Empirical Research on the Influence Mechanisms of Digital Resources Input on Service Innovation in China’s Finance Industry

Abstract

:1. Introduction

2. Theoretical Model and Research Hypotheses

2.1. Digital Resource Input and Service Innovation

2.2. Digital Resource Input, Information Sharing, and Service Innovation

2.3. Digital Resource Input, Value Creation, and Service Innovation

2.4. Moderating Roles of Network Openness

2.5. Moderating Roles of Big Data Technology Capability

3. Methods

3.1. Sampling Methodology and Data Collection

3.1.1. Sampling Methodology

3.1.2. Data Collection and Structure

3.1.3. Research Methods

3.2. Variable Measure and Regression Model

3.2.1. Explained Variables and Explanatory Variables

3.2.2. Intermediary Variables

3.2.3. Moderator Variables

3.2.4. Control Variables

3.2.5. Regression Model Selection

+ β6Optimize + β7Industry + β8 Role + ε

+ β6Optimize + β7 Industry + β8 Role + ε

+ β6Optimize + β7 Industry + β8 Role + ε

+ β6 Optimize + β7 Industry + β8 Role + ε

4. Empirical Test and Results

4.1. Harman Single Factor Analysis

4.2. Descriptive and Correlation Analysis

4.3. Analysis of Regression Results

4.3.1. Main Effect: Digital Resource Input Has a Positive Impact on Service Innovation

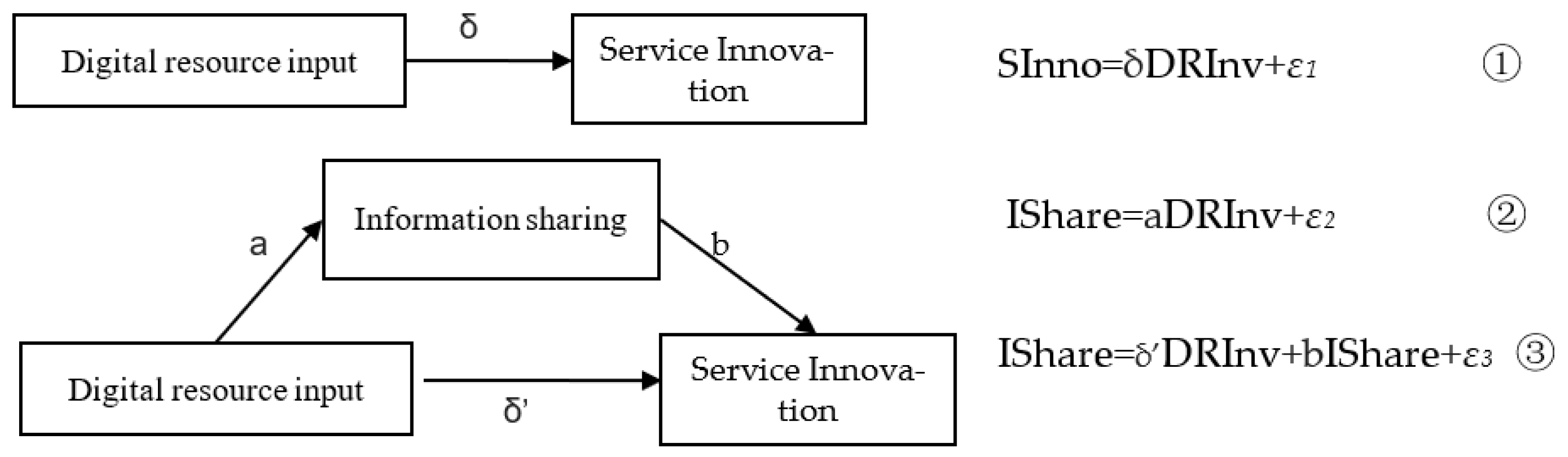

4.3.2. Mediating Effect: The Mediating Effect of Information Sharing and Value Creation

- (1)

- Testing the mediating effect of digital resource input, information sharing, and service innovation

- (2)

- Testing the mediating effect of digital resource input, value creation, and service innovation

4.3.3. Moderating Effect of Network Openness and Big Data Technology Capability

5. Discussions

6. Conclusions and Future Work

6.1. Conclusions

6.2. Possibilities of Future Work

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wang, Z.W.; Yin, H.L. Science and Technology Insurance and Regional Innovation: Evidence from Provincial Panel Data in China. Technol. Anal. Strateg. Manag. 2022, 34, 1054348. [Google Scholar] [CrossRef]

- Wang, X.; Wang, L.; Wang, S. Marketisation as a channel of international technology diffusion and green total factor productivity: Research on the spillover effect from China’s first-tier cities. Technol. Anal. Strat. Manag. 2020, 33, 491–504. [Google Scholar] [CrossRef]

- Liu, N.; Fan, F. Threshold effect of international technology spillovers on China’s regional economic growth. Technol. Anal. Strateg. Manag. 2020, 32, 923–935. [Google Scholar] [CrossRef]

- Chen, X.H.; Yan, D.; Chen, W. Can the digital economy promote FinTech development? Growth Change 2022, 53, 221–247. [Google Scholar] [CrossRef]

- Wang, J.; Xie, Z. Learning from institutional diversity to innovate: A study of Chinese exporters in digital industries. Int. J. Technol. Manag. 2021, 87, 384–411. [Google Scholar] [CrossRef]

- Vicente-Saez, R.; Gustafsson, R.; Martinez-Fuentes, C. Opening up science for a sustainable world: An expansive normative structure of open science in the digital era. Sci. Public Policy 2021, 48, 799–813. [Google Scholar] [CrossRef]

- Wang, J.; Li, X.; Wang, P.; Liu, Q. Bibliometric analysis of digital twin literature: A review of influencing factors and conceptual structure. Technol. Anal. Strat. Manag. 2022, 34, 2026320. [Google Scholar] [CrossRef]

- Xie, X.; Wu, Y.; Sendra Garcia, F.J. Gendered linguistic structures and the innovation performance of new ventures in emerging countries: The moderating effects of digitalisation and the entrepreneurial ecosystem. Int. J. Technol. Manag. 2021, 87, 46–77. [Google Scholar] [CrossRef]

- Sefyrin, J.; Gustafsson, M.; Wihlborg, E. Addressing digital diversity: Care matters in vulnerable digital relations in a Swedish library context. Sci. Public Policy 2021, 48, 841–848. [Google Scholar] [CrossRef]

- Vargo, S.L.; Lusch, R.F. Service dominant logic: Continuing the evolution. J. Acad. Mark. Sci. 2008, 25, 1–10. [Google Scholar] [CrossRef]

- Thanasopon, B.; Papadopoulos, T.; Vidgen, R. The role of openness in the fuzzy front-end of service innovation. Technovation 2015, 47, 32–46. [Google Scholar] [CrossRef]

- Cheng, C.C.J.; Krumwiede, D. What makes a manufacturing firm effective for service innovation: The role of intangible capital under strategic and environmental conditions. Int. J. Prod. Econ. 2017, 193, 113–122. [Google Scholar] [CrossRef]

- Pur, S.; Huesig, S.; Schmidhammer, C. Application and validation of a disruptive potential methodology for digital two-sided platforms-the case of marketplace lending in Germany. Int. J. Technol. Manag. 2022, 88, 205–246. [Google Scholar] [CrossRef]

- Wu, T.; Chen, B.; Shao, Y.; Lu, H. Enable digital transformation: Entrepreneurial leadership, ambidextrous learning and organisational performance. Technol. Anal. Strat. Manag. 2021, 33, 1389–1403. [Google Scholar] [CrossRef]

- Zhou, J.; Liu, C.; Xing, X.; Li, J. How can digital technology-related acquisitions affect a firm’s innovation performance? Int. J. Technol. Manag. 2021, 87, 254–283. [Google Scholar] [CrossRef]

- Hakala, H. Strategic Orientations in Management Literature: Three Approaches to Understanding the Interaction between Market, Technology, Entrepreneurial and Learning Orientations. Int. J. Manag. Rev. 2010, 13, 199–217. [Google Scholar] [CrossRef]

- Laukkanen, T.; Nagy, G.; Hirvonen, S.; Reijonen, H.; Pasanen, M. The effect of strategic orientations on business performance in SMEs. Int. Mark. Rev. 2013, 30, 510–535. [Google Scholar] [CrossRef]

- Hughes, P.; Morgan, R.E.; Kouropalatis, Y. Market knowledge diffusion and business performance. Eur. J. Mark. 2008, 42, 1372–1395. [Google Scholar] [CrossRef]

- Besson, P.; Rowe, F. Strategizing information systems-enabled organizational transformation: A transdisciplinary review and new directions. J. Strateg. Inf. Syst. 2012, 21, 103–124. [Google Scholar] [CrossRef]

- Wang, Y.; Su, X. Driving factors of digital transformation for manufacturing enterprises: A multi-case study from China. Int. J. Technol. Manag. 2021, 87, 229–253. [Google Scholar] [CrossRef]

- Arndt, F.; Ng, W.; Huang, T. Do-It-Yourself laboratories, communities of practice, and open innovation in a digitalised environment. Technol. Anal. Strat. Manag. 2021, 33, 1186–1197. [Google Scholar] [CrossRef]

- Pihlajamaa, M.; Malmelin, N.; Wallin, A. Competence combination for digital transformation: A study of manufacturing companies in Finland. Technol. Anal. Strat. Manag. 2021, 33, 2004111. [Google Scholar] [CrossRef]

- Zheng, Y.; Han, W. Does government behaviour or enterprise investment improve regional innovation performance?—Evidence from China. Int. J. Technol. Manag. 2021, 85, 274–296. [Google Scholar] [CrossRef]

- Garzella, S.; Fiorentino, R.; Caputo, A.; Lardo, A. Business model innovation in SMEs: The role of boundaries in the digital era. Technol. Anal. Strat. Manag. 2020, 33, 31–43. [Google Scholar] [CrossRef]

- Schillo, R.S.; Ebrahimi, H. Gender dimensions of digitalisation: A comparison of Venture Capital backed start-ups across fields. Technol. Anal. Strat. Manag. 2021, 33, 1918336. [Google Scholar] [CrossRef]

- Chu, W.; Kang, M. The effects of customers’ perceived relational benefits on the customer conception of service innovation at service centers for it products: The mediating role of customer participation. J. Adm. Sci. Technol. 2014, 35, 213–235. [Google Scholar]

- Witell, L.; Snyder, H.; Gustafsson, A. Defining service innovation: A review and synthesis. J. Bus. Res. 2016, 19, 2863–2872. [Google Scholar] [CrossRef] [Green Version]

- Hsu, T.T.; Tsai, K.H.; Hsieh, M.H. Strategic orientation and new product performance: The roles of technological capability. Can. J. Adm. Sci. 2014, 31, 44–58. [Google Scholar] [CrossRef]

- Yu, F.; Jiang, D.; Zhang, Y.; Du, H. Enterprise digitalisation and financial performance: The moderating role of dynamic capability. Technol. Anal. Strat. Manag. 2021, 33, 1980211. [Google Scholar] [CrossRef]

- Lemaire, S.L.L.; Bertrand, G.; Maalaoui, A.; Kraus, S.; Jones, P. How women entrepreneurs manage the digitalisation of their business initiating a dialogue between the entrepreneurship as practice approach and the theory of bricolage. Int. J. Technol. Manag. 2021, 87, 78–104. [Google Scholar] [CrossRef]

- Tsou, H.-T.; Chen, J.-S. How does digital technology usage benefit firm performance? Digital transformation strategy and organisational innovation as mediators. Technol. Anal. Strat. Manag. 2021, 33, 1991575. [Google Scholar] [CrossRef]

- Popkova, E.G.; Sergi, B.S.; Rezaei, M.; Ferraris, A. Digitalisation in transport and logistics: A roadmap for entrepreneurship in Russia. Int. J. Technol. Manag. 2021, 87, 7–28. [Google Scholar] [CrossRef]

- Margherita, A.; Nasiri, M.; Papadopoulos, T. The application of digital technologies in company responses to COVID-19: An integrative framework. Technol. Anal. Strat. Manag. 2021, 33, 1990255. [Google Scholar] [CrossRef]

- Nevo, S.; Wade, M. The formation and value of IT-enabled Resources: Antecedents and consequences of synergistic relationships. MIS Q. 2010, 34, 163–183. [Google Scholar] [CrossRef] [Green Version]

- Azma, F.; Mostafapour, M.A.; Rezaei, H. The application of information technology and its relationship with organizational intelligence. Procedia Technol. 2012, 1, 94–97. [Google Scholar] [CrossRef] [Green Version]

- Berman, S.J. Digital transformation: Opportunities to create new business models. Strategy Leadersh. 2012, 40, 16–24. [Google Scholar] [CrossRef]

- Helkkula, A.; Kowalkowski, C.; Tronvoll, B. Archetypes of service innovation: Implications for value cocreation. J. Serv. Res. 2018, 32, 284–301. [Google Scholar] [CrossRef] [Green Version]

- Lepak, D.P.; Smith, K.G. Value creation and value capture: A multilevel perspective. Acad. Manag. Rev. 2007, 32, 180–194. [Google Scholar] [CrossRef] [Green Version]

- Bharadwaj, A.A. Resource-based perspective on information technology: Technology capability and firm performance. MIS Q. 2000, 24, 169–196. [Google Scholar] [CrossRef]

- Mithas, S.; Tafti, A.; Mitchell, W. How a firm’s competitive environment and digital strategic posture influence digital business strategy. MIS Q. 2013, 37, 511–536. [Google Scholar] [CrossRef] [Green Version]

- Rusanen, H.; Halinen, A.; Jaakkola, E. Accessing resources for service innovation: The critical role of network relationships. J. Serv. Manag. 2014, 45, 223–225. [Google Scholar] [CrossRef]

- Barras, R. Towards a theory of innovation in services. Res. Policy 1986, 15, 161–173. [Google Scholar] [CrossRef]

- Maine, E.; Lubik, S.; Garnsey, E. Process-based vs. product-based innovation: Value creation by nanotech ventures. Tech-Novation. 2012, 32, 179–192. [Google Scholar] [CrossRef]

- Lu, H.; Du, D.; Qin, X. Assessing the Dual Innovation Capability of National Innovation System: Empirical Evidence from 65 Countries. Systems 2022, 10, 23. [Google Scholar] [CrossRef]

- Ryu, H.S.; Lee, J.N. Understanding the role of technology in service innovation: Comparison of three theoretical perspectives. Inf. Manag. 2018, 16, 294–307. [Google Scholar] [CrossRef] [Green Version]

- Sun, C.Z.; Yan, X.D.; Zhao, L.S. Coupling efficiency measurement and spatial correlation characteristic of water-energy-food nexus in China. Resour. Conserv. Recycl. 2021, 164, 105151. [Google Scholar] [CrossRef]

- Fan, F.; Du, D.B. The Measure and the Characteristics of Temporal-spatial Evolution of China Science and Technology Resource Allocation Efficiency. J. Geogr. Sci. 2014, 24, 492–508. [Google Scholar] [CrossRef]

- Wang, S.; Wang, X.L.; Lu, F. The impact of collaborative innovation on ecological efficiency—Empirical research based on China’s regions. Technol. Anal. Strateg. Manag. 2020, 32, 242–256. [Google Scholar] [CrossRef]

- Wang, S.; Zhang, J.Q. The symbiosis of scientific and technological innovation efficiency and economic efficiency in China—An analysis based on data envelopment analysis and logistic model. Technol. Anal. Strateg. Manag. 2019, 31, 67–80. [Google Scholar] [CrossRef]

- Xie, J.; Sun, Q.; Wang, S.; Li, X. Does Environmental Regulation Affect Export Quality? Theory and Evidence from China. Int. J. Environ. Res. Public Health 2020, 17, 8237. [Google Scholar] [CrossRef]

- Wang, X.; Wang, L.; Zhang, X. The spatiotemporal evolution of COVID-19 in China and its impact on urban economic resilience. China Econ. Rev. 2022, 74, 101806. [Google Scholar] [CrossRef]

- Yu, H.C.; Zhang, J.Q. Agglomeration and flow of innovation elements and the impact on regional innovation efficiency. Int. J. Technol. Manag. 2022, 28, 12564. [Google Scholar]

- Wang, Z.W.; Zong, Y.X.; Dan, Y.W.; Jiang, S.J. Country risk and international trade: Evidence from the China-B & R countries. Appl. Econ. Lett. 2021, 28, 1784–1788. [Google Scholar]

- Fan, F.; Zhang, X. Transformation effect of resource-based cities based on PSM-DID model: An empirical analysis from China. Environ. Impact Assess. Rev. 2021, 91, 106648. [Google Scholar] [CrossRef]

- Ke, H.; Dai, S. Does innovation efficiency inhibit the ecological footprint? An empirical study of China’s provincial regions. Technol. Anal. Strat. Manag. 2021, 33, 1959910. [Google Scholar] [CrossRef]

- Zhang, J.Q.; Chen, T.T. Empirical Research on Time-Varying Characteristics and Efficiency of the Chinese Economy and Monetary Policy: Evidence from the MI-TVP-VAR Model. Appl. Econ. 2018, 50, 3596–3613. [Google Scholar] [CrossRef]

- Fan, F.; Lian, H.; Liu, X.; Wang, X. Can environmental regulation promote urban green innovation Efficiency? An empirical study based on Chinese cities. J. Clean. Prod. 2020, 287, 125060. [Google Scholar] [CrossRef]

- Xiao, Z.L.; Du, X.Y. Convergence in China’s high-tech industry development performance: A spatial panel model. Appl. Econ. 2017, 49, 5296–5308. [Google Scholar]

- Ke, H.; Dai, S.; Yu, H. Spatial effect of innovation efficiency on ecological footprint: City-level empirical evidence from China. Environ. Technol. Innov. 2021, 22, 101536. [Google Scholar] [CrossRef]

- Wang, S.; Wang, J.; Wei, C.; Wang, X. Collaborative innovation efficiency: From within cities to between cities—Empirical analysis based on innovative cities in China. Growth Chang. 2021, 52, 1330–1360. [Google Scholar] [CrossRef]

- Yang, W.Y.; Fan, F.; Wang, X.L. Knowledge innovation network externalities in the Guangdong-Hong Kong-Macao Greater Bay Area: Borrowing size or agglomeration shadow? Technol. Anal. Strateg. Manag. 2021, 33, 1940922. [Google Scholar] [CrossRef]

- Wang, S.; Wang, J.; Wang, Y.; Wang, X. Spillover and Re-Spillover in China’s Collaborative Innovation. Int. Reg. Sci. Rev. 2022. [Google Scholar] [CrossRef]

- Yu, H.C.; Zhang, J.Q. Industrial collaborative agglomeration and green economic efficiency—Based on the intermediary effect of technical change. Growth Change 2022, 53, 578–596. [Google Scholar]

- Zhang, J.; Wang, S.; Yang, P. Analysis of Scale Factors on China’s Sustainable Development Efficiency Based on Three-Stage DEA and a Double Threshold Test. Sustainability 2020, 12, 2225. [Google Scholar] [CrossRef] [Green Version]

- Fan, F.; Lian, H.; Wang, S. Can regional collaborative innovation improve innovation efficiency? An empirical study of Chinese cities. Growth Chang. 2019, 51, 440–463. [Google Scholar] [CrossRef]

- Wang, S.; Wang, J. The hidden mediating role of innovation efficiency in coordinating development of economy and ecological environment: Evidence from 283 Chinese cities. Environ. Sci. Pollut. Res. 2021, 28, 47668–47684. [Google Scholar] [CrossRef]

- Wang, S.; Hou, D.L. The Mediation Effect of Innovation in the Domestic and International Economic Development Circulation. Technol. Anal. Strateg. Manag. 2022, 34, 1054535. [Google Scholar] [CrossRef]

- Fan, F.; Zhang, X.; Yang, W.; Liu, C. Spatiotemporal Evolution of China’s Ports in the International Container Transport Network under Upgraded Industrial Structure. Transp. J. 2021, 60, 43–69. [Google Scholar] [CrossRef]

- Zhang, H.; Lan, T.; Li, Z.L. Fractal evolution of urban street networks in form and structure: A case study of Hong Kong. Int. J. Geogr. Inf. Sci. 2022, 36, 1100–1118. [Google Scholar] [CrossRef]

- Fan, F.; Zhang, X.Y.; Wang, X.L. Are there political cycles hidden inside collaborative innovation efficiency? An empirical study based on Chinese cities. Sci. Public Policy 2022, 45, 101093005. [Google Scholar] [CrossRef]

- Zhao, L.S.; Hu, R.; Sun, C.Z. Analyzing the spatial-temporal characteristics of the marine economic efficiency of countries along the Maritime Silk Road and the influencing factors. Ocean. Coast. Manag. 2021, 204, 105517. [Google Scholar] [CrossRef]

- Fan, F.; Zhang, K.; Dai, S.; Wang, X. Decoupling analysis and rebound effect between China’s urban innovation capability and resource consumption. Technol. Anal. Strat. Manag. 2021, 33, 1979204. [Google Scholar] [CrossRef]

- Liu, S.; Fan, F.; Zhang, J. Are Small Cities More Environmentally Friendly? An Empirical Study from China. Int. J. Environ. Res. Public Health 2019, 16, 727. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Wang, S.; Jia, M.; Zhou, Y. Impacts of changing urban form on ecological efficiency in China: A comparison between urban agglomerations and administrative areas. J. Environ. Plan. Manag. 2019, 63, 1834–1856. [Google Scholar] [CrossRef]

- Yu, H.C.; Liu, Y.; Liu, C.L. Spatiotemporal Variation and Inequality in China’s Economic Resilience across Cities and Urban Agglomerations. Sustainability 2018, 10, 4754. [Google Scholar] [CrossRef] [Green Version]

- Choi, Y.K. The impact of a platform company’s open innovation activities on its firm value: In the perspective of the venture ecosystem. Technol. Anal. Strateg. Manag. 2022, 34, 322–334. [Google Scholar] [CrossRef]

- Zhu, Q.Y.; Sun, C.Z.; Zhao, L.S. Effect of the marine system on the pressure of the food–energy–water nexus in the coastal regions of China. J. Clean. Prod. 2021, 319, 1–12. [Google Scholar] [CrossRef]

- Fan, F.; Dai, S.; Zhang, K.; Ke, H. Innovation agglomeration and urban hierarchy: Evidence from Chinese cities. Appl. Econ. 2021, 53, 6300–6318. [Google Scholar] [CrossRef]

- Thacher, T.D.; Pludowski, P.; Shaw, N.J.; Mughal, M.Z.; Munns, C.F.; Högler, W. Nutritional rickets in immigrant and refugee children. Public Health Rev. 2016, 37, 3. [Google Scholar] [CrossRef] [Green Version]

- Fan, F.; Cao, D.; Ma, N. Is Improvement of Innovation Efficiency Conducive to Haze Governance? Empirical Evidence from 283 Chinese Cities. Int. J. Environ. Res. Public Health 2020, 17, 6095. [Google Scholar] [CrossRef]

- Tang, H.; Zhang, J. High-speed rail, urban form, and regional innovation: A time-varying difference-in-differences approach. Technol. Anal. Strat. Manag. 2022, 34, 2026322. [Google Scholar] [CrossRef]

- Yu, H.; Zhang, J.; Zhang, M. Cross-national knowledge transfer, absorptive capacity, and total factor productivity: The intermediary effect test of international technology spillover. Technol. Anal. Strat. Manag. 2021, 34, 625–640. [Google Scholar] [CrossRef]

- Fichman, R.G.; Santos, B.; Zheng, Z. Digital innovation as a fundamental and powerful concept in the information systems curriculum. MIS Q. 2014, 38, 329–354. [Google Scholar] [CrossRef] [Green Version]

- Nambisan, S. Software firm evolution and innovation–orientation. J. Eng. Technol. Manag. 2002, 19, 141–165. [Google Scholar] [CrossRef]

- Stauss, B.; Hertog, P.D.; Wietze, V. Capabilities for managing service innovation: Towards a conceptual framework. J. Serv. Manag. 2010, 12, 490–514. [Google Scholar]

| Variables | Frequency | Percentage | |

|---|---|---|---|

| Type of industry | bank | 122 | 37.42% |

| insurance | 56 | 17.18% | |

| trust | 46 | 14.11% | |

| securities | 63 | 19.33% | |

| leasing | 39 | 11.96% | |

| Team role | general manager | 8 | 2.45% |

| senior executive | 85 | 26.07% | |

| core member | 135 | 41.41% | |

| rank and file | 98 | 30.06% | |

| Number of employees | 1–50 | 56 | 17.18% |

| 51–200 | 113 | 34.66% | |

| 201–1000 | 94 | 28.83% | |

| more than 1000 | 63 | 19.33% | |

| Operations duration | 1 year | 19 | 5.83% |

| 2–3 years | 35 | 10.74% | |

| 4–5 years | 65 | 19.94% | |

| more than 5 years | 207 | 63.50% | |

| Digital transformation years | 1 year | 9 | 2.76% |

| 2–3 years | 83 | 25.46% | |

| 4–5 years | 67 | 20.55% | |

| more than 5 years | 167 | 51.23% | |

| Total Variance Interpretation | ||||||

|---|---|---|---|---|---|---|

| Initial Eigenvalue | Extract the Sum of Squares of Loads | |||||

| Component | Total | Variance Percentage | Cumulative % | Total | Variance Percentage | Cumulative % |

| 1 | 14.76 | 20.78 | 20.78 | 14.76 | 20.78 | 20.78 |

| 2 | 2.77 | 3.9 | 24.68 | 2.77 | 3.9 | 24.68 |

| 3 | 2.44 | 3.44 | 28.12 | 2.44 | 3.44 | 28.12 |

| 4 | 2.01 | 2.83 | 30.95 | 2.01 | 2.83 | 30.95 |

| 5 | 1.97 | 2.77 | 33.72 | 1.97 | 2.77 | 33.72 |

| 6 | 1.88 | 2.64 | 36.36 | 1.88 | 2.64 | 36.36 |

| 7 | 1.77 | 2.49 | 38.85 | 1.77 | 2.49 | 38.85 |

| 8 | 1.63 | 2.29 | 41.14 | 1.63 | 2.29 | 41.14 |

| 9 | 1.56 | 2.19 | 43.33 | 1.56 | 2.19 | 43.33 |

| 10 | 1.53 | 2.15 | 45.48 | 1.53 | 2.15 | 45.48 |

| 11 | 1.51 | 2.13 | 47.61 | 1.51 | 2.13 | 47.61 |

| 12 | 1.47 | 2.07 | 49.69 | 1.47 | 2.07 | 49.69 |

| 13 | 1.41 | 1.98 | 51.67 | 1.41 | 1.98 | 51.67 |

| 14 | 1.36 | 1.92 | 53.59 | 1.36 | 1.92 | 53.59 |

| 15 | 1.31 | 1.84 | 55.42 | 1.31 | 1.84 | 55.42 |

| 16 | 1.24 | 1.75 | 57.17 | 1.24 | 1.75 | 57.17 |

| 17 | 1.21 | 1.7 | 58.87 | 1.21 | 1.7 | 58.87 |

| 18 | 1.16 | 1.63 | 60.5 | 1.16 | 1.63 | 60.5 |

| 19 | 1.1 | 1.55 | 62.05 | 1.1 | 1.55 | 62.05 |

| 20 | 1.07 | 1.5 | 63.56 | 1.07 | 1.5 | 63.56 |

| 21 | 1.03 | 1.45 | 65.01 | 1.03 | 1.45 | 65.01 |

| Variable | Variable Symbol | Observed Value | Minimum Value | Maximum Value | Median | Mean | Standard Deviation |

|---|---|---|---|---|---|---|---|

| Digital resource input | DRInv | 326 | 1.173 | 5.000 | 4.333 | 4.213 | 0.481 |

| Service innovation | SInno | 326 | 1.286 | 5.000 | 4.143 | 4.154 | 0.478 |

| Information sharing | IShare | 326 | 1.400 | 5.000 | 4.400 | 4.237 | 0.528 |

| Value creation | VCrea | 326 | 2.400 | 5.000 | 4.212 | 4.125 | 0.621 |

| Big data technology capability | BDTech | 326 | 2.000 | 5.000 | 4.167 | 4.064 | 0.514 |

| Network openness | Open | 326 | 1.167 | 5.000 | 4.333 | 4.152 | 0.511 |

| Number of employees | Number | 326 | 1.000 | 4.000 | 3.000 | 2.627 | 0.989 |

| Time of the company | Time | 326 | 1.000 | 4.000 | 4.000 | 3.743 | 0.606 |

| Average time of optimize | Optimize | 326 | 1.000 | 4.000 | 4.000 | 3.236 | 0.918 |

| Variable | DRInv | SInno | IShare | VCrea | BDTech | Open | Number | DRInv | Optimize |

|---|---|---|---|---|---|---|---|---|---|

| DRInv | 1 | ||||||||

| SInno | 0.256 *** | 1 | |||||||

| IShare | 0.325 *** | 0.427 *** | 1 | ||||||

| VCrea | 0.310 *** | 0.326 *** | 0.198 *** | 1 | |||||

| BDTech | 0.287 *** | 0.279 *** | 0.324 *** | 0.323 *** | 1 | ||||

| Open | 0.239 *** | 0.215 *** | 0.237 *** | 0.255 *** | 0.322 *** | 1 | |||

| Number | 0.054 | 0.049 | 0.060 | −0.020 | 0.036 | 0.072 | 1 | ||

| Time | 0.146 * | 0.158 ** | 0.116 * | 0.092 | 0.006 | 0.069 | 0.171 ** | 1 | |

| Optimize | 0.329 *** | 0.227 *** | 0.219 *** | 0.129 * | 0.219 *** | 0.305 *** | 0.285 *** | 0.196 *** | 1 |

| Variable | Coefficient | T Value | Significant |

|---|---|---|---|

| constant | 1.173 *** | 3.668 | 0.000 |

| DRInv | 0.610 *** | 9.950 | 0.000 |

| Number | 0.005 | 0.285 | 0.861 |

| Time | 0.055 | 1.194 | 0.234 |

| Optimize | −0.005 | −0.183 | 0.851 |

| Industry | control | ||

| Role | control | ||

| R2 value | 0.438 | ||

| Sample | 326 | ||

| Model | Mediating Effect of Information Sharing | Mediating Effect of Value Creation | ||||

|---|---|---|---|---|---|---|

| Variable | Service Innovation (1) | Information Share (2) | Service Innovation (3) | Service Innovation (4) | Value Creation (5) | Service Innovation (6) |

| DRInv | 0.610 *** (9.950) | 0.602 *** (8.842) | 0.385 *** (6.569) | 0.610 *** (9.950) | 0.544 *** (7.868) | 0.342 *** (6.748) |

| IShare | 0.374 *** (7.323) | |||||

| VCrea | 0.493 *** (11.017) | |||||

| BDTech | ||||||

| Number | 0.005 (0.285) | 0.019 (0.583) | −0.002 (−0.101) | 0.005 (0.285) | −0.019 (−0.580) | 0.014 (0.665) |

| Time | 0.055 (1.194) | 0.020 (0.356) | 0.047 (1.157) | 0.055 (1.194) | 0.036 (0.639) | 0.037 (1.012) |

| Optimize | −0.005 (−0.183) | 0.019 (0.491) | −0.012 (−0.428) | −0.005 (−0.183) | −0.027 (−0.684) | 0.008 (0.325) |

| Intercept | 1.173 *** (3.668) | 1.423 *** (3.653) | 0.641 ** (2.176) | 1.173 *** (3.668) | 1.781 *** (4.507) | 0.294 (1.104) |

| Industry | control | control | control | control | control | control |

| Role | control | control | control | control | control | control |

| R2 value | 0.438 | 0.327 | 0.554 | 0.438 | 0.296 | 0.647 |

| VIF value | <2 | <2 | <2 | <2 | <2 | <2 |

| Sample | 326 | 326 | 326 | 326 | 326 | 326 |

| Moderating Effect of Big Data Technology Capability | Moderating Effect of Network Openness | |||||||

|---|---|---|---|---|---|---|---|---|

| Variable | Model 1 Service Innovation | Model 2 Service Innovation | Model 3 Service Innovation | Model 4 Service Innovation | Model 5 Information Sharing | Model 6 Information Sharing | Model 7 Value Creation | Model 8 Value Creation |

| Intercept | 1.425 *** (4.822) | 3.309 *** (3.123) | 1.009 *** (3.746) | 0.299 (0.260) | 1.423 *** (3.653) | −0.165 (−0.128) | 1.781 *** (4.507) | 3.658 *** (2.787) |

| The main effect | ||||||||

| DRInv | 0.602 *** (8.842) | 0.466 (1.489) | 0.544 *** (7.868) | −0.432 (−1.358) | ||||

| IShare | 0.550 *** (11.524) | −0.286 (−1.146) | ||||||

| VCrea | 0.639 *** (14.747) | 0.491 (1.769) | ||||||

| BDTech | −0.292 (−1.023) | 0.380 (1.283) | ||||||

| Open | 0.705 ** (2.023) | −0.257 (−0.726) | ||||||

| Moderating effect | ||||||||

| DRInv × Open | 0.039 (0.465) | 0.193 ** (2.270) | ||||||

| IShare × BDTech | 0.169 ** (2.526) | |||||||

| VCrea × BDTech | 0.008 (0.109) | |||||||

| Control | ||||||||

| Number | −0.013 (−0.503) | −0.003 (−0.146) | 0.010 (0.424) | 0.008 (0.378) | 0.019 (0.583) | 0.017 (0.623) | −0.019 (−0.580) | −0.018 (−0.618) |

| Time | 0.044 (0.971) | 0.081 * (1.990) | 0.031 (0.782) | 0.072 (1.929) | 0.020 (0.356) | 0.055 (1.129) | 0.036 (0.639) | 0.077 (1.556) |

| Optimize | 0.033 (1.058) | 0.004 (0.132) | 0.058 * (2.128) | 0.021 (0.823) | 0.019 (0.491) | −0.031 (−0.889) | −0.027 (−0.684) | −0.091 ** (−2.540) |

| Industry | control | control | control | control | control | control | control | control |

| Role | control | control | control | control | control | control | control | control |

| R2 value | 0.460 | 0.577 | 0.568 | 0.646 | 0.327 | 0.499 | 0.296 | 0.475 |

| VIF value | <2 | <2 | <2 | <2 | <2 | <2 | <2 | <2 |

| Sample | 326 | 326 | 326 | 326 | 326 | 326 | 326 | 326 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, M.; Jiang, W. Empirical Research on the Influence Mechanisms of Digital Resources Input on Service Innovation in China’s Finance Industry. Sustainability 2022, 14, 7143. https://doi.org/10.3390/su14127143

Liu M, Jiang W. Empirical Research on the Influence Mechanisms of Digital Resources Input on Service Innovation in China’s Finance Industry. Sustainability. 2022; 14(12):7143. https://doi.org/10.3390/su14127143

Chicago/Turabian StyleLiu, Mingxia, and Wei Jiang. 2022. "Empirical Research on the Influence Mechanisms of Digital Resources Input on Service Innovation in China’s Finance Industry" Sustainability 14, no. 12: 7143. https://doi.org/10.3390/su14127143