Abstract

This study aims to evaluate the mediating role of sustainability in the relationship between environmental-accounting (EA) disclosures and audit quality (AQ) and firm performance (FP) by using GDP and firm size as the controlled variables. Data were collected from the annual and sustainability reports of 80 manufacturing firms that were listed on the PSX during the last 10 years (2011–2020). STATA 13 software and a multiple-regression model were used. The findings that were deduced from the empirical results indicate that EA with sustainability has a significant negative effect on both proxies of the FP (ROA and ROE). By contrast, AQ with sustainability has an insignificant negative impact on firm performance. This research contributes to the scarce literature and compares the level of EA with sustainability reporting and its impact on the FP with the controlled variables GDP and firm size. This study also contributes to the execution of the reporting and the assurance of sustainability, and it helps regulatory bodies with the integral development of reporting and the assurance of EA.

1. Introduction

Researchers argue that environmental accounting (EA) can be a way toward solving the issue of environmental degradation and shifting toward sustainable solutions [1,2,3,4,5,6,7,8,9,10]. One of the significant reasons for EA is the role of industrial and commercial activities in environmental contamination. As is noted by [11], large organizations intensify this expenditure for controlling environmental pollution, which mainly arises from their manufacturing processes to fulfill the monetary needs of their investors. This is also evidenced by the recent study of [12], which implies that EA is measured through the cost that is attributable to mitigating the environmental damage that arises from industrial activities. In addition, the corporates need to rethink their manufacturing of multistep products that provoke environmental sustainability. Therefore, an EA system is praised that indicates the requirement of EC [12]. Sustainable industrialization is the only option for long-term development. The concern about sustainability has captivated the attention of stakeholders (e.g., customers, producers, and governments) across the globe, and it is taken very seriously. At the customer level, local and international organizations are becoming more active than ever. At the government level, most world leaders are frequently meeting and discussing the issues of environmental sustainability. Similarly, the United Nations Conference (United Nations Framework Convention on Climate Change, or UNFCCC, 2021), which was held in Glasgow, the United Kingdom, from 31st October to 11th November 2021, brought the world leaders to a common platform to discuss the environmental issues. Despite these activities, the global temperature has increased by 0.8 °C since 1980. The emission of carbon dioxide (CO2), which is the source of global warming, has moved from boon to bane. Increased levels of CO2, along with other greenhouses gases, are at a record high. The current statistics show that the level of CO2 is 402.56 parts per million on a volume basis. As more of the heat becomes trapped in the atmosphere, the resultant effect is the temperature rise, which brings natural calamities in the shape of extreme weather [13]. These extreme climate disasters are also claimed by [14] to be closely connected with fast-paced industrialization and economic growth.

As these changes appear to influence the thinking of businesses and academia, the paradigm has now shifted toward sustainable development under climate change. This refers to the ability of organizations to be involved in climate-change efforts. With the rise in social awareness, organizations are under increased pressure to change their work. Organizations have tactically responded to the evolving reality by regarding the new situation not as a threat, but as an opportunity with strategic-level effects. Two facets stand out as the reason for the inducement of firms to pursue sustainable development. First, firms’ conception of cost has changed. The realization of internalizing the environmental cost has increased, which has directed firms to go for environmentally friendly businesses and products, which ultimately results in reduced environmental costs. Second, firms have realized that, if they can proactively work on environmental issues, they can have an added tool to market themselves, which thus increases their market reputation. Ample evidence suggests the use of ecological proactivity as it positively affects market returns [15]. Many studies on EA, sustainability, and environmental audit suggest that audit companies do not understand the problems that are posed to clients by environmental hazards; this is a point of concern. The risks that are related to hazardous environmental operations need further guidance [16,17]. According to [18], data describe whether auditors consider environmental risk in a traditional audit, or they focus on financial information only.

We take Pakistan as the context of this study. No detail about individual firms’ contributions is available owing to the lack of mandatory requirements with regard to environmental disclosures and green audits [19,20]. Nevertheless, the audit firms in Pakistan, such as Elliot and KPMG, are conducting voluntary environmental-risk audits. One of the major constraints that they face is the lack of a proper mechanism to measure the environmental performance at the country level. A measuring mechanism for individual firms must be developed so that the extent of the harm that is caused by the firms can be identified, and so that they may be guided to correct themselves. Despite the significant rise in the volume of research on EA, very little focus is given to Pakistan [21]. Moreover, no comprehensive measure of the effect of e-accountability and e-audit on firm performance (FP) exists [19].

The authors of [22] reviewed 26 articles from the last two decades to intensify the effect of accounting practice on environmental performance. They advocated that several studies handicap the procedure of EA, such as the analysis of sustainability in terms of cost, and the performance index related to the environment. Sustainability assurance and disclosure are themes of the economic and social world in the field of accounting. The author of [23] argues that accounting for the maintenance of sustainability is a difficult and multifaceted process, and not a simple rapport. In addition, he also affirms that large organizations have taken responsibility to initiate environmental costing and reporting for the achievement of sustainable outcomes for a longer period. A significant development is required in the accounting and reporting of sustainability through the incorporation of guidelines given by standards authorities [23] (especially in underdeveloped countries, such as Pakistan). Some studies, such as [24,25,26], reveal that independent financial and nonfinancial audits significantly affect the perception of the various stakeholders of firms. Thus, the environmental disclosure of prominent companies’ positions assures stakeholders and increases the confidence of external users in the companies’ financials [27,28].

To fill the gap, this study investigates and understands corporate accountability and sustainably related to environmental issues in Pakistan, with a focus on Pakistan’s nonfinancial sectors, which include the manufacturing sectors. The study aims to develop a measure of e-accountability and AQ to comprehensively capture their various facets, and to determine the impacts of e-accountability and AQ on firm performance. Furthermore, the study ascertains the mediating role of firms’ environmental sustainability, and how it impacts the e-sustainability of firms.

This study contributes theoretically to the existing research, as it is one of the few studies that adopt the convergent institutional and resource-dependence theories in accounting research in the contexts of emerging economies, in general, and of Pakistan, in particular. This study adds to new knowledge in the context of Pakistan, where most studies do not adopt a theoretical approach. Unfortunately, there is no mechanism in place. The research intends to find the answers to two concerns: the extent of awareness in the form of audit, and the performance in the shape of EA. This research contributes to the development of these mechanisms. This study provides some gauges or measurement tools that can contribute to the achievement of the sustainable development goals (SDGs) that are mentioned in the [29] reports. In doing so, the present study contributes to the literature in two major ways. First, this study explains how environmental accounting could play an instrumental role in the simultaneous pursuit of two important organizational goals (i.e., sustainability and performance). Likewise, the study refutes the conventional wisdom about audit practices with regard to its negligible impact on sustainability and performance. The findings reveal the momentous role of audit practices and it opens a new window of research, where environmental accounting and audit-quality-led sustainability and performance strategies could be developed.

The studies of [21,30] conclude that Pakistan is among the top environmental polluters globally. Conceivably, the poor environmental performance of Pakistan is attributable to the growth in industrial environmental activities [31,32,33]. To reduce the greenhouse gas (GHG) emissions that are emanated from industrial operations across the world, Pakistan, along with 200 other countries, is lagging in the implementation of the Kyoto Protocol of 1997 [34]. An examination as to how Pakistan has taken steps to account for the environment to regulate, monitor, prevent, and reduce carbon emissions, and other corporate environmental issues that prevail in the country, is quite a point of great interest. In this research, we also propose to measure the environmental performances of firms. The purpose of the initial measure is two-fold. First, it can measure the extent of care or carelessness shown by firms. Second, the measure is taken to mitigate the degrading effect that is caused by the firm. The concept is well encompassed by two related terms: green accounting and its accountability (green audit). EA (green accounting) allows the firms to measure their environmental performances, whereas green audit allows the auditing mechanism to verify the authenticity of the procedures.

2. Literature Review

This study focuses on EA-related issues, and it discloses how they are managed and reported by profit-seeking organizations (PSOs) in the developing economies, and specifically in Pakistan. Previous research focuses on one or more parts of social and EA practices. Some give more importance to corporate social responsibility (CSR) [6,35,36,37,38], and others to economic responsibility [39,40,41,42,43] and environmental accountability [7,44,45,46,47]. Moreover, an examination of these studies discloses that explorations in the social and EA areas are scarce, and that they are restricted to developed countries, and specifically to the United States, the United Kingdom, France, and Australia [1,39,48,49,50,51,52,53]. Few studies are on developing countries. With the limited restrictions, a vacuum exists in terms of EA and its accountability in the form of empirical and theoretical research in emerging countries [45]. The same vacuum applies to EA research in Pakistan [21].

EA exhibits the accounting disclosure that requires executives to know the relationship between business actions that influence the environment and the environment-related impact on the business. It is pinpointing and valuing the cost of environment-related actions. Moreover, EA identifies and distinctly observes the consumption and cost of the production means, such as water, energy, and fuel, to reduce costs. Furthermore, it ensures that environmental concerns form a part of capital-investment decisions.

2.1. Environmental Contamination: An Overview

Environmental contamination originates either from nature or from humans. Environmental contamination by nature refers to natural calamities or nonhuman interventions, such as volcanic eruptions, salt spray from the ocean, gases from animals, and plant deterioration [3]. The second type of contamination is caused by humans, and it involves all the residuals that are related to the consumption and production of gases and particles from the chemical wastes of manufacturing processes. The literature further emphasizes that industrialization has caused a large portion of environmental contamination on the earth, and it induces the global community to take initiatives for reducing the harmful effects [3,6,54,55,56]. A study conducted by [54] on sulfur dioxide emissions in Falconbridge, which is a company in Canada, depicts the harmful impact of the company’s activities on the environment. The aforementioned claim reveals that environmental contamination is a matter of greater concern, and that it should be given much attention given the harmful effects on nature and society. Appropriate measures and accountability for environmental contamination, which has become a worldwide problem, are necessary. Global organizations, such as the UN, the World Bank, the UNCED, and the OECD, have been playing their role to manage and ensure environmental accountability because industrialization has created harmful impacts, from one country to another, through globalization [2,57].

2.2. Environmental Pollution Is a Global Issue

The author of [4] argue that environment-related issues have been broadening from domestic-pollution problems to a worldwide issue. He also highlights the robust worldwide movements to pinpoint the distant and instant causes of environmental contamination and the impairment that it has caused to society, nature, and the earth. The authors of [3] emphasize that the world has become more attentive to environmental contamination and to the implications of environmental degradation that is caused by corporate activities. The majority of GHG emissions have originated from developed countries, which has been a major factor in climate change in recent years [58], and which has created harmful effects from developed to developing/emerging countries. By the end of the 20th century, the Kyoto Protocol agreement was signed by 160 countries to regulate GHG emissions at a certain level for the avoidance of the environmental contamination that was a significant threat to human life [59]. Environmental-contamination issues are no longer restricted to the borders of countries but have become a global issue that needs consideration at the local and global levels. Industrialization and corporate manufacturing processes (particularly PSOs) are substantial suppliers of environmental contamination [2,3,54,58]. All these show the significance of evaluating the responsibility of corporations in environmental management and accountability.

2.3. The Role of Corporations in Worldwide Environmental Pollution

Globalization has made PSOs into multinational corporations (MNCs), which cleverly obtain control and occupy the key resources of developing countries [60]. That most of the MNCs are richer than many countries of the world, and especially some developing countries, is an eye-opener. These MNCs are taking advantage of their influence [60,61]. The authors of [60] claim that “Corporations constituted 50 of the world’s biggest economies. Their turnover exceeds the gross national product of many nation-states …. the turnover of companies, such as Ford, General Motors, or Wal-Mart, is bigger than the Gross Domestic Product (GDP) of Greece, Poland, Hong Kong, or South Africa.” Furthermore, these MNCs have become so powerful that they can dictate their terms in the politics and economies of many developing and developed countries, and especially those of emerging economies that rely on them [62].

EA research reveals the increased number of environmental calamities that can be directly attributed to environmental degradation. The increased frequency and ferocity of storms, the rise in the global temperature, and more frequent wildfires have shaken humanity. There is an increased concern on the global stage.

According to [63] reports, 24% of the global disease burden, and 23% of all deaths, can be attributable to environmental factors. According to [64], Asia is the fastest growing economy on the globe. It is also home to some poor developing countries, and to some of the richest. Although many people are lifted out of poverty, half of this region is poor. The development of economies has its own cost. Fast growth, the maintenance of a prosperous lifestyle, and increased demand for resources create mounting pressure on the natural resources in the region. Although some countries come up with innovative policies and directions, such as Bhutan’s national happiness, Thailand’s sufficient economy, and China’s quality growth model, most countries are unaware of the sensitivity of the issue. In Asia, the most affected countries due to pollution are China, India, Pakistan, Indonesia, and Bangladesh [65]. Furthermore, [66] reveals that the emissions of CO2 from the manufacturing and POL industries are liable for 1.6 million deaths each year around the globe in developing countries, such as those in Asia. The largest CO2 emitter on the globe is the Asia Pacific, where 17.27 billion metric tons of CO2 were emitted in 2019. China alone produced approximately 28.8% of the global fossil-fuel and CO2 emissions [64].

2.4. Environmental Practice

2.4.1. Corporate Environmental Responsibility

In this era, when globalization, capitalism, and liberalism are trending, the corporate sector has obtained influence over society; therefore, it is responsible for its actions on society and it must be held accountable. However, in the light of this study, corporations are presumed responsible for the management of their environmental activities in society, and they are answerable for their actions. This is what can be perceived of as accountability [7]. Accounting scholars view this act of responsibility as a way of safeguarding ecofriendly sustainability. To safeguard ecofriendly sustainability, [52] argues that corporations ought to play a positive role in society in ecojustice, ecoefficiency, and eco-effectiveness. He further defined ecojustice as the equality between people and generations toward environmental resources. Ecoefficiency is expressed as less utilization of environmental resources per unit of production. Eco-effectiveness is achieved when a reduction in the overall environmental footprint is considerable. To show the responsibility of the corporate sector, corporations must safeguard the needs of the current generation in terms of an ecofriendly environment, without sacrificing those of coming generations [67].

2.4.2. Corporate Accountability Regarding the Environment

Accountability involves reporting and analyzing financial and nonfinancial environment-related disclosures. It also gives stakeholders information on the cost-and-benefit analyses of business activities that affect the environment [68]. The corporate sector must be accountable for reporting a consequence. According to [68], accountability is a process in which penalty and reward are granted on the basis of approval or blame. The corporate sector becomes accountable for the assurance of environment-related matters. There should be a framework/mechanism for the accountability of corporations with regard to environment-related activities.

Organizations’ rewards and punishments depend on compliance and noncompliance with corporate environmental accountability [68]. He further explains that accountability becomes more useful with the concept of reward and punishment by default. Corporations are then led to report their practices as a responsibility of their accountability. Furthermore, ref. [44] argues that corporations’ reporting should reflect business ethics and social and environmental practices, rather than corporate profitability reporting (financial accountability) only. The reporting practices of corporations tend to be focused on the maximization of shareholders’ wealth (sustainable profits); rather, they should focus on the sustainability of the environment. Various stakeholders, and especially environmental activists, NGOs, regulatory bodies, and research scholars, have shown their concerns. To attain this, corporate reporting should reflect environmental sustainability [45,69]. We can summarize, from the above discussion, that corporations (PSOs) must be bound to comply with their environment-related commitments and be accountable for their activities. One of the ways of conducting this is through environmental reporting.

2.4.3. Environmental Accounting/Reporting as a Medium of Accountability Practice

Environmental accounting/reporting practices take the form of accountability [70]. He further emphasizes this as the “publication of an environmental policy statement”. This reporting practice becomes one of the parts of companies’ annual reports to present the corporate-sector environmental performance and impacts on the environment. He further argues that environmental reporting is the practice of disclosing the environmental performance to the society, be it an exclusive report related to environmental disclosures, or a part of the annual report. The method of publishing environmental issues becomes effective because the environment-related disclosures are available to all of the relevant stakeholders.

2.4.4. EA Disclosures

The environmental cost is the amount that is paid by a company to conduct the environmental-protection process. EA is also used as a proxy by different researchers in the case of environmental costs [71,72,73,74]. The environmental enactments of companies associated with ecologically delicate businesses can attract the attention of associated people that represent the associates of the civilization that are specifically involved with the firms’ environmental enactments for adjacent communities, environmentalists, or regulative organizations [75,76,77].

2.4.5. Environmental Accounting/Reporting and IFRS

For the stakeholders’ need for specific information, what should be included in EA and reporting must be clarified. EA includes the costs to clean up or remediate contaminated sites, environmental fines, penalties and taxes, purchases of pollution-prevention technologies, and waste-management costs [78]. The examination of the international financial-reporting standards shows that no global customary entity is solely responsible for the provisions of such data. Nonetheless, we find remarks, directly and indirectly, on the subject of environmental reporting within the IFRS.

Numerous studies are dedicated to volunteering environmental-revelation data, but much less consideration is given to the environment-related-disclosure needs set by the accounting standards, ordinarily, and the IFRS, especially. The authors of [79] analyzed the state of the literature on the company and environmental reporting from various methods and theoretical points of view. The authors of [80] determined 200+ articles, beginning from 1965 to 2005 (which is the calendar year when the international financial-reporting standards were executed in European countries), that are associated with global accounting coordination. These studies claim that, so far, no specific research has combined environmental reporting with the method of the global accounting standards.

In the absence of the accounting standards that solely incorporate the ecological/environmental matters into the company’s yearly documents/annual accounts, there are isolated or overlapping IAS/IFRS clauses, such as IFRIC 3; IFRS 6, 7, and 8; and IAS 16, 32, 37, 38, and 39. However, specific international accounting and auditing standards are lacking [81,82]. Before going into details on the global initiatives already taken, we go through the literature to show how the evolution of EA and reporting has evolved over the decades.

2.5. Relations between Environmental Accounting and Performance

FP may be affected by EA and reporting. Firms that are not concerned about the environment may face high costs of capital because external stakeholders want high-risk premiums. There are numerous environmental and energy taxes in the United Kingdom, such as the landfill tax. Attracting international investors has also stimulated the FP [83], and the sustainability disclosures of companies significantly affect their growth and size [84]. Corporations with high gearing/leverage tend to report disclosures regarding the environment and social accountability [85]. The key gauge of a firm’s profitability is the size of the firm [86,87,88]. Some studies show that the disclosure of the environmental performance is positively related to the ROE and ROA which measures the FP of the firm [89,90] and it is considered as proxies in the study as shown in Table 1 below. On the other hand, the study of [91,92] found an inverse relationship between EA and the financial performances of firms.

Table 1.

Measurement of independent variables.

2.5.1. Profitability

Firms that earn higher profits are eager to disclose EA information to meet and satisfy the needs of their stakeholders, as is discussed in stakeholder theory. Firms have the opportunity to increase their value on the stock market by disclosing the information related to the environment, besides profitability [89,90]. The authors of [93] researched the connection between EA disclosures and the fiscal-market performances of Great Britain’s leading businesses. The longitudinal statistics show a considerable connection between constantly increased or decreased profits and the disclosures of environment-related information. The empirical findings helped to design the following:

Hypothesis 1 (H1).

There is no impact of e-accounting disclosures on a firm’s performance.

2.5.2. Environmental Sustainability

Environment efficiency (EE) is an effective tool that is used to address challenges that emerge in the measurement of environmental-sustainability constructs. The authors of [94,95,96] studied EE and firm performance. They assessed EE on the basis of input and output variables. The output variables are process waste, the level of GHG emissions, and wastewater. The output variables are measured by using metrics adopted from [97]. The input variables are electricity (kwts), firewood (m3), depreciation (Ksh), and the number of casual employees. DEA, which is a nonparametric approach, is considered appropriate for EE assessment [98]. These output and input variables are the core factors of the manufacturing industry. Environmental, social, and governance (ESG) is the detectable proxy that is used by the industry to gauge the sustainability performance [99,100] as depicts in the Table 1 below. We also determined the same inputs to quote the e-sustainability in this study. It has also been indicated that the impact of sustainability on the manufacturing industry’s performance is undetermined.

Scholars have conducted extensive research on imparting the significance of sustainability reporting. The authors of [101] highlight key advantages, such as profitability, long-run value, quality products, etc., and, ultimately, the gaining of a competitive edge through the disclosure of sustainability reports. The voluntary and abnormality disclosure of EA indicates that less consideration has been emphasized in the development of the sustainability-reporting standards [101]. Likewise, [102] advocates that firm profitability is correlated with environmental disclosure, but it varies from industry to industry. The studies [103,104,105] discovered a positive association between sustainability and FP; however, other studies [106,107] reveal inconclusive findings and have found no significant relationship between them.

The literature supports the correlation between FP and sustainability; on the other hand, the literature also concludes that the FP is influenced by EA. Therefore, to recognize the impact of EA on FP, we clutch e-sustainability as a mediating factor and construct the following:

Hypothesis 2 (H2).

There is no impact of sustainability on a firm’s performance.

Hypothesis 3 (H3).

There is no mediating role that the firm’s environmental sustainability plays in the association between e-accounting disclosures and a firm’sperformance.

2.5.3. AQ

Stakeholder theory assumes a positive relationship between the performance of a firm and its level of decision to engage in audit [108]. Thus, reports from reputable independent auditors ensure transparency, so more investors are attracted, which thus improves the firm’s profitability [109]. The independent assurance of ES has been implied throughout developed nations during the last two decades, and empirical evidence from [110,111] argues for their interrelationship; thus, this study develops the following hypotheses on the basis of the above discussion:

Hypothesis 4 (H4).

There is no impact of audit quality on a firm’s performance.

Hypothesis 5 (H5).

There is an influential role that the firm’s environmental sustainability plays in the association between audit quality and performance.

2.5.4. Firm Size

Some researchers use sustainability disclosures and intervening variables to measure the relationship, which are also used in our models, such as the firm size, firm growth, and financial leverage/gearing. The firm size and ownership structure are coupled with EA disclosure [112,113]. The firm size is a fundamental driver of sustainability disclosure [114,115] which is measured through the log of total asset [85] as shown in Table 1. Furthermore, researchers established a positive association between firm size and EA disclosure of [116,117]. Large organizations tend to disclose their environmental practices for their visibility and image in society [118,119,120]. Huge firms disclose the information about social and environmental aspects because they feel the pressure and expectations from the stakeholders [121,122].

2.5.5. Environmental Accounting and Performance: An Empirical Review

In this section, we review research on social and EA/reporting in developed and developing/emerging economies.

2.5.6. Environmental Accounting/Reporting in Developed Economies

The preliminary studies in social and EA in developed economies focus on the economic aspects, such as profit and sustainability, and tax evasion and avoidance [5,40,123,124]. A study conducted in [125] explains the reason behind the social–environmental reporting practices by corporations. In their study, they investigated the perception of the corporations only, and disregarded the viewpoints of other stakeholders, such as civil societies, NGOs, and regulatory bodies. They found that the corporation’s main motive is to solve the dispute between economic activity and ecological sustainability. They conclude that, although corporations face many complexities in the incorporation of environmental-responsibility compliances, they still regulate the compliances besides their main motive of maximizing the wealth of investors. After examining the above arguments and studies, we perceive that, although corporations comply with commitments and environmental accountability, their primary motive is to maximize profits. The environmental compliances are secondary. On the contrary, some scholars have examined other stakeholders’ points of view. For instance, the studies of [10,53,126,127] reveal that stakeholders demand that the mandatory requirement of environmental reporting be verified by third-party auditors, either in the shape of the separate reporting of environmental compliances, or as a part of an annual report.

2.5.7. Environmental Accounting/Reporting in Developing Economies

The United Nations Development Program [128] claims that emerging economies have faced more social and ecological crises than the developed world. Researchers claim that, to overcome these issues, most of the emerging countries have implemented ecological regulations over the decades. However, these efforts are not so effective because of the weak enforcement mechanism of the monitoring of the regulations by the government [43,45,57,129].

The authors of [130] reviewed the literature on the developing economies by using a desk-based research approach. They highlight that the initial studies focus on CSR. The focus on the environmental aspect is scarce. This study contributes to the literature by placing a particular focus on the environmental aspect. The literature reviews of previous studies reveal that, in developing countries, researchers have used content analysis for investigating the number of companies that disclose ecological problems, and the positivism approach for analysis [131,132,133].

The literature review of developing countries has concerns over the causes, the reporting practices in the emerging economies, and the consequences of local and global regulations on social and ecological accounting practices. However, less literature is available on their effects in emerging economies, which this study attempts to address. The authors of [134] identify that corporations’ voluntary reporting on ecology and sustainability discloses insufficient information regarding the effect of their ecological activities. In the same context, [135] argues that public awareness can be changed with regard to the difference between voluntary and mandatory disclosures by referring to the “voluntary disclosure theory.” The detailed disclosures of corporations can create a better image toward stakeholders. “Legitimacy theory” states that an increase in mandatory regulations can create a negative impact on stakeholders as corporations find a way to conceal it. Similarly, [136] claims that, because of a lack of ecological and social accounting/reporting, companies faced financial adversities in 2008. Some external factors are pointed out by [137,138], and they affect the environmental-reporting disclosures in emerging economies such as Pakistan. These factors are political, economic, and social. In addition, [135] and [14] highlight reasons that inversely influence ecological/environmental- and social-disclosure reporting in Pakistan, including a lack of official/institutional investors and directors. Moreover, [139] reveals that corporations’ environmental-disclosure-reporting practices were expanded in Pakistan after the voluntary disclosure regulations executed by the SECP. The authors of [140] indicate that developing countries have a significant role to play in mitigating global climate change. The per capita (GHG) emissions in developing countries are expected to rise as the standard of living in these countries rises. China is a major country that can play a vital role in reducing emissions. However, China’s environmental plan for reducing emissions peaks in 2050 [141].

2.5.8. Kyoto Protocols and Developing Countries

The Kyoto Protocol operationalizes the UNFCCC by committing industry-based economies and countries to limiting and reducing GHG emissions by agreement [142]. The treaty requires the countries to adopt guidelines and processes for improvement and regular reporting. The protocol only binds the developed countries, and it imposes a heavier burden on them under the principle of “common but differentiated responsibility and respective capabilities” because it recognizes that these countries are largely responsible for the environmental contamination and the high level of GHG emissions in the atmosphere. Some measures are taken in the protocol to reduce the effect on developing countries. Direct measures are the ways in which the constraints that are implemented can substantially reduce the impacts on developing countries. As long as strategies lead to declines in fossil-fuel usage, fuel exporters will suffer outcomes [143].

2.6. Theoretical Explanations

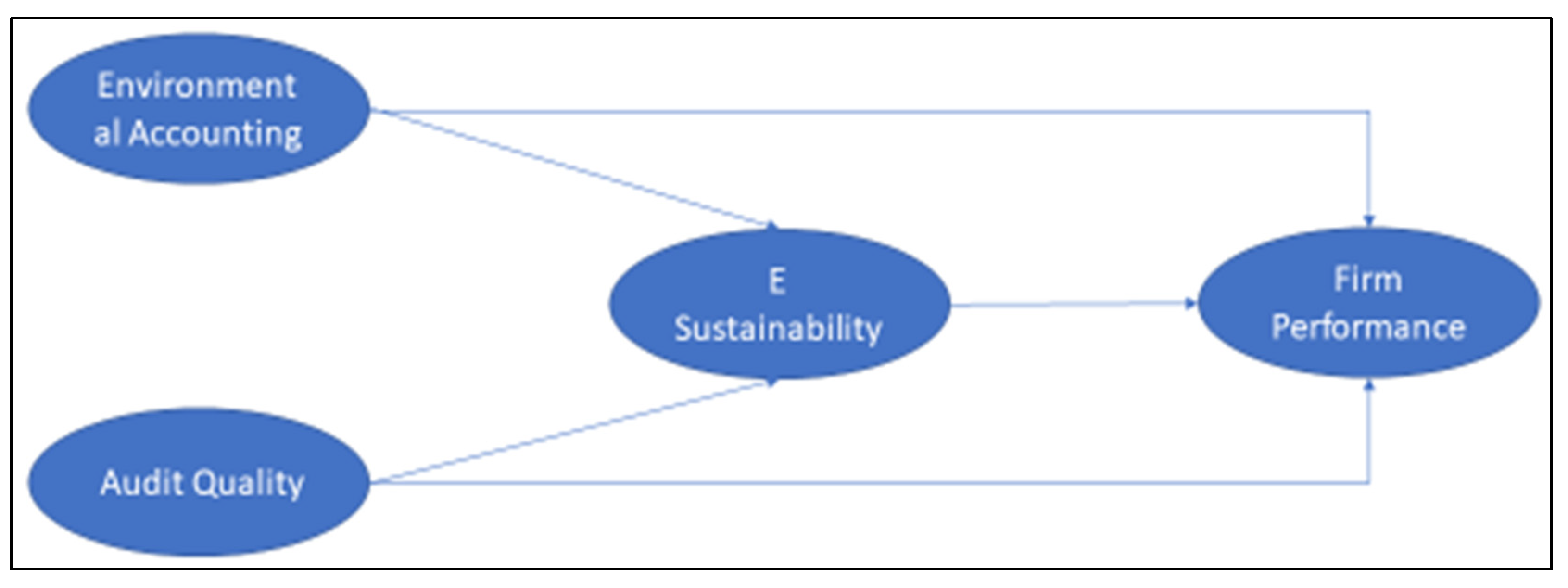

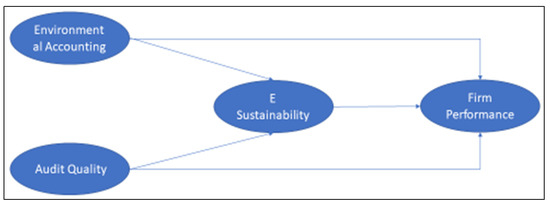

The literature provides knowledge about the theories developed in the area of EA. Among the renowned theories are stakeholder theory, agency cost theory, legitimacy theory, accountability theory, institutional theory, resource-dependency theory, and media-agenda-setting theory [54,144,145,146,147]. The collection of relevant theories such as legitimacy theory, stakeholder theory, and institutional theory supports this study in the context of the development of the social agreement between the firm and the society where it is operational. These theories provide the basis for how and why corporations interact with external pressures, and how such interventions create an impact on their environmental-accountability practices. These theories lend more support to EA practices. In particular, resource-dependency theory supports this study, as it emphasizes the supremacy of the corporations as vital associates of society [145,148,149,150]. Finally, John Elkington, the pioneer of the triple-bottom-line theory, suggests that the corporation’s accounting profit should include the social and environmental impacts, unless the “multidimensional profits” of all of the related entities are calculated to accurately evaluate the benefit for the society or societies involved in the businesses or investments [151]. The TBL framework is very useful in this study, as it provides a framework for reporting environment-related disclosures that also concern the economic and social aspects. After reviewing the empirical studies and the theoretical background of the area, we developed the following conceptual framework Figure 1:

Figure 1.

Conceptual framework.

3. Methodology

The dataset of the study comprises 780 observations, which include the recent 10 years of data of 80 listed manufacturing firms that were collected from published annual and sustainability reports.

3.1. Model

The following models are specified on the basis of the conceptual framework:

where,

FP is the firm performance;

α is the intercept coefficient;

β is the slope coefficient

γ is the slope coefficient of the endogenous variable;

EA is environmental accounting;

EAS is the interaction of EA and sustainability;

AQ is audit quality;

AQS is the interaction of AQ and sustainability;

GDP is the gross domestic product of the country;

Size is the firm size;

i = the listed firms;

t is the time series;

ε is the error term.

Firms take EA as a social constraint, as stated by [152]. The study is conducted on the basis of objectivity, where the accounting efficiency is arbitrated with respect to the presence of time. To test the hypotheses and quantify the data and given that the entire research is based on the analysis of financial ratios, we chose the quantitative research method so that accurate results could be gathered.

3.2. Data

The data were taken from 2011 to 2020 from the annual reports of the companies.

3.3. Statistical Techniques

The nature of the dataset in the study is a balanced panel, and, thus, multiple-regression techniques were used to discover the association between the IVs and the DV. The unit-root Durbin Wu tests were used to investigate the stationarity and endogeneity to meet the assumptions of the linear model [153]. Table 2 represents this finding.

Table 2.

Variable diagnostics.

In Table 2, the p-Value of the augmented Dickey–Fuller (ADF) test indicates that there is no stationarity in a dataset of variables, while Table 3 represents the diagnosis of the final model, and it provides guidance to meet the assumptions of ordinary least square regression. In the table, the Lagrange multiplier test indicates that their random-effect model is appropriate as compared to the pooled model; furthermore, the Hausman-test results point out that the fixed-effect model is rather pertinent to the random-effect model. Finally, since the residuals coefficient is not significant, there is no issue of endogeneity among the independent variables and their residuals.

Table 3.

Model diagnostics.

4. Findings

The result of the study is based on the annual data collected from the 80 manufacturing firms from six divergent sectors, which include the chemical, sugar-mill, cement, pharmaceutical, fertilizer, food, and personal-care sectors.

We initially regressed the ordinary least square model that was proposed by [154], and we found significant results; however, the nature of the data is paneled, and the Breusch and Pagan Lagrangian multiplier test is used, which indicates that the random-effect model is better than the pooled OLS model [52,53,149]. Therefore, the Hausman test is applied to test whether the fixed- or random-effect model is considerable [153]. The results in this study are robust and appropriate because the fixed-effect model that we applied on the basis of the Hausman-test findings absorbs the cluster variance to exclude the impact of heterogeneity that exists in the cross-sectional dataset. Moreover, endogeneity tests are also considered, and the data-cleaning process, which indicate that the endogeneity does not exist in the independent variables.

In Table 4, all four models are significant as their p-Values of the F-ratio signal below 5%, and the adjusted R2 of the regression models are 28.4%, 28.5%, and 15.5%, which were accordingly suggested by [154], and which indicate that the models have explanation power.

Table 4.

Fixed-effect results for the manufacturing-sector models.

In the table, it can be observed that, in Column I, our main independent variable, which is the environmental accounting (EA), significantly affects the firm performance, which is measured through the return on asset (ROA). Moreover, it is evident that, with the inclusion of control variables, such as the macroeconomic indicator (GDP) and the firm-specific indicator (firm size), our principal variable shows a significant impact on the firm performance at a 1% significance level. This manifests that firms that are involved in this practice are highly affected by the inclusion of the environmental-accounting aspect. It is evident in the contemporary literature that EA negatively affects the firm performance [91,92]. The results in Column II highlight that the relationship is still existent between EA and FP, with engaging sustainability as the interactive variable, which is similar to the findings of [104,105].

On the contrary, the results in Columns III and IV point out that there is an insignificant impact of the AQ and the AQS on the firm performance measured through the ROA, which indicates that no such relationship exists between the firm’s financial results and the independent audit. In addition, the variable AQ, and its interaction with sustainability, also exhibit insignificance in this study, and we can conclude that there is no impact of the audit-quality and assurance-of-sustainability reporting on the FP. This finding is endorsed by [106,107]. On the other hand, the results that were generated on the basis of the controlled variables (GDP and firm size) are statistically significant in every single model.

On the basis of the determination of the beta coefficients, ROA is negatively correlated with EA separately, and it positively interacts with sustainability. In addition, the control variable (GDP) surges parallel, and the firm size changes in reverse with the firm operational and financial performances, which are measured by the ROA.

As we précised the above findings, we measured that the firm performance through the ROA is highly significant and is correlated with EA. Along with this, e-sustainability through EA plays a significant role as a mediator. On the contrary, the audit quality did not significantly impact the financial performances of the listed firms.

The study is supported by [91,92], which indicates that the firm FP is inversely relevant to the EA. In the context of theory, legitimacy theory backed this study by the conclusion that an increase in the regulatory framework may react negatively toward stakeholders. On the contrary, in comparison to these findings, the empirical studies [89,90,155] are unfavorable, and they build a positive correlation between EA and FP. The validity and invalidity of the hypotheses of the study are shown in Table 5.

Table 5.

Validity and invalidity of the hypotheses.

5. Conclusions

The core aim of this study is to evaluate the degree of the changes in a firm’s financial performance that are due to variations in the EA and the AQ, with and without the sustainability measure, in the context of Pakistan-based industries. The panel data consisted of 80 listed manufacturing firms, with 10 years as the time domain. The robust model was used to eliminate the effect of cross-sectionalism. The theories that support the model are legitimacy theory, resource-based theory, triple-bottom-line theory, and stakeholder theory. The findings suggest that the FP is significantly and negatively affected by EA. Although it is positively affected after addressing sustainability, the dominance indicates that the cost that is related to environmental protection is comparatively high, as firms cannot generate profits on it. Sustainability is dominantly and reversely associated with FP. Moreover, the AQ factor is insignificant in the model, as is supported by many studies, such as [47,48,89,93,152].

Environment sustainability precisely drives the financial efficiency of firms, but in a reverse pattern, and it is underpinned [14,135]. This finding indicates that Pakistani industries are following the guidelines given by the global risk index (GRI), and they are executing voluntary environmental and social responsibility for protection from environmental contamination. In terms of the endogenous variables, the GDP is positive, and the firm size is negatively correlated with the FP, which presents a favorable condition and implies that the economic indicator significantly charges large manufacturers in Pakistan. This study contributes to the execution of the reporting and the assurance of sustainability, and it helps regulatory bodies with the integral development of reporting and the assurance of EA. The practical aspect of this study is to supply guidelines to management in relation to minimizing the wastage, the manufacturing process, and environmental damages. “Environmental accounting is an important tool for understanding the role played by the natural environment in the economy. Environmental accounts provide data which highlight both the contribution of natural resources to economic well-being and the costs imposed by pollution or resource degradation”, as noted by the IUCN [155].

Future Implications and Limitations

The study has a few important implications for managers who work in the manufacturing sector. First is the need to develop a strong orientation and candidness about the use of environment-focused accounting standards and other performance measures. While collecting the data, we strongly realized that the majority of the firms in the manufacturing industry had no clue about environmental accounting. This was true for even the top management of the companies. This dearth of understanding strongly reveals the need for the orientation of the environmental-accounting approach and standards for the firms. Once the organization becomes aware of the environmental-accounting standards, approaches, and benefits, then it will be able to work on its adoption. Second, the organization needs to embed environmental accounting into its sustainability goals. Several organizations claim to be sustainable, but they do not have any understanding of the environmental-accounting standards and disclosures. On the basis of the findings of this study, we argue that a firm cannot properly manage its drive toward sustainability until it takes into account the environmental-accounting standards. We also have some implications for the policymakers and for the government. Until the government and regulatory institutions standardize and emphasize the need for environmental-accounting adoption, its implementation will remain low. Hence, the government and the related regulatory institutions must develop a framework for the adoption of environmental accounting, and must focus on its implementation.

This study covers major manufacturing sectors to evaluate the association of the sustainability between EA and FP. We suggest a comparative analysis between various manufacturing sectors for future study. Additionally, other factors, including corporate governance and the quality of firm reporting, can be used to measure the impact of the EA disclosure and AQ on FP. The exchange rate is the key indicator of the economy, and so this factor can also be considered as a control variable for future study.

Author Contributions

Conceptualization, M.F.M.; Formal analysis, M.M.; Methodology, M.S.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data is available with the corresponding author and will be provided on demand.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Bebbington, J.; Gray, R. An Account of Sustainability: Failure, Success and a Reconceptualization. Crit. Perspect. Account. 2001, 12, 557–587. [Google Scholar] [CrossRef] [Green Version]

- Boutros-Ghali, B. Opening Speech on Environment and Development; Diane Publishing co.: Rio de Janeiro, Brazil, 1992. [Google Scholar]

- Callan, S.J.; Thomas, J.M. Environmental Economics and Management: Theory, Policy, and Applications, 2nd ed.; Cengage Learning: Boston, MA, USA, 2013. [Google Scholar]

- Darabaris, J. Corporate Environmental Management; CRC Press/Taylor and Francis Group: Boca Raton, FL, USA, 2007. [Google Scholar]

- Freeman, R.E. Stakeholder Management: Framework and Philosophy; Edward Elgar Publishing Limited: Mansfield, MA, USA, 1984. [Google Scholar]

- Gray, R. Is Accounting for Sustainability Actually Accounting for Sustainability and How Would We Know? An Exploration of Narratives of Organisations and the Planet. Account. Organ. Soc. 2010, 35, 47–62. [Google Scholar] [CrossRef]

- Gray, R.; Owen, D.; Adams, C. Accounting & Accountability: Changes and Challenges in Corporate Social and Environmental Reporting; Prentice Hall: Hoboken, NJ, USA, 1996; ISBN 978013175860. Available online: https://eprints.gla.ac.uk/95486/ (accessed on 29 March 2022).

- United Nations. Agenda 21 United Nations Conference on Environment & Development Rio de Janeiro; Brazil, 1992. Available online: https://sustainabledevelopment.un.org/content/documents/Agenda21.pdf (accessed on 29 March 2022).

- United Nations. In Proceedings of the United Nations Conference on Sustainable Development, Rio+20, Rio de Janeiro, Brazil, 20 June 2012. Available online: https://sustainabledevelopment.un.org/conferences (accessed on 29 March 2022).

- Unerman, J. Stakeholder Engagement and Dialogue. In Sustainability Accounting and Accountability; Unerman, J., Bebbington, J., O’Dwyer, B., Eds.; Routledge: London, UK, 2007. [Google Scholar]

- Baker, M.; Schaltegger, S. Pragmatism and New Directions in Social and Environmental Accountability Research. Account. Audit. Account. J. 2015, 28, 263–294. [Google Scholar] [CrossRef]

- Capusneanu, S.; Topor, D.I.; Hint, M.S.; Ionescu, C.A.; Coman, M.D.; Paschia, L.; Nicolau, N.L.G.; Ivan, O.R. Mathematical Model for Identifying and Quantifying the Overall Environmental Cost. J. Bus. Econ. Manag. 2020, 21, 1307–1328. [Google Scholar] [CrossRef]

- United Nation Environment Programme. UNEP 2006 Annual Report; United Nation Environment Programme: Nairobi, Kenya, 2006; p. 87. [Google Scholar] [CrossRef]

- Lee, C.T.; Lim, J.S.; Van Fan, Y.; Liu, X.; Fujiwara, T.; Klemeš, J.J. Enabling Low-Carbon Emissions for Sustainable Development in Asia and Beyond. J. Clean. Prod. 2018, 176, 726–735. [Google Scholar] [CrossRef]

- Dowell, G.; Hart, S.; Yeung, B. Do Corporate Global Environmental Standards Create or Destroy Market Value? Manag. Sci. 2000, 46, 1059–1074. [Google Scholar] [CrossRef] [Green Version]

- Chiang, C. Insights into Current Practices in Auditing Environmental Matters. Manag. Audit. J. 2010, 25, 912–933. [Google Scholar] [CrossRef]

- Moalla, M.; Salhi, B.; Jarboui, A. An Empirical Investigation of Factors Influencing the Environmental Reporting Quality: Evidence from France. Soc. Responsib. J. 2020. [Google Scholar] [CrossRef]

- Ganga, G. Green Audit for the Environmental Sustainability. In Green Public Procurement Strategies for Environmental Sustainability; IGI Global: Hershey, PA, USA, 2019; pp. 45–58. [Google Scholar] [CrossRef]

- Abbasi, K.; Jiao, Z.; Shahbaz, M.; Khan, A. Asymmetric Impact of Renewable and Non-Renewable Energy on Economic Growth in Pakistan: New Evidence from a Nonlinear Analysis. Energy Explor. Exploit. 2020, 38, 1946–1967. [Google Scholar] [CrossRef]

- Tadros, H.; Magnan, M. How Does Environmental Performance Map into Environmental Disclosure? A Look at Underlying Economic Incentives and Legitimacy Aims. Sustain. Account. Manag. Policy J. 2019, 10, 62–96. [Google Scholar] [CrossRef]

- Rustam, A.; Wang, Y.; Zameer, H. Does Foreign Ownership Affect Corporate Sustainability Disclosure in Pakistan? A Sequential Mixed Methods Approach. Environ. Sci. Pollut. Res. 2019, 26, 31178–31197. [Google Scholar] [CrossRef] [PubMed]

- Dasanayaka, C.H.; Murphy, D.F.; Nagirikandalage, P.; Abeykoon, C. The Application of Management Accounting Practices towards the Sustainable Development of Family Businesses: A Critical Review. Clean. Environ. Syst. 2021, 3, 100064. [Google Scholar] [CrossRef]

- Baboukardos, D.; Mangena, M.; Ishola, A. Integrated Thinking and Sustainability Reporting Assurance: International Evidence. Bus. Strategy Environ. 2021, 30, 1580–1597. [Google Scholar] [CrossRef]

- Kinney, W.R. Information Quality Assurance and Internal Control for Management Decision Making. Issues Account. Educ. 2000, 15, 347. [Google Scholar]

- Mercer, M. How Do Investors Assess the Credibility of Management Disclosures? Account. Horiz. 2004, 18, 185–196. [Google Scholar] [CrossRef]

- Pflugrath, G.; Roebuck, P.; Simnett, R. Impact of Assurance and Assurer’s Professional Affiliation on Financial Analysts’ Assessment of Credibility of Corporate Social Responsibility Information. Audit. A J. Pract. Theory 2011, 30, 239–254. [Google Scholar] [CrossRef]

- Birkey, R.N.; Michelon, G.; Patten, D.M.; Sankara, J. Does Assurance on CSR Reporting Enhance Environmental Reputation? An Examination in the US Context. In Accounting Forum; Taylor & Francis: Abingdon, UK, 2016; Volume 40, pp. 143–152. [Google Scholar]

- Sheldon, M.D.; Jenkins, J.G. The Influence of Firm Performance and (Level of) Assurance on the Believability of Management’s Environmental Report. Account. Audit. Account. J. 2020, 33, 501–528. [Google Scholar] [CrossRef]

- United Nations. The United Nations Framework Convention on Climate Change (UNFCCC). In Proceedings of the UN Climate Change Conference COP 25, Madrid, Spain, 2–13 December 2019. [Google Scholar]

- Ullah, R.; Malik, R.N.; Qadir, A. Assessment of Groundwater Contamination in an Industrial City, Sialkot, Pakistan. Afr. J. Environ. Sci. Technol. 2009, 3, 429–446. [Google Scholar]

- Almas, Z.-H. Pakistan’s Current Account Deficit: Tackling the Sustainability Issue. Policy Perspect. 2008, 5, 85–113. [Google Scholar]

- Gul, S.; Muhammad, F.; Rashid, A. Corporate Governance and Corporate Social Responsibility: The Case of Small, Medium, and Large Firms. Pak. J. Commer. Soc. Sci. 2017, 11, 1–34. [Google Scholar]

- Rafique, M.A.; Malik, Q.A.; Waheed, A.; Khan, N.-U. Corporate Governance and Environmental Reporting in Pakistan. Pak. Adm. Rev. 2017, 1, 103–114. [Google Scholar]

- Kyoto Protocol. United Nations Framework Convention on Climate Change (UNFCCC). In Kyoto Protocol to the United Nations Framework Convention on Climate Change; Kyoto Protocol: Kyoto, Japan, 1998. [Google Scholar]

- Carroll, A.B. The Pyramid of Corporate Social Responsibility: Toward the Moral Management of Organizational Stakeholders. Bus. Horiz. 1991, 34, 39–48. [Google Scholar] [CrossRef]

- Dillard, J.; Layzell, D. An Ongoing Journey of Corporate Social Responsibility. In Accounting forum; Elsevier: Amsterdam, The Netherlands, 2014; Volume 38, pp. 212–226. [Google Scholar] [CrossRef]

- Freeman, R.E.; Liedtka, J. Corporate Social Responsibility: A Critical Approach. Bus. Horiz. 1991, 34, 92–98. [Google Scholar] [CrossRef]

- O’Dwyer, B. Conceptions of Corporate Social Responsibility: The Nature of Managerial Capture. Account. Audit. Account. J. 2003, 16, 523–557. [Google Scholar] [CrossRef] [Green Version]

- Freedman, M.; Jaggi, B. Pollution Disclosures, Pollution Performance and Economic Performance. Omega 1982, 10, 167–176. [Google Scholar] [CrossRef]

- Friedman, M. Capitalism and Freedom, 1st ed.; University of Chicago Press: Chicago, IL, USA, 1962; Available online: https://press.uchicago.edu/ucp/books/book/chicago/C/bo68666099.html (accessed on 29 March 2022).

- Lauwo, S.; Otusanya, O.J. Corporate Accountability and Human Rights Disclosures: A Case Study of Barrick Gold Mine in Tanzania. Account. Forum 2014, 38, 91–108. [Google Scholar] [CrossRef]

- Sikka, P. Smoke and Mirrors: Corporate Social Responsibility and Tax Avoidance—A Reply to Hasseldine and Morris. Account. Forum 2013, 37, 15–28. [Google Scholar] [CrossRef]

- Sikka, P. Smoke and Mirrors: Corporate Social Responsibility and Tax Avoidance. Account. Forum 2010, 34, 153–168. [Google Scholar] [CrossRef]

- Adams, C.A. The Ethical, Social and Environmental Reporting-Performance Portrayal Gap. Account. Audit. Account. J. 2004, 17, 731–757. [Google Scholar] [CrossRef]

- Belal, A.R.; Cooper, S.M.; Khan, N.A. Corporate Environmental Responsibility and Accountability: What Chance in Vulnerable Bangladesh? Crit. Perspect. Account. 2015, 33, 44–58. [Google Scholar] [CrossRef] [Green Version]

- Cho, C.H.; Michelon, G.; Patten, D.M. Impression Management in Sustainability Reports: An Empirical Investigation of the Use of Graphs. Account. Public Interest 2012, 12, 16–37. [Google Scholar] [CrossRef]

- Hassan, A.; Kouhy, R. Gas Flaring in Nigeria: Analysis of Changes in Its Consequent Carbon Emission and Reporting. Account. Forum 2013, 37, 124–134. [Google Scholar] [CrossRef]

- Deegan, C. EBOOK: Financial Accounting Theory: European Edition; McGraw Hill: New York, NY, USA, 2011; Available online: https://books.google.com.pk/books?hl=en&lr=&id=tsovEAAAQBAJ&oi=fnd&pg=PR1&dq=Deegan,+C.+EBOOK:+Financial+Accounting+Theory:+European+Edition%3B+McGraw+Hill:+New+York,+NY,+USA,+2011&ots=3Jk6MAKD-J&sig=ikmcsS7u9uoJa7gUwxKvWg2WzrQ&redir_esc=y#v=onepage&q&f=false (accessed on 29 March 2022).

- Freedman, M.; Patten, D.M. Evidence on the Pernicious Effect of Financial Report Environmental Disclosure. In Accounting Forum; Elsevier: Amsterdam, The Netherlands, 2004; Volume 28, pp. 27–41. [Google Scholar] [CrossRef]

- Gray, R.; Owen, D.; Maunders, K. Corporate Social Reporting: Emerging Trends in Accountability and the Social Contract. Account. Audit. Account. J. 1988, 1, 6–20. [Google Scholar] [CrossRef]

- Gray, R.; Adams, C.; Owen, D. Accountability, Social Responsibility and Sustainability: Accounting for Society and the Environment: Pearson Higher Ed.; Pearson Education: London, UK, 2014; Available online: https://www.pearson.com/uk/educators/higher-education-educators/program/Gray-Accountability-Social-Responsibility-and-Sustainability-Accounting-for-Society-and-the-Environment/PGM780327.html (accessed on 29 March 2022).

- Gray, R.; Bebbington, J. Accounting for the Environment; Sage: London, UK, 2001; ISBN 9780761971368. Available online: http://eprints.gla.ac.uk/33528/ (accessed on 29 March 2022).

- O’Dwyer, B.; Owen, D.L. Assurance Statement Practice in Environmental, Social and Sustainability Reporting: A Critical Evaluation. Br. Account. Rev. 2005, 37, 205–229. [Google Scholar] [CrossRef]

- Buhr, N. Environmental Performance, Legislation and Annual Report Disclosure: The Case of Acid Rain and Falconbridge. Account. Audit. Account. J. 1998, 11, 163–190. [Google Scholar] [CrossRef]

- Dierkes, M.; Preston, L.E. Corporate Social Accounting Reporting for the Physical Environment: A Critical Review and Implementation Proposal. Account. Organ. Soc. 1977, 2, 3–22. [Google Scholar] [CrossRef]

- Mathews, M.R. Twenty-Five Years of Social and Environmental Accounting Research: Is There a Silver Jubilee to Celebrate? Account. Audit. Account. J. 1997, 10, 481–531. [Google Scholar] [CrossRef]

- Clapp, J. Global Environmental Governance for Corporate Responsibility and Accountability. Glob. Environ. Politics 2005, 5, 23–34. [Google Scholar] [CrossRef]

- Corfee-Morlot, J.; Kamal-Chaoui, L.; Donovan, M.G.; Cochran, I.; Robert, A.; Teasdale, P.-J. Cities, Climate Change and Multilevel Governance; OECD: Paris, France, 2009. [Google Scholar] [CrossRef]

- Jagger, N. Environmental Careers and Environmental Scientists. In The Environment, Employment and Sustainable Development; Routledge: London, UK, 2002; pp. 116–122. [Google Scholar]

- Mitchell, A.V.; Sikka, P. Taming the Corporations; Association for Accountancy & Business Affairs Basildon: 2005. Available online: https://www.yumpu.com/en/document/read/50923267/taming-the-corporations-it-works (accessed on 29 March 2022).

- Anderson, S.; Cavanagh, J. Report on the Top 200 Corporations. In Inst. Policy Stud.; 2000; Available online: https://www.iatp.org/sites/default/files/Top_200_The_Rise_of_Corporate_Global_Power.pdf (accessed on 29 March 2022).

- Sikka, P. Accounting for Human Rights: The Challenge of Globalization and Foreign Investment Agreements. Crit. Perspect. Account. 2011, 22, 811–827. [Google Scholar] [CrossRef]

- World Health Organization; Regional Office for the Eastern Mediterranean. World Health Organization Annual Report 2019 WHO Country Office Lebanon: Health for All. 2020. Available online: https://apps.who.int/iris/bitstream/handle/10665/333249/9789290223214-eng.pdf (accessed on 29 March 2022).

- United Nations Environment Programme. Emissions Gap Report 2020; United Nations Environment Programme: Nairobi, Kenya, 2020; Available online: https://www.unep.org/emissions-gap-report-2020 (accessed on 29 March 2022).

- Hasnat, G.T.; Kabir, M.A.; Hossain, M.A. Major Environmental Issues and Problems of South Asia, Particularly Bangladesh. In Handbook of Environmental Materials Management; 2018; pp. 1–40. Available online: https://www.researchgate.net/publication/323264078_Major_Environmental_Issues_and_Problems_of_South_Asia_Particularly_Bangladesh (accessed on 29 March 2022).

- United Nation Environment Programme. UNEP 2011 Annual Report; United Nation Environment Programme: Nairobi, Kenya, 2011; p. 116. ISBN 978-92-807-3244-3. [Google Scholar]

- Brundtland, G.H. Report of the World Commission on Environment and Development: “Our Common Future”; UN: New York, NY, USA, 1987; pp. 1–300. [Google Scholar]

- Stewart, J.D. The Role of Information in Public Accountability. Issues Public Sect. Account. 1987. Available online: https://sswm.info/sites/default/files/reference_attachments/UN%20WCED%201987%20Brundtland%20Report.pdf (accessed on 29 March 2022).

- Brophy, M.; Starkey, R. Environmental Reporting. Corp. Environ. Manag. 1 Syst. Strategy. 1998, 175–196. [Google Scholar] [CrossRef]

- Noah, A.O. Accounting for the Environment: The Accountability of the Nigerian Cement Industry. Ph.D. Thesis, University of Essex, Essex, UK, 2017. [Google Scholar]

- Adams, C.A.; Hill, W.-Y.; Roberts, C.B. Corporate Social Reporting Practices in Western Europe: Legitimating Corporate Behaviour? Br. Account. Rev. 1998, 30, 1–21. [Google Scholar] [CrossRef]

- Bagur-Femenías, L.; Perramon, J.; Amat, O. Impact of Quality and Environmental Investment on Business Competitiveness and Profitability in Small Service Business: The Case of Travel Agencies. Total Qual. Manag. Bus. Excell. 2015, 26, 840–853. [Google Scholar] [CrossRef]

- Bhattarai, B.; Beilin, R.; Ford, R. Gender, Agrobiodiversity, and Climate Change: A Study of Adaptation Practices in the Nepal Himalayas. World Dev. 2015, 70, 122–132. [Google Scholar] [CrossRef]

- Makori, D.M.; Jagongo, A. Environmental Accounting and Firm Profitability: An Empirical Analysis of Selected Firms Listed in Bombay Stock Exchange, India. Int. J. Humanit. Soc. Sci. 2013, 3, 248–256. [Google Scholar]

- Cormier, D.; Gordon, I.M.; Magnan, M. Corporate Environmental Disclosure: Contrasting Management’s Perceptions with Reality. J. Bus. Ethics 2004, 49, 143–165. [Google Scholar] [CrossRef]

- Neu, D.; Warsame, H.; Pedwell, K. Managing Public Impressions: Environmental Disclosures in Annual Reports. Account. Organ. Soc. 1998, 23, 265–282. [Google Scholar] [CrossRef]

- Oliveira, J.; Rodrigues, L.L.; Craig, R. Risk-Related Disclosures by Non-Finance Companies: Portuguese Practices and Disclosure Characteristics. Manag. Audit. J. 2011, 26, 817–839. [Google Scholar] [CrossRef] [Green Version]

- Kamal, Y.; Deegan, C. Corporate Social and Environment-Related Governance Disclosure Practices in the Textile and Garment Industry: Evidence from a Developing Country. Aust. Account. Rev. 2013, 23, 117–134. [Google Scholar] [CrossRef]

- Camacho-Gingerich, A.; Branco-Rodriguez, S.; Pitteri, R.; Javier, R. Psychological Adjustment, Cultural, and Legal Issues. In Handbook of Adoption: Implications for Researchers, Practitioner, and Families; Sage: Thousand Oaks, CA, USA, 2007; pp. 149–159. [Google Scholar]

- Baker, C.R.; Barbu, E.M. Evolution of Research on International Accounting Harmonization: A Historical and Institutional Perspective. Socio-Econ. Rev. 2007, 5, 603–632. [Google Scholar] [CrossRef]

- Holthausen, R.W. Accounting Standards, Financial Reporting Outcomes, and Enforcement. J. Account. Res. 2009, 47, 447–458. [Google Scholar] [CrossRef] [Green Version]

- Kvaal, E.; Nobes, C. International Differences in IFRS Policy Choice: A Research Note; 2010. Available online: https://www.jstor.org/stable/25548027 (accessed on 29 March 2022).

- Soufeljil, M.; Sghaier, A.; Kheireddine, H.; Mighri, Z. Ownership Structure and Corporate Performance: The Case of Listed Tunisian Firms. J. Bus. Financ. Aff. 2016, 5, 1–8. [Google Scholar]

- Lucia, L.; Panggabean, R.R. The Effect of Firm’s Characteristic and Corporate Governance to Sustainability Report Disclosure. SEEIJ (Soc. Econ. Ecol. Int. J.) 2018, 2, 18–28. [Google Scholar] [CrossRef]

- Eyigege, A.I. Influence of Firm Size on Financial Performance of Deposit Money Banks Quoted on the Nigeria Stock Exchange. Int. J. Econ. Financ. Res. 2018, 4, 297–302. [Google Scholar]

- Babalola, Y.A. The Effect of Firm Size on Firms Profitability in Nigeria. J. Econ. Sustain. Dev. 2013, 4, 90–94. [Google Scholar]

- Hall, M.; Weiss, L. Firm Size and Profitability. Rev. Econ. Stat. 1967, 49, 319–331. [Google Scholar] [CrossRef]

- Marcus, M. Profitability and Size of Firm: Some Further Evidence. Rev. Econ. Stat. 1969, 51, 104–107. [Google Scholar] [CrossRef]

- Chiu, T.-K.; Wang, Y.-H. Determinants of Social Disclosure Quality in Taiwan: An Application of Stakeholder Theory. J. Bus. Ethics 2015, 129, 379–398. [Google Scholar] [CrossRef]

- Roberts, R.W. Determinants of Corporate Social Responsibility Disclosure: An Application of Stakeholder Theory. Account. Organ. Soc. 1992, 17, 595–612. [Google Scholar] [CrossRef] [Green Version]

- Ezeagba, C. Financial Reporting in Small and Medium Enterprises (SMEs) in Nigeria. Challenges and Options. Int. J. Acad. Res. Account. Financ. Manag. Sci. 2017, 7, 1–10. [Google Scholar] [CrossRef] [Green Version]

- Şimsek, H.; Ozturk, G. Evaluation of the Relationship between Environmental Accounting and Business Performance: The Case of Istanbul Province. Green Financ. 2021, 3, 46–58. [Google Scholar] [CrossRef]

- Murray, A.; Sinclair, D.; Power, D.; Gray, R. Do Financial Markets Care about Social and Environmental Disclosure? Further Evidence and Exploration from the UK. Account. Audit. Account. J. 2006, 19, 228–255. [Google Scholar] [CrossRef]

- Chen, L.; Srinidhi, B.; Tsang, A.; Yu, W. Audited Financial Reporting and Voluntary Disclosure of Corporate Social Responsibility (CSR) Reports. J. Manag. Account. Res. 2016, 28, 53–76. [Google Scholar] [CrossRef]

- Montalban, M.; Raduriau, G. Financialisation of Strategies, Risk Transfer, Liquidity, Property and Control (In French); Groupement de Recherches Economiques et Sociales, 2007; Available online: https://econpapers.repec.org/paper/grswpegrs/2007-09.htm (accessed on 29 March 2022).

- Simpson, D.F.; Power, D.J. Use the Supply Relationship to Develop Lean and Green Suppliers. Supply Chain. Manag. Int. J. 2005, 10, 60–68. [Google Scholar] [CrossRef]

- Azapagic, A.; Bore, J.; Cheserek, B.; Kamunya, S.; Elbehri, A. The Global Warming Potential of Production and Consumption of Kenyan Tea. J. Clean. Prod. 2016, 112, 4031–4040. [Google Scholar] [CrossRef]

- Tian, D.; Zhao, F.; Mu, W.; Kanianska, R.; Feng, J. Environmental Efficiency of Chinese Open-Field Grape Production: An Evaluation Using Data Envelopment Analysis and Spatial Autocorrelation. Sustainability 2016, 8, 1246. [Google Scholar] [CrossRef] [Green Version]

- Buallay, A. Sustainability Reporting and Firm’s Performance: Comparative Study between Manufacturing and Banking Sectors. Int. J. Product. Perform. Manag. 2019, 69, 431–445. [Google Scholar] [CrossRef]

- Lozano, R. Analysing the Use of Tools, Initiatives, and Approaches to Promote Sustainability in Corporations. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 982–998. [Google Scholar] [CrossRef]

- Ikpor, I.M.; Bracci, E.; Kanu, C.I.; Ievoli, R.; Okezie, B.; Mlanga, S.; Ogbaekirigwe, C. Drivers of Sustainability Accounting and Reporting in Emerging Economies: Evidence from Nigeria. Sustainability 2022, 14, 3780. [Google Scholar] [CrossRef]

- Ching, H.Y.; Gerab, F.; Toste, T.H. The Quality of Sustainability Reports and Corporate Financial Performance: Evidence from Brazilian Listed Companies. Sage Open 2017. [Google Scholar] [CrossRef]

- Endrikat, J.; Guenther, E.; Hoppe, H. Making Sense of Conflicting Empirical Findings: A Meta-Analytic Review of the Relationship between Corporate Environmental and Financial Performance. Eur. Manag. J. 2014, 32, 735–751. [Google Scholar] [CrossRef]

- Lu, W.; Taylor, M.E. Which Factors Moderate the Relationship between Sustainability Performance and Financial Performance? A Meta-Analysis Study. J. Int. Account. Res. 2016, 15, 1–15. [Google Scholar] [CrossRef]

- Huang, D.Z. Environmental, Social and Governance (ESG) Activity and Firm Performance: A Review and Consolidation. Account. Financ. 2021, 61, 335–360. [Google Scholar] [CrossRef]

- Margolis, J.D.; Elfenbein, H.A.; Walsh, J.P. Does It Pay to Be Good? A Meta-Analysis and Redirection of Research on the Relationship between Corporate Social and Financial Performance. Ann. Arbor. 2007, 1001, 1–68. [Google Scholar]

- Post, C.; Byron, K. Women on Boards and Firm Financial Performance: A Meta-Analysis. Acad. Manag. J. 2015, 58, 1546–1571. [Google Scholar] [CrossRef]

- Joshi, P.L.; Suwaidan, M.S.; Kumar, R. Determinants of Environmental Disclosures by Indian Industrial Listed Companies: Empirical Study. Int. J. Account. Financ. 2011, 3, 109–130. [Google Scholar] [CrossRef]

- Che-Ahmad, A.; Osazuwa, N.P.; Mgbame, C.O. Environmental Accounting and Firm Profitability in Nigeria: Do Firm-Specific Effects Matter? IUP J. Account. Res. Audit. Pract. 2015, 14, 43–54. [Google Scholar]

- Jones, M.J.; Solomon, J.F. Social and Environmental Report Assurance: Some Interview Evidence. In Accounting Forum; Elsevier: Amsterdam, The Netherlands, 2010; Volume 34, pp. 20–31. [Google Scholar] [CrossRef]

- Boiral, O.; Heras-Saizarbitoria, I. Sustainability Reporting Assurance: Creating Stakeholder Accountability through Hyperreality? J. Clean. Prod. 2020, 243. [Google Scholar] [CrossRef]

- Belal, A.R. Environmental Reporting in Developing Countries: Empirical Evidence from Bangladesh. Eco-Manag. Audit. J. Corp. Environ. Manag. 2000, 7, 114–121. [Google Scholar] [CrossRef]

- Christensen, L.; Gallo, P. Firm Size Matters: An Empirical Investigation of Organisational Size and Ownership on Sustainability-Related Behaviours. Bus. Soc. 2011, 50, 315–349. [Google Scholar]

- Dienes, D.; Sassen, R.; Fischer, J. What Are the Drivers of Sustainability Reporting? A Systematic Review. Sustain. Account. Manag. Policy J. 2016. [Google Scholar] [CrossRef]

- Faller, C.M.; zu Knyphausen-Aufseß, D. Does Equity Ownership Matter for Corporate Social Responsibility? A Literature Review of Theories and Recent Empirical Findings. J. Bus. Ethics 2018, 150, 15–40. [Google Scholar] [CrossRef]

- Andrew, B.; Gul, F.; Guthrie, J.; Teoh, H.Y. A Note on Corporate Social Disclosure Practices in Developing Countries: The Case of Malaysia and Singapore. Br. Account. Rev. 1989, 21, 371–376. [Google Scholar] [CrossRef]

- Teoh, H.-Y.; Thong, G. Another Look at Corporate Social Responsibility and Reporting: An Empirical Study in a Developing Country. Account. Organ. Soc. 1984, 9, 189–206. [Google Scholar] [CrossRef]

- Comyns, B. Determinants of GHG Reporting: An Analysis of Global Oil and Gas Companies. J. Bus. Ethics 2016, 136, 349–369. [Google Scholar] [CrossRef]

- Khan, A.; Muttakin, M.B.; Siddiqui, J. Corporate Governance and Corporate Social Responsibility Disclosures: Evidence from an Emerging Economy. J. Bus. Ethics 2013, 114, 207–223. [Google Scholar] [CrossRef]

- Lu, Y.; Abeysekera, I.; Cortese, C. Corporate Social Responsibility Reporting Quality, Board Characteristics and Corporate Social Reputation: Evidence from China. Pac. Account. Rev. 2015, 27, 95–118. [Google Scholar] [CrossRef]

- Dissanayake, D.; Tilt, C.; Xydias-Lobo, M. Sustainability Reporting by Publicly Listed Companies in Sri Lanka. J. Clean. Prod. 2016, 129, 169–182. [Google Scholar] [CrossRef]

- Khan, I.; Wasim, F. Impact of Corporate Governance and Ownership Structure on Capital Structure. Int. J. Manag. Sci. Bus. Res. 2016, 5. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2880423 (accessed on 29 March 2022).

- Belkaoui, A. The Impact of the Disclosure of the Environmental Effects of Organizational Behavior on the Market. Financ. Manag. 1976, 5, 26–31. [Google Scholar] [CrossRef]

- Friedman, M. 13. September 1970, The Social Responsibility of Business Is to Increase Its Profits. New York Times Mag. 1970, 3, 122–126. [Google Scholar]

- Erusalimsky, A.; Gray, R.; Spence, C. Towards a More Systematic Study of Standalone Corporate Social and Environmental: An Exploratory Pilot Study of UK Reporting. Soc. Environ. Account. J. 2006, 26, 12–19. [Google Scholar] [CrossRef]

- Ahmed, S.S.; Guozhu, J.; Mubarik, S.; Khan, M.; Khan, E. Intellectual capital and business performance: The role of dimensions of absorptive capacity. J. Intellect. Capital. 2019, 21, 23–39. [Google Scholar] [CrossRef]

- Deegan, C.; Blomquist, C. Stakeholder Influence on Corporate Reporting: An Exploration of the Interaction between WWF-Australia and the Australian Minerals Industry. Account. Organ. Soc. 2006, 31, 343–372. [Google Scholar] [CrossRef]

- United Nation Development Program (UNDP). United Nation Development Program Annual Report 2006; United Nation Development Program: New York, NY, USA, 2006. [Google Scholar]

- Morgera, E. The UN and Corporate Environmental Responsibility: Between International Regulation and Partnerships. Rev. Eur. Community Int. Environ. Law 2006, 15, 93–109. [Google Scholar] [CrossRef]

- Belal, A.; Momin, M. Corporate Social Reporting (CSR) in Emerging Economies: A Review and Future Direction. Res. Account. Emerg. Econ. 2009, 9. [Google Scholar] [CrossRef]

- Kuasirikun, N.; Sherer, M. Corporate Social Accounting Disclosure in Thailand. Account. Audit. Account. J. 2004, 17, 629–660. [Google Scholar] [CrossRef]

- Maali, B.; Casson, P.; Napier, C. Social Reporting by Islamic Banks. Abacus 2006, 42, 266–289. [Google Scholar] [CrossRef]

- Naser, K.; Al-Hussaini, A.; Al-Kwari, D.; Nuseibeh, R. Determinants of Corporate Social Disclosure in Developing Countries: The Case of Qatar. Adv. Int. Account. 2006, 19, 1–23. [Google Scholar] [CrossRef]

- Balsalobre-Lorente, D.; Sinha, A.; Driha, O.M.; Mubarik, M.S. Assessing the impacts of ageing and natural resource extraction on carbon emissions: A proposed policy framework for European economies. J. Clean. Prod. 2021, 296, 126470. [Google Scholar] [CrossRef]

- Ali, W.; Frynas, J.G.; Mahmood, Z. Determinants of Corporate Social Responsibility (CSR) Disclosure in Developed and Developing Countries: A Literature Review. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 273–294. [Google Scholar] [CrossRef]

- Al Astal, A.Y.M. Empirical Study on Corporate Social Responsibility in United Arab Emirates. Master’s Thesis, Kuala Lumpur: International Islamic University Malaysia, Kuala Lumpur, Malaysia, 2014. Available online: https://lib.iium.edu.my/mom/services/mom/document/getFile/UnZf9tTmOgoTrHwA1cKKxVNx3EFsmUxV20141218150248156 (accessed on 29 March 2022).

- Bae, S.C.; Chang, K.; Yi, H.-C. Corporate Social Responsibility, Credit Rating, and Private Debt Contracting: New Evidence from Syndicated Loan Market. Rev. Quant. Financ. Account. 2018, 50, 261–299. [Google Scholar] [CrossRef]

- Ibrahim, M.S.; Darus, F.; Yusoff, H.; Muhamad, R. Analysis of Earnings Management Practices and Sustainability Reporting for Corporations That Offer Islamic Products & Services. Procedia Econ. Financ. 2015, 28, 176–182. [Google Scholar] [CrossRef] [Green Version]

- Hassan, M.; Khan Afridi, M.; Irfan Khan, M. Energy Policies and Environmental Security: A Multi-Criteria Analysis of Energy Policies of Pakistan. Int. J. Green Energy 2019, 16, 510–519. [Google Scholar] [CrossRef]

- Jacoby, H.D.; Wing, I.S. Adjustment Time, Capital Malleability and Policy Cost. Energy J. 1999, 20. [Google Scholar] [CrossRef]