Has the COVID-19 Pandemic Affected Maritime Connectivity? An Estimation for China and the Polar Silk Road Countries

Abstract

1. Introduction

2. Materials and Methods

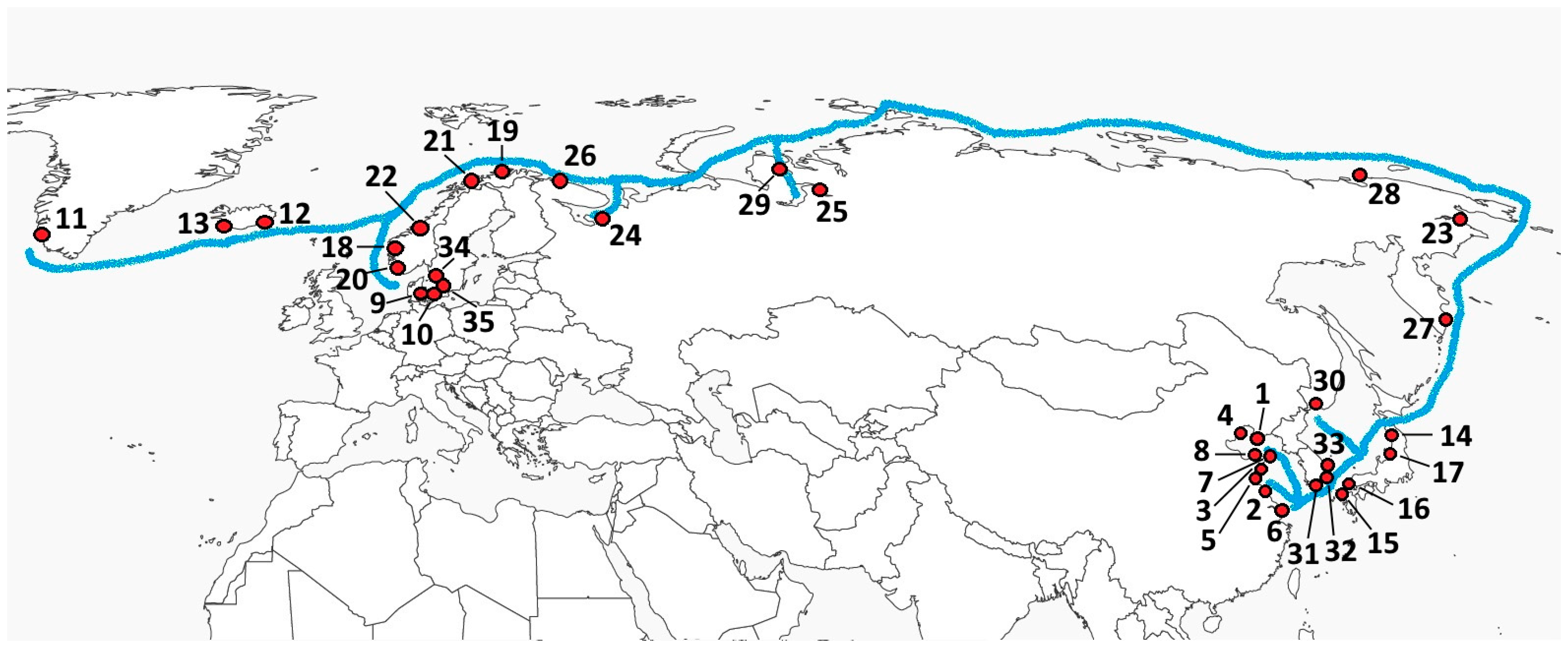

2.1. Countries and Ports

2.2. Variables and Data

- As the pandemic is still progressing (at the time of this writing, January 2021), it is hardly possible to establish an unambiguous relationship between the spread of the disease, lockdown and containment measures, market fluctuations, economic slowdown, and trade activities. Nevertheless, many scholars, including Ding et al. [60], Baber [61], Erokhin and Gao [62], Ceylan et al. [63], and Mityakov [64], demonstrated the applicability of the number of registered COVID-19 cases in international comparisons of the economic effects of the pandemic. In earlier studies of other outbreaks (SARS, MERS, etc.), Bakalis et al. [65], Poudel et al. [66], and Bhargava et al. [67] also found that economic and trade activities could be associated with morbidity and mortality rates. The confirmed COVID-19 cases and death counts were employed by Nallon [16] to calculate the potential risk of COVID-19 spread related to individual ports. Therefore, we use the monthly number of new confirmed COVID-19 cases (X1) and the monthly number of new confirmed COVID-19 deaths (X2) to capture the pandemic’s direct effects on the degree of maritime connectivity.

- Regarding the effects of trade on maritime connectivity, we avoid using UNCTAD’s seaborne trade measure to ensure the cointegration between the variables. As reported by Liang and Liu [68], Hu et al. [69], Bertho et al. [70], and Chang et al. [56], seaborne trade directly relates to maritime connectivity, and thus it cannot be used as an independent variable in our study. Instead, the influences of trade activities on the SCI and the PSCI are reflected by the country’s monthly total exports and imports. Apart from preventing the multicollinearity problem, taking total outbound and inbound trade flows as variables allows us to check whether the role of maritime trade in the total trade turnover of a country has changed during the pandemic. Expressly, we can assume that stronger relationships between shipping connectivity indexes from one side and export and imports from the other can mean a reorientation of total trade towards the maritime sector. To differentiate between the total trade with the world and intra-PSR trade flows, we employ the parameters of total exports to the world (X3) and exports to China (X5) (for China, X5 designates exports to PSR countries) along with total imports from the world (X4) and imports from China (X6) (for China, X6 specifies imports from PSR countries).

- The pandemic has dramatically affected daily economic activities and transportation worldwide [71,72,73]. Generally, as reported by Černikovaitė and Karazijienė [74], Leach et al. [75], Egger et al. [76], and other scholars, the COVID-driven transformations of the economic environment have been reflected in the behavior patterns of businesses and consumers, i.e., supply and demand shifts in the global market. The most common approach to tracking market volatilities is to monitor prices. That is why we employed the Commodity Price Index (CPI), an average of monthly quotations at a commodity’s main marketplace. According to the UNCTAD [77], the CPI is a fixed-base Laspeyres index, where the weights are proportional to the individual commodities’ shares in total merchandise exports of a country in the base period (2014–2016). Four independent variables are included in the study to capture the categories of cargo that dominate in the Asia-Russia-Europe transit via the Northern Sea Route (NSR), the so-far primary operating transport passage in the Arctic Ocean [78]: X7–minerals, ores, and metals; X8–fuels; X9–food products; X10–agricultural raw materials and oilseeds.

| Index | Variable | Unit of Measure | Definition | Source of Data |

|---|---|---|---|---|

| Y | Shipping Connectivity Index (SCI) or Port Shipping Connectivity Index (PSCI) | Points | A degree of a country’s (port’s) integration into global shipping networks | UNCTAD [49,79], MDS Transmodal [50] |

| X1 | Number of new confirmed COVID-19 cases | Number of cases | Monthly new confirmed COVID-19 cases in a country | Johns Hopkins University of Medicine [80], Our World in Data [81] |

| X2 | Number of new confirmed COVID-19 deaths | Number of deaths | Monthly new confirmed COVID-19 deaths in a country | Johns Hopkins University of Medicine [80], Our World in Data [81] |

| X3 | Exports to the world | $ million | Monthly total exports from a country to the world | UNCTAD [79] |

| X4 | Imports from the world | $ million | Monthly total imports to a country from the world | UNCTAD [79] |

| X5 | Exports to a country | $ million | Monthly total exports from a country to China (for China–monthly total exports to PSR countries) | UNCTAD [79] |

| X6 | Imports from a country | $ million | Monthly total imports to a country from China (for China–monthly total imports from PSR countries | UNCTAD [79] |

| X7 | Commodity Price Index: minerals | Points | Index of monthly prices of minerals, ores, and non-precious metals exported by a country (aluminum, copper, iron ore, lead, manganese ore, nickel, phosphate rock, tin, zinc) | UNCTAD [79] |

| X8 | Commodity Price Index: fuels | Points | Index of monthly prices of fuels exported by a country (coal, crude oil, natural gas, including liquefied natural gas) | UNCTAD [79] |

| X9 | Commodity Price Index: food | Points | Index of monthly prices of food products exported by a country (meat and meat products, milk and dairy products, fish and seafood products, sugar, wheat) | UNCTAD [79] |

| X10 | Commodity Price Index: agriculture | Points | Index of monthly prices of agricultural raw materials and oilseeds exported by a country (palm oil, soybean meal, soybean oil, soybeans, sunflower oil) | UNCTAD [79] |

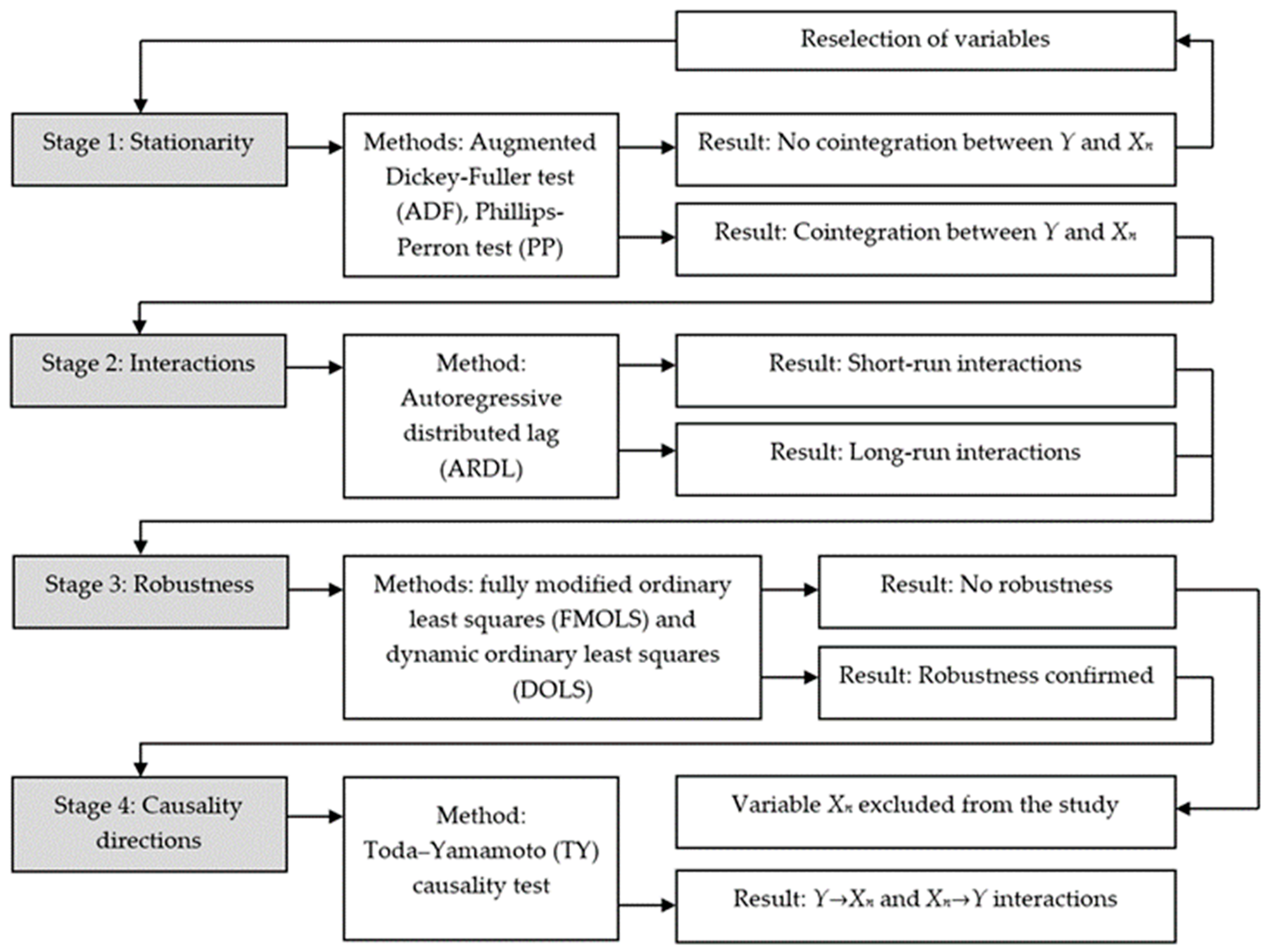

2.3. Methodology Framework

3. Results

3.1. Stationarity of Data

3.2. Interactions between Variables

3.3. Robustness Test

3.4. Causality Directions

4. Discussion

4.1. Pandemic Effects

4.2. Trade Effects

4.3. Market Effects

5. Conclusions

- The number of COVID-19 cases is found to exert a more decisive influence on the maritime connectivity in South Korea, Japan, and China, which experienced the outbreak earlier compared to Nordic countries and Russia, as well as introduced stricter containment measures. The bidirectional relationship between the number of cases and the SCI allows us to assume the contribution of maritime connectivity factors to the transboundary spread of the virus.

- The number of COVID-19 deaths has a negligible impact on the maritime connectivity that can be explained by the fact that governments have been introducing restrictions based on the number of new cases rather than deaths.

- Tight links between the value of trade with the world and the SCI index are revealed across all locations included in the study in the pre-pandemic period, but in 2020, the relationships become weaker amid the influence of non-economic factors.

- The China-PSR trade patterns significantly affect the maritime connectivity in all countries except Russia, where a bulk of trade with China is carried by rail through the land border. Similar to trade with the world, the influence of trade with China on maritime connectivity has weakened in the course of the pandemic.

- While the trade-SCI linkages have become less noticeable, the reverse causality flowing from the connectivity parameters to trade value has intensified with a reduced number of ship calls at ports, quarantine requirements to vessels and crew, and other virus containment measures applied to shipping services.

- Bigger hubs have been able to rebound sooner in their PSCI scores, rising in demand for storage capacity during shipping suspension, while smaller ports continue experiencing depressing effects of restrictions to transit shipping even in the third quarter of 2020. Therefore, we can assume that in times of sudden disruptions in logistics chains, ports with scarcer connections suffer more compared to diversified hubs. However, that depends on how the market situation matches the specialization of a particular port. For instance, in most of the NSR ports, the PSCI has not been much affected due to their narrow specialization on outbound freights (minerals and fuels, for which trade has declined to a lesser degree compared to manufacture and consumer products).

- Prices have exerted divergent influence on maritime connectivity for exporters and importers. In net importers, the SCI score has been supported by more intensive imports amid falling global prices, while net exporters have experienced a negative influence of consumption slowdown on their maritime connectivity indexes.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Countries/Ports | 2015–2019, Average | 2020 | ||||

|---|---|---|---|---|---|---|

| January–March | April–June | July–September | January–March | April–June | July–September | |

| China | 144.25600 | 146.40976 | 147.93279 | 158.37064 | 156.22624 | 160.29146 |

| China: Dalian | 60.93514 | 61.86997 | 61.57053 | 62.50721 | 62.87025 | 62.95251 |

| China: Lianyungang | 33.31145 | 35.07333 | 34.77936 | 41.43848 | 46.19355 | 41.28514 |

| China: Qingdao | 86.18790 | 87.76649 | 90.39664 | 97.98079 | 95.50218 | 96.02562 |

| China: Qinhuangdao | 6.99576 | 7.58951 | 8.90611 | 8.11250 | 8.11250 | 8.11250 |

| China: Rizhao | 11.56061 | 11.86857 | 12.41058 | 14.76849 | 14.66254 | 13.20044 |

| China: Shanghai | 127.02952 | 129.25465 | 130.75849 | 136.85170 | 134.51027 | 138.91384 |

| China: Weihai | 2.41896 | 2.43323 | 2.05983 | 2.00949 | 2.00949 | 2.00949 |

| China: Yantai | 14.92416 | 14.10571 | 13.91985 | 13.04158 | 13.04158 | 12.51689 |

| Denmark | 45.09137 | 45.06750 | 45.65967 | 46.58867 | 46.23473 | 46.33711 |

| Denmark: Aarhus | 42.61198 | 42.66091 | 43.46878 | 44.91011 | 44.92916 | 44.83680 |

| Denmark: Copenhagen | 5.19696 | 4.73303 | 4.56877 | 4.33206 | 4.52781 | 4.72332 |

| Denmark, Greenland: Nuuk | 2.00112 | 2.00106 | 2.01526 | 2.02933 | 2.02933 | 5.08021 |

| Iceland | 5.31360 | 5.29465 | 5.31737 | 6.13933 | 6.01947 | 6.96187 |

| Iceland: Reydharfjordur | 3.79390 | 3.66378 | 3.91174 | 3.82918 | 4.62143 | 4.62143 |

| Iceland: Reykjavik | 5.20064 | 5.21542 | 5.17170 | 5.80252 | 5.53034 | 6.47786 |

| Japan | 75.34626 | 72.88415 | 71.77790 | 78.78389 | 88.64641 | 88.70137 |

| Japan: Akita | 3.34431 | 3.32231 | 3.67081 | 3.81099 | 4.02925 | 4.46471 |

| Japan: Hakata | 19.33510 | 19.04703 | 19.40562 | 18.41141 | 17.49040 | 17.45937 |

| Japan: Kitakyushu | 3.60891 | 3.94439 | 3.84279 | 7.40050 | 5.79934 | 3.64653 |

| Japan: Niigata | 5.75781 | 5.66677 | 5.77444 | 5.79424 | 5.60332 | 5.61266 |

| Norway | 9.71469 | 9.86324 | 10.22606 | 10.63827 | 9.63687 | 10.16871 |

| Norway: Bergen | 5.04260 | 5.16227 | 5.21057 | 5.87044 | 4.87413 | 5.05370 |

| Norway: Hammerfest | 1.57109 | 1.57109 | 1.57109 | 1.51746 | 1.17813 | 1.17813 |

| Norway: Stavanger | 2.32561 | 2.31488 | 2.29814 | 2.55296 | 2.55296 | 3.07447 |

| Norway: Tromso | 1.96436 | 1.96436 | 1.96436 | 1.91074 | 1.17813 | 1.17813 |

| Norway: Trondheim | 1.75531 | 1.79821 | 1.79821 | 1.17973 | 1.17813 | 2.06056 |

| Russia | 46.07389 | 43.19898 | 42.36271 | 35.98139 | 33.90037 | 33.46525 |

| Russia: Anadyr | 0.96594 | 0.96594 | 0.96633 | 0.73057 | 0.73056 | 0.73054 |

| Russia: Arkhangelsk | 0.56784 | 0.55588 | 0.55588 | 0.55586 | 0.55583 | 0.55580 |

| Russia: Dudinka | 1.63985 | 1.63982 | 1.63979 | 1.63980 | 1.63982 | 1.62975 |

| Russia: Murmansk | 3.17882 | 3.18298 | 3.17740 | 3.16982 | 3.17005 | 3.17249 |

| Russia: Petropavlovsk | 2.13561 | 2.14458 | 2.07056 | 1.78557 | 1.78504 | 1.78592 |

| Russia: Pevek | 1.13678 | 1.13679 | 1.13672 | 1.13668 | 1.13670 | 1.13674 |

| Russia: Sabetta | 0.49093 | 0.50922 | 0.50593 | 0.51891 | 0.50478 | 0.51293 |

| Russia: Vladivostok | 16.14067 | 14.07223 | 14.00720 | 13.93689 | 13.45200 | 13.78345 |

| South Korea | 98.44056 | 99.90325 | 101.46473 | 108.39640 | 106.95343 | 107.55277 |

| South Korea: Gwangyang | 60.50077 | 60.79394 | 61.83644 | 66.80079 | 65.30716 | 60.35533 |

| South Korea: Pusan | 108.68804 | 110.22309 | 111.70417 | 118.73122 | 116.39475 | 117.09869 |

| South Korea: Ulsan | 18.87085 | 18.95059 | 19.09108 | 23.73320 | 20.69843 | 19.27688 |

| Sweden | 46.62914 | 46.01937 | 47.93833 | 48.59986 | 47.64887 | 48.41985 |

| Sweden: Gothenburg | 41.34901 | 40.80150 | 42.72292 | 42.28518 | 42.34241 | 41.79951 |

| Sweden: Halmstad | 2.93740 | 3.58594 | 3.27535 | 3.16433 | 1.99846 | 2.72541 |

Appendix B

| Country | Parameter | Y | X3 | X4 | X5 | X6 | X7 | X8 | X9 | X10 |

|---|---|---|---|---|---|---|---|---|---|---|

| China | ADF level | −1.46 ** | −4.18 ** | −2.43 *** | −0.28 ** | −1.36 * | −2.40 ** | −3.12 *** | −0.97 * | −2.57 *** |

| ADF first difference | −3.17 ** | −2.64 *** | −3.29 ** | −1.27 * | −3.18 | −1.97 *** | −1.80 ** | −1.23 * | −3.60 ** | |

| PP level | −4.20 * | −3.80 ** | −2.15 *** | −0.94 ** | −1.15 * | −2.86 ** | −4.23 *** | −1.74 | −2.08 *** | |

| PP first difference | −3.88 ** | −2.95 *** | −3.50 ** | −2.23 * | −2.94 | −1.05 *** | −2.95 ** | −0.60 ** | −3.15 ** | |

| Denmark | ADF level | −2.47 | −3.43 * | −1.26 * | −1.48 *** | −0.62 ** | −3.48 *** | −0.19 * | −2.15 * | −2.42 * |

| ADF first difference | −1.63 * | −2.19 ** | −0.80 ** | −2.03 ** | −1.23 * | −4.62 *** | −1.28 | −1.96 * | −1.69 ** | |

| PP level | −1.94 ** | −3.51 ** | −1.38 * | −1.93 *** | −0.80 ** | −3.23 ** | −0.56 * | −0.48 ** | −2.81 * | |

| PP first difference | −1.05 * | −2.58 * | −0.57 ** | −2.66 ** | −1.75 * | −4.19 *** | −1.44 | −1.57 * | −1.85 ** | |

| Iceland | ADF level | −0.56 *** | −1.33 ** | −2.00 *** | −0.49 *** | −0.55 *** | −2.48 *** | −0.75 * | −0.73 * | −1.33 |

| ADF first difference | −1.18 ** | −0.87 *** | −1.69 ** | −1.11 ** | −2.17 * | −3.70 *** | −2.52 | −0.95 * | −2.02 * | |

| PP level | −0.97 *** | −2.46 ** | −2.93 *** | −0.85 *** | −1.36 ** | −2.57 ** | −0.48 * | −0.22 * | −1.94 | |

| PP first difference | −1.42 ** | −1.39 ** | −1.02 ** | −2.34 ** | −2.19 * | −4.64 ** | −1.76 | −1.08 | −0.76 ** | |

| Japan | ADF level | −2.14 * | −4.40 ** | −3.42 ** | −2.30 *** | −3.03 ** | −0.86 * | −0.41 ** | −2.16 ** | −0.30 |

| ADF first difference | −2.71 ** | −3.81 *** | −2.91 *** | −4.18 ** | −2.48 * | −1.43 ** | −1.03 * | −1.94 * | −1.00 * | |

| PP level | −1.85 ** | −4.28 ** | −1.48 ** | −2.45 *** | −2.22 ** | −0.90 * | −0.69 ** | −2.37 ** | −0.95 | |

| PP first difference | −2.06 ** | −2.65 *** | −2.05 *** | −3.13 ** | −1.40 * | −2.16 | −2.17 | −0.66 *** | −1.38 * | |

| Norway | ADF level | −0.97 | −1.94 * | −0.73 ** | −1.76 ** | −1.14 | −3.25 *** | −4.90 *** | −2.05 *** | −2.73 ** |

| ADF first difference | −1.23 | −3.12 ** | −1.34 * | −2.39 *** | −2.37 * | −2.98 ** | −2.38 ** | −4.78 *** | −1.49 *** | |

| PP level | −1.01 * | −2.83 * | −0.49 *** | −1.97 ** | −1.28 * | −4.42 *** | −3.45 *** | −2.64 *** | −2.04 ** | |

| PP first difference | −1.30 * | −1.47 ** | −1.05 * | −3.00 *** | −1.63 ** | −3.11 ** | −2.06 ** | −3.19 *** | −1.12 *** | |

| Russia | ADF level | −3.58 ** | −2.20 *** | −3.10 *** | −4.01 * | −2.35 * | −4.66 *** | −4.77 *** | −2.57 ** | −3.46 ** |

| ADF first difference | −2.74 ** | −1.95 ** | −2.53 ** | −3.22 ** | −1.46 ** | −3.85 *** | −3.83 *** | −3.33 * | −2.98 ** | |

| PP level | −3.99 ** | −2.41 *** | −4.24 *** | −4.29 * | −2.97 * | −3.79 *** | −4.50 *** | −2.41 ** | −2.35 ** | |

| PP first difference | −1.16 * | −1.53 ** | −2.17 ** | −3.06 ** | −1.09 ** | −4.52 ** | −4.91 *** | −2.84 *** | −3.81 *** | |

| South Korea | ADF level | −2.86 *** | −4.46 * | −2.03 * | −1.21 *** | −3.14 * | −0.78 * | −1.25 * | −4.12 * | −1.06 *** |

| ADF first difference | −3.42 *** | −3.82 * | −1.75 ** | −2.35 ** | −2.22 ** | −0.97 ** | −2.42 ** | −3.90 * | −2.93 ** | |

| PP level | −3.11 ** | −2.17 | −2.84 * | −1.94 *** | −3.85 * | −1.49 | −1.38 * | −3.65 ** | −1.17 *** | |

| PP first difference | −2.95 *** | −3.04 | −1.15 ** | −2.70 ** | −2.37 ** | −1.05 | −0.57 *** | −4.08 * | −2.36 ** | |

| Sweden | ADF level | −0.87 *** | −2.43 ** | −0.99 ** | −1.27 | −1.79 *** | −2.30 ** | −1.12 ** | −1.40 *** | −1.68 * |

| ADF first difference | −1.59 *** | −1.95 ** | −2.53 * | −3.15 | −0.96 ** | −3.21 ** | −2.09 * | −0.73 *** | −2.00 ** | |

| PP level | −1.28 ** | −1.37 *** | −1.74 ** | −0.44 * | −1.45 *** | −2.58 * | −1.50 ** | −1.99 ** | −1.55 * | |

| PP first difference | −0.94 ** | −2.18 *** | −2.06 * | −2.96 | −2.13 ** | −3.42 | −2.86 * | −1.54 ** | −2.42 ** |

| Country | Parameter | Y | X1 | X2 | X3 | X4 | X5 | X6 | X7 | X8 | X9 | X10 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| China | ADF level | −1.20 ** | −1.54 *** | −1.05 *** | −3.14 ** | −2.95 ** | −0.47 ** | −1.55 * | −2.14 ** | −3.43 ** | −1.12 ** | −2.93 *** |

| ADF first difference | −2.78 * | −1.09 ** | −1.36 ** | −3.03 *** | −2.03 ** | −1.51 * | −4.20 | −2.01 *** | −2.74 *** | −1.48 * | −3.00 ** | |

| PP level | −3.35 * | −2.42 ** | −2.28 *** | −2.50 *** | −1.90 *** | −1.90 ** | −1.26 * | −1.70 *** | −3.05 ** | −1.07 | −2.21 *** | |

| PP first difference | −2.36 ** | −1.76 ** | −1.25 ** | −3.27 ** | −2.86 ** | −2.02 * | −2.81 | −1.97 ** | −3.19 ** | −0.83 ** | −3.44 ** | |

| Denmark | ADF level | −2.12 | −0.98 * | −1.37 * | −2.98 ** | −1.12 * | −1.37 *** | −0.78 ** | −3.18 *** | −0.88 * | −2.36 * | −2.58 * |

| ADF first difference | −1.28 * | −1.41 * | −1.29 | −1.43 ** | −0.73 ** | −2.34 ** | −1.05 * | −4.04 ** | −1.51 | −1.45 * | −1.92 ** | |

| PP level | −1.51 ** | −0.72 * | −1.94 * | −2.04 ** | −1.84 * | −1.85 *** | −0.92 ** | −3.22 ** | −0.62 * | −0.55 *** | −2.04 * | |

| PP first difference | −1.23 * | −1.15 | −0.38 ** | −3.19 * | −0.91 ** | −2.04 ** | −1.64 * | −4.85 ** | −1.75 | −1.76 * | −1.71 ** | |

| Iceland | ADF level | −1.17 ** | −0.57 | −1.44 * | −1.95 ** | −1.66 ** | −0.99 *** | −0.88 *** | −2.13 *** | −0.93 * | −0.94 * | −1.03 |

| ADF first difference | −1.32 ** | −2.28 | −0.80 ** | −1.01 ** | −1.09 ** | −1.26 ** | −2.53 * | −3.54 *** | −2.71 * | −0.82 * | −2.35 * | |

| PP level | −1.58 ** | −0.46 * | −0.95 | −2.30 ** | −2.17 *** | −1.80 ** | −1.70 ** | −2.02 ** | −0.80 * | −0.35 * | −1.74 | |

| PP first difference | −1.67 ** | −1.30 | −0.46 * | −1.26 ** | −1.40 ** | −2.25 ** | −2.01 * | −4.36 ** | −1.44 | −1.14 * | −0.65 ** | |

| Japan | ADF level | −2.40 ** | −2.43 ** | −1.82 ** | −3.72 ** | −3.19 ** | −2.00 *** | −3.34 ** | −1.18 * | −0.39 ** | −2.42 ** | −0.86 |

| ADF first difference | −2.05 ** | −3.58 ** | −2.13 * | −3.29 *** | −2.22 *** | −4.44 ** | −2.27 * | −1.27 ** | −1.27 * | −1.83 * | −1.12 * | |

| PP level | −1.62 ** | −2.94 *** | −1.50 ** | −2.14 *** | −1.00 ** | −2.51 *** | −2.18 ** | −1.22 * | −0.95 ** | −2.04 ** | −0.90 | |

| PP first difference | −1.98 ** | −1.56 *** | −2.74 * | −3.00 ** | −1.49 *** | −3.01 ** | −2.00 * | −2.39 | −1.91 * | −0.97 *** | −1.27 * | |

| Norway | ADF level | −0.85 | −1.16 * | −0.66 ** | −2.23 * | −0.86 ** | −1.86 ** | −1.55 | −3.00 *** | −4.82 *** | −1.16 *** | −2.58 ** |

| ADF first difference | −1.51 | −2.05 | −1.37 * | −2.95 ** | −1.28 * | −2.27 *** | −2.36 * | −2.54 ** | −2.83 ** | −4.72 ** | −2.17 ** | |

| PP level | −1.23 * | −1.77 * | −1.01 ** | −2.41 * | −0.74 *** | −1.73 ** | −1.39 * | −3.08 *** | −3.27 ** | −3.30 *** | −1.84 ** | |

| PP first difference | −1.47 * | −2.22 | −2.00 | −1.09 ** | −1.37 * | −2.92 *** | −1.05 ** | −2.47 ** | −2.65 ** | −3.64 *** | −1.75 *** | |

| Russia | ADF level | −2.99 ** | −2.58 ** | −2.45 ** | −2.43 ** | −2.83 *** | −4.19 * | −2.74 * | −4.25 *** | −4.18 *** | −2.09 ** | −3.03 ** |

| ADF first difference | −2.70 ** | −3.14 ** | −3.58 ** | −1.55 ** | −2.06 ** | −3.40 ** | −1.16 ** | −3.13 *** | −3.04 *** | −3.48 * | −2.64 ** | |

| PP level | −3.58 ** | −2.35 * | −2.10 * | −1.86 *** | −3.90 *** | −4.04 * | −2.38 * | −3.29 ** | −4.29 *** | −2.26 ** | −2.22 ** | |

| PP first difference | −1.03 * | −2.73 ** | −3.34 ** | −2.01 ** | −2.44 ** | −3.29 ** | −1.25 ** | −4.21 ** | −4.37 *** | −2.55 *** | −3.75 *** | |

| South Korea | ADF level | −2.75 *** | −4.40 ** | −4.22 ** | −4.17 * | −1.92 * | −1.58 *** | −2.59 ** | −0.80 * | −1.46 * | −4.00 * | −1.39 *** |

| ADF first difference | −3.14 *** | −3.27 *** | −4.71 ** | −3.33 * | −2.85 ** | −2.25 ** | −2.30 ** | −0.75 ** | −1.95 ** | −3.59 * | −2.18 ** | |

| PP level | −2.89 ** | −2.05 *** | −3.18 *** | −2.80 | −2.25 * | −1.71 *** | −3.67 * | −1.06 | −1.57 ** | −3.47 ** | −1.42 *** | |

| PP first difference | −2.43 ** | −3.49 ** | −3.62 ** | −2.74 * | −1.04 ** | −2.53 ** | −2.41 ** | −1.77 | −0.86 *** | −4.23 * | −2.30 ** | |

| Sweden | ADF level | −1.32 ** | −1.98 | −2.04 * | −2.05 ** | −0.62 ** | −1.34 | −1.66 *** | −1.43 ** | −1.00 ** | −1.74 *** | −1.51 * |

| ADF first difference | −1.13 *** | −0.46 * | −1.28 * | −1.48 ** | −2.37 * | −3.00 * | −1.23 ** | −2.59 ** | −1.34 * | −0.88 *** | −1.45 *** | |

| PP level | −1.40 ** | −1.13 | −0.55 ** | −1.51 *** | −1.50 ** | −0.59 * | −1.50 *** | −1.40 ** | −1.82 ** | −1.51 ** | −1.68 * | |

| PP first difference | −1.25 ** | −0.80 * | −1.11 * | −2.16 *** | −1.33 * | −2.85 | −2.28 ** | −2.88 | −2.40 * | −1.65 ** | −2.11 ** |

Appendix C

| Port | Parameter | ∆X3 | ∆X4 | ∆X5 | ∆X6 | ∆X7 | ∆X8 | ∆X9 | ∆X10 | ECM |

|---|---|---|---|---|---|---|---|---|---|---|

| China: Dalian | Coefficient | 0.0994 | 0.2093 | 0.2187 | 0.2045 | 0.0594 | −0.1238 | −0.0457 | −0.1309 | 0.1566 |

| t-stat | 1.0298 | −3.1550 | −1.4885 | −2.0882 | 4.6982 | −2.0997 | 1.4409 | 2.1170 | 2.0297 | |

| Prob | 0.0827 *** | 0.4146 *** | 0.7209 ** | 0.5009 ** | 0.1597 * | 0.5505 ** | 0.1287 *** | 0.4691 *** | 0.1502 ** | |

| China: Lianyungang | Coefficient | 0.1725 | 0.2007 | 0.1044 | 0.1236 | 0.1809 | −0.0562 | 0.0662 | −0.0987 | 0.1419 |

| t-stat | −2.6009 | 3.4482 | −2.0841 | −2.9503 | −3.8751 | 1.7793 | 2.4091 | −3.6092 | −2.5446 | |

| Prob | 0.1388 ** | 0.3091 ** | 0.0529 * | 0.0987 * | 0.3350 * | 0.6720 * | 0.6348 ** | 0.0505 ** | 0.4091 * | |

| China: Qingdao | Coefficient | 0.2476 | 0.2453 | 0.3112 | 0.3598 | 0.0983 | −0.0186 | −0.3007 | −0.1559 | −0.3008 |

| t-stat | 1.5098 | 2.4458 | −4.2678 | −1.9942 | 2.0759 | 1.5631 | 3.6298 | −1.5774 | 1.7832 | |

| Prob | 0.4033 ** | 0.7346 ** | 0.0039 *** | 0.9387 *** | 0.3391 * | 0.8599 ** | 0.1127 *** | 0.2386 *** | 0.2557 ** | |

| China: Qinhuangdao | Coefficient | 0.2092 | 0.1900 | 0.1251 | 0.1409 | 0.0985 | 0.0134 | 0.0263 | −0.0112 | 0.0103 |

| t-stat | 2.6071 | 3.1462 | 1.0093 | 2.0000 | −2.5983 | 1.6673 | 2.6995 | 5.0064 | 3.6084 | |

| Prob | 0.2395 ** | 0.5884 ** | 0.0076 * | 0.7503 * | 0.4774 * | 0.5887 * | 0.2409 ** | 0.3081 ** | 0.1536 * | |

| China: Rizhao | Coefficient | 0.3993 | 0.3588 | 0.1092 | 0.1725 | 0.0070 | 0.1490 | 0.0135 | 0.0146 | 0.1597 |

| t-stat | 4.0075 | 2.4902 | −2.5557 | −1.4647 | 3.5371 | −2.5556 | −2.6734 | 2.7795 | 1.2285 | |

| Prob | 0.5982 ** | 0.5395 ** | 0.4998 * | 0.9098 * | 0.5893 * | 0.6729 * | 0.8995 * | 0.9806 ** | 0.2456 * | |

| China: Shanghai | Coefficient | 0.7300 | 0.7936 | 0.5781 | 0.6045 | 0.1400 | 0.2304 | 0.2289 | −0.2037 | −0.1877 |

| t-stat | 5.1486 | −1.2980 | 1.0008 | 2.6551 | −3.7735 | 2.6780 | −1.3485 | 2.1285 | −3.5832 | |

| Prob | 0.4995 *** | 0.0075 *** | 0.4790 *** | 0.8840 *** | 0.3809 ** | 0.7713 ** | 0.6737 *** | 0.7900 *** | 0.1709 *** | |

| China: Weihai | Coefficient | 0.3215 | 0.4098 | 0.1452 | 0.1793 | 0.0673 | 0.1694 | 0.1891 | 0.0476 | 0.1558 |

| t-stat | 4.6617 | 1.8403 | −4.7937 | −2.0041 | 3.7098 | 2.4843 | 2.1594 | −1.5285 | 3.3790 | |

| Prob | 0.4592 ** | 0.3704 ** | 0.1364 ** | 0.2055 ** | 0.7149 * | 0.7091 * | 0.0005 ** | 0.9287 ** | 0.4421 * | |

| China: Yantai | Coefficient | 0.2498 | 0.2591 | 0.1990 | 0.2286 | 0.1303 | 0.2002 | 0.0309 | −0.1098 | 0.0547 |

| t-stat | 3.6895 | −2.8390 | 2.5558 | 1.8930 | −2.5681 | 3.4673 | 2.1587 | −1.5556 | 2.0965 | |

| Prob | 0.0982 *** | 0.3498 *** | 0.4091 ** | 0.0089 ** | 0.3899 ** | 0.5508 ** | 0.3985 ** | 0.2018 ** | 0.2490 ** | |

| Denmark: Aarhus | Coefficient | 0.1506 | 0.1183 | 0.0552 | 0.0344 | 0.0710 | −0.0305 | 0.1335 | 0.0784 | −0.1257 |

| t-stat | 3.1377 | 2.2407 | 1.1147 | −2.0728 | 1.2745 | −3.4122 | 1.1784 | 2.1995 | 1.1346 | |

| Prob | 0.0793 *** | 0.9874 *** | 0.0005 * | 0.1482 * | 0.2993 * | 0.4355 * | 0.3985 ** | 0.3993 * | 0.2066 * | |

| Denmark: Copenhagen | Coefficient | 0.1285 | 0.1596 | 0.0134 | 0.0637 | 0.0226 | 0.0490 | 0.0621 | 0.1006 | −0.0557 |

| t-stat | −1.2759 | 2.8837 | −2.2861 | −4.0053 | 2.6298 | 4.8794 | 3.1784 | −1.5975 | −1.0086 | |

| Prob | 0.4102 *** | 0.5884 *** | 0.6390 * | 0.0394 * | 0.5094 * | 0.2609 * | 0.7985 * | 0.8585 * | 0.7723 * | |

| Denmark, Greenland: Nuuk | Coefficient | 0.7512 | 0.7056 | 0.1258 | 0.0115 | 0.5035 | −0.1223 | −0.0556 | −0.0144 | 0.1609 |

| t-stat | 3.5008 | 4.2224 | −1.0677 | 2.3379 | −1.7772 | 2.4000 | −1.4700 | −1.1863 | 2.2866 | |

| Prob | 0.5954 *** | 0.3983 *** | 0.2851 * | 0.2807 * | 0.3683 ** | 0.3875 * | 0.3653 * | 0.0005 * | 0.4124 * | |

| Iceland: Reydharfjordur | Coefficient | 0.4872 | 0.4085 | 0.2338 | 0.2561 | 0.5506 | −0.0206 | 0.0725 | 0.0236 | 0.0446 |

| t-stat | 3.1676 | 2.1674 | −1.0365 | 2.5974 | −1.4287 | 2.0565 | 2.1277 | 1.6905 | 1.3378 | |

| Prob | 0.2805 *** | 0.0875 *** | 0.2870 * | 0.3885 * | 0.1209 *** | 0.1274 * | 0.1443 * | 0.2553 * | 0.2785 ** | |

| Iceland: Reykjavik | Coefficient | 0.6609 | 0.6077 | 0.4924 | 0.2567 | 0.1558 | −0.0258 | 0.1408 | 0.0784 | 0.1309 |

| t-stat | 1.8642 | −2.4365 | −2.7385 | 2.3798 | −2.4097 | 1.4596 | 2.2895 | −2.0055 | 2.0554 | |

| Prob | 0.4900 *** | 0.5836 *** | 0.2294 ** | 0.5275 ** | 0.0050 ** | 0.4927 * | 0.2093 ** | 0.7053 ** | 0.2378 ** | |

| Japan: Akita | Coefficient | 0.5064 | 0.6235 | 0.2346 | 0.1999 | 0.1667 | 0.0238 | −0.0606 | −0.0437 | −0.1345 |

| t-stat | 2.0832 | 1.8509 | −3.1459 | −2.4875 | 2.2245 | −1.2977 | 2.5498 | 1.3865 | −1.6299 | |

| Prob | 0.0385 ** | 0.1274 ** | 0.3240 ** | 0.5083 ** | 0.0000 * | 0.2769 * | 0.0627 * | 0.2790 * | 0.4904 ** | |

| Japan: Hakata | Coefficient | 0.4226 | 0.4800 | 0.1665 | 0.2664 | 0.3239 | 0.0304 | 0.0524 | 0.0654 | 0.1297 |

| t-stat | 1.3094 | 2.5821 | 1.9974 | 2.5093 | 1.6008 | 4.6831 | 2.5563 | −2.6003 | 1.5556 | |

| Prob | 0.1317 ** | 0.2650 ** | 0.6339 ** | 0.3837 ** | 0.0236 * | 0.5583 * | 0.2741 * | 0.5995 * | 0.2804 ** | |

| Japan: Kitakyushu | Coefficient | 0.3735 | 0.4407 | 0.1509 | 0.1880 | 0.2013 | 0.1579 | 0.0337 | 0.0597 | −0.2579 |

| t-stat | 1.6220 | 2.6883 | −2.0096 | −2.4985 | 4.1794 | −1.6282 | 2.0084 | 1.4083 | 2.5458 | |

| Prob | 0.4087 ** | 0.0005 ** | 0.5584 ** | 0.3077 ** | 0.6231 ** | 0.4595 * | 0.2863 * | 0.2129 * | 0.4267 * | |

| Japan: Niigata | Coefficient | 0.2336 | 0.2551 | 0.2335 | 0.3134 | 0.0349 | 0.1543 | −0.1245 | −0.0450 | 0.0605 |

| t-stat | −2.5543 | −2.9835 | 3.9598 | 2.0075 | 1.8444 | 2.1886 | 1.3062 | 3.1582 | 1.3490 | |

| Prob | 0.0985 *** | 0.2987 *** | 0.7401 *** | 0.4982 *** | 0.3986 *** | 0.2583 * | 0.2750 ** | 0.2086 ** | 0.4558 ** | |

| Norway: Bergen | Coefficient | 0.2308 | 0.1347 | 0.2134 | 0.2086 | 0.1674 | 0.2996 | 0.1124 | 0.2057 | 0.4007 |

| t-stat | 2.1894 | −1.9845 | −2.6755 | −1.1455 | −2.6281 | 1.3285 | −1.8655 | −2.3348 | −3.3285 | |

| Prob | 0.1307 ** | 0.4808 ** | 0.5897 * | 0.8743 * | 0.3309 ** | 0.5281 ** | 0.2349 ** | 0.0293 ** | 0.5380 ** | |

| Norway: Hammerfest | Coefficient | 0.0565 | 0.0655 | 0.0775 | 0.0776 | 0.2496 | 0.2457 | 0.0985 | 0.3615 | 0.2236 |

| t-stat | 2.0296 | 3.2941 | −3.1709 | −2.3589 | 2.5414 | −2.3987 | −2.1294 | 3.0006 | −2.1137 | |

| Prob | 0.5991 ** | 0.9836 ** | 0.4386 * | 0.3034 * | 0.6083 * | 0.4446 ** | 0.0013 ** | 0.1257 ** | 0.2768 * | |

| Norway: Stavanger | Coefficient | 0.2783 | 0.2997 | 0.0688 | 0.0676 | 0.2379 | 0.2008 | 0.3872 | 0.2027 | 0.3566 |

| t-stat | 5.0046 | 2.0953 | 4.1763 | 1.5583 | −2.5245 | 1.5125 | 2.3409 | 1.1498 | 1.7495 | |

| Prob | 0.2098 *** | 0.4827 *** | 0.5266 ** | 0.4127 ** | 0.0488 ** | 0.2309 ** | 0.3874 ** | 0.1874 ** | 0.5574 ** | |

| Norway: Tromso | Coefficient | 0.2449 | 0.2690 | 0.1295 | 0.0985 | 0.1794 | 0.0738 | 0.0228 | 0.0500 | 0.2323 |

| t-stat | 2.6928 | −4.9007 | 1.5693 | 2.2187 | 1.8609 | −1.7995 | 3.1264 | 1.2046 | −2.8476 | |

| Prob | 0.3582 *** | 0.0006 *** | 0.3475 * | 0.3126 * | 0.3453 ** | 0.6297 * | 0.0996 * | 0.4529 * | 0.2001 ** | |

| Norway: Trondheim | Coefficient | 0.1308 | 0.2564 | 0.3290 | 0.2997 | 0.0775 | 0.1555 | 0.4003 | 0.1654 | 0.3829 |

| t-stat | −1.9387 | 1.5981 | 2.1138 | 1.3854 | −2.5498 | 3.6694 | 2.6595 | −3.5521 | 2.5444 | |

| Prob | 0.2006 *** | 0.4800 *** | 0.3685 ** | 0.1237 ** | 0.2846 ** | 0.3712 ** | 0.0054 ** | 0.4670 ** | 0.0657 *** | |

| Russia: Anadyr | Coefficient | 0.0745 | 0.0011 | 0.0054 | 0.0060 | 0.0664 | −0.0074 | −0.0011 | 0.0014 | −0.0565 |

| t-stat | −1.0043 | −2.8749 | −1.4976 | −2.2381 | 1.7539 | −2.0386 | 2.1554 | 3.4299 | 2.0657 | |

| Prob | 0.0428 * | 0.6066 * | 0.3453 * | 0.5199 * | 0.5665 ** | 0.2525 * | 0.6877 * | 0.5434 * | 0.6225 * | |

| Russia: Arkhangelsk | Coefficient | 0.0314 | 0.0258 | 0.0069 | 0.0234 | 0.1221 | −0.0066 | 0.2023 | 0.1285 | 0.0778 |

| t-stat | −2.5638 | −2.3987 | −2.9744 | 3.0445 | 2.8867 | 2.3854 | −1.6684 | −2.3254 | 2.0444 | |

| Prob | 0.5174 ** | 0.2216 ** | 0.0032 * | 0.6256 * | 0.4543 * | 0.2850 * | 0.0675 * | 0.6193 * | 0.3095 ** | |

| Russia: Dudinka | Coefficient | 0.0067 | 0.0011 | 0.0050 | 0.0013 | 0.1138 | 0.0157 | 0.0098 | 0.0069 | 0.0352 |

| t-stat | −3.1286 | 1.6598 | −2.4873 | −2.4736 | −1.4455 | 2.5180 | 1.5784 | 2.0575 | −1.5476 | |

| Prob | 0.0000 * | 0.4144 * | 0.3864 * | 0.5179 * | 0.0098 ** | 0.1442 * | 0.3591 * | 0.3443 * | 0.6564 * | |

| Russia: Murmansk | Coefficient | 0.1056 | 0.1316 | 0.0423 | 0.0122 | 0.1553 | 0.0205 | 0.1843 | 0.2114 | 0.2573 |

| t-stat | −2.5239 | −1.5830 | −1.6495 | 2.1540 | −2.2376 | −1.1222 | 2.1487 | −2.4986 | −2.0554 | |

| Prob | 0.6928 *** | 0.7455 *** | 0.2442 * | 0.0085 * | 0.4232 ** | 0.0000 ** | 0.6650 ** | 0.3000 ** | 0.1672 *** | |

| Russia: Petropavlovsk | Coefficient | 0.1392 | 0.1609 | 0.0219 | 0.0124 | 0.0664 | 0.0597 | 0.0045 | 0.0067 | 0.2012 |

| t-stat | −4.5667 | −2.1423 | 1.1113 | 2.5548 | −1.7459 | 2.6566 | 2.0027 | −2.5068 | 3.1478 | |

| Prob | 0.6400 * | 0.6998 * | 0.1854 * | 0.6512 * | 0.0051 ** | 0.2875 * | 0.1556 * | 0.4366 * | 0.5465 ** | |

| Russia: Pevek | Coefficient | 0.1614 | 0.0087 | 0.0107 | 0.0053 | 0.0234 | 0.0124 | 0.0064 | 0.0078 | 0.1504 |

| t-stat | 1.7958 | 1.3422 | 2.9876 | 1.4998 | −3.1343 | 2.6579 | −3.5538 | −1.4657 | −1.3227 | |

| Prob | 0.4123 * | 0.5673 * | 0.2333 * | 0.0413 * | 0.2265 ** | 0.4386 * | 0.2656 * | 0.5388 * | 0.5980 * | |

| Russia: Sabetta | Coefficient | 0.0501 | 0.0015 | 0.1254 | 0.0015 | 0.0076 | 0.2235 | 0.0012 | 0.0043 | 0.3670 |

| t-stat | 2.3472 | −2.3762 | 1.2775 | 2.5234 | 2.1121 | −4.2534 | −2.7754 | −3.0987 | 1.1231 | |

| Prob | 0.4653 ** | 0.6909 * | 0.5634 ** | 0.6498 * | 0.5398 * | 0.5767 ** | 0.4486 * | 0.6055 * | 0.3875 ** | |

| Russia: Vladivostok | Coefficient | 0.0638 | 0.2155 | 0.1552 | 0.2237 | 0.0423 | 0.0996 | 0.2667 | 0.2442 | 0.5234 |

| t-stat | 4.7754 | 2.0007 | −2.6578 | 3.3456 | −2.1364 | −2.3687 | 1.2355 | 1.0936 | 2.0669 | |

| Prob | 0.1906 *** | 0.3908 ** | 0.5234 *** | 0.3002 *** | 0.3172 * | 0.4522 ** | 0.2136 *** | 0.2573 *** | 0.4987 *** | |

| South Korea: Gwangyang | Coefficient | 0.4287 | 0.4065 | 0.3286 | 0.3314 | −0.0965 | −0.0940 | −0.0025 | −0.0074 | 0.4906 |

| t-stat | 2.5005 | 1.1749 | −2.0517 | −1.5000 | 3.9187 | −2.6053 | 1.8247 | −2.6819 | 2.4022 | |

| Prob | 0.9276 *** | 0.7378 ** | 0.4005 *** | 0.6249 *** | 0.0005 * | 0.1547 * | 0.1496 * | 0.2760 ** | 0.3795 ** | |

| South Korea: Pusan | Coefficient | 0.8340 | 0.8150 | 0.7349 | 0.6538 | −0.1396 | −0.1548 | −0.0102 | −0.0351 | 0.7007 |

| t-stat | −1.8733 | −2.1244 | −1.4380 | −2.5356 | 1.1487 | 2.5952 | −3.4783 | −1.4958 | −3.6541 | |

| Prob | 0.7612 *** | 0.6626 *** | 0.0095 *** | 0.0298 *** | 0.7395 ** | 0.3813 ** | 0.5849 ** | 0.0006 ** | 0.5328 *** | |

| South Korea: Ulsan | Coefficient | 0.6195 | 0.5892 | 0.5052 | 0.4872 | 0.0056 | −0.0865 | −0.0912 | −0.0873 | 0.5045 |

| t-stat | 4.0557 | 3.1505 | −1.9347 | −2.5360 | −3.9841 | −3.1260 | −2.0375 | −4.5941 | −1.3968 | |

| Prob | 0.3941 *** | 0.7984 *** | 0.0498 *** | 0.8375 *** | 0.1203 * | 0.4891 * | 0.2096 * | 0.7500 ** | 0.4093 ** | |

| Sweden: Gothenburg | Coefficient | 0.6827 | 0.7023 | 0.1854 | 0.1733 | 0.1660 | −0.0097 | 0.0150 | 0.0964 | −0.3264 |

| t-stat | −2.1793 | −1.0065 | −2.0057 | −3.4281 | 2.5377 | −1.3761 | 2.5891 | −1.3681 | −2.7813 | |

| Prob | 0.5482 *** | 0.6398 *** | 0.2941 ** | 0.0054 ** | 0.2198 ** | 0.3405 * | 0.0614 * | 0.2592 * | 0.8867 *** | |

| Sweden: Halmstad | Coefficient | 0.3864 | 0.4290 | 0.1519 | 0.1625 | 0.0634 | −0.0143 | 0.0523 | 0.0775 | 0.0810 |

| t-stat | −1.0709 | −3.5836 | −3.4015 | −1.3096 | 3.8765 | 2.0567 | 3.4175 | 1.8131 | −1.3986 | |

| Prob | 0.5298 *** | 0.4211 *** | 0.2366 ** | 0.4231 ** | 0.3891 ** | 0.1831 * | 0.0022 * | 0.4973 * | 0.5715 ** |

| Port | Parameter | ∆X1 | ∆X2 | ∆X3 | ∆X4 | ∆X5 | ∆X6 | ∆X7 | ∆X8 | ∆X9 | ∆X10 | ECM |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| China: Dalian | Coefficient | −0.0108 | −0.0182 | 0.1113 | 0.1290 | 0.1528 | 0.1670 | 0.0342 | −0.1061 | −0.0100 | −0.1544 | 0.1305 |

| t-stat | 2.0817 | 3.1175 | 2.1865 | −4.4598 | 2.0483 | −3.2391 | 2.5378 | 1.3728 | 2.3597 | 3.0580 | 2.5988 | |

| Prob | 0.1982 ** | 0.0255 ** | 0.3034 ** | 0.3600 ** | 0.3015 * | 0.0045 ** | 0.3066 * | 0.3762 ** | 0.0198 *** | 0.1853 *** | 0.1264 ** | |

| China: Lianyungang | Coefficient | −0.0271 | −0.0390 | 0.0298 | 0.0357 | 0.0466 | 0.0322 | 0.1485 | −0.0394 | 0.0514 | −0.1098 | 0.1692 |

| t-stat | −3.4918 | −2.8776 | 3.1765 | 2.6873 | −1.7671 | −2.5094 | −2.0039 | 4.6380 | 2.5010 | −1.4511 | −3.9830 | |

| Prob | 0.3870 ** | 0.2871 ** | 0.0387 * | 0.0294 * | 0.0529 * | 0.1298 * | 0.2450 * | 0.0045 * | 0.4902 ** | 0.0387 ** | 0.2506 * | |

| China: Qingdao | Coefficient | 0.0189 | 0.0040 | 0.1011 | 0.1245 | 0.2067 | 0.2217 | 0.0551 | −0.0041 | −0.2697 | −0.1673 | −0.3567 |

| t-stat | 2.9876 | 2.0586 | 3.0284 | 3.1257 | −2.5083 | −3.0083 | 4.6348 | 3.5026 | 2.5553 | 3.0856 | 2.0854 | |

| Prob | 0.0281 * | 0.2877 * | 0.2975 * | 0.1654 * | 0.0005 ** | 0.0491 ** | 0.0000 * | 0.4817 ** | 0.0976 *** | 0.1299 *** | 0.2078 ** | |

| China: Qinhuangdao | Coefficient | −0.0677 | −0.0562 | 0.1876 | 0.1522 | 0.0742 | 0.0504 | 0.0723 | 0.0038 | 0.0144 | −0.0030 | 0.0035 |

| t-stat | −2.4980 | −3.5991 | 1.9550 | 3.0973 | 4.3311 | 3.6566 | −2.4475 | 1.5411 | 3.5095 | 4.7109 | 2.6419 | |

| Prob | 0.0485 * | 0.0593 * | 0.1183 ** | 0.3070 ** | 0.0760 * | 0.0872 * | 0.2559 * | 0.3904 * | 0.1567 ** | 0.2054 ** | 0.0754 * | |

| China: Rizhao | Coefficient | −0.1096 | −0.0987 | 0.1542 | 0.1276 | 0.0493 | 0.0910 | 0.0046 | 0.1053 | 0.0059 | 0.0102 | 0.1200 |

| t-stat | −4.8561 | −3.4982 | 2.7091 | 3.0188 | 2.0452 | 2.6413 | 1.9550 | −3.5085 | −2.4832 | 1.6598 | 3.1675 | |

| Prob | 0.5875 ** | 0.1824 ** | 0.2587 ** | 0.4900 ** | 0.0500 * | 0.1287 * | 0.1677 * | 0.0044 * | 0.6910 * | 0.0371 ** | 0.0444 * | |

| China: Shanghai | Coefficient | 0.1203 | 0.1186 | 0.3876 | 0.3497 | 0.2988 | 0.2462 | 0.1011 | 0.1876 | 0.1954 | −0.2459 | −0.2037 |

| t-stat | 2.8762 | 2.0590 | 4.6003 | 3.6065 | 1.5974 | 1.8005 | −4.7492 | 5.3009 | 3.0766 | 2.0076 | −4.1002 | |

| Prob | 0.3094 * | 0.5871 * | 0.3760 *** | 0.4012 *** | 0.2867 *** | 0.3041 *** | 0.0083 ** | 0.0487 ** | 0.2598 *** | 0.0834 *** | 0.1885 *** | |

| China: Weihai | Coefficient | −0.0087 | −0.0124 | 0.1165 | 0.1411 | 0.0313 | 0.0456 | 0.0544 | 0.1250 | 0.1608 | 0.0325 | 0.1341 |

| t-stat | −1.3905 | −2.4870 | 3.9841 | 3.0676 | −4.0606 | −3.3407 | 2.6715 | 3.5734 | 1.0075 | −3.4472 | 2.1765 | |

| Prob | 0.0094 ** | 0.0288 ** | 0.3690 ** | 0.4059 ** | 0.0512 ** | 0.2888 ** | 0.0817 * | 0.2986 * | 0.1842 ** | 0.0000 ** | 0.9874 * | |

| China: Yantai | Coefficient | −0.0582 | −0.0444 | 0.1033 | 0.0962 | 0.1003 | 0.1516 | 0.1249 | 0.1378 | 0.0411 | −0.1126 | 0.0368 |

| t-stat | 3.8654 | 2.5109 | 4.0845 | 3.7764 | 2.5764 | 3.0693 | −2.7308 | 4.1540 | 3.0697 | −1.6093 | 2.1677 | |

| Prob | 0.3751 ** | 0.4225 ** | 0.2870 ** | 0.0061 ** | 0.3986 ** | 0.2100 ** | 0.0031 ** | 0.3991 ** | 0.2134 ** | 0.0421 ** | 0.1295 ** | |

| Denmark: Aarhus | Coefficient | −0.0125 | −0.0056 | 0.3286 | 0.3064 | 0.0275 | 0.0186 | 0.0518 | −0.0186 | 0.1046 | 0.0587 | −0.1079 |

| t-stat | −4.3890 | −3.8271 | 5.0400 | 3.1286 | 1.3884 | −2.6931 | 1.4553 | −2.5583 | 3.0035 | 3.0683 | 2.5872 | |

| Prob | 0.2362 * | 0.3053 * | 0.5156 ** | 0.2791 ** | 0.2380 * | 0.3815 * | 0.1609 * | 0.3990 * | 0.2377 ** | 0.2609 * | 0.1884 * | |

| Denmark: Copenhagen | Coefficient | −0.1274 | −0.1040 | 0.2467 | 0.2075 | 0.0052 | 0.0457 | 0.0071 | 0.0155 | 0.0391 | 0.0846 | −0.0385 |

| t-stat | 2.0071 | 4.8638 | −1.1865 | 2.9666 | −3.1409 | −4.9062 | 2.3645 | 1.6984 | 2.5986 | −2.6122 | −1.4096 | |

| Prob | 0.0385 ** | 0.1787 ** | 0.4003 ** | 0.3781 ** | 0.8726 * | 0.0498 * | 0.3096 * | 0.0682 * | 0.3352 * | 0.4823 * | 0.3193 * | |

| Denmark, Greenland: Nuuk | Coefficient | 0.0383 | 0.0446 | 0.7199 | 0.6483 | 0.0954 | 0.0073 | 0.4338 | −0.0870 | −0.0275 | −0.0081 | 0.1487 |

| t-stat | −1.4984 | −2.0095 | 4.2311 | 3.9750 | 2.8600 | 3.9846 | −2.6094 | 3.5941 | −1.5900 | −3.1977 | 4.1550 | |

| Prob | 0.8780 * | 0.3967 * | 0.7820 *** | 0.5301 *** | 0.0016 * | 0.6019 * | 0.4487 ** | 0.1110 * | 0.4692 * | 0.5239 * | 0.3819 * | |

| Iceland: Reydharfjordur | Coefficient | 0.0298 | 0.0202 | 0.5083 | 0.3716 | 0.2609 | 0.2317 | 0.5790 | −0.0142 | 0.0613 | 0.0103 | 0.0204 |

| t-stat | −2.9334 | −2.0651 | 4.5800 | 3.0825 | −2.4485 | 4.0883 | −2.0554 | 1.4496 | 2.8088 | 1.3585 | 2.5985 | |

| Prob | 0.5912 * | 0.3894 * | 0.3109 *** | 0.2904 *** | 0.5886 * | 0.2076 * | 0.1195 *** | 0.0065 * | 0.0301 * | 0.2780 * | 0.1920 ** | |

| Iceland: Reykjavik | Coefficient | −0.0155 | −0.0097 | 0.6214 | 0.5575 | 0.3173 | 0.2800 | 0.1677 | −0.0097 | 0.1005 | 0.0497 | 0.1106 |

| t-stat | −3.5506 | 4.6090 | 3.1798 | −2.4900 | −1.6960 | 1.9964 | −3.1385 | 2.2853 | 3.8974 | −2.6982 | 3.6899 | |

| Prob | 0.1483 * | 0.3698 * | 0.7926 *** | 0.0187 *** | 0.1678 ** | 0.4209 ** | 0.2509 ** | 0.3880 * | 0.1296 ** | 0.3485 ** | 0.3871 ** | |

| Japan: Akita | Coefficient | −0.1047 | −0.0964 | 0.5388 | 0.6011 | 0.1855 | 0.2076 | 0.1240 | 0.0047 | −0.0371 | −0.0222 | −0.1102 |

| t-stat | −2.0739 | −1.3009 | 2.4150 | 3.0653 | −2.3920 | −3.5391 | 4.7921 | −2.1494 | 1.1986 | 2.1043 | −2.7198 | |

| Prob | 0.3017 ** | 0.4755 ** | 0.5237 ** | 0.0517 ** | 0.1904 ** | 0.4864 ** | 0.3417 * | 0.1000 * | 0.0412 * | 0.1498 * | 0.5931 ** | |

| Japan: Hakata | Coefficient | −0.0341 | −0.0865 | 0.4021 | 0.3500 | 0.1472 | 0.1558 | 0.3572 | 0.0155 | 0.0394 | 0.0417 | 0.1034 |

| t-stat | 4.2880 | 3.6901 | 1.9733 | 2.8499 | 3.0593 | 2.6312 | 1.5996 | 2.9709 | 1.4980 | −1.4020 | 1.8765 | |

| Prob | 0.4494 ** | 0.0007 ** | 0.0598 ** | 0.1784 ** | 0.5700 ** | 0.2909 ** | 0.0038 * | 0.4882 * | 0.2653 * | 0.4883 * | 0.0029 ** | |

| Japan: Kitakyushu | Coefficient | −0.2082 | −0.2136 | 0.3424 | 0.4065 | 0.1975 | 0.1607 | 0.2005 | 0.1003 | 0.0167 | 0.0269 | −0.2690 |

| t-stat | 3.5685 | −2.0071 | 1.5076 | 4.7702 | −1.4767 | −2.0041 | 3.5877 | −1.5987 | 3.2992 | 2.8840 | 3.3851 | |

| Prob | 0.1376 ** | 0.2500 ** | 0.8927 ** | 0.8534 ** | 0.3092 ** | 0.2868 ** | 0.4982 ** | 0.0781 * | 0.1558 * | 0.2641 * | 0.5980 * | |

| Japan: Niigata | Coefficient | 0.1595 | 0.1243 | 0.1980 | 0.2371 | 0.2206 | 0.2547 | 0.0523 | 0.1204 | −0.0861 | −0.0293 | 0.0416 |

| t-stat | 4.1284 | 2.0009 | −1.2956 | −2.0046 | 4.1475 | 1.5083 | 2.9084 | 4.0880 | 3.1822 | 4.1000 | 2.1950 | |

| Prob | 0.3002 ** | 0.2764 ** | 0.0045 *** | 0.0498 *** | 0.0016 *** | 0.1696 *** | 0.5081 *** | 0.3905 * | 0.0015 ** | 0.1729 ** | 0.2407 ** | |

| Norway: Bergen | Coefficient | −0.0103 | −0.0225 | 0.1286 | 0.1085 | 0.1690 | 0.1773 | 0.1503 | 0.2566 | 0.1408 | 0.1774 | 0.3718 |

| t-stat | −4.1852 | −3.0741 | 2.0954 | 3.1264 | −1.5821 | −2.2045 | −1.5938 | 2.0548 | −1.3056 | −2.0063 | −2.2595 | |

| Prob | 0.1084 ** | 0.4827 ** | 0.1008 ** | 0.3851 ** | 0.4593 * | 0.3841 * | 0.2855 ** | 0.7109 ** | 0.1297 ** | 0.5028 ** | 0.2091 ** | |

| Norway: Hammerfest | Coefficient | −0.0287 | −0.0113 | 0.0392 | 0.0506 | 0.0452 | 0.0587 | 0.2014 | 0.2065 | 0.0495 | 0.3125 | 0.2046 |

| t-stat | −3.7918 | −1.0584 | 2.9805 | 3.8562 | −4.0127 | −2.1084 | 1.5039 | −1.5003 | −3.0882 | 1.4995 | −3.0067 | |

| Prob | 0.3866 ** | 0.2095 ** | 0.6733 * | 0.3500 * | 0.2986 * | 0.3762 * | 0.5877 * | 0.4201 ** | 0.0000 ** | 0.0982 ** | 0.0038 * | |

| Norway: Stavanger | Coefficient | 0.0110 | 0.0273 | 0.2409 | 0.2307 | 0.0175 | 0.0385 | 0.1805 | 0.1699 | 0.3019 | 0.2543 | 0.3102 |

| t-stat | 2.1084 | 1.9820 | 4.9864 | 1.3986 | 3.0386 | 2.4761 | −1.4082 | 2.4056 | 4.2066 | 3.0051 | 2.9047 | |

| Prob | 0.3872 * | 0.2574 * | 0.5001 ** | 0.3403 ** | 0.4501 ** | 0.5720 ** | 0.0060 ** | 0.1785 ** | 0.3874 ** | 0.5052 ** | 0.3855 ** | |

| Norway: Tromso | Coefficient | −0.0490 | −0.0502 | 0.2288 | 0.1954 | 0.0787 | 0.0644 | 0.1513 | 0.0284 | 0.0135 | 0.0498 | 0.1984 |

| t-stat | 1.8723 | 3.0001 | 2.6505 | 3.0843 | 2.0004 | 4.3965 | 3.8601 | −2.6097 | 1.0741 | 3.1110 | −2.4091 | |

| Prob | 0.0986 ** | 0.4985 ** | 0.0041 ** | 0.2671 ** | 0.3096 * | 0.4861 * | 0.2312 ** | 0.3550 * | 0.2864 * | 0.3509 * | 0.4986 ** | |

| Norway: Trondheim | Coefficient | 0.0564 | 0.0632 | 0.1152 | 0.1605 | 0.2851 | 0.2550 | 0.0397 | 0.1296 | 0.3750 | 0.2076 | 0.4097 |

| t-stat | 3.2951 | 2.4077 | 3.4096 | 2.2472 | 3.0448 | 2.1977 | −1.5085 | 4.5402 | 1.8563 | −2.0985 | 3.0950 | |

| Prob | 0.0007 ** | 0.0134 ** | 0.2509 *** | 0.4854 *** | 0.2099 ** | 0.3296 ** | 0.4994 ** | 0.3347 ** | 0.5097 ** | 0.1209 ** | 0.0036 *** | |

| Russia: Anadyr | Coefficient | 0.0015 | 0.0019 | 0.0553 | 0.0002 | 0.0038 | 0.0005 | 0.0408 | −0.0003 | −0.0002 | 0.0005 | −0.0481 |

| t-stat | 3.1408 | 2.4801 | −2.1984 | −1.8508 | −2.0045 | −1.0672 | 3.7055 | −4.1834 | 3.8591 | 2.5281 | 1.0833 | |

| Prob | 0.2981 * | 0.0975 * | 0.3061 * | 0.4009 * | 0.3072 * | 0.6820 * | 0.3097 ** | 0.2751 * | 0.6953 * | 0.6509 * | 0.5802 * | |

| Russia: Arkhangelsk | Coefficient | −0.0196 | −0.0207 | 0.0187 | 0.0206 | 0.0054 | 0.0098 | 0.0829 | −0.0040 | 0.1497 | 0.1025 | 0.0496 |

| t-stat | 2.0507 | 3.8502 | −1.3955 | −2.0412 | −4.9287 | 5.0945 | 2.7756 | 3.9852 | −1.5054 | −2.0064 | 3.1247 | |

| Prob | 0.0829 ** | 0.3813 ** | 0.4409 ** | 0.0389 ** | 0.5845 * | 0.5699 * | 0.7281 * | 0.8555 * | 0.0582 * | 0.7177 * | 0.2986 ** | |

| Russia: Dudinka | Coefficient | 0.0062 | 0.0108 | 0.0052 | 0.0005 | 0.0059 | 0.0002 | 0.0665 | 0.0104 | 0.0051 | 0.0040 | 0.0182 |

| t-stat | −1.4078 | −2.5095 | 4.0581 | 2.9770 | 3.9006 | −4.5281 | −1.9664 | 3.8911 | 2.6096 | 4.9873 | −1.9503 | |

| Prob | 0.3769 * | 0.4401 * | 0.7200 * | 0.3086 * | 0.4071 * | 0.5069 * | 0.0052 ** | 0.0837 * | 0.2223 * | 0.5019 * | 0.0849 * | |

| Russia: Murmansk | Coefficient | −0.0295 | −0.0180 | 0.1149 | 0.1509 | 0.0297 | 0.0104 | 0.1147 | 0.0124 | 0.1614 | 0.1808 | 0.2580 |

| t-stat | 4.5096 | 2.5985 | −1.4085 | −3.0955 | −1.0583 | 2.0588 | 1.0095 | 2.0985 | 3.0009 | −2.4621 | −4.9076 | |

| Prob | 0.4507 ** | 0.3811 ** | 0.3222 *** | 0.4086 *** | 0.5929 * | 0.0061 * | 0.3376 ** | 0.5902 * | 0.6871 ** | 0.2984 ** | 0.0791 *** | |

| Russia: Petropavlovsk | Coefficient | 0.0663 | 0.0504 | 0.1146 | 0.1532 | 0.0135 | 0.0067 | 0.0508 | 0.0396 | 0.0023 | 0.0040 | 0.1573 |

| t-stat | 2.0000 | 2.3856 | −3.5041 | −2.0698 | 1.0532 | 4.9433 | −2.9870 | 1.6084 | 2.6830 | −3.8045 | 2.0005 | |

| Prob | 0.5288 * | 0.6902 * | 0.0057 * | 0.1904 * | 0.0994 * | 0.7502 * | 0.3099 ** | 0.0087 * | 0.1481 * | 0.5409 * | 0.4873 ** | |

| Russia: Pevek | Coefficient | 0.0075 | 0.0104 | 0.2094 | 0.0066 | 0.0061 | 0.0013 | 0.0114 | 0.0058 | 0.0014 | 0.0023 | 0.1106 |

| t-stat | −1.9409 | −3.8700 | 2.8895 | 1.0587 | 3.0855 | 2.9555 | −2.0065 | 3.1335 | −4.9722 | −2.5561 | −3.6091 | |

| Prob | 0.0663 * | 0.4426 * | 0.5873 * | 0.4200 * | 0.0000 * | 0.0000 * | 0.1982 ** | 0.5987 * | 0.0003 * | 0.4093 * | 0.3863 * | |

| Russia: Sabetta | Coefficient | 0.0207 | 0.0195 | 0.0396 | 0.0008 | 0.0897 | 0.0002 | 0.0058 | 0.1804 | 0.0004 | 0.0002 | 0.3472 |

| t-stat | −2.2060 | −1.4809 | 2.9487 | 4.0596 | 3.1774 | 2.1247 | 3.0871 | −5.0822 | −3.8961 | −4.2247 | 3.6053 | |

| Prob | 0.4791 * | 0.2853 * | 0.0035 ** | 0.7091 * | 0.6908 ** | 0.7883 * | 0.0039 * | 0.9431 ** | 0.2907 * | 0.6148 * | 0.5686 ** | |

| Russia: Vladivostok | Coefficient | −0.0593 | −0.0355 | 0.0340 | 0.1985 | 0.1345 | 0.1590 | 0.0292 | 0.0853 | 0.2480 | 0.2175 | 0.4112 |

| t-stat | 3.1134 | 1.4094 | 2.0556 | 3.5444 | 1.9800 | 4.9801 | −2.0440 | −3.5104 | 4.1564 | 3.9962 | 2.2275 | |

| Prob | 0.0988 ** | 0.0527 ** | 0.0974 *** | 0.1307 ** | 0.4877 *** | 0.2874 *** | 0.0598 * | 0.1365 * | 0.3902 *** | 0.8271 *** | 0.3609 *** | |

| South Korea: Gwangyang | Coefficient | −0.0570 | −0.0651 | 0.3406 | 0.3053 | 0.3415 | 0.3076 | −0.0817 | −0.0993 | −0.0018 | −0.0036 | 0.2808 |

| t-stat | −3.5442 | −2.2309 | 4.1158 | 3.4724 | −1.5982 | −2.7951 | 2.0041 | −1.5081 | 2.5814 | 3.4140 | 1.7377 | |

| Prob | 0.8691 ** | 0.4255 ** | 0.3754 ** | 0.5160 ** | 0.4773 *** | 0.5870 *** | 0.0482 * | 0.5802 * | 0.1263 * | 0.0006 ** | 0.1283 ** | |

| South Korea: Pusan | Coefficient | 0.0814 | 0.0642 | 0.8115 | 0.8359 | 0.6776 | 0.6015 | −0.1405 | −0.1620 | −0.0057 | −0.0114 | 0.6217 |

| t-stat | 1.8693 | 2.7993 | 4.6346 | 3.0045 | −3.6871 | −1.9865 | 2.0481 | 3.6111 | −1.5548 | −2.6932 | −4.8994 | |

| Prob | 0.0809 ** | 0.5581 ** | 0.9500 *** | 0.8198 *** | 0.6900 *** | 0.5824 *** | 0.3870 ** | 0.4816 ** | 0.8347 ** | 0.5918 ** | 0.6000 *** | |

| South Korea: Ulsan | Coefficient | −0.0474 | −0.0576 | 0.5209 | 0.5573 | 0.5116 | 0.4370 | 0.0045 | −0.0954 | −0.0664 | −0.0407 | 0.5836 |

| t-stat | 3.5500 | 1.4732 | 3.5664 | 4.0560 | −2.8095 | −1.4567 | −3.9582 | −2.0585 | −3.4493 | −2.3763 | −3.1371 | |

| Prob | 0.3571 ** | 0.5918 ** | 0.6816 *** | 0.4176 *** | 0.5983 *** | 0.4442 *** | 0.9185 * | 0.7203 * | 0.0037 * | 0.0448 ** | 0.2795 ** | |

| Sweden: Gothenburg | Coefficient | 0.0045 | 0.0037 | 0.7054 | 0.7650 | 0.1619 | 0.1890 | 0.1581 | −0.0018 | 0.0136 | 0.0744 | −0.3028 |

| t-stat | 1.5828 | 2.5336 | −4.9007 | −3.1974 | −1.8592 | −2.2971 | 1.8429 | −3.0284 | 1.7083 | 2.1286 | −3.1401 | |

| Prob | 0.3752 * | 0.4975 * | 0.8162 *** | 0.7005 *** | 0.6866 ** | 0.2309 ** | 0.4105 ** | 0.1562 * | 0.0000 * | 0.0287 * | 0.5982 *** | |

| Sweden: Halmstad | Coefficient | 0.0006 | 0.0004 | 0.3569 | 0.4021 | 0.1047 | 0.1456 | 0.0368 | −0.0035 | 0.0275 | 0.0805 | 0.0485 |

| t-stat | 3.7099 | 2.8671 | −3.0988 | −2.6810 | −4.6438 | −2.0974 | 2.0815 | 4.4911 | 2.6092 | 3.8881 | −2.7002 | |

| Prob | 0.3812 * | 0.4502 * | 0.4713 *** | 0.5658 *** | 0.1870 ** | 0.2619 ** | 0.5092 ** | 0.2976 * | 0.4983 * | 0.2550 * | 0.2976 ** |

Appendix D

| Port | Parameter | X3 | X4 | X5 | X6 | X7 | X8 | X9 | X10 | Constant |

|---|---|---|---|---|---|---|---|---|---|---|

| China: Dalian | Coefficient | 0.1235 | 0.2248 | 0.2035 | 0.1944 | 0.0720 | −0.1424 | −0.0565 | −0.1527 | 3.2765 |

| t-stat | 1.2741 *** | −3.4297 *** | −1.9264 ** | −2.3273 ** | 3.8319 * | −1.8300 ** | 1.7347 *** | 2.3091 *** | 2.2281 | |

| China: Lianyungang | Coefficient | 0.1638 | 0.2134 | 0.1386 | 0.1307 | 0.2015 | −0.0748 | 0.0548 | −0.1132 | 2.4523 |

| t-stat | −2.4371 ** | 2.9999 ** | −2.3982 * | −3.2591 * | −3.4778 * | 1.9756 * | 2.7232 ** | −3.4544 ** | 3.1742 | |

| China: Qingdao | Coefficient | 0.2655 | 0.2318 | 0.3445 | 0.3616 | 0.1232 | −0.0375 | −0.3111 | −0.1459 | −4.1376 |

| t-stat | 1.4967 ** | 2.6805 ** | −4.5940 *** | −1.8367 *** | 2.3719 * | 1.7622 ** | 3.4780 *** | −1.3254 *** | −1.5005 | |

| China: Qinhuangdao | Coefficient | 0.2352 | 0.2002 | 0.1453 | 0.1542 | 0.0863 | 0.0283 | 0.0387 | −0.0371 | 5.1893 |

| t-stat | 2.8307 ** | 3.1531 ** | 1.2763 * | 2.5395 * | −2.1279 * | 1.4721 * | 1.0724 ** | 4.3864 ** | 3.4722 | |

| China: Rizhao | Coefficient | 0.4176 | 0.3726 | 0.1280 | 0.1666 | 0.0084 | 0.1637 | 0.0255 | 0.0169 | 4.8531 |

| t-stat | 4.3809 ** | 2.0827 ** | −2.3195 * | −2.0874 * | 3.4807 * | −2.1489 * | −2.2987 * | 2.3206 ** | 3.3678 * | |

| China: Shanghai | Coefficient | 0.7254 | 0.7742 | 0.5683 | 0.5967 | 0.1798 | 0.2483 | 0.2659 | −0.3215 | −5.2730 |

| t-stat | 4.9512 *** | −2.3945 *** | 1.1700 *** | 2.4843 *** | −3.4615 ** | 2.3311 ** | −1.0315 *** | 3.8843 *** | −3.1662 | |

| China: Weihai | Coefficient | 0.3017 | 0.4276 | 0.1635 | 0.1955 | 0.0564 | 0.1829 | 0.1946 | 0.0636 | 2.2113 |

| t-stat | 4.5200 ** | 1.6991 ** | −4.2046 ** | −2.2316 ** | 3.2851 * | 2.1272 * | 3.0271 ** | −1.8200 ** | 3.6585 | |

| China: Yantai | Coefficient | 0.2784 | 0.2465 | 0.1739 | 0.2341 | 0.1529 | 0.2585 | 0.0555 | −0.1478 | 4.3971 |

| t-stat | 3.0773 *** | −2.5710 *** | 3.2285 ** | 1.7275 ** | −2.3004 ** | 3.1964 ** | 2.7232 ** | −2.7193 ** | 2.2276 | |

| Denmark: Aarhus | Coefficient | 0.1845 | 0.1344 | 0.0722 | 0.0624 | 0.0965 | −0.0421 | 0.1617 | 0.0995 | −3.5323 |

| t-stat | 2.3808 *** | 2.5956 *** | 1.5310 * | −2.2937 * | 1.5312 * | −3.1375 * | 1.2534 ** | 2.3852 * | 1.5905 | |

| Denmark: Copenhagen | Coefficient | 0.1402 | 0.1732 | 0.0255 | 0.0813 | 0.0400 | 0.0667 | 0.0511 | 0.1267 | −4.6628 |

| t-stat | −1.5213 *** | 3.1648 *** | −2.0176 * | −4.2565 * | 2.1406 * | 4.5489 * | 2.7042 * | −1.8553 * | −2.7390 | |

| Denmark, Greenland: Nuuk | Coefficient | 0.7235 | 0.6857 | 0.1523 | 0.0246 | 0.5275 | −0.1382 | −0.0756 | −0.0250 | 5.2034 |

| t-stat | 3.0804 *** | 4.1621 *** | −1.4592 * | 2.4521 * | −1.9221 ** | 2.3176 * | −1.3413 * | −1.5126 * | 3.5615 | |

| Iceland: Reydharfjordur | Coefficient | 0.5156 | 0.4275 | 0.2551 | 0.2472 | 0.5384 | −0.0347 | 0.0614 | 0.0411 | 2.3587 |

| t-stat | 2.7443 *** | 2.6310 *** | −1.2964 * | 2.8333 * | −1.6565 *** | 2.4251 * | 2.7256 * | 1.8324 * | 2.0671 | |

| Iceland: Reykjavik | Coefficient | 0.6842 | 0.6198 | 0.4823 | 0.2755 | 0.1716 | −0.0423 | 0.1399 | 0.0638 | 4.2592 |

| t-stat | 2.1763 *** | −2.5334 *** | −2.5562 ** | 2.6216 ** | −2.6288 ** | 1.7262 * | 3.1762 ** | −1.8230 ** | 3.7460 | |

| Japan: Akita | Coefficient | 0.5111 | 0.6087 | 0.2431 | 0.2284 | 0.1803 | 0.0479 | −0.0843 | −0.0655 | −4.5829 |

| t-stat | 2.2875 ** | 2.7918 ** | −3.3827 ** | −2.5197 ** | 2.6951 * | −1.6035 * | 2.4114 * | 1.5314 * | −2.7044 | |

| Japan: Hakata | Coefficient | 0.4584 | 0.4975 | 0.1963 | 0.2512 | 0.3560 | 0.0671 | 0.0782 | 0.0821 | 4.8276 |

| t-stat | 1.7721 ** | 2.8512 ** | 3.0008 ** | 2.4908 ** | 1.9542 * | 3.2556 * | 2.3907 * | −2.6630 * | 2.7921 | |

| Japan: Kitakyushu | Coefficient | 0.3927 | 0.4584 | 0.1746 | 0.2165 | 0.2294 | 0.1777 | 0.0653 | 0.0882 | −5.6415 |

| t-stat | 1.8409 ** | 2.9116 ** | −2.3875 ** | −2.1840 ** | 4.5517 ** | −1.8623 * | 2.7621 * | 1.7313 * | −4.5526 | |

| Japan: Niigata | Coefficient | 0.2752 | 0.2460 | 0.2861 | 0.3485 | 0.0514 | 0.1405 | −0.1584 | −0.0621 | 3.3840 |

| t-stat | −2.8150 *** | −2.3854 *** | 3.3705 *** | 2.6832 *** | 1.7280 *** | 2.7334 * | 1.7335 ** | 3.5992 ** | 2.0052 | |

| Norway: Bergen | Coefficient | 0.2516 | 0.1563 | 0.2440 | 0.2186 | 0.1843 | 0.3247 | 0.1360 | 0.2239 | 3.5287 |

| t-stat | 2.3543 ** | −2.1885 ** | −2.2598 * | −1.4934 * | −3.7609 ** | 1.6111 ** | −2.3952 ** | −2.5251 ** | 2.1645 | |

| Norway: Hammerfest | Coefficient | 0.0744 | 0.0800 | 0.0961 | 0.0709 | 0.2665 | 0.2330 | 0.0941 | 0.3883 | 5.3054 |

| t-stat | 2.3187 ** | 3.5816 ** | −3.0335 * | −2.5882 * | 2.9174 * | −3.5792 ** | −2.5304 ** | 3.4737 ** | 3.5287 | |

| Norway: Stavanger | Coefficient | 0.2995 | 0.3447 | 0.0927 | 0.0731 | 0.2652 | 0.1755 | 0.4265 | 0.2385 | 4.2556 |

| t-stat | 4.1850 *** | 2.5643 *** | 4.4436 ** | 1.8520 ** | −3.0186 ** | 1.7234 ** | 2.8667 ** | 1.7114 ** | 2.0081 | |

| Norway: Tromso | Coefficient | 0.2713 | 0.2862 | 0.1543 | 0.1256 | 0.1913 | 0.0996 | 0.0309 | 0.0622 | 3.4619 |

| t-stat | 2.2246 *** | −4.5505 *** | 2.6285 * | 2.7095 * | 1.7200 ** | −2.2838 * | 3.5176 * | 2.3787 * | 2.0387 | |

| Norway: Trondheim | Coefficient | 0.1637 | 0.2739 | 0.3612 | 0.3330 | 0.0908 | 0.1831 | 0.4274 | 0.1916 | 5.1862 |

| t-stat | −2.3062 *** | 1.8174 *** | 2.7556 ** | 1.8621 ** | −3.1634 ** | 4.2559 ** | 2.2965 ** | −3.0001 ** | 4.6559 | |

| Russia: Anadyr | Coefficient | 0.0706 | 0.0032 | 0.00109 | 0.0075 | 0.0837 | −0.0112 | −0.0030 | 0.0028 | −3.1780 |

| t-stat | −2.5873 * | −3.5985 * | −1.3917 * | −2.6173 * | 1.4095 ** | −2.3887 * | 2.6774 * | 2.1795 * | −2.5545 | |

| Russia: Arkhangelsk | Coefficient | 0.0581 | 0.0374 | 0.0095 | 0.0457 | 0.1520 | −0.0135 | 0.2487 | 0.1553 | 5.2761 |

| t-stat | −2.3995 ** | −2.0456 ** | −3.5286 * | 3.6812 * | 3.2293 * | 2.7697 * | −1.9990 * | −2.0046 * | 4.6882 | |

| Russia: Dudinka | Coefficient | 0.0089 | 0.0037 | 0.0077 | 0.0065 | 0.1671 | 0.0202 | 0.00116 | 0.0122 | 3.4550 |

| t-stat | −3.3553 * | 1.8820 * | −2.8148 * | −2.9153 * | −1.8729 ** | 2.8151 * | 1.5370 * | 2.7609 * | 2.7166 | |

| Russia: Murmansk | Coefficient | 0.1417 | 0.1815 | 0.0621 | 0.0120 | 0.1773 | 0.0266 | 0.11744 | 0.2751 | 6.3375 |

| t-stat | −3.0815 *** | −2.0058 *** | −1.8130 * | 2.4839 * | −2.0194 ** | −1.7810 ** | 2.7151 ** | −2.0365 ** | 5.0949 | |

| Russia: Petropavlovsk | Coefficient | 0.1550 | 0.1732 | 0.0445 | 0.0278 | 0.0709 | 0.0628 | 0.0076 | 0.0090 | 3.5812 |

| t-stat | −4.2656 * | −2.8954 * | 1.8182 * | 3.3365 * | −1.6845 ** | 3.1475 * | 2.6187 * | −2.1154 * | 3.2980 | |

| Russia: Pevek | Coefficient | 0.1822 | 0.00135 | 0.0163 | 0.0189 | 0.0200 | 0.0447 | 0.0103 | 0.0067 | 4.3167 |

| t-stat | 1.9457 * | 1.6089 * | 3.8265 * | 1.7704 * | −3.5287 ** | 2.1860 * | −3.1498 * | −1.5980 * | 2.0095 | |

| Russia: Sabetta | Coefficient | 0.0663 | 0.0043 | 0.1664 | 0.0091 | 0.0084 | 0.2788 | 0.0060 | 0.0069 | 3.7599 |

| t-stat | 2.5055 ** | −2.0787 * | 1.9875 ** | 2.4980 * | 2.5112 * | −4.5909 ** | −3.1693 * | −3.4897 * | 2.4631 | |

| Russia: Vladivostok | Coefficient | 0.0884 | 0.2352 | 0.1713 | 0.2054 | 0.0535 | 0.1275 | 0.2926 | 0.2112 | 6.2680 |

| t-stat | 4.4591 *** | 2.3716 ** | −2.5361 *** | 3.8276 *** | −2.6289 * | −2.5804 ** | 1.2017 *** | 1.7975 *** | 5.3799 | |

| South Korea: Gwangyang | Coefficient | 0.4516 | 0.4285 | 0.3590 | 0.3082 | −0.0904 | −0.1126 | −0.0132 | −0.0089 | 3.2795 |

| t-stat | 2.8029 *** | 1.5296 ** | −2.3983 *** | −1.6396 *** | 4.8275 * | −2.8227 * | 1.5541 * | −2.4002 ** | 2.7891 | |

| South Korea: Pusan | Coefficient | 0.8217 | 0.7814 | 0.7093 | 0.6619 | −0.1541 | −0.1773 | −0.0158 | −0.0594 | 5.3987 |

| t-stat | −2.0039 *** | −2.5870 *** | −1.4069 *** | −2.9276 *** | 1.8266 ** | 2.0095 ** | −4.5203 ** | −1.8886 ** | 3.1963 | |

| South Korea: Ulsan | Coefficient | 0.6573 | 0.5718 | 0.5608 | 0.4767 | 0.0134 | −0.0874 | −0.1227 | −0.0995 | 4.0440 |

| t-stat | 4.1280 *** | 3.0052 *** | −2.4816 *** | −2.0086 *** | −4.5598 * | −3.2790 * | −2.4986 * | −4.2644 ** | 3.8215 | |

| Sweden: Gothenburg | Coefficient | 0.7031 | 0.7394 | 0.2001 | 0.1670 | 0.1783 | −0.0144 | 0.0169 | 0.0931 | 6.4778 |

| t-stat | −2.3827 *** | −1.6590 *** | −2.3857 ** | −3.5281 ** | 3.5990 ** | −1.8976 * | 2.1024 * | −1.5509 * | 4.6380 | |

| Sweden: Halmstad | Coefficient | 0.4136 | 0.4322 | 0.1760 | 0.1574 | 0.0775 | −0.0353 | 0.0665 | 0.0963 | 5.1385 |

| t-stat | −1.4789 *** | −3.2971 *** | −3.9178 ** | −1.6660 ** | 4.9836 ** | 2.4812 * | 3.0009 * | 1.5987 * | 3.0041 |

| Port | Parameter | X1 | X2 | X3 | X4 | X5 | X6 | X7 | X8 | X9 | X10 | Constant |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| China: Dalian | Coefficient | −0.0157 | −0.0245 | 0.1470 | 0.1568 | 0.1773 | 0.1982 | 0.0561 | −0.1450 | −0.0239 | −0.1725 | 3.7612 |

| t-stat | 2.2249 ** | 3.0019 ** | 2.9387 ** | −4.0012 ** | 2.6981 * | −3.5099 ** | 2.8512 * | 1.9563 ** | 2.0045 *** | 3.2986 *** | 2.6546 | |

| China: Lianyungang | Coefficient | −0.0358 | −0.0442 | 0.0528 | 0.0647 | 0.0425 | 0.0513 | 0.1630 | −0.0672 | 0.0730 | −0.1379 | 6.3715 |

| t-stat | −3.2905 ** | −2.5990 ** | 3.6111 * | 2.1295 * | −1.6056 * | −2.6276 * | −2.4389 * | 4.1508 * | 2.6884 ** | −1.5203 ** | 4.2100 | |

| China: Qingdao | Coefficient | 0.0312 | 0.0054 | 0.1452 | 0.1555 | 0.2234 | 0.2521 | 0.0618 | −0.0083 | −0.2953 | −0.1476 | −5.8761 |

| t-stat | 3.1649 * | 2.5189 * | 3.3765 * | 3.6186 * | −2.6701 ** | −3.3478 ** | 4.7165 * | 3.4514 ** | 2.6197 *** | 3.2421 *** | −3.3409 | |

| China: Qinhuangdao | Coefficient | −0.0754 | −0.0548 | 0.2387 | 0.1752 | 0.0733 | 0.0567 | 0.0831 | 0.0097 | 0.0205 | −0.0044 | 5.1285 |

| t-stat | −2.6285 * | −3.7153 * | 1.7440 ** | 3.1508 ** | 4.5172 * | 3.3196 * | −2.2590 * | 1.3896 * | 4.0089 ** | 3.5217 ** | 4.0006 | |

| China: Rizhao | Coefficient | −0.1340 | −0.1195 | 0.1297 | 0.1201 | 0.0376 | 0.0935 | 0.0097 | 0.1582 | 0.0094 | 0.0190 | 4.1138 |

| t-stat | −4.2759 ** | −3.0164 ** | 2.2256 ** | 3.2378 ** | 2.1390 * | 2.8527 * | 1.8361 * | −3.4800 * | −2.7182 * | 1.3114 ** | 3.5706 | |

| China: Shanghai | Coefficient | 0.1304 | 0.1256 | 0.4150 | 0.3628 | 0.4209 | 0.2514 | 0.1523 | 0.2195 | 0.2156 | −0.2230 | −6.1713 |

| t-stat | 2.5981 * | 2.1294 * | 3.7598 *** | 3.4519 *** | 1.3871 *** | 1.5662 *** | −4.5299 ** | 5.3298 ** | 3.1590 *** | 2.1308 *** | −4.2992 | |

| China: Weihai | Coefficient | −0.0122 | −0.0237 | 0.1442 | 0.1753 | 0.0674 | 0.0751 | 0.0640 | 0.1483 | 0.1815 | 0.0427 | 5.7634 |

| t-stat | −1.5380 ** | −2.6908 ** | 4.5700 ** | 3.4729 ** | −4.2568 ** | −3.6225 ** | 2.8321 * | 3.2648 * | 1.2930 ** | −3.5113 ** | 2.5310 | |

| China: Yantai | Coefficient | −0.0503 | −0.0531 | 0.1256 | 0.0950 | 0.1241 | 0.1553 | 0.1452 | 0.1527 | 0.0505 | −0.1486 | 4.4456 |

| t-stat | 3.6125 ** | 2.7142 ** | 4.4003 ** | 3.6128 ** | 2.3987 ** | 3.1786 ** | −2.5009 ** | 4.7996 ** | 3.2913 ** | −2.7962 ** | 3.5897 | |

| Denmark: Aarhus | Coefficient | −0.0246 | −0.0097 | 0.3419 | 0.2915 | 0.0347 | 0.0224 | 0.0575 | −0.0192 | 0.1164 | 0.0740 | −5.1362 |

| t-stat | −4.4085 * | −3.7736 * | 5.3600 ** | 3.6262 ** | 1.5503 * | −2.2843 * | 1.6448 * | −2.4861 * | 3.7080 ** | 3.5123 * | −4.6251 | |

| Denmark: Copenhagen | Coefficient | −0.1566 | −0.1454 | 0.2503 | 0.2264 | 0.0060 | 0.0554 | 0.0083 | 0.0164 | 0.0435 | 0.0777 | −3.2587 |

| t-stat | 2.3051 ** | 4.7238 ** | −1.4967 ** | 2.7481 ** | −3.3714 * | −4.7006 * | 2.5091 * | 1.5226 * | 2.6172 * | −2.4553 * | −2.3521 | |

| Denmark, Greenland: Nuuk | Coefficient | 0.0366 | 0.0473 | 0.7351 | 0.6775 | 0.0921 | 0.0070 | 0.4516 | −0.0832 | −0.0299 | −0.0134 | 4.5600 |

| t-stat | −1.5827 * | −2.2518 * | 4.2879 *** | 3.8163 *** | 2.7265 * | 3.6198 * | −2.6315 ** | 3.4440 * | −1.7451 * | −3.5819 * | 4.2187 | |

| Iceland: Reydharfjordur | Coefficient | 0.0342 | 0.0215 | 0.5274 | 0.3969 | 0.2830 | 0.2697 | 0.5930 | −0.0156 | 0.0715 | 0.0147 | 5.0232 |

| t-stat | −2.4054 * | −2.7916 * | 4.2613 *** | 3.3514 *** | −2.5326 * | 4.4625 * | −2.4811 *** | 1.6822 * | 2.6380 * | 1.0000 * | 3.5714 | |

| Iceland: Reykjavik | Coefficient | −0.0236 | −0.0174 | 0.6532 | 0.5731 | 0.3003 | 0.2954 | 0.1850 | −0.0123 | 0.1486 | 0.0638 | 6.3522 |

| t-stat | −3.7198 * | 4.5261 * | 3.3899 *** | −2.5247 *** | −1.8345 ** | 1.9685 ** | −3.2747 ** | 2.4981 * | 3.5344 ** | −2.8625 ** | 5.4910 | |

| Japan: Akita | Coefficient | −0.1123 | −0.0909 | 0.5563 | 0.6215 | 0.1964 | 0.2240 | 0.1498 | 0.0086 | −0.0465 | −0.0341 | −3.5213 |

| t-stat | −2.5934 ** | −1.5487 ** | 2.5712 ** | 3.3408 ** | −2.5370 ** | −3.0567 ** | 4.4665 * | −2.4565 * | 1.3173 * | 2.4226 * | −2.3999 | |

| Japan: Hakata | Coefficient | −0.0405 | −0.0864 | 0.4340 | 0.3422 | 0.1635 | 0.1754 | 0.3613 | 0.0170 | 0.0381 | 0.0654 | 3.6280 |

| t-stat | 4.2984 ** | 3.7282 ** | 1.8651 ** | 2.8537 ** | 3.2049 ** | 2.6210 ** | 1.7506 * | 2.8418 * | 1.7399 * | −1.5980 * | 2.1341 | |

| Japan: Kitakyushu | Coefficient | −0.2316 | −0.2300 | 0.3145 | 0.4928 | 0.2250 | 0.1549 | 0.2407 | 0.1255 | 0.0182 | 0.0333 | −5.3826 |

| t-stat | 3.7388 ** | −2.2738 ** | 1.7507 ** | 4.5755 ** | −1.6131 ** | −2.1213 ** | 2.6628 ** | −1.5673 * | 3.1996 * | 2.0276 * | −3.0024 | |

| Japan: Niigata | Coefficient | 0.1775 | 0.1104 | 0.2158 | 0.2470 | 0.2015 | 0.2824 | 0.0600 | 0.1364 | −0.0975 | −0.0409 | 6.2345 |

| t-stat | 3.5172 ** | 1.7396 ** | −2.5573 *** | −3.6369 *** | 4.3862 *** | 2.5731 *** | 1.5382 *** | 4.7211 * | 2.7523 ** | 3.3278 ** | 4.6117 | |

| Norway: Bergen | Coefficient | −0.0164 | −0.0331 | 0.1485 | 0.1001 | 0.1884 | 0.1569 | 0.1754 | 0.2362 | 0.1565 | 0.1831 | 3.5220 |

| t-stat | −3.8526 ** | −3.5920 ** | 2.1567 ** | 2.8332 ** | −1.7210 * | −2.4352 * | −2.3709 ** | 2.5863 ** | −2.4207 ** | −2.7456 ** | 2.3476 | |

| Norway: Hammerfest | Coefficient | −0.0265 | −0.0326 | 0.0472 | 0.0743 | 0.0399 | 0.0545 | 0.2356 | 0.2134 | 0.0612 | 0.3007 | 5.9992 |

| t-stat | −3.4387 ** | −2.4187 ** | 3.4206 * | 2.6938 * | −3.4251 * | −2.5710 * | 2.4884 * | −1.6307 ** | −3.2655 ** | 1.6284 ** | 3.5475 | |

| Norway: Stavanger | Coefficient | 0.0153 | 0.0242 | 0.2580 | 0.2421 | 0.0166 | 0.0532 | 0.1775 | 0.1863 | 0.3350 | 0.2675 | 6.6820 |

| t-stat | 3.2854 * | 2.4966 * | 4.7364 ** | 1.6408 ** | 3.2489 ** | 2.3005 ** | −1.5113 ** | 2.5981 ** | 4.1673 ** | 3.2151 ** | 4.7532 | |

| Norway: Tromso | Coefficient | −0.0483 | −0.0574 | 0.2341 | 0.1752 | 0.0785 | 0.0519 | 0.1670 | 0.0445 | 0.0256 | 0.0662 | 5.5311 |

| t-stat | 2.5800 ** | 3.2856 ** | 2.7209 ** | 3.1954 ** | 2.3661 * | 3.5998 * | 3.4839 ** | −2.9113 * | 1.2749 * | 3.4806 * | 3.8006 | |

| Norway: Trondheim | Coefficient | 0.0677 | 0.0585 | 0.1217 | 0.1751 | 0.2630 | 0.2652 | 0.0523 | 0.1400 | 0.3675 | 0.2138 | 4.3717 |

| t-stat | 2.3692 ** | 3.6401 ** | 2.5962 *** | 2.3760 *** | 3.2624 ** | 2.2471 ** | −1.6296 ** | 4.1625 ** | 2.8841 ** | −2.1532 ** | 3.9552 | |

| Russia: Anadyr | Coefficient | 0.0018 | 0.0023 | 0.0562 | 0.0009 | 0.0065 | 0.0012 | 0.0550 | −0.0031 | −0.0042 | 0.0013 | −5.3276 |

| t-stat | 2.1535 * | 2.5184 * | −1.2396 * | −1.2536 * | −2.1427 * | −1.3074 * | 2.6186 ** | −3.5283 * | 4.0635 * | 2.1467 * | −4.4884 | |

| Russia: Arkhangelsk | Coefficient | −0.0332 | −0.0411 | 0.0357 | 0.0448 | 0.0125 | 0.0231 | 0.0824 | −0.0057 | 0.1621 | 0.1274 | 4.1235 |

| t-stat | 2.1574 ** | 3.6275 ** | −2.5583 ** | −3.5751 ** | −4.8266 * | 5.2408 * | 1.6200 * | 4.8652 * | −2.6333 * | −3.6755 * | 3.0053 | |

| Russia: Dudinka | Coefficient | 0.0095 | 0.0127 | 0.0234 | 0.0032 | 0.0070 | 0.0035 | 0.0844 | 0.0159 | 0.0167 | 0.0281 | 3.2344 |

| t-stat | −2.3746 * | −2.4993 * | 4.3857 * | 2.6350 * | 3.5416 * | −4.3683 * | −1.7268 ** | 3.7004 * | 2.5758 * | 4.5006 * | 2.1206 | |

| Russia: Murmansk | Coefficient | −0.0443 | −0.0325 | 0.1342 | 0.1781 | 0.0453 | 0.0328 | 0.1367 | 0.0335 | 0.1862 | 0.1775 | 6.1731 |

| t-stat | 4.1986 ** | 3.6174 ** | −2.6315 *** | −3.4277 *** | −2.2200 * | 2.3990 * | 1.2708 ** | 2.2847 * | 3.4721 ** | −2.2740 ** | 4.5255 | |

| Russia: Petropavlovsk | Coefficient | 0.0857 | 0.0546 | 0.1473 | 0.1624 | 0.0366 | 0.0247 | 0.0612 | 0.0554 | 0.0135 | 0.0076 | 3.2346 |

| t-stat | 2.2249 * | 2.3358 * | −3.8821 * | −2.5290 * | 1.2987 * | 4.5224 * | −2.2775 ** | 1.7189 * | 2.5000 * | −3.5227 * | 2.9672 | |

| Russia: Pevek | Coefficient | 0.0070 | 0.0122 | 0.2425 | 0.0258 | 0.0021 | 0.0046 | 0.0230 | 0.0337 | 0.0255 | 0.0088 | 5.3381 |

| t-stat | −1.8421 * | −3.4339 * | 2.5190 * | 1.3912 * | 3.3059 * | 2.4483 * | −2.3995 ** | 3.2694 * | −4.7141 * | −2.1945 * | 4.0053 | |

| Russia: Sabetta | Coefficient | 0.0243 | 0.0330 | 0.0527 | 0.0035 | 0.1232 | 0.0024 | 0.0113 | 0.2055 | 0.0013 | 0.0005 | 4.1225 |

| t-stat | −2.5992 * | −1.7268 * | 2.3981 ** | 4.2664 * | 3.0676 ** | 2.8495 * | 3.4887 * | −5.1837 ** | −3.4416 * | −4.3663 * | 3.3406 | |

| Russia: Vladivostok | Coefficient | −0.0884 | −0.0561 | 0.0402 | 0.2145 | 0.1567 | 0.1783 | 0.0285 | 0.0996 | 0.2743 | 0.2284 | 6.5893 |

| t-stat | 3.2056 ** | 1.5725 ** | 2.6843 *** | 3.3003 ** | 1.3280 *** | 4.5871 *** | −2.1264 * | −3.4720 * | 4.0065 *** | 3.4071 *** | 5.2444 | |

| South Korea: Gwangyang | Coefficient | −0.0664 | −0.0852 | 0.3643 | 0.3315 | 0.3364 | 0.3142 | −0.1398 | −0.1145 | −0.0020 | −0.0074 | 4.3718 |

| t-stat | −3.2817 ** | −2.5006 ** | 4.1509 ** | 3.4782 ** | −1.7016 *** | −3.5290 *** | 2.2750 * | −2.4988 * | 3.4285 * | 3.5311 ** | 2.2269 | |

| South Korea: Pusan | Coefficient | 0.0953 | 0.0714 | 0.8165 | 0.8554 | 0.6571 | 0.6794 | −0.1562 | −0.1724 | −0.0055 | −0.0247 | 6.1378 |

| t-stat | 1.7136 ** | 2.2485 ** | 4.9127 *** | 4.2942 *** | −3.2704 *** | −1.6228 *** | 2.3007 ** | 3.7506 ** | −1.4682 ** | −2.8156 ** | 4.4093 | |

| South Korea: Ulsan | Coefficient | −0.0676 | −0.0608 | 0.5153 | 0.5429 | 0.5620 | 0.4475 | 0.0063 | −0.1164 | −0.0725 | −0.0637 | 5.7107 |

| t-stat | 3.3175 ** | 1.2601 ** | 3.4274 *** | 4.1212 *** | −2.0053 *** | −1.7312 *** | −3.9279 * | −2.1505 * | −3.1000 * | −2.4861 ** | 3.2123 | |

| Sweden: Gothenburg | Coefficient | 0.0068 | 0.0052 | 0.6987 | 0.7425 | 0.1850 | 0.1874 | 0.1637 | −0.0032 | 0.0145 | 0.0957 | −4.1752 |

| t-stat | 1.3791 * | 2.4720 * | −4.2405 *** | −3.6029 *** | −1.7442 ** | −2.4933 ** | 1.7446 ** | −3.1268 * | 1.5286 * | 2.3864 * | −3.6973 | |

| Sweden: Halmstad | Coefficient | 0.0005 | 0.0007 | 0.3316 | 0.4254 | 0.1261 | 0.1100 | 0.0432 | −0.0047 | 0.0530 | 0.0813 | 2.2097 |

| t-stat | 3.3796 * | 2.4305 * | −3.2777 *** | −2.7315 *** | −4.5985 ** | −2.6013 ** | 2.3615 ** | 4.5841 * | 2.7998 * | 3.7286 * | 2.0585 |

References

- United Nations Conference on Trade and Development. Review of Maritime Transport; United Nations Publications: New York, NY, USA, 2020. [Google Scholar]

- United Nations. World Economic Situation and Prospects as of Mid-2020; United Nations: New York, NY, USA, 2020. [Google Scholar]

- International Energy Agency. Global Energy Review 2020: The Impacts of the COVID-19 Crisis on Global Energy Demand and CO2 Emissions; International Energy Agency: Paris, France, 2020. [Google Scholar]

- Wang, C.; Horby, P.W.; Hayden, F.G.; Gao, G.F. A Novel Coronavirus Outbreak of Global Health Concern. Lancet 2020, 395, 470–473. [Google Scholar] [CrossRef]

- Chang, S.L.; Harding, N.; Zachreson, C.; Cliff, O.; Prokopenko, M. Modelling Transmission and Control of the COVID-19 Pandemic in Australia. Nat. Commun. 2020, 11, 5710. [Google Scholar] [CrossRef]

- Liu, J.; Hao, J.; Sun, Y.; Shi, Z. Network Analysis of Population Flow Among Major Cities and Its Influence on COVID-19 Transmission in China. Cities 2021, 112, 103138. [Google Scholar] [CrossRef]

- Hsiang, S.; Allen, D.; Annan-Phan, S.; Bell, K.; Bolliger, I.; Chong, T.; Druckenmiller, H.; Huang, L.Y.; Hultgren, A.; Krasovich, E.; et al. The Effect of Large-Scale Anti-Contagion Policies on the COVID-19 Pandemic. Nature 2020, 584, 262–267. [Google Scholar] [CrossRef]

- Monios, J.; Wilmsmeier, G. Deep Adaptation to Climate Change in the Maritime Transport Sector: A New Paradigm for Maritime Economics? Marit. Policy Manag. 2020, 47, 853–872. [Google Scholar] [CrossRef]

- World Trade Organization. World Trade Statistical Review 2020; World Trade Organization: Geneva, Switzerland, 2020. [Google Scholar]

- Organisation for Economic Co-Operation and Development. OECD Economic Outlook: Volume 2020; OECD Publishing: Paris, France, 2020. [Google Scholar]

- Notteboom, T.; Pallis, T.; Rodrigue, J.-P. Disruptions and Resilience in Global Container Shipping and Ports: The COVID-19 Pandemic versus the 2008-2009 Financial Crisis. Marit. Econ. Logist. 2021. [Google Scholar] [CrossRef]

- Van Tatenhove, J.P.M. COVID-19 and European Maritime Futures: Different Pathways to Deal with the Pandemic. Marit. Stud. 2021, 20, 63–74. [Google Scholar] [CrossRef]

- Kolesnikova, M. EU Maritime Economy and COVID-19. Contemp. Eur. 2020, 4, 102–111. [Google Scholar] [CrossRef]

- Organisation for Economic Co-Operation and Development. COVID-19 and Global Value Chains: Policy Options to Build. More Resilient Production Networks; OECD Publishing: Paris, France, 2020. [Google Scholar]

- Liu, X.; Liu, Y.; Yan, Y. China Macroeconomic Report 2020: China’s Macroeconomy Is on the Rebound Under the Impact of COVID-19. Econ. Political Stud. 2020, 8, 395–435. [Google Scholar] [CrossRef]

- Nallon, E. COVID-19: A Maritime Perspective. Available online: https://www.maritime-executive.com/blog/covid-19-a-maritime-perspective-1 (accessed on 12 February 2021).

- Mishra, V.K.; Dutta, B.; Goh, M.; Figueira, J.R.; Greco, S. A Robust Ranking of Maritime Connectivity: Revisiting UNCTAD’s Liner Shipping Connectivity Index (LSCI). Marit. Econ. Logist. 2021. [Google Scholar] [CrossRef]

- Handfield, R.; Graham, G.; Burns, L. Corona Virus, Tariffs, Trade Wars and Supply Chain Evolutionary Design. Int. J. Oper. Prod. Manag. 2020, 40, 1649–1660. [Google Scholar] [CrossRef]

- Xi, J. The Governance of China II; Foreign Languages Press: Beijing, China, 2017. [Google Scholar]

- Wiederer, C.K. Logistics Infrastructure Along the Belt and Road Initiative Economies; World Bank Group: Washington, DC, USA, 2018. [Google Scholar]

- State Council of the People’s Republic of China. Vision for Maritime Cooperation under the Belt and Road Initiative. Available online: http://english.www.gov.cn/archive/publications/2017/06/20/content_281475691873460.htm (accessed on 8 February 2021).

- Zhao, L. 3 Sea Routes Planned for Belt & Road Initiative. Available online: http://english.www.gov.cn/state_council/ministries/2017/06/21/content_281475692760102.htm (accessed on 8 February 2021).

- State Council of the People’s Republic of China. China’s Arctic Policy. The State Council Information Office of the People’s Republic of China; The State Council of the People’s Republic of China: Beijing, China, 2018.

- Tillman, H.; Yang, J.; Nielsson, E.T. The Polar Silk Road: China’s New Frontier of International Cooperation. China Q. Int. Strateg. Stud. 2018, 4, 345–362. [Google Scholar] [CrossRef]

- Gao, T. Going North: China’s Role in the Arctic Blue Economic Corridor. In Handbook of Research on International Collaboration, Economic Development, and Sustainability in the Arctic; Erokhin, V., Gao, T., Zhang, X., Eds.; IGI Global: Hershey, PA, USA, 2019; pp. 133–161. [Google Scholar] [CrossRef]

- Bennett, M. North by Northeast: Toward an Asian-Arctic Region. Eurasian Geogr. Econ. 2014, 55, 71–93. [Google Scholar] [CrossRef]

- Stephenson, S.R.; Brigham, L.; Smith, L.C. Marine Accessibility along Russia’s Northern Sea Route. Polar Geogr. 2013, 37, 111–133. [Google Scholar] [CrossRef]

- Meng, Q.; Zhang, Y.; Xu, M. Viability of Transarctic Shipping Routes: A Literature Review from the Navigational and Commercial Perspectives. Marit. Policy Manag. 2017, 44, 16–41. [Google Scholar] [CrossRef]

- Guy, E.; Lasserre, F. Commercial Shipping in the Arctic: New Perspectives, Challenges, and Regulations. Polar Rec. 2016, 3, 1–11. [Google Scholar] [CrossRef]

- Jorgensen-Dahl, A. Future of Resources and Shipping in the Arctic; Centre for High North Logistics: Kirkenes, Norway, 2010. [Google Scholar]

- Zhang, Y.; Meng, Q.; Zhang, L. Is the Northern Sea Route Attractive to Shipping Companies? Some Insights from Recent Ship Traffic Data. Mar. Policy 2016, 73, 53–60. [Google Scholar] [CrossRef]

- Ng, A.K.Y.; Andrews, J.; Babb, D.; Lin, Y.; Becker, A. Implications of Climate Change for Shipping: Opening the Arctic Seas. Wires Clim. Chang. 2018, 9, ee507. [Google Scholar] [CrossRef]

- Becker, A.; Ng, A.K.Y.; McEvoy, D.; Mullett, J. Implications of Climate Change for Shipping: Ports and Supply Chains. Wires Clim. Chang. 2018, 9, ee508. [Google Scholar] [CrossRef]

- Erokhin, V.; Gao, T.; Zhang, X. Handbook of Research on International Collaboration, Economic Development, and Sustainability in the Arctic; IGI Global: Hershey, PA, USA, 2019. [Google Scholar] [CrossRef]

- Xu, H.; Yin, Z.; Jia, D.; Jin, F.; Ouyang, H. The Potential Seasonal Alternative of Asia-Europe Container Service via Northern Sea Route under the Arctic Sea Ice Retreat. Marit. Policy Manag. 2011, 38, 541–560. [Google Scholar] [CrossRef]

- Cao, Y.; Yu, M.; Hui, F.; Zhang, J.; Cheng, X. Review of Navigability Changes in Trans-Arctic Routes. Chin. Sci. Bull. 2021, 66, 21–33. [Google Scholar] [CrossRef]

- Farre, A.B.; Stephenson, S.R.; Chen, L.; Czub, M.; Dai, Y.; Demchev, D.; Efimov, Y.; Graczyk, P.; Grythe, H.; Keil, K.; et al. Commercial Arctic Shipping through the Northeast Passage: Routes, Resources, Governance, Technology, and Infrastructure. Polar Geogr. 2014, 37, 298–324. [Google Scholar] [CrossRef]

- Kikkas, K. International Transport Corridors and the Arctic. Mod. Innov. Res. 2015, 6, 178–184. [Google Scholar]

- Zalyvsky, N. The Northern Sea Route: The Potential of Expectations and the Real Functioning Problems. Arct. North 2015, 20, 32–50. [Google Scholar] [CrossRef]

- Fisenko, A. Geopolitical, Transportation and Economic Aspects of Development the Northern Sea Route in Russia. Transp. Bus. Russ. 2013, 107, 235–238. [Google Scholar]

- Zelentsov, V. Development of Arctic Transportation in Russia. Asia-Pac. J. Mar. Sci. Educ. 2012, 2, 9–16. [Google Scholar]

- Erokhin, V.; Gao, T.; Zhang, X. Arctic Blue Economic Corridor: China’s Role in the Development of a New Connectivity Paradigm in the North. In Arctic Yearbook 2018. Arctic Development: In Theory and in Practice; Heininen, L., Exner-Pirot, H., Eds.; Northern Research Forum: Akureyri, Iceland, 2018; pp. 456–474. [Google Scholar]

- Lasserre, F. Case Studies of Shipping along Arctic Routes. Analysis and Profitability Perspectives for the Container Sector. Transp. Res. Part. A Policy Pract. 2014, 66, 144–161. [Google Scholar] [CrossRef]

- Cariou, P.; Faury, O. Relevance of the Northern Sea Route (NSR) for Bulk Shipping. Transp. Res. Part. A Policy Pract. 2015, 78, 337–346. [Google Scholar] [CrossRef]

- Zhao, H.; Hu, H.; Lin, Y. Study on China-EU Container Shipping Network in the Context of Northern Sea Route. J. Transp. Geogr. 2016, 53, 50–60. [Google Scholar] [CrossRef]

- Peng, Y.; Li, Z.; Zhang, X.; Bao, Q.; Li, X. Prediction on Freight Function Structure of China’s Coastal Ports Under the Polar Silk Road: A Cargo Attraction Potential Perspective. Eurasian Geogr. Econ. 2020. [Google Scholar] [CrossRef]

- Erokhin, V.; Gao, T. Northern Sea Route: An Alternative Transport Corridor within China’s Belt and Road Initiative. In The Belt and Road Initiative: Law, Economics, and Politics; Chaisse, J., Gorski, J., Eds.; Brill Nijhoff: Leiden, The Netherlands, 2018; pp. 146–167. [Google Scholar]

- Enderwick, P. Viewpoint–Could the Belt and Road Initiative Be Derailed? An Analysis of Impediments to Completion. Crit. Perspect. Int. Bus. 2020. [Google Scholar] [CrossRef]

- United Nations Conference on Trade and Development. Liner Shipping Connectivity Index, Quarterly. Available online: https://unctad.org/system/files/official-document/statcpbmn1_en.pdf (accessed on 10 February 2021).

- MDS Transmodal. Data and Models. Available online: https://www.mdst.co.uk/data (accessed on 9 February 2021).

- Lin, P.-C.; Kuo, S.-Y.; Chang, J.-H. The Direct and Spillover Effects of Liner Shipping Connectivity on Merchandise Trade. Marit. Bus. Rev. 2020, 5, 159–173. [Google Scholar] [CrossRef]

- Bartholdi, J.; Jarumaneeroj, P.; Ramudhin, A. A New Connectivity Index for Container Ports. Marit. Econ. Logist. 2016, 18, 231–249. [Google Scholar] [CrossRef]

- Fugazza, M.; Hoffmann, J. Liner Shipping Connectivity as Determinant of Trade. J. Shipp. Trade 2017, 2, 1. [Google Scholar] [CrossRef]

- Minárik, M.; Čiderová, D. The “New Global”: The Role of Cargo Maritime Transport of Goods with focus on the Transportation Corridor between Southeast Asia and Northwestern Europe. Shs Web Conf. 2021, 92, 09010. [Google Scholar] [CrossRef]

- Frazila, R.B.; Zukhruf, F. Measuring Connectivity for Domestic Maritime Transport Network. J. East. Asia Soc. Transp. Stud. 2015, 11, 2363–2376. [Google Scholar] [CrossRef]

- Chang, S.; Huang, Y.; Shang, K.; Chiang, W. Impacts of Regional Integration and Maritime Transport on Trade: With Special Reference to RCEP. Marit. Bus. Rev. 2020, 5, 143–158. [Google Scholar] [CrossRef]

- Şeker, A. The Impacts of Liner Shipping Connectivity and Economic Growth on International Trade Case of European Countries and Turkey. In Handbook of Research on the Applications of International Transportation and Logistics for World Trade; Ceyhun, G.Ç., Ed.; IGI Global: Hershey, PA, USA, 2019; pp. 139–150. [Google Scholar] [CrossRef]

- Panahi, R.; Ghasemi, A.; Golpira, A. Future of Container Shipping in Iranian Ports: Traffic and Connectivity Index Forecast. J. Adv. Transp. 2017, 1, 5847372. [Google Scholar] [CrossRef]

- Jouili, T.A. Determinants of Liner Shipping Connectivity. Int. J. Adv. Appl. Sci. 2019, 6, 5–10. [Google Scholar] [CrossRef]