Impacts of Digital Technostress and Digital Technology Self-Efficacy on Fintech Usage Intention of Chinese Gen Z Consumers

Abstract

1. Introduction

2. Literature Review and Hypotheses

2.1. Fintech Growth in China

2.2. Digital Technostress

2.3. Digital Technology Self-Efficacy

3. Research Model and Methodology

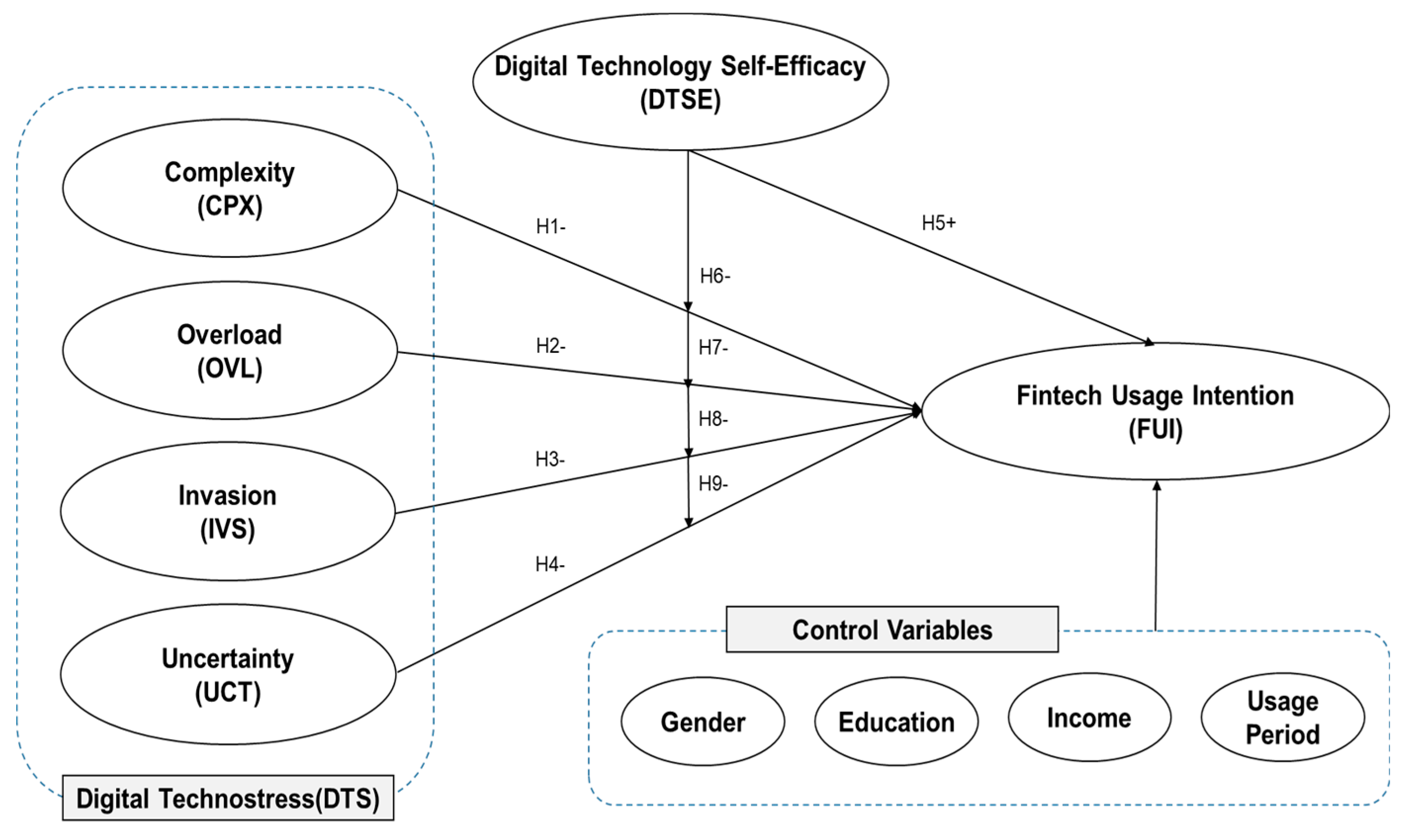

3.1. Research Model

3.2. Data Collection and Sampling

3.3. Construct Measurement

3.4. Research Methodology

4. Empirical Analysis and Results

4.1. Validity and Reliability of Measurement Instruments

4.2. Correlation Test

4.3. Hypotheses Test

5. Discussion and Conclusions

5.1. Summary and Discussion

5.2. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Gomber, P.; Koch, J.A.; Siering, M. Digital finance and FinTech: Current research and future research directions. J. Bus. Econ. 2017, 87, 537–580. [Google Scholar] [CrossRef]

- Walden, S. What is FinTech and How Does It Affect How I Bank? Available online: https://www.forbes.com/advisor/banking/what-is-fintech/ (accessed on 27 January 2021).

- Gabor, D.; Brooks, S. The digital revolution in financial inclusion: International development in the fintech era. New Pol. Econ. 2017, 22, 423–436. [Google Scholar] [CrossRef]

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the FinTech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. J. Manag. Inf. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Mittal, S.; Lloyd, J.; The Rise of FinTech in China: Redefining Financial Services. EY and DBS Bank, November. Available online: https://www.finyear.com/attachment/785371/ (accessed on 12 January 2021).

- Chen, L. From FinTech to finlife: The case of FinTech development in China. China Econ. J. 2016, 9, 225–239. [Google Scholar] [CrossRef]

- Kukreja, G. FinTech adoption in China: Challenges, regulations, and opportunities. In Innovative Strategies for Implementing FinTech in Banking; IGI Global: Hershey, PA, USA, 2021; pp. 166–173. [Google Scholar] [CrossRef]

- Huang, Y. Fintech Development in the People’s Republic of China and Its Macroeconomic Implications. 2020. Available online: https://www.adb.org/publications/fintech-development-prc-its-macroeconomic-implications (accessed on 10 December 2020).

- Statista Research Department. FinTech in China: Statistics & Facts. Available online: https://www.statista.com/topics/6893/fintech-in-china/ (accessed on 22 January 2021).

- Hua, X.; Huang, Y. Understanding China’s FinTech sector: Development, impacts and risks. Eur. J. Fin. 2021, 27, 321–333. [Google Scholar] [CrossRef]

- CNNIC. Statistical Report on Internet Development in China. Available online: https://cnnic.com.cn/IDR/ReportDownloads/202012/P020201201530023411644.pdf (accessed on 22 February 2021).

- Zhou, T. An empirical examination of continuance intention of mobile payment services. Dec. Supp. Syst. 2013, 54, 1085–1091. [Google Scholar] [CrossRef]

- Chuang, L.M.; Liu, C.-C.; Kao, H.-K. The Adoption of Fintech Service: TAM Perspective. Int. J. Manag. Admin. Sci. 2016, 3, pp. 1–15. Available online: https://www.ijmas.org/3-7/IJMAS-3601-2016.pdf (accessed on 2 October 2020).

- Wang, Z.; Guan, Z.; Hou, F.; Li, B.; Zhou, W. What determines customers’ continuance intention of FinTech? Evidence from YuEbao. Ind. Manag. Data Syst. 2019, 119, 1625–1637. [Google Scholar] [CrossRef]

- Brod, C. Technostress: The Human Cost of the Computer Revolution; Basic Books: New York, NY, USA, 1984. [Google Scholar]

- Tim, S. Millennial Shoppers are Old News: Looking Ahead to Gen Z. Available online: https://www.gfk.com/blog/2014/09/millennial-shoppers-are-old-news-looking-ahead-to-gen-z (accessed on 2 November 2020).

- EY. Global FinTech Adoption Index 2019. Available online: https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/banking-and-capital-markets/ey-global-fintech-adoption-index.pdf (accessed on 11 January 2021).

- Gruin, J.; Knaack, P. Not just another shadow bank: Chinese authoritarian capitalism and the “developmental” promise of digital financial innovation. New Pol. Econ. 2020, 25, 370–387. [Google Scholar] [CrossRef]

- Zhang, Y.Z.; Rohlfer, S.; Rajasekera, J. An eco-systematic view of cross-sector FinTech: The case of Alibaba and Tencent. Sustainability 2020, 12, 8907. [Google Scholar] [CrossRef]

- Lloyd, J. What Is Next for Asia in FinTech Adoption. Available online: https://www.ey.com/en_gl/banking-capital-markets/what-is-next-for-asia-in-fintech-adoption (accessed on 28 January 2021).

- FSEC, E-Finance and Financial Security 2019-10. Available online: http://webcache.googleusercontent.com/search?q=cache:VsFCYLiNa80J:www.fsec.or.kr/common/proc/fsec/bbs/146/fileDownLoad/2108.do+&cd=2&hl=ko&ct=clnk&gl=kr (accessed on 14 January 2021).

- Cannon, W. B. The Wisdom of the Body; W.W. Norton & Company: New York, NY, USA, 1932. [Google Scholar]

- Selye, H. The Stress of Life; McGraw-Hill Book Company: New York, NY, USA, 1956. [Google Scholar]

- Cooper, C.L.; Marshall, J. Occupational sources of stress: A review of the literature relating to coronary heart disease and mental ill health. J. Occup. Psychol. 1976, 49, 11–28. [Google Scholar] [CrossRef]

- Beehr, T.A.; Newman, J.E. Job stress, employee health, and organizational effectiveness: A facet analysis, model, and literature review 1. Pers. Psychol. 1978, 31, 665–699. [Google Scholar] [CrossRef]

- Beehr, T.A.; Johnson, L.B.; Nieva, R. Occupational stress: Coping of police and their spouses. J. Organ. Behav. 1995, 16, 3–25. [Google Scholar] [CrossRef]

- Kanner, A.D.; Coyne, J.C.; Schaefer, C.; Lazarus, R.S. Comparison of two modes of stress measurement: Daily hassles and uplifts versus major life events. J. Behav. Med. 1981, 4, 1–39. [Google Scholar] [CrossRef] [PubMed]

- Lazarus, R.S.; Folkman, S. Stress, Appraisal, and Coping; Springer: New York, NY, USA, 1984. [Google Scholar]

- McCauley, C.D.; Ruderman, M.N.; Ohlott, P.J.; Morrow, J.E. Assessing the developmental components of managerial jobs. J. Appl. Psychol. 1994, 79, 544. [Google Scholar] [CrossRef]

- Hudiburg, R.A. Psychology of computer use: Computer technology hassles scale: Revision, reliability, and some correlates. Psych. Rep. 1989, 65, 1387–1394. [Google Scholar] [CrossRef]

- Shu, Q.; Tu, Q.; Wang, K. The impact of computer self-efficacy and technology dependence on computer-related technostress: A social cognitive theory perspective. Int. J. Hum. Comp. Int. 2011, 27, 923–939. [Google Scholar] [CrossRef]

- Arnetz, B.B.; Wiholm, C. Technological stress: Psychophysiological symptoms in modern offices. J. Psych. Res. 1997, 43, 35–42. [Google Scholar] [CrossRef]

- Weil, M.M.; Rosen, L.D. Technostress: Coping with Technology @WORK @HOME @PLAY; John Wiley & Sons: New York, NY, USA, 1997. [Google Scholar]

- Salanova, M.; Llorens, S.; Cifre, E. The dark side of technologies: Technostress among users of information and communication technologies. Int. J. Psych. 2013, 48, 422–436. [Google Scholar] [CrossRef]

- Tarafdar, M.; Tu, Q.; Ragu-Nathan, B.; Ragu-Nathan, T.S. The impact of technostress on role stress and productivity. J. Manag. Inf. Syst. 2007, 24, 301–328. [Google Scholar] [CrossRef]

- Brillhart, P.E. Technostress in the workplace managing stress in the electronic workplace. J. Amer. Acad. Bus. 2004, 5, 302–307. [Google Scholar]

- Ayyagari, R.V.G.; Purvis, R.L. Technostress: Technology antecedents and implications. Mis. Quart. 2011, 35, 831–858. [Google Scholar] [CrossRef]

- Ragu-Nathan, T.S.; Tarafdar, M.; Ragu-Nathan, B.S.; Tu, Q. The consequences of technostress for end users in organizations: Conceptual development and empirical validation. Inf. Syst. Res. 2008, 19, 417–433. [Google Scholar] [CrossRef]

- Lee, H.S.; Lee, S.J. An Empirical Study on the Discontinuance Intention of Smart Device in Post Adoption Context. J. Knowl. Inf. Tech. 2014, 9, pp. 13–21. Available online: https://www.kci.go.kr/kciportal/ci/sereArticleSearch/ciSereArtiView.kci?sereArticleSearchBean.artiId=ART001852153 (accessed on 14 January 2021).

- Çoklar, A.N.; Şahin, Y.L. Technostress levels of social network users based on ICTs in Turkey. Eur. J. Soc. Sci. 2011, 23, 171–182. [Google Scholar]

- Chen, J.V.; Tran, A.; Nguyen, T. Understanding the discontinuance behavior of mobile shoppers as a consequence of technostress: An application of the stress-coping theory. Comput. Hum. Behav. 2019, 95, 83–93. [Google Scholar] [CrossRef]

- Stokols, D.; Altman, I. Handbook of Environmental Psychology; Wiley: New York, NY, USA, 1987. [Google Scholar]

- Zhang, S.; Zhao, L.; Lu, Y.; Yang, J. Do you get tired of socializing? An empirical explanation of discontinuous usage behaviour in social network services. Inf. Manag. 2016, 53, 904–914. [Google Scholar] [CrossRef]

- Krafft, M.; Arden, C.M.; Verhoef, P.C. Permission marketing and privacy concerns—Why do customers (not) grant permissions? J. Int. Mark. 2017, 39, 39–54. [Google Scholar] [CrossRef]

- Luqman, A.; Cao, X.; Ali, A.; Masood, A.; Yu, L. Empirical investigation of Facebook discontinues usage intentions based on SOR paradigm. Comput. Hum. Behav. 2017, 70, 544–555. [Google Scholar] [CrossRef]

- Bandrua, A. Social Foundations of Thought and Action; Prentice: Englewood Cliffs, NJ, USA, 1986. [Google Scholar]

- Bandura, A. Self-efficacy: Toward a unifying theory of behavioral change. Psychol. Rev. 1977, 84, 191. [Google Scholar] [CrossRef]

- Bandura, A. Self-Efficacy: The Exercise of Control; Freeman: New York, NY, USA, 1997. [Google Scholar]

- Bagozzi, R.P. Salesforce performance and satisfaction as a function of individual difference, interpersonal, and situational factors. J. Mark. Res. 1978, 15, 517–531. [Google Scholar] [CrossRef]

- Gist, M.E.; Schwoerer, C.; Rosen, B. Effects of alternative training methods on self-efficacy and performance in computer software training. J. Appl. Psych. 1989, 74, 884–891. [Google Scholar] [CrossRef]

- Martocchio, J.J. Effects of conceptions of ability on anxiety, self-efficacy, and learning in training. J. Appl. Psych. 1994, 79, 819–825. [Google Scholar] [CrossRef] [PubMed]

- Shea, C.M.; Howell, J.M. Charismatic leadership and task feedback: A laboratory study of their effects on self-efficacy and task performance. Leadersh. Quart. 1993, 10, 375–396. [Google Scholar] [CrossRef]

- Lee, J. An Exploratory Analysis of the Antecedents of Self-Efficacy in the Work Environment. J. Oganz. Mang. 2003, 27, pp. 175–198. Available online: http://scholar.dkyobobook.co.kr/searchExtDetail.laf?barcode=4010016697318&vendorGb=01&academyCd=16 (accessed on 14 January 2021).

- Cassidy, S.; Eachus, P. Developing the computer user self-efficacy (CUSE) scale: Investigating the relationship between computer efficacy, gender, and experience. J. Edu. Comp. Res. 2002, 26, 133–153. [Google Scholar] [CrossRef]

- Eastin, M.S.; Larose, R. Internet self-efficacy and the psychology of the digital divide. J. Comp. Med. Com. 2000, 6, 1–18. [Google Scholar] [CrossRef]

- Venkatesh, V.; Davis, F.D. A model of the antecedents of perceived ease of use: Development and test. Dec. Sci. 1996, 27, 451–481. [Google Scholar] [CrossRef]

- Compeau, D.R.; Higgins, C.A. Computer Self-efficacy: Development of a measure and initial test. Mis. Quart. 1995, 19, 189–211. [Google Scholar] [CrossRef]

- Rogers, E.M. Diffusion of Innovations; Simon and Schuster: New York, NY, USA, 2010. [Google Scholar]

- Jerusalem, M.; Mittag, W. Self-efficacy in stressful life transitions. In Self-Efficacy in Changing Societies; Bandura, A., Ed.; Cambridge University Press: Cambridge, UK, 1995; pp. 177–201. [Google Scholar]

- Lu, C.Q.; Siu, O.L.; Cooper, C.L. Managers’ occupational stress in China: The role of self-efficacy. Pers. Individ. Differ. 2005, 38, 569–578. [Google Scholar]

- Julious, S.A. Sample size of 12 per group rule of thumb for a pilot study. Pharm. Stat. 2005, 4, 287–291. [Google Scholar] [CrossRef]

- Browne, R.H. On the use of a pilot sample for sample size determination. Stat. Med. 1995, 14, 1933–1940. [Google Scholar] [CrossRef]

- Egea, J.M.O.; González, M.V.R. Explaining physicians’ acceptance of EHCR systems: An extension of TAM with trust and risk factors. Comp. Hum. Behav. 2011, 27, 319–332. [Google Scholar] [CrossRef]

- Tarafdar, M.; Tu, Q.; Ragu-Nathan, T.S.; Ragu-Nathan, B.S. Crossing to the dark side: Examining creators, outcomes, and inhibitors of technostress. Commun. ACM 2011, 54, 113–120. [Google Scholar] [CrossRef]

- Zedeck, S. Problems with the use of “moderator” variables. Psychol. Bull. 1971, 76, 295–310. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equations models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Hair, J.F.; Sarstedt, M.; Pieper, T.M.; Ringle, C.M. The use of partial least squares structural equation modeling in strategic management research: A review of past practices and recommendations for future applications. Long Range Plan. 2012, 45, 320–340. [Google Scholar] [CrossRef]

- Grewal, R.; Cote, J.A.; Baumgartner, H. Multicollinearity and Measurement Error in Structural Equation Models: Implications for Theory Testing. Mark. Sci. 2004, 23, 519–529. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Cohen, J.; Cohen, P.; Stephen, G.W.; Leona, S.A. Applied Multiple Regression/Correlation Analysis for the Behavioral Sciences, 3rd ed.; Lawrence Erlbaum Associates, Inc.: Mahwah, NJ, USA, 2002. [Google Scholar]

- Vasilios, P.; Nikolaos, S.; Anestis, K. Generation Z consumers’ expectations of interactions in smart retailing: A future agenda. J. Comp. Hum. Behav. 2017, 77, 374–381. [Google Scholar] [CrossRef]

| Researcher | Sub-Dimensions | Number |

|---|---|---|

| Brod [15] | work overload, invasion of individual life, high complexity of technology, occupational crisis | 4 |

| Brillhart [36] | data smog, multitasking madness, computer hassles, burn-out | 4 |

| Tarafdar et al. [35] | overload, invasion, complexity, insecurity, uncertainty | 5 |

| Ragu-Nathan et al. [38] | techno-overload, techno-complexity, techno-anxiety, techno-uncertainty | 4 |

| Ayyagari et al. [37] | work-home conflict, work overload, invasion of privacy, role ambiguity, job insecurity | 5 |

| Attribute Structure of Sample | Frequency | Percentage (%) | |

|---|---|---|---|

| Gender | Male | 142 | 53.4 |

| Female | 124 | 46.6 | |

| Marriage status | Single | 252 | 94.7 |

| Married | 14 | 5.3 | |

| Educational background | Middle school | 13 | 4.9 |

| High school | 27 | 10.2 | |

| Undergraduate school | 186 | 69.9 | |

| Graduate school or above | 40 | 15.1 | |

| Monthly personal income | Under 500 yuan | 65 | 24.4 |

| 501–1000 yuan | 80 | 30.1 | |

| 1001–2000 yuan | 43 | 16.2 | |

| 2001–3000 yuan | 22 | 8.3 | |

| 3001–5000 yuan | 17 | 6.4 | |

| Above 5000 yuan | 39 | 14.7 | |

| Usage period of smart phone | Less than 1 year | 7 | 2.6 |

| 1–3 years | 27 | 10.2 | |

| 3–5 years | 44 | 16.5 | |

| 5–7 years | 67 | 25.2 | |

| 7–9 years | 57 | 21.4 | |

| Longer than 9 years | 64 | 24.1 | |

| Constructs | Measurement Items | Sources |

|---|---|---|

| CPX | I do not know enough about digital technology to handle my job satisfactorily. | [35,64] |

| I need a long time to understand and use new digital technologies. | ||

| I do not find enough time to study and upgrade my digital technology skills. | ||

| I often find it too complex for me to understand and use new digital technologies. | ||

| OVL | I am forced by digital technology to do more work than I can handle. | |

| I am forced by digital technology to know even unnecessary information. | ||

| I am forced by digital technology to work much faster. | ||

| I am forced by digital technology to work with very tight time schedules. | ||

| IVS | I feel my personal life is being invaded by digital technology. | |

| I spend less time with my family due to this technology. | ||

| I sacrifice my personal time to keep up with new technologies. | ||

| UCT | I think there are always new developments in digital technologies. | |

| I think there are constant changes in computer and mobile software. | ||

| DTSE | I believe I can handle most digital technology well. | [54] |

| Most digital technologies I have had experience with have been easy to use. | ||

| Digital technology helps me to save a lot of time. | ||

| FUI | I love to choose financial services that adapt fintech. | [63] |

| I want to use the fintech services as much as possible. | ||

| I prefer fintech payment methods over other payment methods, such as credit card, cash payment, or bank transfer, etc. | ||

| I would recommend fintech services to my friends if I had the chance. |

| Measurement Items | CPX | OVL | IVS | UCT | DTSE | FUI |

|---|---|---|---|---|---|---|

| CPX1 | 0.904 | 0.146 | 0.199 | 0.058 | −0.018 | 0.014 |

| CPX 2 | 0.907 | 0.089 | 0.219 | −0.006 | 0.013 | −0.033 |

| CPX 3 | 0.891 | 0.081 | 0.216 | 0.061 | −0.033 | −0.023 |

| CPX 4 | 0.895 | 0.065 | 0.210 | 0.064 | −0.078 | −0.046 |

| OVL1 | 0.084 | 0.744 | 0.176 | 0.336 | 0.165 | 0.229 |

| OVL 2 | 0.241 | 0.814 | 0.237 | 0.057 | 0.204 | −0.029 |

| OVL 3 | 0.087 | 0.797 | 0.187 | 0.307 | 0.144 | 0.188 |

| IVS 1 | 0.296 | 0.216 | 0.811 | 0.199 | 0.013 | 0.012 |

| IVS 2 | 0.330 | 0.228 | 0.822 | 0.025 | 0.094 | −0.022 |

| IVS 3 | 0.282 | 0.127 | 0.871 | 0.078 | 0.021 | −0.017 |

| UCT1 | 0.217 | 0.365 | 0.209 | 0.757 | 0.176 | 0.076 |

| UCT 2 | −0.018 | 0.293 | 0.084 | 0.765 | 0.303 | 0.247 |

| DTSE1 | −0.060 | 0.186 | 0.007 | 0.128 | 0.840 | 0.306 |

| DTSE2 | −0.011 | 0.079 | 0.007 | 0.074 | 0.856 | 0.323 |

| DTSE3 | −0.057 | 0.250 | 0.127 | 0.294 | 0.707 | 0.206 |

| FUI1 | −0.038 | 0.076 | 0.020 | 0.150 | 0.197 | 0.902 |

| FUI2 | −0.075 | 0.112 | 0.014 | 0.114 | 0.166 | 0.927 |

| FUI3 | 0.004 | 0.085 | −0.001 | 0.077 | 0.210 | 0.906 |

| FUI4 | 0.018 | 0.063 | −0.054 | 0.000 | 0.218 | 0.894 |

| Cronbach’s α | 0.946 | 0.861 | 0.904 | 0.780 | 0.863 | 0.947 |

| Eigenvalue | 3.646 | 2.464 | 2.459 | 1.576 | 2.327 | 3.693 |

| Variance Explained (%) | 19.44 | 12.97 | 12.41 | 8.29 | 12.25 | 19.43 |

| Variables | gen. | edu. | inc. | sup. | CPX | OVL | IVS | UCT | DTSE | FUI |

|---|---|---|---|---|---|---|---|---|---|---|

| gen. | 1 | |||||||||

| edu. | 0.185 ** | 1 | ||||||||

| inc. | −0.140 * | 0.091 | 1 | |||||||

| sup. | −0.075 | 0.224 ** | 0.306 ** | 1 | ||||||

| CPX | −0.087 | −0.063 | −0.069 | −0.078 | 1 | |||||

| OVL | −0.025 | 0.162 ** | 0.017 | 0.185 ** | 0.295 ** | 1 | ||||

| IVS | −0.074 | 0.098 | 0.057 | 0.027 | 0.551 ** | 0.480 ** | 1 | |||

| UCT | 0.047 | 0.176 ** | −0.060 | 0.140 * | 0.201 ** | 0.573 ** | 0.363 ** | 1 | ||

| DTSE | 0.007 | 0.123 * | 0.014 | 0.131 * | −0.049 | 0.450 ** | 0.143 ** | 0.513 ** | 1 | |

| FUI | −0.036 | 0.140 * | 0.039 | 0.053 | −0.042 | 0.284 ** | 0.016 | 0.338 ** | 0.531 ** | 1 |

| Variables | (Dependent variable) Fintech Usage Intention | ||||

|---|---|---|---|---|---|

| N = 266 | |||||

| Model 1 | Model 2 | Model 3 | Model 4 | ||

| Control variables | Gender. | −0.060 | −0.077 | −0.079 | −0.088 |

| Education | 0.147 ** | 0.094 | 0.099 | 0.096 | |

| Income | 0.014 | 0.058 | 0.061 | 0.078 | |

| Usage Per. | 0.012 | −0.066 | −0.069 | −0.094 | |

| Independent variables | CPX | −0.071 | 0.011 | −0.615 ** | |

| OVL | −0.177 ** | 0.056 | −0.800 *** | ||

| IVS | −0.151 ** | −0.133 ** | −0.544 *** | ||

| UCT | −0.228 *** | −0.105 | −0.420 ** | ||

| Moderating variable | DTSE | 0.470 *** | 0.661 *** | ||

| Interactions | CPX *DTSE | −0.357 ** | |||

| OVL *DTSE | −0.498 ** | ||||

| IVS *DTSE | −0.201 | ||||

| UCT *DTSE | −0.167 | ||||

| R2 | 0.024 | 0.163 | 0.314 | 0.385 | |

| F | 1.594 | 6.255 | 12.996 | 12.110 | |

| ΔF | - | 20.81 | 3.73 | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, Y.-K. Impacts of Digital Technostress and Digital Technology Self-Efficacy on Fintech Usage Intention of Chinese Gen Z Consumers. Sustainability 2021, 13, 5077. https://doi.org/10.3390/su13095077

Lee Y-K. Impacts of Digital Technostress and Digital Technology Self-Efficacy on Fintech Usage Intention of Chinese Gen Z Consumers. Sustainability. 2021; 13(9):5077. https://doi.org/10.3390/su13095077

Chicago/Turabian StyleLee, You-Kyung. 2021. "Impacts of Digital Technostress and Digital Technology Self-Efficacy on Fintech Usage Intention of Chinese Gen Z Consumers" Sustainability 13, no. 9: 5077. https://doi.org/10.3390/su13095077

APA StyleLee, Y.-K. (2021). Impacts of Digital Technostress and Digital Technology Self-Efficacy on Fintech Usage Intention of Chinese Gen Z Consumers. Sustainability, 13(9), 5077. https://doi.org/10.3390/su13095077