Effect of Depreciation Method for Long-Term Tangible Assets on Sustainable Management: From a Nuclear Power Generation Cost Perspective under the Nuclear Phase-Out Policy

Abstract

:1. Introduction

2. Materials and Methods

2.1. Construction Costs of Nuclear Power Plants

2.2. Depreciation Method of Nuclear Power Plants

2.2.1. Straight-Line Method (SLM)

2.2.2. Decelerated Depreciation Method (DDM)

2.3. Capacity Factor (CF) of Nuclear Power Plants

2.4. Unit Sales Price of Electricity

2.5. Input Data and Analysis Method for Scenario Analysis

3. Results

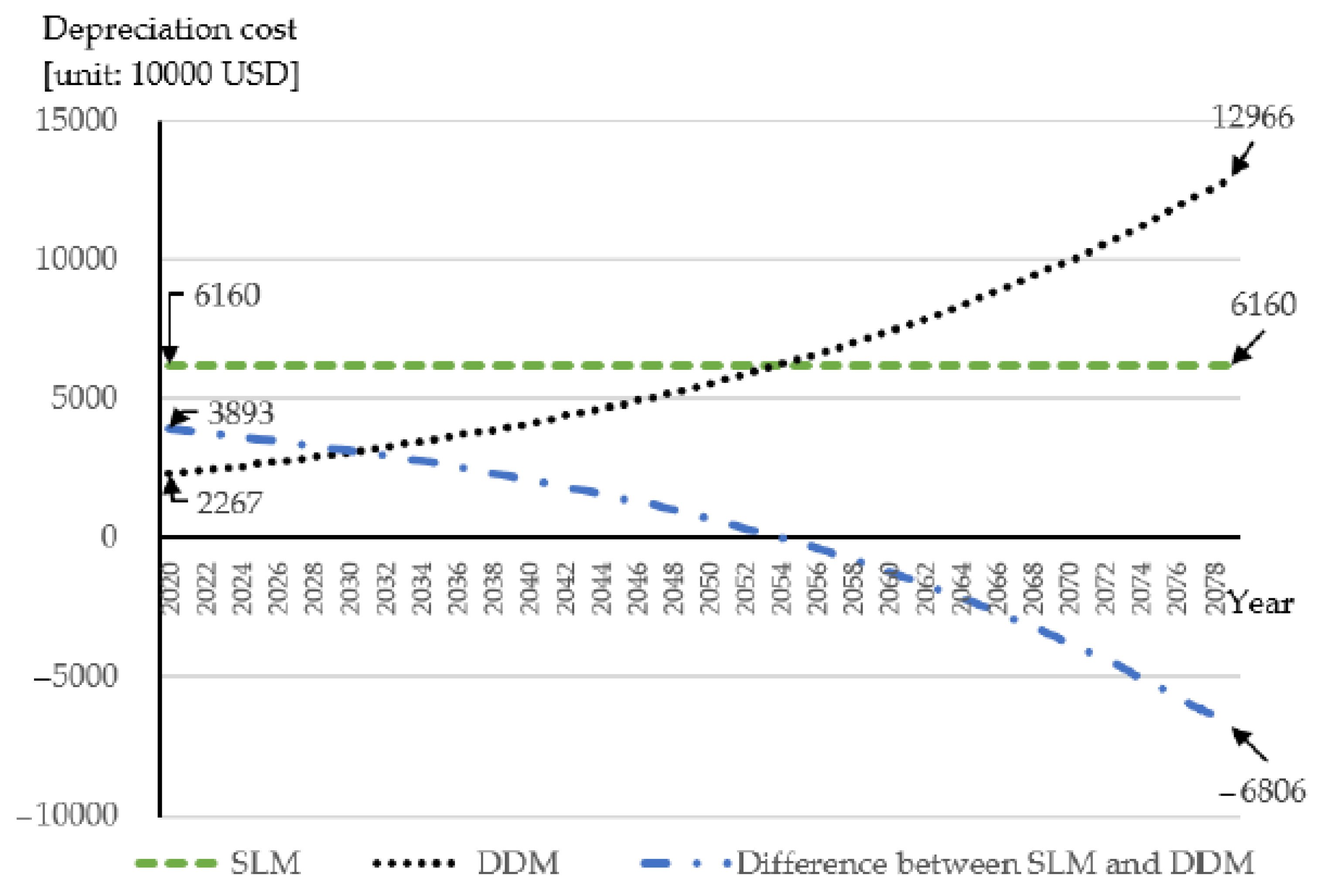

3.1. Results of Depreciation Cost Analysis

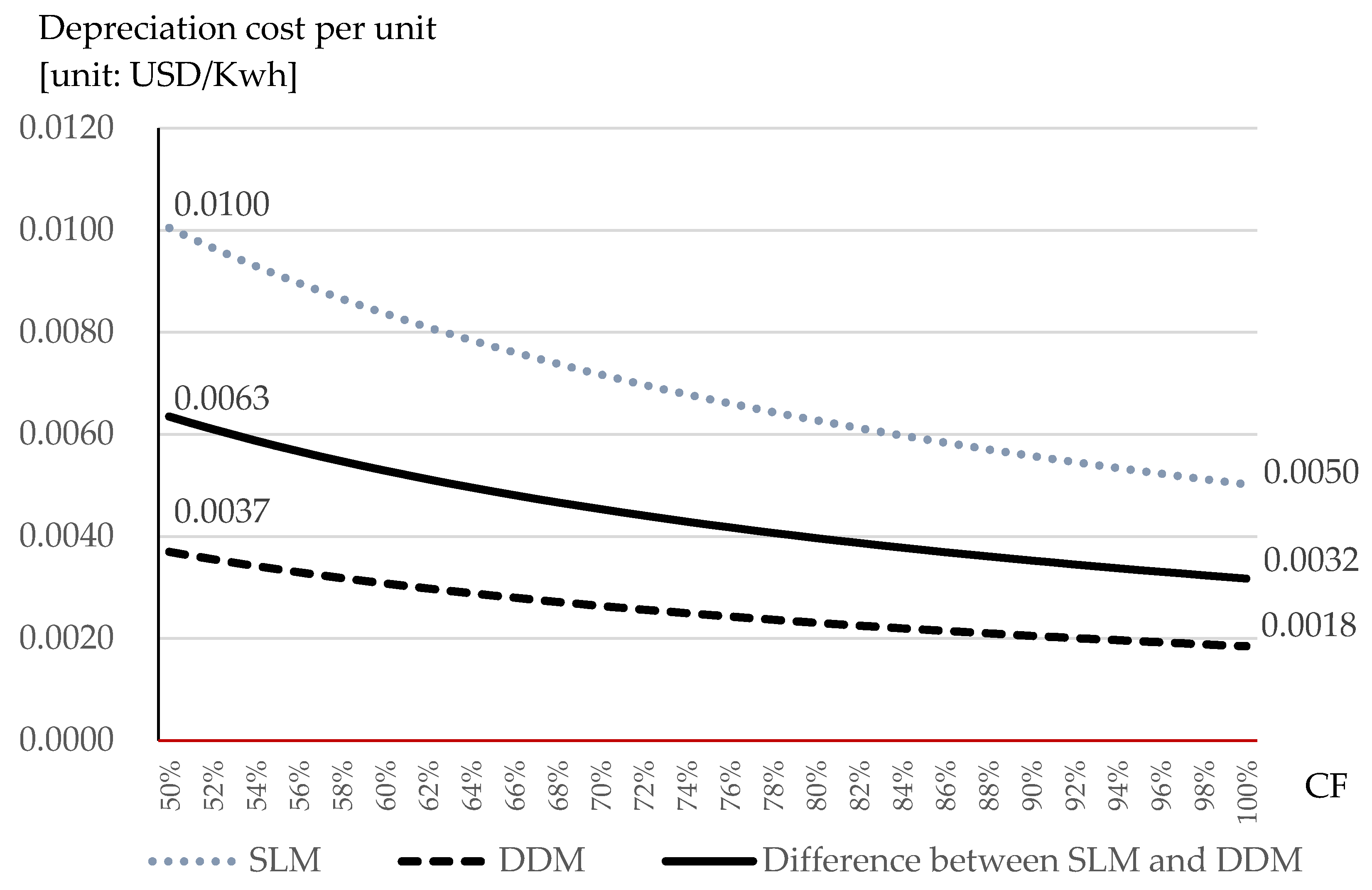

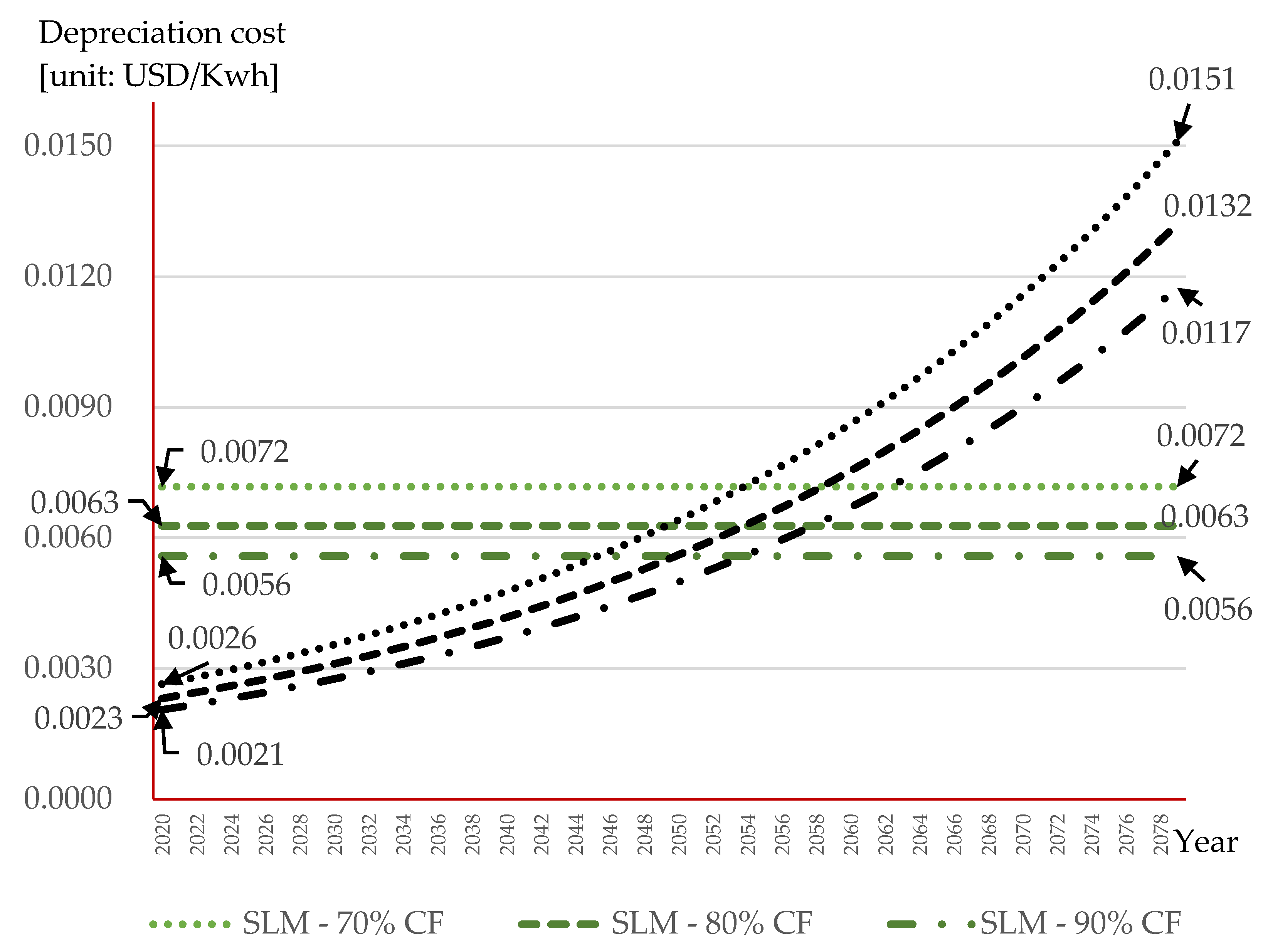

3.2. Results of Analysis of Depreciation Cost Per Unit for Given Scenarios

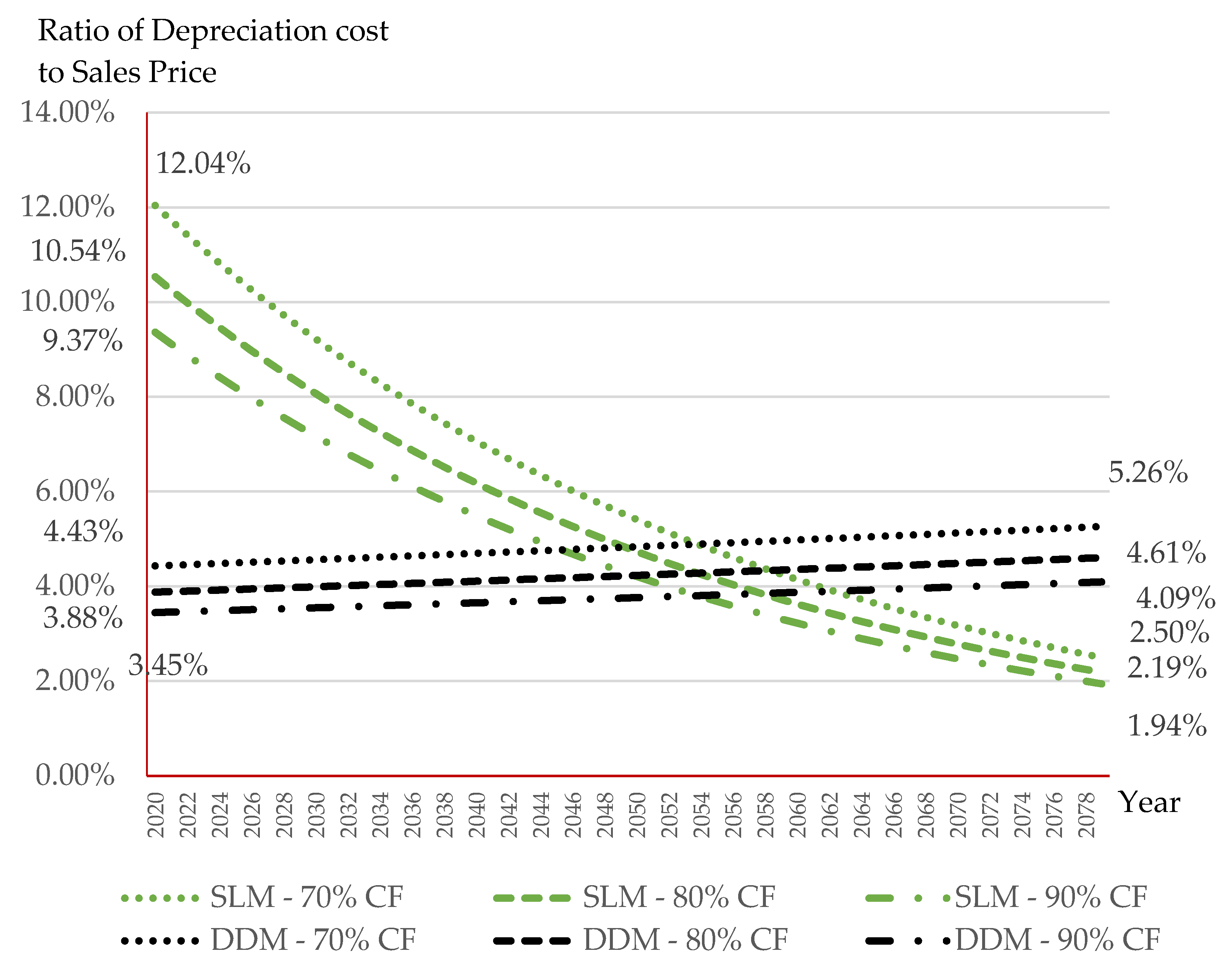

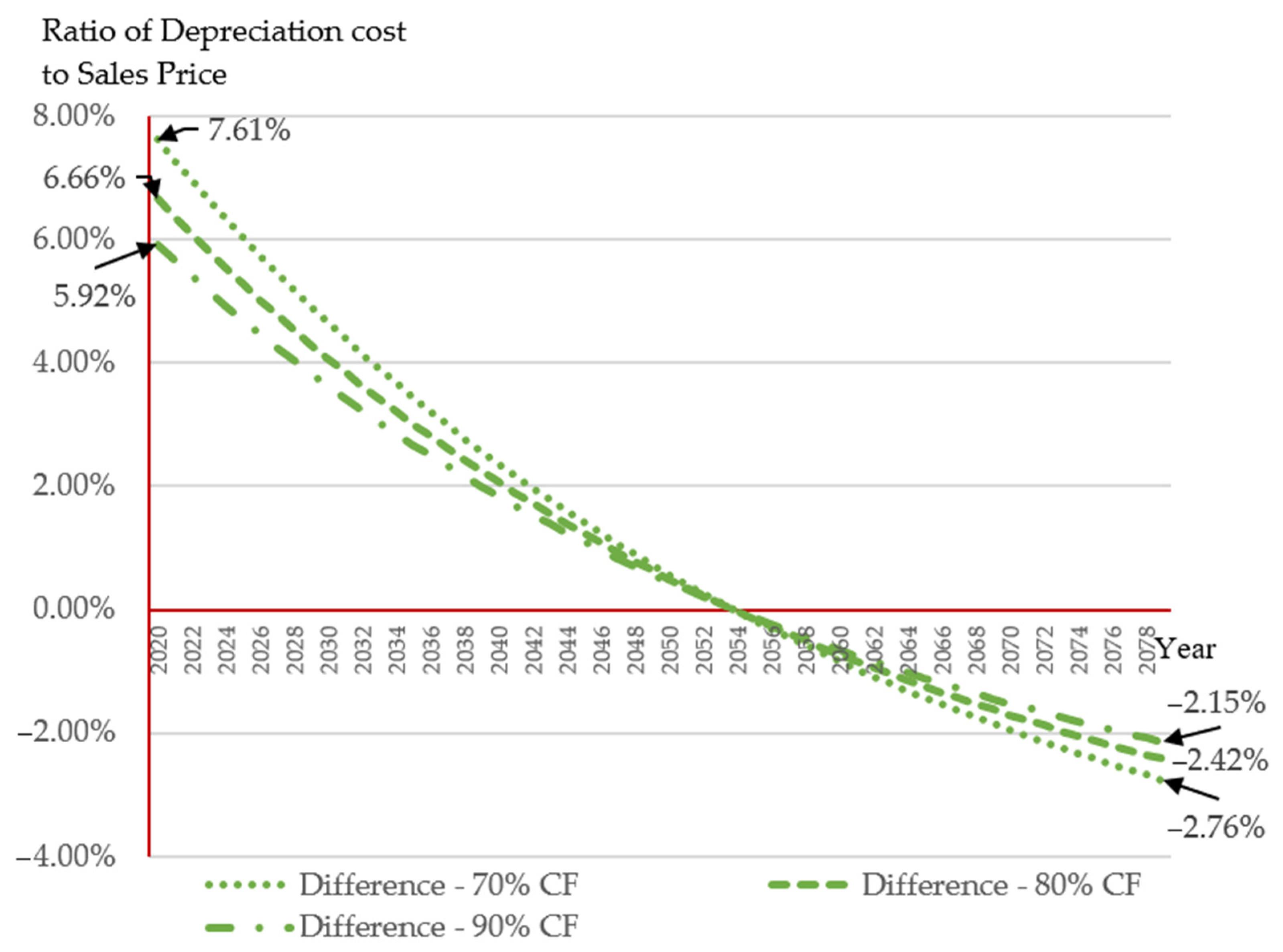

3.3. Results of Analysis of Ratio of Depreciation Cost to Sales Price

4. Conclusions and Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- MOTIE. Nuclear Power Generation 2016; Ministry of Trade, Industry and Energy: Sejong, Korea, 2016; pp. 706–747.

- Nuclear Power Plant Status. Available online: https://npp.khnp.co.kr/index.khnp?menuCd=DOM_000000102002001001 (accessed on 31 December 2019).

- Power Generation Capacity of Nuclear Power Plants. Available online: https://npp.khnp.co.kr/idex.khnp?menuCd=DOM_000000102002001002 (accessed on 31 December 2019).

- MOTIE. 8th Basic Plan for Electricity Supply and Demand; No. 2017-611; Ministry of Trade, Industry and Energy: Sejong, Korea, 2017; pp. 1–41.

- Nam, H. Impact of nuclear phase-out policy and energy balance in 2029 based on the 8th Basic Plan for long-term electricity supply and demand in South Korea. Renew. Sustain. Energy Rev. 2020, 122, 109723. [Google Scholar] [CrossRef]

- Capacity Factor of Nuclear Power Plants. Available online: https://npp.khnp.co.kr/index.khnp?menuCd=DOM_000000102002003000 (accessed on 31 December 2019).

- Kim, K.S. Changes in risk perception of Seoul National University students in nuclear power under opposing government policy. Sustainability 2018, 10, 2350. [Google Scholar] [CrossRef] [Green Version]

- MOTIE. 9th Basic Plan for Electricity Supply and Demand; No. 2020-741; Ministry of Trade, Industry and Energy: Sejong, Korea, 2020; pp. 1–47.

- Kang, S.J. The Theory of Cost Estimation; Dunam Press: Seoul, Korea, 2010; pp. 25–33, 341–345. [Google Scholar]

- Garrison, R.H.; Noreen, E.W.; Brewer, P.C. Managerial Accounting, 13th ed.; McGraw-Hill: New York, NY, USA, 2010; pp. 36–53. [Google Scholar]

- Mowen, M.M.; Hansen, D.R.; Heitger, D.L. Cornerstones of Managerial Accounting, 5th ed.; Cengage Learning: Boston, MA, USA, 2014; pp. 28–92. [Google Scholar]

- Baek, T.Y. Management Accounting, 7th ed.; Shinyoungsa Press: Paju, Korea, 2021; pp. 41–58. [Google Scholar]

- Kim, S.; Ko, W.; Bang, S. Analysis of unit process cost for an engineering-scale pyroprocess facility using a process costing method in Korea. Energies 2015, 8, 8775–8797. [Google Scholar] [CrossRef] [Green Version]

- Bang, S.; Chung, Y.; Chun, D.; Kwon, C.; Hong, S. Cost estimation and efficiency analysis of Korean CANDU spent fuel disposal alternatives in consideration of future price volatility. Sci. Technol. Nuclear Install. 2016, 2016. [Google Scholar] [CrossRef]

- Kim, S.; Jang, H.; Gao, R.; Kim, C.; Chung, Y.; Bang, S. Break-Even Point Analysis of Sodium-Cooled Fast Reactor Capital Investment Cost Comparing the Direct Disposal Option and Pyro-Sodium-Cooled Fast Reactor Nuclear Fuel Cycle Option in Korea. Sustainability 2017, 9, 1518. [Google Scholar] [CrossRef] [Green Version]

- NABO. Issues and Problems of Nuclear Power Generation Costs; National Assembly Budget Office: Seoul, Korea, 2014; pp. 32–33, 36–38.

- KHNP. Nuclear Power Generation 2016; Korea Hydro & Nuclear Power Co. LTD.: Gyeongju, Korea, 2016; pp. 164–179. [Google Scholar]

- KAERI. An Economic Feasibility Study on the Introduction Scenarios of Sodium-Cooled Fast Reactor; KAERI/CM-2007/2014; Korea Atomic Energy Research Institute: Daejeon, Korea, 2014; p. 46. [Google Scholar]

- MOTIE. Regulations for Calculating Radioactive Waste Management Costs and Spent Fuel Management Charges; No. 2013-63; Ministry of Trade, Industry and Energy: Sejong, Korea, 2013; p. 5.

- MOTIE. Regulations for Calculating Radioactive Waste Management Costs and Spent Fuel Management Charges; No. 2015-132; Ministry of Trade, Industry and Energy: Sejong, Korea, 2015; p. 3.

- MOTIE. Regulations for Calculating Radioactive Waste Management Costs and Spent Fuel Management Charges; No. 2017-195; Ministry of Trade, Industry and Energy: Sejong, Korea, 2017; p. 5.

- MOTIE. Regulations for Calculating Radioactive Waste Management Costs and Spent Fuel Management Charges; No. 2019-217; Ministry of Trade, Industry and Energy: Sejong, Korea, 2019; p. 6.

- Weygandt, J.J.; Kieso, D.E.; Kimmel, P.D. Accounting Principles, 8th ed.; Wiley: Danvers, CO, USA, 2008; pp. 422–441. [Google Scholar]

- Kieso, D.E.; Weygandt, J.J.; Warfield, T.D. Intermediate Accounting: IFRS Edition, 2nd ed.; Wiley: Danvers, CO, USA, 2014; pp. 494–503. [Google Scholar]

- Kim, S.; Ko, W.; Youn, S.; Gao, R.; Chung, Y.; Bang, S. Advanced depreciation cost analysis for a commercial pyroprocess facility in Korea. Nuclear Eng. Technol. 2016, 48, 733–743. [Google Scholar] [CrossRef] [Green Version]

- Lee, H.I.; Choi, K.; Baek, W.S.; Choi, Y.S. Accounting Principles, 10th ed.; Shinyoungsa Press: Paju, Korea, 2021; pp. 447–456. [Google Scholar]

- KHNP. Audit Report 2019; Korea Hydro & Nuclear Power Co. LTD: Gyeongju, Korea, 2020; pp. 80–81. [Google Scholar]

- Moonitz, M.; Brown, E.C. The annuity method of estimating depreciation. Account. Rev. 1939, 14, 424–429. Available online: http://www.jstor.org/stable/239369 (accessed on 31 December 2020).

- Reynolds, I.N. Selecting the proper depreciation method. Account. Rev. 1961, 36, 239–248. Available online: https://www.jstor.org/stable/243227 (accessed on 31 December 2020).

- Zeff, S. The IASB and FASB stumble over the annuity method of depreciation. Account. Eur. 2014, 11, 55–57. [Google Scholar] [CrossRef]

- Electricity Sales Price. Available online: http://epsis.kpx.or.kr/epsisnew/selectEkmaUpsBftChart.do?menuId=040701 (accessed on 31 December 2019).

| Category | Capacity (MW) | Construction Cost (Million USD) | Durable Period (Year) | |

|---|---|---|---|---|

| Two Units | One Unit | |||

| APR 1400 | 1400 | 6481 | 3241 | 60 |

| Year | Inflation Rate (%) | Estimated Construction Cost (Million USD) |

|---|---|---|

| 2012 | - | 3241 |

| 2013 | 2.930 | 3336 |

| 2014 | 2.930 | 3433 |

| 2015 | 1.400 | 3481 |

| 2016 | 1.400 | 3530 |

| 2017 | 1.210 | 3573 |

| 2018 | 1.210 | 3616 |

| 2019 | 1.100 | 3656 |

| 2020 | 1.100 | 3696 |

| Category | Year | Capacity Factor (%) | Average (%) |

|---|---|---|---|

| Before the policy | 2001 | 93.2 | 89.02 |

| 2002 | 92.7 | ||

| 2003 | 94.2 | ||

| 2004 | 91.4 | ||

| 2005 | 95.5 | ||

| 2006 | 92.3 | ||

| 2007 | 90.3 | ||

| 2008 | 93.4 | ||

| 2009 | 91.7 | ||

| 2010 | 91.2 | ||

| 2011 | 90.7 | ||

| 2012 | 82.3 | ||

| 2013 * | 75.5 | ||

| 2014 | 85.0 | ||

| 2015 | 85.3 | ||

| 2016 | 79.7 | ||

| After the policy | 2017 | 71.2 | 69.23 |

| 2018 | 65.9 | ||

| 2019 | 70.6 |

| Scenario | Assumption | CF | Power Generation (kW) |

|---|---|---|---|

| 1 | Continuation-nuclear phase-out policy | 70 | 8,584,800,000 |

| 2 | Compromise | 80 | 9,811,200,000 |

| 3 | Discontinuation-nuclear phase-out policy | 90 | 11,037,600,000 |

| Year | Sales Price Per Unit (USD/kWh) | Year-on-Year Increase Rate | Average Increase Rate |

|---|---|---|---|

| 2001 | 0.03965 | 0.027 (2.7%) | |

| 2002 | 0.03955 | −0.002 | |

| 2003 | 0.04312 | 0.090 | |

| 2004 | 0.03952 | −0.083 | |

| 2005 | 0.03910 | −0.011 | |

| 2006 | 0.03813 | −0.025 | |

| 2007 | 0.03940 | 0.033 | |

| 2008 | 0.03902 | −0.010 | |

| 2009 | 0.03556 | −0.089 | |

| 2010 | 0.03961 | 0.114 | |

| 2011 | 0.03912 | −0.012 | |

| 2012 | 0.03952 | 0.010 | |

| 2013 | 0.03903 | −0.013 | |

| 2014 | 0.05470 | 0.401 | |

| 2015 | 0.06269 | 0.146 | |

| 2016 | 0.06791 | 0.083 | |

| 2017 | 0.06068 | −0.106 | |

| 2018 | 0.06210 | 0.023 | |

| 2019 | 0.05831 | −0.061 |

| Category | Input Data and Analysis Method | References |

|---|---|---|

| Construction cost | 3696 (million USD) | 2020 year |

| Durable period | 60 years | |

| Depreciation method | Straight-line method | |

| Decelerated Depreciation Method | ||

| Scenarios of CF | 70% | After the policy |

| 80% | Compromise (Average) | |

| 90% | Before the policy | |

| Sales price increase rate | 0.027 (2.7%) | Average increase rate |

| Exchange rate | 1 USD = 1000 KRW |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bang, S.; Park, S. Effect of Depreciation Method for Long-Term Tangible Assets on Sustainable Management: From a Nuclear Power Generation Cost Perspective under the Nuclear Phase-Out Policy. Sustainability 2021, 13, 5270. https://doi.org/10.3390/su13095270

Bang S, Park S. Effect of Depreciation Method for Long-Term Tangible Assets on Sustainable Management: From a Nuclear Power Generation Cost Perspective under the Nuclear Phase-Out Policy. Sustainability. 2021; 13(9):5270. https://doi.org/10.3390/su13095270

Chicago/Turabian StyleBang, SungSig, and SangYun Park. 2021. "Effect of Depreciation Method for Long-Term Tangible Assets on Sustainable Management: From a Nuclear Power Generation Cost Perspective under the Nuclear Phase-Out Policy" Sustainability 13, no. 9: 5270. https://doi.org/10.3390/su13095270

APA StyleBang, S., & Park, S. (2021). Effect of Depreciation Method for Long-Term Tangible Assets on Sustainable Management: From a Nuclear Power Generation Cost Perspective under the Nuclear Phase-Out Policy. Sustainability, 13(9), 5270. https://doi.org/10.3390/su13095270