Can Market Reforms Curb the Expansion of Industrial Land?—Based on the Panel Data Analysis of Five National-Level Urban Agglomerations

Abstract

:1. Introduction

2. Theoretical Framework and Hypothesis

2.1. Theoretical Analysis

2.2. Conceptual Framework and Research Hypotheses

3. Data and Methods

3.1. Research Area and Data

3.1.1. Research Area

3.1.2. Data Sources

3.2. Research Method

3.2.1. Measurement of Marketization Degree

3.2.2. Industrial Land Input Coefficient: Total Price of Industrial Land Transfer/Domestic Product Value (GDP)

3.2.3. Test of the Mechanism of the Influence of Industrial Land Marketization on the Scale of Industrial Land Expansion

3.3. Variable Selection

3.3.1. Explained Variable: Scale of Industrial Land Expansion

3.3.2. Explanatory Variable: MIL

3.3.3. Control Variable

4. Research Results

4.1. Measurement of the MIL

4.1.1. The Marketization Rate of Industrial Land Marketization by Quantity (MIQ)

4.1.2. The Marketization Rate of Industrial Land Marketization by Price (MIP)

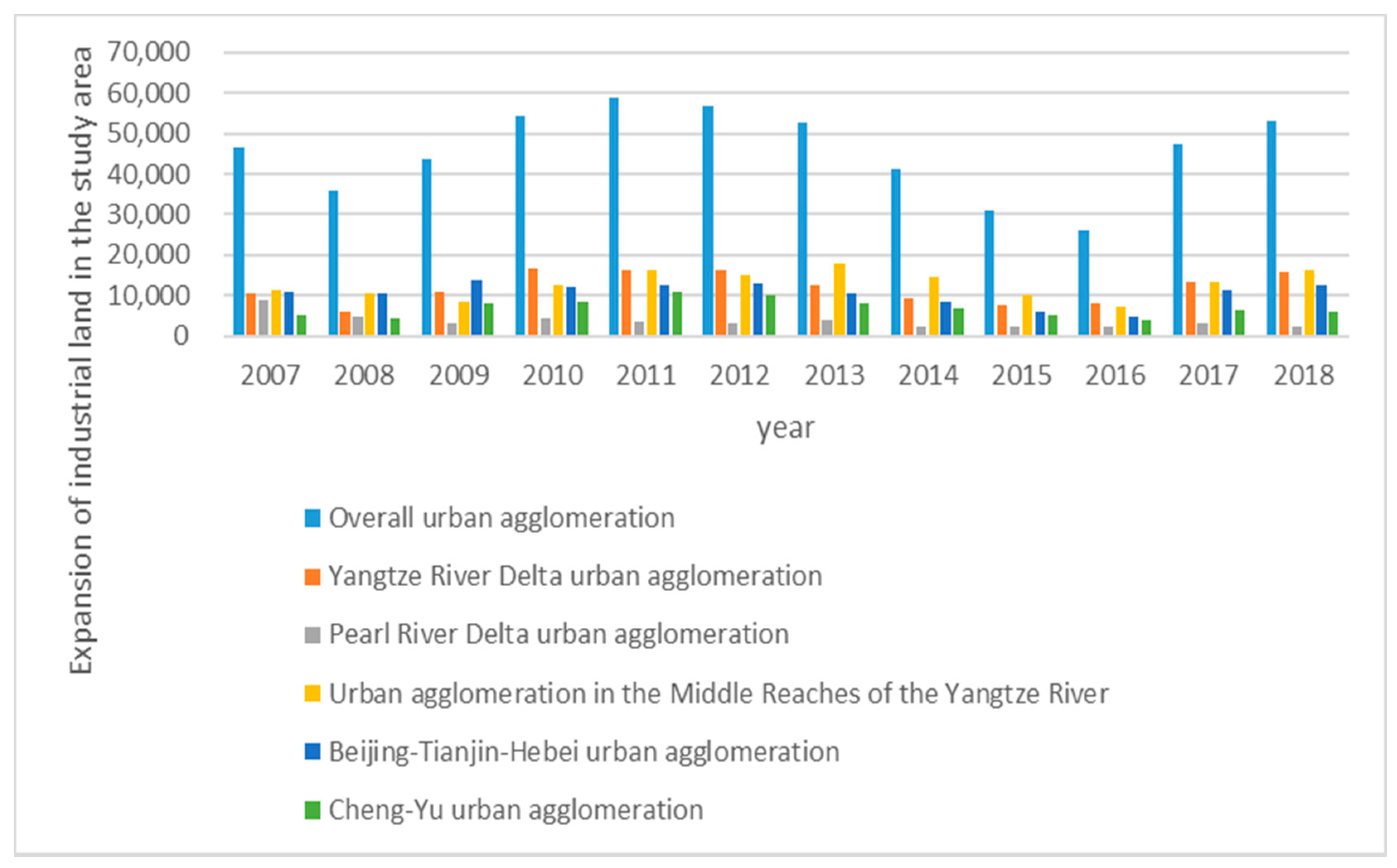

4.2. Newly Added Industrial Land Area (Expansion Scale of Industrial Land) in the Study Area

4.3. Result of Land Input Coefficient

4.4. Validation Results of the Impact of MIL on the Scale of Industrial Land Expansion

5. Conclusions and Policy Implication

5.1. Conclusions

5.2. Policy Implication

6. Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Xie, D. A study on the adjustment of administrative divisions during the rapid urbanization period. Mod. City Stud. 2009, 24, 82–87. [Google Scholar]

- Huang, H.; Li, Y.; Wang, Z. Research on the spatiotemporal evolution and influencing factors of ecological efficiency of industrial land in provincial cities in China based on super-SBM Model. Acta Ecol. Sin. 2020, 40, 100–111. [Google Scholar]

- Gao, W.; Ma, K.; Liu, H. Research on the evolution of industrial land conservation and intensive use policy since China’s reform and opening up. China Land Sci. 2013, 27, 37–43. [Google Scholar]

- Ustaoglu, E.; Silva, F.; Lavalle, C. Quantifying and modelling industrial and commercial land-use demand in France. Environ. Dev. Sustain. 2020, 22, 519–549. [Google Scholar] [CrossRef]

- Choy, L.; Lai, Y.; Lok, W. Economic performance of industrial development on collective land in the urbanization process in China: Empirical evidence from Shenzhen. Habitat Int. 2013, 40, 184–193. [Google Scholar] [CrossRef]

- Vandermeer, M.; Halleux, J. Evaluation of the spatial and economic effectiveness of industrial land policies in Northwest Europe. Eur. Plan. Stud. 2017, 25, 1454–1475. [Google Scholar] [CrossRef] [Green Version]

- Tu, F.; Yu, X.; Ruan, J. ILUE under government intervention: Evidence from Hangzhou, China. Habitat Int. 2014, 43, 1–10. [Google Scholar] [CrossRef]

- Chen, W.; Chen, W.; Ning, S.; Liu, E.; Zhou, X.; Wang, Y.; Zhao, M. Exploring the ILUE of China’s resource-based cities. Cities 2019, 93, 215–223. [Google Scholar] [CrossRef]

- Seager, T.; Theis, T. A taxonomy of metrics for testing the industrial ecology hypothesis and application to design of freezer insulation. J. Clean. Prod. 2004, 12, 865–875. [Google Scholar] [CrossRef]

- Singh, R.; Murty, H.; Gupta, S.; Dikshit, A. An overview of sustainability assessment methodologies. Ecol. Indic. 2012, 15, 281–299. [Google Scholar] [CrossRef]

- Kuznets, S. Economic growth and income inequality. Am. Econ. Rev. 1995, 45, 1–28. [Google Scholar]

- Xiao, S.; Huang, X.; Pu, L.; Chen, Y.; Chen, Z.; Zhao, D. Resource-saving society development comprehensive evaluation index system and its application: Taking Jiangsu Province as an example. Econ. Geogr. 2008, 01, 118–123. [Google Scholar]

- Ye, W.; Tong, C. Commentary on the United Nations Sustainable Development Index System. China Popul. Resour. Environ. 1997, 3, 83–87. [Google Scholar]

- Jia, H.; Huang, X.; Yu, S. Development and countermeasures of intensive use of industrial land in China. China Land Sci. 2010, 24, 52–56. [Google Scholar]

- Guo, G.; Ding, C.; Wang, Y. The impact of new urbanization on industrial land use efficiency: Theoretical framework and empirical test. China Land Sci. 2016, 30, 81–89. [Google Scholar]

- Zou, W.; Zhao, J.; Wu, Q. Research on the impact of land tenure tax on land use efficiency of industrial enterprises: Based on the survey of typical enterprises in Jiangsu Province. China Land Sci. 2014, 28, 60–67. [Google Scholar]

- Tian, L.; Ma, W. Government intervention in city development of China: A tool of land supply. Land Use Policy 2009, 26, 599–609. [Google Scholar] [CrossRef]

- Liu, Y.; Chen, J. Land system, financing model and industrialization with Chinese characteristics. China Ind. Econ. 2020, 3, 5–23. [Google Scholar]

- Krugman, P. The Myth of Asia’s Miracle. Foreign Aff. 1994, 73, 62–78. [Google Scholar] [CrossRef]

- Lin, Y.; Cai, F.; Li, Z. Comparative Advantage and Development Strategy—Reinterpretation of the “East Asian Miracle”. Chin. Soc. Sci. 1999, 5, 4–20+204. [Google Scholar]

- Syrquin, M. Productivity Growth and Factor Reallocation. In Industrialization and Growth; Chenery, H., Ed.; Oxford University Press: Oxford, UK, 1986. [Google Scholar]

- Hsieh, C.; Klenow, P. Misallocation and Manufacturing TFP in China and India. Q. J. Econ. 2009, 124, 1403–1448. [Google Scholar] [CrossRef] [Green Version]

- Roland, G. Transition and Economics: Politics, Markets and Firms; MIT Press: Cambridge, UK, 2000. [Google Scholar]

- Cai, F.; Wang, M.; Qu, Y. China’s industrial relocation and labor mobility trend. China Ind. Econ. 2009, 8, 5–16. [Google Scholar]

- Cai, F. How does China’s economic growth turn to total factor productivity-driven? Chin. Soc. Sci. 2013, 1, 56–71. [Google Scholar]

- Liu, K. How does the land system with Chinese characteristics affect China’s economic growth—An analysis based on the multi-sector dynamic general equilibrium framework. China Ind. Econ. 2018, 10, 80–98. [Google Scholar]

- Feng, J.; Lichtenberg, E.; Ding, C. Balancing act: Economic incentives, administrative restrictions, and urban land expansion in China. China Econ. Rev. 2015, 36, 184–197. [Google Scholar] [CrossRef]

- Li, J.; Qu, F. Research on the Impact of Land Market Reform on Intensive Use of Construction Land. China Land Sci. 2012, 26, 70–75. [Google Scholar]

- Acemoglu, D.; Finkelstein, A. Input and technology choices in regulated industries: Evidence from the health care sector. J. Political Econ. 2008, 116, 837–880. [Google Scholar] [CrossRef] [Green Version]

- Buera, F.; Kaboski, J.; Shin, Y. Finance and Development: A Tale of Two Sectors. Am. Econ. Rev. 2011, 101, 1964–2002. [Google Scholar] [CrossRef] [Green Version]

- Brandt, L.; Rawski, T. China’s Great Economic Trans Formation; Cambridge University Press: London, UK, 2008. [Google Scholar]

- Wang, X.; Zhang, L.; Xu, X. Local government land transfer, infrastructure investment and local economic growth. China Ind. Econ. 2014, 7, 31–43. [Google Scholar]

- Liu, S.; Wang, Z.; Zhang, W.; Xiong, X. The exhaustion of the “land for development” model: An empirical study based on the threshold regression model. Manag. World 2020, 36, 80–92. [Google Scholar]

- Lu, X.; Jiang, X.; Gong, M. How land transfer marketization influence on green total factor productivity from the approach of industrial structure? Evidence from China. Land Use Policy 2020, 95, 104610. [Google Scholar] [CrossRef]

- Wang, Q.; Chen, Z.; Ye, Y.; Huang, X. The Economic Driving Mechanism of Land Market Development: Theoretical and Empirical Analysis. China Popul. Resour. Environ. 2007, 3, 75–80. [Google Scholar]

- Zhou, L.; Tian, L.; Gao, Y.; Ling, Y.; Fan, C.; Hou, D.; Shen, T.; Zhou, W. How did industrial land supply respond to transitions in state strategy? An analysis of prefecture-level cities in China from 2007 to 2016. Land Use Policy 2019, 87, 104009. [Google Scholar] [CrossRef]

- Yang, Q.; Zhuo, P.; Yang, J. The bottom-line competition between the transfer of industrial land and the quality of foreign investment: An empirical study based on the panel data of prefecture-level cities in China from 2007 to 2011. Manag. World 2014, 11, 24–34. [Google Scholar]

- Qian, Z.; Mou, Y. China’s land marketization level: Measurement and analysis. Manag. World 2012, 7, 67–75. [Google Scholar]

- Tan, D.; Huang, X.; Chen, Z.; Wang, S.; Hu, C. Analysis of the degree of land marketization in China and its influencing factors. Urban Issues 2008, 1, 14–18. [Google Scholar]

- Qu, S.; Hu, S.; Li, W.; Wang, H.; Li, Q. Interaction between urban land expansion and land use policy: An analysis using the DPSIR framework. Land Use Policy 2020, 99, 104856. [Google Scholar] [CrossRef]

- Liu, Z.; Zhang, J.; Golubchikov, O. Edge-Urbanization: Land Policy, Development Zones, and Urban Expansion in Tianjin. Sustainability 2019, 11, 2538. [Google Scholar] [CrossRef] [Green Version]

- Liu, T.; Cao, G.; Yan, Y.; Wang, R. Urban land marketization in China: Central policy, local initiative, and market mechanism. Land Use Policy 2016, 57, 265–276. [Google Scholar] [CrossRef]

- Chen, B.; Wu, C.; Huang, X.; Yang, X. Examining the Relationship between Urban Land Expansion and Economic Linkage Using Coupling Analysis: A Case Study of the Yangtze River Economic Belt, China. Sustainability 2020, 12, 1227. [Google Scholar] [CrossRef] [Green Version]

- Xie, H.; Zhu, Z.; Wang, B.; Liu, G.; Zhai, Q. Does the Expansion of Urban Construction Land Promote Regional Economic Growth in China? Evidence from 108 Cities in the Yangtze River Economic Belt. Sustainability 2018, 10, 4073. [Google Scholar] [CrossRef] [Green Version]

- Li, X.; Wang, M.; Liu, X.; Chen, Z.; Wei, X.; Che, W. MCR-Modified CA–Markov Model for the Simulation of Urban Expansion. Sustainability 2018, 10, 3116. [Google Scholar] [CrossRef] [Green Version]

- Zheng, Q.; Wang, K.; Huang, L.; Zheng, Q.; Abubakar, G. Monitoring the Different Types of Urban Construction Land Expansion (UCLE) in China’s Port City: A Case Study of Ningbo’s Central City. Sustainability 2017, 9, 2374. [Google Scholar] [CrossRef] [Green Version]

- Xiong, C.; Tan, R. Will the land supply structure affect the urban expansion form? Habitat Int. 2018, 75, 25–37. [Google Scholar] [CrossRef]

- Wei, Y.; Li, H.; Yue, W. Urban Land Expansion and Regional Inequality in Transitional China. Landsc. Urban Plan. 2017, 163, 17–31. [Google Scholar] [CrossRef]

- Chen, J.; Gao, J.; Chen, W. Urban land expansion and the transitional mechanisms in Nanjing, China. Habitat Int. 2016, 53, 274–283. [Google Scholar] [CrossRef]

- Quan, B.; Bai, Y.; Romkens, M.; Chang, K.; Song, H.; Guo, T. Urban land expansion in Quanzhou City, China, 1995–2010. Habitat Int. 2015, 48, 131–139. [Google Scholar] [CrossRef]

- He, C.; Li, J.; Zhang, X.; Liu, Z.; Zhang, D. Will rapid urban expansion in the drylands of northern China continue: A scenario analysis based on the Land Use Scenario Dynamics-urban model and the Shared Socioeconomic Pathways. J. Clean. Prod. 2017, 165, 57–69. [Google Scholar] [CrossRef]

- Alice, C.; Yann, L.; Harold, L. What drives land take and urban land expansion? A systematic review. Land Use Policy Int. J. Cover. All Asp. Land Use 2018, 79, 339–349. [Google Scholar]

- Gao, J.; Wei, Y.; Chen, W. Economic transition and urban land expansion in Provincial China. Habitat Int. 2014, 44, 461–473. [Google Scholar] [CrossRef]

- Xu, J.; Wang, X. Reversing Uncontrolled and Unprofitable Urban Expansion in Africa through Special Economic Zones: An Evaluation of Ethiopian and Zambian Cases. Sustainability 2020, 12, 9246. [Google Scholar] [CrossRef]

- Kuang, W.; Liu, J.; Dong, J.; Chi, W.; Zhang, C. The rapid and massive urban and industrial land expansions in China between 1990 and 2010: A CLUD-based analysis of their trajectories, patterns, and drivers. Landsc. Urban Plan. 2016, 145, 21–33. [Google Scholar] [CrossRef]

- Wu, Y.; Dong, S.; Huang, H.; Zhai, J.; Li, Y.; Huang, D. Quantifying urban land expansion dynamics through improved land management institution model: Application in Ningxia-Inner Mongolia, China. Land Use Policy 2018, 78, 386–396. [Google Scholar] [CrossRef]

- Wang, Z.; Zhang, H.; Chai, J. Differences in Urban Built-Up Land Expansion in Zhengzhou and Changsha, China: An Approach Based on Different Geographical Features. Sustainability 2018, 10, 4258. [Google Scholar] [CrossRef] [Green Version]

- Li, Z.; Luan, W.; Zhang, Z.; Su, M. Relationship between urban construction land expansion and population/economic growth in Liaoning Province, China. Land Use Policy 2020, 99, 105022. [Google Scholar] [CrossRef]

- Wu, C.; Huang, X.; Chen, B. Telecoupling mechanism of urban land expansion based on transportation accessibility: A case study of transitional Yangtze River economic Belt, China. Land Use Policy 2020, 96, 104687. [Google Scholar] [CrossRef]

- Yan, Y.; Ju, H.; Zhang, S.; Jiang, W. Spatiotemporal Patterns and Driving Forces of Urban Expansion in Coastal Areas: A Study on Urban Agglomeration in the Pearl River Delta, China. Sustainability 2020, 12, 191. [Google Scholar] [CrossRef] [Green Version]

- Luo, J.; Zhang, X.; Wu, Y.; Shen, J.; Shen, L.; Xing, X. Urban land expansion and the floating population in China: For production or for living? Cities 2018, 74, 219–228. [Google Scholar] [CrossRef]

- Shen, X.; Wang, X.; Zhang, Z.; Lu, Z.; Lv, T. Evaluating the effectiveness of land use plans in containing urban expansion: An integrated view. Land Use Policy Int. J. Cover. All Asp. Land Use 2019, 80, 205–213. [Google Scholar] [CrossRef]

- Yang, S.; Hu, S.; Wang, S.; Zou, L. Effects of rapid urban land expansion on the spatial direction of residential land prices: Evidence from Wuhan, China. Habitat Int. 2020, 101, 102186. [Google Scholar] [CrossRef]

- Hu, Y.; Kong, X.; Zheng, J.; Sun, J.; Wang, L.; Min, M. Urban Expansion and Farmland Loss in Beijing during 1980–2015. Sustainability 2018, 10, 3927. [Google Scholar] [CrossRef] [Green Version]

- Li, L.; Bao, H.; Robinson, G. The return of state control and its impact on land market efficiency in urban China. Land Use Policy 2020, 99, 104878. [Google Scholar] [CrossRef]

- Zhang, L.; Li, X.; Liu, B.; Qian, J. Can the market-oriented allocation of land elements promote the optimization of industrial structure? —Analysis based on microscopic land transaction data. China Land Sci. 2018, 32, 23–31. [Google Scholar]

- Yang, Q.; Peng, Y. Promotional competition and industrial land transfer: An analysis based on panel data of Chinese cities from 2007 to 2011. Econ. Theory Econ. Manag. 2015, 9, 5–17. [Google Scholar]

- Gao, Y.; Zhong, T. The impact of the land market on the expansion of urban construction land-Based on an analysis of 285 cities’ panel data. Resour. Sci. 2016, 38, 2024–2036. [Google Scholar]

- Wu, Y.; Zhou, Y. China’s urban land market equilibrium and land intensive use. Econ. Geogr. 2009, 29, 984–988. [Google Scholar]

| Variable | Unit | Obs. | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|---|

| Industrial land expansion area | hm2 | 924 | 592.72 | 559.42 | 4.67 | 4406.36 |

| Industrial land marketization rate | % | 924 | 0.88 | 0.22 | 0 | 1 |

| GDP | 108 yuan | 924 | 3512.156 | 4753.527 | 176.75 | 32,679.87 |

| GDP per capita | 104 yuan | 924 | 6.23 | 21.33 | 0.59 | 642.18 |

| The ratio of secondary industry to GDP structure | % | 924 | 49.30 | 8.12 | 0 | 66.99 |

| Foreign direct investment | 108 dollar | 924 | 17.01 | 31.56 | 0 | 308.26 |

| Employment in the secondary industry | 104 | 924 | 46.10 | 57.42 | 2.23 | 429.13 |

| Amount of industrial investment | 108 yuan | 924 | 1461.84 | 1722.32 | 38.86 | 11,993.95 |

| Industrial wastewater discharge | 104 tons/hm2 | 924 | 10,789.29 | 12,074.93 | 0 | 91260 |

| Industrial sulfur dioxide emissions | 104 tons/hm2 | 924 | 5.74 | 7.17 | 0 | 68.29 |

| Industrial smoke and dust emissions | 104 tons/hm2 | 924 | 3.37 | 9.42 | 0 | 185.98 |

| Industrial output | 108 yuan | 924 | 5696.26 | 6696.18 | 83.46 | 35,976.65 |

| Number of industrial enterprises | 1company | 924 | 2346.42 | 2595.76 | 128 | 18,792 |

| Study Area | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Overall urban agglomeration | 0.381 | 0.810 | 0.862 | 0.903 | 0.923 | 0.919 | 0.936 | 0.939 | 0.964 | 0.950 | 0.985 | 0.975 |

| Yangtze River Delta urban agglomeration | 0.359 | 0.907 | 0.943 | 0.943 | 0.971 | 0.975 | 0.962 | 0.977 | 0.967 | 0.958 | 0.983 | 0.970 |

| Pearl River Delta urban agglomeration | 0.150 | 0.764 | 0.704 | 0.791 | 0.892 | 0.843 | 0.857 | 0.830 | 0.881 | 0.849 | 0.995 | 0.998 |

| Beijing-Tianjin-Hebei urban agglomeration | 0.307 | 0.725 | 0.786 | 0.814 | 0.899 | 0.867 | 0.908 | 0.930 | 0.962 | 0.957 | 0.953 | 0.958 |

| Urban agglomeration in the middle reaches of the Yangtze River | 0.435 | 0.822 | 0.927 | 0.943 | 0.946 | 0.961 | 0.954 | 0.941 | 0.977 | 0.965 | 0.992 | 0.993 |

| Cheng-Yu urban agglomeration | 0.500 | 0.787 | 0.815 | 0.930 | 0.871 | 0.874 | 0.942 | 0.962 | 0.982 | 0.962 | 0.998 | 0.952 |

| Study Area | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Overall urban agglomeration | 0.416 | 0.850 | 0.901 | 0.936 | 0.950 | 0.934 | 0.960 | 0.963 | 0.978 | 0.979 | 0.996 | 0.895 |

| Yangtze River Delta urban agglomeration | 0.359 | 0.915 | 0.957 | 0.951 | 0.978 | 0.971 | 0.981 | 0.981 | 0.986 | 0.968 | 0.984 | 0.926 |

| Pearl River Delta urban agglomeration | 0.180 | 0.930 | 0.904 | 0.910 | 0.969 | 0.900 | 0.959 | 0.900 | 0.912 | 0.955 | 1.000 | 0.918 |

| Beijing-Tianjin-Hebei urban agglomeration | 0.328 | 0.732 | 0.827 | 0.890 | 0.906 | 0.882 | 0.919 | 0.955 | 0.971 | 0.974 | 1.000 | 0.863 |

| Urban agglomeration in the middle reaches of the Yangtze River | 0.482 | 0.858 | 0.937 | 0.954 | 0.972 | 0.971 | 0.975 | 0.967 | 0.994 | 0.985 | 1.000 | 0.840 |

| Cheng-Yu urban agglomeration | 0.572 | 0.824 | 0.842 | 0.946 | 0.909 | 0.900 | 0.945 | 0.980 | 0.984 | 0.995 | 1.000 | 0.973 |

| Overall Urban Agglomeration | CYUA | BTHUA | MYRUA | YRUA | PRDUA | |

|---|---|---|---|---|---|---|

| 2007 | 0.0052 | 0.0024 | 0.0048 | 0.0034 | 0.0052 | 0.0060 |

| 2008 | 0.0052 | 0.0029 | 0.0058 | 0.0079 | 0.0028 | 0.0044 |

| 2009 | 0.0066 | 0.0049 | 0.0077 | 0.0072 | 0.0075 | 0.0042 |

| 2010 | 0.0072 | 0.0053 | 0.0056 | 0.0077 | 0.0098 | 0.0070 |

| 2011 | 0.0071 | 0.0054 | 0.0061 | 0.0087 | 0.0079 | 0.0051 |

| 2012 | 0.0066 | 0.0054 | 0.0059 | 0.0076 | 0.0077 | 0.0050 |

| 2013 | 0.0062 | 0.0046 | 0.0061 | 0.0075 | 0.0066 | 0.0045 |

| 2014 | 0.0042 | 0.0031 | 0.0046 | 0.0049 | 0.0043 | 0.0033 |

| 2015 | 0.0033 | 0.0020 | 0.0034 | 0.0035 | 0.0037 | 0.0039 |

| 2016 | 0.0026 | 0.0014 | 0.0031 | 0.0023 | 0.0036 | 0.0032 |

| 2017 | 0.3406 | 0.9464 | 0.1262 | 0.2175 | 0.5934 | 0.9327 |

| 2018 | 0.2163 | 0.1620 | 0.2822 | 0.2888 | 0.1735 | 0.0697 |

| Explained Variable: Scale of Industrial Land Expansion | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Explanatory Variables | Overall Urban Agglomeration | YRUA | PRDUA | BTHUA | MYRUA | CYUA | ||||||

| Model 1 | Model 2 | Model3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 | Model 10 | Model 11 | Model 12 | |

| Industrial land marketization rate | −134.081 ** (−2.10) | −191.510 *** (−3.03) | 110.875 (0.65) | 195.865 (1.18) | −456.245 *** (−3.11) | −612.993 *** (−4.24) | −139.175 (−0.74) | −556.366 *** (−2.96) | −77.537 (−0.73) | −109.588 (−1.11) | −114.9 * (−1.11) | −113.6 (−1.2) |

| GDP per capita | 0.178 (0.31) | 0.057 (0.10) | −12.661 (−0.65) | −19.049 (−1.20) | 0.575 (0.08) | −8.335 (−1.01) | 45.674 (1.40) | 82.406 *** (2.60) | 15.954 (1.14) | −0.004 (0.00) | 0.186 (0.49) | 0.191 (0.5) |

| The ratio of secondary industry to GDP structure | 9.340 *** (3.32) | 7.377 *** (2.87) | 20.975 (1.62) | 1.184 (0.14) | 24.335 ** (2.32) | 2.139 (0.39) | 17.485 *** (2.71) | 35.351 *** (6.62) | 1.891 (0.45) | −0.985 (−0.29) | 10.2 *** (2.66) | 3.684 (1.2) |

| Foreign direct investment | −6.690 *** (−6.33) | −3.554 *** (−3.66) | −15.40 *** (−4.64) | −5.404 *** (−3.05) | −2.698 (−0.67) | −0.67 (−0.22) | −2.309 (−1.38) | −3.416 ** (−2.04) | −9.554 *** (−2.74) | −4.340 (−1.42) | 4.959 (1.43) | 6.44 ** (2.1) |

| Employment in the secondary industry | 0.216 (0.40) | 1.162 ** (2.19) | −4.284 *** (−3.38) | −0.979 (−0.89) | −0.516 (−0.52) | −0.492 (−0.49) | 6.122 (1.60) | −1.367 (−0.51) | 3.607 (1.46) | 5.673 *** (3.23) | −5.98 ** (−2.42) | −4.7 ** (−1.9) |

| Industrial fixed assets | 0.042 (1.44) | 0.101 *** (3.57) | 0.095 (1.51) | 0.027 (0.46) | −0.103 * (−1.96) | 0.044 (0.87) | −0.022 (−0.28) | 0.062 (0.90) | −0.027 (0.45) | 0.047 (0.82) | 0.141 1.38) | 0.078 (1.0) |

| Industrial waste emissions | 0.001 (−0.80) | 0.001 (1.62) | 0.001 (1.04) | 0.001 (0.51) | 0.001 (−0.46) | 0.001 (0.39) | 0.001 *** (−3.79) | 0.001 (−0.93) | 0.001 (1.07) | 0.001 ** (2.19) | 0.001 −0.93) | 0.01 (−0.6) |

| Industrial output | −0.004 (0.661) | −0.016 * (−1.87) | 0.084 *** (3.42) | 0.031 * (1.75) | 0.001 (0.09) | 0.001 (0.02) | −0.091 *** (−2.69) | −0.025 (−0.97) | 0.001 (−0.04) | 0.001 (0.25) | −0.1 *** −2.76 | −0.1 *** (−2.9) |

| Number of industrial enterprises | 0.034 ** (2.06) | 0.058 *** (4.39) | −0.028 (−1.06) | 0.033 * (1.85) | −0.043 (−1.00) | −0.011 (−0.39) | 0.194 ** (2.60) | 0.357 *** (7.69) | 0.122 (1.25) | 0.179 ** (2.46) | 0.51 *** (2.7) | 0.68 *** 10.0 |

| −cons | 254.859 * (1.67) | 168.731 (1.21) | −633.370 (−0.76) | 297.309 (0.56) | 104.906 (0.18) | 902.615 *** (2.73) | 368.171 (0.89) | −1160.33 *** (−3.73) | 214.300 (0.96) | 249.425 (1.36) | −256.4 −1.09 | −130.7 (−0.2) |

| R | 0.100 | 0.205 | 0.298 | 0.272 | 0.429 | 0.277 | 0.413 | 0.627 | 0.057 | 0.35 | 0.297 | 0.731 |

| Explained Variable: Scale of Industrial Land Expansion | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Explanatory Variables | Overall Urban Agglomeration | YRUA | PRDUA | BTHUA | MYRUA | CYUA | ||||||

| Model 1 | Model 2 | Model3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 | Model 10 | Model 11 | Model 12 | |

| Industrial land marketization rate | −204.613 *** (−3.18) | −256.179 *** (−3.96) | 80.132 (0.50) | 136.700 (0.82) | −580.192 *** (−4.05) | −636.210 *** (−4.34) | −138.314 (−0.73) | −529.325 *** (−2.72) | −289.6 *** (−2.95) | −284.6 *** (−3.00) | −89.20 (−0.77) | −95.23 (−0.9) |

| GDP per capita | 0.186 (0.33) | 0.065 (0.11) | −12.821 (−0.66) | −18.560 (−1.16) | 1.939 (0.27) | −8.007 (−1.07) | 45.286 (1.39) | 82.396 ** (2.57) | 0.914 (0.06) | −9.160 (−0.69) | 0.195 (0.51) | 0.192 (0.5) |

| The ratio of secondary industry to GDP structure | 9.881 *** (3.52) | 7.744 *** (3.02) | 21.065 (1.63) | 0.442 (0.05) | 30.907 *** (3.01) | 4.018 (0.73) | 17.546 *** (2.71) | 34.778 *** (6.43) | 4.179 (1.02) | 0.628 (0.19) | 10.2 *** (2.63) | 3.549 (1.1) |

| Foreign direct investment | −6.695 *** (−6.35) | −3.589 *** (−3.71) | −15.19 *** (−4.34) | −5.587 *** (−3.14) | −2.603 (−0.67) | −1.446 (−0.48) | −2.315 (−1.38) | −3.509 ** (−2.09) | −17.37 *** (−4.38) | −8.274 ** (−2.54) | 5.070 (1.46) | 6.51 ** (2.1) |

| Employment in the secondary industry | 0.267 (0.49) | 1.223 ** (2.32) | −4.332 *** (−3.42) | −1.032 (−0.93) | −0.450 (−0.48) | −0.407 (−0.41) | 6.323 * (1.66) | −0.528 (−0.20) | 1.801 (0.75) | 4.228 ** (2.32) | −5.90 ** (−2.38) | −4.6 * (−1.9) |

| Industrial fixed assets | 0.049 * (1.67) | 0.107 *** (3.80) | 0.091 (1.45) | 0.025 (0.43) | −0.075 (−1.45) | 0.083 (1.62) | −0.024 (−0.31) | 0.057 (0.81) | −0.053 (−0.86) | 0.007 (0.11) | 0.135 (1.31) | 0.076 (1.0) |

| Industrial waste emissions | 0.001 (−0.93) | 0.001 (1.50) | 0.001 (1.03) | 0.001 (0.43) | 0.001 (−0.95) | 0.001 (0.04) | 0.001 *** (−3.81) | 0.001 (−1.00) | 0.001 (1.17) | 0.001 ** (2.48) | 0.001 (−0.89) | 0.01 (0.7) |

| Industrial output | −0.005 (−0.55) | −0.017 ** (−2.06) | 0.087 *** (3.65) | 0.032 * (1.83) | −0.003 (−0.17) | −0.009 (−0.72) | −0.091 *** (−2.69) | −0.029 (−1.12) | 0.1 *** (3.58) | 0.055 ** (2.45) | −0.1 *** (−2.79) | −0.1 *** (−2.9) |

| Number of industrial enterprises | 0.034 ** (2.06) | 0.058 *** (4.39) | −0.026 (−1.00) | 0.033 * (1.85) | −0.020 (−0.49) | 0.007 (0.27) | 0.197 ** (2.62) | 0.365 *** (7.83) | 0.039 (0.41) | 0.153 ** (2.10) | 0.50 *** (2.6) | 0.67 *** 9.91 |

| −cons | 289.952 * (1.90) | 211.984 (1.52) | −646.095 (−0.77) | 383.497 (0.72) | −180.790 (−0.32) | 846.022 *** (2.61) | 362.794 (0.88) | −1150.29 *** (−3.64) | 350.838 (1.62) | 334.583 * (1.83) | −256.2 (−1.08) | −135.3 (−0.8) |

| R | 0.106 | 0.211 | 0.297 | 0.267 | 0.470 | 0.283 | 0.413 | 0.621 | 0.130 | 0.345 | 0.294 | 0.730 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pu, W.; Zhang, A. Can Market Reforms Curb the Expansion of Industrial Land?—Based on the Panel Data Analysis of Five National-Level Urban Agglomerations. Sustainability 2021, 13, 4472. https://doi.org/10.3390/su13084472

Pu W, Zhang A. Can Market Reforms Curb the Expansion of Industrial Land?—Based on the Panel Data Analysis of Five National-Level Urban Agglomerations. Sustainability. 2021; 13(8):4472. https://doi.org/10.3390/su13084472

Chicago/Turabian StylePu, Wenfang, and Anlu Zhang. 2021. "Can Market Reforms Curb the Expansion of Industrial Land?—Based on the Panel Data Analysis of Five National-Level Urban Agglomerations" Sustainability 13, no. 8: 4472. https://doi.org/10.3390/su13084472