Asymmetric and Symmetric Link between Quality of Institutions and Sectorial Foreign Direct Investment Inflow in India: A Fresh Insight Using Simulated Dynamic ARDL Approach

Abstract

:1. Introduction

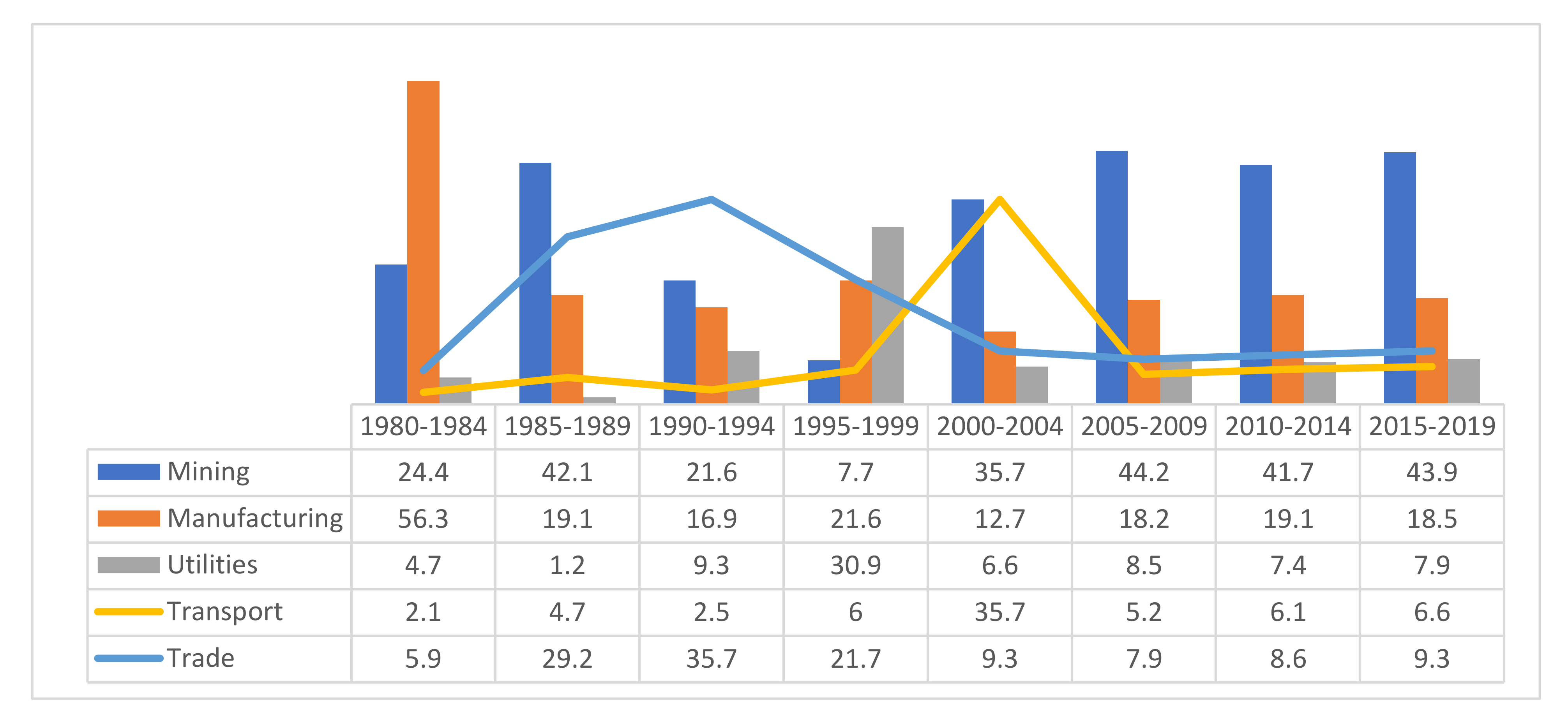

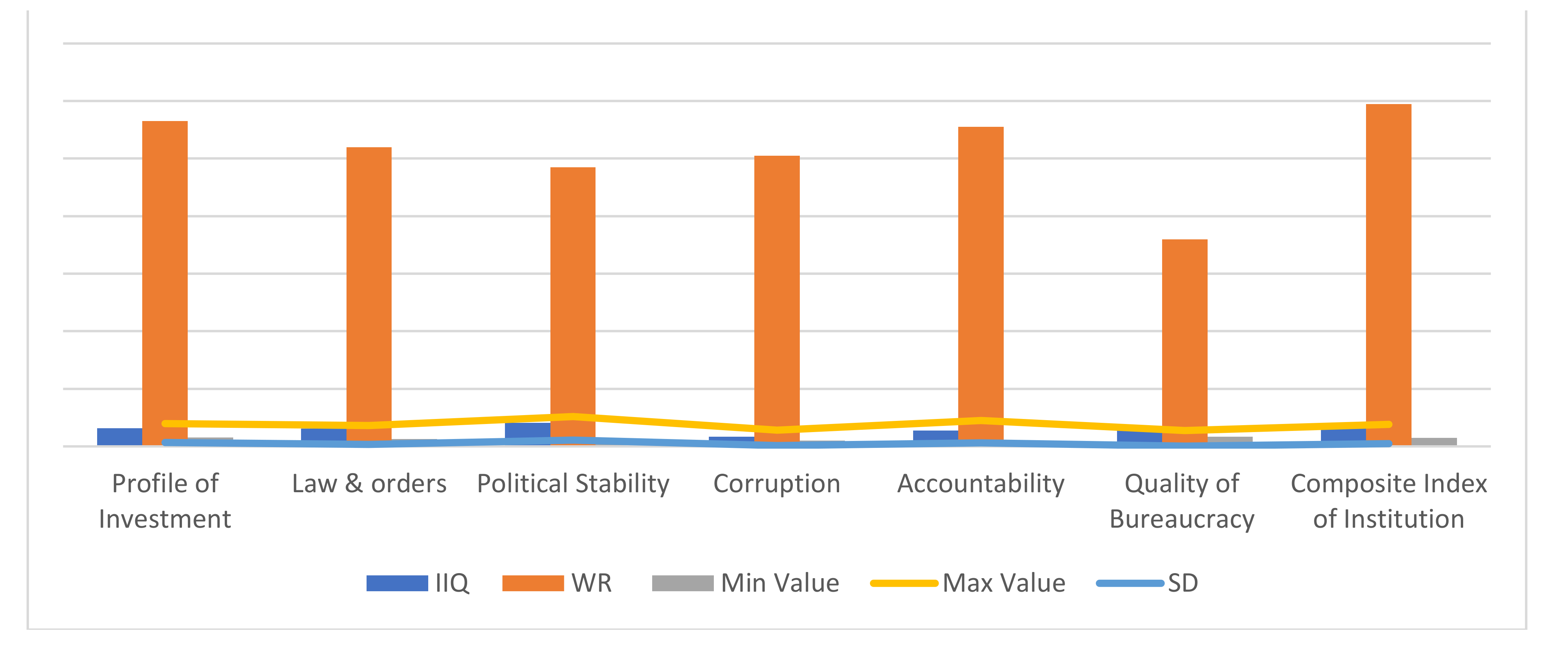

2. FDI Trends and Institutional Quality in India

3. Literature Review

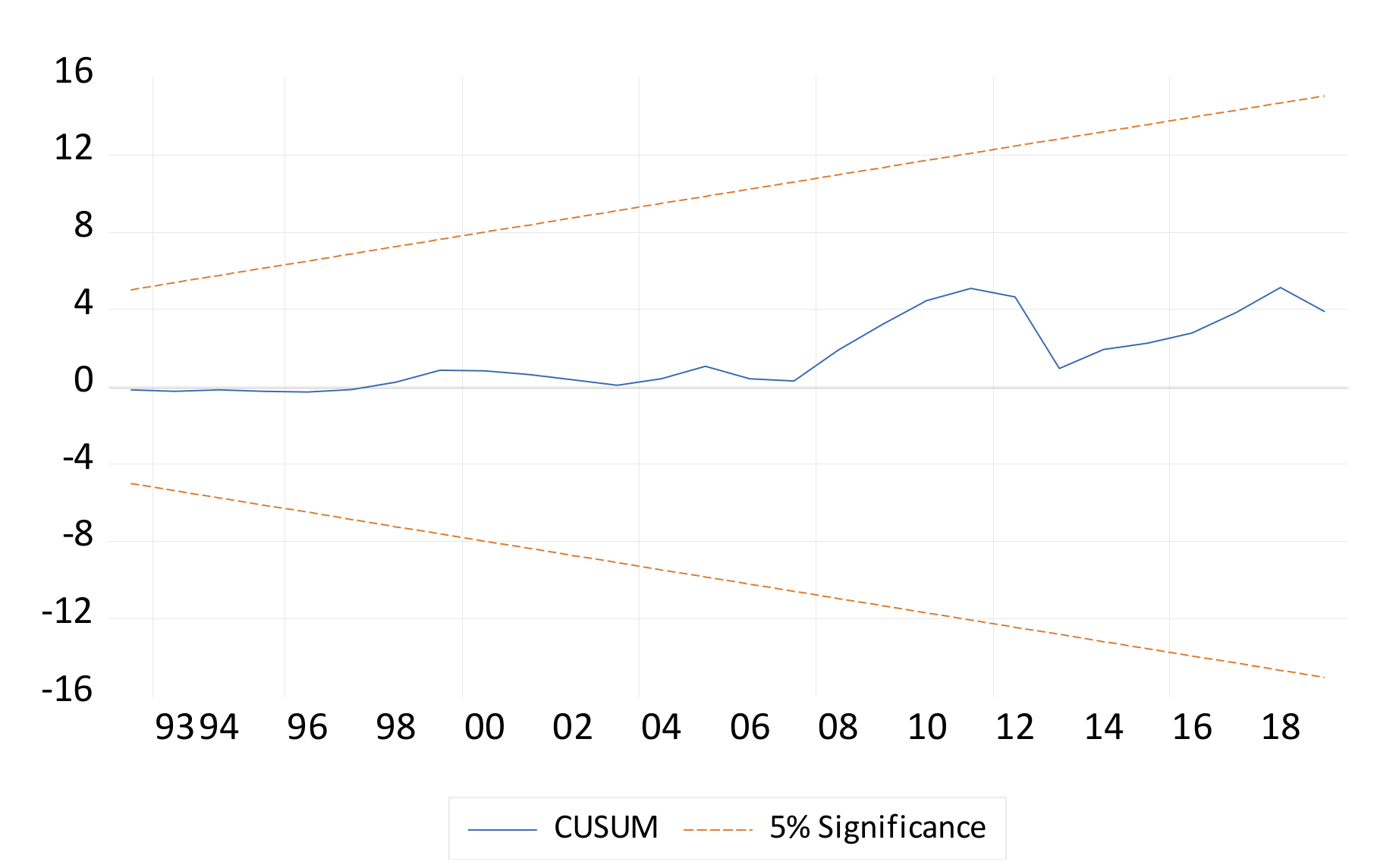

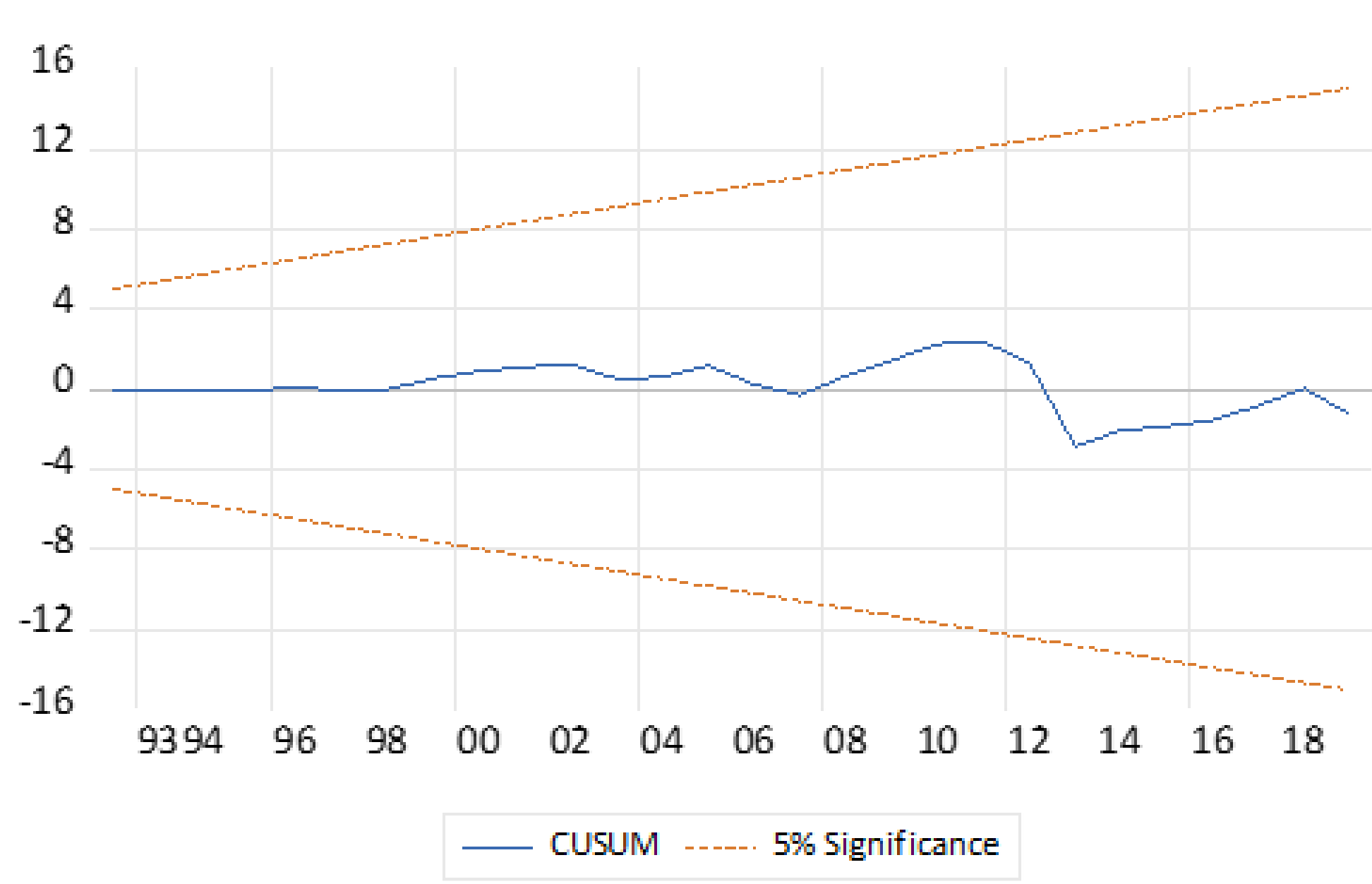

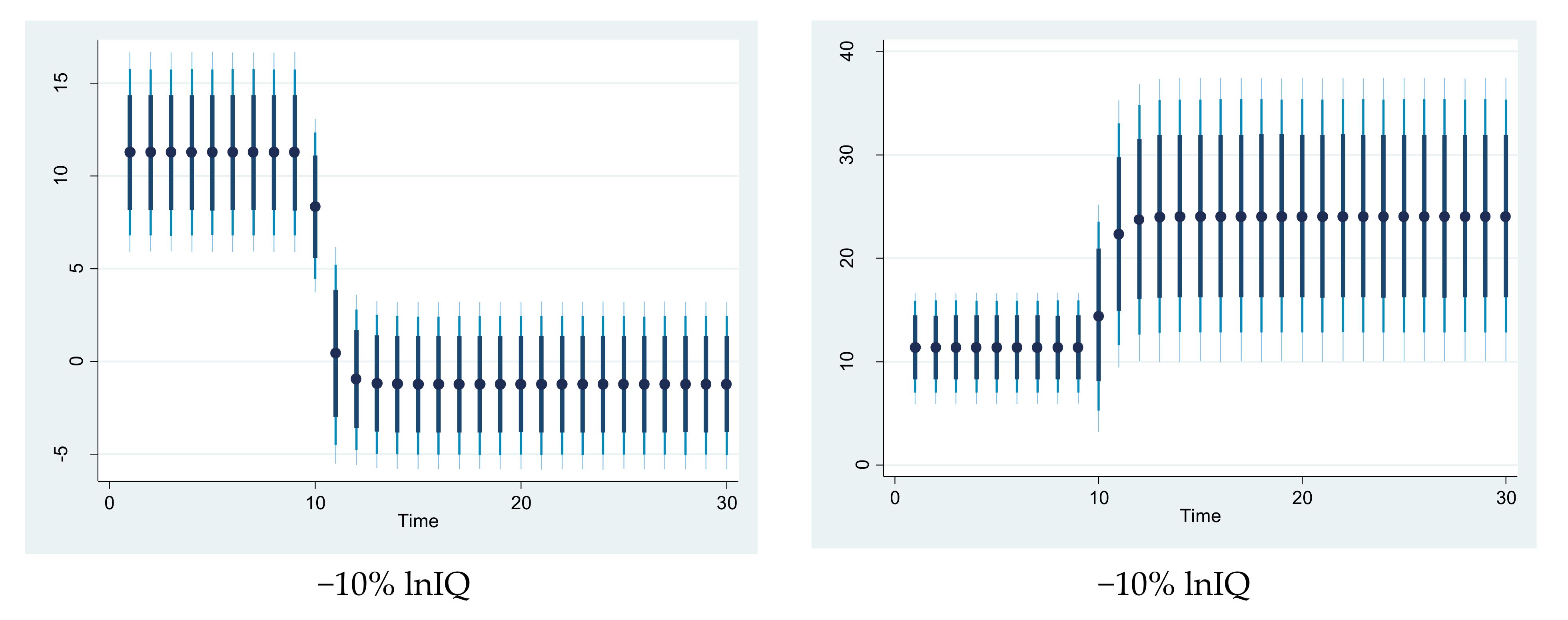

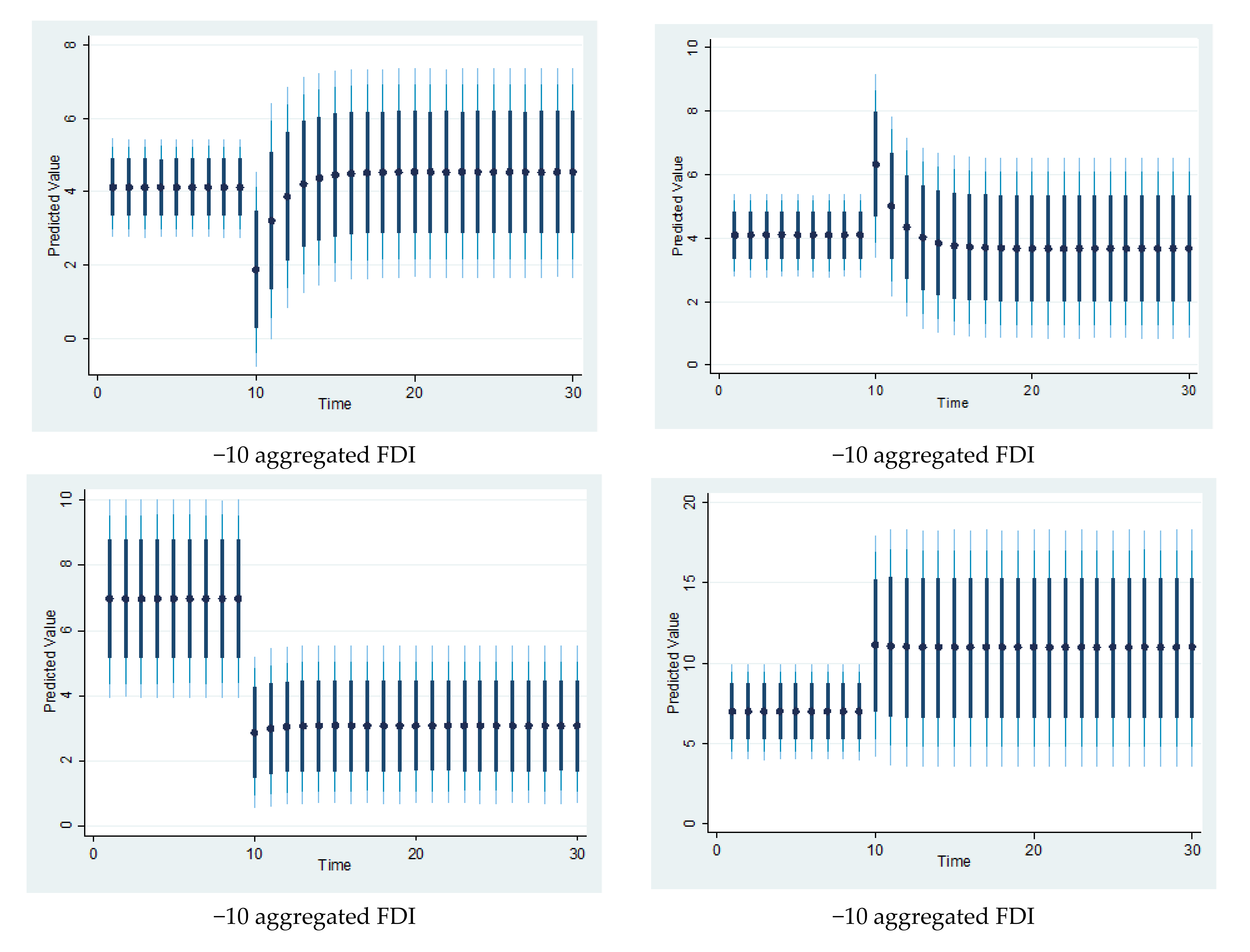

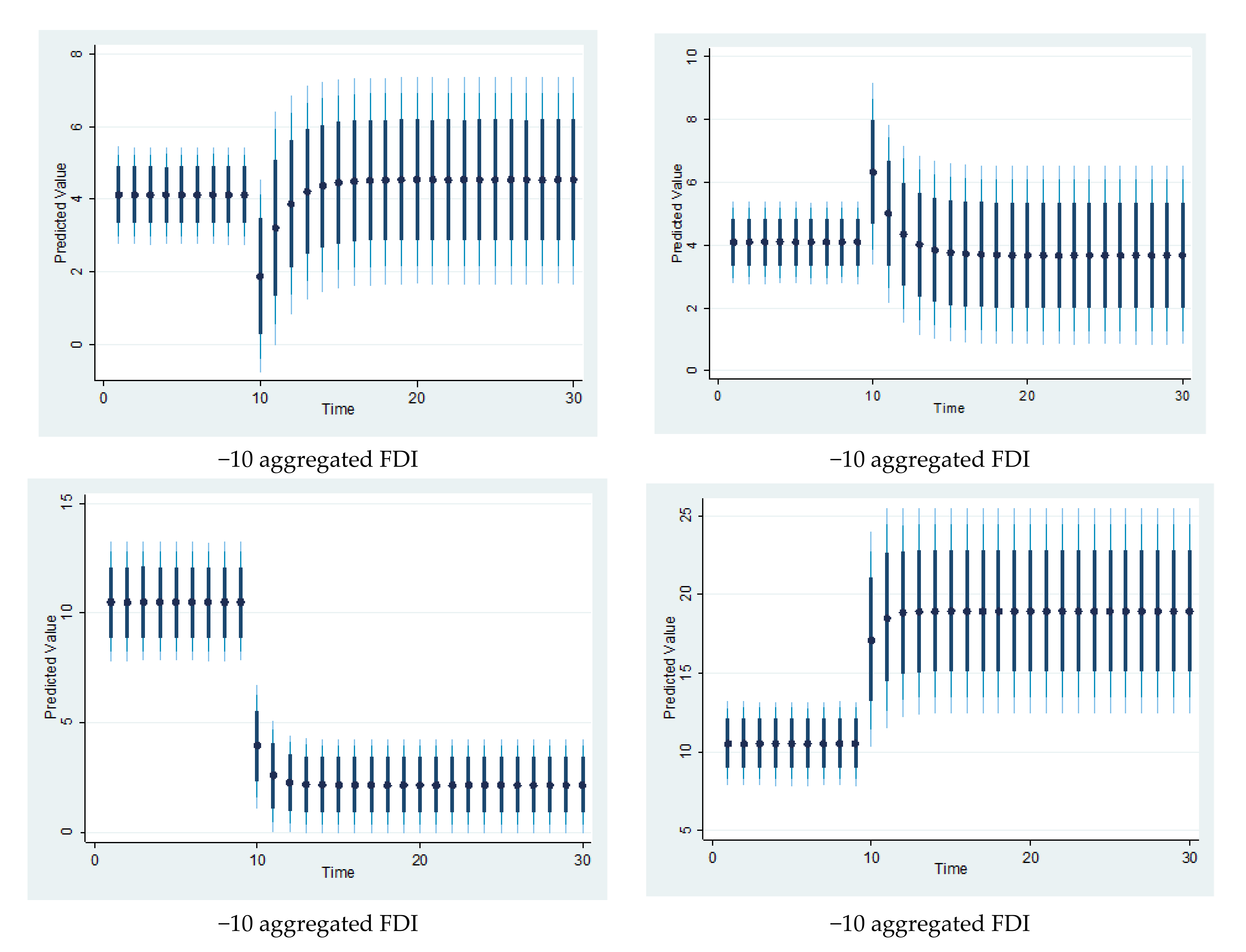

4. Data and Research Methodology

4.1. Data Sources

4.2. Econometric Methodology

5. Results and Discussions

6. Conclusions and Policy Implication

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Rehman, F.U.; Ahmad, E.; Khan, M.; Popp, J.; Oláh, J. Does Trade Related Sectoral Infrastructure Make Chinese Exports More Sophisticated and Diversified? Sustainability 2021, 13, 5408. [Google Scholar] [CrossRef]

- Fon, R.M.; Filippaios, F.; Stoian, C.; Lee, S.H. Does foreign direct investment promote institutional development in Africa? Int. Bus. Rev. 2021, 30, 101835. [Google Scholar] [CrossRef]

- Contractor, F.J. The world economy will need even more globalization in the post-pandemic 2021 decade. J. Int. Bus. Stud. 2021, 1–16. [Google Scholar] [CrossRef] [PubMed]

- Kottaridi, C.; Giakoulas, D.; Monolopoulos, D. Escapism FDI from developed Economies: The Role of Regulatory Context and Corporate Taxation. Int. Bus. Rev. 2019, 28, 36–47. [Google Scholar] [CrossRef]

- Soh, K.L.; Wong, W.P.; Tang, C.F. The role of institutions at the nexus of logistic performance and foreign direct investment in Asia. Asian J. Shipp. Logist. 2021, 37, 165–173. [Google Scholar] [CrossRef]

- Azzimonti, M. Does partisan conflict deter FDI inflows to the US? J. Int. Econ. 2019, 120, 162–178. [Google Scholar] [CrossRef]

- Camarero, M.; Moliner, S.; Tamarit, C. Japan’s FDI drivers in a time of financial uncertainty. New evidence based on Bayesian Model Averaging. Jpn. World Econ. 2021, 57, 101058. [Google Scholar] [CrossRef]

- Chen, D.; Yu, X.; Zhang, Z. Foreign direct investment comovement and home country institutions. J. Bus. Res. 2019, 95, 220–231. [Google Scholar] [CrossRef]

- Cicatiello, L.; De Simone, E.; Ercolano, S.; Gaeta, G.L. Assessing the impact of fiscal transparency on FDI inflows. Socio-Econ. Plan. Sci. 2021, 73, 100892. [Google Scholar] [CrossRef]

- Wang, L.-H.; Lin, C.-H.; Fung, H.-G.; Kao, T.-C. Foreign direct investment and downside risk: Evidence from Taiwan. Pac.-Basin Financ. J. 2019, 57, 101114. [Google Scholar] [CrossRef]

- Tang, R.W. Pro-market institutions and outward FDI of emerging market firms: An institutional arbitrage logic. Int. Bus. Rev. 2021, 30, 101814. [Google Scholar] [CrossRef]

- Piteli, E.; Kafouros, M.; Pitelis, C.N. Follow the people and the money: Effects of inward FDI on migrant remittances and the contingent role of new firm creation and institutional infrastructure in emerging. J. World Bus. 2021, 56, 101178. [Google Scholar] [CrossRef]

- Nam, J.; Bon Sesay, J.; Wynne, K.; Zhang, G. Financial efficiency and accounting quality: The impact of institutional micro-factors on FDI. J. Policy Model. 2020, 42, 451–465. [Google Scholar] [CrossRef]

- François, A.; Panel, S.; Weill, L. Educated dictators attract more foreign direct investment. J. Comp. Econ. 2020, 48, 37–55. [Google Scholar] [CrossRef]

- Challe, E.; Lopez, J.I.; Mengus, E. Institutional quality and capital inflows: Theory and evidence. J. Int. Money Financ. 2019, 96, 168–191. [Google Scholar] [CrossRef]

- Antonietti, R.; Franco, C. From FDI to economic complexity: A panel Granger causality analysis. Struct. Chang. Econ. Dyn. 2021, 56, 225–239. [Google Scholar] [CrossRef]

- Gu, J. FDI characteristics, industry homogeneity, and audit fees in Japanese multinationals. J. Multinatl. Financ. Manag. 2021, 61, 100678. [Google Scholar] [CrossRef]

- Kellard, N.M.; Kontonikas, A.; Lamla, M.J.; Maiani, S.; Wood, G. Risk, financial stability and FDI. J. Int. Money Financ. 2020, 120, 102232. [Google Scholar] [CrossRef]

- Slesman, L.; Abubakar, Y.A.; Mitra, J. Foreign direct investment and entrepreneurship: Does the role of institutions matter? Int. Bus. Rev. 2021, 30, 101774. [Google Scholar] [CrossRef]

- Heavilin, J.; Songur, H. Institutional distance and Turkey’s outward foreign direct investment. Res. Int. Bus. Financ. 2020, 54, 101299. [Google Scholar] [CrossRef]

- Jordan, S.; Philips, A.Q. Cointegration testing and dynamic simulations of autoregressive distributed lag models. Stata J. 2018, 18, 902–923. [Google Scholar] [CrossRef] [Green Version]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Reddy, K.S. Pot the ball? Sovereign wealth funds’ outward FDI in times of global financial market turbulence: A yield institu-tions-based view. Cent. Bank Rev. 2019, 19, 129–139. [Google Scholar] [CrossRef]

- Srivastava, S. The role of foreign direct investment in India’s services exports: An empirical investigation. Singap. Econ. Rev. 2006, 51, 175–194. [Google Scholar] [CrossRef]

- Asiedu, E.; Dynamics, A.V.-M. Discount factors and thresholds: Foreign investment when enforcement is imperfect. Macroecon. Dyn. 2000, 4, 1–21. [Google Scholar] [CrossRef] [Green Version]

- Campos, J.; Lien, D.; Pradhan, S. The impact of corruption on investment: Predictability matters. World Dev. 1999, 27, 1059–1067. [Google Scholar] [CrossRef]

- Gastanaga, V.; Nugent, J.B.; Pashamova, B. Host country reforms and FDI inflows: How much dif-ference do they make? World Dev. 1998, 26, 1299–1314. [Google Scholar] [CrossRef]

- Liu, H.; Islam, M.; Khan, M.; Hosain, M.I.; Pervaiz, K. Does financial deepening attract foreign direct investment? Fresh evidence from panel threshold analysis. Res. Int. Bus. Financ. 2020, 53, 101198. [Google Scholar] [CrossRef]

- Aust, V.; Morais, A.I.; Pinto, I. How does foreign direct investment contribute to Sustainable Development Goals? Evidence from African countries. J. Clean. Prod. 2020, 245, 118823. [Google Scholar] [CrossRef]

- Ali, F.; Fiess, N.; MacDonald, R. Climbing to the top? Foreign direct investment and property rights. Econ. Inq. 2010, 49, 289–302. [Google Scholar] [CrossRef] [Green Version]

- Ades, A.; Di Tella, R. Rents, Competition, and Corruption. Am. Econ. Rev. 1999, 89, 982–993. [Google Scholar] [CrossRef]

- Ahmad, M.; Alam, S.; Butt, M.; Haroon, Y. Foreign direct investment, exports, and domestic output in Pakistan. Pak. Dev. Rev. 2003, 42, 715–723. [Google Scholar] [CrossRef] [Green Version]

- Alfaro, L.; Kalemli-Ozcan, S.; Volosocych, V. Capital Flows in a Globalized World: The Role of Policies and Institutions. In Capital Controls and Capital Flows in Emerging Economies: Policies, Practices, and Consequences; University of Chicago Press: Chicago, IL, USA, 2007; pp. 19–72. [Google Scholar]

- Fuentelsaz, L.; Garrido, E.; Maicas, J.P. The effect of informal and formal institutions on foreign market entry selection and performance. J. Int. Manag. 2020, 26, 100735. [Google Scholar] [CrossRef]

- Jung, J. Institutions and Telecommunications Investment. Inf. Econ. Policy 2020, 50, 100849. [Google Scholar] [CrossRef]

- Lakshmi, G.; Saha, S.; Bhattarai, K. Does corruption matter for stock markets? The role of heterogeneous institutions. Econ. Model. 2021, 94, 386–400. [Google Scholar] [CrossRef] [PubMed]

- Athreye, S.; Saeed, A.; Baloch, M.S. Financial crisis of 2008 and outward foreign investments from China and India. J. World Bus. 2021, 56, 101190. [Google Scholar] [CrossRef]

- Buchanan, B.G.; Le, Q.V.; Rishi, M. Foreign direct investment and institutional quality: Some empirical evidence. Int. Rev. Financ. Anal. 2012, 21, 81–89. [Google Scholar] [CrossRef]

- Bhagwati, J.N. In Defence of Globalization; Oxford University Press: Oxford, UK, 2007. [Google Scholar]

- Globerman, S.; Shapiro, D. Global Foreign Direct Investment Flows: The Role of Governance Infrastructure. World Dev. 2002, 30, 1899–1919. [Google Scholar] [CrossRef]

- Uddin, M.; Chowdhury, A.; Zafar, S.; Shafique, S.; Liu, J. Institutional determinants of inward FDI: Evidence from Pakistan. Int. Bus. Rev. 2019, 28, 344–358. [Google Scholar] [CrossRef]

- Dang, D.A. How foreign direct investment promote institutional quality: Evidence from Vietnam. J. Comp. Econ. 2013, 41, 1054–1072. [Google Scholar] [CrossRef]

- Abdel-Latif, H. FDI response to political shocks: What can the Arab Spring tell us? J. Behav. Exp. Financ. 2019, 24, 100233. [Google Scholar] [CrossRef]

- Zhang, M.; Li, G.; Mu, H.L.; Ning, Y.D. Energy and energy efficiencies in the Chinese transportation sector, 1980–2009. Energy 2011, 36, 770–776. [Google Scholar] [CrossRef]

- Rehman, F.U.; Noman, A.A.; Ding, Y. Does infrastructure increase exports and reduce trade deficit? Evidence from selected South Asian countries using a new Global Infrastructure Index. J. Econ. Struct. 2020, 9, 1–23. [Google Scholar] [CrossRef] [Green Version]

- Rehman, F.; Ding, Y.; Noman, A.A.; Khan, M.A. The nexus between infrastructure and export: An empirical evidence from Pakistan. Glob. J. Emerg. Mark. Econ. 2020, 12, 141–157. [Google Scholar] [CrossRef]

- Jordan, S.; Philips, A.Q. Dynamic simulation and testing for single-equation cointegrating and stationary autoregressive distributed lag models. R J. 2019, 10, 469. [Google Scholar] [CrossRef] [Green Version]

- Sarkodie, S.; Strezov, V.; Weldekidan, H.; Asamoah, E.F.; Owusu, P.A.; Doyi, I.N.Y. Environmental sustainability assessment using dynamic autoregressive-distributed lag simulations—Nexus between greenhouse gas emissions, biomass energy. Sci. Total Environ. 2019, 668, 318–332. [Google Scholar] [CrossRef] [PubMed]

- Khan, M.A.; Ahmed, M.; Popp, J.; Oláh, J. US Policy Uncertainty and Stock Market Nexus Revisited through Dynamic ARDL Simulation and Threshold Modelling. Mathematics 2020, 8, 2073. [Google Scholar] [CrossRef]

- Ketteni, E.; Kottaridi, C. The impact of regulations on the FDI-growth nexus within the institution-based view: A nonlinear specification with varying coefficients. Int. Bus. Rev. 2019, 28, 415–427. [Google Scholar] [CrossRef]

- Rehman, F.; Ding, Y.; Noman, A.A.; Khan, M.A. China’s outward foreign direct investment and exports diversification: An asymmetric analysis. J. Chin. Econ. Foreign Trade Stud. 2020, 13, 45–69. [Google Scholar] [CrossRef]

- Rehman, F.; Ding, Y. The nexus between outward foreign direct investment and export sophisti-cation: New evidence from China. Appl. Econ. Lett. 2019, 27, 357–365. [Google Scholar] [CrossRef]

- Zivot, E.; Andrews, D.W.K. Further Evidence on the Great Crash, the Oil-Price Shock, and the Unit-Root Hypothesis. J. Bus. Econ. Stat. 2002, 20, 25–44. [Google Scholar] [CrossRef]

- Narayan, P.K. The saving and investment nexus for China: Evidence from cointegration tests. Appl. Econ. 2005, 37, 1979–1990. [Google Scholar] [CrossRef]

- Gupta, S.; Kumar, N. Time varying dynamics of globalization effect in India. Port. Econ. J. 2020, 1–17. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, M.; Mohammadian, A. Who benefits from euro depreciation in the euro zone? Empirica 2019, 46, 577–595. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, M.; Ratha, A. The J-Curve: A literature review. Appl. Econ. 2004, 36, 1377–1398. [Google Scholar] [CrossRef]

- Lucarelli, S.; Andrini, F.U.; Bianchi, A. Euro depreciation and trade asymmetries between Germany and Italy versus the US: Industry-level estimates. Appl. Econ. 2018, 50, 15–34. [Google Scholar] [CrossRef]

- Rehman, F.U.; Khan, M.A.; Pervaiz, K.; Liaqat, I. The causal, linear and nonlinear nexus between sectoral FDI and infrastructure in Pakistan: Using a new global infrastructure index. Res. Int. Bus. Financ. 2020, 52, 101129. [Google Scholar] [CrossRef]

| IIQ | WR | Min Value | Max Value | SD | |

|---|---|---|---|---|---|

| Invest.Profile | 6.31 | 113 | 3.11 | 7.93 | 1.42 |

| Law and orders | 6.17 | 104 | 2.5 | 7.31 | 0.67 |

| Political | 8.16 | 97 | 2.47 | 10.37 | 2.19 |

| Corruption | 3.41 | 101 | 1.97 | 5.7 | 0.31 |

| Accountability | 5.53 | 111 | 1.05 | 8.97 | 1.17 |

| Bureaucracy | 6.73 | 72 | 3.31 | 5.51 | 0.10 |

| Total Index of Institution | 6.61 | 119 | 2.91 | 7.69 | 0.98 |

| Variables | Obs | Mean | St.Dev | Min | Max |

|---|---|---|---|---|---|

| QI | 30 | 0.096 | 1.048 | −1.714 | 1.846 |

| FDIPR | 30 | 117.348 | 147.104 | −3.689 | 564.13 |

| FDISR | 30 | 647.094 | 346.24 | 119.69 | 1483.40 |

| FDITR | 30 | 641.273 | 997.95 | −183.10 | 3859.50 |

| FDI | 30 | 1546.10 | 1482.788 | 271.90 | 5591 |

| TOP | 30 | 0.33 | 0.038 | 0.254 | 0.388 |

| HCA | 30 | 53.59 | 1.38 | 55.21 | 56.60 |

| DIN | 30 | −0.628 | 0.063 | −0.768 | −0.447 |

| GINF | 30 | −0.674 | 0.235 | −1.93 | −0.32 |

| ADF Test | DF-GLS Test | |||

|---|---|---|---|---|

| Variables | I(0) | I(1) | I(0) | I(1) |

| QI | −1.279 | −4.395 *** | 1.392 | −5.128 *** |

| FDIPR | −5.689 *** | −5.344 *** | −5.892 *** | −5.351 *** |

| FDISR | −1.483 | −3.753 ** | −1.583 | −3.935 *** |

| FDITR | −2.551 | −3.224 ** | −2.702 | −3.368 *** |

| FDI | −2.852 | −3.362 ** | −2.971 * | −3.542 *** |

| TOP | −2.402 | −6.346 *** | −2.538 | −6.157 *** |

| HCA | −3.697 ** | −4.425 *** | −2.583 | −4.948 *** |

| DIN | −5.578 *** | −6.383 *** | −5.803 *** | −6.38 *** |

| GINF | −1.982 | −5.358 *** | −1.542 | −5.483 *** |

| Variables | I(0) | Break | I(1) | Break |

|---|---|---|---|---|

| QI | −2.54 | 2005 | −4.94 *** | 2000 |

| FDIPR | −6.345 *** | 2003 | −6.47 *** | 2008 |

| FDISR | −2.73 | 2010 | −4.54 ** | 2007 |

| FDITR | −3.45 | 2008 | −5.29 *** | 2006 |

| FDI | −3.25 | 2008 | −5.41 *** | 2012 |

| TOP | −3.11 | 2013 | −6.52 *** | 2006 |

| HCA | −2.63 | 1998 | −4.71 ** | 2006 |

| DIN | −5.92 *** | 2009 | −6.29 *** | 2012 |

| GINF | −2.75 | 2003 | −4.52 ** | 2010 |

| QI to Aggregated and Disaggregated FDI | ||||||||

|---|---|---|---|---|---|---|---|---|

| FDI [1] | FDISR [2] | FDIPR [3] | FDITR [4] | |||||

| Variables | F-stat | ECT | F-Stat | ECT | F-Stat | ECT | F-Stat | ECT |

| FDI/QI | 4.84 * | −2.13 | 2.38 | −2.11 | 7.49 *** | −2.49 | 7.67 ** | −2.80 |

| FDI/QI/GINF | 3.08 | −2.35 | 1.75 | −3.55 | 5.67 ** | −2.51 | 5.27 ** | −2.91 |

| FDI/QI/GINF/HCA | 3.86 * | −6.21 *** | 3.31 | −5.58 *** | 12.51 *** | −6.14 ** | 2.95 | −4.19 |

| FDI/QI/GINF/HCA/TOP | 11.8 *** | −8.75 *** | 8.61 *** | 5.42 *** | 9.54 *** | −6.16 ** | 4.43 ** | −7.31 ** |

| FDI/QI/GINF/HCA/TOP/DI | 7.25 *** | −9.2 *** | −9.67 *** | 4.05 * | 4.14 * | −6.16 *** | 5.61 *** | −7.35 *** |

| Aggregated and Disaggregated FDI to QI | ||||||||

|---|---|---|---|---|---|---|---|---|

| FDI [1] | FDISR [2] | FDIPR [3] | FDITR [4] | |||||

| Variables | F−Stat | ECT | F−Stat | ECT | F−Stat | ECT | F−Stat | ECT |

| QI/FDI | 8.32 *** | −0.78 *** | 7.49 ** | −0.28 | 3.48 | −0.37 | 3.48 | −0.28 |

| QI/FDI/GINF | 5.51 ** | −0.78 *** | 4.86 ** | −0.24 | 2.26 | −0.38 | 2.26 | −0.34 |

| QI/FDI/GINF/HCA | 4.37 ** | −0.82 *** | 3.82 * | −0.46 *** | 2.16 | −0.68 *** | 2.13 | −0.26 ** |

| QI/FDI/GINF/HCA/TOP | 3.62 ** | −0.73 *** | 3.72 * | −0.49 *** | 3.9 ** | −0.73 *** | 3.99 ** | −0.37 ** |

| QI/FDI/GINF/HCA/TOP/DIN | 4.94 | −0.64 *** | 4.71 ** | −0.47 *** | 3.42 * | −0.72 *** | 2.09 | −0.46 ** |

| Econometric Issues | Test Names | F-Statistics | p-Values | Null-Hypothesis Accepted/Rejected | Equations |

|---|---|---|---|---|---|

| Heteroscedasticity | Breusch–Pagan–Godfrey | 0.261 | 0.642 | Accepted | |

| Serial Correlation | Breusch–Godfrey LM | 0.796 | 0.478 | Accepted | |

| Normality | Jarque–Bera | 4.773 | 0.219 | Accepted | |

| Specification | Ramsey RESET | 2.544 | 0.142 | Accepted | |

| Heteroscedasticity | Breusch–Pagan–Godfrey | 2.165 | 0.615 | Accepted | |

| Serial Correlation | Breusch–Godfrey LM | 2.942 | 0.340 | Accepted | |

| Normality | Jarque–Bera | 0.108 | 0.831 | Accepted | |

| Specification | Ramsey RESET | 0.137 | 0.756 | Accepted |

| Dependent Variables | Short Run (F-Stat) | Long Run (ECT) | Status H1 | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Aggregated FDI to QI | |||||||||

| D.QI | D.GINF | D.HCA | D.TOP | QI | GINF | HCA | TOP | Accepted | |

| DFDI | 0.33 | 2.27 | 7.497 *** | 0.47 | −0.27 *** | −0.45 *** | −0.44 *** | −0.27 *** | Accepted |

| FDIPR to QI | |||||||||

| DFDI | 0.035 | 0.67 | 0.951 *** | 0.043 | −0.87 *** | −0.83 *** | −0.80 *** | −0.88 *** | Accepted |

| FDISR to QI | |||||||||

| DFDI | 1.41 | 1.11 | 4.51 *** | 2.58 * | −0.12 ** | −0.13 ** | −0.38 *** | −0.17 ** | Accepted |

| FDITR to QI | |||||||||

| DFDI | 0.77 | 1.95 | 1.53 | 0.28 | −0.30 *** | −0.27 *** | −0.52 *** | −0.28 *** | Accepted |

| QI to Aggregated FDI (Reverse Causality) | |||||||||

| D.FDI | D.QI | D.HCA | D.TOP | FDI | QI | HCA | TOP | ||

| DQI | 5.98 *** | 0.49 | 3.65 ** | 0.09 | −0.17 *** | −0.25 *** | −0.15 *** | 0.18 *** | Accepted |

| QI to FDIPR (Reverse Causality) | |||||||||

| DQI | 2.23 * | 0.45 | 0.49 | 3.81 ** | −0.91 *** | 0.92 *** | 0.95 *** | 0.94 *** | Accepted |

| QI to FDISR (Reverse Causality) | |||||||||

| DQI | 1.48 | 0.25 | 4.51 *** | 0.88 | 0.51 *** | 0.34 *** | −0.85 *** | −0.43 *** | Accepted |

| QI to FDITR (Reverse Causality) | |||||||||

| DQI | 1.06 | 2.13 * | 0.41 | 2.35 * | −0.27 *** | −0.36 *** | −0.37 *** | −0.56 *** | Accepted |

| Variables | FDI [1] | FDIPR [2] | FDISR [3] | FDITR [4] |

|---|---|---|---|---|

| 0.421 ** | 0.164 | 0.138 | 0.201 | |

| (0.015) | (0.285) | 0.163) | (0.341) | |

| 0.214 ** | 0.101 | 0.393 | 0.458 | |

| (0.042) | (0.295) | 0.274) | (0.528) | |

| 5.58 *** | 1.302 ** | 7.34 *** | −8.83 * | |

| (1.523) | (0.852) | (2.624) | (3.725) | |

| 6.47 ** | 11.29 | 3.182 | 5.472 | |

| (1.528) | (14.842) | (2.264) | (6.725) | |

| 3.47 *** | 3.685 | 8.263 | 6.581 *** | |

| (0.328) | (3.716) | (9.625) | (3.872) | |

| −3.68 ** | −2.79 | 12.64 | −11.51 | |

| (1.625) | (3.726) | (13.924) | (9582) | |

| 0.689 ** | 0.207 * | 3.294 *** | 1.504 *** | |

| (0.062) | (0.074) | (0.973) | (0.042) | |

| −0.876 ** | 2.38 *** | 10.27 *** | 7.759 *** | |

| (0.023) | (0.528) | (4.827) | (5.826) | |

| 0.937 ** | 0.655 * | 0.386 * | 0.191 | |

| (0.064) | (0.924) | (0.173) | (0.620) | |

| 4.35 ** | 10.58 *** | 12.86 *** | 10.37 *** | |

| (1.623) | (3.825) | (6.74) | (7.105) | |

| 35.53 ** | 10.35 ** | 47.47 *** | 56.49 *** | |

| (18.726) | (5.104) | (28.618) | (10.815) | |

| 1.36 * | −0.83 * | 5.67 | −4.27 | |

| (0.805) | (0.091) | (6.810) | (3.326) | |

| −21.94 *** | −66.82 *** | −31.21 ** | −43.53 *** | |

| (3.917) | (4.325) | (6.160) | (5.013) | |

| 7.28 *** | 3.27 ** | 1.21 | 2.85 | |

| 34 | 34 | 34 | 34 | |

| 0.901 | 0.932 | 0.893 | 0.912 | |

| 0.412 * | 0.141 * | 8.52 *** | 0.013 | |

| 5.23 *** | 1.93 * | 1.45 * | 1.92 * | |

| Variables | FDI [1] | FDIPR [2] | FDISR [3] | FDITR [4] |

|---|---|---|---|---|

| 0.421 ** | 0.164 | 0.138 | 0.201 | |

| (0.015) | (0.285) | 0.163) | (0.341) | |

| 0.214 ** | 0.101 | 0.393 | 0.458 | |

| (0.042) | (0.295) | 0.274) | (0.528) | |

| 5.58 *** | 1.302 ** | 7.34 *** | −8.83 * | |

| (1.523) | (0.852) | (2.624) | (3.725) | |

| 6.47 ** | 11.29 | 3.182 | 5.472 | |

| (1.528) | (14.842) | (2.264) | (6.725) | |

| 3.47 *** | 3.685 | 8.263 | 6.581 *** | |

| (0.328) | (3.716) | (9.625) | (3.872) | |

| −3.68 ** | −2.79 | 12.64 | −11.51 | |

| (1.625) | (3.726) | (13.924) | (9582) | |

| 0.689 ** | 0.207 * | 3.294 *** | 1.504 *** | |

| (0.062) | (0.074) | (0.973) | (0.042) | |

| −0.876 ** | 2.38 *** | 10.27 *** | 7.759 *** | |

| (0.023) | (0.528) | (4.827) | (5.826) | |

| 0.937 ** | 0.655 * | 0.386 * | 0.191 | |

| (0.064) | (0.924) | (0.173) | (0.620) | |

| 4.35 ** | 10.58 *** | 12.86 *** | 10.37 *** | |

| (1.623) | (3.825) | (6.74) | (7.105) | |

| 35.53 ** | 10.35 ** | 47.47 *** | 56.49 *** | |

| (18.726) | (5.104) | (28.618) | (10.815) | |

| 1.36 * | −0.83 * | 5.67 | −4.27 | |

| (0.805) | (0.091) | (6.810) | (3.326) | |

| −21.94 *** | −66.82 *** | −31.21 ** | −43.53 *** | |

| (3.917) | (4.325) | (6.160) | (5.013) | |

| 7.28 *** | 3.27 ** | 1.21 | 2.85 | |

| 34 | 34 | 34 | 34 | |

| 0.901 | 0.932 | 0.893 | 0.912 | |

| 0.412 * | 0.141 * | 8.52 *** | 0.013 | |

| 5.23 *** | 1.93 * | 1.45 * | 1.92 * | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rehman, F.U.; Popp, J.; Ahmad, E.; Khan, M.A.; Lakner, Z. Asymmetric and Symmetric Link between Quality of Institutions and Sectorial Foreign Direct Investment Inflow in India: A Fresh Insight Using Simulated Dynamic ARDL Approach. Sustainability 2021, 13, 13760. https://doi.org/10.3390/su132413760

Rehman FU, Popp J, Ahmad E, Khan MA, Lakner Z. Asymmetric and Symmetric Link between Quality of Institutions and Sectorial Foreign Direct Investment Inflow in India: A Fresh Insight Using Simulated Dynamic ARDL Approach. Sustainability. 2021; 13(24):13760. https://doi.org/10.3390/su132413760

Chicago/Turabian StyleRehman, Faheem Ur, József Popp, Ejaz Ahmad, Muhammad Asif Khan, and Zoltán Lakner. 2021. "Asymmetric and Symmetric Link between Quality of Institutions and Sectorial Foreign Direct Investment Inflow in India: A Fresh Insight Using Simulated Dynamic ARDL Approach" Sustainability 13, no. 24: 13760. https://doi.org/10.3390/su132413760