An Optimal Dispatching Model for Integrated Energy Microgrid Considering the Reliability Principal–Agent Contract

Abstract

:1. Introduction

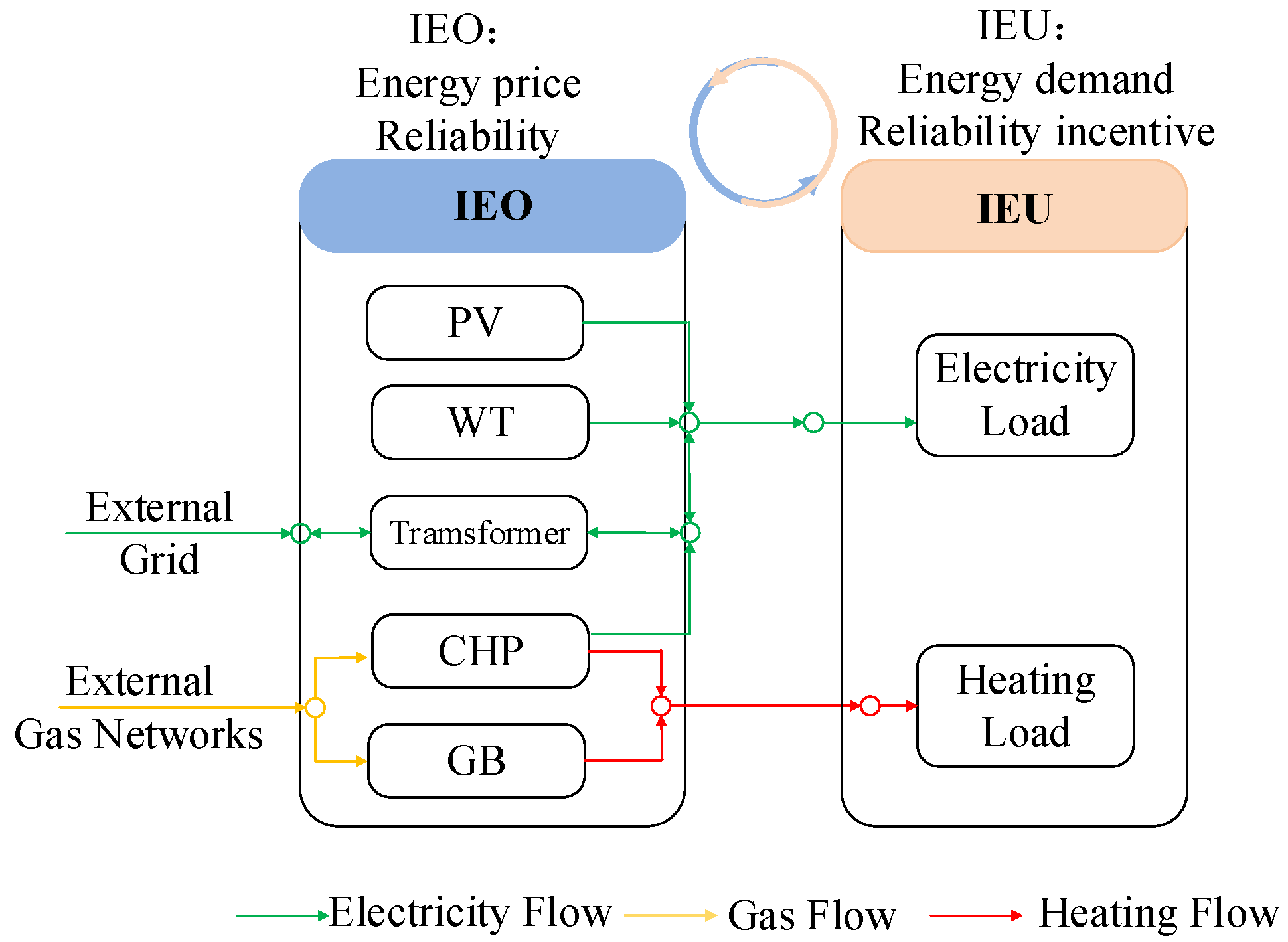

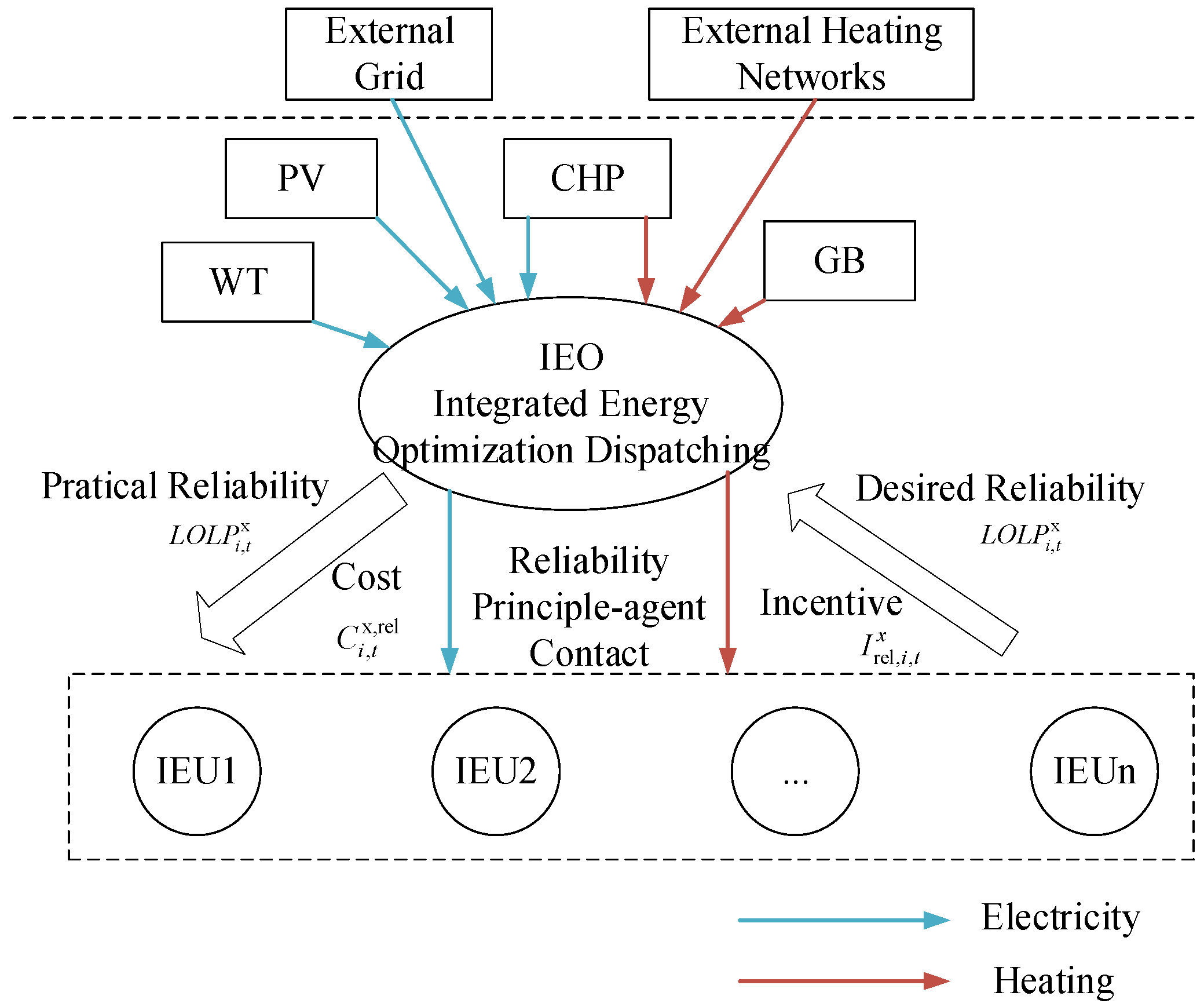

2. Energy Reliability Principal-Agent Model

2.1. Reliability Principal-Agent Function

2.2. Reliability Principal-Agent Constraint

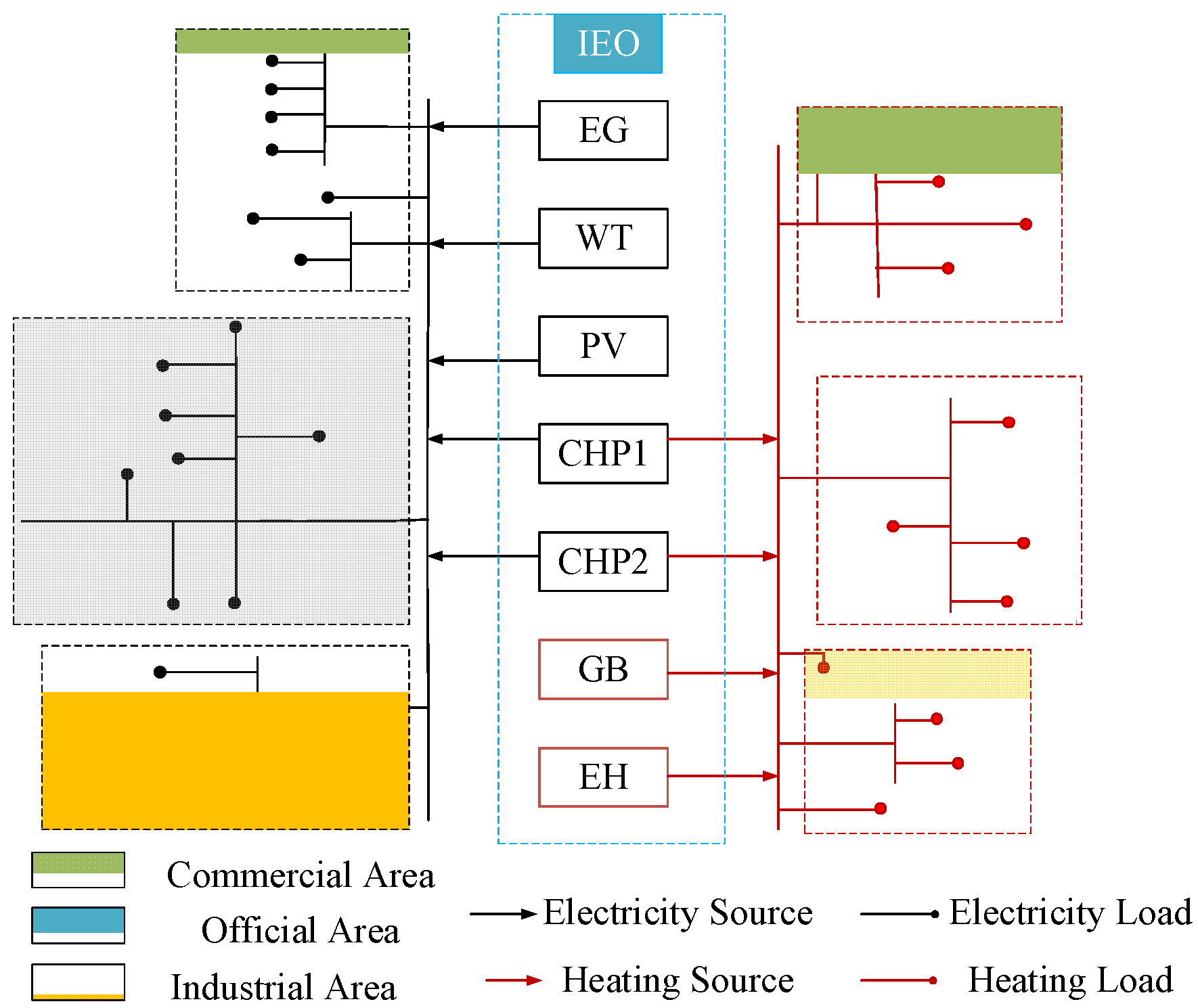

3. IEM Optimal Dispatching Model Considering Reliability Principal-Agent Contact

3.1. Objective

3.2. Energy Dispatching Constraints

3.2.1. Economic Constraints

3.2.2. Operational Constraints for Normal State

- Energy balance constraint

- Multi energy supply constraints

3.3. Energy Reliability Model

3.3.1. Component State Probability

3.3.2. Energy System Reliability Assessment

4. Bi-Level Cooperative Gaming Model

4.1. User-Side Model in the Lower Level

4.2. Frameworks of Cooperative Gaming

5. Solution of Bi-Level Optimization

6. Case Study

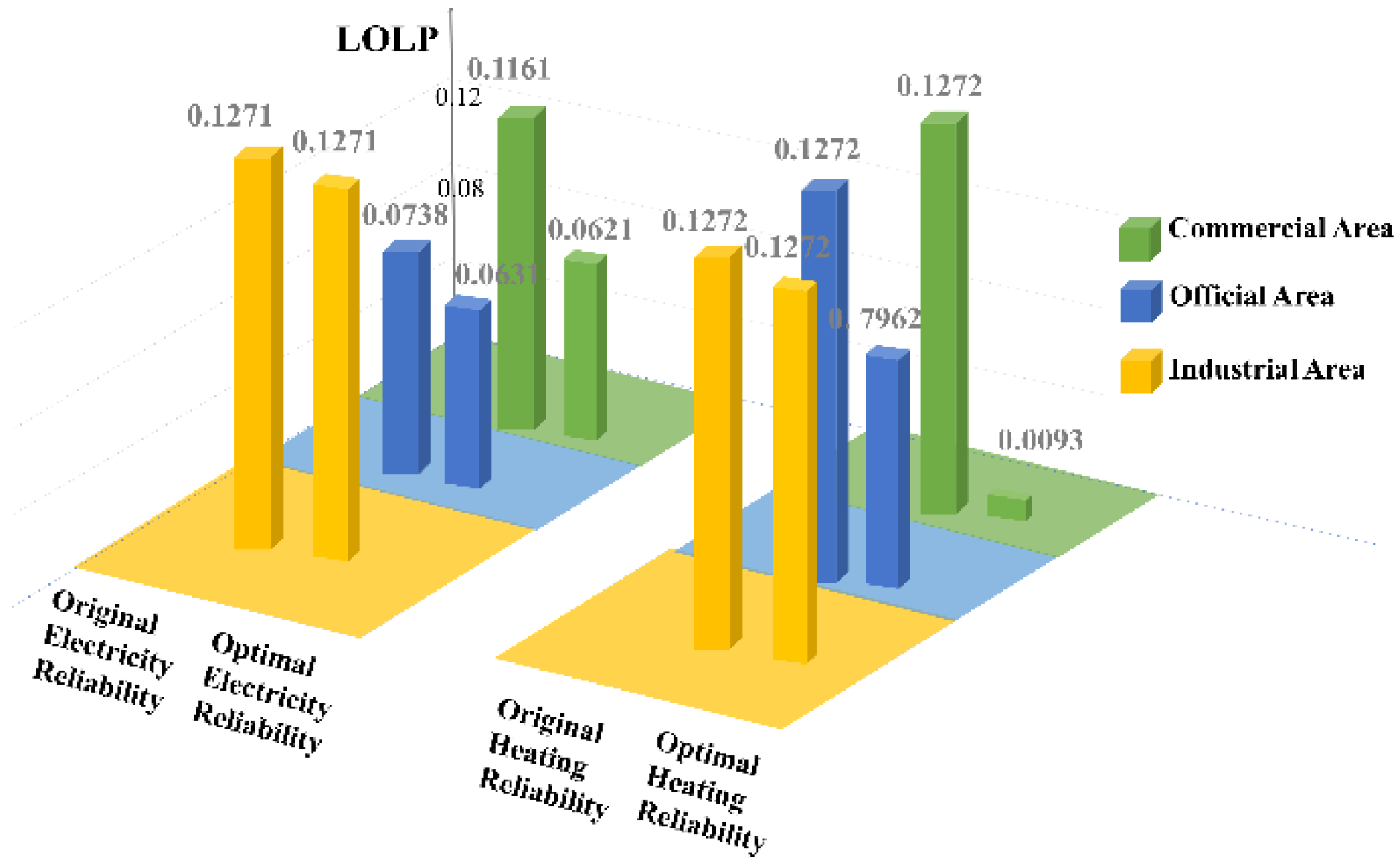

6.1. Comparison of Cost and Benefits of Reliability Improving

6.2. Comparing Reliability of Multiple Types of Users during Peak and Valley Times

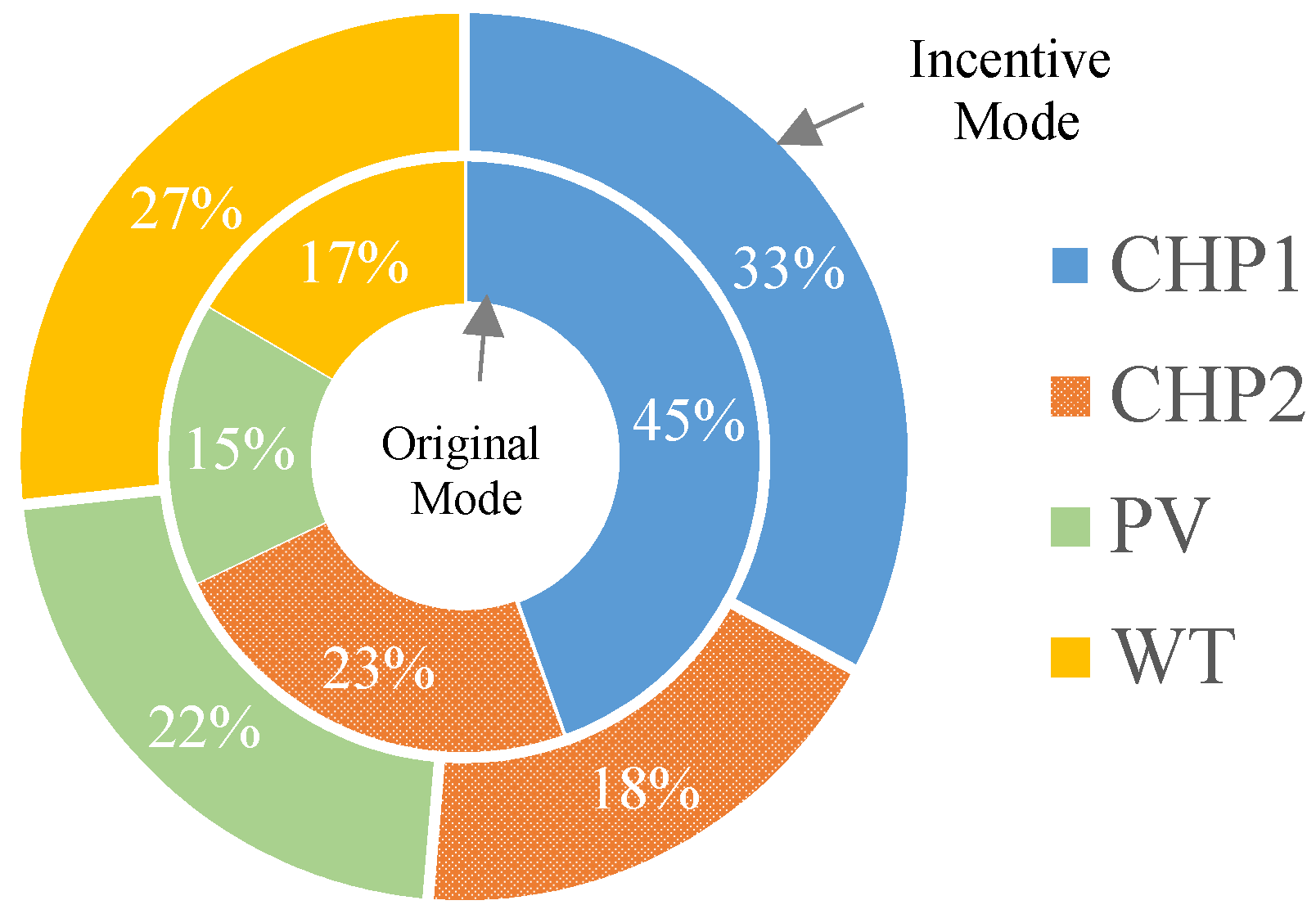

6.3. Comparison of Energy Dispatching Structure under Normal Operation Scenario

6.4. Reliability Transaction in the Incentive Mode

6.5. Sensitivity Analysis on IEO Cost with user’s Energy-Using Benefits

7. Conclusions

- (1)

- In terms of economy, on the one hand, the model effectively reduces the energy dispatching cost of IEO, because of the improvement of reliability in the system, the space for low-price sustainable energy consumption is enhanced; on the other hand, the loss of energy supply interruption for IEUs is targeted, and their energy utilization are improved to different degrees, which realizes the win–win situation of multiple participants in the cooperative game.

- (2)

- In terms of system reliability, the model optimizes the allocation of reliability resources by the market mechanism, which significantly improves the system reliability with low cost on IEO; each type of user within the IEM also achieves a personalized improvement of energy reliability in the time dimension.

- (3)

- In terms of energy structure, the model can effectively improve the sustainable energy consumption capacity in the IEM, and promote the energy structure developing in the direction of low carbon and environmental friendliness.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Krakowski, V.; Assoumou, E.; Mazauric, V.; Maïzi, N. Feasible path toward 40-100% renewable energy shares for power supply in France by 2050: A prospective analysis. Appl. Energy 2016, 171, 501–522. [Google Scholar] [CrossRef]

- Jeong, J.; Shin, H.; Song, H. A Countermeasure for Preventing Flexibility Deficit under High-Level Penetration of Renewable Energies: A Robust Optimization Approach. Sustainability 2018, 10, 16. [Google Scholar] [CrossRef] [Green Version]

- Tian, L.; Xie, Y.; Hu, B.; Liu, X.; Deng, T.; Luo, H.; Li, F. A Deep Peak Regulation Auxiliary Service Bidding Strategy for CHP Units Based on a Risk-Averse Model and District Heating Network Energy Storage. Energies 2019, 12, 27. [Google Scholar] [CrossRef] [Green Version]

- Tsai, C.H.; Figueroa-Acevedo, A.; Boese, M.; Li, Y.; Mohan, N.; Okullo, J.; Heath, B.; Bakke, J. Challenges of planning for high renewable futures: Experience in the US midcontinent electricity market. Renew. Sustain. Energy Rev. 2020, 131, 14. [Google Scholar] [CrossRef]

- Mohammadi, R.; Mashhadi, H.R.; Shahidehpour, M. Shahidehpour. Market-Based Customer Reliability Provision in Distribution Systems Based on Game Theory: A Bi-Level Optimization Approach. IEEE Trans. Smart Grid 2019, 10, 3840–3848. [Google Scholar] [CrossRef]

- Yang, X.; Gu, C.H.; Yan, X.H. Reliability-Based Probabilistic Network Pricing with Demand Uncertainty. IEEE Trans. Power Syst. 2020, 35, 3342–3352. [Google Scholar] [CrossRef]

- Yang, H.; Wang, L.; Zhang, Y.; Tai, H.M.; Ma, Y.; Zhou, M. Reliability evaluation of power system considering time of use electricity pricing. IEEE Trans. Power Syst. 2019, 34, 1991–2002. [Google Scholar] [CrossRef]

- Wang, S.; Zhao, C.; Liu, L.; Xie, S. Reliability pricing method based on consumer-centric reliability metrics with the integration of energy storage system. Energy Procedia 2019, 158, 4160–4165. [Google Scholar] [CrossRef]

- Zhai, J.; Wu, X.; Zhu, S.; Yang, B.; Liu, H. Optimization of Integrated Energy System Considering Photovoltaic Uncertainty and Multi-Energy Network. IEEE Access 2020, 8, 141558–141568. [Google Scholar] [CrossRef]

- Fumagalli, E.; Black, J.W.; Ilic, M.; Vogelsang, I. A reliability insurance scheme for the electricity distribution grid. In Proceedings of the IEEE Power Engineering Society Summer Meeting, Vancouver, BC, Canada, 15–19 July 2001. [Google Scholar] [CrossRef] [Green Version]

- Abedi, S.M.; Haghifam, M.R. Comparing reliability insurance scheme to performance-based regulation in terms of consumers’ preferences. IET Gener. Transm. Distrib. 2013, 7, 655–663. [Google Scholar] [CrossRef]

- Fumagalli, E.; Black, J.W.; Vogelsang, I.; Ilic, M. Quality of service provision in electric power distribution system through reliability insurance. IEEE Trans. Power Syst. 2004, 19, 1286–1293. [Google Scholar] [CrossRef]

- Liang, H.; Liu, Y.; Shen, Y.; Li, F.; Man, Y. A Hybrid Bat Algorithm for Economic Dispatch with Random Wind Power. IEEE Trans. Power Syst. 2018, 33, 5052–5061. [Google Scholar] [CrossRef]

- Dong, J.; Zhu, L.; Dong, Q.; Kritprajun, P.; Liu, Y.; Liu, Y.; Tolbert, L.M.; Hambrick, J.C.; Xue, Y.S.; Ollis, T.B.; et al. Integrating Transactive Energy into Reliability Evaluation for a Self-healing Distribution System with Microgrid. IEEE Trans. Sustain. Energy 2022, 13, 122–134. [Google Scholar] [CrossRef]

- Habibi, M.; Vahidinasab, V.; Pirayesh, A.; Shafie-khah, M.; Catalão, J.P. An Enhanced Contingency-based Model for Joint Energy and Reserve Markets Operation by Considering Wind and Energy Storage Systems. IEEE Trans. Ind. Inform. 2021, 17, 3241–3252. [Google Scholar] [CrossRef]

- Zhang, Z.; Wang, C.; Lv, H.; Liu, F.; Sheng, H.; Yang, M. Day-Ahead Optimal Dispatch for Integrated Energy System Considering Power-to-Gas and Dynamic Pipeline Networks. IEEE Trans. Ind. Appl. 2021, 57, 3317–3328. [Google Scholar] [CrossRef]

- Faridpak, B.; Farrokhifar, M.; Alahyari, A.; Marzband, M. A Mixed Epistemic-Aleatory Stochastic Framework for the Optimal Operation of Hybrid Fuel Stations. IEEE Trans. Veh. Technol. 2021, 70, 9764–9774. [Google Scholar] [CrossRef]

- Chen, Z.; Zhu, G.; Zhang, Y.; Ji, T.; Liu, Z.; Lin, X.; Cai, Z. Stochastic dynamic economic dispatch of wind-integrated electricity and natural gas systems considering security risk constraints. CSEE J. Power Energy Syst. 2019, 5, 324–334. [Google Scholar] [CrossRef]

- Yao, L.; Wang, X.; Qian, T.; Qi, S.; Zhu, C. Robust day-ahead scheduling of electricity and natural gas systems via a risk-averse adjustable uncertainty set approach. Sustainability 2018, 10, 3848. [Google Scholar] [CrossRef] [Green Version]

- Wu, H.; Shahidehpour, M.; Li, Z.; Tian, W. Chance-constrained day-ahead scheduling in stochastic power system operation. IEEE Trans. Power Syst. 2014, 29, 1583–1591. [Google Scholar] [CrossRef]

- Li, H.R.; Zhang, C.H.; Sun, B. Optimal design for component capacity of integrated energy system based on the active dispatch mode of multiple energy storages. Energy 2021, 227, 14. [Google Scholar] [CrossRef]

- Cao, M.; Shao, C.; Hu, B.; Xie, K.; Li, W.; Peng, L.; Zhang, W. Reliability Assessment of Integrated Energy Systems Considering Emergency Dispatch Based on Dynamic Optimal Energy Flow. IEEE Trans. Sustain. Energy 2021, 13, 290–301. [Google Scholar] [CrossRef]

| Reliability Improving Cost (USD) | Users’ Improving Gain (USD) | IEO Improving Profit (USD) | |

|---|---|---|---|

| Electricity | 224,221 | 340,208 | 525,182 |

| Heating | 175,871 | 509,806 | |

| Total | 400,092 | 850,014 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, B.; Chen, Y.; Li, B.; Zhu, Y.; Zhang, C. An Optimal Dispatching Model for Integrated Energy Microgrid Considering the Reliability Principal–Agent Contract. Sustainability 2022, 14, 7645. https://doi.org/10.3390/su14137645

Chen B, Chen Y, Li B, Zhu Y, Zhang C. An Optimal Dispatching Model for Integrated Energy Microgrid Considering the Reliability Principal–Agent Contract. Sustainability. 2022; 14(13):7645. https://doi.org/10.3390/su14137645

Chicago/Turabian StyleChen, Biyun, Yanni Chen, Bin Li, Yun Zhu, and Chi Zhang. 2022. "An Optimal Dispatching Model for Integrated Energy Microgrid Considering the Reliability Principal–Agent Contract" Sustainability 14, no. 13: 7645. https://doi.org/10.3390/su14137645