Assessing Customer Preferences for Shopping Centers: Effects of Functional and Communication Factors

Abstract

:1. Introduction

2. Literature Review

- Discuss selections factors (functional and socio-communication) of customer preference for shopping centers.

- Construct a hierarchical framework of establish a sustainable design model of future development of shopping centers.

3. Materials and Methods

4. Results

5. Discussion

Research Limitations and Future Study

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Amirtha, R.; Sivakumar, V.J.; Hwang, Y. Influence of Perceived Risk Dimensions on e-Shopping Behavioural Intention among Women—A Family Life Cycle Stage Perspective. J. Theor. Appl. Electron. Commer. Res. 2020, 16, 320–355. [Google Scholar] [CrossRef]

- Ballestar, M.T. Editorial: Segmenting the future of e-commerce, one step at a time. J. Theor. Appl. Electr. Commer. Res. 2021, 16. [Google Scholar] [CrossRef]

- Delgado-de Miguel, J.F.; Buil-Lopez Menchero, T.; Esteban-Navarro, M.Á.; García-Madurga, M.Á. Proximity Trade and Urban Sustainability: Small Retailers’ Expectations Towards Local Online Marketplaces. Sustain. J. Rec. 2019, 11, 7199. [Google Scholar] [CrossRef] [Green Version]

- Lin, Y.-C.; Lee, C.L.; Newell, G. The added-value role of industrial and logistics REITs in the Pacific Rim region. J. Prop. Investig. Finance 2020, 38, 597–616. [Google Scholar] [CrossRef]

- He, B.; Bai, K.-J. Digital twin-based sustainable intelligent manufacturing: A review. Adv. Manuf. 2021, 9, 1–21. [Google Scholar] [CrossRef]

- Pham, H.; Kim, S.-Y. The effects of sustainable practices and managers’ leadership competences on sustainability performance of construction firms. Sustain. Prod. Consum. 2019, 20, 1–14. [Google Scholar] [CrossRef]

- Oldenburg, R. The Great Good Place: Cafes, Coffee Shops, Community Centers, Beauty Parlors, General Stores, Bars, Hangouts and How They Get You through the Day, 1st ed.; Paragon House: New York, NY, USA, 1989. [Google Scholar]

- Ritzer, G.; Ryan, J.M. (Eds.) The Concise Encyclopedia of Sociology; Blackwell Publishing Ltd.: Oxford, UK, 2011. [Google Scholar]

- Noble, A.J.; Schenk, T. Psychological distress after subarachnoid hemorrhage: Patient support groups can help us better detect it. J. Neurol. Sci. 2014, 343, 125–131. [Google Scholar] [CrossRef]

- Phelan, H.A. A New Model for Shopping Malls|Intelligence|BoF. Available online: https://www.businessoffashion.com/articles/intelligence/a-new-model-for-shopping-malls (accessed on 28 September 2020).

- Goldman, A.I. Pathways to Knowledge; Oxford University Press (OUP): Oxford, UK, 2002. [Google Scholar]

- Guy, C.M. Classifications of retail stores and shopping centres: Some methodological issues. GeoJournal 1998, 45, 255–264. [Google Scholar] [CrossRef]

- Guy, C. Internationalisation of large-format retailers and leisure providers in western Europe: Planning and property impacts. Int. J. Retail. Distrib. Manag. 2001, 29, 452–461. [Google Scholar] [CrossRef]

- Nickson, D.; Warhurst, C.; Dutton, E. The importance of attitude and appearance in the service encounter in retail and hospitality. Manag. Serv. Qual. Int. J. 2005, 15, 195–208. [Google Scholar] [CrossRef]

- Peiser, R.; Hamilton, D. Professional Real Estate Development: The ULI Guide to the Business, 3rd ed.; Urban Land Institute: Washington, DC, USA, 2012. [Google Scholar]

- Burt, S.; Davies, K.; Dawson, J.; Sparks, L. Categorizing patterns and processes in retail grocery internationalisation. J. Retail. Consum. Serv. 2008, 15, 78–92. [Google Scholar] [CrossRef]

- Blut, M.; Beatty, S.E.; Evanschitzky, H.; Brock, C. The Impact of Service Characteristics on the Switching Costs–Customer Loyalty Link. J. Retail. 2014, 90, 275–290. [Google Scholar] [CrossRef]

- Sekliuckiene, J.; Žitkienė, R. Innovative Changes of the Retailing System’s Competition Development in Lithuania. Manag. Organ. Syst. Res. 2003, 28, 125–135. [Google Scholar]

- Rudienė, E.; Vengrauskas, V. Mažmeninės prekybos internacionalizavimo lygio rodiklių nustatymas ir jų vertinimas. Bus. Syst. Econ. 2011, 8234, 129–137. [Google Scholar]

- Gudonavičienė, R.; Alijošienė, S. Influence of Shopping Centre Image Attributes on Customer Choices. Econ. Manag. 2013, 18, 545–552. [Google Scholar] [CrossRef] [Green Version]

- Langvinienė, N.; Sekliuckiene, J. Internationalization in Retail Trade Services Market as Latecomer Countries Problem: The Case of Lithuania. Soc. Sci. 2011, 73, 74–85. [Google Scholar] [CrossRef] [Green Version]

- ICSC. Shopping Center Definitions. Available online: https://www.icsc.com/news-and-views/research/shopping-center-definitions (accessed on 28 September 2020).

- Thang, D.C.L.; Tan, B.L.B. Linking consumer perception to preference of retail stores: An empirical assessment of the multi-attributes of store image. J. Retail. Consum. Serv. 2003, 10, 193–200. [Google Scholar] [CrossRef]

- Cachero-Martinez, S.; Vazquez-Casielle, R. Living positive experiences in store: How it influences shopping experience value and satisfaction? J. Bus. Econ. Manag. 2017, 18, 537–553. [Google Scholar] [CrossRef] [Green Version]

- Darian, J.C.; Tucci, L.A.; Wiman, A.R. Perceived salesperson service attributes and retail patronage intentions. Int. J. Retail. Distrib. Manag. 2001, 29, 205–213. [Google Scholar] [CrossRef]

- Rao, F. Resilient Forms of Shopping Centers Amid the Rise of Online Retailing: Towards the Urban Experience. Sustain. J. Rec. 2019, 11, 3999. [Google Scholar] [CrossRef] [Green Version]

- Han, H.; Sahito, N.; Nguyen, T.V.T.; Hwang, J.; Asif, M. Exploring the Features of Sustainable Urban Form and the Factors that Provoke Shoppers towards Shopping Malls. Sustain. J. Rec. 2019, 11, 4798. [Google Scholar] [CrossRef] [Green Version]

- Barata-Salgueiro, T.; Guimarães, P. Public Policy for Sustainability and Retail Resilience in Lisbon City Center. Sustain. J. Rec. 2020, 12, 9433. [Google Scholar] [CrossRef]

- Goodman, R. City Structures 22 Sustainable Form and the Shopping Mall City Structures 22-1. Sustainable Urban Form and the Shopping Mall: An Investigation of Retail Provision in New Housing Subdivisions in Melbourne’s Growth Areas; Oxford University Press: Oxford, UK, 2003. [Google Scholar] [CrossRef]

- Chebat, J.-C.; Michon, R.; Haj-Salem, N.; Oliveira, S. The effects of mall renovation on shopping values, satisfaction and spending behaviour. J. Retail. Consum. Serv. 2014, 21, 610–618. [Google Scholar] [CrossRef]

- Pantano, E.; Timmermans, H. (Eds.) Advanced Technologies Management for Retailing; IGI Global: Hershey, PA, USA, 2011. [Google Scholar]

- DeLisle, J.R. Toward the Global Classification of Shopping Centers. Int. Counc. Shopp. Centers En línea. 2009, 27. Available online: http//www.icsc.org/srch/rsrch/wp/GlobalRetailClass_Feb2009.pdf (accessed on 10 February 2009).

- Coleman, P. Shopping Environments: Evolution, Planning and Design; Routledge: Oxford, UK, 2006. [Google Scholar]

- Dunne, P.M.; Lusch, R.F.; Griffith, D.A. Retailing. South-Western College Pub, 4th ed.; South-Western College Pub: Mason, WA, USA, 2001. [Google Scholar]

- Reilly, W.J. University of Texas Bulletin Methods for the Study of Retail; University of Texas: Austin, TX, USA, 1929. [Google Scholar]

- Delic, M.; Knezevic., B. Development of Shopping Centers in Central and Southeastern Europe. In DAAAM International Scientific Book 2013; DAAAM International: Vienna, Austria, 2014; pp. 471–484. [Google Scholar]

- Girdzijauskas, S.; Štreimikienė, D.; Mackevičius, R. Ekonominių Svyravimų Logistinė Analizė Sektoriaus Stagnacija; Journal of Management: Klaipėda, Lithuania, 2009; Volume 14. [Google Scholar]

- Perreault, W.D.; McCarthy, E.J. Basic Marketing: A Global-Managerial Approach, 15th ed.; McGraw-Hill/Irwin: Boston, MA, USA, 2005. [Google Scholar]

- Varley, R.; Rafiq, M. Principles of Retail Management; Palgrave Macmillan: London, UK, 2004. [Google Scholar]

- Karatepe, O.M. Service Quality, Customer Satisfaction and Loyalty: The Moderating Role of Gender/Aptarnavimo Kokybė, Vartotojų Pasitenkinimas Ir Lojalumas Vartotojų Lyties Atžvilgiu. J. Bus. Econ. Manag. 2011, 12, 278–300. [Google Scholar] [CrossRef] [Green Version]

- Blackwell, R.D.; Engel, F.J.; Miniard, P.W. Consumer Behavior; Harcourt College Publishers: London, UK, 2001. [Google Scholar]

- Levy, M.; Witz, B.; Grewal, D. Retailing Management, 10th ed.; McGraw-Hill/Irwin: New York, NY, USA, 2019. [Google Scholar]

- Sullivan, M.; Adcock, D. Retail Marketing; Cengage Learning EMEA: London, UK, 2002. [Google Scholar]

- The SAGE. Handbook of Qualitative Research|SAGE Publications Inc. Available online: https://us.sagepub.com/en-us/nam/the-sage-handbook-of-qualitative-research/book242504 (accessed on 23 February 2021).

- Borowski, P.F. New Technologies and Innovative Solutions in the Development Strategies of Energy Enterprises. HighTech Innov. J. 2020, 1, 39–58. [Google Scholar] [CrossRef]

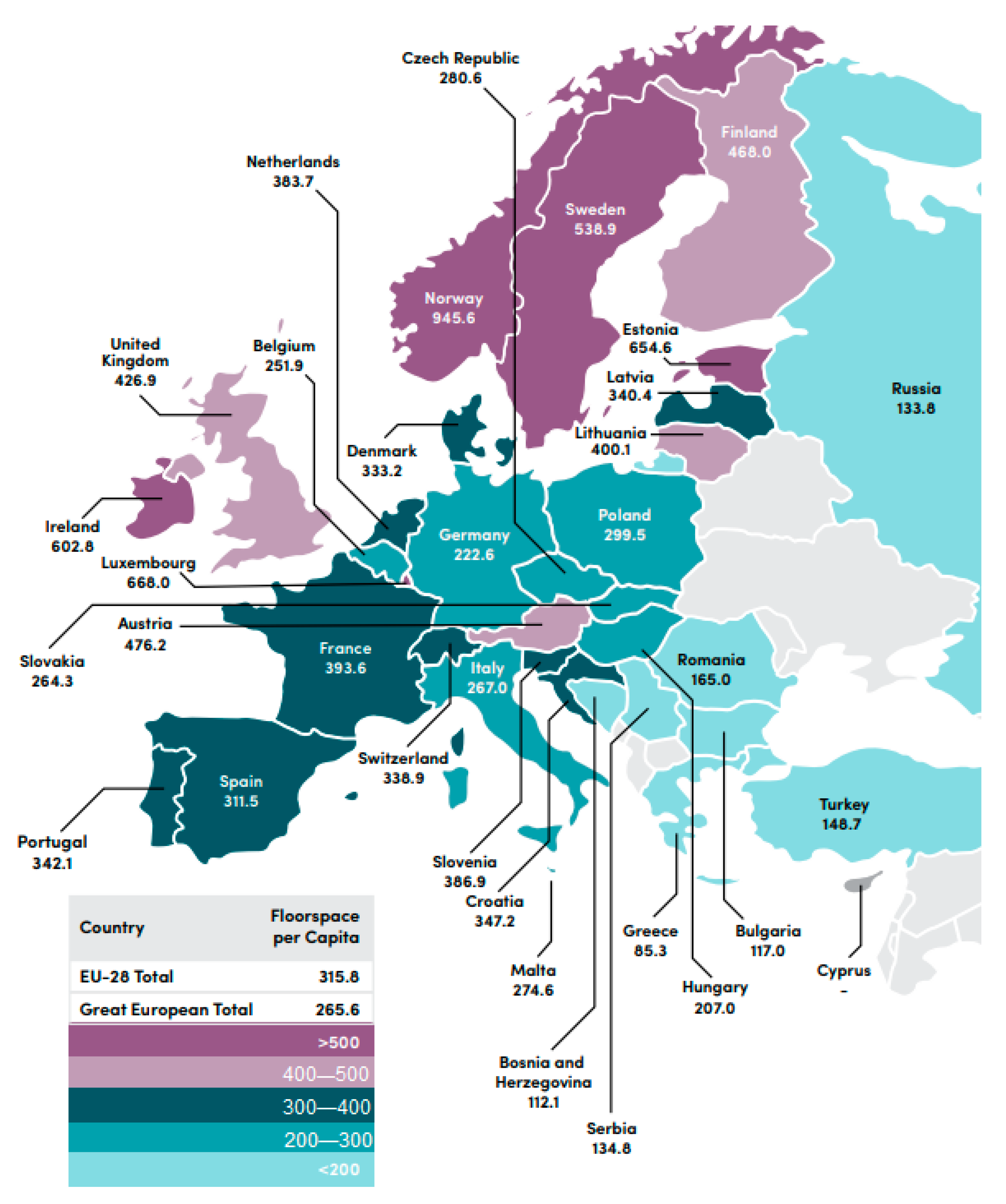

- ICSC. The Socio-Economic Impact of European Retail Real Estate. Available online: https://www.icsc.com/uploads/t07-subpage/European_Impact_Study-2017.pdf (accessed on 28 September 2017).

- Zubrutė, L. Asociacijos Siūlo, Kaip Kompensuoti Patalpų Nuomos Kaštus—Verslo Žinios. Available online: https://www.vz.lt/nekilnojamasis-turtas-statyba/2020/04/10/asociacija-valstybei-siulo-kompensuoti-patalpu-nuomoskastus (accessed on 29 September 2020).

- Čiulada, L. Didžiausi 2017 m. sandoriai ir ko laukti 2018-aisiais—Verslo žinios. Available online: https://www.vz.lt/rinkos/2018/01/02/didziausi-2017-m-sandoriai-ir-ko-laukti-2018-aisiais#ixzz6KbidaWfH (accessed on 28 September 2020).

| Products and Services | Customer Service | Impact Factors | Functional Factors | Social-Communication Factors | Social-Demographic Factors |

|---|---|---|---|---|---|

| Assortment [9,33,37,39,41,42] | Quality [9,20,31,33,38,41,43] | Shopping center image [14,15,20,41] | Location [9,12,23,26,31,38] | Working hours [42] | Age |

| Quality of goods [33,38,39,43] | Speed [9,20,38,41,43] | Public opinion [14,20,41] | Size [9,20,32] | Advertising [38,41,43] | Gender |

| Price level [9,23,38,41,43] | Number of consultations [20,43] | Media opinion [14,41] | Atmosphere [9,20,39] | Promotion and sale [38,41,43] | Occupation |

| Additional service [12,26,31,38,39,41,43] | Cleanliness and hygiene [9,20,39] | Loyalty program [38,41,43] | Income | ||

| External environment [9,20,39] | Emotional factors [26] | Transport | |||

| Access and parking lot [9,20,23,38] |

| Attribute | Category | Total Number of People | Percentage |

|---|---|---|---|

| Gender | Male | 228 | 45 |

| Female | 279 | 55 | |

| Age | 16–19 | 15 | 3 |

| 20–29 | 167 | 33 | |

| 30–39 | 167 | 33 | |

| 40–49 | 105 | 21 | |

| 50–59 | 53 | 10 | |

| Occupation | Business owner | 25 | 5 |

| Business manager | 20 | 4 | |

| Specialist | 264 | 52 | |

| Worker | 60 | 12 | |

| Student | 101 | 20 | |

| Housewife | 30 | 6 | |

| Pensioner | 0 | 0 | |

| Unemployed | 7 | 1 | |

| Monthly income | No data | 88 | 17 |

| Up to 200 EUR | 30 | 6 | |

| 201–400 EUR | 101 | 20 | |

| 401–600 EUR | 127 | 25 | |

| 601–800 EUR | 86 | 17 | |

| 801–1000 EUR | 30 | 6 | |

| 1001–1200 EUR | 25 | 5 | |

| More than 1200 EUR | 20 | 4 | |

| Owns car | Yes | 410 | 81 |

| No | 97 | 19 |

| EXPERTS | POSITION | Experience Working with Shopping Centers |

|---|---|---|

| Expert No.1 | Shopping center developer consultant, rental manager | 6 years worked as the rental manager of UAB ECE Project management (Ozas), 5 years as UAB Baltic Shopping Centers Rental manager (Mega, Banginis), |

| Expert No.2 | General Director of UAB Akropolis group | 2.5 years was the General Director of UAB Akropolis group, “Akropolis” Development manager in Riga in 2019 |

| Expert No.3 | Director of GO9 | 6.5 years as Director of GO9; |

| Expert No.4 | Director of UAB Prosperitas Baltica | 15.5 years as Director of CUP |

| Expert No.5 | Marketing Manager specialist, | 6 years worked for shopping centers “Akropolis”, 8 years. “Ozas”, 1.5 years UAB Westerwijk valdymas |

| Expert No.6 | Real estate development specialist, consultant | 7 years as UAB Newsec asset management group manager, 4 years was the Head of the rental department of UAB Resolution |

| Name of Shopping Center in | Trading Area, m2 | By Type | By Size | By Purpose | By ICSC Classification [46] | By Levy, Witz and Grewal (2019) [42] |

|---|---|---|---|---|---|---|

| Akropolis | 98.000 | Traditional shopping center | Extra large | General purpose | Superregional | Shopping center |

| Ozas | 62.000 | Traditional shopping center | Large | General purpose | Regional | Shopping center |

| Panorama | 56.000 | Traditional shopping center | Large | General purpose | Regional | Shopping center |

| CUP | 26.000 | Traditional shopping center | Average | General purpose | District | Neighborhood/Community Center |

| Outlet Parkas | 19.500 | Specialized | Average | Specialized | Outlets | Outlet center |

| Europa | 17.500 | Specialized | Small center | Specialized | District | Fashion Center |

| Ogmios centras | N.D. | Specialized | Shopping park | Specialized | District | Omni Centre |

| Nordika | 35.000 | Traditional shopping center | Average | General purpose | District | Neighborhood/Community Center |

| Big | 28.000 | Traditional shopping center | Average | General purpose | District | Neighborhood/Community Center |

| Mandarinas | 7.800 | Traditional shopping center | Small | General purpose | District | Neighborhood/Community Center |

| Mada | 27.800 | Traditional shopping center | Small | General purpose | District | Neighborhood/Community Center |

| AKROPOLIS | PANORAMA | OZAS | |||

|---|---|---|---|---|---|

| Top Mentions | % | Top Mentions | % | Top Mentions | % |

| Lots of shops/large selection | 22 | Convenient location/close to home | 8 | Movie Theater | 14 |

| Many people | 19 | Events/exhibitions | 8 | Lots of shops/large selection | 10 |

| Movie theater | 10 | Lots of shops/large selection | 7 | Grocery Store | 9 |

| Fun/interesting activities | 9 | Shopping center/shops | 7 | Shopping center/shops | 8 |

| Large | 9 | Restaurants/cafes/food | 6 | Spacy | 8 |

| Shopping center/shops | 9 | Grocery Store | 6 | For children/families | 7 |

| Ice arena | 8 | Far/uncomfortable to come | 6 | Restaurants/cafes/food | 5 |

| Grocery Store | 7 | Cozy/nice/tidy | 6 | Interesting/good shops | 5 |

| Household goods store | 4 | Convenient | 5 | Events/exhibitions | 4 |

| Noise/hustle | 4 | Information/Television | 5 | Convenient | 4 |

| Dimension | Evaluation Criteria | Mean | SD | Location | Variety | Wide Range | Food Zones | Price-Quality | Big Parking |

|---|---|---|---|---|---|---|---|---|---|

| Functional Factors | Convenient location | 3.97 | 0.7279 | 1.00 | |||||

| Variety of shops | 3.58 | 0.7761 | 0.002 | 1.00 | |||||

| Wide range of goods | 3.72 | 0.7739 | 0.118 ** | −0.314 ** | 1.00 | ||||

| Food zones | 2.64 | 0.5674 | 0.051 | −0.564 ** | 0.023 | 1.0 | |||

| Price–quality ratio | 2.74 | 0.9803 | −0.021 | 0.045 ** | 0.448 * | 0.331 | 1.00 | ||

| Big parking lot | 3.64 | 0.8654 | 0.518 * | −0.067 ** | 0.421 ** | −0.342 | −0.045 | 1.00 | |

| Family friendly | Working hours | Customer service | Design | Atmosphere | Events | ||||

| Social factors | Family friendly | 3.94 | 0.6747 | 1.00 | |||||

| Working hours | 2.86 | 0.6854 | 0.005 | 1.00 | |||||

| Customer service quality | 3.37 | 0.7379 | 0.014 | −0.342 | 1.00 | ||||

| Atmosphere | 3.21 | 0.7303 | 0.517 ** | 0.032 | 0.546 | 1.00 | |||

| Events quality and quantity | 3.27 | 0.6747 | 0.474 ** | 0.045 | 0.321 | −0.265 | 1.00 | ||

| Entertainment variety | 2.99 | 0.8758 | 0.054 * | 0.457 ** | 0.023 | −0.321 | 0.342 | 1.00 | |

| Advertising | Promotion | Loyalty | Design | ||||||

| Communication factors | Advertising | 3.45 | 0.8769 | 1.00 | |||||

| Promotion and sale | 4.23 | 0.6423 | 0.558 ** | 1.00 | |||||

| Loyalty program | 3.12 | 0.5734 | 0.320 ** | −0.342 | 1.00 | ||||

| Internal and external design | 2.99 | 0.7689 | −0.023 * | −0.032 | −0.451 | 1.00 |

| Shopping Centers | Associations | Statements |

|---|---|---|

| AKROPOLIS | Large | Big and old |

| For everyone | For everyone, most people and from the province | |

| PANORAMA | Gourmet food | Gourmet area, gourmets, more expensive, good place for lunch |

| More clothing stores | Niche fashion; more interesting shops, aesthetics, fewer people | |

| OZAS | For young people | Fast, aggressive, youth, events |

| CUP | Restaurants | Restaurants |

| Lots of shops | Lots of “other” open-air shops and services | |

| EUROPA | Expensive | Luxury stores and brands |

| Rational Statements | Emotional Attachment of Customers |

|---|---|

| <…Good tenant mix (choice of stores), convenient layout and parking, marketing…> <…The widest choice of services; comfortable leisure areas…> <…More interesting entertainment, social projects, events (fashion, educational, conferences…> <…Clearer navigation and positioning, exclusivity…> | <…Emotion is the main engine of sales. Trends in shopping centers show that more and more often the visitor comes not for shopping, but for entertainment…> <…Personalization and customer engagement through digital solutions (…) where the customer can share ideas, suggestions, automate purchases, queuing, e.g., post office, pay for parking…> <…Assessing Customer Priorities…> |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Černikovaitė, M.; Karazijienė, Ž.; Bivainienė, L.; Dambrava, V. Assessing Customer Preferences for Shopping Centers: Effects of Functional and Communication Factors. Sustainability 2021, 13, 3254. https://doi.org/10.3390/su13063254

Černikovaitė M, Karazijienė Ž, Bivainienė L, Dambrava V. Assessing Customer Preferences for Shopping Centers: Effects of Functional and Communication Factors. Sustainability. 2021; 13(6):3254. https://doi.org/10.3390/su13063254

Chicago/Turabian StyleČernikovaitė, Miglė, Žaneta Karazijienė, Lina Bivainienė, and Valdas Dambrava. 2021. "Assessing Customer Preferences for Shopping Centers: Effects of Functional and Communication Factors" Sustainability 13, no. 6: 3254. https://doi.org/10.3390/su13063254

APA StyleČernikovaitė, M., Karazijienė, Ž., Bivainienė, L., & Dambrava, V. (2021). Assessing Customer Preferences for Shopping Centers: Effects of Functional and Communication Factors. Sustainability, 13(6), 3254. https://doi.org/10.3390/su13063254