1. Introduction

Banana tops the list of the most popular fresh fruits consumed in the U.S. It is also one of the top five leading fruits imported in the U.S. Due to fresh bananas’ delicate and perishable properties, the U.S. imports fresh bananas predominantly from Latin American countries because of their proximity. Other benefits include minimizing transportation costs and time wastage during banana distribution due to the production countries’ converging import policies [

1]. Ecuador, Guatemala, Costa Rica, Columbia, Mexico, and Honduras are the primary supplier of fresh bananas to the U.S., with Guatemala as the leading supplier [

2].

During the outbreak of the novel coronavirus (COVID-19), there was an unprecedented decline in global economic activity. Actions to minimize the virus’s rapid spread led to the lockdown of country borders, which resulted in a reduction in international travel and trade, causing bottlenecks in supply chains. There was also an implementation of physical distancing measures to slow down the spread of the coronavirus, which was unfavorable for relatively labor-intensive production, processing, and trade of tropical fruits [

3,

4]. Delays in supply chains had adverse effects on tropical fruits.

There was shrinkage of fruits in transit, which affected fruit quality and reduced shipments’ weight and economic values received by importing countries. Quarantine-related delays at ports and borders, high shortages of reefer containers, and airfreight belly capacity slowed down the transportation and trade of agricultural products. At the same time, market closures interrupted accessibility to local and national distribution outlets. In addition, the disruption of input factories and importation routes led to increased wastage reports, particularly for delicate, perishable, and less traded fruits [

4].

The U.S. is the largest importer of fresh bananas impacted by the COVID-19 shock. In this research, we analyzed the price linkages between import- and retail-level banana prices to provide empirical evidence regarding price transmission in the fresh banana marketing channel during the COVID-19 pandemic. Price is the principal factor by which various levels of markets are linked [

5]. We examined dynamic price adjustments and the possible presence of asymmetric price transmission between import- and retail-level banana prices during the COVID-19 shock. The price behavior along the supply chain showed the effects of the exogenous shock on different stages of the banana marketing channel and provided information on market integration and efficiency.

The investigation and understanding of banana market price interactions and adjustments help economic agents and policymakers anticipate price movements along the marketing channel in advance of exogenous shocks such as COVID-19 to implement appropriate strategic responses and policies to establish required conditions for market efficiency and integration. This research attempted to answer the following research questions: Is there a significant lag in the speed of price adjustments along the fresh banana supply chain? The research investigated whether there was a price asymmetric adjustment along the fresh banana marketing channel during the COVID-19 period using the VEC model.

Additionally, we examined and measured the magnitude of price adjustments caused by the COVID-19 pandemic. We used historical decomposition graphs to estimate the magnitude of price adjustments due to the pandemic shock. We investigated how different stages of the U.S. banana market adjusted in response to the shock and how prices at the retail level responded to changes in the import-level prices.

The results reveal differential effects of the COVID-19 pandemic on the speeds and magnitudes of import and retail prices along the fresh banana supply chain, pointing to the inefficiency of the U.S. fresh banana marketing channel. The deviation from the long-run equilibrium was corrected much faster for the import banana prices than retail prices. This study concluded that speeds and magnitudes of price adjustments at the import and retail levels during the period of the pandemic were asymmetric, increasing the margins with welfare and policy implications.

The rest of this research is organized as follows: The next section provides the background and literature review; then, conceptual framework and empirical methods are presented. The following section provides the details of the methodology and model specifications; then, the dataset and data sources are described. The following section discusses the empirical results. Finally, conclusions and implications of this study are presented.

2. Background and Literature Review

2.1. U.S. Banana Market

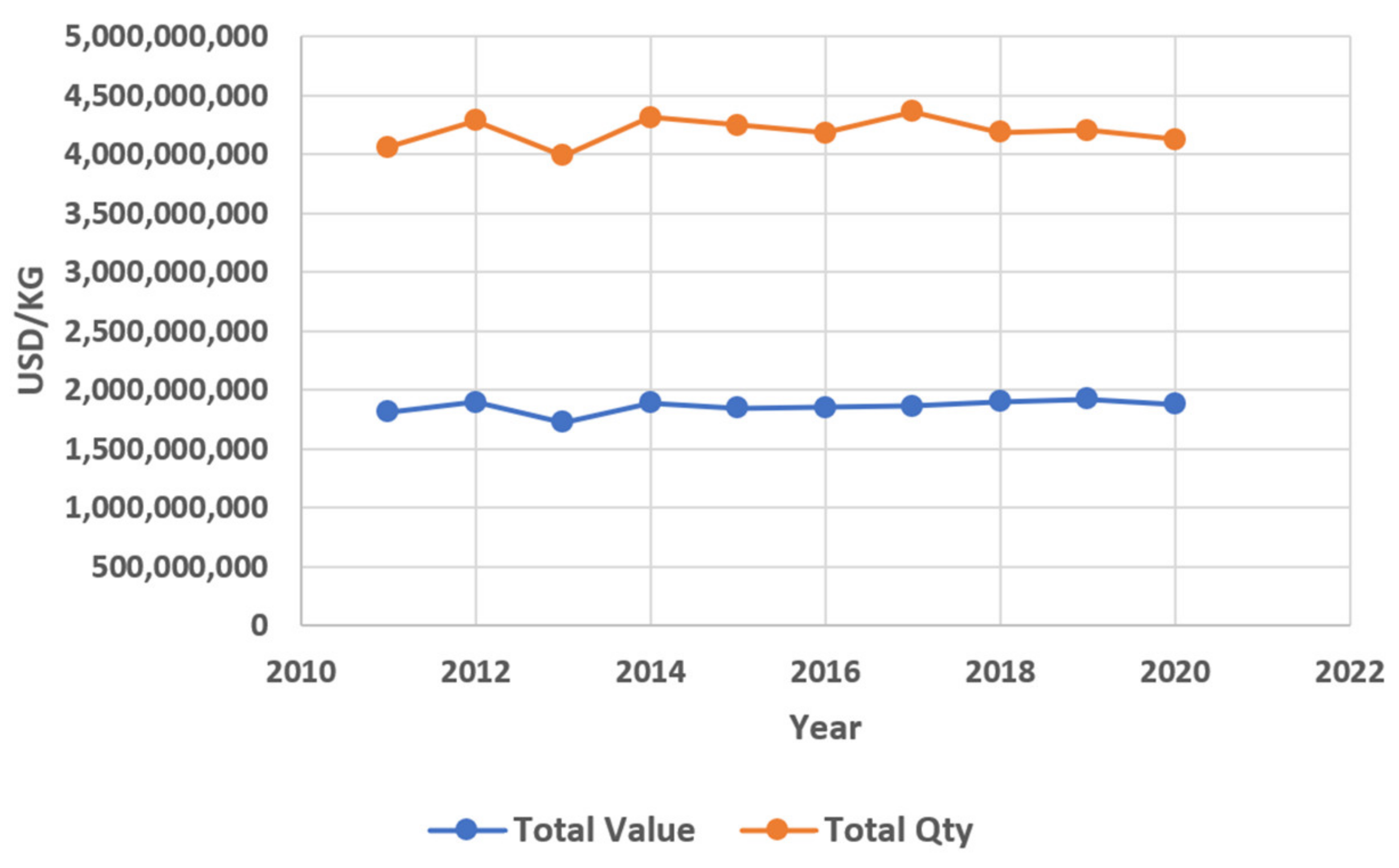

The U.S. local production of fresh bananas in Hawaii and Florida is minimal. In 2019, its estimated production was 3400 tons for an estimated 300 hectares [

6]. Due to the negligible production, the banana has become the leading fresh fruit imported by the U.S. from Latin America (

Figure 1 and

Figure 2) [

2,

7]. Guatemala has remained the top supplier of fresh bananas to the U.S. since it overtook Costa Rica in 2004. Costa Rican banana exports to the U.S. market declined due to a combination of factors such as harsh weather, which also disrupted production and new opportunities to export to the EU markets. On the other hand, Ecuador has maintained its relative position as the third-largest supplier of fresh bananas to the U.S [

8].

A few huge players, i.e., big businesses, control the world’s fresh banana market. Dole Food Company, Chiquita Brands International, and Del Monte Fresh Produce are the world’s three biggest growers and exporters of fresh bananas.

Only a few huge international corporations are involved in fruit cultivation, processing, purchasing, transportation, and marketing, making this market oligopolistic. These businesses are vertically integrated, having banana plantations in nearly every banana-producing region. They own plantations, shipping, and ripening facilities, and have built their own distribution networks, providing them with significant economies of scale and market strength in the banana markets [

1].

2.2. Literature Review

2.2.1. Vertical Price Transmission

Vertical price relationships are usually demonstrated by the magnitude and speed of price adjustment along the supply chain. The magnitude and speed at which prices adjust to shocks depend on several factors, such as the nature of the product, market structure, contracts, and actions of market agents (wholesalers, distributors, processors, and retailers) linking markets at different levels [

9]. There are many studies focused on vertical price transmission, and the extent to which price adjustment may be asymmetric has been explored extensively as commodity markets have become more concentrated and integrated at each level [

10,

11,

12,

13,

14], among many others. Peltzman argued that asymmetric price transmission is a rule and should not be classified as an exception [

15]. He concluded that since asymmetric price transmission is common in most producer and consumer markets, standard economic theory that does not account for this phenomenon should be classified as incorrect.

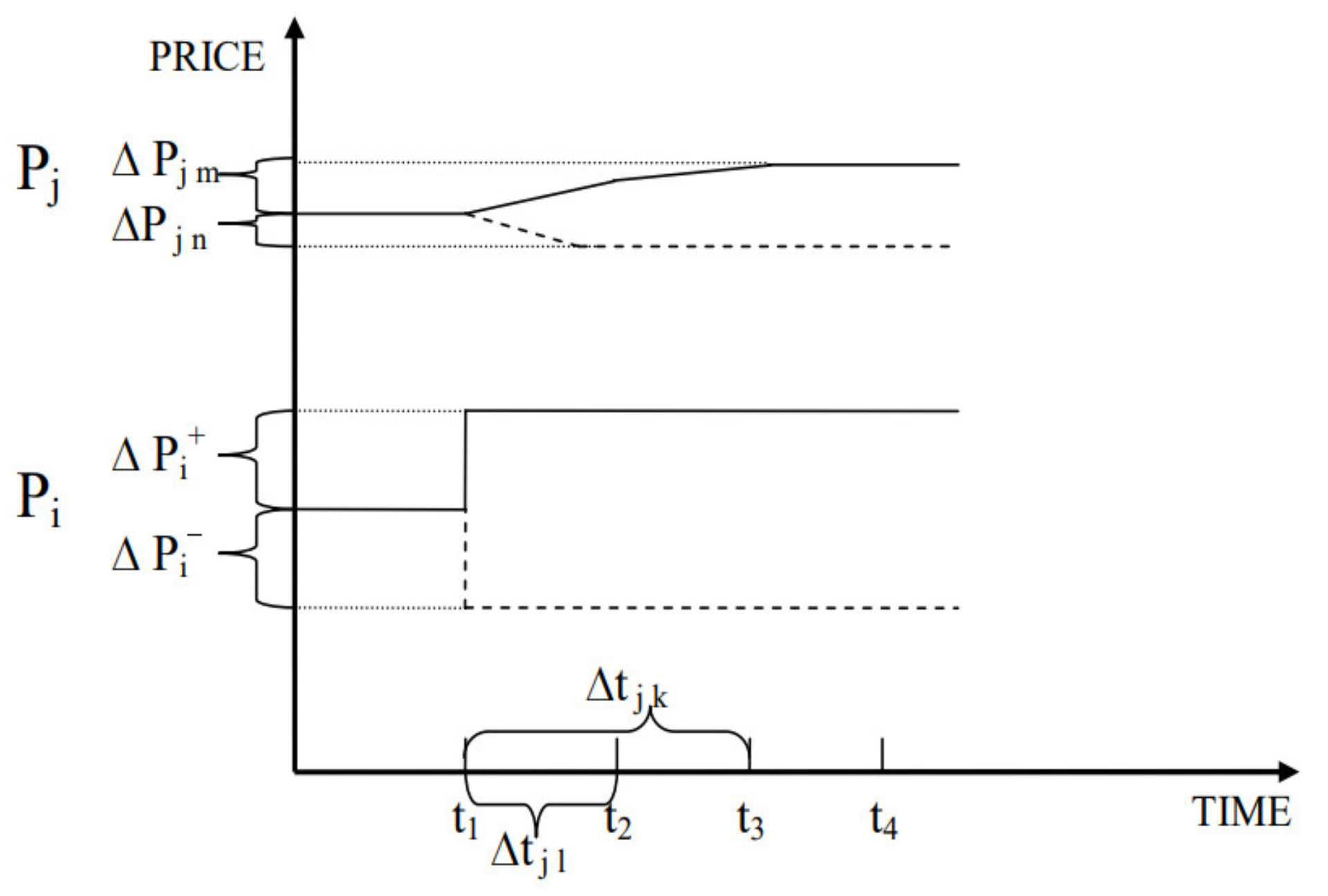

Figure 3 summarizes the concept of price transmission. It illustrates a positive and a negative shock of the same magnitude in one period,

t1, to an input price,

Pi, and the adjustment in output price,

Pj. In the figure, the shock’s initial incidence is on the commodity’s producer price, and the impulse is transmitted according to some underlying process to the retail price. The Δ

P+ and Δ

P− are positive and negative shocks of the same magnitude to the producer price, Δ

Pjm is the adjustment in the retail price to the positive producer price shock, Δ

Pjn is the adjustment in the retail price to the negative producer price shock, and Δ

tjk is the time lag for adjustment in the retail price to the positive producer price shock. At the same time, Δ

tjl is the time lag for adjustment in the retail price to the negative producer price shock [

9].

Summarily, ΔP+ > ΔPjm, i.e., relative positive producer price change, is more significant than retail price change. In this case, the initial price increase at one level has not been fully transmitted up the supply chain, while ΔP− < ΔPjm, i.e., a relative negative change in producer price, is less than the change in retail price.

2.2.2. Empirical Research on Price Transmission

The literature on vertical price transmission is vast, and the studies covering the impact of COVID-19 on international travel and trade and its effects on the U.S. economy and the rest of the world are many [

16,

17] The agricultural commodity markets and their supply chains under the COVID-19 pandemic have been analyzed for market demand condition changes and trends, given the supply chain disruptions due the pandemic shock. The pandemic led to physical distancing measures, labor shortages, agricultural productivity decreases, and lockdown policies, which crippled supply chain efficiency, leading to price increases, job losses, and decreases in income streams, shortages of food, changes in consumer demand patterns, and a higher risk of facing a recession [

18,

19].

The core objective of price transmission is to highlight the adjustments of prices due to market shocks at different stages of the marketing channel. The speeds at which prices adjust along the vertical supply chains of commodity markets determine the level of efficiency of those markets. Vavra and Goodwin [

9] and Lloyd [

20] reviewed several research articles outlining the econometrics methods employed. They have discussed in detail the underlying trends in price transmission literature across different agricultural food markets.

Rosa et al. [

21] used time series analysis to investigate the presence of market interactions and price transmission between two spatially separated markets (the U.S. and Italy) for crude oil and top traded agricultural commodities such as wheat, corn, and soybeans. This study employed the VEC model and cointegration to analyze the spatial market relationship and price transmission using weekly spot prices of the three agricultural commodities as well as oil prices. They checked for evidence of structural breaks using the Zivot–Andrews breakpoint test. Their results indicate asymmetric speeds of price adjustments for crude oil and the agricultural commodity prices.

Rojas et al. [

22] investigated the price response of retailers to wholesale- and farm-level prices and compared that against Keith Collins’ assertion at a congressional hearing. This research uses quantity-weighted prices obtained from the Economic Research Service (ERS) of USDA and weekly scanner data to argue that retailers are more responsive to price changes along the supply chain than the evidence from the Bureau of Labor Statistics (BLS) data suggests. They employed a VEC model and cointegration. Their results show that ERS prices responded more promptly than the BLS prices. The ERS retail prices adjusted significantly to changes in the wholesale prices, while the BLS prices did not. Overall, the findings confirm an asymmetric price relationship between retail and wholesale prices using both BLS and ERS price sets. Their result is not incongruent with similar studies, which they acknowledged might be a result of the short time period of pricing data used in their research.

Pozo et al. [

23] studied the merits of using weekly or monthly BLS, and scanner price datasets for retail-level prices. Their research used a threshold VEC model with a unidirectional relation along the supply chain—farm to wholesale to retail levels. Their scanner data results indicate a symmetrical price transmission relationship along the U.S. beef supply chain, indicating the efficiency of the U.S. beef market. Their finding is similar to Rojas et al. except that the outcome from their BLS datasets suggests price asymmetry in the U.S. beef supply chain.

Darbandi and Saghaian [

10] studied the impact of the great recession along the U.S. beef supply chain. They used the VEC model and historical decomposition graphs to analyze price transmission on monthly prices along the three stages of the supply chain—farm, wholesale, and retail levels. The results of this research led to the conclusion that the U.S. beef market was inefficient given the presence of a significant level of asymmetric speeds of price adjustment. The great recession had a significant impact on the beef market with the magnitude of the shock differing across different stages of the beef supply chain.

2.2.3. Price Transmission during the COVID-19 Pandemic

For the duration of COVID-19, there was little research carried out on price transmission for different agricultural markets in the U.S. One exception is Erol and Saghaian [

24], who assessed the dynamic price transmission in the U.S. beef supply chain, using a VEC model and historical decomposition graphs to analyze the effects of COVID-19 on the speeds and magnitudes of price adjustments at different stages of the U.S. beef supply chain. This study accounted for the presence of endogenous structural breaks in the price series over the studied period. The results highlight a differential impact of the COVID-19 shock across the different stages of the supply chain with asymmetric price adjustments. They showed that farmers and consumers bear the adverse effects of the pandemic shock, while the wholesale- and retail-level prices were shown to be positively affected by the pandemic shock. However, the wholesale-level prices were found to adjust faster than the retail prices. Overall, the beef market showed significant evidence of price asymmetry along different stages of the marketing chain due the pandemic shock.

2.2.4. Causes of Asymmetric Price Transmission

Different researchers have presented several different reasons in an attempt to explain the causes of price asymmetries and imperfect pass-through of prices. Ball and Mankiw [

25] asserted that inflation and nominal input price shocks might lead to resistance to altering prices. Bailey and Borsen [

26] underlined that price asymmetry may occur because of uneven price changes in the underlying cost of adjustments. Ward [

27] added that retailers selling perishable and short-shelf goods might often be reluctant to adjust prices positively to match farm-level price changes given the risk of good spoilage.

Hein [

28] argued that altering prices for long-lasting products could cause a loss of goodwill. It was found that the fear of being “out of line” with their market competitors when costs change keeps merchants in check, indicating asymmetric responses to cost increases and decreases [

29,

30]. In addition, price asymmetry might occur due to inventory management. To avoid running out of stock, retailers may reduce their prices more slowly than the reduction in farm-level prices [

31,

32]. Weldegebriel [

33] argued that imperfect price transmission is not limited to the presence of oligopoly and oligopsony power. He highlighted that the key factors affecting price transmission are the functional forms of retail demand and farm input supply.

Additional reasons for price asymmetry can be ascribed to market power, transactional and transport cost, increasing return to scale, product differentiation, exchange rates, border, and domestic policies [

34,

35]. To the best of our knowledge, there is no research in regard to price transmission along the banana supply chain in the U.S. banana market. The study fills this gap and examines the dynamic price transmission along the U.S. fresh banana supply chain—from the import to the retail levels, using a VEC model to evaluate the speeds of price adjustments at different levels of the U.S. banana market, and historical decomposition graphs to analyze the magnitude of the impact of the COVID-19 pandemic on the import and retail price series of the fresh banana marketing channel.

3. Materials and Methods

3.1. Conceptual Framework and Estimation Approach

The basic model adopted by several researchers to study vertical price transmission was introduced by Wolffram and modified by Houck [

36,

37]. Based on the Wolffram–Houck specification, the relationship between two price levels,

Pi and

Pj, can be estimated mathematically by the following equation:

where ∆

+ and ∆

− show the positive and negative changes in prices, respectively.

β0, β+, and β− are coefficients (If β+ and β− are equal, then the price transmission is symmetric). τ is the time period.

This model has been criticized because it ignores the non-stationary nature of the time series data. In other words, research that was analyzed using only the “Wolffram–Houck” model specification has a limitation of first-order autocorrelation. This is because of the non-stationarity nature of time series data, leading to spurious and inconsistent regression [

38]. The stationarity test was first applied to avoid the limitation of spuriosity and inconsistency in the regression carried out in this research. Then, an appropriate model was used to check the price relationship. The Augmented Dicky–Fuller (ADF) test, which is widely employed in empirical analysis, was used in this paper to test for stationarity in the variables because it considers the possibility of higher-order correlation by assuming that a series follows an autoregressive (AR) process. The null hypothesis of the ADF states that the series is not stationary, i.e., “

the series has a unit root”, and the mean and variance are not constant over time [

39].

Peron discovered that the results of the unit root tests could be altered by the presence of structural breaks in the time series data. Ignoring structural breaks in estimation could result in unreliable estimates for price relationships. To address this issue, the study used the Phillips–Peron (PP) approach and Zivot–Andrews unit root test to obtain the reliable estimates given the presence of endogenous structural breaks [

40,

41]. The rejection of the null hypothesis implies that the price series are stationary. Stock and Watson recommend the application of multiple methods when testing for cointegration between time series variables. This research applied the Autoregressive Distributed Lag (ARDL) and Johansen’s cointegration test to determine if a long-run relationship existed among the price series [

42,

43].

We used the ARDL “bound test” to determine the presence of a long-run relationship between the two price series, i.e., the import prices and the retail prices, using the Wald test (F test) to test the null hypothesis that the coefficients across both price series were equal to zero. Then, the F-statistics value was compared with the critical value. If the F statistics fell above the upper critical value, the null hypothesis was rejected. This implies that a long-run relationship existed between both price variables. However, if the F-statistics value fell below the lower-bound critical value, we failed to reject the null hypothesis and concluded that no cointegration existed between the variables. Furthermore, the decision was inconclusive if the F statistics fell between the lower- and upper-bound critical value [

44,

45,

46,

47,

48].

The Johansen technique is prevalent for estimating series’ cointegration relationships. Its procedure relies on the relationship between the rank of a matrix and its characteristic roots [

49,

50]. Johansen suggested starting with the vector autoregressive model (VAR) in selecting the appropriate number of lags based on the likelihood ratio test. According to the Engle–Granger Representative Theorem, if the two series (i.e., the import- and the retail-level price) are cointegrated, they will be most efficiently represented by an error correction specification [

9]. The Vector Error Correction model is specified as follows:

where

X is a p-element vector of observations of all variables in the system at the time

t,

α0 is a vector of intercept terms, Γ

iΔXt−1term accounts for stationary variation related to the history of variables, and the Π matrix contains the cointegration relationship.

In this research,

X is a 2 × 1 matrix since there were two price series (import- and retail-level price). All variables were non-stationary at all levels, and it was hypothesized that Π =

αβ′ where “

β” is a matrix combining the cointegration vectors. This cointegration requires that the

β matrix contain parameters such as

Zt, where

Zt =

β′Xt is stationary. The

β matrix contains the cointegration vector, representing the underlying long-run relation, and the

α matrix represents the speed at which each variable changes to return to its respective long-run equilibrium after a temporary shock [

10,

13,

50,

51].

3.2. Data Description

The import-level monthly price data used in this research were collected from USDA, Foreign Agricultural Service, spanning two decades (from January 2001 to December 2020), while the monthly retail price data were obtained from the U.S. Bureau of Labor Statistics, which is a good data source for this research. The monthly retail price data used for this analysis also span from January 2001 to December 2020.

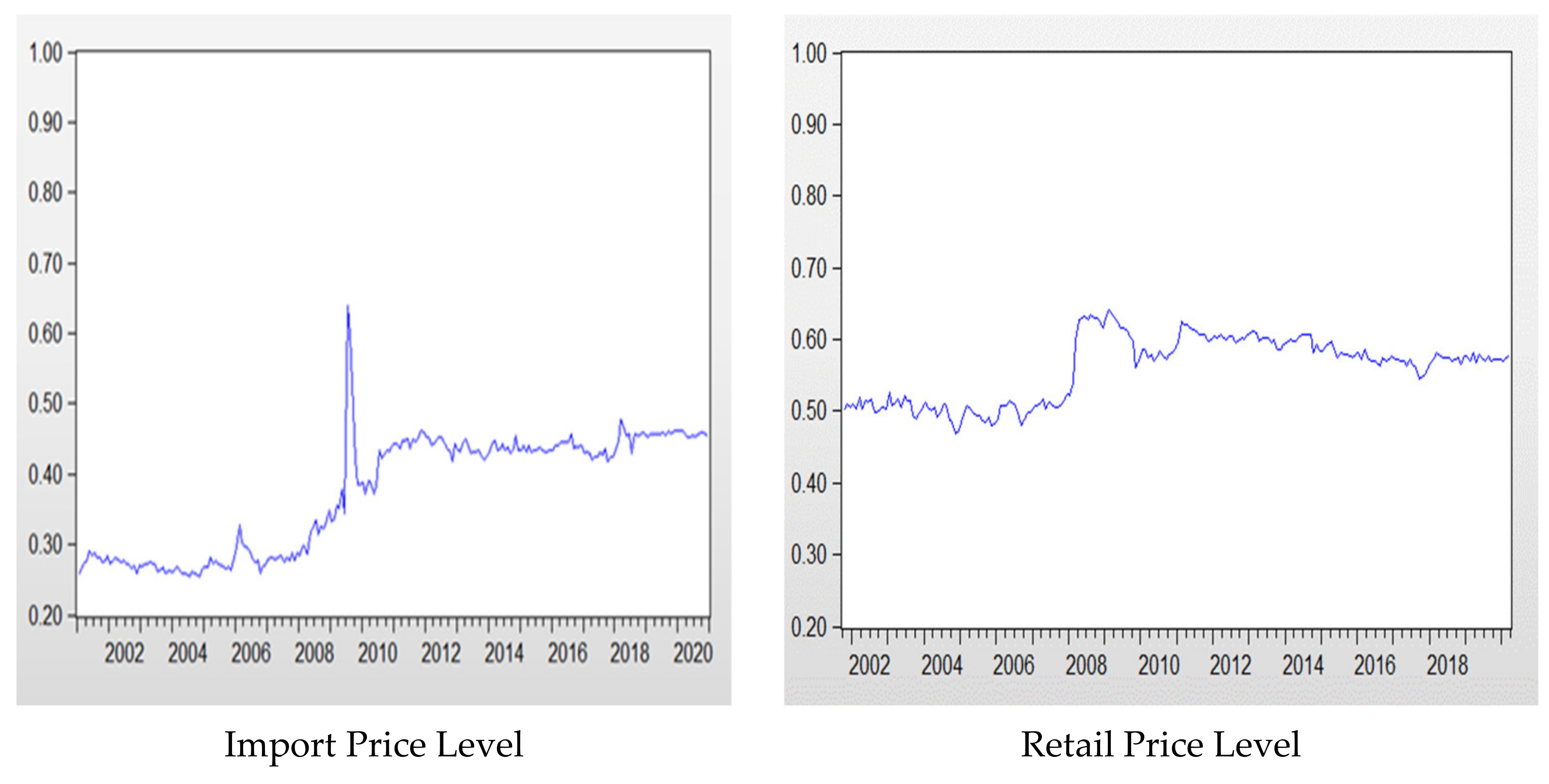

Table 1 presents descriptive statistics of the price series, and

Figure 4 depicts the trends.

4. Empirical Results and Discussions

4.1. Stationarity Test

As discussed earlier in this research, it is necessary to check the nature of time series data to ascertain if they are stationary or non-stationary before running the pass-through regressions. For this purpose, this research used ADF and PP tests, and the results are reported in

Table 2.

Also, the research used Zivot-Andrews unit root test to check for stationarity while accounting for the presence of structural breaks. The result from this test is reported in

Table 3.

From the Augmented Dickey–Fuller and Phillips–Perron unit root test, all the series were found to be integrated in one order. Hence, we proceeded to check the long-run equilibrium or cointegration. For this purpose, this research used the Johansen cointegration and ARDL test, and the results are reported in

Table 4 and

Table 5, respectively.

4.2. Cointegration Test

Johansen’s cointegration test is a likelihood ratio test that ascertains the number of cointegration vectors or rank (r). The results of the Johansen’s cointegration test reject the null hypothesis r = 0. We failed to reject the null hypothesis that r = 1, indicating that there was only one vector in the long-run relationship. This result agrees with the theoretical assertion that the cointegration rank r can be at most one less than the number of endogenous variables in the model [

10,

13]. Additionally, the Wald test statistic value from the ARDL result fell above the upper critical value, leading to the rejection of the null hypothesis. Thus far, we have ascertained that the variables were stationary at the first difference level, and a long-run relationship existed between them. Therefore, we can conclude that the VEC model is an appropriate model. The cointegration test results are presented in

Table 4 and

Table 5.

4.3. Causality Test

We tested for Granger causality between the two variables—import- and retail-level prices—to determine whether the prices series at each level was useful in predicting the price at the other levels in the supply chain. The model utilized a logarithmic functional form, which is more flexible. The variables are expressed in a natural logarithmic form to reduce the outlier effects. The number of lags (5) used in this analysis was obtained from the Akaike Information Criterion (AIC). The causality test results, as presented in

Table 6, imply that the import prices do not Granger-cause retail prices or vice versa. This means that the two price series cannot be relied upon to predict each other. Hence, we failed to reject the null hypothesis.

4.4. Structural Breaks

The Quandt–Andrews breakpoint test for structural breaks revealed a sharp change in the retail and import pricing data in February 2008 and July 2009, respectively, which was the period of the great recession. The structural break period can also be confirmed visually in

Figure 4. To balance the data, the periods before and after a structural break in the import price (I.P.) and retail price (R.P.) were represented with dummy (D) variables 0 and 1, respectively. Applying the rule of thumb, the Akaike Information Criterion (AIC) was selected because it has the minimum value. This is different from the findings of Koehler and Murphree [

52]. They stated that applying the Schwarz Information Criterion (SIC) is preferable because it leads to lower-order models for prediction. Hence, the optimal lag of 5 was used for the analysis, as indicated by the AIC.

Table 7 provides empirical estimates of the speed of adjustment for the two price series where import- and retail-level prices are the dependent variables of the models.

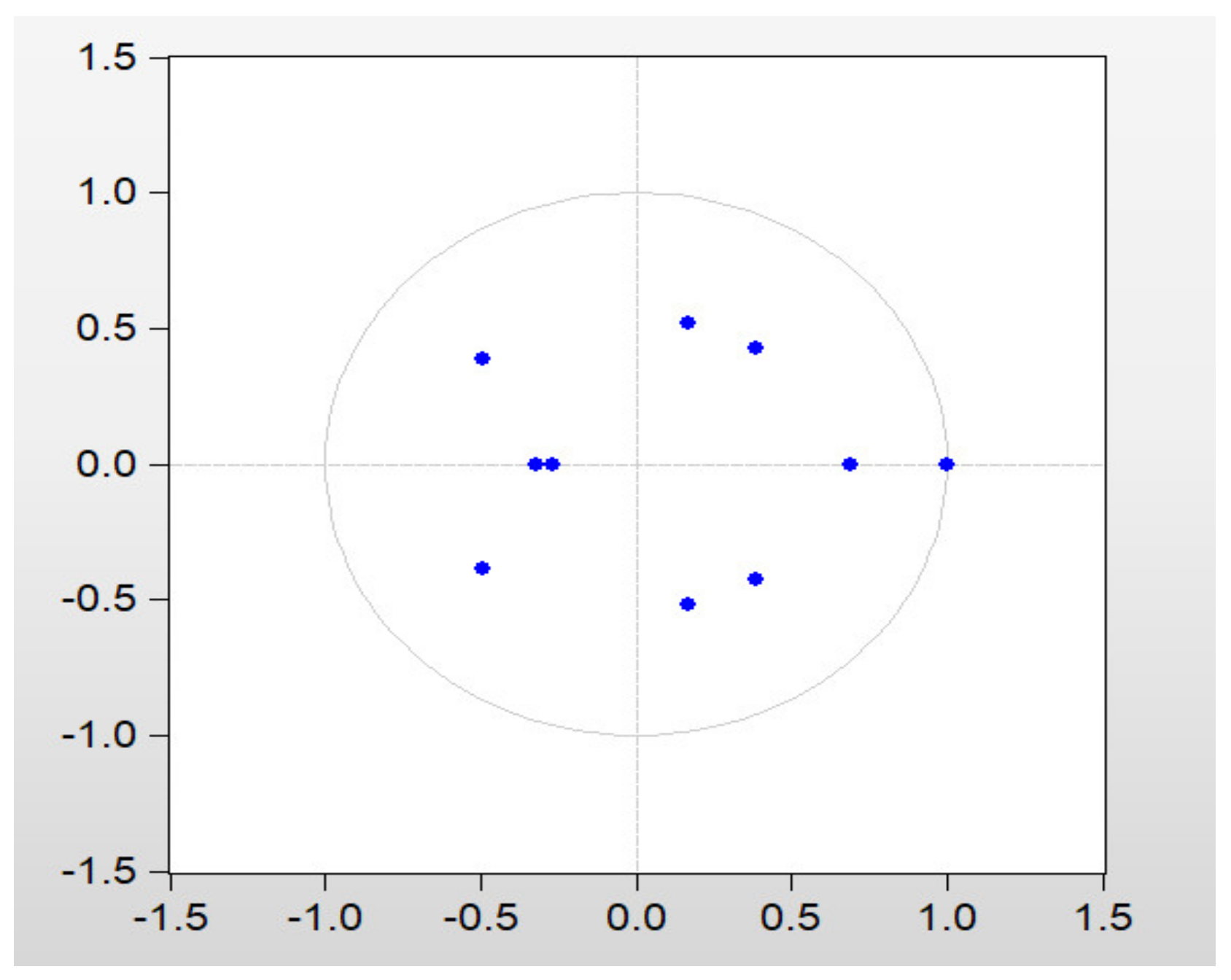

4.5. Speeds of Adjustment

The lagged error correction term coefficient is the short-term adjustment coefficient. The degree to which prices adjust to reach long-run disequilibrium or how quickly the system returns to its long-run equilibrium after a temporary shock is explained by the adjustment coefficient. The coefficient of the retail point price was statistically significant, while the coefficient of the import point price was statistically insignificant.

In this research, the speed of adjustment for the import-level price (−65%) was statistically significant at the 1-percent significance level, while the retail point price adjustment (−2.8%) was statistically insignificant. This shows that the underlying period price deviation from the long-run equilibrium is corrected in the current period at an adjustment speed of 65 percent and 2.8 percent at the import and retail levels, respectively, and that indicates an asymmetric price relationship in the speed of price adjustment with the import-level prices adjusting significantly faster than the retail prices. This finding goes to show that along the fresh banana marketing channel, the retail level is less efficient than the import level as the retail price takes longer to reach the steady-state equilibrium after the external shock, therefore implying that the burden of the shock falls predominantly on the consumers. The results are presented in

Table 7. The root graph (

Figure 5) shows that all points are within the circle boundary, which implies that the model is stable.

4.6. Historical Decomposition Graphs

Historical decomposition graphs are based upon partitioning of the moving average series into two parts:

where

Pt+j is the multivariate stochastic process,

U is its multivariate noise process, and

X is the deterministic part of

Pt+j. The first sum represents that part of

Pt+j due to innovations (shocks) that drive the joint behavior of banana prices for period

t + 1 to

t +

j, the horizon of interest, while the second is the forecast of price series based on information available at time

t, i.e., the date of an event.

S is the counter for the number of time periods. The historical decomposition graph measures the magnitude and reveals the short-run effects of banana markets shocks on the prices [

13].

The research used eviews software to extract the historical decomposition graphs. The orange line represents the actual prices, and the blue line shows the predicted prices. It is important to note that the COVID-19 pandemic influenced the actual prices, and the dynamic impacts of any shock could last for a long time. However, the scope of this study was limited to the period of the COVID-19 pandemic (i.e., from November 2019 to December 2020). The results are shown in

Figure 6 and

Figure 7.

The COVID-19 virus was first discovered in Wuhan, China, in November 2019. However, the first case of this virus was confirmed in the United States in January 2020 [

53]. In the research, monthly data cutting across 14 months (from November 2019 to December 2020) were used for forecasting and testing the impact of the COVID-19 pandemic on the fresh banana price.

Overall, the historical decomposition results show that the COVID-19 pandemic shock impacted banana prices; however, the impact was substantially different for the two price series, which resulted in the widening import-retail price margins. At the import level, there was a successive price drop against the forecasted price from March 2020 to September 2020, while the reverse was the case at the retail level of the supply chain as there was an increase in fresh banana price against the forecasted price from March 2020 to August 2020. The observed finding is different from the finding of Hassan and Simoni [

14] discovered that shipping point price declines are transmitted entirely and faster than shipping point price increases [

14]. Their findings are in line with Ward [

27], who asserted that the perishable nature of agricultural commodities might be the primary catalyst of price asymmetry. Ward added that retailers may be reluctant to increase the price of short-self goods proportional to an increase in price at the producer level as they fear being unable to sell these perishable goods within the period of their shelf life. However, the reverse appears to be the situation given the outcome of this research. The producers are hesitant to adjust their prices positively given the risk that they could be left with unsold spoiled bananas.

The historical decomposition graphs show that the retail prices were higher than the forecasted prices for six-month time period, and the import prices were higher than the forecasted prices for three-month time period. The fresh banana retail prices returned to the forcasted prices after the fifth month, while import-level prices recovered over time from the negative impact of the shock in the seventh month and then declined afterward.

While the import-level prices were affected negatively (i.e., decreased) during the pandemic, the retail prices were positively affected (i.e., increased) by the pandemic shock in the short run. The retailers enjoyed significant benefits of a price increase due to the exogenous shock, with consumers paying higher prices for a more extended period and producers receiving lower prices. The historical decomposition graph findings reveal the magnitude of asymmetric prices for the fresh banana marketing channel due to the pandemic shock. Hence, both methods support the results of an asymmetric price transmission along the supply chain in the U.S. fresh banana market.

4.7. Robustness Check

The estimated results of the VEC model show that the relevant coefficient for the speed of adjustment at the import level was significant. However, if the error terms are serially correlated, it implies that the estimated standard errors are not valid, and the coefficients are biased. In this research, the robustness check was investigated using Breusch–Godfrey (BG) test, which is based on the Lagrange Multiplier (LM) test. This test was adopted against the Durbin–Watson (DW) test because the DW test is valid only when the model has a constant term, the serial correlation is of the first order, and the lagged dependent variable is not included in the model [

10]. The test result reported in

Table 8 shows that the null hypothesis should not be rejected, which represents that there was no sign of robustness in the analysis.

5. Summary, Conclusions, and Policy Implications

This study analyzed dynamic price adjustments in the vertical supply channel of the U.S. fresh banana market using import- and retail-level monthly price series ranging from January 2001 to December 2020. To analyze the dynamic price adjustments along the vertical marketing channel, time series analyses, such as the cointegration test, VEC model, and historical decomposition graphs, were employed to calculate the speeds and magnitudes of price adjustments. ADF, PP, and Zivot–Andrews unit root tests were employed to analyze the nature of the datasets, the Johansen cointegration and ARDL test were used to monitor the long-run relationship of the two time series, the Quandt–Andrews breakpoint test was used to determine the presence of structural breaks, and then the VEC model was used to estimate the speeds of adjustments, while historical decomposition graphs were used to analyze the magnitudes of price adjustment during the COVID-19 pandemic shock.

The results show that the import-level prices adjusted at a speed of 65 percent, while the speed at which the retail price adjusted was statistically insignificant (2.8 percent). The historical decomposition graphs reveal price asymmetry between the import- and retail-level prices during the COVID-19 exogenous shock. The impact of the COVID-19 pandemic caused prices to decrease at the import level but increase at the retail level. As such, retailers increased their price margins, with consumers bearing the burden of the pandemic shock by paying higher than expected prices.

In general, price changes depend on transportation and transaction costs, economies of scale, product differentiation, contracts, exchange rates, and import and domestic policies. Over time, retail prices have returned to the expected market prices and import prices have also gravitated to the forecasted price.

A possible explanation for the asymmetric price adjustment is that at the import level, the COVID-19 lockdown affected international trade and caused a delay at ports and borders, which led to the degradation of the quality and economic value of fruits in transport. However, at the retail level, the COVID-19 shock induced panic buying and an increase in fresh fruit consumption among consumers looking to boost their body’s immune system against the virus and other diseases [

4]. With the rise in demand, there was a corresponding price increase.

Another possible explanation, shared by previous research [

10,

34,

35], is the fact that retailers in the marketing channel are concentrated and have market power. Hence, they could “delay” passing the lower import prices to consumers. The U.S. banana marketing channel is dominated by a few prominent players (firms) at the import and retail levels. Firms at both levels possess strong market power and could implicitly collude on prices. According to USDA import data, the U.S. imports over 99 percent of fresh bananas for domestic consumption from Latin America through a supply chain dominated by large, concentrated firms. The imperfectly competitive nature of this form of market structure could be one of the reasons for the inefficiency of the U.S. banana market.

The limitation of this research is lack of wholesale prices to examine the reaction of the wholesale-level prices to the pandemic shock and changes in prices, and exclusion of government policies. Furthermore, we recommend that future research in this area examines the comparative advantage of domestically produced bananas and the opportunity cost of allocating additional agricultural land for banana production. All things being equal, an increment in the local banana production could help make the banana market more competitive and efficient. Studies regarding the inclusion of vertically integrated domestic banana production with advanced technology could increase competition in the U.S. fresh banana marketing channel.

Author Contributions

S.O. is the primary author in this article. His roles include research topic conceptualization, data collection, methodology, writing—original draft preparation, and software application. S.H.S.’s contributions to this article include writing—revision and editing, and supervision. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data are available upon request.

Acknowledgments

The authors would like to thank the editors and the reviewers for all their efforts. Sayed H. Saghaian acknowledges the support from the United States Department of Agriculture, National Institute of Food and Agriculture, Hatch project No. KY004052, under accession number 1012994.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Su, C.-H.; Ishdorj, A.; Leatham, D.J. An Analysis of the Banana Import market in the US. In Proceedings of the 2011 Annual Meeting, Corpus Christi, TX, USA, 5–8 February 2011. [Google Scholar]

- United States Department of Agriculture, Foreign Agricultural Service, GATS. Available online: https://apps.fas.usda.gov/gats/default.aspx (accessed on 19 August 2021).

- FAO. Banana Market Review-Preliminary Results 2020. In Food and Agriculture Organization of the United Nations Banana Market Review Report, Rome, Italy. 2021. Available online: https://www.fao.org/3/cb6639en/cb6639en.pdf (accessed on 19 August 2021).

- Altendorf, S. Preliminary assessment of the impacts of the COVID-19 pandemic on trade in bananas and tropical fruits. In Food Outlook; Food and Agriculture Organization of the United Nations: Rome, Italy, 2020; pp. 11–15. [Google Scholar]

- Goodwin, B.K.; Holt, M.T. Price transmission and asymmetric adjustment in the US beef sector. Am. J. Agric. Econ. 1999, 81, 630–637. [Google Scholar] [CrossRef]

- FAOSTAT. Available online: https://www.fao.org/faostat/en/#compare (accessed on 5 September 2021).

- Johnson, R. The US Trade Situation for Fruit and Vegetable Products; Congressional Research Service: Washington, DC, USA, 2014. [Google Scholar]

- Evans, E.; Ballen, F. Banana Market; 2576-0009; Report FE901. University of Florida, IFAS Extension: Gainesville, FL, USA, 2012. Available online: https://edis.ifas.ufl.edu/publication/FE901 (accessed on 5 September 2021).

- Vavra, P.; Goodwin, B.K. Analysis of price transmission along the food chain. In OECD Food, Agriculture and Fisheries Papers; OECD Publishing: Paris, France, 2005. [Google Scholar]

- Darbandi, E.; Saghaian, S. Vertical price transmission in the US beef markets with a focus on the great recession. J. Agribus. 2016, 34, 91–110. [Google Scholar]

- Pozo, V.F.; Schroeder, T.C.; Bachmeier, L.J. Asymmetric Price Transmission in the US beef market: New evidence from new data. In Proceedings of the NCCC-134 Conference on Applied Commodity Price Analysis, Forecasting, and Market Risk Management, St. Louis, MO, USA, 22–23 April 2013. [Google Scholar]

- Saghaian, S.H.; Ozertan, G.; Spaulding, A.D. Dynamics of price transmission in the presence of a major food safety shock: Impact of H5N1 avian influenza on the Turkish poultry sector. J. Agric. Appl. Economics 2008, 40, 1015–1031. [Google Scholar] [CrossRef] [Green Version]

- Saghaian, S.H. Beef safety shocks and dynamics of vertical price adjustment: The case of BSE discovery in the US beef sector. Agribus. Int. J. 2007, 23, 333–348. [Google Scholar] [CrossRef]

- Hasan, D.; Simoni, M. Price linkage and transmission between shippers and retailers in the French fresh vegetable channel. In Proceedings of the 2002 International Congress, Zaragoza, Spain, 28–31 August 2002. [Google Scholar]

- Peltzman, S. Prices rise faster than they fall. J. Polit. Econ. 2000, 108, 466–502. [Google Scholar] [CrossRef]

- Laborde, D.; Martin, W.; Vos, R. Impacts of COVID-19 on global poverty, food security, and diets: Insights from global model scenario analysis. Agric. Econ. 2021, 52, 375–390. [Google Scholar] [CrossRef] [PubMed]

- Beckman, J.; Countryman, A.M. The Importance of Agriculture in the Economy: Impacts from COVID-19. Am. J. Agric. Econ. 2021, 103, 1595–1611. [Google Scholar] [CrossRef]

- Barman, A.; Das, R.; De, P.K. Impact of COVID-19 in food supply chain: Disruptions and recovery strategy. Curr. Res. Behav. Sci. 2021, 2, 100017. [Google Scholar] [CrossRef]

- Swinnen, J.; Vos, R. COVID-19 and impacts on global food systems and household welfare: Introduction to a special issue. Agric. Econ. 2021, 52, 365–374. [Google Scholar] [CrossRef]

- Lloyd, T. Forty Years of Price Transmission Research in the Food Industry: Insights, Challenges and Prospects. J. Agric. Econ. 2017, 68, 3–21. [Google Scholar] [CrossRef] [Green Version]

- Rosa, F.; Vasciaveo, M.; Weaver, R.D. Agricultural and oil commodities: Price transmission and market integration between US and Italy. BAE 2014, 3, 93–117. [Google Scholar]

- Rojas, C.; Andino, A.; Purcell, W.D. Retailers’ response to wholesale price changes: New evidence from scanner-based quantity-weighted beef prices. Agribusiness 2008, 24, 1–15. [Google Scholar] [CrossRef] [Green Version]

- Pozo, V.F.; Bachmeier, L.J.; Schroeder, T.C. Are there price asymmetries in the US beef market? J. Commod. Mark. 2021, 21, 100127. [Google Scholar] [CrossRef]

- Erol, E.; Saghaian, S.H. The COVID-19 Pandemic and Dynamics of Price Adjustment in the US Beef Sector. Sustainability 2022, 14, 4391. [Google Scholar] [CrossRef]

- Ball, L.; Mankiw, N.G. Asymmetric price adjustment and economic fluctuations. Econ. J. 1994, 104, 247–261. [Google Scholar] [CrossRef] [Green Version]

- Bailey, D.; Brorsen, B.W. Price asymmetry in spatial fed cattle markets. West. J. Agric. Econ. 1989, 14, 246–252. [Google Scholar]

- Ward, R.W. Asymmetry in retail, wholesale, and shipping point pricing for fresh vegetables. Am. J. Agric. Econ. 1982, 64, 205–212. [Google Scholar] [CrossRef]

- Heien, D.M. Markup pricing in a dynamic model of the food industry. Am. J. Agric. Econ. 1980, 62, 10–18. [Google Scholar] [CrossRef]

- Blinder, A.S. On sticky prices: Academic theories meet the real world. In Monetary Policy; Gregory Mankiw, N., Ed.; The University of Chicago Press: Chicago, IL, USA, 1994; pp. 117–154. [Google Scholar]

- Blinder, A.; Canetti, E.R.; Lebow, D.E.; Rudd, J.B. Asking About Prices: A New Approach to Understanding Price Stickiness; Russell Sage Foundation: New York, NY, USA, 1998. [Google Scholar]

- Reagan, P.B.; Weitzman, M.L. Asymmetries in price and quantity adjustments by the competitive firm. J. Econ. Theory 1982, 27, 410–420. [Google Scholar] [CrossRef]

- Wohlgenant, M.K. Competitive storage, rational expectations, and short-run food price determination. Am. J. Agric. Econ. 1985, 67, 739–748. [Google Scholar] [CrossRef]

- Weldegebriel, H.T. Imperfect price transmission: Is market power really to blame? J. Agric. Econ. 2004, 55, 101–114. [Google Scholar] [CrossRef]

- Luoma, A.; Luoto, J.; Taipale, M. Threshold Cointegration and Asymmetric Price Transmission in Finnish Beef and Pork Markets; Pellervo Economic Research Institute: Helsinki, Finland, 2004. [Google Scholar]

- Conforti, P. Paper 7–Price transmission in selected agricultural markets. In FAO Commodity and Trade Policy Research Working Paper; Food and Agriculture Organization of the United Nations: Rome, Italy, 2004. [Google Scholar]

- Wolffram, R. Positivistic measures of aggregate supply elasticities: Some new approaches: Some critical notes. Am. J. Agric. Econ. 1971, 53, 356–359. [Google Scholar] [CrossRef]

- Houck, J.P. An approach to specifying and estimating nonreversible functions. Am. J. Agric. Econ. 1977, 59, 570–572. [Google Scholar] [CrossRef]

- Cramon-Taubadel, S.V. Estimating asymmetric price transmission with the error correction representation: An application to the German pork market. Eur. Rev. Agric. Econ. 1998, 25, 1–18. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar]

- Perron, P. The great crash, the oil price shock, and the unit root hypothesis. Econ. J. Econ. Soc. 1989, 57, 1361–1401. [Google Scholar] [CrossRef]

- Zivot, E.; Andrews, D.W.K. Further Evidence on the Great Crash, the Oil-Price Shock, and the Unit-Root Hypothesis. J. Bus. Econ. Stat. 1992, 10, 251. [Google Scholar]

- Boetel, B.L.; Liu, D.J. Estimating structural changes in the vertical price relationships in US beef and pork markets. J. Agric. Resour. Econ. 2010, 35, 228–244. [Google Scholar]

- Stock, J.H.; Watson, M.W. A simple estimator of cointegrating vectors in higher order integrated systems. Econ. J. Econ. Soc. 1993, 61, 783–820. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econ. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Morley, B. Causality between economic growth and immigration: An ARDL bounds testing approach. Econ. Lett. 2006, 90, 72–76. [Google Scholar] [CrossRef]

- Asgari, M.; Saghaian, S.H.; Reed, M.R. The Impact of Energy Sector on Overshooting of Agricultural Prices. Am. J. Agric. Econ. 2020, 102, 589–606. [Google Scholar] [CrossRef]

- Karantininis, K.; Katrakylidis, K.; Persson, M. Price transmission in the Swedish pork chain: Asymmetric non linear ARDL. In Proceedings of the EAAE 2011 Congress, Zurich, Switzerland, 30 August–2 September 2011. [Google Scholar]

- Wong, K.; Hook, L. Peasaran et al. (2001) Bound Test and ARDL Cointegration Test. 2001. Available online: https://www.researchgate.net/publication/322208483_Peasaran_et_al_2001_Bound_Test_and_ARDL_cointegration_Test/references (accessed on 7 June 2020).

- Johansen, S. Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econ. J. Econ. Soc. 1991, 59, 1551–1580. [Google Scholar] [CrossRef]

- Johansen, S.; Juselius, K. Testing structural hypotheses in a multivariate cointegration analysis of the PPP and the UIP for UK. J. Econ. 1992, 53, 211–244. [Google Scholar] [CrossRef]

- Schmidt, M.B. The dynamic behavior of wages and prices: Cointegration tests within a large macroeconomic system. Southern Econ. J. 2000, 67, 123–138. [Google Scholar]

- Koehler, A.B.; Murphree, E.S. A comparison of the Akaike and Schwarz criteria for selecting model order. J. R. Stat. Soc. Ser. C (Appl. Stat.) 1988, 37, 187–195. [Google Scholar] [CrossRef]

- CDC. Coronavirus Detected in the U.S. Available online: https://www.cdc.gov/media/releases/2020/p0121-novel-coronavirus-travel-case.html (accessed on 7 June 2020).

Figure 1.

Imports of fresh bananas from major Latin American countries (Guatemala, Costa Rica, Ecuador, Honduras, Mexico, and Colombia). Source: USDA, Foreign Agricultural Services, Global Agricultural Trade System.

Figure 1.

Imports of fresh bananas from major Latin American countries (Guatemala, Costa Rica, Ecuador, Honduras, Mexico, and Colombia). Source: USDA, Foreign Agricultural Services, Global Agricultural Trade System.

Figure 2.

The five leading fresh fruit exporters to the U.S. Sources: USDA, Economic Research Service, USDC, Bureau of the Census data compiled by USDA, Foreign Agricultural Services, Global Agricultural Trade System.

Figure 2.

The five leading fresh fruit exporters to the U.S. Sources: USDA, Economic Research Service, USDC, Bureau of the Census data compiled by USDA, Foreign Agricultural Services, Global Agricultural Trade System.

Figure 3.

Illustration of an asymmetric vertical price transmission. Source: Analysis of Price Transmission along the Food Chain, OECD Food, Agriculture, and Fisheries.

Figure 3.

Illustration of an asymmetric vertical price transmission. Source: Analysis of Price Transmission along the Food Chain, OECD Food, Agriculture, and Fisheries.

Figure 4.

Import- and retail-level price trend (from 2001 to 2020). Source: research data analysis.

Figure 4.

Import- and retail-level price trend (from 2001 to 2020). Source: research data analysis.

Figure 5.

The characteristic roots of the polynomial in the estimated VEC model.

Figure 5.

The characteristic roots of the polynomial in the estimated VEC model.

Figure 6.

The COVID-19 pandemic impact on retail-level price in the U.S. fresh banana market. Source: research findings.

Figure 6.

The COVID-19 pandemic impact on retail-level price in the U.S. fresh banana market. Source: research findings.

Figure 7.

The COVID-19 pandemic impact on import-level price in the U.S. fresh banana market. Source: research findings.

Figure 7.

The COVID-19 pandemic impact on import-level price in the U.S. fresh banana market. Source: research findings.

Table 1.

Descriptive statistics of continuous price data (from 2001 to 2020).

Table 1.

Descriptive statistics of continuous price data (from 2001 to 2020).

| | Import Price | Retail Price |

|---|

| Mean | 0.37 | 0.56 |

| Median | 0.43 | 0.57 |

| Maximum | 0.63 | 0.64 |

| Minimum | 0.25 | 0.46 |

| Std. Dev. | 0.08 | 0.04 |

| Skewness | −0.11 | −0.26 |

| Kurtosis | 1.8 | 1.72 |

| Observations | 240 | 240 |

Table 2.

Stationarity test result.

Table 2.

Stationarity test result.

| Test | ADF | ADF | PP | PP |

|---|

| Variables | Level | First Difference | Level | First Difference |

|---|

| Import-Level Prices | −1.582 | −8.822 *** | −1.828 | −23.920 *** |

| Retail-Level Prices | −1.867 | −15.302 *** | −1.905 | −15.302 *** |

Table 3.

Zivot-Andrews Unit Root Test allowing for Structural Breaks.

Table 3.

Zivot-Andrews Unit Root Test allowing for Structural Breaks.

| Variables | Stat. | Breakpoint Date |

|---|

| Import-Level Prices | −7.7438 *** | 2009M07 |

| Retail-Level Prices | −7.1872 *** | 2008M02 |

Table 4.

Johansen cointegration test result.

Table 4.

Johansen cointegration test result.

| Unrestricted Cointegration Rank Test (TRACE) | | | | |

| Null Hypothesis | Eigen Value | Trace Statistics | 0.05 Critical Value | Prob ** |

| r = 0 ** | 0.067597 | 20.49238 | 15.49471 | 0.0081 |

| r ≤ 1 | 0.015983 | 3.834709 | 3.841466 | 0.0502 |

| Unrestricted Cointegration Rank Test (Maximum Eigen Value) | | | | |

| Null Hypothesis | Eigen Value | Max. Eigen Statistics | 0.05 Critical Value | Prob ** |

| r = 0 ** | 0.067597 | 16.65767 | 14.2646 | 0.0205 |

| r ≤ 1 | 0.015983 | 3.834709 | 3.841466 | 0.0502 |

Table 5.

ARDL test result showing short-run and long-run coefficients.

Table 5.

ARDL test result showing short-run and long-run coefficients.

| Import Price (IP) = Retail Price (RP) | | | | |

|---|

| F Statistics | | 7.523 ** | | |

| Estimated Short-run coefficients of the ARDL (5,2) | | | | |

| Variable | Coefficients | Standard Error | T Stat. | Prob. |

| CointEq (−1) | −0.6487 | 0.0407 | −15.944 | 0 |

| Δ(Import Price[−1]) | −0.6487 | 0.0407 | −3.3538 | 0 |

| Δ(Import Price[−2]) | −0.0769 | 0.0397 | −1.9388 | 0.053 |

| Δ(Import Price[−3]) | −0.0867 | 0.0375 | −2.3101 | 0.021 |

| Δ(Import Price[−4]) | 0.0722 | 0.0361 | −2.0003 | 0.047 |

| Δ(Retail Price) | 0.1622 | 0.1122 | 1.446 | 0.046 |

| Δ(Retail Price[−1] | −0.2021 | 0.1109 | −1.8225 | 0.069 |

| Estimated Long-run coefficients of the ARDL (5,2) | | | | |

| Variable | Coefficients | Standard Error | T Stat. | Prob. |

| Retail price | 0.9078 | 0.2036 | 4.4594 | 0 |

| Constant | −0.6714 | 0.1399 | −4.9001 | 0 |

Table 6.

Granger causality test results.

Table 6.

Granger causality test results.

| Null Hypothesis | Observation | F Stat. | Prob. |

|---|

| Retail prices (in logarithmic form) | 234 | 2.806 ** | 0.018 |

| Import Prices (in logarithmic form) | | 2.103 * | 0.066 |

Table 7.

Empirical estimates of speed adjustment.

Table 7.

Empirical estimates of speed adjustment.

| Variables | ln (Import Price) | ln (Retail Price) |

|---|

| Error correction term (ECT) | −0.6496 (−15.470) *** | −0.0278 (−0.175) |

| R-squared | 0.773 | 0.165 |

| Akaike AIC | −4.426 | −5.396 |

| Schwarz SIC | −4.219 | −5.19 |

Table 8.

Serial correlation test results.

Table 8.

Serial correlation test results.

| Breusch–Godfrey Serial Correlation LM Test | | | |

|---|

| Null hypothesis: there is no serial correlation | | | |

| F Statistics | 3.2057 | Prob. F | 0.524 |

| Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).