Role of Distribution Centers Disruptions in New Retail Supply Chain: An Analysis Experiment

Abstract

:1. Introduction

- (1)

- Which node disruption has the greatest impact on the operation and performance of the new retail supply chain?

2. Literature Review

2.1. New Retail/Omnichannel Retail Supply Chain Operation

2.2. Supply Chain Disruption Research with Simulation

3. Case-Study and Simulation Mode

3.1. Case-Study

3.2. Simulation Methods and Models

4. Experimental Results and Analysis

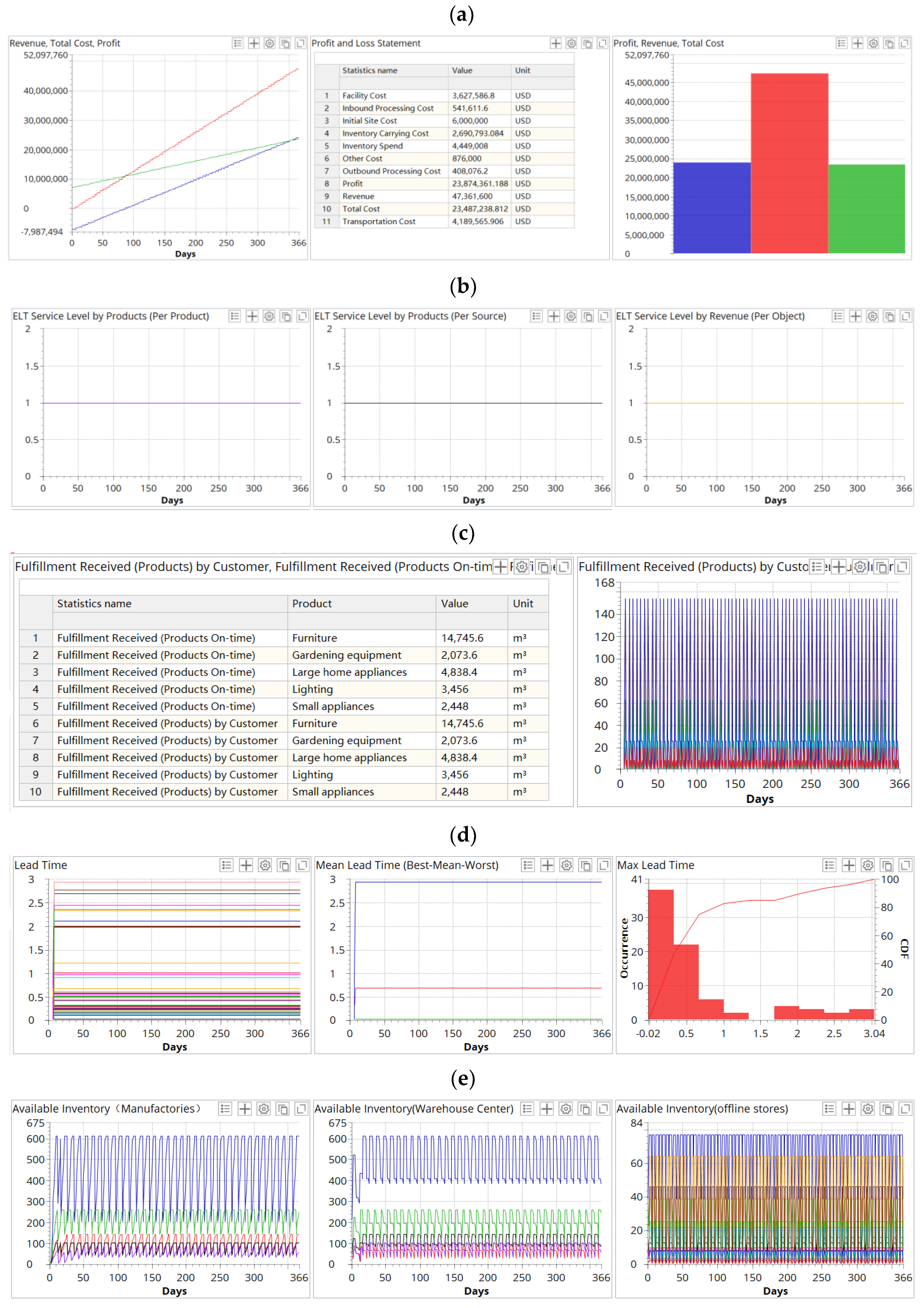

4.1. The Supply Chain Performance and Analysis without Disruption

4.2. The Supply Chain Performance and Analysis with Disruption

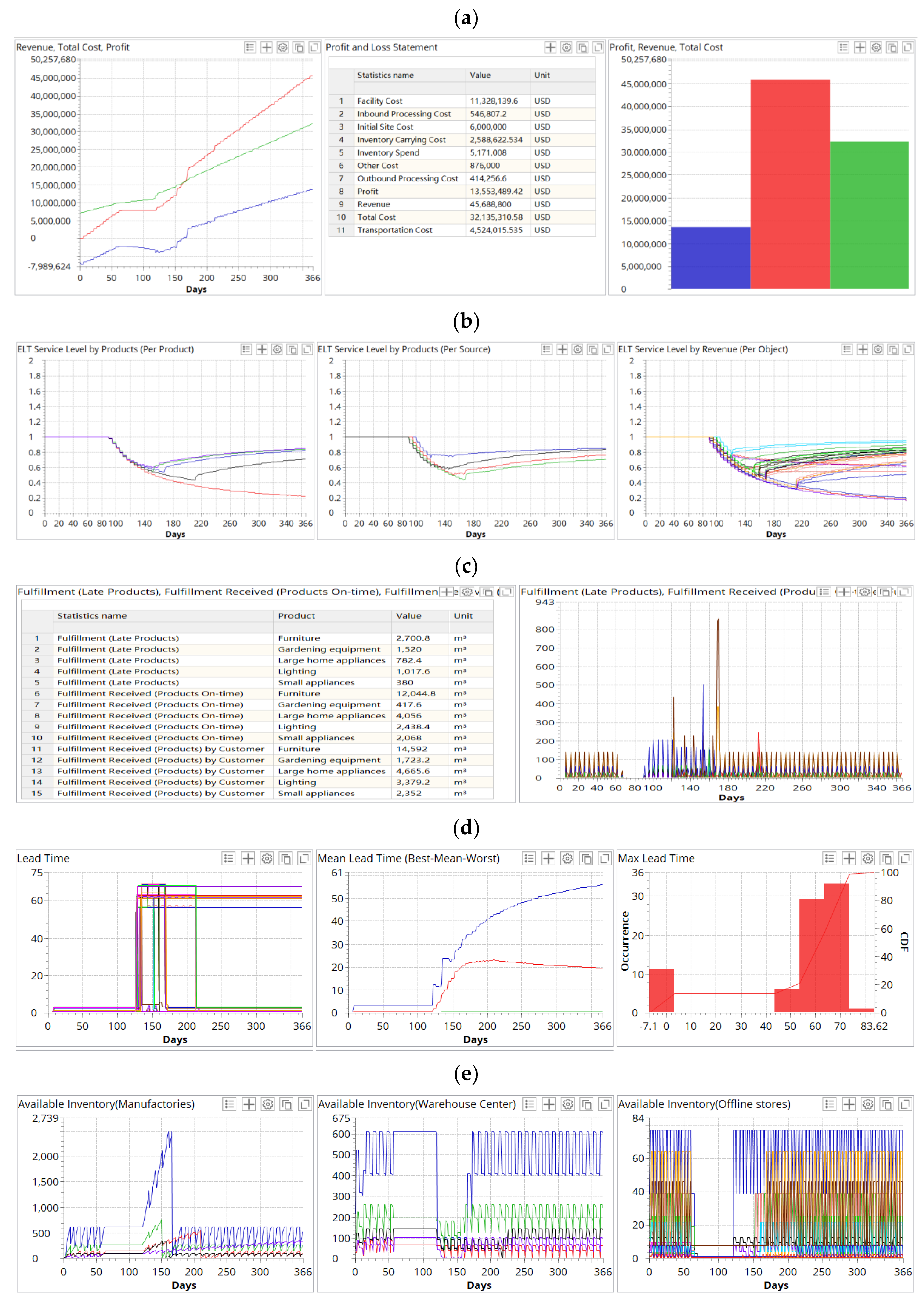

4.2.1. Disruption Occurs at the Manufacturer

4.2.2. Disruption Occurs at the Warehouse Center

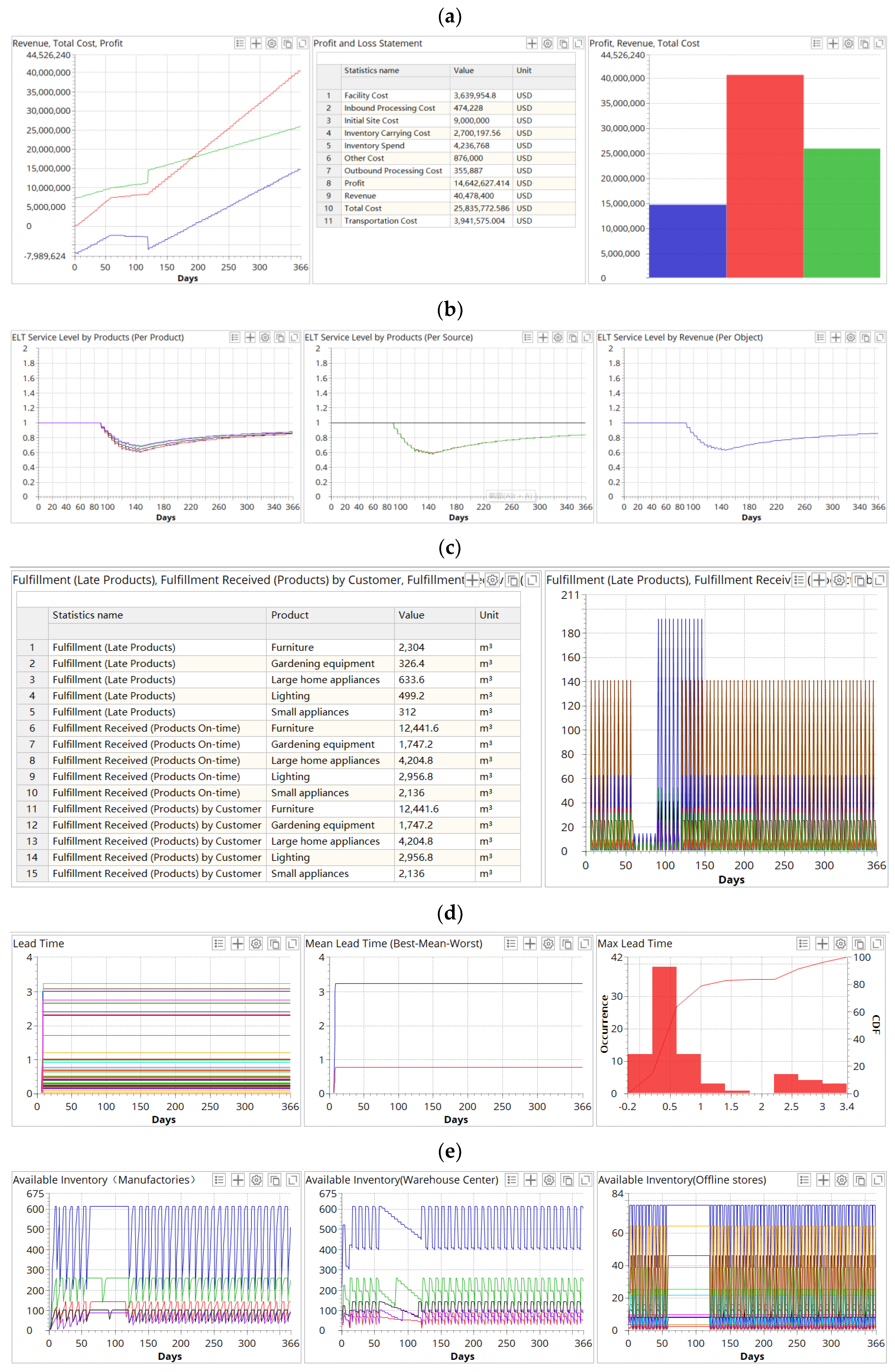

4.2.3. Disruption Occurs at the Offline Store

5. Conclusions and Future Research

- How do disruptions affect the operation and performance of the new retail supply chain?

- Which node disruption has the greatest impact on the operation and performance of the new retail supply chain?

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Gao, F.; Su, X. Omnichannel Retail Operations with Buy-Online-and-Pick-up-in-Store. Manag. Sci. 2017, 63, 2478–2492. [Google Scholar] [CrossRef] [Green Version]

- Jerath, K.; Netessine, S.; Veeraraghavan, S.K. Revenue Management with Strategic Customers: Last-Minute Selling and Opaque Selling. Manag. Sci. 2010, 56, 430–448. [Google Scholar] [CrossRef] [Green Version]

- Ofek, E.; Katona, Z.; Sarvary, M. “Bricks and Clicks”: The Impact of Product Returns on the Strategies of Multichannel Retailers. Mark. Sci. 2011, 30, 42–60. [Google Scholar] [CrossRef] [Green Version]

- Cao, E. Coordination of Dual-Channel Supply Chains Under Demand Disruptions Management Decisions. Int. J. Prod. Res. 2014, 52, 7114–7131. [Google Scholar] [CrossRef]

- Heydari, J.; Aslani, A.; Sabbaghnia, A. A Collaborative Scenario-Based Decision Model for A Disrupted Dual-Channel Supply Chain Benchmarking Against the Centralized Structure. Benchmarking Int. J. 2019, 27, 933–957. [Google Scholar] [CrossRef]

- Huang, G.; Ding, Q.; Dong, C.; Pan, Z. Joint Optimization of Pricing and Inventory Control for Dual-Channel Problem under Stochastic Demand. Ann. Oper. Res. 2021, 298, 307–337. [Google Scholar] [CrossRef]

- Soleimani, F.; Khamseh, A.A.; Naderi, B. Optimal Decisions in A Dual-Channel Supply Chain Under Simultaneous Demand and Production Cost Disruptions. Ann. Oper. Res. 2016, 243, 301–321. [Google Scholar] [CrossRef]

- Song, H.; Chao, Y.; Xi, Z. Pricing and Production Decisions in Dual-Channel Supply Chains with Demand Disruptions. Comput. Ind. Eng. 2012, 62, 70–83. [Google Scholar] [CrossRef]

- Wang, X.; Chi, T.N. New Retail Versus Traditional Retail in E-Commerce: Channel Establishment, Price Competition, and Consumer Recognition. Ann. Oper. Res. 2020, 291, 921–937. [Google Scholar] [CrossRef]

- Li, S. Research on the Integrated Development Model of e-Commerce Channel and Physical Retail Channel. In Proceedings of the 9th International Symposium, ISICA 2017, Guangzhou, China, 18–19 November 2017; Revised Selected Papers, Part II. pp. 273–279. [Google Scholar]

- Wang, Y.; Chang, J. Future Development Trend of “New Retail” and E-Commerce Based on Big Data. J. Phys. Conf. Ser. 2021, 1852, 032029. [Google Scholar] [CrossRef]

- Li, G.; Zhang, T.; Tayi, G.K. Inroad into Omni-Channel Retailing: Physical Showroom Deployment of An Online Retailer. Eur. J. Oper. Res. 2020, 283, 676–691. [Google Scholar] [CrossRef]

- Rigby, D. The Future of Shopping. Harv. Bus. Rev. 2011, 89, 65–76. [Google Scholar]

- von Briel, F. The Future of Omnichannel Retail: A Four-Stage Delphi Study. Technol. Forecast. Soc. Chang. 2018, 132, 217–229. [Google Scholar] [CrossRef]

- Wei, S. Analysis of Marketing Innovation Under the New Retail Mode-Taking “Luckin coffee” as an Example. In Proceedings of the E3S Web of Conferences, Dali, China, 18–20 December 2020; Volume 235, p. 01074. [Google Scholar] [CrossRef]

- Zhang, S.; Zhong, F.; Zhang, J.; Du, D.; Yuan, M. Research on Online Shopping Return Mode in “New Retail” Era. In Proceedings of the IOP Conference Series Earth and Environmental Science, Changchun, China, 21–23 August 2020; Volume 526, p. 012199. [Google Scholar] [CrossRef]

- Wang, O.; Somogyi, S.; Charlebois, S. Food Choice in the E-Commerce Era: A Comparison between Business-To-Consumer (B2C), Online-To-Offline (O2O) and New Retail. Br. Food J. 2020, 122, 1215–1237. [Google Scholar] [CrossRef]

- Ding, D.; Lannes, B.; Zhu, L.; Gao, H.; Peng, L.; Song, F.; Jiang, Z. Embracing China’s New Retail. Available online: http://www.bain.com/publications/articles/embracing-chinas-new-retail.aspx (accessed on 13 March 2018).

- Zhang, A.; Liang, C.; Yin, J. How Can Dmall Do Better? Discussion on New Retail Marketing Mode Based on 4Cs Theory. In Proceedings of the 2018 International Conference on E-Business and Applications, Da Nang, Viet Nam, 23–25 February 2018; pp. 46–50. [Google Scholar] [CrossRef]

- Zhang, J.; Xu, Q.; He, Y. Omnichannel Retail Operations with Consumer Returns and Order Cancellation. Transp. Res. Part E Logist. Transp. Rev. 2018, 118, 308–324. [Google Scholar] [CrossRef]

- Avery, J.; Steenburgh, T.J.; Deighton, J.; Caravella, M. Adding Bricks to Clicks: Predicting the Patterns of Cross-Channel Elasticities Over Time. J. Mark. 2012, 76, 96–111. [Google Scholar] [CrossRef]

- Shao, X. Omnichannel Retail Move in A Dual-Channel Supply Chain. Eur. J. Oper. Res. 2021, 294, 936–950. [Google Scholar] [CrossRef]

- Xie, D.; Chen, H. Coordinating Dual-Channel Supply Chain Under Price Mechanism with Production Cost Disruption. Manag. Sci. Eng. 2015, 9, 1–7. [Google Scholar] [CrossRef]

- World Bank. The Global Economic Outlook during the COVID-19 Pandemic: A Changed World. Available online: https://www.worldbank.org/en/news/feature/2020/06/08/the-global-economic-outlook-during-the-covid-19-pandemic-a-changed-world (accessed on 4 June 2021).

- Goswami, S.; Chouhan, V. Impact of Change in Consumer Behaviour and Need Prioritisation on Retail Industry in Rajasthan During COVID-19 Pandemic. Mater. Today Proc. 2021, 46, 10262–10267. [Google Scholar] [CrossRef]

- Obaka, A.I. Effect of COVID-19 on Retail Businesses in Nigeria: A Survey of Selected SMEs. Discov. Med. 2020, 56, 748–765. [Google Scholar]

- Sharma, M.; Luthra, S.; Joshi, S.; Kumar, A. Accelerating Retail Supply Chain Performance Against Pandemic Disruption: Adopting Resilient Strategies to Mitigate the Long-Term Effects. J. Enterp. Inf. Manag. 2021, 34, 1844–1873. [Google Scholar] [CrossRef]

- Evans, O. Socio-Economic Impacts of Novel Coronavirus: The Policy Solutions. BizEcons Q. 2020, 7, 3–12. [Google Scholar] [CrossRef] [Green Version]

- Goddard, E. The Impact of COVID-19 on Food Retail and Food Service in Canada: Preliminary Assessment. Can. J. Agric. Econ.-Rev. Can. D Agroecon. 2020, 68, 157–161. [Google Scholar] [CrossRef]

- Bhatti, A.; Akram, H.; Basit, H.M.; Khan, A.U.; Raza, S.M.; Naqvi, M.B. E-commerce Trends during COVID-19 Pandemic. Int. J. Future Gener. Commun. Netw. 2020, 13, 1449–1452. [Google Scholar]

- Roggeveen, A.L.; Sethuraman, R. How the COVID-19 Pandemic May Change the World of Retailing. J. Retail. 2020, 96, 169–171. [Google Scholar] [CrossRef]

- Sayyida, S.; Hartini, S.; Gunawan, S.; Husin, S.N. The Impact of the Covid-19 Pandemic on Retail Consumer Behavior. Aptisi Trans. Manag. 2021, 5, 79–88. [Google Scholar] [CrossRef]

- Gao, F.; Su, X. Online and Offline Information for Omnichannel Retailing. Manuf. Serv. Oper. Manag. 2017, 19, 84–98. [Google Scholar] [CrossRef] [Green Version]

- Li, H. Omni-Channel Operations with Showrooms and Consumer Returns. In Proceedings of the 2018 15th International Conference on Service Systems and Service Management (ICSSSM), Hangzhou, China, 21–22 July 2018; pp. 1–6. [Google Scholar] [CrossRef]

- Gu, Z.; Tayi, G.K. Consumer Pseudo-Showrooming and Omni-Channel Placement Strategies. Mis Q. 2017, 41, 583–606. [Google Scholar] [CrossRef]

- Bell, D.R.; Gallino, S.; Moreno, A. Offline Showrooms in Omnichannel Retail: Demand and Operational Benefits. Manag. Sci. 2017, 64, 1477–1973. [Google Scholar] [CrossRef]

- He, Y.; Xu, Q.; Wu, P. Omnichannel Retail Operations with Refurbished Consumer Returns. Int. J. Prod. Res. 2020, 58, 271–290. [Google Scholar] [CrossRef]

- Gallino, S.; Moreno, A. Integration of Online and Offline Channels in Retail: The Impact of Sharing Reliable Inventory Availability Information. Manag. Sci. 2014, 60, 1434–1451. [Google Scholar] [CrossRef] [Green Version]

- Jin, M.; Li, G.; Cheng, T.C.E. Buy Online and Pick Up In-Store: Design of The Service Area. Eur. J. Oper. Res. 2018, 268, 613–623. [Google Scholar] [CrossRef]

- Alikhani, R.; Torabi, S.A.; Altay, N. Retail Supply Chain Network Design with Concurrent Resilience Capabilities. Int. J. Prod. Econ. 2021, 234, 108042. [Google Scholar] [CrossRef]

- Sadghiani, N.S.; Torabi, S.A.; Sahebjamnia, N. Retail Supply Chain Network Design Under Operational and Disruption Risks. Transp. Res. Part E Logist. Transp. Rev. 2015, 75, 95–114. [Google Scholar] [CrossRef]

- Llaguno, A.; Mula, J.; Campuzano-Bolarin, F. State of The Art, Conceptual Framework and Simulation Analysis of The Ripple Effect on Supply Chains. Int. J. Prod. Res. 2021, 60, 2044–2066. [Google Scholar] [CrossRef]

- Dolgui, A.; Ivanov, D.; Sokolov, B. Ripple Effect in The Supply Chain: An Analysis and Recent Literature. Int. J. Prod. Res. 2018, 56, 414–430. [Google Scholar] [CrossRef] [Green Version]

- Carvalho, H.; Barroso, A.P.; Machado, V.H.; Azevedo, S.G.; Cruz-Machado, V. Supply Chain Redesign for Resilience Using Simulation. Comput. Ind. Eng. 2012, 62, 329–341. [Google Scholar] [CrossRef]

- Ivanov, D. Disruption Tails and Revival Policies: A Simulation Analysis of Supply Chain Design and Production-Ordering Systems in The Recovery and Post-Disruption Periods. Comput. Ind. Eng. 2019, 127, 558–570. [Google Scholar] [CrossRef]

- Ivanov, D.; Rozhkov, M. Coordination of Production and Ordering Policies Under Capacity Disruption and Product Write-Off Risk: An Analytical Study with Real-Data Based Simulations of a Fast Moving Consumer Goods Company. Ann. Oper. Res. 2017, 291, 387–407. [Google Scholar] [CrossRef]

- Ivanov, D.; Pavlov, A.; Dolgui, A.; Pavlov, D.; Sokolov, B. Disruption-Driven Supply Chain (Re)-Planning and Performance Impact Assessment with Consideration of Pro-Active and Recovery Policies. Transp. Res. Part E Logist. Transp. Rev. 2016, 90, 7–24. [Google Scholar] [CrossRef] [Green Version]

- Schmitt, A.J.; Singh, M. A Quantitative Analysis of Disruption Risk in A Multi-Echelon Supply Chain. Int. J. Prod. Econ. 2012, 139, 22–32. [Google Scholar] [CrossRef]

- Ivanov, D. Simulation-Based Ripple Effect Modelling in The Supply Chain. Int. J. Prod. Res. 2017, 55, 2083–2101. [Google Scholar] [CrossRef]

- Xu, M.; Wang, X.; Zhao, L. Predicted Supply Chain Resilience Based on Structural Evolution Against Random Supply Disruptions. Int. J. Syst. Sci. Oper. Logist. 2014, 1, 105–117. [Google Scholar] [CrossRef]

- Ivanov, D. Revealing Interfaces of Supply Chain Resilience and Sustainability: A Simulation Study. Int. J. Prod. Res. 2018, 56, 3507–3523. [Google Scholar] [CrossRef] [Green Version]

- Ivanov, D. Exiting The COVID-19 Pandemic: After-Shock Risks and Avoidance of Disruption Tails in Supply Chains. Ann. Oper. Res. 2021, 1–18. [Google Scholar] [CrossRef]

- Wilson, M.C. The Impact of Transportation Disruptions on Supply Chain Performance. Transp. Res. Part E Logist. Transp. Rev. 2007, 43, 295–320. [Google Scholar] [CrossRef]

- Thomas, A.V.; Mahanty, B. Dynamic Assessment of Control System Designs of Information Shared Supply Chain Network Experiencing Supplier Disruption. Oper. Res. 2021, 21, 425–451. [Google Scholar] [CrossRef]

- Thomas, V.A.; Mahanty, B. Assessment of Emergency Sourcing Strategy of a Supply Chain Through Dynamic Simulation Approach. J. Ind. Prod. Eng. 2020, 37, 56–69. [Google Scholar] [CrossRef]

- Battini, D.; Ivanov, D.; Gianesello, P. Closed-Loop Supply Chain Simulation with Disruption Considerations: A Case-Study on Tesla. Int. J. Inventory Res. 2017, 4, 257. [Google Scholar] [CrossRef] [Green Version]

- Ivanov, D. Simulation-Based Single vs. Dual Sourcing Analysis in The Supply Chain with Consideration of Capacity Disruptions, Big Data and Demand Patterns. Int. J. Integr. Supply Manag. 2017, 11, 24–43. [Google Scholar] [CrossRef]

- Ivanov, D.; Sokolov, B.; Solovyeva, I.; Dolgui, A.; Jie, F. Dynamic Recovery Policies for Time-Critical Supply Chains Under Conditions of Ripple Effect. Int. J. Prod. Res. 2016, 54, 7245–7258. [Google Scholar] [CrossRef]

- Yan, B.; Jin, Z.; Liu, Y.; Yang, J. Decision on Risk-Averse Dual-Channel Supply Chain Under Demand Disruption. Commun. Nonlinear Sci. Numer. Simul. 2018, 55, 206–224. [Google Scholar] [CrossRef] [Green Version]

- Chen, K.; Xiao, T. Demand disruption and coordination of the supply chain with a dominant retailer. Eur. J. Oper. Res. 2009, 197, 225–234. [Google Scholar] [CrossRef]

- Xu, M.; Qi, X.; Gang, Y.; Zhang, H.; Gao, C. The Demand Disruption Management Problem for A Supply Chain System with Nonlinear Demand Functions. J. Syst. Sci. Syst. Eng. 2003, 12, 82–97. [Google Scholar] [CrossRef]

- Unnikrishnan, A.; Figliozzi, M. Online Freight Network Assignment Model with Transportation Disruptions and Recourse. Transp. Res. Rec. J. Transp. Res. Board 2011, 2224, 17–25. [Google Scholar] [CrossRef] [Green Version]

- Cavallo, A.; Cavallo, E.; Rigobon, R. Prices and Supply Disruptions during Natural Disasters. NBER Working Paper No. w19474. Available online: https://ssrn.com/abstract=2332544 (accessed on 28 September 2013).

- Hou, J.; Zeng, A.Z.; Zhao, L. Coordination with A Backup Supplier Through Buy-Back Contract Under Supply Disruption. Transp. Res. Part E Logist. Transp. Rev. 2010, 46, 881–895. [Google Scholar] [CrossRef]

- Li, J.; Wang, S.; Cheng, T.C.E. Competition and Cooperation in A Single-Retailer Two-Supplier Supply Chain with Supply Disruption. Int. J. Prod. Econ. 2010, 124, 137–150. [Google Scholar] [CrossRef]

- Kinra, A.; Ivanov, D.; Das, A.; Dolgui, A. Ripple Effect Quantification by Supplier Risk Exposure Assessment. Int. J. Prod. Res. 2020, 58, 5559–5578. [Google Scholar] [CrossRef]

| Products | Price (USD) | Cost (USD) |

|---|---|---|

| Furniture | 1100 | 400 |

| Lighting | 700 | 300 |

| Small appliances | 270 | 120 |

| Large home appliances | 850 | 350 |

| Gardening equipment | 800 | 350 |

| Object | Inventory Policy | Production Time (Unit/Day) | ||

|---|---|---|---|---|

| Min | Max | Initial Stock | ||

| Manufactory1 | ||||

| Furniture | 384 | 768 | 384 | 0.01 |

| Lighting | 180 | 360 | 180 | 0.03 |

| Manufactory2 | ||||

| Small appliances | 510 | 1020 | 510 | 0.008 |

| Large home appliances | 324 | 648 | 324 | 0.015 |

| Manufactory3 | ||||

| Gardening equipment | 108 | 216 | 108 | 0.06 |

| Online platform | ||||

| Furniture | 384 | 768 | 384 | |

| Lighting | 180 | 360 | 180 | |

| Small appliances | 510 | 1020 | 510 | |

| Large home appliances | 324 | 648 | 324 | |

| Gardening equipment | 108 | 216 | 108 | |

| Offline stores | ||||

| Furniture | 117 | 234 | 117 | |

| Lighting | 58 | 116 | 58 | |

| Small appliances | 162 | 324 | 162 | |

| Large home appliances | 96 | 192 | 96 | |

| Gardening equipment | 37 | 74 | 37 | |

| Group | Provides |

|---|---|

| Finances | Detailed information on generated revenue and incurred expenses |

| Service Level | Detailed information on the quality of provided delivery services |

| Lead Time | The total time for each product from the upstream facilities to the downstream facilities |

| Fulfillment | Order fulfillment, including Late Products, Received Products, On-time Received Products |

| Available Inventory | Describes the daily average dynamic inventory quantity of each product |

| Scenarios | Revenue | Total Cost | Profit | ELT | Lead Time |

|---|---|---|---|---|---|

| Normal-state | 47,361,600 | 23,487,238.812 | 23,874,361.188 | 1.000 | 54 |

| M1 disruption | 47,361,600 | 28,421,001.970 | 18,940,598.030 | 0.832 | 888 |

| Warehouse center disruption | 45,688,800 | 32,135,310.580 | 13,553,489.420 | 0.767 | 1110 |

| Offline store disruption | 40,478,400 | 25,835,772.586 | 14,642,627.414 | 0.852 | 63 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ding, C.; Liu, L.; Zheng, Y.; Liao, J.; Huang, W. Role of Distribution Centers Disruptions in New Retail Supply Chain: An Analysis Experiment. Sustainability 2022, 14, 6529. https://doi.org/10.3390/su14116529

Ding C, Liu L, Zheng Y, Liao J, Huang W. Role of Distribution Centers Disruptions in New Retail Supply Chain: An Analysis Experiment. Sustainability. 2022; 14(11):6529. https://doi.org/10.3390/su14116529

Chicago/Turabian StyleDing, Can, Li Liu, Yi Zheng, Jianxiu Liao, and Wenxing Huang. 2022. "Role of Distribution Centers Disruptions in New Retail Supply Chain: An Analysis Experiment" Sustainability 14, no. 11: 6529. https://doi.org/10.3390/su14116529

APA StyleDing, C., Liu, L., Zheng, Y., Liao, J., & Huang, W. (2022). Role of Distribution Centers Disruptions in New Retail Supply Chain: An Analysis Experiment. Sustainability, 14(11), 6529. https://doi.org/10.3390/su14116529