | 0.6 | 0.5 | |||

| Market | Fluctuating input prices | 71.1 | 72.6 | 70.0 | 72.3 | 80.1 | 66.7 | 67.6 |

| Fluctuating output prices | 27.8 | 26.7 | 28.5 | 27.2 | 19.9 | 31.0 | 31.0 | |

| Lack of markets | 1.1 | 0.7 | 1.5 | 0.6 | 2.3 | 1.4 | ||

| Consumption | Reduced number of meals | 79.4 | 76.4 | 81.5 | 74.8 | 80.2 | 76.6 | 85.0 |

| Reduced quantities of food | 14.4 | 16.3 | 13.1 | 17.4 | 14.4 | 15.6 | 10.9 | |

| Food contamination | 5.6 | 6.4 | 5.0 | 6.1 | 5.4 | 7.0 | 4.1 | |

| Food lacking necessary nutrients | 0.6 | 1.0 | 0.3 | 1.7 | 0.8 | |||

| Institutional | Price controls | 87.7 | 86.6 | 88.9 | 81.8 | 91.4 | 86.7 | 86.7 |

| COVID-19-related restrictions | 5.5 | 4.9 | 6.2 | 6.1 | 2.9 | 10.0 | 6.7 | |

| High export tariff | 3.1 | 3.7 | 2.5 | 3.0 | 4.3 | 3.3 | ||

| Breach of contract farming agreement | 1.8 | 2.4 | 1.2 | 6.1 | 3.3 | |||

| Cheap imports | 0.6 | 1.2 | 1.4 | |||||

| Tenure security | 0.6 | 1.2 | 3.3 | |||||

| Lack of price control | 0.6 | 1.2 | 3.0 | |||||

Appendix D

Appendix D.1. Collinearity Test across the Manifest Variables

| Variable | VIF |

|---|---|

| ffrefuture1 | 1.342 |

| ffrefuture1 | 1.478 |

| ffrehisto1 | 1.339 |

| ffrehisto1 | 1.473 |

| fprevent1 | 1.112 |

| fprevent1 | 1.666 |

| fseverity1 | 1.111 |

| fseverity1 | 1.42 |

| mfrefuture1 | 1.026 |

| mfrefuture1 | 1.151 |

| mprevent1 | 1.195 |

| mprevent1 | 1.572 |

| mseverity1 | 1.213 |

| mseverity1 | 1.387 |

| pfrefuture1 | 1.382 |

| pfrefuture1 | 1.509 |

| pfrehisto1 | 1.393 |

| pfrehisto1 | 1.508 |

| pprevent1 | 1.085 |

| pprevent1 | 1.502 |

| pseverity1 | 1.043 |

| pseverity1 | 1.236 |

Appendix D.2. Regression Analysis of Effect of Variables of Interest on Risk Perceptions

| Dependent Variable | Risk Perception |

|---|---|

| Risk aversion | −0.313 *** |

| (0.101) | |

| Dietary diversity | 0.005 |

| (0.025) | |

| Age | 0.006 |

| (0.004) | |

| Life satisfaction | −0.024 ** |

| (0.01) | |

| Locus of control | 0.008 |

| (0.009) | |

| Asset count | −0.025 |

| (0.016) | |

| factor (Education)2 | 0.701 |

| (1.049) | |

| factor (Education)3 | 0.344 |

| (0.983) | |

| factor (Education)4 | 0.037 |

| (0.984) | |

| factor (Education)5 | 0.301 |

| (0.993) | |

| factor (Education)6 | −0.112 |

| (1.015) | |

| factor (Occupation)2 | 0.02 |

| (0.205) | |

| factor (Occupation)3 | −0.134 |

| (0.212) | |

| factor (Occupation)4 | −0.103 |

| (0.158) | |

| factor (Occupation)6 | −0.739 |

| (0.982) | |

| Constant | 0.149 |

| (1.08) | |

| Observations | 435 |

| R2 | 0.084 |

| Adjusted R2 | 0.051 |

| Residual Std. Error | 0.975 (df = 419) |

| F Statistic | 2.569 *** (df = 15; 419) |

References

- Meraner, M.; Finger, R. Risk perceptions, preferences and management strategies: Evidence from a case study using German livestock farmers. J. Risk Res. 2019, 22, 110–135. [Google Scholar] [CrossRef]

- Nastis, S.A.; Mattas, K.; Baourakis, G. Understanding farmers’ behavior towards sustainable practices and their perceptions of risk. Sustainability 2019, 11, 1–13. [Google Scholar] [CrossRef] [Green Version]

- Knight, F.H. Risk, Uncertainty and Profit; Houghton Mifflin Company: Boston, MA, USA; New York, NY, USA, 1921. [Google Scholar]

- Loewenstein, G.F.; Hsee, C.K.; Weber, E.U.; Welch, N. Risk as Feelings. Psychol. Bull. 2001, 127, 267–286. [Google Scholar] [CrossRef] [PubMed]

- Dhami, S. The Foundations of Behavioral Economic Analysis, 1st ed.; Oxford University Press: Oxford, UK, 2016. [Google Scholar]

- Wilson, R.S.; Zwickle, A.; Walpole, H. Developing a Broadly Applicable Measure of Risk Perception. Risk Anal. 2019, 39, 777–791. [Google Scholar] [CrossRef] [PubMed]

- Komarek, A.M.; de Pinto, A.; Smith, V.H. A review of types of risks in agriculture: What we know and what we need to know. Agric. Syst. 2020, 178, 102738. [Google Scholar] [CrossRef]

- Ansah, I.G.K.; Gardebroek, C.; Ihle, R. Shock interactions, coping strategy choices and household food security. Clim. Dev. 2020, 13, 414–426. [Google Scholar] [CrossRef]

- Martin, W.E.; Martin, I.M.; Kent, B. The role of risk perceptions in the risk mitigation process: The case of wildfire in high risk communities J. Environ. Manag. 2009, 91, 489–498. [Google Scholar] [CrossRef]

- Renn, O. Risk Perception and Risk Management. In Proceedings of the 14th Congress of the World Energy Conference, Montreal, QC, Canada, 17–21 September 1989; Volume 2, pp. 1–16. [Google Scholar]

- Breakwell, D.G.M. Risk: Social Psychological Perspectives, 2nd ed.; Elsevier: Amsterdam, The Netherlands, 2015. [Google Scholar]

- Foresight4Food. Understanding Small-Scale Agriculture. Available online: https://www.foresight4food.net/understanding-small-scale-agriculture/ (accessed on 9 November 2021).

- Weber, E.U.; Blais, A.R.; Betz, N.E. A Domain-specific Risk-attitude Scale: Measuring Risk Perceptions and Risk Behaviors. J. Behav. Decis. Mak. 2002, 15, 263–290. [Google Scholar] [CrossRef]

- Hardaker, J.B. Some Issues in Dealing with Risk in Agriculture by J Brian Hardaker No. 2000-3—March 2000 Working Paper Series in Agricultural and Resource Economics Some Issues in Dealing with Risk in Agriculture; University of New England: Armidale, NSW, Australia, 2000; Volume 3. [Google Scholar]

- Kahneman, D.; Tversky, A. Prospect theory: An analysis of decision under risk. Econometrica 1979, 47, 263–292. [Google Scholar] [CrossRef] [Green Version]

- Dercon, S.; Christiaensen, L. Consumption risk, technology adoption and poverty traps: Evidence from Ethiopia. J. Dev. Econ. 2011, 96, 159–173. [Google Scholar] [CrossRef] [Green Version]

- Wachinger, G.; Renn, O.; Begg, C.; Kuhlicke, C. The risk perception paradox-implications for governance and communication of natural hazards. Risk Anal. 2013, 33, 1049–1065. [Google Scholar] [CrossRef] [PubMed]

- Lindell, M.K.; Perry, R.W. The Protective Action Decision Model: Theoretical Modifications and Additional Evidence. Risk Anal. 2012, 32, 616–632. [Google Scholar] [CrossRef]

- Siegrist, M.; Hartmann, C. Consumer acceptance of novel food technologies. Nat. Food 2020, 1, 343–350. [Google Scholar] [CrossRef]

- Sullivan-Wiley, K.A.; Gianotti, A.G.S. Risk Perception in a Multi-Hazard Environment. World Dev. 2017, 97, 138–152. [Google Scholar] [CrossRef]

- Raue, M.; Lermer, E.; Streicher, B. Psychological perspectives on risk and risk analysis: Theory, models, and applications. In Psychological Perspectives on Risk and Risk Analysis: Theory, Models, and Applications; Springer: Berlin/Heidelberg, Germany, 2018; pp. 1–379. [Google Scholar]

- Renn, O.; Rohrmann, B. Cross-Cultural Risk Perception: A Survey of Empirical Studies. Statew. Agric. L. Use Baseline 2015 2000, 13, 242. [Google Scholar]

- Slovic, P.; Peters, E. Risk perception and affect. Curr. Dir. Psychol. Sci. 2006, 15, 322–325. [Google Scholar] [CrossRef]

- Epstein, S. Integration of the Cognitive and the Psychodynamic Unconscious. Am. Psychol. 1994, 49, 709–724. [Google Scholar] [CrossRef] [PubMed]

- Kahneman, D. Thinking, Fast and Slow; Farrar, Straus and Giroux: New York, NY, USA, 2011. [Google Scholar]

- Kahneman, D.; Slovic, P.; Tversky, A. Judgment Under Uncertainty: Heuristics and Biases; Cambridge University Press; Press Syndicate of the University of Cambridge: Cambridge, UK; New York, NY, USA, 1982. [Google Scholar]

- Cullen, A.C.; Anderson, C.L.; Biscaye, P.; Reynolds, T.W. Variability in Cross-Domain Risk Perception among Smallholder Farmers in Mali by Gender and Other Demographic and Attitudinal Characteristics. Risk Anal. 2018, 38, 1361–1377. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Slovic, P. Risk Perception Paul. Science 1987, 236, 280–285. [Google Scholar] [CrossRef] [PubMed]

- Duong, T.T.; Brewer, T.; Luck, J.; Zander, K. A global review of farmers’ perceptions of agricultural risks and risk management strategies. Agriculture 2019, 9, 10. [Google Scholar] [CrossRef] [Green Version]

- Harwood, J.; Richard, H.; Coble, K.; Perry, J.; Somwaru, A. Managing Risk in Farming: Concepts, Research, and Analysis. Agric. Econ. Rep. 1999, 774, 125. [Google Scholar]

- Machakos County Government. Machakos County Integrated Development Plan II; County Government of Machakos: Machakos, Kenya, 2018. [Google Scholar]

- Food and Agriculture Organization. Guidelines for Measuring Household and Individual Dietary Diversity; Food and Agriculture Organization: Rome, Italy, 2010. [Google Scholar]

- Lumpkin, J.R. Scale for Survey Research1. Psychol. Rep. 1985, 55, 655–659. [Google Scholar] [CrossRef]

- Rotter, J.B. Generalized Expectancies for Internal versus External Control of reinforcement. Psychol. Monogr. Gen. Appl. 1966, 80, 1–28. [Google Scholar] [CrossRef] [Green Version]

- Armaş, I.; Cretu, R.Z.; Ionescu, R. Self-efficacy, stress, and locus of control: The psychology of earthquake risk perception in Bucharest, Romania. Int. J. Disaster Risk Reduct. 2017, 22, 71–76. [Google Scholar] [CrossRef]

- Tanaka, T.; Camerer, C.F.; Nguyen, Q. American Economic Association Risk and Time Preferences: Linking Experimental and Household Survey Data from Vietnam Author (s). Available online: https://www.jstor.org/stable/27804941 (accessed on 10 November 2019).

- Prelec, D. The Probability Weighting Function. Econometrica 1999, 66, 497–527. [Google Scholar] [CrossRef] [Green Version]

- Sjöberg, L. The methodology of risk perception research. Qual. Quant. 2000, 34, 407–418. [Google Scholar] [CrossRef]

- Van der Linden, S. Determinants and Measurement of Climate Change Risk Perception, Worry, and Concern; Oxford University Press: Oxford, UK, 2017. [Google Scholar]

- Paek, H.; Hove, T. Risk perceptions and risk characteristics risk and risk perception: Definitions and dimensions. Oxford Res. Encycl. Commun. 2017, 1–15. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Hult, G.T.; Ringle, C.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); SAGE: Thousand Oaks, CA, USA, 2016. [Google Scholar]

- Burns, W.J.; Slovic, P.; Kasperson, R.E.; Kasperson, J.X.; Renn, O.; Emani, S. Incorporating Structural Models into Research on the Social Amplification of Risk: Implications for Theory Construction and Decision Making. Risk Anal. 1993, 13, 611–623. [Google Scholar] [CrossRef] [Green Version]

- Hair, J.F.; Howard, M.C.; Nitzl, C. Assessing measurement model quality in PLS-SEM using confirmatory composite analysis. J. Bus. Res. 2020, 109, 101–110. [Google Scholar] [CrossRef]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Becker, J.M.; Klein, K.; Wetzels, M. Hierarchical Latent Variable Models in PLS-SEM: Guidelines for Using Reflective-Formative Type Models. Long Range Plann. 2012, 45, 359–394. [Google Scholar] [CrossRef]

- OECD. Managing Risk in Agriculture: A Holistic Approach; OECD: Paris, France, 2009. [Google Scholar]

- van Duinen, R.; Filatova, T.; Geurts, P.; van der Veen, A. Empirical Analysis of Farmers’ Drought Risk Perception: Objective Factors, Personal Circumstances, and Social Influence. Risk Anal. 2015, 35, 741–755. [Google Scholar] [CrossRef] [PubMed]

- Renn, O.; Siovic, P.; Burns, W.J.; Kasperson, J.X.; Kasperson, R.E. Social amplification theory: Theoretical foundations and empirical applications. J. Soc. Issues 1992, 48, 127–160. [Google Scholar] [CrossRef]

- Azariadis, C.; Stachurski, J. Chapter 5 Poverty Traps. Handb. Econ. Growth 2005, 1, 295–384. [Google Scholar]

- Brown, G.D.; Largey, A.; McMullan, C. The impact of gender on risk perception: Implications for EU member states’ national risk assessment processes. Int. J. Disaster Risk Reduct. 2021, 63, 102452. [Google Scholar] [CrossRef]

- Gustafson, P.E. Gender differences in risk perception: Theoretical and methodological perspectives. Risk Anal. 1998, 18, 805–811. [Google Scholar] [CrossRef] [PubMed]

| Variable | Gender | Sub-County | |||||

|---|---|---|---|---|---|---|---|

| Total | Male (a) | Female (b) | Kathiani (a) | Machakos (b) | Mwala (c) | Yatta (d) | |

| Age | 51.3 | 54.0 b | 49.3 | 51.8 | 52.1 | 52.4 | 49.3 |

| Annual household expenditure (000 shillings) | 149.7 | 172.4 b | 133.7 | 144.9 | 172.1 | 143.0 | 141.9 |

| Dietary diversity score | 11.5 | 11.6 | 11.4 | 11.5 | 11.7 | 11.2 | 11.6 |

| Household size | 5 | 4.9 | 5.1 | 5.0 b | 4.1 | 5.2 b | 5.5 b |

| Asset count | 6.6 | 7.0 b | 6.3 | 6.2 | 6.2 | 6.6 | 7.2 a,b |

| Risk aversion | 0.5 | 0.5 | 0.6 | 0.6 b | 0.4 | 0.5 | 0.5 |

| Locus of control * | 8.4 | 8.9 b | 8 | 8.2 | 8.7 | 7.6 | 8.9 |

| Life satisfaction score * | 18.7 | 19 | 18.5 | 18.6 | 20.0 a,c,d | 18.1 | 18.4 |

| Propensity to take risks * | 4.7 | 5.1 b | 4.5 | 4.4 | 5.5 a,c,d | 4.5 | 4.5 |

| Variable | Gender | Sub-County | ||||||

|---|---|---|---|---|---|---|---|---|

| Total n = 792 | Male n = 327 | Female n = 465 | Kathiani n = 187 | Machakos n = 178 | Mwala n = 193 | Yatta n = 234 | ||

| Occupation | Farming (crop/livestock) | 73.2 | 79.8 | 68.6 | 77.0 | 75.8 | 69.9 | 70.9 |

| Employed (Informal) | 8.5 | 7.3 | 9.2 | 3.2 | 9.0 | 11.4 | 9.8 | |

| Employed (Formal sector) | 6.4 | 5.8 | 6.9 | 6.4 | 4.5 | 8.8 | 6.0 | |

| Business | 11.4 | 6.7 | 14.6 | 12.3 | 9.6 | 9.8 | 13.2 | |

| Student | 0.3 | 0.3 | 0.2 | 1.1 | ||||

| None | 0.3 | 0.4 | 1.1 | |||||

| Education | Informal education | 0.3 | 0.4 | 1.1 | ||||

| No education | 1.5 | 0.6 | 2.2 | 0.5 | 2.2 | 2.6 | 0.9 | |

| Primary | 43.8 | 35.5 | 49.7 | 34.8 | 42.7 | 40.9 | 54.3 | |

| Secondary | 39.8 | 46.5 | 35.1 | 48.7 | 37.1 | 40.9 | 33.8 | |

| Vocational training | 11.0 | 11.3 | 10.8 | 13.9 | 10.1 | 13.0 | 7.7 | |

| University | 3.7 | 6.1 | 1.9 | 1.1 | 7.9 | 2.6 | 3.4 | |

| Affected by COVID-19 | Yes | 57.3 | 57.2 | 57.4 | 68.4 | 37.1 | 56.5 | 64.5 |

| Farming capital | Own savings | 56.1 | 54.7 | 57.0 | 44.9 | 69.1 | 59.1 | 52.6 |

| Income from previous season | 31.7 | 34.9 | 29.5 | 47.6 | 16.3 | 29.5 | 32.5 | |

| Borrowing from friends | 2.3 | 2.1 | 2.4 | 0.5 | 6.7 | 0.5 | 1.7 | |

| Borrowing from bank | 1.5 | 2.4 | 0.9 | 1.6 | 2.2 | 2.1 | 0.4 | |

| Borrowing from MFI | 2.1 | 2.8 | 1.7 | 1.6 | 2.8 | 2.1 | 2.1 | |

| Remittances from family | 2.3 | 0.3 | 3.7 | 3.2 | 1.1 | 2.6 | 2.1 | |

| Table banking | 1.5 | 0.6 | 2.2 | 1.7 | 2.1 | 2.1 | ||

| Livestock sales | 2.5 | 2.1 | 2.8 | 0.5 | 2.1 | 6.4 | ||

| Variable | Description (How the Question Was Asked) | Response |

|---|---|---|

| Historic frequency (frehisto1 *) | How many times has the risk occurred in the last 5 years (10 seasons) | Number ranging from 1 to 10 |

| Future frequency (frefuture1) | How many times is the risk likely to occur in the next 5 years | Number ranging from 1 to 10 |

| Severity (severity1) | On a scale of 1 to 5, where 1 is not bad, and 5 is extremely bad, how could you rate this risk | 5-point Likert |

| Sources | What are the main sources of the risk | Number |

| Consequences | What are the main consequences of the risk | Number |

| Ability to prevent (prevent1) | On a scale of 1 to 5, where 1 is very able and 5 is not able at all, are you able to prevent (cope with) the risk from happening | 5-point Likert |

| Adaptation (adaptation1) | Did you do anything to reduce the impact of the risk | Yes/No |

| Risk Attribute/Risk | Low Crop Yield | Reduction in Agricultural Incomes | Fluctuating Input Prices | Reduced Number of Meals | Price Controls | Sickness | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| M * n = 307 | F n = 449 | M n = 241 | F n = 310 | M n = 153 | F n = 244 | M n = 127 | F n = 175 | M n = 13 | F n = 16 | M n = 121 | F n = 181 | |

| Severity | ||||||||||||

| Not severe | 4.6 | 4.5 | 4.6 | 5.2 | 4.6 | 2.9 | 7.1 | 4.6 | 15.4 | 12.5 | 6.6 | 1.1 |

| Moderately severe | 34.2 | 28.1 | 32.0 | 31.3 | 33.3 | 25.0 | 44.9 | 35.4 | 38.5 | 56.3 | 31.4 | 27.1 |

| Severe | 21.8 | 27.4 | 26.6 | 22.3 | 20.9 | 19.3 | 17.3 | 28.6 | 30.8 | 25 | 26.4 | 23.2 |

| Very severe | 24.8 | 29.2 | 22.4 | 28.1 | 22.9 | 32.8 | 20.5 | 22.9 | 15.4 | 26.4 | 37.6 | |

| Extremely severe | 14.7 | 10.9 | 14.5 | 13.2 | 18.3 | 20.1 | 10.2 | 8.6 | 6.3 | 9.1 | 11 | |

| Perceived ability to prevent risk | ||||||||||||

| Very able | 5.9 | 3.8 | 4.6 | 4.8 | 2.0 | 0.4 | 7.9 | 5.1 | 6.3 | 0.8 | 4.4 | |

| Moderately able | 32.9 | 26.5 | 29.9 | 25.8 | 15.0 | 20.1 | 21.3 | 14.3 | 23.1 | 12.5 | 23.1 | 18.8 |

| Able | 23.8 | 23.6 | 24.5 | 20.0 | 13.1 | 8.2 | 28.3 | 30.9 | 23.1 | 19.8 | 23.2 | |

| Unable | 29.0 | 30.7 | 27.8 | 34.5 | 34.6 | 41.0 | 32.3 | 36.6 | 23.1 | 75 | 30.6 | 29.3 |

| Extremely unable | 8.5 | 15.4 | 13.3 | 14.8 | 35.3 | 30.3 | 10.2 | 13.1 | 30.8 | 6.3 | 25.6 | 24.3 |

| Why risk is most problematic | ||||||||||||

| Risk affects many aspects of life | 33.3 | 26.3 | 48.6 | 40.0 | 33.0 | 26.3 | 15.2 | 17.4 | 39 | 24.7 | 57.9 | 53.9 |

| The risk occurs more frequently | 4.0 | 4.3 | 3.5 | 1.8 | 5.2 | 5.6 | 1 | 2.3 | 1.2 | 3.7 | 2.9 | |

| I lack sufficient coping | 11.9 | 12.1 | 5.7 | 10.5 | 13.5 | 14.1 | 9.8 | 7.4 | 9.8 | 11.1 | 6.2 | 5.3 |

| I have no control | 6.1 | 5.2 | 6.4 | 3.7 | 13.5 | 15.4 | 2.5 | 2.7 | 18.3 | 33.3 | 4.1 | 5.3 |

| Consequences are irreversible | 4.0 | 6.7 | 0.4 | 0.5 | 0.3 | 0.2 | 1.2 | 2.5 | 2.1 | 4.4 | ||

| Effects carry over many seasons | 4.3 | 3.2 | 2.1 | 0.8 | 5.9 | 8.5 | 1 | 1.3 | 7.3 | 6.2 | 0.7 | 1.5 |

| Affects all member of my household | 33.0 | 37.6 | 33.0 | 41.6 | 25.3 | 27.6 | 70.6 | 68.8 | 22 | 16 | 25.5 | 24.8 |

| Effects carry over the entire season | 3.4 | 4.5 | 0.4 | 1.1 | 3.1 | 2.2 | 1.2 | 2.5 | 3.4 | 1.9 | ||

| Attribute | Fluctuating Input Prices | Low Crop Yield | Reduction in Agricultural Incomes | Risk Perception | ||||

|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 1 | Model 2 | Model 1 | Model 2 | Model 1 | Model 2 | |

| ffrefuture1 | 0.256 | 0.25 | 0.142 | 0.139 | ||||

| ffrehisto1 | 0.258 | 0.222 | 0.139 | 0.132 | ||||

| fprevent1 | 0.543 | 0.574 | 0.212 | 0.219 | ||||

| fseverity1 | 0.445 | 0.443 | 0.185 | 0.185 | ||||

| mfrefuture1 | 0.34 | 0.309 | 0.11 | 0.107 | ||||

| mprevent1 | 0.58 | 0.605 | 0.198 | 0.205 | ||||

| mseverity1 | 0.483 | 0.475 | 0.182 | 0.183 | ||||

| pfrefuture1 | 0.326 | 0.294 | 0.152 | 0.144 | ||||

| pfrehisto1 | 0.269 | 0.213 | 0.146 | 0.137 | ||||

| pprevent1 | 0.611 | 0.673 | 0.216 | 0.223 | ||||

| pseverity1 | 0.314 | 0.317 | 0.127 | 0.127 | ||||

| Construct | Mean | p Values | ||

|---|---|---|---|---|

| Model 1 | Model 2 | Model 1 | Model 2 | |

| Fluctuating input prices | 0.335 | 0.664 | 0.000 | 0.000 |

| Fluctuating input prices -> Low crop yields * | 0.488 | 0.000 | ||

| Low crop yield | 0.420 | 0.668 | 0.000 | 0.000 |

| Low crop yields -> Reduction in agricultural incomes * | 0.58 | 0.000 | ||

| Reduction in agricultural incomes | 0.446 | 0.447 | 0.000 | 0.000 |

| Risk Attribute | Reduction in Agricultural Incomes | Fluctuating Input Prices | Low Crop Yields | |||

|---|---|---|---|---|---|---|

| Outer Weights (Female-Male) | p-Value | Outer Weights (Female-Male) | p-Value | Outer Weights (Female-Male) | p-Value | |

| ffrefuture1 | −0.078 | 0.527 | ||||

| ffrehisto1 | −0.226 | 0.041 ** | ||||

| fprevent1 | 0.261 | 0.025 ** | ||||

| fseverity1 | −0.053 | 0.639 | ||||

| mfrefuture1 | −0.185 | 0.217 | ||||

| mprevent1 | 0.154 | 0.303 | ||||

| mseverity1 | −0.147 | 0.333 | ||||

| pfrefuture1 | 0.21 | 0.131 | ||||

| pfrehisto1 | −0.229 | 0.073 * | ||||

| pprevent1 | 0.092 | 0.417 | ||||

| pseverity1 | −0.061 | 0.637 | ||||

| Risk Perceptions | Total Effects-Diff (Female-Male) | p-Value |

|---|---|---|

| Fluctuating input prices -> Low crop yield | 0.12 | 0.101 |

| Fluctuating input prices -> Reduction in agricultural incomes | 0.056 | 0.392 |

| Fluctuating input prices -> Risk perception | 0.127 | 0.03 ** |

| Low crop yield -> Reduction in agricultural incomes | −0.031 | 0.642 |

| Low crop yield -> Risk perception | −0.079 | 0.123 |

| Reduction in agricultural incomes -> Risk perception | −0.051 | 0.282 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Osiemo, J.; Ruben, R.; Girvetz, E. Farmer Perceptions of Agricultural Risks; Which Risk Attributes Matter Most for Men and Women. Sustainability 2021, 13, 12978. https://doi.org/10.3390/su132312978

Osiemo J, Ruben R, Girvetz E. Farmer Perceptions of Agricultural Risks; Which Risk Attributes Matter Most for Men and Women. Sustainability. 2021; 13(23):12978. https://doi.org/10.3390/su132312978

Chicago/Turabian StyleOsiemo, Jamleck, Ruerd Ruben, and Evan Girvetz. 2021. "Farmer Perceptions of Agricultural Risks; Which Risk Attributes Matter Most for Men and Women" Sustainability 13, no. 23: 12978. https://doi.org/10.3390/su132312978

APA StyleOsiemo, J., Ruben, R., & Girvetz, E. (2021). Farmer Perceptions of Agricultural Risks; Which Risk Attributes Matter Most for Men and Women. Sustainability, 13(23), 12978. https://doi.org/10.3390/su132312978