Towards Personal Financial Sustainability Based on Human Capital Analysis in Korea

Abstract

:1. Introduction

2. Models for Human Capital and Asset Allocation

2.1. Income Process

2.2. Risk of Income

2.3. Portfolio Model

3. Human Capital Analysis

3.1. Income Data

3.2. Fixed Effects Analysis

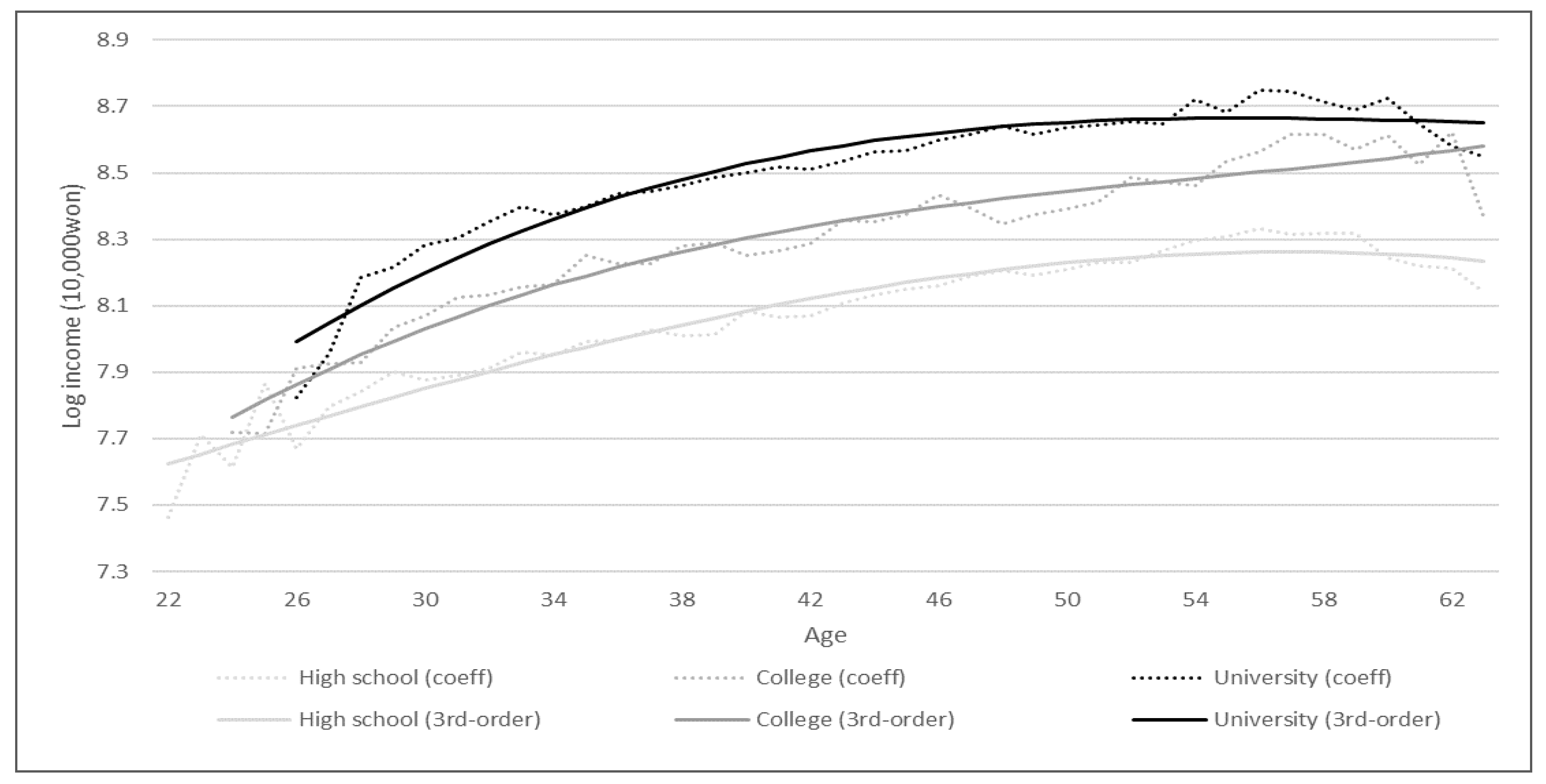

3.2.1. Fixed Effects Regression by Education

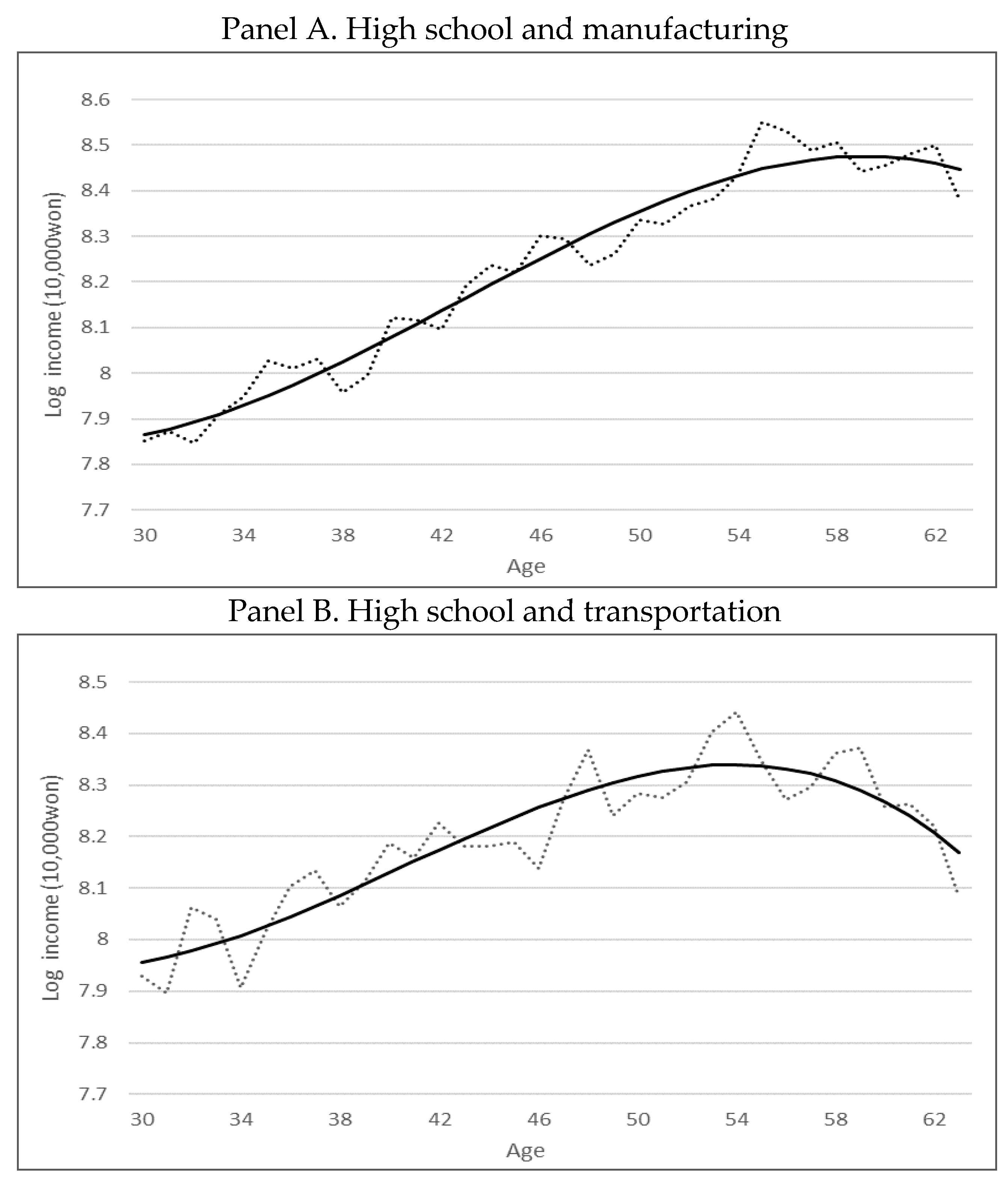

3.2.2. Fixed Effects Regression by Education and Industry

4. Life-Cycle Asset Allocation

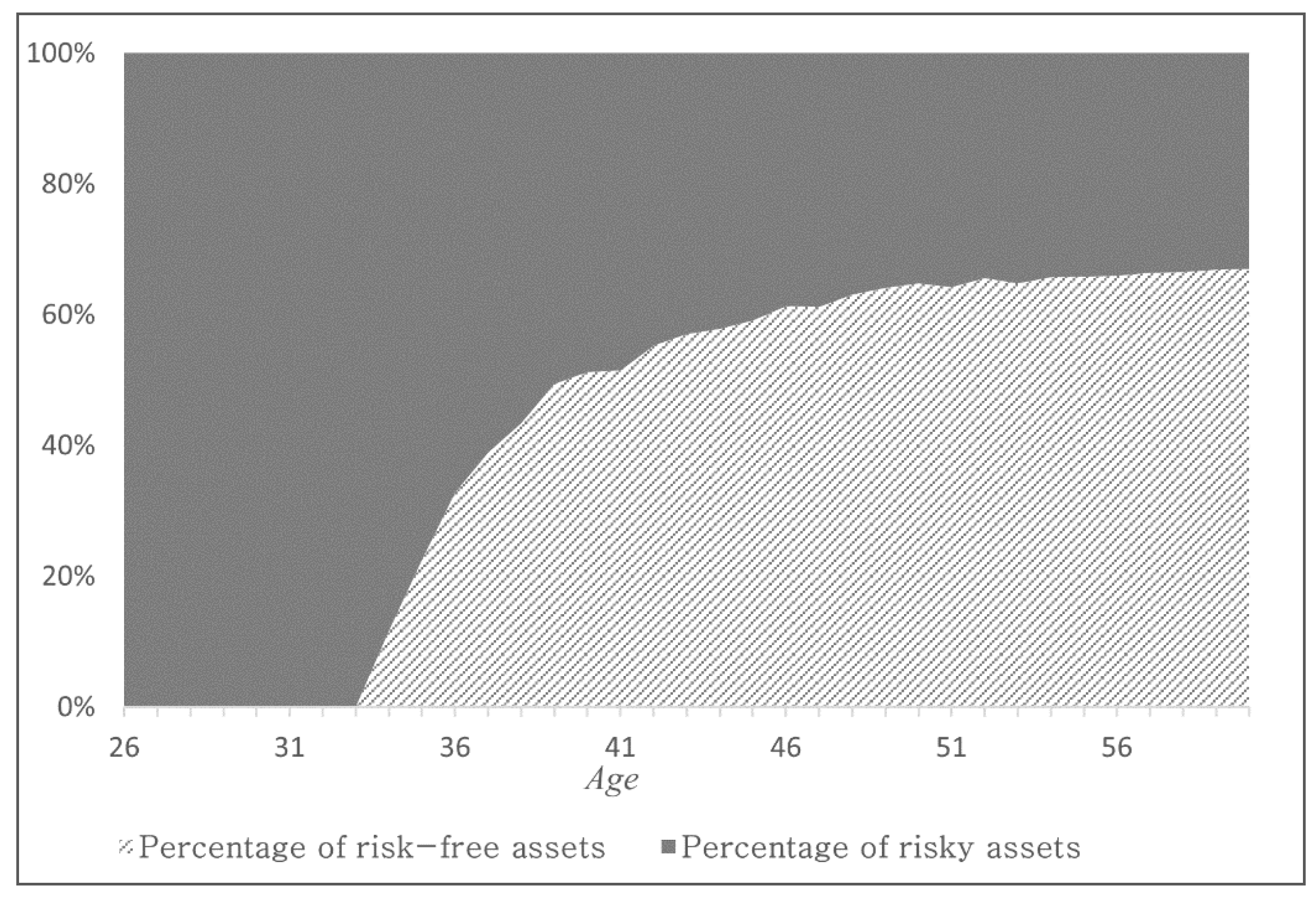

4.1. Asset Allocation Based on Education Level

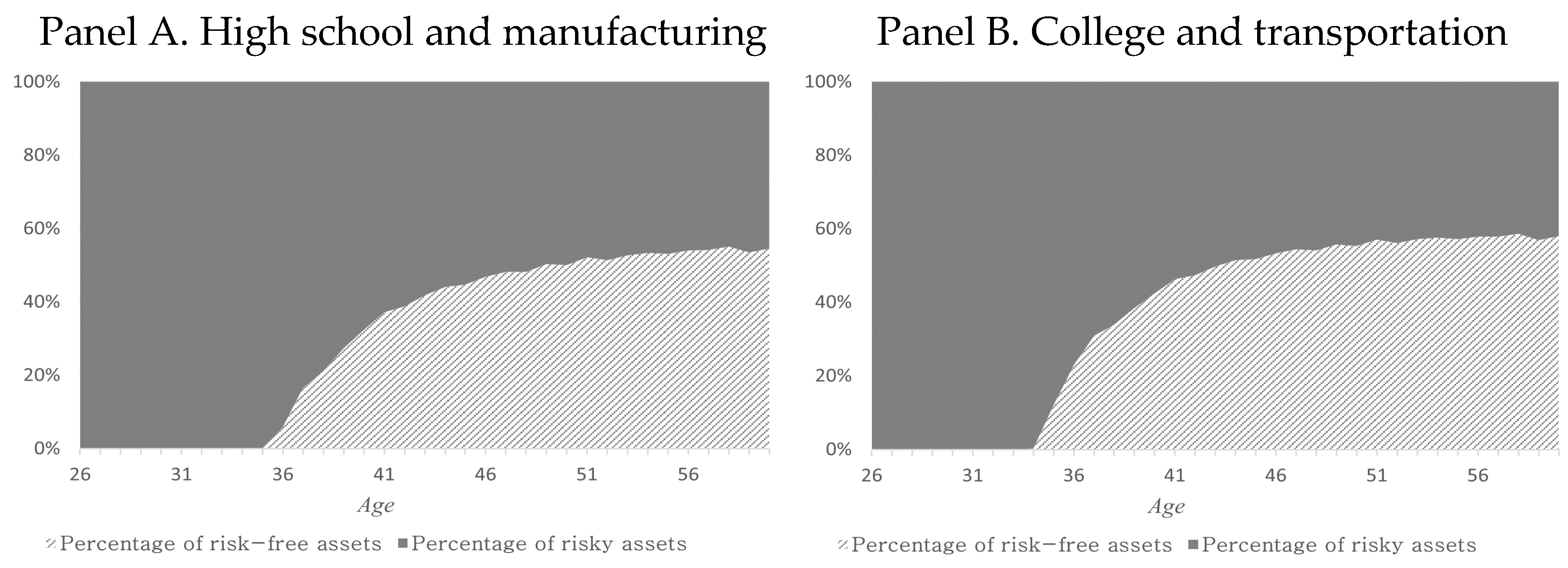

4.2. Asset Allocation Based on Education and Industry

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- OECD. Health at a Glance 2019: OECD Indicators; OECD Publishing: Paris, France, 2019. [Google Scholar] [CrossRef]

- Han, J.; Ko, D.; Choe, H. Classifying retirement preparation planners and doers: A multi-country study. Sustainability 2019, 11, 2815. [Google Scholar] [CrossRef] [Green Version]

- Markowitz, H.M. Portfolio selection. J. Financ. 1952, 7, 77–91. [Google Scholar]

- Fabozzi, F.J.; Gupta, F.; Markowitz, H.M. The legacy of modern portfolio theory. J. Investig. 2002, 11, 7–22. [Google Scholar] [CrossRef] [Green Version]

- Kolm, P.N.; Tütüncü, R.; Fabozzi, F.J. 60 Years of portfolio optimization: Practical challenges and current trends. Eur. J. Oper. Res. 2014, 234, 356–371. [Google Scholar] [CrossRef]

- Kim, W.C.; Kim, J.H.; Fabozzi, F.J. Robust Equity Portfolio Management + Website: Formulations, Implementations, and Properties Using MATLAB; John Wiley & Sons: Hoboken, NJ, USA, 2015. [Google Scholar]

- Lee, Y.; Kim, W.C.; Kim, J.H. Achieving portfolio diversification for individuals with low financial sustainability. Sustainability 2020, 12, 7073. [Google Scholar] [CrossRef]

- Modigliani, F. The life cycle hypothesis of saving, the demand for wealth and the supply of capital. Soc. Res. 1966, 33, 160–217. [Google Scholar]

- Kritzman, M. Target-date funds: A regime-based approach. J. Retire. 2017, 5, 96–105. [Google Scholar] [CrossRef]

- Mincer, J. Investment in human capital and personal income distribution. J. Political Econ. 1958, 66, 281–302. [Google Scholar] [CrossRef]

- Merton, R.C. Optimum consumption and portfolio rules in a continuous-time model. J. Econ. Theory 1971, 3, 373–413. [Google Scholar] [CrossRef] [Green Version]

- Zanella, N. Risk Capacity over the Life Cycle: The Role of Human Capital, High Priority Goals, and Discretionary Wealth. J. Wealth Manag. 2015, 18, 27. [Google Scholar] [CrossRef]

- Bodie, Z.; Merton, R.C.; Samuelson, W.F. Labor supply flexibility and portfolio choice in a life cycle model. J. Econ. Dyn. Control 1992, 16, 427–449. [Google Scholar] [CrossRef] [Green Version]

- Heaton, J.; Lucas, D. Market frictions, savings behavior, and portfolio choice. Macroecon. Dyn. 1997, 1, 76–101. [Google Scholar] [CrossRef]

- Viceira, L.M. Optimal portfolio choice for long-horizon investors with nontradable labor income. J. Financ. 2001, 56, 433–470. [Google Scholar] [CrossRef]

- Benzoni, L.; Collin-Dufresne, P.; Goldstein, R.S. Portfolio choice over the life-cycle when the stock and labor markets are cointegrated. J. Financ. 2007, 62, 2123–2167. [Google Scholar] [CrossRef]

- Kim, K.; Yoo, K. Impact of Aging on Household Finance Behavior: Analysis Using the OECD National Panel; KIF Working Paper; Korea Institute of Finance: Seoul, Korea, 2014; pp. 1–57. [Google Scholar]

- Jeong, W.; Kim, M. Activation of Lifetime Asset Management Service in response to aging population. Korea Insur. Res. Inst. 2015, 2015, 1–91. [Google Scholar]

- Ibbotson, R.G.; Milevsky, M.A.; Chen, P.; Zhu, K.X. Lifetime Financial Advice: Human Capital, Asset Allocation, and Insurance; The Research Foundation of CFA Institute: Charlottesville, VA, USA, 2007; pp. 1–103. [Google Scholar]

- Cocco, J.F.; Gomes, F.J.; Maenhout, P.J. Consumption and portfolio choice over the life cycle. Rev. Financ. Stud. 2005, 18, 491–533. [Google Scholar] [CrossRef]

- Carroll, C.D.; Samwick, A. The Nature of Precautionary Wealth. J. Monet. Econ. 1997, 40, 41–72. [Google Scholar] [CrossRef] [Green Version]

- Chae, J.E.; Hong, H.K. The expansion of higher education led by private universities in Korea. Asia Pac. J. Educ. 2009, 29, 341–355. [Google Scholar] [CrossRef]

- Yoon, J.; Park, S.; Kim, D.J. Assessing the Effects of Higher-Education Factors on the Job Satisfaction of Engineering Graduates in Korea. Sustainability 2020, 12, 3342. [Google Scholar] [CrossRef] [Green Version]

- Weinberg, B.A. Long-term wage fluctuations with industry-specific human capital. J. Labor Econ. 2001, 19, 231–264. [Google Scholar] [CrossRef]

- Estrada, J. The retirement Glidepath: An international perspective. J. Investig. 2016, 25, 28–54. [Google Scholar] [CrossRef]

- Neal, D. Industry-specific human capital: Evidence from displaced workers. J. Labor Econ. 1995, 13, 653–677. [Google Scholar] [CrossRef] [Green Version]

| Survey Number | Year | Number of Households | Number of Individuals |

|---|---|---|---|

| 1 | 1998 | 5000 | 13,321 |

| 2 | 1999 | 4507 | 12,037 |

| 3 | 2000 | 4266 | 11,205 |

| 4 | 2001 | 4248 | 11,051 |

| 5 | 2002 | 4298 | 10,966 |

| 6 | 2003 | 4592 | 11,541 |

| 7 | 2004 | 4761 | 11,660 |

| 8 | 2005 | 4849 | 11,580 |

| 9 | 2006 | 5001 | 11,756 |

| 10 | 2007 | 5069 | 11,855 |

| 11 | 2008 | 5116 | 11,734 |

| 12 | 2009 | 6721 | 14,489 |

| 13 | 2010 | 6683 | 14,118 |

| 14 | 2011 | 6686 | 13,899 |

| 15 | 2012 | 6753 | 13,998 |

| 16 | 2013 | 6785 | 13,887 |

| 17 | 2014 | 6838 | 13,168 |

| 18 | 2015 | 6934 | 14,011 |

| 19 | 2016 | 7012 | 14,202 |

| 20 | 2017 | 7066 | 14,475 |

| 21 | 2018 | 7090 | 14,444 |

| High School | College | University | ||

|---|---|---|---|---|

| Coeff. | Intercept | 7.507 *** | 7.802 *** | 7.872 *** |

| Family size | 0.059 *** | 0.051 *** | 0.044 *** | |

| Marital status | 0.320 *** | 0.255 *** | 0.384 *** | |

| Sample size | 23,510 | 7388 | 16,218 | |

| R2 | 0.122 | 0.171 | 0.146 | |

| Adj. R2 | 0.121 | 0.167 | 0.143 | |

| F-statistic | 74.24 | 36.17 | 68.88 | |

| High School | College | University | |

|---|---|---|---|

| Intercept | −1.177 | −3.003 | −3.253 |

| Age | 0.029 | 0.148 | 0.170 |

| Age2/10 | 0.002 | −0.026 | −0.027 |

| Age3/100 | −0.001 | 0.002 | 0.001 |

| R2 | 0.937 | 0.939 | 0.923 |

| Adj. R2 | 0.932 | 0.934 | 0.917 |

| High School | College | University | |

|---|---|---|---|

| 0.175 *** | 0.146 *** | 0.141 *** | |

| 0.005 *** | 0.010 *** | 0.005 *** | |

| ρ | 0.633 ** | 0.335 | −0.011 ** |

| Manufacturing | Transportation | |||||

|---|---|---|---|---|---|---|

| High School | College | University | High School | College | University | |

| Intercept | 8.167 *** | 7.996 *** | 8.243 *** | 7.623 *** | 7.707 *** | 7.815 *** |

| Family size | 0.068 *** | 0.082 *** | 0.007 | 0.053 *** | 0.043 | 0.039 |

| Marital status | 0.225 *** | 0.210 *** | 0.351 *** | 0.416 *** | 0.556 *** | 0.232 ** |

| Age poly. intercept | 1.320 | 2.238 | −1.942 | 1.558 | −5.920*** | 5.703 |

| Age | −0.171 ** | −0.205 | 0.079 | −0.167 * | 0.353 *** | −0.425 * |

| Age2/10 | 0.047 *** | 0.054 | −0.008 | 0.046 ** | −0.069 ** | 0.106 * |

| Age3/100 | −0.004 *** | −0.004 * | 0.000 | −0.004 ** | 0.005 ** | −0.008 ** |

| Manufacturing | Transportation | |||||

|---|---|---|---|---|---|---|

| High School | College | University | High School | College | University | |

| 0.129 *** | 0.132 *** | 0.099 *** | 0.110 *** | 0.105 *** | 0.103 *** | |

| 0.006 *** | 0.004 | 0.004 *** | 0.004 *** | 0.001 | 0.000 | |

| Risky Asset | Risk-Free Asset | |

|---|---|---|

| Annualized mean | 11% | 4% |

| Annualized std. dev. | 24% | - |

| High School | College | University | ||||

|---|---|---|---|---|---|---|

| Age | Risky Asset | Risk-Free Asset | Risky Asset | Risk-Free Asset | Risky Asset | Risk-Free Asset |

| 26 | 100% | - | 100% | - | 100% | - |

| 30 | 100% | - | 100% | - | 100% | - |

| 34 | 88.34% | 11.66% | 97.04% | 2.96% | 100% | - |

| 35 | 77.44% | 22.56% | 83.81% | 16.19% | 89.29% | 10.71% |

| 40 | 48.75% | 51.53% | 50.50% | 49.50% | 51.89% | 48.11% |

| 45 | 40.80% | 59.20% | 41.53% | 58.47% | 41.98% | 58.02% |

| 50 | 35.13% | 64.87% | 35.51% | 64.49% | 35.73% | 64.27% |

| 55 | 34.16% | 65.84% | 34.37% | 65.63% | 34.48% | 65.52% |

| 60 | 33.01% | 66.99% | 32.99% | 67.01% | 32.99% | 67.01% |

| High School | College | University | |

|---|---|---|---|

| Construction | 0.653 | 0.283 | 0.030 |

| Educational service | 0.495 | 0.331 | 0.057 |

| Agriculture, forestry and fisheries | 0.600 | 0.516 | 0.086 |

| Real estate and rental | 0.109 | 0.041 | 0.084 |

| Accommodation and restaurant business | 0.216 | 0.273 | −0.321 |

| Transportation | 0.576 | 0.238 | 0.071 |

| Manufacturing | 0.086 | 0.011 | 0.110 |

| High School & Manufacturing | College & Transportation | |||

|---|---|---|---|---|

| Age | Risky Asset | Risk-Free Asset | Risky Asset | Risk-Free Asset |

| 26 | 100% | - | 100% | - |

| 30 | 100% | - | 100% | - |

| 34 | 100% | - | 99.77% | 0.23% |

| 35 | 100% | - | 87.98% | 12.02% |

| 36 | 94.10% | 5.90% | 77.07% | 22.93% |

| 40 | 67.65% | 32.35% | 57.56% | 42.44% |

| 45 | 55.29% | 44.71% | 48.25% | 51.75% |

| 50 | 49.96% | 50.04% | 44.62% | 55.38% |

| 55 | 46.93% | 53.07% | 42.82% | 57.18% |

| 60 | 45.47% | 54.53% | 42.03% | 57.97% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, J.; Lee, G.; Kim, J.H. Towards Personal Financial Sustainability Based on Human Capital Analysis in Korea. Sustainability 2021, 13, 2700. https://doi.org/10.3390/su13052700

Yu J, Lee G, Kim JH. Towards Personal Financial Sustainability Based on Human Capital Analysis in Korea. Sustainability. 2021; 13(5):2700. https://doi.org/10.3390/su13052700

Chicago/Turabian StyleYu, Jaeyong, Gunyoung Lee, and Jang Ho Kim. 2021. "Towards Personal Financial Sustainability Based on Human Capital Analysis in Korea" Sustainability 13, no. 5: 2700. https://doi.org/10.3390/su13052700