Abstract

There is a scarcity of literature involving studies about the effect of risk management on the relationship between corporate governance and a firm’s financial performance, especially in emerging markets. The study fills this gap and adds to the existing literature by investigating whether risk management acts as a mediator between corporate governance and the firm’s financial performance. This study found that risk management partially mediates the relationship between board size and financial performance. Our results further indicate that risk management acts as a partial mediator between foreign ownership and financial performance.

1. Introduction

Corporate governance has become a subject of global importance in the aftermath of corporate scandals, such as Enron, and its significance has further increased after the global financial crisis of 2007–2008. It is even more significant and relevant in emerging markets, such as Pakistan, which ranks poorly on the Corruption Perceptions Index (CPI) and the Worldwide Governance Indicators (WGI). Corporate governance is a holistic approach that entails transparency and effective risk management to manage business affairs in order to protect and increase the interests of shareholders along with considering the interests of other stakeholders [1,2,3]. When risk is not managed effectively, corporate governance deteriorates [4], and we consequently observe financial institutions incurring huge losses such as those that exacerbated the global financial crisis [5]. A better framework of corporate governance tends to decrease the risk of financial crises [6].

The agency conflict between shareholders and managers influences risk management behavior that affects a firm’s performance [2]. To understand this conflict and consequent firm performance, a plethora of studies have investigated the relationship between corporate governance and firm performance, but the study results have remained inconsistent. However, not much has been done to explore the empirical relationship between corporate governance and risk management. The literature related to corporate governance and risk management is so scarce that one may question whether risk management falls within the realm of corporate governance [7]. The ultimate responsibility of a company’s risk management lies with its board [8]. Therefore, we take risk management as a mediating variable to examine whether risk plays a significant role in influencing the relationship between corporate governance and a firm’s financial performance.

We have selected Pakistan, which is an emerging economy that is presently experiencing economic decline, and it is likely to recover economic growth from 2021 onwards with an improvement in macroeconomic conditions and adjustments in fiscal management [9]. However, higher corruption levels and weak governance systems, which are witnessed by the poor performance of Pakistan with its CPI and WGI, coupled with political instability and observed socio-economic networks, have led to crony capitalism in the bank-based economy of Pakistan [10]. As such, it seems quite interesting to study the governance–performance–risk nexus in the Pakistani context, in which we did not find any relevant literature to the best of our knowledge. Therefore, this study adds to the existing literature by investigating the mediating role of risk management between corporate governance and a firm’s financial performance in Pakistan.

Financial institutions are selected as study samples because of the rationale that the global financial crisis of 2008 was triggered by the failure of risk models of banks (particularly commercial banks) in the U.S. However, due to the tradable nature of risk in financial institutions, the commercial banks of the U.S. passed on their risk to other participants in the financial market, mostly to the investment banks [11]. The breakdown of the financial market in the U.S. impacted the financial institutions in all countries [7]. This allows studying governance and risk management in financial institutions [12].

Most of the studies related to corporate governance considered commercial banks only, but we argue that ignoring important components of the financial industry does not provide a complete picture of corporate governance and risk management in this industry [13]. Due to the advancements in the financial market, the difference between financial institutions has become blurred. Moreover, financial institutions (commercial banks, investment banks, and insurance companies) mostly face common risks [14]. For this purpose, we considered three players in the financial sector of Pakistan, which include commercial banks, investment banks, and insurance companies.

This paper intends to address the question of what relationship do the dimensions of corporate governance (managerial, institutional, government, foreign and block-holder ownership, board size and independence, audit committee independence, CEO remuneration, and CEO/Chairman duality) have with the performance of financial institutions in Pakistan, and does risk management mediate the relationship between the corporate governance dimensions and financial performance?

2. Background and Theoretical Framework

2.1. Managerial Ownership, Risk Management, and Financial Performance

A good framework of corporate governance results in improved performance [6]. Researchers have identified a number of different elements of corporate governance and their role in the corporate performance. Corporate ownership is the first element that gained attention. To help resolve agency problems in corporate governance framework, many researchers advocated that managerial ownership helps improve the firm’s performance [15], and others observed that the directors of a firm, who also have a stake in the ownership, will prefer actions that are in the best interest of all shareholders [16]. Consequently, they expect a direct relationship between managerial ownership, the firm’s performance, and risk management. However, a nuanced analysis of the relationship between managerial ownership and financial performance, which was measured by the return on assets, reveals a non-linear positive relationship between the two variables. In some industries, insider ownership barely results in alleviating the agency cost beyond a certain level [17]. Based on these arguments, we develop the first hypothesis, H1A, along with its opposing hypothesis, H1B.

Hypothesis 1A (H1A).

An increase in managerial ownership could have a positive effect on the performance of financial institutions and risk management mediates this relationship.

Hypothesis 1B (H1B).

An increase in managerial ownership could have a negative effect on the performance of financial institutions and risk management mediates this relationship.

2.2. Institutional Ownership, Risk Management, and Financial Performance

Considering the wealth of the accumulated experience that institutional owners bring in, some researchers have observed that institutional ownership helps improve the firm’s performance [18,19]; however, others have suggested that institutional ownership may not have a positive relationship with the firm’s performance [15]. Using these references we develop a hypothesis, H2A, along with its competing hypothesis, H2B.

Hypothesis 2A (H2A).

An increase in institutional ownership could have a positive effect on the performance of financial institutions and risk management mediates this relationship.

Hypothesis 2B (H2B).

An increase in institutional ownership could have a negative effect on the performance of financial institutions and risk management mediates this relationship.

2.3. Government Ownership, Risk Management, and Financial Performance

Government ownership is distinctive institutional ownership. A study of 47 Malaysian firms revealed that government ownership positively affects a firm’s performance because the investors believe that government would provide the required resources to the firm in times of financial distress [20]. Contrary to this, others found a lower long-term performance of government-owned banks as compared to their private counterparts, because the government-owned banks suffer from poor loan recovery and increased bad debts [21]. Additionally, institutional investors can shape corporate risk management, because they often possess better knowledge, broader skill sets, greater sizes, networks, and voting power. Alternatively, government-owned banks suffer from high default risk and poor loan quality [22,23], which is also observed in government-owned commercial banks in China [24]. Based on these arguments and references, we develop a hypothesis, H3A, along with its competing hypothesis, H3B.

Hypothesis 3A (H3A).

An increase in government ownership could have a positive effect on the performance of financial institutions and risk management mediates this relationship.

Hypothesis 3B (H3B).

An increase in government ownership could have a negative effect on the performance of financial institutions and risk management mediates this relationship.

2.4. Foreign Ownership, Risk Management, and Financial Performance

Foreign ownership is another element in the corporate governance framework that may have implications for a firm’s performance. Some studies suggest that a significant proportion of foreign ownership leads to increased foreign investors’ confidence and an enhanced firm valuation [25,26]. Greater involvement of foreign members on a board plays an important strategic role, which helps to enhance internationalization and the financial performance of firms [27]. Foreign shareholders increase the efficiency of banks because they bring improved corporate governance and risk management practices [28]. In contrast, another study found that domestic banks in Pakistan perform better in recovering loans as compared to foreign banks [29]. These arguments lead to the development of the hypothesis, H4A, along with its opposing hypothesis, H4B.

Hypothesis 4A (H4A).

An increase in foreign ownership could have a positive effect on the performance of financial institutions and risk management mediates this relationship.

Hypothesis 4B (H4B).

An increase in foreign ownership could have a negative effect on the performance of financial institutions and risk management mediates this relationship.

2.5. Block-Holder Ownership, Risk Management, and Financial Performance

Theoretical and empirical observations suggest a positive and negative association of block-holder ownership with firm performance. For example, block-holder ownership positively affects firm performance in Pakistan [30]; however, high block-holder ownership in Chinese banks leads to managerial entrenchment that negatively affects firm performance [24], which is probably because block-holders may fail to manage risk effectively [31,32]. Block-holder ownership tends to restrict managerial independence, which adversely affects financial performance [27]. In the light of these arguments, hypothesis, H5A, along with its opposing hypothesis, H5B is formed.

Hypothesis 5A (H5A).

An increase in block-holder ownership could have a positive effect on the performance of financial institutions and risk management mediates this relationship.

Hypothesis 5B (H5B).

An increase in block-holder ownership could have a negative effect on the performance of financial institutions and risk management mediates this relationship.

2.6. Board Size, Risk Management, and Financial Performance

The board size and composition of the board are key elements of corporate governance that have different implications. For example, some researchers have found a significant positive relationship between board size and firm performance [33], while others have observed that larger boards encounter poor communication and free-rider problems and perform less efficiently as a result [34]. However, larger boards may help to mitigate coordination problems and improve firm financial performance if the board members are assigned advisory and monitory roles on the subcommittees [35]. A study revealed the curvilinear relationship between board size and financial performance [36]. From the viewpoint of risk management, some researchers have found that small boards are efficient for risk management [8], but others argued that small boards take more risks compared to large boards [37]. These references lead to the development of the hypothesis, H6A, along with its competing hypothesis, H6B.

Hypothesis 6A (H6A).

An increase in board size could have a positive effect on the performance of financial institutions and risk management mediates this relationship.

Hypothesis 6B (H6B).

An increase in board size could have a negative effect on the performance of financial institutions and risk management mediates this relationship.

2.7. Board Independence, Risk Management and Financial Performance

Some researchers have observed that a greater number of non-executive directors on board increases asset quality and financial performance [38]. The findings from a study on BRICK countries and Turkey disclose that board independence, among other corporate governance measures, plays a key role to improve the financial structure of the firms [39]. In addition to this, the IMF observes that non-executive directors play a better role in managing and controlling corporate risk [40]. We develop a hypothesis, H7A, along with its opposing hypothesis, H7B for running empirical tests.

Hypothesis 7A (H7A).

An increase in board independence could have a positive effect on the performance of financial institutions and risk management mediates this relationship.

Hypothesis 7B (H7B).

An increase in board independence could have a negative effect on the performance of financial institutions and risk management mediates this relationship.

2.8. Audit Committee Independence, Risk Management and Financial Performance

An audit committee is at the core of effective corporate governance. As such, its independence leads to an increase in a firm’s value [41], but a study of Pakistani firms found that higher independence of the audit committee leads to lower firm performance [42]. Additionally, greater independence of an audit committee provides enhanced governance and risk management practices that are directly associated with improved firm monitoring [41]. Accordingly, we develop a hypothesis, H8A, along with its opposing hypothesis, H8B from the references and arguments.

Hypothesis 8A (H8A).

An increase in audit committee independence could have a positive effect on the performance of financial institutions and risk management mediates this relationship.

Hypothesis 8B (H8B).

An increase in audit committee independence could have a negative effect on the performance of financial institutions and risk management mediates this relationship.

2.9. CEO Remuneration, Risk Management, and Financial Performance

A study found an increase in executive remuneration is directly related to an increase in a firm’s performance [43], whereas another study observed that the relationship of CEO remuneration is statistically insignificant with the performance of banks in Pakistan [44]. Executive compensation, which largely depends on the company’s performance, such as the stock price or EPS, may trigger executives to take risks beyond the risk tolerance of the company, which results in ineffective risk management [45]. Interestingly, the firms that gave a heavy annual bonus took more risk before the 2007–2008 financial crisis, and as a result, they experienced heavier losses during the crisis [46]. From these arguments, we develop hypothesis H9A, along with its competing hypothesis, H9B.

Hypothesis 9A (H9A).

An increase in CEO Remuneration could have a positive effect on performance of financial institutions and risk management mediates this relationship.

Hypothesis 9B (H9B).

An increase in CEO Remuneration could have a negative effect on the performance of financial institutions and risk management mediates this relationship.

2.10. CEO Duality, Risk Management, and Financial Performance

CEO duality is another element of corporate governance that may have different implications on a firm’s performance and its risk management behavior. Some researchers have found a positive association between CEO/Chairperson duality and the accounting-based measures of performance [47], whereas others have argued that dual leadership in an organization may inflict agency costs and found that CEO duality adversely affects a firm’s performance and market valuation [48]. Furthermore, CEO duality is directly associated with lower risk management in U.S. banks [32], but other researchers have found only weak evidence supporting that the duality status affects long-term performance after controlling for other factors that might impact that performance [49]. In the light of these arguments, we develop hypothesis H10A, along with its competing hypothesis, H10B.

Hypothesis 10A (H10A).

CEO Duality could have a positive effect on the performance of financial institutions and risk management mediates this relationship.

Hypothesis 10B (H10B).

CEO Duality could have a negative effect on the performance of financial institutions and risk management mediates this relationship.

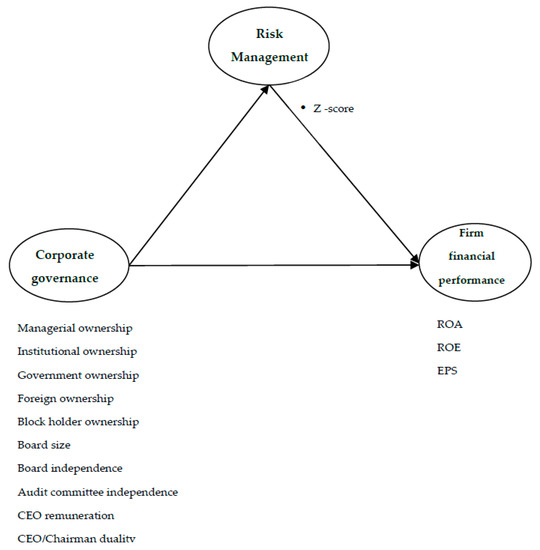

Most of the studies have neglected the possibilities of the indirect effects between corporate governance and firm performance. Consequently, the relationship between the two variables may not be fully understood [50]. Inconsistent results indicate a plausible mediating role of some other variables [51], and we argue that risk management may be mediating the relationship between corporate governance and financial performance. Consequently, the conceptual framework of this study is presented in Figure 1. We used three proxies to represent a firm’s performance, which includes the return on assets (ROA), the return on equity (ROE), and the earnings per share (EPS). As a proxy of risk management, we used the z-score, which measures the distance from insolvency [52]. We calculated the z-score as the sum of the ROA and the capital asset ratio, which is the total equity/total assets, divided by the standard deviation of the ROA, and we considered it as an appropriate proxy for the insolvency risk because it incorporates both the equity capital buffer and the asset side risk [53].

Figure 1.

Conceptual framework.

Based on the above review of the relevant literature, we identified the variables and their proxies, which were used in the study. Table 1 summarizes the study measures.

Table 1.

Measurement of variables and their symbols.

We organized the rest of the paper as follows. Section 3 provides a description of the data and the methodology used in the study. Section 4 presents the empirical results and their discussions. Lastly, the conclusion and the policy implication are discussed in Section 5. The references are provided at the end of the study.

3. Data and Methodology

We used 12 years of data, which included the period from 2006 to 2017, for 67 listed financial institutions in Pakistan, which included 21 commercial banks, 26 insurance companies, and 20 investment banks, on the Pakistan Stock Exchange. We used StructuralEquation Modeling (SEM) on a balanced panel data of 804 firm-year observations to analyze whether risk management mediates the relationship between corporate governance and financial performance using the mediation technique [54]. We provided the descriptive statistics in Table 2, which shows that amongst all dimensions of corporate governance, the CEO remuneration has the highest standard deviation (i.e., 1.655). The low mean value for ROA (0.031) reflects the higher leverage of financial institutions. Moreover, the mean, minimum and maximum values of CAR (0.320, −033, and 0.996) further strengthen the argument for greater debt financing of financial institutions. The standard deviation of ROA of each financial company was calculated to determine the Z-score. The low values of the mean and standard deviation of “Std. Deviation ROA” shows low asset contribution in net profit generation in most of the financial institutions in Pakistan. The mean and standard deviation of Z-Score (1.606 and 1.043) indicates a higher variation in the insolvency risk of the financial institutions that are operating in the volatile business environment in Pakistan.

Table 2.

Descriptive statistics.

To avoid spurious results, we checked the problem of multi-collinearity and calculated the Variance Inflation Factor (VIF). The obtained VIF values, which are between 1.04 and 2.53, suggest the non-existence of multi-collinearity. Assessing the construct validity determines the quality of the measures used in the study [55]. Before checking the significance of the study model, the validity of the study measures must be ensured [56].

Discriminant validity indicates that the study measures are unrelated, and they measure different traits [57]. A consequence of poor discriminant validity is multi-collinearity [58]. To ensure discriminant validity, we checked the problem of multi-collinearity and calculated the Variance Inflation Factor (VIF) as previously mentioned. The non-existence of multi-collinearity suggests that the data has discriminant validity.

Convergent validity indicates that the study measures converge and measure the same traits [57]. A significant correlation between the variables indicates the presence of convergent validity [59,60]. The Pearson correlation shows that the independent variables of the study show a significant correlation, which suggests the existence of convergent validity.

Using the mediation technique [54] of Structural Regression (SR) through AMOS 21, we first calculated the effect of corporate governance on firm’s financial performance without adding a mediator using the following equations.

We then bootstrapped the mediator in the model.

4. Results and Discussion

Table 3 illustrates the results which suggest that in the absence of a mediator, different dimensions of corporate governance have an impact on the different proxies of financial performance. We found that managerial ownership (MO) has a significant positive effect on the EPS. This finding is in line with earlier studies and supports the suggestion from the components of the agency theory, which states that managerial ownership mitigates the manager–owner agency problem [5]. The theoretical and empirical literature argue that the institutions have accumulated resources, information, power, and the capability to make effective decisions. As such, we expected a significant positive effect of institutional ownership (IO) on the firm’s performance. However, contrary to the theoretical and empirical evidence, we found that the IO negatively affects ROE and EPS. A plausible explanation may be the observed crony capitalism in Pakistan [10]. This finding has serious policy implications for the regulators of the banks and the capital market in Pakistan. Furthermore, government ownership (GO) has an insignificant relationship with all three measures of financial performance, which generally conforms with an earlier study that the behavior of government-owned firms is inconsistent [61]. Additionally, we found a direct significant relationship of foreign ownership (FO) with all three of the measures of financial performance. This finding supports the observations of earlier studies [25] that foreign ownership brings in expertise that leads to investors’ confidence, and it consequently enhances the firm’s valuation. Moreover, block-holder ownership (BH) positively affects the ROE, which suggests that the owners with higher stakes in the firm try to enforce better governance to help improve the firm’s performance. We also found that the CEO remuneration (REM) negatively affects the ROA, which contradicts the common argument that highly paid managers are more skillful and help improve the firm’s performance [62]. In addition to this, we found that board size (BS) has a significant direct relationship with all three measures of financial performance, which suggests that larger boards possess more experience, expertise, diversity, and a collective wealth of skills, which helps to improve the firm’s performance. Moreover, we found that larger boards are more independent, and board independence (BI) may consequently supplement to help improve the firm’s performance. Furthermore, audit committee independence (ACI) positively affects the ROA, which conforms to an earlier study [41]. We found that the duality of the CEO and the chairperson (DUO) negatively affect the ROE, which is contrary to the finding that there is only weak evidence supporting that duality affects the firm’s performance, [49]. A plausible explanation for this negative effect may be a potential power struggle in the hierarchical society of Pakistan, which has weaker traditions in areas such as the rule of law.

Table 3.

Results of SEM (direct and indirect effects).

The results further suggest that when we add the mediator, the significant positive effect of managerial ownership (MO) on the EPS still exists. However, the indirect effect becomes insignificant, which violates the condition of mediation. The direct effect of institutional ownership (IO) on financial performance (ROE and EPS) becomes significantly positive in the presence of a mediator. This finding signifies that firms with greater institutional shareholders have better risk management policies and improved financial performances [63]. However, the indirect effect of the IO on the ROE and the EPS is insignificant, which implies that there is not any mediation. Furthermore, in the presence of a mediator, the direct effect of government ownership (GO) on the ROA becomes significantly negative [21], which indicates that in risk-laden settings, the government ownership exacerbates the firm’s financial performance. This finding provides an argument in favor of the privatization of state-owned enterprises in developing countries, such Pakistan, that faces volatile political/economic environments. The indirect effect between GO and ROA becomes insignificant, which suggests that there is not any mediation with this dimension. The direct effect of block-holder ownership (BH) and CEO remuneration (REM) remains the same with all three proxies of the firm’s performance. However, the indirect relationship becomes insignificant, which indicates that there is not any mediation with these dimensions. In the absence of a mediator, the BI has an insignificant positive relationship with ROE, which becomes slightly significant in the presence of a mediator. This result confirms earlier studies [37,40] and suggests that the independence of the board plays an important role in corporate risk management, which helps to improve the firm’s performance. The direct and indirect relationship between audit committee independence (ACI), CEO/Chairman duality (DUO), and financial performance become insignificant when we add a mediator.

The results in Table 3 show that the direct effects between the FO, the BS, and all three proxies of the firm’s performance reduce in the presence of a mediator. Additionally, the indirect effects and the direct effects between the FO, the BS, and all three proxies of the firm’s performance are significant in the presence of a mediator, which indicates that risk management partially mediates the relationship between FO, BS, and firm’s performance. In line with an earlier study [28], we observed that foreign owners bring improved corporate governance and risk management practices, which result in increased firm performance. Moreover, conforming to an earlier study [64], we found that risk management acts as a partial mediator between board size and financial performance and argue that larger boards bring diversity, an accumulated wealth of knowledge, experience, the necessary skillset to enrich corporate governance, and risk management practices that result in improving the firm’s performance.

Table 4 shows the results of structural equation modeling of commercial banks which state that risk management acts as a complete mediator between block-holder ownership (BH) and all three proxies of the financial performance of commercial banks.

Table 4.

Results of structural equation modeling-commercial banks.

These results substantiate the observation from [31] that risk influences the relationship between block-holder ownership and a firm’s performance. Our data reveals that block-holder ownership is highest in commercial banks as compared to investment banks and insurance companies. As such, we observed a more pronounced effect of mediation in this sector in Pakistan. The results show that risk management completely mediates the relationship between managerial ownership (MO) and the financial performance (measured by ROE and ROA) of commercial banks. The managers/owners possess strategic inside information about the appropriate level of risk that the firm is willing to take [65]. Consequently, the directors’ higher percentages of shares lead them to take more idiosyncratic risks to increase their returns on stocks [66].

Risk management completely mediates the relationship between board independence (BI) and financial performance (measured as ROA) of commercial banks. This result is in accordance with the study conducted by the GFSR [40], which concluded that non-executive directors play a better role in managing and controlling risk, which positively affects the firm’s performance. Table 4 also indicates that risk management partially mediates the relationship between audit committee independence (ACI) and financial performance (measured by EPS) of commercial banks. The audit committee evaluates the corporate risk appetite, designs the hedging activities, and has good knowledge and understanding of the corporate risk profile. We argue that audit committee independence channelizes their specialized knowledge and skills to improve the firm’s performance [41]. The results also show no effect of mediation between FO and all measures of financial performance in commercial banks of Pakistan.

Table 5 shows the results of structural equation modeling of insurance companies. These results reveal that risk does not mediate the relationship between BH and all the three proxies of financial performance in insurance companies of Pakistan.

Table 5.

Results of structural equation modeling-insurance companies.

Table 5 shows that managerial ownership has an insignificant negative relationship with no effect of mediation in the insurance companies of Pakistan. This effect may be due to the excessive amount of managerial ownership in this sector. A plausible explanation may be provided by [67], who affirmed that the financial performance tends to decrease when insider ownership exceeds 40–50%. Table 5 shows that the effect of mediation between board independence (BI) and financial performance is not significant in insurance companies. It is also observed that ACI has an insignificant indirect relationship with the financial performance of insurance companies. Hence, we do not witness the mediation effect in insurance companies. Table 5 shows a partial mediation of risk management between foreign ownership (FO) and financial performance (measured by ROE) in the insurance sector of Pakistan, which conforms to an earlier study [28].

Table 6 shows the structural equation modeling results of investment banks. From Table 6 it can be seen that risk does not mediate the relationship between BH and all the three proxies of financial performance in investment banks of Pakistan.

Table 6.

Results of structural equation modeling-investment banks.

Just as in commercial banks, risk management also completely mediates the relationship between the managerial ownership (MO) and financial performance (measured by ROE and ROA) of investment banks in Pakistan because the management possesses more inside information about the risk level of the firm [65]. Table 6 shows that the risk management effect of mediation between board independence (BI) and financial performance is not significant in investment banks. Similarly, ACI has an insignificant indirect relationship with the financial performance of the investment banks. Hence, we do not witness the mediation effect in investment banks. Table 6 also shows no effect of mediation between FO and all measures of financial performance in investment banks of Pakistan.

Table 4, Table 5 and Table 6 further indicate no risk management mediation effect between corporate governance dimensions of institutional ownership (IO), government ownership (GO), CEO remuneration (REM), board size (BS), CEO/Chairman duality (DUO) and all measures of financial performance in commercial banks, insurance companies and investment banks of Pakistan. An insightful observation in result analyses is that risk management does not mediate the relationship between board size and financial performance in each sector; however, an overall analysis of all three sectors shows an effect of mediation. In commercial banks of Pakistan, there exists an inverse U-shaped relationship between board size and financial performance [68], but risk mediation is not evidenced in this sector. The relationship between board size and financial performance is insignificant in insurance companies of Pakistan [69], which explains why mediation of risk is not witnessed in this sector. Furthermore, Table 6 shows an insignificant relationship between board size and financial performance in investment banks; however, there is a scarcity in the literature related to corporate governance practices in investment banks of Pakistan. Similarly, the overall study results assert that risk management partially mediates the relationship between foreign ownership and financial performance; however, Table 4 and Table 6 show the absence of mediation in commercial and investment banks. When we run an overall analysis of all three sectors (with 804 observations), the larger dataset estimates the population more closely and we witness significant mediation between board size and firm performance and foreign ownership and firm performance.

Moreover, Table 5 shows that risk management partially mediates the relationship between foreign ownership and ROE as a financial performance measure only. The dataset of insurance companies reveals that insurance companies are highly leveraged, with a mean value of ROA (0.06) and ROE (0.14), respectively. The high leverage of insurance companies was also verified by the study conducted by [70]. Moreover, the analysis of the dataset revealed that foreign ownership of insurance companies is quite low, with a mean value of 0.04. We argue that due to less shareholding, foreign owners are majorly more concerned with equity returns only, which is why mediation results are significant through this path of financial performance.

Overall, our results emphasize that corporate governance can improve a firm’s performance in the financial sector in Pakistan through proper risk management. This synthesis is even more important and relevant for a developing economy, such as Pakistan, which faces a volatile business environment coupled with an institutional void and prevalent crony capitalism [10].

5. Conclusions and Policy Implication

The effect of corporate governance on a firm’s performance has been widely studied. However, we observed a scarcity of literature involving studies about the effect of risk management on the relationship between corporate governance and the firm’s financial performance, especially in emerging markets such as Pakistan. The study fills this gap and adds to the existing literature by investigating whether risk management acts as a mediator between corporate governance and the firm’s financial performance.

We conclude that the different forms of ownership have an impact on financial performance. The positive effect of managerial ownership on financial performance implies that managerial ownership should be ensured in the shareholders’ structure of financial institutions to a certain degree. The negative effect of institutional ownership reinforces commonly perceived crony capitalism in Pakistan [10]. In an emerging market facing a volatile geo-political and economic environment, the policy implication of this conclusion is that the regulators and the economic managers of Pakistan need to improve the corporate governance and the existing legal framework to curb crony capitalism. The State Bank of Pakistan reported USD 4.3 billion as non-performing loans of all the banks and the DFIs in Pakistan in the last quarter of 2018. This will help improve the performance of these financial firms. Consequently, it will bring stability to the capital market in Pakistan. It may be relevant to point out that the huge non-performing loans are one of the major reasons for the underperforming financial institutions in Pakistan that have a spillover effect on the other economic sectors.

Government ownership aggravates the performance of the financial institutions in Pakistan in risk-laden settings. This conclusion advocates the privatization of state-owned enterprises. Furthermore, we conclude that foreign ownership not only positively affects the financial performance, but we also observe the partial mediation of risk. The policy implication of this conclusion is that the political and the economic leadership of Pakistan needs to adopt a coherent policy framework that brings geo-political and socio-economic stability to attract foreign investors who will bring improved corporate governance and risk management practices that will eventually result in improving the performance of the financial institutions in Pakistan.

Block-holder ownership positively affects the performance of financial institutions. Due to the poor legal environment, block-holder ownership is prevalent in Pakistan. Block-holders, which are mainly family members, foreign investors, and managerial owners, result in the greater financial performance of firms in Pakistan [30]. Moreover, the negative effect of CEO remuneration on risk management and financial performance implies that executives tend to take risks beyond the risk appetite of the firm when they are given greater remunerations [45]. This result has a significant policy implication for the board of directors. The results of the mediation further indicate that risk acts as a partial mediator between board size and financial performance. This result suggests that a higher number of board members in the financial sector of Pakistan will help to bring improved risk management practices that will result in helping to increase the firm’s performance.

Furthermore, the board composition of the financial institutions must ensure the independence of the board, which keeps in view its positive effect on risk management. Similarly, our results show that the independence of the audit committee results in a better financial performance. In contrast with the agency theory, the inclusion of insiders (executives) in the audit committee tended to reduce the firm’s performance [41]. These results provide insightful policy implications for board composition. Finally, the dual role of the CEO and the chairman of the board negatively affects financial performance. This result strengthens the notion of crony capitalism and requires adjustments in the corporate governance framework of the financial institutions in Pakistan.

Author Contributions

Conceptualization, H.R. and M.R.; methodology, H.R., M.R., and M.Z.U.H.; software, H.R. and M.R.; validation, H.R., M.R., and M.Z.U.H.; formal analysis, H.R., M.R., and M.Z.U.H.; investigation, H.R. and M.R.; resources, H.R. and M.R.; data curation, H.R. and M.R.; writing—original draft preparation, H.R., M.R., M.Z.U.H., J.H. and K.-B.K.; writing—review and editing, H.R., M.R., M.Z.U.H., J.H. and K.-B.K. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the Dong-A University research fund.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data sharing not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Jenkinson, T.; Mayer, C. The assessment: Corporate governance and corporate control. Oxf. Rev. Econ. Policy 1992, 8, 1–10. [Google Scholar] [CrossRef]

- Jenson, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Tarraf, H.; Majeske, K. Impact of risk taking on bank financial performance during 2008 financial crisis. J. Financ. Account. 2013, 13, 1–18. [Google Scholar]

- Governance, C. The Financial Crisis: Key Findings and Main Messages; Organization for Economic Cooperation and Development (OECD): Paris, France, 2009; Volume 19, pp. 19–32. [Google Scholar]

- Bebchuk, L.; Cohen, A.; Ferrell, A. What matters in corporate governance? Rev. Financ. Stud. 2009, 22, 783–827. [Google Scholar] [CrossRef]

- Claessens, S.; Yurtoglu, B.B. Corporate governance in emerging markets: A survey. Emerg. Mark. Rev. 2013, 15, 1–33. [Google Scholar] [CrossRef]

- Gericke, R. Corporate Governance and Risk Management in Financial Institutions: An International Comparison between Brazil and Germany; Springer: Berlin/Heidelberg, Germany, 2018. [Google Scholar]

- McNulty, T.; Florackis, C.; Ormrod, P. Corporate Governance and Risk: A Study of Board Structure and Process; ACCA Research Report; ACCA: London, UK, 2012; Volume 129. [Google Scholar]

- World Bank. The World Bank in Pakistan. Available online: https://www.worldbank.org/en/country/pakistan/overview (accessed on 12 June 2019).

- Ahsan, T.; Qureshi, M.A. The impact of financial liberalization on capital structure adjustment in Pakistan: A doubly censored modelling. Appl. Econ. 2017, 49, 4148–4160. [Google Scholar] [CrossRef]

- Keuper, F.; Neumann, F. Corporate Governance, Risk Management und Compliance—Innovative Konzepte und Strategien; Springer Fachmedien: Wiesbaden, Germany, 2010. [Google Scholar] [CrossRef]

- Rossi, C. A Risk Professional’s Survival Guide: Applied Best Practices in Risk Management; Wiley: Hoboken, NJ, USA, 2014. [Google Scholar]

- Bhagat, S.; Bolton, B.; Lu, J. Size, leverage, and risk-taking of financial institutions. J. Bank. Financ. 2015, 59, 520–537. [Google Scholar] [CrossRef]

- Saunders, A.; Cornett, M. Financial Institutions Management: A Risk Management Approach; McGraw Hill: New York, NY, USA, 2018. [Google Scholar]

- Li, X.; Sun, S.T.; Yannelis, C. Managerial ownership and firm performance: Evidence from the 2003 Tax Cut. SSRN Electron. J. 2018. [Google Scholar] [CrossRef]

- Singh, H.; Harianto, F. Management-board relationships, takeover risk, and the adoption of golden parachutes. Acad. Manag. J. 1989, 32, 7–24. [Google Scholar] [CrossRef]

- Jelinek, K.; Stuerke, P.S. The nonlinear relation between agency costs and managerial equity ownership. Int. J. Manag. Financ. 2009, 5, 156–178. [Google Scholar] [CrossRef]

- Han, K.C.; Suk, D.Y. The effect of ownership structure on firm performance: Additional evidence. Rev. Financ. Econ. 1998, 7, 143–155. [Google Scholar] [CrossRef]

- Lin, Y.; Fu, X. Does institutional ownership influence firm performance? Evidence from China. Int. Rev. Econ. Financ. 2017, 49, 17–57. [Google Scholar] [CrossRef]

- Graves, S.B.; Waddock, S.A. Institutional ownership and control: Implications for long-term corporate strategy. Acad. Manag. Perspect. 1990, 4, 75–83. [Google Scholar] [CrossRef]

- Najid, N.A.; Rahman, R.A. Government ownership and performance of Malaysian government-linked companies. Int. Res. J. Financ. Econ. 2011, 61, 1450–2887. [Google Scholar]

- Berger, A.N.; Clarke, G.R.; Cull, R.; Klapper, L.; Udell, G.F. Corporate governance and bank performance: A joint analysis of the static, selection, and dynamic effects of domestic, foreign, and state ownership. J. Bank. Financ. 2005, 29, 2179–2221. [Google Scholar] [CrossRef]

- Barry, T.A.; Lepetit, L.; Tarazi, A. Ownership structure and risk in publicly held and privately owned banks. J. Bank. Financ. 2011, 35, 1327–1340. [Google Scholar] [CrossRef]

- Dong, Y.; Girardone, C.; Kuo, J.M. Governance, efficiency and risk taking in Chinese banking. Br. Account. Rev. 2017, 49, 211–229. [Google Scholar] [CrossRef]

- Ghazali, N.A.M. Ownership structure, corporate governance and corporate performance in Malaysia. Int. J. Commer. Manag. 2010, 20, 109–119. [Google Scholar] [CrossRef]

- Nguyen, T.; Pham, T.; Dao, T.; Tran, T. The impact of foreign ownership and management on firm performance in Vietnam. J. Asian Financ. Econ. Bus. 2020, 7, 409–418. [Google Scholar] [CrossRef]

- Filatotchev, I.; Isachenkova, N.; Mickiewicz, T. Corporate governance, managers’ independence, exporting, and performance of firms in transition economies. Emerg. Mark. Financ. Trade 2007, 43, 62–77. [Google Scholar] [CrossRef]

- Bonin, J.P.; Hasan, I.; Wachtel, P. Bank performance, efficiency and ownership in transition countries. J. Bank. Financ. 2005, 29, 31–53. [Google Scholar] [CrossRef]

- Mian, A. Distance constraints: The limits of foreign lending in poor economies. J. Financ. 2006, 61, 1465–1505. [Google Scholar] [CrossRef]

- Javid, A.Y.; Iqbal, R. Ownership concentration, corporate governance and firm performance: Evidence from Pakistan. Pak. Dev. Rev. 2008, 643–659. [Google Scholar] [CrossRef]

- Laeven, L.; Levine, R. Bank governance, regulation and risk taking. J. Financ. Econ. 2009, 93, 259–275. [Google Scholar] [CrossRef]

- Rahman, A.; Azureen, N.; Rejab, A.F. The Effect of Risk Taking on Ownership Structure and Bank Performance: A Malaysia Case. Int. Rev. Bus. Res. Pap. 2013, 9, 68–82. [Google Scholar]

- Haniffa, R.; Hudaib, M. Corporate governance structure and performance of Malaysian listed companies. J. Bus. Financ. Account. 2006, 33, 1034–1062. [Google Scholar] [CrossRef]

- Lipton, M.; Lorsch, J.W. A modest proposal for improved corporate governance. Bus. Lawyer 1992, 48, 59–77. [Google Scholar]

- Dato, M.H.; Mersland, R.; Mori, N. Board committees and performance in microfinance institutions. Int. J. Emerg. Mark. 2018. [Google Scholar] [CrossRef]

- Mayur, M.; Saravanan, P. Performance implications of board size, composition and activity: Empirical evidence from the Indian banking sector. Corp. Gov. 2017, 17, 466–489. [Google Scholar] [CrossRef]

- Pathan, S. Strong boards, CEO power and bank risk-taking. J. Bank. Financ. 2009, 33, 1340–1350. [Google Scholar] [CrossRef]

- Liang, C.J.; Lin, Y.L.; Huang, T.T. Does endogenously determined ownership matter on performance? Dynamic evidence from the emerging Taiwan market. Emerg. Mark. Financ. Trade 2011, 47, 120–133. [Google Scholar] [CrossRef]

- Aras, G. The effect of corporate governance practices on financial structure in emerging markets: Evidence from BRICK countries and lessons for Turkey. Emerg. Mark. Financ. Trade 2015, 51, 5–24. [Google Scholar] [CrossRef]

- IMF-Global Financial Stability Report. Global Financial Stability Report. Risk Taking, Liquidity, and Shadow Banking. Curbing Excess while Promoting Growth; IMF-Global Financial Stability Report: Washington, DC, USA, 2014. [Google Scholar]

- Collier, P.; Gregory, A. Audit committee activity and agency costs. J. Account. Public Policy 1999, 18, 311–332. [Google Scholar] [CrossRef]

- Dar, L.; Naseem, M.A.; Niazi, G.S.K.; Rehman, R.U. Corporate Governance and Firm Performance: A Case Study of Pakistan Oil and Gas Companies listed In Karachi Stock Exchange. Glob. J. Manag. Bus. Res. 2011, 11, 1–11. [Google Scholar]

- Mehran, H. Executive compensation structure, ownership, and firm performance. J. Financ. Econ. 1995, 38, 163–184. [Google Scholar] [CrossRef]

- Sheikh, N.A.; Karim, S. Effects of internal governance indicators on performance of commercial banks in Pakistan. Pak. J. Soc. Sci. 2015, 35, 77–90. [Google Scholar]

- Tonello, M. The role of the board in turbulent times: Overseeing risk management and executive compensation. SSRN Electron. J. 2008. [Google Scholar] [CrossRef]

- Erkens, D.H.; Hung, M.; Matos, P. Corporate governance in the 2007–2008 financial crisis: Evidence from financial institutions worldwide. J. Corp. Financ. 2012, 18, 389–411. [Google Scholar] [CrossRef]

- Basuroy, S.; Gleason, K.C.; Kannan, Y.H. CEO compensation, customer satisfaction, and firm value. Rev. Account. Financ. 2014, 13, 326–352. [Google Scholar] [CrossRef]

- Yermack, D. Higher market valuation of companies with a small board of directors. J. Financ. Econ. 1996, 40, 185–211. [Google Scholar] [CrossRef]

- Baliga, B.R.; Moyer, R.C.; Rao, R.S. CEO duality and firm performance: What’s the fuss? Strateg. Manag. J. 1996, 17, 41–53. [Google Scholar] [CrossRef]

- Hsu, W.H.L.; Wang, G.Y.; Hsu, Y.P. Testing mediator and moderator effects of independent director on firm performance. Int. J. Math. Models Methods Appl. Sci. 2012, 5, 698–705. [Google Scholar]

- Boyd, B.K. CEO duality and firm performance: A contingency model. Strateg. Manag. J. 1995, 16, 301–312. [Google Scholar] [CrossRef]

- Hannan, T.H.; Hanweck, G.A. Bank insolvency risk and the market for large certificates of deposit. J. Money Credit Bank. 1988, 20, 203–211. [Google Scholar] [CrossRef]

- Angkinand, A.; Wihlborg, C. Deposit insurance coverage, ownership, and banks’ risk-taking in emerging markets. J. Int. Money Financ. 2010, 29, 252–274. [Google Scholar] [CrossRef]

- Preacher, K.J.; Hayes, A.F. SPSS and SAS procedures for estimating indirect effects in simple mediation models. Behav. Res. Methods Instrum. Comput. 2004, 36, 717–731. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E.; Tatham, R.L. Multivariate Data Analysis; Prentice Hall: Upper Saddle River, NJ, USA, 1998; Volume 5, pp. 207–219. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Kenny, D.A. Multitrait Multimethod Matrix: Definitions and Introduction. 2012. Available online: http://davidakenny.net/cm/mtmm.htm (accessed on 28 April 2020).

- Kenny, D.A. Multiple Latent Variable Models: Confirmatory Factor Analysis. 2016. Available online: http://davidakenny.net/cm/mfactor.htm (accessed on 12 July 2019).

- Drummond, R.J.; Jones, K.D. Assessment Procedures for Counselors and Helping Professionals; Pearson/Merrill Prentice Hall: Upper Saddle River, NJ, USA, 2006. [Google Scholar]

- Watson, J.C.; Flamez, B. Counseling Assessment and Evaluation: Fundamentals of Applied Practice; SAGE: Newbury Park, CA, USA, 2015. [Google Scholar]

- Shleifer, A.; Vishny, R.W. A survey of corporate governance. J. Financ. 1997, 52, 737–783. [Google Scholar] [CrossRef]

- Eling, M.; Marek, S.D. Corporate governance and risk taking: Evidence from the UK and German insurance markets. J. Risk Insur. 2014, 81, 653–682. [Google Scholar] [CrossRef]

- Hutchinson, M.; Seamer, M.; Chapple, L.E. Institutional investors, risk/performance and corporate governance. Int. J. Account. 2015, 50, 31–52. [Google Scholar] [CrossRef]

- Haleblian, J.; Finkelstein, S. Top management team size, CEO dominance, and firm performance: The moderating roles of environmental turbulence and discretion. Acad. Manag. J. 1993, 36, 844–863. [Google Scholar] [CrossRef]

- Ross, S.A. The determination of financial structure: The incentive-signalling approach. Bell J. Econ. 1977, 23–40. [Google Scholar] [CrossRef]

- Core, J.E.; Guay, W.; Larcker, D.F. The power of the pen and executive compensation. J. Financ. Econ. 2008, 88, 1–25. [Google Scholar] [CrossRef]

- McConnell, J.J.; Servaes, H. Additional evidence on equity ownership and corporate value. J. Financ. Econ. 1990, 27, 595–612. [Google Scholar] [CrossRef]

- Haris, M.; Yao, H.; Tariq, G.; Javaid, H.; Ain, Q. Corporate Governance, Political Connections, and Bank Performance. Int. J. Financ. Stud. 2019, 7, 62. [Google Scholar] [CrossRef]

- Junaid, M.; Xue, Y.; Syed, M.; Ziaullah, M.; Numair, R. Corporate governance mechanism and performance of insurers in Pakistan. Green Financ. 2020, 2, 243–262. [Google Scholar] [CrossRef]

- Sheikh, S.; Syed, A.; Shah, S. Corporate reinsurance utilisation and capital structure: Evidence from Pakistan insurance industry. Geneva Pap. Risk Insur. Issues Pract. 2018, 43, 300–334. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).