A Temporal Perspective in Eco2 Building Design

Abstract

:1. Introduction

2. Method: Eco2

2.1. Goal and Scope

- Which material and energy supply solutions result in the lowest environmental impacts, expressed in environmental life cycle costs (eLCC) and/or the lowest financial life cycle costs (fLCC)?

- Do temporal parameters change recommendations?

- Does monetary valuation change recommendations?

2.2. Life Cycle Phases

2.3. Functional Unit

2.4. Building Decomposition

2.5. Scenario Development

2.6. Time-Based Life Cycle Inventory

2.7. Impact Assessment

2.8. Interpretation and Communication of Results

2.8.1. Monetary Valuation

2.8.2. Temporal Parameters

3. Results

3.1. Results: Standard Scenario

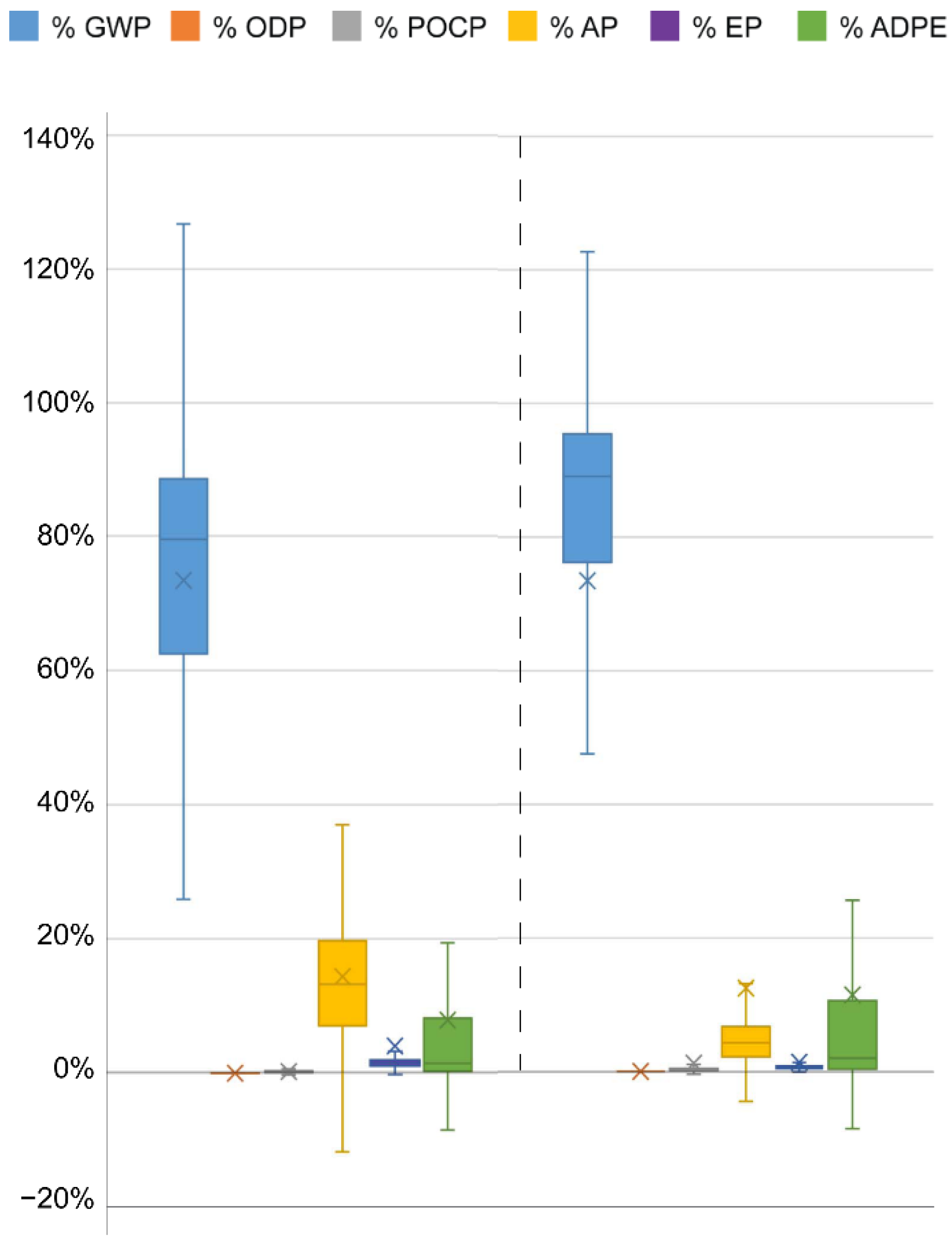

3.1.1. Structure and Finishes (CG 300)

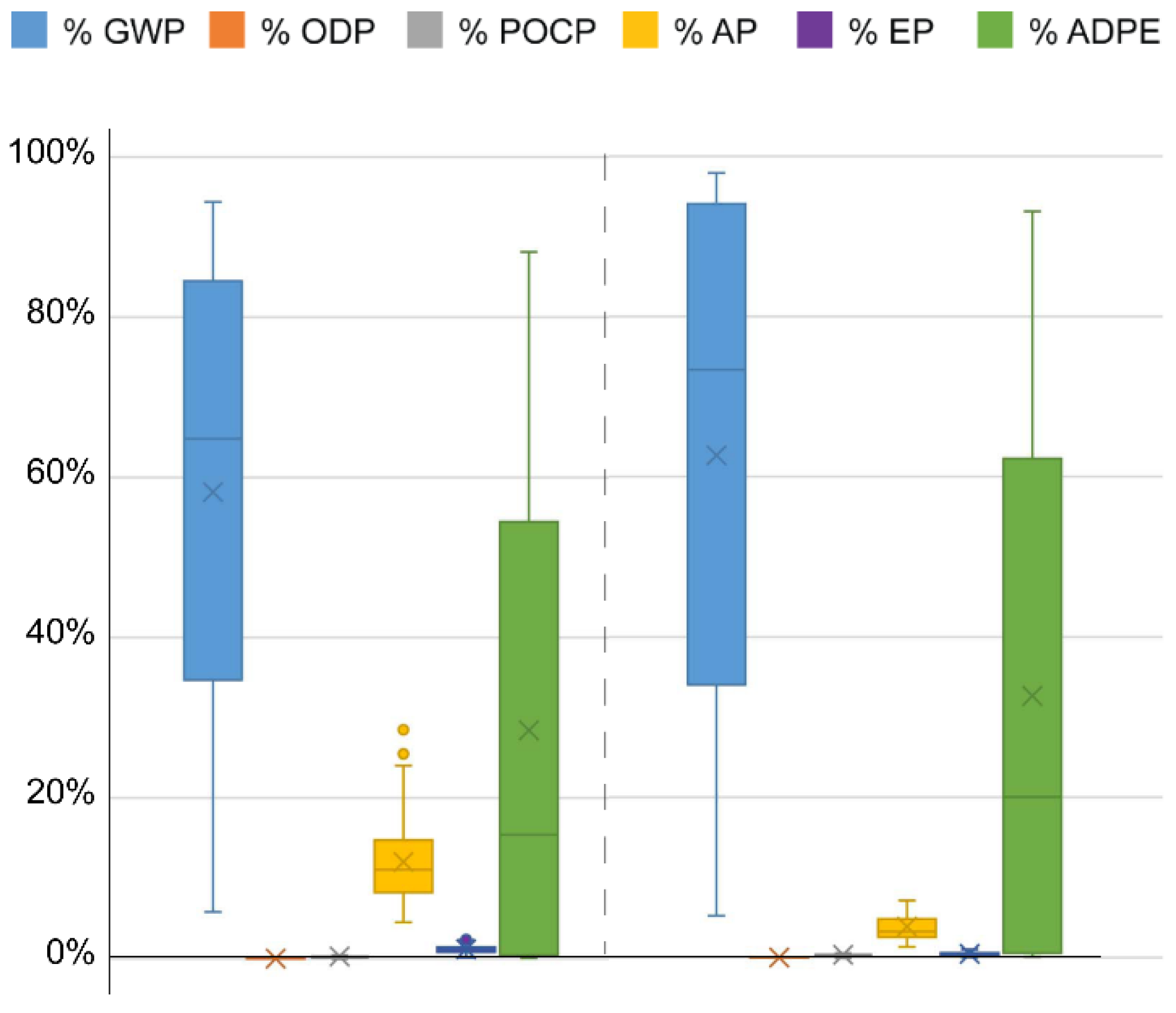

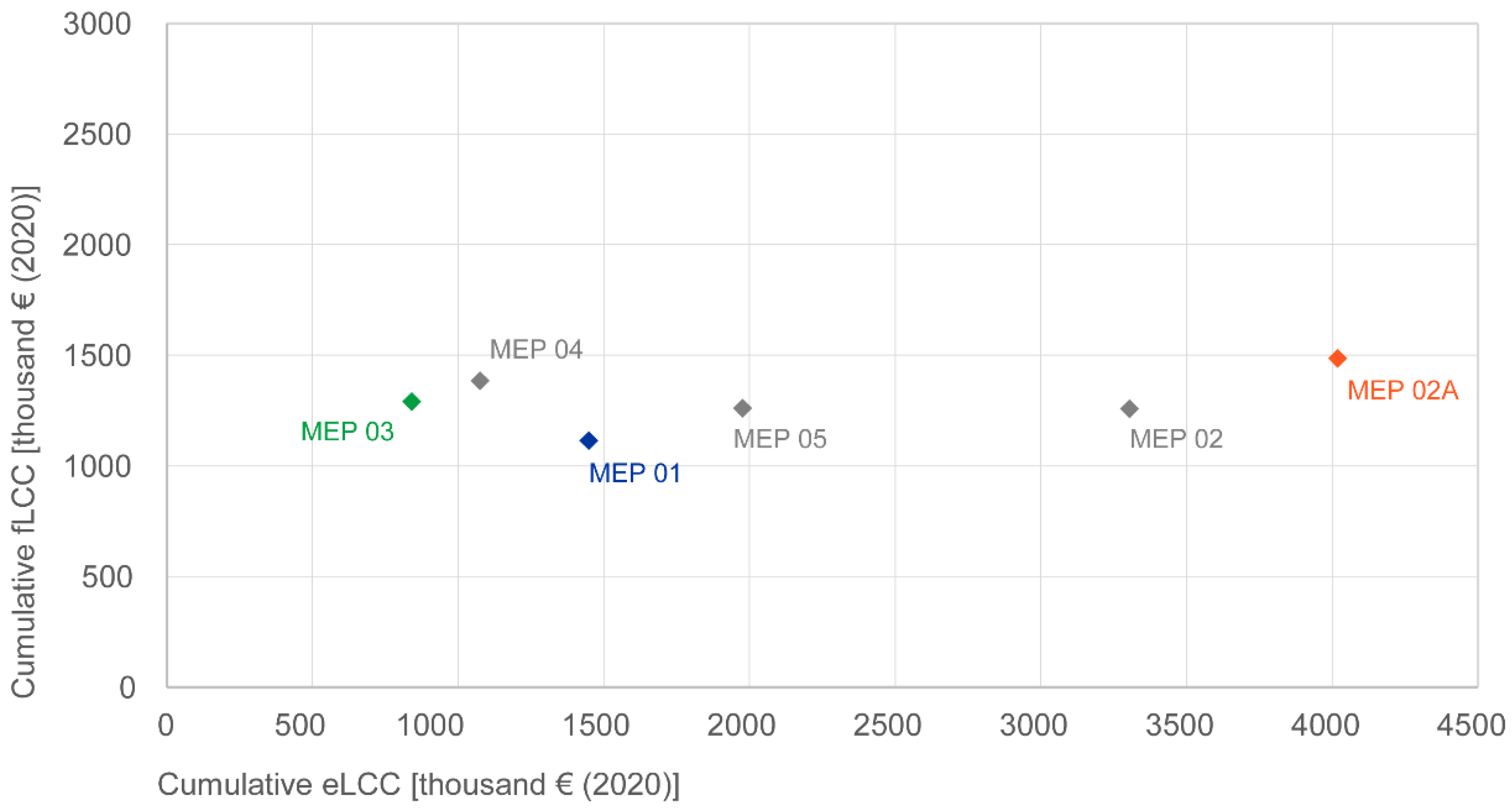

3.1.2. MEP Systems and Operational Phase (CG 400 + B6)

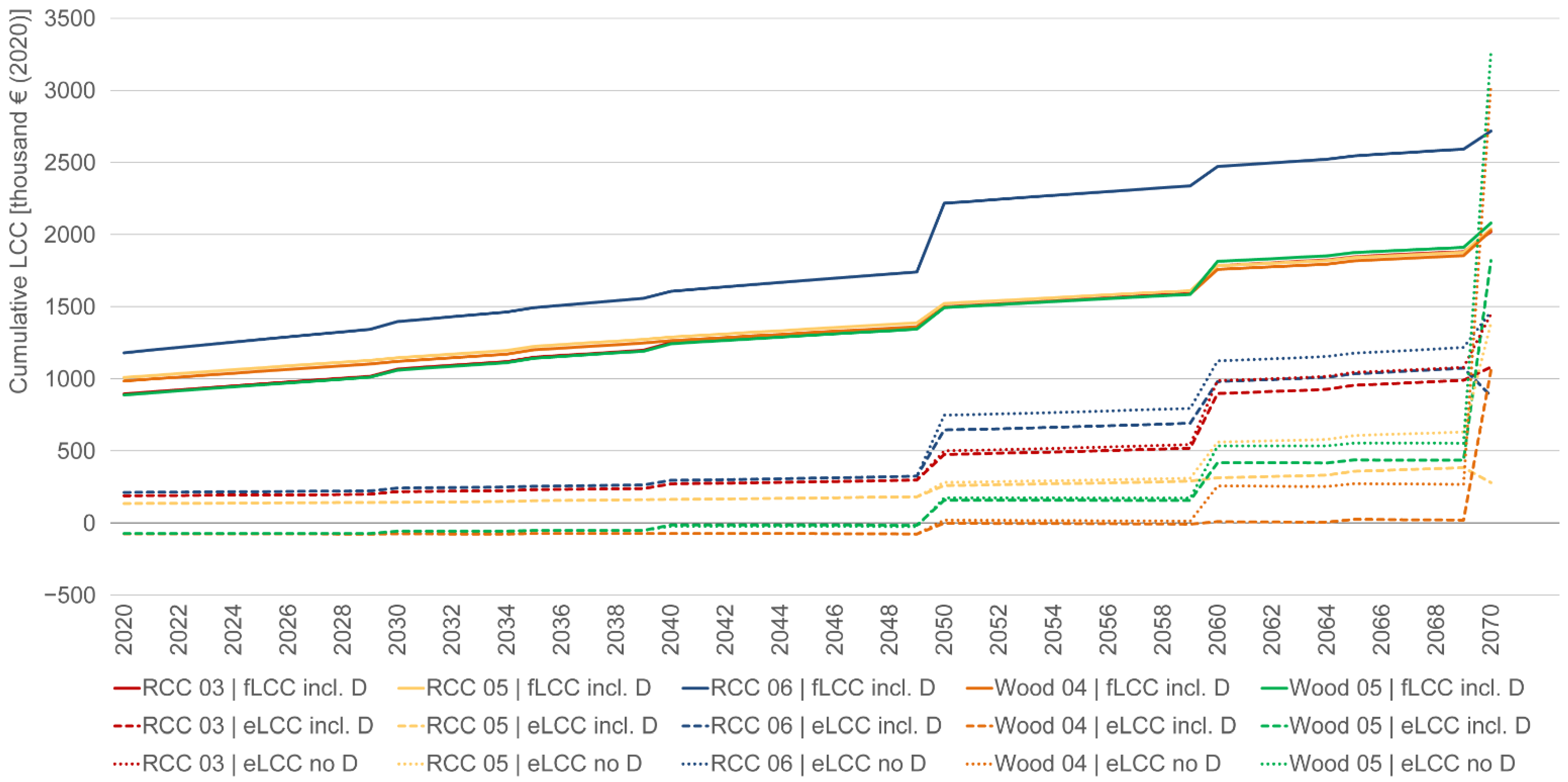

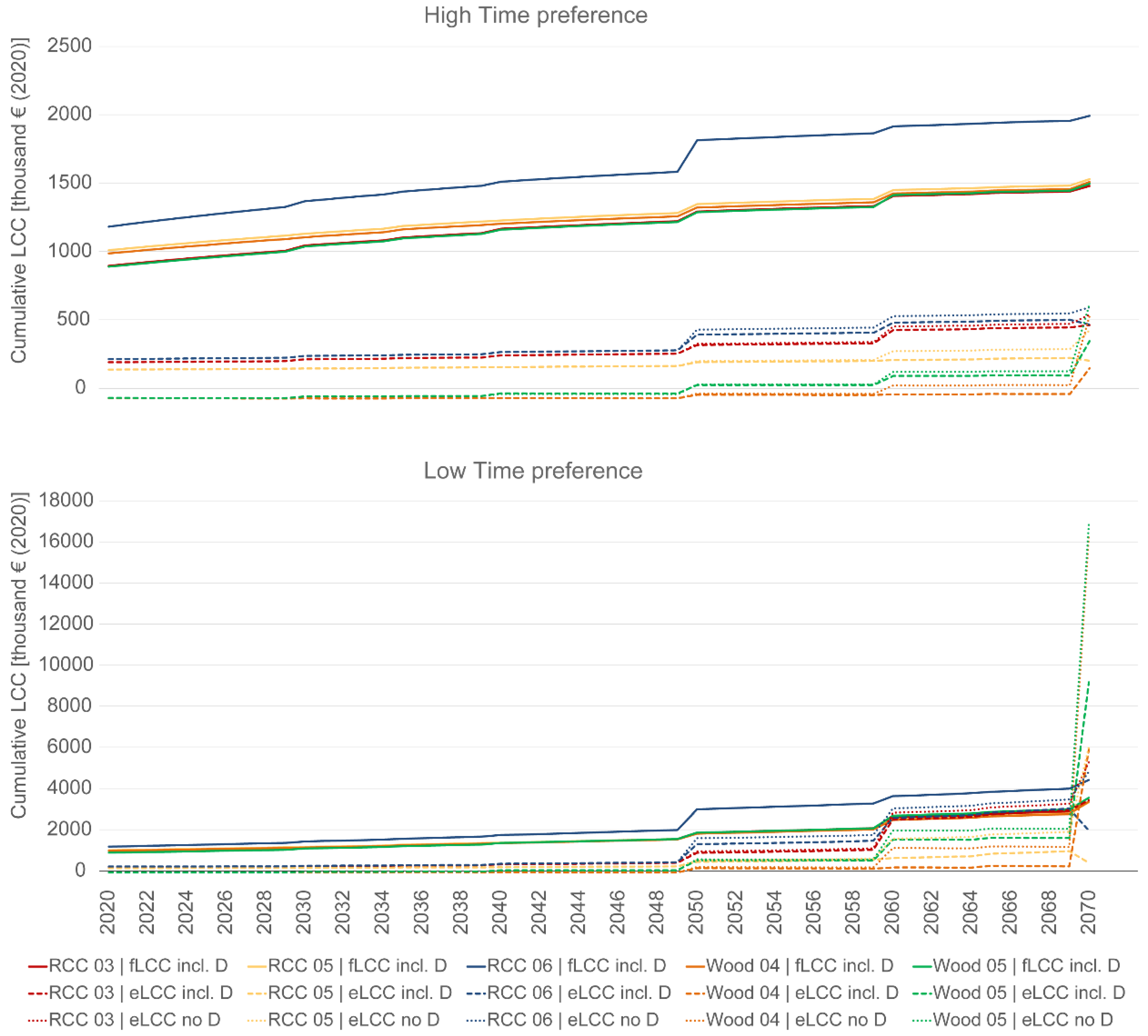

3.2. Temporal Dimension: Scenario Analysis

3.2.1. Structure and Finishes (CG 300)

3.2.2. MEP Systems and Building Operation (CG 400 + B6)

3.3. Implications of Monetary Valuation

3.3.1. Weighting Environmental Impact Indicators

- the building’s structural and finish materials (CG 300);

- MEP systems (HVAC systems, electrical systems and sanitary installations: CG 400); and

- operational energy use (life cycle phase B6).

3.3.2. Varying Monetary Valuation

4. Discussion

4.1. Gaps and Limitations of the Use Case

4.2. Quasi-Dynamic LCA

4.3. Monetary Weighting

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Abbreviations

| AP | acidification potential |

| ADPE | abiotic depletion potential of elements |

| BIM | building information modelling |

| BNB | Bewertungssystem nachhaltiges Bauen (building sustainability evaluation system) |

| DGNB | Deutsche Gesellschaft für nachhaltiges Bauen (German sustainable building council) |

| EC | environmental cost |

| eLCC | environmental life cycle cost |

| EP | eutrophication potential |

| fLCC | financial life cycle cost |

| GHG | greenhouse gas |

| GWP | global warming potential |

| HVAC | heating, ventilation, air conditioning |

| LCA | life cycle assessment |

| LCC | life cycle costing |

| MEP | mechanical, electrical, plumbing |

| NPC | net present cost |

| ODP | ozone depletion potential |

| POCP | photochemical ozone creation potential |

| PV | photovoltaic |

| RSL | reference service life |

| TP | time preference |

Appendix A. Case Study Specifications

| Variation Name | Structure | Ext. Wall Core | Ext. Wall Finish | Window Frames | Insulation Material Int. Floors | Floor Finish | Interior Load-Bearing Walls | Interior Non-Load-Bearing Walls |

|---|---|---|---|---|---|---|---|---|

| RCC 03 | RCC | SL brick | EIFS (EPS) | PVC | EPS | carpet | masonry | metal stud drywall |

| RCC 05 | RCC | Wood frame | Ventilated (alum. siding) | wood | wood fiber | wood parquet | masonry | wood stud drywall |

| RCC 06 | RCC | Curtain wall (alu.) | Aluminum siding | (alum.) | EPS | carpet | masonry | metal stud drywall |

| Wood 04 | Solid wood | Wood frame | Ventilated (alum. siding) | wood | wood fiber | wood parquet | solid wood | wood stud drywall |

| Wood 05 | Solid wood | Wood frame | EIFS (wood fiber) | PVC | EPS | carpet | solid wood | metal stud drywall |

| Variation Name | Heating Supply | Cooling Supply | PV |

|---|---|---|---|

| MEP 01 | Groundwater heat pump | Compression (electricity) | yes |

| MEP 02 | Gas condensing boiler | Compression (electricity) | yes |

| MEP 02A | Gas condensing boiler | Compression (electricity) | no |

| MEP 03 | Renewable district heat | Compression (electricity) | yes |

Appendix B. Case Study Results: Medium Monetary Valuation

| Variation | eLCC (No D) | eLCC (Incl. D) | fLCC | eLCC No D/fLCC | eLCC Incl. D/LCC |

| RCC 01 | 1,454,277€ | 1,067,346€ | 2,098,014€ | 69.3% | 50.9% |

| RCC 01A | 1,351,859€ | 1,026,404€ | 2,110,477€ | 64.1% | 48.6% |

| RCC 02 | 1,328,615€ | 990,597€ | 2,044,960€ | 65.0% | 48.4% |

| RCC 02A | 1,283,670€ | 967,248€ | 2,049,106€ | 62.6% | 47.2% |

| RCC 02B | 1,398,825€ | 932,434€ | 2,068,703€ | 67.6% | 45.1% |

| RCC 03 | 1,448,969€ | 1,080,746€ | 2,020,972€ | 71.7% | 53.5% |

| RCC 04 | 1,450,918€ | 744,124€ | 2,059,883€ | 70.4% | 36.1% |

| RCC 05 | 1,386,873€ | 279,927€ | 2,038,062€ | 68.0% | 13.7% |

| RCC 06 | 1,465,022€ | 880,698€ | 2,717,295€ | 53.9% | 32.4% |

| Wood 04 | 3,043,717€ | 1,058,493€ | 2,027,408€ | 150.1% | 52.2% |

| Wood 04A | 3,170,602€ | 1,408,453€ | 2,048,539€ | 154.8% | 68.8% |

| Wood 05 | 3,266,101€ | 1,819,585€ | 2,079,617€ | 157.1% | 87.5% |

| Wood 06 | 3,159,066€ | 1,283,054€ | 2,651,549€ | 119.1% | 48.4% |

| Variation | fLCC + eLCC (No D) | fLCC + eLCC (Incl. D) | Ranking Based on fLCC | Ranking Based on fLCC + eLCC No D | Ranking Based on fLCC + eLCC Incl. D |

| RCC 01 | 3,552,291€ | 3,165,360€ | 10 | 8 | 9 |

| RCC 01A | 3,462,336€ | 3,136,881€ | 11 | 4 | 8 |

| RCC 02 | 3,373,575€ | 3,035,557€ | 4 | 2 | 5 |

| RCC 02A | 3,332,777€ | 3,016,355€ | 6 | 1 | 4 |

| RCC 02B | 3,467,528€ | 3,001,137€ | 8 | 5 | 3 |

| RCC 03 | 3,469,941€ | 3,101,718€ | 1 | 6 | 7 |

| RCC 04 | 3,510,800€ | 2,804,007€ | 7 | 7 | 2 |

| RCC 05 | 3,424,935€ | 2,317,989€ | 3 | 3 | 1 |

| RCC 06 | 4,182,317€ | 3,597,993€ | 13 | 9 | 11 |

| Wood 04 | 5,071,124€ | 3,085,900€ | 2 | 10 | 6 |

| Wood 04A | 5,219,141€ | 3,456,992€ | 5 | 11 | 10 |

| Wood 05 | 5,345,719€ | 3,899,203€ | 9 | 12 | 12 |

| Wood 06 | 5,810,615€ | 3,934,603€ | 12 | 13 | 13 |

| Variation | eLCC (No D) | eLCC (Incl. D) | fLCC | eLCC No D/fLCC | eLCC Incl. D/LCC |

| RCC 01 | 542,878€ | 463,417€ | 1,543,833€ | 35.2% | 30.0% |

| RCC 01A | 522,332€ | 455,761€ | 1,552,990€ | 33.6% | 29.3% |

| RCC 02 | 510,346€ | 440,888€ | 1,505,893€ | 33.9% | 29.3% |

| RCC 02A | 498,599€ | 433,668€ | 1,508,939€ | 33.0% | 28.7% |

| RCC 02B | 516,114€ | 419,739€ | 1,523,337€ | 33.9% | 27.6% |

| RCC 03 | 537,319€ | 461,208€ | 1,479,057€ | 36.3% | 31.2% |

| RCC 04 | 525,496€ | 387,226€ | 1,523,891€ | 34.5% | 25.4% |

| RCC 05 | 422,631€ | 201,149€ | 1,528,473€ | 27.7% | 13.2% |

| RCC 06 | 591,671€ | 464,252€ | 1,992,432€ | 29.7% | 23.3% |

| Wood 04 | 526,262€ | 145,253€ | 1,507,964€ | 34.9% | 9.6% |

| Wood 04A | 513,725€ | 176,521€ | 1,498,082€ | 34.3% | 11.8% |

| Wood 05 | 615,922€ | 344,207€ | 1,494,950€ | 41.2% | 23.0% |

| Wood 06 | 631,454€ | 258,236€ | 1,950,873€ | 32.4% | 13.2% |

| Variation | fLCC + eLCC (No D) | fLCC + eLCC (Incl. D) | Ranking Based on fLCC | Ranking Based on fLCC + eLCC No D | Ranking Based on fLCC + eLCC Incl. D |

| RCC 01 | 2,086,711€ | 2,007,250€ | 10 | 10 | 10 |

| RCC 01A | 2,075,321€ | 2,008,750€ | 11 | 9 | 11 |

| RCC 02 | 2,016,239€ | 1,946,781€ | 4 | 4 | 9 |

| RCC 02A | 2,007,538€ | 1,942,607€ | 6 | 2 | 7 |

| RCC 02B | 2,039,451€ | 1,943,076€ | 7 | 7 | 8 |

| RCC 03 | 2,016,376€ | 1,940,265€ | 1 | 5 | 6 |

| RCC 04 | 2,049,387€ | 1,911,117€ | 8 | 8 | 5 |

| RCC 05 | 1,951,104€ | 1,729,622€ | 9 | 1 | 3 |

| RCC 06 | 2,584,102€ | 2,456,684€ | 13 | 13 | 13 |

| Wood 04 | 2,034,226€ | 1,653,217€ | 5 | 6 | 1 |

| Wood 04A | 2,011,808€ | 1,674,603€ | 3 | 3 | 2 |

| Wood 05 | 2,110,872€ | 1,839,157€ | 2 | 11 | 4 |

| Wood 06 | 2,582,327€ | 2,209,109€ | 12 | 12 | 12 |

| Variation | eLCC (No D) | eLCC (Incl. D) | fLCC | eLCC No D/fLCC | eLCC Incl. D/LCC |

| RCC 01 | 5,273,049€ | 3,325,161€ | 3,473,354€ | 152% | 96% |

| RCC 01A | 4,765,285€ | 3,116,764€ | 3,494,411€ | 136% | 89% |

| RCC 02 | 4,693,824€ | 2,989,530€ | 3,376,265€ | 139% | 89% |

| RCC 02A | 4,497,741€ | 2,898,623€ | 3,383,270€ | 133% | 86% |

| RCC 02B | 5,122,728€ | 2,793,300€ | 3,416,381€ | 150% | 82% |

| RCC 03 | 5,270,709€ | 3,426,129€ | 3,359,262€ | 157% | 102% |

| RCC 04 | 5,466,532€ | 1,784,772€ | 3,381,828€ | 162% | 53% |

| RCC 05 | 6,030,094€ | 389,459€ | 3,331,686€ | 181% | 12% |

| RCC 06 | 4,820,728€ | 1,966,446€ | 4,408,017€ | 109% | 45% |

| Wood 04 | 16,343,445€ | 5,900,299€ | 3,354,515€ | 487% | 176% |

| Wood 04A | 17,225,915€ | 7,963,048€ | 3,462,528€ | 497% | 230% |

| Wood 05 | 16,886,119€ | 9,170,541€ | 3,546,134€ | 476% | 259% |

| Wood 06 | 16,030,523€ | 6,352,276€ | 4,331,642€ | 370% | 147% |

| Variation | fLCC + eLCC (No D) | fLCC + eLCC (Incl. D) | Ranking Based on fLCC | Ranking Based on fLCC + eLCC No D | Ranking Based on fLCC + eLCC Incl. D |

| RCC 01 | 8,746,403€ | 6,798,514€ | 9 | 6 | 9 |

| RCC 01A | 8,259,697€ | 6,611,175€ | 10 | 3 | 7 |

| RCC 02 | 8,070,089€ | 6,365,795€ | 4 | 2 | 5 |

| RCC 02A | 7,881,011€ | 6,281,893€ | 6 | 1 | 4 |

| RCC 02B | 8,539,110€ | 6,209,681€ | 7 | 4 | 3 |

| RCC 03 | 8,629,972€ | 6,785,391€ | 3 | 5 | 8 |

| RCC 04 | 8,848,360€ | 5,166,600€ | 5 | 7 | 2 |

| RCC 05 | 9,361,780€ | 3,721,145€ | 1 | 9 | 1 |

| RCC 06 | 9,228,746€ | 6,374,463€ | 13 | 8 | 6 |

| Wood 04 | 19,697,961€ | 9,254,814€ | 2 | 10 | 10 |

| Wood 04A | 20,688,443€ | 11,425,575€ | 8 | 13 | 12 |

| Wood 05 | 20,432,253€ | 12,716,675€ | 11 | 12 | 13 |

| Wood 06 | 20,362,165€ | 10,683,919€ | 12 | 11 | 11 |

| Variation | eLCC (No D) | eLCC (Incl. D) | fLCC | eLCC No D/fLCC | eLCC Incl. D/LCC |

| MEP 01 | 2,981,472€ | 1,448,856€ | 1,115,159€ | 267% | 130% |

| MEP 02 | 4,766,964€ | 3,303,755€ | 1,259,252€ | 379% | 262% |

| MEP 02A | 5,026,850€ | 4,018,056€ | 1,486,969€ | 338% | 270% |

| MEP 03 | 2,288,667€ | 839,932€ | 1,291,476€ | 177% | 65% |

| MEP 04 | 2,540,220€ | 1,074,498€ | 1,384,925€ | 183% | 78% |

| MEP 05 | 3,441,577€ | 1,975,856€ | 1,259,789€ | 273% | 157% |

| Variation | fLCC + eLCC (No D) | fLCC + eLCC (Incl. D) | Ranking Based on fLCC | Ranking Based on fLCC + eLCC No D | Ranking Based on fLCC + eLCC Incl D |

| MEP 01 | 4,096,632€ | 2,564,015€ | 1 | 3 | 3 |

| MEP 02 | 6,026,216€ | 4,563,007€ | 2 | 5 | 5 |

| MEP 02A | 6,513,819€ | 5,505,026€ | 6 | 6 | 6 |

| MEP 03 | 3,580,143€ | 2,131,408€ | 4 | 1 | 1 |

| MEP 04 | 3,925,144€ | 2,459,423€ | 5 | 2 | 2 |

| MEP 05 | 4,701,366€ | 3,235,645€ | 3 | 4 | 4 |

| Variation | eLCC (No D) | eLCC (Incl. D) | fLCC | eLCC No D/fLCC | eLCC Incl. D/LCC |

| MEP 01 | 1,088,355€ | 710,178€ | 694,507€ | 157% | 102% |

| MEP 02 | 1,682,423€ | 1,321,373€ | 735,427€ | 229% | 180% |

| MEP 02A | 1,774,694€ | 1,525,775€ | 798,743€ | 222% | 191% |

| MEP 03 | 842,553€ | 485,090€ | 744,455€ | 113% | 65% |

| MEP 04 | 929,199€ | 567,529€ | 796,000€ | 117% | 71% |

| MEP 05 | 1,259,322€ | 897,652€ | 748,330€ | 168% | 120% |

| Variation | fLCC + eLCC (No D) | fLCC + eLCC (Incl. D) | Ranking Based on fLCC | Ranking Based on fLCC + eLCC No D | Ranking Based on fLCC + eLCC Incl D |

| MEP 01 | 1,782,862€ | 1,404,685€ | 1 | 3 | 3 |

| MEP 02 | 2,417,850€ | 2,056,800€ | 2 | 5 | 5 |

| MEP 02A | 2,573,437€ | 2,324,518€ | 6 | 6 | 6 |

| MEP 03 | 1,587,008€ | 1,229,545€ | 3 | 1 | 1 |

| MEP 04 | 1,725,199€ | 1,363,529€ | 5 | 2 | 2 |

| MEP 05 | 2,007,652€ | 1,645,982€ | 4 | 4 | 4 |

| Variation | eLCC (No D) | eLCC (Incl. D) | fLCC | eLCC No D/fLCC | eLCC Incl. D/LCC |

| MEP 01 | 10,031,652€ | 3,109,839€ | 2,275,466€ | 441% | 137% |

| MEP 02 | 16,407,963€ | 9,798,936€ | 2,795,097€ | 587% | 351% |

| MEP 02A | 17,328,600€ | 12,767,399€ | 3,623,491€ | 478% | 352% |

| MEP 03 | 7,662,784€ | 1,118,765€ | 2,912,465€ | 263% | 38% |

| MEP 04 | 8,539,929€ | 1,919,577€ | 3,130,728€ | 273% | 61% |

| MEP 05 | 11,558,841€ | 4,938,490€ | 2,741,389€ | 422% | 180% |

| Variation | fLCC + eLCC (No D) | fLCC + eLCC (Incl. D) | Ranking Based on fLCC | Ranking Based on fLCC + eLCC No D | Ranking Based on fLCC + eLCC Incl D |

| MEP 01 | 12,307,118€ | 5,385,305€ | 1 | 3 | 3 |

| MEP 02 | 19,203,060€ | 12,594,033€ | 2 | 5 | 5 |

| MEP 02A | 20,952,091€ | 16,390,891€ | 6 | 6 | 6 |

| MEP 03 | 10,575,249€ | 4,031,229€ | 3 | 1 | 1 |

| MEP 04 | 11,670,656€ | 5,050,305€ | 5 | 2 | 2 |

| MEP 05 | 14,300,230€ | 7,679,879€ | 4 | 4 | 4 |

Appendix C. Weighting of Oekobaudat 2020-II Data by Monetary Valuation

References

- Global Alliance for Buildings and Construction, International Energy Agency (IEA) and the United Nations Environment Programme. 2021 Global Status Report for Buildings and Construction; IEA: Paris, France, 2021. [Google Scholar]

- Eurostat. Material Flow Accounts Statistics—Material Footprints. Available online: https://ec.europa.eu/eurostat/statistics-explained/SEPDF/cache/36609.pdf (accessed on 30 March 2022).

- IEA, International Energy Agency. World Energy Outlook. 2021. Available online: https://iea.blob.core.windows.net/assets/4ed140c1-c3f3-4fd9-acae-789a4e14a23c/WorldEnergyOutlook2021.pdf (accessed on 16 February 2022).

- Ghisellini, P.; Ripa, M.; Ulgiati, S. Exploring environmental and economic costs and benefits of a circular economy approach to the construction and demolition sector. A literature review. J. Clean. Prod. 2018, 178, 618–643. [Google Scholar] [CrossRef]

- Publications Office. Directive (EU) 2018/ of The European Parliament and of the Council of 30 May 2018 Amending Directive 2010/31/EU on The Energy Performance of Buildings and Directive 2012/27/EU on Energy Efficiency; Official Journal of the European Union L 156/91; European Union: Maastricht, The Netherlands, 2018. [Google Scholar]

- Bahramian, M.; Yetilmezsoy, K. Life cycle assessment of the building industry: An overview of two decades of research (1995–2018). Energy Build. 2020, 219, 109917. [Google Scholar] [CrossRef]

- Goh, B.H.; Sun, Y. The development of life-cycle costing for buildings. Build. Res. Inf. 2015, 44, 319–333. [Google Scholar] [CrossRef]

- França, W.T.; Barros, M.V.; Salvador, R.; de Francisco, A.C.; Moreira, M.T.; Piekarski, C.M. Integrating life cycle assessment and life cycle cost: A review of environmental-economic studies. Int. J. Life Cycle Assess. 2021, 26, 244–274. [Google Scholar] [CrossRef]

- Schneider-Marin, P.; Winkelkotte, A.; Lang, W. Integrating Environmental and Economic Perspectives in Building Design. Sustainability 2022, 14, 4637. [Google Scholar] [CrossRef]

- Islam, H.; Jollands, M.; Setunge, S. Life cycle assessment and life cycle cost implication of residential buildings—A review. Renew. Sustain. Energy Rev. 2015, 42, 129–140. [Google Scholar] [CrossRef]

- Hester, J.; Gregory, J.; Ulm, F.-J.; Kirchain, R. Building design-space exploration through quasi-optimization of life cycle impacts and costs. Build. Environ. 2018, 144, 34–44. [Google Scholar] [CrossRef]

- European Commission. Ecodesign and Energy Labelling. Available online: https://ec.europa.eu/growth/single-market/european-standards/harmonised-standards/ecodesign_en (accessed on 30 March 2022).

- Schneider-Marin, P.; Lang, W. Environmental costs of buildings: Monetary valuation of ecological indicators for the building industry. Int. J. Life Cycle Assess. 2020, 25, 1637–1659. [Google Scholar] [CrossRef]

- Stevanovic, M.; Allacker, K.; Vermeulen, S. Development of an Approach to Assess the Life Cycle Environmental Impacts and Costs of General Hospitals through the Analysis of a Belgian Case. Sustainability 2019, 11, 856. [Google Scholar] [CrossRef] [Green Version]

- Resch, E.; Andresen, I.; Cherubini, F.; Brattebø, H. Estimating dynamic climate change effects of material use in buildings—Timing, uncertainty, and emission sources. Build. Environ. 2020, 187, 107399. [Google Scholar] [CrossRef]

- Asdrubali, F.; Baggio, P.; Prada, A.; Grazieschi, G.; Guattari, C. Dynamic life cycle assessment modelling of a NZEB building. Energy 2020, 191, 116489. [Google Scholar] [CrossRef]

- Obrecht, T.P.; Jordan, S.; Legat, A.; Passer, A. The role of electricity mix and production efficiency improvements on greenhouse gas (GHG) emissions of building components and future refurbishment measures. Int. J. Life Cycle Assess. 2021, 26, 839–851. [Google Scholar] [CrossRef]

- Klauß, S.; Maas, A. Entwicklung einer Datenbank mit Modellgebäuden für Energiebezogene Untersuchungen, Insbesondere der Wirtschaftlichkeit. Forschungsinitiative Zukunft Bau. 2010. Available online: https://www.irbnet.de/daten/baufo/20118035234/Endbericht.pdf (accessed on 14 May 2022).

- Abualdenien, J.; Schneider-Marin, P.; Zahedi, A.; Harter, H.; Exner, H.; Steiner, D.; Singh, M.M.; Borrmann, A.; Lang, W.; Petzold, F.; et al. Consistent management and evaluation of building models in the early design stages. J. Inf. Technol. Constr. 2020, 25, 212–232. [Google Scholar] [CrossRef]

- Schneider-Marin, P.; Harter, H.; Tkachuk, K.; Lang, W. Uncertainty Analysis of Embedded Energy and Greenhouse Gas Emissions Using BIM in Early Design Stages. Sustainability 2020, 12, 2633. [Google Scholar] [CrossRef] [Green Version]

- Vollmer, M.; Harter, H.; Schneider-Marin, P.; Lang, W.; Pfoh, S. Ferdinand Tausendpfund –Lebenszyklusanalyse und Gebäudemonitoring: Innovation; Fakultät für Architektur, Technische Universität München: Munich, Germany, 2019. [Google Scholar]

- Abualdenien, J.; Borrmann, A. A meta-model approach for formal specification and consistent management of multi-LOD building models. Adv. Eng. Inform. 2019, 40, 135–153. [Google Scholar] [CrossRef] [Green Version]

- Singh, M.M.; Geyer, P. Information requirements for multi-level-of-development BIM using sensitivity analysis for energy performance. Adv. Eng. Inform. 2019, 43, 101026. [Google Scholar] [CrossRef]

- Singh, M.M.; Singaravel, S.; Klein, R.; Geyer, P. Quick energy prediction and comparison of options at the early design stage. Adv. Eng. Inform. 2020, 46, 101185. [Google Scholar] [CrossRef]

- Harter, H.; Singh, M.M.; Schneider-Marin, P.; Lang, W.; Geyer, P. Uncertainty Analysis of Life Cycle Energy Assessment in Early Stages of Design. Energy Build. 2019, 208, 109635. [Google Scholar] [CrossRef]

- BMI. Ökobaudat. Available online: https://www.oekobaudat.de/datenbank/archiv/oekobaudat-2020-ii.html. (accessed on 14 January 2022).

- f:data GmbH. Baupreislexikon. Available online: www.baupreislexikon.de (accessed on 11 December 2020).

- BKI. BKI Baukosten Positionen Neubau 2020: Statistische Kostenkennwerte für Positionen; BKI: Stuttgart, Germany, 2020; ISBN 978-3-481-04060-4. [Google Scholar]

- Weka Media. SIRADOS Baupreishandbuch 2020 Gebäudetechnik; WEKA MEDIA GmbH & Co. KG: Kissing, Germany, 2020; ISBN 978-3-8111-0267-5. [Google Scholar]

- Deutsches Institut für Normung e.V. DIN V 18599 Energetische Bewertung von Gebäuden–Berechnung des Nutz-, End- und Primärenergiebedarfs für Heizung, Kühlung, Lüftung, Trinkwarmwasser und Beleuchtung. Beuth Verlag: Berlin, Germany, 2016; (DIN V 18599). [Google Scholar]

- Mirzaie, S.; Thuring, M.; Allacker, K. End-of-life modelling of buildings to support more informed decisions towards achieving circular economy targets. Int. J. Life Cycle Assess. 2020, 25, 2122–2139. [Google Scholar] [CrossRef]

- Wastiels, L.; van Dessel, J.; Delem, L. Relevance of the recycling potential (module D) in building LCA: A case study on the retrofitting of a house in Seraing. In Proceedings of the WSB14 World Sustainable Building Conference, Barcelona, Spain, 28–30 October 2014. [Google Scholar]

- Lu, H.R.; El Hanandeh, A.; Gilbert, B. A comparative life cycle study of alternative materials for Australian multi-storey apartment building frame constructions: Environmental and economic perspective. J. Clean. Prod. 2017, 166, 458–473. [Google Scholar] [CrossRef]

- DGNB GmbH. ENV1.1 Oekobilanz des Gebaeudes. DGNB System—Kriterienkatalog Gebäude Neubau; DGNB GmbH: Stuttgart, Germany, 2018. [Google Scholar]

- BMVBS. Bewertungssystem Nachhaltiges Bauen (BNB) Bilanzierungsregeln für die Erstellung von Ökobilanzen: Neubau Büro- und Verwaltungsgebäude. 2015. Available online: https://www.bnb-nachhaltigesbauen.de/fileadmin/steckbriefe/verwaltungsgebaeude/neubau/v_2015/LCA-Bilanzierungsregeln_BNB_BN_2015.pdf (accessed on 15 February 2021).

- DGNB GmbH. DGNB Kriterium- ECO1.1 Gebaeudebezogene-Kosten-im-Lebenszyklus; DGNB GmbH: Stuttgart, Germany, 2018. [Google Scholar]

- BMVBS. Bewertungssystem Nachhaltiges Bauen (BNB) Lebenszykluskosten: 2.1.1 Gebäudebezogene Kosten im Lebenszyklus. 2015. Available online: https://www.bnb-nachhaltigesbauen.de/fileadmin/steckbriefe/verwaltungsgebaeude/neubau/v_2015/BNB_BN2015_211.pdf (accessed on 29 November 2020).

- DIN Deutsches Institut für Normung e.V. DIN 276 Kosten im Bauwesen; Building Costs; Beuth Verlag: Berlin, Germany, 2018. [Google Scholar]

- GAEB. Standardleistungsbuch Bau. Available online: https://www.gaeb.de/en/products/stlb-bau/ (accessed on 6 June 2021).

- Soust-Verdaguer, B.; Martínez, A.G.; Llatas, C.; de Cózar, J.G.; Allacker, K.; Trigaux, D.; Alsema, E.; Berg, B.; Dowdell, D.; Debacker, W.; et al. Implications of using systematic decomposition structures to organize building LCA information: A comparative analysis of national standards and guidelines- IEA EBC ANNEX 72. IOP Conf. Ser. Earth Environ. Sci. 2020, 588, 022008. [Google Scholar] [CrossRef]

- Schneider-Marin, P.; Dotzler, C.; Röger, C.; Lang, W.; Glöggler, J.; Meier, K.; Runkel, S. Design2Eco|Schlussbericht: Lebenszyklusbetrachtung im Planungsprozess von Büro- und Verwaltungsgebäuden—Entscheidungsgrundlagen und Optimierungsmöglichkeiten für frühe Planungsphasen; Fraunhofer IRB Verlag: Stuttgart, Germany, 2019. [Google Scholar]

- Hollberg, A.; Kiss, B.; Röck, M.; Soust-Verdaguer, B.; Wiberg, A.H.; Lasvaux, S.; Galimshina, A.; Habert, G. Review of visualising LCA results in the design process of buildings. Build. Environ. 2020, 190, 107530. [Google Scholar] [CrossRef]

- Hellweg, S.; Hofstetter, T.; Hungerbuhler, K. Discounting and the environment should current impacts be weighted differently than impacts harming future generations? Int. J. Life Cycle Assess. 2003, 8, 8–18. [Google Scholar] [CrossRef]

- Hoel, M.; Sterner, T. Discounting and relative prices. Clim. Chang. 2007, 84, 265–280. [Google Scholar] [CrossRef]

- Azar, C.; Sterner, T. Discounting and distributional considerations in the context of global warming. Ecol. Econ. 1996, 19, 169–184. [Google Scholar] [CrossRef]

- Bünger, B.; Matthey, A. Methodenkonvention 3.0 zur Ermittlung von Umweltkosten: Methodische Grundlagen; Umweltbundesamt: Dessau-Roßlau, Germany, 2018. [Google Scholar]

- Matthey, A.; Bünger, B. Methodenkonvention 3.0 zur Ermittlung von Umweltkosten: Kostensätze. Stand 02/2019; Umweltbundesamt: Dessau-Roßlau, Germany, 2019. [Google Scholar]

- Weidema, B.P. Using the budget constraint to monetarise impact assessment results. Ecol. Econ. 2009, 68, 1591–1598. [Google Scholar] [CrossRef]

- Vogtländer, J. Ecocosts 2017_V1-6 Midpoint Tables. Available online: http://www.ecocostsvalue.com/EVR/model/theory/subject/5-data.html (accessed on 19 November 2019).

- Ahlroth, S.; Finnveden, G. Ecovalue08–A new valuation set for environmental systems analysis tools. J. Clean. Prod. 2011, 19, 1994–2003. [Google Scholar] [CrossRef]

- Steen, B.; Palander, S. EPS-2015d-Including-Climate-Impacts-from-Secondary-Particles. Available online: https://www.lifecyclecenter.se/publications/eps-2015d1-excluding-climate-impacts-from-secondary-particles/ (accessed on 4 January 2020).

- ISO 15686-5; Buildings and Constructed Assets—Service Life Planning; Part 5: Life-Cycle-Costing. International Organization for Standardization: Geneva, Switzerland, 2017.

- BBSR. Nutzungsdauern von Bauteilen für Lebenszyklusanalysen nach Bewertungssystem Nachhaltiges Bauen (BNB). 2017. Available online: https://www.nachhaltigesbauen.de/austausch/nutzungsdauern-von-bauteilen/ (accessed on 7 March 2020).

- Conci, M.; Konstantinou, T.; Dobbelsteen, A.V.D.; Schneider, J. Trade-off between the economic and environmental impact of different decarbonisation strategies for residential buildings. Build. Environ. 2019, 155, 137–144. [Google Scholar] [CrossRef]

- Goulouti, K.; Padey, P.; Galimshina, A.; Habert, G.; Lasvaux, S. Uncertainty of building elements’ service lives in building LCA & LCC: What matters? Build. Environ. 2020, 183, 106904. [Google Scholar] [CrossRef]

- Marsh, R. Building lifespan: Effect on the environmental impact of building components in a Danish perspective. Arch. Eng. Des. Manag. 2016, 13, 80–100. [Google Scholar] [CrossRef]

- Rauf, A.; Crawford, R.H. Building service life and its effect on the life cycle embodied energy of buildings. Energy 2015, 79, 140–148. [Google Scholar] [CrossRef]

- Häfliger, I.-F.; John, V.; Passer, A.; Lasvaux, S.; Hoxha, E.; Saade, M.R.M.; Habert, G. Buildings environmental impacts’ sensitivity related to LCA modelling choices of construction materials. J. Clean. Prod. 2017, 156, 805–816. [Google Scholar] [CrossRef] [Green Version]

- Harter, H.; Schneider-Marin, P.; Lang, W. The Energy Grey Zone–Uncertainty in Embedded Energy and Greenhouse Gas Emissions Assessment of Buildings in Early Design Phases. In Proceedings of the Sixth International Symposium on Life-Cycle Civil Engineering (IALCCE 2018), Gent, Belgium, 28–31 October 2018. [Google Scholar]

- Churkina, G.; Organschi, A.; Reyer, C.P.O.; Ruff, A.; Vinke, K.; Liu, Z.; Reck, B.K.; Graedel, T.E.; Schellnhuber, H.J. Buildings as a global carbon sink. Nat. Sustain. 2020, 3, 269–276. [Google Scholar] [CrossRef]

- Hoxha, E.; Passer, A.; Saade, M.R.M.; Trigaux, D.; Shuttleworth, A.; Pittau, F.; Allacker, K.; Habert, G. Biogenic carbon in buildings: A critical overview of LCA methods. Build. Cities 2020, 1, 504–524. [Google Scholar] [CrossRef]

| Parameter | Elements Included | Description | Variations |

|---|---|---|---|

| Spatial system boundary | CG 300 | all building parts | construction type, material choices |

| CG 400 | MEP, incl. HVAC; lighting | energy supply system | |

| Temporal system boundary | 50 years | ||

| LCA: A1-A3; B2-B4; B6; C3-C4; D | D included/excluded | ||

| LCC: A1-A5; B2-B4; B6; C1-C4; D | |||

| Data source LCA | Oekobaudat 2020-II | [26] | |

| Data sources LCC | Baupreislexikon | [27] | |

| Baukostenindex (BKI) | [28] (few data gaps CG 300) | ||

| Sirados | [29] (few data gaps CG 400) | ||

| Operational impacts | heating, cooling, lighting | [30] electricity generated on-site subtracted from monthly electricity consumption; surplus fed into the grid | energy supply (HVAC system) |

| Indicator | EC GWP [€/kg CO2-eq.] | EC ODP [€/kg R11-eq.] | EC POCP [€/kg Ethen-eq.] | EC AP [€/kg SO2-eq.] | EC EP [€/kg PO4-eq.] | EC ADPE [€/kg Sb-eq.] |

|---|---|---|---|---|---|---|

| Model | Damage costs; 0% pure time preference; equity weighting 1 | Damage costs 2 | Marginal prevention costs 3 | Damage costs 1 | Damage costs 4 | Restoration costs 5 |

| Value 2020 | 0.65€ | 90.91€ | 9.59€ | 14.71€ | 20.74€ | 17 232.63€ |

| Variation | +30%; −70% | N/A | N/A | ±30% | N/A | ±30% |

| CG 300 Materials for Structure and Finishes | CG 400 Materials for MEP Systems | Phase B6, Operational Energy Use Fossil | Phase B6, Operational Energy Use Renewable * | |

|---|---|---|---|---|

| Indicators causing largest share of ecological cost | GWP AP ADPE | GWP ADPE AP | GWP | GWP AP |

| Average contribution indicator to total EC (min valuation) | 73% 14% 8% | 58% 28% 12% | 91% | 47% 40% |

| Average contribution indicator to total EC (max valuation) | 73% 12% 11% | 63% 33% 4% | 97% | 66% 22% |

| Discount Rate | Price Increase | |

|---|---|---|

| fLCC construction | 3% (±1.5%) | 2% (±1%) |

| fLCC services | 2% (±1%) | |

| fLCC energy | 5% (±2%) | |

| eLCC | 0% (±1.5%) | 5% (±2%) |

| CG 300 Structural and Finish Materials | CG 400 Building Services (MEP Systems) | Phase B6 Building Operation (Energy Use) | |

|---|---|---|---|

| Indicators causing largest amount of eLCC | GWP ADPE | ADPE GWP | GWP (93–98% for non-renewables) |

| Ratio eLCC/fLCC (net present cost) | no D: 54% to 157% incl. D: 14% to 88% | no D: 156% to 237% incl. D: −11% to 33% | 97% to 568% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Schneider-Marin, P.; Lang, W. A Temporal Perspective in Eco2 Building Design. Sustainability 2022, 14, 6025. https://doi.org/10.3390/su14106025

Schneider-Marin P, Lang W. A Temporal Perspective in Eco2 Building Design. Sustainability. 2022; 14(10):6025. https://doi.org/10.3390/su14106025

Chicago/Turabian StyleSchneider-Marin, Patricia, and Werner Lang. 2022. "A Temporal Perspective in Eco2 Building Design" Sustainability 14, no. 10: 6025. https://doi.org/10.3390/su14106025

APA StyleSchneider-Marin, P., & Lang, W. (2022). A Temporal Perspective in Eco2 Building Design. Sustainability, 14(10), 6025. https://doi.org/10.3390/su14106025